FOURTH QUARTER 2022 Supplemental Operating and Financial Data ALL AMOUNTS IN THIS REPORT ARE UNAUDITED. Exhibit 99.2 Muse at Torrey Pines San Diego, CA

Supplemental Q4 2022 2 CORPORATE INFORMATION Company Profile ....................................................................................................................................................................................................................................................... 3 Investor Information ................................................................................................................................................................................................................................................ 4 Research Coverage .................................................................................................................................................................................................................................................. 5 FINANCIALS Key Financial Data .................................................................................................................................................................................................................................................... 6 Condensed Consolidated Balance Sheets .......................................................................................................................................................................................................... 7 Consolidated Statements of Income (Loss) ........................................................................................................................................................................................................ 8 Consolidated Statements of Income (Loss) (Additional Data) ......................................................................................................................................................................... 9 Debt Summary .......................................................................................................................................................................................................................................................... 10 Debt Maturity Schedule .......................................................................................................................................................................................................................................... 11 Leverage Ratios, Coverage Ratios and Public Debt Covenants ..................................................................................................................................................................... 12 Summary of Capital Expenditures ........................................................................................................................................................................................................................ 13 Redevelopment Information .................................................................................................................................................................................................................................. 14 Property Acquisitions / Dispositions Information Since January 1, 2022 ...................................................................................................................................................... 16 Investments in Unconsolidated Joint Ventures .................................................................................................................................................................................................. 17 Calculation and Reconciliation of NOI and Cash Basis NOI ............................................................................................................................................................................ 19 NOI and Cash Basis NOI ........................................................................................................................................................................................................................................ 20 Same Property NOI and Cash Basis NOI ............................................................................................................................................................................................................ 21 Calculation and Reconciliation of NOI, Cash Basis NOI, Same Property NOI and Same Property Cash Basis NOI by Segment ...................................................... 22 Calculation and Reconciliation of EBITDA, EBITDAre and Adjusted EBITDAre .......................................................................................................................................... 26 Calculation and Reconciliation of FFO and Normalized FFO Attributable to Common Shareholders ................................................................................................... 27 PORTFOLIO INFORMATION Portfolio Summary by Geographic Diversification and Property Type .......................................................................................................................................................... 28 Portfolio Summary ................................................................................................................................................................................................................................................... 29 SHOP Unit Count ..................................................................................................................................................................................................................................................... 30 Rent Coverage and Occupancy ............................................................................................................................................................................................................................. 31 Office Portfolio and Same Property - Results of Operations .......................................................................................................................................................................... 32 SHOP Segment and Same Property - Results of Operations .......................................................................................................................................................................... 35 SHOP Segment - Five Star Managed and Other Operator Managed Communities Results of Operations .......................................................................................... 36 Office Portfolio Leasing Summary ........................................................................................................................................................................................................................ 38 Tenants Representing 1% or More of Total Annualized Rental Income ........................................................................................................................................................ 39 Office Portfolio Lease Expiration Schedule ........................................................................................................................................................................................................ 40 Non-Segment Lease Expiration Schedule ........................................................................................................................................................................................................... 41 NON-GAAP FINANCIAL MEASURES AND CERTAIN DEFINITIONS ............................................................................................................................................................................. 42 WARNING CONCERNING FORWARD-LOOKING STATEMENTS .................................................................................................................................................................................. 46 Table of Contents Please refer to Non-GAAP Financial Measures and Certain Definitions beginning on page 42 for terms used throughout this document.

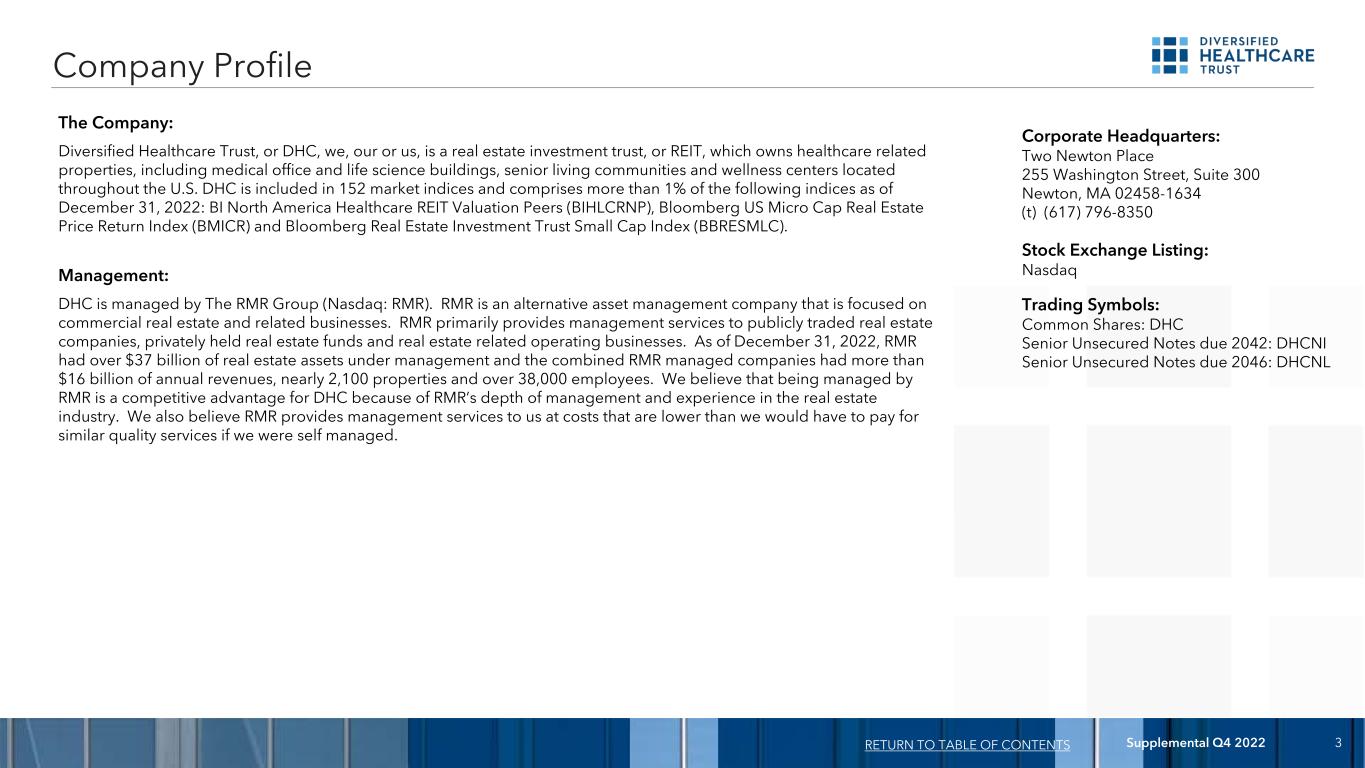

Supplemental Q4 2022 3 The Company: Diversified Healthcare Trust, or DHC, we, our or us, is a real estate investment trust, or REIT, which owns healthcare related properties, including medical office and life science buildings, senior living communities and wellness centers located throughout the U.S. DHC is included in 152 market indices and comprises more than 1% of the following indices as of December 31, 2022: BI North America Healthcare REIT Valuation Peers (BIHLCRNP), Bloomberg US Micro Cap Real Estate Price Return Index (BMICR) and Bloomberg Real Estate Investment Trust Small Cap Index (BBRESMLC). Management: DHC is managed by The RMR Group (Nasdaq: RMR). RMR is an alternative asset management company that is focused on commercial real estate and related businesses. RMR primarily provides management services to publicly traded real estate companies, privately held real estate funds and real estate related operating businesses. As of December 31, 2022, RMR had over $37 billion of real estate assets under management and the combined RMR managed companies had more than $16 billion of annual revenues, nearly 2,100 properties and over 38,000 employees. We believe that being managed by RMR is a competitive advantage for DHC because of RMR’s depth of management and experience in the real estate industry. We also believe RMR provides management services to us at costs that are lower than we would have to pay for similar quality services if we were self managed. Corporate Headquarters: Two Newton Place 255 Washington Street, Suite 300 Newton, MA 02458-1634 (t) (617) 796-8350 Stock Exchange Listing: Nasdaq Trading Symbols: Common Shares: DHC Senior Unsecured Notes due 2042: DHCNI Senior Unsecured Notes due 2046: DHCNL Company Profile RETURN TO TABLE OF CONTENTS

Supplemental Q4 2022 4 Board of Trustees: John L. Harrington Lisa Harris Jones Daniel F. LePage Independent Trustee Lead Independent Trustee Independent Trustee David A. Pierce Jeffrey P. Somers Independent Trustee Independent Trustee Jennifer F. Francis Adam D. Portnoy Managing Trustee Chair of the Board & Managing Trustee Executive Officers: Jennifer F. Francis Richard W. Siedel, Jr. President and Chief Executive Officer Chief Financial Officer and Treasurer Contact Information: Investor Relations Inquiries Diversified Healthcare Trust Financial, investor and media inquiries should be directed to Two Newton Place Melissa McCarthy, Manager, Investor Relations, at 255 Washington Street, Suite 300 (617) 796-8234, or ir@dhcreit.com Newton, MA 02458-1634 (t) (617) 796-8350 (email) ir@dhcreit.com (website) www.dhcreit.com Investor Information RETURN TO TABLE OF CONTENTS 4 Maguire Road Lexington, MA

Supplemental Q4 2022 5 Equity Research Coverage: B. Riley Securities, Inc. BofA Securities Colliers Securities LLC Bryan Maher Joshua Dennerlein David Toti (646) 885-5423 (646) 855-1681 (401) 488-4797 bmaher@brileyfin.com joshua.dennerlein@bofa.com david.toti@colliers.com JMP Securities RBC Capital Markets Aaron Hecht Michael Carroll (415) 835-3963 (440) 715-2649 ahecht@jmpsecurities.com michael.carroll@rbccm.com Rating Agencies: Moody’s Investors Service S & P Global Lori Marks Alan Zigman (212) 553-1098 (416) 507-2556 lori.marks@moodys.com alan.zigman@spglobal.com Research Coverage RETURN TO TABLE OF CONTENTS DHC is followed by the equity research analysts and its publicly held debt is rated by the rating agencies listed on this page. Please note that any opinions, estimates or forecasts regarding DHC's performance made by these analysts or agencies do not represent opinions, forecasts or predictions of DHC or its management. DHC does not by its reference on this page imply its endorsement of or concurrence with any information, conclusions or recommendations provided by any of these analysts or agencies.

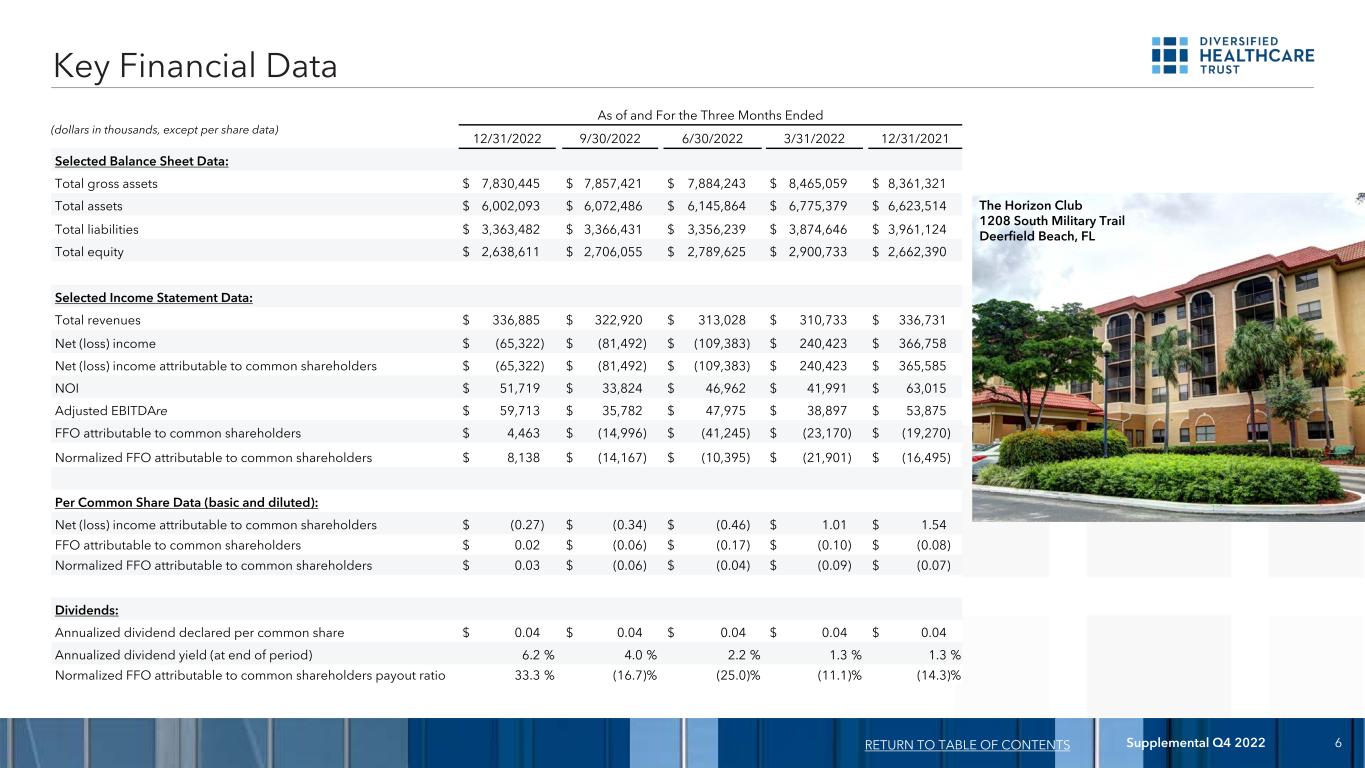

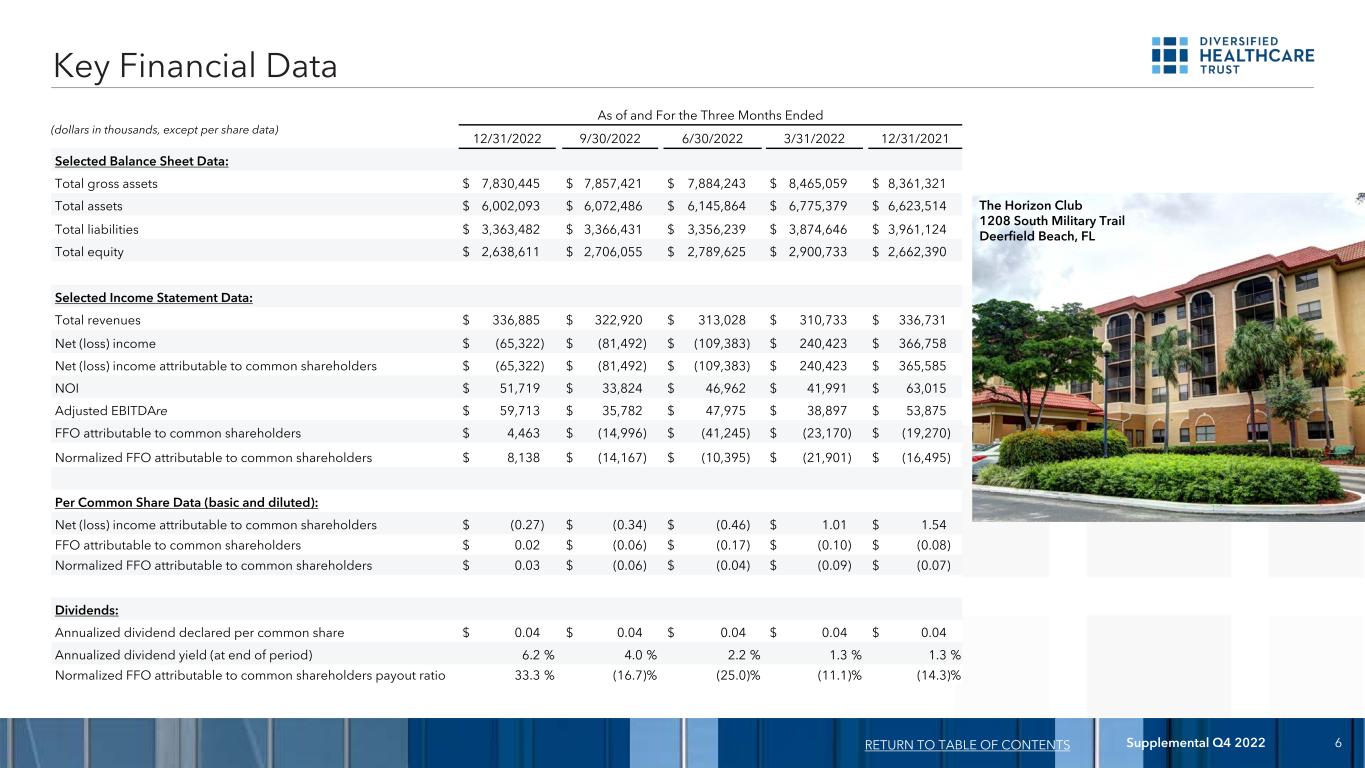

Supplemental Q4 2022 6 Key Financial Data RETURN TO TABLE OF CONTENTS As of and For the Three Months Ended 12/31/2022 9/30/2022 6/30/2022 3/31/2022 12/31/2021 Selected Balance Sheet Data: Total gross assets $ 7,830,445 $ 7,857,421 $ 7,884,243 $ 8,465,059 $ 8,361,321 Total assets $ 6,002,093 $ 6,072,486 $ 6,145,864 $ 6,775,379 $ 6,623,514 Total liabilities $ 3,363,482 $ 3,366,431 $ 3,356,239 $ 3,874,646 $ 3,961,124 Total equity $ 2,638,611 $ 2,706,055 $ 2,789,625 $ 2,900,733 $ 2,662,390 Selected Income Statement Data: Total revenues $ 336,885 $ 322,920 $ 313,028 $ 310,733 $ 336,731 Net (loss) income $ (65,322) $ (81,492) $ (109,383) $ 240,423 $ 366,758 Net (loss) income attributable to common shareholders $ (65,322) $ (81,492) $ (109,383) $ 240,423 $ 365,585 NOI $ 51,719 $ 33,824 $ 46,962 $ 41,991 $ 63,015 Adjusted EBITDAre $ 59,713 $ 35,782 $ 47,975 $ 38,897 $ 53,875 FFO attributable to common shareholders $ 4,463 $ (14,996) $ (41,245) $ (23,170) $ (19,270) Normalized FFO attributable to common shareholders $ 8,138 $ (14,167) $ (10,395) $ (21,901) $ (16,495) Per Common Share Data (basic and diluted): Net (loss) income attributable to common shareholders $ (0.27) $ (0.34) $ (0.46) $ 1.01 $ 1.54 FFO attributable to common shareholders $ 0.02 $ (0.06) $ (0.17) $ (0.10) $ (0.08) Normalized FFO attributable to common shareholders $ 0.03 $ (0.06) $ (0.04) $ (0.09) $ (0.07) Dividends: Annualized dividend declared per common share $ 0.04 $ 0.04 $ 0.04 $ 0.04 $ 0.04 Annualized dividend yield (at end of period) 6.2 % 4.0 % 2.2 % 1.3 % 1.3 % Normalized FFO attributable to common shareholders payout ratio 33.3 % (16.7) % (25.0) % (11.1) % (14.3) % (dollars in thousands, except per share data) The Horizon Club 1208 South Military Trail Deerfield Beach, FL

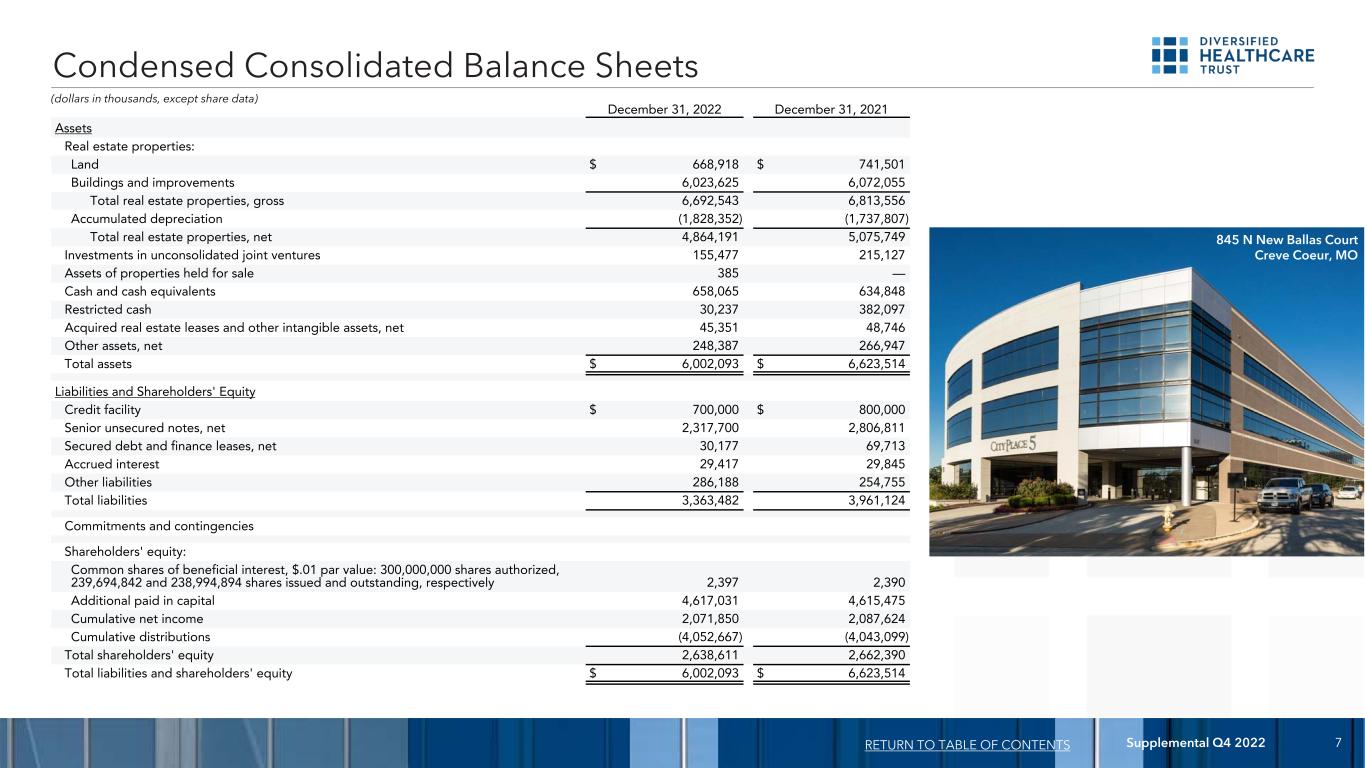

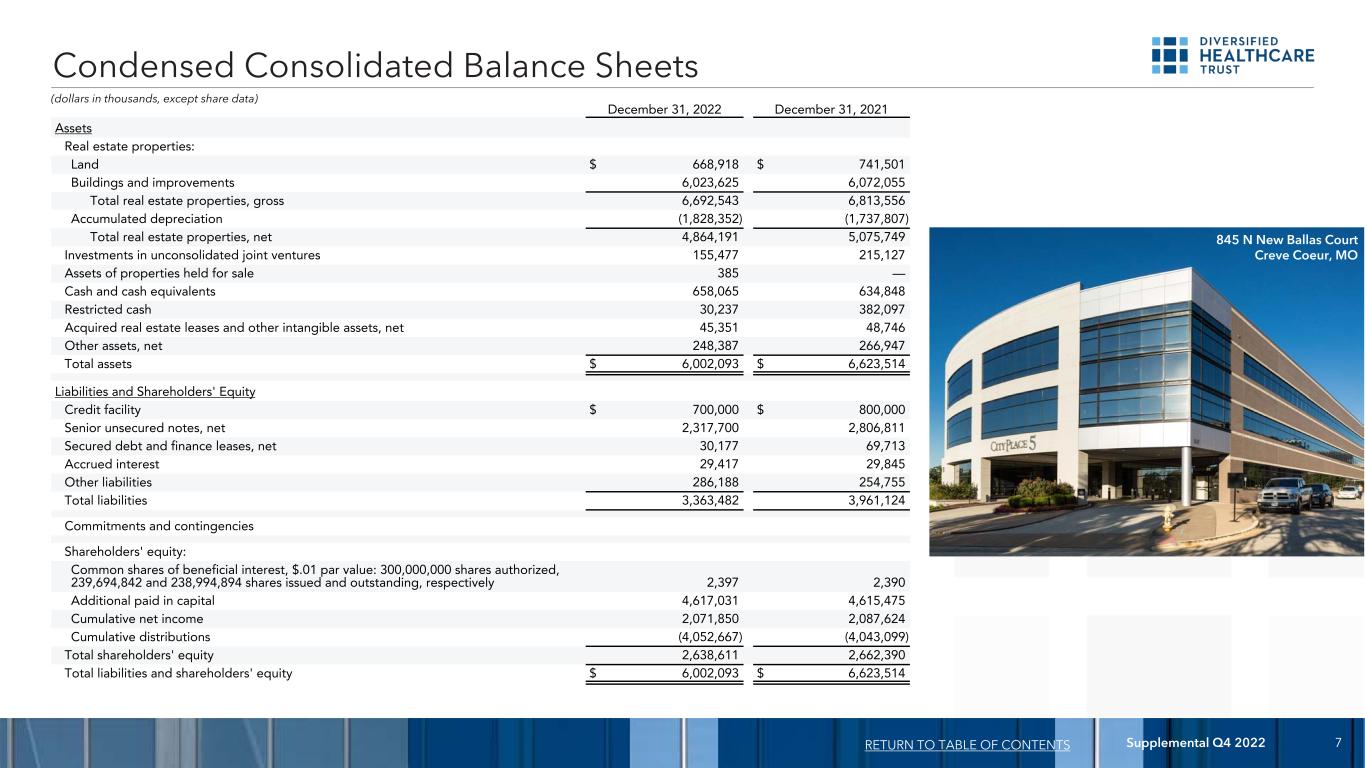

Supplemental Q4 2022 7 December 31, 2022 December 31, 2021 Assets Real estate properties: Land $ 668,918 $ 741,501 Buildings and improvements 6,023,625 6,072,055 Total real estate properties, gross 6,692,543 6,813,556 Accumulated depreciation (1,828,352) (1,737,807) Total real estate properties, net 4,864,191 5,075,749 Investments in unconsolidated joint ventures 155,477 215,127 Assets of properties held for sale 385 — Cash and cash equivalents 658,065 634,848 Restricted cash 30,237 382,097 Acquired real estate leases and other intangible assets, net 45,351 48,746 Other assets, net 248,387 266,947 Total assets $ 6,002,093 $ 6,623,514 Liabilities and Shareholders' Equity Credit facility $ 700,000 $ 800,000 Senior unsecured notes, net 2,317,700 2,806,811 Secured debt and finance leases, net 30,177 69,713 Accrued interest 29,417 29,845 Other liabilities 286,188 254,755 Total liabilities 3,363,482 3,961,124 Commitments and contingencies Shareholders' equity: Common shares of beneficial interest, $.01 par value: 300,000,000 shares authorized, 239,694,842 and 238,994,894 shares issued and outstanding, respectively 2,397 2,390 Additional paid in capital 4,617,031 4,615,475 Cumulative net income 2,071,850 2,087,624 Cumulative distributions (4,052,667) (4,043,099) Total shareholders' equity 2,638,611 2,662,390 Total liabilities and shareholders' equity $ 6,002,093 $ 6,623,514 Condensed Consolidated Balance Sheets (dollars in thousands, except share data) RETURN TO TABLE OF CONTENTS 845 N New Ballas Court Creve Coeur, MO

Supplemental Q4 2022 8 For the Three Months Ended December 31, For the Year Ended December 31, 2022 2021 2022 2021 Revenues: Rental income $ 68,973 $ 102,034 $ 260,740 $ 408,589 Residents fees and services 267,912 234,697 1,022,826 974,623 Total revenues 336,885 336,731 1,283,566 1,383,212 Expenses: Property operating expenses 285,166 273,716 1,109,070 1,091,812 Depreciation and amortization 63,353 68,388 239,280 271,131 General and administrative 5,764 8,549 26,435 34,087 Acquisition and certain other transaction related costs 779 2,327 2,605 17,506 Impairment of assets — — — (174) Total expenses 355,062 352,980 1,377,390 1,414,362 (Loss) gain on sale of properties (202) 461,434 321,862 492,272 Losses on equity securities, net (4,276) (15,289) (25,660) (42,232) Interest and other income (1) 9,169 786 15,929 20,635 Interest expense (including net amortization of debt premiums, discounts and issuance costs of $1,960, $3,631, $8,658 and $13,408, respectively) (49,341) (63,518) (209,383) (255,759) Loss on modification or early extinguishment of debt — — (30,043) (2,410) (Loss) income from continuing operations before income tax benefit (expense) and equity in net (losses) earnings of investees (62,827) 367,164 (21,119) 181,356 Income tax benefit (expense) 135 (406) (710) (1,430) Equity in net (losses) earnings of investees (2,630) — 6,055 — Net (loss) income (65,322) 366,758 (15,774) 179,926 Net income attributable to noncontrolling interest — (1,173) — (5,411) Net (loss) income attributable to common shareholders $ (65,322) $ 365,585 $ (15,774) $ 174,515 Weighted average common shares outstanding (basic and diluted) 238,562 238,149 238,314 237,967 Per common share data (basic and diluted): Net (loss) income attributable to common shareholders $ (0.27) $ 1.54 $ (0.07) $ 0.73 Consolidated Statements of Income (Loss) (amounts in thousands, except per share data) RETURN TO TABLE OF CONTENTS (1) See footnote on the following page.

Supplemental Q4 2022 9 For the Three Months Ended December 31, For the Year Ended December 31, 2022 2021 2022 2021 Additional Data: General and administrative expenses / total assets (at end of period) 0.1 % 0.1 % 0.4 % 0.5 % Non-cash straight line rent adjustments included in rental income $ 1,723 $ 2,042 $ 8,916 $ 5,846 Lease value amortization included in rental income $ (41) $ 1,648 $ (245) $ 7,211 Non-cash share based compensation $ 281 $ 315 $ 1,733 $ 1,960 Non-cash amortization included in property operating expenses $ 200 $ 200 $ 797 $ 797 Non-cash amortization included in general and administrative expenses $ 743 $ 743 $ 2,974 $ 2,974 COVID-19 Economic Relief (1) $ 3,243 $ 587 $ 4,327 $ 19,554 Consolidated Statements of Income (Loss) (Additional Data) (dollars in thousands) RETURN TO TABLE OF CONTENTS (1) We recognized as other income funds received under the Coronavirus Aid, Relief, and Economic Security Act and the American Rescue Plan Act in our SHOP segment of $3,243 and $587 during the three months ended December 31, 2022 and 2021, respectively, and $4,327 and $19,554 during the years ended December 31, 2022 and 2021, respectively.

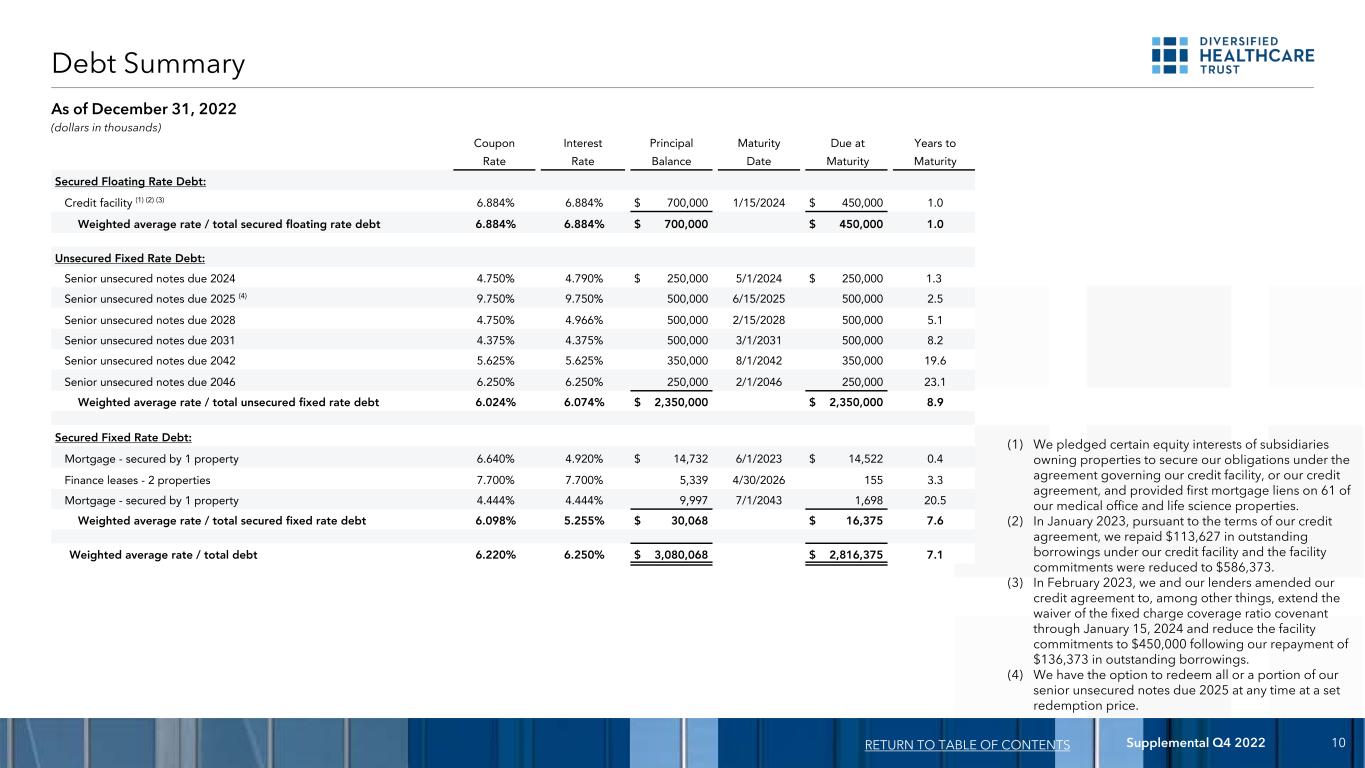

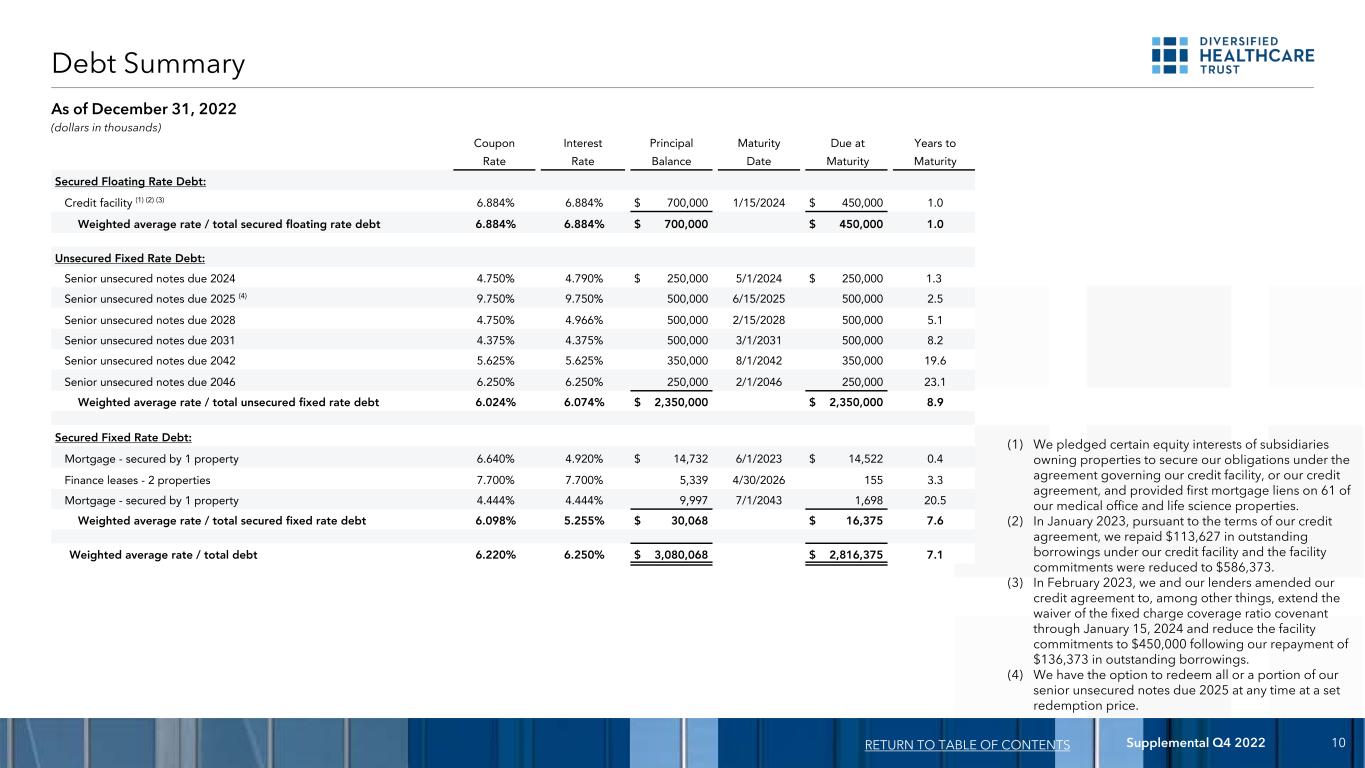

Supplemental Q4 2022 10 Coupon Interest Principal Maturity Due at Years to Rate Rate Balance Date Maturity Maturity Secured Floating Rate Debt: Credit facility (1) (2) (3) 6.884% 6.884% $ 700,000 1/15/2024 $ 450,000 1.0 Weighted average rate / total secured floating rate debt 6.884% 6.884% $ 700,000 $ 450,000 1.0 Unsecured Fixed Rate Debt: Senior unsecured notes due 2024 4.750% 4.790% $ 250,000 5/1/2024 $ 250,000 1.3 Senior unsecured notes due 2025 (4) 9.750% 9.750% 500,000 6/15/2025 500,000 2.5 Senior unsecured notes due 2028 4.750% 4.966% 500,000 2/15/2028 500,000 5.1 Senior unsecured notes due 2031 4.375% 4.375% 500,000 3/1/2031 500,000 8.2 Senior unsecured notes due 2042 5.625% 5.625% 350,000 8/1/2042 350,000 19.6 Senior unsecured notes due 2046 6.250% 6.250% 250,000 2/1/2046 250,000 23.1 Weighted average rate / total unsecured fixed rate debt 6.024% 6.074% $ 2,350,000 $ 2,350,000 8.9 Secured Fixed Rate Debt: Mortgage - secured by 1 property 6.640% 4.920% $ 14,732 6/1/2023 $ 14,522 0.4 Finance leases - 2 properties 7.700% 7.700% 5,339 4/30/2026 155 3.3 Mortgage - secured by 1 property 4.444% 4.444% 9,997 7/1/2043 1,698 20.5 Weighted average rate / total secured fixed rate debt 6.098% 5.255% $ 30,068 $ 16,375 7.6 Weighted average rate / total debt 6.220% 6.250% $ 3,080,068 $ 2,816,375 7.1 Debt Summary (dollars in thousands) RETURN TO TABLE OF CONTENTS As of December 31, 2022 (1) We pledged certain equity interests of subsidiaries owning properties to secure our obligations under the agreement governing our credit facility, or our credit agreement, and provided first mortgage liens on 61 of our medical office and life science properties. (2) In January 2023, pursuant to the terms of our credit agreement, we repaid $113,627 in outstanding borrowings under our credit facility and the facility commitments were reduced to $586,373. (3) In February 2023, we and our lenders amended our credit agreement to, among other things, extend the waiver of the fixed charge coverage ratio covenant through January 15, 2024 and reduce the facility commitments to $450,000 following our repayment of $136,373 in outstanding borrowings. (4) We have the option to redeem all or a portion of our senior unsecured notes due 2025 at any time at a set redemption price.

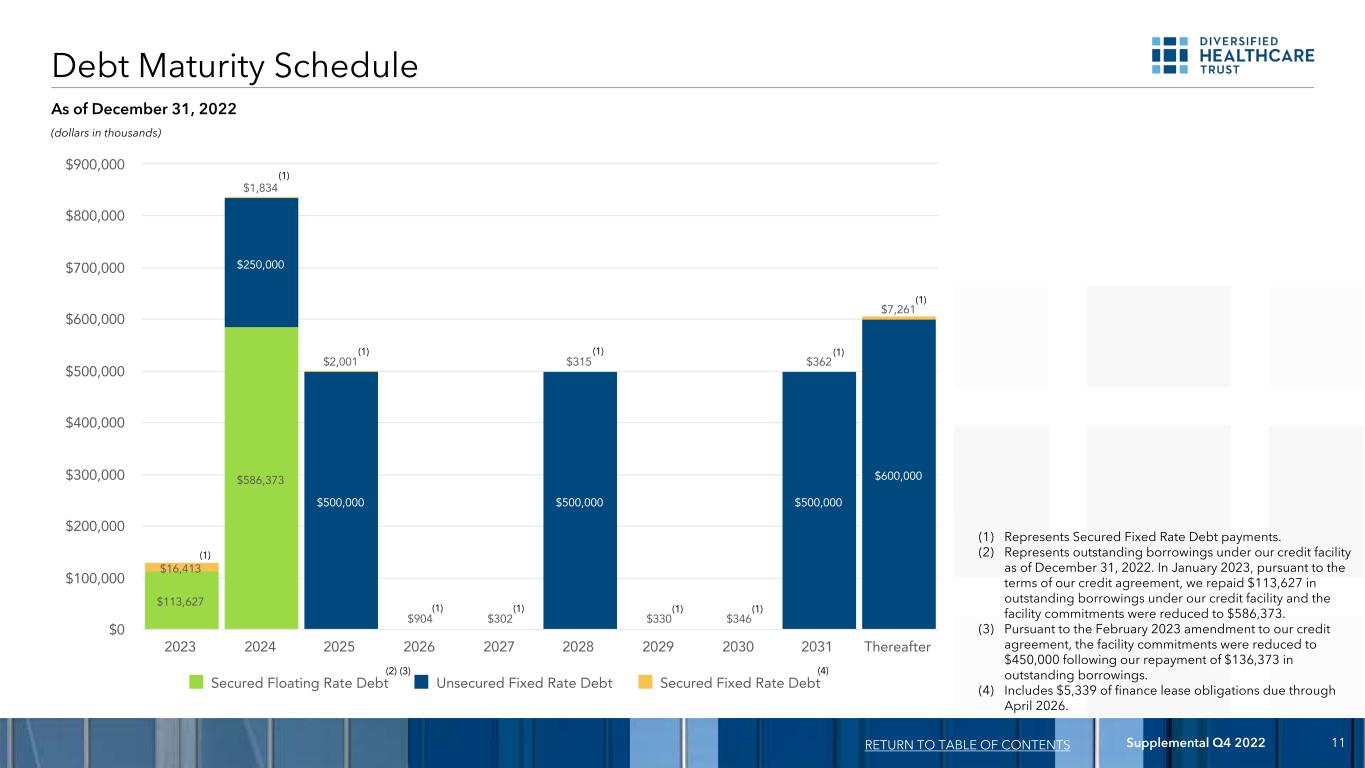

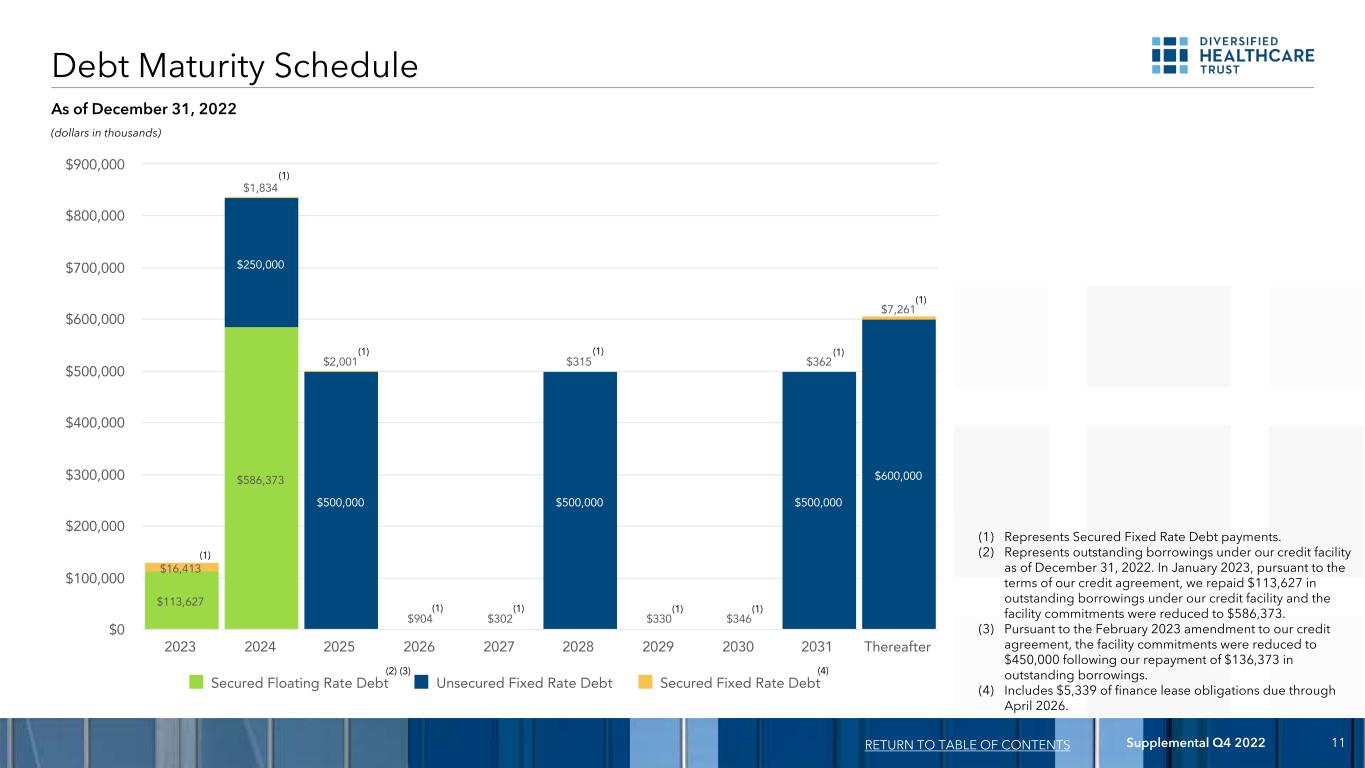

Supplemental Q4 2022 11 $113,627 $586,373 $250,000 $500,000 $500,000 $500,000 $600,000 $16,413 $1,834 $2,001 $904 $302 $315 $330 $346 $362 $7,261 Secured Floating Rate Debt Unsecured Fixed Rate Debt Secured Fixed Rate Debt 2023 2024 2025 2026 2027 2028 2029 2030 2031 Thereafter $0 $100,000 $200,000 $300,000 $400,000 $500,000 $600,000 $700,000 $800,000 $900,000 Debt Maturity Schedule (1) (1) (4) (2) (3) RETURN TO TABLE OF CONTENTS (dollars in thousands) As of December 31, 2022 (1) (1) Represents Secured Fixed Rate Debt payments. (2) Represents outstanding borrowings under our credit facility as of December 31, 2022. In January 2023, pursuant to the terms of our credit agreement, we repaid $113,627 in outstanding borrowings under our credit facility and the facility commitments were reduced to $586,373. (3) Pursuant to the February 2023 amendment to our credit agreement, the facility commitments were reduced to $450,000 following our repayment of $136,373 in outstanding borrowings. (4) Includes $5,339 of finance lease obligations due through April 2026. (1) (1) (1) (1) (1) (1) (1)

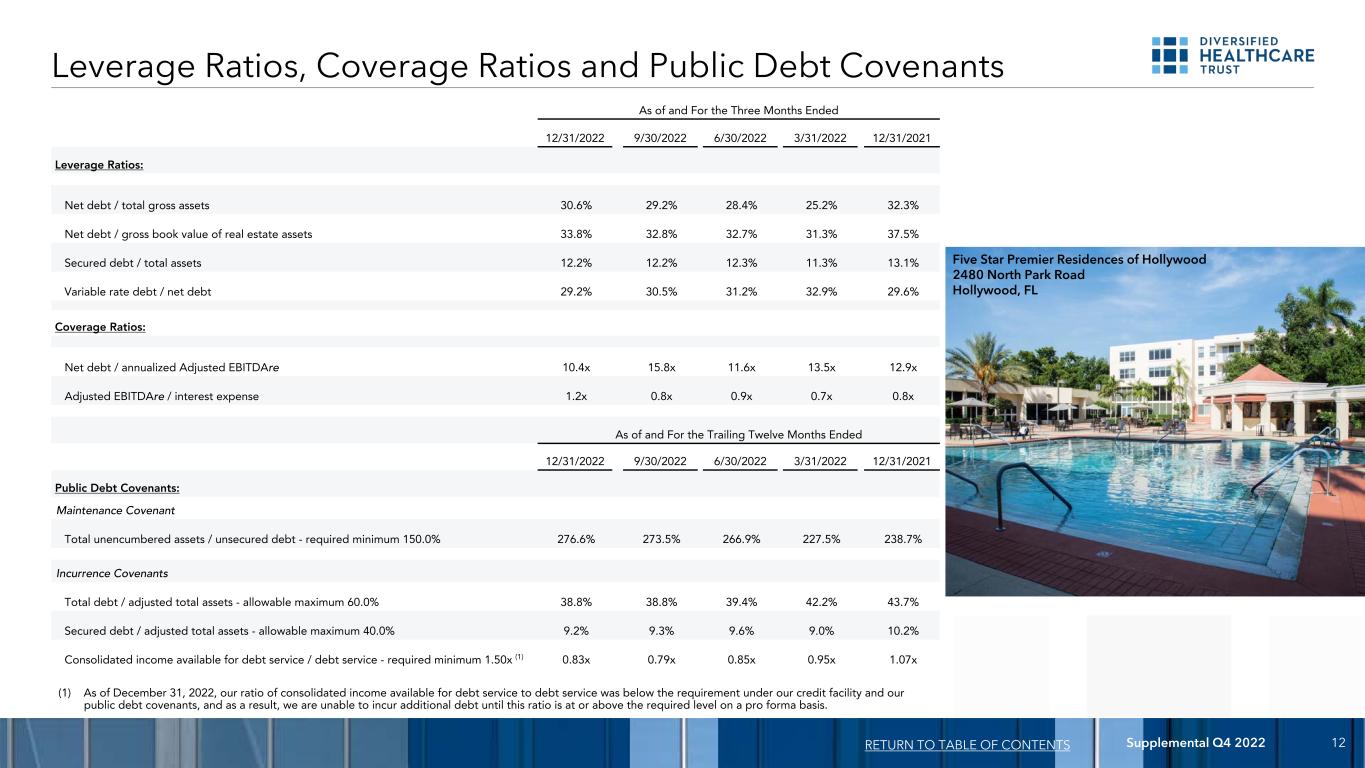

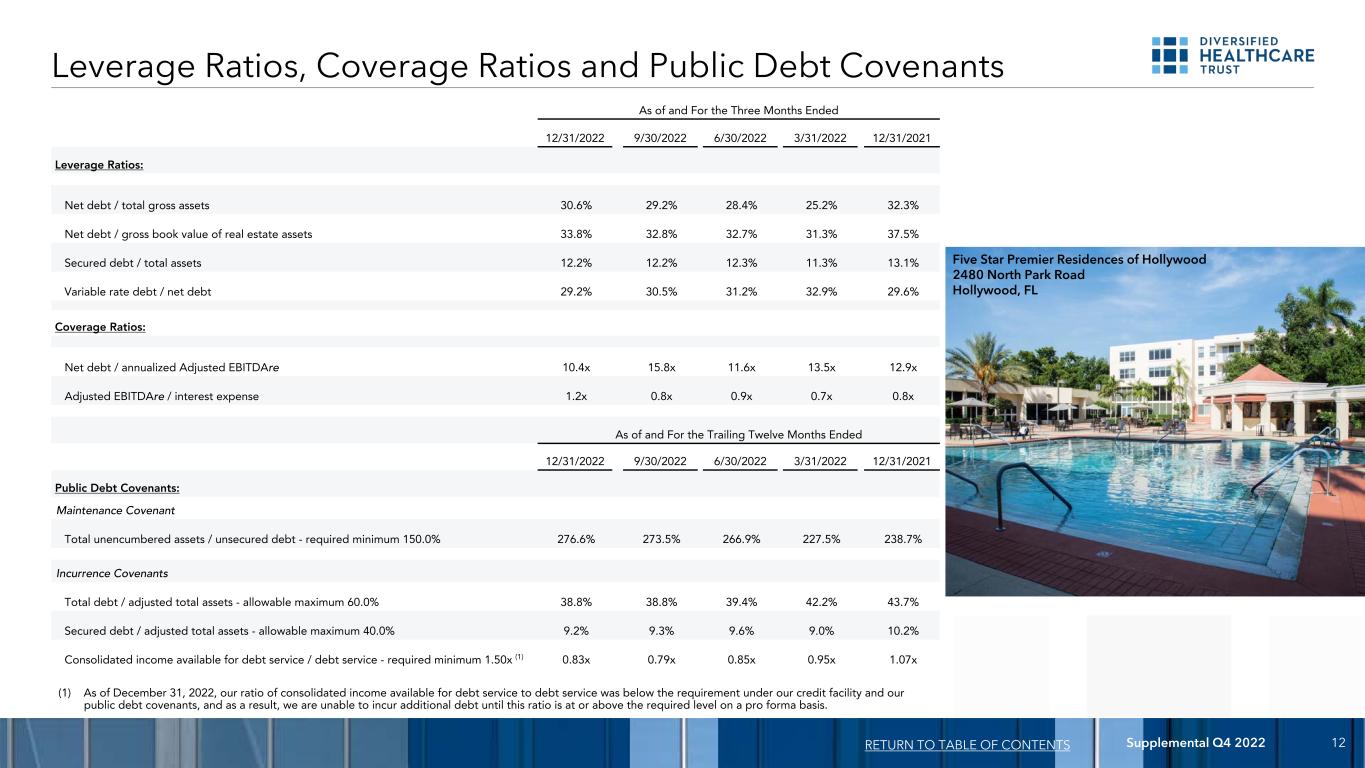

Supplemental Q4 2022 12 Leverage Ratios, Coverage Ratios and Public Debt Covenants RETURN TO TABLE OF CONTENTS As of and For the Three Months Ended 12/31/2022 9/30/2022 6/30/2022 3/31/2022 12/31/2021 Leverage Ratios: Net debt / total gross assets 30.6% 29.2% 28.4% 25.2% 32.3% Net debt / gross book value of real estate assets 33.8% 32.8% 32.7% 31.3% 37.5% Secured debt / total assets 12.2% 12.2% 12.3% 11.3% 13.1% Variable rate debt / net debt 29.2% 30.5% 31.2% 32.9% 29.6% Coverage Ratios: Net debt / annualized Adjusted EBITDAre 10.4x 15.8x 11.6x 13.5x 12.9x Adjusted EBITDAre / interest expense 1.2x 0.8x 0.9x 0.7x 0.8x As of and For the Trailing Twelve Months Ended 12/31/2022 9/30/2022 6/30/2022 3/31/2022 12/31/2021 Public Debt Covenants: Maintenance Covenant Total unencumbered assets / unsecured debt - required minimum 150.0% 276.6% 273.5% 266.9% 227.5% 238.7% Incurrence Covenants Total debt / adjusted total assets - allowable maximum 60.0% 38.8% 38.8% 39.4% 42.2% 43.7% Secured debt / adjusted total assets - allowable maximum 40.0% 9.2% 9.3% 9.6% 9.0% 10.2% Consolidated income available for debt service / debt service - required minimum 1.50x (1) 0.83x 0.79x 0.85x 0.95x 1.07x (1) As of December 31, 2022, our ratio of consolidated income available for debt service to debt service was below the requirement under our credit facility and our public debt covenants, and as a result, we are unable to incur additional debt until this ratio is at or above the required level on a pro forma basis. Five Star Premier Residences of Hollywood 2480 North Park Road Hollywood, FL

Supplemental Q4 2022 13 (dollars and sq. ft. in thousands, except per sq. ft. and unit data) Summary of Capital Expenditures RETURN TO TABLE OF CONTENTS For the Three Months Ended 12/31/2022 9/30/2022 6/30/2022 3/31/2022 12/31/2021 Office Portfolio lease related costs $ 9,558 $ 4,277 $ 4,633 $ 6,759 $ 15,941 Office Portfolio building improvements 4,516 3,535 3,319 585 5,462 SHOP fixed assets and capital improvements 39,418 24,724 25,059 20,328 76,039 Recurring capital expenditures $ 53,492 $ 32,536 $ 33,011 $ 27,672 $ 97,442 Office Portfolio avg. sq. ft. during period 8,811 8,767 8,724 9,259 10,360 SHOP avg. units managed during period 25,212 25,077 25,082 25,217 25,385 Office Portfolio building improvements per avg. sq. ft. during period $ 0.51 $ 0.40 $ 0.38 $ 0.06 $ 0.53 SHOP fixed assets and capital improvements per avg. unit managed during period $ 1,563 $ 986 $ 999 $ 806 $ 2,995 Development, redevelopment and other activities - Office Portfolio $ 5,111 $ 9,069 $ 17,593 $ 16,617 $ 11,022 Development, redevelopment and other activities - SHOP 59,981 28,224 14,282 16,114 3,620 Total development, redevelopment and other activities $ 65,092 $ 37,293 $ 31,875 $ 32,731 $ 14,642

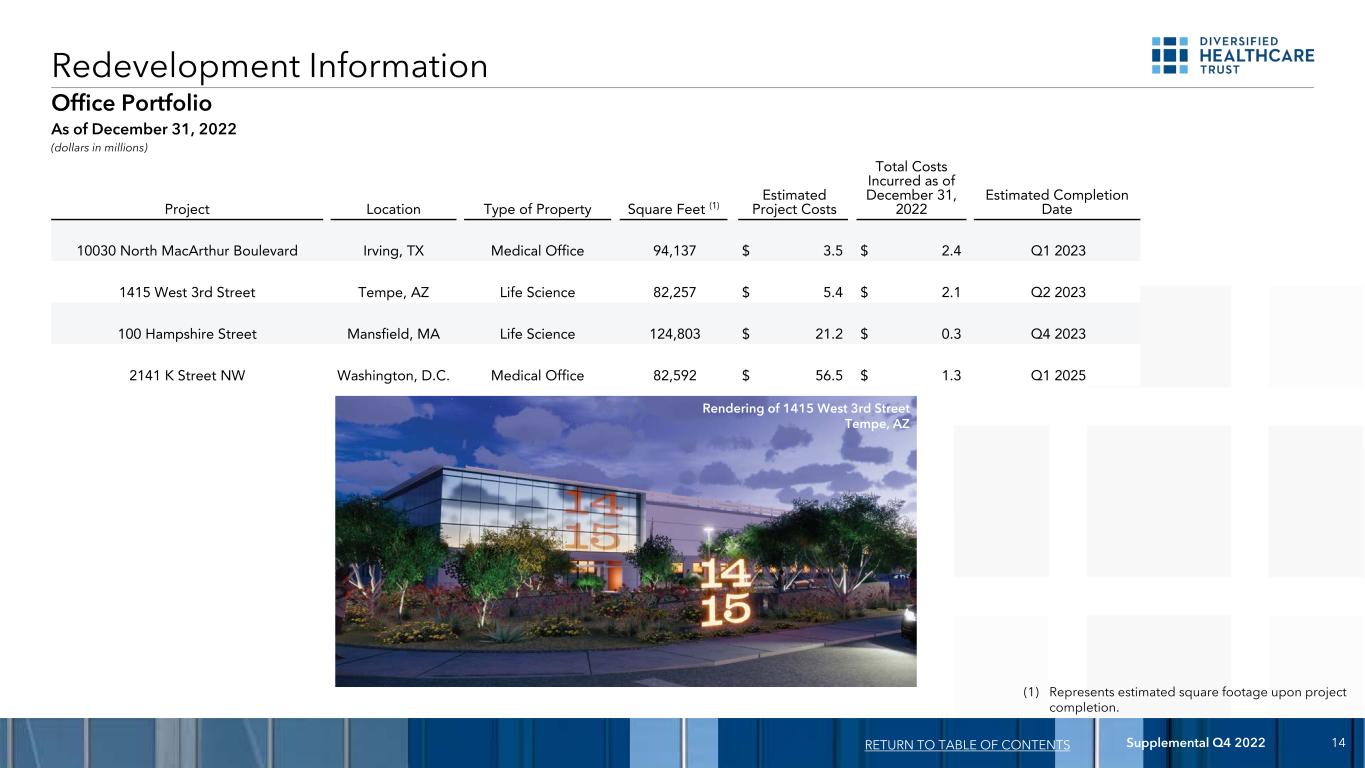

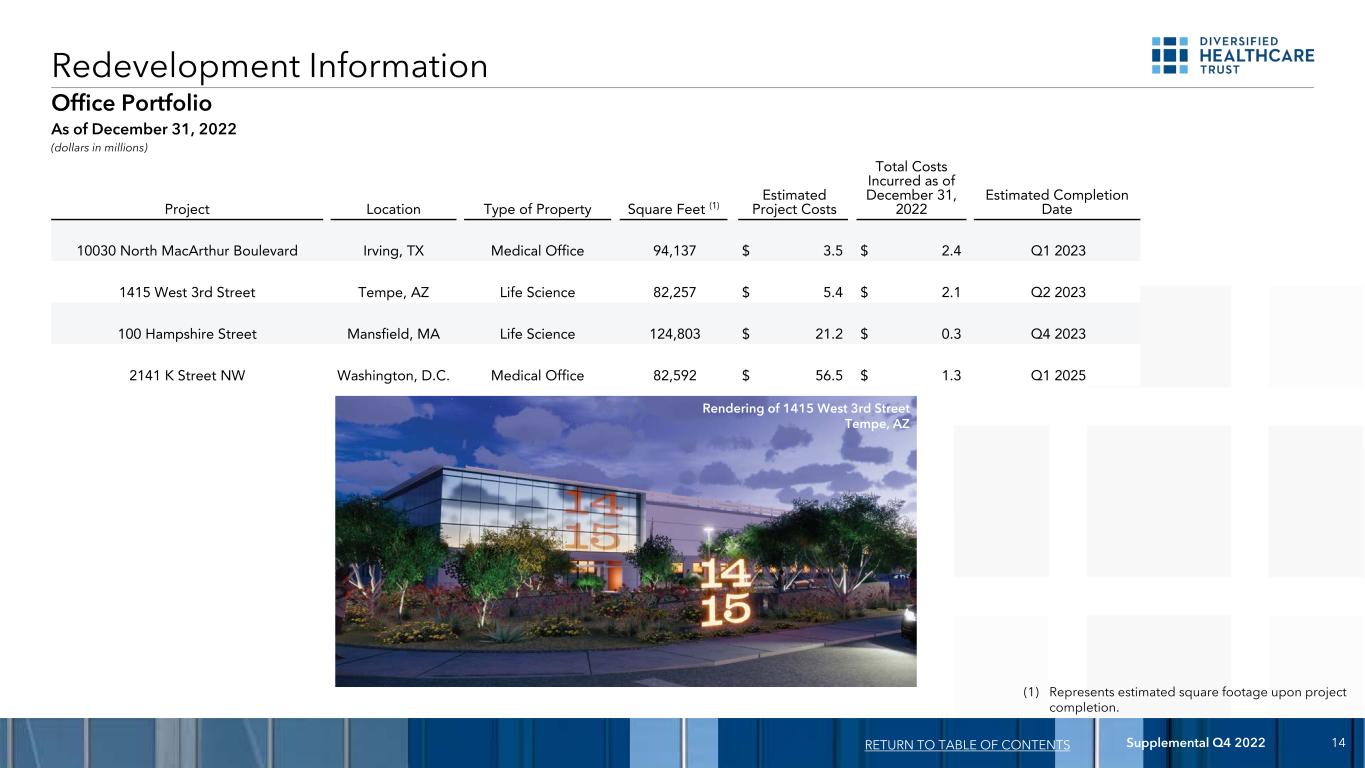

Supplemental Q4 2022 14 Project Location Type of Property Square Feet (1) Estimated Project Costs Total Costs Incurred as of December 31, 2022 Estimated Completion Date 10030 North MacArthur Boulevard Irving, TX Medical Office 94,137 $ 3.5 $ 2.4 Q1 2023 1415 West 3rd Street Tempe, AZ Life Science 82,257 $ 5.4 $ 2.1 Q2 2023 100 Hampshire Street Mansfield, MA Life Science 124,803 $ 21.2 $ 0.3 Q4 2023 2141 K Street NW Washington, D.C. Medical Office 82,592 $ 56.5 $ 1.3 Q1 2025 (1) Represents estimated square footage upon project completion. Redevelopment Information (dollars in millions) RETURN TO TABLE OF CONTENTS Rendering of 1415 West 3rd Street Tempe, AZ Office Portfolio As of December 31, 2022

Supplemental Q4 2022 15 Project Location Type of Property Number of Units Estimated Project Costs (1) Total Costs Incurred as of December 31, 2022 Estimated Completion Date Five Star Premier Residences of Teaneck Teaneck, NJ IL/AL 218 $ 9.8 $ 7.0 Q2 2023 Leisure Park Lakewood, NJ IL/AL/MC 355 $ 9.0 $ 5.7 Q2 2023 Phase I The Remington Club San Diego, CA IL/AL 342 $ 18.0 $ 4.4 Q2 2023 Phase I Pueblo Norte Senior Living Scottsdale, AZ IL/AL 197 $ 16.5 $ 3.5 Q2 2023 Phase I The Forum at Memorial Woods Houston, TX IL/AL/MC 325 $ 12.0 $ 3.0 Q2 2023 Phase II Five Star Residences of Dayton Place Denver, CO IL/AL/MC 239 $ 6.0 $ 2.4 Q2 2023 Five Star Premier Residences of Chevy Chase Chevy Chase, MD IL/AL 330 $ 20.5 $ 1.0 Q4 2023 The Forum at Desert Harbor Peoria, AZ IL/AL 230 $ 16.0 $ 0.9 Q4 2023 Phase I Other Projects National Various 5,783 $ 120.4 $ 18.9 Various Redevelopment Information (continued) (dollars in millions) RETURN TO TABLE OF CONTENTS SHOP As of December 31, 2022 (1) For those projects completed in phases, the estimated project costs represent estimated construction costs for that phase.

Supplemental Q4 2022 16 Property Acquisitions / Dispositions Information Since January 1, 2022 Acquisitions: Date Acquired Location Type of Property Number of Properties Sq. Ft. Gross Purchase Price Gross Purchase Price per Sq. Ft. Cap Rate (1) Weighted Average Remaining Lease Term (2) Occupancy (3) Tenant 7/27/2022 Fremont, CA Life Science 1 89 $ 82,000 $ 921 6.5% 11.5 100% Alamar Biosciences, Inc. Dispositions: Date Sold Location Type of Property Number of Properties Gross Sales Price 2/3/2023 Columbia, SC Senior Living (4) 1 $ 1,100 2/28/2023 South Park, PA Senior Living (4) 1 1,100 2/28/2023 Elizabeth, PA Senior Living (4) 1 600 Total Dispositions 3 $ 2,800 Joint Venture Activity: Date Sold Location Type of Property Number of Properties DHC Ownership Retained Gross Proceeds 1/28/2022 Various Life Science / Medical Office 10 20% $ 653,300 6/28/2022 Boston, MA Life Science 1 10% 108,000 Total 11 $ 761,300 (dollars and sq. ft. in thousands, except per sq. ft. data) RETURN TO TABLE OF CONTENTS (1) Represents the ratio of the estimated GAAP based annual rental income, excluding the impact of above and below market lease amortization, less estimated annual property operating expenses, if any, and excluding depreciation and amortization expense, to the gross purchase price on the date of acquisition, including the principal amount of any assumed debt and excluding acquisition costs. (2) Weighted average remaining lease term based on rental income at the time of acquisition. (3) Occupancy based on leasable square feet as of the acquisition date. (4) The property was closed prior to disposition.

Supplemental Q4 2022 17 Investments in Unconsolidated Joint Ventures (1) (dollars in thousands) RETURN TO TABLE OF CONTENTS As of December 31, 2022 Year Ended December 31, 2022 Joint Venture Location Type of Property Number of Properties Square Feet Occupancy at December 31, 2022 Weighted Average Lease Term at December 31, 2022 DHC Ownership DHC Carrying Value of Investment at December 31, 2022 Joint Venture FFO Joint Venture EBITDAre Seaport Innovation LLC Boston, MA Life Science 1 1,134,479 100% 6.1 years 10% $ 104,697 $ 58,380 (2) $ 80,945 (2) The LSMD Fund REIT LLC Various Medical Office / Life Science 10 1,068,763 97% 6.0 years 20% 50,780 14,050 (3) 32,012 (3) Total / Weighted Average 11 2,203,242 99% 6.0 years $ 155,477 $ 72,430 $ 112,957 Investments in Unconsolidated Joint Ventures Unconsolidated Debt Joint Venture Secured Debt (4) Coupon Rate Maturity Date Principal Balance at December 31, 2022 (5) DHC Ownership DHC Share of Principal Balance at December 31, 2022 (6) Seaport Innovation LLC Fixed Rate - 1 Property 3.530% 8/6/2026 $ 620,000 10% $ 62,000 The LSMD Fund REIT LLC Fixed Rate - 9 Properties 3.457% 2/11/2032 189,800 20% 37,960 The LSMD Fund REIT LLC Floating Rate - 1 Property (7) 5.900% 2/9/2024 266,825 20% 53,365 Total / Weighted Average 4.104% $ 1,076,625 $ 153,325 (1) Our property list, including properties owned by these unconsolidated joint ventures, is available on our website. (2) On June 28, 2022, we sold a 10% equity interest in this joint venture. (3) Represents data for the period from January 28, 2022 (formation date of the joint venture) to December 31, 2022. (4) The mortgage loans require interest-only payments until the respective maturity dates. (5) Reflects the entire balance of the debt secured by the properties. We continue to provide certain guarantees on the debt secured by the Seaport Innovation LLC property. (6) Reflects our proportionate share of the principal debt balances based on our ownership percentage of the joint ventures as of December 31, 2022. (7) Original maturity date of February 9, 2024 is subject to three, one year extension options and requires interest to be paid at an annual rate of secured overnight financing rate, or SOFR, plus a premium of 1.90%. Interest rate is as of December 31, 2022. The joint venture has also purchased an interest rate cap through February 2024 with a SOFR strike rate equal to 4.00%.

Supplemental Q4 2022 18 Investments in Unconsolidated Joint Ventures (continued) (1) (dollars in thousands) RETURN TO TABLE OF CONTENTS As of December 31, 2022 (1) Our property list, including properties owned by these unconsolidated joint ventures, is available on our website. (2) Based on the aggregate annualized rental income of our unconsolidated joint ventures as of December 31, 2022. A nn ua liz ed R en ta l In co m e Seaport Innovation LLC The LSMD Fund REIT LLC 2023 2024 2025 2026 2027 2028 2029 and thereafter $— $25,000 $50,000 $75,000 $100,000 Unconsolidated Joint Ventures Lease Expiration Schedule Number of Leases Expiring 18 11 19 15 5 8 32 % of Total Annualized Rental Income Expiring 2.0% 4.2% 5.8 % 3.3% 0.4 % 62.8% 21.5% Major Tenants of Unconsolidated Joint Ventures Joint Venture Tenant % of Annualized Rental Income of Joint Ventures Seaport Innovation LLC Vertex Pharmaceuticals Inc. 61.8% The LSMD Fund REIT LLC Cedars-Sinai Medical Center 10.8% The LSMD Fund REIT LLC Seattle Genetics, Inc. 2.7% The LSMD Fund REIT LLC Stryker Corporation 2.0% The LSMD Fund REIT LLC Complete Genomics, Inc. 1.9% Life Science: 72% Medical Office: 28% Property Type (2) MA: 66% CA: 25% TX: 4% WA: 3% NY: 2% Geographic Diversification (2)

Supplemental Q4 2022 19 Calculation and Reconciliation of NOI and Cash Basis NOI (dollars in thousands) RETURN TO TABLE OF CONTENTS For the Three Months Ended For the Year Ended 12/31/2022 9/30/2022 6/30/2022 3/31/2022 12/31/2021 12/31/2022 12/31/2021 Calculation of NOI and Cash Basis NOI: Revenues: Rental income $ 68,973 $ 63,960 $ 62,522 $ 65,285 $ 102,034 $ 260,740 $ 408,589 Residents fees and services 267,912 258,960 250,506 245,448 234,697 1,022,826 974,623 Total revenues 336,885 322,920 313,028 310,733 336,731 1,283,566 1,383,212 Property operating expenses (285,166) (289,096) (266,066) (268,742) (273,716) (1,109,070) (1,091,812) NOI 51,719 33,824 46,962 41,991 63,015 174,496 291,400 Non-cash straight line rent adjustments included in rental income (1,723) (2,738) (2,710) (1,745) (2,042) (8,916) (5,846) Lease value amortization included in rental income 41 42 57 105 (1,648) 245 (7,211) Non-cash amortization included in property operating expenses (200) (199) (199) (199) (200) (797) (797) Cash Basis NOI $ 49,837 $ 30,929 $ 44,110 $ 40,152 $ 59,125 $ 165,028 $ 277,546 Reconciliation of Net Income (Loss) to NOI and Cash Basis NOI: Net (loss) income $ (65,322) $ (81,492) $ (109,383) $ 240,423 $ 366,758 $ (15,774) $ 179,926 Equity in net losses (earnings) of investees 2,630 (2,127) (3,204) (3,354) — (6,055) — Income tax (benefit) expense (135) 13 (640) 1,472 406 710 1,430 Loss on modification or early extinguishment of debt — — 29,560 483 — 30,043 2,410 Interest expense 49,341 46,936 55,975 57,131 63,518 209,383 255,759 Interest and other income (9,169) (4,099) (2,266) (395) (786) (15,929) (20,635) Losses on equity investments, net 4,276 2,674 10,157 8,553 15,289 25,660 42,232 Loss (gain) on sale of properties 202 5,044 686 (327,794) (461,434) (321,862) (492,272) Impairment of assets — — — — — — (174) Acquisition and certain other transaction related costs 779 289 609 928 2,327 2,605 17,506 General and administrative 5,764 6,179 7,207 7,285 8,549 26,435 34,087 Depreciation and amortization 63,353 60,407 58,261 57,259 68,388 239,280 271,131 NOI 51,719 33,824 46,962 41,991 63,015 174,496 291,400 Non-cash straight line rent adjustments included in rental income (1,723) (2,738) (2,710) (1,745) (2,042) (8,916) (5,846) Lease value amortization included in rental income 41 42 57 105 (1,648) 245 (7,211) Non-cash amortization included in property operating expenses (200) (199) (199) (199) (200) (797) (797) Cash Basis NOI $ 49,837 $ 30,929 $ 44,110 $ 40,152 $ 59,125 $ 165,028 $ 277,546

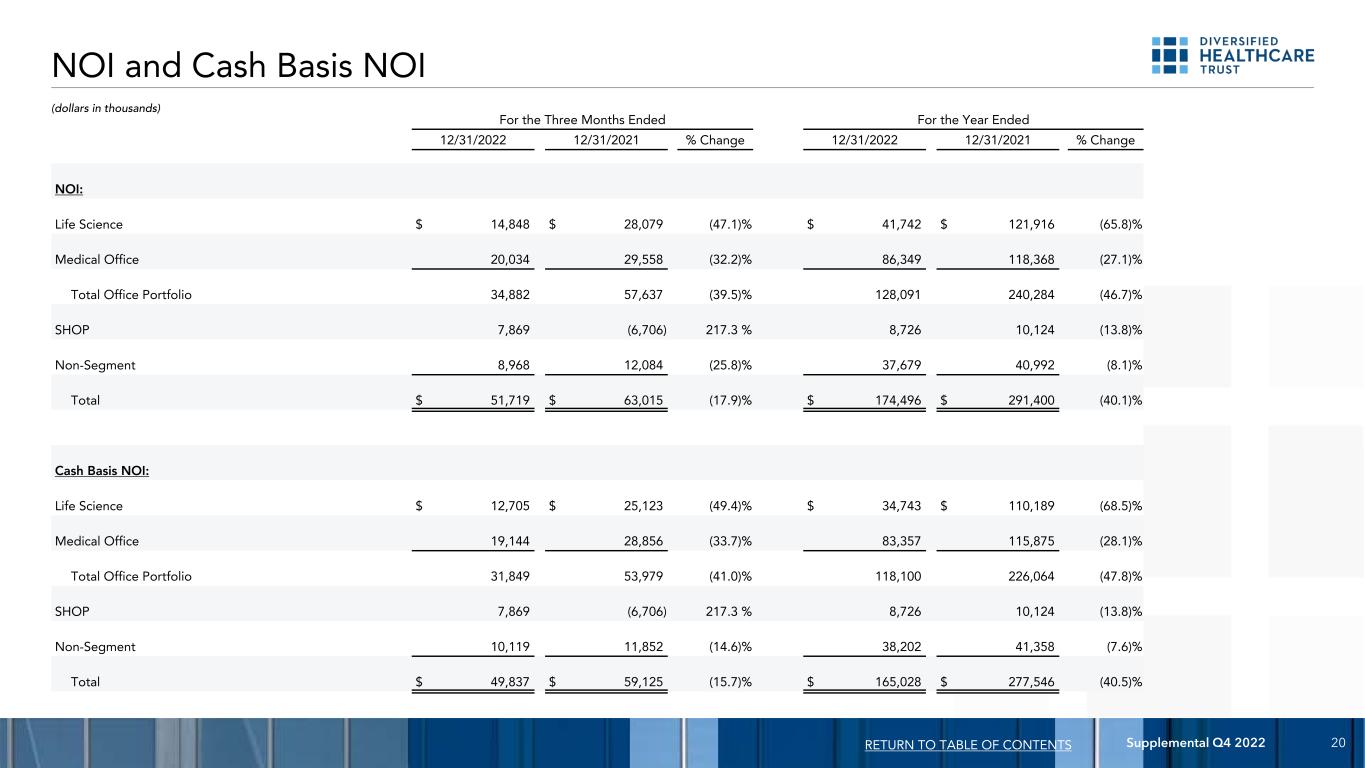

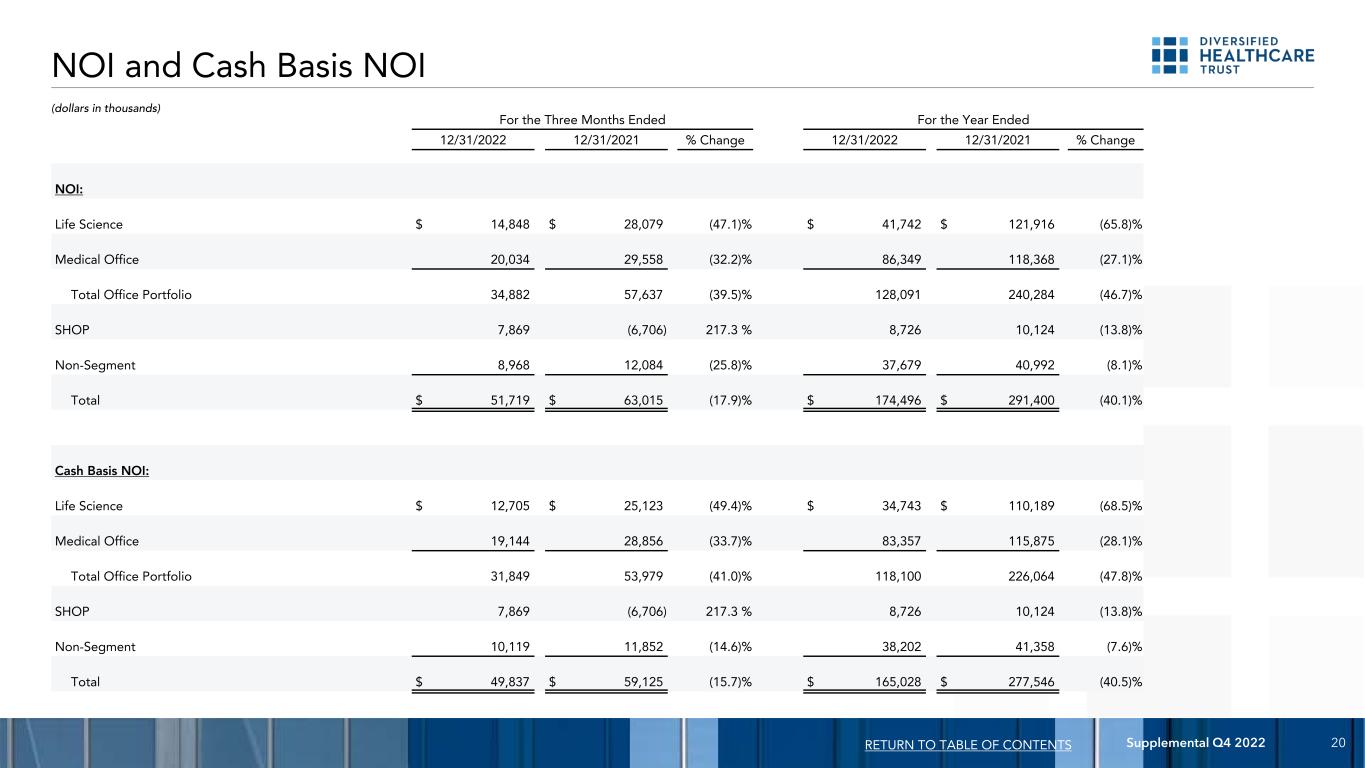

Supplemental Q4 2022 20 For the Three Months Ended For the Year Ended 12/31/2022 12/31/2021 % Change 12/31/2022 12/31/2021 % Change NOI: Life Science $ 14,848 $ 28,079 (47.1) % $ 41,742 $ 121,916 (65.8) % Medical Office 20,034 29,558 (32.2) % 86,349 118,368 (27.1) % Total Office Portfolio 34,882 57,637 (39.5) % 128,091 240,284 (46.7) % SHOP 7,869 (6,706) 217.3 % 8,726 10,124 (13.8) % Non-Segment 8,968 12,084 (25.8) % 37,679 40,992 (8.1) % Total $ 51,719 $ 63,015 (17.9) % $ 174,496 $ 291,400 (40.1) % Cash Basis NOI: Life Science $ 12,705 $ 25,123 (49.4) % $ 34,743 $ 110,189 (68.5) % Medical Office 19,144 28,856 (33.7) % 83,357 115,875 (28.1) % Total Office Portfolio 31,849 53,979 (41.0) % 118,100 226,064 (47.8) % SHOP 7,869 (6,706) 217.3 % 8,726 10,124 (13.8) % Non-Segment 10,119 11,852 (14.6) % 38,202 41,358 (7.6) % Total $ 49,837 $ 59,125 (15.7) % $ 165,028 $ 277,546 (40.5) % NOI and Cash Basis NOI (dollars in thousands) RETURN TO TABLE OF CONTENTS

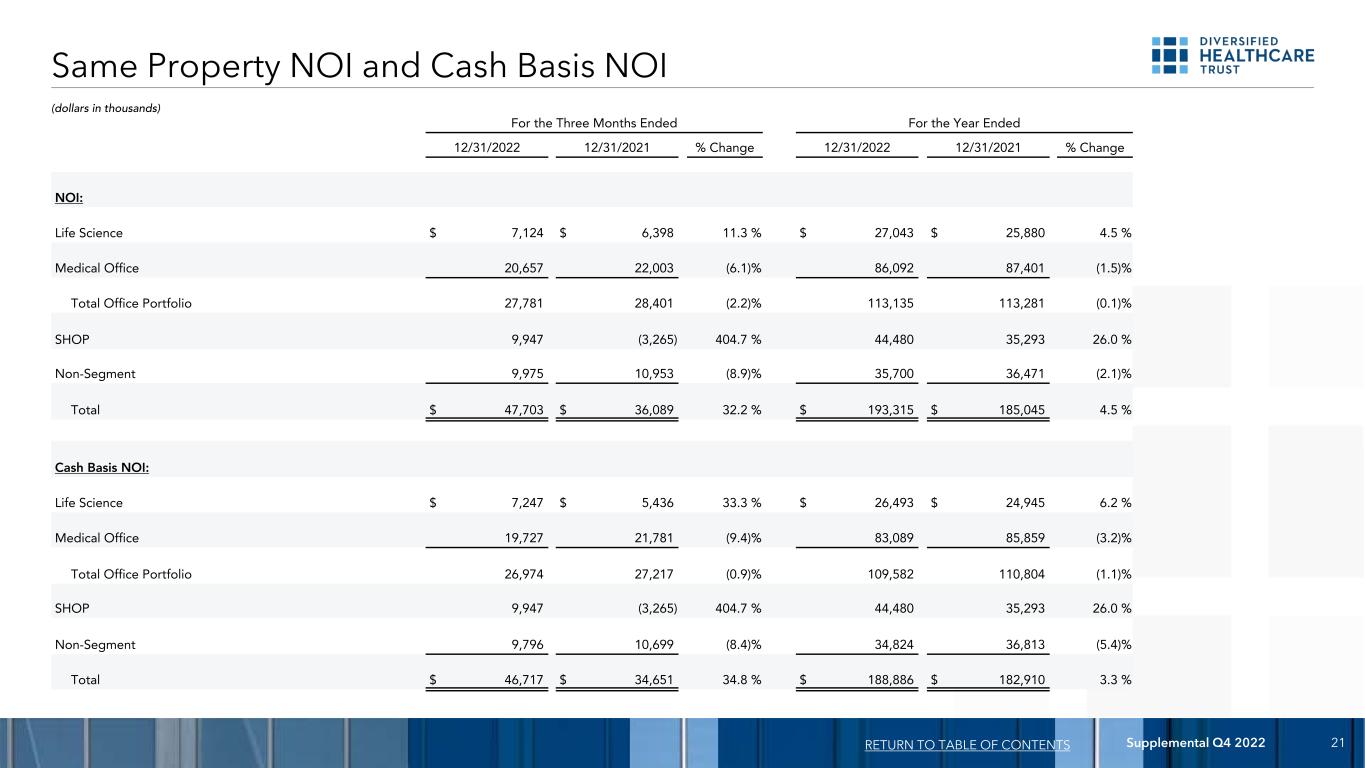

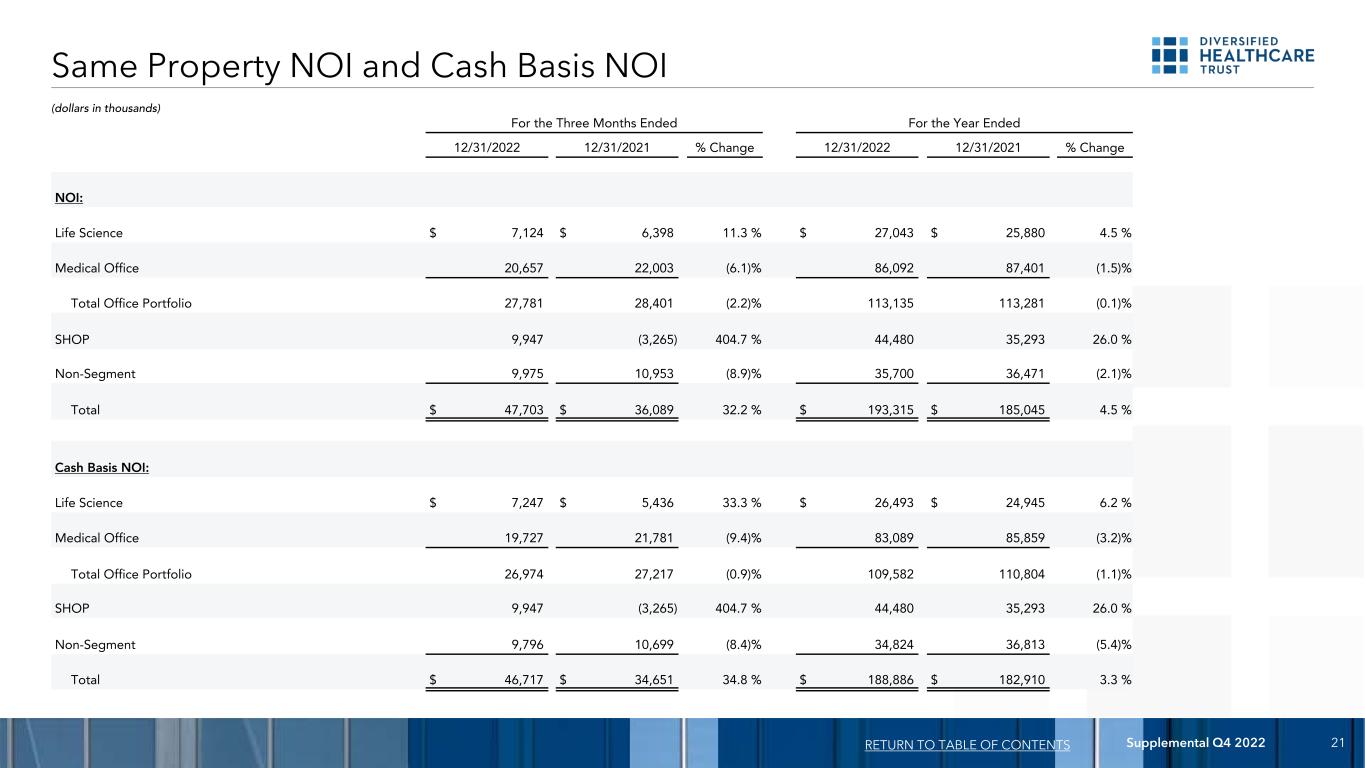

Supplemental Q4 2022 21 Same Property NOI and Cash Basis NOI (dollars in thousands) RETURN TO TABLE OF CONTENTS For the Three Months Ended For the Year Ended 12/31/2022 12/31/2021 % Change 12/31/2022 12/31/2021 % Change NOI: Life Science $ 7,124 $ 6,398 11.3 % $ 27,043 $ 25,880 4.5 % Medical Office 20,657 22,003 (6.1) % 86,092 87,401 (1.5) % Total Office Portfolio 27,781 28,401 (2.2) % 113,135 113,281 (0.1) % SHOP 9,947 (3,265) 404.7 % 44,480 35,293 26.0 % Non-Segment 9,975 10,953 (8.9) % 35,700 36,471 (2.1) % Total $ 47,703 $ 36,089 32.2 % $ 193,315 $ 185,045 4.5 % Cash Basis NOI: Life Science $ 7,247 $ 5,436 33.3 % $ 26,493 $ 24,945 6.2 % Medical Office 19,727 21,781 (9.4) % 83,089 85,859 (3.2) % Total Office Portfolio 26,974 27,217 (0.9) % 109,582 110,804 (1.1) % SHOP 9,947 (3,265) 404.7 % 44,480 35,293 26.0 % Non-Segment 9,796 10,699 (8.4) % 34,824 36,813 (5.4) % Total $ 46,717 $ 34,651 34.8 % $ 188,886 $ 182,910 3.3 %

Supplemental Q4 2022 22 Calculation and Reconciliation of NOI, Cash Basis NOI, Same Property NOI and Same Property Cash Basis NOI by Segment RETURN TO TABLE OF CONTENTS (dollars in thousands) Office Portfolio For the Three Months Ended Calculation of NOI and Cash Basis NOI: 12/31/2022 9/30/2022 6/30/2022 3/31/2022 12/31/2021 Rental income $ 59,529 $ 55,254 $ 52,610 $ 54,997 $ 89,950 Property operating expenses (24,647) (24,179) (22,026) (23,447) (32,313) NOI $ 34,882 $ 31,075 $ 30,584 $ 31,550 $ 57,637 NOI $ 34,882 $ 31,075 $ 30,584 $ 31,550 $ 57,637 Less: Non-cash straight line rent adjustments included in rental income 2,891 2,573 2,532 1,511 1,827 Lease value amortization included in rental income (58) (59) (74) (122) 1,631 Non-cash amortization included in property operating expenses 200 199 199 199 200 Cash Basis NOI $ 31,849 $ 28,362 $ 27,927 $ 29,962 $ 53,979 Reconciliation of NOI to Same Property NOI: NOI $ 34,882 $ 31,075 $ 30,584 $ 31,550 $ 57,637 Less: NOI of properties not included in same property results 7,101 2,440 2,080 3,334 29,236 Same Property NOI $ 27,781 $ 28,635 $ 28,504 $ 28,216 $ 28,401 Reconciliation of Same Property NOI to Same Property Cash Basis NOI: Same Property NOI $ 27,781 $ 28,635 $ 28,504 $ 28,216 $ 28,401 Less: Non-cash straight line rent adjustments included in rental income 693 514 793 1,187 1,230 Lease value amortization included in rental income (58) (59) (74) (132) (144) Non-cash amortization included in property operating expenses 172 209 135 172 98 Same Property Cash Basis NOI $ 26,974 $ 27,971 $ 27,650 $ 26,989 $ 27,217

Supplemental Q4 2022 23 Calculation and Reconciliation of NOI, Cash Basis NOI, Same Property NOI and Same Property Cash Basis NOI by Segment (continued) RETURN TO TABLE OF CONTENTS (dollars in thousands) SHOP For the Three Months Ended Calculation of NOI and Cash Basis NOI: 12/31/2022 9/30/2022 6/30/2022 3/31/2022 12/31/2021 Residents fees and services $ 267,912 $ 258,960 $ 250,506 $ 245,448 $ 234,697 Property operating expenses (260,043) (264,722) (244,040) (245,295) (241,403) NOI / Cash Basis NOI $ 7,869 $ (5,762) $ 6,466 $ 153 $ (6,706) Reconciliation of NOI / Cash Basis NOI to Same Property NOI / Same Property Cash Basis NOI: NOI / Cash Basis NOI $ 7,869 $ (5,762) $ 6,466 $ 153 $ (6,706) Less: NOI / Cash Basis NOI of properties not included in same property results (2,078) (7,460) (3,472) (3,004) (3,441) Same Property NOI / Same Property Cash Basis NOI $ 9,947 $ 1,698 $ 9,938 $ 3,157 $ (3,265)

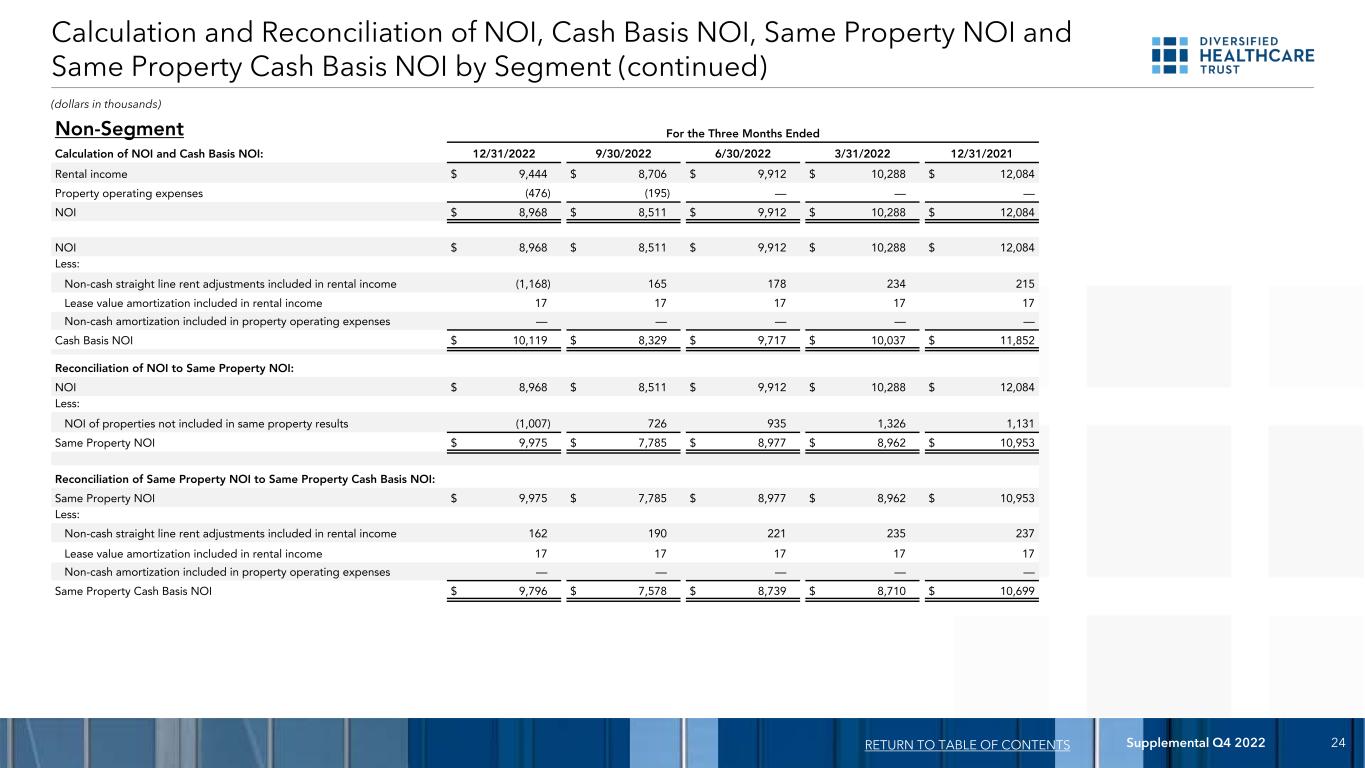

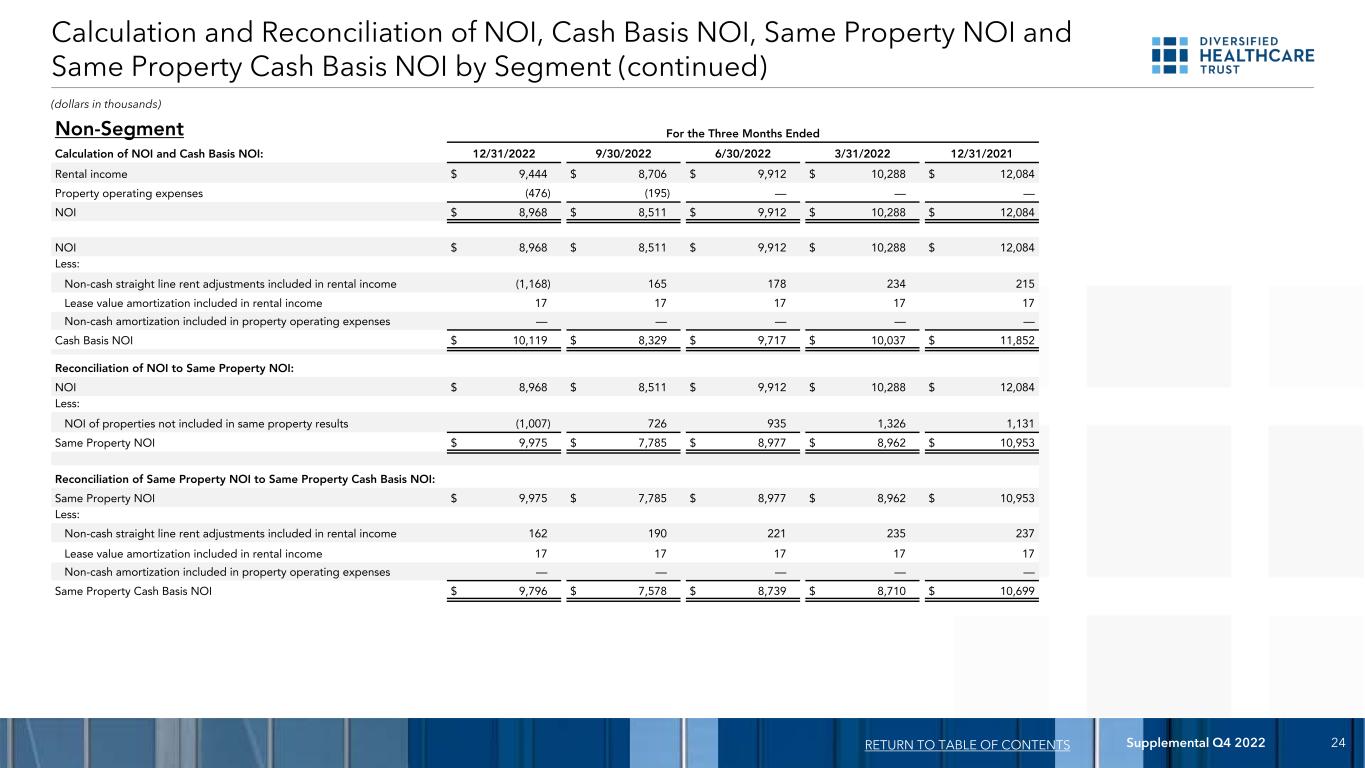

Supplemental Q4 2022 24 Calculation and Reconciliation of NOI, Cash Basis NOI, Same Property NOI and Same Property Cash Basis NOI by Segment (continued) RETURN TO TABLE OF CONTENTS (dollars in thousands) Non-Segment For the Three Months Ended Calculation of NOI and Cash Basis NOI: 12/31/2022 9/30/2022 6/30/2022 3/31/2022 12/31/2021 Rental income $ 9,444 $ 8,706 $ 9,912 $ 10,288 $ 12,084 Property operating expenses (476) (195) — — — NOI $ 8,968 $ 8,511 $ 9,912 $ 10,288 $ 12,084 NOI $ 8,968 $ 8,511 $ 9,912 $ 10,288 $ 12,084 Less: Non-cash straight line rent adjustments included in rental income (1,168) 165 178 234 215 Lease value amortization included in rental income 17 17 17 17 17 Non-cash amortization included in property operating expenses — — — — — Cash Basis NOI $ 10,119 $ 8,329 $ 9,717 $ 10,037 $ 11,852 Reconciliation of NOI to Same Property NOI: NOI $ 8,968 $ 8,511 $ 9,912 $ 10,288 $ 12,084 Less: NOI of properties not included in same property results (1,007) 726 935 1,326 1,131 Same Property NOI $ 9,975 $ 7,785 $ 8,977 $ 8,962 $ 10,953 Reconciliation of Same Property NOI to Same Property Cash Basis NOI: Same Property NOI $ 9,975 $ 7,785 $ 8,977 $ 8,962 $ 10,953 Less: Non-cash straight line rent adjustments included in rental income 162 190 221 235 237 Lease value amortization included in rental income 17 17 17 17 17 Non-cash amortization included in property operating expenses — — — — — Same Property Cash Basis NOI $ 9,796 $ 7,578 $ 8,739 $ 8,710 $ 10,699

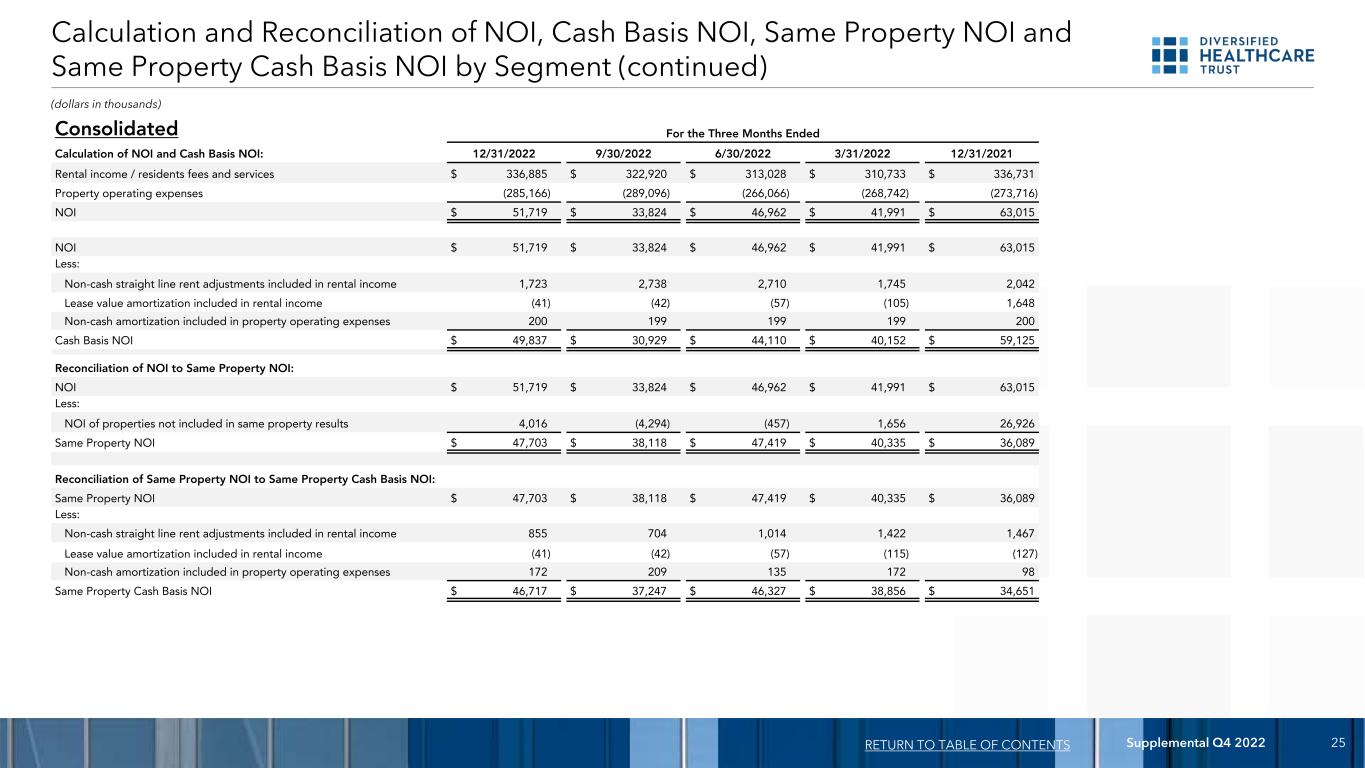

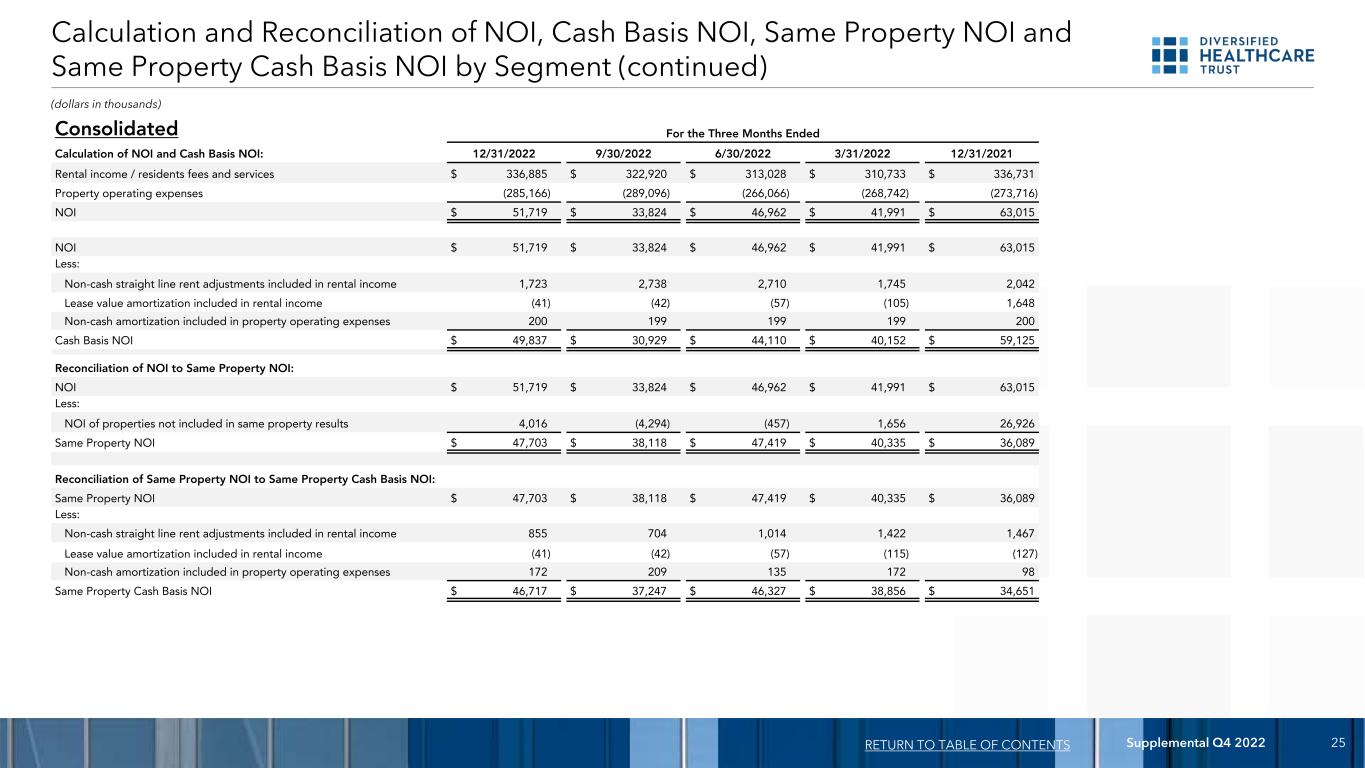

Supplemental Q4 2022 25 Calculation and Reconciliation of NOI, Cash Basis NOI, Same Property NOI and Same Property Cash Basis NOI by Segment (continued) RETURN TO TABLE OF CONTENTS (dollars in thousands) Consolidated For the Three Months Ended Calculation of NOI and Cash Basis NOI: 12/31/2022 9/30/2022 6/30/2022 3/31/2022 12/31/2021 Rental income / residents fees and services $ 336,885 $ 322,920 $ 313,028 $ 310,733 $ 336,731 Property operating expenses (285,166) (289,096) (266,066) (268,742) (273,716) NOI $ 51,719 $ 33,824 $ 46,962 $ 41,991 $ 63,015 NOI $ 51,719 $ 33,824 $ 46,962 $ 41,991 $ 63,015 Less: Non-cash straight line rent adjustments included in rental income 1,723 2,738 2,710 1,745 2,042 Lease value amortization included in rental income (41) (42) (57) (105) 1,648 Non-cash amortization included in property operating expenses 200 199 199 199 200 Cash Basis NOI $ 49,837 $ 30,929 $ 44,110 $ 40,152 $ 59,125 Reconciliation of NOI to Same Property NOI: NOI $ 51,719 $ 33,824 $ 46,962 $ 41,991 $ 63,015 Less: NOI of properties not included in same property results 4,016 (4,294) (457) 1,656 26,926 Same Property NOI $ 47,703 $ 38,118 $ 47,419 $ 40,335 $ 36,089 Reconciliation of Same Property NOI to Same Property Cash Basis NOI: Same Property NOI $ 47,703 $ 38,118 $ 47,419 $ 40,335 $ 36,089 Less: Non-cash straight line rent adjustments included in rental income 855 704 1,014 1,422 1,467 Lease value amortization included in rental income (41) (42) (57) (115) (127) Non-cash amortization included in property operating expenses 172 209 135 172 98 Same Property Cash Basis NOI $ 46,717 $ 37,247 $ 46,327 $ 38,856 $ 34,651

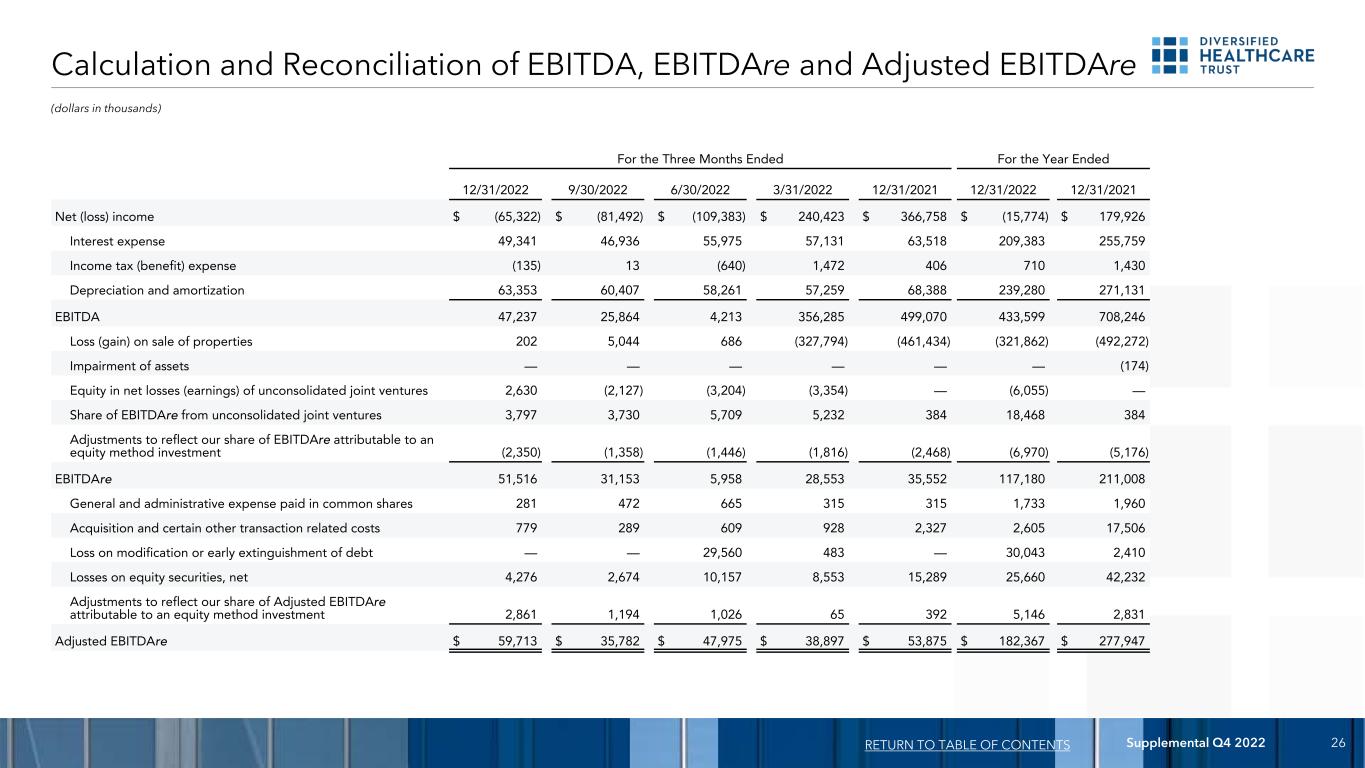

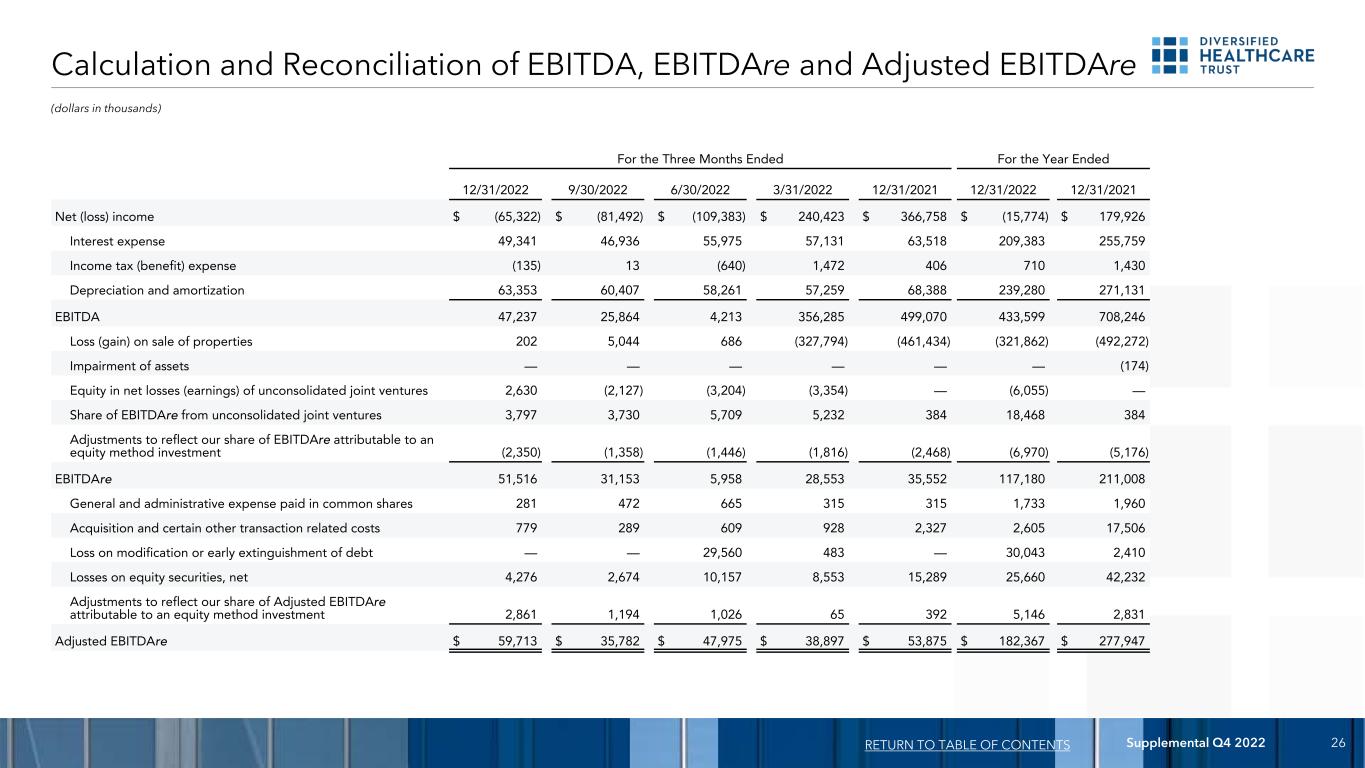

Supplemental Q4 2022 26 Calculation and Reconciliation of EBITDA, EBITDAre and Adjusted EBITDAre (dollars in thousands) For the Three Months Ended For the Year Ended 12/31/2022 9/30/2022 6/30/2022 3/31/2022 12/31/2021 12/31/2022 12/31/2021 Net (loss) income $ (65,322) $ (81,492) $ (109,383) $ 240,423 $ 366,758 $ (15,774) $ 179,926 Interest expense 49,341 46,936 55,975 57,131 63,518 209,383 255,759 Income tax (benefit) expense (135) 13 (640) 1,472 406 710 1,430 Depreciation and amortization 63,353 60,407 58,261 57,259 68,388 239,280 271,131 EBITDA 47,237 25,864 4,213 356,285 499,070 433,599 708,246 Loss (gain) on sale of properties 202 5,044 686 (327,794) (461,434) (321,862) (492,272) Impairment of assets — — — — — — (174) Equity in net losses (earnings) of unconsolidated joint ventures 2,630 (2,127) (3,204) (3,354) — (6,055) — Share of EBITDAre from unconsolidated joint ventures 3,797 3,730 5,709 5,232 384 18,468 384 Adjustments to reflect our share of EBITDAre attributable to an equity method investment (2,350) (1,358) (1,446) (1,816) (2,468) (6,970) (5,176) EBITDAre 51,516 31,153 5,958 28,553 35,552 117,180 211,008 General and administrative expense paid in common shares 281 472 665 315 315 1,733 1,960 Acquisition and certain other transaction related costs 779 289 609 928 2,327 2,605 17,506 Loss on modification or early extinguishment of debt — — 29,560 483 — 30,043 2,410 Losses on equity securities, net 4,276 2,674 10,157 8,553 15,289 25,660 42,232 Adjustments to reflect our share of Adjusted EBITDAre attributable to an equity method investment 2,861 1,194 1,026 65 392 5,146 2,831 Adjusted EBITDAre $ 59,713 $ 35,782 $ 47,975 $ 38,897 $ 53,875 $ 182,367 $ 277,947 RETURN TO TABLE OF CONTENTS

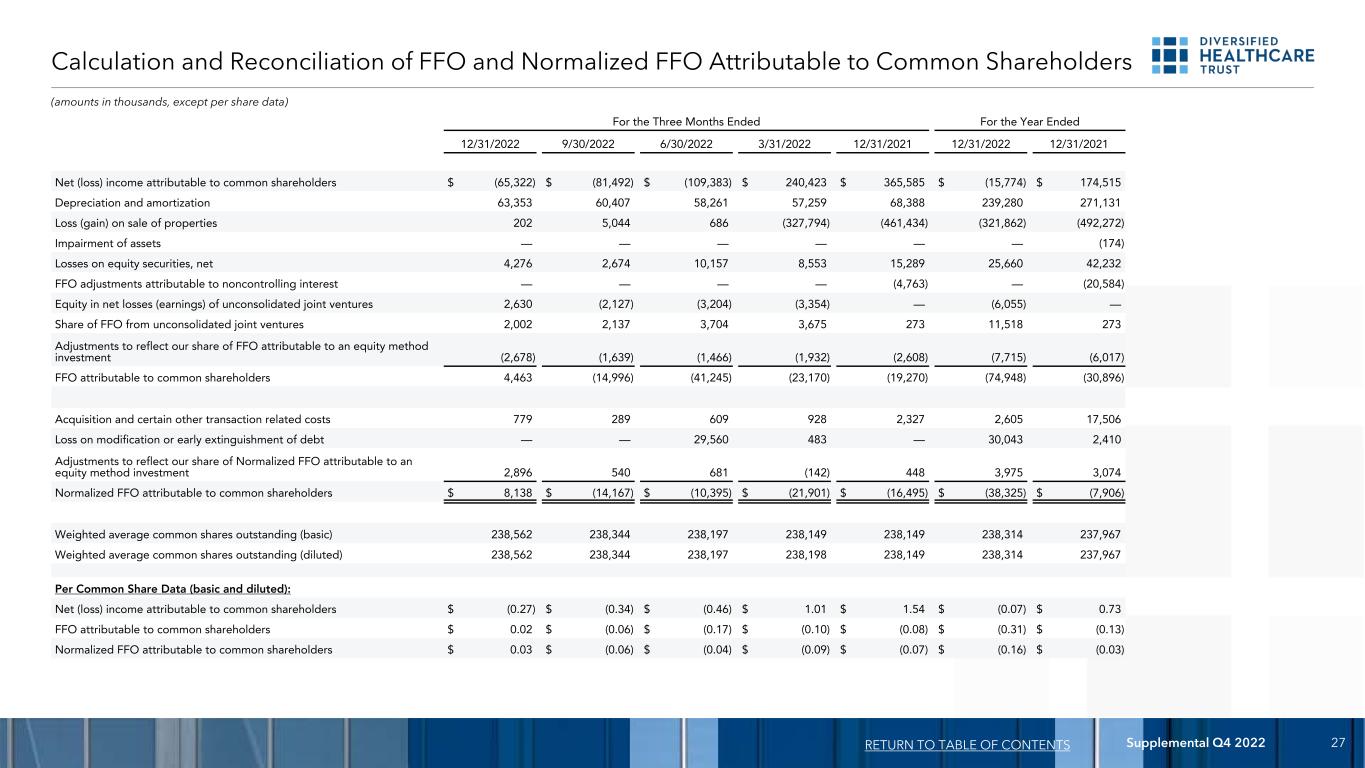

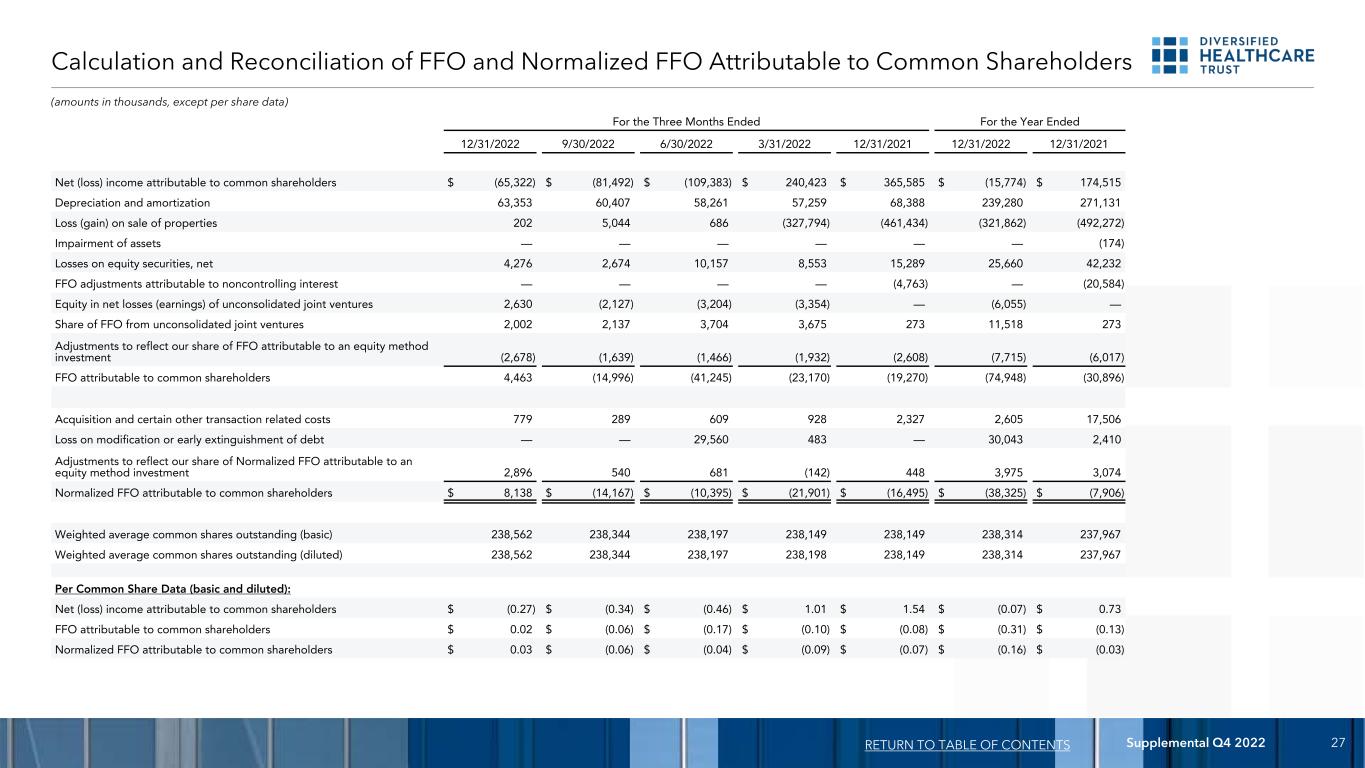

Supplemental Q4 2022 27 Calculation and Reconciliation of FFO and Normalized FFO Attributable to Common Shareholders (amounts in thousands, except per share data) RETURN TO TABLE OF CONTENTS For the Three Months Ended For the Year Ended 12/31/2022 9/30/2022 6/30/2022 3/31/2022 12/31/2021 12/31/2022 12/31/2021 Net (loss) income attributable to common shareholders $ (65,322) $ (81,492) $ (109,383) $ 240,423 $ 365,585 $ (15,774) $ 174,515 Depreciation and amortization 63,353 60,407 58,261 57,259 68,388 239,280 271,131 Loss (gain) on sale of properties 202 5,044 686 (327,794) (461,434) (321,862) (492,272) Impairment of assets — — — — — — (174) Losses on equity securities, net 4,276 2,674 10,157 8,553 15,289 25,660 42,232 FFO adjustments attributable to noncontrolling interest — — — — (4,763) — (20,584) Equity in net losses (earnings) of unconsolidated joint ventures 2,630 (2,127) (3,204) (3,354) — (6,055) — Share of FFO from unconsolidated joint ventures 2,002 2,137 3,704 3,675 273 11,518 273 Adjustments to reflect our share of FFO attributable to an equity method investment (2,678) (1,639) (1,466) (1,932) (2,608) (7,715) (6,017) FFO attributable to common shareholders 4,463 (14,996) (41,245) (23,170) (19,270) (74,948) (30,896) Acquisition and certain other transaction related costs 779 289 609 928 2,327 2,605 17,506 Loss on modification or early extinguishment of debt — — 29,560 483 — 30,043 2,410 Adjustments to reflect our share of Normalized FFO attributable to an equity method investment 2,896 540 681 (142) 448 3,975 3,074 Normalized FFO attributable to common shareholders $ 8,138 $ (14,167) $ (10,395) $ (21,901) $ (16,495) $ (38,325) $ (7,906) Weighted average common shares outstanding (basic) 238,562 238,344 238,197 238,149 238,149 238,314 237,967 Weighted average common shares outstanding (diluted) 238,562 238,344 238,197 238,198 238,149 238,314 237,967 Per Common Share Data (basic and diluted): Net (loss) income attributable to common shareholders $ (0.27) $ (0.34) $ (0.46) $ 1.01 $ 1.54 $ (0.07) $ 0.73 FFO attributable to common shareholders $ 0.02 $ (0.06) $ (0.17) $ (0.10) $ (0.08) $ (0.31) $ (0.13) Normalized FFO attributable to common shareholders $ 0.03 $ (0.06) $ (0.04) $ (0.09) $ (0.07) $ (0.16) $ (0.03)

Supplemental Q4 2022 28 FL: 10% CA: 9% TX: 9% GA: 6% MD: 5% NC: 4% WI: 4% VA: 4% IL: 4% IN: 4% 26 Other States + D.C.: 41% (based on Gross Book Value of Real Estate Assets as of December 31, 2022) (1) Senior living communities are categorized by the type of living units which constitute a majority of the living units at the community. (2) Memory care communities are classified as assisted living communities. Portfolio Summary by Geographic Diversification and Property Type Geographic Diversification RETURN TO TABLE OF CONTENTS Assisted Living: 7% Independent Living: 31% SNFs: 1% Life Science: 15% Medical Office: 43% Wellness Centers: 3% Property Type(1) (2) (based on Q4 2022 Same Property NOI)

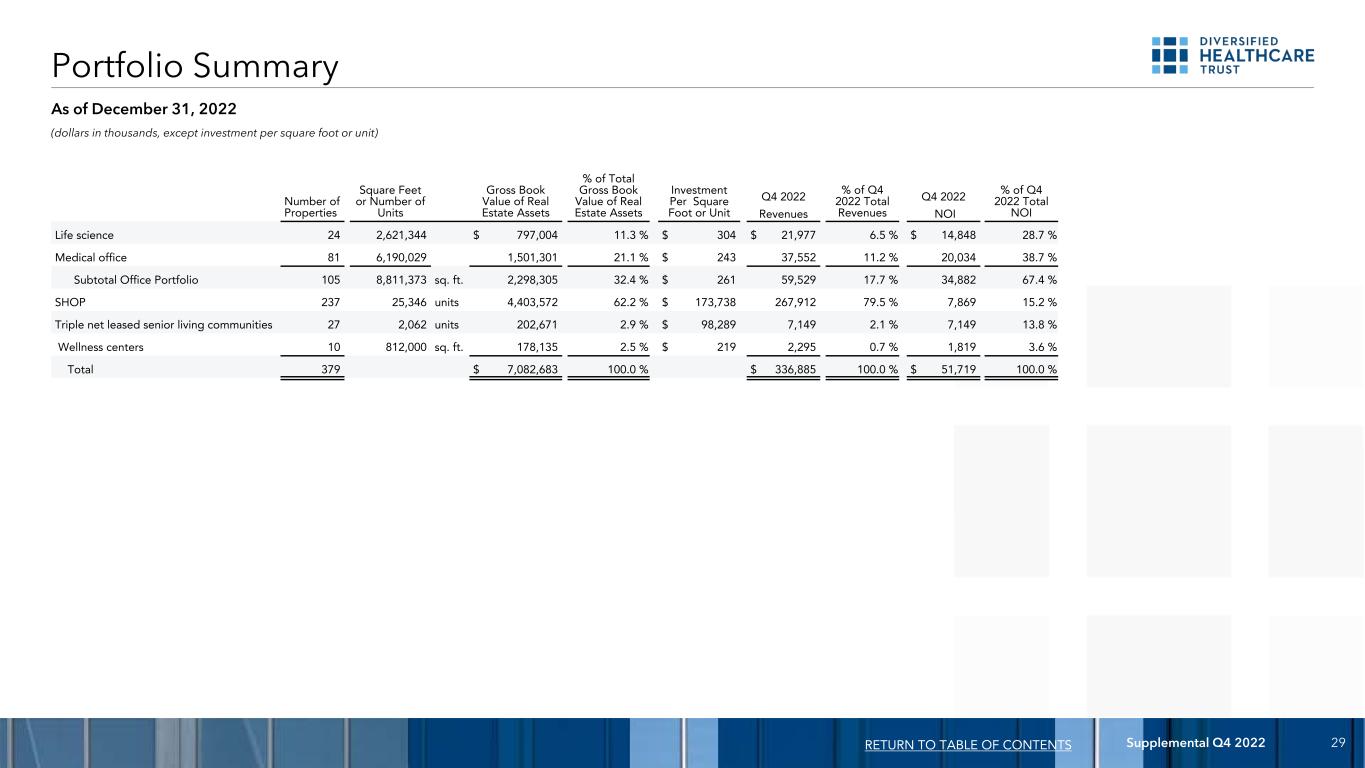

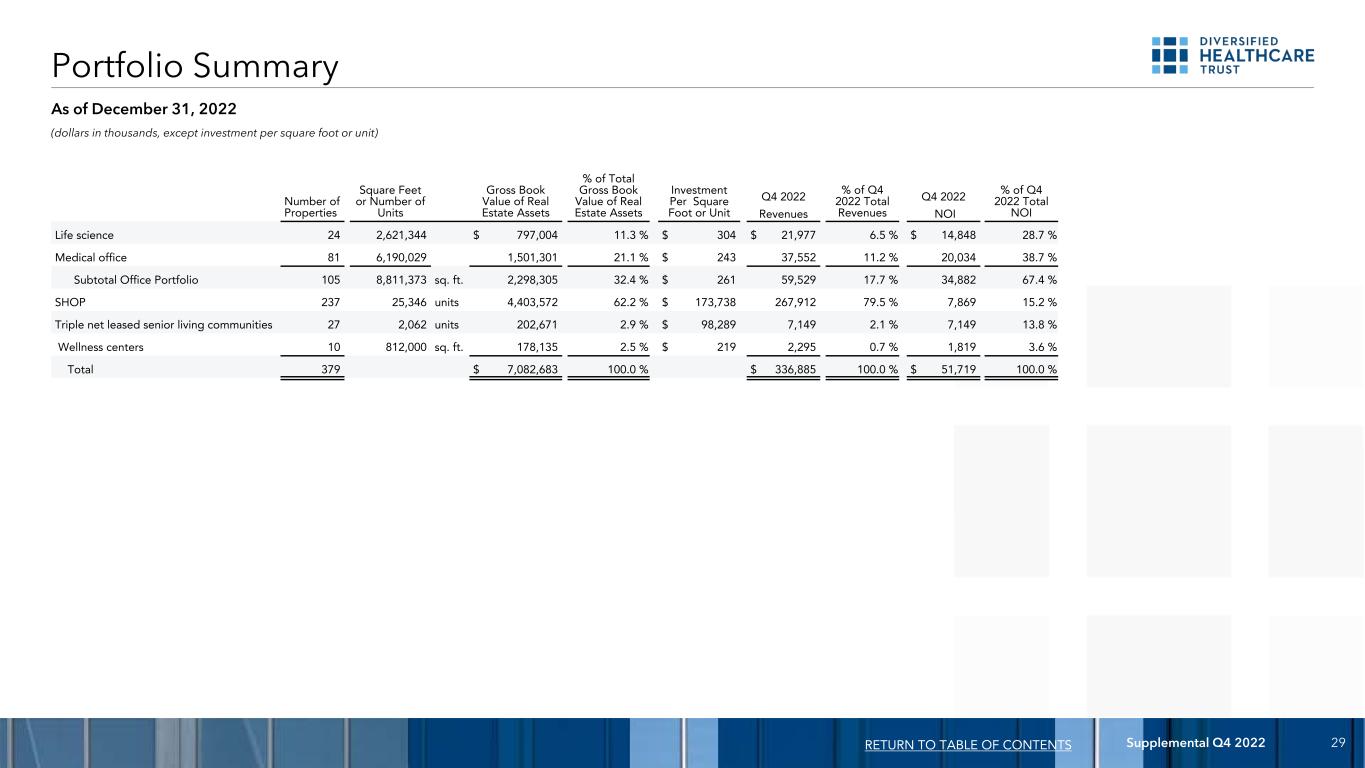

Supplemental Q4 2022 29 Portfolio Summary RETURN TO TABLE OF CONTENTS (dollars in thousands, except investment per square foot or unit) As of December 31, 2022 Number of Properties Square Feet or Number of Units Gross Book Value of Real Estate Assets % of Total Gross Book Value of Real Estate Assets Investment Per Square Foot or Unit % of Q4 2022 Total Revenues % of Q4 2022 Total NOI Q4 2022 Q4 2022 Revenues NOI Life science 24 2,621,344 $ 797,004 11.3 % $ 304 $ 21,977 6.5 % $ 14,848 28.7 % Medical office 81 6,190,029 1,501,301 21.1 % $ 243 37,552 11.2 % 20,034 38.7 % Subtotal Office Portfolio 105 8,811,373 sq. ft. 2,298,305 32.4 % $ 261 59,529 17.7 % 34,882 67.4 % SHOP 237 25,346 units 4,403,572 62.2 % $ 173,738 267,912 79.5 % 7,869 15.2 % Triple net leased senior living communities 27 2,062 units 202,671 2.9 % $ 98,289 7,149 2.1 % 7,149 13.8 % Wellness centers 10 812,000 sq. ft. 178,135 2.5 % $ 219 2,295 0.7 % 1,819 3.6 % Total 379 $ 7,082,683 100.0 % $ 336,885 100.0 % $ 51,719 100.0 %

Supplemental Q4 2022 30 SHOP Unit Count RETURN TO TABLE OF CONTENTS Unit Count as of December 31, 2022 Manager Location Number of Properties (1) Assisted Living Independent Living and Active Adult Memory Care Skilled Nursing Total Five Star Senior Living National 119 6,494 9,685 1,544 — 17,723 Oaks-Caravita Senior Care GA/SC 26 1,061 40 314 — 1,415 Phoenix Senior Living AL/AR/KY/MO/ NC/SC 23 971 137 190 164 1,462 Charter Senior Living FL/MD/TN/VA 17 683 — 294 — 977 Cedarhurst Senior Living IL/WI 13 680 10 95 — 785 Stellar Senior Living CO/TX/WY 10 — 177 — 992 1,169 Northstar Senior Living AZ/CA 7 121 — 297 — 418 Navion Senior Solutions SC 5 210 — 25 — 235 Life Care Services DE 3 71 196 12 238 517 Oaks Senior Living GA 3 159 — 105 — 264 IntegraCare Senior Living PA 2 127 — 16 — 143 Omega Senior Living NE 1 69 — — — 69 The RMR Group LLC TX 1 — 169 — — 169 Total 230 10,646 10,414 2,892 1,394 25,346 (1) Excludes seven closed senior living communities.

Supplemental Q4 2022 31 Rent Coverage and Occupancy Rent Coverage (1): For the Twelve Months Ended 9/30/2022 6/30/2022 3/31/2022 12/31/2021 9/30/2021 Triple net leased senior living communities 1.23 x 1.24 x 1.24 x 1.27 x 1.26 x Wellness centers (2) 1.80 x 1.72 x 1.59 x 1.68 x 1.60 x Total 1.39 x 1.37 x 1.33 x 1.38 x 1.36 x Occupancy - Triple net leased senior living communities (1): For the Twelve Months Ended 9/30/2022 6/30/2022 3/31/2022 12/31/2021 9/30/2021 Occupancy 79.9 % 79.2 % 77.7 % 76.4 % 75.5 % Same Property Occupancy (3) 79.9 % 79.2 % 77.7 % 76.4 % 75.5 % RETURN TO TABLE OF CONTENTS (1) All tenant operating data presented is based upon the operating results provided by our tenants for the indicated periods. We report our operating data one quarter in arrears as this is the most recent prior period for which tenant operating results are available to us from our tenants. We have not independently verified tenant operating data. (2) Excludes rent coverage for a tenant of six wellness centers that was in default under the applicable leases with us on December 31, 2022. (3) Same property occupancy includes those properties classified as same property for the three months ended December 31, 2022 for all periods presented.

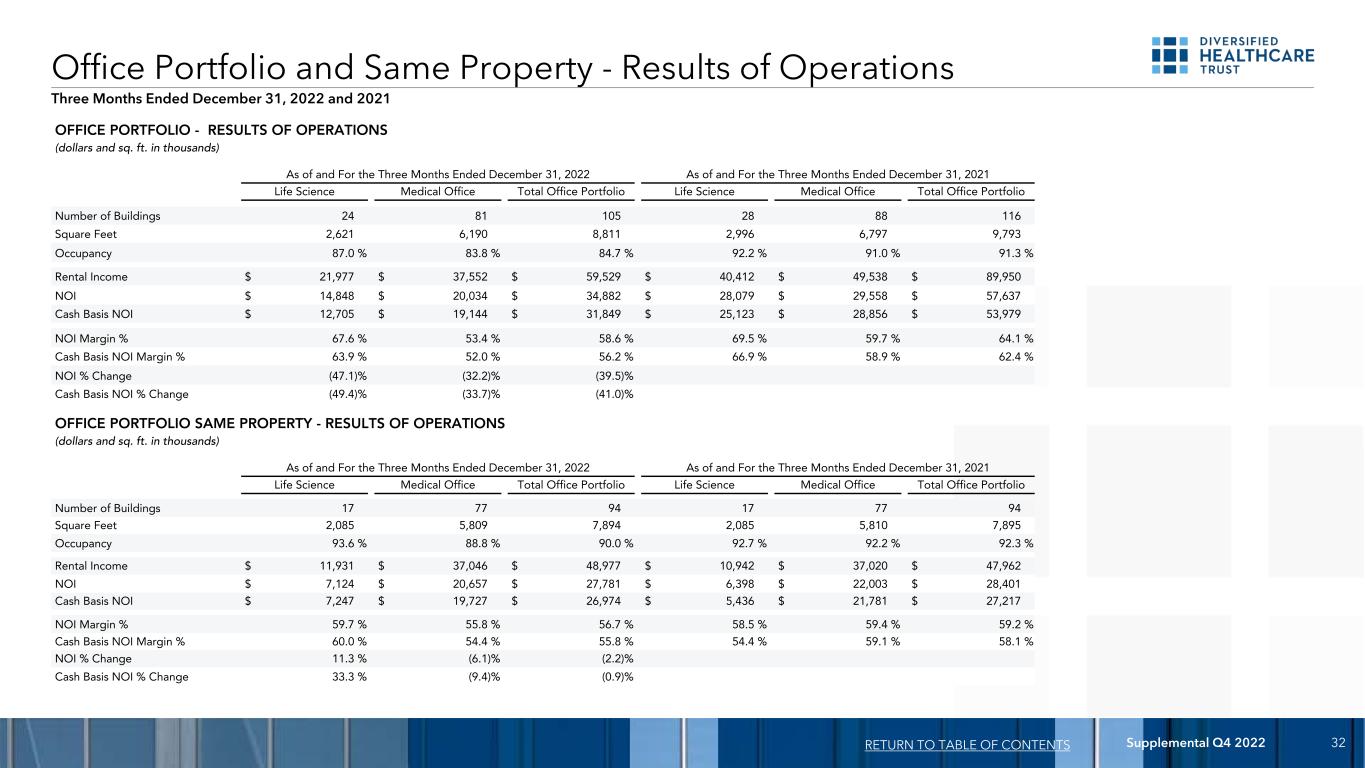

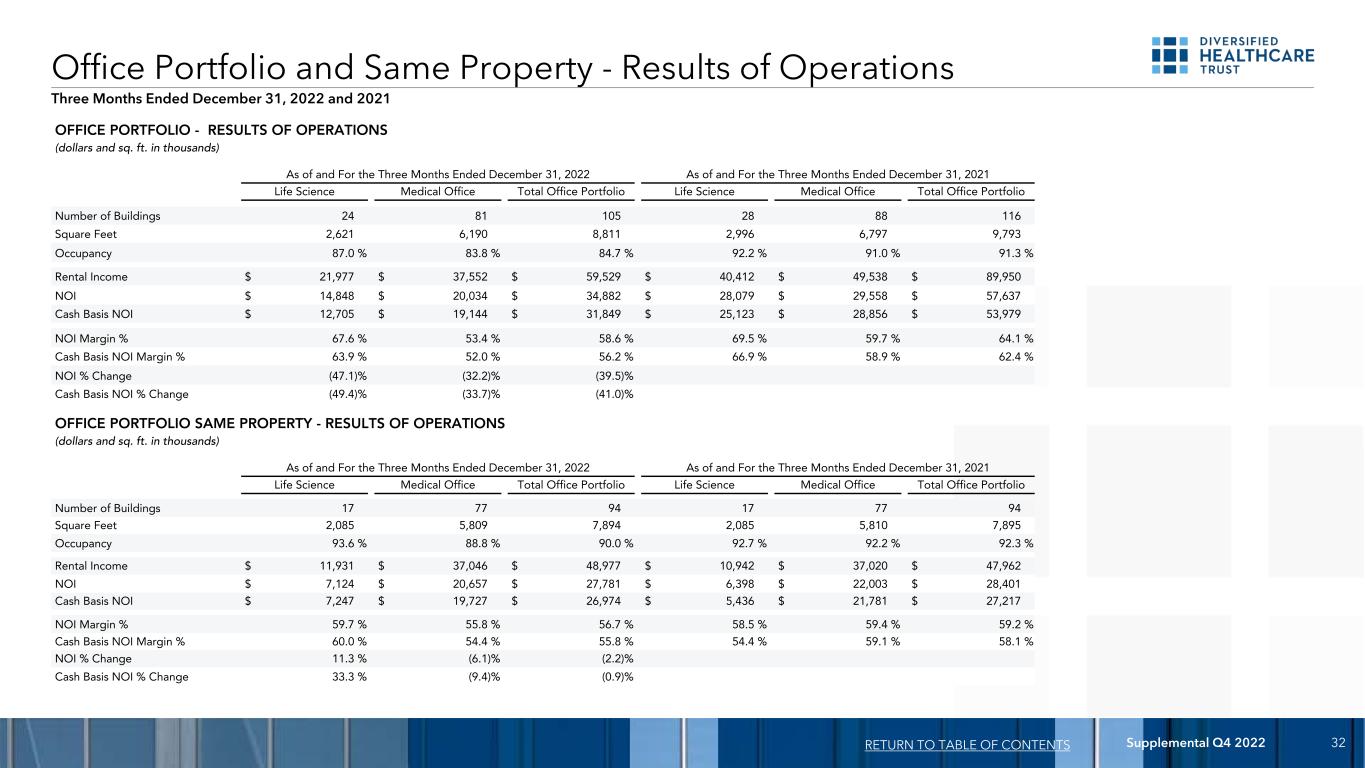

Supplemental Q4 2022 32RETURN TO TABLE OF CONTENTS OFFICE PORTFOLIO - RESULTS OF OPERATIONS (dollars and sq. ft. in thousands) As of and For the Three Months Ended December 31, 2022 As of and For the Three Months Ended December 31, 2021 Life Science Medical Office Total Office Portfolio Life Science Medical Office Total Office Portfolio Number of Buildings 24 81 105 28 88 116 Square Feet 2,621 6,190 8,811 2,996 6,797 9,793 Occupancy 87.0 % 83.8 % 84.7 % 92.2 % 91.0 % 91.3 % Rental Income $ 21,977 $ 37,552 $ 59,529 $ 40,412 $ 49,538 $ 89,950 NOI $ 14,848 $ 20,034 $ 34,882 $ 28,079 $ 29,558 $ 57,637 Cash Basis NOI $ 12,705 $ 19,144 $ 31,849 $ 25,123 $ 28,856 $ 53,979 NOI Margin % 67.6 % 53.4 % 58.6 % 69.5 % 59.7 % 64.1 % Cash Basis NOI Margin % 63.9 % 52.0 % 56.2 % 66.9 % 58.9 % 62.4 % NOI % Change (47.1) % (32.2) % (39.5) % Cash Basis NOI % Change (49.4) % (33.7) % (41.0) % OFFICE PORTFOLIO SAME PROPERTY - RESULTS OF OPERATIONS (dollars and sq. ft. in thousands) As of and For the Three Months Ended December 31, 2022 As of and For the Three Months Ended December 31, 2021 Life Science Medical Office Total Office Portfolio Life Science Medical Office Total Office Portfolio Number of Buildings 17 77 94 17 77 94 Square Feet 2,085 5,809 7,894 2,085 5,810 7,895 Occupancy 93.6 % 88.8 % 90.0 % 92.7 % 92.2 % 92.3 % Rental Income $ 11,931 $ 37,046 $ 48,977 $ 10,942 $ 37,020 $ 47,962 NOI $ 7,124 $ 20,657 $ 27,781 $ 6,398 $ 22,003 $ 28,401 Cash Basis NOI $ 7,247 $ 19,727 $ 26,974 $ 5,436 $ 21,781 $ 27,217 NOI Margin % 59.7 % 55.8 % 56.7 % 58.5 % 59.4 % 59.2 % Cash Basis NOI Margin % 60.0 % 54.4 % 55.8 % 54.4 % 59.1 % 58.1 % NOI % Change 11.3 % (6.1) % (2.2) % Cash Basis NOI % Change 33.3 % (9.4) % (0.9) % Office Portfolio and Same Property - Results of Operations Three Months Ended December 31, 2022 and 2021

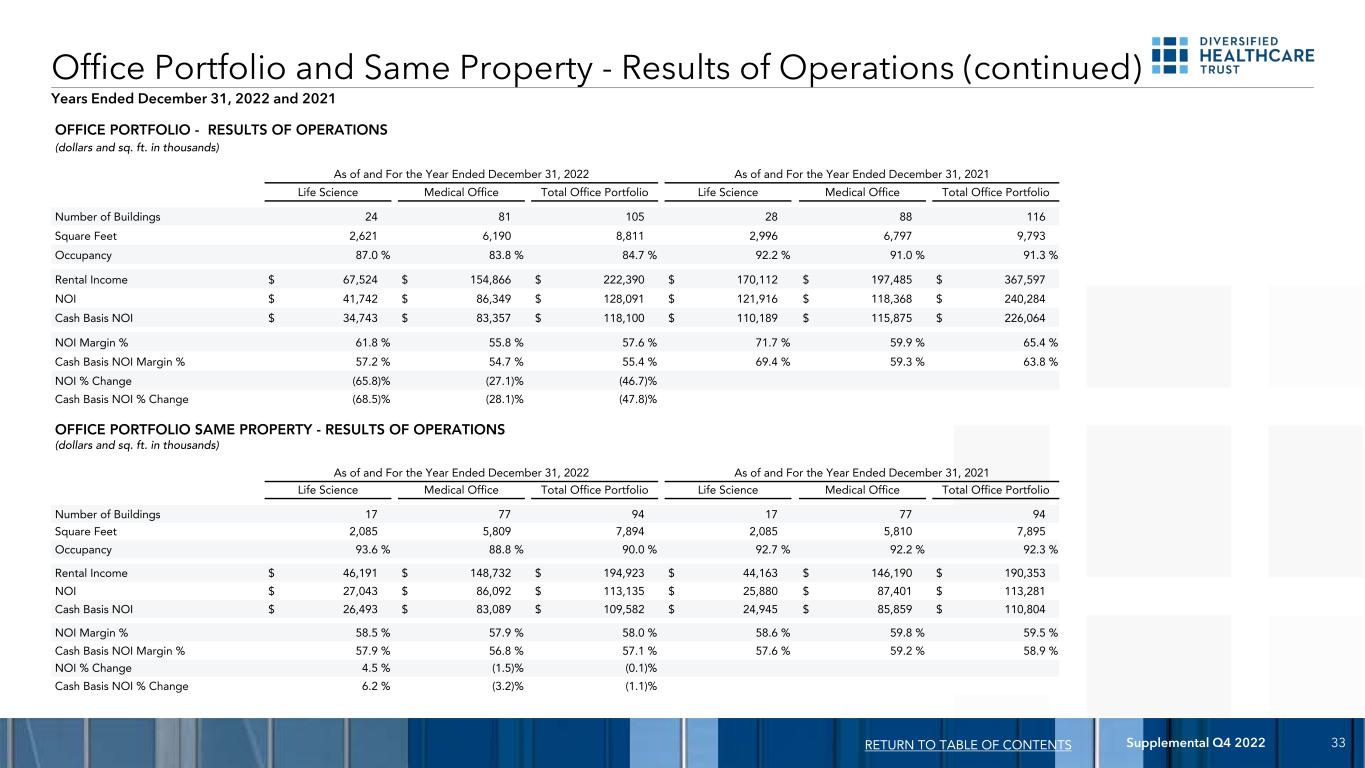

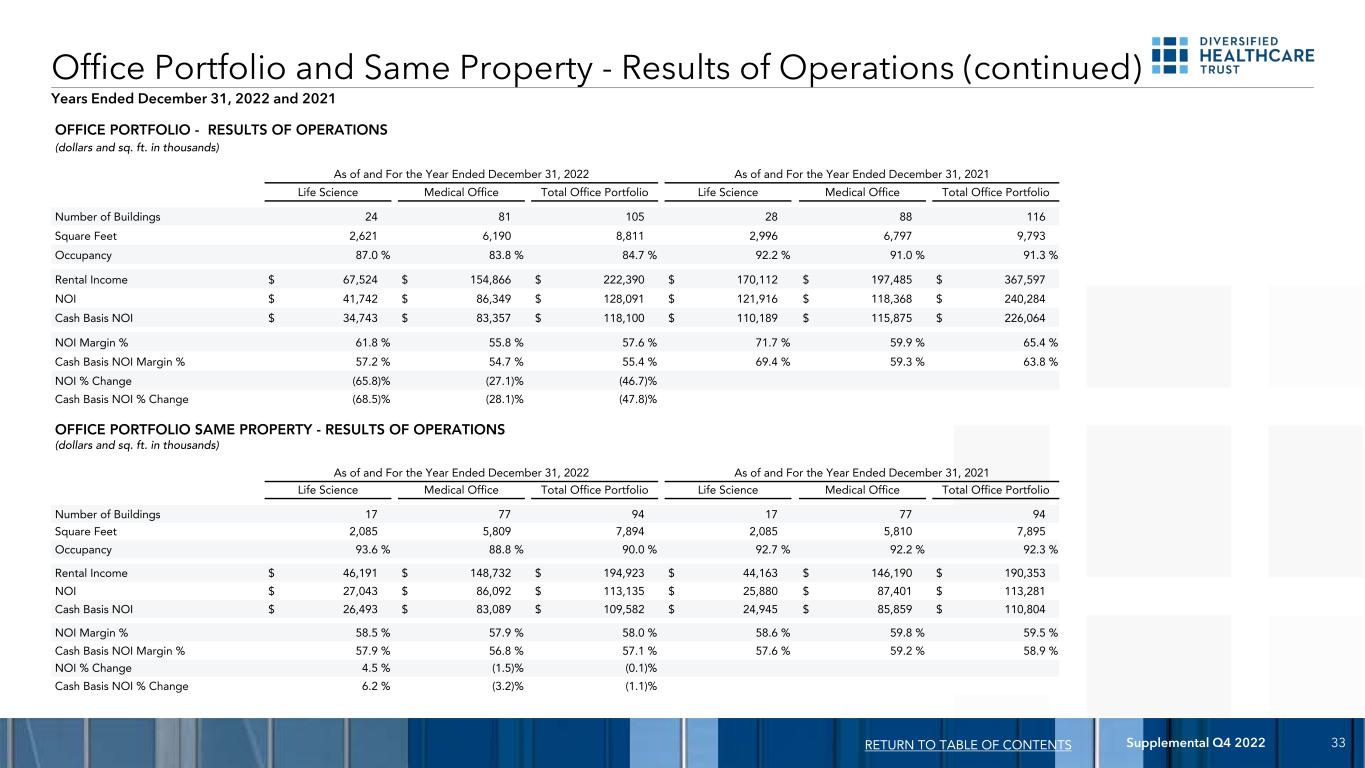

Supplemental Q4 2022 33 Office Portfolio and Same Property - Results of Operations (continued) RETURN TO TABLE OF CONTENTS OFFICE PORTFOLIO - RESULTS OF OPERATIONS (dollars and sq. ft. in thousands) As of and For the Year Ended December 31, 2022 As of and For the Year Ended December 31, 2021 Life Science Medical Office Total Office Portfolio Life Science Medical Office Total Office Portfolio Number of Buildings 24 81 105 28 88 116 Square Feet 2,621 6,190 8,811 2,996 6,797 9,793 Occupancy 87.0 % 83.8 % 84.7 % 92.2 % 91.0 % 91.3 % Rental Income $ 67,524 $ 154,866 $ 222,390 $ 170,112 $ 197,485 $ 367,597 NOI $ 41,742 $ 86,349 $ 128,091 $ 121,916 $ 118,368 $ 240,284 Cash Basis NOI $ 34,743 $ 83,357 $ 118,100 $ 110,189 $ 115,875 $ 226,064 NOI Margin % 61.8 % 55.8 % 57.6 % 71.7 % 59.9 % 65.4 % Cash Basis NOI Margin % 57.2 % 54.7 % 55.4 % 69.4 % 59.3 % 63.8 % NOI % Change (65.8) % (27.1) % (46.7) % Cash Basis NOI % Change (68.5) % (28.1) % (47.8) % OFFICE PORTFOLIO SAME PROPERTY - RESULTS OF OPERATIONS (dollars and sq. ft. in thousands) As of and For the Year Ended December 31, 2022 As of and For the Year Ended December 31, 2021 Life Science Medical Office Total Office Portfolio Life Science Medical Office Total Office Portfolio Number of Buildings 17 77 94 17 77 94 Square Feet 2,085 5,809 7,894 2,085 5,810 7,895 Occupancy 93.6 % 88.8 % 90.0 % 92.7 % 92.2 % 92.3 % Rental Income $ 46,191 $ 148,732 $ 194,923 $ 44,163 $ 146,190 $ 190,353 NOI $ 27,043 $ 86,092 $ 113,135 $ 25,880 $ 87,401 $ 113,281 Cash Basis NOI $ 26,493 $ 83,089 $ 109,582 $ 24,945 $ 85,859 $ 110,804 NOI Margin % 58.5 % 57.9 % 58.0 % 58.6 % 59.8 % 59.5 % Cash Basis NOI Margin % 57.9 % 56.8 % 57.1 % 57.6 % 59.2 % 58.9 % NOI % Change 4.5 % (1.5) % (0.1) % Cash Basis NOI % Change 6.2 % (3.2) % (1.1) % Years Ended December 31, 2022 and 2021

Supplemental Q4 2022 34 (1) Same property includes those properties classified as same property for the three months ended December 31, 2022 for all periods presented. RETURN TO TABLE OF CONTENTS OFFICE PORTFOLIO - RESULTS OF OPERATIONS (dollars and sq. ft. in thousands) As of and For the Three Months Ended 12/31/2022 9/30/2022 6/30/2022 3/31/2022 12/31/2021 Number of Buildings 105 105 104 104 116 Square Feet 8,811 8,811 8,723 8,724 9,793 Occupancy 84.7 % 85.9 % 88.1 % 89.3 % 91.3 % Rental Income $ 59,529 $ 55,254 $ 52,610 $ 54,997 $ 89,950 NOI $ 34,882 $ 31,075 $ 30,584 $ 31,550 $ 57,637 Cash Basis NOI $ 31,849 $ 28,362 $ 27,927 $ 29,962 $ 53,979 NOI Margin % 58.6 % 56.2 % 58.1 % 57.4 % 64.1 % Cash Basis NOI Margin % 56.2 % 53.8 % 55.7 % 55.9 % 62.4 % Sequential NOI % Change 12.3 % 1.6 % (3.1) % (45.3) % Sequential Cash Basis NOI % Change 12.3 % 1.6 % (6.8) % (44.5) % Year Over Year NOI % Change (39.5) % Year Over Year Cash Basis NOI % Change (41.0) % OFFICE PORTFOLIO SAME PROPERTY - RESULTS OF OPERATIONS (1) (dollars and sq. ft. in thousands) As of and For the Three Months Ended 12/31/2022 9/30/2022 6/30/2022 3/31/2022 12/31/2021 Number of Buildings 94 94 94 94 94 Square Feet 7,894 7,894 7,894 7,895 7,895 Occupancy 90.0 % 90.2 % 91.1 % 92.4 % 92.3 % Rental Income $ 48,977 $ 49,775 $ 48,205 $ 47,967 $ 47,962 NOI $ 27,781 $ 28,635 $ 28,504 $ 28,216 $ 28,401 Cash Basis NOI $ 26,974 $ 27,971 $ 27,650 $ 26,989 $ 27,217 NOI Margin % 56.7 % 57.5 % 59.1 % 58.8 % 59.2 % Cash Basis NOI Margin % 55.8 % 56.7 % 58.2 % 57.5 % 58.1 % Sequential NOI % Change (3.0) % 0.5 % 1.0 % (0.7) % Sequential Cash Basis NOI % Change (3.6) % 1.2 % 2.4 % (0.8) % Year Over Year NOI % Change (2.2) % Year Over Year Cash Basis NOI % Change (0.9) % Office Portfolio and Same Property - Results of Operations (continued) Trailing Five Quarters

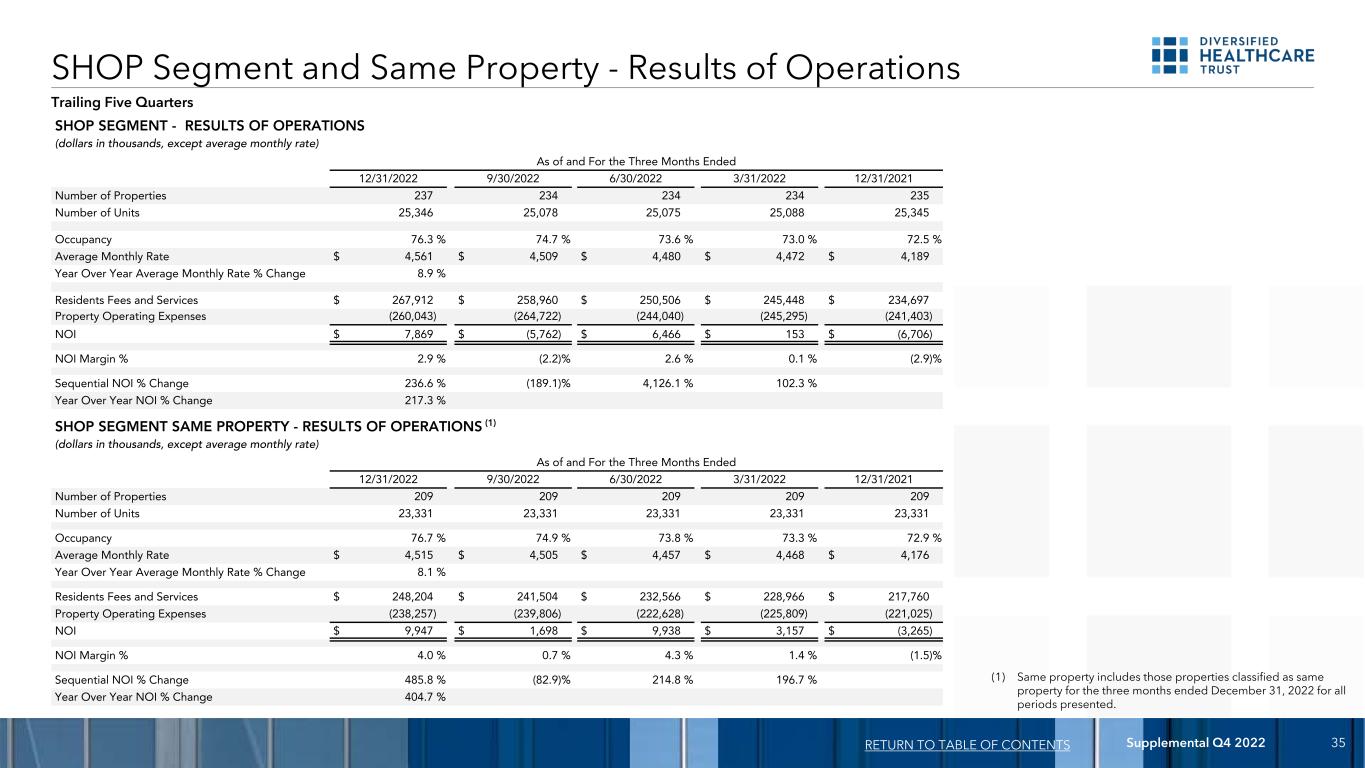

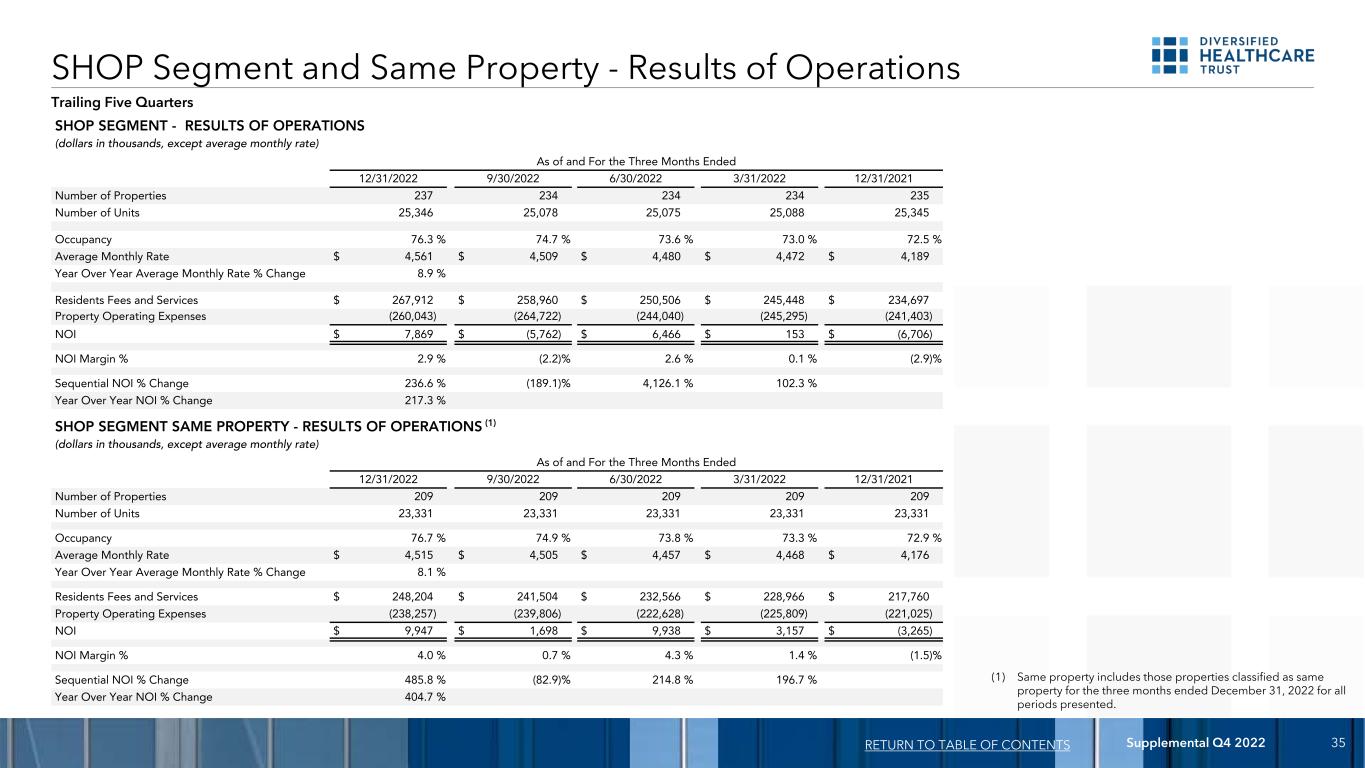

Supplemental Q4 2022 35 SHOP Segment and Same Property - Results of Operations RETURN TO TABLE OF CONTENTS SHOP SEGMENT - RESULTS OF OPERATIONS (dollars in thousands, except average monthly rate) As of and For the Three Months Ended 12/31/2022 9/30/2022 6/30/2022 3/31/2022 12/31/2021 Number of Properties 237 234 234 234 235 Number of Units 25,346 25,078 25,075 25,088 25,345 Occupancy 76.3 % 74.7 % 73.6 % 73.0 % 72.5 % Average Monthly Rate $ 4,561 $ 4,509 $ 4,480 $ 4,472 $ 4,189 Year Over Year Average Monthly Rate % Change 8.9 % Residents Fees and Services $ 267,912 $ 258,960 $ 250,506 $ 245,448 $ 234,697 Property Operating Expenses (260,043) (264,722) (244,040) (245,295) (241,403) NOI $ 7,869 $ (5,762) $ 6,466 $ 153 $ (6,706) NOI Margin % 2.9 % (2.2) % 2.6 % 0.1 % (2.9) % Sequential NOI % Change 236.6 % (189.1) % 4,126.1 % 102.3 % Year Over Year NOI % Change 217.3 % SHOP SEGMENT SAME PROPERTY - RESULTS OF OPERATIONS (1) (dollars in thousands, except average monthly rate) As of and For the Three Months Ended 12/31/2022 9/30/2022 6/30/2022 3/31/2022 12/31/2021 Number of Properties 209 209 209 209 209 Number of Units 23,331 23,331 23,331 23,331 23,331 Occupancy 76.7 % 74.9 % 73.8 % 73.3 % 72.9 % Average Monthly Rate $ 4,515 $ 4,505 $ 4,457 $ 4,468 $ 4,176 Year Over Year Average Monthly Rate % Change 8.1 % Residents Fees and Services $ 248,204 $ 241,504 $ 232,566 $ 228,966 $ 217,760 Property Operating Expenses (238,257) (239,806) (222,628) (225,809) (221,025) NOI $ 9,947 $ 1,698 $ 9,938 $ 3,157 $ (3,265) NOI Margin % 4.0 % 0.7 % 4.3 % 1.4 % (1.5) % Sequential NOI % Change 485.8 % (82.9) % 214.8 % 196.7 % Year Over Year NOI % Change 404.7 % (1) Same property includes those properties classified as same property for the three months ended December 31, 2022 for all periods presented. Trailing Five Quarters

Supplemental Q4 2022 36RETURN TO TABLE OF CONTENTS SHOP SEGMENT - RESULTS OF OPERATIONS (dollars in thousands, except average monthly rate) As of and For the Three Months Ended December 31, 2022 As of and For the Three Months Ended December 31, 2021 Five Star Managed Communities Other Operator Managed Communities(1) Total SHOP Segment Five Star Managed Communities Other Operator Managed Communities(1) Total SHOP Segment Number of Properties 119 118 237 120 115 235 Number of Units 17,723 7,623 25,346 17,899 7,446 25,345 Occupancy 76.6 % 75.4 % 76.3 % 74.1 % 68.8 % 72.5 % Average Monthly Rate $ 4,217 $ 5,375 $ 4,561 $ 3,833 $ 5,130 $ 4,189 Average Monthly Rate % Change 10.0 % 4.8 % 8.9 % Residents Fees and Services $ 174,475 $ 93,437 $ 267,912 $ 155,793 $ 78,904 $ 234,697 Property Operating Expenses (159,540) (100,503) (260,043) (153,098) (88,305) (241,403) NOI $ 14,935 $ (7,066) $ 7,869 $ 2,695 $ (9,401) $ (6,706) NOI Margin % 8.6 % (7.6) % 2.9 % 1.7 % (11.9) % (2.9) % NOI % Change 454.2 % 24.8 % 217.3 % SHOP Segment - Five Star Managed and Other Operator Managed Communities Results of Operations Three Months Ended December 31, 2022 and 2021 (1) During 2021, we transitioned 107 senior living communities from Five Star to 10 other third party managers. In 2022, we transitioned one additional community from Five Star, and we and the applicable operator agreed to terminate the lease agreements for three senior living communities and replace them with management agreements.

Supplemental Q4 2022 37RETURN TO TABLE OF CONTENTS SHOP SEGMENT - RESULTS OF OPERATIONS (dollars in thousands, except average monthly rate) As of and For the Year Ended December 31, 2022 As of and For the Year Ended December 31, 2021 Five Star Managed Communities Other Operator Managed Communities(1) Total SHOP Segment Five Star Managed Communities Other Operator Managed Communities(1) Total SHOP Segment Number of Properties 119 118 237 120 115 235 Number of Units 17,723 7,623 25,346 17,899 7,446 25,345 Occupancy 75.0 % 72.9 % 74.4 % 72.8 % 66.9 % 71.1 % Average Monthly Rate $ 4,143 $ 5,425 $ 4,506 $ 4,079 $ 5,031 $ 4,339 Average Monthly Rate % Change 1.6 % 7.8 % 3.8 % Residents Fees and Services $ 673,885 $ 348,941 $ 1,022,826 $ 668,452 $ 306,171 $ 974,623 Property Operating Expenses (631,260) (382,840) (1,014,100) (635,452) (329,047) (964,499) NOI $ 42,625 $ (33,899) $ 8,726 $ 33,000 $ (22,876) $ 10,124 NOI Margin % 6.3 % (9.7) % 0.9 % 4.9 % (7.5) % 1.0 % NOI % Change 29.2 % (48.2) % (13.8) % SHOP Segment - Five Star Managed and Other Operator Managed Communities Results of Operations Years Ended December 31, 2022 and 2021 (1) During 2021, we transitioned 107 senior living communities from Five Star to 10 other third party managers. In 2022, we transitioned one additional community from Five Star, and we and the applicable operator agreed to terminate the lease agreements for three senior living communities and replace them with management agreements.

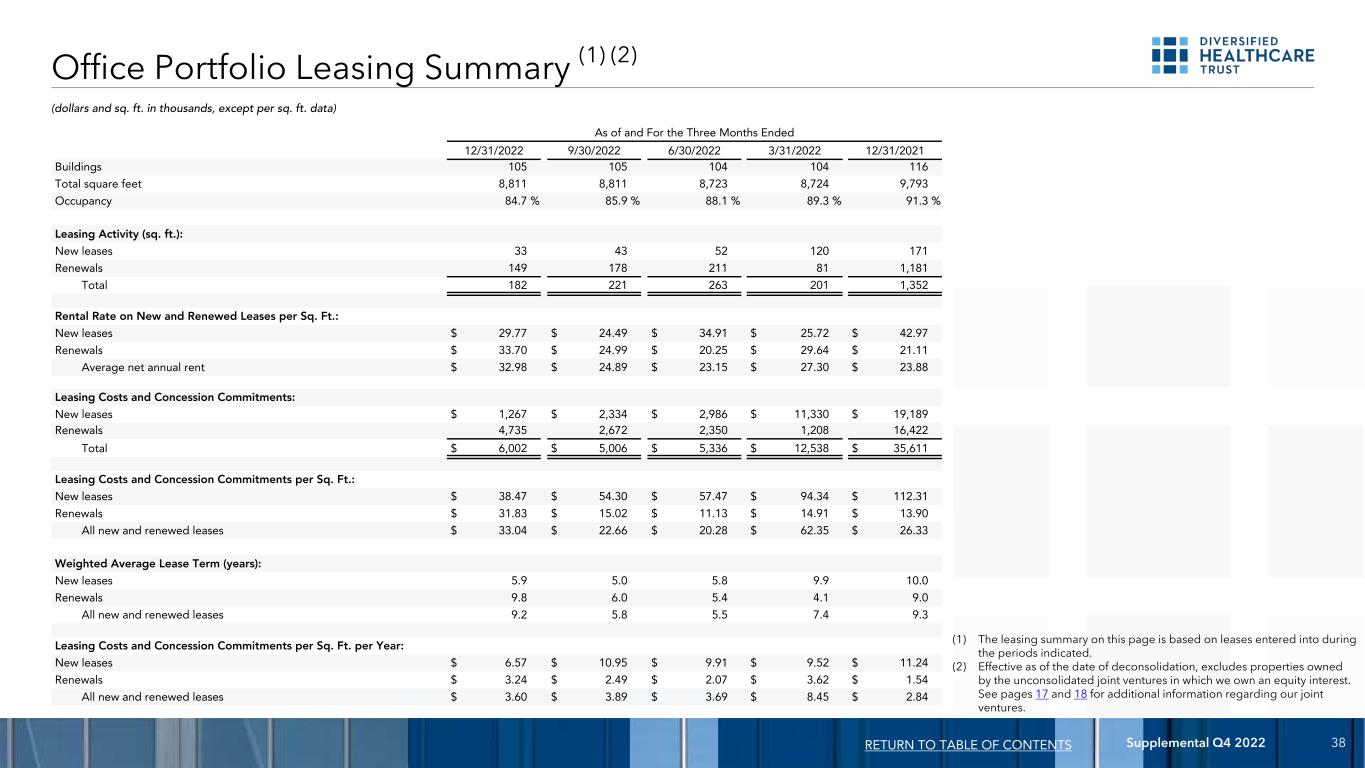

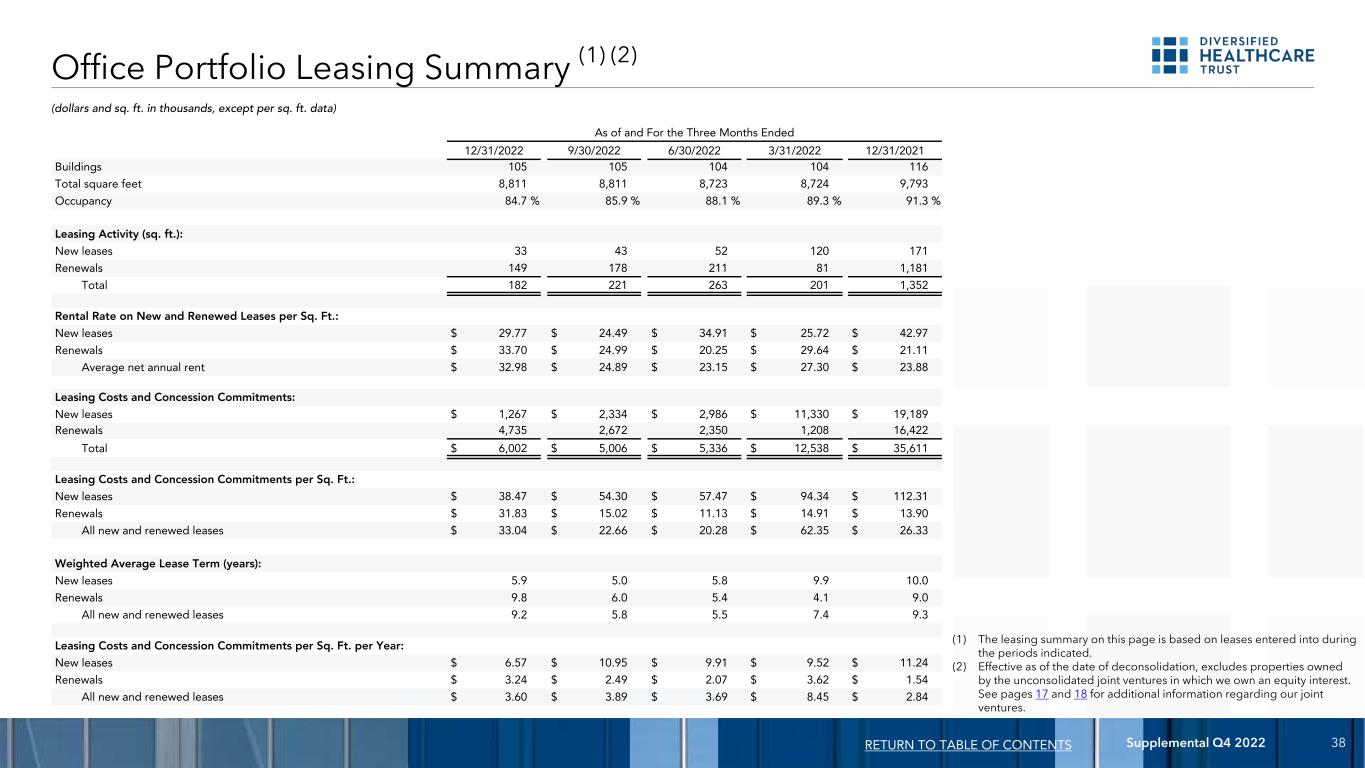

Supplemental Q4 2022 38 Office Portfolio Leasing Summary (1) (2) (1) The leasing summary on this page is based on leases entered into during the periods indicated. (2) Effective as of the date of deconsolidation, excludes properties owned by the unconsolidated joint ventures in which we own an equity interest. See pages 17 and 18 for additional information regarding our joint ventures. (dollars and sq. ft. in thousands, except per sq. ft. data) RETURN TO TABLE OF CONTENTS As of and For the Three Months Ended 12/31/2022 9/30/2022 6/30/2022 3/31/2022 12/31/2021 Buildings 105 105 104 104 116 Total square feet 8,811 8,811 8,723 8,724 9,793 Occupancy 84.7 % 85.9 % 88.1 % 89.3 % 91.3 % Leasing Activity (sq. ft.): New leases 33 43 52 120 171 Renewals 149 178 211 81 1,181 Total 182 221 263 201 1,352 Rental Rate on New and Renewed Leases per Sq. Ft.: New leases $ 29.77 $ 24.49 $ 34.91 $ 25.72 $ 42.97 Renewals $ 33.70 $ 24.99 $ 20.25 $ 29.64 $ 21.11 Average net annual rent $ 32.98 $ 24.89 $ 23.15 $ 27.30 $ 23.88 Leasing Costs and Concession Commitments: New leases $ 1,267 $ 2,334 $ 2,986 $ 11,330 $ 19,189 Renewals 4,735 2,672 2,350 1,208 16,422 Total $ 6,002 $ 5,006 $ 5,336 $ 12,538 $ 35,611 Leasing Costs and Concession Commitments per Sq. Ft.: New leases $ 38.47 $ 54.30 $ 57.47 $ 94.34 $ 112.31 Renewals $ 31.83 $ 15.02 $ 11.13 $ 14.91 $ 13.90 All new and renewed leases $ 33.04 $ 22.66 $ 20.28 $ 62.35 $ 26.33 Weighted Average Lease Term (years): New leases 5.9 5.0 5.8 9.9 10.0 Renewals 9.8 6.0 5.4 4.1 9.0 All new and renewed leases 9.2 5.8 5.5 7.4 9.3 Leasing Costs and Concession Commitments per Sq. Ft. per Year: New leases $ 6.57 $ 10.95 $ 9.91 $ 9.52 $ 11.24 Renewals $ 3.24 $ 2.49 $ 2.07 $ 3.62 $ 1.54 All new and renewed leases $ 3.60 $ 3.89 $ 3.69 $ 8.45 $ 2.84

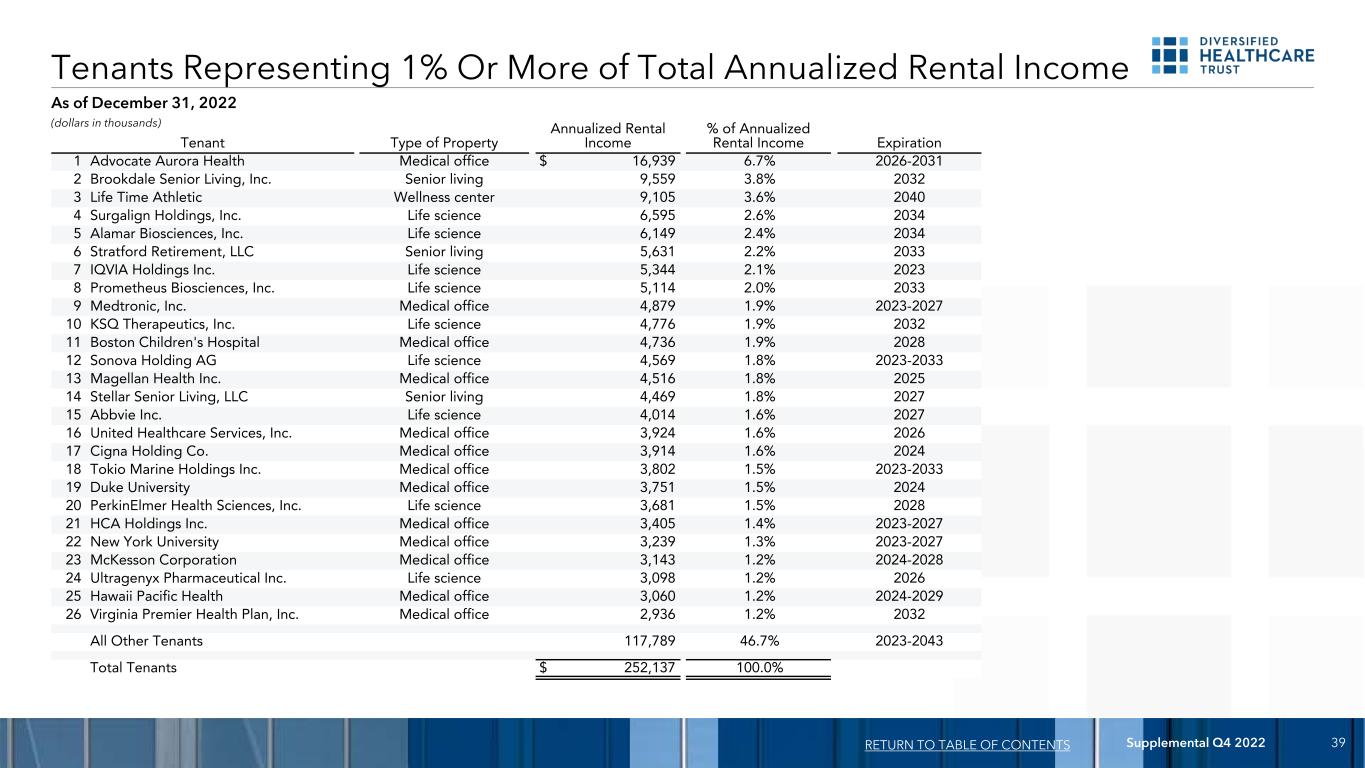

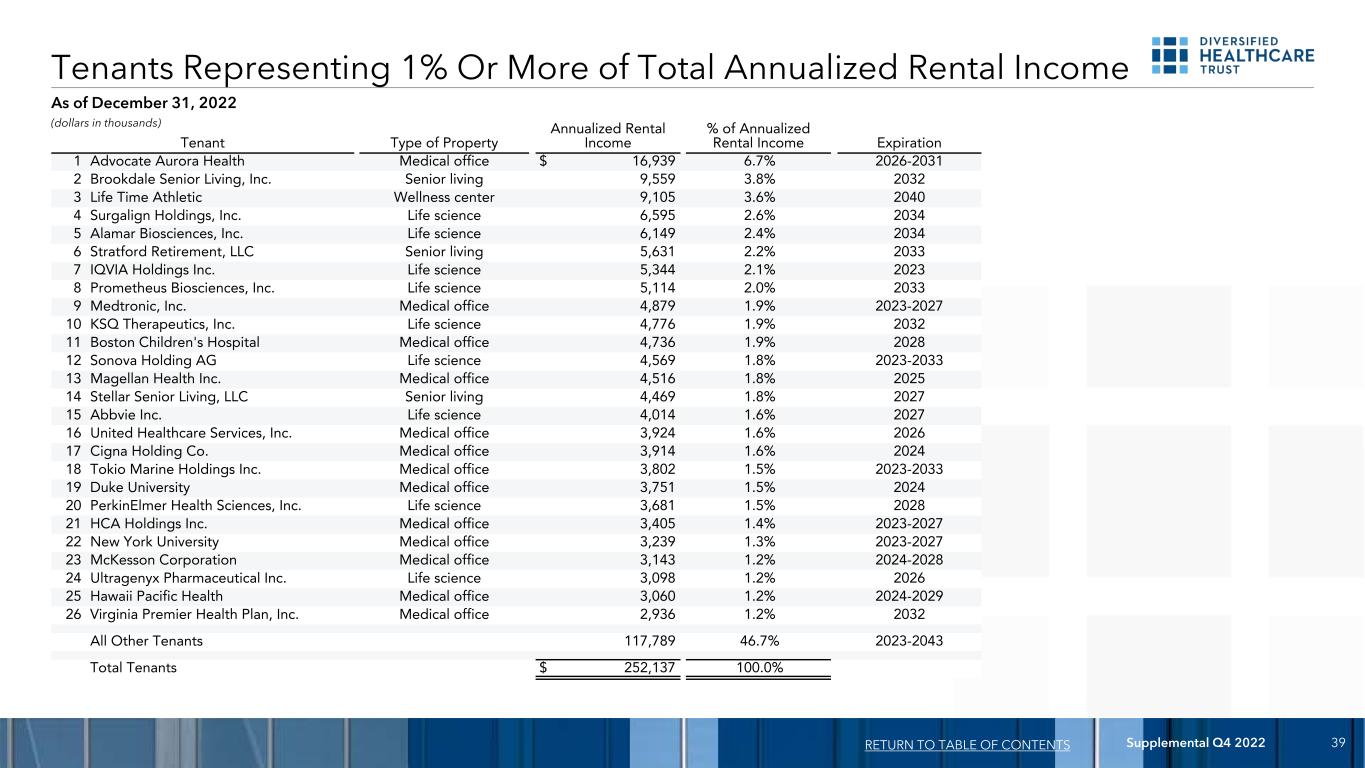

Supplemental Q4 2022 39 As of December 31, 2022 Tenants Representing 1% Or More of Total Annualized Rental Income RETURN TO TABLE OF CONTENTS (dollars in thousands) Tenant Type of Property Annualized Rental Income % of Annualized Rental Income Expiration 1 Advocate Aurora Health Medical office $ 16,939 6.7% 2026-2031 2 Brookdale Senior Living, Inc. Senior living 9,559 3.8% 2032 3 Life Time Athletic Wellness center 9,105 3.6% 2040 4 Surgalign Holdings, Inc. Life science 6,595 2.6% 2034 5 Alamar Biosciences, Inc. Life science 6,149 2.4% 2034 6 Stratford Retirement, LLC Senior living 5,631 2.2% 2033 7 IQVIA Holdings Inc. Life science 5,344 2.1% 2023 8 Prometheus Biosciences, Inc. Life science 5,114 2.0% 2033 9 Medtronic, Inc. Medical office 4,879 1.9% 2023-2027 10 KSQ Therapeutics, Inc. Life science 4,776 1.9% 2032 11 Boston Children's Hospital Medical office 4,736 1.9% 2028 12 Sonova Holding AG Life science 4,569 1.8% 2023-2033 13 Magellan Health Inc. Medical office 4,516 1.8% 2025 14 Stellar Senior Living, LLC Senior living 4,469 1.8% 2027 15 Abbvie Inc. Life science 4,014 1.6% 2027 16 United Healthcare Services, Inc. Medical office 3,924 1.6% 2026 17 Cigna Holding Co. Medical office 3,914 1.6% 2024 18 Tokio Marine Holdings Inc. Medical office 3,802 1.5% 2023-2033 19 Duke University Medical office 3,751 1.5% 2024 20 PerkinElmer Health Sciences, Inc. Life science 3,681 1.5% 2028 21 HCA Holdings Inc. Medical office 3,405 1.4% 2023-2027 22 New York University Medical office 3,239 1.3% 2023-2027 23 McKesson Corporation Medical office 3,143 1.2% 2024-2028 24 Ultragenyx Pharmaceutical Inc. Life science 3,098 1.2% 2026 25 Hawaii Pacific Health Medical office 3,060 1.2% 2024-2029 26 Virginia Premier Health Plan, Inc. Medical office 2,936 1.2% 2032 All Other Tenants 117,789 46.7% 2023-2043 Total Tenants $ 252,137 100.0%

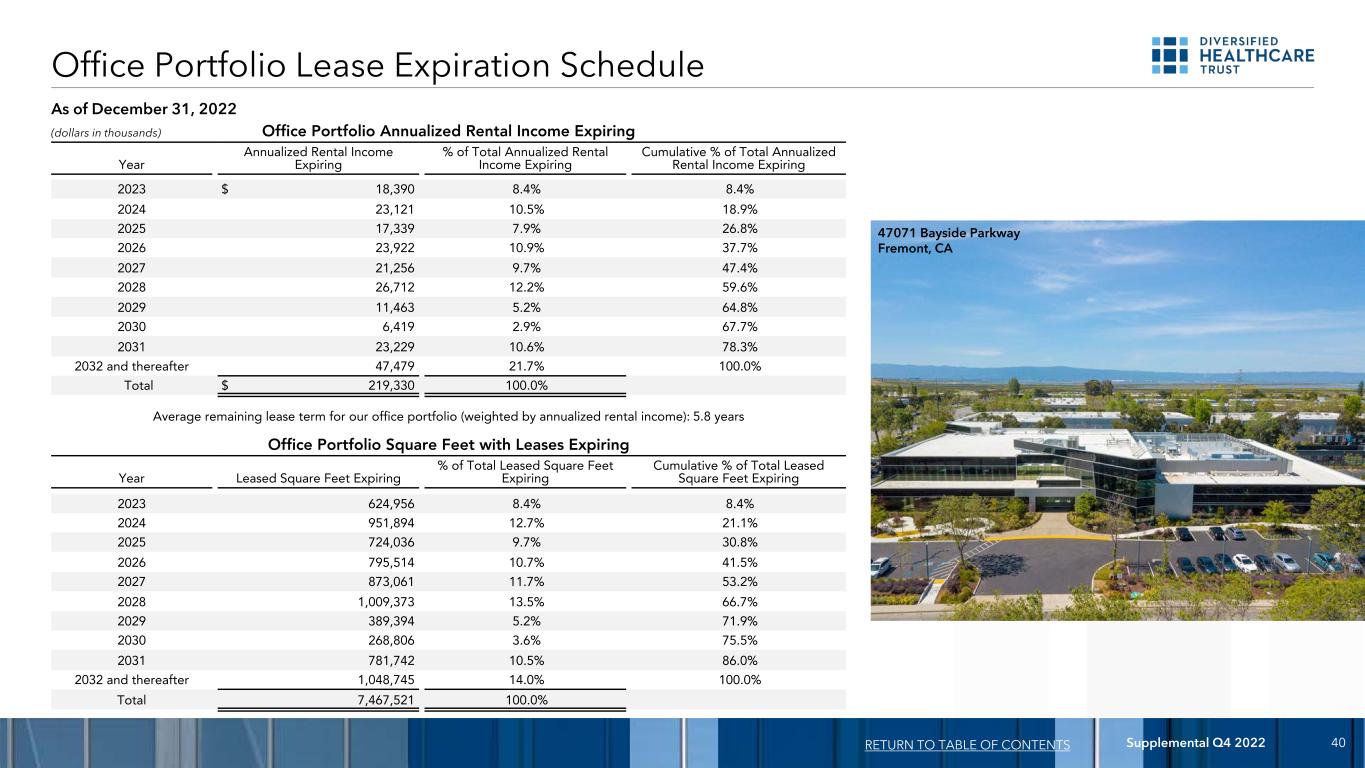

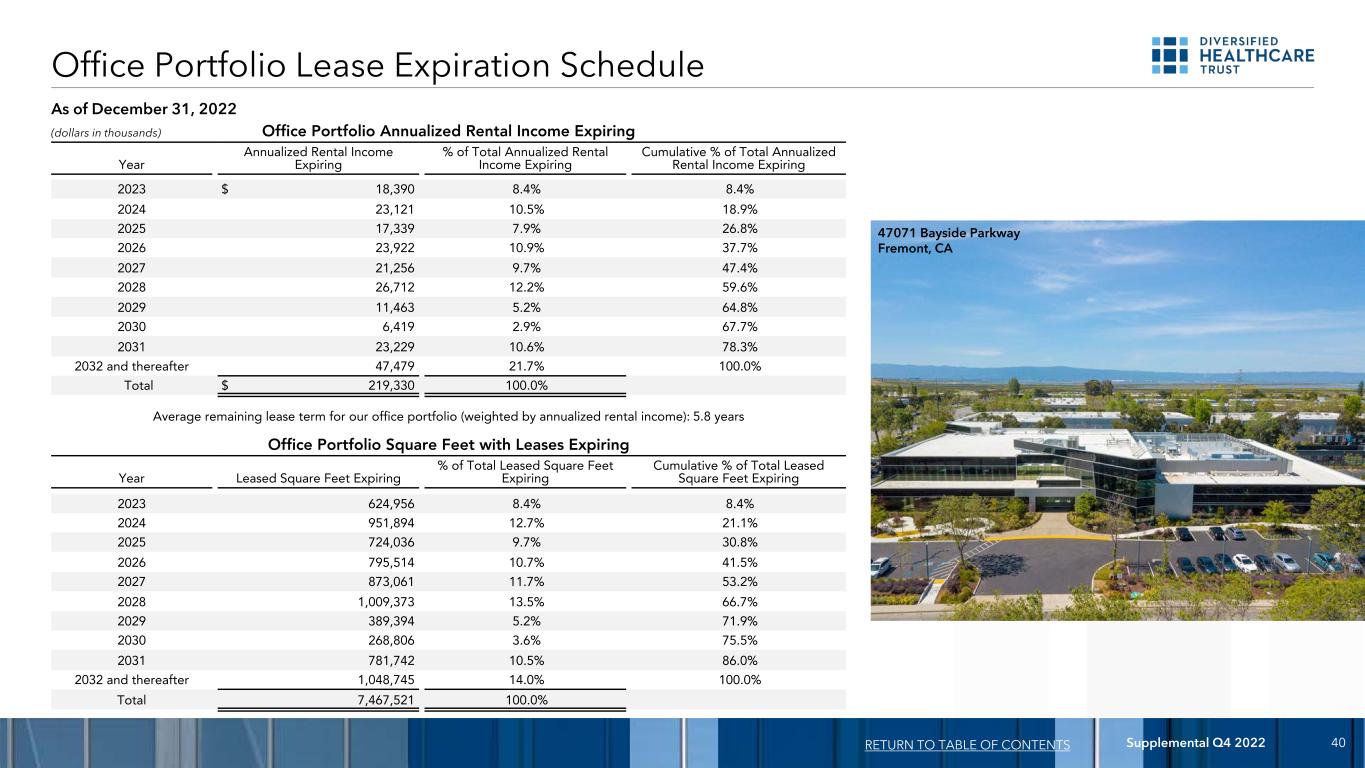

Supplemental Q4 2022 40 Office Portfolio Lease Expiration Schedule RETURN TO TABLE OF CONTENTS (dollars in thousands) As of December 31, 2022 Office Portfolio Annualized Rental Income Expiring Year Annualized Rental Income Expiring % of Total Annualized Rental Income Expiring Cumulative % of Total Annualized Rental Income Expiring 2023 $ 18,390 8.4% 8.4% 2024 23,121 10.5% 18.9% 2025 17,339 7.9% 26.8% 2026 23,922 10.9% 37.7% 2027 21,256 9.7% 47.4% 2028 26,712 12.2% 59.6% 2029 11,463 5.2% 64.8% 2030 6,419 2.9% 67.7% 2031 23,229 10.6% 78.3% 2032 and thereafter 47,479 21.7% 100.0% Total $ 219,330 100.0% Average remaining lease term for our office portfolio (weighted by annualized rental income): 5.8 years Office Portfolio Square Feet with Leases Expiring Year Leased Square Feet Expiring % of Total Leased Square Feet Expiring Cumulative % of Total Leased Square Feet Expiring 2023 624,956 8.4% 8.4% 2024 951,894 12.7% 21.1% 2025 724,036 9.7% 30.8% 2026 795,514 10.7% 41.5% 2027 873,061 11.7% 53.2% 2028 1,009,373 13.5% 66.7% 2029 389,394 5.2% 71.9% 2030 268,806 3.6% 75.5% 2031 781,742 10.5% 86.0% 2032 and thereafter 1,048,745 14.0% 100.0% Total 7,467,521 100.0% 47071 Bayside Parkway Fremont, CA

Supplemental Q4 2022 41 Non-Segment Annualized Rental Income Expiring Year Number of Properties Number of Units or Square Feet Annualized Rental Income Expiring % of Total Annualized Rental Income Expiring Cumulative % of Total Annualized Rental Income Expiring 2023 — — $ — —% —% 2024 — — — —% —% 2025 — — — —% —% 2026 — — — —% —% 2027 4 533 units 4,469 13.6% 13.6% 2028 (1) 6 354,000 sq. ft. — —% 13.6% 2029 1 155 units 547 1.7% 15.3% 2030 2 283 units 3,496 10.7% 26.0% 2031 (2) 1 — — —% 26.0% 2032 and thereafter 23 1,091 units and 458,000 sq. ft. 24,295 74.0% 100.0% Total 37 $ 32,807 100.0% Non-Segment Lease Expiration Schedule As of December 31, 2022 (dollars in thousands) RETURN TO TABLE OF CONTENTS (1) Excludes annualized rental income from our leases with a tenant of six wellness centers. As of December 31, 2022, the tenant was in default on its obligations to us under these leases. As of February 28, 2023, we amended our lease for three of these properties and repossessed one of the three remaining properties. We have also reached an agreement with the tenant to repossess the remaining two properties in March 2023. (2) Excludes annualized rental income from our lease with a tenant of one closed senior living community. As of December 31, 2022, the tenant was in default on its obligations to us under this lease.

Supplemental Q4 2022 42 Non-GAAP Financial Measures We present certain "non-GAAP financial measures" within the meaning of applicable rules of the Securities and Exchange Commission, or the SEC, including net operating income, or NOI, Cash Basis NOI, same property NOI, same property Cash Basis NOI, earnings before interest, income tax, depreciation and amortization, or EBITDA, EBITDA for real estate, or EBITDAre, Adjusted EBITDAre, funds from operations attributable to common shareholders, or FFO attributable to common shareholders, and normalized funds from operations attributable to common shareholders, or Normalized FFO attributable to common shareholders. These measures do not represent cash generated by operating activities in accordance with GAAP and should not be considered alternatives to net income (loss) or net income (loss) attributable to common shareholders as indicators of our operating performance or as measures of our liquidity. These measures should be considered in conjunction with net income (loss) and net income (loss) attributable to common shareholders as presented in our consolidated statements of income (loss). We consider these non-GAAP measures to be appropriate supplemental measures of operating performance for a REIT, along with net income (loss) and net income (loss) attributable to common shareholders. We believe these measures provide useful information to investors because by excluding the effects of certain historical amounts, such as depreciation and amortization, they may facilitate a comparison of our operating performance between periods and with other REITs and, in the case of NOI, Cash Basis NOI, same property NOI and same property Cash Basis NOI, reflecting only those income and expense items that are generated and incurred at the property level may help both investors and management to understand the operations of our properties. NOI, Cash Basis NOI, Same Property NOI and Same Property Cash Basis NOI The calculations of NOI, Cash Basis NOI, same property NOI and same property Cash Basis NOI exclude certain components of net income (loss) in order to provide results that are more closely related to our property level results of operations. We calculate NOI, Cash Basis NOI, same property NOI and same property Cash Basis NOI as shown on pages 19 through 25. We define NOI as income from our real estate less our property operating expenses. NOI excludes amortization of capitalized tenant improvement costs and leasing commissions that we record as depreciation and amortization. We define Cash Basis NOI as NOI excluding non-cash straight line rent adjustments, lease value amortization, lease termination fee amortization, if any, and non-cash amortization included in property operating expenses. We calculate same property NOI and same property Cash Basis NOI in the same manner that we calculate the corresponding NOI and Cash Basis NOI amounts, except that we only include same properties in calculating same property NOI and same property Cash Basis NOI. We use NOI, Cash Basis NOI, same property NOI and same property Cash Basis NOI to evaluate individual and company wide property level performance. Other real estate companies and REITs may calculate NOI, Cash Basis NOI, same property NOI and same property Cash Basis NOI differently than we do. EBITDA, EBITDAre and Adjusted EBITDAre We calculate EBITDA, EBITDAre and Adjusted EBITDAre as shown on page 26. EBITDAre is calculated on the basis defined by the National Association of Real Estate Investment Trusts, or Nareit, which is EBITDA, excluding gains or losses on the sale of properties, equity in net earnings or losses of unconsolidated joint ventures, impairment of assets, if any, and including adjustments to reflect our proportionate share of EBITDAre of our equity method investment in AlerisLife and our proportionate share of EBITDAre from our unconsolidated joint ventures, as well as certain other adjustments currently not applicable to us. In calculating Adjusted EBITDAre, we adjust for the items shown on page 26. Other real estate companies and REITs may calculate EBITDA, EBITDAre and Adjusted EBITDAre differently than we do. FFO and Normalized FFO Attributable to Common Shareholders We calculate FFO attributable to common shareholders and Normalized FFO attributable to common shareholders as shown on page 27. FFO attributable to common shareholders is calculated on the basis defined by Nareit, which is net income (loss) attributable to common shareholders, calculated in accordance with GAAP, excluding any gain or loss on sale of properties, equity in net earnings or losses of unconsolidated joint ventures, loss on impairment of real estate assets, gains or losses on equity securities, net, if any, including adjustments to reflect our proportionate share of FFO of our equity method investment in AlerisLife and our proportionate share of FFO from our unconsolidated joint ventures, plus real estate depreciation and amortization of consolidated properties and minus FFO adjustments attributable to noncontrolling interest, as well as certain other adjustments currently not applicable to us. In calculating Normalized FFO attributable to common shareholders, we adjust for the items shown on page 27. FFO attributable to common shareholders and Normalized FFO attributable to common shareholders are among the factors considered by our Board of Trustees when determining the amount of distributions to our shareholders. Other factors include, but are not limited to, requirements to maintain our qualification for taxation as a REIT, limitations in the agreements governing our debt, the availability to us of debt and equity capital, our expectation of our future capital requirements and operating performance, and our expected needs for and availability of cash to pay our obligations. Other real estate companies and REITs may calculate FFO attributable to common shareholders and Normalized FFO attributable to common shareholders differently than we do. Non-GAAP Financial Measures and Certain Definitions RETURN TO TABLE OF CONTENTS

Supplemental Q4 2022 43 Adjusted total assets Adjusted total assets is the original cost of real estate assets calculated in accordance with GAAP before depreciation and after impairment write downs, if any, and excludes accounts receivable and intangible assets. AlerisLife AlerisLife means AlerisLife Inc. Annualized dividend yield Annualized dividend yield is the annualized dividend declared during the applicable period divided by the closing price of DHC's common shares on The Nasdaq Stock Market LLC at the end of the relevant period. Annualized rental income Annualized rental income is based on rents pursuant to existing leases as of December 31, 2022. Annualized rental income includes estimated percentage rents, straight line rent adjustments and estimated recurring expense reimbursements for certain net and modified gross leases; excludes lease value amortization at certain of our medical office and life science properties and wellness centers. Annualized rental income amounts for our medical office and life science properties also exclude 100% of rents pursuant to existing leases as of December 31, 2022 from the medical office and life science properties owned by unconsolidated joint ventures in which we own an equity interest. Average monthly rate Average monthly rate is calculated by taking the average daily rate, which is defined as total residents fees and services divided by occupied units during the period, and multiplying it by 30 days. Building improvements Building improvements generally include expenditures to replace obsolete building components that extend the useful life of existing assets or other improvements to increase the marketability of the property. Cash basis NOI margin % Cash basis NOI margin % is defined as cash basis NOI as a percentage of cash basis rental income. Cash basis rental income excludes non-cash straight line rent adjustments, lease value amortization and lease termination fee amortization, if any. Consolidated income available for debt service Consolidated income available for debt service is earnings from operations excluding interest expense, depreciation and amortization, taxes, loss on asset impairment, gains or losses on equity securities, gains or losses on sales of properties, modification or early extinguishment of debt and equity in net earnings or losses of unconsolidated joint ventures and including distributions from our unconsolidated joint ventures, determined together with debt service for the applicable period. Coupon rate Coupon rate is the interest rate stated in, or determined pursuant to, the contract terms. Development, redevelopment and other activities Development, redevelopment and other activities generally include capital expenditures that reposition a property or result in new sources of revenue. From time to time we invest in revenue producing capital improvements at certain of our triple net leased senior living communities. As a result, annual rents payable to us increase pursuant to the terms of the applicable leases. These capital improvements are not included in our development, redevelopment and other activities. Estimated completion date Estimated completion date can depend on various factors, including when lease agreements are signed with tenants. Therefore, the actual completion date may vary. Estimated project costs Estimated project costs include estimated construction costs and leasing capital up to stabilization. Five Star Five Star, or Five Star Senior Living, is an operating division of AlerisLife. Five Star managed communities Five Star managed communities are the senior living communities in our SHOP segment that are managed by Five Star. Non-GAAP Financial Measures and Certain Definitions (continued) RETURN TO TABLE OF CONTENTS

Supplemental Q4 2022 44 GAAP GAAP is U.S. generally accepted accounting principles. Gross book value of real estate assets Gross book value of real estate assets is real estate assets at cost plus certain acquisition costs, before depreciation and purchase price allocations, less impairment writedowns, if any. Gross purchase price Gross purchase price includes assumed debt, if any, and excludes acquisition costs and purchase price allocation adjustments, if any. Gross sales price Gross sales price excludes closing costs. Incurrence covenants Incurrence covenants are financial covenants which we are required to comply with in order to incur additional debt under our credit facility and the indentures governing our senior unsecured notes. Interest rate Interest rate includes the effect of mark to market accounting for certain assumed mortgages and premiums and discounts on certain mortgages and unsecured notes; excludes effects of debt issuance costs and the 30 basis points facility fee on our credit facility. Investment per square foot or unit Investment per square foot or unit represents gross book value of real estate assets divided by number of rentable square feet or living units, as applicable, at December 31, 2022. Lease related costs Lease related costs generally include capital expenditures to improve tenants’ space or amounts paid directly to tenants to improve their space and leasing related costs, such as brokerage commissions and tenant inducements. Leasing costs and concession commitments Leasing costs and concession commitments include commitments made for leasing expenditures and concessions, such as tenant improvements, leasing commissions, tenant reimbursements and free rent. Maintenance covenant Our maintenance covenant is a financial covenant which we are required to comply with on a quarterly basis pursuant to the indentures governing our senior unsecured notes. Net debt Net debt is total debt less cash. NOI margin % NOI margin % is defined as NOI as a percentage of rental income or residents fees and services, as appropriate. Non-Segment Non-Segment operations consists of triple net leased senior living communities that are leased to third party operators and wellness centers, and any other income or expenses that are not attributable to a specific reporting segment. Occupancy Occupancy for our Office Portfolio is presented as of the end of the period shown; occupancy for our SHOP segment and other tenants is presented for the duration of the period shown, or the most recent prior period of equivalent length for which tenant and manager operating results are available to us. Occupancy excludes data for our wellness centers. Life science and medical office occupancy data includes (i) out of service assets undergoing redevelopment, (ii) space which is leased but is not occupied or is being offered for sublease by tenants and (iii) space being fitted out for occupancy. Triple net leased senior living communities occupancy excludes data for periods prior to our ownership of certain properties, as well as properties sold or classified as held for sale, or for which there was a transfer of operations during the periods presented. Non-GAAP Financial Measures and Certain Definitions (continued) RETURN TO TABLE OF CONTENTS