1. Nature of Organization and Basis of Presentation |

Nature of Organization |

Allegiant Networks, LLC (“Allegiant” or the “Company”) was incorporated on October 27, 2006. The Company is a value-added provider of an array of business applications to meet its clients’ information technology needs. The Company has a dedicated network service practice that provides managed services, cyber security, application hosting, disaster recovery, business continuity, cloud migration, and hardware and software products. The Company serves customers in the United States with concentrations in Kansas and Missouri. The Company is headquartered in Overland Park, Kansas. |

Basis of Presentation |

The accompanying financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America ("GAAP"). These accounting principles require management to make assumptions and estimates that affect the reported amounts and disclosures of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts and disclosures of revenues and expenses during the reporting period. The Company bases its estimates on historical experience and on various other assumptions that it believes are reasonable under the circumstances. However, due to the inherent uncertainties in making estimates, actual results could differ from those estimates. |

2. Summary of Significant Accounting Policies |

Cash and Cash Equivalents |

Cash equivalents represent short-term investments consisting of money market funds that are carried at cost, which approximates fair value. The Company considers all short-term investments with an original maturity of three months or less at the date of purchase to be cash equivalents. |

The Company’s cash and cash equivalents are held with high credit-quality financial institutions. Account balances are insured by the Federal Deposit Insurance Corporation (“FDIC”) up to certain limits. The Company’s cash accounts may exceed FDIC insured amounts, however, the Company has not experienced any losses in such accounts and believes it is not exposed to any significant credit risk on cash and cash equivalents. |

Allowance for Doubtful Accounts |

Trade accounts receivable are recorded at the invoiced amount and typically do not bear interest. The Company estimates an allowance for credit losses related to accounts receivable for future expected credit losses by using relevant information such as historical information, current conditions, and reasonable and supportable forecasts. The allowance for doubtful accounts as of June 30, 2022 and December 31, 2021 was $-0-. |

2. Summary of Significant Accounting Policies (cont.) |

Asset Impairments |

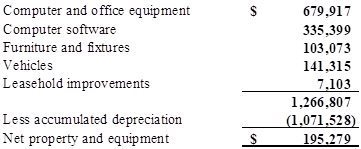

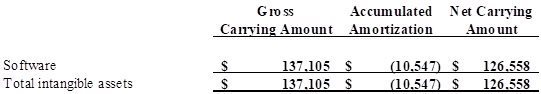

Significant judgment by management is required to determine estimates and assumptions used in the valuation of property and equipment and intangibles. The Company evaluates the recoverability of its long-lived assets whenever events or substantive changes in circumstances indicate that the carrying amount may not be recoverable. The evaluation is based on the undiscounted cash flows generated by the underlying asset groups, including estimated future operating results, trends or other determinants of fair value. If the total of the expected future undiscounted cash flows was determined to be less than the carrying amount of the asset group, the Company would recognize an impairment charge to the extent the carrying amount of the asset group exceeds its estimated fair value. The Company had no triggering events or impairment of its long-lived assets as on June 30, 2022 and December 31, 2021. |

Fair Value Measurements |

Fair value is defined under US GAAP as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. A fair value hierarchy has been established for valuation inputs to prioritize the inputs into three levels based on the extent to which inputs used in measuring fair value are observable in the market. Each fair value measurement is reported in one of the three levels which is determined by the lowest level input that is significant to the fair value measurement in its entirety. These levels are: |

Level 1 - observable inputs such as quoted prices for identical instruments traded in active markets. |

Level 2 - inputs are based on quoted prices for similar instruments in active markets, quoted prices for identical or similar instruments in markets that are not active and model-based valuation techniques for which all significant assumptions are observable in the market or can be corroborated by observable market data for substantially the full term of the assets or liabilities. |

Level 3 - inputs are generally unobservable and typically reflect management’s estimates of assumptions that market participants would use in pricing the asset or liability. The fair values are therefore determined using model-based techniques that include option pricing models, discounted cash flow models and similar techniques. |

Revenue Recognition |

The Company adopted the requirements of Accounting Standard Update 2014-09, Revenue from Contracts with Customers: Topic 606 (“ASC 606”), using the modified retrospective method. |

2. Summary of Significant Accounting Policies (cont.) |

The Company derives revenue primarily from subscription services from its offerings and related installation services. The Company recognizes revenue from the subscription of its cloud service offerings upon: The Company determines revenue recognition through the following steps: |

| · | identification of the contract, or contracts with a customer; |

| | |

| · | identification of the performance obligations in the contract; |

| | |

| · | determination of the transaction price; |

| | |

| · | allocation of the transaction price to the performance obligations in the contract; and |

| | |

| · | recognition of revenue, when, or as, the Company satisfies a performance obligation. |

Revenue is measured based on a consideration specified in a contract with a customer. The Company recognizes revenue when it satisfies a performance obligation by transferring control over a product, service, or software solution to a customer. Taxes assessed by a governmental authority that are both imposed on and concurrent with a specific revenue-producing transaction, that are collected by the Company from a customer, are excluded from revenue. Determining whether products and services are considered distinct performance obligations that should be accounted for separately versus together may require significant judgment. Judgment is also required to determine the timing of the recognition, as well as the standalone selling price for each distinct performance obligation. In instances where the standalone selling price is not directly observable, the Company determines such standalone selling price using information that may include market conditions and other observable inputs. Changes in the allocation of the sales price between delivered and undelivered elements can impact the timing of revenue recognized but does not change the total revenue recognized on any agreement. The consideration (including any discounts) is allocated between separate products and services in a bundle based on their relative stand-alone selling prices. Professional services revenue includes project coordination fees. The Company generally allocates a portion of the project coordination fees to the equipment, which in certain circumstances, is recognized at the time of the installation or customer acceptance, and a portion to the service, which is recognized over the contract term using the straight-line method. The project coordination fees were not material for the six months ended June 30, 2022 and 2021. The Company’s standard contracts typically have a term of thirty-six months or less. |

Revenue Recognition for Hardware |

Revenues from sales of hardware products are recognized on a gross basis as the Company is acting as a principal in these transactions, with the selling price to the customer recorded as product sales and the acquisition cost of the product recorded as cost of sales. The Company recognizes revenue from these transactions when control has passed to the customer. |

2. Summary of Significant Accounting Policies (cont.) |

Revenue Recognition for Telephone Subscriptions |

Revenue from telephony subscriptions are recognized as a single performance obligation on a gross basis as the Company is acting as a principal in these transactions. Revenue is recognized ratably over the contractual subscription term, beginning on the date that the platform is delivered to the customer. Telephony subscriptions are sold on a monthly basis for stated terms. Usage in excess of stated terms is billed in arrears. |

In most contracts, the Company is responsible for fulfilling the promised services to the customer and providing remedy or refund for work if the customer is not satisfied with the delivered services, has inventory risk in the arrangement and has full control to set the price for the customer. |

Revenue Recognition for Software |

Revenues from software license sales are recognized as a single performance obligation on a gross basis as the Company is acting as a principal in these transactions at the point the software license is delivered to the customer. Generally, software licenses are sold on a monthly subscription basis, which allows customers to upgrade, at no additional cost, to the latest versions during the period that the software assurance is in effect with the assistance of the Company’s professionals. As a result, the Company recognizes revenue ratably over the contract term. In other cases, the Company will sell software licenses without ongoing support or future obligations and recognize revenue at the time of delivery. |

The Company sells cloud computing solutions which include Software as a Service (“SaaS”). SaaS solutions to offer the Company’s customers access to software in the cloud that enhances office productivity, provides security or assists in collaboration. The Company recognizes revenue for cloud computing solutions for arrangements with monthly invoicing to the customer at the time of invoice on a gross basis as the Company is acting as a principal in the transaction. |

The Company does not customize its software nor are installation services required to be performed specifically by the Company, as the customer has a right to utilize internal resources or a third-party service company. In most contracts, the Company is responsible for fulfilling the promised services to the customer and providing remedy or refund for work if the customer is not satisfied with the delivered services, has inventory risk in the arrangement and has full control to set the price for the customer. |

2. Summary of Significant Accounting Policies (cont.) |

Revenue Recognition for Services |

The Company provides professional services, which include project managers and consultants recommending, designing and implementing IT solutions, installation and providing project support. Revenue from professional services is recognized on a gross basis each month as work is performed and the Company transfers those services. |

Revenues from the sale of data center services, such as managed and remote managed services, server co-location, cabling, internet connectivity and data backup and storage provided by the Company, are recognized over the period the service is provided. Most hosting and managed service obligations are based on the quantity and pricing parameters established in the agreement. As the customer receives the benefit of the service each month, the Company recognizes the respective revenue on a gross basis as the Company is acting as a principal in the transaction. |

The Company sells solutions which include Infrastructure as a Service (“IaaS”) and Device as a Service (“DaaS”). IaaS solutions utilize a cloud-based solution, including storage, computing, networking, monitoring and support performed by the Company. The Company recognizes revenue on a gross basis for cloud computing solutions for arrangements with monthly invoicing to the customer over the contract term. DaaS products provide customers with the option to utilize a vendor’s device for a monthly fee. The vendor coordinates the delivery, return and pricing. For such monthly fees, the Company is acting as an agent in the transaction and recognizes revenue as it invoices the customer on a net basis. |

Warranty and Support |

The Company’s vendor partners warrant most of the products the Company sells. These manufacturer warranties are assurance-type warranties and are not considered separate performance obligations. The warranties are not sold separately and only provide assurance that products will conform with the manufacturer’s specifications. In some transactions, a third party will provide the customer with an extended warranty. These extended warranties are sold separately and provide the customer with a service in addition to assurance that the product will function as expected including updates and patches. The Company considers these warranties to be separate performance obligations from the underlying product. For extended warranties, the Company is arranging for those services to be provided by the third party and therefore is acting as an agent in the transaction and records revenue on a net basis at the time of sale. |

2. Summary of Significant Accounting Policies (cont.) |

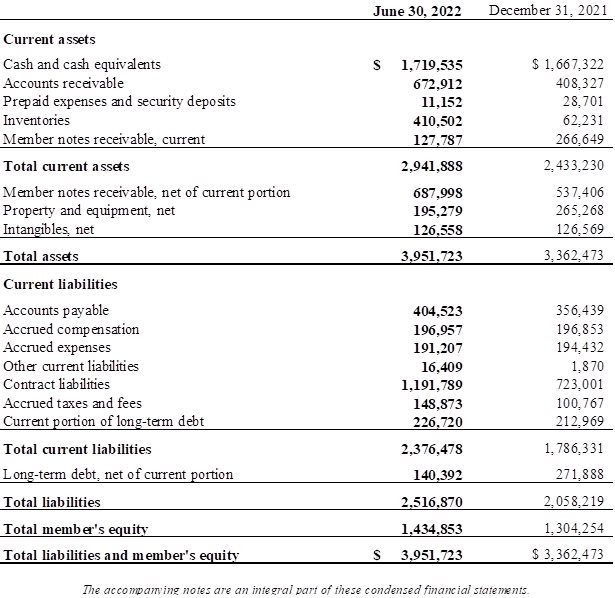

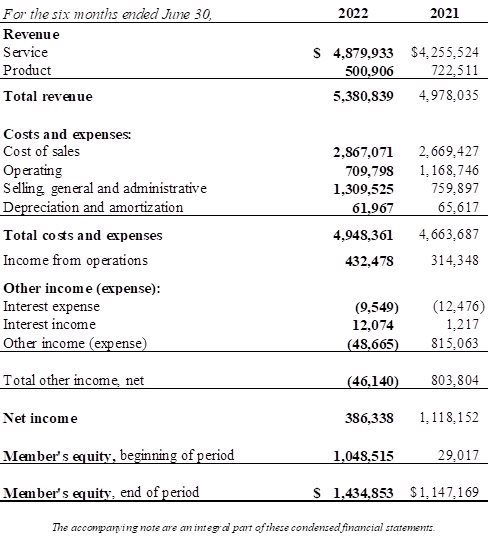

The total revenue recognized over time and at a point in time was $4,879,933 and $500,906 as of June 30, 2022, respectively. As of June 30, 2022, the ending balance of accounts receivable and deferred revenue (contract liability) were $672,912 and $1,191,789, respectively. |

The total revenue recognized over time and at a point in time was $4,255,524 and $722,511 as of June 30, 2021, respectively. As of December 31, 2021, the ending balance of accounts receivable and deferred revenue (contract liability) were $715,791 and $594,197, respectively. |

Shipping and Handling |

The Company records freight billed to its customers as sales and the related freight costs as cost of sales when the underlying product revenue is recognized. For freight not billed to its customers, the Company records the freight costs as cost of sales. The Company’s typical shipping terms result in shipping being performed before the customer obtains control of the product. The Company considers shipping to be a fulfillment activity and not a separate performance obligation. |

Costs and Expenses |

The Company’s expenses consist of operating, selling, general and administrative expenses, depreciation and amortization expense and interest expense. |

Costs to Obtain or Fulfill a Contract |

Topic 606 requires that incremental costs of obtaining a contract are recognized as an asset and amortized to expense in a pattern that matches the timing of the revenue recognition of the related contract. The Company has determined the only significant incremental costs incurred to obtain contracts with customers within the scope of Topic 606 are certain sales commissions paid to associates. In addition, the Company elected the practical expedient to recognize the incremental costs of obtaining a contract when incurred for contracts where the amortization period for the asset the Company would otherwise have recognized is one year or less. The Company pays direct sales representatives their commissions at contract inception and installation. In addition, direct sales representatives will receive additional commissions at a contract renewal. The Company pays monthly indirect commissions and are generally paid based upon previous invoicing and customer collected payments for the specific month. |

Sales Tax |

Sales tax amounts collected from customers for remittance to governmental authorities are presented on a net basis in the Statement of Operations. |

2. Summary of Significant Accounting Policies (cont.) |

Advertising |

Advertising costs are generally charged to expense in the period incurred and are recorded in selling, general and administrative expenses in the Statement of Operations. During the six months ended June 30, 2022 and 2021, the Company had advertising costs of $-0-. |

Contract Liabilities |

Primarily consist of advance payment on annual contracts and coordination fees without standalone value. The coordination fees are recognized ratably over the contract term. |

Concentrations of Credit Risk |

Financial instruments that potentially subject the Company to concentrations of credit risk consist principally of cash and cash equivalents and accounts receivable. As discussed above, the Company maintains its cash and cash equivalents with a large established financial institution. The Company monitors the balances of individual accounts and establishes an allowance for doubtful accounts when and if necessary. Through the six months ended June 30, 2022, the Company has not experienced significant losses. |

Revenues from individual customers greater than 10% of the revenue for the six months ended June 30, 2022 and 2021, were as follows: |

The Company had no customers in excess of 10% of revenues for the six months ended June 30, 2022 and 2021. |

The Company had two customers with individual balances greater than 10% of accounts receivable as of June 30, 2022. The aggregate of these two customers represented 44% of the total accounts receivable as of June 30, 2022. The Company had two customers with individual balances greater than 10% of accounts receivable at December 31, 2021. The aggregate of these two customers represented 44% of the total accounts receivable as of December 31, 2021. |

Taxes |

The Company has elected to be treated as an S-Corporation for both Federal and state income tax purposes. The effect of this election is the elimination of income taxes at the corporate level and the inclusion of the Company's income or loss in the individual tax returns of the member. Therefore, no provision for Federal or state income taxes is included in the accompanying financial statements. For income tax purposes, the Company uses the accrual basis of accounting. |

2. Summary of Significant Accounting Policies (cont.) |

ASC 740-10, Accounting for Uncertainty in Income Taxes clarifies the accounting for uncertainty in income taxes recognized in an entity’s financial statements. This Interpretation prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. In addition, ASC 740-10 provides guidance on derecognition, classification, interest and penalties, accounting in interim periods, disclosure, and transition. For the Company, tax positions taken include the Company’s status as an S-Corporation and the approval and qualification for this status. Management has reviewed the current status of the Company’s election as an S-Corporation and has concluded that the Company has no liability or required disclosure relating to this tax position. Corporate tax years ended December 31, 2018 and prior are no longer subject to tax authority audit. |

New Accounting Standards |

In February 2016, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2016-02, Leases, which requires a lessee to recognize in its statement of financial position an asset and liability for most leases with a term greater than 12 months. Lessees should recognize a liability to make lease payments and a right-of-use asset representing the lessee’s right to use the underlying asset for the lease term. ASU 2016-02 was delayed and is now effective for interim periods beginning within fiscal years after December 15, 2022 for privately held companies. The Company is currently evaluating the impact the adoption of this standard will have on its financial statements. |

3. Member Notes Receivable |

On October 1, 2016, the Company entered into a loan agreement with its sole member with an original aggregate principal balances of $207,077. The note receivable bears interest at 2.9% per annum through October 1, 2036. As of June 30, 2022 and December 31, 2021, the principal balance outstanding was $174,567, respectively. |

On December 31, 2020, the Company entered into a second shareholder loan agreement with its sole member with an original aggregate principal balance of $603,817. The note receivable bears interest at 2.9% through January 1, 2026. As of June 30, 2022 and December 31, 2021, the principal balance outstanding was $603,817, respectively. |

Included in the balance was unpaid interest of $37,400 and $25,671 as of June 30, 2022 and December 31, 2021, respectively. In September of 2022, the sole member repaid these loans in full. |

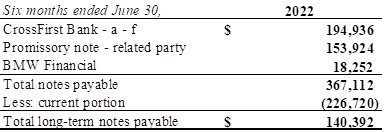

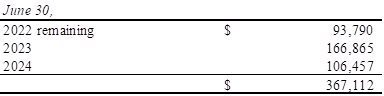

7. Long-Term Debt and Finance Leases |

The Company has the following loans from CrossFirst Bank: |

a. Loan date of March 3, 2018 with Principal of $50,000, annual interest rate of 5.5% and a maturity date of March 5, 2023. The balance of the loan as of June 30, 2022 and December 31, 2021 was $9,227 and $15,169, respectively. |

b. Loan date of March 14, 2018 with Principal of $75,000, annual interest rate of 5.5% and a maturity date of March 14, 2023. The balance of the loan as of June 30, 2022 and December 31, 2021 was $13,838 and $22,751, respectively. |

c. Loan date of April 24, 2019 with Principal of $26,500, annual interest rate of 6% and a maturity date of April 24, 2022. The balance of the loan as of June 30, 2022 and December 31, 2021 was $0 and $3,178, respectively. |

d. Loan date of July 1, 2019 with Principal of $142,180, annual interest rate of 6% and a maturity date of July 1, 2023. The balance of the loan as of June 30, 2022 and December 31, 2021 was $0 and $20,329, respectively. |

e. Loan date of October 30, 2020 with Principal of $125,000, annual interest rate of 4.25% and a maturity date of October 30, 2023. The balance of the loan as of June 30, 2022 and December 31, 2021 was $57,554 and $78,304, respectively. |

f. Loan date of September 9, 2021 with Principal of $150,000, annual interest rate of 4.5% and a maturity date of September 9, 2024. The balance of the loan as of June 30, 2022 and December 31, 2021 was $114,317 and $138,195, respectively. |

The above loans with CrossFirst bank are secured against all business assets of the Company and repaid in full in September 2022. |

On December 31, 2019, the Company entered into a promissory note agreement with a former owner and current employee with a principal of $300,000, an interest rate of 4.5% per annum and a maturity date of December 1, 2024. The balance on the note as on June 30, 2022 and December 31, 2021 was $153,924 and $183,522, respectively, and is considered a related party. The sole member contributed the remaining unpaid amount to the Company and the Company repaid this note in full subsequent to June 30, 2022. |

The Company finances a vehicle with BMW Financial that was purchased on March 20, 2019 with a principal of $53,000, Interest rate of 4.89% per annum and a maturity date of April 4, 2025. The balance on the loan as on June 30, 2022 and December 31, 2021 was $18,252 and $23,350, respectively. This loan is secured against the Company’s vehicle and repaid in full in September 2022. |

Litigation |

From time to time the Company is party to various claims and lawsuits that arise in the ordinary course of business. While it is not possible to predict with certainty the outcome of the claims or lawsuits, it is the opinion of management that the ultimate outcome of all actions would not have a material effect on the Company’s financial position. |

10. Paycheck Protection Program Loans |

On April 7, 2020, the Company received the funding of a loan from CrossFirst Bank in the aggregate amount of $592,600 pursuant to the Paycheck Protection Program (the “PPP”) under the Federal Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”), which was enacted March 27, 2020. The PPP is administered by the U.S. Small Business Administration. The loan matures April 7, 2022, and bears interest at a rate of 1% per year, payable monthly commencing November 7, 2020. The note may be prepaid at any time prior to maturity with no prepayment penalties. Funds from the loan are to be used to maintain payroll, continue group health care benefits and pay for rent and utilities. Under the terms of the PPP, certain amounts of the loan may be forgiven if they are used for qualifying expenses as described in the CARES Act, including qualifying payroll costs, covered rent payments, and covered utilities. |

The Company applied for and was successful in obtaining a full forgiveness of the PPP loan and as such has recorded $592,600 as other income in 2021. |

10. Paycheck Protection Program Loans (cont.) |

On January 25, 2021, the Company received the funding of a second loan from CrossFirst Bank in the aggregate amount of $799,000 pursuant to the Paycheck Protection Program (the “PPP”) under the Federal Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”), which was enacted March 27, 2020. The PPP is administered by the U.S. Small Business Administration. The loan matures January 25, 2026, and bears interest at a rate of 1% per year, payable monthly commencing November 7, 2020. The note may be prepaid at any time prior to maturity with no prepayment penalties. Funds from the loan are to be used to maintain payroll, continue group health care benefits and pay for rent and utilities. Under the terms of the PPP, certain amounts of the loan may be forgiven if they are used for qualifying expenses as described in the CARES Act, including qualifying payroll costs, covered rent payments, and covered utilities. |

The Company applied for and was successful in obtaining a full forgiveness of the PPP loan and as such has recorded $799,000 as other income in 2021. |

11. Subsequent Events |

Management has evaluated events and transactions subsequent to the balance sheet date through the date of the independent auditor’s report (the day the financial statements were available to be issued) for potential recognition or disclosure in the financial statements. Management has not identified any item requiring recognition or disclosure, except for those included in Notes 3. |

On October 17, 2022, the Company entered into a definitive agreement to be acquired by Crexendo, Inc. and Subsidiaries. The acquisition was finalized on November 1, 2022 and the Company became a wholly owned subsidiary of Crexendo, Inc. and Subsidiaries. |