UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of January, 2015

Commission File Number

Novogen Limited

(Translation of registrant’s name into English)

16-20 Edgeworth David Ave, Hornsby, NSW 2077, Australia

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F þ Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark if the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes ¨ No þ

If “yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b)

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Novogen Limited(Registrant)

Lionel Mateo

Lionel Mateo

Company Secretary

Date 30 January 2015

NOVOGEN LIMITED

ACN 063 259 754

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION.

THE MATTERS RAISED IN THIS DOCUMENT WILL AFFECT YOUR SHAREHOLDING IN THE COMPANY. YOU ARE ADVISED TO READ THIS DOCUMENT IN ITS ENTIRETY BEFORE THE GENERAL MEETING REFERRED TO BELOW IS CONVENED.

IF YOU ARE IN ANY DOUBT ABOUT THE ACTION YOU SHOULD TAKE IN RESPONSE TO THIS DOCUMENT, PLEASE CONSULT YOUR STOCKBROKER, SOLICITOR, ACCOUNTANT OR OTHER PROFESSIONAL ADVISER.

NOTICE OF GENERAL MEETING,

EXPLANATORY STATEMENT

AND

PROXY FORM

THIS IS A NOTICE OF A GENERAL MEETING OF THE COMPANY TO BE HELD AT2.00 PM (SYDNEY TIME) ON WEDNESDAY 4 MARCH 2015 AT ROOM PINAROO 5, THE GRACE HOTEL, 77 YORK STREET SYDNEY, NEW SOUTH WALES.

A PROXY FORM FOR USE AT THIS MEETING IS INCLUDED WITH THIS DOCUMENT.

TO BE VALID, PROXY FORMS MUST BE COMPLETED AND RETURNED TO THE COMPANY BYNO LATER THAN 2.00 PM (SYDNEY TIME) ON MONDAY 2 MARCH 2015.

TABLE OF CONTENTS

2

PART A: ABOUT THESE DOCUMENTS

Shareholders in Novogen Limited ACN 063 259 754 (Company) are requested to consider and vote upon each of the Resolutions set out in the Notice.

You can vote by:

| • | | attending and voting at the Meeting; or |

| • | | appointing someone as your proxy to attend and vote at the Meeting on your behalf, by completing and returning the Proxy FormDIRECTLY to the Company or the Share Registry in the manner set out on the Proxy Form. The Company or its Share Registry must receive your duly completed Proxy Form by no later than 2.00 pm (Sydney time) on Monday 2 March 2015. |

A glossary of capitalised terms used throughout this Document (including the Proxy Form) is contained inPart E. Unless expressly provided otherwise in this Document, each capitalised term used in this Document has the meaning given inPart E.

Please read the whole of this Document carefully before determining how you wish to vote and then cast your vote accordingly, either in person or by proxy.

3

PART B: LETTER FROM THE CHAIR

30 January 2015

Dear Shareholder

I am pleased to invite you to attend the General Meeting of the Shareholders of Novogen Limited, which is scheduled to be held at Room Pinaroo 5, The Grace Hotel, 77 York Street Sydney, New South Wales on 2 March 2015 at 2.00 pm (Sydney time). Enclosed with this letter is the Notice of Meeting which details the items of business to be dealt with at the Meeting.

A General Meeting is an important event, usually called to deal with extraordinary events that occur outside of the Annual General Meeting.

I hope therefore that you will give this matter your attention.

I commend to you the 3 resolutions.

The first 2 resolutions relate to a recent capital raising that saw 46,900,800 ordinary shares issued to three US investment funds, raising the sum of $5.85M.

These funds have been earmarked to bring the Company’s first pipeline drug candidate, Cantrixil, through its Phase 1 clinical trial program, as well as providing general working capital for the next 12 months.

One of the terms of the transaction is that options (warrants) were issued on a 1:1 basis. These options carry an exercise price of 15 cents ($0.15) and an expiry date of 5 years.

In all, 48,776,825 Options are to be issued to the US Investors and the Placement Agent.

Resolution 1 seeks to refresh the 15% discretionary headroom available to directors of Australian public companies. This headroom was utilized in the recent offering and the Board now seeks to have it reinstated.

Resolution 2 seeks shareholder approval to issue the Options as per the funding agreement with the US Investors.

Resolution 3 concerns a proposed Employee Share Option Plan (ESOP). The value of your investment in Novogen is a direct consequence of the efforts of Novogen staff. The Board believes that it is a positive step to allow those staff to participate in the potential value of the science on which they are working. The Australian Government recently announced its intention to amend taxation laws to remove a significant barrier to the issuance of options under an ESOP. Accordingly, the Board wishes to reinstate the ESOP ahead of that pending Federal Government amendment.

RESOLUTIONS

The Board recommends that Shareholders voteFOR each of the Resolutions proposed in the Notice.

VOTING

If you plan to attend the Meeting, please bring a copy of the enclosed Proxy Form with you to facilitate registration.

If you are unable to join us, you are encouraged to appoint a proxy to attend and vote on your behalf. To be valid for the purposes of the Meeting, Proxy Forms must be completed and returned as instructed in Section 2 of Part C of the Notice of Meeting, by no later than 2.00 pm (Sydney time) on 2 March 2015. Full instructions for voting by proxy are detailed after the Glossary.

4

Your vote is important and we encourage you to either attend the Meeting in person or complete the Proxy Form accompanying this Document and return it to the Company or the Share Registry in accordance with the directions provided.

|

| Yours faithfully |

|

|

| Prof Graham Kelly |

| Executive Chairman |

5

PART C: NOTICE OF GENERAL MEETING

Novogen Limited

ACN 063 259 754

Section 1: Time and Place of Meeting

NOTICE is hereby given that a General Meeting of Novogen Limited ACN 063 259 754 (Company) will be held at the following time and location, and will conduct the business specified in Section 3 below:

| | |

| Date: | | 4 March 2015 |

| |

| Time: | | 2.00 pm (Sydney time) |

| |

| Location: | | Room Pinaroo 5, The Grace Hotel, 77 York Street Sydney, New South Wales |

Section 2: Directions Regarding Meeting

How to Vote

You may vote by attending the Meeting in person, by proxy or authorised representative.

Voting in Person

To vote in person, please attend the Meeting on the date, time and place set out above.

Voting by Proxy

To vote by proxy, please complete and sign the Proxy Form enclosed with this Document as soon as possible and either send, deliver, courier or mail the duly completed Proxy Form:

| | • | | directly to the Company, attention Company Secretary: |

| | • | | by mail to PO Box 2333, Hornsby Westfield NSW 1635 Australia; |

| | • | | by facsimile to + 61 02 9476 0388; or |

| | • | | by delivery to Suite 1.02, 16-20 Edgeworth David Ave, Hornsby NSW 2077 Australia; |

or

| | • | | by mail Computershare Investor Services Pty Limited, GPO Box 242, Melbourne VIC 3001 Australia; |

| | • | | 1800 783 447 (within Australia) or +61 3 9473 2555 (outside Australia); |

| | • | | delivery to Computershare Investor Services Pty Limited, Level 4, 60 Carrington Street, Sydney NSW 2000 Australia, or |

| | • | | online at www.investorvote.com.au or for Intermediary Online subscribers only (custodians)www.intermediaryonline.com |

so that it is received no later than 2.00 pm (Sydney time) on Monday 2 March 2015.

Complete details on how to vote by proxy are set out on the back of your Proxy Form.

6

Please read this Document carefully and in its entirety before determining how you wish to vote in relation to the Resolutions, and then cast your vote accordingly, either in person or by proxy or authorised representative.

If you do not understand any part of this Document, or are in any doubt as to the course of action you should follow in response to this Document, you should contact your stockbroker or financial or other professional adviser immediately.

Determination of Membership and Voting Entitlement for the Purpose of the Meeting

For the purpose of determining a person’s entitlement to vote at the Meeting and in accordance with regulation 7.11.37 of theCorporations Regulations 2001 (Cth), a person will be recognised as a Shareholder if that person is registered as a Shareholder at 7.00 pm (Sydney time) on Monday 2 March 2015.

Voting Exclusion Statements

In accordance with the Corporations Act and the Listing Rules, the following persons must not cast any votes on the relevant Resolution specified below, and the Company will disregard any votes cast on that Resolution by:

| • | | the person or class of persons excluded from voting; and |

| • | | an associate of that person or those persons. |

| | |

Resolution | | Excluded Voters |

| |

| 1 | | Any person who participated in the issues of Shares proposed to be subsequently approved under Listing Rule 7.4. |

| |

| 2 | | Any person who may participate in the proposed issue of Securities and any person who may obtain a benefit except a benefit solely in the capacity of a holder of ordinary securities, if Resolution 2 is passed. |

| |

| 3 | | Any person who may participate in the proposed issue of Securities and any person who may obtain a benefit except a benefit solely in the capacity of a holder of ordinary securities, if Resolution 3 is passed. |

However, the Company need not disregard a vote if it is cast by:

| (i) | a person as proxy for a person who is entitled to vote, in accordance with the directions on the Proxy Form; or |

| (ii) | the Chair as proxy for a person who is entitled to vote, in accordance with a direction on the Proxy Form to vote as the proxy decides. |

Proxies

A Shareholder entitled to attend and vote at the Meeting pursuant to the Constitution is entitled to appoint no more than two proxies. Where more than one proxy is appointed, each proxy may be appointed to represent a specific proportion of the member’s voting rights. A proxy need not be a Shareholder. Any instrument of proxy deposited or received by the Company in which the name of the appointee is not filled in shall be deemed to be given in the favour of the Chair.

The instrument appointing a proxy, as well as any power of attorney (or a certified copy thereof) under which a proxy is appointed, must be received by the Company or the Share Registry by no later than 2.00 pm (Sydney time) on Monday 2 March 2015, in accordance with the instructions provided on the back of the Proxy Form.

7

The instrument of appointment of a proxy must be executed by the appointor or its duly authorised representative. The Proxy Form which accompanies this Notice may be used to appoint a proxy for the purposes of the Meeting.

Corporate Representative

A Shareholder that is a company and that wishes to appoint a person to act as its representative at the Meeting must provide that person with a letter executed in accordance with the company’s constitution and the Corporations Act authorising him or her to act as the Shareholder’s representative.

Section 3: Resolutions of General Meeting

RESOLUTION 1 - SUBSEQUENT APPROVAL OF ISSUES OF SHARES

To consider and, if thought fit, to pass the following resolution (with or without amendment) asanOrdinary Resolution:

“That, for the purposes of Listing Rule 7.1 and for all other purposes, subsequent approval is given under Listing Rule 7.4 to the allotment and issue of 46,900,800 Shares as described in the Explanatory Statement.”

RESOLUTION 2 - APPROVAL OF ISSUE OF OPTIONS

To consider and, if thought fit, to pass the following resolution (with or without amendment) asanOrdinary Resolution:

“That, for the purposes of Listing Rule 7.1 and section 50.1 of the Company’s Constitution and for all other purposes, approval is given to the issue of up to 48,776,825 Options on the terms described in the Explanatory Statement.”

RESOLUTION 3 - APPROVAL OF EMPLOYEE INCENTIVE SCHEME

To consider and, if thought fit, to pass the following resolution (with or without amendment) asanOrdinary Resolution:

“That all issues of securities under the Novogen Employee Share Option Plan, the terms of which are described in the Explanatory Statement, be approved as an exception to Listing Rule 7.1 and for all other purposes.”

OTHER BUSINESS

To transact any other business as may be brought before the Meeting.

|

| By order of the Board |

|

|

| Prof Graham Kelly |

| Executive Chairman |

|

| Dated: 30 January 2015 |

8

PART D: EXPLANATORY STATEMENT

This Explanatory Statement is included in and forms part of the Notice of Meeting. It contains an explanation of, and information about, the Resolutions to be considered at the Meeting. It is given to Shareholders to help them determine how to vote on the Resolutions set out in the Notice of Meeting.

Shareholders should read this Explanatory Statement in full as the individual sections of this Document may not necessarily give a comprehensive review of the Resolutions proposed in the Notice of Meeting.

If you are in doubt about what to do in relation to a Resolution, you should consult your stockbroker or financial or other professional advisor.

| A. | BACKGROUND TO APPLICABLE LISTING RULES |

Listing Rule 7.1, known as the “15% rule”, limits the capacity of an ASX-listed company to issue Equity Securities without the approval of its shareholders. In broad terms, the Listing Rule provides that a company may not issue or agree to issue Equity Securities equal to more than 15% of the total number of ordinary securities on issue in the capital of the Company 12 months prior to the proposed date of issue or agreement to issue (excluding any shares issued in reliance on the 15% rule in that 12 month period) unless the issue or agreement to issue is approved by shareholders or otherwise comes within one of the exceptions to Listing Rule 7.1.

A company in general meeting can ratify, by Ordinary Resolution, issues of Equity Securities made in the preceding 12 months without shareholder approval in reliance on the 15% rule, so as to reverse the “depletion” of the company’s Headroom.

Listing Rule 7.4, known as the “subsequent approval of an issue of securities” rule, validates an issue of Equity Securities made without shareholder approval under Listing Rule 7.1 as if it had been made with shareholder approval for the purposes of Listing Rule 7.1 if both of the following criteria are satisfied, namely:

| | • | | the issue was not made in breach of Listing Rule 7.1; and |

| | • | | the holders of ordinary securities in the company subsequently approve that issue. |

| B. | DISCLOSURE IN RELATION TO THE RESOLUTIONS |

| | (a) | Resolution 1 – Subsequent approval of issues of securities |

Background

As mentioned above, under Listing Rule 7.1, a company is able to, within a twelve month period, issue securities up to 15% of its issued ordinary securities without shareholder approval. On 15 November 2013 at its annual general meeting the Company approved under Listing Rule 7.1A an increase in the number of securities it could issue without shareholder approval from 15% to 25%. This is often called the “Headroom” (see Glossary).

9

On 18 and 19 December 2014 the Company agreed to issue the US Investors:

| | (i) | 46,900,800 Shares to raise A$5,862,851.25, and |

| | (ii) | subject to shareholder approval, 46,900,800 unlisted Options. |

See below Reasons for the issue of the Shares and Options.

| | (b) | Resolution 2 – Approval of issue of Options |

Background

Members’ approval is sought for the proposed issue of 48,776,825 Options.

46,900,800 Options will be issued to the US Investors and 1,876,025 Options will be issued to the placement agent as part of the placement fee. The placement fee represents 4% of the total number of Shares issued to the US Investors and the Options are issued on the same terms as set out below.

Each Option will have an exercise price of AUD$0.15 and an expiry date of five (5) years after its issue and entitle the holder upon payment of the exercise price to one ordinary share in the capital of the Company. The Shares issuable upon exercise of the Options will rank pari passu in all respects with the existing shares of the Company from the date of allotment. Further terms of the Options are set out below.

The Options will not be listed unless the Company at its discretion applies to ASX and the requirements of ASX for an additional class of securities are able to be satisfied.

The placement of the Options is subject to the prior approval of the shareholders of the Company under ASX Listing Rule 7.1. The Company agreed to convene a general meeting (EGM) at which a resolution would be put to the shareholders of the Company to approve the proposed placement of the Options under ASX Listing Rule 7.1. This is that proposed resolution.

The Company will not be in breach of its agreement with the US Investors in any way if this resolution is not passed, but if it is not passed, the ability of the Company to use up any available Headroom to issue securities in the Company until all the Options are issued to the US Investors as agreed.

Failure to approve the issue would restrict the ability of Novogen to seek more funds which are required to continue its research program.

Section 50.1(1) of the Company’s Constitution provides that the Company may by resolution passed at a general meeting increase the issued share capital by the creation of new Shares of such amount as is specified in the resolution.

Further, pursuant to Listing Rules 7.1 and 7.2, an issue of the Options made by the Company with the prior approval of Shareholders, and an issue of Shares by the Company on conversion or exercise of the Options, will not be counted as part of the 15% Rule.

In other words, if Shareholders approve the issue of the Options, the issue of those any Shares issued as a result of the exercise of those Options will not reduce the Company’s Headroom in respect of issue of Equity Securities in the following 12 month period.

10

Reason for the issue of the Shares and the Options

Background information

The Funds raised will be applied to the following four purposes:

| | B. | General research and development (R&D) activity; |

| | D. | General corporate functions. |

A. Phase 1 clinical study:

The Company’s first pipeline drug candidate, Cantrixil, is being brought into a Phase 1 study in Australia in the second half of 2015.

Funds will be applied to completing the pre-clinical studies to allow the use of Cantrixil in humans, to manufacturing drug to meet clinical trial needs, and hospital costs involved in conducting a study in approximately 30 patients.

B. General R&D purposes:

The Company has a pipeline of 4 drugs. Studies will continue on TRXE-009, TRXE-0025 and Anisina in order to progress these drug candidates towards the clinic, although additional funds will be required if these 3 drug candidates are to be brought into the clinic.

Project Jacob Hope is a degenerative diseases/regenerative medicine/autoimmune diseases program that involves basic research. Funding for this program will continue on a limited basis.

C. Infra-structure purposes:

The Company intends to maintain its current virtual business model. Novogen does not currently and nor is planning to have laboratory facilities, relying instead on Novogen scientists overseeing collaborations with universities and research institutions globally. However, an active clinical program will require additional personnel and facilities to house an expanding company.

D. General corporate purposes:

The cost of conducting a business is a direct function of size and activity. Novogen is growing quickly, and regulatory, legal and patenting costs will continue to rise accordingly.

Disclosure Statement

In accordance with the disclosure requirements of Listing Rule 7.3, the Company advises as follows:

Maximum Number of Securities

The maximum number of Options that will be issued pursuant to Resolution 2 is 48,776,825.

Date of issue of Options

The Company will issue the Options immediately after the resolution is passed and in any event within three months of the date of the meeting.

11

Issue price of Options

The Company agreed to issue the Options for no further consideration as part of its placement of Shares to the US Investors. In the placement the US Investors paid A$0.125 for each Share and Option.

Allottees

The Options will be issued to the US Investors or their nominees.

Terms of Options

Each Option will confer on its holder the right to purchase one Share at $0.15 per Share and will be exercisable at any time within five years from its date of issue.

Any Shares issued upon the exercise of any Option will, upon their issue, rank pari passu with, and be issued on the same terms and conditions as, all other Shares.

Options are unlisted and can only be traded under strict circumstances, including the offer, sale, pledge or transfer to the Company or by abiding to the U.S. Securities Act.

Upon exercise of the Options, the Company will apply for quotation of the Shares issued as a result of the exercise.

The Company will register the Options with the SEC in the U.S. in order to allow the Investors to trade the shares issued upon the exercise of the Options faster.

Voting Exclusion Statement

The voting exclusion statement in respect of Resolution 2 is set out in Part C, Section 2 of this Document.

| | (c) | Resolution 3 – Approval of issue of securities under the Novogen Employee Share Option Plan |

The key terms of Novogen Employee Share Option Plan (ESOP) are summarised in the table below:

| | | | | | |

| What is the purpose of the ESOP? | | To assist in the recruitment, reward, retention and motivation of employees of the Novogen group of companies. |

| |

| What kind of option is granted under the ESOP? | | Each option is an option to subscribe for one fully paid ordinary share (Share) in the Company (Option). |

| |

| Who can participate? | | Any employee (full or part time) or officer of: |

| (a) | | the Company; |

| (b) | | any company that is a related body corporate of the Company; or |

| (c) | | any company in which the Company has voting power of at least 20% of the voting shares, |

| who the board of directors of the Company decides in its discretion is eligible to participate (Participant). |

12

| | | | |

| Who manages and administers the ESOP? | | The board of directors of the Company, or a committee appointed by the board of directors of the Company (Committee). |

| |

| How many Shares can the Company issue? | | At any time, the aggregate of the total number of Shares: |

| (a) | | which the Company would have to issue if all Options granted under the ESOP which have not lapsed were exercised; |

| | |

| | (b) | | which the Company would have to issue if all options which have been granted under employee incentive schemes of the Company, which have not lapsed were exercised; and |

| | |

| | (c) | | issued under employee incentive schemes of the Company during the period of 5 years preceding that time, |

| |

| | must not exceed 5 per cent of the number of issued Shares at that time (whether fully paid or partly paid). |

| |

| | In working out the aggregate number of Shares the Company can issue, disregard any Share or option for a Share issued: |

| | |

| | (a) | | to or by a person situated outside Australia at time of receipt of the offer; |

| | |

| | (b) | | by way of or as a result of an excluded offer or invitation within the meaning in the Corporations Law as it stood before 13 March 2000; and |

| | |

| | (c) | | by way of or as a result of an offer which does not need disclosure to investors because of section 708 of the Corporations Act 2001 (Cth). |

13

| | | | | | |

| How are Participants invited to participate in the ESOP? | | The Committee may from time to time give a Participant notice inviting the Participant to apply for Options. The invitation will specify, among other things: |

| (a) | | the number of Options for which the Participant is invited to apply; |

| | |

| | (b) | | the amount payable (if any) by the Participant as consideration for the Options and the terms of its payment; |

| | |

| | (c) | | the exercise price; |

| | |

| | (d) | | the Vesting Period (as defined below); |

| | |

| | (e) | | the Option Period (as defined below); |

| | |

| | (f) | | the exercise conditions (if any) determined by the Committee to be applicable in respect of each Option; |

| | |

| | (g) | | the closing date for applying for each Option; |

| | |

| | (h) | | how the Company will during the Option Period make available to the Participant the current market price of Shares; and |

| | |

| | (i) | | how the Participant is to apply for the Option. |

| |

| What is the vesting period for each Option? | | Either two years after the date of grant or another period as determined by the board or Committee (Vesting Period). |

| |

| What is the option period for each Option? | | The period starting on the date the Option is granted and ending (unless another period is specified in the invitation) on the fifth anniversary of that date (or some other date as determined by the Committee from time to time) (Option Period) |

| |

What is the formula to calculate the exercise price? | | O’ = O - E[P - (S + D)] |

| N + 1 |

| | Where: |

| O’= | | the new Exercise Price of the Option or the Minimum Price, whichever is the greater. |

| O = | | the old Exercise Price of the Option. |

| | |

| | E = | | the number of Shares into which an Option is exercisable. |

| | |

| | P = | | the average closing price (excluding special crossings, overnight sales and exchange traded option exercises) on the Stock Exchange Automated Trading System provided for the trading of securities on ASX of Shares (weighted by reference to volume) during the 5 trading days before the ex rights date or ex entitlements date. |

| | |

| | S = | | the subscription price for one security under the renounceable rights or entitlements issue, |

| | |

| | D = | | the dividend due but not yet paid on existing Shares (except those to be issued under the renounceable rights issue or entitlements issue). |

| | |

| | N = | | number of Shares with rights or entitlements required to be held to receive a right to one new security. |

14

| | | | | | |

When do the Options lapse? | | Each Option lapses: |

| | (a) | | on exercise of the Option; |

| | |

| | (b) | | if the Option is not exercised - at the end of the Option Period; |

| | |

| | (c) | | if the Participant: |

| | | |

| | | | (i) | | dies; |

| | | |

| | | | (ii) | | ceases to be an Employee during the Vesting Period; or |

| | | |

| | | | (iii) | | ceases to be an Employee after the Vesting Period and the Option is not exercised within 30 business days after that happens; |

| | |

| | (d) | | if the Committee becomes aware of circumstances which, in the reasonable opinion of the Committee indicate that the Participant has acted fraudulently, dishonestly or in a manner which is in breach of his or her obligations and the Committee (in its absolute discretion) determines that the Option lapses; or |

| | |

| | (e) | | if the Company commences to be wound up; |

| |

| How long will the ESOP last? | | The ESOP will continue until the board or Committee decides to terminate or discontinue it. The board or Committee can also decide to suspend the ESOP for a fixed period or indefinitely. |

| |

| How can the ESOP be amended? | | The board or Committee may at any time by resolution amend and modify the ESOP. |

| |

| Can the Options be transferred? | | Each Option is personal to the Participant and is not transferable, transmissible, assignable or chargeable except: |

| | |

| | (a) | | on the death of the Participant after the Vesting Period and before the end of the Option Period, with the written approval of the Committee; or |

| | |

| | (b) | | otherwise with the Committee’s prior written consent. |

Voting Exclusion Statement

The voting exclusion statement in respect of Resolution 2 is set out in Part C, Section 2 of this Document.

15

PART E: GLOSSARY

For the purposes of this Document, the following terms have the meanings prescribed below:

| | |

| $ | | Australian dollars. |

| |

| 15% Rule | | Has the meaning given to that term in Section A of the Explanatory Statement. |

| |

| ASX | | ASX Limited ACN 008 624 691 or the securities exchange market operated by it, as the context requires. |

| |

| Associate | | Has the meaning given to that term in the Note to Listing Rule 14.11. |

| |

| Board | | The board of Directors. |

| |

| Chair | | The person chairing the Meeting. |

| |

| Company | | Novogen Limited ACN 063 259 754. |

| |

| Constitution | | The constitution of the Company. |

| |

| Corporations Act | | Corporations Act 2001 (Cth). |

| |

| Current Directors | | The Directors as at the date of this Document. |

| |

| Director | | A director of the Company from time to time |

| |

| Document | | This document entitled “Notice of General Meeting, Explanatory Statement and Proxy Form” and any annexures or schedules to or of the foregoing. |

| |

| Equity Security | | Has the meaning given to that term in Listing Rule 19.12. |

| |

| Explanatory Statement | | Part D of this Document, forming part of the Notice. |

| |

| Headroom | | The ability to issue Equity Securities without requiring Shareholder approval under Listing Rule 7.1 or 7.1A. |

| |

| Listing Rule | | The listing rules of the ASX as amended from time to time. |

| |

| Meeting | | The General Meeting of the Company convened by the Notice. |

| |

| Notice or Notice of Meeting | | The notice convening this Meeting of which the Explanatory Statement forms part. |

| |

| Options | | The 48,776,825 options proposed to be issued to the US Investors and the Placement Agent if Resolution 2 is passed. The options will carry the terms set out in this Explanatory Statement. |

| |

| Ordinary Resolution | | A resolution of Shareholders that is approved by Shareholders who are entitled to vote on that resolution and who hold no less than 50% (in number) of all voting Equity Securities of the Company. |

16

| | |

| |

| Placement Agent | | H.C.Wainwright & Co., LLC |

| |

| Proxy Form | | The proxy form attached to this Document |

| |

| Resolution | | A resolution set out in the Notice. |

| |

| Securities | | Collectively Shares and options. |

| |

| Share | | A fully paid ordinary share in the issued capital of the Company. |

| |

| Share Registry | | Computershare Australia, Level 4, 60 Carrington Street, Sydney, New South Wales. |

| |

| Shareholder | | A registered holder of one or more Share(s). |

| |

trading day | | Has the meaning given to that term in Listing Rule 19.12. |

| |

| US Investors | | Anson Investments Master Fund LP, Iroquois Master Fund Limited and Hudson Bay Master Fund Limited |

17

TO VOTE BY COMPLETING THE PROXY FORM

STEP 1 - Appointment of Proxy

Indicate here who you want to appoint as your Proxy

If you wish to appoint the Chairman of the Meeting as your proxy, mark the box. If you wish to appoint someone other than the Chairman of the Meeting as your proxy please write the full name of that individual or body corporate. If you leave this section blank, or your named proxy does not attend the Meeting, the Chairman of the Meeting will be your proxy. A proxy need not be a securityholder of the Company. Do not write the name of the Company or the registered securityholder in the space.

Proxy which is a Body Corporate

Where a body corporate is appointed as your proxy, the representative of that body corporate attending the Meeting must have provided an “Appointment of Corporate Representative” prior to admission. An Appointment of Corporate Representative form can be obtained from the Share Registry.

Appointment of a Second Proxy

You are entitled to appoint up to two proxies to attend the Meeting and vote on a poll. If you wish to appoint a second proxy, an additional Proxy Form may be obtained by telephoning the Share Registry or you may use a photocopy this form.

To appoint a second proxy you must:

| (b) | complete two Proxy Forms. On each Proxy Form state the percentage of your voting rights or the number of securities applicable to that form. If the appointments do not specify the percentage or number of votes that each proxy may exercise, each proxy may exercise half your votes. Fractions of votes will be disregarded. |

| (c) | return both forms together in the same envelope. |

STEP 2 - Voting Directions to your Proxy

You can tell your Proxy how to vote.

To direct your proxy how to vote, place a mark in one of the boxes opposite each item of business. All your securities will be voted in accordance with such a direction unless you indicate only a portion of voting rights are to be voted on any item by inserting the percentage or number of securities you wish to vote in the appropriate box or boxes. If you do not mark any of the boxes on a given item, your proxy may vote as he or she chooses. If you mark more than one box on an item your vote on that item will be invalid.

STEP 3 - Sign the Form

This form must be signed. In the spaces provided you must sign this form as follows:

Individual: This form is to be signed by the securityholder.

Joint Holding: where the holding is in more than one name, all the securityholders must sign.

Power of Attorney: to sign under a Power of Attorney, you must have already lodged it with the Share Registry. Alternatively, attach a certified photocopy of the Power of Attorney to this form when you return it.

18

Companies: this form must be signed by a director jointly with either another director or a company secretary. Where the company has a sole director who is also the sole company secretary, this form must be signed by that person. Please indicate the office held by signing in the appropriate place.

STEP 4 - Lodgement of a Proxy

This Proxy Form (and any Power of Attorney under which it is signed) must be received at an address given below not later than 48 hours before the commencement of the Meeting at 2.00 pm (Sydney time) on Wednesday 4 March 2015. Any Proxy Form received after that time will not be valid for the scheduled Meeting.

Proxies may be lodged:

To vote by proxy, please complete and sign the Proxy Form enclosed with this Document as soon as possible and either send, deliver, courier or mail the duly completed and signed Proxy Form:

| | • | | directly to the Company, attention Company Secretary: |

| | • | | by mail to PO Box 2333, Hornsby Westfield NSW 1635 Australia |

| | • | | by facsimile to + 61 02 9476 0388; or |

| | • | | by delivery to Suite 1.02, 16-20 Edgeworth David Ave, Hornsby NSW 2077 Australia; |

or

| | • | | by mail Computershare Investor Services Pty Limited, GPO Box 242, Melbourne VIC 3001 Australia; |

| | • | | 1800 783 447 (within Australia) or +61 3 9473 2555 (outside Australia); |

| | • | | delivery to Computershare Investor Services Pty Limited, Level 4, 60 Carrington Street, Sydney NSW 2000 Australia, or |

| | • | | online at www.investorvote.com.au or for Intermediary Online subscribers only (custodians)www.intermediaryonline.com |

Proxy forms must be received by 2.00 pm Monday 2 March 2015 to be valid.

19

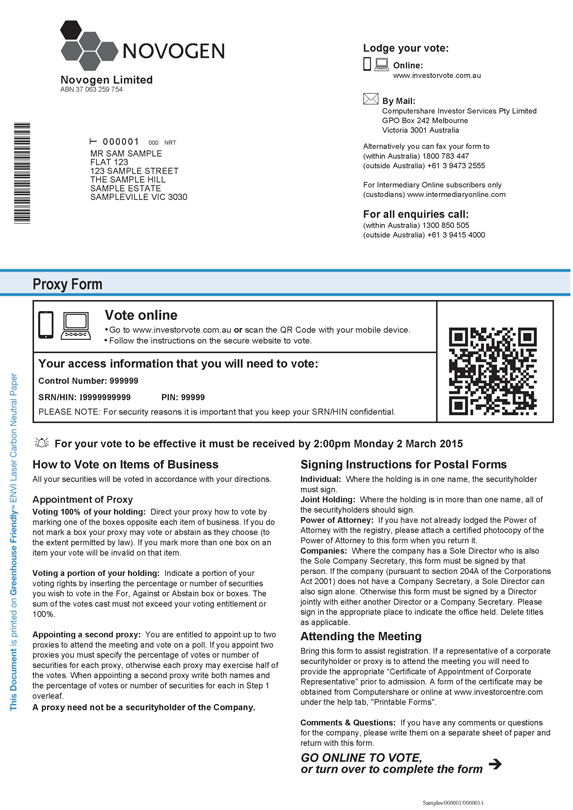

Lodge your vote: NOVOGEN Online:

Novogen Limited www.investorvote.com.au ABN 37 063 259 754

By Mail: Computershare Investor Services Pty Limited GPO Box 242 Melbourne Victoria 3001 Australia

T 000001 000 NRT Alternatively you can fax your form to (within Australia) 1800 783 447 (outside Australia) +61 3 9473 2555

MR SAM SAMPLE FLAT 123 123 SAMPLE STREET THE SAMPLE HILL SAMPLE ESTATE SAMPLEVILLE VIC 3030

For Intermediary Online subscribers only (custodians) www.intermediaryonline.com

For all enquiries call: (within Australia) 1300 850 505 (outside Australia) +61 3 9415 4000

Proxy Form Vote online

Go to www.investorvote.com.au or scan the QR Code with your mobile device.

Follow the instructions on the secure website to vote.

Your access information that you will need to vote:

Control Number: 999999

SRN/HIN: I9999999999

PLEASE NOTE: For security reasons it is important that you keep your SRN/HIN confidential.

PIN: 99999

For your vote to be effective it must be received by 2:00pm Monday 2 March 2015

How to Vote on Items of Business

All your securities will be voted in accordance with your directions.

Appointment of Proxy

Voting 100% of your holding: Direct your proxy how to vote by marking one of the boxes opposite each item of business. If you do not mark a box your proxy may vote or abstain as they choose (to the extent permitted by law). If you mark more than one box on an item your vote will be invalid on that item.

Voting a portion of your holding: Indicate a portion of your voting rights by inserting the percentage or number of securities you wish to vote in the For, Against or Abstain box or boxes. The sum of the votes cast must not exceed your voting entitlement or 100%.

Appointing a second proxy: You are entitled to appoint up to two proxies to attend the meeting and vote on a poll. If you appoint two proxies you must specify the percentage of votes or number of securities for each proxy, otherwise each proxy may exercise half of the votes. When appointing a second proxy write both names and the percentage of votes or number of securities for each in Step 1 overleaf.

A proxy need not be a securityholder of the Company.

Signing Instructions for Postal Forms

Individual: Where the holding is in one name, the securityholder must sign.

Joint Holding: Where the holding is in more than one name, all of the securityholders should sign.

Power of Attorney: If you have not already lodged the Power of Attorney with the registry, please attach a certified photocopy of the Power of Attorney to this form when you return it.

Companies: Where the company has a Sole Director who is also the Sole Company Secretary, this form must be signed by that person. If the company (pursuant to section 204A of the Corporations Act 2001) does not have a Company Secretary, a Sole Director can also sign alone. Otherwise this form must be signed by a Director jointly with either another Director or a Company Secretary. Please sign in the appropriate place to indicate the office held. Delete titles as applicable.

Attending the Meeting

Bring this form to assist registration. If a representative of a corporate securityholder or proxy is to attend the meeting you will need to provide the appropriate “Certificate of Appointment of Corporate Representative” prior to admission. A form of the certificate may be obtained from Computershare or online at www.investorcentre.com under the help tab, “Printable Forms”.

Comments & Questions: If you have any comments or questions for the company, please write them on a separate sheet of paper and return with this form.

GO ONLINE TO VOTE, or turn over to complete the form

Samples/000001/000001/i

This Document is printed on Greenhouse FriendlyTM ENVI Laser Carbon Neutral Paper

MR SAM SAMPLE

FLAT 123

123 SAMPLE STREET

THE SAMPLE HILL

SAMPLE ESTATE

SAMPLEVILLE VIC 3030

Change of address. If incorrect, mark this box and make the correction in the space to the left. Securityholders sponsored by a broker (reference number commences with ‘X’) should advise your broker of any changes.

I 9999999999 I ND

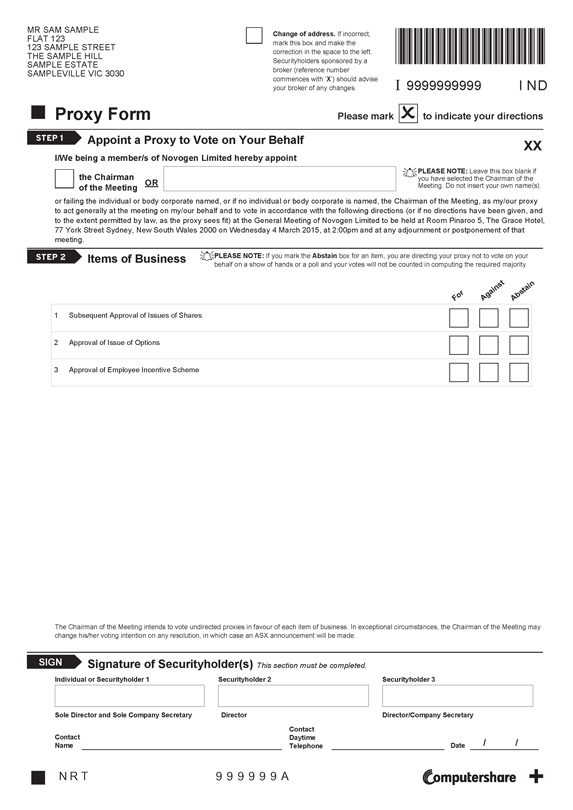

Proxy Form Please mark X to indicate your directions

STEP 1 Appoint a Proxy to Vote on Your Behalf XX

I/We being a member/s of Novogen Limited hereby appoint

the Chairman of the Meeting

OR

PLEASE NOTE: Leave this box blank if you have selected the Chairman of the Meeting. Do not insert your own name(s).

or failing the individual or body corporate named, or if no individual or body corporate is named, the Chairman of the Meeting, as my/our proxy to act generally at the meeting on my/our behalf and to vote in accordance with the following directions (or if no directions have been given, and to the extent permitted by law, as the proxy sees fit) at the General Meeting of Novogen Limited to be held at Room Pinaroo 5, The Grace Hotel, 77 York Street Sydney, New South Wales 2000 on Wednesday 4 March 2015, at 2:00pm and at any adjournment or postponement of that meeting.

STEP 2 Items of Business

PLEASE NOTE: If you mark the Abstain box for an item, you are directing your proxy not to vote on your behalf on a show of hands or a poll and your votes will not be counted in computing the required majority.

For Against Abstain

1 Subsequent Approval of Issues of Shares

2 Approval of Issue of Options

3 Approval of Employee Incentive Scheme

The Chairman of the Meeting intends to vote undirected proxies in favour of each item of business. In exceptional circumstances, the Chairman of the Meeting may change his/her voting intention on any resolution, in which case an ASX announcement will be made.

SIGN Signature of Securityholder(s) This section must be completed.

Individual or Securityholder 1

Securityholder 2

Securityholder 3

Sole Director and Sole Company Secretary

Director

Director/Company Secretary

Contact Name

Contact Daytime

Telephone Date / /

NRT

999999A

Computershare +