UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November, 2017

Commission File Number

Novogen Limited

(Translation of registrant’s name into English)

Level 5, 20 George Street, Hornsby, NSW 2077, Australia

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☑ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark if the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes ☐ No ☑

If “yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b)

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Novogen Limited(Registrant)

Kate Hill

Kate Hill

Company Secretary

Date 15 November 2017

| | |

| |

ASX:NRT NASDAQ:NVGN Novogen Ltd (Company) ABN 37 063 259 754 Capital Structure Ordinary Shares on issue: 483 M Board of Directors Mr Iain Ross Chairman Non-Executive Director Mr Bryce Carmine Non-Executive Director Mr Steven Coffey Non-Executive Director Dr James Garner Chief Executive Officer Managing Director | | MARKET RELEASE 15 November 2017 NOVOGEN AGM PRESENTATION MATERIALS Sydney, 15 November 2017 – Novogen Ltd (ASX: NRT; NASDAQ: NVGN), an Australian oncology drug development company, is pleased to provide materials to be presented at its AGM, to be held later today in Sydney. Items released • Chairman’s address to AGM • CEO’s presentation to shareholders [ENDS] About Novogen Limited Novogen Limited (ASX: NRT; NASDAQ: NVGN) is an emerging oncology-focused biotechnology company, based in Sydney, Australia. Novogen has a portfolio of development candidates, diversified across several distinct technologies, with the potential to yield first-in-class and best- in-class agents in a range of oncology indications. The lead program is GDC-0084, a small molecule inhibitor of the PI3K / AKT / mTOR pathway, which is being developed to treat glioblastoma multiforme. Licensed from Genentech in late 2016, GDC-0084 is anticipated to enter phase II clinical trials in 2017. A second clinical program, TRX-E-002-01 (Cantrixil) commenced a phase I clinical trial in ovarian cancer in December 2016. In addition, the company has several preclinical programs in active development, the largest of which is substantially funded by a CRC-P grant from the Australian Federal Government. For more information, please visit:www.novogen.com |

NOVOGEN ANNUAL GENERAL MEETING

15 NOVEMBER 2017

CHAIRMAN’S ADDRESS

Ladies and Gentleman,

It is my great pleasure to welcome you to the Annual General Meeting of Novogen shareholders. This is my first meeting as Chairman of the company, and I want to take the opportunity at the outset to pay tribute to my predecessor, John O’Connor. John has been a dedicated supporter of Novogen for many years, and has been instrumental in driving the recent transformation of the organisation.

In fact, the changes that we made to the Board earlier this year- which saw John O’Connor and Ian Phillips step down as directors of the company – illustrate the pace and scale of transformation in Novogen. When I was invited tore-join the Board in 2015, this was anearly-stage drug discovery company, with enormous enthusiasm and drive, but with a very long journey in front of it before it would be able to return value to shareholders. Today, it is amid-clinical stage company, with one very exciting asset about tore-enter the clinic, and with the potential to yield a valuable marketed product in only perhaps four years or so. Another is working its way through a phase I clinical trial, and may also prove to be an important new treatment option for patients. This is, by any standard of measurement, one of the more exciting portfolios in Australian biotech.

The company itself has changed accordingly. In the eighteen months or so since he joined us, our CEO, James Garner, has built a lean, buthighly-credentialed team ofinternationally-experienced professionals. We have also benefitted greatly from our Scientific Advisory Board, and indeed the team have just spent the last two days discussing the portfolio with them in great detail. Successful biotech companies are dependent on great people just as much as on strong drug candidates, and I am confident that Novogen is nowwell-equipped in this regard for the tasks ahead of it.

Several of the resolutions that are being presented to shareholders for their consideration today are associated with this ongoing transformation of the business. In particular, we have proposed to change the name of the company – to Kazia Therapeutics – and to consolidate the capital structure. I want to take a moment to explain these initiatives.

1

Novogen has been around for almost 25 years, and it has lived many lives. It has been a veterinary products supply company, a manufacturer of supplements for menopausal symptoms, and at various times a drug development company, not just in oncology, but also in cardiovascular and genetic diseases. There are things to be proud of in that history, but it is also an enormous weight to carry for what is, as a consequence of our recent pipeline and team transformation, in reality, effectively astart-up company. Time and again, we have heard from investors that the company as it is today bears no relation to its many predecessors, and that we should change the name to make this fact clear.

A new name is not a substitute for a successful,well-run business, and it will be incumbent on us to make sure that Kazia Therapeutics delivers on its enormous promise. We feel that it deserves to be judged on its own merits, and not on the strengths or weaknesses of the distant past. No doubt an expensive marketing consultancy would be able to tell you in great detail exactly what the word Kazia means, but the simple truth is that it will carry whatever meaning we give it, through the work we do, and the benefit we bring to patients in need.

The consolidation of our common stock is somewhat similarly motivated. The 483 million shares that we have on issue speak to the many previous engagements between the company and equity capital markets, and the consequent low share price represents an invitation to a certain kind of speculative investor. We believe that a tighter capital structure should, in the context of the other steps we are taking, help the company to move towards a more appropriate valuation.

I am fully aware that any resolutions we put before you may seem presumptuous in the context of our current share price. I want to assure you that all of these carefully considered measures are devoted directly or indirectly to the purpose of allowing the full value of the company to be recognised in the market. Each of your directors are shareholders too, and we have all bought every share we own on the open market, so we share your interest in seeing the company prosper. It has at times been a journey that tests the patience, but the year ahead will see us begin to generate clinical trial data from our pipeline, and this is really the true measure of any biotech company. All companies in our industry are ultimately judged on one thing and one thing only, and that is the ability to demonstrate benefit to patients in aproperly-conducted clinical trial. After eighteen months of transformation, Novogen stands on the cusp of this event.

2

To continue to deliver impactful clinical trial data will, in due course, require us to attend to thelong-term funding of the company. We have achieved a great deal with the resources that were available to us over the past several years, but it will likely require additional capital to drive all our assets to a point where their value can be realised. That capital may come from a number of sources, including licensing/partnering transactions, grant funding or equity funding. I assure you that your Board remains alert to all opportunities.

In the meantime, I thank you for your ongoing support of the company, and I commend to you the important matters that stand before you today. My fellow directors and I are committed to helping this company achieve its undeniable potential, and we look forward to beginning to realise the fruits of those endeavours in the year ahead. Finally, to our Shareholders I want to thank you for your patience and support and to the management and staff I want to recognise your incredible efforts over the last 12 months.

3

Presentation to Shareholders 15 November 2017 Dr James Garner Chief Executive Officer Novogen Limited NRT NVGN

Forward-Looking Statements This presentation contains “forward-looking statements” within the meaning of the “safe-harbor” provisions of the Private Securities Litigation Reform Act of 1995. Such statements involve known and unknown risks, uncertainties and other factors that could cause the actual results of the Company to differ materially from the results expressed or implied by such statements, including changes from anticipated levels of customer acceptance of existing and new products and services and other factors. Accordingly, although the Company believes that the expectations reflected in such forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. The Company has no obligation to sales, future international, national or regional economic and competitive conditions, changes in relationships with customers, access to capital, difficulties in developing and marketing new products and services, marketing existing products and services update the forward-looking information contained in this presentation.

Novogen has continued to deliver on milestones across its portfolio during 2017 Commencement of Cantrixil phase I study in ovarian cancer December 2016 Awarded $3 million CRC-P grant for ‘next-generation’ ATM discovery program February 2017 Termination of ATM-3507 program due to unfavourable preclinical data April 2017 US and EU patents granted for Cantrixil and Trilexium July & August 2017 FDA meeting for GDC-0084 phase II study September 2017 Package of preclinical assets licensed to Heaton-Brown Life Sciences November 2017 Commencement of GDC-0084 phase II study in glioblastoma planned

Our efforts are attracting increasing attention from media and the investment community

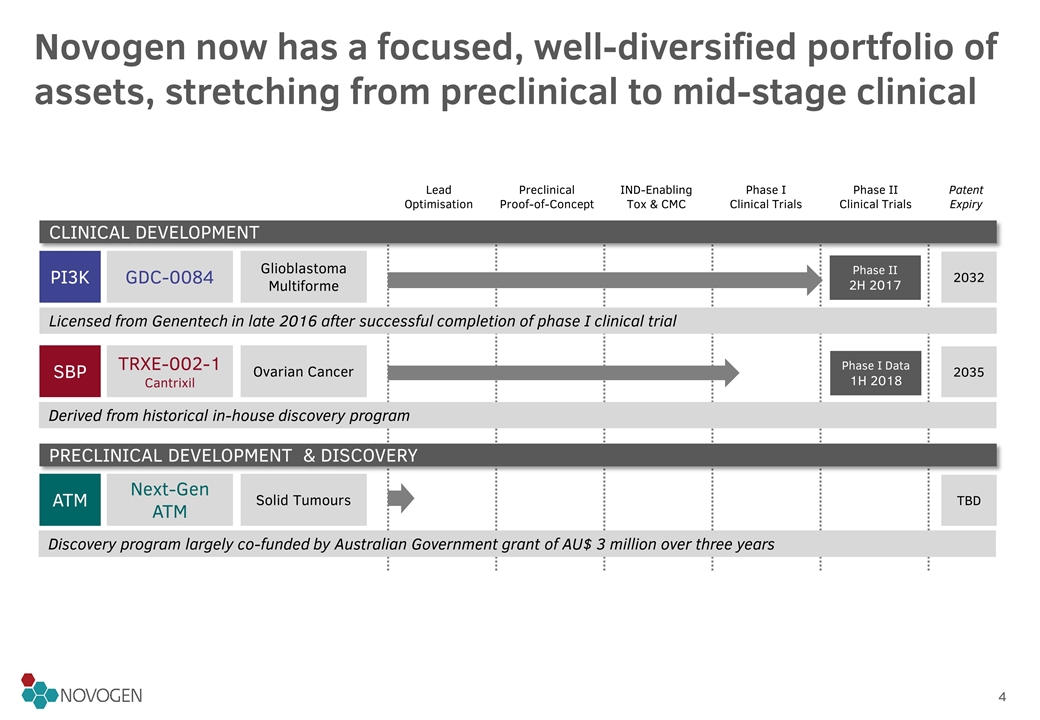

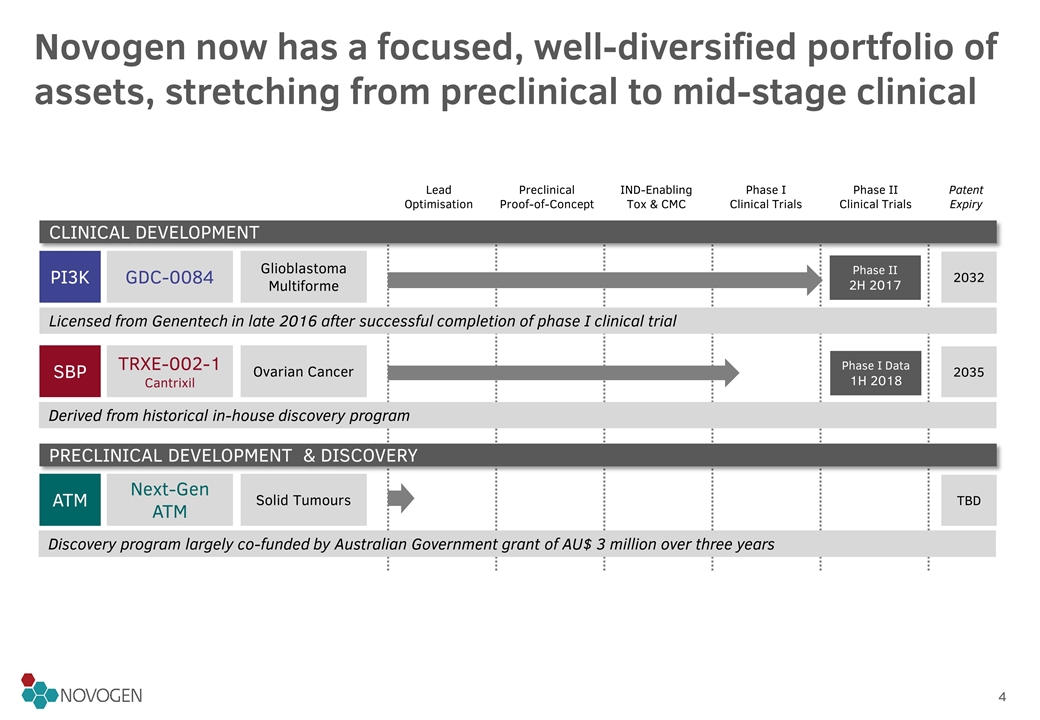

Novogen now has a focused, well-diversified portfolio of assets, stretching from preclinical to mid-stage clinical Lead Optimisation Preclinical Proof-of-Concept IND-Enabling Tox & CMC Phase I Clinical Trials Phase II Clinical Trials Patent Expiry SBP TRXE-002-1 Cantrixil 2035 PI3K GDC-0084 2032 Ovarian Cancer Glioblastoma Multiforme Phase II 2H 2017 CLINICAL DEVELOPMENT Phase I Data 1H 2018 PRECLINICAL DEVELOPMENT & DISCOVERY ATM Next-Gen ATM Solid Tumours TBD Licensed from Genentech in late 2016 after successful completion of phase I clinical trial Derived from historical in-house discovery program Discovery program largely co-funded by Australian Government grant of AU$ 3 million over three years

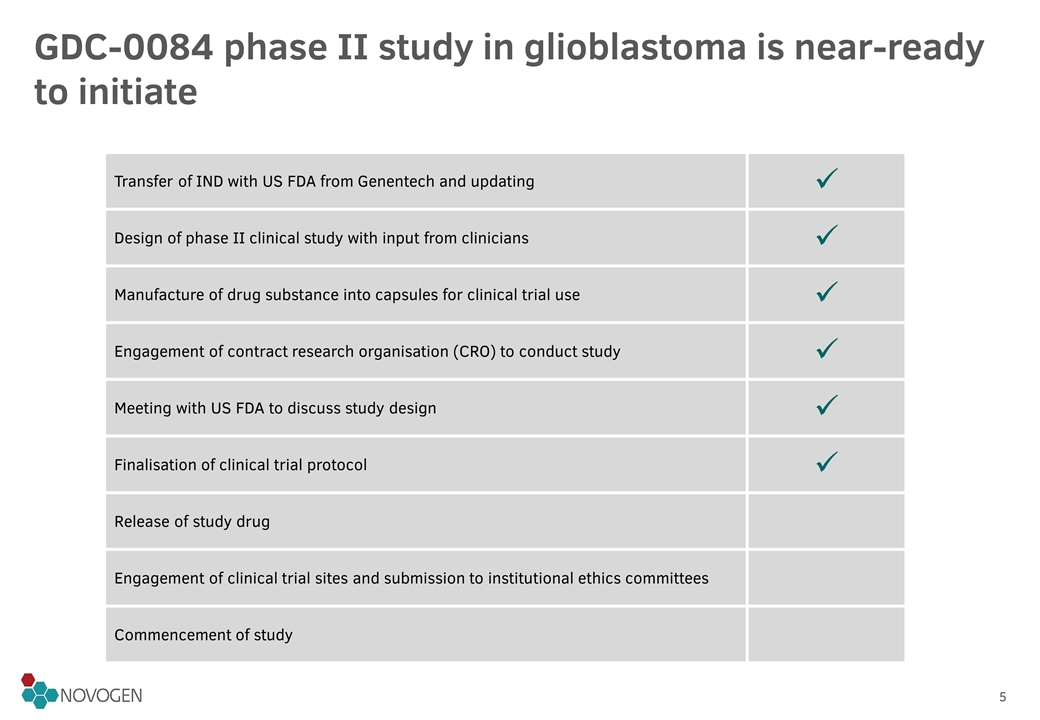

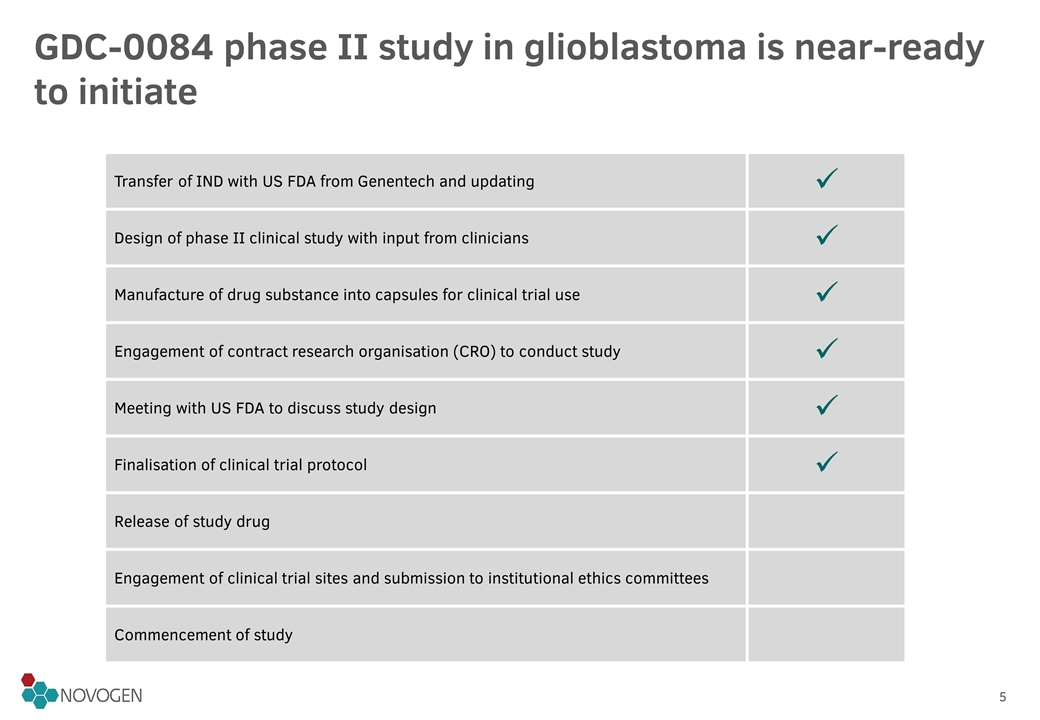

GDC-0084 phase II study in glioblastoma is near-ready to initiate Transfer of IND with US FDA from Genentech and updating ü Design of phase II clinical study with input from clinicians ü Manufacture of drug substance into capsules for clinical trial use ü Engagement of contract research organisation (CRO) to conduct study ü Meeting with US FDA to discuss study design ü Finalisation of clinical trial protocol ü Release of study drug Engagement of clinical trial sites and submission to institutional ethics committees Commencement of study

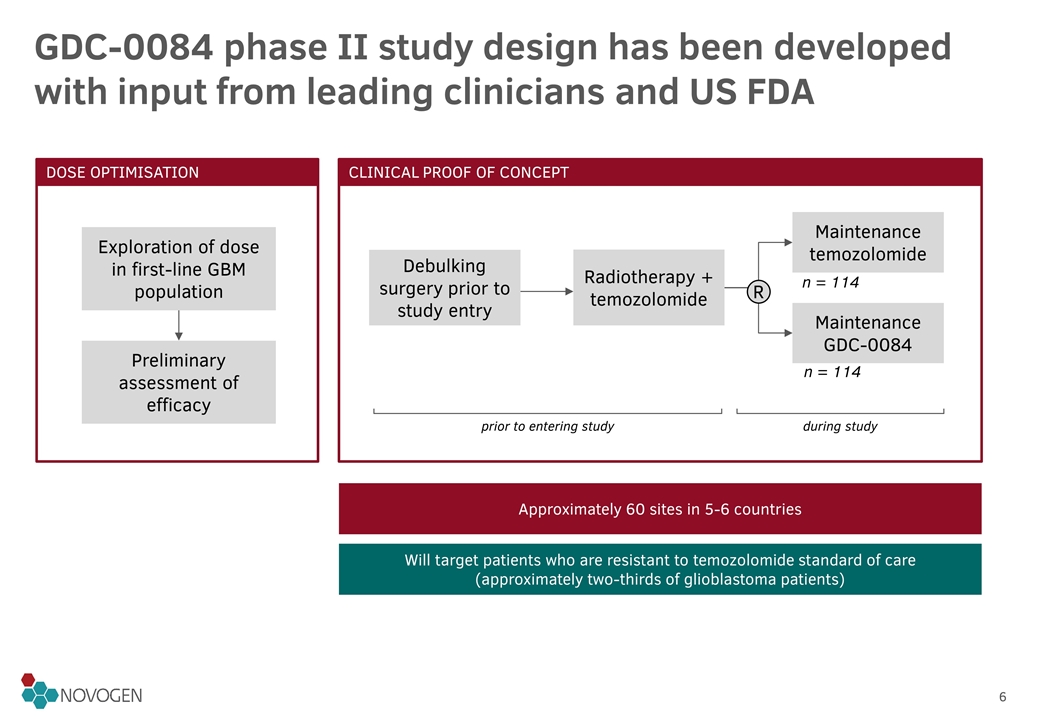

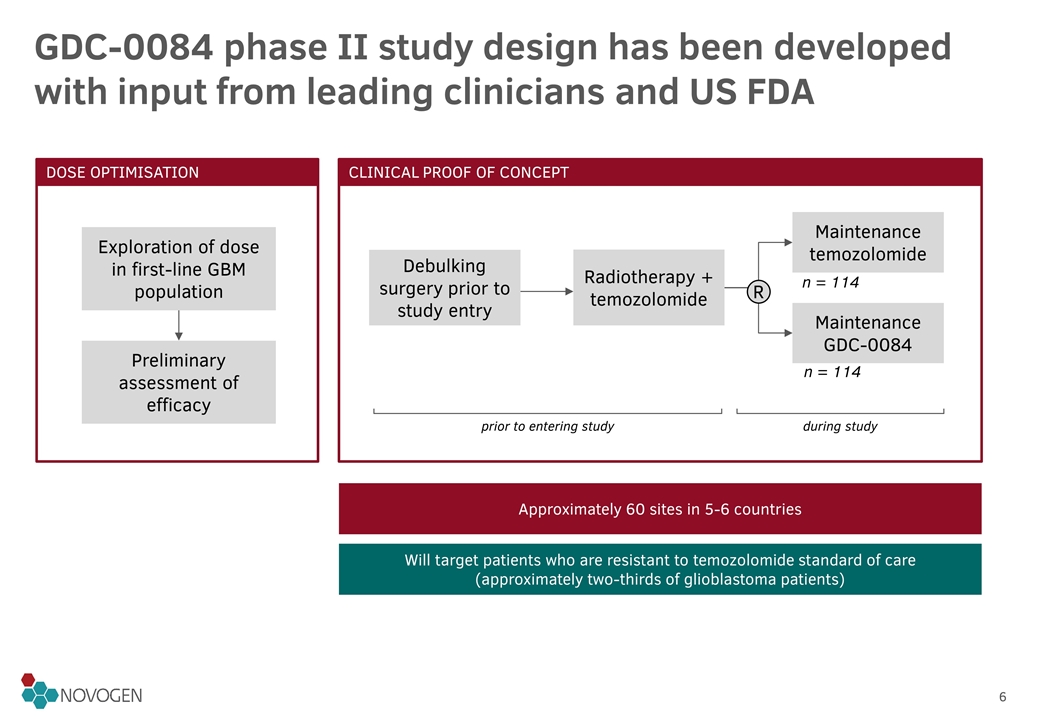

GDC-0084 phase II study design has been developed with input from leading clinicians and US FDA Debulking surgery prior to study entry Radiotherapy + temozolomide Maintenance temozolomide Maintenance GDC-0084 R prior to entering study during study n = 114 n = 114 CLINICAL PROOF OF CONCEPT DOSE OPTIMISATION Exploration of dose in first-line GBM population Preliminary assessment of efficacy Approximately 60 sites in 5-6 countries Will target patients who are resistant to temozolomide standard of care (approximately two-thirds of glioblastoma patients)

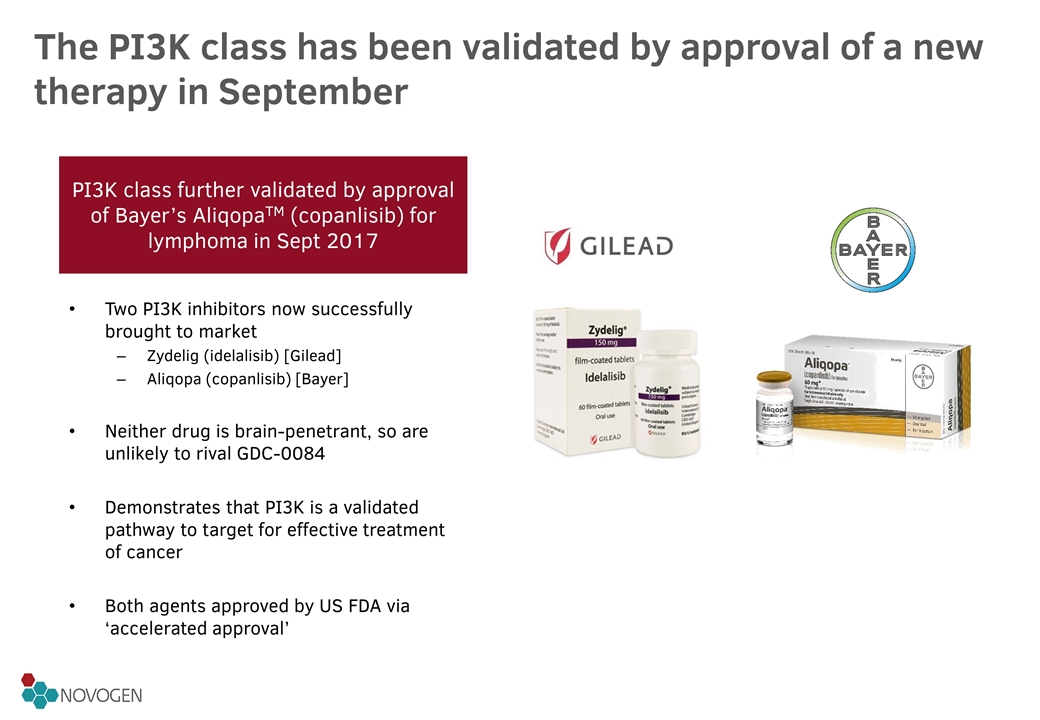

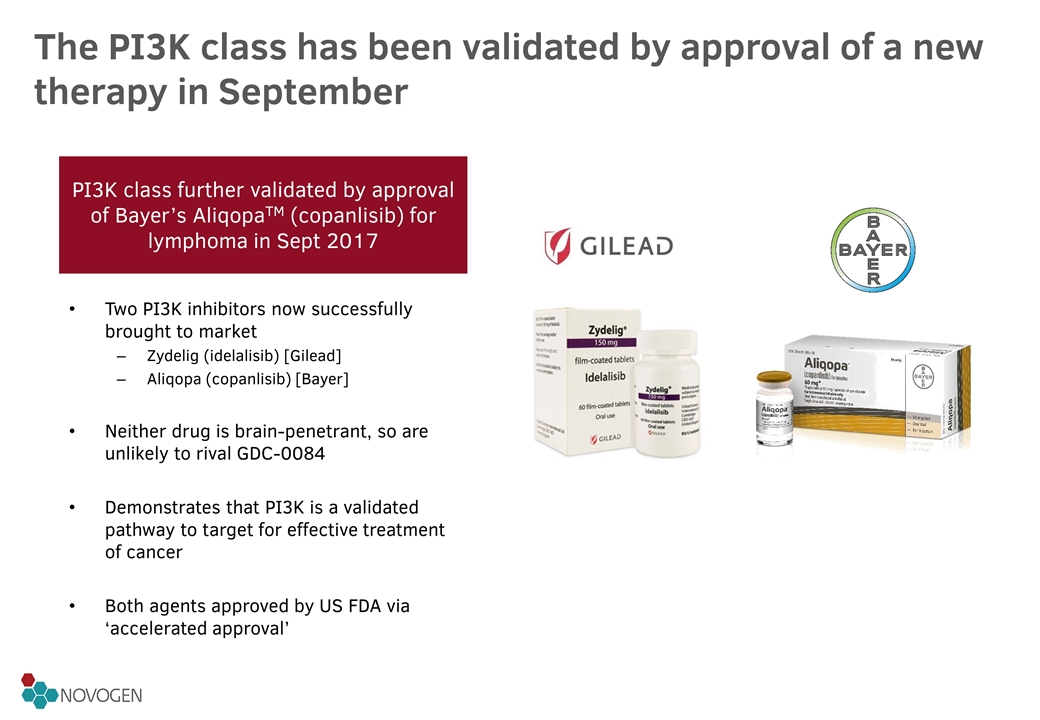

The PI3K class has been validated by approval of a new therapy in September Two PI3K inhibitors now successfully brought to market Zydelig (idelalisib) [Gilead] Aliqopa (copanlisib) [Bayer] Neither drug is brain-penetrant, so are unlikely to rival GDC-0084 Demonstrates that PI3K is a validated pathway to target for effective treatment of cancer Both agents approved by US FDA via ‘accelerated approval’ PI3K class further validated by approval of Bayer’s AliqopaTM (copanlisib) for lymphoma in Sept 2017

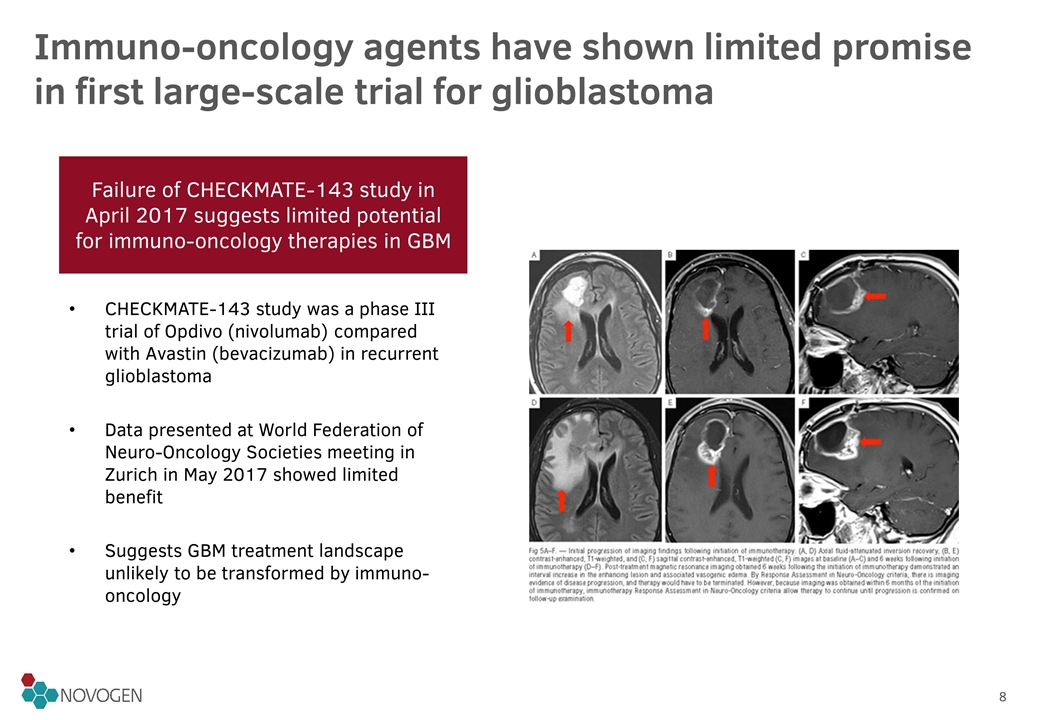

Failure of CHECKMATE-143 study in April 2017 suggests limited potential for immuno-oncology therapies in GBM Immuno-oncology agents have shown limited promise in first large-scale trial for glioblastoma CHECKMATE-143 study was a phase III trial of Opdivo (nivolumab) compared with Avastin (bevacizumab) in recurrent glioblastoma Data presented at World Federation of Neuro-Oncology Societies meeting in Zurich in May 2017 showed limited benefit Suggests GBM treatment landscape unlikely to be transformed by immuno-oncology

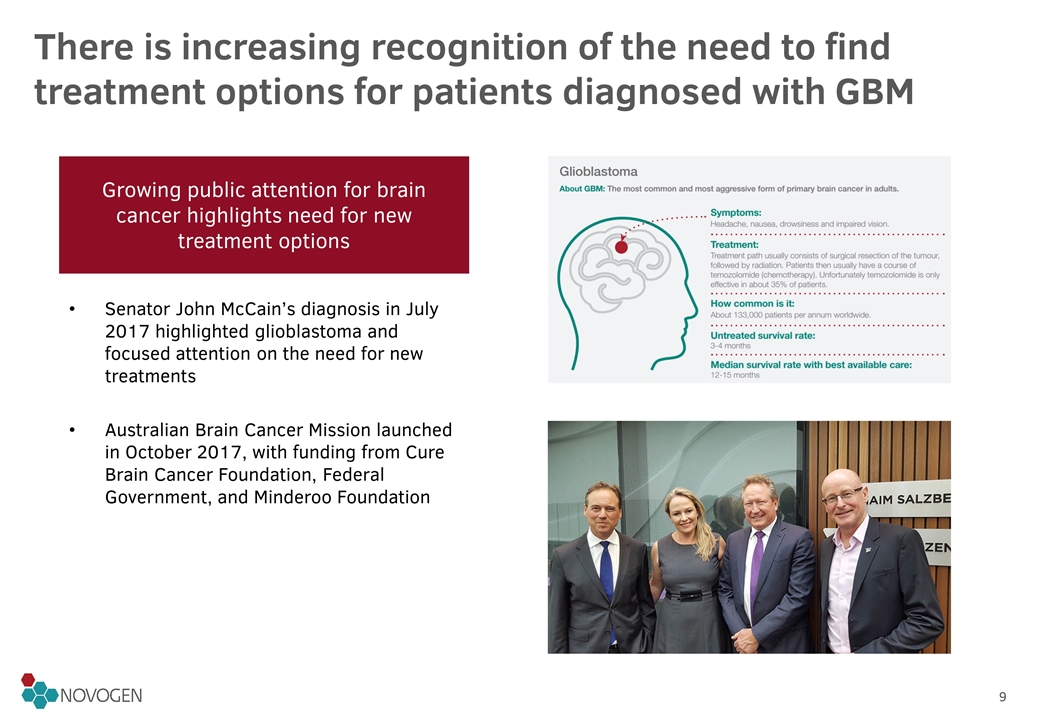

Growing public attention for brain cancer highlights need for new treatment options There is increasing recognition of the need to find treatment options for patients diagnosed with GBM Senator John McCain’s diagnosis in July 2017 highlighted glioblastoma and focused attention on the need for new treatments Australian Brain Cancer Mission launched in October 2017, with funding from Cure Brain Cancer Foundation, Federal Government, and Minderoo Foundation

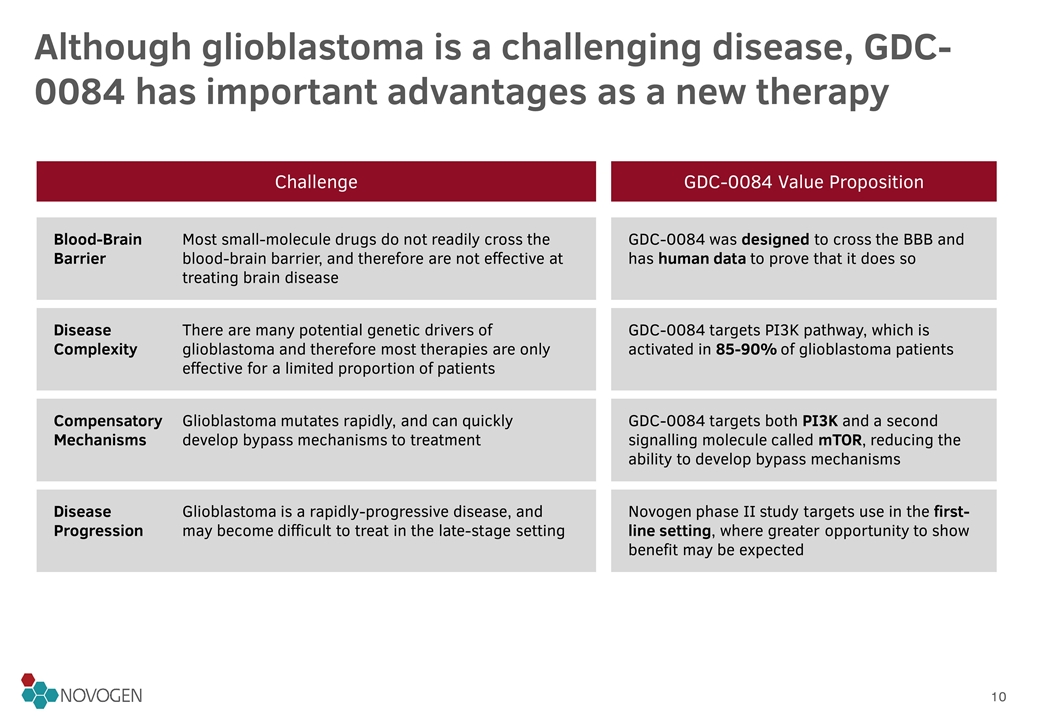

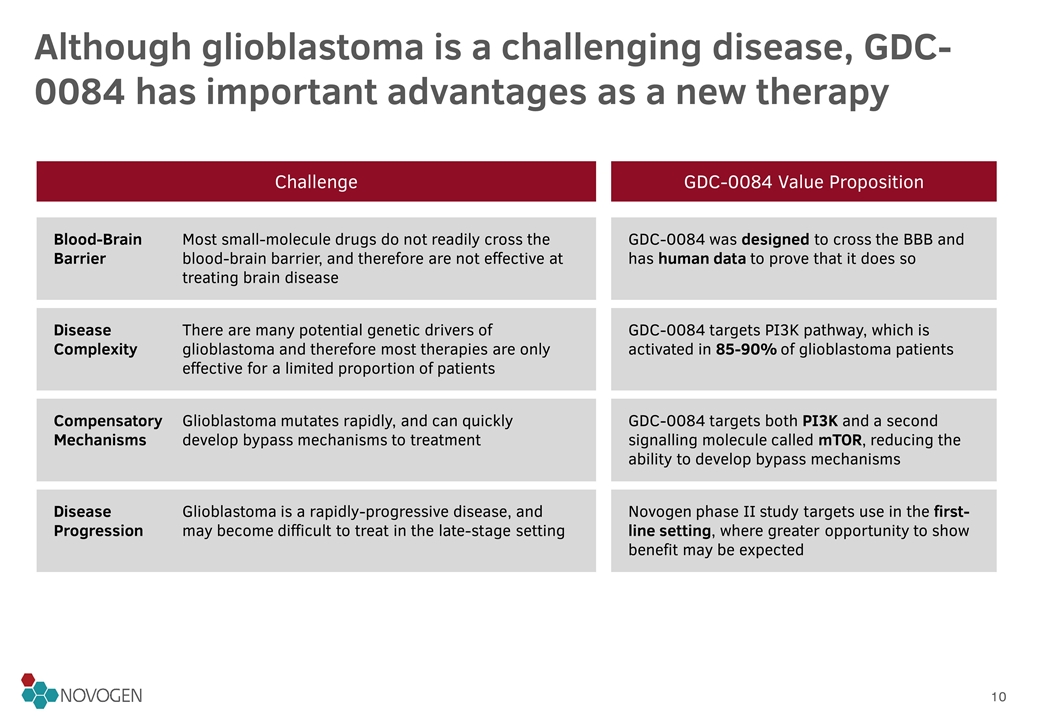

Although glioblastoma is a challenging disease, GDC-0084 has important advantages as a new therapy Challenge GDC-0084 Value Proposition Blood-Brain Barrier Most small-molecule drugs do not readily cross the blood-brain barrier, and therefore are not effective at treating brain disease GDC-0084 was designed to cross the BBB and has human data to prove that it does so Disease Complexity There are many potential genetic drivers of glioblastoma and therefore most therapies are only effective for a limited proportion of patients GDC-0084 targets PI3K pathway, which is activated in 85-90% of glioblastoma patients Compensatory Mechanisms Glioblastoma mutates rapidly, and can quickly develop bypass mechanisms to treatment GDC-0084 targets both PI3K and a second signalling molecule called mTOR, reducing the ability to develop bypass mechanisms Disease Progression Glioblastoma is a rapidly-progressive disease, and may become difficult to treat in the late-stage setting Novogen phase II study targets use in the first-line setting, where greater opportunity to show benefit may be expected

Single asset company with one PI3K inhibitor in phase I human trials US$ 128 million Market Cap One PI3K inhibitor in phase II human trials, one other drug in phase III, and two in animal testing US$ 530 million Market Cap One PI3K inhibitor in phase II human trials Acquired by big pharma in 2011 for US$ 375 million Other companies focused on the PI3K pathway have been highly-valued in the market

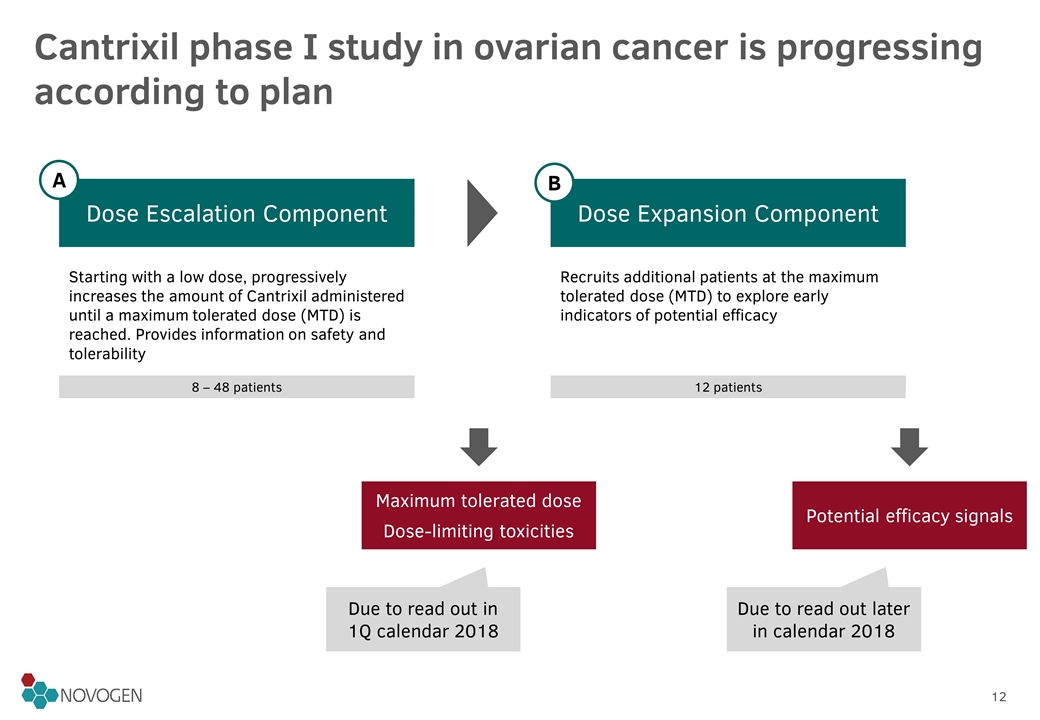

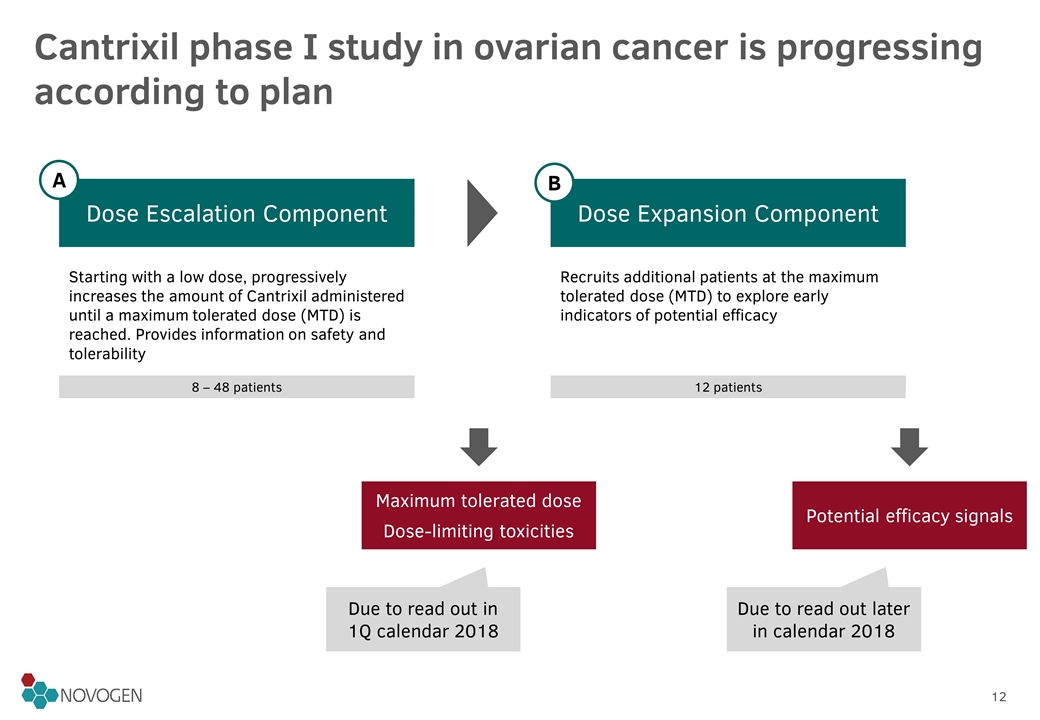

Cantrixil phase I study in ovarian cancer is progressing according to plan Dose Escalation Component Dose Expansion Component Starting with a low dose, progressively increases the amount of Cantrixil administered until a maximum tolerated dose (MTD) is reached. Provides information on safety and tolerability Recruits additional patients at the maximum tolerated dose (MTD) to explore early indicators of potential efficacy Maximum tolerated dose Dose-limiting toxicities Potential efficacy signals Due to read out in 1Q calendar 2018 Due to read out later in calendar 2018 8 – 48 patients 12 patients A B

We are seeking support of shareholders to complete the Company’s transformation Novogen has been many things to many people, and we remain proud of our historical achievements. However, to fully realise our future potential, we need our stakeholders to be able to see us with fresh eyes, and to consider us without the encumbrance of the Company’s numerous and varied past iterations. With the imminent return of GDC-0084 to the clinic, and the successful transition of Cantrixil into human trials last year, Novogen has earned the right to redefine itself, and your Board seeks your support for the Company’s revitalised sense of purpose. Iain Ross Chairman of the Board

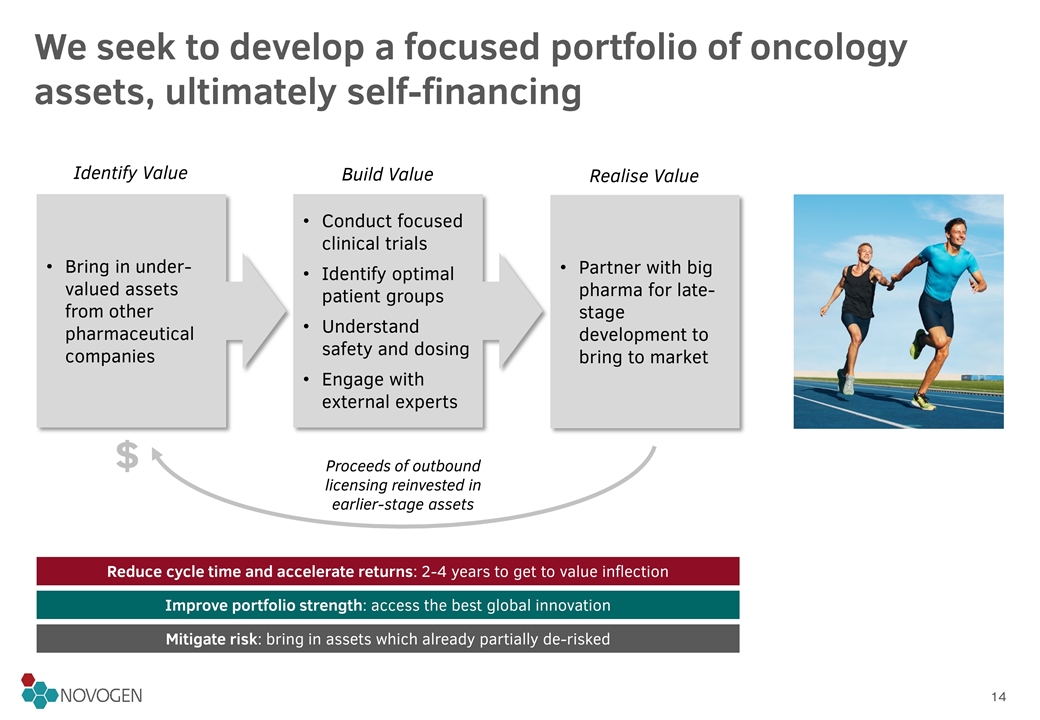

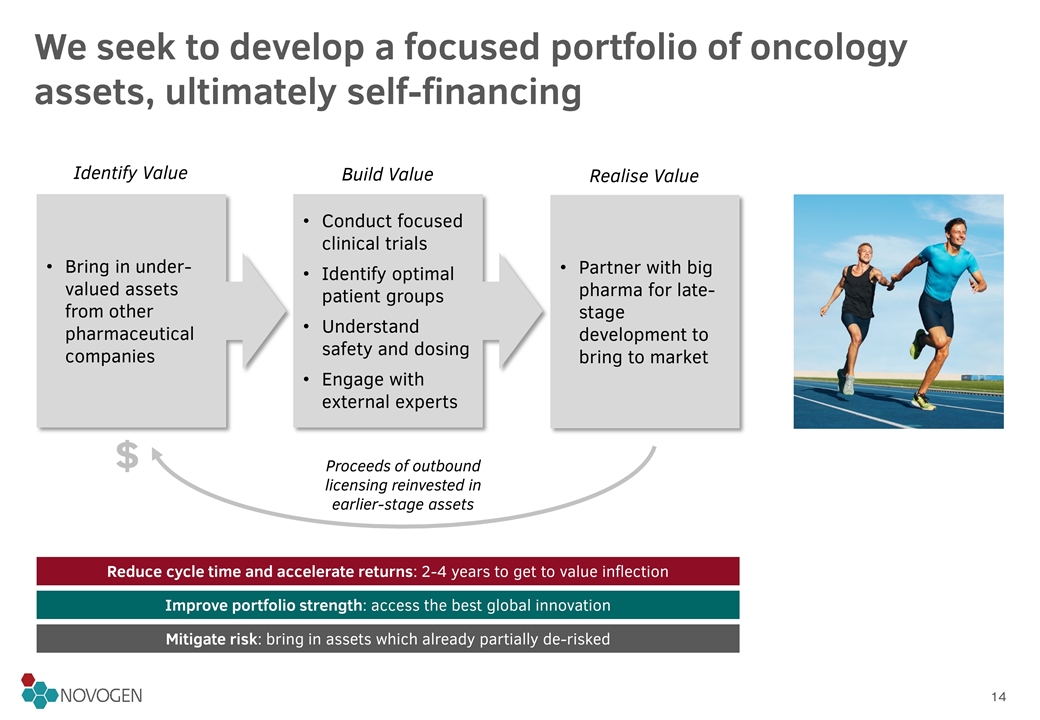

We seek to develop a focused portfolio of oncology assets, ultimately self-financing Partner with big pharma for late-stage development to bring to market Bring in under-valued assets from other pharmaceutical companies Conduct focused clinical trials Identify optimal patient groups Understand safety and dosing Engage with external experts Identify Value Build Value Realise Value Proceeds of outbound licensing reinvested in earlier-stage assets $ Reduce cycle time and accelerate returns: 2-4 years to get to value inflection Improve portfolio strength: access the best global innovation Mitigate risk: bring in assets which already partially de-risked

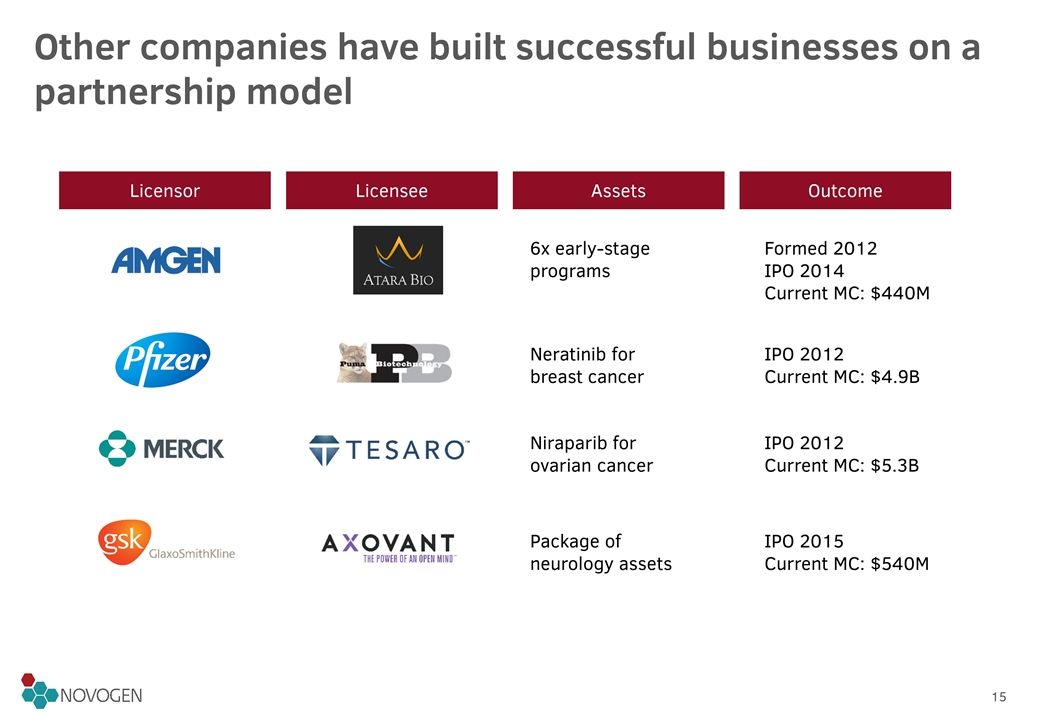

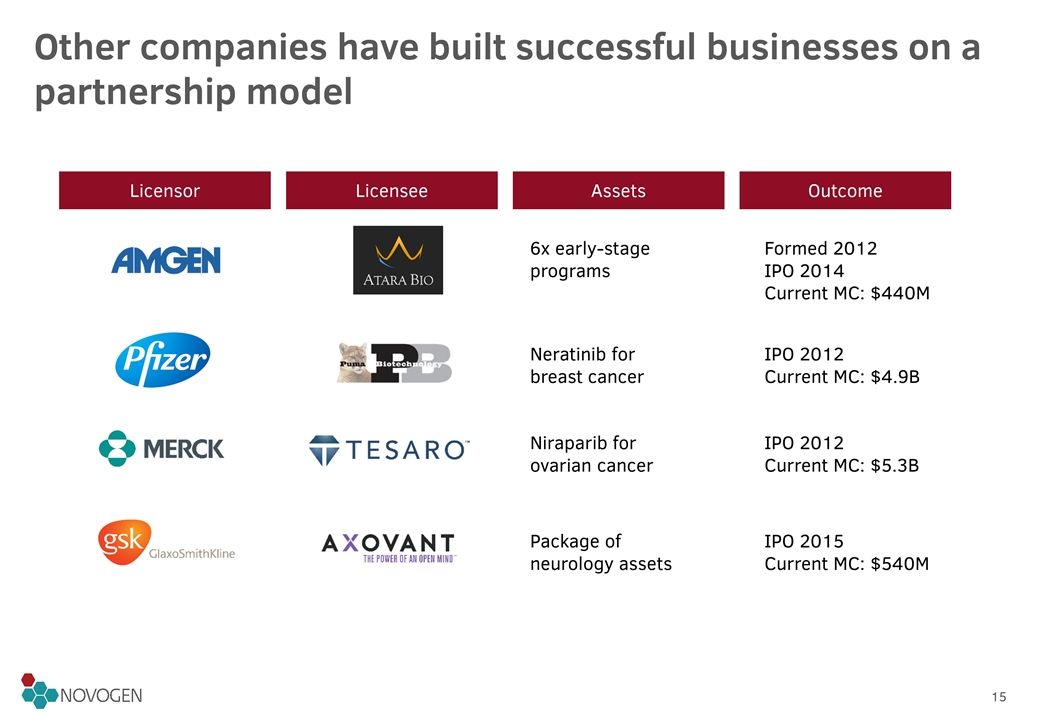

Other companies have built successful businesses on a partnership model Licensor Licensee Assets Outcome 6x early-stage programs Neratinib for breast cancer Niraparib for ovarian cancer Formed 2012 IPO 2014 Current MC: $440M IPO 2012 Current MC: $4.9B IPO 2012 Current MC: $5.3B Package of neurology assets IPO 2015 Current MC: $540M

We have already demonstrated that we can achieve much of what is required to succeed Key Success Factors Proof Points Identify and bring in high-quality assets from international big pharma companies Novogen’s successful deal with Genentech for GDC-0084 in October 2016 Build a diverse portfolio of assets so as to reduce risk of program failure and increase ‘shots on goal’ Two programs, with distinct mechanisms of action, currently in clinical studies; a third program in early-stage development Efficiently and effectively develop new therapies that answer unmet patient need Two open INDs with US FDA; One international clinical trial underway, and a second about to start Partner with larger companies to commercialise new products so that value can be delivered to shareholders Extensive track record of pharmaceutical licensing and commercialisation among management team and Board ü ü ü ü

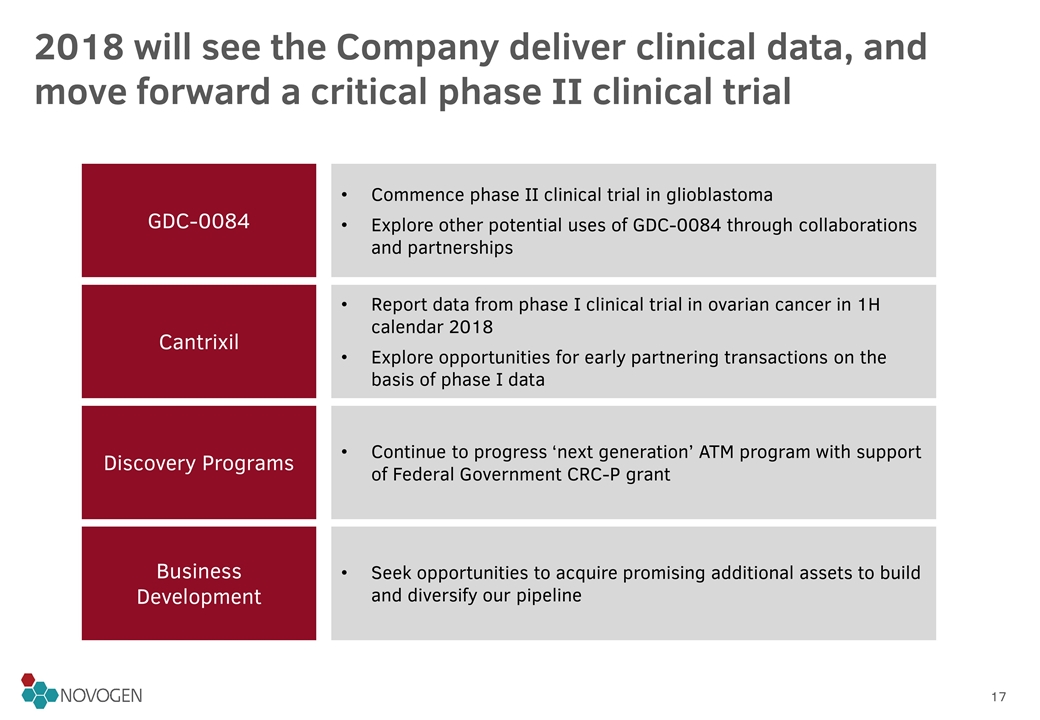

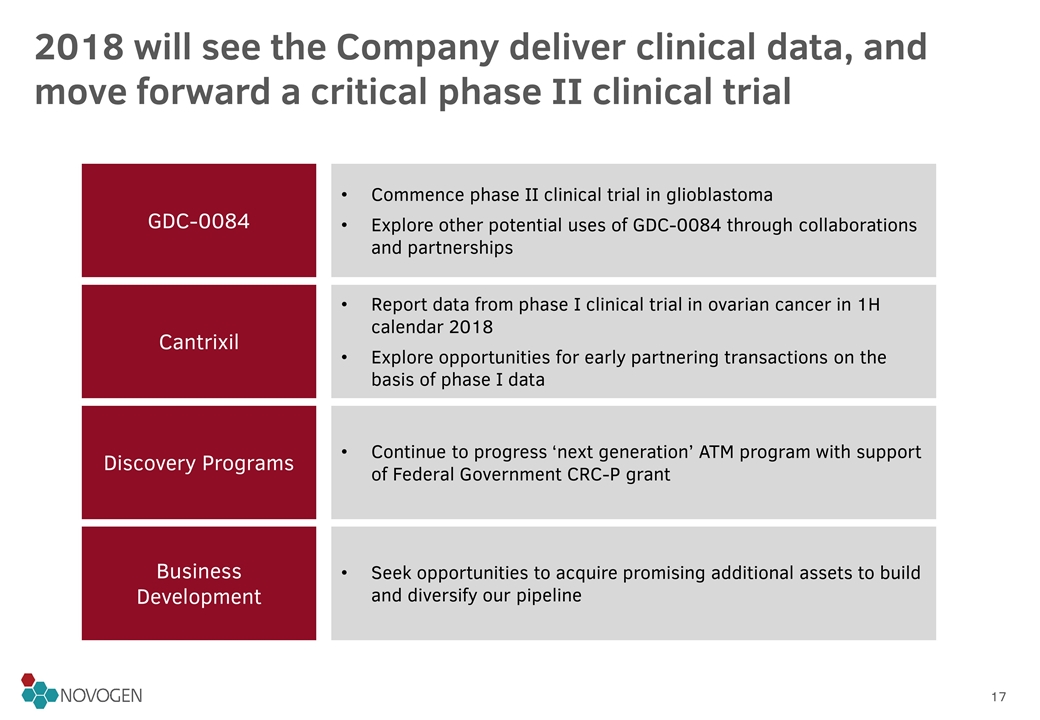

2018 will see the Company deliver clinical data, and move forward a critical phase II clinical trial GDC-0084 Cantrixil Discovery Programs Business Development Commence phase II clinical trial in glioblastoma Explore other potential uses of GDC-0084 through collaborations and partnerships Report data from phase I clinical trial in ovarian cancer in 1H calendar 2018 Explore opportunities for early partnering transactions on the basis of phase I data Continue to progress ‘next generation’ ATM program with support of Federal Government CRC-P grant Seek opportunities to acquire promising additional assets to build and diversify our pipeline