- CXDO Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Crexendo (CXDO) DEF 14ADefinitive proxy

Filed: 18 Oct 04, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12 | |

Imergent, Inc. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. | ||||

Imergent, Inc.

754 East Technology Avenue

Orem, Utah 84097

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held on November 30, 2004

The annual meeting of the stockholders of Imergent, Inc. will be held at 754 East Technology Avenue, Orem, Utah on November 30, 2004 at 12:00 p.m., local time.

The purpose of the meeting is to consider, discuss, vote and act upon the following proposals:

The items of business are more fully described in the proxy statement accompanying this notice. Only stockholders of record at the close of business on October 20, 2004 may vote at the meeting or any adjournment or postponement of the meeting.

Your vote is important. Please complete, sign, date and return your proxy card in the enclosed envelope promptly.

| By order of the Board of Directors, | |||

By: | /s/ JEFFREY G. KORN Jeffrey G. Korn, Secretary | ||

October 14, 2004

THIS PROXY STATEMENT AND THE ACCOMPANYING MATERIALS ARE SOLELY FOR THE INFORMATION OF OUR PRESENT STOCKHOLDERS. NO ONE SHOULD BUY OR SELL ANY SECURITY IN RELIANCE ON ANY STATEMENT HEREIN. THIS PROXY STATEMENT AND THE ACCOMPANYING MATERIALS ARE NEITHER AN OFFER TO BUY OR SELL NOR A SOLICITATION OF OFFERS TO BUY OR SELL ANY SECURITY.

Imergent, Inc.

754 East Technology Avenue

Orem, Utah 84097

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

To be held November 30, 2004

SOLICITATION AND REVOCABILITY OF PROXY

General

We are furnishing you this statement in connection with the solicitation by our Board of Directors of proxies to be voted at an annual meeting of stockholders that our Board of Directors has called for November 30, 2004 at 754 East Technology Avenue, Orem, Utah at 12:00 p.m. local time, and at any and all postponements or adjournments thereof. This proxy statement and the enclosed form of proxy card are being sent to stockholders on or about October 27, 2004.

The purpose of the meeting is to consider, discuss and vote and act on a number of proposals, as follows:

We use several abbreviations in this statement. We may refer to our company as "us," "we," "Imergent" or the "Company." The terms "meeting," and "annual meeting," refer to our 2004 Annual Meeting of Stockholders.

The enclosed annual report to stockholders is not to be regarded as proxy soliciting material. If you would like an additional copy of the report, please contact us at 754 E. Technology Avenue, Orem, Utah 84097, Attn: Investor Relations, telephone: (801) 227-0004.

Record Date and Voting Securities

Our Board of Directors has fixed the close of business on October 20, 2004 as the record date for the determination of stockholders entitled to receive notice of and to vote at the meeting and any adjournment or postponement of the meeting. Only holders of record of our common stock on October 20, 2004 are entitled to vote at the meeting. If your shares are owned of record in the name of a broker or other nominee, you should follow the voting instructions provided by your nominee. Each holder of record of common stock at the close of business on the record date is entitled to one vote per share on each matter to be voted upon by the stockholders at the meeting. As of October 12, 2004, there were 11,658,437 shares of our common stock issued and outstanding.

Voting and Revocability of Proxies

You may vote by completing and returning the enclosed proxy or by voting in person at the annual meeting. Our Board of Directors is soliciting the accompanying proxy for use at the meeting. The proxy may be revoked at any time prior to its use by: (1) delivering to our secretary a signed notice of revocation or a later dated proxy, (2) attending the annual meeting and voting in person, or (3) giving notice of revocation of the proxy at the annual meeting. Attendance at the meeting will not in itself constitute the revocation of a proxy. Prior to the meeting, any written notice of revocation should be sent to Imergent, Inc., 754 East Technology Avenue, Orem, Utah, 84097, Attention: Corporate Secretary. Any notice of revocation that is delivered at the meeting should be hand delivered to our secretary at or before the vote is taken. A stockholder may be requested to present identification documents for the purpose of establishing such stockholder's identity.

Our shares of common stock, represented by properly executed proxies, will be voted in accordance with the instructions indicated on such proxies. If no specific instructions are given, the shares will be voted FOR the election of the nominees for director set forth herein and FOR approval of the other proposals listed in the proxy. In addition, if other matters come before the annual meeting, the persons named in the accompanying form of proxy will vote in accordance with their best judgment with respect to such matters.

One or more inspectors of election, duly appointed for that purpose, will count and tabulate the votes cast and report the results of the votes at the meeting to our management. Your vote at the meeting will not be disclosed except as needed to permit the inspector to tabulate and certify the votes, or as is required by law.

Please fill in, sign and date the enclosed Proxy and return it promptly in the enclosed envelope. No postage will be required for you to return the Proxy in the enclosed envelope if you mail it in the United States. You will be able to revoke your Proxy and vote in person if you decide to attend the meeting. The last valid vote you submit chronologically will supercede your prior vote(s).

Quorum, Voting Requirements and Effect of Abstentions and Non-Votes

At the meeting, the inspector of election will determine the presence of a quorum and tabulate the results of the voting by stockholders. The holders of a majority of the total number of outstanding shares of stock that are entitled to vote at the meeting, at least 5,829,219 shares, must be present in person or by proxy in order to have the quorum that is necessary for the transaction of business at the annual meeting. Shares of common stock represented in person or by proxy (including shares that abstain or do not vote with respect to one or more of the matters to be voted upon) will be counted for purposes of determining whether a quorum exists. If a quorum is not present, the meeting will be adjourned until a quorum is obtained.

The nominees for director who receive a plurality of the votes cast by the holders of our common stock, in person or by proxy at the meeting, will be elected. Broker "non-votes" are not counted for purposes of the election of directors. A "non-vote" occurs, with respect to a proposal, when a broker or nominee holding shares for a beneficial owner does not have discretionary voting power and has not received instructions from the beneficial owner. The affirmative vote of the holders of a majority of the common shares present in person or represented by proxy and entitled to vote is required to approve the other proposals. An abstention is counted as a vote against a proposal. A broker "non-vote" is not counted for purposes of approving a proposal. Stockholders have no dissenters' or appraisal rights in connection with the proposals to be presented at the meeting.

2

Expense of Solicitation of Proxies

We will pay the cost of soliciting proxies for our annual meeting. In addition to solicitation by mail, our directors, officers and employees, without additional pay, may solicit proxies by telephone, telecopy or in person. Arrangements will be made with brokerage houses and other custodians, nominees and fiduciaries to send proxies and proxy material to their principals, and we will reimburse them for their expenses in so doing.

BENEFICIAL OWNERSHIP OF SHARES

The following table sets forth, as of October 12, 2004, the number of shares of common stock beneficially owned by each of the following persons and groups and the percentage of the outstanding shares owned by each person and group: (i) each person who is known by us to be the owner of record or beneficial owner of more than 5% of the outstanding common stock; (ii) all of our current directors and executive officers as a group.

With respect to certain of the individuals listed below, we have relied upon information set forth in statements filed with the Securities and Exchange Commission pursuant to Section 13(d) or 13(g) of the Securities Exchange Act of 1934. Except as otherwise noted below, the address of each of the persons in the table is c/o Imergent, Inc., 754 East Technology Ave., Orem, Utah 84097.

| Name of Beneficial Owner | Shares Owned | Number of Warrants and Option Grants Under Imergent Stock Option Plans(1) | Total Beneficial Ownership(2) | Percent of Class Beneficially Owned | |||||

|---|---|---|---|---|---|---|---|---|---|

| Donald L. Danks | 511,751 | — | 511,751 | 4.4 | % | ||||

Brandon Lewis | 292,248 | 206,736 | 498,984 | 4.2 | % | ||||

David Rosenvall | 103,970 | 65,695 | 169,665 | 1.4 | % | ||||

David Wise | 77,076 | 77,153 | 154,229 | 1.3 | % | ||||

Robert Lewis | — | 20,139 | 20,139 | 0.2 | % | ||||

Gary S. Gladstein | 29,500 | 40,000 | 69,500 | 0.6 | % | ||||

Thomas Scheiner | — | 20,000 | 20,000 | 0.2 | % | ||||

Peter Fredericks | 85,500 | 40,000 | 125,500 | 1.1 | % | ||||

All current directors and executive officers as a group (8 persons) | 1,100,045 | 469,723 | 1,569,768 | 12.9 | % |

3

persons and entities named in the table have sole voting and sole investment power with respect to the shares set forth opposite such stockholder's name.

PROPOSAL I

Election of Directors

At the meeting, two (2) Class I directors are to be elected for a term ending at the annual meeting of our stockholders for fiscal year 2006, or until each of their respective successors has been duly elected and qualified. In May 2000, our stockholders approved an amendment to our Bylaws that provided for a classified board and two-year staggered terms of the members of our board of directors. The amendment contemplates the election of one-half of the directors at each annual meeting and was originally intended to significantly extend the time required to effect a change in control of our Board of Directors.

It is intended that valid proxies received will be voted, unless contrary instructions are given, to elect the two (2) nominees named in the following table to serve as Class I directors. Should any nominee decline or be unable to accept such nomination to serve as a director, an event that we do not currently anticipate, the persons named in the enclosed proxy reserve the right, in their discretion, to vote for a lesser number of or for substitute nominees designated by the board of directors, to the extent consistent with our certificate of incorporation and our bylaws.

Nominees of the Board

Our Board of Directors has nominated the following individuals to serve on our Board of Directors until our annual meeting of stockholders for fiscal year 2006 or until their respective successors are elected. Each of the nominees has agreed to be named in this Proxy Statement and to serve if elected.

| Director Name | Age | Position | Class/Term | |||

|---|---|---|---|---|---|---|

| Thomas Scheiner | 48 | Director | I/2006 | |||

Donald L. Danks | 47 | Director | I/2006 |

The Board of Directors recommends a vote "FOR"

all of the incumbent directors identified above.

Information Concerning Directors and Officers

Set forth in the table below are the names, ages and positions of each person nominated by the Board for election as a director, each person whose term of office as a Director will continue after the Annual Meeting and each of our current executive officers. With the exception of Brandon and Robert

4

Lewis, who are cousins, none of our directors or executive officers has any family relationship to any other director or executive officer.

| Name | Age | Position | ||

|---|---|---|---|---|

| Donald L. Danks | 47 | Chairman of the Board of Directors and Chief Executive Officer | ||

Peter Fredericks | 46 | Director | ||

Gary S. Gladstein | 60 | Director | ||

Thomas Scheiner | 48 | Director | ||

Brandon Lewis | 34 | Director, Chief Operating Officer and President | ||

Robert Lewis | 33 | Chief Financial Officer | ||

David Rosenvall | 38 | Chief Technology Officer | ||

David Wise | 44 | Vice-President, Operations |

Set forth below is a brief description of the business experience for the previous five years of our nominees for director, our incumbent directors and of our other executive officers.

Directors Standing for Election

Donald L. Danks

Mr. Danks has served as our Chairman since January 2001. He also served as our Chief Executive Officer from January 5, 2001 to May 7, 2002 and has served in this position from July 1, 2003 until the present. He was one of our original investors and is currently one of our largest stockholders. During the five years previous to joining us as our CEO, Mr. Danks was involved in the creation, funding and business development of early-stage technology companies. In addition to attracting inceptive capital for client companies, Mr. Danks assisted in the development of their business plans, helped in the recruitment of senior management, supported the development of the public market for their securities by introducing them to institutional investors and market makers and oversaw ongoing corporate finance needs. Previously, Mr. Danks was the co-founder and President of Prosoft Training.com, (Nasdaq: POSO), a company involved in Internet technology training, education and certification. Mr. Danks holds a B.S. from UCLA.

Thomas Scheiner

Mr. Scheiner has spent over 20 years founding, managing, investing in, and advising technology companies both in Europe and the United States. He has been a partner at Apax, a large international private equity firm located in Munich, Germany, as well as a business strategy consultant at the Boston Consulting Group. His experience includes such technology sectors as software and telecommunications. Mr. Scheiner holds an MBA with distinction from the Harvard Business School and a Ph.D. from the Vienna University of Economics and Business Administration.

Incumbent Directors

Gary S. Gladstein

Mr. Gladstein has been with Soros Fund Management for over 17 years. Mr. Gladstein is currently a Senior Consultant to Soros Fund Management, LLC, an investment advisory firm. He served as a Managing Director and Chief Operating Officer of Soros Fund Management LLC from from 1985

5

thought 1999. Mr. Gladstein served as Chief Financial Officer of Kohlberg Kravis Roberts & Co. from 1983 through 1985. He was a Principal at Ernst & Young from 1970 through 1983 and is a CPA. Mr. Gladstein has a Bachelor of Arts degree in economics from the University of Connecticut and a Masters in Business Administration from Columbia University. Mr. Gladstein is also a director of Mueller Industries, Inc., Jos. A. Bank Clothiers, Inc. and Cresud Inc., an Argentinean company.

Peter Fredericks

Mr. Fredericks is a private equity investor, who has worked with numerous technology companies since 1982, with particular focus on software and Internet infrastructure. Mr. Fredericks' experience also includes working as a strategy consultant with the Boston Consulting Group. Mr. Fredericks received his Bachelor of Arts degree in Economics with distinction from Stanford University, his Master in Business Administration from Harvard University, where he was a Baker Scholar, and his Ph.D. from the Vienna University of Economics and Business Administration. Mr. Fredericks is also a director of Flanders Corporation.

Brandon Lewis

Mr. Lewis has served as our Chief Operating Officer since June 2003, as our President since May 2002, and prior thereto, since January 2001, he served as our Executive Vice-President for Sales and Marketing. He has served as a director since May 2002. He was Vice-President of sales and marketing and Chief Operating Officer of Galaxy Enterprises, Inc. from 1997 until he joined our company after our merger with Galaxy. Prior to Galaxy, Mr. Lewis was Vice-President of sales and marketing for Profit Education Systems, Inc. a worldwide marketing and sales organization. Mr. Lewis earned his B.S. degree from Brigham Young University.

Other Executive Officers

Robert Lewis

Mr. Lewis has served as our Chief Financial Officer since February 2004. Prior to that, he served from December 2003 to February 2004 as Director of Finance of Imergent, Inc. Prior to that he held various positions of increasing responsibility at PricewaterhouseCoopers from 1994 to November 2003. Most recently he was a Senior Manager in the Technology, InfoComm and Entertainment Industry Group at PricewaterhouseCoopers. Mr. Lewis earned his B.S. degree in Accounting from Brigham Young University and is a CPA.

David Rosenvall

Mr. Rosenvall was appointed as our Chief Technology Officer in February 2001. Prior thereto, he served as our Chief Architect from September 1999. He initially joined us in November 1998 as part of our acquisition of StoresOnline.com. From September 1997-December 1998, Mr. Rosenvall was president of Spartan Multimedia in Calgary, Alberta, Canada, and from January 1995 to August 1997, he was Vice-President for Research and Development at Xentel, another Calgary company. Mr. Rosenvall holds a B.S. in Mechanical Engineering from the University of Calgary and an M.B.A. from Brigham Young University.

David Wise

Mr. Wise was Chief Operating Officer of Galaxy Mall prior to becoming our Vice President-Operations in July 2000. Prior to joining Galaxy Mall, Mr. Wise was, from 1998 to 1999, president of Wise Business Solutions. From 1992 to 1999, he was chief financial officer and chief operating officer of Capsoft Development Corp. He served as COO of Medcare Operating Solutions from 1988 to 1989.

6

Mr. Wise graduated cum laud from Brigham Young University with his Masters in Business Administration in 1991.

Director Compensation

Beginning in July 2004, our current directors are awarded cash compensation of a $10,000 annual retainer, $2,500 for each quarter that an independent member is chairman of a committee, $1,000 paid for each board meeting that is physically attended, and 10,000 options vesting on the first day of each fiscal year (July 1). Prior to July 2004, our directors did not receive cash compensation in their capacity as directors. Employee directors are not compensated for their service on the Board. All directors are reimbursed for reasonable expenses incurred in connection with attending meetings of the board of directors.

Information About Board and Committee Meetings

During fiscal year 2004, our Board of Directors held four (4) scheduled Board meetings, as well as participated in monthly update calls. Each of our incumbent directors attended no fewer than 75% of the meetings of our board and any committees of which such directors are members in fiscal year 2004. In addition to attending meetings, directors also discharge their responsibilities by review of company reports to directors, by visits to our facilities, through correspondence and via telephone conferences with our executive officers and others.

Our Board of Directors has established three committees, the Audit Committee, the Compensation Committee and the Nominating Committee, each comprised of Messrs. Gladstein, Fredericks and Scheiner. Our Board of Directors has determined that each of these persons is "independent" under the rules of the American Stock Exchange and applicable regulatory requirements.

The Audit Committee, which is chaired by Gary Gladstein, held four meetings during fiscal 2004. The Audit Committee operates under a charter adopted by our Board of Directors on March 23, 2004. A copy of our Audit Committee charter is attached as Appendix A to this proxy statement. The Audit Committee is responsible for reviewing and discussing the Company's audited financial statements with management, discussing information with the Company's auditors relating to the auditors' judgments about the quality of our accounting principles, recommending to the Board of Directors that the audited financials be included in the Company's Annual Report on Form 10-K and overseeing compliance with the Securities and Exchange Commission requirements for disclosure of auditors' services and activities. The Audit Committee has established a policy requiring its review and pre-approval of all audit services, review and attest engagements and permitted non audit services to be performed by our independent auditors. The policy allows the Audit Committee to delegate pre-approval authority to one or more Audit Committee members, and requires any such member or members to present any decision made pursuant to delegated authority at the next Audit Committee meeting. The Audit Committee may establish additional or other procedures for the approval of audit and non-audit services that our independent auditors perform.

Peter Fredericks serves as Chairman of our Compensation Committee. The Compensation Committee held one meeting in 2004, and otherwise acted by Unanimous Consent. The Compensation Committee evaluates the performance of Senior Executive Management, pursuant to the Compensation Committee Charter, a copy of which is posted to our website at www.imergentinc.com.

On December 3, 2003 our Board of Directors established a Nominating Committee with Thomas Scheiner as Chairman. The Nominating Committee, which held one meeting in 2004, operates pursuant to a charter, a copy of which is posted to our website at www.imergentinc.com.

In the course of reviewing potential director candidates, the Nominating Committee will consider nominees recommended by security holders of the Company. When considering a potential candidate

7

for membership on the Board of Directors, the Nominating Committee may consider, in addition to the minimum qualifications and other criteria for Board membership approved by the Board of Directors, all facts and circumstances that the Nominating Committee deems appropriate or advisable, including, among other things, the skills of the proposed Director candidate, his or her availability, depth and breadth of business experience or other background characteristics, his or her independence and the needs of the Board of Directors. At a minimum, each nominee, whether proposed by a stockholder or any other party, is expected to have the highest personal and professional integrity, shall demonstrate sound judgment and shall be expected to effectively interact with other members of the Board of Directors to serve the long-term interests of the Company and its stockholders. In addition, the Nominating Committee may consider whether the nominee has direct experience in the Company's industry or in the markets in which the Company operates and whether the nominee, if elected, assists in achieving a mix of Board members that represents a diversity of background and experience. The procedures to be followed by security holders in submitting such recommendations are described below in the section entitled "Submission of Security holder Recommendations for Director Candidates."

Submission of Securityholder Recommendations for Director Candidates

All security holder recommendations for Director candidates must be submitted in writing to the Secretary of the Company, Jeffrey G. Korn at 754 East Technology Avenue, Orem, UT 84097 who will forward all recommendations to the Nominating Committee. All security holder recommendations for Director candidates must be submitted to the Company not less than 120 calendar days prior to the date on which the Company's Proxy Statement was released to stockholders in connection with the previous year's Annual Meeting. All security holder recommendations for Director candidates must include (1) the name and address of record of the security holder, (2) a representation that the security holder is a record holder of the Company's securities, or if the security holder is not a record holder, evidence of ownership in accordance with Rule 14a-8(b)(2) of the Securities Exchange Act of 1934, (3) the name, age, business and residential address, educational background, public company directorships, current principal occupation or employment, and principal occupation or employment for the preceding five full fiscal years of the proposed Director candidate, (4) a description of the qualifications and background of the proposed director candidate which addresses the minimum qualifications and other criteria for Board membership approved by the Board of Directors from time to time, (5) a description of all arrangements or understandings between the security holder and the proposed Director candidate, (6) the consent of the proposed Director candidate to be named in the proxy statement, to have all required information regarding such Director candidate included in the Proxy Statement, and to serve as a Director if elected, and (7) any other information regarding the proposed Director candidate that is required to be included in a proxy statement filed pursuant to the rules of the Securities and Exchange Commission.

Section 16(a) Beneficial Ownership Reporting Compliance

Based on a review of reports and representations submitted to us, all reports regarding beneficial ownership of our securities required to be filed under Section 16(a) of the Exchange Act for the 2004 fiscal year were timely filed.

Code of Business Conduct

The Company has adopted a code of business conduct and ethics applicable to the Company's directors, officers and employees. A copy of this code is posted to the Company's website at www.imergentinc.com. In the event that we amend or waive any of the provisions of such code applicable to our chief executive officer, chief accounting officer or controller, we intend to satisfy our disclosure obligations under Item 5.05 of Form 8-K by posting such information on our website.

8

Shareholder Communications

Shareholders and other interested parties who wish to communicate with non-management directors of the Company shall send their correspondences to: Imergent Non Management Directors at Imergent Inc. 754 East Technology Avenue, Orem Utah 84097, or by email to nonmanagmentdirectors@imergentinc.com.

PROPOSAL II

Ratification of Appointment of Auditors

At the meeting we will ask the stockholders to ratify the appointment of the firm Grant Thornton LLP as independent auditors to audit our consolidated financial statements for the fiscal year ending June 30, 2005. A representative of Grant Thornton is expected to be present at the Annual Meeting.

Stockholder ratification of the selection of Grant Thornton LLP as our independent auditors is not required by our Bylaws or other applicable legal requirement. However, our Board of Directors is submitting the selection of Grant Thornton LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Audit Committee will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee at its discretion may direct the appointment of a different independent accounting firm at any time during the year if it determines that such a change would be in our best interests and in the best interests of our stockholders.

The affirmative vote of the holders of a majority of the shares of our common stock present or represented and voting at the 2004 Annual Meeting will be required to approve this proposal.

The Board of Directors recommends a vote "FOR" the proposal to ratify the appointment

of Grant Thornton LLP as our independent auditors for the fiscal year ending June 30, 2005.

9

Fees of Independent Auditors

We have set forth below the aggregate fees billed for professional services rendered to us by Grant Thornton LLP in connection with fiscal years 2004 and 2003:

| | | 2004 | 2003 | |||||

|---|---|---|---|---|---|---|---|---|

| (1) | Audit Fees (for work relating to: audit of our annual and review of our quarterly financial statements; SEC filings; and audit and other consultations (e.g., reviews relating to SEC filings)) | $ | 150,813 | $ | 132,000 | |||

(2) | Audit Related Fees (for work relating to: internal control and implementation assessments and reviews; consultations regarding financial accounting and reporting standards; and advisory services relating to Sarbanes-Oxley compliance) | $ | 5,000 | $ | 12,000 | |||

(3) | Tax Fees (for work relating to: tax compliance (e.g., accounting for income taxes and submission of tax returns); and tax planning and advice (e.g., in connection with assessments of the utilization of NOL carryforwards and other deferred tax assets and understanding of tax regulations in foreign countries related to our international expansion)) | $ | 180,485 | $ | 54,000 | |||

(4) | All Other Fees (none) | $ | — | $ | — | |||

10

Summary Compensation Table

The following table contains information concerning our chief executive officer during fiscal year 2004 and our four most highly-compensated executive officers during fiscal year 2004 who were serving as executive officers at the end of fiscal year 2004 (as a group, the "named executive officers").

| | | Annual Compensation | Long-Term Compensation Awards | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name and Principal Position | Year | Salary ($) | Bonus ($) | Restricted Stock Awards ($) | Stock Options (#) | All Other Compensation $ | ||||||

| Donald L. Danks(1) Chief Executive Officer | 2004 2003 2002 | 45,750 — — | — — — | — — — | — — — | 3,000 — — | ||||||

Brandon Lewis(2) President | 2004 2003 2002 | 167,308 118,957 104,787 | 173,625 67,159 124,565 | — — — | 150,000 150,000 — | 8,000 — — | ||||||

Robert Lewis(3) Chief Financial Officer | 2004 2003 2002 | 36,923 — — | 15,624 — — | — — — | 50,000 — — | 1,600 — — | ||||||

David Rosenvall Chief Technology Officer | 2004 2003 2002 | 140,000 123,396 111,539 | 17,625 11,735 20,760 | — — — | — 65,000 — | 4,000 — — | ||||||

David Wise Vice President—Operations | 2004 2003 2002 | 128,846 94,176 102,139 | 40,250 19,708 53,852 | — — — | — 85,000 — | 4,800 — — | ||||||

All Officers and Directors as a Group | 2004 2003 2002 | 518,827 336,529 318,465 | 247,124 98,602 199,177 | — — — | 200,000 300,000 — | 21,400 — — | ||||||

Employment Agreements

We currently do not have, nor did we have during fiscal 2004, employment agreements with any of our executive officers.

11

Stock Option Grants in Last Fiscal Year

The following table sets forth certain information concerning options to purchase our common stock that were granted in fiscal year 2004 to the named executive officers. We did not grant SARs in fiscal year 2004.

| | Individual Grants | | | Potential Realizable Value At Assumed Annual Rates of Stock Price Appreciation For Option Term $ | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Number of Securities Underlying Options Granted | Percent of Total Options Granted to Employees in Fiscal Year | | | ||||||||||

| Name | Exercise or Base Price $ | Expiration Date | 5% | 10% | 0% | |||||||||

| Donald Danks | — | — | — | — | — | — | — | |||||||

Brandon Lewis | 150,000 | 56.0 | % | 4.50 | 7/22/2006 | 108,994 | 235,023 | — | ||||||

Robert Lewis | 50,000 | 18.7 | % | 6.05 | 11/04/2006 | 48,845 | 105,325 | — | ||||||

David Wise | — | — | — | — | — | — | — | |||||||

David Rosenvall | — | — | — | — | — | — | — | |||||||

Aggregated Stock Option Exercises in Last Fiscal Year and Fiscal Year End Option Values

The following table sets forth information concerning the year-end number and value of unexercised options with respect to each of the named executive officers. None of these individuals exercised any options during fiscal year 2004.

| | Numbers of Securities Underlying Unexercised Options at Fiscal Year End (#) | Value of Unexercised In-The-Money Options at Fiscal Year End ($)(1) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Name | ||||||||||

| Exercisable | Unexerciseable | Exercisable | Unexerciseable | |||||||

| Donald Danks | — | — | — | — | ||||||

Brandon Lewis | 183,514 | 164,734 | $ | 658,913 | $ | 553,000 | ||||

David Rosenvall | 71,250 | 20,000 | $ | 257,575 | $ | 109,600 | ||||

David Wise | 75,161 | 31,915 | $ | 308,338 | $ | 164,400 | ||||

Robert Lewis | — | 50,000 | — | $ | 46,500 | |||||

12

Equity Compensation Plan Information

The following table and note provide information about shares of our common stock that were issuable as of October 12, 2004 pursuant to exercise of options under all of our existing equity compensation plans.

| Plan Category | Number of securities to be issued upon exercise of outstanding options | Weighted-average exercise price of outstanding options | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | ||||

|---|---|---|---|---|---|---|---|

| | (a) | (b) | (c) | ||||

| Equity compensation plans approved by security holders | 1,304,316 | $ | 7.92 | 1,572,635 | |||

| Equity compensation plans not approved by security holders | — | — | — | ||||

| Total | 1,304,316 | $ | 7.92 | 1,572,635 | |||

Compensation Committee Interlocks and Insider Participation

On September 19, 2003 the Board of Directors appointed a Compensation Committee of independent directors consisting of Peter Fredericks, Chairman, Gary S. Gladstein and Thomas Scheiner. No interlocking relationships existed between our Compensation Committee and the board of directors or compensation committee of any other company, nor has any such interlocking relationship existed in the past. There are no interlocking relationships between us and other entities that might affect the determination of the compensation of our directors and executive officers.

Board Compensation Committee Report on Executive Compensation

The Compensation Committee of our Board of Directors believes that the compensation levels of our executive officers should consist of (i) base salaries that are commensurate with executives of other comparable e-commerce companies and (ii) cash bonus opportunities based on achievement of objectives set by the Compensation Committee with respect to the chief executive officer and the president, and by the chief executive officer and the president, in consultation with the Compensation Committee, with respect to our other executive officers. The Compensation Committee also believes that it is important to provide our executive officers with significant stock-based incentive compensation that increases in value in direct correlation with improvement in the performance of our common stock, thereby aligning management's interest with that of our stockholders.

The Compensation Committee considered the following factors (ranked in order of importance) when determining compensation of our executive officers: (i) our performance measured by attainment of specific strategic objectives, stock price performance and operating results; (ii) the individual performance of each executive officer, including the achievement by the executive (or the executive's functional group) of identified goals; and (iii) historical cash and equity compensation levels.

The salaries of some of our executive officers were initially set by their respective employment agreements. As stated above, the compensation of executive officers is now based upon individual performance and comparative industry compensation levels. Typically, early in each year, a performance plan is established. Each plan sets forth overall goals to be achieved by us, as well as specific performance goals to be achieved by each of our executive officers according to his or her duties and responsibilities, for the relevant year. These overall compensation goals include: (i) the meeting of targets relating to the gross revenues from operations; (ii) the meeting of targets relating to new customers in each of our targeted markets and to additional sales to existing customers in each of those markets; (iii) the acquisition of technologies and businesses consistent with our business and product

13

goals and the successful integration of the acquired businesses and technologies; (iv) the enhancement of strategic relationships; (v) the meeting of cash flow, expense and other budgetary targets; and (vi) the achievement of appreciation in our stock price.

Bonus compensation for each executive, when awarded, was determined based on the executive's achievement of overall corporate goals and individual and functional area goals. Other executive officers received salary increases and bonuses based on their achievement of overall corporate goals and individual and functional area goals. On average, the Compensation Committee believes the cash compensation for our executive officers is comparable to industry salary and bonus levels.

The full Board of Directors and, upon formation of the Compensation Committee, the Compensation Committee, administer and authorize all grants and awards made under the 1998 Stock Compensation Program, the 1998 Stock Option Plan for Senior Executives and the 1999 Stock Option Plan for Non-Executives. In some instances, awards have been authorized for new employees as incentives to join us. In determining whether and in what amount to grant stock options or other equity compensation to executive officers, the Board of Directors or the non-employee members of the Compensation Committee have considered the amount and date of vesting of then-currently outstanding incentive equity compensation granted previously to each executive officer. The Compensation Committee believes that continued grants of equity compensation to key executives are necessary to retain and motivate exceptionally talented executives who are necessary to achieve our long-term goals, especially at a time of significant growth and competition in our industry.

During recent fiscal years, the Board of Directors or non-employee members of the Compensation Committee have approved grants of equity compensation to all the executive officers named in the Summary Compensation Table above and approved grants of equity compensation to certain of the other executive officers, consistent with the overarching policy of the Board and Compensation Committee of granting equity compensation to key executives and to our employees in general.

Respectfully submitted,

Peter Fredericks, Chairman

Thomas Schneiner

Gary S. Gladstein

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

John J. Poelman, our former Chief Executive Officer and a former director, was the sole owner of Electronic Commerce International, Inc. ("ECI") during the fiscal year ended June 30, 2002 and during the three months ended September 30, 2002. During this period, we purchased a merchant account solutions product from ECI that provided on-line, real-time processing of credit card transactions and resold this product to our customers. We also formerly utilized the services of ECI to provide a leasing opportunity to customers who purchased our products at our Internet training workshops. Effective October 1, 2002, Mr. Poelman sold certain assets and liabilities of ECI, including ECI's corporate name and its relationship with us, to an unrelated third party. Total revenue generated by us from the sale of ECI's merchant account solutions product, while ECI's business was owned by Mr. Poelman, was $1,453,612 and $5,106,494 for the years ended June 30, 2003 and 2002, respectively. The cost to us for these products and services totaled $223,716 and $994,043 for the years ended June 30, 2003 and 2002, respectively. During the years ended June 30, 2003 and 2002, we processed leasing transactions for our customers through ECI in the amounts of $0 and $1,090,520, respectively. As of June 30, 2003 we had no receivable balance due from ECI for leases in process or amounts due to ECI for the purchase of the merchant account software while owned by Mr. Poelman.

We utilize Electronic Marketing Services, LLC. ("EMS") to provide a live chat capability for our customers. Ryan Poelman, who owns EMS, is the son of John J. Poelman, our former Chief Executive

14

Officer and former director. Our revenues generated from EMS' products and services were $6,330,343 and 4,806,497 for the years ended June 30, 2003 and 2002, respectively. The cost to us for these products and services totaled $994,827 and $479,984 during the years ended June 30, 2003 and 2002, respectively. In addition, we had $92,094 as of June 30, 2003 recorded in accounts payable relating to the amounts owed to EMS for product and services.

We send complimentary gift packages to our customers who register to attend our workshop training sessions. An additional gift is sent to workshop attendees who purchase products at the conclusion of the workshop. We utilize Simply Splendid, LLC ("Simply Splendid") to provide these gift packages to our customers. Aftyn Morrison, who owns Simply Splendid, is the daughter of John J. Poelman, who was formerly our Chief Executive Officer and a former director. We paid Simply Splendid $421,265 and $0 to provide these products during the years ended June 30, 2003 and 2002, respectively. In addition, we had $22,831 as of June 30, 2003 recorded in accounts payable relating to the amounts owed to Simply Splendid for gift packages.

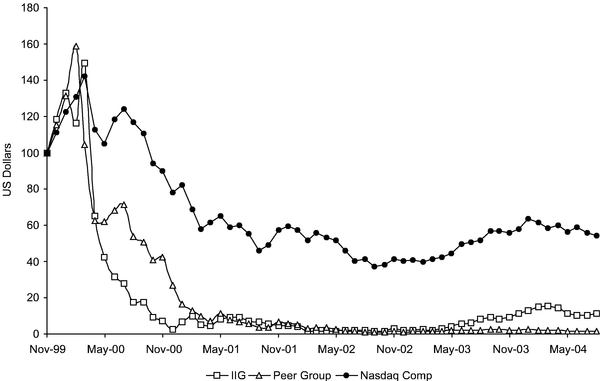

The graph below sets forth the cumulative total stockholder return on a monthly basis assuming the investment of $100.00 on the date specified by the graph in each of our common stock, the NASDAQ Composite Index, and the peer group for our common stock (the "Peer Group"). The Peer Group is composed of those companies with whom we compete and are as follows: ART Technology Group, Inc., Broadvision, Inc., Vignette Corporation, and Cybersource Corporation.

Five-year cumulative return

(Investment of $100 on November 18, 1999)

15

In accordance with its written charter adopted by the Board of Directors on March 23, 2004, the Audit Committee is responsible for reviewing and discussing the Company's audited financial statements with management, discussing information with the Company's auditors relating to the auditors' judgments about the quality of our accounting principles, recommending to the Board of Directors that the audited financials be included in the Company's Annual Report on Form 10-K and overseeing compliance with the Securities and Exchange Commission requirements for disclosure of auditors' services and activities. During fiscal year 2003 and until August 12, 2003, the Audit Committee consisted of our Board of Directors. On August 12, 2003 an Audit Committee consisting of Gary S. Gladstein (Chairman), Thomas Scheiner and Peter Fredericks was appointed. The Board of Directors has determined that each of these persons is independent. The Audit Committee Charter is in compliance with all regulatory requirements, and is published on our website.

The Company's management has the primary responsibility for the Company's financial statements as well as its financial reporting process, principles and internal controls. The Company's independent auditors are responsible for performing an audit of our financial statements and expressing an opinion as to the conformity of such financial statements with generally accepted accounting principles. The Audit Committee is responsible for, among other things, reviewing the results of the audit engagement with our independent auditors; reviewing the adequacy, scope and results of the internal accounting controls and procedures; reviewing the degree of independence of the auditors; reviewing the auditors' fees; and recommending the engagement of auditors to the full board of directors.

In this context, the Audit Committee reviewed and discussed the audited financial statements of the Company as of and for the year ended June 30, 2004 with management and the independent auditors. The Audit Committee discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees), as currently in effect. In addition, the Audit Committee received written confirmation, in accordance with Independence Standard No. 1 (Independence Discussions with Audit Committees), as currently in effect, and discussed with the auditors their independence from the Company. The Audit Committee has also considered whether the independent auditor's provisions of non-audit services to us is compatible with maintaining the auditor's independence.

The members of the Audit Committee are not engaged in the accounting or auditing profession. In the performance of their oversight function, the members of the Audit Committee necessarily relied upon the information, opinions, reports and statements presented to them by management of the Company and by the independent auditors. As a result, the Audit Committee's oversight and the review and discussions referred to above do not assure that management has maintained adequate financial reporting processes, principles and internal controls, that our financial statements are accurate, that the audit of such financial statements has been conducted in accordance with generally accepted auditing standards or that our auditors meet the applicable standards for auditor independence.

Based on the reports and discussions above, the Audit Committee recommended that the audited financial statements be included in our Annual Report on Form 10-K for the year ended June 30, 2004.

Members of the Audit Committee of the Board of Directors

Gary S. Gladstein, Chairman

Peter Fredericks

Thomas Scheiner

The above report of the Audit Committee will not be deemed to be incorporated by reference to any filing by us under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that we specifically incorporate the same by reference.

16

Annual Report

Our Annual Report on Form 10-K for the fiscal year ended June 30, 2004 is enclosed herewith. Additional copies of such report are available upon request.

Stockholder Proposals for Action at Our Next Annual Meeting

Any stockholder who wishes to present any proposal for stockholder action at the next Annual Meeting of Stockholders to be held in 2005, must be received by our Secretary, at our offices, no later than June 30, 2005, in order to be included in our proxy statement and form of proxy for that meeting. Such proposals should be addressed to the Corporate Secretary, Imergent, Inc., 754 East Technology Avenue, Orem, Utah 84097. If a stockholder proposal is introduced at the 2005 Annual Meeting of Stockholders without any discussion of the proposal in our proxy statement, and the stockholder does not notify us on or before August 14, 2005, as required by SEC Rule 14(a)-4(c)(1), of the intent to raise such proposal at the Annual Meeting of Stockholders, then proxies received by us for the 2004 Annual Meeting will be voted by the persons named in such proxies in their discretion with respect to such proposal. Notice of such proposal is to be sent to the above address.

Our bylaws require stockholders to give advance notice of any matter stockholders wish to present for action at an annual meeting of stockholders (other than matters to be included in our proxy statement, which are discussed in the previous paragraph). The required notice must be received at our principal executive offices not less than 30 days nor more than 60 days prior to the annual meeting, unless less than 40 days' notice of the date of the annual meeting is given to stockholders, in which case the required stockholder notice must be given no later than ten days following the date notice is given of the annual meeting. The chairman of the meeting has the discretion to determine and declare any matter not complying with the foregoing notice provisions to be not properly brought before the meeting.

Other Matters

As of the date of this statement, our Board of Directors does not intend to present and has not been informed that any other person intends to present a matter for action at the meeting other than as set forth herein and in the Notice of Meeting. If any other matter properly comes before the meeting, the holders of proxies will vote the shares represented by them in accordance with their best judgment.

In addition to the solicitation of proxies by mail, certain of our officers and employees, without extra compensation, may solicit proxies personally or by telephone, telegraph, or cable. We will also request brokerage houses, nominees, custodians, and fiduciaries to forward soliciting materials to the beneficial owners of our common stock held of record and will reimburse such persons for forwarding such material. We will pay the costs of this solicitation of proxies.

* * *

| By Order of the Directors | |

/s/ JEFFREY G. KORN Jeffrey G. Korn, Secretary | |

Dated: October 14, 2004 |

17

FRONT OF PROXY CARD

IMERGENT, INC.

Proxy for the Annual Meeting of Stockholders to be held on November 30, 2004

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS OF IMERGENT, INC.

PROXY

The undersigned stockholder of IMERGENT, INC. hereby appoints Donald L. Danks and Jeffrey G. Korn, and each of them, proxies with full power of substitution to act for and on behalf of the undersigned and to vote all stock standing in the name of the undersigned as of the close of business on October 20, 2004, which the undersigned would be entitled to vote if personally present at the Annual Meeting of Stockholders ("Meeting") to be held Tuesday, November 30, 2004, at 754 East Technology Avenue, Orem, Utah, commencing at 12:00 p.m. (local time), and at any and all adjournments or postponements thereof, upon all matters properly coming before the Meeting.

| COMMENTS: | CHANGE OF ADDRESS: | |

(If you have written in the above space, please mark the corresponding box on the reverse side of this card)

You are encouraged to specify your choices by marking the appropriate boxes (see reverse side) but you need not mark any boxes if you wish to vote in accordance with our Board of Directors' recommendations. The proxies named above cannot vote your shares unless you sign and return this card.

| SEE REVERSE SIDE |

BACK OF PROXY CARD

Preliminary Copies—Confidential

ý Please mark your votes as in this example.

| The Board of Directors recommends a vote "For" Item 1: | ||||||||

1. | ELECTION OF THE FOLLOWING PERSONS TO SERVE AS DIRECTORS OF THE COMPANY, TO SERVE FOR TWO YEARS OR UNTIL THEIR SUCCESSORS ARE DULY ELECTED AND QUALIFIED: | FOR o | WITHHELD o | |||||

(1) Donald L. Danks—Class I—2006 (2) Thomas Scheiner—Class I—2006 | ||||||||

(To withhold authority to vote FOR any individual nominee, strike a line through the nominee's name in the list above, in which case your shares will be voted for all remaining nominees.) | ||||||||

The Board of Directors recommends a vote "For" Item 2: | ||||||||

2. | RATIFICATION OF THE APPOINTMENT OF GRANT THORNTON LLP AS OUR AUDITORS FOR THE FISCAL YEAR ENDED JUNE 30, 2005. | FOR o | AGAINST o | ABSTAIN o | ||||

This proxy, when properly executed, will be voted in the manner directed herein. If no designation (i.e. "For," "Withheld," "Against" or "Abstain") is made, the proxies named on the reverse side hereof intend to vote the shares to which this proxy relates "For" Items 1 and 2. The proxies will vote in their discretion on any other matters properly coming before the Meeting. The signer hereby revokes all proxies heretofore given by the signer to vote at the Meeting or any adjournment or postponement thereof.

| SIGNATURE(S) | Date |

| Note: | Please sign exactly as name appears hereon. Joint owners should each sign. When signing as attorney, executor, administrator, or guardian, please give full title as such. |