UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February, 2016

Commission File Number

Novogen Limited

(Translation of registrant’s name into English)

16-20 Edgeworth David Ave, Hornsby, NSW 2077, Australia

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F þ Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark if the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes ¨ No þ

If “yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b)

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Novogen Limited(Registrant)

Lionel Mateo

Lionel Mateo

Company Secretary

Date 22 February 2016

NOVOGEN LIMITED

ABN 37 063 259 754

Interim Report

For the half-year ended 31 December 2015

Appendix 4D

| | |

| Novogen Limited | |  |

| Appendix 4D | |

| Interim report | | |

1. Company details

| | |

| Name of entity: | | Novogen Limited |

| ABN: | | 37 063 259 754 |

| Reporting period: | | For the half-year ended 31 December 2015 |

| Previous period: | | For the half-year ended 31 December 2014 |

2. Results for announcement to the market

| | | | | | | | | | | | |

| | | | | | | | | $ | |

| | | |

Revenues from ordinary activities | | | up | | | | 2920.5% to | | | | 168,091 | |

| | | |

Loss from ordinary activities after tax attributable to the owners of Novogen Limited | | | up | | | | 70.6% to | | | | (3,833,605 | ) |

| | | |

Loss for the half-year attributable to the owners of Novogen Limited | | | up | | | | 70.6% to | | | | (3,833,605 | ) |

Dividends

There were no dividends paid, recommended or declared during the current financial period.

Comments

The loss for the consolidated entity after providing for income tax and non-controlling interest amounted to $3,833,605 (31 December 2014: $2,247,407).

Operating revenue for the half year ended 31 December 2015 was $168,091 compared to $5,565 for the half year ended 31 December 2014 and general and administrative expenses for the half year ended 31 December 2015 was $3,080,825, compared to $1,513,242 in the previous corresponding period.

The loss for the half year ended 31 December 2015 includes Research and Development spending of $5,010,928, compared to $2,593,767 for the half year ended 31 December 2014.

The consolidated entity’s current assets at 31 December 2015 were $41,121,101 (June 2015 $44,648,638), with current liabilities of $1,515,032 (June 2015 $1,777,388).

3. Net tangible assets

| | | | | | | | |

| | | Reporting

period

Cents | | | Previous

period

Cents | |

| | |

Net tangible assets per ordinary security | | | 9.33 | | | | 10.16 | |

| | | | | | | | |

4. Control gained over entities

Not Applicable

5. Loss of control over entities

Not applicable.

| | |

Novogen Limited Appendix 4D Interim report | |  |

6. Dividends

Current period

There were no dividends paid, recommended or declared during the current financial period.

Previous period

There were no dividends paid, recommended or declared during the previous financial period.

7. Dividend reinvestment plans

Not applicable.

8. Details of associates and joint venture entities

Not applicable.

9. Foreign entities

Details of origin of accounting standards used in compiling the report:

Not applicable.

10. Audit qualification or review

Details of audit/review dispute or qualification (if any):

The financial statements were subject to a review by the auditors and the review report is attached as part of the Half Yearly Report.

11. Attachments

Details of attachments (if any):

The Half Yearly Report of Novogen Limited for the half-year ended 31 December 2015 is attached.

12. Signed

| | | | | | |

| Signed | | /s/ John O’Connor | | | | Date: 22 February 2016 |

| | |

| John O’Connor | | | | |

| Chairman | | | | |

| Novogen Limited | | | | |

Novogen Limited

ABN 37 063 259 754

Interim Report - 31 December 2015

| | |

Novogen Limited Directors’ report 31 December 2015 | |  |

The directors present their report, together with the financial statements, on the consolidated entity (referred to hereafter as the ‘consolidated entity’) consisting of Novogen Limited (referred to hereafter as the ‘company’ or ‘parent entity’) and the entities it controlled at the end of, or during, the half-year ended 31 December 2015.

Directors

The following persons were Directors of Novogen Limited during the whole of the financial year and up to the date of this report, unless otherwise stated:

Steven Coffey

Peter Gunning

James Garner - Note 1

Iain Ross - Note 2

Ian Phillips - Note 3

John O’Connor - Note 4

Bryce Carmine - Note 5

Graham Kelly - Note 6

Note 1 - James Garner was appointed as CEO on 10 December 2015, effective from 1 February 2016. He was appointed as Executive Director on 5 February 2016

Note 2 - Iain Ross stepped down as Acting CEO and remains on the board as Non-Executive Director on 5 February 2016

Note 3 - Ian Phillips resigned as Interim Chairman and remains on the board as Non-Executive Director on 5 February 2016

Note 4 - John O’Connor was appointed as Chairman on 5 February 2016

Note 5 - Bryce Carmine was appointed as Deputy Chairman on 5 February 2016

Note 6 - Graham Kelly resigned as Chairman on 1 July 2015 and resigned as CEO on 22 July 2015.

Principal activities

During the financial year the principal continuing activity of the consolidated entity consisted of pharmaceutical research and development.

Review of operations

The loss for the consolidated entity after providing for income tax and non-controlling interest amounted to $3,833,605 (31 December 2014: $2,247,407).

The attached financial statements detail the performance and financial position of the consolidated entity for the half-year ended 31 December 2015.

Cash resources

At 31 December 2015, the consolidated entity had total funds of $37,631,544, comprising cash in hand and at bank of $20,631,544 and short term deposits of $17,000,000.

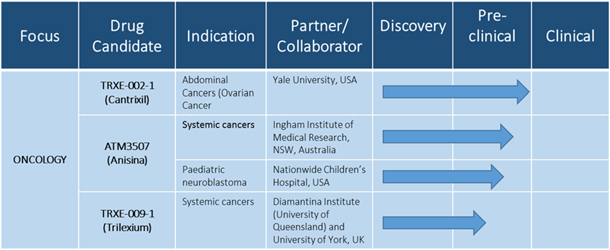

Science Review

The company has two main technology platforms: the in-house developed super-benzopyran (SBP) technology; and the in-licensed first-in-class anti-tropomyosin (ATM) technology. We have made significant advances in progressing Cantrixil toward the clinic. We are now in the process of preparing a final draft of our Investigational New Drug (IND) application comprising Chemistry and Manufacturing Controls (CMC), formal toxicology, safety pharmacology reports, and a final draft of our clinical protocol. We have also taken significant steps in progressing Anisina (ATM3507) into the next stage of its development program (CMC and drug safety evaluation).

From an operational perspective the principle activities of the group during the last reporting period were to:

| | • | | Compile and review final Cantrixil (TRXE-002-1) ICH compliant Pharmacology reports prepared by our collaborators at Yale University; |

| | • | | Complete scale up manufacture of TRXE-002-1 drug substance to cGMP standards and drug product to GLP standards; |

| | • | | Compile and review all ICH compliant reports from our partner Contract Research organizations; |

1

| | |

| Novogen Limited | |  |

| Directors’ report | |

| 31 December 2015 | |

| | • | | Engage our Phase I trial sites, Clinical Research Organisation, and clinical Investigators to prepare a draft the Phase I clinical protocol for TRXE-002-1; |

| | • | | Engage our Regulatory consultants on the preparation of our TRXE-002-1 IND application; |

| | • | | Engage with Hospital Human Research Ethics Committees in preparation for submission of our Clinical Trial Protocol and ethics submission; |

| | • | | Finalisein vitroandin vivo on-target and proof-of-concept studies to justify the progression of Anisina (ATM3507) into safety evaluation studies; |

| | • | | Complete scale-up and manufacturer of ATM3507 drug substance and drug-product to GLP standards; |

| | • | | Engage Contract Research Organisations to commence ATM3507 toxicology and safety-pharmacology studies; |

| | • | | Engage a contract manufacturer to produce GMP-grade ATM3507 drug substance and drug product for clinical trial and initiate drug stability tests; |

| | • | | Generate proof-of-concept data around Trilexium and continue the drug formulation/feasibility program; |

| | • | | Continue to mine the SBP and ATM technology platforms to identify a pipeline of drug-candidates; and |

| | • | | Continue to execute our patent strategy around the SBP and ATM technology platforms. |

Since announcing on 31st August 2015 that the company was deprioritising certain discovery programs associated with the Degenerative Diseases and Regenerative Medicine initiatives, we have made significant advances in the development of Cantrixil and Anisina ensuring that every dollar spent increases the intrinsic value of the respective drug candidates. This is highlighted by the fact that the TRXE-002-1 CMC and safety Reports, and Phase I clinical protocol documents are currently being finalized in readiness for incorporation into HREC and IND applications. This focus has enabled us to make pleasing progress on the ATM3507 CMC and safety evaluation programs, and for Trilexium, establish key proof-of-concept data justifying its progression into a process a R&D formulation program. Additionally, we have reached significant milestones around our intellectual property estate for both the SBP and ATM technology portfolios with the patent protecting Cantrixil and Trilexium being granted in Australia, and the patent protecting Anisina being accepted in Australia thereby facilitating the roll out of these patents into other jurisdictions.

Our focus has also allowed us to continue mining our ATM and SBP technology platforms enabling us to build a more extensive patent base around each technology platform covering composition of matter, method and manufacture and method of use. The SBP technology, discovered by Dr. Andrew Heaton (covered by two discrete patent families) has tremendous intrinsic chemical flexibility, permitting the synthesis of a multitude of analogues that can be tuned to elicit a range of pleiotropic biological effects. Similarly, our target based design strategy for the anti-tropomyosin technology (covered by five discrete patents), has the potential to yield a range of analogues that can be tuned to improve efficacy as a monotherapy and also when used in combination. We have an active medicinal chemistry/drug discovery program for each technology platform and have already identified promising lead analogues that are progressing through additional pre-clinical proof-of-concept/pharmaceutics triage programs in effort to ensure that we have a pipeline analogues at various stages of development.

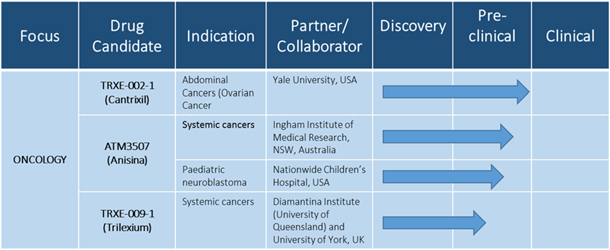

Oncology Lead Development Programs

Cantrixil

Cantrixil was identified using Novogen’s proprietary VAL-ID - Versatile Approach to Library-based Iterative Design – SBP medicinal chemistry program developed by Dr. Andrew Heaton. This strategy is based around the design, synthesis and evaluation of targeted small-molecule libraries and has proven to be a rapid and robust method of identifying lead compounds. Our Yale collaborators led by Professor Gil Mor, have demonstrated that Cantrixil induces a novel mode of cell death in ovarian cancer stem cells via c-Jun activation and inhibition of pERK, and is able to induce cell death in a range of malignant cells that constitute a tumor.

The company has established robust proof-of-concept data in relevant pre-clinical models of ovarian cancer, finalised GMP manufacture of the API and commenced manufacture of the GMP drug products in preparation for clinical trials. The safety evaluation package is being assembled as required by regulators with safety relevant signals being identified. Initial cardiac safety concerns have been addressed with a GLP compliant cardiac safety study in dogs, finding no test-article effects on cardiac function. Adverse TRXE-002 1-related effects were limited to microscopic findings in the testes and epididymides for male rats and dogs at high doses. Macroscopic observations associated with TRXE-002-1 at necropsy were confined to sporadic distention of the cecum and colon and colon obstruction in rats. TRX-E-002-1 was shown to be non-mutagenic using in two separate assays, and high doses of TRXE-002-1 (200 and 400 mg/kg) caused a significant increase in incidence of micronuclei in male and female mice.

It is important to note that the standard treatment for ovarian cancer patients has not significantly changed over the past 30 years and their prognosis remains exceptionally poor with as many as 80% of patients suffering a relapse, and of those patients that do survive, only 35% percent of patients are alive 10 years post diagnosis. Therefore an urgent unmet clinical need remains for all ovarian cancer patients.

2

| | |

Novogen Limited Directors’ report 31 December 2015 | |  |

During the period we have achieved the following significant milestones:

| | • | | Completed manufacture of GMP drug substance and GLP drug product; |

| | • | | Completed safety appraisal and identified key safety signals in two species; |

| | • | | Engaged trial sites, clinical investigators and Clinical Research organisation; |

| | • | | Drafted a Phase I protocol and identified a starting dose in humans; |

| | • | | Finalised Proof-of-concept studies in clinically relevant pre-clinical models of human ovarian cancer (as developed by Yale University) using the proposed clinical route of delivery and schedule; and |

| | • | | Submitted a manuscript to a peer-reviewed Journal reporting on Cantrixil pre-clinical efficacy and Mechanism of Action. |

Trilexium

As with Cantrixil, Trilexium was identified out of our SBP Medicinal Chemistry program and is the least advanced of our Oncology Lead development programs. Recently the Company announced that Trilexium affects the viability of cancer cells by increasing rates of cell death (via caspase-mediated apoptosis) and reducing proliferation. This effect has been observed across a range of cancer types (including melanoma, Diffuse Intrinsic Pontine Glioma (DIPG), prostate and brain cancers plus and we have observed good evidence of efficacy (including survival) in several rodent models of cancer using an intravenous formulation. These data have convinced us to commence a drug-product prototype manufacturing program aimed at optimizing the current intravenous formulation for Trilexium.

Anisina

Cancer cells rely on a cytoskeleton to proliferate, metastasize and survive. The two major components of the cytoskeleton, important for these functions, are the microfilaments and microtubules. The ATMs exert their effect by binding to and impairing the function of a core component of the microfilament, tropomyosin Tpm3.1. The ATMs appear to work selectively against cancer cells as, unlike normal cells, cancer cells rely on Tpm3.1 for survival. Whilst the ATMs have proven themselves to be effective anti-cancer compounds in cell based assays, what makes this class of compounds attractive is their ability to improve the effectiveness of standard of care chemotherapeutics which target the other core component of the cytoskeleton, the microtubules.In vitro studies confirm that when an ATM is used in combination with a vinca alkaloid – such as vincristine- a 20-30 fold increase in cancer cell death is observed when compared with the effect achieved with either of the compounds on their own.

Our first ATM drug candidate, ATM3507, was identified from Novogen’s proprietary VAL-ID ATM medicinal chemistry program based on: i) its ability to bind to and inhibit the function of the target protein, Tpm3.1, ii) its effectiveness against a panel of both adult and pediatric tumor cell lines and, iii) its ability to enhance the sensitivity of adult and pediatric cancer cell lines to the standard of care microtubule targeting agents such as the taxanes and vinca alkaloids.

Pre-clinicalin vivo studies have confirmed the effectiveness of ATM3507 in animal models of adult and paediatric (neuroblastoma) cancers both on its own and in combination with standard of care microtubule inhibitors when dosed intravenously in a cyclodextrin formulation. Mice have been shown to tolerate this formulation and delivery schedule well. We have now have commenced the requisite IND-enabling studies with the intention of taking ATM3507 through to the clinic as an IV delivered drug to be used in an adjuvant setting with a vinca alkaloid or taxanes. The commencement of our ATM3507 clinical program is dependent on the successful completion of our Anisina toxicology program.

Significant Milestone achieved:

| | • | | Conducted several Proof-of-concept studies demonstrating efficacy in clinically relevant pre-clinicalin vivo models of human cancer using the proposed clinical route of delivery and schedule both as monotherapy and in adjuvant setting (with anti-microtubule agents); |

| | • | | Completed manufacture of GLP drug substance and drug product; |

| | • | | Identified mode of delivery and dosing schedule; |

| | • | | Commenced safety appraisal to identify key safety signals in two species and starting dose in humans. |

3

| | |

| Novogen Limited | |  |

| Directors’ report | |

| 31 December 2015 | |

Drug Discovery

Novogen’s two core discovery platforms utilise industry standard discovery strategies; ligand based design in the SBP platform and structure based design in the ATM platform. The design of new SBP drugs is based on an iterative feedback process whereby sequential logical changes to chemical structure, shape and electronic signature are mapped against a biological activity score. This affords the ability to generate new SBP’s with pleiotropic activity against cancer, degenerative diseases and other indications. The iterative process has been successful in the design and discovery of Cantrixil and Trilexium in the oncology space and a range of hit compounds in degenerative diseases.

The strategic advantage with Novogen’s SBP discovery program is the ability to generate diverse learning sets of compounds efficiently through our 4-step manufacturing process. This efficiency speeds up the generation of new hit compounds and the selection of optimised lead compounds. Several new families of SBP’s are under development that are generating new hit compounds that have significantly different structures and electronic signatures. These new families of SBP’s are providing back-up compounds for existing indications and allowing us to expand our composition of matter and method of use patent portfolio to a broad range of cancer and degenerative diseases.

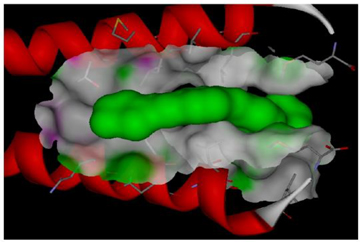

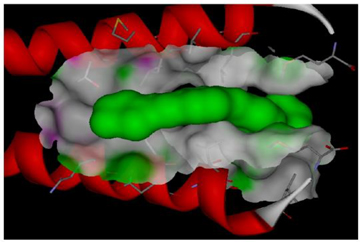

The ATM discovery platform utilises a structure based design approach. Extensive biological work has allowed us to generate a 3-D molecular map of the key cancer tropomyosin Tpm 3.1. Having a model of this structure has allowed us to design compounds utilisingin silico techniques that have the potential to specifically bind to this tropomyosin. The VA-LID approach to library design has then been utilised to generate a diverse set of compounds based on the computer modelling. A series ofin vitro andin vivo screens were then used to select Anisina from a range of hit compounds. Novogen is currently designing new variants of Anisina and new families of compounds that can bind to Tpm 3.1 in different modes. This is generating a series of back-up compounds to Anisina and new classes of ATM’s with a variety of biological activities. This design strategy is now being used on a number of new tropomyosins to generate new families of compounds with the potential to disrupt a number of key cellular processes associated with actin filaments.

| | |

| | Example of a new ATM class of compound docked into one of the binding sites of Tpm 3.1. demonstrating how in silico techniques can be used to design highly specific and active ATM analogs. |

4

| | |

| Novogen Limited | |  |

| Directors’ report | |

| 31 December 2015 | |

Intellectual Property Update

Novogen’s patent portfolio currently spans the two distinct technology platforms – the super-benzopyrans and the anti-tropomyosins. Each technology platform comprises several chemically distinct compound families. Novogen’s goal is to ensure robust patent protection encompassing the libraries of chemically related molecules built around the lead compounds TRXE-002 (Cantrixil) TRXE-009 (Trilexium) and Anisina.

Strategic patent coverage is being sought in key jurisdictions such as the US, Europe, Australia, China and Japan.

Key developments during the year include:

| | • | | An international patent application (PCT/AU2015/050040) was filed for Novogen’s first family of super-benzopyran compounds. This application covers lead compounds TRXE-002 (Cantrixil) and TRXE-009 (Trilexium). The International Search Report indicated that all claims were found to be novel and inventive, which has allowed for a seamless transition of this patent into the national phase. The patent has been filed in a number of jurisdictions, including Australia, USA and Europe, with more international filings planned; |

| | • | | A standard Australian patent was filed (AU 2015201006) covering a series of SBP compounds to increase the breadth of the SBP portfolio outside our lead SBP candidates; |

| | • | | A provisional patent application ((US 62/253461) covering a broad range of SBP’s and their specific activity in regenerative medicine has been filed and is progressing to a full PCT application in November 2016; |

| | • | | Two international patent applications were filed covering a range of compounds from Novogen’s anti-tropomyosin program. One of these applications (PCT/AU2015/050400) covers the lead anti-tropomyosin drug candidate, Anisina. This application has now entered the national phase in Australia and New Zealand, with other jurisdictions to follow; and |

| | • | | Novogen’s anti-tropomyosin patent portfolio was further expanded with two new provisional filings (US 62/167182 and US 62/278,886) covering two novel families of compounds. This brings the total number of anti-tropomyosin patent families to six, and cements Novogen’s dominant intellectual property position in this emerging field of drug discovery. |

Super-Benzopyran Patents

| | | | | | |

Title | | Patent number | | Filing Date | | Status |

Functionalised Benzopyran Compounds and Use Thereof (TRI series) | | PCT/AU2015/050040 | | 5-Feb-15 | | PCT filed. Entered national phase: AU/NZ 28 Aug 2015 US Aug 2015 EU 9 Sep 2015 Singapore 2 Sep 2015 Israel 10 Sept 2015 |

| | | |

Benzopyran Compounds and Use Thereof (CS-6 blocking patent) | | AU 2015201006 | | 27-Feb-15 | | Standard patent filed in Australia. |

| | | |

Benzopyran compounds and their use in regenerative medicine | | US 62/253,461 | | 10-Nov-15 | | Provisional application filed. |

5

| | |

| Novogen Limited | |  |

| Directors’ report | |

| 31 December 2015 | |

Anti-Tropomyosin Patents

| | | | | | |

Title | | Patent number | | Filing Date | | Status |

| Functionalised and substituted indoles as anti-cancer agents (2000 series) | | PCT/AU2014/050373 | | 25-Nov-14 | | PCT filed. |

| | | |

| Functionalised and substituted indoles as anti-cancer agents (4000 series) | | PCT/AU2014/050372 | | 25-Nov-14 | | PCT filed. |

| | | |

| Functionalised and substituted carbazoles as anti-cancer agents (1000 series) | | PCT/AU2015/050399 | | 16-Jul-15 | | PCT filed. |

| | | |

| Functionalised and substituted indoles as anti-cancer agents (3500 series) | | PCT/AU2015/050400 | | 16-Jul-15 | | PCT filed. Entered national phase in AU/NZ 16 Sept 2015. Patent acceptance expected early Feb. |

| | | |

| 1,2,3,5-Tetrasubstituted indoles and their use in proliferative diseases (3000 series) | | US 62/167182 | | 27-May-15 | | Provisional application filed. |

| | | |

| Functionalised and substituted indoles as anti-cancer agent (3000 series update) | | US 62/278,886 | | 14-Jan-16 | | Provisional application filed |

Significant changes in the state of affairs

Resignation of Executive Chairman

On 1 July 2015, the consolidated entity announced the resignation of Dr Graham Kelly as executive Chairman of the Board of Directors.

Appointment of Interim Chairman

On 1 July 2015, the consolidated entity announced the appointment of Mr Ian M. Phillips, MNZM, as Interim Chairman of the Board of Directors.

Resignation of CEO

On 22 July 2015, the consolidated entity announced the resignation of Dr Graham Kelly as CEO, as well as Director of all entities within the group.

Appointment of Director and Acting CEO

On 22 July 2015, the consolidated entity announced the appointment of Mr Iain Ross as Director and Acting Chief Executive Officer of the consolidated entity.

Appointment of CEO

On 10 December 2015, the consolidated entity announced the appointment of Dr James Garner as CEO. Dr Garner took up his new function from 1 February 2016. Mr Iain Ross remains as Non-Executive Director of the consolidated entity.

6

| | |

| Novogen Limited | |  |

| Directors’ report | |

| 31 December 2015 | |

Filing of SEC F-3 form

On 16 September 2015, the consolidated entity filed an F-3 Form with the Securities Exchange Commission (SEC) of the United States of America. The F-3 Form allowed the consolidated entity to register the resale of 77,625,000 ordinary shares, comprised of ordinary shares issuable upon exercise of (i) 51,750,000 options at the initial exercise price of $0.30 per ordinary share that expire on 30 December 2015 (“Short-term Options”) and (ii) 25,875,000 options at the initial exercise price of

$0.40 per ordinary share that expire on 30 June 2020 (“Long-term Options”); issued by the consolidated entity in a private placement to U.S. based funds, which was announced to the market on 20 April 2015.

The Short-term Options expired on 30 December 2015 without being exercised

Exercise of options

During the Half-Year period ending 31 December 2015, the consolidated entity issued 6,616,517 ordinary shares, all following the exercise of options. The details of these options are as follows:

| | • | | 1,000,000 options expiring on 18 December 2019, at an exercise price of $0.15 per option; |

| | • | | 5,614,224 options expiring on 18 November 2015, at an exercise price of $0.125 per option; and |

| | • | | 2,293 options expiring 4 December 2015, at an exercise price of $0.30 per option. |

Expiry of options

During the Half-Year period ending 31 December 2015, 112,093,480 options lapsed, the details of these options are as follows:

| | • | | 58,971,151 options, issued as part of the rights entitlement offer completed on 6 June 2015, with an exercise price of $0.30 per option, expired on 4 December 2015; and |

| | • | | 53,130,000 options, issued as part of the private placement to U.S. based funds and placement agents, which was completed on 27 April 2015, with an exercise price of $0.30 per option, expired on 30 December 2015. |

Issue of options to employees

The consolidated entity issued in aggregate 5,500,008 share options to its employees on 16 November 2015.

The options were issued under the Employee Share Option Plan, which was approved by the Shareholders on 4 March 2015.

The options vest in tranches, they have an exercise price of $0.22 per option and expire on 16 November 2020.

There were no other significant changes in the state of affairs of the consolidated entity during the financial half-year.

Matters subsequent to the end of the financial half-year

Start of Dr James Garner and appointment as Director

As announced to the market on 10 December 2015, Dr James Garner took up his function as Chief Executive Officer (CEO) of Novogen Limited on 1 February 2016. He was appointed as a Director of the Company on 5 February 2016.

7

| | |

| Novogen Limited | |  |

| Directors’ report | |

| 31 December 2015 | |

Extraordinary General Meeting of Shareholders

The Company will be holding a general meeting of shareholders on Friday 18 March 2016. The Notice of Meeting, Explanatory Statement and Proxy Form (NoM) was released on ASX and dispatched to Shareholders on 16 February 2016.

The NoM put the following resolutions to the vote of Shareholders:

| | • | | Resolution 1: Issue of up to 7,500,000 options to Dr James Garner. The options are issued as employee share options, as agreed in Dr Garner’s employment agreement. They are issued under the Employee Share Option Plan, which was approved by the Shareholders on 4 March 2015. |

| | • | | Resolution 2: Election of Mr Iain G. Ross as a Director of Novogen Limited. This is a requirement from the Company’s constitution as Mr Ross is no longer acting as CEO, he must be put forth for re-election at the following General Meeting. |

| | • | | Resolution 3: Increase of Non-Executive Directors Remuneration Cap. This is to update the remuneration cap which was last approved by the shareholders in 2005. The limit is currently set at $560,000 for Non-Executive Directors. The resolution increases such limit to $900,000. |

Issue of options to Dr James Garner

Provided that the shareholders approve the issue of options to Dr James Garner, CEO of Novogen Limited and Director of the Board (at the time), the Company will issue up to 7,500,000 options. The options will be issued in two tranches with various vesting periods and exercise prices. The Commencement Date is 1 February 2016.

| • | | Tranche 1: 5,000,000 options, with exercise price of $0.1988 per option, which is based on a 45% premium on the 30 Day VWAP of shares traded in Novogen limited at the close of business on 14 December 2015. This tranche of options vests in 5 sub-tranches as follows: |

| | 1) | 6 months: 750,000 options; |

| | 2) | 1 year: 750,000 options; |

| | 3) | 18 months: 750,000 options; |

| | 4) | 2 years: 750,000 options; and |

| | 5) | 3 years: 2,000,000 options. |

The exercise periods start (i) for sub-tranches (1) to (4): on the second anniversary of the Commencement Date; (ii) for sub-tranche (5): on the third anniversary of the Commencement Date (ie: the vesting date for that tranche)

| • | | Tranche 2: 2,500,000 options, with exercise price of $0.2605 per option, which is based on a 90% premium on the 30 Day VWAP of shares traded in Novogen limited at the close of business on 14 December 2015. This tranche of options vests after 4 years from the Commencement Date. |

The exercise period starts on the fourth anniversary of the Commencement Date.

No other matter or circumstance has arisen since 31 December 2015 that has significantly affected, or may significantly affect the consolidated entity’s operations, the results of those operations, or the consolidated entity’s state of affairs in future financial years.

Auditor’s independence declaration

A copy of the auditor’s independence declaration as required under section 307C of the Corporations Act 2001 is set out on page 10.

8

| | |

| Novogen Limited | |  |

| Directors’ report | |

| 31 December 2015 | |

This report is made in accordance with a resolution of Directors, pursuant to section 298(2)(a) of the Corporations Act 2001.

On behalf of the Directors

|

/s/ John O’Connor |

| John O’Connor |

| Chairman |

|

| 22 February 2016 |

| Sydney |

9

| | |

| | Level 17, 383 Kent Street Sydney NSW 2000 Correspondence to: Locked Bag Q800 QVB Post Office Sydney NSW 1230 T+61 2 8297 2400 F+61 2 9299 4445 Einfo.nsw@au.gt.com W www.grantthornton.com.au |

Auditor’s Independence Declaration

To The Directors of Novogen Limited

In accordance with the requirements of section 307C of the Corporations Act 2001, as lead auditor for the review of Novogen Limited for the half-year ended 31 December 2015, I declare that, to the best of my knowledge and belief, there have been:

| a | No contraventions of the auditor independence requirements of the Corporations Act 2001 in relation to the review; and |

| b | No contraventions of any applicable code of professional conduct in relation to the review. |

|

| /s/ Grant Thornton |

| GRANT THORNTON AUDIT PTY LTD |

| Chartered Accountants |

|

| /s/ Louise Worsley |

| Louise Worsley |

| Partner - Audit & Assurance |

Sydney, 22 February 2016

Grant Thornton Audit Pty Ltd ACN 130 913 594

a subsidiary or related entity of Grant Thornton Australia Ltd ABN 41 127 556 389

‘Grant Thornton’ refers to the brand under which the Grant Thornton member firms provide assurance, tax and advisory services to their clients and/or refers to one or more member firms, as the context requires. Grant Thornton Australia Ltd is a member firm of Grant Thornton International Ltd (GTIL). GTIL and the member firms are not a worldwide partnership. GTIL and each member firm is a separate legal entity. Services are delivered by the member firms. GTIL does not provide services to clients. GTIL and its member firms are not agents of, and do not obligate one another and are not liable for one another’s acts or omissions. In the Australian context only, the use of the term ‘Grant Thornton’ may refer to Grant Thornton Australia Limited ABN 41 127 556 389 and its Australian subsidiaries and related entities. GTIL is not an Australian related entity to Grant Thornton Australia Limited.

Liability limited by a scheme approved under Professional Standards Legislation. Liability is limited in those States where a current scheme applies.

10

| | |

| Novogen Limited | |  |

| Contents | |

| 31 December 2015 | |

General information

The financial statements cover Novogen Limited as a consolidated entity consisting of Novogen Limited and the entities it controlled at the end of, or during, the half-year. The financial statements are presented in Australian dollars, which is Novogen Limited’s functional and presentation currency.

Novogen Limited is a listed public company limited by shares, incorporated and domiciled in Australia. Its registered office and principal place of business is:

Level 5

20 George Street

Hornsby NSW 2077

A description of the nature of the consolidated entity’s operations and its principal activities are included in the directors’ report, which is not part of the financial statements.

The financial statements were authorised for issue, in accordance with a resolution of directors, on 29 February 2016.

11

| | |

| Novogen Limited | |  |

| Statement of profit or loss and other comprehensive income | |

| For the half-year ended 31 December 2015 | |

| | | | | | | | | | |

| | | | | Consolidated | |

| | | Note | | Dec 2015 | | | Dec 2014 | |

| | | | | $ | | | $ | |

| | | |

Revenue | | 4 | | | 168,091 | | | | 5,565 | |

| | | |

Other income | | 5 | | | 4,090,053 | | | | 1,950,364 | |

| | | |

Expenses | | | | | | | | | | |

Research and development expense | | | | | (5,010,928 | ) | | | (2,593,767 | ) |

General and administrative expense | | | | | (3,080,825 | ) | | | (1,513,242 | ) |

Net fair value loss on convertible note derivative | | | | | — | | | | (222,095 | ) |

Finance costs | | 6 | | | (36 | ) | | | (61,219 | ) |

| | | | | | | | | | |

| | | |

Loss before income tax expense | | | | | (3,833,645 | ) | | | (2,434,394 | ) |

| | | |

Income tax expense | | | | | — | | | | — | |

| | | | | | | | | | |

| | | |

Loss after income tax expense for the half-year | | | | | (3,833,645 | ) | | | (2,434,394 | ) |

| | | |

Other comprehensive income | | | | | | | | | | |

| | | |

Items that may be reclassified subsequently to profit or loss | | | | | | | | | | |

Net exchange difference on translation of financial statements of foreign controlled entities, net of tax | | | | | (148,359 | ) | | | (280,316 | ) |

Loss on the revaluation of available-for-sale financial assets, net of tax | | | | | (257 | ) | | | (10,696 | ) |

| | | | | | | | | | |

| | | |

Other comprehensive income for the half-year, net of tax | | | | | (148,616 | ) | | | (291,012 | ) |

| | | | | | | | | | |

| | | |

Total comprehensive income for the half-year | | | | | (3,982,261 | ) | | | (2,725,406 | ) |

| | | | | | | | | | |

| | | |

Loss for the half-year is attributable to: | | | | | | | | | | |

Non-controlling interest | | | | | (40 | ) | | | (186,987 | ) |

Owners of Novogen Limited | | | | | (3,833,605 | ) | | | (2,247,407 | ) |

| | | | | | | | | | |

| | | |

| | | | | (3,833,645 | ) | | | (2,434,394 | ) |

| | | | | | | | | | |

| | | |

Total comprehensive income for the half-year is attributable to: | | | | | | | | | | |

Non-controlling interest | | | | | (205,102 | ) | | | (217,902 | ) |

Owners of Novogen Limited | | | | | (3,777,159 | ) | | | (2,507,504 | ) |

| | | | | | | | | | |

| | | |

| | | | | (3,982,261 | ) | | | (2,725,406 | ) |

| | | | | | | | | | |

| | | |

| | | | | Cents | | | Cents | |

| | | |

Basic earnings per share | | 18 | | | (0.902 | ) | | | (1.274 | ) |

Diluted earnings per share | | 18 | | | (0.902 | ) | | | (1.274 | ) |

The above statement of profit or loss and other comprehensive income should be read in conjunction with the accompanying notes

12

| | |

| Novogen Limited | |  |

| Statement of financial position | |

| As at 31 December 2015 | |

| | | | | | | | | | |

| | | | | Consolidated | |

| | | Note | | Dec 2015 | | | Jun 2015 | |

| | | | | $ | | | $ | |

| | | |

Assets | | | | | | | | | | |

| | | |

Current assets | | | | | | | | | | |

Cash and cash equivalents | | 7 | | | 37,631,544 | | | | 44,371,486 | |

Trade and other receivables | | | | | 246,148 | | | | 150,602 | |

Income tax refund due | | | | | 4,344 | | | | — | |

R&D rebate due | | | | | 2,865,708 | | | | — | |

Other assets | | | | | 373,357 | | | | 126,550 | |

| | | | | | | | | | |

Total current assets | | | | | 41,121,101 | | | | 44,648,638 | |

| | | | | | | | | | |

| | | |

Non-current assets | | | | | | | | | | |

Available-for-sale financial assets | | | | | 15,367 | | | | 15,624 | |

Property, plant and equipment | | 8 | | | 614,006 | | | | 85,065 | |

Intangibles | | | | | 1,107,576 | | | | 1,390,114 | |

| | | | | | | | | | |

Total non-current assets | | | | | 1,736,949 | | | | 1,490,803 | |

| | | | | | | | | | |

| | | |

Total assets | | | | | 42,858,050 | | | | 46,139,441 | |

| | | | | | | | | | |

| | | |

Liabilities | | | | | | | | | | |

| | | |

Current liabilities | | | | | | | | | | |

Trade and other payables | | | | | 1,432,459 | | | | 1,618,682 | |

Employee benefits | | | | | 82,573 | | | | 158,706 | |

| | | | | | | | | | |

Total current liabilities | | | | | 1,515,032 | | | | 1,777,388 | |

| | | | | | | | | | |

| | | |

Non-current liabilities | | | | | | | | | | |

Trade and other payables | | | | | 152,734 | | | | — | |

| | | | | | | | | | |

Total non-current liabilities | | | | | 152,734 | | | | — | |

| | | | | | | | | | |

| | | |

Total liabilities | | | | | 1,667,766 | | | | 1,777,388 | |

| | | | | | | | | | |

| | | |

Net assets | | | | | 41,190,284 | | | | 44,362,053 | |

| | | | | | | | | | |

| | | |

Equity | | | | | | | | | | |

Contributed equity | | 9 | | | 191,301,217 | | | | 190,404,198 | |

Other contributed equity | | 10 | | | 1,716,101 | | | | 1,716,101 | |

Reserves | | 11 | | | 770,147 | | | | 989,721 | |

Accumulated losses | | 12 | | | (152,277,734 | ) | | | (148,444,129 | ) |

| | | | | | | | | | |

Equity attributable to the owners of Novogen Limited | | | | | 41,509,731 | | | | 44,665,891 | |

Non-controlling interest | | 13 | | | (319,447 | ) | | | (303,838 | ) |

| | | | | | | | | | |

| | | |

Total equity | | | | | 41,190,284 | | | | 44,362,053 | |

| | | | | | | | | | |

The above statement of financial position should be read in conjunction with the accompanying notes

13

| | |

| Novogen Limited | |  |

| Statement of changes in equity | |

| For the half-year ended 31 December 2015 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Consolidated | | Issued capital $ | | | $ | | | Reserves $ | | | Accumulated losses $ | | | Non-

controlling interest $ | | | Total equity $ | |

| | | | | | |

Balance at 1 July 2014 | | | 142,585,975 | | | | — | | | | 230,328 | | | | (141,305,533 | ) | | | (98,736 | ) | | | 1,412,034 | |

| | | | | | |

Loss after income tax expense for the half-year | | | — | | | | — | | | | — | | | | (2,247,407 | ) | | | (186,987 | ) | | | (2,434,394 | ) |

Other comprehensive income for the half-year, net of tax | | | — | | | | — | | | | (260,097 | ) | | | — | | | | (30,915 | ) | | | (291,012 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total comprehensive income for the half-year | | | — | | | | — | | | | (260,097 | ) | | | (2,247,407 | ) | | | (217,902 | ) | | | (2,725,406 | ) |

| | | | | | |

Transactions with owners in their capacity as owners: | | | | | | | | | | | | | | | | | | | | | | | | |

Contributions of equity, net of transaction costs | | | 7,368,825 | | | | — | | | | — | | | | — | | | | — | | | | 7,368,825 | |

Share-based payments (note 19) | | | — | | | | — | | | | 130,459 | | | | — | | | | — | | | | 130,459 | |

Recognition of equity component of compound financial instrument | | | — | | | | 1,500,000 | | | | — | | | | — | | | | — | | | | 1,500,000 | |

Transfers | | | — | | | | 216,101 | | | | (216,101 | ) | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Balance at 31 December 2014 | | | 149,954,800 | | | | 1,716,101 | | | | (115,411 | ) | | | (143,552,940 | ) | | | (316,638 | ) | | | 7,685,912 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Consolidated | | Issued capital $ | | | Other contributed equity $ | | | Reserves $ | | | Retained profits $ | | | Non-

controlling interest $ | | | Total equity $ | |

| | | | | | |

Balance at 1 July 2015 | | | 190,404,198 | | | | 1,716,101 | | | | 989,721 | | | | (148,444,129 | ) | | | (303,838 | ) | | | 44,362,053 | |

| | | | | | |

Loss after income tax expense for the half-year | | | — | | | | — | | | | — | | | | (3,833,605 | ) | | | (40 | ) | | | (3,833,645 | ) |

Other comprehensive income for the half-year, net of tax | | | — | | | | — | | | | (133,047 | ) | | | — | | | | (15,569 | ) | | | (148,616 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total comprehensive income for the half-year | | | — | | | | — | | | | (133,047 | ) | | | (3,833,605 | ) | | | (15,609 | ) | | | (3,982,261 | ) |

| | | | | | |

Transactions with owners in their capacity as owners: | | | | | | | | | | | | | | | | | | | | | | | | |

Contributions of equity, net of transaction costs (note 9) | | | 781,651 | | | | — | | | | — | | | | — | | | | — | | | | 781,651 | |

Share-based payments (note 19) | | | 115,368 | | | | — | | | | (115,368 | ) | | | — | | | | — | | | | — | |

Employee share-based payment options | | | — | | | | — | | | | 28,841 | | | | — | | | | — | | | | 28,841 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Balance at 31 December 2015 | | | 191,301,217 | | | | 1,716,101 | | | | 770,147 | | | | (152,277,734 | ) | | | (319,447 | ) | | | 41,190,284 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

The above statement of changes in equity should be read in conjunction with the accompanying notes

14

| | |

| Novogen Limited | |  |

| Statement of cash flows | |

| For the half-year ended 31 December 2015 | |

| | | | | | | | | | |

| | | | | Consolidated | |

| | | Note | | Dec 2015 | | | Dec 2014 | |

| | | | | $ | | | $ | |

| | | |

Cash flows from operating activities | | | | | | | | | | |

Loss before income tax expense for the half-year | | | | | (3,833,645 | ) | | | (2,434,394 | ) |

| | | |

Adjustments for: | | | | | | | | | | |

Depreciation and amortisation | | | | | 304,122 | | | | 287,238 | |

Net gain on disposal of property, plant and equipment | | | | | (545 | ) | | | — | |

Share-based payments | | | | | 28,841 | | | | — | |

Foreign exchange differences | | | | | (1,221,800 | ) | | | (554,756 | ) |

Net fair value loss on derivative | | | | | — | | | | 222,095 | |

Imputed interest on convertible note | | | | | — | | | | 60,959 | |

| | | | | | | | | | |

| | | |

| | | | | (4,723,027 | ) | | | (2,418,858 | ) |

| | | |

Change in operating assets and liabilities: | | | | | | | | | | |

Increase in trade and other receivables | | | | | (2,897,173 | ) | | | (16,362 | ) |

Increase in income tax refund due | | | | | (4,344 | ) | | | (3,401 | ) |

Increase in prepayments | | | | | (232,634 | ) | | | (18,926 | ) |

Increase in other operating assets | | | | | (14,173 | ) | | | — | |

(Decrease)/Increase in trade and other payables | | | | | (181,413 | ) | | | 991,850 | |

Decrease in employee benefits | | | | | (76,132 | ) | | | (9,933 | ) |

Increase in other provisions | | | | | 91,582 | | | | — | |

| | | | | | | | | | |

| | | |

Net cash used in operating activities | | | | | (8,037,314 | ) | | | (1,475,630 | ) |

| | | | | | | | | | |

| | | |

Cash flows from investing activities | | | | | | | | | | |

Payments for property, plant and equipment | | 8 | | | (488,987 | ) | | | (4,272 | ) |

Payments for intangibles | | | | | (2,625 | ) | | | — | |

Proceeds from disposal of property, plant and equipment | | | | | 2,785 | | | | — | |

Payments for security deposits | | | | | (64,081 | ) | | | — | |

| | | | | | | | | | |

| | | |

Net cash used in investing activities | | | | | (552,908 | ) | | | (4,272 | ) |

| | | | | | | | | | |

| | | |

Cash flows from financing activities | | | | | | | | | | |

Proceeds from issue of shares | | 9 | | | 852,867 | | | | 7,722,881 | |

Share issue transaction costs | | | | | (71,219 | ) | | | (640,040 | ) |

| | | | | | | | | | |

| | | |

Net cash from financing activities | | | | | 781,648 | | | | 7,082,841 | |

| | | | | | | | | | |

| | | |

Net (decrease)/increase in cash and cash equivalents | | | | | (7,808,574 | ) | | | 5,602,939 | |

Cash and cash equivalents at the beginning of the financial half-year | | | | | 44,371,486 | | | | 2,502,125 | |

Effects of exchange rate changes on cash and cash equivalents | | | | | 1,068,632 | | | | (76,391 | ) |

| | | | | | | | | | |

| | | |

Cash and cash equivalents at the end of the financial half-year | | | | | 37,631,544 | | | | 8,028,673 | |

| | | | | | | | | | |

The above statement of cash flows should be read in conjunction with the accompanying notes

15

| | |

| Novogen Limited | |  |

| Notes to the financial statements | |

| 31 December 2015 | |

Note 1. Significant accounting policies

These general purpose financial statements for the interim half-year reporting period ended 31 December 2015 have been prepared in accordance with Australian Accounting Standard AASB 134 ‘Interim Financial Reporting’ and the Corporations Act 2001, as appropriate for for-profit oriented entities. Compliance with AASB 134 ensures compliance with International Financial Reporting Standard IAS 34 ‘Interim Financial Reporting’.

These general purpose financial statements do not include all the notes of the type normally included in annual financial statements. Accordingly, these financial statements are to be read in conjunction with the annual report for the year ended 30 June 2015 and any public announcements made by the company during the interim reporting period in accordance with the continuous disclosure requirements of the Australian Securities Exchange Listing Rules and the Corporations Act 2001.

The principal accounting policies adopted are consistent with those of the previous financial year and corresponding interim reporting period, unless otherwise stated.

New, revised or amending Accounting Standards and Interpretations adopted

The consolidated entity has adopted all of the new, revised or amending Accounting Standards and Interpretations issued by the Australian Accounting Standards Board (‘AASB’) that are mandatory for the current reporting period.

Any new, revised or amending Accounting Standards or Interpretations that are not yet mandatory have not been early adopted.

Note 2. Restatement of comparatives

Reclassification

Comparative information in the profit of loss statement has been restated to correct an error in classification of expenses. The profit and loss for the half year ended 31 December 2014 included salary and related general expenses of scientists totalling $646,263 in general and administrative expenses. These expenses have been reclassified from general and administrative expenses to research and development expenses. The restatement is to reflect the nature of the expense in a more accurate manner. A third balance sheet has not been presented as the reclassification has no impact on the financial results for the half year ended 31 December 2014 or the closing financial position at that date.

Note 3. Operating segments

Identification of reportable operating segments

The consolidated entity’s operating segment is based on the internal reports that are reviewed and used by the Board of Directors (being the Chief Operating Decision Makers (‘CODM’)) in assessing performance and in determining the allocation of resources.

The information reported to the CODM, on at least a monthly basis, is the consolidated results as shown in the statement of profit or loss and other comprehensive income and statement of financial position.

Note 4. Revenue

| | | | | | | | |

| | | Consolidated | |

| | | Dec 2015 | | | Dec 2014 | |

| | | $ | | | $ | |

| | |

Bank interest | | | 168,091 | | | | 5,565 | |

| | | | | | | | |

16

| | |

Novogen Limited | |  |

Notes to the financial statements | |

31 December 2015 | |

Note 5. Other income

| | | | | | | | |

| | | Consolidated | |

| | | Dec 2015 | | | Dec 2014 | |

| | | $ | | | $ | |

| | |

Net foreign exchange gain | | | 1,221,800 | | | | 366,768 | |

Net gain on disposal of property, plant and equipment | | | 545 | | | | — | |

Subsidies and grants | | | 2,000 | | | | 45,455 | |

Research and development rebate | | | 2,865,708 | | | | 1,538,141 | |

| | | | | | | | |

| | |

Other income | | | 4,090,053 | | | | 1,950,364 | |

| | | | | | | | |

Note 6. Expenses

| | | | | | | | |

| | | Consolidated | |

| | | Dec 2015 | | | Dec 2014 | |

| | | $ | | | $ | |

| | |

Loss before income tax includes the following specific expenses: | | | | | | | | |

| | |

Depreciation | | | | | | | | |

Property, plant and equipment | | | 18,958 | | | | 2,186 | |

| | | | | | | | |

| | |

Amortisation | | | | | | | | |

Patents and intellectual property | | | 285,052 | | | | 285,052 | |

Software | | | 112 | | | | — | |

| | | | | | | | |

| | |

Total amortisation | | | 285,164 | | | | 285,052 | |

| | | | | | | | |

| | |

Total depreciation and amortisation | | | 304,122 | | | | 287,238 | |

| | | | | | | | |

| | |

Finance costs | | | | | | | | |

Interest and finance charges paid/payable | | | 36 | | | | 260 | |

Imputed interest on convertible note | | | — | | | | 60,959 | |

| | | | | | | | |

| | |

Finance costs expensed | | | 36 | | | | 61,219 | |

| | | | | | | | |

| | |

Rental expense relating to operating leases | | | | | | | | |

Minimum lease payments | | | 103,176 | | | | 46,855 | |

| | | | | | | | |

| | |

Superannuation expense | | | | | | | | |

Defined contribution superannuation expense | | | 97,080 | | | | 71,385 | |

| | | | | | | | |

Note 7. Current assets - cash and cash equivalents

| | | | | | | | |

| | | Consolidated | |

| | | Dec 2015 | | | Jun 2015 | |

| | | $ | | | $ | |

| | |

Cash at bank and on hand | | | 20,631,544 | | | | 44,356,339 | |

Short-term deposits | | | 17,000,000 | | | | 15,147 | |

| | | | | | | | |

| | |

| | | 37,631,544 | | | | 44,371,486 | |

| | | | | | | | |

17

| | |

Novogen Limited | |  |

Notes to the financial statements | |

31 December 2015 | |

Note 8. Non-current assets - property, plant and equipment

| | | | | | | | |

| | | Consolidated | |

| | | Dec 2015 | | | Jun 2015 | |

| | | $ | | | $ | |

| | |

Leasehold improvements - at cost | | | 464,259 | | | | — | |

Less: Accumulated depreciation | | | (4,339 | ) | | | — | |

| | | | | | | | |

| | | 459,920 | | | | — | |

| | | | | | | | |

| | |

Plant and equipment - at cost | | | 188,667 | | | | 152,872 | |

Less: Accumulated depreciation | | | (34,581 | ) | | | (67,807 | ) |

| | | | | | | | |

| | | 154,086 | | | | 85,065 | |

| | | | | | | | |

| | |

| | | 614,006 | | | | 85,065 | |

| | | | | | | | |

Reconciliations

Reconciliations of the written down values at the beginning and end of the current financial half-year are set out below:

| | | | | | | | | | | | |

| | | Leasehold

Improvement | | | Plant and

equipment | | | Total | |

| Consolidated | | $ | | | $ | | | $ | |

| | | |

Balance at 1 July 2015 | | | — | | | | 85,065 | | | | 85,065 | |

Additions | | | 464,259 | | | | 85,879 | | | | 550,138 | |

Disposals | | | — | | | | (2,239 | ) | | | (2,239 | ) |

Depreciation expense | | | (4,339 | ) | | | (14,619 | ) | | | (18,958 | ) |

| | | | | | | | | | | | |

| | | |

Balance at 31 December 2015 | | | 459,920 | | | | 154,086 | | | | 614,006 | |

| | | | | | | | | | | | |

Note 9. Equity - contributed equity

| | | | | | | | | | | | | | | | |

| | | | | | Consolidated | | | | |

| | | Dec 2015 Shares | | | Jun 2015 Shares | | | Dec 2015 $ | | | Jun 2015 $ | |

| | | | |

Ordinary shares - fully paid | | | 429,733,982 | | | | 423,116,465 | | | | 191,301,217 | | | | 190,404,198 | |

| | | | | | | | | | | | | | | | |

Movements in ordinary share capital

| | | | | | | | | | | | | | | | |

| Details | | Date | | | Shares | | | Issue price | | | $ | |

| | | | |

Balance | | | 1 July 2015 | | | | 423,116,465 | | | | | | | | 190,404,198 | |

Issue of shares on exercise of options | | | 24 July 2015 | | | | 1,000 | | | $ | 0.400 | | | | 400 | |

Issue of shares on exercise of options | | | 24 July 2015 | | | | 1,000,000 | | | $ | 0.150 | | | | 150,000 | |

Issue of shares on exercise of options | | | 8 October 2015 | | | | 109,309 | | | $ | 0.125 | | | | 13,664 | |

Issue of shares on exercise of options | | | 23 November 2015 | | | | 1,990,545 | | | $ | 0.125 | | | | 248,818 | |

Issue of shares on exercise of options | | | 24 November 2015 | | | | 3,514,370 | | | $ | 0.125 | | | | 439,296 | |

Issue of shares on exercise of options | | | 09 December 2015 | | | | 2,293 | | | $ | 0.300 | | | | 688 | |

Share issue transaction costs | | | | | | | — | | | $ | 0.000 | | | | (71,215 | ) |

Share-based payments fair value movement | | | | | | | — | | | $ | 0.000 | | | | 115,368 | |

| | | | | | | | | | | | | | | | |

| | | | |

Balance | | | 31 December 2015 | | | | 429,733,982 | | | | | | | | 191,301,217 | |

| | | | | | | | | | | | | | | | |

Share buy-back

There is no current on-market share buy-back.

18

| | |

| Novogen Limited | |  |

| Notes to the financial statements | |

| 31 December 2015 | |

Note 10. Equity - Other contributed equity

| | | | | | | | |

| | | Consolidated | |

| | | Dec 2015 | | | Jun 2015 | |

| | | $ | | | $ | |

| | |

Convertible loan note - Triaxial | | | 1,716,101 | | | | 1,716,101 | |

| | | | | | | | |

On 4 December 2014, the consolidated entity and the convertible note holder (‘Triaxial’) signed a Convertible Note Deed Poll (‘Deed’) which superseded the precedent Loan Agreement between Triaxial shareholders and the consolidated entity. The Deed extinguishes the liability created by the Loan Agreement, which previously allowed for a cash settlement and now allows Triaxial to convert their debt into ordinary shares during the current financial year, providing that the company achieves defined milestones established in the schedule of the Deed. Accordingly the convertible note has been reclassified as an equity instrument rather than debt instrument.

The convertible note may be exercised at the holders discretion as follows:

| • | | on completion of Phase 1a clinical trials: $400,000 converted into 16,000,000 ordinary shares in the company; |

| • | | on receipt of Investigational New Drug approval from the US Food and Drug Administration $500,000 converted into 20,000,000 ordinary shares in the company; and |

| • | | on completion of Phase II clinical trials: $600,000 converted into 24,000,000 ordinary shares in the company. |

The milestones listed above refer to any drug developed based on the super-benzopyran technology.

Note 11. Equity - reserves

| | | | | | | | |

| | | Consolidated | |

| | | Dec 2015 | | | Jun 2015 | |

| | | $ | | | $ | |

| | |

Available-for-sale reserve | | | (43,260 | ) | | | (43,003 | ) |

Foreign currency reserve | | | (445,549 | ) | | | (312,759 | ) |

Share-based payments reserve | | | 1,258,956 | | | | 1,345,483 | |

| | | | | | | | |

| | |

| | | 770,147 | | | | 989,721 | |

| | | | | | | | |

Share based payments reserve for Employee Share Option Plan

The company issued 5,500,008 options to employees of the Company pursuant to the Company’s Employee Share Option Plan, which was approved by the Shareholders on 4 March 2015. Please refer to Note 18 Share based payment for details.

Note 12. Equity - accumulated losses

| | | | | | | | |

| | | Consolidated | |

| | | Dec 2015 | | | Jun 2015 | |

| | | $ | | | $ | |

| | |

Accumulated losses at the beginning of the financial half-year | | | (148,444,129 | ) | | | (141,305,533 | ) |

Loss after income tax expense for the half-year | | | (3,833,605 | ) | | | (7,138,596 | ) |

| | | | | | | | |

| | |

Accumulated losses at the end of the financial half-year | | | (152,277,734 | ) | | | (148,444,129 | ) |

| | | | | | | | |

19

| | |

| Novogen Limited | |  |

| Notes to the financial statements | |

| 31 December 2015 | |

Note 13. Equity - non-controlling interest

| | | | | | | | |

| | | Consolidated | |

| | | Dec 2015 | | | Jun 2015 | |

| | | $ | | | $ | |

| | |

Issued capital | | | 23 | | | | 23 | |

Reserves | | | (50,576 | ) | | | (35,006 | ) |

Accumulated losses | | | (268,894 | ) | | | (268,855 | ) |

| | | | | | | | |

| | |

| | | (319,447 | ) | | | (303,838 | ) |

| | | | | | | | |

Note 14. Equity - dividends

There were no dividends paid, recommended or declared during the current or previous financial half-year.

Note 15. Fair value measurement

Fair value hierarchy

The following tables detail the consolidated entity’s assets and liabilities, measured or disclosed at fair value, using a three level hierarchy, based on the lowest level of input that is significant to the entire fair value measurement, being:

Level 1: Quoted prices (unadjusted) in active markets for identical assets or liabilities that the entity can access at the measurement date

Level 2: Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly

Level 3: Unobservable inputs for the asset or liability

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Consolidated - Dec 2015 | | $ | | | $ | | | $ | | | $ | |

| | | | |

Assets | | | | | | | | | | | | | | | | |

Ordinary shares | | | 15,367 | | | | — | | | | — | | | | 15,367 | |

| | | | | | | | | | | | | | | | |

Total assets | | | 15,367 | | | | — | | | | — | | | | 15,367 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Consolidated - Jun 2015 | | $ | | | $ | | | $ | | | $ | |

| | | | |

Assets | | | | | | | | | | | | | | | | |

Ordinary shares | | | 15,624 | | | | — | | | | — | | | | 15,624 | |

| | | | | | | | | | | | | | | | |

Total assets | | | 15,624 | | | | — | | | | — | | | | 15,624 | |

| | | | | | | | | | | | | | | | |

There were no transfers between levels during the financial half-year.

The carrying amounts of trade and other receivables and trade and other payables are assumed to approximate their fair values due to their short-term nature.

Note 16. Contingent liabilities

The consolidated entity is continuing to prosecute its Intellectual Property (‘IP’) rights and in June 2007 announced that the Vienna Commercial Court had upheld a provisional injunction against an Austrian company, APOtrend. The consolidated entity has provided a guarantee to the value of €250,000 ($381,527) with the court to confirm its commitment to the ongoing enforcement process. As at 31 December 2015, the receivable balance has been fully impaired on the basis that it is unlikely to be recovered. The receivable balance and the corresponding provision for impairment is classified as ‘deposits held’.

20

| | |

| Novogen Limited | |  |

| Notes to the financial statements | |

| 31 December 2015 | |

Note 17. Events after the reporting period

Start of Dr James Garner and appointment as Director

As announced to the market on 10 December 2015, Dr James Garner took up his function as Chief Executive Officer (CEO) of Novogen Limited on 1 February 2016. He was appointed as a Director of the Company on 5 February 2016.

Extraordinary General Meeting of Shareholders

The Company will be holding a general meeting of shareholders on Friday 18 March 2016. The Notice of Meeting, Explanatory Statement and Proxy Form (NoM) was released on ASX and dispatched to Shareholders on 16 February 2016.

The NoM put the following resolutions to the vote of shareholders:

| | • | | Resolution 1: Issue of up to 7,500,000 options to Dr James Garner. The options are issued as employee share options, as agreed in Dr Garner’s employment agreement. They are issued under the Employee Share Option Plan, which was approved by the shareholders on 4 March 2015. |

| | • | | Resolution 2: Election of Mr Iain G. Ross as a Director of Novogen Limited. This is a requirement from the Company’s constitution as Mr Ross is no longer acting as CEO, he must be put forth for re-election at the following General Meeting. |

| | • | | Resolution 3: Increase of Non-Executive Directors Remuneration Cap. This is to update the remuneration cap which was last approved by the shareholders in 2005. The limit is currently set at $560,000 for Non-Executive Directors. The resolution increase such limit to $900,000. |

Issue of options to Dr James Garner

Provided that the shareholders approve the issue of options to Dr James Garner, CEO of Novogen Limited and Director of the Board (at the time), the Company will issue up to 7,500,000 options. The options will be issued in two tranches with various vesting periods and exercise prices. The Commencement Date is 1 February 2016.

| • | | Tranche 1: 5,000,000 options, with exercise price of $0.1988 per option, which is based on a 45% premium on the 30 Day VWAP of shares traded in Novogen limited at the close of business on 14 December 2015. This tranche of options vests in 5 sub-tranches as follows: |

| 1) | 6 months: 750,000 options; |

| 2) | 1 year: 750,000 options; |

| 3) | 18 months: 750,000 options; |

| 4) | 2 years: 750,000 options; and |

| 5) | 3 years: 2,000,000 options. |

The exercise periods start (i) for sub-tranches (1) to (4): on the second anniversary of the Commencement Date; (ii) for sub-tranche (5): on the third anniversary of the Commencement Date (ie: the vesting date for that tranche

| • | | Tranche 2: 2,500,000 options, with exercise price of $0.2605 per option, which is based on a 90% premium on the 30 Day VWAP of shares traded in Novogen limited at the close of business on 14 December 2015. This tranche of options vests after 4 years from the Commencement Date. |

The exercise period starts on the fourth anniversary of the Commencement Date.

No other matter or circumstance has arisen since 31 December 2015 that has significantly affected, or may significantly affect the consolidated entity’s operations, the results of those operations, or the consolidated entity’s state of affairs in future financial years.

21

| | |

| Novogen Limited | |  |

| Notes to the financial statements | |

| 31 December 2015 | |

Note 18. Earnings per share

| | | | | | | | |

| | | Consolidated | |

| | | Dec 2015 | | | Dec 2014 | |

| | | $ | | | $ | |

| | |

Loss after income tax | | | (3,833,645 | ) | | | (2,434,394 | ) |

Non-controlling interest | | | 40 | | | | 186,987 | |

| | | | | | | | |

| | |

Loss after income tax attributable to the owners of Novogen Limited | | | (3,833,605 | ) | | | (2,247,407 | ) |

| | | | | | | | |

| | |

| | | Number | | | Number | |

| | |

Weighted average number of ordinary shares used in calculating basic earnings per share | | | 425,165,999 | | | | 176,356,169 | |

| | | | | | | | |

| | |

Weighted average number of ordinary shares used in calculating diluted earnings per share | | | 425,165,999 | | | | 176,356,169 | |

| | | | | | | | |

| | |

| | | Cents | | | Cents | |

| | |

Basic earnings per share | | | (0.902 | ) | | | (1.274 | ) |

Diluted earnings per share | | | (0.902 | ) | | | (1.274 | ) |

60,000,000 unlisted convertible notes with a face value of $1,500,000, 37,230,999 unlisted options and 29,484,002 listed options have been excluded from the above calculations as they were antidilutive.

Note 19. Share-based payments

The following table shows the movement of share options during the half year ended 31 December 2015, expiry date and exercise prices:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Dec 2015 | |

| Tranche | | Grant date | | | Expiry date | | | Exercise

price | | | Balance at

the start of

the half-year | | | Granted | | | Exercised | | | Expired/

forfeited/ other | | | Balance at

the end of the half- year | |

| | | | | | | | |

1 | | | 04/03/2015 | | | | 16/12/2019 | | | $ | 0.150 | | | | 466,470 | | | | — | | | | — | | | | — | | | | 466,470 | |

2 | | | 04/03/2015 | | | | 18/12/2019 | | | $ | 0.150 | | | | 199,521 | | | | — | | | | — | | | | — | | | | 199,521 | |

3 | | | 24/06/2015 | | | | 30/12/2015 | | | $ | 0.300 | | | | 1,380,000 | | | | — | | | | — | | | | (1,380,000 | ) | | | — | |

4 | | | 24/06/2015 | | | | 30/06/2020 | | | $ | 0.400 | | | | 5,190,000 | | | | — | | | | — | | | | — | | | | 5,190,000 | |

5* | | | 15/10/2015 | | | | 16/11/2020 | | | $ | 0.220 | | | | — | | | | 5,500,008 | | | | — | | | | — | | | | 5,500,008 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 7,235,991 | | | | 5,500,008 | | | | — | | | | (1,380,000 | ) | | | 11,355,999 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | $ | 0.358 | | | $ | 0.220 | | | $ | 0.000 | | | $ | 0.300 | | | $ | 0.298 | |

| * | Employee share options. Please refer to “Employee share options” section below for more details. |

Options from Tranche 1 to Tranche 4 listed above were vested and exercisable at the end of the period.

The weighted average remaining contractual life of options outstanding at the end of the period is 4.65 years.

22

| | |

| Novogen Limited | |  |

| Notes to the financial statements | |

| 31 December 2015 | |

Note 19. Share-based payments (continued)

Employee share options

During the half year ended 31 December 2015, 5,500,008 options have been issued to the employees during the year by the consolidated entity pursuant to the Company’s Employee Share Option Plan.

The options will vest over 3 years in one year cliffs. The Vesting Period applying to 1/3 (one third) of the total Options issued under this invitation will be 16/11/2016, 16/11/2017 and 16/11/2018 respectively.

An option will only vest if the option holder continues to be a full time employee with the Company or an Associated Company during the Vesting Period relating to the Option.

Conditions for an option to be exercised:

| | • | | The option must have vested and a period of 2 years from the date the option was issued must have expired; |

| | • | | Option holder must have provided the Company with an Exercise Notice and have paid the Exercise Price for the option; |

| | • | | The Exercise Notice must be for the exercise of at least the Minimum Number of Options; and |

| | • | | The Exercise Notice must have been provided to the Company and Exercise Price paid before the expiry of 5 years from the date the Option is issued. |

Options Valuation

In order to obtain a fair valuation of these options, the following assumptions have been made:

The Black and Scholes option valuation methodology has been used. This Option Valuation methodology has been used with the expectation that the majority of these options would be exercised towards the end of the term of these options.

The exercise prices and expiry dates of these options are disclosed in the table above.

The closing price of an ordinary share as at the close of 4 March 2015 (for Tranches 1 and 2), 24 June 2015 (for Tranche 3 and 4) and 15 October 2015 (for Tranche 5) was 18.0 cents, 24.50 cents and 14.0 cents respectively. These dates were used as deemed dates of grant and this price as deemed spot price on the date of grant for the valuation purposes.

For Tranches 1 and 2, the risk-free rate of a five year Australian Government bond, being 2.07% (on 4 March 2015), was used. For Tranche 3, the risk-free rate of a two year Australian Government bond, being 2.02% (on 4 March 2015) was applied. Similarly, the risk-free rates of a five year Australian Government bond, being 2.34% (on 24 June 2015) and 2.04% (on 15 October 2015), were applied for Tranche 4 and Tranche 5 respectively.

The Tranches 1, 2, 3 and 4 options do not have any vesting conditions and vest immediately on the grant date (Tranche 3 expired on 30/12/2015).

The Tranche 5 options will vest over 3 years in one year cliffs. The Vesting Period applying to 1/3 (one third) of the total Options issued under this invitation will be 16/11/2016, 16/11/2017 and 16/11/2018 respectively.

No discount rate was applied for all the Tranches listed below.

Based on the above assumptions, the table below sets out the valuation for each remaining tranche of options.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Tranche | | Grant date | | | Expiry date | | | Share price at Grant Date | | | Exercise

price | | | Volatility

(%) | | | Option

Life | | | Fair value per option | |

| | | | | | | |

1 | | | 04/03/2015 | | | | 16/12/2019 | | | $ | 0.180 | | | $ | 0.150 | | | | 120.00 | % | | | 4.79 | | | $ | 0.150 | |

2 | | | 04/03/2015 | | | | 18/12/2019 | | | $ | 0.180 | | | $ | 0.150 | | | | 120.00 | % | | | 4.79 | | | $ | 0.150 | |

4 | | | 24/06/2015 | | | | 30/06/2020 | | | $ | 0.245 | | | $ | 0.400 | | | | 150.00 | % | | | 5.02 | | | $ | 0.217 | |

5 | | | 15/10/2015 | | | | 16/11/2020 | | | $ | 0.140 | | | $ | 0.220 | | | | 158.11 | % | | | 5.01 | | | $ | 0.217 | |

23

| | |

| Novogen Limited | |  |

| Directors’ declaration | |

| 31 December 2015 | |

In the directors’ opinion:

| | • | | the attached financial statements and notes comply with the Corporations Act 2001, Australian Accounting Standard AASB 134 ‘Interim Financial Reporting’, the Corporations Regulations 2001 and other mandatory professional reporting requirements; |

| | • | | the attached financial statements and notes give a true and fair view of the consolidated entity’s financial position as at 31 December 2015 and of its performance for the financial half-year ended on that date; and |

| | • | | there are reasonable grounds to believe that the company will be able to pay its debts as and when they become due and payable. |

Signed in accordance with a resolution of directors made pursuant to section 303(5)(a) of the Corporations Act 2001.

On behalf of the directors

|

/s/ John O’Connor |

| John O’Connor |

| Chairman |

|

| 22 February 2016 |

| Sydney |

24

| | |

| | Grant Thornton Audit Pty Ltd ACN130 913 594 Level 17, 383 Kent Street Sydney NSW 2000 Correspondence to: Locked Bag Q800 QVB Post Office Sydney NSW 1230 T+61 2 8297 2400 F+61 2 9299 4445 Einfo.nsw@au.gt.com W www.grantthornton.com.au |

Independent Auditor’s Review Report

To the Members of Novogen Limited

We have reviewed the accompanying half-year financial report of Novogen Limited

(“Company”), which comprises the consolidated financial statements being the statement of financial position as at 31 December 2015, and the statement of profit or loss and other comprehensive income, statement of changes in equity and statement of cash flows for the half-year ended on that date, notes comprising a statement or description of accounting policies, other explanatory information and the directors’ declaration of the consolidated entity, comprising both the Company and the entities it controlled at the half-year’s end or from time to time during the half-year.

Directors’ responsibility for the half-year financial report

The directors of Novogen Limited are responsible for the preparation of the half-year financial report that gives a true and fair view in accordance with Australian Accounting Standards and the Corporations Act 2001 and for such controls as the directors determine is necessary to enable the preparation of the half-year financial report that is free from material misstatement, whether due to fraud or error.

Auditor’s responsibility