SCHEDULE 14-A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant [x]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[x] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12

| | First Federal Bankshares, Inc. | |

| | (Name of Registrant as Specified In Its Charter) | |

| | | |

| | | |

| | (Name of Person(s) Filing Proxy Statement) | |

Payment of Filing Fee (Check the appropriate box):

[x] No fee required.

[ ] $125 per Exchange Act Rules 0-11(c)(1)(ii), 14a-6(i)(1), or 14a-6(j)(2).

[ ] $500 per each party to the controversy pursuant to Exchange Act Rule 14a-6(i)(3).

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

| | 1) Title of each class of securities to which transaction applies: |

| | |

| | ........................................................................ |

| | |

| | 2) Aggregate number of securities to which transaction applies: |

| | |

| | ....................................................................... |

| | |

| | 3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11: |

| | |

| | ....................................................................... |

| | |

| | 4) Proposed maximum aggregate value of transaction: |

| | |

| | ........................................................................ |

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

1) Amount Previously Paid:

2) Form, Schedule or Registration Statement No.:

3) Filing Party:

4) Date Filed:

September 21, 2006

Dear Fellow Stockholder:

On behalf of the Board of Directors and management of First Federal Bankshares, Inc. (the “Company”), I cordially invite you to attend the 2006 Annual Meeting of Stockholders. The meeting will be held at 9:00 a.m., Central Daylight Savings Time on October 26, 2006 at the Sioux City Convention Center, 801 4th Street, Sioux City, Iowa.

The enclosed Notice of Annual Meeting and Proxy Statement describe the formal business to be transacted. During the meeting we will also report on the Company’s fiscal 2006 financial and operating performance.

An important aspect of the meeting process is the stockholder vote on corporate business items. I urge you to exercise your rights as a stockholder to vote and participate in this process. Stockholders are being asked to consider and vote upon the proposals (i) to elect three directors of the Company (ii) to approve the Company’s 2006 Stock-Based Incentive Plan and (iii) to ratify the appointment of the independent registered public accounting firm of the Company for the fiscal year ending June 30, 2007. The Board has carefully considered these proposals and believes that their approval is in the best interests of the Company and its stockholders. Accordingly, your Board of Directors unanimously recommends that you vote for each of these proposals.

I encourage you to attend the meeting in person. Whether or not you attend the meeting, I hope that you will read the enclosed Proxy Statement and then complete, sign and date the enclosed proxy card and return it in the postage prepaid envelope provided. Returning a properly executed and dated proxy card will save the Company additional expense in soliciting proxies and will ensure that your shares are represented. Please note that you may vote in person at the meeting even if you have previously returned the proxy.

Thank you for your attention to this important matter.

| | Sincerely, |

| | |

| | /s/ Arlene T. Curry |

| | Arlene T. Curry |

| | Chairman of the Board |

| | |

| | |

| | /s/ Michael W. Dosland |

| | Michael W. Dosland |

| | President and Chief Executive Officer |

FIRST FEDERAL BANKSHARES, INC.

329 Pierce Street

Sioux City, Iowa 51101

(712) 277-0200

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be Held on October 26, 2006

Notice is hereby given that the Annual Meeting of Stockholders (the “Meeting”) of First Federal Bankshares, Inc. will be held at the Sioux City Convention Center, 801 4th Street, Sioux City, Iowa at 9:00 a.m., Central Daylight Savings Time, on October 26, 2006.

A Proxy Card and a Proxy Statement for the Meeting are enclosed.

The Meeting is for the purpose of considering and acting upon:

| | 1. | The election of three directors of the Company; |

| | 2. | The approval of the Company’s 2006 Stock-Based Incentive Plan; |

| 3. | The ratification of the appointment of McGladrey & Pullen, LLP as the independent registered public accounting firm of the Company for the fiscal year ending June 30, 2007; |

and such other matters as may properly come before the Meeting, or any adjournments thereof. The Board of Directors is not aware of any other business to come before the Meeting.

Any action may be taken on the foregoing proposals at the Meeting on the date specified above, or on any date or dates to which the Meeting may be adjourned. Stockholders of record at the close of business on September 1, 2006 (the “Record Date”) are the stockholders entitled to vote at the Meeting and any adjournments thereof. A list of stockholders entitled to vote at the Meeting will be available at 329 Pierce Street, Sioux City, Iowa for a period of ten days prior to the Meeting and will also be available for inspection at the Meeting.

You are requested to complete and sign the enclosed form of proxy, which is solicited on behalf of the Board of Directors, and to mail it promptly in the enclosed envelope. The proxy will not be used if you attend and vote at the Meeting in person.

| | BY ORDER OF THE BOARD OF DIRECTORS |

| | |

| | /s/ Suzette F. Hoevet |

| | |

| | Suzette F. Hoevet |

| | Secretary |

Sioux City, Iowa

September 21, 2006

IMPORTANT: THE PROMPT RETURN OF PROXIES WILL SAVE THE COMPANY THE EXPENSE OF FURTHER REQUESTS FOR PROXIES TO ENSURE A QUORUM AT THE MEETING. A SELF-ADDRESSED ENVELOPE IS ENCLOSED FOR YOUR CONVENIENCE. NO POSTAGE IS REQUIRED IF MAILED WITHIN THE UNITED STATES. |

PROXY STATEMENT

First Federal Bankshares, Inc.

329 Pierce Street

Sioux City, Iowa 51101

(712) 277-0200

ANNUAL MEETING OF STOCKHOLDERS

To Be Held October 26, 2006

This Proxy Statement is furnished in connection with the solicitation on behalf of the Board of Directors of First Federal Bankshares, Inc. (the “Company”), the parent company of First Federal Bank (the “Bank” or “First Federal”), of proxies to be used at the Annual Meeting of Stockholders of the Company (the “Meeting”) which will be held at the Sioux City Convention Center, 801 4th Street, Sioux City, Iowa on October 26, 2006, at 9:00 a.m., Central Daylight Savings Time, and all adjournments of the Meeting. The accompanying Notice of Annual Meeting and this Proxy Statement are first being mailed to stockholders on or about September 21, 2006.

At the Meeting, stockholders of the Company are being asked to consider and vote upon the proposals to elect three directors of the Company, to approve the Company’s 2006 Stock-Based Incentive Plan, and to ratify the appointment of McGladrey & Pullen, LLP as the independent registered public accounting firm of the Company for the fiscal year ending June 30, 2007.

Vote Required and Proxy Information

All shares of the Company’s Common Stock, par value $.01 per share (the “Common Stock”), represented at the Meeting by properly executed proxies received prior to or at the Meeting, and not revoked, will be voted at the Meeting in accordance with the instructions thereon. If no instructions are indicated, properly executed proxies will be voted for the proposals set forth in this Proxy Statement. The Company does not know of any matters, other than as described in the Notice of Annual Meeting, that are to come before the Meeting. If any other matters are properly presented at the Meeting for action, the persons named in the enclosed form of proxy and acting thereunder will have the discretion to vote on such matters in accordance with their best judgment.

The holders of a majority of all of the shares of the Company’s Common Stock entitled to vote at the Meeting, present in person or by proxy, shall constitute a quorum for all purposes. Abstentions and broker non-votes are counted for purposes of determining a quorum. In the event there are not sufficient votes for a quorum, or to approve or ratify any matter being presented at the Meeting, the Meeting may be adjourned in order to permit the further solicitation of proxies.

As to the election of directors, the proxy card being provided by the Board of Directors enables a stockholder to vote FOR the election of the nominees proposed by the Board, or to WITHHOLD AUTHORITY to vote for one or more of the nominees being proposed. Under Delaware law and the Company’s Certificate of Incorporation and Bylaws, directors are elected by a plurality of votes cast, without regard to either broker non-votes or proxies as to which authority to vote for the nominees being proposed is withheld.

As to the approval of the 2006 First Federal Bankshares, Inc. Stock-Based Incentive Plan (the “Incentive Plan”), by checking the appropriate box, a stockholder may: (i) vote FOR the approval of the Incentive Plan; (ii) vote AGAINST the approval of the Incentive Plan; or (iii) ABSTAIN from voting on the approval of the Incentive Plan. The approval of this matter requires the affirmative vote of a majority of the total shares present and voting, without regard to broker non-votes or proxies marked ABSTAIN.

As to the ratification of the appointment of McGladrey & Pullen, LLP as the independent registered public accounting firm of the Company, by checking the appropriate box, a stockholder may: (i) vote FOR the item; (ii) vote AGAINST the item; or (iii) ABSTAIN from voting on the item. Under Delaware law and the Company’s

Certificate of Incorporation and Bylaws, the ratification of this matter shall be determined by a majority of the votes cast without regard to broker non-votes or proxies marked ABSTAIN.

Proxies solicited hereby will be returned to the Company and will be tabulated by the Inspector of Election designated by the Board of Directors.

A proxy given pursuant to the solicitation may be revoked at any time before it is voted. Proxies may be revoked by: (i) filing with the Secretary of the Company at or before the Meeting a written notice of revocation bearing a later date than the proxy; (ii) duly executing a subsequent proxy relating to the same shares and delivering it to the Secretary of the Company at or before the Meeting; or (iii) attending the Meeting and voting in person (although attendance at the Meeting will not in and of itself constitute revocation of a proxy). Any written notice revoking a proxy should be delivered to Suzette F. Hoevet, Secretary, First Federal Bankshares, Inc., 329 Pierce Street, Sioux City, Iowa 51101.

In accordance with the provisions of the Company’s Certificate of Incorporation, record holders of Common Stock who beneficially own in excess of 10% of the outstanding shares of Common Stock (the “Limit”) are not entitled to any vote with respect to the shares held in excess of the Limit. The Company’s Certificate of Incorporation authorizes the Board of Directors (i) to make all determinations necessary or desirable to implement the Limit, including determining whether persons or entities are acting in concert, and (ii) to demand that any person who is reasonably believed to beneficially own stock in excess of the Limit supply information to the Company to enable the Board of Directors to implement and apply the Limit.

Voting Securities and Certain Holders Thereof

Stockholders of record as of the close of business on September 1, 2006 will be entitled to one vote for each share of Common Stock then held. As of that date, the Company had 3,380,109 shares of Common Stock issued and outstanding. The following table sets forth information as of September 1, 2006 regarding share ownership of those persons or entities known by management to own beneficially more than five percent of the issued and outstanding Common Stock and of all directors and executive officers of the Company as a group. This information is based solely upon information supplied to the Company and the filings required pursuant to the Securities Exchange Act of 1934.

Beneficial Owner | | Shares Beneficially Owned | | Percent of Class |

| | | | | |

First Federal Employee Stock Ownership Plan (1) 329 Pierce Street Sioux City, Iowa 51101 | | 228,891 | | 6.77% |

| | | | | |

Tontine Financial Partners, L.P. Tontine Management, L.L.C. Jeffrey L. Gendell 55 Railroad Avenue, 3rd Floor Greenwich, Connecticut 06830 | | 302,900 (2) | | 8.96% |

| | | | | |

| Directors and executive officers of the Company as a group (15 persons) | | 306,659 (3) | | 9.07% |

___________________________

(1) The amount reported represents shares held by the Employee Stock Ownership Plan (“ESOP”), 143,959 shares of which have been allocated to accounts of participants. First Bankers Trust Services of Quincy, Illinois, the trustee of the ESOP, may be deemed to beneficially own the shares held by the ESOP that have not been allocated to accounts of participants. Participants in the ESOP are entitled to instruct the trustee as to the voting of shares allocated to their accounts under the ESOP. Unallocated shares held in the ESOP’s suspense account are voted by the trustee in the same proportion as allocated shares voted by participants.

(2) As of June 30, 2006. Based upon a Schedule 13F filed with the SEC by Tontine Financial Partners, L.P.

(3) Amount includes shares held directly, as well as shares held jointly with family members, shares held in retirement accounts, shares held in a fiduciary capacity or by certain family members, with respect to which shares the holder may be deemed to have sole or shared voting and/or investment power. The amount above excludes options that have not vested and do not vest within 60 days of September 1, 2006.

PROPOSAL I - ELECTION OF DIRECTORS

The Company’s Board of Directors is presently composed of ten members, each of whom is also a director of the Bank. The directors are divided into three classes. Directors of the Company are generally elected to serve for three-year terms which are staggered to provide for the election of approximately one-third of the directors each year. Three directors will be elected at the Meeting to serve for three-year terms and until their respective successors shall have been elected and shall qualify.

The following table sets forth certain information regarding the Company’s Board of Directors, including their terms of office, and nominees for election as directors. It is intended that the proxies solicited on behalf of the Board of Directors (other than proxies in which the vote is withheld as to the nominee) will be voted at the Meeting for the election of the nominees identified in the following table. If any nominee is unable to serve, the shares represented by all such proxies will be voted for the election of such substitute as the Board of Directors may recommend. At this time, the Board of Directors knows of no reason why any nominee might be unable to serve, if elected. Except as described herein, there are no arrangements or understandings between any director or nominee and any other person pursuant to which such director or nominee was selected.

Name (1) | Age at June 30, 2006 | Position(s) Held | Director Since (2) | Current Term to Expire | Shares of Common Stock Beneficially Owned at September 1, 2006 (3) | Percent of Class |

| | | | | | | |

NOMINEES FOR TERMS TO EXPIRE IN 2009 |

| | | | | | | |

| Jon G. Cleghorn | 64 | Director | 1998 | 2006 | 42,800 (4) | 1.27 |

| Michael W. Dosland | 46 | President, CEO, Director | 2006 | 2006 | 16,000 | * |

| David M. Roederer | 55 | — | — | — | — | * |

| | | | | | | |

DIRECTORS CONTINUING IN OFFICE |

| | | | | | | |

| Arlene T. Curry, J.D. | 48 | Chairman of the Board | 2002 | 2008 | 7,769 (5) | * |

| Gary L. Evans | 67 | Director | 1989 | 2008 | 25,676 (4) | * |

| Allen J. Johnson | 67 | Director | 1993 | 2008 | 12,769 (4) | * |

| Barry E. Backhaus | 61 | Director | 1987 | 2007 | 101,052 (6) | 2.99 |

| Ronald A. Jorgensen | 49 | Director | 2005 | 2007 | 1,000 | * |

| Charles D. Terlouw | 57 | Director | 2006 | 2007 | 500 | * |

____________________________

* Less than 1%.

(1) The mailing address for each person listed is 329 Pierce Street, Sioux City, Iowa 51101.

(2) In certain cases, reflects initial appointment to the Board of Directors of the Bank or its mutual predecessor, First Federal Savings and Loan Association of Sioux City, as the case may be.

(3) Includes all shares of Common Stock held directly, as well as by spouses and minor children, in trust and other indirect ownership, over which shares the directors effectively exercise sole or shared voting and/or investment power. Includes shares granted under the 1999 Recognition and Retention Plan, as amended (a restricted stock plan, described below), which are subject to future vesting but as to which voting may currently be directed.

(4) Includes 450 shares subject to options under the 1999 Stock Option Plan that have vested.

(5) Includes 4,450 shares subject to options under the 1999 Stock Options Plan that have vested or that vest within 60 days of the Record Date.

(6) Includes 3,700 shares subject to options under the 1999 Stock Option Plan that have vested.

The business experience of each of the above directors and the non-director nominee for director is set forth below. All directors have held their present positions for at least the past five years, except as otherwise indicated.

Board of Directors

Arlene T. Curry has served as Chairman of the Board since October 2005. Ms. Curry is an attorney serving as counsel for various family-owned businesses. Ms. Curry was previously a partner in a Sioux City law firm, Crary, Huff, Inkster, Sheehan, Ringgenberg, Hartnett & Storm, P.C. From 2000 to 2005, Ms. Curry was the Executive Director of the Kind World Foundation, Dakota Dunes, South Dakota, and Senior Counsel for Waitt Media, Inc.

Michael W. Dosland, a Certified Public Accountant and a Chartered Financial Analyst, was appointed President and Chief Executive Officer of the Bank and Company on January 17, 2006. Mr. Dosland most recently served as Senior Vice President and Chief Financial Officer of First Federal Capital Bank in Wisconsin until that bank’s acquisition in 2004. From May 2004 to November 2005, Mr. Dosland, a Lieutenant Colonel in the Wisconsin Army National Guard, was on Active Duty with the US Army and commanded a 680-man Infantry Battalion deployed in Iraq.

Barry E. Backhaus retired in March 2006 after serving as President and Chief Executive Officer of the Bank since 1990 and Chairman of the Board from 1997 to October 2005. He has been affiliated with the Bank since 1969. Mr. Backhaus has been President, Chief Executive Officer and Chairman of the Board of the Company since its formation in 1998.

Jon G. Cleghorn is retired. From the time of its formation in 1998 until his retirement in July 2004, Mr. Cleghorn was Executive Vice President and Chief Operating Officer of the Company. Mr. Cleghorn has been affiliated with the Bank in various capacities since 1974. He was the Executive Vice President of the Bank from 1990 until his retirement.

Gary L. Evans is the retired President and Chief Executive Officer of Sioux Honey Association.

Allen J. Johnson is the retired President and Chief Executive Officer of Great West Casualty Company, a property and casualty company located in South Sioux City, Nebraska.

Ronald A. Jorgensen is the Vice President for Business and Finance of Morningside College, Sioux City, Iowa.

David M. Roederer is the Managing Partner of Stratavizion Consulting Group, Inc., in Des Moines, Iowa.

Charles D. Terlouw is a retired Audit Partner with KPMG LLP and currently serves as an Associate Professor of Accounting at Drake University, Des Moines, Iowa.

Board Independence

The Board of Directors has determined that, except as to Messrs. Backhaus, Cleghorn and Dosland, each member of the Board is an “independent director” within the meaning of the NASDAQ corporate governance listing standards. Mr. Dosland is not considered independent because he is an executive officer of First Federal Bankshares, Inc. Messrs. Backhaus and Cleghorn are not considered independent because, prior to their retirements in March 2006 and July 2004, respectively, they were executive officers of First Federal Bankshares, Inc.

Meetings and Committees of the Board of Directors

General The business of the Company’s Board of Directors is conducted through meetings and activities of the Board and its committees. During the fiscal year ended June 30, 2006, the Board of Directors held eight regular meetings and no special meetings. During the fiscal year ended June 30, 2006, no directors attended fewer than 75 percent of the total meetings of the Board of Directors and committees on which such director served except Mr. Van Engelenhoven. Mr. Van Engelenhoven was unable to attend three Board meetings, two Audit Committee meetings, and one Compensation and Benefits Committee meeting.

The standing committees include the Compensation and Benefits, Nominating and Audit Committees.

Nominating Committee The Nominating Committee consists of Directors Arlene T. Curry, Gary L. Evans, and Ronald A. Jorgensen. Each member of the Nominating Committee is considered “independent” as defined in the NASDAQ corporate governance listing standards. The Board of Directors has adopted a written charter for the Committee, which is available at the Company’s website at www.firstfederalbank.com. The Committee met once during the fiscal year ended June 30, 2006.

The functions of the Nominating Committee include the following:

| | · | to lead the search for individuals qualified to become members of the Board and to select director nominees to be presented for stockholder approval; |

| | · | to review and monitor compliance with the requirements for board independence; |

| | · | to review the committee structure and make recommendations to the Board regarding committee membership; |

| | · | to develop and recommend to the Board for its approval a set of corporate governance guidelines; and |

| | · | to develop and recommend to the Board for its approval a self-evaluation process for the Board and its committees. |

The Nominating Committee identifies nominees by first evaluating the current members of the Board of Directors willing to continue in service. Current members of the Board with skills and experience that are relevant to the Company’s business and who are willing to continue in service are first considered for re-nomination, balancing the value of continuity of service by existing members of the Board with that of obtaining a new perspective. If any member of the Board does not wish to continue in service, or if the Committee or the Board decides not to re-nominate a member for re-election, or if the size of the Board is increased, the Committee would solicit suggestions for director candidates from all Board members. In addition, the Committee is authorized by its charter to engage a third party to assist in the identification of director nominees. The Nominating Committee would seek to identify a candidate who at a minimum satisfies the following criteria:

| · | has the highest personal and professional ethics and integrity and whose values are compatible with the Company’s; |

| · | has had experiences and achievements that have given him or her the ability to exercise and develop good business judgment; |

| · | is willing to devote the necessary time to the work of the Board and its committees, which includes being available for Board and committee meetings; |

| · | is familiar with the communities in which the Company operates and/or is actively engaged in community activities; |

| · | is involved in other activities or interests that do not create a conflict with his or her responsibilities to the Company and its stockholders; and |

| · | has the capacity and desire to represent the balanced, best interests of the stockholders of the Company as a group, and not primarily a special interest group or constituency. |

Finally, the Nominating Committee will take into account whether a candidate satisfies the criteria for “independence” under the NASDAQ corporate governance listing standards, and if a nominee is sought for service on the audit committee, the financial and accounting expertise of a candidate, including whether the individual qualifies as an audit committee financial expert.

Procedures for the Nomination of Directors by Stockholders The Nominating Committee has adopted procedures for the submission of director nominees by stockholders. If a determination is made that an additional candidate is needed for the Board, the Nominating Committee will consider candidates submitted by the Company’s stockholders. Stockholders can submit qualified names of candidates for director by writing to our Corporate Secretary, at 329 Pierce Street, Sioux City, Iowa 51101. The Corporate Secretary must receive a submission not less

than ninety (90) days prior to the anniversary date of the Company’s proxy materials for the preceding year’s annual meeting. The submission must include the following information:

| · | the name and address of the stockholder as they appear on the Company’s books, and number of shares of the Company’s common stock that are owned beneficially by such stockholder (if the stockholder is not a holder of record, appropriate evidence of the stockholder’s ownership will be required); |

| · | the name, address and contact information for the candidate, and the number of shares of common stock of the Company that are owned by the candidate (if the candidate is not a holder of record, appropriate evidence of the stockholder’s ownership will be required); |

| · | a statement of the candidate’s business and educational experience; |

| · | such other information regarding the candidate as would be required to be included in the proxy statement pursuant to SEC Rule 14A; |

| · | a statement detailing any relationship between the candidate and the Company; |

| · | a statement detailing any relationship between the candidate and any customer, supplier or competitor of the Company; |

| · | detailed information about any relationship or understanding between the proposing stockholder and the candidate; and |

| · | a statement that the candidate is willing to be considered and willing to serve as a director if nominated and elected. |

Submissions that are received and that meet the criteria outlined above are forwarded to the Chairman of the Nominating Committee for further review and consideration. A nomination submitted by a stockholder for presentation by the stockholder at an annual meeting of stockholders must comply with the procedural and informational requirements described in this proxy statement under the heading “Stockholder Proposals.”

Stockholder Communications with the Board A stockholder of the Company who wishes to communicate with the Board or with any individual director may write to the Corporate Secretary of the Company, 329 Pierce Street, Sioux City, Iowa 51101, Attention: Board Administration. The letter should indicate that the author is a stockholder and if shares are not held of record, should include appropriate evidence of stock ownership. Depending on the subject matter, management will:

| · | forward the communication to the director or directors to whom it is addressed; |

| · | attempt to handle the inquiry directly, for example where it is a request for information about the Company or a stock-related matter; or |

| · | not forward the communication if it is primarily commercial in nature, relates to an improper or irrelevant topic, or is unduly hostile, threatening, illegal or otherwise inappropriate. |

At each Board meeting, management will present a summary of all communications received since the last meeting that were not forwarded and make those communications available to the directors.

Compensation and Benefits Committee The Compensation and Benefits Committee consists of Directors Gary L. Evans, Arlene T. Curry, Allen J. Johnson and David Van Engelenhoven. Each member of the Compensation and Benefits Committee is considered “independent” as defined in the NASDAQ corporate governance listing standards. The Committee meets to review, evaluate and recommend goals relevant to the Company’s management, review such officers’ performance in light of these goals and determine (or recommend to the full Board of Directors for determination) such officers’ cash and equity compensation based on this evaluation.

The Committee determines compensation and benefit programs and adjustments. The Committee met four times in fiscal 2006. The Board of Directors has adopted a written charter for the Committee, which is available at the Company’s website at www.firstfederalbank.com. The report of the Compensation and Benefits Committee is included elsewhere in this Proxy Statement.

Audit Committee The Audit Committee consists of Directors Ronald A. Jorgensen, Allen J. Johnson, Charles D. Terlouw and David Van Engelenhoven. Each member of the Audit Committee is considered “independent” as defined in the NASDAQ corporate governance listing standards and under SEC Rule 10A-3. The Board of Directors has determined that Ronald A. Jorgensen and Charles D. Terlouw each qualifies as an “audit committee financial expert” as that term is defined by the rules and regulations of the SEC. The duties and responsibilities of the Audit Committee include, among other things:

| · | retaining, overseeing and evaluating a firm of independent certified public accountants to audit the Company’s annual financial statements; |

| · | in consultation with the independent registered public accounting firm and the internal auditor, reviewing the integrity of the Company’s financial reporting processes, both internal and external; |

| · | approving the scope of the audit in advance; |

| · | reviewing the financial statements and the audit report with management and the independent registered public accounting firm; |

| · | considering whether the provision by the independent registered public accounting firm of services not related to the annual audit and quarterly reviews is consistent with maintaining the independent registered public accounting firm’s independence; |

| · | reviewing earnings and financial releases and quarterly reports filed with the SEC; |

| · | consulting with the internal audit staff and reviewing management’s administration of the system of internal accounting controls as required by Section 404 of the Sarbanes-Oxley Act of 2002; |

| · | approving all engagements for audit and non-audit services by the independent registered public accounting firm; and |

| · | reviewing the adequacy of the Audit Committee Charter. |

The Audit Committee met five times during the fiscal year ended June 30, 2006. The Audit Committee reports to the Board on its activities and findings. The Board of Directors has adopted a written charter for the Audit Committee, which was appended to the 2005 Annual Meeting Proxy Statement as Appendix A and which is available at the Company’s website at www.firstfederalbank.com.

Audit Committee Report

As part of its responsibilities, the Audit Committee hereby reports the following:

| | 1. | The Audit Committee has reviewed and discussed the audited financial statements with the Company’s management. |

| | 2. | The Audit Committee has discussed with the independent registered public accounting firm the matters required to be discussed by SAS 61 (Codification of Statements on Auditing Standards, AU 380). |

| 3. | The Audit Committee has received the written disclosures and the letter from the independent registered public accounting firm required by Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees, and has discussed with the independent registered public accounting firm its independence. |

| | 4. | Based on review and discussions referred to in paragraph 1 through 3 above, the Audit Committee recommended to the Board of Directors of the Company, and the Board has approved, that the audited financial statements be included in the Company’s annual report on Form 10-K for the fiscal year ended June 30, 2006, for filing with the Securities and Exchange Commission. In addition, the Audit Committee appointed McGladrey & Pullen, LLP as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2007, subject to the ratification of this appointment by the stockholders. |

This report shall not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that the Company specifically incorporates this information by reference. This report shall not otherwise be deemed filed under such Acts.

The undersigned members of the Audit Committee have submitted this report.

Ronald A. Jorgensen, Chairman

Allen J. Johnson

Charles D. Terlouw

David Van Engelenhoven

Ownership Reports by Officers and Directors

The Common Stock of the Company is registered pursuant to Section 12(g) of the Securities Exchange Act of 1934 (the “Exchange Act”). The officers and directors of the Company and beneficial owners of greater than 10% of the Company’s Common Stock (“10% beneficial owners”) are required to file reports on Forms 3, 4 and 5 with the Securities and Exchange Commission (the “SEC”) disclosing changes in beneficial ownership of the Common Stock. SEC rules require disclosure in the Company’s proxy statement of the failure of an officer, director or 10% beneficial owner of the Company’s Common Stock to file a Form 3, 4 or 5 on a timely basis. Based on the Company’s review of such ownership reports, no officer or director of the Company failed to file such ownership reports on a timely basis for the fiscal year ended June 30, 2006, except for a late Form 4 for Ronald A. Jorgensen related to a series of small acquisitions in a six month period which exceeded $10,000 in market value.

Executive Compensation

Summary Compensation Table The following table sets forth for the fiscal years ended June 30, 2006, 2005 and 2004, certain information as to the total remuneration paid by the Bank to each of the individuals who served in the position of Chief Executive Officer of the Bank and the Company during fiscal year 2006, and to the four other most highly compensated executive officers of the Company whose total annual salary and bonus exceeded $100,000 for fiscal year 2006 (the “named executive officers”).

Name and principal position | Year Ended June 30, | Annual Compensation (1) | Long-Term Compensation | All Other Compensation |

Salary | Bonus (2) | Other Annual Compensation (3) | Awards | Payouts |

Restricted Stock Awards (4) | Options/ SARS (#) | LTIP Payouts |

Michael W. Dosland President & CEO | 2006 | $104,532 | $— | $— | $— | 10,000 | $— | $25,000(5) |

Barry E. Backhaus President & CEO (Retired 3/06) | 2006 2005 2004 | 174,029 238,374 229,575 | — 10,704 26,033 | — — — | — 59,846 — | — 3,700 — | — — — | 5,220(6) — — |

Steven L. Opsal Executive Vice President | 2006 2005 2004 | 144,500 138,600 132,817 | — 5,186 17,779 | — — — | — 37,419 — | — 2,300 — | — — — | — — — |

Scott Sehnert SVP/Commercial Banking Manager | 2006 2005 2004 | 121,800 117,200 116,967 | — 1,754 4,248 | — — — | 14,967 | — 900 — | — — — | 51,331(7) 66,219 54,556 |

BJ Schneiderman SVP/Residential Lending Manager | 2006 2005 2004 | 96,425 92,000 90,292 | — 1,377 3,295 | — — — | 14,967 | — 900 — | — — — | 34,168(7) 30,874 63,196 |

Peggy Smith SVP/Operations Manager | 2006 2005 2004 | 111,000 99,500 89,242 | — 2,978 9,232 | — — — | — 14,967 — | — 900 — | — — — | — 2,500 — |

(1) The Company does not maintain a deferred compensation plan for employees. Amounts do not include benefits pursuant to the Bank’s Pension Plan. See “Benefits.”

(2) Amounts represent bonuses earned by the executive and accrued as compensation expense by the Company in the fiscal year shown. Amounts are actually paid in the following fiscal year.

(3) The Company also provides certain members of senior management with the use of an automobile, membership dues and other personal benefits. The aggregate amount of such other benefits provided to each of the named executive officers did not exceed the lesser of $50,000 or 10% of the officer’s aggregate salary and annual bonus.

(4) On September 23, 2004, Messrs. Backhaus, Opsal, Sehnert, and Schneiderman and Ms. Smith were granted 2,551, 1,595, 638, 638 and 638 shares, respectively, pursuant to the Company’s 1999 Recognition and Retention Plan, all of which vested on September 23, 2005. The dollar amounts shown in the table are based on the closing price of the Company’s common stock on September 22, 2004, as reported on the Nasdaq Global Market, which was $23.46. Dividends on unvested shares are distributed to the officer as and when declared and paid. The aggregate number and value of unvested restricted shares held by the named executive officers at June 30, 2006 was 700 shares and $15,190, respectively.

(5) Represents a hiring and relocation bonus paid to Mr. Dosland in connection with his employment as President and Chief Executive Officer.

(6) Represents a payment to Mr. Backhaus upon his retirement in recognition of years of service to the Company and the Bank.

(7) Represents non-discretionary compensation based on loan production.

Directors’ Compensation

Each non-employee member of the Board of Directors of First Federal received fees of $750 for each meeting attended in fiscal 2006. As of October 27, 2005, the Outside Chairman of the Board receives $1,250 for

each meeting chaired. Each non-employee member of the Loan Committee, Nominating Committee, Compensation and Benefits Committee and Audit Committee was paid $250, $250, $400 and $500, respectively, for each committee meeting attended in fiscal 2006. During the fiscal year ended June 30, 2006, First Federal paid a total of $166,100 in directors’ and committee fees, which amounts included fees deferred at the election of directors pursuant to the Deferred Compensation Plan for Directors. See “Benefits—Deferred Compensation Plan for Directors.”

In addition to the foregoing fees, First Federal pays annual retainer fees of $7,500 for each non-employee director and $15,000 for the Outside Chairman of the Board; $4,000 for the Audit Committee Chairperson, and $2,000 for the Compensation and Benefits Committee Chairperson. Such retainer fees are paid on a quarterly basis.

No separate compensation was paid to directors for service on the Board of Directors or Board Committees of the Company.

Benefits

Pension Plan To reduce costs, First Federal Bank froze the defined benefit pension plan effective August 1, 2005 which suspended annual contributions and ended the enrollment of new employees into the plan. Prior to August 1, 2005, all regular full-time employees who have attained the age of 21 and completed one year of service of 1,000 hours or more were enrolled into a defined benefit non-contributory pension plan. Employees who were enrolled prior to August 1, 2005 will be eligible for monthly payments to or on behalf of each covered employee upon the employee’s retirement. These payments are calculated in accordance with a formula based on the employee’s “average annual compensation,” which is defined as the highest average of eligible compensation for five consecutive calendar years of employment.

The formula for determining normal retirement allowance is: 1.0%* X years of benefit service X high 5 average salary = regular annual allowance.

Employee benefits for employees enrolled under the plan vest as designated in the schedule below:

| Completed Years | Vested |

of Employment | Percentages |

| | |

| Fewer than 5 | 0% |

| 5 or more | 100% |

The following table illustrates regular annual allowance amounts at age 65 under the regular retirement benefit plan provisions available at various levels of compensation and years of benefit service (figured on the formula shown above) and are not subject to any deduction for Social Security benefits or other offset amounts:

| | | Years of Benefit Service | |

| Average Final Compensation (1) | | 10 | | 15 | | 20 | | 25 | | 30 | | 35 | |

| | | | | | | | | | | | | | |

| $ 20,000 | | $ | 2,000 | | $ | 3,000 | | $ | 4,000 | | $ | 5,000 | | $ | 6,000 | | $ | 7,000 | |

| $ 30,000 | | $ | 3,000 | | $ | 4,500 | | $ | 6,000 | | $ | 7,500 | | $ | 9,000 | | $ | 10,500 | |

| $ 50,000 | | $ | 5,000 | | $ | 7,500 | | $ | 10,000 | | $ | 12,500 | | $ | 15,000 | | $ | 17,500 | |

| $ 75,000 | | $ | 7,500 | | $ | 11,250 | | $ | 15,000 | | $ | 18,750 | | $ | 22,500 | | $ | 26,250 | |

| $100,000 | | $ | 10,000 | | $ | 15,000 | | $ | 20,000 | | $ | 25,000 | | $ | 30,000 | | $ | 35,000 | |

| $150,000 | | $ | 15,000 | | $ | 22,500 | | $ | 30,000 | | $ | 37,500 | | $ | 45,000 | | $ | 52,500 | |

___________________________

(1) Average Final Compensation is average “Salary” and, for Messrs. Sehnert and Schneiderman only, “All Other Compensation” as reported in the Summary Compensation Table, for the highest five years of salary.

_____________________________________

*2% on all accrued benefits through September 1, 1996; 1.5% on all accrued benefits through February 1, 2004.

As of June 30, 2006, Mr. Backhaus had 35 years of benefit service under the pension plan; Mr. Opsal had 29 years of benefit service; Mr. Sehnert had one year of benefit service; Mr. Schneiderman had 30 years of benefit service; and Ms. Smith had 14 years of benefit service.

Employee Stock Ownership Plan and Trust The Bank has established the Employee Stock Ownership Plan (the “ESOP”) for eligible employees. The ESOP is a tax-qualified plan subject to the requirements of the Employee Retirement Income Security Act of 1974 (“ERISA”) and the Internal Revenue Code of 1986, as amended (the “Code”). Employees with a 12 month period of employment with the Bank during which they worked at least 1,000 hours and who have attained age 21 are eligible to participate. Shares purchased by the ESOP are held in a suspense account for allocation among participants.

Contributions to the ESOP and shares released from the suspense account are allocated among participants on the basis of compensation in the year of allocation, up to an annual adjusted maximum level of compensation. Benefits generally become 100% vested after five years of credited service. Participants were credited for years of service with the Bank prior to the effective date of the ESOP. Forfeitures are reallocated among remaining participating employees in the same proportion as contributions. Benefits may be payable upon death, retirement, early retirement, disability, or separation from service.

The Compensation and Benefits Committee administers the ESOP. The Committee may instruct the trustee of the ESOP regarding investment of funds contributed to the ESOP. The ESOP trustee must vote all allocated shares held in the ESOP in accordance with the instructions of the participating employees. Under the ESOP, unallocated shares and shares held in the suspense account will be voted in a manner calculated to most accurately reflect the instructions the ESOP trustee has received from participants regarding allocated stock, subject to and in accordance with the fiduciary duties under ERISA owed by the trustee to the ESOP participants.

Stock Option Plans In 1992, the Board of Directors of the Bank adopted the First Federal Savings Bank of Siouxland 1992 Incentive Stock Option Plan (the “1992 Stock Option Plan”) and the 1992 Stock Option Plan for Outside Directors (the “Directors’ Plan”). In connection with the formation of the Company, options under such plans to purchase common stock of the Bank were converted into options to purchase the Company’s common stock. All officers and key employees of the Company, the Bank and its subsidiaries are eligible to participate in the 1992 Stock Option Plan. Only non-employee directors are eligible to participate in the Directors’ Plan. In 1999, the Board of Directors of the Company adopted the 1999 Stock Option Plan, which was approved by Company stockholders in October 1999 and amended and restated in 2003 (the “1999 Stock Option Plan”). Officers, employees and non-employee directors of the Company, the Bank and its subsidiaries are all eligible to participate in the 1999 Stock Option Plan.

Pursuant to the 1992 Stock Option Plan, the Directors’ Plan and the 1999 Stock Option Plan, stock options for 164,353, 41,088 and 263,500 shares, respectively, were eligible for issuance to plan participants. Pursuant to these option plans, grants may be made of (i) options to purchase Common Stock intended to qualify as incentive stock options under Section 422 of the Code, (ii) options that do not so qualify (“non-qualified options”), and (iii) reload options, dividend equivalent rights and “Limited Rights” (described below) that are exercisable only upon a change in control of the Company. Incentive stock options may only be granted to employees of the Company, the Bank or an affiliate of the Company or the Bank. Non-employee directors may be granted non-qualified stock options.

The grant of awards under the 1992 Stock Option Plan was determined by a committee of the Board of Directors consisting of the four non-employee directors serving on the Compensation and Benefits Committee. The grant of awards under the 1999 Stock Option Plan is determined by a committee of the Board of Directors consisting of (i) at least two non-employee directors of the Company or (ii) the entire Board of the Company. With respect to the Directors’ Plan, all options were granted at the time of the implementation of the plan. Each then director was granted non-qualified options to purchase 3,903 shares and the Chairman of the Board received options for an additional 3,903 shares of common stock.

In granting options to plan participants, the Compensation and Benefits Committee considers, among other things, position and years of service, and the value of the individual’s services to the Company and the Bank. Options are exercisable at a rate prescribed by the Committee; provided, however, that all options are 100%

exercisable in the event the optionee terminates his employment due to death, disability, retirement or in the event of a change in control (as defined in the Plan). The exercise price may be paid in cash or Common Stock, or in the case of the 1999 Stock Option Plan, by a cashless exercise through a broker-dealer. Under the 1992 Stock Option Plan, the Company may issue replacement options in exchange for previously granted non-statutory options at exercise prices that may be less than the previous exercise price, but may not be less than 85% of the fair market value of the Common Stock on the date such replacement options are granted.

The term of stock options generally does not exceed 10 years from the date of grant. No incentive stock option granted in connection with the plans is exercisable more than three months after the date on which the optionee ceases to perform services for the Bank or the Company for any reason other than death, disability, retirement or, in connection with a change in control. In the case of the 1992 Stock Option Plan, incentive stock options may be exercised for up to one year in the event of termination of employment due to death, disability, retirement or a change-in-control of the Company, and for up to five years in the case of the 1999 Stock Option Plan. In the case of both the 1992 Stock Option Plan and 1999 Stock Option Plan and by operation of law, if an optionee ceases to perform services for the Bank or the Company due to retirement or following a change in control, any incentive stock options exercised more than three months following the date the optionee ceases to perform services shall be treated as a non-statutory stock option as described above. In the case of the 1999 Stock Option Plan, if an optionee ceases to perform services for the Bank or the Company due to disability, any incentive stock options exercised more than one year following the date the optionee ceases to perform services shall be treated as non-statutory stock options as described above. Incentive stock options exercised by the heirs or devisees of a deceased optionee are eligible for incentive option treatment if the optionee’s death occurred while employed or within three months of termination of employment. Options granted under the Directors’ Plan expire upon the earlier of 10 years following the date of grant or one year following the date the optionee ceases to be a director.

Pursuant to the 1992 Stock Option Plan and the 1999 Stock Option Plan, the Compensation and Benefits Committee may grant Limited Rights to employees simultaneously with the grant of any option. A Limited Right gives the option holder the right, upon a change in control of the Company or the Bank, to receive the excess of the market value of the shares represented by the Limited Rights on the date exercised over the exercise price. Limited Rights generally will be subject to the same terms and conditions and exercisable to the same extent as stock options, as described above. Payment upon exercise of a Limited Right will be in cash. Limited Rights may be granted at the time of, and must be related to, the grant of a stock option. Upon the exercise of a Limited Right, the related option will cease to be exercisable. If a Limited Right is granted with and related to an incentive stock option, the Limited Right must satisfy all the restrictions and limitations to which the related incentive stock option is subject.

The 1999 Stock Option Plan provides for dividend equivalent rights, which may also be granted at the time of the grant of a stock option. Dividend equivalent rights entitle the option holder to receive an amount of cash at the time that certain extraordinary dividends are declared equal to the amount of the extraordinary dividend multiplied by the number of shares of common stock underlying the unexercised portion of the related options. For these purposes, an extraordinary dividend is defined as any dividend paid on shares of Common Stock where the rate of dividend exceeds the Bank’s weighted average cost of funds on interest-bearing liabilities for the current and preceding three quarters.

The 1999 Stock Option Plan also provides for reload options, which may also be granted at the time of the grant of a stock option. Reload options entitle the option holder, who has delivered shares that he or she owns as payment of the exercise price for option stock, to a new option to acquire additional shares equal in amount to the shares he or she has traded in to satisfy the option exercise price. Reload options may also be granted to replace option shares retained by the employer for payment of the option holder’s withholding tax. The option price at which additional shares of stock can be purchased by the option holder through the exercise of a reload option is equal to the market value of the previously owned stock at the time it was surrendered to the employer. The option period during which the reload option may be exercised expires at the same time as that of the original option that the holder has exercised.

Shares as to which awards may be granted under the plans, and shares then subject to awards, will be adjusted by the Compensation and Benefits Committee in the event of any merger, consolidation, reorganization,

recapitalization, stock dividend, stock split, combination or exchange of shares or other change in the corporate structure of the Company without receipt of payment or consideration by the Company.

Shares issued upon the exercise of a stock option may be either authorized but unissued shares, or reacquired shares held by the Company as treasury stock. Any shares subject to an award that expires or is terminated unexercised will again be available for issuance under the respective plan. Generally, in the discretion of the Compensation and Benefits Committee, all or any non-qualified stock options granted under a stock option plan may be transferable by the participant but only to the persons or classes of persons determined by the Committee. No other award or any other right or interest therein is assignable or transferable except under limited exceptions set forth in the option plan.

As of June 30, 2006, except for options to purchase 650 shares under the 1999 Stock Option Plan, there were no stock options available for grant under any of the Company’s current stock option plans.

Set forth below is certain information regarding options granted to the named executive officers during fiscal 2006.

OPTIONS GRANTED IN LAST FISCAL YEAR |

Name | Options Granted | Percent of Total Options Granted to Employees in FY 2006 | Exercise Price | Expiration Date | Grant Date Present Value (1) |

| Michael W. Dosland | 10,000 | 68% | $20.75 | 1-19-2016 | $73,890 |

_________________________

(1) The grant-date value was calculated using the Black-Scholes option model, an expected life of 7.5 years, expected volatility of 35.01%, yield rate of 2.17% and risk-free rate of return of 4.34%.

The table below sets forth certain information with respect to options exercised by the named executive officers in fiscal 2006 and unexercised options held by the named executive officers as of June 30, 2006.

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR AND FISCAL YEAR-END OPTION VALUES |

Name | Shares Acquired Upon Exercise (#) | Value Realized | Number of Unexercised Options at Fiscal Year-End | Value of Unexercised In- The-Money Options at Fiscal Year-End |

Exercisable/Unexercisable | Exercisable/Unexercisable |

| Barry E. Backhaus | 25,000 | $289,850 | 3,700/— | $—/$— |

| B. J. Schneiderman | 2,000 | $25,500 | 8,900/— | $99,600/$— |

| Michael W. Dosland | — | — | —/10,000 | $—/$9,500 |

| Steven L. Opsal | — | — | 33,887/— | $320,209/$— |

| Scott Sehnert | — | — | 6,900/4,000 | $43,740/$29,160 |

| Peggy Smith | — | — | 5,900/— | $62,250/$— |

Recognition and Retention Plan In 1999 the Company established the 1999 Recognition and Retention Plan, which was approved by the Company stockholders in October 1999 and amended and restated in 2003 (the “1999 Recognition Plan”). The Bank provided sufficient funds for the 1999 Recognition Plan to acquire 79,050 authorized-but-unissued shares of Common Stock of the Company.

Key employees and non-employee directors of the Company and the Bank are eligible to participate in the 1999 Recognition Plan. The plan is intended to provide plan participants with a proprietary interest in the Company in a manner designed to encourage such persons to remain with these entities and to provide further incentives to achieve corporate objectives.

The Compensation and Benefits Committee administers the plan and makes awards under the plan. Awards are granted in the form of shares of Common Stock held by the plan. Awards are nontransferable and nonassignable and the shares awarded are earned (i.e., become vested) at a rate or rates determined by the Committee. The Committee members may provide for a less or more rapid earnings rate with respect to awards granted under the plan. Awards become fully vested upon termination of employment due to death, disability, retirement and a change in control. Where an officer terminates employment with the Company or the Bank for any other reason, the officer’s nonvested awards will be forfeited.

When shares become vested, the participants will recognize income equal to the fair market value of the Common Stock at that time. The amount of income recognized by a participant will be a deductible expense for federal income tax purposes for the Company. Under the 1999 Recognition Plan, unvested shares are held by the Company in escrow. Dividends on unvested shares are distributed to participants when paid. In addition, participants have the right to vote the shares awarded to them, whether or not vested.

Restricted stock awarded under this plan will be adjusted by the Committee in the event of a reorganization, recapitalization, stock split, stock dividend, combination or exchange of shares, merger, consolidation or other change in corporate structure.

Equity Compensation Plan Disclosure Set forth below is information as of June 30, 2006 regarding compensation plans under which equity securities of the Company are authorized for issuance.

Plan | Number of Securities to be Issued upon Exercise of Outstanding Options and Rights | Weighted Average Exercise Price | Number of Securities Remaining Available for Issuance under Plans |

| Equity compensation plans approved by stockholders | 118,061 | $14.10 | 1,288 (1) |

| Equity compensation plans not approved by stockholders | — | — | — |

| Total | 118,061 | $14.10 | 1,288 (1) |

_____________________________

(1) Represents shares available for future issuance pursuant to the 1999 Recognition and Retention Plan, as amended and pursuant to the exercise of options under the 1999 Stock Option Plan, as amended.

2005 Deferred Compensation Plan for Directors The Board of Directors of the Bank adopted a 2005 Deferred Compensation Plan for Directors (the “2005 Deferred Plan”), which became effective as of January 1, 2005. The 2005 Deferred Plan is designed to comply with the requirements of Code Section 409A. Pursuant to the 2005 Deferred Plan, directors of the Bank may elect to defer all or one-half of their fees received for service on the Board of Directors and on committees of the Board of Directors. Compensation paid to directors who are also Bank employees and special compensation for services to the Bank such as legal and investment advisory services are not eligible for deferral. The Bank credits to a special memorandum account the amounts of any such deferred fees as of the last day of each month. Interest is paid on such amounts at a rate equal to the average weighted cost of certificates of deposit of the Bank for the previous month. Prior to January 1 of each deferral year, a director must file an election with the Bank designating the form in which he will receive his deferred compensation benefit. Such deferral election is irrevocable with respect to the calendar year for which it is filed, provided, however, that a director may delay distributions or modify a previous deferral election from a lump sum distribution to annual payments upon his separation from service if: (i) the new deferral election is not effective for 12 months, (ii) the original distribution date is at least 12 months from the date of the change in the election, and (iii) the new distribution date must be at least five years after the original distribution date. Deferred fees will be paid out upon the director’s death, disability, or separation from service as a director of the Bank. At the election of the director, the distribution may be paid out in a lump sum or in equal monthly installments over a period of ten years, or such shorter period as shall be approved by the Board of Directors.

1995 Deferred Compensation Plan for Directors In March 1995, the Board of Directors of the Bank adopted a Deferred Compensation Plan for Directors (the “Deferred Plan”), which became effective as of January 1, 1995. Pursuant to the Deferred Plan, directors of the Bank may elect to defer all or one-half of their fees received for service on the Board of Directors and on committees of the Board of Directors. The Bank shall credit to a

special memorandum account the amounts of any such deferred fees as of the last day of each month. Interest will be paid on such amounts at a rate equal to the average weighted cost of certificates of deposit of the Bank for the previous month. Deferred fees will be paid out upon the death, disability or termination of a director as a director of the Bank. At the election of the director, the distribution may be paid out in a lump sum or in equal monthly installments over a period of ten years, or such shorter period as shall be approved by the Board of Directors. Contributions to the Deferred Plan were frozen, effective December 31, 2004.

First Federal Bank Incentive Award Plan Effective for the 2006 fiscal year, the Board of Directors approved the First Federal Bank Incentive Award Plan. This plan provides cash award opportunities for employees, including officers, based upon their attainment of specified individual goals and objectives. The plan includes “triggers” that can eliminate any payment under the plan if certain levels of Bank performance are not met. The Bank’s net income fell below the trigger amount for the fiscal year 2006, thereby effectively eliminating any payouts under the First Federal Bank Incentive Award Plan in that fiscal year.

First Federal Bank Cash Incentive Plan Effective for the 2007 fiscal year, the Board of Directors approved the First Federal Bank Cash Incentive Plan. This plan provides cash award opportunities for employees, including officers, based upon the attainment of Bank-wide performance goals, which include net income growth fiscal year over fiscal year, return on assets and return on equity as compared to the performance of a Board-approved peer group of publicly held banks. The plan also includes “triggers” that can eliminate any payment under the plan if certain levels of Bank performance are not met.

Certain Transactions with the Bank

Under federal law, all loans or extensions of credit to executive officers and directors must be made on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with the general public and must not involve more than the normal risk of repayment or present other unfavorable features. However, regulations permit executive officers and directors to receive the same terms through benefit or compensation plans that are widely available to other employees, as long as the director or executive officer is not given preferential treatment compared to the other participating employees. In addition, loans made to a director or executive officer in excess of the greater of $25,000 or 5% of the Bank’s capital and surplus (up to a maximum of $500,000) must be approved in advance by a majority of the disinterested members of the Board of Directors. All loans made by First Federal to its officers, directors, and executive officers were made in the ordinary course of business, were made on the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with other persons and did not involve more than the normal risk of collectibility or present other unfavorable features.

As of June 30, 2006, the aggregate principal balance of loans outstanding for all Company executive officers and directors, and family members was $1.6 million.

Employment Agreements

The continued success of the Company and the Bank depends to a significant degree on the skills and competence of its officers. The Company has entered into an employment agreement with Michael W. Dosland, pursuant to which Mr. Dosland will serve as President and Chief Executive Officer of the Company and the Bank. The agreement has an initial term of two years. Unless notice of non-renewal is provided, the agreement renews annually. Under the agreement, the initial base salary for Mr. Dosland is $230,000 per year. The base salary will be reviewed at least annually and may be increased, but not decreased. In addition to the base salary, the agreement provides for, among other things, participation in bonus programs and other employee pension benefit and fringe benefit plans applicable to executive employees, use of an automobile and reimbursement of expenses associated with the use of such automobile. Pursuant to the agreement, the Company granted Mr. Dosland 10,000 options to purchase Company common stock, and paid Mr. Dosland a $25,000 hiring and relocation bonus. Pursuant to the agreement, Mr. Dosland’s employment may be terminated for just cause at any time, in which event he would have no right to receive compensation or other benefits for any period after termination.

Pursuant to the agreement, Mr. Dosland is entitled to severance payments and benefits in the event of his termination of employment under specified circumstances. In the event his employment is terminated for reasons

other than for just cause, disability or retirement, or in the event he resigns during the term of the agreement following (1) the failure to elect or reelect or to appoint or reappoint him to his executive position, (2) a material change in his functions, duties, or responsibilities, which change would cause his position to become one of lesser responsibility, importance or scope, (3) the liquidation or dissolution of the Company or the Bank, (4) a change in control of the Company, or (5) a breach of the employment agreement by the Company, Mr. Dosland would be entitled to a severance payment equal to two times the sum of his base salary and the highest rate of bonus awarded to him during the prior two years, payable in a lump sum. In addition, he would be entitled, at the Company’s sole expense, to the continuation of life, medical, dental and disability coverage for 24 months after termination of the agreement. Pursuant to the agreement, Mr. Dosland is entitled to no additional benefits under the employment agreement upon his retirement at age 65.

Barry E. Backhaus, whom Mr. Dosland succeeded as President and Chief Executive Officer, was a party to an employment agreement with the Company and the Bank. In connection with Mr. Backhaus’ retirement as President and Chief Executive Officer in March 2006, this employment agreement expired.

Steven L. Opsal, Executive Vice President of the Company and the Bank, was a party to an employment agreement with the Company and the Bank. In connection with Mr. Opsal’s resignation from the Company and the Bank, effective at the Company’s 2006 Annual Meeting of Stockholders, Mr. Opsal and the Company entered into a separation agreement, pursuant to which Mr. Opsal’s employment agreement was terminated. The separation agreement also provides that the Bank will pay Mr. Opsal in January 2007 the one-time lump sum of $200,000, less appropriate taxes and deductions. Under the separation agreement, Mr. Opsal (and his spouse and dependents) are entitled to receive continued health insurance coverage under applicable state or federal “COBRA” laws for 18 months following the termination of his employment, provided that Mr. Opsal (and/or his spouse or dependents) timely elect such continuation coverage and timely remit the applicable premiums. The separation agreement provides that all other employee benefits will cease as of the termination of Mr. Opsal’s employment, including life insurance coverage, disability insurance coverage, retirement plan participation and other fringe benefits. Finally, stock options awarded to Mr. Opsal were made exercisable in accordance with their terms following the termination of Mr. Opsal’s employment, and the Company and the Bank agreed for six years to provide Mr. Opsal coverage under a standard directors’ and officers’ liability insurance policy, and to indemnify Mr. Opsal to the fullest extent permitted under federal law.

In consideration for these benefits, among other things, Mr. Opsal agreed, for a period of 18 months, not to compete with the Company and the Bank in the Bank’s market area and not to solicit employees, customers or clients of the Company or the Bank. Finally, Mr. Opsal agreed to make himself available as a consultant to the Company and the Bank for up to ten hours per month for a period of 18 months, for no additional consideration.

Report of the Compensation and Benefits Committee on Executive Compensation

The following Report of the Company’s Compensation Committee is provided in accordance with the rules and regulations of the Securities and Exchange Commission. Pursuant to such rules and regulations, this Report and the Performance Graph shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933, as amended or the Securities Exchange Act of 1934, as amended, except to the extent that the Company specifically incorporates this information by reference, and otherwise shall not be deemed “soliciting material” filed with the Securities and Exchange Commission subject to Regulation 14A or 14C of the Securities and Exchange Commission or subject to the liabilities of Section 18 of the Securities Exchange Act of 1934, as amended.

Under rules established by the SEC, the Company is required to provide certain data and information in regard to the compensation and benefits provided to its Chief Executive Officer and other executive officers. In the period covered by this Report, the Chief Executive Officer and other executive officers did not receive compensation from the Company; instead, the compensation discussed in this Report relates to that provided by the Bank.

The Compensation and Benefits Committee reviews the performance of executive management and approves changes to base compensation, bonuses and benefits for senior management. It is intended that the executive compensation program will enable the Company and the Bank to attract, develop and retain highly

qualified, motivated and effective executive officers who are capable of maximizing the Company’s performance for the benefit of the Company’s shareholders. The Committee has adopted a compensation strategy that seeks to provide competitive compensation strongly aligned with the financial performance of the Company and the Bank.

To assist it in performing its duties, the Committee uses a peer comparison employing at least two published compensation surveys in determining the salary, bonuses and benefits of executive management. The Committee requests and reviews survey data because such data provide information relating to compensation practices at other financial institutions of similar asset and business mix, as well as compensation trends generally. The Committee understands the inherent limitations of survey data and does not seek to set compensation levels at prescribed percentile rankings within a peer group. It does use survey data to determine on an historical basis whether the base salary, annual incentive and equity compensation place the Company at a percentile ranking relative to its peers that is generally consistent with the Company’s percentile ranking among the same peer group for performance measures that include, but are not limited to, return on average assets, return on average equity, asset growth, total shareholder return, efficiency ratio and earnings per share growth. If the Committee determines that the Company’s compensation ranking is out of line with corporate performance rankings, it considers adjustments to the compensation program.

The Committee also relies on legal counsel for advice as to its obligations under applicable corporate, securities, tax and employment laws, for assistance in interpreting its obligations under compensation plans and agreements, and for drafting plans and agreements to document business decisions.

In addition to survey and other data referred to above, the Committee also considers the views of the Chief Executive Officer in making compensation decisions affecting executive officers who report to him. While the Committee weighs a variety of different factors in its deliberations, it has emphasized and will continue to emphasize profitability, net income, earnings per share and book value as factors in setting the compensation of the Chief Executive Officer and other executive officers.

Other non-quantitative factors considered by the Committee included general management oversight of the Company and the Bank, the quality of communication with the Board of Directors, and the productivity of employees. Finally, the Committee considered the standing of the Bank with customers and the community, as evidenced by the level of customer/community complaints and compliments. While each of the quantitative and non-quantitative factors described was considered by the Committee, such factors were not assigned a specific weighting in evaluating the performance of the Chief Executive Officer and the other executive officers.

The Company’s executive compensation program consists of three key elements:

| | | |

| | • | base salary, which is designed to provide a reasonable level of predictable income to support an appropriate standard of living in the communities where our executive officers live and work; |

| | | |

| | • | annual cash incentives, which are designed to motivate our executives to meet or exceed annual performance objectives that are derived from the Company’s annual business plan; and |

| | | |

| | • | long-term incentives in the form of stock options and restricted stock, which are designed to retain talented employees and provide an incentive to maximize shareholder return in the longer term. |

Base Salary — The Committee seeks to set base salaries for our executives based on the middle of the range for comparable executives at peer institutions. Because salaries are designed to provide predictable income, they do not vary substantially and directly with performance. Actual salaries may vary above or below the mid-range to reflect tenure in office or performance that is above or below average levels. For fiscal year 2006, base salary increases for our executive officers ranged from 3.9% to 11.6%, with an average increase of 6.1%. The base salary paid in fiscal year 2006 to Barry E. Backhaus, President and Chief Executive Officer, decreased 27.0% from base salary in fiscal year 2005, reflecting his retirement as President and Chief Executive Officer in March 2006.

Cash Incentives — In fiscal year 2006, the Company paid non-discretionary, pre-determined compensation to certain senior lending officers based on loan production by the team of employees reporting to the senior lending officers. Bonus amounts for these executive officers ranged from 35.4% to 42.1% of base salary rates.

Equity Compensation — The Company generally considers stock option and restricted stock grants at the time of hire for newly hired executives and, to the extent options and stock is available, annually in connection with the Committee’s annual executive officer compensation review for incumbent executives. A vesting schedule is attached to these awards so that they have a retention feature as well as a long-term incentive feature. It has not been the Committee’s practice to reduce compensation in subsequent years based on stock price performance that causes previously granted equity awards to increase in value, nor to grant additional compensation where stock price performance has impaired the value of previous awards. The Committee believes that such practices could weaken the intended linkage between compensation and mid-to long-term shareholder return.

In fiscal year 2006, the Company did not approve the grant of stock options or restricted stock, except for the award of 10,000 options to Mr. Dosland in connection with his hiring as President and Chief Executive Officer in January 2006 and except for the award of 4,800 options to Michael S. Moderski in connection with his hiring as Senior Vice President and Chief Financial Officer in April 2006.

This report has been provided by the Compensation and Benefits Committee.

| | Gary L. Evans, Chairman | Arlene T. Curry |

| | Allen J. Johnson | David Van Engelenhoven |

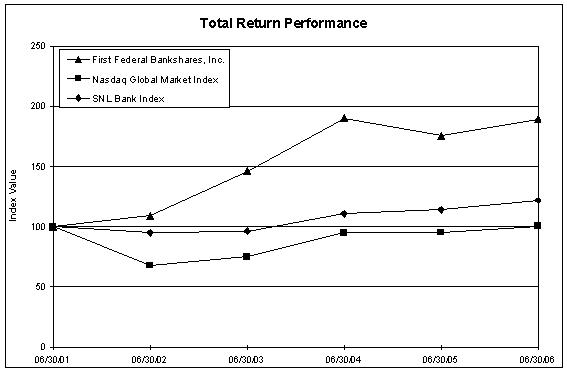

Stock Performance Graph

Set forth below is a stock performance graph comparing the yearly cumulative total return on the Company’s Common Stock with (a) the yearly cumulative total return on stocks included in the Nasdaq Global Market Index, and (b) the yearly cumulative total return on stocks included in the SNL Bank Index. The cumulative total return on the Company’s common stock was computed assuming the reinvestment of dividends at the frequency rate with which dividends were paid during the period shown, and reflects the exchange of 1.64696 shares of Company Common Stock for each share of Bank common stock in April 1999. The information presented below is for the period beginning on June 30, 2001 and ending on June 30, 2006.

There can be no assurance that the Company’s stock performance will continue in the future with the same or similar trend depicted in the graph. The Company will not make or endorse any predictions as to future stock performance.

| | 6/30/01 | 6/30/02 | 6/30/03 | 6/30/04 | 6/30/05 | 6/30/06 |

| First Federal Bankshares, Inc. | 100.00 | 109.09 | 146.02 | 190.20 | 175.43 | 189.19 |

| Nasdaq Global Market Index | 100.00 | 67.72 | 75.11 | 94.78 | 95.21 | 100.53 |

| SNL Bank Index | 100.00 | 94.98 | 96.43 | 110.72 | 114.09 | 121.76 |

Transactions with Certain Related Persons