EXHIBIT 10.43

LEASE AGREEMENT

between

NL VENTURES V PLANT CITY, L.P.

as Lessor

and

MODTECH HOLDINGS, INC.

as Lessee

| | | | | Page |

| | | ARTICLE I | | |

| | | | | |

| Section 1.01 | | Lease of Premises; Title and Condition | | 1 |

| Section 1.02 | | Use | | 2 |

| Section 1.03 | | Term | | 2 |

| Section 1.04 | | Options to Extend the Term | | 2 |

| Section 1.05 | | Rent | | 3 |

| | | | | |

| | | ARTICLE II | | |

| | | | | |

| Section 2.01 | | Maintenance and Repair | | 3 |

| Section 2.02 | | Alterations, Replacements and Additions | | 4 |

| | | ARTICLE III | | |

| | | | | |

| Section 3.01 | | Severable Property | | 5 |

| Section 3.02 | | Removal | | 5 |

| Section 3.03 | | License of Incidental Rights | | 5 |

| | | ARTICLE IV | | |

| | | | | |

| Section 4.01 | | Lessee’s Assignment and Subletting | | 5 |

| Section 4.02 | | Transfer by Lessor | | 6 |

| Section 4.03 | | Assignment/Subletting Exceptions | | 6 |

| | | ARTICLE V | | |

| | | | | |

| Section 5.01 | | Net Lease | | 7 |

| Section 5.02 | | Taxes and Assessments; Compliance With Law | | 8 |

| Section 5.03 | | Liens | | 10 |

| Section 5.04 | | Indemnification | | 11 |

| Section 5.05 | | Permitted Contests | | 12 |

| Section 5.06 | | Environmental Compliance | | 13 |

TABLE OF CONTENTS

(continued)

| | | | | Page |

| | | ARTICLE VI | | |

| | | | | |

| Section 6.01 | | Intentionally Deleted | | 16 |

| Section 6.02 | | Condemnation and Casualty | | 16 |

| Section 6.03 | | Insurance | | 18 |

| | | ARTICLE VII | | |

| | | | | |

| Section 7.01 | | Conditional Limitations; Default Provisions | | 20 |

| Section 7.02 | | Bankruptcy or Insolvency | | 24 |

| Section 7.03 | | Additional Rights of Lessor | | 24 |

| | | ARTICLE VIII | | |

| | | | | |

| Section 8.01 | | Notices and Other Instruments | | 25 |

| Section 8.02 | | Estoppel Certificates; Financial Information | | 26 |

| | | ARTICLE IX | | |

| | | | | |

| Section 9.01 | | No Merger | | 28 |

| Section 9.02 | | Surrender | | 28 |

| Section 9.03 | | Time | | 28 |

| Section 9.04 | | Separability; Binding Effect; Governing Law | | 28 |

| Section 9.05 | | Table of Contents and Headings; Internal References | | 28 |

| Section 9.06 | | Counterparts | | 28 |

| Section 9.07 | | Lessor’s Liability | | 29 |

| Section 9.08 | | Amendments and Modifications | | 29 |

| Section 9.09 | | Additional Rent | | 29 |

| Section 9.10 | | Consent of Lessor | | 29 |

| Section 9.11 | | Quiet Enjoyment | | 29 |

| Section 9.12 | | Holding Over | | 29 |

| Section 9.13 | | Compliance with Terrorism Laws | | 30 |

| Section 9.14 | | Financing and Subordination, Non-Disturbance and Attornment | | 30 |

| Section 9.15 | | Disclaimer of Purchase Rights | | 31 |

TABLE OF CONTENTS

| | | | | Page |

| Section 9.16 | | Security Deposit | | 31 |

| Section 9.17 | | Intentionally Deleted | | 32 |

| Section 9.18 | | Intentionally Deleted | | 32 |

| Section 9.19 | | Short Form Memorandum of Lease | | 32 |

| Section 9.20 | | Separation of Lease | | 32 |

| Section 9.21 | | Brokers | | 32 |

| Section 9.22 | | Waiver of Jury Trial | | 32 |

| Section 9.23 | | No Partnership | | 32 |

| Section 9.24 | | No Construction Against Drafter | | 33 |

| Section 9.25 | | Security Interest and Security Agreement | | 33 |

| Section 9.26 | | Radon Gas Disclosure | | 33 |

| | | | | |

| EXHIBIT A | | LEGAL DESCRIPTION | | |

| EXHIBIT B | | PERMITTED EXCEPTIONS | | |

| EXHIBIT C | | BASIC RENT SCHEDULE | | |

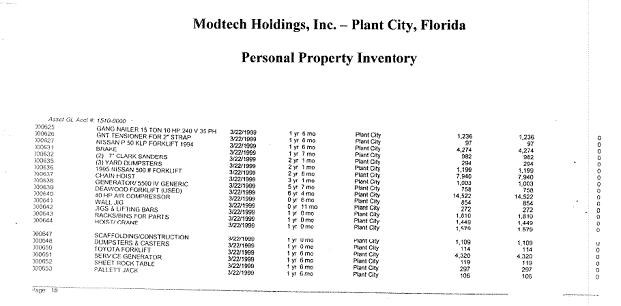

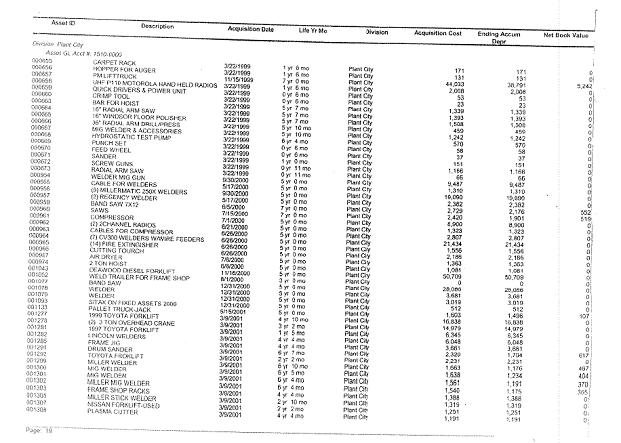

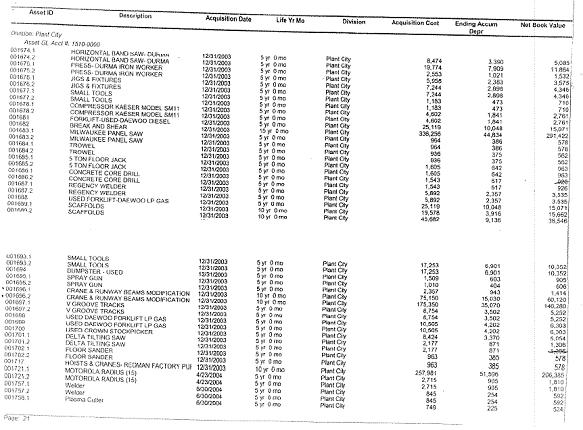

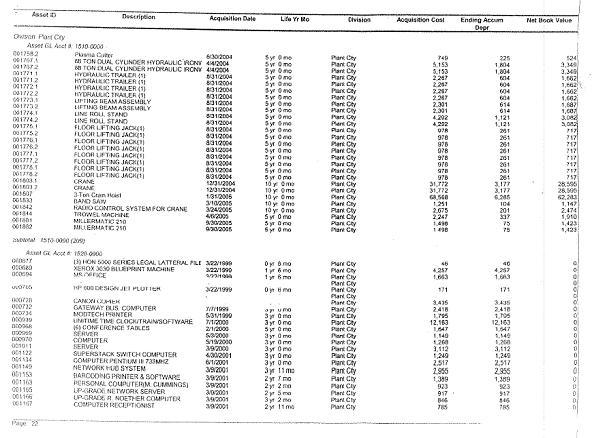

| EXHIBIT D | | SEVERABLE PROPERTY | | |

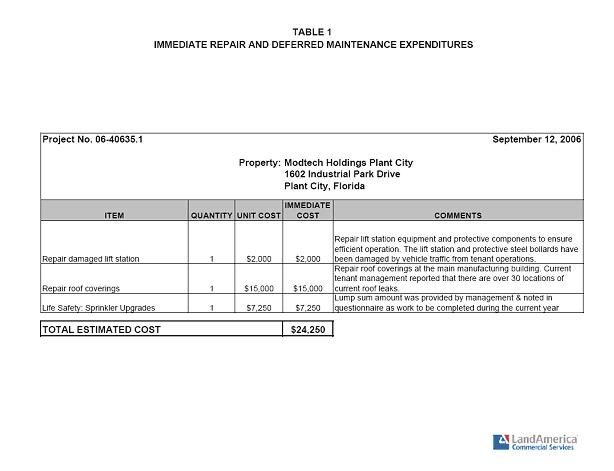

| EXHIBIT E | | IMMEDIATE REPAIRS | | |

| EXHIBIT F | | LANDLORD’S WAIVER AND CONSENT | | |

LEASE AGREEMENT

THIS LEASE AGREEMENT (this “Lease”) dated as of _______________, 2006, is made and entered into between NL VENTURES V PLANT CITY, L.P., a Texas limited partnership (“Lessor”), and MODTECH HOLDINGS, INC., a Delaware corporation (“Lessee”).

ARTICLE I

Section 1.01 Lease of Premises; Title and Condition. Upon and subject to the terms and conditions herein specified, Lessor hereby leases to Lessee, and Lessee hereby leases from Lessor, the premises (the “Premises”) consisting of:

(a) those parcels of land more particularly described in Exhibit A attached hereto and made a part hereof for all purposes having the following address: 1602 Industrial Park Dr., Plant City, Florida 33566, together with all of Lessor’s right, title and interest, if any, in and to all easements, rights-of-way, appurtenances and other rights and benefits associated with such parcel(s) of land and to all public or private streets, roads, avenues, alleys or passways, open or proposed, on or abutting such parcel(s) of land (collectively, the “Land”); and

(b) all of the buildings, structures, fixtures, facilities, installations and other improvements of every kind and description now or hereafter in, on, over and under the Land and all plumbing, gas, electrical, ventilating, lighting and other utility systems, ducts, hot water heaters, oil burners, domestic water systems, elevators, escalators, canopies, air conditioning systems and all other building systems and fixtures attached to or comprising a part of the buildings, including, but not limited to, all other building systems and fixtures necessary to the ownership, use, operation, repair and maintenance of the buildings, structures, fixtures, facilities, installations and other improvements of every kind, but excluding all Severable Property (as defined in Section 3.01 hereof) (collectively, the “Improvements”).

The Premises are leased to Lessee in their present condition without representation or warranty by Lessor and subject to the rights of parties in possession, to the existing state of title, to all applicable Legal Requirements (as defined in Section 5.02(b)) now or hereafter in effect and to liens and encumbrances listed in Exhibit B attached hereto and made a part hereof (collectively, “Permitted Exceptions”) for all purposes. Lessee has examined the Premises and title to the Premises and has found all of the same satisfactory for all purposes. LESSOR LEASES AND WILL LEASE AND LESSEE TAKES AND WILL TAKE THE PREMISES “AS IS”, “WHERE-IS” and “WITH ALL FAULTS”. LESSEE ACKNOWLEDGES THAT LESSOR (WHETHER ACTING AS LESSOR HEREUNDER OR IN ANY OTHER CAPACITY) HAS NOT MADE NOR SHALL LESSOR BE DEEMED TO HAVE MADE, ANY WARRANTY OR REPRESENTATION, EXPRESS OR IMPLIED, WITH RESPECT TO ANY OF THE PREMISES, INCLUDING ANY WARRANTY OR REPRESENTATION AS TO (i) ITS FITNESS, DESIGN OR CONDITION FOR ANY PARTICULAR USE OR PURPOSE, (ii) THE QUALITY OF THE MATERIAL OR WORKMANSHIP THEREIN, (iii) THE EXISTENCE OF ANY DEFECT, LATENT OR PATENT, (iv) LESSOR'S TITLE THERETO, (v) VALUE, (vi) COMPLIANCE WITH SPECIFICATIONS, (vii) LOCATION, (viii) USE, (ix) CONDITION, (x) MERCHANTABILITY, (xi) QUALITY, (xii) DESCRIPTION, (xiii) DURABILITY, (xiv) OPERATION, (xv) THE EXISTENCE OF ANY HAZARDOUS SUBSTANCE, HAZARDOUS CONDITION OR HAZARDOUS ACTIVITY OR (xvi) COMPLIANCE OF THE PREMISES WITH ANY LAW; AND ALL RISKS INCIDENT THERETO ARE TO BE BORNE BY LESSEE. LESSEE ACKNOWLEDGES THAT THE PREMISES ARE OF ITS SELECTION AND TO ITS SPECIFICATIONS AND THAT THE PREMISES HAVE BEEN INSPECTED BY LESSEE AND ARE SATISFACTORY TO LESSEE. IN THE EVENT OF ANY DEFECT OR DEFICIENCY IN ANY OF THE PREMISES OF ANY NATURE, WHETHER LATENT OR PATENT, LESSOR SHALL NOT HAVE ANY RESPONSIBILITY OR LIABILITY WITH RESPECT THERETO OR FOR ANY INCIDENTAL OR CONSEQUENTIAL DAMAGES (INCLUDING STRICT LIABILITY IN TORT). The provisions of this paragraph have been negotiated and are intended to be a complete exclusion and negation of any warranty by Lessor, express or implied, with respect to any of the Premises, arising pursuant to the Uniform Commercial Code or any other law now or hereafter in effect or arising otherwise.

Section 1.02 Use. Lessee may use the Premises for any purpose allowed under current zoning requirements and for no other purpose. Lessee shall not knowingly use or occupy or permit any of the Premises to be used or occupied, nor knowingly do or permit anything to be done in or on any of the Premises, in a manner which would (i) make void or voidable or cause any insurer to cancel any insurance required by this Lease, or make it difficult or impossible to obtain any such insurance at commercially reasonable rates, (ii) make void or voidable, cancel or cause to be canceled or release any material warranty, guaranty or indemnity running to the benefit of the Premises or Lessor, (iii) cause structural injury to any of the Improvements, (iv) constitute a public or private nuisance or waste; or (v) violate any Legal Requirements (as defined below).

Section 1.03 Term. This Lease shall be for a Primary Term of twenty (20) years beginning on November 1, 2006, and ending at 11:59 p.m. on October 31, 2026. The time period during which this Lease shall actually be in effect, including the Primary Term and any Extended Term (as defined hereinbelow), as any of the same may be terminated prior to their scheduled expiration pursuant to the provisions hereof, is referred to herein as the “Term.” The term “Lease Year” shall mean, with respect to the first Lease Year, the period commencing on the date hereof and ending at 11:59 p.m. on October 31, 2007, and each succeeding twelve (12) month period during the Term.

Section 1.04 Options to Extend the Term. Unless an Event of Default (as defined herein) has occurred and is continuing at the time any option is exercised, Lessee shall have the right and option to extend the Lease Term for two (2) additional periods of five (5) years each, each commencing immediately after the expiration of the then existing term of this Lease (an “Extended Term”), unless this Lease shall expire or be terminated pursuant to any provision hereof. Lessee shall exercise its option to extend the Term for each of the Extended Terms by giving written notice of intent to Lessor at any time not more than 24 or less than 9 months prior to the expiration of the then existing Term or Extended Term. Upon the request of Lessor or Lessee, the parties hereto will, at the expense of Lessee, execute and exchange an instrument in recordable form setting forth the extension of the Term in accordance with this Section 1.04. If Lessee timely and properly exercises the foregoing option(s), the Basic Rent due shall be set forth in Exhibit C, and all other terms and conditions of this Lease shall be applicable.

Section 1.05 Rent. In consideration of this Lease, during the Term, Lessee shall pay to Lessor the amounts set forth in Exhibit C as annual basic rent for the Premises (“Basic Rent”). Lessee shall pay Basic Rent and all other sums payable to Lessor hereunder to Lessor (or, upon Lessor’s request, to any mortgagee(s) or beneficiary(ies) identified by Lessor (whether one or more, the “Mortgagee”) under any mortgages, deeds of trust or similar security instruments creating a lien on the interest of Lessor in the Premises (whether one or more, the “Mortgage”)) by wire transfer, in immediately available funds, as follows:

Bank: LaSalle Bank, Chicago, Illinois

ABA Routing #: 071 000 505

Account Number: 5201 588 695

Account Name: NL Ventures V LP Rent Account

Bank Contact: Tom Borow @ 773-864-2583,

or at such other address or to such other person as Lessor from time to time may designate. Lessor shall give Lessee not less than fifteen (15) days prior written notice of any change in the address to which such payments are to be made. If the party entitled to receive Basic Rent or such party’s address shall change, Lessee may, until receipt of notice of such change from the party entitled to receive Basic Rent or other sums payable hereunder immediately preceding such change, continue to pay Basic Rent and other sums payable hereunder to the party to which, and in the manner in which, the preceding installment of Basic Rent or other sums payable hereunder, as the case may be, was paid. Such Basic Rent shall be paid in equal monthly installments in advance on the first day of each month. Any rental payment made in respect of a period which is less than one month shall be prorated by multiplying the then applicable monthly Basic Rent by a fraction the numerator of which is the number of days in such month with respect to which rent is being paid and the denominator of which is the total number of days in such month. Lessee shall perform all its obligations under this Lease at its sole cost and expense, and shall pay all Basic Rent, and other sums payable hereunder when due and payable, without notice or demand.

ARTICLE II

Section 2.01 Maintenance and Repair.

(a) Lessee acknowledges that it has received the Premises in the condition disclosed in the Property Condition Report (the “Property Condition Report”), prepared by LandAmerica Assessment Corporation and dated September 12, 2006 (LAC Project No.: 06-40635.1). Lessee, at its own expense, agrees to repair or cause to be repaired all of the necessary repairs not related to the roof as cited in the Table 1 of the Property Condition Report (a copy of which is attached hereto as Exhibit E) within ninety (90) days after the date hereof. Lessee, at its own expense, also agrees to repair, replace or install a new roof (but not, unless necessary, the structural elements thereof) before December 31, 2007, in compliance with the terms of Section 2.02 hereof such that the repaired, replaced or new roof shall have a minimum remaining useful life equal to the Term. Lessee, at its own expense, will maintain all parts of the Premises in as good repair, appearance and condition as when received, reasonable wear and tear excepted, and will take all action and will make all structural and nonstructural, foreseen and unforeseen and ordinary and extraordinary changes and repairs which may be required to keep all parts of the Premises in as good repair and condition as when received, reasonable wear and tear excepted (including, but not limited to, all painting, glass, utilities, conduits, fixtures and equipment, foundation, roof, exterior walls, heating and air conditioning systems, wiring, plumbing, sprinkler systems and other utilities, and all paving, sidewalks, roads, parking areas, curbs and gutters and fences). Lessee, at its own expense, will retain an independent consultant reasonably approved by Lessor to conduct annual inspections of the roof and the heating and air conditioning systems of the Premises and to provide Lessee and Lessor with a written report of its findings. Lessee shall promptly cause a licensed contractor to perform any recommended or necessary repairs or maintenance measures reflected in such report. No more than once in any Lease Year (except when Lessor has reasonable cause), Lessor, its contractors, subcontractors, servants, employees and agents, shall have the right to enter upon the Premises with prior notice during normal business hours (except in the event of an emergency, in which case no notice shall be required) to inspect same to ensure that all parts of the Premises are maintained in as good repair and condition as when received, reasonable wear and tear excepted, and Lessee shall not be entitled to any abatement or reduction in rent by reason thereof. Lessor shall not be required to maintain, repair or rebuild all or any part of the Premises. Lessee waives the right to require Lessor to maintain, repair or rebuild all or any part of the Premises or make repairs at the expense of Lessor pursuant to any Legal Requirements, agreement, contract, covenant, condition or restrictions at any time.

(b) If all or any part of the Improvements shall encroach upon any property, street or right-of-way adjoining or adjacent to the Premises, or shall violate the agreements or conditions affecting the Premises or any part thereof, or shall hinder, obstruct or impair any easement or right-of-way to which the Premises are subject, or any improvement located on an adjoining or adjacent property to the Premises shall encroach onto the Premises, then, if Lessor is not made whole by existing insurance policies, promptly after written request of Lessor (unless such encroachment, violation, hindrance, obstruction or impairment is a Permitted Exception) or of any person so affected, Lessee shall, at its expense, either (i) obtain valid and effective waivers or settlements of all claims, liabilities and damages resulting therefrom or (ii) if Lessor consents thereto, make such changes, including alteration or removal, to the Improvements and take such other action as shall be necessary to remove or eliminate such encroachments, violations, hindrances, obstructions or impairments. To the extent any easements are, in Lessor’s good faith judgment, necessary for Lessee’s use and occupancy of the Premises as contemplated by this Lease, upon Lessee’s written request, Lessor will execute such easements.

Section 2.02 Alterations, Replacements and Additions. Lessee may, at its expense, make additions to and alterations of the Improvements, and construct additional Improvements, provided that (i) the fair market value, the utility, the square footage or the useful life of the Premises shall not be lessened thereby, (ii) such work shall be expeditiously completed in a good and workmanlike manner and in compliance with all applicable Legal Requirements and the requirements of all insurance policies required to be maintained by Lessee hereunder, (iii) no structural alterations shall be made to the Improvements or structural demolitions conducted in connection therewith unless Lessee shall have obtained Lessor’s consent and furnished Lessor with such surety bonds or other security acceptable to Lessor as shall be reasonably acceptable to Lessor (but in no event greater than the cost of such alterations or demolitions), (iv) no additions, replacements or alterations (other than cosmetic, interior or nonstructural alterations) which cost in excess of $100,000 shall be made unless prior written consent from Lessor shall have been obtained, and (v) no Event of Default exists. Cosmetic, interior or nonstructural alterations (including demolition or construction of interior demising walls that are non-structural and non load-bearing) that cost $100,000 or less shall not require prior written consent from Lessor. All additions and alterations of the Premises, without consideration by Lessor, shall be and remain part of the Premises (not subject to removal upon termination) and the property of Lessor and shall be subject to this Lease. To the extent that Lessor shall fail to respond to any request for consent by Lessee pursuant to this Section 2.02 within fifteen (15) days after receipt of such request, Lessor’s consent will be deemed given fifteen (15) days after Lessor receives such request.

ARTICLE III

Section 3.01 Severable Property. Lessee may, at its expense, install, assemble or place on the Premises and remove and substitute any severable property used or useful in Lessee’s business, all as more particularly described in Exhibit D attached hereto and made a part hereof for all purposes (collectively, the “Severable Property”). Upon the written request of Lessee, Lessor will enter into an agreement subordinating its rights in the Severable Property on a form substantially similar to that attached hereto as Exhibit F.

Section 3.02 Removal. So long as no Event of Default exists, Lessee may remove the Severable Property at any time during the Term. Any of Lessee’s Severable Property not removed by Lessee prior to the expiration of this Lease or thirty (30) days after an earlier termination shall be considered abandoned by Lessee and may be appropriated, sold, destroyed or otherwise disposed of by Lessor without obligation to account therefor. Lessee will repair at its expense all damage to the Premises necessarily caused by the removal of Lessee’s Severable Property, whether effected by Lessee or by Lessor.

Section 3.03 License of Incidental Rights. During the Term, Lessor hereby grants a license to Lessee for the use of the “Incidental Rights,” “Plans” and “Property Agreements” that were conveyed to Lessor by and as defined in that certain Bill of Sale and Assignment of Incidental Rights and Plans of even date herewith.

ARTICLE IV

Section 4.01 Lessee’s Assignment and Subletting. Lessee may, for its own account, assign this Lease or sublet the use of all or any part of the Premises for the Term of this Lease so long as no Event of Default shall exist hereunder and, subject to the provisions of Section 4.03 below, Lessee shall have obtained Lessor’s and, if Mortgagee shall require, such Mortgagee's prior written consent to such assignment or sublease. Any transfer of all or substantially all of the assets or stock of Lessee, any merger of Lessee into another entity or of another entity into Lessee, or any transfer occurring by operation of law shall be deemed to constitute an assignment by Lessee of its interest hereunder for the purposes hereof. Each such assignment or sublease shall expressly be made subject to the provisions hereof. No such assignment or sublease shall modify or limit any right or power of Lessor hereunder or affect or reduce any obligation of Lessee hereunder, and all such obligations shall be those of Lessee and shall continue in full effect as obligations of a principal and not of a guarantor or surety, as though no subletting or assignment had been made, such liability of the Lessee named herein to continue notwithstanding any subsequent modifications or amendments of this Lease; provided, however, that (other than with respect to any modifications required by law or on account of bankruptcy or insolvency) if any modification or amendment is made without the consent of Lessee named herein, such modification or amendment shall be ineffective as against Lessee named herein to the extent, and only to the extent, that the same shall increase the obligations of Lessee, it being expressly agreed that Lessee named herein shall remain liable to the full extent of this Lease as if such modification had not been made. Neither this Lease nor the Term hereby demised shall be mortgaged by Lessee, nor shall Lessee mortgage or pledge its interest in any sublease of the Premises or the rentals payable thereunder. Any sublease made otherwise than as expressly permitted by this Section 4.01 and any assignment of Lessee’s interest hereunder made otherwise than as expressly permitted by this Section 4.01 shall be void. Lessee shall, within twenty (20) days after the execution of any assignment or sublease, deliver a conformed copy thereof to Lessor.

Section 4.02 Transfer by Lessor. Lessor shall be free to transfer its fee interest in the Premises or any part thereof or interest therein, subject, however, to the terms of this Lease. Any such transfer shall relieve the transferor of all liability and obligation hereunder (to the extent of the interest transferred) accruing after the date of the transfer and any assignee shall be bound by the terms and provisions of this Lease.

Section 4.03 Assignment/Subletting Exceptions. Notwithstanding the provisions of Section 4.01, Lessee shall have the right to assign or sublet its interest in this Lease or all or any portion of the Premises at any time without the consent of Lessor or Mortgagee to (i) the surviving entity of any merger, reorganization, consolidation or similar transaction with Lessee, (ii) any Affiliate of Lessee, (iii) any person or entity who purchases substantially all of the assets of Lessee (whether by means of a stock or asset purchase), or (iv) any proposed assignee or sublessee that has a tangible net worth of $10,000,000.00 or more, as shown on such prospective assignee’s or sublessee’s most recent balance sheet prepared in accordance with GAAP, which balance sheet may not have been prepared more than 6 months prior to such assignment or sublease. In addition, Lessee may sublease up to 20% of the Premises to any party without Lessor's consent. The exceptions afforded Lessee in this Section shall be conditioned on the following:

(a) Lessee is not then in default beyond applicable notice and cure periods hereunder;

(b) Lessor is provided a copy of such assignment or sublease;

(c) Any subletting or assignment of the Premises shall be subject to the terms of this Lease and Lessee shall remain liable hereunder, as same may be amended from time to time;

(d) Each sublease permitted under this Section shall contain provisions to the effect that (i) such sublease is only for actual use and occupancy by the sublessee; (ii) such sublease is subject and subordinate to all of the terms, covenants and conditions of this Lease and to all of the rights of Lessor hereunder; (iii) that any security deposit paid by sublessee shall be pledged to Lessor subject to the terms of the sublease and subject to Lessee’s right to apply the security deposit in accordance with the sublease; and (iv) in the event this Lease shall terminate before the expiration of such sublease, the sublessee thereunder will, at Lessor’s option, attorn to Lessor and be entitled to quiet possession of the Property for the term of the sublease and both Lessor and sublessee waive any rights they may have to terminate the sublease or possession thereunder, as a result of the termination of this Lease;

(e) Lessee agrees to pay, or to cause the assignee or sublessee, as applicable, to pay, on behalf of Lessor any and all reasonable out-of-pocket costs of Lessor, including reasonable attorneys’ fees paid or payable to outside counsel, occasioned by such subletting or assignment. Further, Lessee agrees that Lessor shall in no event be liable for any leasing commissions, finish-out costs, rent abatements or other costs, fees or expenses incurred by Lessee in subleasing or assigning or seeking to sublease or assign its leasehold interest in the Premises, and Lessee agrees to indemnify, defend and hold harmless Lessor and its partners, and their respective officers, directors, shareholders, agents, employees and representatives from, against and with respect to any and all such commissions, costs, fees and expenses; and

(f) In the case of an assignment of the entire Lease, the assignee agrees in writing to honor and perform all of the obligations of Lessee hereunder from and after the date of such assignment.

For the purposes of this Section, “Affiliate” shall be defined as with respect to any Person, any other Person that, directly or indirectly, controls or is controlled by or is under common control with such Person, and shall include the spouse of any natural person, with the term “control” and any derivatives thereof meaning the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of a Person, whether through ownership of voting securities, by contract, or otherwise. “Person” shall mean an individual, partnership, association, corporation or other entity.

ARTICLE V

Section 5.01 Net Lease.

(a) It is expressly understood and agreed by and between the parties that this Lease is an absolute net lease, and the Basic Rent and all other sums payable hereunder to or on behalf of Lessor shall be paid without notice or demand and without setoff, counterclaim, abatement, suspension, deduction or defense.

(b) Except as otherwise expressly provided in this Lease, this Lease shall not terminate, nor shall Lessee have any right to terminate this Lease or be entitled to the abatement of any rent or any reduction thereof, nor shall the obligations hereunder of Lessee be otherwise affected, by reason of any damage to or destruction of all or any part of the Premises from whatever cause, the taking of the Premises or any portion thereof by condemnation or otherwise, the prohibition, limitation or restriction of Lessee’s use of the Premises, any latent or other defect in any of the Premises, the breach of any warranty of any seller or manufacturer of any of the Improvements or Severable Property, the bankruptcy, insolvency, reorganization, composition, readjustment, liquidation, dissolution or winding-up of, or other proceeding affecting Lessor, the exercise of any remedy, including foreclosure, under any mortgage or collateral assignment, any action with respect to this Lease (including the disaffirmance hereof) which may be taken by Lessor, any trustee, receiver or liquidator of Lessor or any court under the Federal Bankruptcy Code or otherwise, and market or economic changes, or interference with such use by any private person or corporation, or by reason of any eviction by paramount title resulting by a claim from Lessor’s predecessor in title, or for any other cause whether similar or dissimilar to the foregoing, any present or future law to the contrary notwithstanding, it being the intention of the parties hereto that the rent and all other charges payable hereunder to or on behalf of Lessor shall continue to be payable in all events and the obligations of Lessee hereunder shall continue unaffected, unless the requirement to pay or perform the same shall be terminated pursuant to an express provision of this Lease. Nothing contained in this Section 5.01 shall be deemed a waiver by Lessee of any rights that it may have with respect to any default by Lessor hereunder or under any other agreement.

(c) The obligations of Lessee hereunder shall be separate and independent covenants and agreements. Lessee covenants and agrees that it will remain obligated under this Lease in accordance with its terms, and that Lessee will not take any action to terminate, rescind or avoid this Lease, notwithstanding the bankruptcy, insolvency, reorganization, composition, readjustment, liquidation, dissolution, winding-up or other proceeding affecting Lessor or any assignee of Lessor in any such proceeding and notwithstanding any action with respect to this Lease which may be taken by any trustee or receiver of Lessor or of any assignee of Lessor in any such proceeding or by any court in any such proceeding.

(d) Except as otherwise expressly provided in this Lease, Lessee waives all rights now or hereafter conferred by law (i) to quit, terminate or surrender this Lease or the Premises or any part thereof or (ii) to any abatement, suspension, deferment or reduction of the rent, or any other sums payable hereunder to or on behalf of Lessor, regardless of whether such rights shall arise from any present or future constitution, statute or rule of law.

Section 5.02 Taxes and Assessments; Compliance With Law.

(a) Lessee shall pay, as additional rent, prior to delinquency, the following (collectively, “Taxes”): (i) all taxes, assessments, levies, fees, water and sewer rents and charges and all other governmental charges, general and special, ordinary and extraordinary, foreseen and unforeseen, which are, at any time prior to or during the Term imposed or levied upon or assessed against or which arise with respect to (A) the Premises, (B) any Basic Rent, additional rent or other sums payable hereunder, (C) this Lease or the leasehold estate hereby created or (D) the operation, possession or use of the Premises; (ii) all gross receipts or similar taxes (i.e., taxes based upon gross income which fail to take into account deductions with respect to depreciation, interest, taxes or ordinary and necessary business expenses, in each case relating to the Premises) imposed or levied upon, assessed against or measured by any Basic Rent, additional rent or other sums payable hereunder; (iii) all sales, value added, ad valorem, use and similar taxes at any time levied, assessed or payable on account of the leasing, operation, possession or use of the Premises; and (iv) all charges of utilities, communications and similar services serving the Premises. Notwithstanding the foregoing, “Taxes,” as used herein, shall not include, and Lessee shall not be required to pay any franchise, estate, inheritance, transfer, income, capital gains or similar tax of or on Lessor unless such tax is imposed, levied or assessed in direct substitution for any other tax, assessment, charge or levy which Lessee is required to pay pursuant to this Section 5.02(a); provided, however, that if, at any time during the Term, the method of taxation shall be such that there shall be assessed, levied, charged or imposed on Lessor a capital levy or other tax directly on the rents received therefrom, or upon the value of the Premises or any present or future improvement or improvements on the Premises, then all such levies and taxes or the part thereof so measured or based shall be included in the term “Taxes” and payable by Lessee, and Lessee shall pay and discharge the same as herein provided. Lessee will furnish to Lessor, promptly after request therefor, proof of payment of all items referred to above which are payable by Lessee. If any assessment, levy or similar charge may legally be paid in installments, Lessee may pay such assessment in installments; in such event, Lessee shall be liable only for installments which become due and payable with respect to any tax period occurring in whole or in part during the Term hereof; provided, however, that all amounts referred to in this Section 5.02(a) for the fiscal or tax year in which the Term shall expire shall be apportioned so that Lessee shall pay only those portions thereof which correspond with the portion of such year as are within the Term of this Lease. Lessor shall cooperate with Lessee in any proceeding that may be necessary to cause assessments or levies to be payable in installments. If an assessment or levy may not be paid in installments and the useful life of the project or improvement to which such assessment or levy pertains extends beyond the Term of this Lease, Lessee shall only be required to pay that pro rata portion of the assessment or levy that is attributable to the Term.

(b) Lessee shall comply with and cause the Premises to comply with and shall assume all obligations and liabilities with respect to (i) all laws, ordinances and regulations and other governmental rules, orders and determinations presently in effect or hereafter enacted, made or issued, whether or not presently contemplated (collectively, “Legal Requirements”), as applied to the Premises or the ownership, operation, use or possession thereof, including, but not limited to, maintaining an adequate number of vehicular parking spaces, and (ii) all contracts, insurance policies (including, without limitation, to the extent necessary to prevent cancellation thereof and to insure full payment of any claims made under such policies), agreements, covenants, conditions and restrictions now or hereafter applicable to the Premises or the ownership, operation, use or possession thereof (other than covenants, conditions and restrictions imposed by Lessor subsequent to the date of this Lease without the consent of Lessee), including, but not limited to, all such Legal Requirements, contracts, agreements, covenants, conditions and restrictions which require structural, unforeseen or extraordinary changes, except for when such structural changes are required during the last two (2) years of the Term; provided, however, that, with respect to any of the obligations of Lessee in clause (ii) above which are not now in existence, Lessee shall not be required to so comply unless Lessee is either a party thereto or has given its written consent thereto, or unless the same is occasioned by Legal Requirements or Lessee’s default (including any failure or omission by Lessee) under this Lease. Nothing in clause (ii) of the immediately preceding sentence or the following sentence shall modify the obligations of Lessee under Section 5.04 of this Lease.

(c) On the date hereof and promptly after any future date on which the Taxes are increased by an applicable taxing authority, Lessee shall pay to Lessor that amount necessary to ensure there will be on deposit with Lessor an amount which when added to the Tax Escrow Payments will result in there being an amount on deposit sufficient to pay the Taxes at least two (2) months prior to the due date thereof (“Initial Tax Escrow Payment”). Thereafter, Lessee shall, in addition to and concurrently with the payment of Basic Rent as required in subsection 1.05 hereof, pay one-twelfth of the amount (as estimated by Lessor) of the annual Taxes (each such payment, a “Tax Escrow Payment,” and together with the Initial Tax Escrow Payment, hereinafter collectively referred to as the “Tax Escrow Payments”) next becoming due and payable with respect to the Premises. Lessee shall also pay to Lessor on demand therefor the amount by which the actual Taxes exceed the payment by Lessee required in this subsection. Notwithstanding anything to the contrary contained in this Lease, so long as Lessee shall have complied with its obligations under this Section 5.02(c), Lessor shall be solely liable for the application of the Tax Escrow Payments to the actual payment of Taxes as and when the same become due. Absent an Event of Default, any excess Tax Escrow Payments remaining at the expiration of the Term shall be refunded to Lessee.

Section 5.03 Liens.

(a) Lessee will remove and discharge any charge, lien, security interest or encumbrance upon the Premises or upon any Basic Rent, additional rent or other sums payable hereunder which arises for any reason, including, without limitation, all liens which arise out of the possession, use, occupancy, construction, repair or rebuilding of the Premises or by reason of labor or materials furnished or claimed to have been furnished to Lessee or for the Premises, but not including (i) the Permitted Exceptions, (ii) this Lease and any assignment hereof or any sublease permitted hereunder and (iii) any mortgage, charge, lien, security interest or encumbrance created or caused by or through Lessor or its agents, employees or representatives without the consent of Lessee. Lessee may contest any charges, liens, security interest or encumbrances on the Premises in accordance with Section 5.05. Lessee may provide a bond or other security reasonably acceptable to Lessor (but in no event greater in amount than the amount of such encumbrance) to remove or pay all costs associated with the removal of any such lien, provided the conditions of Section 5.05 shall be satisfied. Nothing contained in this Lease shall be construed as constituting the consent or request of Lessor, express or implied, to or for the performance (on behalf of or for the benefit of Lessor) by any contractor, laborer, materialman or vendor, of any labor or services or for the furnishing of any materials for any construction, alteration, addition, repair or demolition of or to the Premises or any part thereof. NOTICE IS HEREBY GIVEN THAT LESSOR WILL NOT BE LIABLE FOR ANY LABOR, SERVICES OR MATERIALS FURNISHED OR TO BE FURNISHED TO LESSEE, OR TO ANYONE HOLDING AN INTEREST IN THE PREMISES OR ANY PART THEREOF THROUGH OR UNDER LESSEE, AND THAT NO MECHANIC'S OR OTHER LIENS FOR ANY SUCH LABOR, SERVICES OR MATERIALS SHALL ATTACH TO OR AFFECT THE INTEREST OF LESSOR IN AND TO THE PREMISES UNLESS BY OR THROUGH LESSOR OR ITS AGENTS, EMPLOYEES OR REPRESENTATIVES.

(b) In no event shall the interest of Lessor be subject to the liens for improvements made by Lessee, and this Lease expressly prohibits such liability. Pursuant to Section 713.10 Florida Statutes (“Florida Construction Lien Law”), this provision specifically provides that no interest of Lessor shall be subject to liens for improvements made by Lessee at Lessee’s direction. This provision shall serve as notice to all potential construction lienors that Lessor shall not be liable for and the Premises shall not be subject to liens for work performed or materials supplied at Lessee’s request or at the request of anyone claiming an interest through Lessee. Lessee shall provide notice to its contractors doing any work on the Premises of the existence of this provision in the Lease.

Section 5.04 Indemnification.

(a) Except for the gross negligence or willful misconduct of any Indemnified Party (as defined herein), Lessee shall defend all actions against Lessor and any partner, officer, director, member, employee or shareholder of the foregoing (collectively, “Indemnified Parties”), with respect to, and shall pay, protect, indemnify and save harmless the Indemnified Parties from and against, any and all liabilities, losses, damages, costs, expenses (including, without limitation, reasonable attorneys’ fees and expenses), causes of action, suits, claims, demands or judgments of any nature arising from (i) injury to or death of any person, or damage to or loss of property, on or about the Premises, or connected with the use, condition or occupancy of any thereof, (ii) default by Lessee under this Lease, (iii) use, act or omission of Lessee or its agents, contractors, licensees, sublessees or invitees, (iv) contest referred to in Section 5.05 of this Lease, and (v) liens against the Premises in violation of Section 5.03 of this Lease. LESSEE UNDERSTANDS AND AGREES THAT THE FOREGOING INDEMNIFICATION OBLIGATIONS OF LESSEE ARE EXPRESSLY INTENDED TO AND SHALL INURE TO THE BENEFIT OF THE INDEMNIFIED PARTIES EVEN IF SOME OR ALL OF THE MATTERS FOR WHICH SUCH INDEMNIFICATION IS PROVIDED ARE CAUSED OR ALLEGED TO HAVE BEEN CAUSED BY THE SOLE, SIMPLE, JOINT OR CONCURRENT NEGLIGENCE OR STRICT LIABILITY OF ANY OF THE INDEMNIFIED PARTIES, BUT NOT TO THE EXTENT CAUSED BY THE INDEMNIFIED PARTIES' GROSS NEGLIGENCE OR WILLFUL MISCONDUCT. The obligations of Lessee under this Section 5.04 shall survive any termination, expiration, rejection in bankruptcy, or assumption in bankruptcy of this Lease.

(b) The rights and obligations of Lessor and Lessee with respect to claims by Lessor against Lessee brought pursuant to this Section 5.04 and Section 5.06 shall be subject to the following conditions:

(i) If Lessor receives notice of the assertion of any claim in respect of which it intends to make an indemnification claim under this Section 5.04 or Section 5.06, Lessor shall promptly provide written notice of such assertion to Lessee; provided that failure of Lessor to give Lessee prompt notice as provided herein shall not relieve Lessee of any of its obligations hereunder, except to the extent the Lessee is prejudiced by such failure. The notice shall describe in reasonable detail the nature of the claim and the basis for an indemnification claim under Section 5.04 or Section 5.06, and shall be accompanied by all papers and documents which have been served upon Lessor and such other documents and information as may be appropriate to an understanding of such claim and the liability of Lessee to indemnify Lessor hereunder. Except as required by law, the Lessor shall not answer or otherwise respond to such claim or take any other action which may prejudice the defense thereof unless and until Lessee has been given the opportunity to assume the defense thereof as required by this Section 5.04 and refused to do so.

(ii) Upon receipt of an indemnification notice under this Section 5.04, the Lessee shall have the right, but not the obligation, to promptly assume and take exclusive control of the defense, negotiation and/or settlement of such claim; provided, however, that if the representation of both parties by Lessee’s counsel would be inappropriate due to actual or potential differing interests between them, then the Lessee shall not be obligated to assume such defense, but such conflict shall not lessen Lessee’s indemnity obligation hereunder. In the event of a conflict of interest or dispute or during the continuance of an Event of Default, Lessor shall have the right to select separate counsel, and the cost of such counsel shall be paid by Lessee. The parties acknowledge that, with respect to claims for which insurance is available, the rights of the parties to select counsel for the defense of such claims shall be subject to such approval rights as the insurance company providing coverage may have.

(iii) The party controlling the defense of a claim shall keep the other party reasonably informed at all stages of the defense of such claim. The party not controlling the defense of any claim shall have the right, at its sole cost and expense, to participate in, but not control, the defense of any such claim. Each party shall reasonably cooperate with the other in the defense, negotiation and/or settlement of any such claim. In connection with any defense of a claim undertaken by Lessee, Lessor shall provide Lessee, and its counsel, accountants and other representatives, with reasonable access to relevant books and records and make available such personnel of Lessor as Lessee may reasonably request.

Section 5.05 Permitted Contests.

(a) Lessee, at its expense, may contest, by appropriate legal proceedings conducted in good faith and with due diligence, any Legal Requirements with which Lessee is required to comply pursuant to Section 5.02(b) or any Environmental Law under Section 5.06, or the amount or validity or application, in whole or in part, of any tax, assessment or charge which Lessee is obligated to pay or any lien, encumbrance or charge not permitted by Sections 2.01, 2.02, 5.02(a), 5.03 and 6.02, provided that unless Lessee has already paid such tax, assessment or charge (i) the commencement of such proceedings shall suspend the enforcement or collection thereof against or from Lessor and against or from the Premises, (ii) neither the Premises nor any rent therefrom nor any part thereof or interest therein would be in any danger of being sold, forfeited, attached or lost, (iii) Lessee shall have furnished such security, if any, as may be required in the proceedings and as may be reasonably required by Lessor, and (iv) if such contest be finally resolved against Lessee, Lessee shall promptly pay the amount required to be paid, together with all interest and penalties accrued thereon. Lessor, at Lessee’s expense, shall execute and deliver to Lessee such authorizations and other documents as reasonably may be required in any such contest. Lessee shall indemnify and save Lessor harmless against any cost or expense of any kind that may be imposed upon Lessor in connection with any such contest and any loss resulting therefrom. Notwithstanding any other provision of this Lease to the contrary, Lessee shall not be in default hereunder in respect to the compliance with any Legal Requirements with which Lessee is obligated to comply pursuant to Section 5.02(b), any Environmental Law under Section 5.06, or in respect to the payment of any tax, assessment or charge which Lessee is obligated to pay or any lien, encumbrance or charge not permitted by Section 2.01, 2.02, 5.02(a), 5.03 and 6.02 which Lessee is in good faith contesting.

(b) Without limiting the provisions of Section 5.05(a), so long as no Event of Default exists and the conditions set forth in Section 5.05(a) are satisfied, Lessor hereby irrevocably appoints Lessee as Lessor’s attorney-in-fact solely for the purpose of prosecuting a contest of any tax, assessment or charge which Lessee is obligated to pay. Such appointment is coupled with an interest. Notwithstanding the foregoing appointment, if Lessee determines it to be preferable in prosecution of a contest of a tax, assessment or charge, upon Lessee’s prior request, Lessor shall execute the real estate tax complaint and/or other documents reasonably needed by Lessee to prosecute the complaint as to such tax, assessment or charge and return same to Lessee within ten (10) days. In such event, Lessee shall pay all of Lessor’s costs and expenses in connection therewith, including, without limitation, reasonable attorneys’ fees and Lessee shall arrange for preparation of such documentation at Lessee’s sole cost and expense.

Section 5.06 Environmental Compliance.

(a) For purposes of this Lease:

(i) the term “Environmental Laws” shall mean and include the Resource Conservation and Recovery Act, as amended by the Hazardous and Solid Waste Amendments of 1984, the Comprehensive Environmental Response, Compensation and Liability Act, the Hazardous Materials Transportation Act, the Toxic Substances Control Act, the Federal Insecticide, Fungicide and Rodenticide Act and all applicable federal, state and local environmental laws, ordinances, rules, requirements, regulations and publications, as any of the foregoing may have been or may be from time to time amended, supplemented or supplanted and any and all other federal, state or local laws, ordinances, rules, requirements, regulations and publications, now or hereafter existing, relating to (i) the preservation or regulation of the public health, welfare or environment, (ii) the regulation or control of toxic or hazardous substances or materials, or (iii) any wrongful death, personal injury or property damage that is caused by or related to the presence, growth, proliferation, reproduction, dispersal, or contact with any biological organism or portion thereof (living or dead), including molds or other fungi, bacteria or other microorganisms or any etiologic agents or materials; and

(ii) the term “Regulated Substance” shall mean and include any, each and all substances, biological and etiologic agents or materials now or hereafter regulated pursuant to any Environmental Laws, including, but not limited to, any such substance, biological or etiological agent or material now or hereafter defined as or deemed to be a “regulated substance,” “pesticide,” “hazardous substance” or “hazardous waste” or included in any similar or like classification or categorization thereunder.

(b) Lessee shall:

(i) not cause or permit any Regulated Substance to be placed, held, located, released, transported or disposed of on, under, at or from the Premises in violation of Environmental Laws;

(ii) contain at or remove from the Premises, or perform any other necessary remedial action regarding, any Regulated Substance in any way affecting the Premises if, as and when such containment, removal or other remedial action is required under any Legal Requirements and, whether or not so required, shall perform any containment, removal or remediation of any kind involving any Regulated Substance in any way materially adversely affecting the Premises in compliance with all Legal Requirements and, upon reasonable request of Lessor after consultation with Lessee (which request may be given only if Lessor has received information such that it reasonably believes that environmental contamination exists which may have a material adverse effect on the Premises), shall arrange a Site Assessment (as such term is defined in Section 5.06(c)), or such other or further testing or actions as may be required by Legal Requirements or as may be mutually agreed to by Lessor and Lessee, to be conducted at the Premises by qualified companies retained by Lessee specializing in environmental matters and reasonably satisfactory to Lessor in order to ascertain compliance with all Legal Requirements and the requirements of this Lease, all of the foregoing to be at Lessee’s sole cost and expense;

(iii) provide Lessor with written notice (and a copy as may be applicable) of any of the following within ten (10) days of receipt thereof: (A) Lessee’s obtaining knowledge or notice of any kind of the material presence, or any actual or threatened release, of any Regulated Substance in any way materially adversely affecting the Premises; (B) Lessee’s receipt or submission, or Lessee’s obtaining knowledge or notice of any kind, of any report, citation, notice or other communication from or to any federal, state or local governmental or quasi-governmental authority regarding any Regulated Substance in any way materially adversely affecting the Premises; or (C) Lessee’s obtaining knowledge or notice of any kind of the incurrence of any cost or expense by any federal, state or local governmental or quasi-governmental authority or any private party in connection with the assessment, monitoring, containment, removal or remediation of any kind of any Regulated Substance in any way materially adversely affecting the Premises, or of the filing or recording of any lien on the Premises or any portion thereof in connection with any such action or Regulated Substance in any way materially adversely affecting the Premises; and

(iv) in addition to the requirements of Section 5.04 hereof, defend all actions against the Indemnified Parties and Mortgagee and pay, protect, indemnify and save harmless the Indemnified Parties and Mortgagee from and against any and all liabilities, losses, damages, costs, expenses (including, without limitation, reasonable attorneys’ fees and expenses), causes of action, suits, claims, demands or judgments of any nature relating to any Environmental Laws, Regulated Substances or other environmental matters concerning the Premises; except to the extent caused by or through Lessor, Mortgagee, or their agents, employees or representatives. The indemnity contained in this Section 5.06 shall survive the expiration or earlier termination of this Lease, unless at such time Lessee provides Lessor a Site Assessment (as defined below) acceptable to Lessor showing the Premises to be free of Regulated Substances and not in violation of Environmental Laws and that there exists no condition which could result in any violations of Environmental Laws.

(c) Upon reasonable cause and prior written notice from Lessor, Lessee shall permit such reasonably qualified persons as Lessor may designate (“Site Reviewers”) to visit the Premises and perform environmental site investigations and assessments (“Site Assessments”) on the Premises for the purpose of determining whether there exists on the Premises any Regulated Substance or violation of Environmental Laws or any condition which could result in any violations of Environmental Laws. Such Site Assessments may include both above and below the ground environmental testing for violations of Environmental Laws and such other tests as may be necessary, in the reasonable opinion of the Site Reviewers, to conduct the Site Assessments. Lessee shall supply to the Site Reviewers such historical and operational information regarding the Premises as may be reasonably requested by the Site Reviewers to facilitate the Site Assessments, and shall make available for meetings with the Site Reviewers appropriate personnel having knowledge of such matters. The cost of performing and reporting a Site Assessment shall be paid by Lessee.

(d) If any violation of Environmental Laws occurs or is found to exist and, in Lessor's reasonable judgment based upon the written bids of reputable environmental professionals, the cost of remediation of, or other response action with respect to, the same is likely to exceed $100,000, Lessee shall provide to Lessor, within ten (10) days after Lessor's request therefor, adequate financial assurances that Lessee will effect such remediation in accordance with applicable Environmental Laws. Such financial assurances shall be a bond or letter of credit reasonably satisfactory to Lessor in form and substance and in an amount equal to one hundred and fifty percent (150%) of Lessor’s reasonable estimate of the anticipated cost of such remedial action, based upon a Site Assessment performed pursuant to Section 5.06(c). Notwithstanding any other provision in this Lease, if a violation of Environmental Laws occurs or is found to exist and the Term would otherwise terminate or expire, and such violation(s) of Environmental Laws is proximately caused, in whole or in part, by the actions and/or omissions of Lessee, and the Premises cannot be rented to another lessee on commercially reasonable terms during the remedial action, then, at the option of Lessor, the Term shall be automatically extended beyond the date of termination or expiration and this Lease shall remain in full force and effect beyond such date until the earlier to occur of (i) the completion of all remedial action in accordance with applicable Environmental Laws, or (ii) the date specified in a written notice from Lessor to Lessee terminating this Lease.

(e) If Lessee fails to correct any violation of Environmental Laws which occurs or is found to exist, Lessor shall have the right (but no obligation) to take any and all actions as Lessor shall reasonably deem necessary or advisable in order to cure such violation of Environmental Laws.

(f) All future leases, subleases or concession agreements permitted by this Lease relating to the Premises entered into by Lessee shall contain covenants of the other party not to knowingly at any time (i) cause any violation of Environmental Laws to occur or (ii) permit any Person occupying the Premises through said subtenant or concessionaire to knowingly cause any violation of Environmental Laws to occur.

ARTICLE VI

Section 6.01 Intentionally Deleted.

Section 6.02 Condemnation and Casualty.

(a) General Provisions. Except as provided in Section 6.02(b) and (c), Lessee hereby irrevocably assigns to Lessor any award, compensation or insurance payment to which Lessee may become entitled by reason of Lessee’s interest in the Premises (i) if the use, occupancy or title of the Premises or any part thereof is taken, requisitioned or sold in, by or on account of any actual or threatened eminent domain proceeding or other action by any person having the power of eminent domain (“Condemnation”) or (ii) if the Premises or any part thereof is damaged or destroyed by fire, flood or other casualty (“Casualty”). All awards, compensations and insurance payments on account of any Condemnation or Casualty are herein collectively called “Compensation.” Lessee may not unilaterally negotiate, prosecute or adjust any claim for any Compensation. Lessee must consult with and obtain Lessor’s consent thereto. If the parties are unable to so agree, then they shall appoint an entity or individual that specializes in such negotiations who shall negotiate, prosecute and adjust a claim for Compensation. Lessor shall be entitled to participate in any such proceeding, action, negotiation, prosecution, appeal or adjustment as contemplated herein. Notwithstanding anything to the contrary contained in this Article VI, if permissible under applicable law, any separate Compensation made to Lessee for its moving and relocation expenses, anticipated loss of business profits, loss of goodwill or fixtures and equipment paid for by Lessee and which are not part of the Premises (including, without limitation, the Severable Property) shall be paid directly to and shall be retained by Lessee (and shall not be deemed to be “Compensation”). All Compensation shall be applied pursuant to this Section 6.02, and all such Compensation (less the expense of collecting such Compensation) is herein called the “Net Proceeds.” Except as specifically set for herein, all Net Proceeds shall be paid to the Proceeds Trustee (as defined herein) and applied pursuant to this Section 6.02. If the Premises or any part thereof shall be damaged or destroyed by Casualty, and if the estimated cost of rebuilding, replacing or repairing the same shall exceed $50,000, Lessee promptly shall notify Lessor thereof.

(b) Substantial Condemnation During the Term. If a Condemnation shall, in Lessee’s good faith judgment, affect all or a substantial portion of the Premises and shall render the Premises unsuitable for restoration for continued use and occupancy in Lessee’s business, then Lessee may, not later than sixty (60) days after a determination has been made as to when possession of the Premises must be delivered with respect to such Condemnation, deliver to Lessor (i) notice of its intention (“Notice of Intention”) to terminate this Lease on the next rental payment date which occurs after the earlier of (a) ninety (90) days after the delivery of such notice or (b) delivery of the Premises to the condemning authority (the “Condemnation Termination Date”), and (ii) a certificate of an authorized officer of Lessee describing the event giving rise to such termination and stating that Lessee has determined that such Condemnation has rendered the Premises unsuitable for restoration for continued use and occupancy in Lessee’s business. This Lease shall terminate on the Condemnation Termination Date, except with respect to obligations and liabilities of Lessee hereunder, actual or contingent, which have accrued on or prior to the Condemnation Termination Date, upon payment by Lessee of (1) all Basic Rent, additional rent and other sums due and payable hereunder to and including the Condemnation Termination Date, and (2) an amount equal to the excess, if any, of (a) the aggregate of all Basic Rent, additional rent and other sums which would be payable under this Lease, from the Condemnation Termination Date for what would be the then unexpired Term in the absence of such Condemnation, discounted at the rate equal to the then current yield on United States Treasury Notes having a maturity as of the stated date for expiration of the then existing Term of this Lease, plus 2% per annum (the “Reference Rate”), over (b) the Net Proceeds. The Net Proceeds shall belong to Lessor.

(c) Substantial Casualty During the Last Two Years of the Term. If an insured Casualty shall, in Lessee’s good-faith judgment, affect all or a substantial portion of the Premises during the last two (2) years of the Term and shall render the Premises unsuitable for restoration for continued use and occupancy in Lessee’s business, then Lessee may, not later than one hundred and fifty (150) days after such Casualty, deliver to Lessor (i) notice of its intention to terminate this Lease on the next rental payment date which occurs not less than sixty (60) days after the delivery of such notice (the “Casualty Termination Date”), (ii) a certificate of an authorized officer of Lessee describing the event giving rise to such termination and stating that Lessee has determined that such Casualty has rendered the Premises unsuitable for restoration for continued use and occupancy in Lessee’s business, and (iii) documentation to the effect that termination of this Lease will not be in violation of any agreement then in effect with which Lessee is obligated to comply pursuant to this Lease. Upon payment by Lessee of all Basic Rent, additional rent and other sums then due and payable hereunder to and including the Casualty Termination Date, this Lease shall terminate on the Casualty Termination Date except with respect to obligations and liabilities of Lessee hereunder, actual or contingent, which have accrued on or prior to the Casualty Termination Date, and the Net Proceeds shall belong to Lessor.

(d) Less Than Substantial Condemnation or Any Casualty Prior to the Last Two Years of the Term. If, after a Condemnation or Casualty, Lessee does not give or does not have the right to give notice of its intention to terminate this Lease as provided in subsection 6.02(b) or (c), then this Lease shall continue in full force and effect and Lessee shall, at its expense, rebuild, replace or repair the Premises in conformity with the requirements of subsections 2.01, 2.02 and 5.03 so as to restore the Premises (in the case of Condemnation, as nearly as practicable) to the condition, and character thereof immediately prior to such Casualty or Condemnation; provided that Lessee and Lessor shall use reasonable efforts to consider modifications which would make the Improvements a more contemporary design. To the extent the Net Proceeds with respect to any Casualty are less than $100,000, such amount shall be paid to Lessee to be used to rebuild, replace or repair the Premises in a lien free and good and workmanlike manner. To the extent the Net Proceeds from any Casualty are $100,000 or greater, such amount shall be paid to the Proceeds Trustee and prior to any such rebuilding, replacement or repair, Lessee shall determine the maximum cost thereof (the “Restoration Cost”), which amount shall be reasonably acceptable to Lessor. The Restoration Cost shall be paid on a pro rata basis out of Lessee’s own funds and the Net Proceeds to the extent that the Restoration Cost exceeds the Net Proceeds payable in connection with such occurrence, after which expenditure Lessee shall be entitled to receive the Net Proceeds from the Proceeds Trustee, but only against (i) certificates of Lessee delivered to Lessor and the Proceeds Trustee from time to time but no more often than monthly as such work of rebuilding, replacement and repair progresses, each such certificate describing the work for which Lessee is requesting payment and the cost incurred by Lessee in connection therewith and stating that Lessee has not theretofore received payment for such work and (ii) such additional documentation or conditions as Lessor or the Proceeds Trustee may reasonably require, including, but not limited to, copies of all contracts and subcontracts relating to restoration, architects’ certifications, title policy updates and lien waivers or releases. Any Net Proceeds remaining after final payment has been made for such work and after Lessee has been reimbursed for any portions it contributed to the Restoration Cost with respect to any Casualty shall be paid to Lessee and with respect to any Condemnation shall be paid to Lessor. In the event of any temporary Condemnation, this Lease shall remain in full effect and Lessee shall be entitled to receive the Net Proceeds allocable to such temporary Condemnation, except that any portion of the Net Proceeds allocable to the period after the expiration or termination of the Term shall be paid to Lessor. If the cost of any rebuilding, replacement or repair required to be made by Lessee pursuant to this subsection 6.02(d) shall exceed the amount of such Net Proceeds, the deficiency shall be paid by Lessee. Notwithstanding anything herein to the contrary, in the event of a less than substantial Condemnation, Lessee and Lessor shall equitably adjust the Basic Rent to take into consideration any diminished utility of the Premises after completion of any rebuilding, replacement or repair required to be made by Lessee pursuant to this Section 6.02(d).

Section 6.03 Insurance.

(a) Lessee will maintain insurance on the Premises of the following character:

(i) Insurance (on an occurrence basis) against all risks of direct physical loss (“Causes of Loss - Special Form”), including loss by fire, lightning, flooding (if the Premises are in a flood zone), earthquakes (if the Premises are in an earthquake zone), and other risks which at the time are included under “extended coverage” endorsements, on ISO form CP1030, or its equivalent, in amounts sufficient to prevent Lessor and Lessee from becoming a coinsurer of any loss but in any event in amounts not less than 100% of the actual replacement value of the Improvements, exclusive of foundations and excavations, without any exclusions other than standard printed exclusions and without exclusion for terrorism and with deductibles of not more than $25,000 per occurrence (except with respect to wind damage, which shall have a deductible of no more than $250,000);

(ii) Commercial general liability insurance and/or umbrella liability insurance (on an occurrence basis), on ISO form CG 0001 0798, or its equivalent, against claims for bodily injury, death or property damage occurring on, in or about the Premises in the minimum amounts of $5,000,000 for bodily injury or death to any one person, $10,000,000 for any one accident and $5,000,000 for property damage to others or in such greater amounts as are then customary for property similar in use to the Premises, with deletions of contractual liability exclusions with respect to personal injury and with defense to be provided as an additional benefit and not within the limits of liability and with deductibles of not more than $25,000 per occurrence;

(iii) Rent loss insurance or business interruption insurance in an amount sufficient to cover loss of rents from the Premises pursuant to this Lease for a period of at least twelve (12) months, with endorsements to cover interruption of utilities outside of the Premises;

(iv) Worker’s compensation insurance to the extent required by the law of the state in which the Premises are located;

(v) Boiler and machinery insurance in respect of any boilers and similar apparatus located on the Premises in the minimum amount of $500,000 or in such greater amounts as to adequately insure the Premises;

(vi) During any period of construction on the Premises, builder’s risk insurance on a completed value, nonreporting basis for the total cost of such alterations or improvements, and workers’ compensation insurance as required by applicable law. This coverage may be provided by Lessee’s all risk property insurance pursuant to Section 6.03(a)(i) herein; and

(vii) Such other insurance in such kinds and amounts, with such deductibles and against such risks, as Mortgagee may reasonably require or as is commonly obtained in the case of property similar in use to the Premises and located in the state in which the Premises are located by prudent owners of such property.

Such insurance shall be written by companies authorized to do business in the state where the Premises are located and carrying a claims paying ability rating of at least A:XII by A.M. Best or A by Standard and Poor's, as applicable, and with the exception of workers’ compensation insurance, shall name Lessor as an additional insured as its interest may appear.

(b) Every such policy provided pursuant to Section 6.03(a)(i), above shall (i) bear a mortgagee endorsement in favor of Mortgagee under any Mortgage, and any loss under any such policy shall be payable to the Mortgagee which has a first lien on such interest (if there is more than one first Mortgagee, then to the trustee for such Mortgagees) to be held and applied by Mortgagee toward restoration pursuant to Section 6.02, and (ii) contain an ordinance or law coverage endorsement. Every such policy with the exception of workers’ compensation insurance, shall name the Mortgagee as an additional insured as its interest may appear. Every policy referred to in subsection 6.03(a) shall provide that it will not be cancelled or amended except after thirty (30) days written notice to Lessor and the Mortgagee and that it shall not be invalidated by any act or negligence of Lessor, Lessee or any person or entity having an interest in the Premises, nor by occupancy or use of the Premises for purposes more hazardous than permitted by such policy, nor by any foreclosure or other proceedings relating to the Premises, nor by change in title to or ownership of the Premises. The “Proceeds Trustee” shall be a financial institution selected by Lessor and reasonably approved by Lessee and may be the Mortgagee.

(c) Lessee shall deliver to Lessor (i) upon request copies of the applicable insurance policies and (ii) original or duplicate certificates of insurance, reasonably satisfactory to Lessor evidencing the existence of all insurance which is required to be maintained by Lessee hereunder and payment of all premiums therefor, such delivery to be made (i) upon the execution and delivery hereof and (ii) at least ten (10) days prior to the expiration of any such insurance. Lessee shall not obtain or carry separate insurance concurrent in form or contributing in the event of loss with that required by this Section 6.03 unless Lessor is named an additional insured therein and unless there is a mortgagee endorsement in favor of Mortgagee with loss payable as provided herein. Lessee shall immediately notify Lessor whenever any such separate insurance is obtained and shall deliver to Lessor the policies or certificates evidencing the same. Any insurance required hereunder may be provided under blanket policies, provided that the Premises are specified therein.

(d) If an Event of Default shall occur, upon the request of Lessor, Lessee shall, in addition to and concurrently with the payment of Basic Rent as required in Section 1.05 hereof, pay one-twelfth of the amount (as estimated by Lessor or Mortgagee, as applicable) of the annual premiums for insurance (collectively, the “Insurance Escrow Payments”) required under this Section 6.03 next becoming due and payable with respect to the Premises. Notwithstanding the foregoing, Lessee shall also be required to pay into escrow any other amounts required by Mortgagee. Lessee shall also pay to Lessor on demand therefor the amount by which the actual insurance premiums exceed the payment by Lessee required in this subsection.

(e) The requirements of this Section 6.03 shall not be construed to negate or modify Lessee’s obligations under Section 5.04.

(f) Notwithstanding anything contained in this Lease to the contrary, each party hereto hereby waives any and all rights of recovery, claim, action or cause of action, against the other party and its agents, officers, and employees, for any loss or damage that may occur to the Premises, including the Improvements, regardless of cause or origin, including the negligence of the other party and its agents, officers, and employees, without prejudice to any waiver or indemnity provisions applicable to Lessee and any limitation of liability provisions applicable to Lessor hereunder, of which provisions Lessee shall notify all insurers.

ARTICLE VII

Section 7.01 Conditional Limitations; Default Provisions.

(a) Any of the following occurrences or acts shall constitute an Event of Default under this Lease:

(i) If Lessee shall (1) fail to pay any Basic Rent, additional rent or other sum when due (provided that for such failure to pay to constitute an Event of Default such failure must continue to exist after Lessor has provided Lessee with five business (5) days written notice of Lessee’s failure to timely pay such sums and provided that Lessor is obligated to provide such written notice no more than two times for any consecutive twelve (12) month period) or (2) fail to observe or perform any other provision hereof and such nonmonetary failure shall continue for thirty (30) days after written notice to Lessee of such failure (provided that, in the case of any such failure which cannot be cured by the payment of money and cannot with diligence be cured within such thirty (30) day period, if Lessee shall commence promptly to cure the same and thereafter prosecute the curing thereof with diligence, the time within which such failure may be cured shall be extended for such period not to exceed one hundred and eighty (180) days as is necessary to complete the curing thereof with diligence);

(ii) If any representation or warranty of Lessee set forth in any certificate provided by Lessee pursuant to this Lease, shall prove to be incorrect in any material adverse respect as of the time when the same shall have been made in a way adverse to Lessor and Lessor shall suffer a loss or detriment as a result thereof, including, without limitation, the taking of any action (including, without limitation, the demise of the Premises to Lessee herein) in reliance upon such representation or warranty and, in each case, the facts shall not be conformed to the representation and warranty as soon as practicable in the circumstances (but in no event to exceed that period of time that in Lessor’s reasonable judgment is necessary to complete the curing thereof with diligence) after written notice to Lessee from Lessor of such inaccuracy and Lessor restored to the position it would have enjoyed had such representation or warranty been accurate at the time it was made;

(iii) If Lessee shall file a petition in bankruptcy or for reorganization or for an arrangement pursuant to any federal or state law or shall be adjudicated a bankrupt or become insolvent or shall make an assignment for the benefit of creditors, or if a petition proposing the adjudication of Lessee as a bankrupt or its reorganization pursuant to any federal or state bankruptcy law or any similar federal or state law shall be filed in any court and Lessee shall consent to or acquiesce in the filing thereof or such petition shall not be discharged or denied within ninety (90) days after the filing thereof;

(iv) If a receiver, trustee or conservator of Lessee or of all or substantially all of the assets of Lessee or of the Premises or Lessee’s or estate therein shall be appointed in any proceeding brought by Lessee, or if any such receiver, trustee or conservator shall be appointed in any proceeding brought against Lessee and shall not be discharged within ninety (90) days after such appointment, or if Lessee shall consent to or acquiesce in such appointment;

(v) If the Premises shall have been abandoned for a period of thirty (30) consecutive days;

(vi) If a Letter of Credit has been posted as the Security Deposit or other security hereunder, and the issuer of the Letter of Credit cancels, terminates or refuses to honor it, and Lessee shall fail to renew the Letter of Credit within thirty (30) days or shall fail to post a cash equivalent amount of the Letter of Credit or a replacement letter of credit within fifteen (15) days after notice of such cancellation, termination or refusal; and

(vii) If a monetary Event of Default occurs under this Lease more than three (3) times within any consecutive twelve (12) month period, irrespective of whether or not such Event of Default is cured.

(b) If an Event of Default shall have happened and be continuing, Lessor shall have the right to give Lessee notice of Lessor’s termination of the Term. Upon the giving of such notice, the Term and the estate hereby granted shall expire and terminate on such date as fully and completely and with the same effect as if such date were the date herein fixed for the expiration of the Term, and all rights of Lessee hereunder shall expire and terminate, but Lessee shall remain liable as hereinafter provided.

(c) If an Event of Default shall have happened and be continuing, Lessor shall have the immediate right, whether or not the Term shall have been terminated pursuant to subsection 7.01(b), to reenter and repossess the Premises and the right to remove all persons and property (subject to Section 3.02) therefrom by summary proceedings, ejectment or any other legal action or in any lawful manner Lessor determines to be necessary or desirable. Lessor shall be under no liability by reason of any such reentry, repossession or removal. No such reentry, repossession or removal shall be construed as an election by Lessor to terminate the Term unless a notice of such termination is given to Lessee pursuant to subsection 7.01(b) or unless such termination is decreed by a court.