Acquisition of Charter Bank by Citizens Holding Company Exhibit 99.1

Forward-Looking Statement Disclosure This presentation contains forward-looking statements, as defined by federal securities laws, including, among other forward-looking statements, certain plans, expectations and goals, and including statements about the benefits of the proposed merger of Charter Bank with and into The Citizens Bank of Philadelphia (the "Merger"). Words such as “may,” “believe,” “expect,” “anticipate,” “intend,” “will,” “should,” “plan,” “estimate,” “predict,” “continue” and “potential,” as well as similar expressions, are meant to identify forward-looking statements. Such forward-looking statements involve numerous assumptions, risks and uncertainties that may cause actual results to differ materially from those expressed or implied in any such statements. Factors that could cause or contribute to such differences include, without limitation, the following: the parties’ ability to consummate the Merger or satisfy the conditions to the completion of the Merger; the parties’ ability to meet expectations regarding the timing, completion and accounting and tax treatments of the Merger; the businesses of the banks may not be integrated successfully or such integration may take longer to accomplish than expected; the expected cost savings and any revenue synergies from the Merger may not be fully realized within the expected timeframes; disruption from the Merger may make it more difficult to maintain relationships with customers, employees or others; diversion of management time to Merger-related issues; and dilution caused by the issuance of additional shares of Citizens Holding Company ("Citizens") common stock in connection with the Merger. Forward-looking statements speak only as of the date they are made, and Citizens undertakes no obligation to update or revise forward-looking statements. Additional Information This Presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. Citizens intends to file a registration statement on Form S-4 with the SEC to register the shares of Citizens stock that will be issued to Charter Bank's shareholders in connection with the Merger. The registration statement will include a proxy statement/prospectus and other relevant materials in connection with the transaction. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS REGARDING THE MERGER AND ANY OTHER RELEVANT DOCUMENTS CAREFULLY IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE MERGER. Investors can obtain free copies of these documents and other documents filed with the SEC on its website at http://www.sec.gov. Investors may also obtain free copies of the documents filed with the SEC by Citizens on its website at www.citizensholdingcompany.com. Citizens and Charter Bank, and certain of their respective directors, executive officers and other members of management and employees, may be deemed to be participants in the solicitation of proxies from Charter Bank’s shareholders in respect of the Merger. Information regarding the directors and executive officers of Citizens and Charter Bank and other persons who may be deemed participants in the solicitation of Charter Bank’s shareholders will be included in the proxy statement/prospectus. Information about Citizens' directors and executive officers and their ownership of Citizens common stock can also be found in Citizens' Annual Report on Form 10-K for the year ended December 31, 2018. Additional information regarding the interests of such participants will be included in the proxy statement/prospectus to be filed with the SEC. Non-GAAP Disclosure This presentation contains financial information determined by methods other than in accordance with accounting principles generally accepted in the United States of America (“GAAP”). Management uses these “non-GAAP” measures in its analysis of our performance. Management believes that these non-GAAP financial measures allow better comparability with prior periods, as well as with peers in the industry who provide a similar presentation, and provide a greater understanding of our ongoing operations. These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. A reconciliation of these non-GAAP measures to the most directly comparable GAAP measure is included in the Appendix. This presentation is solely for informational purposes to assist interested parties in making their own evaluation of us. It does not purport to contain all of the information that may be relevant. Interested parties should conduct their own investigation and analysis of us, the data set forth in this presentation, and other information provided by or on behalf of us. Certain information contained in this presentation may be derived from information provided by industry sources. We believe such information is accurate and that the sources from which it has been obtained are reliable. However, we cannot guarantee the accuracy of, and have not independently verified, such information. Safe Harbor Statements

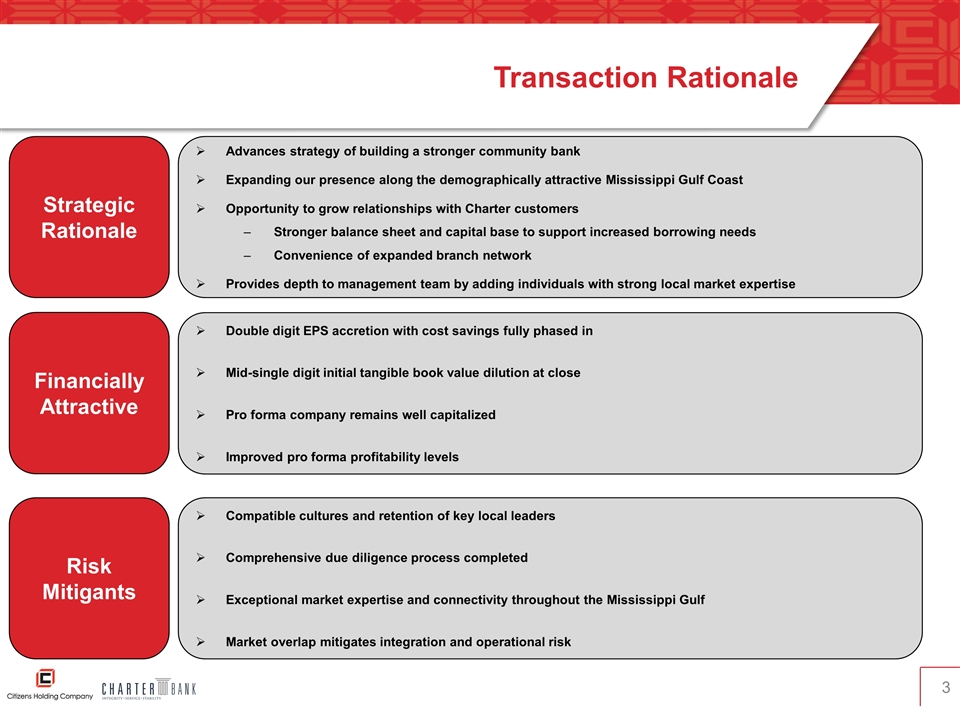

Transaction Rationale Strategic Rationale Financially Attractive Risk Mitigants Advances strategy of building a stronger community bank Expanding our presence along the demographically attractive Mississippi Gulf Coast Opportunity to grow relationships with Charter customers Stronger balance sheet and capital base to support increased borrowing needs Convenience of expanded branch network Provides depth to management team by adding individuals with strong local market expertise Double digit EPS accretion with cost savings fully phased in Mid-single digit initial tangible book value dilution at close Pro forma company remains well capitalized Improved pro forma profitability levels Compatible cultures and retention of key local leaders Comprehensive due diligence process completed Exceptional market expertise and connectivity throughout the Mississippi Gulf Market overlap mitigates integration and operational risk

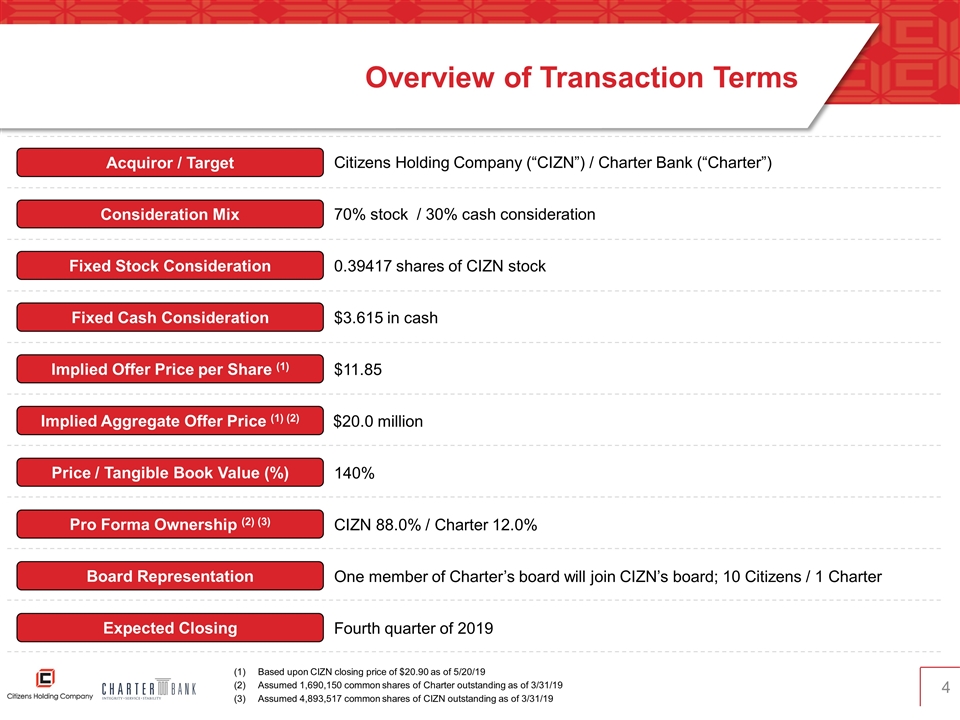

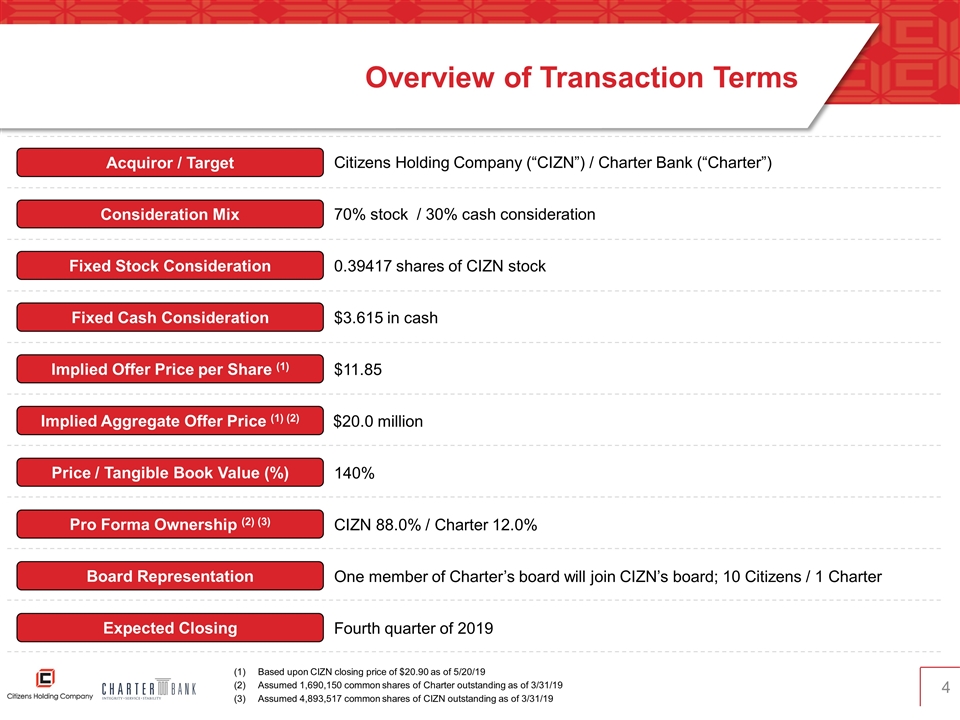

Acquiror / Target Implied Offer Price per Share (1) Price / Tangible Book Value (%) Citizens Holding Company (“CIZN”) / Charter Bank (“Charter”) $11.85 140% Consideration Mix Pro Forma Ownership (2) (3) 70% stock / 30% cash consideration CIZN 88.0% / Charter 12.0% Fixed Stock Consideration 0.39417 shares of CIZN stock Implied Aggregate Offer Price (1) (2) $20.0 million Expected Closing Fourth quarter of 2019 Board Representation One member of Charter’s board will join CIZN’s board; 10 Citizens / 1 Charter Fixed Cash Consideration $3.615 in cash Based upon CIZN closing price of $20.90 as of 5/20/19 Assumed 1,690,150 common shares of Charter outstanding as of 3/31/19 Assumed 4,893,517 common shares of CIZN outstanding as of 3/31/19 Overview of Transaction Terms

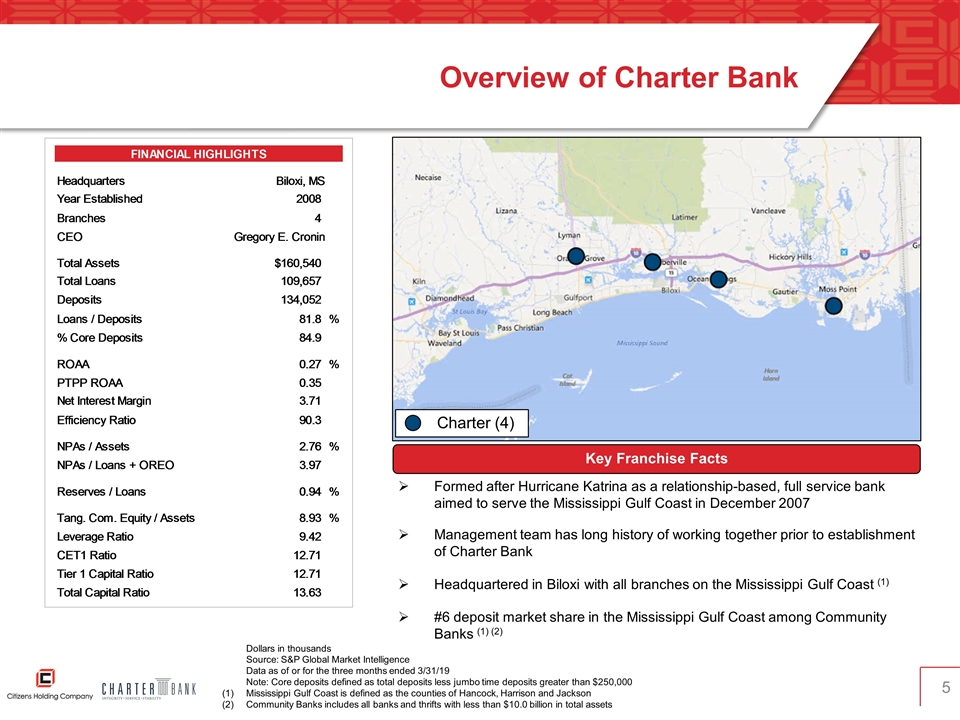

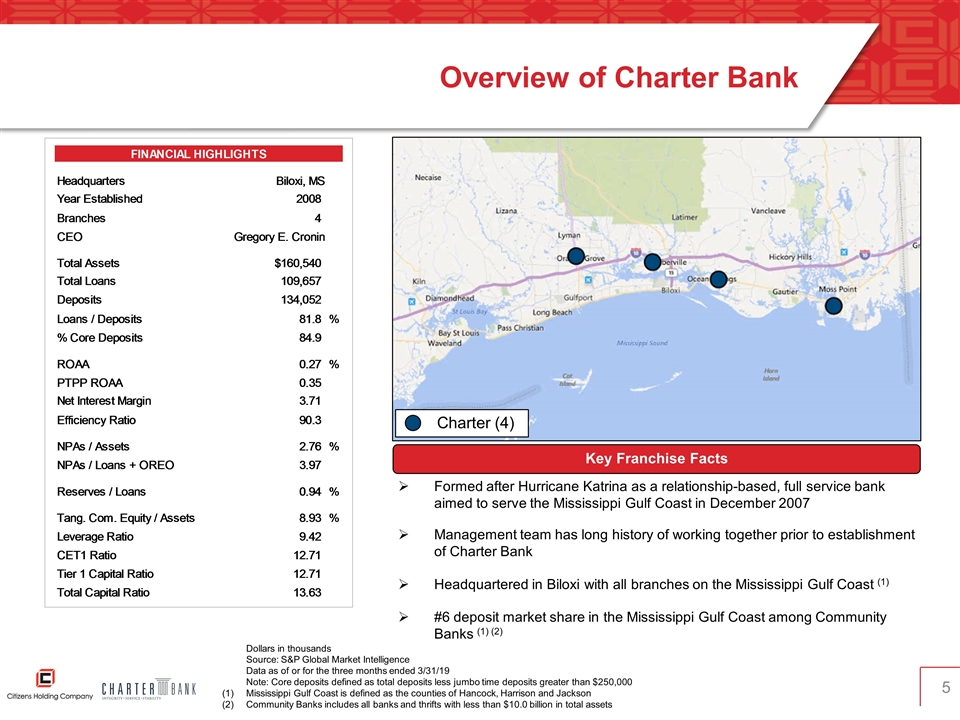

Dollars in thousands Source: S&P Global Market Intelligence Data as of or for the three months ended 3/31/19 Note: Core deposits defined as total deposits less jumbo time deposits greater than $250,000 Mississippi Gulf Coast is defined as the counties of Hancock, Harrison and Jackson Community Banks includes all banks and thrifts with less than $10.0 billion in total assets Overview of Charter Bank Charter (4) Formed after Hurricane Katrina as a relationship-based, full service bank aimed to serve the Mississippi Gulf Coast in December 2007 Management team has long history of working together prior to establishment of Charter Bank Headquartered in Biloxi with all branches on the Mississippi Gulf Coast (1) #6 deposit market share in the Mississippi Gulf Coast among Community Banks (1) (2) Key Franchise Facts

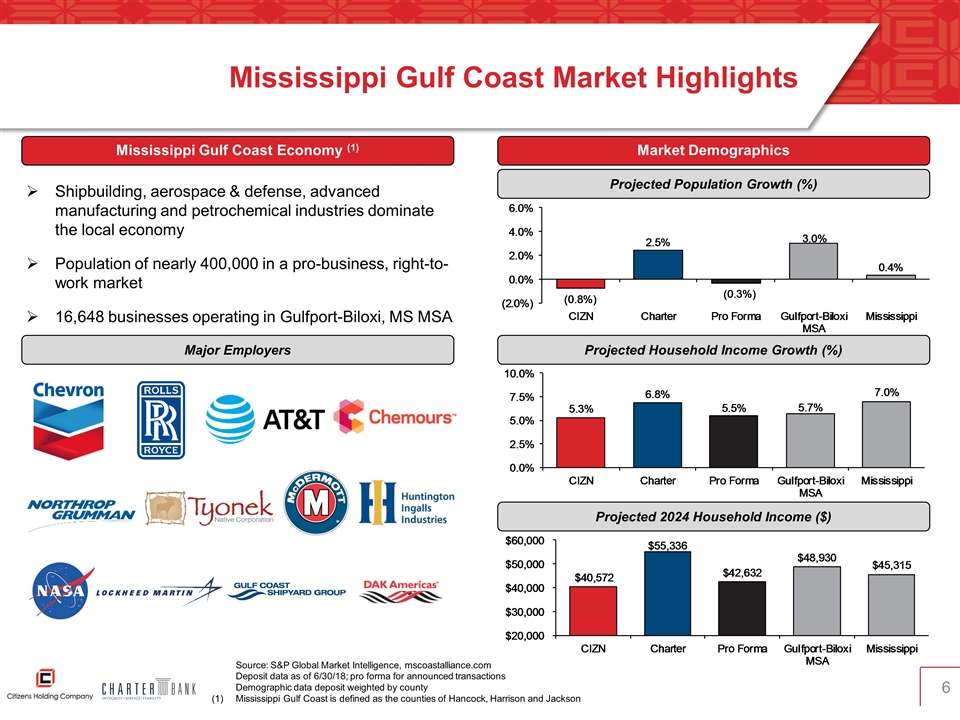

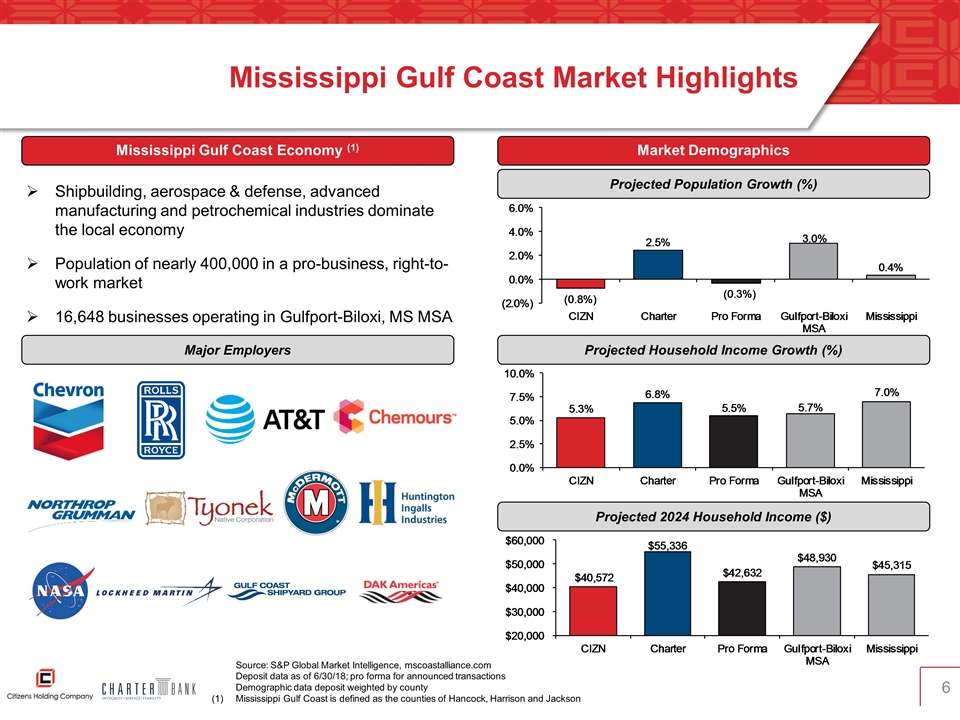

Mississippi Gulf Coast Economy (1) Source: S&P Global Market Intelligence, mscoastalliance.com Deposit data as of 6/30/18; pro forma for announced transactions Demographic data deposit weighted by county (1)Mississippi Gulf Coast is defined as the counties of Hancock, Harrison and Jackson Mississippi Gulf Coast Market Highlights Shipbuilding, aerospace & defense, advanced manufacturing and petrochemical industries dominate the local economy Population of nearly 400,000 in a pro-business, right-to-work market 16,648 businesses operating in Gulfport-Biloxi, MS MSA Market Demographics Projected Population Growth (%) Projected Household Income Growth (%) Projected 2024 Household Income ($) Major Employers

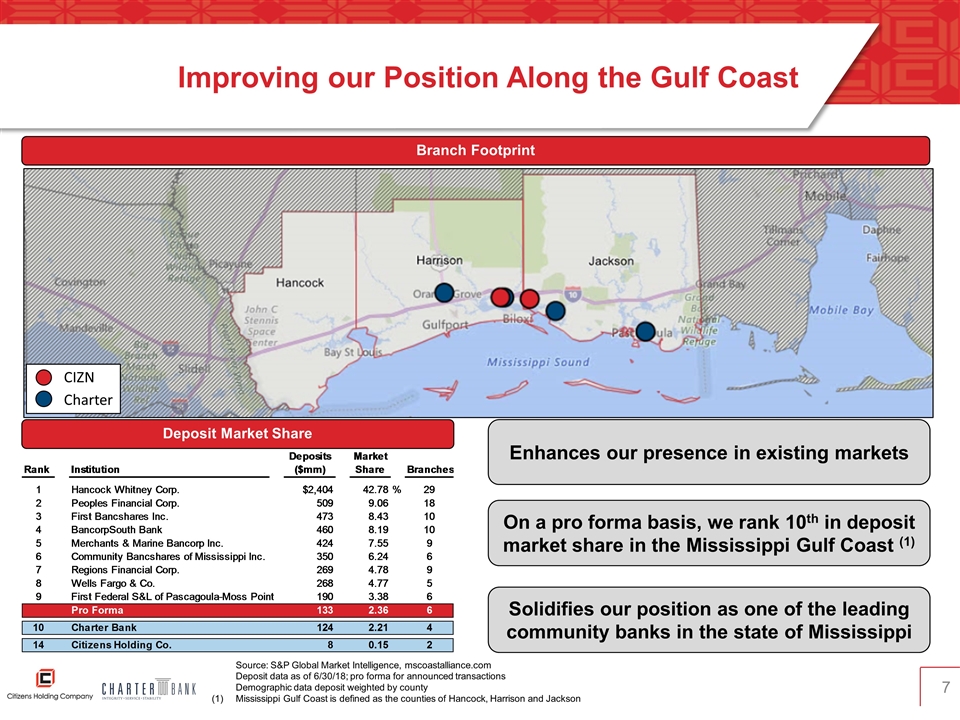

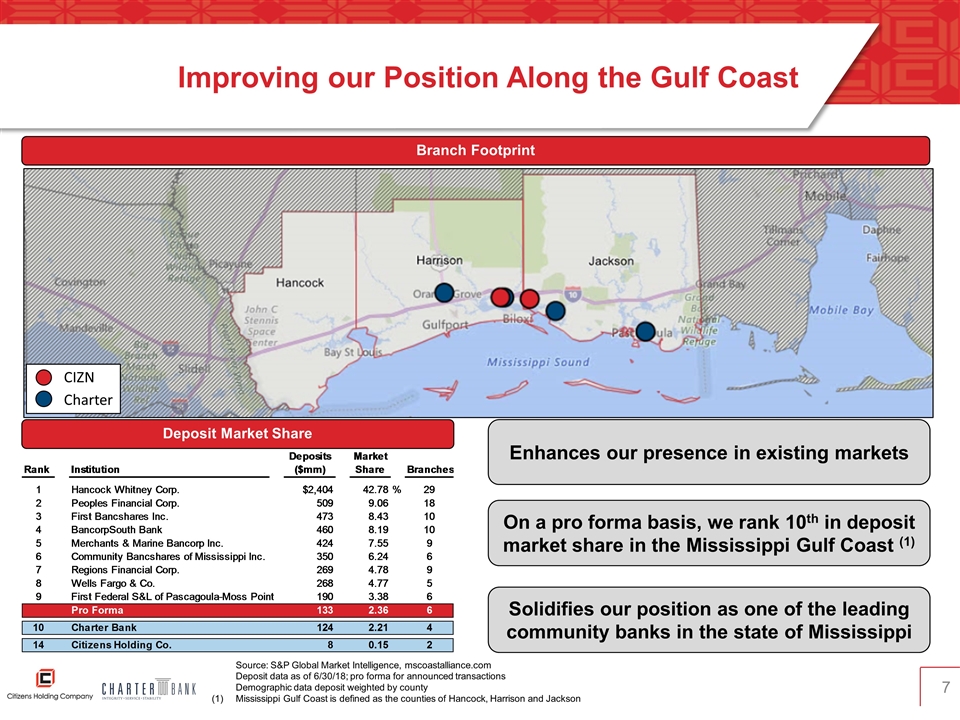

Deposit Market Share Source: S&P Global Market Intelligence, mscoastalliance.com Deposit data as of 6/30/18; pro forma for announced transactions Demographic data deposit weighted by county (1)Mississippi Gulf Coast is defined as the counties of Hancock, Harrison and Jackson Improving our Position Along the Gulf Coast Branch Footprint CIZN Charter Enhances our presence in existing markets On a pro forma basis, we rank 10th in deposit market share in the Mississippi Gulf Coast (1) Solidifies our position as one of the leading community banks in the state of Mississippi

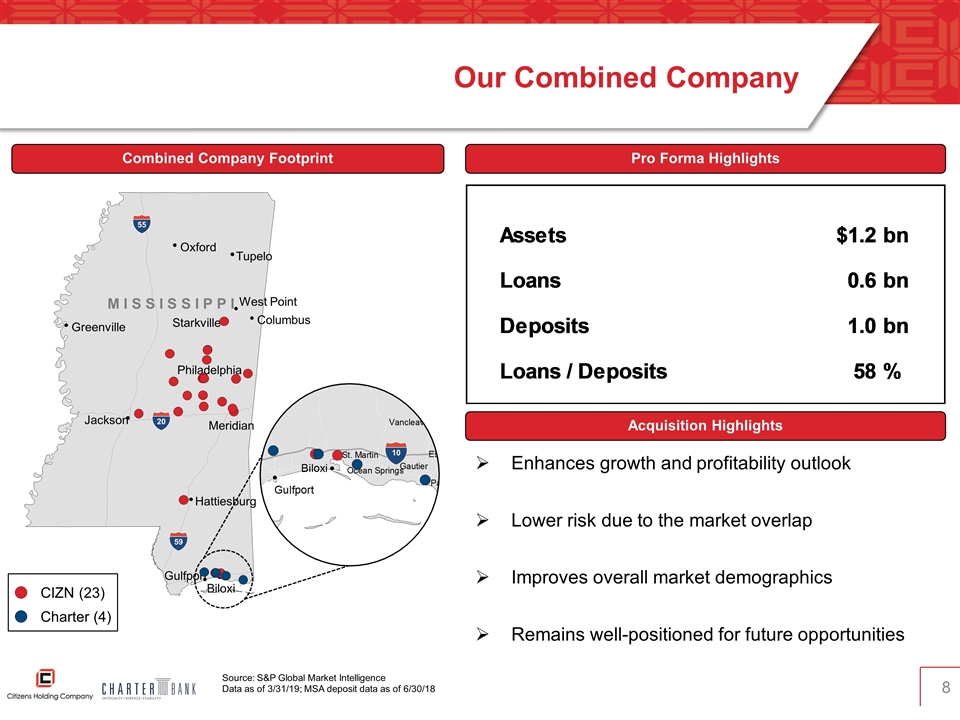

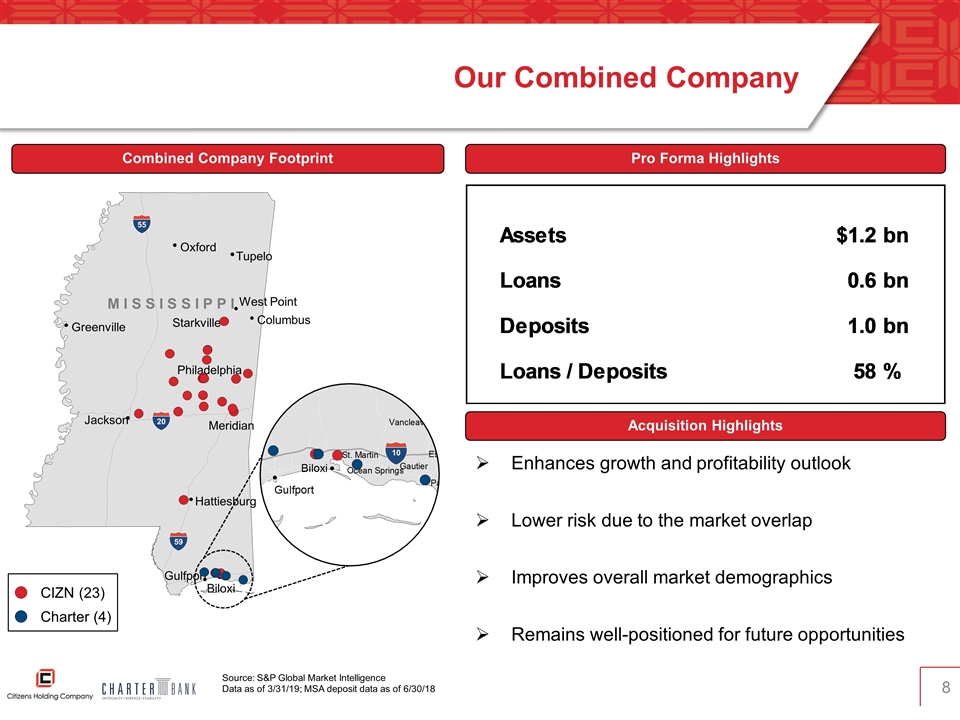

Source: S&P Global Market Intelligence Data as of 3/31/19; MSA deposit data as of 6/30/18 Our Combined Company Pro Forma Highlights Combined Company Footprint CIZN (23) Charter (4) M I S S I S S I P P I West Point Starkville Hattiesburg Gulfport Biloxi Jackson Meridian Greenville Tupelo Columbus Oxford Philadelphia 55 59 20 10 Enhances growth and profitability outlook Lower risk due to the market overlap Improves overall market demographics Remains well-positioned for future opportunities Acquisition Highlights

Appendix

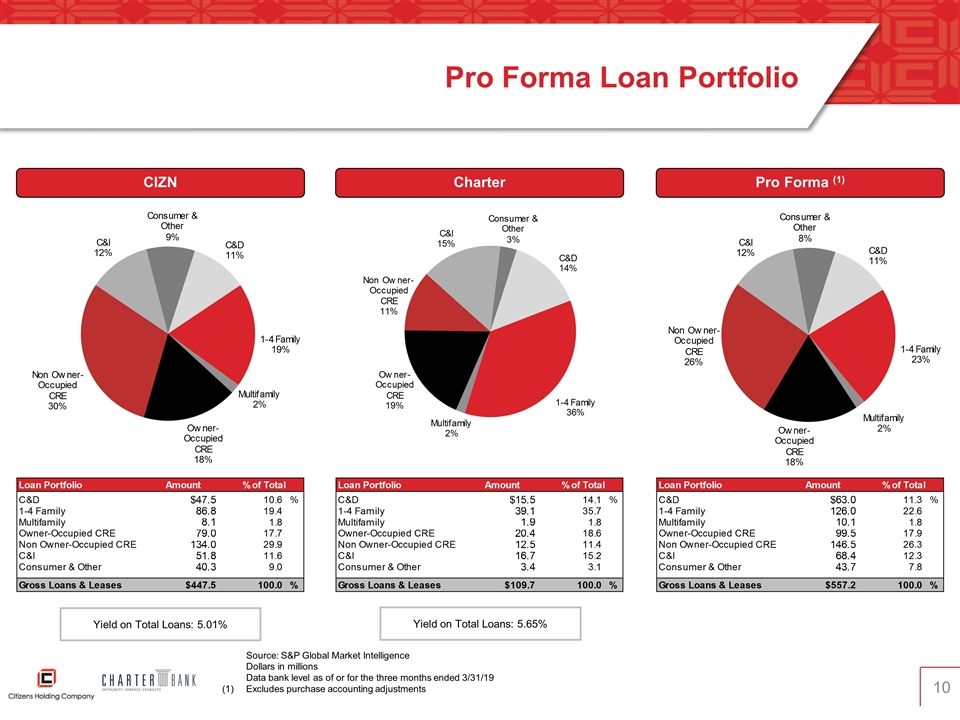

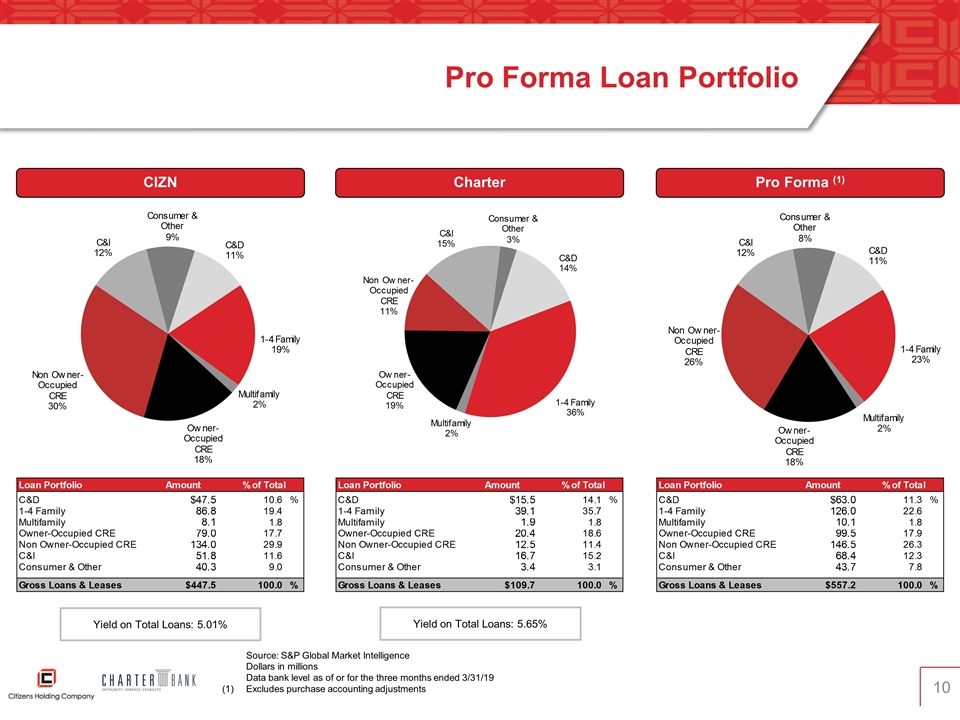

Pro Forma Loan Portfolio CIZN Charter Pro Forma (1) Yield on Total Loans: 5.01% Yield on Total Loans: 5.65% Source: S&P Global Market Intelligence Dollars in millions Data bank level as of or for the three months ended 3/31/19 Excludes purchase accounting adjustments

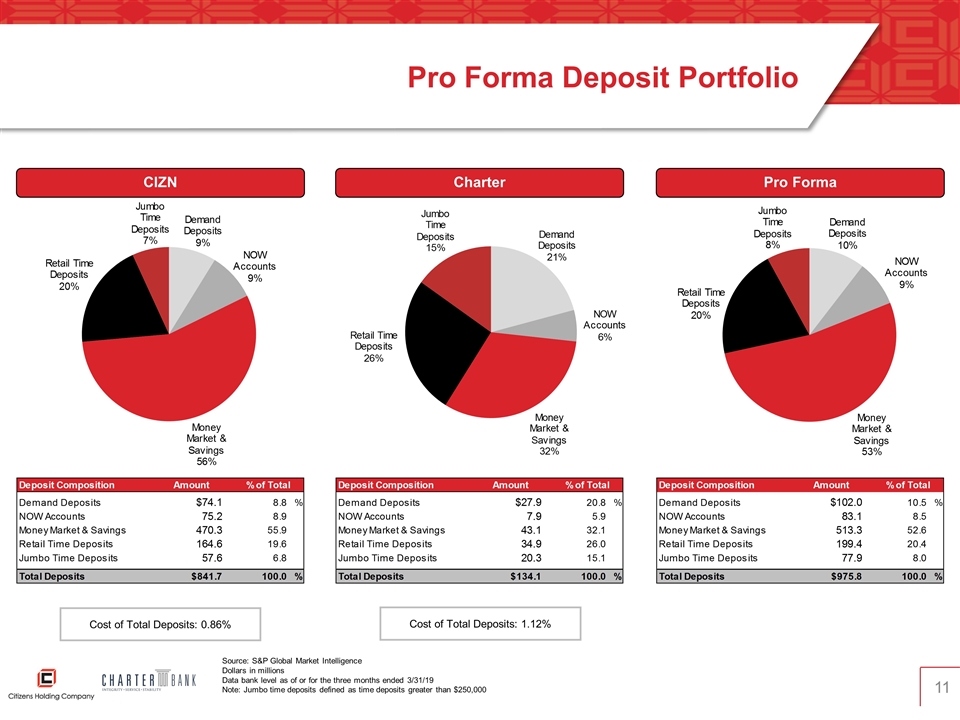

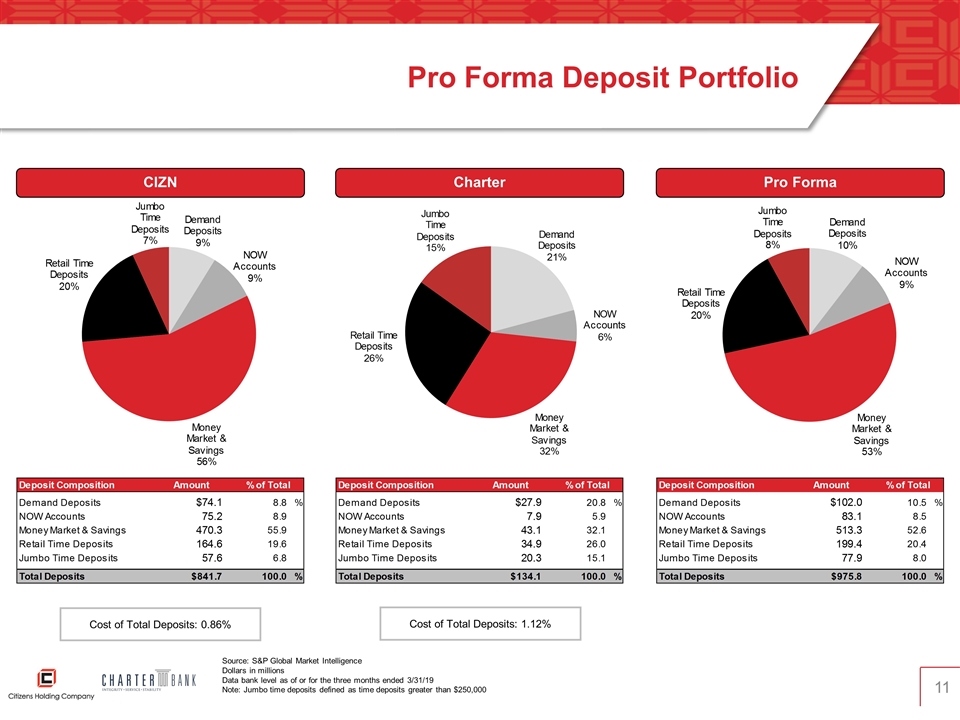

Pro Forma Deposit Portfolio CIZN Charter Pro Forma Cost of Total Deposits: 0.86% Cost of Total Deposits: 1.12% Source: S&P Global Market Intelligence Dollars in millions Data bank level as of or for the three months ended 3/31/19 Note: Jumbo time deposits defined as time deposits greater than $250,000

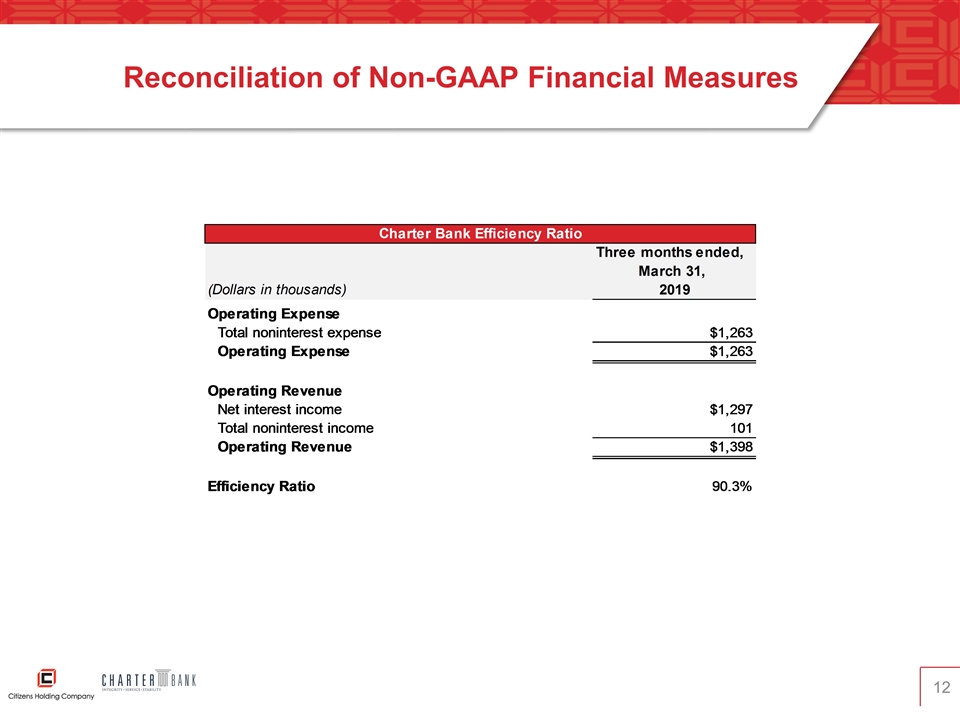

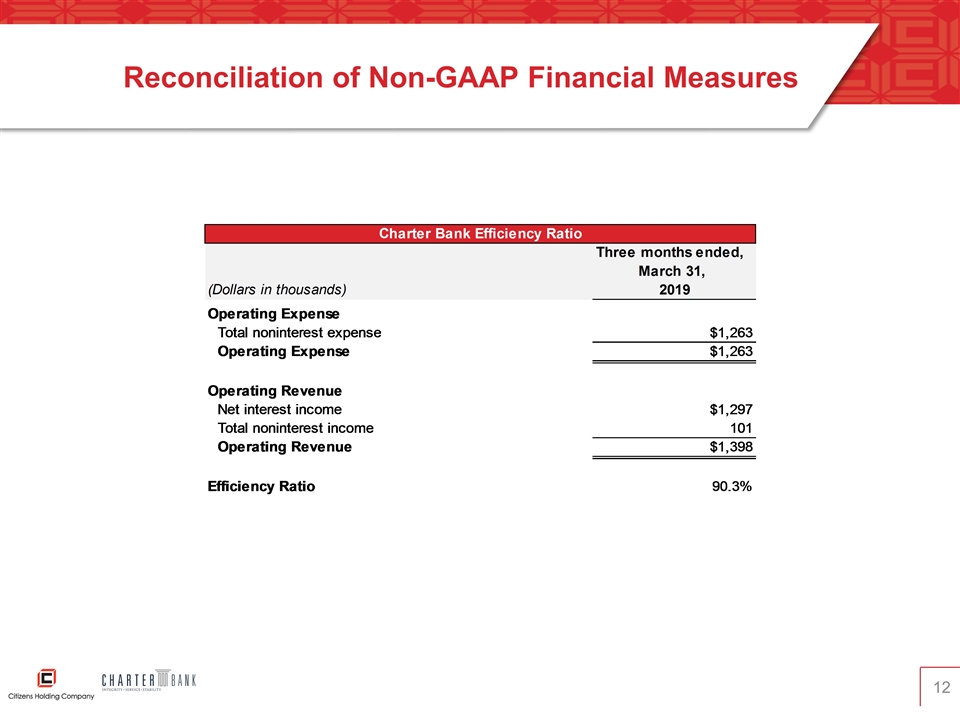

Reconciliation of Non-GAAP Financial Measures

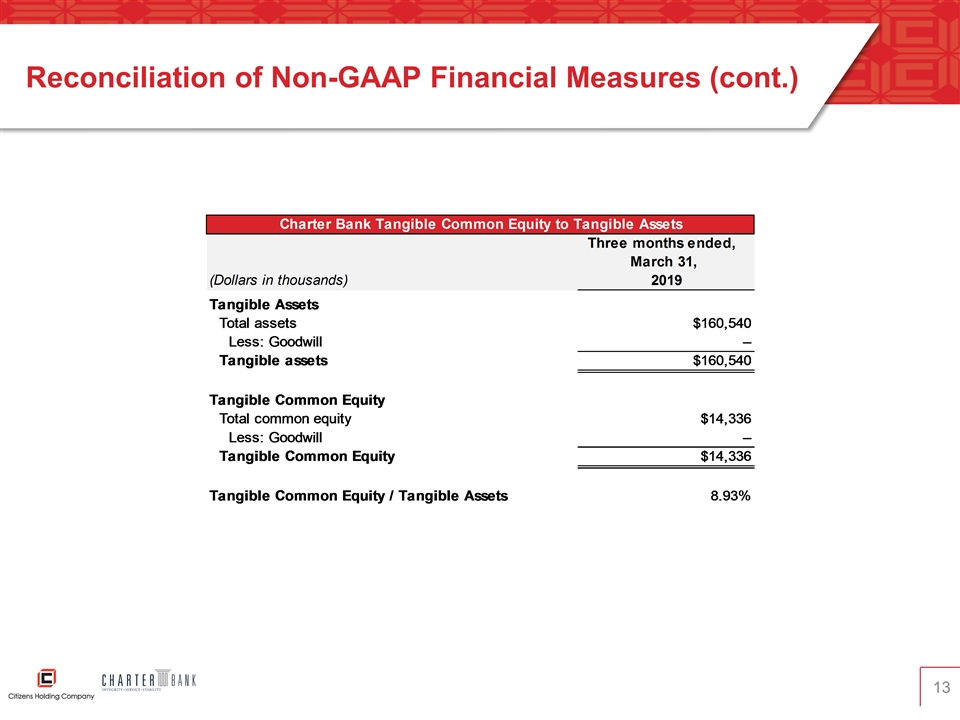

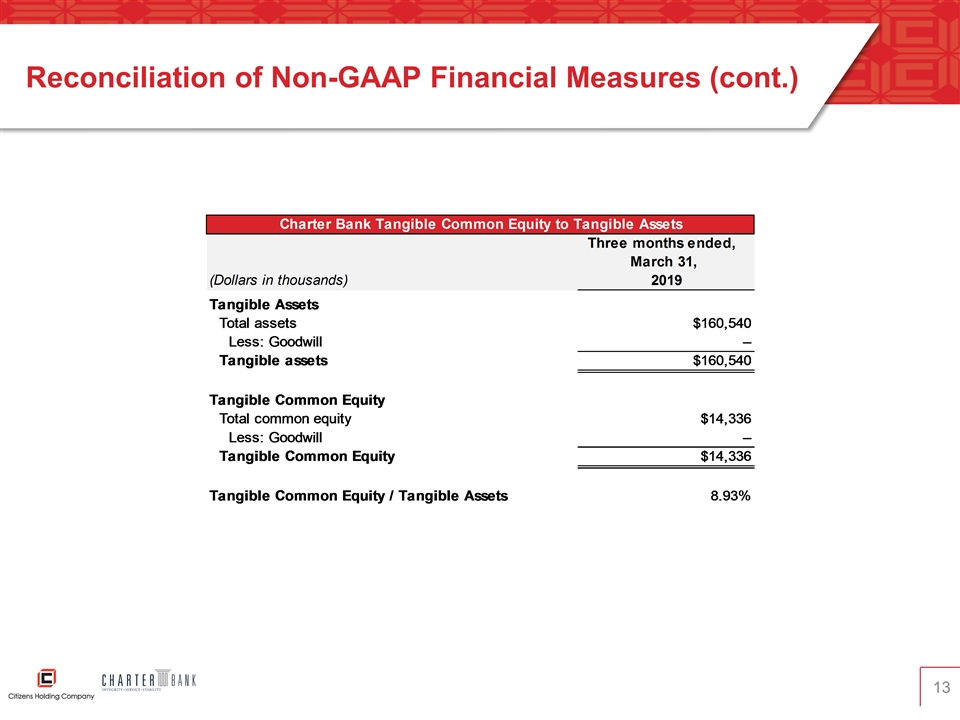

Reconciliation of Non-GAAP Financial Measures (cont.)

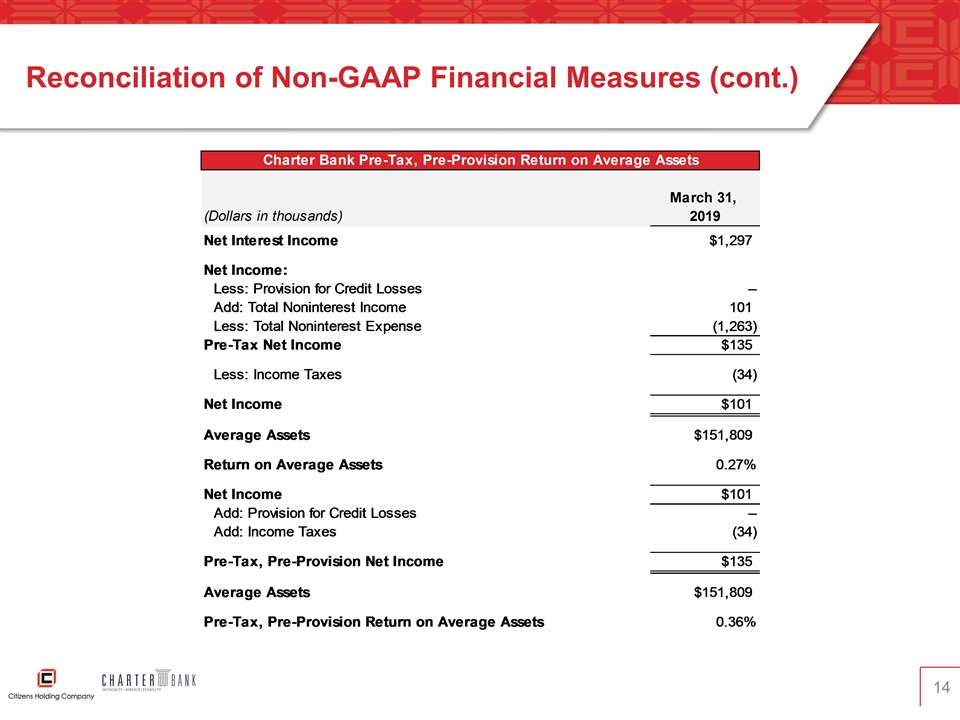

Reconciliation of Non-GAAP Financial Measures (cont.)

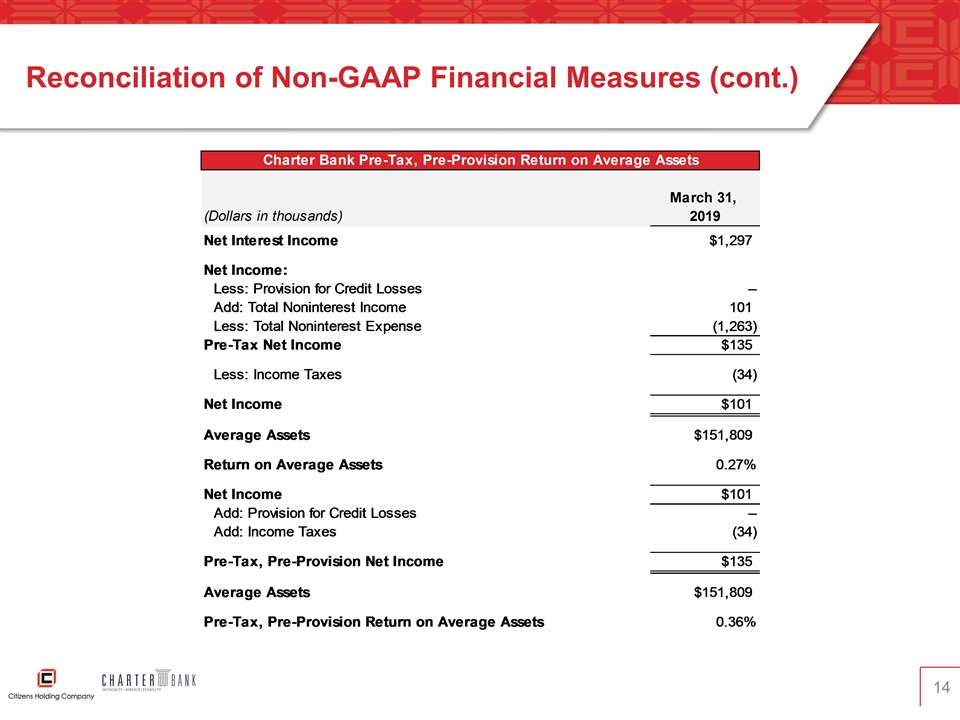

Reconciliation of Non-GAAP Financial Measures (cont.)