UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09195

SA FUNDS – INVESTMENT TRUST

(Exact name of registrant as specified in charter) |

8182 Maryland Avenue, Suite 500, St. Louis, MO 63105

(Address of principal executive offices) (zip code) |

Jeff Yorg, Esq.

Chief Compliance Officer

SA Funds – Investment Trust

8182 Maryland Avenue, Suite 500,

St. Louis, MO 63105

(Name and Address of Agent for Service)

Copies to:

Brian F. Link, Esq. Managing Director and Managing Counsel State Street Bank and Trust Company One Congress Street, 15th Floor Boston, Massachusetts 02114 | Mark D. Perlow, Esq. Counsel to the Trust Dechert LLP One Bush Street, Suite 1600 San Francisco, California 94104-4446 |

Registrant’s telephone number, including area code: (844) 366-0905

Date of fiscal year end: June 30

Date of reporting period: December 31, 2023

Item 1. Report to Shareholders.

SEMI-ANNUAL REPORT

December 31, 2023

PORTFOLIOS OF INVESTMENTS

SA U.S. Fixed Income Fund

SA Global Fixed Income Fund

SA U.S. Core Market Fund

SA U.S. Value Fund

SA U.S. Small Company Fund

SA International Value Fund

SA International Small Company Fund

SA Emerging Markets Value Fund

SA Real Estate Securities Fund

SA Worldwide Moderate Growth Fund

TABLE OF CONTENTS

Any information in this shareholder report regarding market or economic trends or the factors influencing the performance of SA Funds – Investment Trust (the “Trust”) are statements of the opinion of Trust management as of the date of this report. Any such opinion is subject to change at any time based upon market or other conditions and we disclaim responsibility to update such opinions. These statements should not be relied upon as investment advice. Past performance is no guarantee of future results, and there is no guarantee that stated investment objectives will be achieved.

SA U.S. Fixed Income Fund

PORTFOLIO OF INVESTMENTS — AS OF DECEMBER 31, 2023 (Unaudited)

| | | FACE

AMOUNT | | | VALUE† | |

| YANKEE CORPORATE BONDS AND NOTES — 11.4% | | | | | | | | |

| Communication — 0.7% | | | | | | | | |

NTT Finance Corp., 0.583%,

3/01/24 ± | | $ | 3,500,000 | | | $ | 3,472,006 | |

| | | | | | | | | |

| Energy — 0.1% | | | | | | | | |

TransCanada PipeLines Ltd.,

1.000%, 10/12/24 | | | 500,000 | | | | 482,370 | |

| | | | | | | | | |

| Financial — 10.2% | | | | | | | | |

AerCap Ireland Capital DAC/

AerCap Global Aviation Trust,

2.875%, 8/14/24 | | | 3,000,000 | | | | 2,943,702 | |

Bank of Montreal, 0.625%,

7/09/24 | | | 2,000,000 | | | | 1,951,694 | |

Bank of Montreal, SOFR +

1.330%, 6.746%, 6/05/26 ‡ | | | 1,000,000 | | | | 1,008,489 | |

Bank of Nova Scotia, SOFR +

1.090%, 6.419%, 6/12/25 ‡ | | | 3,500,000 | | | | 3,506,779 | |

Canadian Imperial Bank of

Commerce, 3.100%, 4/02/24 | | | 4,500,000 | | | | 4,471,747 | |

Commonwealth Bank of

Australia, SOFR + 0.400%,

5.761%, 7/07/25 ±‡ | | | 1,950,000 | | | | 1,945,678 | |

Cooperatieve Rabobank UA,

2.625%, 7/22/24 ± | | | 2,000,000 | | | | 1,969,381 | |

Cooperatieve Rabobank UA,

SOFR + 0.700%, 6.049%,

7/18/25 ‡ | | | 1,109,000 | | | | 1,110,646 | |

Mitsubishi UFJ Financial Group,

Inc., 3.407%, 3/07/24 | | | 3,946,000 | | | | 3,930,181 | |

NatWest Markets PLC, 0.800%,

8/12/24 ± | | | 4,250,000 | | | | 4,126,455 | |

Royal Bank of Canada, SOFR +

0.440%, 5.815%, 1/21/25 ‡ | | | 635,000 | | | | 633,397 | |

Royal Bank of Canada, SOFR +

0.570%, 5.953%, 4/27/26 ‡ | | | 895,000 | | | | 885,431 | |

Skandinaviska Enskilda Banken

AB, 0.650%, 9/09/24 ± | | | 1,000,000 | | | | 967,405 | |

Societe Generale SA, 2.625%,

10/16/24 ± | | | 750,000 | | | | 732,568 | |

Sumitomo Mitsui Banking Corp.,

3.400%, 7/11/24 | | | 1,000,000 | | | | 989,989 | |

Sumitomo Mitsui Financial

Group, Inc., 2.696%, 7/16/24 | | | 1,966,000 | | | | 1,937,612 | |

Sumitomo Mitsui Trust Bank Ltd.,

0.850%, 3/25/24 ± | | | 4,000,000 | | | | 3,959,603 | |

Svenska Handelsbanken AB,

SOFR + 0.910%, 6.328%,

6/10/25 ±‡ | | | 2,000,000 | | | | 2,004,086 | |

Westpac Banking Corp.,

1.019%, 11/18/24 | | | 1,958,000 | | | | 1,893,196 | |

Westpac Banking Corp.,

3.300%, 2/26/24 | | | 2,000,000 | | | | 1,994,197 | |

Westpac Banking Corp., SOFR +

0.720%, 6.063%,

11/17/25 ‡ | | | 5,000,000 | | | | 5,011,300 | |

| | | | | | | | 47,973,536 | |

| | | | | | | | | |

| Government — 0.4% | | | | | | | | |

Province of Manitoba Canada,

2.600%, 4/16/24 | | | 101,000 | | | | 100,157 | |

Svensk Exportkredit AB, SOFR +

1.000%, 6.387%, 8/03/26 ‡ | | | 1,600,000 | | | | 1,626,162 | |

| | | | | | | | 1,726,319 | |

TOTAL YANKEE

CORPORATE BONDS

AND NOTES (Identified

Cost $54,162,692) | | | | | | | 53,654,231 | |

| | | | | | | | | |

| CORPORATE BONDS AND NOTES — 15.7% | | | | | | | | |

| Basic Material — 0.2% | | | | | | | | |

Sherwin-Williams Co. (The),

3.125%, 6/01/24 | | | 700,000 | | | | 692,730 | |

| | | | | | | | | |

| Communications — 1.6% | | | | | | | | |

Amazon.com, Inc., 2.730%,

4/13/24 | | | 5,000,000 | | | | 4,964,934 | |

Discovery Communications LLC,

3.900%, 11/15/24 | | | 2,680,000 | | | | 2,643,304 | |

| | | | | | | | 7,608,238 | |

| | | | | | | | | |

| Consumer, Cyclical — 1.6% | | | | | | | | |

General Motors Financial Co.,

Inc., 1.050%, 3/08/24 | | | 900,000 | | | | 892,027 | |

General Motors Financial Co.,

Inc., SOFR + 0.620%, 5.988%,

10/15/24 ‡ | | | 1,939,000 | | | | 1,935,908 | |

Marriott International, Inc.,

3.600%, 4/15/24 | | | 2,750,000 | | | | 2,736,609 | |

Volkswagen Group of America

Finance LLC, 2.850%,

9/26/24 ± | | | 2,000,000 | | | | 1,961,243 | |

| | | | | | | | 7,525,787 | |

| | | | | | | | | |

| Consumer, Non-cyclical — 1.7% | | | | | | | | |

Cardinal Health, Inc., 3.079%,

6/15/24 | | | 3,165,000 | | | | 3,127,342 | |

Cigna Group. (The), 3.500%,

6/15/24 | | | 80,000 | | | | 79,223 | |

Elevance Health, Inc., 3.500%,

8/15/24 | | | 2,747,000 | | | | 2,711,498 | |

Gilead Sciences, Inc., 3.700%,

4/01/24 | | | 1,001,000 | | | | 996,365 | |

Roche Holdings, Inc., SOFR +

0.740%, 6.136%, 11/13/26 ±‡ | | | 900,000 | | | | 902,286 | |

| | | | | | | | 7,816,714 | |

| | | | | | | | | |

| Energy — 0.7% | | | | | | | | |

Energy Transfer LP, 5.875%,

1/15/24 | | | 536,000 | | | | 535,890 | |

Marathon Petroleum Corp.,

3.625%, 9/15/24 | | | 3,000,000 | | | | 2,954,307 | |

| | | | | | | | 3,490,197 | |

| | | | | | | | | |

| Financial — 7.5% | | | | | | | | |

American Express Co., 3.375%,

5/03/24 | | | 4,500,000 | | | | 4,466,586 | |

American Tower Corp., 0.600%,

1/15/24 | | | 2,500,000 | | | | 2,495,222 | |

The accompanying notes are an integral part of these financial statements.

1

SA U.S. Fixed Income Fund

PORTFOLIO OF INVESTMENTS — AS OF DECEMBER 31, 2023 (Unaudited) (Continued)

| | | FACE

AMOUNT | | | VALUE† | |

| CORPORATE BONDS AND NOTES (Continued) | | | | | | | | |

| Financial (Continued) | | | | | | | | |

Camden Property Trust, 3.500%,

9/15/24 | | $ | 3,000,000 | | | $ | 2,953,608 | |

Capital One Financial Corp.,

3.200%, 2/05/25 | | | 1,000,000 | | | | 976,683 | |

Capital One Financial Corp.,

3.300%, 10/30/24 | | | 2,000,000 | | | | 1,967,768 | |

Charles Schwab Corp. (The),

SOFR + 0.520%, 5.916%,

5/13/26 ‡ | | | 3,500,000 | | | | 3,444,316 | |

| Citigroup, Inc., 3.750%, 6/16/24 | | | 3,000,000 | | | | 2,975,461 | |

Goldman Sachs Group, Inc.

(The), 3.850%, 7/08/24 | | | 2,000,000 | | | | 1,982,467 | |

Goldman Sachs Group, Inc.

(The), 4.000%, 3/03/24 | | | 1,000,000 | | | | 997,199 | |

Morgan Stanley, Series F,

3.875%, 4/29/24 | | | 4,800,000 | | | | 4,774,457 | |

Nuveen Finance LLC, 4.125%,

11/01/24 ± | | | 4,000,000 | | | | 3,940,726 | |

State Street Corp., SOFR +

0.845%, 6.234%, 8/03/26 ‡ | | | 3,500,000 | | | | 3,498,891 | |

Ventas Realty LP, 3.750%,

5/01/24 | | | 493,000 | | | | 489,631 | |

| | | | | | | | 34,963,015 | |

| | | | | | | | | |

| Industrial — 1.8% | | | | | | | | |

John Deere Capital Corp., SOFR

+ 0.560%, 5.975%,

3/07/25 ‡ | | | 4,000,000 | | | | 4,013,478 | |

Penske Truck Leasing Co. LP/

PTL Finance Corp., 3.450%,

7/01/24 ± | | | 1,750,000 | | | | 1,729,271 | |

| RTX Corp., 3.200%, 3/15/24 | | | 2,695,000 | | | | 2,682,091 | |

Ryder System, Inc., 3.650%,

3/18/24 | | | 60,000 | | | | 59,716 | |

| | | | | | | | 8,484,556 | |

| | | | | | | | | |

| Utility — 0.6% | | | | | | | | |

Edison International, 3.550%,

11/15/24 | | | 3,000,000 | | | | 2,946,111 | |

| | | | | | | | | |

TOTAL CORPORATE BONDS

AND NOTES (Identified

Cost $74,207,552) | | | | | | | 73,527,348 | |

| | | | | | | | | |

| U.S. GOVERNMENT & AGENCY OBLIGATIONS — 40.8% | | | | | | | | |

| Sovereign — 7.7% | | | | | | | | |

Federal Home Loan Bank

Discount Notes, 0.000%,

2/06/24 # | | | 1,000,000 | | | | 994,302 | |

Federal Home Loan Bank

Discount Notes, 0.000%,

2/14/24 # | | | 35,120,000 | | | | 34,878,823 | |

| | | | | | | | 35,873,125 | |

| | | | | | | | | |

| U.S. Treasury Securities — 33.1% | | | | | | | | |

U.S. Treasury Floating Rate

Notes, 3 mo. Treasury Money

Market Yield + 0.125%,

5.456%, 7/31/25 ‡ | | | 46,000,000 | | | | 45,941,308 | |

U.S. Treasury Floating Rate

Notes, 3 mo. Treasury Money

Market Yield + 0.170%,

5.486%, 10/31/25 ‡ | | | 24,550,000 | | | | 24,518,541 | |

U.S. Treasury Floating Rate

Notes, 3 mo. Treasury Money

Market Yield + 0.169%,

5.500%, 4/30/25 ‡ | | | 46,350,000 | | | | 46,332,702 | |

U.S. Treasury Floating Rate

Notes, 3 mo. Treasury Money

Market Yield + 0.200%,

5.531%, 1/31/25 ‡ | | | 38,600,000 | | | | 38,601,828 | |

| | | | | | | | 155,394,379 | |

TOTAL U.S. GOVERNMENT

& AGENCY OBLIGATIONS

(Identified

Cost $191,275,686) | | | | | | | 191,267,504 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENTS — 31.6% | | | | | | | | |

| Commercial Paper — 15.9% | | | | | | | | |

| 3M Co., 0.000%, 2/05/24 # | | | 1,828,000 | | | | 1,817,184 | |

| 3M Co., 0.000%, 3/15/24 # | | | 1,500,000 | | | | 1,481,939 | |

| Aon Corp., 0.000%, 2/14/24 # | | | 3,000,000 | | | | 2,978,232 | |

| AT&T, Inc., 1.000%, 3/19/24 | | | 600,000 | | | | 592,449 | |

Australia & New Zealand Banking

Group Ltd., 5.560%,

1/08/24 | | | 1,000,000 | | | | 998,523 | |

Bayer Corp., 0.000%,

7/24/24 # | | | 3,250,000 | | | | 3,136,003 | |

Cigna Group. (The), 5.600%,

1/03/24 | | | 1,500,000 | | | | 1,498,870 | |

Cooperatieve Rabobank UA,

5.540%, 2/01/24 | | | 4,500,000 | | | | 4,477,595 | |

Cooperatieve Rabobank UA,

5.560%, 2/07/24 | | | 1,000,000 | | | | 994,141 | |

DNB Bank ASA, 5.550%,

1/30/24 | | | 3,000,000 | | | | 2,985,966 | |

Dominion Energy, Inc., 0.000%,

3/05/24 # | | | 2,750,000 | | | | 2,721,124 | |

Duke Energy Corp., 0.000%,

2/27/24 # | | | 3,254,000 | | | | 3,223,440 | |

LVMH Moet Hennessy Louis

Vuitton SE, 0.000%,

5/21/24 # | | | 3,750,000 | | | | 3,671,622 | |

Microsoft Corp., 0.000%,

5/06/24 # | | | 13,750,000 | | | | 13,492,402 | |

National Securities Clearing

Corp., 0.000%, 5/07/24 # | | | 1,250,000 | | | | 1,226,094 | |

National Securities Clearing

Corp., 1.000%, 5/10/24 | | | 7,800,000 | | | | 7,647,577 | |

National Securities Clearing

Corp., 5.460%, 2/01/24 | | | 5,000,000 | | | | 4,974,823 | |

The accompanying notes are an integral part of these financial statements.

2

SA U.S. Fixed Income Fund

PORTFOLIO OF INVESTMENTS — AS OF DECEMBER 31, 2023 (Unaudited) (Continued)

| | | FACE

AMOUNT | | | VALUE† | |

| SHORT-TERM INVESTMENTS (Continued) | | | | | | | | |

| Commercial Paper (Continued) | | | | | | | | |

NextEra Energy Capital Holdings,

Inc., 0.000%, 1/26/24 # | | $ | 3,250,000 | | | $ | 3,235,895 | |

Province of Alberta Canada,

0.000%, 3/25/24 # | | | 1,000,000 | | | | 987,110 | |

Stanley Black & Decker, Inc.,

1.000%, 1/18/24 | | | 3,000,000 | | | | 2,990,923 | |

United Overseas Bank Ltd.,

0.010%, 5/16/24 | | | 2,000,000 | | | | 1,959,122 | |

VW Credit, Inc., 0.000%,

4/17/24 # | | | 1,250,000 | | | | 1,228,474 | |

Walt Disney Co. (The), 0.000%,

3/05/24 # | | | 1,000,000 | | | | 989,610 | |

Walt Disney Co. (The), 5.500%,

2/21/24 | | | 3,500,000 | | | | 3,470,826 | |

Westpac Banking Corp.,

0.000%, 5/15/24 # | | | 1,990,000 | | | | 1,950,067 | |

| | | | | | | | 74,730,011 | |

| | | | | | | | | |

| U.S. Treasury Securities — 15.3% | | | | | | | | |

U.S. Treasury Bills, 0.000%,

1/30/24 # | | | 4,800,000 | | | | 4,780,258 | |

U.S. Treasury Bills, 0.000%,

3/12/24 # | | | 18,000,000 | | | | 17,818,245 | |

U.S. Treasury Bills, 0.000%,

4/11/24 # | | | 20,500,000 | | | | 20,204,971 | |

U.S. Treasury Bills, 0.000%,

4/25/24 # | | | 27,000,000 | | | | 26,558,093 | |

U.S. Treasury Bills, 0.000%,

5/09/24 # | | | 2,300,000 | | | | 2,258,022 | |

| | | | | | | | 71,619,589 | |

| | | | | | | | | |

| | | SHARES | | | | | |

| Investment Company — 0.4% | | | | | | | | |

State Street Institutional U.S.

Government Money Market

Fund 5.070% | | | 1,752,845 | | | | 1,752,845 | |

| | | | | | | | | |

TOTAL SHORT-TERM

INVESTMENTS (Identified

Cost $148,084,897) | | | | | | | 148,102,445 | |

| | | | | | | | | |

Total Investments — 99.5%

(Identified Cost $467,730,827) | | | | | | | 466,551,528 | |

Cash and Other Assets, Less

Liabilities — 0.5% | | | | | | | 2,301,157 | |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 468,852,685 | |

| | † | See Note 1 |

| | ± | 144A Securities. Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration to qualified institutional buyers. These securities have been deemed by the Fund to be liquid and at December 31, 2023 amounted to $27,710,707 or 5.91% of the net assets of the Fund. |

| | ‡ | Floating rate or variable rate note. Rate shown is as of December 31, 2023. |

| | # | Zero coupon bond |

Key to abbreviations:

SOFR — Secured Overnight Financing Rate

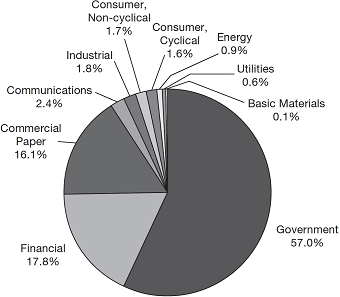

Portfolio Sectors as of December 31, 2023

(As a percentage of total investment excluding short-term

money market investment)

The accompanying notes are an integral part of these financial statements.

3

SA Global Fixed Income Fund

PORTFOLIO OF INVESTMENTS — AS OF DECEMBER 31, 2023 (Unaudited)

| | | | | FACE

AMOUNT | | | VALUE† | |

| BONDS AND NOTES — 76.3% | | | | | | | | | | |

| Australia — 8.7% | | | | | | | | | | |

Australia & New Zealand

Banking Group Ltd., 1.550%,

8/29/24 | | AUD | | | 500,000 | | | $ | 334,035 | |

Australia & New Zealand

Banking Group Ltd., 4.050%,

5/12/25 | | AUD | | | 1,000,000 | | | | 677,419 | |

Australia & New Zealand

Banking Group Ltd.,

(3-mo. Swap + 0.830%),

5.188%, 3/31/26 ‡ | | AUD | | | 1,500,000 | | | | 1,025,786 | |

Australia & New Zealand

Banking Group Ltd.,

(3-mo. Swap + 0.920%),

5.267%, 11/04/25 ‡ | | AUD | | | 2,500,000 | | | | 1,713,459 | |

Australia & New Zealand

Banking Group Ltd.,

(3-mo. Swap + 0.970%),

5.389%, 5/12/27 ‡ | | AUD | | | 500,000 | | | | 342,630 | |

Australia & New Zealand

Banking Group Ltd.,

(3-mo. Swap + 1.200%),

5.547%, 11/04/27 ‡ | | AUD | | | 500,000 | | | | 345,120 | |

Commonwealth Bank of

Australia, 4.200%, 8/18/25 | | AUD | | | 1,700,000 | | | | 1,153,258 | |

Commonwealth Bank of

Australia, (3-mo. Swap +

0.700%), 4.852%, 1/14/27 ‡ | | AUD | | | 1,000,000 | | | | 680,044 | |

Commonwealth Bank of

Australia, (3-mo. Swap +

0.900%), 5.054%, 1/13/26 ‡ | | AUD | | | 6,200,000 | | | | 4,246,632 | |

Commonwealth Bank of

Australia, (3-mo. Swap +

0.800%), 5.183%, 8/18/25 ‡ | | AUD | | | 2,000,000 | | | | 1,368,000 | |

Commonwealth Bank of

Australia, (3-mo. Swap +

1.150%), 5.304%, 1/13/28 ‡ | | AUD | | | 1,500,000 | | | | 1,033,271 | |

Commonwealth Bank of

Australia, (SOFR + 0.400%),

5.761%, 7/07/25 ±‡ | | USD | | | 3,548,000 | | | | 3,540,136 | |

Commonwealth Bank of

Australia, (SOFR + 0.630%),

6.049%, 9/12/25 ౠ| | USD | | | 233,000 | | | | 233,294 | |

Commonwealth Bank of

Australia, (SOFR + 0.740%),

6.162%, 3/14/25 ‡ | | USD | | | 2,900,000 | | | | 2,907,545 | |

National Australia Bank Ltd.,

0.250%, 5/20/24 | | EUR | | | 2,076,000 | | | | 2,259,761 | |

National Australia Bank Ltd.,

2.900%, 2/25/27 | | AUD | | | 1,000,000 | | | | 648,995 | |

National Australia Bank Ltd.,

3.900%, 5/30/25 | | AUD | | | 2,400,000 | | | | 1,621,528 | |

National Australia Bank Ltd.,

(3-mo. Swap + 0.770%),

4.980%, 1/21/25 ‡ | | AUD | | | 1,300,000 | | | | 888,690 | |

National Australia Bank Ltd.,

(3-mo. Swap + 0.780%),

5.199%, 5/12/26 ‡ | | AUD | | | 1,500,000 | | | | 1,024,709 | |

National Australia Bank Ltd.,

(3-mo. Swap + 0.900%),

5.267%, 5/30/25 ‡ | | AUD | | | 5,900,000 | | | | 4,041,159 | |

National Australia Bank Ltd.,

(3-mo. Swap + 0.920%),

5.298%, 11/25/25 ‡ | | AUD | | | 2,500,000 | | | | 1,713,456 | |

National Australia Bank Ltd.,

(3-mo. Swap + 1.200%),

5.578%, 11/25/27 ‡ | | AUD | | | 500,000 | | | | 345,180 | |

National Australia Bank Ltd.,

(SOFR + 0.380%), 5.747%,

1/12/25 ±‡ | | USD | | | 250,000 | | | | 249,576 | |

National Australia Bank Ltd.,

(SOFR + 0.760%), 6.156%,

5/13/25 ౠ| | USD | | | 3,110,000 | | | | 3,119,262 | |

Westpac Banking Corp.,

2.700%, 3/17/25 | | AUD | | | 1,400,000 | | | | 933,359 | |

Westpac Banking Corp.,

3.300%, 2/26/24 | | USD | | | 3,535,000 | | | | 3,524,744 | |

Westpac Banking Corp.,

4.125%, 6/04/26 | | AUD | | | 2,300,000 | | | | 1,554,004 | |

Westpac Banking Corp.,

(3-mo. Swap + 0.700%),

4.943%, 1/25/27 ‡ | | AUD | | | 1,000,000 | | | | 679,869 | |

Westpac Banking Corp.,

(3-mo. Swap + 0.690%),

5.053%, 3/17/25 ‡ | | AUD | | | 3,000,000 | | | | 2,048,819 | |

Westpac Banking Corp.,

(3-mo. Swap + 0.750%),

5.138%, 2/16/26 ‡ | | AUD | | | 1,000,000 | | | | 682,814 | |

Westpac Banking Corp.,

(3-mo. Swap + 0.800%),

5.219%, 8/11/25 ‡ | | AUD | | | 6,000,000 | | | | 4,103,315 | |

Westpac Banking Corp.,

(3-mo. Swap + 0.980%),

5.368%, 2/16/28 ‡ | | AUD | | | 500,000 | | | | 342,115 | |

Westpac Banking Corp.,

(3-mo. Swap + 0.950%),

5.369%, 11/11/25 ‡ | | AUD | | | 1,400,000 | | | | 959,974 | |

Westpac Banking Corp.,

(3-mo. Swap + 1.230%),

5.649%, 11/11/27 ‡ | | AUD | | | 1,500,000 | | | | 1,036,178 | |

| | | | | | | | | | 51,378,136 | |

| | | | | | | | | | | |

| Belgium — 0.3% | | | | | | | | | | |

Kingdom of Belgium Government

Bond, 2.600%, 6/22/24 | | EUR | | | 1,800,000 | | | | 1,977,918 | |

| | | | | | | | | | | |

| Canada — 10.2% | | | | | | | | | | |

Canada Government Bonds,

0.750%, 2/01/24 | | CAD | | | 3,300,000 | | | | 2,481,989 | |

Canada Government Bonds,

2.250%, 3/01/24 | | CAD | | | 1,400,000 | | | | 1,051,883 | |

Canada Treasury Bills, 0.000%,

2/01/24 # | | CAD | | | 2,000,000 | | | | 1,502,327 | |

CDP Financial, Inc., (SOFR +

0.400%), 5.799%, 5/19/25 ±‡ | | USD | | | 5,400,000 | | | | 5,401,167 | |

The accompanying notes are an integral part of these financial statements.

4

SA Global Fixed Income Fund

PORTFOLIO OF INVESTMENTS — AS OF DECEMBER 31, 2023 (Unaudited) (Continued)

| | | | | FACE

AMOUNT | | | VALUE† | |

| BONDS AND NOTES (Continued) | | | | | | | | | | |

| Canada (Continued) | | | | | | | | | | |

CPPIB Capital, Inc., 0.375%,

6/20/24 | | EUR | | | 6,450,000 | | | $ | 7,010,090 | |

CPPIB Capital, Inc., 0.875%,

12/17/24 | | GBP | | | 600,000 | | | | 735,671 | |

CPPIB Capital, Inc., (SOFR +

1.250%), 6.666%, 3/11/26 ±‡ | | USD | | | 250,000 | | | | 254,491 | |

Export Development Canada,

2.625%, 2/21/24 | | USD | | | 55,000 | | | | 54,789 | |

OMERS Finance Trust, 2.500%,

5/02/24 | | USD | | | 810,000 | | | | 801,956 | |

Province of Alberta Canada,

2.950%, 1/23/24 | | USD | | | 1,980,000 | | | | 1,977,066 | |

Province of Alberta Canada,

3.100%, 6/01/24 | | CAD | | | 700,000 | | | | 524,173 | |

Province of Manitoba Canada,

2.600%, 4/16/24 | | USD | | | 4,300,000 | | | | 4,264,105 | |

Province of Ontario Canada,

0.375%, 6/14/24 | | EUR | | | 2,000,000 | | | | 2,174,111 | |

Province of Ontario Canada,

3.050%, 1/29/24 | | USD | | | 6,320,000 | | | | 6,308,710 | |

Province of Ontario Canada,

3.100%, 8/26/25 | | AUD | | | 2,000,000 | | | | 1,333,418 | |

Province of Ontario Canada,

3.500%, 6/02/24 | | CAD | | | 800,000 | | | | 599,998 | |

Province of Quebec Canada,

0.750%, 12/13/24 | | GBP | | | 600,000 | | | | 734,804 | |

Province of Quebec Canada,

2.500%, 4/09/24 | | USD | | | 8,336,000 | | | | 8,269,714 | |

Province of Quebec Canada,

3.700%, 5/20/26 | | AUD | | | 3,500,000 | | | | 2,349,504 | |

Province of Saskatchewan

Canada, 3.200%, 6/03/24 | | CAD | | | 1,500,000 | | | | 1,123,958 | |

PSP Capital, Inc., 3.290%,

4/04/24 | | CAD | | | 3,600,000 | | | | 2,704,968 | |

Royal Bank of Canada, 4.200%,

6/22/26 | | AUD | | | 500,000 | | | | 336,761 | |

Toronto-Dominion Bank (The),

3.226%, 7/24/24 | | CAD | | | 10,450,000 | | | | 7,804,854 | |

| | | | | | | | | | 59,800,507 | |

| | | | | | | | | | | |

| Denmark — 0.7% | | | | | | | | | | |

Denmark Government Bond,

0.000%, 11/15/24 # | | DKK | | | 1,600,000 | | | | 230,664 | |

Kommunekredit, 0.250%,

2/16/24 | | EUR | | | 2,000,000 | | | | 2,198,468 | |

Kommunekredit, 2.000%,

6/25/24 | | GBP | | | 1,300,000 | | | | 1,629,737 | |

| | | | | | | | | | 4,058,869 | |

| | | | | | | | | | | |

| Finland — 1.0% | | | | | | | | | | |

Kuntarahoitus OYJ, 0.125%,

3/07/24 | | EUR | | | 2,250,000 | | | | 2,468,351 | |

Kuntarahoitus OYJ, 0.875%,

12/16/24 @ | | GBP | | | 2,900,000 | | | | 3,557,381 | |

| | | | | | | | | | 6,025,732 | |

| | | | | | | | | | | |

| France — 5.4% | | | | | | | | | | |

Agence Francaise de

Developpement EPIC,

3.125%, 1/04/24 | | EUR | | | 5,000,000 | | | | 5,519,557 | |

Caisse d’Amortissement de

la Dette Sociale, 0.375%,

5/27/24 | | USD | | | 1,500,000 | | | | 1,470,328 | |

Caisse d’Amortissement de

la Dette Sociale, 2.375%,

1/25/24 | | EUR | | | 5,500,000 | | | | 6,066,571 | |

Caisse d’Amortissement de

la Dette Sociale, 3.375%,

3/20/24 | | USD | | | 371,000 | | | | 369,339 | |

Caisse des Depots et

Consignations, (SOFR +

0.340%), 5.724%, 5/03/26 ‡ | | USD | | | 4,800,000 | | | | 4,794,817 | |

Dexia Credit Local SA, 0.000%,

5/29/24 # | | EUR | | | 1,200,000 | | | | 1,304,796 | |

Dexia Credit Local SA, 0.500%,

7/16/24 | | USD | | | 5,500,000 | | | | 5,360,780 | |

French Republic Government

Bond OAT, 0.000%, 3/25/24 # | | EUR | | | 2,000,000 | | | | 2,190,021 | |

French Republic Government

Bond OAT, 2.250%, 5/25/24 | | EUR | | | 1,000,000 | | | | 1,097,989 | |

| SFIL SA, 0.000%, 5/24/24 # | | EUR | | | 500,000 | | | | 543,484 | |

| SNCF Reseau, 4.500%, 1/30/24 | | EUR | | | 200,000 | | | | 220,872 | |

Societe Nationale SNCF SACA,

4.625%, 2/02/24 | | EUR | | | 1,350,000 | | | | 1,490,963 | |

UNEDIC ASSEO, 2.375%,

5/25/24 | | EUR | | | 1,100,000 | | | | 1,206,987 | |

| | | | | | | | | | 31,636,504 | |

| | | | | | | | | | | |

| Germany — 5.1% | | | | | | | | | | |

Erste Abwicklungsanstalt,

0.250%, 3/01/24 | | USD | | | 9,000,000 | | | | 8,924,590 | |

Kreditanstalt fuer Wiederaufbau,

0.250%, 3/08/24 | | USD | | | 4,733,000 | | | | 4,689,333 | |

Kreditanstalt fuer Wiederaufbau,

0.875%, 7/18/24 | | GBP | | | 400,000 | | | | 497,912 | |

Landeskreditbank Baden-

Wuerttemberg Foerderbank,

0.375%, 12/09/24 | | GBP | | | 1,486,000 | | | | 1,814,349 | |

Landeskreditbank Baden-

Wuerttemberg Foerderbank,

2.000%, 7/23/24 | | USD | | | 7,562,000 | | | | 7,424,441 | |

Landwirtschaftliche Rentenbank,

4.250%, 1/09/25 | | AUD | | | 3,780,000 | | | | 2,572,589 | |

Landwirtschaftliche Rentenbank,

5.375%, 4/23/24 | | NZD | | | 1,000,000 | | | | 631,498 | |

| NRW Bank, 0.375%, 12/16/24 | | GBP | | | 400,000 | | | | 488,116 | |

| NRW Bank, 1.050%, 3/31/26 | | AUD | | | 2,350,000 | | | | 1,486,607 | |

State of North Rhine-Westphalia

Germany, 0.625%,

12/16/24 @ | | GBP | | | 1,300,000 | | | | 1,589,947 | |

| | | | | | | | | | 30,119,382 | |

The accompanying notes are an integral part of these financial statements.

5

SA Global Fixed Income Fund

PORTFOLIO OF INVESTMENTS — AS OF DECEMBER 31, 2023 (Unaudited) (Continued)

| | | | | FACE

AMOUNT | | | VALUE† | |

| BONDS AND NOTES (Continued) | | | | | | | | | | |

| Netherlands — 5.0% | | | | | | | | | | |

| BNG Bank NV, 0.250%, 6/07/24 | | EUR | | | 1,900,000 | | | $ | 2,066,833 | |

| BNG Bank NV, 2.000%, 4/12/24 | | GBP | | | 2,565,000 | | | | 3,238,594 | |

| BNG Bank NV, 3.250%, 7/15/25 | | AUD | | | 1,400,000 | | | | 938,916 | |

Cooperatieve Rabobank UA,

(SOFR + 0.700%), 6.073%,

7/18/25 ‡ | | USD | | | 3,952,000 | | | | 3,957,867 | |

Cooperatieve Rabobank UA,

(3-mo. Swap + 0.880%),

5.246%, 5/22/26 ‡ | | AUD | | | 700,000 | | | | 477,771 | |

Cooperatieve Rabobank UA,

(SOFR + 0.900%), 6.261%,

10/05/26 ‡ | | USD | | | 1,110,000 | | | | 1,110,439 | |

Nederlandse Waterschapsbank

NV, 2.000%, 12/16/24 | | GBP | | | 1,950,000 | | | | 2,414,935 | |

Nederlandse Waterschapsbank

NV, 1.125%, 3/15/24 | | USD | | | 2,150,000 | | | | 2,132,227 | |

Netherlands Government Bond,

0.000%, 1/15/24 # | | EUR | | | 1,950,000 | | | | 2,149,760 | |

Netherlands Government Bond,

2.000%, 7/15/24 | | EUR | | | 3,900,000 | | | | 4,274,459 | |

Shell International Finance BV,

0.750%, 5/12/24 | | EUR | | | 4,900,000 | | | | 5,350,967 | |

Shell International Finance BV,

1.125%, 4/07/24 | | EUR | | | 1,130,000 | | | | 1,238,410 | |

| | | | | | | | | | 29,351,178 | |

| | | | | | | | | | | |

| New Zealand — 1.2% | | | | | | | | | | |

New Zealand Government Bond,

0.500%, 5/15/24 | | NZD | | | 4,000,000 | | | | 2,483,708 | |

New Zealand Local Government

Funding Agency Bond,

2.250%, 4/15/24 | | NZD | | | 6,800,000 | | | | 4,258,790 | |

| | | | | | | | | | 6,742,498 | |

| | | | | | | | | | | |

| Norway — 2.0% | | | | | | | | | | |

Kommunalbanken AS, 1.000%,

12/12/24 | | GBP | | | 750,000 | | | | 921,215 | |

Kommunalbanken AS, 0.600%,

6/01/26 | | AUD | | | 1,500,000 | | | | 936,442 | |

Kommunalbanken AS, 2.000%,

6/19/24 | | USD | | | 2,000,000 | | | | 1,969,545 | |

Kommunalbanken AS, 2.750%,

2/05/24 | | USD | | | 600,000 | | | | 598,716 | |

Kommunalbanken AS, 4.250%,

7/16/25 | | AUD | | | 1,490,000 | | | | 1,013,501 | |

Kommunalbanken AS, (SOFR +

1.000%), 6.422%, 6/17/26 ‡ | | USD | | | 300,000 | | | | 304,403 | |

Norway Government Bond,

3.000%, 3/14/24 | | NOK | | | 64,000,000 | | | | 6,277,466 | |

| | | | | | | | | | 12,021,288 | |

| | | | | | | | | | | |

| Singapore — 1.0% | | | | | | | | | | |

Monetary Authority of Singapore

Bills, 0.000%, 1/12/24 # | | SGD | | | 6,800,000 | | | | 5,146,637 | |

United Overseas Bank Ltd.,

(3-mo. Swap + 0.350%),

4.733%, 5/20/24 ‡ | | AUD | | | 600,000 | | | | 408,824 | |

| | | | | | | | | | 5,555,461 | |

| | | | | | | | | | | |

| Supranational — 11.4% | | | | | | | | | | |

African Development Bank,

0.250%, 1/24/24 | | EUR | | | 800,000 | | | | 881,370 | |

Asian Development Bank,

1.625%, 3/15/24 @ | | USD | | | 6,126,000 | | | | 6,080,012 | |

Asian Development Bank, (SOFR +

1.000%), 6.406%, 8/27/26 ‡ | | USD | | | 342,000 | | | | 347,392 | |

Asian Infrastructure Investment

Bank (The), 1.000%, 5/06/26 | | AUD | | | 1,900,000 | | | | 1,193,181 | |

Asian Infrastructure Investment

Bank (The), (SOFR + 0.620%),

6.016%, 8/16/27 ‡ | | USD | | | 5,000,000 | | | | 5,017,566 | |

Eurofima Europaeische

Gesellschaft fuer die

Finanzierung von

Eisenbahnmaterial, 0.250%,

2/09/24 | | EUR | | | 191,000 | | | | 210,108 | |

European Bank for

Reconstruction &

Development, (SOFR +

0.190%), 5.558%, 4/14/26 ‡ | | USD | | | 318,000 | | | | 317,515 | |

European Financial Stability

Facility, 0.000%, 4/19/24 # | | EUR | | | 7,990,000 | | | | 8,728,096 | |

European Financial Stability

Facility, 1.750%, 6/27/24 | | EUR | | | 598,000 | | | | 654,460 | |

European Financial Stability

Facility, 2.125%, 2/19/24 | | EUR | | | 6,550,000 | | | | 7,216,072 | |

European Investment Bank,

1.500%, 1/26/24 | | NOK | | | 21,000,000 | | | | 2,062,465 | |

European Investment Bank,

2.625%, 3/15/24 | | USD | | | 2,100,000 | | | | 2,088,213 | |

European Investment Bank,

3.250%, 1/29/24 | | USD | | | 1,623,000 | | | | 1,620,483 | |

European Investment Bank,

4.750%, 8/07/24 | | AUD | | | 700,000 | | | | 477,801 | |

European Stability Mechanism,

0.125%, 4/22/24 | | EUR | | | 7,772,620 | | | | 8,492,153 | |

European Union, 1.875%,

4/04/24 | | EUR | | | 500,000 | | | | 549,563 | |

Inter-American Development

Bank, 1.700%, 10/10/24 | | CAD | | | 448,000 | | | | 330,137 | |

Inter-American Development

Bank, 3.000%, 2/21/24 | | USD | | | 963,000 | | | | 959,645 | |

Inter-American Development

Bank, 4.750%, 8/27/24 | | AUD | | | 5,500,000 | | | | 3,754,842 | |

Inter-American Development

Bank, (SOFR + 0.170%),

5.592%, 9/16/26 ‡ | | USD | | | 1,500,000 | | | | 1,494,391 | |

Inter-American Development

Bank, (SOFR + 0.350%),

5.691%, 10/04/27 ‡ | | USD | | | 283,000 | | | | 282,597 | |

International Bank for

Reconstruction &

Development, 1.800%,

7/26/24 | | CAD | | | 692,000 | | | | 513,293 | |

| | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

6

SA Global Fixed Income Fund

PORTFOLIO OF INVESTMENTS — AS OF DECEMBER 31, 2023 (Unaudited) (Continued)

| | | | | FACE

AMOUNT | | | VALUE† | |

| BONDS AND NOTES (Continued) | | | | | | | | | | |

| Supranational (Continued) | | | | | | | | | | |

International Bank for

Reconstruction &

Development, 2.500%,

3/19/24 | | USD | | | 11,000,000 | | | $ | 10,932,632 | |

International Bank for

Reconstruction &

Development, (SOFR +

0.370%), 5.733%, 1/12/27 ‡ | | USD | | | 1,000,000 | | | | 1,002,831 | |

International Bank for

Reconstruction &

Development, (SOFR +

0.430%), 5.829%, 8/19/27 ‡ | | USD | | | 650,000 | | | | 652,061 | |

International Finance Corp.,

1.375%, 9/13/24 | | CAD | | | 100,000 | | | | 73,673 | |

Nordic Investment Bank,

1.500%, 3/13/25 | | NOK | | | 6,000,000 | | | | 571,942 | |

Nordic Investment Bank, (SOFR +

1.000%), 6.393%, 5/12/26 ‡ | | USD | | | 750,000 | | | | 762,261 | |

| | | | | | | | | | 67,266,755 | |

| | | | | | | | | | | |

| Sweden — 5.7% | | | | | | | | | | |

Kommuninvest I Sverige AB,

3.250%, 1/16/24 | | USD | | | 3,343,000 | | | | 3,340,331 | |

Kommuninvest I Sverige AB,

0.375%, 2/16/24 | | USD | | | 1,500,000 | | | | 1,490,723 | |

Kommuninvest I Sverige AB,

1.000%, 10/02/24 | | SEK | | | 30,670,000 | | | | 2,978,738 | |

Kommuninvest I Sverige AB,

1.000%, 5/12/25 | | SEK | | | 13,000,000 | | | | 1,249,493 | |

Kommuninvest I Sverige AB,

1.375%, 5/08/24 ± | | USD | | | 750,000 | | | | 739,509 | |

Kommuninvest I Sverige AB,

1.375%, 5/08/24 | | USD | | | 4,200,000 | | | | 4,141,251 | |

Kommuninvest I Sverige AB,

2.875%, 7/03/24 ± | | USD | | | 1,671,000 | | | | 1,650,806 | |

Svensk Exportkredit AB,

3.625%, 9/03/24 | | USD | | | 2,875,000 | | | | 2,842,953 | |

Svensk Exportkredit AB,

0.375%, 3/11/24 | | USD | | | 3,000,000 | | | | 2,971,053 | |

Svensk Exportkredit AB,

0.375%, 7/30/24 | | USD | | | 6,363,000 | | | | 6,187,267 | |

Svensk Exportkredit AB, (SOFR +

1.000%), 6.387%, 8/03/26 ‡ | | USD | | | 1,835,000 | | | | 1,865,005 | |

Svenska Handelsbanken AB,

0.550%, 6/11/24 ± | | USD | | | 250,000 | | | | 244,403 | |

Sweden Treasury Bills, 0.000%,

3/20/24 # | | SEK | | | 40,000,000 | | | | 3,932,523 | |

| | | | | | | | | | 33,634,055 | |

| | | | | | | | | | | |

| United Kingdom — 2.9% | | | | | | | | | | |

Network Rail Infrastructure Finance

PLC, 4.750%, 1/22/24 | | GBP | | | 1,955,000 | | | | 2,490,964 | |

U.K. Treasury Bills, 0.000%,

1/08/24 # | | GBP | | | 839,000 | | | | 1,068,513 | |

U.K. Treasury Bills, 0.000%,

1/15/24 # | | GBP | | | 1,000,000 | | | | 1,272,280 | |

U.K. Treasury Bills, 0.000%,

3/11/24 # | | GBP | | | 9,500,000 | | | | 11,990,178 | |

| | | | | | | | | | 16,821,935 | |

| | | | | | | | | | | |

| United States — 15.7% | | | | | | | | | | |

Amazon.com, Inc., 2.730%,

4/13/24 | | USD | | | 7,000,000 | | | | 6,950,907 | |

| Apple, Inc., 2.513%, 8/19/24 | | CAD | | | 5,000,000 | | | | 3,708,434 | |

Exxon Mobil Corp., 0.142%,

6/26/24 | | EUR | | | 4,614,000 | | | | 5,003,122 | |

Roche Holdings, Inc., 3.350%,

9/30/24 ± | | USD | | | 5,000,000 | | | | 4,935,364 | |

Roche Holdings, Inc., (SOFR +

0.740%), 6.136%, 11/13/26 ±‡ | | USD | | | 1,050,000 | | | | 1,052,667 | |

| Sanofi SA, 0.625%, 4/05/24 | | EUR | | | 2,800,000 | | | | 3,066,236 | |

U.S. Treasury Floating Rate

Notes, (3 mo. Treasury Money

Market Yield + 0.125%),

5.456%, 7/31/25 ‡ | | USD | | | 45,000,000 | | | | 44,942,585 | |

U.S. Treasury Floating Rate

Notes, (3 mo. Treasury Money

Market Yield + 0.170%),

5.486%, 10/31/25 ‡ | | USD | | | 22,500,000 | | | | 22,471,168 | |

| | | | | | | | | | 92,130,483 | |

TOTAL BONDS AND NOTES

(Identified Cost $443,848,558) | | | | | | | | | 448,520,701 | |

| | | | | | | | | | | |

| SHORT-TERM INVESTMENTS — 25.5% | | | | | | | | | | |

| Commercial Paper — 23.1% | | | | | | | | | | |

Australia & New Zealand Banking

Group Ltd., 0.010%, 2/20/24 | | | | | 5,000,000 | | | | 4,960,755 | |

Australia & New Zealand Banking

Group Ltd., 0.010%, 2/22/24 | | | | | 4,000,000 | | | | 3,967,448 | |

Bank of Montreal, 0.000%,

4/11/24 # | | | | | 4,250,000 | | | | 4,184,662 | |

Bank of Montreal, 0.000%,

5/01/24 # | | | | | 9,000,000 | | | | 8,836,062 | |

Caisse d’Amortissement de

la Dette Sociale, 0.010%,

4/29/24 | | | | | 4,000,000 | | | | 3,927,537 | |

Caisse des Depots et

Consignations, 0.010%,

3/01/24 | | | | | 3,000,000 | | | | 2,971,776 | |

Caisse des Depots et

Consignations, 0.010%,

3/26/24 | | | | | 2,000,000 | | | | 1,973,677 | |

Caisse des Depots et

Consignations, 1.000%,

5/15/24 | | | | | 6,750,000 | | | | 6,613,421 | |

Canadian Imperial Bank of

Commerce, 0.010%, 6/11/24 | | | | | 3,000,000 | | | | 2,928,218 | |

CDP Financial, Inc., 5.550%,

3/11/24 | | | | | 3,000,000 | | | | 2,967,276 | |

CDP Financial, Inc., 0.000%,

3/27/24 # | | | | | 6,000,000 | | | | 5,920,127 | |

CDP Financial, Inc., 0.000%,

4/10/24 # | | | | | 3,000,000 | | | | 2,954,024 | |

Cooperatieve Rabobank UA,

5.550%, 2/12/24 | | | | | 5,000,000 | | | | 4,967,037 | |

Corpoerative Centrale, 5.570%,

2/12/24 | | | | | 5,000,000 | | | | 4,967,037 | |

DNB Bank ASA, 5.540%,

1/19/24 | | | | | 7,000,000 | | | | 6,978,489 | |

| | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

7

SA Global Fixed Income Fund

PORTFOLIO OF INVESTMENTS — AS OF DECEMBER 31, 2023 (Unaudited) (Continued)

| | | FACE

AMOUNT | | | VALUE† | |

| SHORT-TERM INVESTMENTS (Continued) | | | | | | | | |

| Commercial Paper (Continued) | | | | | | | | |

DNB Bank ASA, 1.000%,

4/23/24 | | | 4,500,000 | | | $ | 4,423,389 | |

DNB Bank ASA, 0.000%,

5/16/24 # | | | 2,000,000 | | | | 1,959,533 | |

Export Development Canada,

0.010%, 1/17/24 | | | 5,000,000 | | | | 4,986,000 | |

FMS Wertmanagement, 0.000%,

5/10/24 # | | | 2,000,000 | | | | 1,961,415 | |

LVMH Moet Hennessy Louis

Vuitton SE, 5.460%, 2/06/24 | | | 1,750,000 | | | | 1,739,899 | |

National Securities Clearing

Corp., 0.000%, 4/22/24 # | | | 3,500,000 | | | | 3,440,415 | |

National Securities Clearing

Corp., 0.000%, 5/07/24 # | | | 3,000,000 | | | | 2,942,627 | |

Nederlandse Waterschapsbank

NV, 0.000%, 4/02/24 # | | | 3,600,000 | | | | 3,549,517 | |

| NRW Bank, 0.010%, 2/09/24 | | | 1,300,000 | | | | 1,291,966 | |

| NRW Bank, 0.010%, 2/12/24 | | | 1,500,000 | | | | 1,490,072 | |

| NRW Bank, 0.010%, 3/04/24 | | | 3,200,000 | | | | 3,169,064 | |

| NRW Bank, 5.550%, 3/07/24 | | | 7,000,000 | | | | 6,929,330 | |

Oesterreichische Kontrollbank

AG, 0.000%, 2/12/24 # | | | 1,200,000 | | | | 1,191,975 | |

Province of Alberta Canada,

0.000%, 3/07/24 # | | | 6,000,000 | | | | 5,938,728 | |

PSP Capital, Inc., 5.450%,

2/02/24 | | | 3,500,000 | | | | 3,482,056 | |

Toronto-Dominion Bank (The),

0.000%, 3/18/24 # | | | 2,000,000 | | | | 1,975,993 | |

Toronto-Dominion Bank (The),

0.000%, 3/12/24 # | | | 3,000,000 | | | | 2,966,795 | |

Toronto-Dominion Bank (The),

0.000%, 3/05/24 # | | | 3,400,000 | | | | 3,366,053 | |

United Overseas Bank Ltd.,

5.600%, 2/27/24 | | | 10,000,000 | | | | 9,910,250 | |

| | | | | | | | 135,832,623 | |

| | | | | | | | | |

| | | SHARES | | | | | |

| Investment Company — 1.3% | | | | | | | | |

State Street Institutional U.S.

Government Money Market

Fund 5.070% | | | 7,786,761 | | | | 7,786,761 | |

| | | | | | | | | |

| Collateral For Securities On Loan — 1.1% | | | | | | | | |

State Street Navigator Securities

Lending Government Money

Market Portfolio 5.360% | | | 6,114,720 | | | | 6,114,720 | |

| | | | | | | | | |

TOTAL SHORT-TERM INVESTMENTS

(Identified Cost $149,734,455) | | | | | | | 149,734,104 | |

| | | | | | | | | |

Total Investments — 101.8%

(Identified Cost $593,583,013) | | | | | | | 598,254,805 | |

Liabilities in excess of Cash and

Other Assets — (1.8%) | | | | | | | (10,421,722 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 587,833,083 | |

| | † | See Note 1 |

| | ‡ | Floating rate or variable rate note. Rate shown is as of December 31, 2023. |

| | ± | 144A Securities. Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration to qualified institutional buyers. These securities have been deemed by the Fund to be liquid and at December 31, 2023 amounted to $21,420,676 or 3.64% of the net assets of the Fund. |

| | # | Zero coupon bond |

| | @ | A portion or all of the security was held on loan. As of December 31, 2023, the market value of the securities on loan was $5,982,590. |

Key to abbreviations:

AUD — Australian Dollar

CAD — Canadian Dollar

DKK — Danish Krone

EUR — Euro Currency

GBP — British Pound

NOK — Norwegian Krone

NZD — New Zealand Dollar

OAT — Obligations Assimilables du Trésor

SEK — Swedish Krona

SOFR — Secured Overnight Financing Rate

SGD — Singapore Dollar

USD — U.S. Dollar

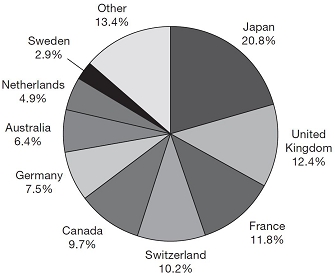

Country weightings as of December 31, 2023

(As a percentage of total investment excludingshort-term money

market investment)

The accompanying notes are an integral part of these financial statements.

8

SA Global Fixed Income Fund

PORTFOLIO OF INVESTMENTS — AS OF DECEMBER 31, 2023 (Unaudited) (Continued)

Forward Foreign Currency Exchange Contracts sold outstanding as of December 31, 2023

Settlement

Date | | | | Currency

Purchased | | | | Currency

Sold | | Counterparty | | | Total

Value | | | Unrealized

Appreciation | | | Unrealized

Depreciation | |

| 01/04/24 | | USD | | 65,014,277 | | GBP | | 53,473,643 | | Bank of America N.A. | | $ | 68,160,561 | | | $ | — | | | $ | (3,146,284 | ) |

| 01/04/24 | | USD | | 9,289,930 | | GBP | | 7,404,685 | | State Street Bank and Trust Co. | | | 9,438,435 | | | | — | | | | (148,504 | ) |

| 01/05/24 | | USD | | 3,629,617 | | DKK | | 25,485,361 | | Morgan Stanley & Co., Inc. | | | 3,774,472 | | | | — | | | | (144,855 | ) |

| 01/05/24 | | USD | | 30,564,038 | | EUR | | 28,803,893 | | Morgan Stanley & Co., Inc. | | | 31,800,506 | | | | — | | | | (1,236,467 | ) |

| 01/08/24 | | USD | | 8,475,297 | | NOK | | 92,418,010 | | Morgan Stanley & Co., Inc. | | | 9,097,537 | | | | — | | | | (622,240 | ) |

| 01/10/24 | | USD | | 27,209,567 | | AUD | | 42,278,066 | | State Street Bank and Trust Co. | | | 28,816,943 | | | | — | | | | (1,607,376 | ) |

| 01/12/24 | | USD | | 23,323,796 | | EUR | | 21,561,974 | | State Street Bank and Trust Co. | | | 23,811,621 | | | | — | | | | (487,824 | ) |

| 01/16/24 | | USD | | 6,925,819 | | NZD | | 11,691,368 | | State Street Bank and Trust Co. | | | 7,390,939 | | | | — | | | | (465,120 | ) |

| 01/16/24 | | USD | | 5,125,063 | | SEK | | 55,661,908 | | Morgan Stanley & Co., Inc. | | | 5,521,542 | | | | — | | | | (396,480 | ) |

| 01/16/24 | | USD | | 3,820,216 | | SEK | | 39,841,091 | | State Street Bank and Trust Co. | | | 3,952,151 | | | | — | | | | (131,935 | ) |

| 01/18/24 | | USD | | 4,946,727 | | SEK | | 54,245,527 | | HSBC Bank USA | | | 5,381,468 | | | | — | | | | (434,741 | ) |

| 01/19/24 | | USD | | 11,612,751 | | AUD | | 17,122,032 | | State Street Bank and Trust Co. | | | 11,673,828 | | | | — | | | | (61,077 | ) |

| 01/19/24 | | USD | | 17,635,821 | | EUR | | 16,023,952 | | State Street Bank and Trust Co. | | | 17,700,667 | | | | — | | | | (64,847 | ) |

| 01/22/24 | | USD | | 795,990 | | DKK | | 5,414,576 | | State Street Bank and Trust Co. | | | 802,602 | | | | — | | | | (6,613 | ) |

| 01/23/24 | | USD | | 12,810,749 | | AUD | | 19,521,017 | | State Street Bank and Trust Co. | | | 13,311,165 | | | | — | | | | (500,417 | ) |

| 01/23/24 | | USD | | 20,999,067 | | CAD | | 28,711,063 | | Morgan Stanley & Co., Inc. | | | 21,674,466 | | | | — | | | | (675,398 | ) |

| 01/23/24 | | USD | | 1,565,888 | | CAD | | 2,154,208 | | State Street Bank and Trust Co. | | | 1,626,248 | | | | — | | | | (60,360 | ) |

| 01/23/24 | | USD | | 28,723,652 | | EUR | | 26,888,733 | | HSBC Bank USA | | | 29,706,991 | | | | — | | | | (983,339 | ) |

| 01/23/24 | | USD | | 2,263,751 | | SEK | | 24,878,590 | | State Street Bank and Trust Co. | | | 2,468,590 | | | | — | | | | (204,839 | ) |

| 01/29/24 | | USD | | 231,342 | | DKK | | 1,555,987 | | State Street Bank and Trust Co. | | | 230,726 | | | | 616 | | | | — | |

| 03/14/24 | | USD | | 5,085,102 | | SGD | | 6,800,000 | | State Street Bank and Trust Co. | | | 5,169,271 | | | | — | | | | (84,169 | ) |

| | | | | | | | | | | | | | | | | $ | 616 | | | $ | (11,462,885 | ) |

Forward Foreign Currency Exchange Contracts purchased outstanding as of December 31, 2023

Settlement

Date | | | | Currency

Purchased | | | | Currency

Sold | | Counterparty | | Total

Value | | | Unrealized

Appreciation | | | Unrealized

Depreciation | |

| 01/04/24 | | GBP | | 32,054,879 | | USD | | 40,542,410 | | State Street Bank and Trust Co. | | $ | 40,858,980 | | | $ | 316,570 | | | $ | — | |

| 01/04/24 | | GBP | | 1,675,856 | | USD | | 2,136,731 | | State Street Bank and Trust Co. | | | 2,136,142 | | | | — | | | | (589 | ) |

| 01/05/24 | | DKK | | 25,485,361 | | USD | | 3,653,094 | | State Street Bank and Trust Co. | | | 3,774,473 | | | | 121,378 | | | | — | |

| 01/05/24 | | EUR | | 7,927,047 | | USD | | 8,403,396 | | State Street Bank and Trust Co. | | | 8,751,738 | | | | 348,341 | | | | — | |

| 01/10/24 | | AUD | | 912,235 | | USD | | 609,275 | | State Street Bank and Trust Co. | | | 621,784 | | | | 12,509 | | | | — | |

| 01/16/24 | | SEK | | 38,099,555 | | USD | | 3,521,410 | | State Street Bank and Trust Co. | | | 3,779,394 | | | | 257,984 | | | | — | |

| 01/18/24 | | SEK | | 54,245,527 | | USD | | 5,022,550 | | State Street Bank and Trust Co. | | | 5,381,468 | | | | 358,918 | | | | — | |

| 01/22/24 | | DKK | | 5,414,576 | | USD | | 800,176 | | State Street Bank and Trust Co. | | | 802,602 | | | | 2,427 | | | | — | |

| 01/23/24 | | CAD | | 984,209 | | USD | | 710,920 | | State Street Bank and Trust Co. | | | 742,996 | | | | 32,076 | | | | — | |

| 01/23/24 | | EUR | | 5,395,644 | | USD | | 5,781,132 | | State Street Bank and Trust Co. | | | 5,961,171 | | | | 180,040 | | | | — | |

| | | | | | | | | | | | | | | | | $ | 1,630,243 | | | $ | (589 | ) |

| Total | | | | | | | | | | | | | | | | $ | 1,630,859 | | | $ | (11,463,474 | ) |

The accompanying notes are an integral part of these financial statements.

9

SA U.S. Core Market Fund

SUMMARY PORTFOLIO OF INVESTMENTS — AS OF DECEMBER 31, 2023 (Unaudited)

| | | SHARES | | | VALUE† | |

| COMMON STOCKS — 95.8% | | | | | | | | |

| Aerospace & Defense — 1.6% | | | | | | | | |

| Lockheed Martin Corp. | | | 5,830 | | | $ | 2,642,389 | |

| Other Securities^ | | | 44,445 | | | | 7,932,818 | |

| | | | | | | | 10,575,207 | |

| | | | | | | | | |

| Air Freight & Logistics — 0.7% | | | | | | | | |

| United Parcel Service, Inc., Class B | | | 14,911 | | | | 2,344,457 | |

| Other Securities^ | | | 13,055 | | | | 2,021,799 | |

| | | | | | | | 4,366,256 | |

| | | | | | | | | |

| Automobile Components — 0.1% | | | | | | | | |

| Other Securities^ | | | 17,795 | | | | 906,212 | |

| | | | | | | | | |

| Automobiles — 1.4% | | | | | | | | |

| Tesla, Inc. * | | | 32,766 | | | | 8,141,696 | |

| Other Securities^ | | | 41,644 | | | | 876,173 | |

| | | | | | | | 9,017,869 | |

| | | | | | | | | |

| Beverages — 1.8% | | | | | | | | |

| Coca-Cola Co. (The) | | | 73,733 | | | | 4,345,085 | |

| PepsiCo, Inc. | | | 32,018 | | | | 5,437,937 | |

| Other Securities^ | | | 24,519 | | | | 1,819,786 | |

| | | | | | | | 11,602,808 | |

| | | | | | | | | |

| Biotechnology — 2.4% | | | | | | | | |

| AbbVie, Inc. | | | 37,978 | | | | 5,885,451 | |

| Amgen, Inc. | | | 12,097 | | | | 3,484,178 | |

| Other Securities^ | | | 46,935 | | | | 6,048,038 | |

| | | | | | | | 15,417,667 | |

| | | | | | | | | |

| Broadline Retail — 3.4% | | | | | | | | |

| Amazon.com, Inc. * | | | 143,078 | | | | 21,739,271 | |

| Other Securities^ | | | 12,658 | | | | 697,805 | |

| | | | | | | | 22,437,076 | |

| | | | | | | | | |

| Building Products — 0.7% | | | | | | | | |

| Other Securities^ | | | 41,993 | | | | 4,613,525 | |

| | | | | | | | | |

| Capital Markets — 2.4% | | | | | | | | |

| Other Securities^ | | | 110,532 | | | | 15,573,435 | |

| | | | | | | | | |

| Chemicals — 1.4% | | | | | | | | |

| Other Securities^ | | | 76,390 | | | | 9,458,332 | |

| | | | | | | | | |

| Commercial Banks — 2.3% | | | | | | | | |

| JPMorgan Chase & Co. | | | 37,681 | | | | 6,409,538 | |

| Other Securities^ | | | 218,386 | | | | 8,365,324 | |

| | | | | | | | 14,774,862 | |

| | | | | | | | | |

| Commercial Services & Supplies — 0.8% | | | | | | | | |

| Other Securities^ | | | 38,476 | | | | 5,048,279 | |

| | | | | | | | | |

| Communications Equipment — 0.8% | | | | | | | | |

| Cisco Systems, Inc. | | | 63,490 | | | | 3,207,515 | |

| Other Securities^ | | | 13,868 | | | | 1,936,565 | |

| | | | | | | | 5,144,080 | |

| | | | | | | | | |

| Computers & Peripherals — 6.8% | | | | | | | | |

| Apple, Inc. | | | 218,711 | | | | 42,108,429 | |

| Other Securities^ | | | 44,842 | | | | 2,030,416 | |

| | | | | | | | 44,138,845 | |

| | | | | | | | | |

| Construction & Engineering — 0.2% | | | | | | | | |

| Other Securities^ | | | 14,260 | | | | 1,159,717 | |

| | | | | | | | | |

| Construction Materials — 0.1% | | | | | | | | |

| Other Securities^ | | | 5,136 | | | | 920,399 | |

| | | | | | | | | |

| Consumer Finance — 0.6% | | | | | | | | |

| American Express Co. | | | 12,072 | | | | 2,261,569 | |

| Other Securities^ | | | 18,881 | | | | 1,759,920 | |

| | | | | | | | 4,021,489 | |

| | | | | | | | | |

| Consumer Staples Distribution & Retail — 2.1% | | | | | | | | |

| Costco Wholesale Corp. | | | 7,611 | | | | 5,023,869 | |

| Walmart, Inc. | | | 25,166 | | | | 3,967,420 | |

| Other Securities^ | | | 58,215 | | | | 4,922,015 | |

| | | | | | | | 13,913,304 | |

| | | | | | | | | |

| Containers & Packaging — 0.4% | | | | | | | | |

| Other Securities^ | | | 52,280 | | | | 2,624,615 | |

| | | | | | | | | |

| Distributors — 0.1% | | | | | | | | |

| Other Securities^ | | | 7,254 | | | | 815,236 | |

| | | | | | | | | |

| Diversified Consumer Services — 0.1% | | | | | | | | |

| Other Securities^ | | | 10,493 | | | | 431,014 | |

| | | | | | | | | |

| Diversified Telecommunication Services — 0.6% | | | | | | | | |

| Verizon Communications, Inc. | | | 73,799 | | | | 2,782,222 | |

| Other Securities^ | | | 68,193 | | | | 1,210,617 | |

| | | | | | | | 3,992,839 | |

| | | | | | | | | |

| Electric Utilities — 1.5% | | | | | | | | |

| Other Securities^ | | | 163,283 | | | | 10,016,554 | |

| | | | | | | | | |

| Electrical Equipment — 0.7% | | | | | | | | |

| Other Securities^ | | | 27,368 | | | | 4,344,953 | |

| | | | | | | | | |

| Electronic Equipment, Instruments & Components — 0.8% | | | | | | | | |

| Other Securities^ | | | 50,989 | | | | 4,910,580 | |

| | | | | | | | | |

| Energy Equipment & Services — 0.3% | | | | | | | | |

| Other Securities^ | | | 49,147 | | | | 1,668,050 | |

| | | | | | | | | |

| Entertainment — 0.8% | | | | | | | | |

| Netflix, Inc. * | | | 4,747 | | | | 2,311,219 | |

| Other Securities^ | | | 47,160 | | | | 3,232,598 | |

| | | | | | | | 5,543,817 | |

| | | | | | | | | |

| Financial Services — 4.1% | | | | | | | | |

| Berkshire Hathaway, Inc., Class B* | | | 15,784 | | | | 5,629,521 | |

| MasterCard, Inc., Class A | | | 19,164 | | | | 8,173,638 | |

| Visa, Inc., Class A | | | 32,889 | | | | 8,562,651 | |

| Other Securities^ | | | 67,661 | | | | 4,520,953 | |

| | | | | | | | 26,886,763 | |

The accompanying notes are an integral part of these financial statements.

10

SA U.S. Core Market Fund

SUMMARY PORTFOLIO OF INVESTMENTS — AS OF DECEMBER 31, 2023 (Unaudited) (Continued)

| | | SHARES | | | VALUE† | |

| COMMON STOCKS (Continued) | | | | | | | | |

| Food Products — 0.8% | | | | | | | | |

| Other Securities^ | | | 75,895 | | | $ | 4,939,966 | |

| | | | | | | | | |

| Gas Utilities — 0.1% | | | | | | | | |

| Other Securities^ | | | 9,056 | | | | 550,260 | |

| | | | | | | | | |

| Ground Transportation — 1.3% | | | | | | | | |

| Union Pacific Corp. | | | 15,597 | | | | 3,830,935 | |

| Other Securities^ | | | 63,987 | | | | 4,644,134 | |

| | | | | | | | 8,475,069 | |

| | | | | | | | | |

| Health Care Equipment & Supplies — 1.6% | | | | | | | | |

| Other Securities^ | | | 83,737 | | | | 10,154,856 | |

| | | | | | | | | |

| Health Care Providers & Services — 2.7% | | | | | | | | |

| UnitedHealth Group, Inc. | | | 14,112 | | | | 7,429,545 | |

| Other Securities^ | | | 57,496 | | | | 9,875,887 | |

| | | | | | | | 17,305,432 | |

| | | | | | | | | |

| Health Care Technology — 0.0% | | | | | | | | |

| Other Securities^ | | | 1,334 | | | | 256,822 | |

| | | | | | | | | |

| Hotels, Restaurants & Leisure — 2.1% | | | | | | | | |

| McDonald’s Corp. | | | 11,067 | | | | 3,281,476 | |

| Other Securities^ | | | 71,481 | | | | 10,334,197 | |

| | | | | | | | 13,615,673 | |

| | | | | | | | | |

| Household Durables — 0.5% | | | | | | | | |

| Other Securities^ | | | 24,012 | | | | 3,289,521 | |

| | | | | | | | | |

| Household Products — 1.3% | | | | | | | | |

| Procter & Gamble Co. (The) | | | 45,612 | | | | 6,683,982 | |

| Other Securities^ | | | 21,817 | | | | 2,060,955 | |

| | | | | | | | 8,744,937 | |

| | | | | | | | | |

| Independent Power Producers & Energy Traders — 0.1% | | | | | | | | |

| Other Securities^ | | | 17,302 | | | | 455,504 | |

| | | | | | | | | |

| Industrial Conglomerates — 0.7% | | | | | | | | |

| Honeywell International, Inc. | | | 12,502 | | | | 2,621,795 | |

| Other Securities^ | | | 15,880 | | | | 1,785,969 | |

| | | | | | | | 4,407,764 | |

| | | | | | | | | |

| Insurance — 1.9% | | | | | | | | |

| Other Securities^ | | | 104,625 | | | | 12,693,077 | |

| | | | | | | | | |

| Interactive Media & Services — 6.0% | | | | | | | | |

| Alphabet, Inc., Class A * | | | 86,420 | | | | 12,072,010 | |

| Alphabet, Inc., Class C * | | | 87,329 | | | | 12,307,276 | |

| Meta Platforms, Inc., Class A * | | | 40,998 | | | | 14,511,652 | |

| Other Securities^ | | | 9,025 | | | | 238,301 | |

| | | | | | | | 39,129,239 | |

| | | | | | | | | |

| IT Services — 1.7% | | | | | | | | |

| Accenture PLC, Class A | | | 12,877 | | | | 4,518,668 | |

International Business Machines

Corp. | | | 20,148 | | | | 3,295,205 | |

| Other Securities^ | | | 24,607 | | | | 3,226,212 | |

| | | | | | | | 11,040,085 | |

| | | | | | | | | |

| Leisure Equipment & Products — 0.1% | | | | | | | | |

| Other Securities^ | | | 13,013 | | | | 572,398 | |

| | | | | | | | | |

| Life Sciences Tools & Services — 1.2% | | | | | | | | |

| Thermo Fisher Scientific, Inc. | | | 4,458 | | | | 2,366,262 | |

| Other Securities^ | | | 30,049 | | | | 5,290,204 | |

| | | | | | | | 7,656,466 | |

| | | | | | | | | |

| Machinery — 2.3% | | | | | | | | |

| Caterpillar, Inc. | | | 11,832 | | | | 3,498,367 | |

| Other Securities^ | | | 74,952 | | | | 11,721,588 | |

| | | | | | | | 15,219,955 | |

| | | | | | | | | |

| Marine Transportation — 0.0% | | | | | | | | |

| Other Securities^ | | | 322 | | | | 25,271 | |

| | | | | | | | | |

| Media — 0.8% | | | | | | | | |

| Comcast Corp., Class A | | | 59,894 | | | | 2,626,352 | |

| Other Securities^ | | | 47,759 | | | | 2,672,256 | |

| | | | | | | | 5,298,608 | |

| | | | | | | | | |

| Metals & Mining — 0.5% | | | | | | | | |

| Other Securities^ | | | 48,900 | | | | 3,225,859 | |

| | | | | | | | | |

| Multi-Utilities — 0.6% | | | | | | | | |

| Other Securities^ | | | 65,593 | | | | 3,978,083 | |

| | | | | | | | | |

| Oil, Gas & Consumable Fuels — 3.4% | | | | | | | | |

| Chevron Corp. | | | 20,640 | | | | 3,078,662 | |

| ConocoPhillips | | | 20,640 | | | | 2,395,685 | |

| Exxon Mobil Corp. | | | 58,738 | | | | 5,872,625 | |

| Other Securities^ | | | 177,204 | | | | 10,949,241 | |

| | | | | | | | 22,296,213 | |

| | | | | | | | | |

| Paper & Forest Products — 0.0% | | | | | | | | |

| Other Securities^ | | | 1,020 | | | | 72,247 | |

| | | | | | | | | |

| Passenger Airlines — 0.1% | | | | | | | | |

| Other Securities^ | | | 26,155 | | | | 708,811 | |

| | | | | | | | | |

| Personal Products — 0.3% | | | | | | | | |

| Other Securities^ | | | 67,791 | | | | 2,206,853 | |

| | | | | | | | | |

| Pharmaceuticals — 4.4% | | | | | | | | |

| Eli Lilly & Co. | | | 19,445 | | | | 11,334,879 | |

| Johnson & Johnson | | | 37,932 | | | | 5,945,462 | |

| Merck & Co., Inc. | | | 40,422 | | | | 4,406,807 | |

| Other Securities^ | | | 146,853 | | | | 6,834,475 | |

| | | | | | | | 28,521,623 | |

The accompanying notes are an integral part of these financial statements.

11

SA U.S. Core Market Fund

SUMMARY PORTFOLIO OF INVESTMENTS — AS OF DECEMBER 31, 2023 (Unaudited) (Continued)

| | | SHARES | | | VALUE† | |

| COMMON STOCKS (Continued) | | | | | | | | |

| Professional Services — 1.2% | | | | | | | | |

| Automatic Data Processing, Inc. | | | 9,817 | | | $ | 2,287,067 | |

| Other Securities^ | | | 53,100 | | | | 5,311,734 | |

| | | | | | | | 7,598,801 | |

| | | | | | | | | |

| Real Estate Management & Development — 0.2% | | | | | | | | |

| Other Securities^ | | | 11,262 | | | | 1,054,487 | |

| | | | | | | | | |

| Semiconductors & Semiconductor Equipment — 7.9% | | | | | | | | |

| Advanced Micro Devices, Inc. * | | | 15,685 | | | | 2,312,126 | |

| Applied Materials, Inc. | | | 18,581 | | | | 3,011,423 | |

| Broadcom, Inc. | | | 8,421 | | | | 9,399,941 | |

| NVIDIA Corp. | | | 33,925 | | | | 16,800,338 | |

| QUALCOMM, Inc. | | | 25,043 | | | | 3,621,969 | |

| Texas Instruments, Inc. | | | 19,702 | | | | 3,358,403 | |

| Other Securities^@ | | | 107,672 | | | | 12,660,357 | |

| | | | | | | | 51,164,557 | |

| | | | | | | | | |

| Software — 8.3% | | | | | | | | |

| Adobe, Inc. * | | | 8,683 | | | | 5,180,278 | |

| Microsoft Corp. | | | 84,739 | | | | 31,865,253 | |

| Oracle Corp. | | | 26,244 | | | | 2,766,905 | |

| Other Securities^ | | | 89,752 | | | | 14,129,820 | |

| | | | | | | | 53,942,256 | |

| | | | | | | | | |

| Specialty Retail — 2.6% | | | | | | | | |

| Home Depot, Inc. (The) | | | 18,311 | | | | 6,345,677 | |

| TJX Cos., Inc. (The) | | | 26,082 | | | | 2,446,753 | |

| Other Securities^ | | | 45,891 | | | | 8,075,411 | |

| | | | | | | | 16,867,841 | |

| | | | | | | | | |

| Textiles, Apparel & Luxury Goods — 0.7% | | | | | | | | |

| Other Securities^ | | | 43,187 | | | | 4,564,829 | |

| | | | | | | | | |

| Tobacco — 0.5% | | | | | | | | |

| Other Securities^ | | | 48,948 | | | | 3,124,437 | |

| | | | | | | | | |

| Trading Companies & Distributors — 0.6% | | | | | | | | |

| Other Securities^ | | | 24,189 | | | | 3,835,236 | |

| | | | | | | | | |

| Water Utilities — 0.1% | | | | | | | | |

| Other Securities^ | | | 7,137 | | | | 595,441 | |

| | | | | | | | | |

| Wireless Telecommunication Services — 0.2% | | | | | | | | |

| Other Securities^ | | | 8,733 | | | | 1,400,162 | |

| | | | | | | | | |

TOTAL COMMON STOCKS

(Identified Cost $125,491,704) | | | | | | | 623,312,422 | |

| | | | | | | | | |

| MUTUAL FUNDS — 4.0% | | | | | | | | |

| | | | | | | | | |

| Others — 4.0% | | | | | | | | |

| DFA U.S. Micro Cap Portfolio | | | 996,416 | | | | 26,185,802 | |

| | | | | | | | | |

TOTAL MUTUAL FUNDS

(Identified Cost $11,701,377) | | | | | | | 26,185,802 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENTS — 0.3% | | | | | | | | |

| | | | | | | | | |

| Investment Company — 0.3% | | | | | | | | |

State Street Institutional U.S.

Government Money Market

Fund 5.070% | | | 1,794,923 | | | | 1,794,923 | |

| | | | | | | | | |

| Collateral For Securities On Loan — 0.0% | | | | | | | | |

State Street Navigator Securities

Lending Government Money Market

Portfolio 5.360% | | | 114,936 | | | | 114,936 | |

| | | | | | | | | |

TOTAL SHORT-TERM INVESTMENTS

(Identified Cost $1,909,859) | | | | | | | 1,909,859 | |

| | | | | | | | | |

Total Investments — 100.1%

(Identified Cost $139,102,940) | | | | | | | 651,408,083 | |

Liabilities in excess of Cash and

Other Assets — (0.1%) | | | | | | | (921,371 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 650,486,712 | |

| | † | See Note 1 |

| | ^ | The Summary Portfolio of Investments does not reflect the Fund’s complete portfolio holdings. “Other Securities” are those securities that are not among the top 50 holdings of the Fund or do not represent more than 1% of the net assets of the Fund. Certain individual securities within this category may include non-income producing, bankrupt/delisted, and/or fair valued securities. |

| | * | Non-income producing security |

| | @ | A portion or all of the security was held on loan. As of December 31, 2023, the fair value of the securities on loan was $657,584. |

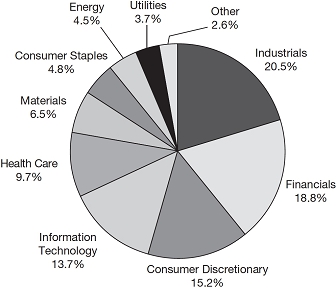

Portfolio Sectors as of December 31, 2023

(As a percentage of long-term investments)

The accompanying notes are an integral part of these financial statements.

12

SA U.S. Value Fund

SUMMARY PORTFOLIO OF INVESTMENTS — AS OF DECEMBER 31, 2023 (Unaudited)

| | | SHARES | | | VALUE† | |

| COMMON STOCKS — 99.7% | | | | | | | | |

| Aerospace & Defense — 2.0% | | | | | | | | |

| RTX Corp. | | | 36,091 | | | $ | 3,036,697 | |

| Other Securities^ | | | 56,112 | | | | 7,503,811 | |

| | | | | | | | 10,540,508 | |

| | | | | | | | | |

| Air Freight & Logistics — 0.8% | | | | | | | | |

| FedEx Corp. | | | 16,968 | | | | 4,292,395 | |

| | | | | | | | | |

| Automobile Components — 0.4% | | | | | | | | |

| Other Securities^ | | | 39,876 | | | | 2,432,185 | |

| | | | | | | | | |

| Automobiles — 1.0% | | | | | | | | |

| General Motors Co. | | | 98,964 | | | | 3,554,787 | |

| Other Securities^ | | | 150,516 | | | | 1,834,790 | |

| | | | | | | | 5,389,577 | |

| | | | | | | | | |

| Beverages — 0.4% | | | | | | | | |

| Other Securities^ | | | 18,957 | | | | 2,106,772 | |

| | | | | | | | | |

| Biotechnology — 1.9% | | | | | | | | |

| Gilead Sciences, Inc. | | | 45,490 | | | | 3,685,145 | |

| Other Securities^ | | | 22,332 | | | | 6,364,677 | |

| | | | | | | | 10,049,822 | |

| | | | | | | | | |

| Broadline Retail — 0.2% | | | | | | | | |

| Other Securities^ | | | 20,328 | | | | 886,707 | |

| | | | | | | | | |

| Building Products — 1.1% | | | | | | | | |

| Other Securities^ | | | 65,606 | | | | 5,947,653 | |

| | | | | | | | | |

| Capital Markets — 3.2% | | | | | | | | |

| Goldman Sachs Group, Inc. (The) | | | 18,498 | | | | 7,135,973 | |

| Morgan Stanley | | | 58,923 | | | | 5,494,570 | |

| Other Securities^ | | | 81,343 | | | | 4,654,560 | |

| | | | | | | | 17,285,103 | |

| | | | | | | | | |

| Chemicals — 4.0% | | | | | | | | |

| Linde PLC | | | 14,100 | | | | 5,791,011 | |

| Other Securities^ | | | 187,299 | | | | 15,754,102 | |

| | | | | | | | 21,545,113 | |

| | | | | | | | | |

| Commercial Banks — 10.3% | | | | | | | | |

| Bank of America Corp. | | | 196,564 | | | | 6,618,310 | |

| Citigroup, Inc. | | | 79,030 | | | | 4,065,303 | |

| JPMorgan Chase & Co. | | | 142,484 | | | | 24,236,528 | |

| Wells Fargo & Co. | | | 126,013 | | | | 6,202,360 | |

| Other Securities^ | | | 458,809 | | | | 14,495,791 | |

| | | | | | | | 55,618,292 | |

| | | | | | | | | |

| Commercial Services & Supplies — 0.2% | | | | | | | | |

| Other Securities^ | | | 8,792 | | | | 922,830 | |

| | | | | | | | | |

| Communications Equipment — 0.5% | | | | | | | | |

| Other Securities^ | | | 58,476 | | | | 2,546,768 | |

| | | | | | | | | |

| Computers & Peripherals — 1.1% | | | | | | | | |

| Other Securities^ | | | 245,284 | | | | 5,895,586 | |

| | | | | | | | | |

| Construction & Engineering — 0.2% | | | | | | | | |

| Other Securities^ | | | 7,778 | | | | 849,076 | |

| | | | | | | | | |

| Construction Materials — 0.7% | | | | | | | | |

| Other Securities^ | | | 12,730 | | | | 4,014,416 | |

| | | | | | | | | |

| Consumer Finance — 1.4% | | | | | | | | |

| Capital One Financial Corp. | | | 28,539 | | | | 3,742,034 | |

| Other Securities^ | | | 86,437 | | | | 3,716,325 | |

| | | | | | | | 7,458,359 | |

| | | | | | | | | |

| Consumer Staples Distribution & Retail — 2.2% | | | | | | | | |

| Kroger Co. (The) | | | 64,415 | | | | 2,944,410 | |

| Walmart, Inc. | | | 34,998 | | | | 5,517,435 | |

| Other Securities^ | | | 66,489 | | | | 3,372,501 | |

| | | | | | | | 11,834,346 | |

| | | | | | | | | |

| Containers & Packaging — 0.5% | | | | | | | | |

| Other Securities^ | | | 81,189 | | | | 2,980,331 | |

| | | | | | | | | |

| Distributors — 0.4% | | | | | | | | |

| Other Securities^ | | | 40,502 | | | | 2,206,813 | |

| | | | | | | | | |

| Diversified Telecommunication Services — 2.8% | | | | | | | | |

| AT&T, Inc. | | | 455,881 | | | | 7,649,683 | |

| Verizon Communications, Inc. | | | 198,247 | | | | 7,473,912 | |

| | | | | | | | 15,123,595 | |

| | | | | | | | | |

| Electric Utilities — 0.2% | | | | | | | | |

| Other Securities^ | | | 22,148 | | | | 1,145,052 | |

| | | | | | | | | |

| Electrical Equipment — 0.4% | | | | | | | | |

| Other Securities^ | | | 13,646 | | | | 2,425,002 | |

| | | | | | | | | |

| Electronic Equipment, Instruments & Components — 1.3% | | | | | | | | |

| Other Securities^ | | | 140,790 | | | | 7,005,590 | |

| | | | | | | | | |

| Energy Equipment & Services — 0.3% | | | | | | | | |

| Other Securities^ | | | 49,652 | | | | 1,697,105 | |

| | | | | | | | | |

| Entertainment — 1.0% | | | | | | | | |

| Walt Disney Co. (The) | | | 34,691 | | | | 3,132,250 | |

| Other Securities^ | | | 97,449 | | | | 2,376,958 | |

| | | | | | | | 5,509,208 | |

The accompanying notes are an integral part of these financial statements.

13

SA U.S. Value Fund

SUMMARY PORTFOLIO OF INVESTMENTS — AS OF DECEMBER 31, 2023 (Unaudited) (Continued)

| | | SHARES | | | VALUE† | |

| COMMON STOCKS (Continued) | | | | | | | | |

| Financial Services — 3.3% | | | | | | | | |

| Berkshire Hathaway, Inc., Class B * | | | 38,117 | | | $ | 13,594,809 | |

| Other Securities^ | | | 47,636 | | | | 4,250,307 | |

| | | | | | | | 17,845,116 | |

| | | | | | | | | |

| Food Products — 2.8% | | | | | | | | |

| Mondelez International, Inc., Class A | | | 51,728 | | | | 3,746,659 | |

| Other Securities^ | | | 183,907 | | | | 11,387,178 | |

| | | | | | | | 15,133,837 | |

| | | | | | | | | |

| Ground Transportation — 1.0% | | | | | | | | |

| Norfolk Southern Corp. | | | 16,359 | | | | 3,866,941 | |

| Other Securities^@ | | | 20,030 | | | | 1,413,637 | |

| | | | | | | | 5,280,578 | |

| | | | | | | | | |

| Health Care Equipment & Supplies — 2.0% | | | | | | | | |

| Medtronic PLC | | | 37,706 | | | | 3,106,220 | |

| Other Securities^ | | | 69,716 | | | | 7,969,640 | |

| | | | | | | | 11,075,860 | |

| | | | | | | | | |

| Health Care Providers & Services — 5.1% | | | | | | | | |

| Cigna Group (The) | | | 19,065 | | | | 5,709,014 | |

| CVS Health Corp. | | | 58,448 | | | | 4,615,054 | |

| Elevance Health, Inc. | | | 13,010 | | | | 6,134,996 | |

| Humana, Inc. | | | 7,918 | | | | 3,624,940 | |

| Laboratory Corp. of America Holdings | | | 13,769 | | | | 3,129,556 | |

| Other Securities^ | | | 42,977 | | | | 4,486,421 | |

| | | | | | | | 27,699,981 | |

| | | | | | | | | |

| Hotels, Restaurants & Leisure — 0.5% | | | | | | | | |

| Other Securities^@ | | | 74,123 | | | | 2,588,312 | |

| | | | | | | | | |

| Household Durables — 3.2% | | | | | | | | |

| DR Horton, Inc. | | | 46,332 | | | | 7,041,537 | |

| Lennar Corp., Class A | | | 23,116 | | | | 3,445,209 | |

| PulteGroup, Inc. | | | 41,840 | | | | 4,318,725 | |

| Other Securities^@ | | | 16,717 | | | | 2,233,734 | |

| | | | | | | | 17,039,205 | |

| | | | | | | | | |

| Independent Power Producers & Energy Traders — 0.2% | | | | | | | | |

| Other Securities^ | | | 25,467 | | | | 980,989 | |

| | | | | | | | | |

| Industrial Conglomerates — 0.3% | | | | | | | | |

| Other Securities^ | | | 11,962 | | | | 1,526,710 | |

| | | | | | | | | |

| Insurance — 4.6% | | | | | | | | |

| Hartford Financial Services Group, Inc. (The) | | | 47,472 | | | | 3,815,799 | |

| Travelers Companies, Inc. (The) | | | 21,374 | | | | 4,071,533 | |

| Other Securities^@ | | | 200,433 | | | | 16,944,140 | |

| | | | | | | | 24,831,472 | |

| | | | | | | | | |

| Interactive Media & Services — 1.0% | | | | | | | | |

| Meta Platforms, Inc., Class A * | | | 15,106 | | | | 5,346,920 | |

| | | | | | | | | |

| IT Services — 0.8% | | | | | | | | |

| Other Securities^ | | | 65,046 | | | | 4,595,251 | |

| | | | | | | | | |

| Life Sciences Tools & Services — 1.6% | | | | | | | | |

| Danaher Corp. | | | 19,132 | | | | 4,425,997 | |

| Thermo Fisher Scientific, Inc. | | | 6,997 | | | | 3,713,937 | |

| Other Securities^ | | | 2,104 | | | | 266,724 | |

| | | | | | | | 8,406,658 | |

| | | | | | | | | |

| Machinery — 3.7% | | | | | | | | |

| PACCAR, Inc. | | | 34,507 | | | | 3,369,609 | |

| Parker-Hannifin Corp. | | | 6,463 | | | | 2,977,504 | |

| Other Securities^ | | | 116,861 | | | | 13,608,157 | |

| | | | | | | | 19,955,270 | |

| | | | | | | | | |

| Media — 2.9% | | | | | | | | |

| Comcast Corp., Class A | | | 280,380 | | | | 12,294,663 | |

| Other Securities^ | | | 113,898 | | | | 3,171,079 | |

| | | | | | | | 15,465,742 | |

| | | | | | | | | |

| Metals & Mining — 3.6% | | | | | | | | |

| Freeport-McMoRan, Inc. | | | 106,539 | | | | 4,535,365 | |

| Nucor Corp. | | | 38,084 | | | | 6,628,139 | |

| Steel Dynamics, Inc. | | | 33,820 | | | | 3,994,142 | |

| Other Securities^ | | | 52,486 | | | | 4,457,619 | |

| | | | | | | | 19,615,265 | |

| | | | | | | | | |

| Oil, Gas & Consumable Fuels — 13.3% | | | | | | | | |

| Chevron Corp. | | | 97,929 | | | | 14,607,090 | |

| ConocoPhillips | | | 92,400 | | | | 10,724,868 | |

| Exxon Mobil Corp. | | | 222,398 | | | | 22,235,352 | |

| Marathon Petroleum Corp. | | | 30,104 | | | | 4,466,229 | |

| Other Securities^ | | | 324,829 | | | | 19,347,441 | |

| | | | | | | | 71,380,980 | |

| | | | | | | | | |

| Passenger Airlines — 0.4% | | | | | | | | |

| Other Securities^ | | | 61,218 | | | | 2,218,286 | |

| | | | | | | | | |

| Personal Products — 0.0% | | | | | | | | |

| Other Securities^ | | | 1,233 | | | | 68,345 | |

| | | | | | | | | |

| Pharmaceuticals — 2.7% | | | | | | | | |

| Bristol-Myers Squibb Co. | | | 79,893 | | | | 4,099,310 | |

| Pfizer, Inc. | | | 322,258 | | | | 9,277,808 | |

| Other Securities^ | | | 73,753 | | | | 1,329,309 | |

| | | | | | | | 14,706,427 | |

| | | | | | | | | |

| Professional Services — 0.6% | | | | | | | | |

| Other Securities^ | | | 32,040 | | | | 3,214,101 | |

| | | | | | | | | |

| Real Estate Management & Development — 0.5% | | | | | | | | |

| Other Securities^ | | | 23,853 | | | | 2,675,718 | |

The accompanying notes are an integral part of these financial statements.

14

SA U.S. Value Fund

SUMMARY PORTFOLIO OF INVESTMENTS — AS OF DECEMBER 31, 2023 (Unaudited) (Continued)

| | | SHARES | | | VALUE† | |

| COMMON STOCKS (Continued) | | | | | | | | |

| Semiconductors & Semiconductor Equipment — 4.9% | | | | | | | | |

| Analog Devices, Inc. | | | 18,542 | | | $ | 3,681,700 | |

| Intel Corp. | | | 228,574 | | | | 11,485,844 | |

| Micron Technology, Inc. | | | 67,598 | | | | 5,768,813 | |

| Other Securities^ | | | 50,225 | | | | 5,217,624 | |

| | | | | | | | 26,153,981 | |

| | | | | | | | | |

| Software — 0.6% | | | | | | | | |

| Other Securities^ | | | 13,921 | | | | 3,014,434 | |

| | | | | | | | | |

| Specialty Retail — 0.1% | | | | | | | | |

| Other Securities^ | | | 8,119 | | | | 623,052 | |

| | | | | | | | | |

| Textiles, Apparel & Luxury Goods — 0.1% | | | | | | | | |

| Other Securities^ | | | 8,655 | | | | 498,576 | |

| | | | | | | | | |

| Trading Companies & Distributors — 0.5% | | | | | | | | |

| Other Securities^ | | | 4,510 | | | | 2,586,124 | |

| | | | | | | | | |

| Wireless Telecommunication Services — 0.9% | | | | | | | | |

| T-Mobile U.S., Inc. | | | 29,534 | | | | 4,735,186 | |

| | | | | | | | | |

TOTAL COMMON STOCKS

(Identified Cost $314,334,482) | | | | | | | 536,970,580 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENTS — 0.5% | | | | | | | | |

| Investment Company — 0.5% | | | | | | | | |

State Street Institutional U.S.

Government Money Market

Fund 5.070% | | | 2,454,862 | | | | 2,454,862 | |

| | | | | | | | | |

TOTAL SHORT-TERM INVESTMENTS

(Identified Cost $2,454,862) | | | | | | | 2,454,862 | |

| | | | | | | | | |

Total Investments — 100.2%

(Identified Cost $316,789,344) | | | | | | | 539,425,442 | |

Liabilities in excess of Cash and Other

Assets — (0.2%) | | | | | | | (1,101,623 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 538,323,819 | |

| | † | See Note 1 |

| | ^ | The Summary Portfolio of Investments does not reflect the Fund’s complete portfolio holdings. “Other Securities” are those securities that are not among the top 50 holdings of the Fund or do not represent more than 1% of the net assets of the Fund. Certain individual securities within this category may include non-income producing, bankrupt/delisted, and/or fair valued securities. |

| | * | Non-income producing security |

| | @ | A portion or all of the security was held on loan. As of December 31, 2023, the fair value of the securities on loan was $640,475. |

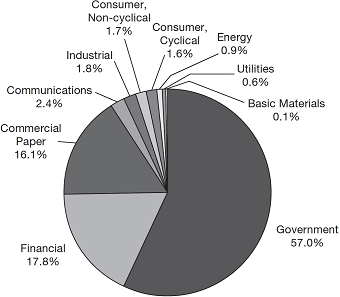

Portfolio Sectors as of December 31, 2023

(As a percentage of long-term investments)

The accompanying notes are an integral part of these financial statements.

15

SA U.S. Small Company Fund

SUMMARY PORTFOLIO OF INVESTMENTS — AS OF DECEMBER 31, 2023 (Unaudited)

| | | SHARES | | | VALUE† | |

| COMMON STOCKS — 99.9% | | | | | | | | |

| Aerospace & Defense — 1.2% | | | | | | | | |

| Other Securities^ | | | 55,684 | | | $ | 3,666,653 | |

| | | | | | | | | |

| Air Freight & Logistics — 0.2% | | | | | | | | |

| Other Securities^ | | | 19,908 | | | | 685,496 | |

| | | | | | | | | |

| Automobile Components — 1.6% | | | | | | | | |

| Autoliv, Inc. | | | 6,598 | | | | 727,034 | |

| Other Securities^ | | | 97,081 | | | | 4,409,929 | |

| | | | | | | | 5,136,963 | |

| | | | | | | | | |

| Automobiles — 0.3% | | | | | | | | |

| Other Securities^ | | | 30,654 | | | | 934,781 | |

| | | | | | | | | |

| Beverages — 0.7% | | | | | | | | |