UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. [ ])

Filed by Registrant [x]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| [x] Preliminary Proxy Statement | [ ] Confidential, for Use of the Commission |

| [ ] Definitive Proxy Statement | Only (as Permitted by Rule 14a-6(e)(2)) |

| [ ] Definitive Additional Materials | |

| [ ] Soliciting Material Pursuant to §240.14a-12 |

Crexendo, Inc. ® |

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box).

[ x ]

No fee required.

[ ]

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

__ ___________________________

(2) Aggregate number of securities to which transaction applies:

__ _______________________________________________

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

_________________________________________________________________________

(4) Proposed maximum aggregate value of transaction:

$[_____] equal to the sum of the aggregate cash merger consideration of $10,000,000 and the aggregate stock merger consideration calculated based on the average of the high and low prices of the common stock as reported by the Nasdaq Stock Market as of ______, 2021

(5) Total fee paid: __$[_____]________________________________________________

_______________________________________________

[ ]

Fee paid previously with preliminary materials.

[ ]

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a) (2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

1) Amount Previously Paid:

_________________________________________________________________________

2) Form, Schedule or Registration Statement No.:

_________________________________________________________________________

3) Filing Party:

_________________________________________________________________________

4) Date Filed:

_________________________________________________________________________

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Date: Monday, May 17, 2021

Time: 2:00 p.m. local time

Place: Crexendo, Inc. Corporate Headquarters

1615 S. 52nd St., Tempe, AZ 85281

Matters to be voted on at our 2021 annual meeting of stockholder (the “Annual Meeting”) include:

●

a proposal to approve, in accordance with Nasdaq Listing Rule 5635, the issuance of shares of our common stock, par value $0.001 per share, in connection with the proposed acquisition of NetSapiens, Inc. through certain merger and reorganization transactions pursuant to that certain Agreement and Plan of Merger and Reorganization dated March 5, 2021, a copy of which is attached to the accompanying proxy statement as Annex A;

●

a proposal to elect three directors, each for a term of two years, expiring at our annual meeting of stockholders to be held during 2023 or until his or her successor shall have been duly chosen and qualified, or until his or her earlier death, resignation, retirement, disqualification or removal;

●

proposal to approve and adopt the Crexendo, Inc. 2021 Equity Incentive Plan, a copy of which is attached to the accompanying proxy statement as Annex B;

●

proposal to approve and adopt an amendment to our Articles of Incorporation, in the form attached to the accompanying proxy statement as Annex C, to increase the authorized number of shares of our common stock from 25,000,000 to 50,000,000; and

●

proposal to ratify the appointment of Urish Popeck & Co., LLC as our independent registered public accounting firm for our fiscal year ending December 31, 2021.

The Annual Meeting will also address such other business as may properly come before the Annual Meeting or any postponement or adjournment thereof. The foregoing items of business are more fully described in the proxy statement accompanying this Notice.

Only stockholders of record at the close of business on March 31, 2021 are entitled to notice of and to vote at the Annual Meeting or any adjournments thereof. A list of stockholders entitled to vote at the Annual Meeting will be available at the Annual Meeting and during the ten-day period prior to the date of the Annual Meeting at our corporate headquarters at the address above for inspection by stockholders during ordinary business hours for any purpose germane to the Annual Meeting.

By order of our Board of Directors,

By: /s/ Jeffrey G. Korn

Jeffrey G. Korn, Secretary

April 26, 2021

Crexendo, Inc.

_____________________

PROXY STATEMENT

FOR 2021 ANNUAL MEETING OF STOCKHOLDERS

_____________________

WHETHER OR NOT YOU EXPECT TO ATTEND THE ANNUAL MEETING, PLEASE ENSURE THAT YOUR SHARES ARE REPRESENTED AT THE ANNUAL MEETING BY VOTING IN ONE OF THE FOLLOWING WAYS:

| (1) | VIA THE INTERNET – GO TO THE WEBSITE DESIGNATED ON THE ENCLOSED PROXY CARD. |

| (2) | BY TELEPHONE – CALL THE TELEPHONE NUMBER DESIGNATED ON THE ENCLOSED PROXY CARD. |

| (3) | BY MAIL – COMPLETE, DATE, AND SIGN THE ENCLOSED PROXY CARD AND MAIL IT IN THE ENCLOSED, SELF-ADDRESSED ENVELOPE. NO POSTAGE IS NEEDED IF THE PROXY CARD IS MAILED WITHIN THE UNITED STATES. |

YOUR PROMPT RESPONSE IS HELPFUL AND YOUR COOPERATION WILL BE APPRECIATED.

INFORMATION CONCERNING SOLICITATION AND VOTING

The enclosed proxy is solicited on behalf of the Board of Directors (“Board”) of Crexendo, Inc. (“Crexendo” or, the “Company”), for use at the annual meeting of stockholders to be held on Monday, May 17, 2021, at 2:00 p.m. local time (the “Annual Meeting”), and at any postponement or adjournment thereof. The Annual Meeting will be held at Crexendo’s corporate headquarters at 1615 South 52nd Street, Tempe, AZ, 85281. The purposes of the Annual Meeting are set forth in the accompanying Notice of Annual Meeting of Stockholders.

We are monitoring developments regarding the coronavirus or COVID-19 and preparing in the event any changes for our Annual Meeting are necessary or appropriate. If we decide to make any change, such as to the date or location or to hold the meeting solely by remote communication, we will announce the change in advance and post details, including instructions on how stockholders can participate, on our website www.crexendo.com and file them with the Securities and Exchange Commission (the “SEC”).

This proxy statement (“Proxy Statement”), the enclosed form of proxy and the Company’s annual report for the fiscal year ended December 31, 2020 (“Annual Report”) shall be mailed on or about April 26, 2021 to holders of record of shares of the Company’s common stock, as of March 31, 2021 (the “Record Date”), using the full set delivery option pursuant to Rule 14a-16(n) under the Securities Exchange Act of 1934, as amended. Only stockholders of record at the close of business as of the Record Date are entitled to vote at the Annual Meeting. On the Record Date, there were 18,424,611 shares of common stock issued and outstanding.

GENERAL INFORMATION ABOUT THE MEETING

Who May Vote

You may vote if our records show that you own shares of Crexendo as of March 31, 2021. As of the close of business on March 31, 2021, we had a total of 18,424,611 shares of common stock issued and outstanding, which were held of record by approximately 137 stockholders. As of March 31, 2021, we had no shares of preferred stock outstanding. You are entitled to one vote for each share that you own.

Voting Your Proxy

If a broker, bank or other nominee holds your shares, you will receive instructions from them that you must follow in order to have your shares voted. If a bank, broker or other nominee holds your shares and you wish to attend the meeting and vote in person, you must obtain a “legal proxy” from the record holder of the shares giving you the right to vote the shares.

Stockholders of record as of the Record Date can vote their proxy via one of three ways: (i) internet, (ii) phone or fax, and (iii) by mail. It is not necessary to mail your proxy card if you are voting by internet or phone. If you have questions in regards to your proxy, or need assistance in voting, please contact our independent proxy tabulator, Issuer Direct Corp. at 866-752-8683, proxy@iproxydirect.com.

If you submit a proxy using one of the methods described above, your proxy may be revoked at any time prior to its use by: (1) delivering to our secretary a signed notice of revocation or a later dated proxy, (2) attending the meeting and voting in person, or (3) giving notice of revocation of the proxy at the meeting. Attendance at the meeting will not in itself constitute the revocation of a proxy. Prior to the meeting, any written notice of revocation should be sent to Crexendo, Inc., 1615 South 52nd Street, Tempe, AZ, 85281 Attention: Corporate Secretary. Any notice of revocation that is delivered at the meeting should be hand delivered to our corporate secretary before the vote is taken. A stockholder may be requested to present identification documents for the purpose of establishing such stockholder’s identity. The last valid vote you submit chronologically will supersede your prior vote(s).

One or more inspectors of election, duly appointed for that purpose, will count and tabulate the votes cast and report the results of the votes at the meeting to our management. Your vote at the meeting will not be disclosed except as needed to permit the inspector to tabulate and certify the votes, or as is required by law.

Matters to be Presented

We are not aware of any matters to be presented other than those described in this Proxy Statement. If any matters not described in this Proxy Statement are properly presented at the meeting, the proxy holders will use their own judgment to determine how to vote your shares. If the meeting is adjourned, the proxy holders can vote your shares on the new meeting date as well, unless you have revoked your proxy instructions.

Cost of This Proxy Solicitation

We will pay the cost of this proxy solicitation. We may, on request, reimburse brokerage firms and other nominees for their expenses in forwarding proxy materials to beneficial owners. In addition to soliciting proxies by mail, we expect that our directors, officers and employees may solicit proxies in person or by the Internet, telephone, or facsimile. None of these individuals will receive any additional or special compensation for doing this, although we will reimburse these individuals for their reasonable out-of-pocket expenses.

Interest of Certain Persons in Matters to Be Acted Upon

No director or executive officer, other than in his role as nominee, director or executive officer, associate of any director or executive officer or any other person has any substantial interest, direct or indirect by security holdings or otherwise, in the matters described herein which, to the extent such director, executive officer or associate of such director or executive officer is a stockholder of the Company, is not shared by all other stockholders pro rata and in accordance with their respective stock ownership interests.

Quorum Requirement;Abstentions and Broker Non-Votes

A quorum is necessary to hold a valid meeting of stockholders. The presence, in person or by proxy, of a majority of the issued and outstanding shares of common stock entitled to vote as of the Record Date constitutes a quorum at the Annual Meeting. Shares that are voted “WITHHELD” or “ABSTAIN” will be counted as shares that are present and entitled to vote for purposes of determining the presence of a quorum with respect to any matter, but will not be counted as votes in favor of such matter. If you have returned valid proxy instructions or attend the meeting in person, your common stock will be counted for the purpose of determining whether there is a quorum, even if you wish to abstain from voting on some or all matters at the meeting.

If you are a beneficial owner of shares held in “street name” and do not provide the organization that holds your shares with specific voting instructions, under the rules of various national and regional securities exchanges, the organization that holds your shares may generally vote on routine matters but cannot vote on non-routine matters. If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, the organization that holds your shares does not have the authority to vote on the matter with respect to those shares. This is generally referred to as a “broker non-vote.”

Proposal I - the Parent Stock Issuance Proposal (as defined below), Proposal II - the Election of Directors, Proposal III - the Adoption of the 2021 Plan Proposal (as defined below) and Proposal IV - the Articles Amendment Proposal (as defined below) are considered non-routine matters under applicable rules. A broker cannot vote without instructions on non-routine matters, and therefore broker non-votes may exist in connection with these proposals. Broker non-votes will have no effect on these proposals except that they will be deemed as votes “against” Proposal IV.

Proposal V - the proposal to ratify the appointment of Urish Popeck & Co., LLC as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2021 is considered a routine matter under applicable rules. A broker may generally vote on routine matters, and therefore no broker non-votes are expected to exist in connection with Proposal V.

2

Our Voting Recommendations

When proxies are properly dated, executed and returned, the shares represented by such proxies will be voted at the Annual Meeting in accordance with the instructions of the stockholder. However, if no specific instructions are given, the shares will be voted in accordance with the following recommendations of our Board:

●

“FOR” Proposal I to approve, in accordance with Nasdaq Listing Rule 5635, the issuance of shares of our common stock in connection with the proposed acquisition of NetSapiens, Inc. through certain merger and reorganization transactions pursuant to that certain Agreement and Plan of Merger and Reorganization dated March 5, 2021 (the “Parent Stock Issuance Proposal”);

●

“FOR” Proposal II to elect Steven G. Mihaylo, David Williams, and Todd Goergen to the Board as Class I directors, each for a term of two years, expiring at our annual meeting of stockholders to be held during 2023;

●

“FOR” Proposal III to approve the Crexendo, Inc. 2021 Equity Incentive Plan (the “Adoption of the 2021 Plan Proposal”);

●

“FOR” Proposal IV to adopt an amendment to our Articles of Incorporation to increase authorized number of shares of our common stock from 25,000,000 to 50,000,000 (the “Articles Amendment Proposal”);

●

“FOR” Proposal V to ratify Urish Popeck & Co., LLC as our independent registered public accounting firm for the fiscal year ending December 31, 2021.

No Dissenters’ Rights

Stockholders of the Company have no rights of appraisal or similar rights of dissenters with respect to any proposal to be voted upon in this Proxy Statement.

Deadlines for Receipt of Stockholder Proposals

Stockholders may present proposals for action at a future meeting only if they comply with the requirements of the proxy rules established by the SEC and our bylaws. Stockholder proposals that are intended to be included in our proxy statement and form of proxy relating to the meeting for our 2022 annual meeting of stockholders must be received by us no later than December 26, 2021 to be considered for inclusion and must comply with Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Any stockholder who intends to present a proposal at the 2022 annual meeting of stockholders other than for inclusion in the Company’s proxy statement and form of proxy must be submitted no later than March 12, 2022.

Beneficial Ownership of Shares

The following table sets forth, as of March 31, 2021, the number of shares of our common stock beneficially owned by each of the following persons and groups and the percentage of the outstanding shares owned by each person and group including: (i) each person who is known by us to be the owner of record or beneficial owner of more than 5% of the outstanding shares of our common stock; (ii) each director and nominee; (iii) each of our named executive officers; and (iv) all of our current directors and executive officers as a group.

With respect to certain of the individuals listed below, we have relied upon information set forth in statements filed with the SEC pursuant to Section 13(d) or 13(g) of the Exchange Act. Except as otherwise noted below, the address of each person identified in the following table is c/o Crexendo, Inc., 1615 South 52nd Street, Tempe, Arizona, 85281.

3

| Name of Beneficial Owner | Shares Owned | Number of Outstanding Options and Restricted Stock Units (1) | Total Beneficial Ownership (2) | Percent of Class Beneficially Owned |

| Steven G. Mihaylo (3) | 10,298,468 | 16,066 | 10,314,534 | 55.9% |

| Todd Goergen (4) | 368,534 | 110,498 | 479,032 | 2.6% |

| Jeffrey Bash | 199,992 | 60,498 | 260,490 | 1.4% |

| David Williams | 24,674 | 60,983 | 85,657 | 0.5% |

| Anil Puri | 13,501 | 70,498 | 83,999 | 0.5% |

| Doug Gaylor | 9,498 | 333,228 | 342,726 | 1.8% |

| Ron Vincent | 14,911 | 153,895 | 168,806 | 0.9% |

| Jon Brinton | - | 17,728 | 17,728 | 0.1% |

| All current directors and executive officers as a group (8 persons) | 10,929,578 | 823,394 | 11,752,972 | 61.1% |

(1)

Reflects options that will be exercisable or vested, as the case may be, as of March 31, 2021, or within 60 days thereafter and restricted stock units that are scheduled to vest within 60 days of March 31, 2021.

(2)

Beneficial ownership is determined in accordance with the rules of the SEC, based upon 18,424,611 shares of common stock outstanding on March 31, 2021. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares of common stock subject to options held by that person that are currently exercisable or become exercisable within 60 days following March 31, 2021 and restricted stock units that are scheduled to vest within 60 days of March 31, 2021 are deemed outstanding. These shares, however, are not deemed outstanding for the purpose of computing the percentage ownership of any other person. The persons and entities named in the table have sole voting and sole investment power with respect to the shares set forth opposite such stockholder’s name.

(3)

Shares owned consists of 847,286 shares held personally, 9,371,182 shares in The Steven G. Mihaylo Trust dated August 19, 1999, as amended, of which Steven G. Mihaylo is the Trustee, 80,000 shares in The Steven Mihaylo and Lois Mihaylo Foundation.

(4)

Shares owned consists of 13,534 shares held personally, 355,000 shares held by his family’s private equity firm Ropart Asset Management FD II LLC.

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act requires our directors and executive officers, and persons who own more than ten percent of a registered class of our equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of our common stock and other equity securities. Officers, directors and greater than ten percent stockholders are required by SEC regulation to furnish us with copies of all Section 16(a) forms they file. Based on a review of reports and representations submitted to us, all reports regarding beneficial ownership of our securities required to be filed under Section 16(a) for the year ended December 31, 2020 were timely filed, except for the following:

1.

Mr. Jon Brinton’s November 23, 2020 Form 3 was not filed timely. Mr. Brinton filed his Form 3 on April 13, 2021, once he was able to obtain his CIK Confirmation Code from the SEC.

4

CAUTIONARY INFORMATION REGARDING FORWARD-LOOKING STATEMENTS

This Proxy Statement, and the documents incorporated by reference into this Proxy Statement, contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, but not limited to, statements regarding: the potential synergies that may be achieved by the combined companies pursuant to that certain Merger Agreement (as defined below); the parties’ ability to meet the conditions for consummating the transactions contemplated by the Merger Agreement on the anticipated schedule; the occurrence of any event, change or other circumstance that could give rise to the termination of the Merger Agreement; the outcome of any legal proceedings that may be instituted against the Company related to the Merger Agreement or the transactions contemplated thereby; and the amount of the costs, fees, expenses and other charges related to such transactions. The use of words such as, but not limited to, “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” or “would” and similar words expressions are intended to identify forward-looking statements. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies and other future conditions and on information currently available to us. New risks and uncertainties may emerge from time to time, and it is not possible to predict all risks and uncertainties. No representations or warranties (expressed or implied) are made about the accuracy of any such forward-looking statements. We may not actually achieve the forecasts disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Such forward-looking statements are subject to a number of material risks and uncertainties including but not limited to those set forth under the caption “Risk Factors” in our most recent Annual Report on Form 10-K filed with the SEC, as well as discussions of potential risks, uncertainties, and other important factors in our subsequent filings with the SEC. Any forward-looking statement speaks only as of the date on which it was made. Neither we, nor our affiliates, advisors or representatives, undertake any obligation to publicly update or revise any forward-looking statement, whether as result of new information, future events or otherwise, except as required by law. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date hereof.

MARKET AND INDUSTRY DATA

Unless otherwise indicated, information contained in this Proxy Statement concerning our industry and the markets in which we or NetSapiens operate is based on information from independent industry and research organizations, other third-party sources (including industry publications, surveys and forecasts), and management estimates. Management estimates are derived from publicly available information released by independent industry analysts and third-party sources, as well data from internal research, and are based on assumptions made by us or NetSapiens upon reviewing such data and our knowledge of such industry and markets which we believe to be reasonable. Although we believe the data from these third-party sources are reliable as of their respective dates, neither we nor NetSapiens have independently verified the accuracy or completeness of this information. In addition, projections, assumptions and estimates of the future performance of our industry and our future performance are necessarily subject to uncertainty and risk due to a variety of factors, including those described in “Risk Factors” in our Annual Report.

TRADEMARKS, SERVICE MARKS AND TRADE NAMES

We own or have rights to various trademarks, service marks and trade names that we use in connection with the operation of our business. This Proxy Statement may also contain trademarks, service marks and trade names of third parties, which are the property of their respective owners. Our use or display of third parties’ trademarks, service marks, trade names or food products in this Proxy Statement is not intended to imply a relationship with, or endorsement or sponsorship by, these other parties. Solely for convenience, the trademarks, service marks and trade names referred to in this Proxy Statement may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks, service marks and trade names.

5

———————

PROPOSAL I

THE APPROVAL OF, UNDER APPLICABLE NASDAQ LISTING RULES, THE ISSUANCE OF SHARES OF OUR COMMON STOCK PURSUANT TO THE MERGER AGREEMENT (THE “PARENT STOCK ISSUANCE PROPOSAL”)

———————

SUMMARY TERM SHEET

The following summary highlights selected information about the transactions (“Transactions”) contemplated by that certain Agreement and Plan of Merger and Reorganization, dated March 5, 2021 (the “Merger Agreement”), by and among the Company, Crexendo Merger Sub, Inc., a Delaware corporation and a direct, wholly-owned subsidiary of the Company (“Merger Sub I”), Crexendo Merger Sub, LLC, a Delaware limited liability company and a direct, wholly-owned subsidiary of the Company (“Merger Sub II” and, together with Merger Sub I, the “Merger Subs”), NetSapiens, Inc., a Delaware corporation (“NetSapiens”), and David Wang as the Stockholder Representative (as defined in the Merger Agreement) and may not contain all of the information that is important to you. Accordingly, we encourage you to read carefully this entire Proxy Statement, its annexes and the documents referred to in this Proxy Statement, in particular the Merger Agreement, which is attached to this Proxy Statement as Annex A.

Unless we otherwise indicate or unless the context requires otherwise, all references in this Proxy Statement to “the Company,” “Crexendo”, “Parent”, “we”, “our” and “us” refer to Crexendo, Inc., a Nevada corporation, together with its wholly-owned subsidiaries.

Parties to the Mergers

The parties to the Mergers (as defined below) are:

Crexendo, Inc.

1615 S. 52nd Street

Tempe, AZ 85281

Telephone: (602) 714-8500

Crexendo, Inc. is an award-winning premier provider of cloud communications, UCaaS (Unified Communications as a Service), call center, collaboration services, and other cloud business services that are designed to provide enterprise-class cloud services to any size business at affordable monthly rates. The Company has two operating segments, which consist of cloud telecommunications and web services.

NetSapiens, Inc.

1200 Prospect Street, Suite 200

La Jolla, CA 92037

Telephone: (858) 764-5200

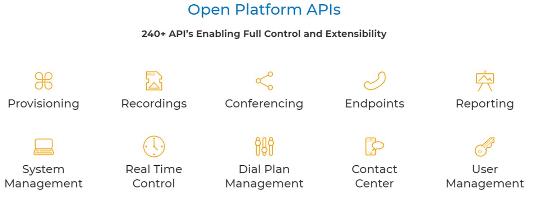

NetSapiens, Inc., provides an award-winning, patented cloud-native communications platform delivered via a high availability, multi-tenant solution that can be consumed however the service providers prefer, in their cloud or the NetSapiens cloud, on a subscription or a purchase model.

Crexendo Merger Sub, Inc. (Merger Sub I)

1615 S. 52nd Street

Tempe, AZ 85281

Telephone: (602) 714-8500

Crexendo Merger Sub, LLC (Merger Sub II)

1615 S. 52nd Street

Tempe, AZ 85281

Telephone: (602) 714-8500

Merger Sub I and Merger Sub II are Crexendo’s wholly-owned subsidiaries. They were formed solely for the purpose of effecting the Transactions, and have not engaged in any other business.

6

Summary of the Mergers (Page 9)

Pursuant to the Merger Agreement, Merger Sub I will merge with and into NetSapiens, with NetSapiens continuing as the surviving entity (the “First Merger”), and, as a part of the same overall transaction, the surviving entity of the First Merger will merge with and into Merger Sub II, with Merger Sub II continuing as the surviving entity and a wholly-owned subsidiary of the Company (the “Second Merger,” and, together with the First Merger, the “Mergers”). Immediately following the consummation of the Second Merger, the name of Merger Sub II will be changed to “NetSapiens, LLC”.

Overview of the Merger Agreement (Page 10)

Merger Consideration

Subject to the terms of the Merger Agreement, the total base consideration for the Mergers, including repayment of debt and expenses, is approximately $50 million, consisting of (1) $10 million in cash, and (2) approximately $40 million in the form of shares of the Company’s common stock or Company options valued at $6.19 per share for the purpose of determining the aggregate number of shares payable to NetSapiens’ equityholders (the “Merger Shares”). The merger consideration is subject to customary upward or downward adjustments for NetSapiens’ net working capital and closing cash. In addition, holders of outstanding common stock, in-the-money stock options and in-the-money warrants of NetSapiens will receive a portion of the merger consideration as described above on a pro rata basis and/or in accordance with the Merger Agreement and any option or warrant cancellation agreements entered into by such equityholders. When taking into account the anticipated adjustments for net working capital and closing cash, the Company expects to issue approximately 3,114,690 shares of the Company’s common stock valued at $6.19 per share for common stock consideration of approximately $19.3 million and approximately 4,438,321 options with an aggregate value of $21.8 million, net of the aggregate exercise price of $5.6 million, at the closing.

Conditions to the Completion of the Mergers

The completion of the Mergers is subject to the satisfaction or waiver of certain conditions, including: (i) the adoption of the Merger Agreement by the affirmative vote of the holders of a majority of all outstanding shares of NetSapiens entitled to vote thereon (the “NetSapiens Stockholder Approval”); (ii) the approval of the issuance of the Merger Shares and the other matters requiring stockholder approval for the consummation of the Transactions (collectively, the “Parent Proposals”) by the affirmative vote of the holders of a majority of all outstanding shares of the Company entitled to vote thereon (the “Parent Stockholder Approval”); and (iii) the absence of governmental restraints or prohibitions preventing the consummation of the Mergers.

The obligation of each of the Company and NetSapiens to consummate the Mergers is also conditioned on, among other things, the truth and correctness of the representations and warranties made by the other party as of the closing date (subject to certain “materiality” and “material adverse effect” qualifiers), the performance of the covenants required by the Merger Agreement in all material respects and there being no material adverse effect with respect to the Company or NetSapiens. In addition, the obligation of NetSapiens to consummate the Mergers is conditioned on it reasonably and in good faith determining that the Transactions qualify as a tax-free reorganization pursuant to Section 368(a)(1) of the Internal Revenue Code of 1986, as amended (the “Code”).

Termination of the Merger Agreement

The Merger Agreement contains certain termination rights for each of the Company and NetSapiens, including in the event that: (i) the Mergers are not consummated on or before 120 days after the signing date (the “End Date”), provided that this right to termination shall not be available to the party whose breach of representation, warranty or covenant resulted in the failure to consummate the Mergers by the End Date; (ii) the NetSapiens Stockholder Approval or the Parent Stockholder Approval is not obtained; or (iii) if any law or governmental order having the effect of preventing the consummation of the Transactions shall have become final and nonappealable, provided that this right to termination shall not be available to the party whose breach of representation, warranty or covenant resulted in the issuance of such law or governmental order.

7

Either of the Company or NetSapiens may also terminate the Merger Agreement if the other party has materially breached any representation, warranty or covenant causing certain closing conditions to not be satisfied, subject to a 20-day cure period, provided, that, the terminating party is not in any material breach of its representation, warranty or covenant.

The Merger Agreement further provides that subject to certain limitations, if either the Company or NetSapiens fails to obtain its stockholder approval of the Transactions prior to the End Date, then it will need to pay the other party the out-of-pocket expenses incurred by the other party to effect the Mergers since entering into the non-binding letter of intent regarding the Mergers (the “Expenses”); provided, that, if NetSapiens fails to obtain its stockholder approval as a result of its board of directors changing its recommendation in favor of the Transactions or causing NetSapiens to enter into an alternative transaction with respect to a Superior Proposal (as defined in the Merger Agreement), NetSapiens will be required to pay the Expenses as well as grant a two-year license to use NetSapiens’ technologies to the Company, as specified in the Merger Agreement.

Voting and Support Agreements (Page 14)

Concurrent with the execution of the Merger Agreement, the Company and certain principal stockholders of NetSapiens entered into a voting and support agreement (the “NetSapiens Principal Stockholders Voting and Support Agreement”), pursuant to which such stockholders agreed to, among other things, vote the shares of common stock of NetSapiens beneficially owned by them in favor of the adoption of the Merger Agreement and the Transactions, provided, that the agreement shall not limit the stockholders’ actions in their capacity as a director or officer of NetSapiens.

Concurrent with the execution of the Merger Agreement, NetSapiens and the majority stockholder of the Company also entered into a voting and support agreement (the “Parent Majority Stockholder Voting and Support Agreement”, collectively with the NetSapiens Principal Stockholders Voting and Support Agreement, the “Voting and Support Agreements”), pursuant to which the stockholder agreed to, among other things, vote the shares of common stock of the Company beneficially owned by him in favor of the adoption of the Parent Proposals, provided, that the agreement shall not limit the stockholder’s actions in his capacity as a director or officer of the Company.

Reasons for Entering into the Merger Agreement (Page 16)

The Merger Agreement was unanimously approved by our Board at a meeting held on March 5, 2021.

Our Board’s reasons for entering into the Merger Agreement include to:

●

increase scale, enhance the Company’s technology infrastructure and offering, and expand the Company’s customers and geographic footprint;

●

expand the Company’s management, technical and marketing resources;

●

better address our customers’ needs, specifically as it relates to the complementary nature of our cloud telecommunications services and NetSapiens’ strength in research and development and innovation in communications platform solutions;

●

strengthen the position of both Crexendo and NetSapiens in seeking growth opportunities in an increasingly competitive global marketplace;

●

increase the Company’s international exposure and opportunity;and

●

increase the Company’s stockholder value through enhanced revenue opportunities and cost saving strategies.

8

Our Board approved the Merger Agreement after discussing with our senior management a number of factors, including those described above and the business, results of operations, financial performance and condition, strategic direction and prospects of NetSapiens. Our Board did not find it useful to and did not attempt to quantify, rank or otherwise assign weights to these factors. In addition, our Board did not undertake to make any specific determination as to whether any particular factor, or any aspect of any particular factor, was favorable or unfavorable to its ultimate determination, but rather our Board conducted an overall analysis of the factors described above, including discussions with our management and its financial and legal advisors.

Effect of the Mergers on Our Current Stockholders (Page 15)

Immediately following the Mergers, NetSapiens’ equityholders will own approximately 14.5% of the issued and outstanding shares of common stock of the Company and the Company’s pre-Mergers stockholders will own approximately 85.5% of the issued and outstanding common stock.

Management Following the Mergers (Page 19)

Following the Mergers, our Board will be comprised of six persons, one of which will be appointed by NetSapiens. The current five directors of the Company including those being nominated for election at the Annual Meeting, if elected, will continue to serve as our directors. Steven G. Mihaylo will continue to serve as the Chairman of our Board.

The current executive officers of the Company are expected to retain their respective positions following the Mergers. Upon completion of the Mergers, the current executive officers of NetSapiens, Anand Buch, James Murphy and David Wang are expected to continue to serve in their respective positions at NetSapiens.

Biographical information relating to the post-Mergers directors and officers is included at pages 19 and 20 below.

Risk Factors (Page 20)

The closing of the Transactions and the combined business are subject to various risks and uncertainties.

Regulatory Matters (Page 15)

Neither the Company nor NetSapiens is required to make any filings or to obtain approvals or clearances from any antitrust regulatory authorities in the United States or other countries to consummate the Mergers. The Company must comply with applicable federal and state securities laws and the NASDAQ Listing Rules in connection with the issuance of shares of common stock in the Mergers, including the filing with the SEC of this Proxy Statement.

Reasons for Stockholder Approval (Page 56)

Our common stock is listed on the Nasdaq Capital Market, and, as such, we are subject to the applicable rules of the Nasdaq Stock Market LLC, or NASDAQ Listing Rules, including NASDAQ Listing Rule 5635. In order to comply with the NASDAQ Listing Rules and to satisfy a closing condition under the Merger Agreement, we are seeking stockholder approval of this Proposal I, the Parent Stock Issuance Proposal. We are seeking stockholder approval of this proposal in order to satisfy the requirements of NASDAQ Listing Rule 5635 with respect to the issuance of shares of common stock in excess of the 20% of the voting power outstanding before the issuance. We are also seeking stockholder approval of Proposal III, the Adoption of the 2021 Plan Proposal in order to satisfy a closing condition under the Merger Agreement to issue registered stock options to NetSapiens’ option holders who will exchange their NetSapiens options for Crexendo options at the closing and Proposal IV, the Articles Amendment Proposal in order to ensure we have an adequate amount of authorized shares of common stock to complete the Transactions pursuant to the Merger Agreement.

9

THE MERGER AGREEMENT AND THE MERGERS

The following is a summary of the material provisions of the Merger Agreement, which is filed as Exhibit 2.1 to the Company’s Current Report on Form 8-K filed with the SEC on March 8, 2021, and is incorporated into this Proxy Statement by reference. You should refer to the full text of the Merger Agreement for details about the transactions and the terms and conditions of the Merger Agreement, which is attached to this Proxy Statement as Annex A, and carefully read this entire Proxy Statement and the other documents to which we have referred you. You should also review the section entitled “Where You Can Find Additional Information.”

The representations and warranties of the Company, NetSapiens and Merger Subs contained in the Merger Agreement have been made solely for the benefit of the parties to the Merger Agreement. In addition, such representations and warranties (a) have been made only for purposes of the Merger Agreement, (b) have been qualified by certain documents filed with, or furnished to, the SEC by the Company prior to the date of the Merger Agreement, (c) are subject to important qualifications, limitations and supplemental information agreed to by the Company, NetSapiens, Merger Sub I and Merger Sub II in connection with negotiating the terms of the Merger Agreement, (d) are subject to materiality qualifications contained in the Merger Agreement which may differ from what may be viewed as material by investors, (e) were made only as of the date of the Merger Agreement or such other date as is specified in the Merger Agreement and (f) have been included in the Merger Agreement for the purpose of allocating risk between the Company, Merger Sub I and Merger Sub II, on the one hand, and NetSapiens, on the other hand, rather than establishing matters as facts. Accordingly, the investors should not rely on the representations and warranties or any descriptions thereof as characterization of the actual state of facts or condition of the Company or NetSapiens or their respective subsidiaries or businesses. Moreover, information concerning the subject matter of the representations and warranties may change after the date of the Merger Agreement, which subsequent information may or may not be fully reflected in the Company’s public disclosures.

The representations and warranties in the Merger Agreement and the description of them in this Proxy Statement should not be read alone but instead should be read in conjunction with the other information contained in the reports, statements and filings the Company publicly files with the SEC. Such information can be found elsewhere in this proxy statement and in the public filings the Company makes with the SEC, as described in the section entitled “Where You Can Find Additional Information.”

The Mergers

On March 5, 2021, we entered into the Merger Agreement with the Merger Subs, which are our wholly-owned subsidiaries, NetSapiens and David Wang as the Stockholder Representative.

Pursuant to the Merger Agreement, Merger Sub I will merge with and into NetSapiens, with NetSapiens continuing as the surviving entity of the First Merger, and, as a part of the same overall transaction, the surviving entity of the First Merger will merge with and into Merger Sub II, with Merger Sub II continuing as the surviving entity and a wholly-owned subsidiary of the Company. Immediately following the consummation of the Second Merger, the name of Merger Sub II will be changed to “NetSapiens, LLC”. We expect the consummation of the Transactions to occur in May 2021, subject to the terms and conditions provided in the Merger Agreement.

Merger Consideration; Issuance of Merger Shares

Subject to the terms of the Merger Agreement, the total base consideration for the Mergers, including repayment of debt and expenses, is approximately $50 million, consisting of (1) $10 million in cash, and (2) approximately $40 million in the form of shares of the Company’s common stock, par value $0.001 per share (“Common Stock”), or Company options valued at $6.19 per share for the purpose of determining the aggregate number of shares payable to NetSapiens’ equityholders (the “Merger Shares”).

The merger consideration is subject to customary upward or downward adjustments for NetSapiens’ net working capital and closing cash through a true-up process that may be initiated by the Company no later than 90 days after the closing.

10

At the closing, a portion of NetSapiens’ outstanding in-the-money options (the “Exchange Options”) will be cancelled and exchanged for the Company’s options to be issued under the Company’s equity incentive plan at an exchange ratio determined pursuant to the Merger Agreement (the “Assumed Options”). In addition, holders of outstanding common stock, in-the-money stock options and in-the-money warrants of NetSapiens will receive a portion of the merger consideration as described above on a pro rata basis and/or in accordance with the Merger Agreement and any option or warrant cancellation agreements entered into by such equityholders. When taking into account the anticipated adjustments for net working capital and closing cash, the Company expects to issue approximately 3,114,690 shares of the Common Stock valued at $6.19 per share for Common Stock consideration of approximately $19.3 million and approximately 4,438,321 options with an aggregate value of $21.8 million, net of the aggregate exercise price of $5.6 million, at the closing.

The issuance of Common Stock to Crexendo’s equityholders will be effected by means of a private placement, which is exempt from registration under the Securities Act of 1933, as amended (the “Securities Act”), in reliance on Section 4(a)(2) of the Securities Act and Rule 506 of Regulation D promulgated thereunder.

The Company agrees to issue options to purchase registered shares of Common Stock in exchange of the Assumed Options under the Merger Agreement. The Company expects to issue the Exchange Options under the 2021 Equity Incentive Plan (the “2021 Plan”) which was adopted by our Board on April 9, 2021. The Company is seeking stockholder approval of the 2021 Plan at the Annual Meeting and expects to register the shares of Common Stock issuable under the 2021 Plan on a Form S-8 with the SEC after obtaining the stockholder approval of the 2021 Plan and prior to the closing.

Representations and Warranties

The Merger Agreement contains mutual customary representations and warranties made by each of the Company, Merger Subs and NetSapiens.

NetSapiens has made representations and warranties about itself and its subsidiaries to the Company and the Merger Subs regarding the following:

●

Organization and good standing;

●

Authority and enforceability;

●

Governmental approvals and consents;

●

No conflicts;

●

Company capital structure;

●

Company subsidiaries;

●

Company financial statements; internal financial controls;

●

No undisclosed liabilities;

●

No changes;

●

Taxes;

●

Real property;

●

Tangible property;

●

Intellectual property;

●

Material contracts;

●

Employee benefit plans;

●

Employment matters;

●

Authorizations;

●

Litigation;

●

Insurance;

●

Compliance with legal requirements;

●

Interested party transactions;

●

Books and records; powers of attorney;

●

Company broker’s fees;

●

Top customers and top suppliers;

●

Environmental matters;

●

State takeover statutes;

●

Disclosure; and

●

No other representations.

11

The Company and each of Merger Subs have made representations and warranties about themselves and their subsidiaries to NetSapiens regarding the following:

●

Organization and good standing;

●

Authority and enforceability;

●

Governmental approvals and consents;

●

No conflicts;

●

Litigation; compliance with laws;

●

SEC reports and financial statements;

●

Total stock consideration;

●

Parent broker’s fees;

●

Financial ability;

●

Taxes;

●

Listing;

●

No parent material adverse effect; and

●

No other representations; non-reliance.

Pre-Closing Covenants

The Merger Agreement contains customary pre-closing covenants, including covenants for NetSapiens, which include, among other things, covenants:

●

not to solicit, initiate or knowingly take any action to facilitate or encourage, and, subject to certain exceptions, not to participate or engage in any discussions or negotiations, or cooperate in any way with respect to, any inquiries or the making of, any proposal of an alternative transaction;

●

subject to certain exceptions, not to withdraw, qualify or modify the support of its board of directors for the Merger Agreement and the Transactions, as applicable; and

●

to use its reasonable best efforts to obtain governmental and third party consents and approvals.

In addition, the Merger Agreement contains covenants that require each of the Company and NetSapiens to hold a stockholder vote on the Mergers and the other Transactions as soon as reasonably practicable after signing the Merger Agreement and, subject to certain exceptions, require each of the boards of directors of the Company and NetSapiens to recommend to its stockholders to approve the Transactions. The Merger Agreement also contains other customary mutual covenants relating to the preparation of this proxy statement, the granting of access to information, confidentiality, the public announcement of the Transactions, notification in certain events and conducting each party’s business in the ordinary course of business consistent with past practice.

Additional Post-Closing Covenants

The Merger Agreement provides that for benefits eligibility purposes, each NetSapiens employee who continues to be employed by the post-closing combined business (each, a “Continuing Employee”) shall be credited with all service with NetSapiens and its subsidiaries prior to the closing. In addition, during the period from the closing date to December 31, 2021, the Company will and will cause its applicable subsidiary to provide to Continuing Employees: (i) base salary or hourly wage, (ii) commission and target bonus opportunities (excluding equity-based compensation), (iii) retirement and welfare benefits and (iv) severance benefits, all of which will be no less favorable than prior to the closing; as well as (iv) to certain manager-level Continuing Employees, at least one month of severance for every two years of service up to a maximum of six months’ severance for service provided to NetSapiens prior to the closing or to the post-closing combined business. None of these provisions is intended to provide nor create any third party beneficiary rights in any NetSapiens stockholder or employee, including any rights of employment for any specified period and/or any employee benefits, other than the parties to the Merger Agreement, and their respective successors and permitted assigns.

12

Pursuant to the Merger Agreement, all rights of indemnification, advancement of expenses and exculpation by NetSapiens and its subsidiaries existing in favor of its current or past directors and officers as provided in the organizational documents of NetSapiens and its subsidiaries on the date of the Merger Agreement shall be assumed by the Company at the closing. NetSapiens shall also acquire for the benefit of the persons covered by NetSapiens or its subsidiaries’ directors’ and officers’ liability insurance policies a “tail” coverage for six years following the closing (the “D&O Policy”), which the Company shall take all commercially reasonable actions (other than paying additional premiums) to maintain in effect.

Following the closing, the Company will also take all necessary actions to elect an individual designated by the NetSapiens and acceptable to the Company (which approval shall not be unreasonably withheld) (or any successor thereto as designated by the Stockholder Representative, the “NetSapiens Board Designee”) to the Company’s Board. In addition, the Company and its majority stockholder will execute a voting agreement regarding the election of the NetSapiens Board Designee.

Conditions to the Completion of the Mergers

The completion of the Mergers is subject to the satisfaction or waiver of certain conditions, including:

●

the adoption of the Merger Agreement by the affirmative vote of the holders of a majority of all outstanding shares of NetSapiens entitled to vote thereon;

●

the approval of the issuance of the Shares and the other Parent Proposals by the affirmative vote of the holders of a majority of all outstanding shares of the Company entitled to vote thereon; and

●

the absence of governmental restraints or prohibitions preventing the consummation of the Mergers.

The obligation of each of the Company and NetSapiens to consummate the Mergers is also conditioned on, among other things,

●

the truth and correctness of the representations and warranties made by the other party as of the closing date (subject to certain “materiality” and “material adverse effect” qualifiers);

●

the performance of the covenants required by the Merger Agreement in all material respects; and

●

there being no material adverse effect with respect to the Company or NetSapiens.

In addition, the obligation of NetSapiens to consummate the Mergers is conditioned on it reasonably and in good faith determining that the Transactions qualify as a tax-free reorganization pursuant to Section 368(a)(1) of the Code.

On or prior to the closing, NetSapiens shall deliver or cause to deliver to the Company such deliverables including, among other things, (a) joinder agreements executed by (i) the holders of no less than 90% of the shares of NetSapiens’ common stock held by all Contributing Equityholders (as defined in the Merger Agreement) and (ii) all Contributing Equityholders except no more than five Contributing Equityholders; (b) employment agreements in substantially the Company’s standard form executed by Anand Buch, James Murphy and David Wang (the “Key Employee Agreements”); (c) resignation letters of all current directors and officers of NetSapiens; and (d) the D&O Policy. On or prior to the closing, the Company shall deliver or cause to deliver to NetSapiens such deliverables including, among other things, (x) a representation and warranty insurance policy to the Company for the benefit of the Company with a policy limit up to $5 million (the “R&W Insurance Policy”); and (y) a voting agreement executed by the Company and its majority stockholder regarding the election of the NetSapiens Board Designee.

13

Termination of the Merger Agreement

The Merger Agreement contains certain termination rights for each of the Company and NetSapiens, including in the event that:

●

the Mergers are not consummated on or before 120 days after the signing date, provided that this right to terminate shall not be available to the party whose breach of representation, warranty or covenant resulted in the failure of the Mergers to be consummated on or before the End Date;

●

the NetSapiens Stockholder Approval is not received pursuant to its due stockholder voting process;

●

the Parent Stockholder Approval is not obtained at the Annual Meeting or at any adjournment or postponement thereof; or

●

if any law or governmental order having the effect of preventing the consummation of the Transactions shall have become final and nonappealable, provided that this right to termination shall not be available to the party whose breach of representation, warranty or covenant resulted in the issuance of such law or governmental order.

Either of the Company or NetSapiens may also terminate the Merger Agreement if the other party has materially breached any representation, warranty or covenant causing certain closing conditions to not be satisfied, subject to a 20-day cure period, provided, that, the terminating party is not in any material breach of its representation, warranty or covenant.

From and after the date of the Merger Agreement until six business days prior to the closing, each of the Company and NetSapiens may supplement or amend its disclosures made applicable to its representations with respect to matters arising after the date of the Merger Agreement. The party receiving such updates may request for an indemnity to the extent that the aggregate estimated losses resulting from such updates exceeds $100,000 and may elect to terminate the Merger Agreement if the parties cannot reach agreement on such indemnity.

The Merger Agreement further provides that subject to certain limitations, if either the Company or NetSapiens fails to obtain its stockholder approval of the Transactions prior to the End Date, then it will need to pay the other party the out-of-pocket expenses incurred by the other party to effect the Mergers since entering into the non-binding letter of intent dated October 22, 2020 regarding the Mergers; provided, that, if NetSapiens fails to obtain its stockholder approval as a result of its board of directors changing its recommendation in favor of the Transactions or causing NetSapiens to enter into an alternative transaction with respect to a Superior Proposal (as defined in the Merger Agreement), NetSapiens will be required to pay the Expenses as well as grant a two-year license to use NetSapiens’ technologies to the Company, as specified in the Merger Agreement.

Indemnification of the Parties

The Merger Agreement provides for mutual indemnification for breaches of representations and covenants, subject to certain deductible and cap limitations, and for establishing certain indemnification related escrow accounts at the closing to secure NetSapiens’ indemnification obligations to the Company. Except in the case of indemnification claims for breaches of the Fundamental Representations (as defined in the Merger Agreement), the Company needs to seek recovery with respect to any indemnification claims for breaches of representations of NetSapiens in the following order: (i) first, against a $250,000 deductible; (ii) second, against any funds then held in the indemnity escrow fund to which the parties shall deposit 40,388 Merger Shares at the closing; and (iii) then, under the R&W Insurance Policy.

Amendments

At any time prior to the effective time of the Mergers, the Merger Agreement may be amended by written agreement signed by each of the parties thereto, provided, however, that: (a) following the receipt of the NetSapiens Stockholder Approval, there shall be no amendment which by law would require further approval by the holders of NetSapiens’ common stock without such approval and (b) following the receipt of the Parent Stockholder Approval, there shall be no amendment which by law would require further approval by the holders of Common Stock without such approval.

14

Voting and Support Agreements

Concurrent with the execution of the Merger Agreement, the Company and certain principal stockholders of NetSapiens entered into a voting and support agreement, pursuant to which such stockholders agreed to, among other things, (i) vote the shares of common stock of NetSapiens beneficially owned by them in favor of the adoption of the Merger Agreement and the Transactions, and (ii) against any action, proposals, transaction or agreement that would result in a breach of any representation, warrant, covenant, obligation or agreement of NetSapiens contained in the Merger Agreement, provided, that the agreement shall not limit the stockholders’ actions in their capacity as a director or officer of NetSapiens.

Concurrent with the execution of the Merger Agreement, NetSapiens and the majority stockholder of the Company also entered into a voting and support agreement, pursuant to which the stockholder agreed to, among other things, (i) vote the shares of common stock of the Company beneficially owned by him in favor of the adoption of the Parent Proposals, and (ii) against any action, proposals, transaction or agreement that would result in a breach of any representation, warrant, covenant, obligation or agreement of the Company contained in the Merger Agreement, provided, that the agreement shall not limit the stockholder’s actions in his capacity as a director or officer of the Company.

Each Voting and Support Agreement will terminate upon the earlier to occur of, (x) the mutual written consent of the parties therein, (y) the closing of the Mergers, and (z) the date of termination of the Merger Agreement.

Total Common Stock Outstanding after the Merger

Immediately following the Mergers, NetSapiens’ equityholders will own approximately 14.5% of the issued and outstanding shares of common stock of the Company and the Company’s pre-Mergers stockholders will own approximately 85.5% of the issued and outstanding Common Stock.

Upon completion of the Mergers, we will no longer be a “controlled company” within the meaning of the NASDAQ Listing Rules.

Regulatory Requirements or Approvals for the Mergers

Neither the Company nor NetSapiens is required to make any filings or to obtain approvals or clearances from any antitrust regulatory authorities in the United States or other countries to consummate the Mergers. The Company must comply with applicable federal and state securities laws and the NASDAQ Listing Rules in connection with the issuance of shares of common stock in the Mergers, including the filing with the SEC of this Proxy Statement.

Material Agreements or Relationships

Other than the Merger Agreement, the Voting and Support Agreements and the Key Employee Agreements, which are discussed elsewhere in this Proxy Statement, there is no present or proposed material agreement, arrangement, understanding or relationship between the Company or any of its executive officers, directors, controlling persons or subsidiaries and NetSapiens or any of its executive officers, directors, controlling persons or subsidiaries. Please see the section titled “Reasons for Entering into the Merger Agreement and Background of the Mergers” for information relating to the negotiations between the Company and NetSapiens leading up to the proposed Mergers.

Federal Securities Law Consequences; Resale Restrictions

The issuance of Common Stock in the Mergers to NetSapiens’ equityholders will be effected by means of a private placement, that is exempt from registration under the Securities Act in reliance on Section 4(a)(2) of the Securities Act and Rule 506 of Regulation D promulgated thereunder and such shares will be “restricted securities.” The shares of Common Stock issued in connection with the Mergers will not be registered under the Securities Act upon issuance and will not be freely transferable. Holders of such shares may not sell their respective shares unless the shares are registered under the Securities Act or an exemption is available under the Securities Act.

15

Material U.S. Federal Income Tax Considerations of the Mergers

The following discussion summarizes certain material U.S. federal income tax considerations of the Mergers. This summary is based upon current provisions of the Code, existing Treasury Regulations under the Code and current administrative rulings and court decisions, all of which are subject to change or different interpretation. Any change, which may or may not be retroactive, could alter the tax consequences to us or our stockholders as described in this summary. No ruling from the U.S. Internal Revenue Service, or the IRS, has been or will be requested in connection with the Mergers and there can be no assurance that the IRS will not challenge the statements and conclusions set forth below or a court would not sustain any such challenge. No attempt has been made to comment on all U.S. federal income tax consequences of the Mergers that may be relevant to particular U.S. holders. In addition, the following discussion does not address state, local or foreign tax consequences of the Mergers, the Medicare tax on net investment income, U.S. federal estate and gift tax, the alternative minimum tax, the rules regarding qualified small business stock within the meaning of Section 1202 of the Code, or any other aspect of any U.S. federal tax other than the income tax.

Crexendo and NetSapiens intend for the Mergers to qualify as a reorganization within the meaning of Section 368(a) of the Code and the Merger Agreement to constitute a “plan of reorganization” within the meaning of Treasury Regulations Sections 1.368-2(g) and 1.368-3. The parties thereto shall report for all tax, financial and accounting purposes the Transactions as a reorganization under Section 368(a) of the Code, unless otherwise required by applicable law. Because of the form of the Mergers, U.S. holders of our Common Stock, as of immediately prior to the Mergers, did not sell, exchange or dispose of any shares of Common Stock as a result of the Mergers. Thus, there will be no material U.S. federal income tax consequences to our stockholders, as of immediately prior to the Mergers, as a result of the Mergers.

HOLDERS OF OUR COMMON STOCK ARE ADVISED AND EXPECTED TO CONSULT THEIR OWN TAX ADVISORS REGARDING THE U.S. FEDERAL INCOME TAX CONSEQUENCES OF THE MERGERS IN LIGHT OF THEIR PERSONAL CIRCUMSTANCES AND THE CONSEQUENCES OF THE MERGERS UNDER STATE, LOCAL AND FOREIGN TAX LAWS.

REASONS FOR ENTERING INTO THE MERGER AGREEMENT AND

BACKGROUND OF THE MERGERS

Reasons for Entering into the Merger Agreement

The Merger Agreement was unanimously approved by our Board at a meeting held on March 5, 2021. Before reaching its decision, the Board:

●

reviewed our business and liquidity situation and growth plans;

●

engaged in extensive meetings and calls with our management and representatives regarding NetSapiens’ business, product and financial prospects, among other typical due diligence matters;

●

reviewed due diligence reports regarding legal, financial and accounting matters and certain tax matters related to the Mergers and NetSapiens;

●

reviewed strategic alternatives, including the possibility of remaining independent, combinations with other partners, and the business and financial prospects of other potential merger or acquisition targets;

●

the terms and conditions of the Merger Agreement, including the form and amount of the merger consideration and the representations, warranties, covenants, conditions to closing and termination rights contained in the Merger Agreement;

●

the relative ownership interests of the NetSapiens stockholders and the Company stockholders in the combined company immediately following the Mergers; and

●

its assessment of the likelihood that the Mergers would be completed in a timely manner and that management would be able to successfully operate the NetSapiens business after the completion of the Transactions.

16

After reviewing and considering the above-described factors, our Board decided to enter into the Merger Agreement based on its belief that the combination of Crexendo and NetSapiens will:

●

increase scale, enhance the Company’s technology infrastructure and offering, and expand the Company’s customers and geographic footprint;

●

expand the Company’s management, technical and marketing resources;

●

better address our customers’ needs, specifically as relates to the complementary nature of our cloud telecommunications services and NetSapiens’ strength in research and development and innovation in communications platform solutions;

●

strengthen the position of both Crexendo and NetSapiens in seeking growth opportunities in an increasingly competitive global marketplace;

●

increase our international exposure and opportunity; and

●

increase the Company’s stockholder value through enhanced revenue opportunities and cost saving strategies.

In the course of its deliberations, our Board also considered a variety of risks and other countervailing factors related to entering into the Merger Agreement, including:

●

the substantial expenses to be incurred in connection with the Mergers;

●

the possible volatility, at least in the short term, of the trading price of our Common Stock resulting from the announcement of the Mergers;

●

the likelihood of disruptive stockholder litigation following announcement of the Mergers; and

●

various other risks associated with the combined business and the Mergers, including those described in the section entitled “Risk Factors” beginning on page 20 of this Proxy Statement.

The foregoing information and factors considered by our Board are not intended to be exhaustive but are believed to include all of the material factors considered by our Board. In view of the wide variety of reasons considered in connection with its evaluation of the Mergers and the complexity of these matters, our Board did not find it useful to attempt, and did not attempt, to quantify, rank or otherwise assign relative weights to these reasons. In considering the reasons described above, individual members of our Board may have given different weight to different reasons. Our Board conducted an overall analysis of the factors described above, including thorough discussions with, and questioning of, our management team, our legal and financial advisors, and considered the reasons overall to be favorable to, and to support, its determination.

Background of the Mergers

Doug Gaylor, our Chief Operating Officer, initially met Anand Buch, NetSapiens’ Chief Executive Officer, at a Cloud Communications Alliance (“CCA”) event in September 2019. Mr. Buch discussed the NetSapiens platform and technology that NetSapiens licensed. Those discussions did not lead to any substantive follow up discussions.

In February 2020, Mr. Gaylor and Mr. Buch met again at a CCA event, where Mr. Gaylor followed up with technology discussion regarding Crexendo potentially obtaining a license for certain technology including the then upcoming NetSapiens interactive video meeting software.

17

Through licensing discussions, Crexendo became aware that NetSapiens was interested in a potential merger or sale. Crexendo was impressed with the NetSapiens technology and its well established and growing partners (customer base).

Our Board has regularly reviewed our results of operations and competitive position, as well as our strategic respective alternatives. From time to time, our Board has evaluated potential strategic transactions, including business combinations, such as the Mergers with NetSapiens, that could potentially benefit us.

Crexendo was contacted by a selling broker for NetSapiens in April of 2020. There were some early discussions about potential fit and it was subsequently suggested that the parties enter into a Non-Disclosure Agreement to allow discussions of a potential transaction allowing the parties to provide more detailed information. On April 30, 2020, the parties agreed to terms on a Non-Disclosure Agreement.

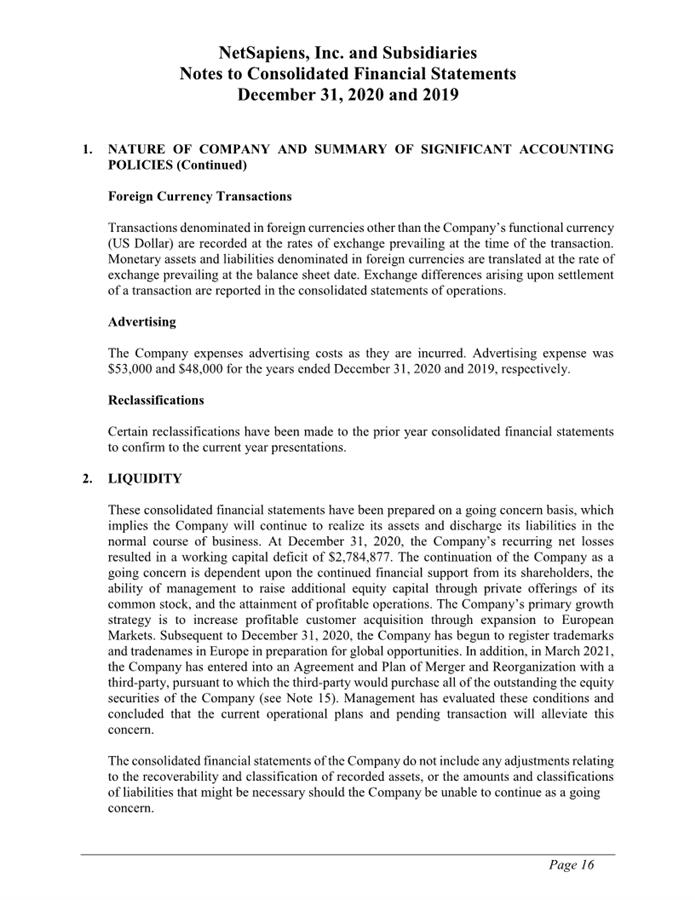

The parties engaged in conversations no less than weekly. Executive and engineering teams had regular meetings. NetSapiens provided detailed financial and other information Crexendo deemed relevant. After significant review, regular meetings and a determination that a merger on mutually agreeable terms would be in the best interest of the Crexendo and NetSapiens stockholders, the parties negotiated and entered into a non-binding letter of intent on October 22, 2020.

With the signing of the letter of intent Crexendo provided a detailed due diligence list to NetSapiens which established a “data room” to share the requested information. Crexendo also provided information to NetSapiens that NetSapiens deemed relevant for its review. After thorough review of the diligence documents by both parties it was mutually determined that the parties should negotiate and draft a binding acquisition agreement allowing for a merger whereby Crexendo would acquire all of the outstanding stock of the NetSapiens stockholders.

The parties negotiated for over three months on a definitive agreement.

On March 4, 2021, the board of directors of NetSapiens unanimously approved the Merger Agreement through a written consent.

On March 5, 2021, the Crexendo Board unanimously approved the Merger Agreement at a meeting. Prior to the meeting, the Company’s financial advisor, Colliers Securities LLC (“Colliers”), provided its valuation analysis regarding NetSapiens to the Board for its consideration.

On March 8, 2021, the Company, the Merger Subs, NetSapiens and its Stockholder Representative executed the Merger Agreement, following which the Company issued a press release, announcing the Transactions, and filed applicable disclosure documents with the SEC.

Colliers Valuation Analysis

On March 4, 2021, Colliers delivered a valuation analysis regarding NetSapiens to the management and Board of the Company. In conducting the valuation analysis, Colliers reviewed:

●

A draft of the Merger Agreement.

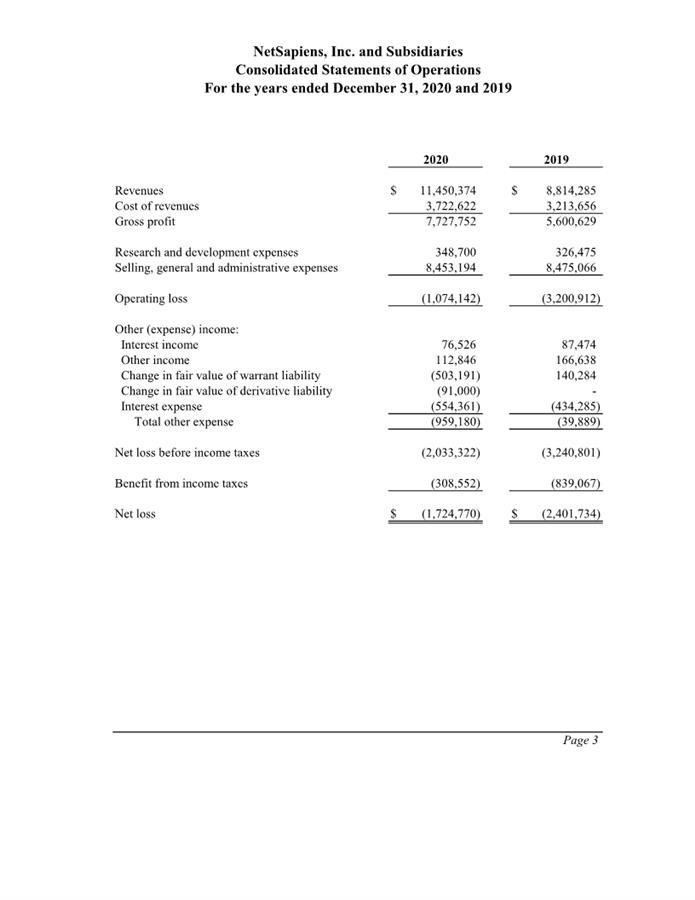

●

Audited financial results for NetSapiens for the fiscal year ended December 31, 2019 and preliminary unaudited results for the fiscal year ended December 31, 2020.

●

Forecasts prepared by NetSapiens management for the fiscal years ended December 31, 2021 – 2023.

●

NetSapiens Internet website.

●

Organization documents for the various entities as filed with the Secretary of State.

●

Various other company documents found in the virtual data room.

●

Notes from phone calls with the parties to discuss background, financial results, financial position, strategy and plan.

●

The outlook for the economy and Unified Communications as a Service industry.

●

Guideline public companies and guideline transactions.

●

Various other internally prepared management reports and other information as needed to perform its analysis.

18

The valuation analysis presented included several different methodologies, each of which derived a range of implied enterprise values for NetSapiens as reflected by either a multiple to earnings before interest, taxes, depreciation and amortization for a 12-month period (“EBITDA”) or, a multiple to revenue for a 12-month period.

●

The first analysis presented was a “comparable companies analysis” which attempted to provide an implied enterprise value of a company by comparing it to similar publicly traded companies. Colliers reviewed the financial data for 15 peer publicly traded companies and examined enterprise value as a multiple of revenue and EBITDA for the fiscal year 2020 and 2021 (projected) using median values derived from the data of the guideline public companies incorporating a liquidity discount and acquisition control premium. Its valuation results based on a comparison to the guideline public companies provided a range of implied values for the equity of NetSapiens of between $57.4 million and $82.3 million.

●

The second analysis presented was a “comparable transactions analysis” which generates an implied enterprise value of a company based on publicly available financial terms of selected comparable change of control transactions involving companies that share certain characteristics with the company being valued. Colliers reviewed 35 transactions which occurred during the past five years and applied revenue and EBITDA valuation metrics derived from data regarding these transactions to NetSapiens’ 2020 revenue and EBITDA. Its valuation results based on a comparison to the guideline transactions provided a range of implied values for the equity of NetSapiens of between $39.7 million and $51.0 million.

●

The third analysis presented was a “discounted cash flow analysis.” The discounted cash flow analysis is used to calculate a range of theoretical values for a business by combining: (i) the net present value of implied future cash flows and (ii) a terminal value assuming a sale at either a multiple of revenue or EBITDA. Colliers used data from the guideline transactions to arrive at terminal values used in the discounted cash flow analysis and also based its analysis on financial forecasts provided by management. Its results based on the discounted cash flow analysis used with revenue and EBITDA multiples provided a range of implied values for the equity of NetSapiens of between $56.8 million and $75.3 million.

Overall, Colliers’ valuation of the equity of NetSapiens ranged from a low of $39.7 million to a high of $82.3 million. Based on equal weighting of the above described three valuation techniques, its overall analysis results in mean and median equity values of approximately $57.6 million and $61.5 million, respectively.

Colliers provided its valuation analysis for the sole benefit and use by the our Board in its consideration of the Mergers. The valuation analysis may not be used for any other purpose or reproduced, disseminated, quoted or referred to at any time, in any manner or for any purpose without Colliers’ prior written consent, except that Colliers has consented to the description of the valuation analysis being included in this Proxy Statement. The valuation analysis is not a recommendation to our Board or to any stockholder as to how to vote with respect to the proposed Mergers or to take any other action in connection with the Mergers or otherwise.

Qualifications of Colliers Securities LLC