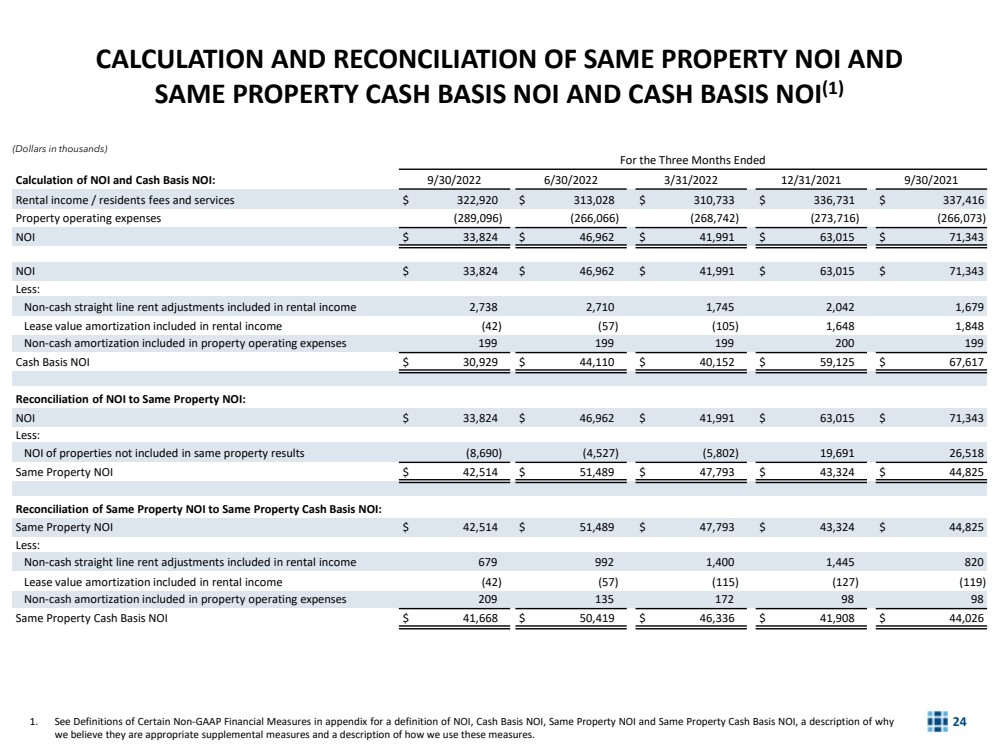

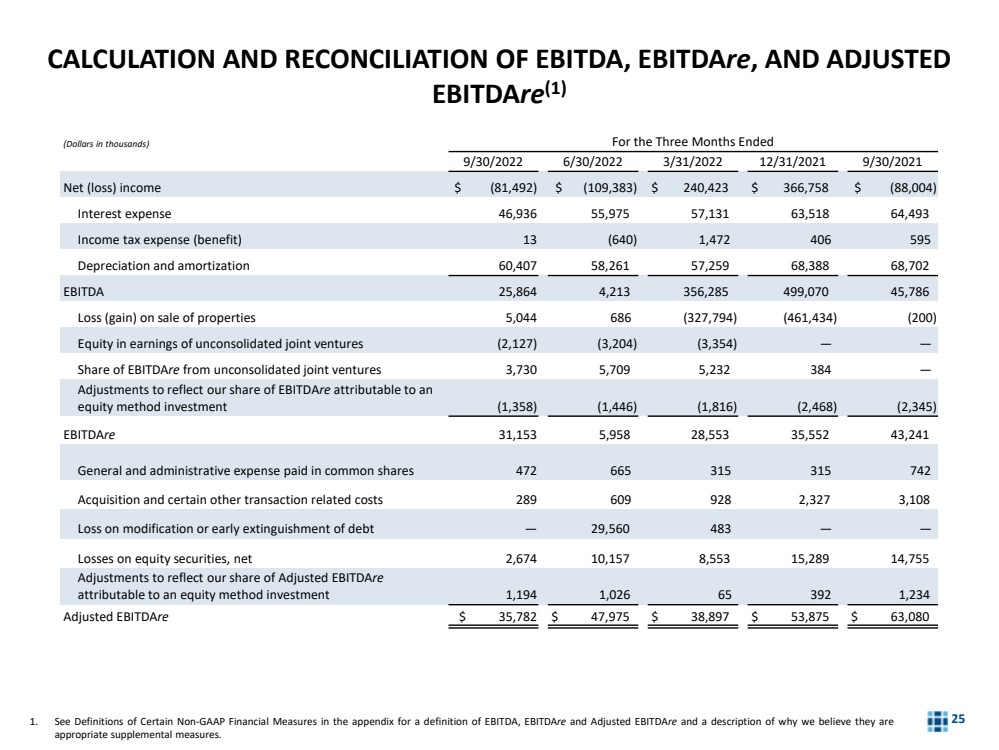

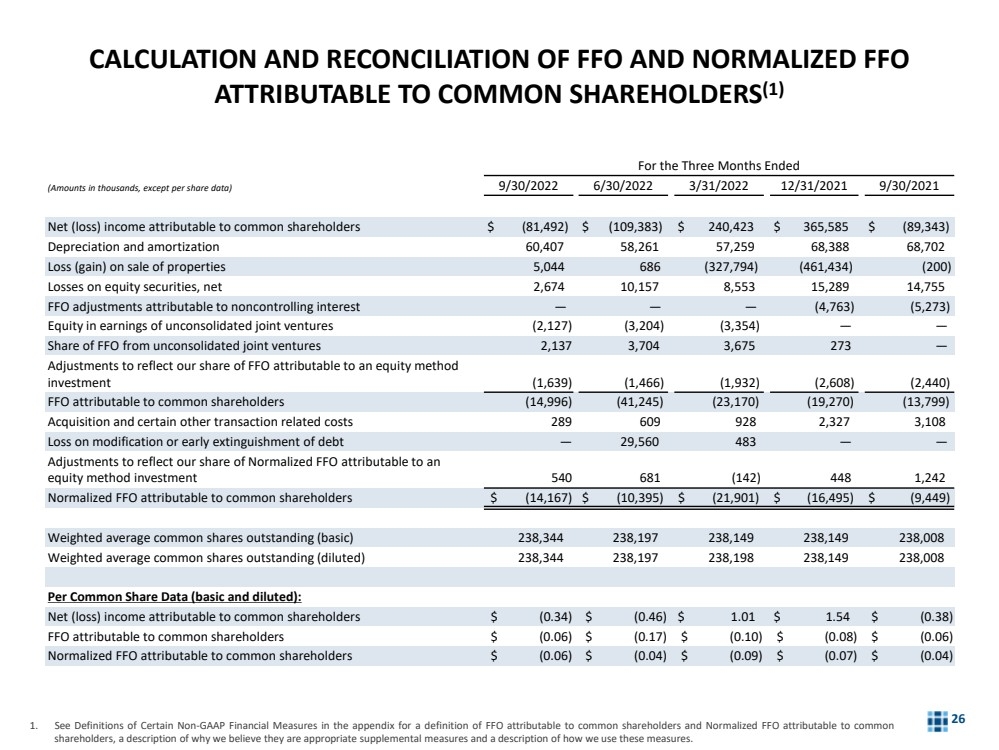

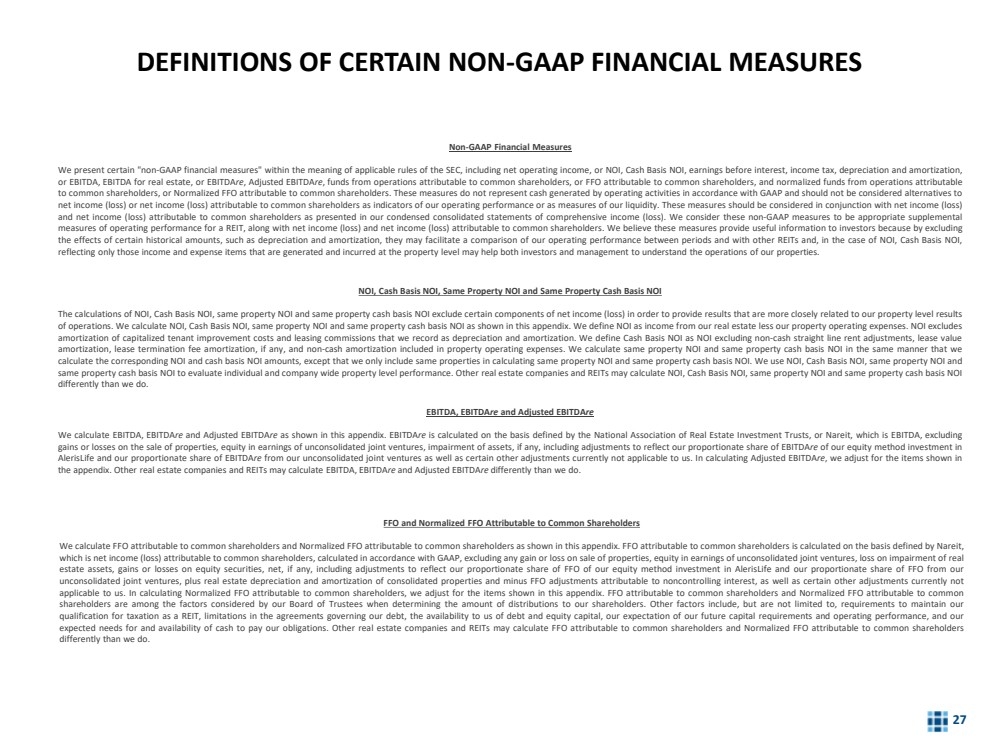

| 2 WARNING CONCERNING FORWARD LOOKING STATEMENTSThis presentation contains statements that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities laws. Also, whenever we use words such as “believe”, “expect”, “anticipate”,“intend”, “plan”, “estimate”, “will”, “may” and negatives or derivatives of these or similar expressions, we are making forward-looking statements. These forward-looking statements are based upon our present intent, beliefs or expectations, but forward-looking statements are not guaranteed to occur and may not occur. Forward-looking statements in this presentation relate to various aspects of our business, includingthe duration and severity of the economic downturn resulting from the COVID-19 pandemic and its continuing impact on us and our managers’ and other operators’ and tenants’ businesses, the ability of our senior living community managers to minimize negative economic impacts, including the current inflationary conditions andrising interest rates,supply chain challengesand a possible recession, on our senior living communities and to manage them profitably and increase our returns, our belief that we are well positioned to weather the present disruptions facing the real estate industry and, in particular,the real estate healthcare industry, including the senior living industry,whether the aging U.S. population and increasing life spans of seniors will increase the demand for senior living communities and other medical and healthcare related properties and healthcare services, our ability to retain our existing tenants, attract new tenants and maintain or increase current rental rates on terms as favorable to us as our prior leases, our leasing pipeline, the credit qualities of ourtenants, our ability to compete for tenancies and acquisitions effectively, our expectation that our redevelopment projects will be completed on budget and by the estimated completion dates, our acquisitions and sales of properties, our closures and repositioning of senior livingcommunities, the impact of increasing labor costs and shortages and commodity and other price inflation due to supply chain challenges or other market conditions, our ability to raise debt or equity capital, our ability to complete dispositions, the future availabilityofborrowings under our revolving credit facility, our policies and plans regarding investments, financings and dispositions, our ability to pay distributions to our shareholders and to sustain the amount of such distributions, whether we may contribute additional properties to our joint ventures and receive proceeds from the other investors in our joint ventures in connection with any such contributions or enter into new joint venture arrangements, our ability to pay interest on and principal of our debt, our ability to appropriately balance our use of debt and equity capital, our credit ratings, our expected management fees and the expected trading price of our common shares. Our actual results may differ materially from those contained in or implied by our forward-looking statements as a result of various factors, such as the impacts of the COVID-19 pandemic on us and our managers and other operators and tenants, the impacts of economic conditions on us and our managers and other operators and tenants, compliance with, and changes to, applicable laws, regulationsand rules, limitations imposed on our business and our ability to satisfy complex rules in order for us to maintain our qualification for taxation as a real estate investment trust (REIT) for U.S. federal income tax purposes, competition within the healthcare and real estateindustries, actual and potential conflicts of interest with our related parties and acts of terrorism, wars, other hostilities or other geopolitical risks, outbreaks of pandemics, including the COVID-19 pandemic, or other manmade or natural disasters beyond our control. For example: (a) (i) under the current economic conditions for the industries in which our properties and businesses operateor otherwise, our managers and other operators and tenants may not be able to profitably operate their businesses at our properties, our tenants may becomeunable or unwilling to pay their rent obligations to us, or our senior living community managers may be unable to generate our minimum returns for sustained periods; (ii) if we default under our credit facility or other debt obligations, we may be required to repay our outstanding borrowings and other debt; and (iii) although we have taken steps to enhance our ability to maintain sufficient liquidity, unanticipated events may require us to expend amounts not currently planned; (b) our senior living community managers and other operators may experience operating and financial challenges, resulting from a number of factors, some of which are beyond their control, and which challenges directly impact our operating results; (c) we may sell some or all of our common sharesof AlerisLifeInc. (AlerisLife), or our ownership interest in AlerisLife may otherwise be diluted in the future; (d) our distributions to our shareholders are set by our Board of Trustees, which considers many factors when setting or resetting our distribution rate, including our historical and projected net income, normalized funds from operations (Normalized FFO), requirements to maintain our qualification for taxation as a REIT,limitations in the agreements governing our debt, the availability to us of debt and equity capital, our expectation of our future capital requirements and operating performance, our expected needs for and availability of cash to pay our obligations and other factors deemed relevant by our Board of Trustees in its discretion, and our projected cash available for distribution in the future may change and may vary from our expectations; accordingly, future distributions may be increased or decreased and we cannot be sure as to the rate at which future distributions will be paid; (e) our ability to make future distributions to our shareholders and to make payments of principal and interest on our debt depends upon a number of factors, including our future earnings, the capital costs we incur to lease andoperate our properties and our working capital requirements; accordingly, we may be unable to pay our debt obligations when they become due or to maintain our current rate of distributions on our common shares and future distributions may be reduced or eliminated; (f)we cannot be sure we will sell any properties we plan to sell or what the terms or timing of any such sales may be, and any updating, rebalancing or repositioning of our portfolio may not result in the benefits we expect and properties we may sell may be at prices thatare less than expected and less than their carrying values; (g) contingencies in our acquisition and sale agreements that we may enter may notbe satisfied and any acquisitions and sales pursuant to such agreements and any related management arrangements we may expectto enter may not occur, may be delayed or the terms of such transactions or arrangements may change; (h) the capital investments we are making at our senior living communities and our plan to invest significant additional capital in our senior living communities to better position them in their respective markets in order to increase our future returns may not be successful and may not achieve our expected results,and our senior living communities may not be competitive despite these capital investments, or these capital investments may bedelayed or may cost more than expected due to supply chain disruptions, market inflation, labor shortages or other conditions; (i) our redevelopment projects may not be successful and may cost more or take longer to complete than we currently expect, andwemay not realize the returns we expect from these projects and we may incur losses from these projects, and potential leasing arrangements related to our redevelopment projects may not materialize; (j) we may spend more for capital expenditures or redevelopment projects than we currently expect; (k) our existing joint ventures and any additional joint ventures we may enter into in the future may not be successful; (l) ourtenants may experience losses and default on their rent obligations to us; (m) some of our tenants may not renew expiring leases, and we may be unable to obtain new tenants to maintain or increase the historical occupancy rates of, or rents from, our properties, and wemay incur significant costs to reposition or re-lease a vacant property for a new operator and vacancies may reduce the value of the property; (n) we may be unable to identify properties that we want to acquire or to negotiate acceptable purchase prices, acquisition financing, management agreements or lease terms for new properties, and we are currently subject to restrictions on our ability to make acquisitions pursuant to the agreement governing our revolving credit facility; (o) rents that we receive from our properties may decline because of changing market conditions or otherwise; (p) although we have obtained a waiver from compliance with the fixed charge coverageratio covenant included in our credit agreement through December 2022, if our operating results and financial condition are further adversely impacted by current economic conditions or otherwise, or our operating results do not sufficiently and timely improve, we may fail to comply with the terms of the waiver and other requirements under our credit agreement, and we may also fail to satisfy certain financial requirements under the agreements governing our public debt (for example, our ratio of consolidated income available for debt service to debt service was below the 1.5x incurrence requirement under our credit agreement and our public debt covenants as of September30, 2022, and we cannot be certain how long this ratio will remain below 1.5x; we are unable to incur additional debt until this ratio is at or above 1.5x on a pro forma basis, but we are not required to repay outstanding debt as a result of failure to comply with this financial requirement; if we believe we will not be able to satisfy our financial or other covenants, we expect that we would seek waivers or amendments prior to any covenant violation or seek other financial alternatives; however, we may fail to obtain any such waivers or amendments or financing alternatives on acceptable terms or at all); (q) we are currently fully drawn under our revolving credit facility and will be required to repay a portion of the amount outstanding thereunder by January 2023 due to a reduction in the borrowing capacity, and we could also be required to repay our outstanding debt in the event of non-compliance with certain other requirements of our credit agreement or the agreements governing our public debt; we may therefore experience further liquidity constraints and we will be limited to our cash on hand or be forced to raise additional sources of capital or take other measures to maintain adequate liquidity; actual costs under our revolving credit facility or other floating rate debt will be higher than the stated rates because of fees and expenses associated with such debt; (r) further changes in our credit ratings may cause the interest and fees we pay to further increase; (s) ourresidents and patients may become unable to fund our charges with private resources and we may be required or may elect for business reasons to accept or pursue revenues from government sources, which could result in an increased part of our net operating income (NOI) and revenue being generated from government payments and our becoming more dependent on government payments, and if the government fails to payusor our managers or other operators amount due because of government defaults, shutdowns, budgetary constraints or otherwise, weand they may be significantly negatively impacted; (t) circumstances that adversely affect the ability of seniors or their families to pay for our managers’ or other operators’ services, such as economic downturns, weak housing market conditions, higherlevels of unemployment among our residents’ family members, lower levels of consumer confidence, high inflation, rising interest rates, stock market volatility and/or changes in demographics generally could affect the profitability of our senior living communities; (u) our unspent leasing related obligations may cost more or less and may take longer to complete than we currently expect, and we may incur increasing amounts for these and similar purposes in the future; (v) we may not realize the benefits we expect from the Environmental, Social and Governance (ESG) program of The RMR Group LLC (RMR) and initiatives and we or RMR may not succeed in meeting existing or future standards regarding ESG; (w) the trading price of our common shares is beyond our control and may increase or decrease more thanwe currently expect; and (x) the advantages we believe we may realize from our relationships with related parties may not materialize. Our Annual Report on Form 10-K for the year ended December 31, 2021and our other filings with the Securities and Exchange Commission (SEC) identify other important factors that could cause differences from our forward-looking statements. Our filings with the SEC are available on the SEC’s website at www.sec.gov. You should not place undue reliance upon our forward-looking statements. Except as required by law, we do not intend to update or change any forward-looking statements as a result of new information, future events or otherwise.NON-GAAP FINANCIAL MEASURESThis presentation contains non-GAAP financial measures including Normalized FFO, adjusted EBITDAre, NOI, cash basis NOI, same property NOI and same property cash basis NOI. Reconciliations for these metrics to the closest U.S. generally accepted accounting principles (GAAP) metrics are included in an appendix hereto.Note: •Unless otherwise noted, data is presented as of September30, 2022.•Five Star Senior Living(Five Star) is an operating division of AlerisLife, Inc.(Nasdaq: ALR), and themanager of certain of our managed senior living communities.•AlerisLife Inc. (f/k/a Five Star Senior Living Inc.) (AlerisLife) is used for any discussion of our ownership of AlerisLife common shares. |