UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November, 2020

Commission File Number

Kazia Therapeutics Limited

(Translation of registrant’s name into English)

Three International Towers Level 24 300 Barangaroo Avenue Sydney NSW 2000

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☑ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark if the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes ☐ No ☑

If “yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b)

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Kazia Therapeutics Limited (Registrant)

Kate Hill

Kate Hill

Company Secretary

Date 6 November 2020

ASX RELEASE

6 November 2020

KAZIA ANNUAL GENERAL MEETING MATERIALS

Sydney, 6 November 2020 – Kazia Therapeutics Limited (ASX: KZA; NASDAQ: KZIA), an Australian oncology-focused biotechnology company, is pleased to provide the Chairman’s Address and CEO presentation which will be discussed at our Annual General Meeting at 9am this morning.

[ENDS]

About Kazia Therapeutics Limited

Kazia Therapeutics Limited (ASX: KZA, NASDAQ: KZIA) is an innovative oncology-focused biotechnology company, based in Sydney, Australia. Our pipeline includes two clinical-stage drug development candidates, and we are working to develop therapies across a range of oncology indications.

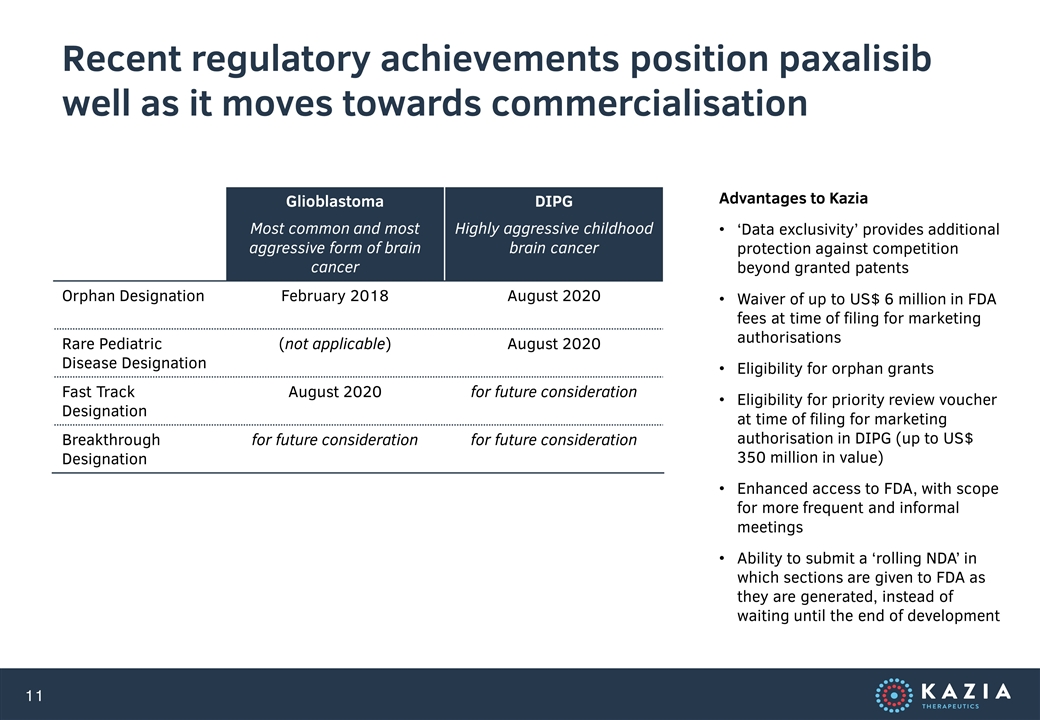

Our lead program is paxalisib (formerly GDC-0084), a small molecule inhibitor of the PI3K / AKT / mTOR pathway, which is being developed to treat glioblastoma, the most common and most aggressive form of primary brain cancer in adults. Licensed from Genentech in late 2016, paxalisib entered a phase II clinical trial in 2018. Interim data was reported most recently at AACR in June 2020, and further data is expected in 2H 2020. Five additional studies are in start-up or ongoing in other forms of brain cancer. Paxalisib was granted Orphan Drug Designation for glioblastoma by the US FDA in February 2018, and Fast Track Designation for glioblastoma by the US FDA in August 2020. In addition, paxalisib was granted Rare Pediatric Disease Designation and Orphan Designation by the US FDA for DIPG in August 2020.

TRX-E-002-1 (Cantrixil), is a third-generation benzopyran molecule with activity against cancer stem cells and is being developed to treat ovarian cancer. TRX-E-002-1 has completed a phase I clinical trial in Australia and the United States with the final data expected in the second half of calendar 2020. Interim data was presented most recently at the AACR conference in June 2020. Cantrixil was granted orphan designation for ovarian cancer by the US FDA in April 2015.

For more information, please visit www.kaziatherapeutics.com.

This document was authorized for release to the ASX by James Garner, Chief Executive Officer, Managing Director.

KAZIA ANNUAL GENERAL MEETING

6 NOVEMBER 2020

CHAIRMAN’S ADDRESS

Ladies and Gentlemen,

It is my pleasure to welcome you to the Annual General Meeting for Kazia Therapeutics Limited. Due to the ongoing COVID-19 pandemic, our AGM this year is being conducted in a virtual format. I regret not having the opportunity to meet with shareholders in person on this occasion, but I very much hope that we will soon be able to return to some degree of normality.

Indeed, the virtual format is but one example of the fact that today’s AGM takes place in the context of an extraordinary global environment. For each of us, 2020 has been a uniquely challenging year, and I expect that the impact of this period will continue to be felt for several years to come.

Given this backdrop, it is gratifying to report that 2020 has been Kazia’s most successful year ever. In order to flourish, a biotech company must win on many fronts – it must secure investment, it must earn the trust of regulators, it must build productive partnerships, and it must generate positive clinical data. In each of those areas, Kazia has excelled this year, and I am proud to take this opportunity to talk to you about several of our key achievements.

At the ASCO annual meeting in June, we reported further interim data from the phase II study of paxalisib in glioblastoma. This suggested the potential for a survival benefit relative to the approved standard of care. If this finding is replicated in a pivotal study, it will represent a remarkable addition to the therapeutic armamentarium in this very challenging disease.

Consequently, that pivotal study has been an area of substantial focus for us in recent months. Perhaps the most significant landmark this year, indeed arguably the most significant landmark in Kazia’s short history, has been the operational commencement of the GBM AGILE study. As shareholders will be aware, it is intended to serve as the pivotal study for registration of paxalisib in glioblastoma. In the past month, we have quietly become a ‘phase III company’, focused on what we believe to be one of the most exciting drug candidates in the global pipeline for brain cancer.

GBM AGILE encapsulates so much of what makes Kazia unique and innovative. It is a partnership, involving some of the leading experts in brain cancer and a number of leading US-based not-for-profit organisations. It is scientifically ground-breaking, using cutting-edge statistical techniques to efficiently evaluate several drugs simultaneously. It is strongly supported by regulators. And it is tremendously cost-effective, representing a demand on our cashflow that amounts to only a fraction of the cost of a comparable standalone study. In this, as in everything our company has done, we have found a way to accomplish more with the capital invested by our shareholders.

GBM AGILE is not the only new study this year. We were also proud to launch a phase II clinical trial in primary CNS lymphoma, in a new collaboration with Dana-Farber Cancer Institute. This will be the seventh clinical trial of paxalisib that Kazia has initiated. It has often been remarked that this broad portfolio of work would be the pride of a much larger organisation. For a company such as Kazia, the capital and resource efficiency with which these studies have been implemented is genuinely remarkable.

Looking forward, this broad program translates to one thing: data. Having seven clinical studies implies seven streams of new information about paxalisib over the next few years. As a very high-level generalisation, we expect new data from the paxalisib program to be reported approximately each quarter, on average, for the foreseeable future. Each of those read-outs will generate new opportunities for investors, partners, and regulators to evaluate the company’s work and the potential of the drug.

To be clear, not every study will be definitive. Despite all our scientific advances, drug development remains a process of trial and error. Some of these endeavours will no doubt prove more exciting than others. The beauty of the program that has been built, however, is that we don’t need to win every time. In fact, if we were to see success in just one of these patient groups – be it glioblastoma, or DIPG, or primary CNS lymphoma, or brain metastases – we would have a very promising commercial opportunity on our hands. Conversely, we can only truly fail if every single study proves unsuccessful. In that sense, Kazia has not only succeeded in cultivating enormous economic potential, but also in substantially mitigating risk, which is always the flipside of any biotech investment.

On the topic of investment, we have been grateful to welcome new shareholders to the register, and for the support of those existing shareholders who have participated in our two financing rounds this year. It is a measure of how far Kazia has come that the company’s share register now includes several very high-quality, long-term and sector specialist institutional investors. We greatly appreciate the support of all our shareholders, large and small, recent and longstanding, and we never take it for granted.

I should comment briefly on our second asset, Cantrixil, which is in development for ovarian cancer. We presented positive data from the phase I study of Cantrixil at the AACR annual meeting earlier this year. As we have said previously, our aspiration for Cantrixil is to find a good quality partner for the asset, one who shares our belief in its potential, but also one which can bring the necessary expertise and resources to fulfil that potential. With final data nearly in hand, we expect those discussions to be a key priority in coming months.

In closing, this has been a terrific year for our company. We embark now on the most exciting part of our journey: the final chapter of paxalisib’s development, which we hope will establish it as the first new drug treatment for glioblastoma in decades.

In closing, I want to commend our CEO, James Garner, and his management team, for all their determination and hard work throughout the year. On behalf of my colleagues on the Board, I also want to thank all our shareholders for their ongoing support of the company. Your faith in us is a substantial part of what motivates us to work hard every day to ensure the company’s success. We look forward to continuing that journey with you as paxalisib moves closer towards becoming a commercial product.

Presentation to Annual General Meeting of Shareholders Dr James Garner Chief Executive Officer Sydney, NSW 6 November 2020

Forward-Looking Statements This presentation contains “forward-looking statements” within the meaning of the “safe-harbor” provisions of the Private Securities Litigation Reform Act of 1995. Such statements involve known and unknown risks, uncertainties and other factors that could cause the actual results of the Company to differ materially from the results expressed or implied by such statements, including changes from anticipated levels of customer acceptance of existing and new products and services and other factors. Accordingly, although the Company believes that the expectations reflected in such forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. The Company has no obligation to sales, future international, national or regional economic and competitive conditions, changes in relationships with customers, access to capital, difficulties in developing and marketing new products and services, marketing existing products and services update the forward-looking information contained in this presentation.

Investment Rationale World-Class Asset in Brain Cancer Clear Path to Commercialisation Strong Corporate Story Paxalisib developed by Genentech, the world’s most successful cancer drug company Well-proven mechanism of action, with unique differentiating factor of brain penetration Strong scientific rationale for development in brain cancer Encouraging clinical data emerging from US-based phase II study Potential best-in-class toxicity profile FDA-endorsed GBM AGILE study will serve as pivotal study for registration US$ 1.5 billion pa commercial opportunity in glioblastoma, with potential upside in other cancers High unmet medical need – existing standard of care ineffective in two-thirds of patients 5x additional clinical studies at top tier US hospitals provide multiple shots on goal Optimised regulatory position with Orphan, Fast Track, and Rare Paediatric Disease Designations Kazia is a late-clinical-stage company, funded for phase III, with one of the leading assets in the global glioblastoma pipeline, and the potential to address a $1.5 billion market Highly-efficient operating model, with ~80% of expenditure applied directly to R&D Lean team of internationally-experienced drug developers Good potential for partnering and / or M&A during remaining development of paxalisib

Investment Rationale Paxalisib is… Ü In a pivotal study for registration Ü Well-funded Ü Diversified into other brain cancers Ü Attractive for partnering and and and

Agenda Operational Report Financial Report Looking Ahead

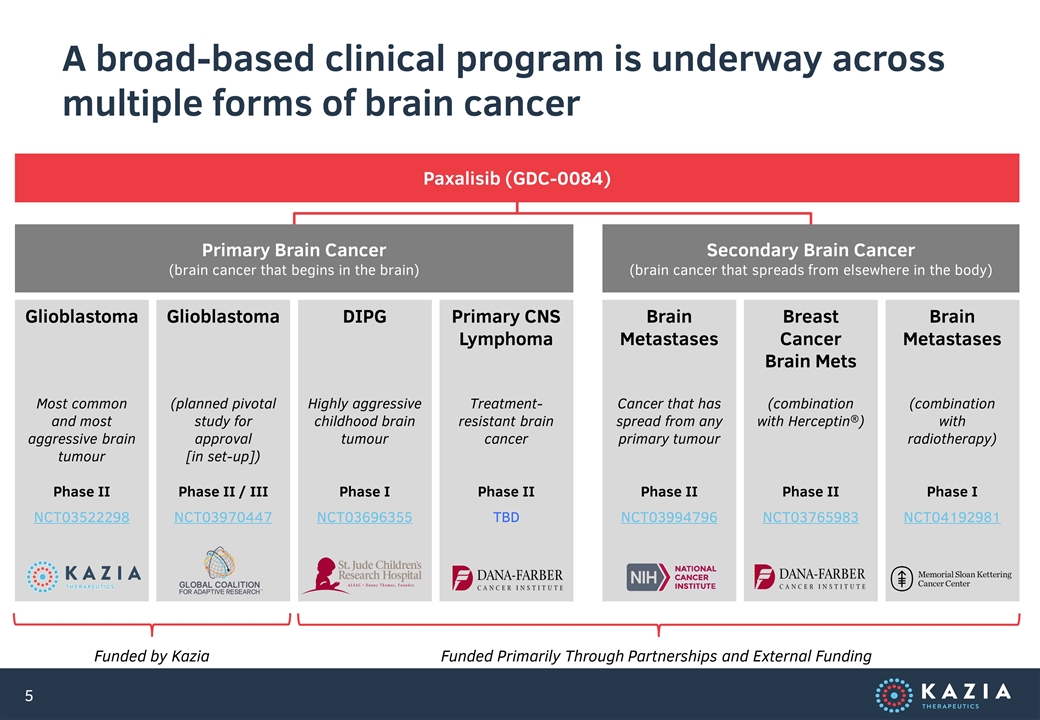

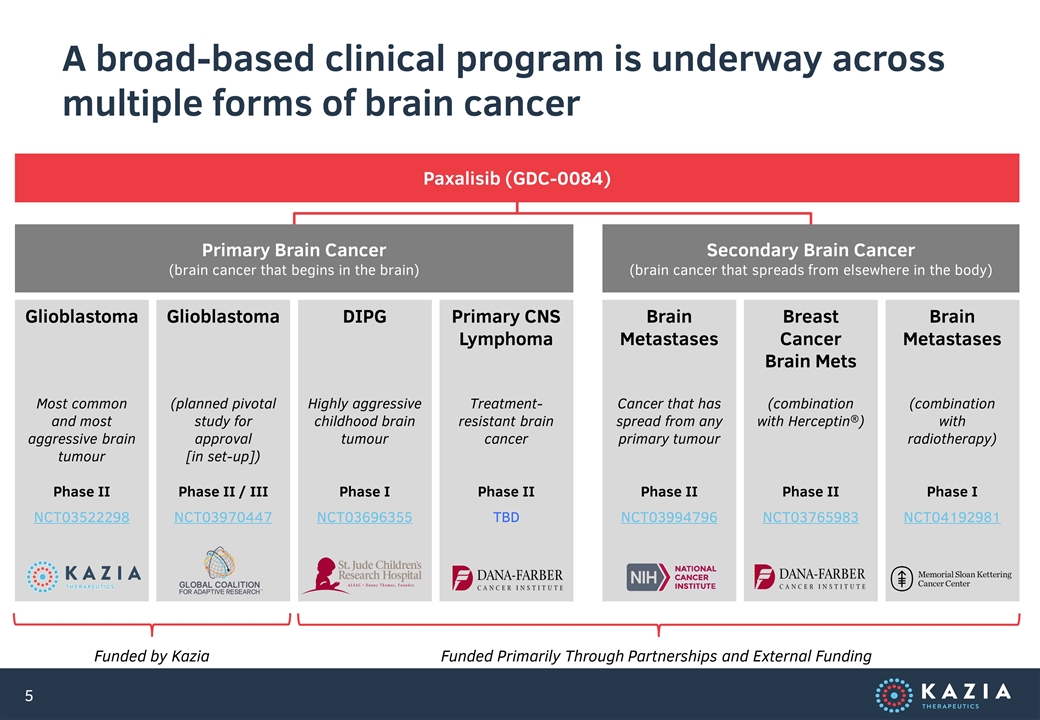

A broad-based clinical program is underway across multiple forms of brain cancer Glioblastoma Most common and most aggressive brain tumour Phase II NCT03522298 Glioblastoma (planned pivotal study for approval [in set-up]) Phase II / III NCT03970447 Brain Metastases Cancer that has spread from any primary tumour Phase II NCT03994796 Breast Cancer Brain Mets (combination with Herceptin®) Phase II NCT03765983 Brain Metastases (combination with radiotherapy) Phase I NCT04192981 Primary Brain Cancer (brain cancer that begins in the brain) Secondary Brain Cancer (brain cancer that spreads from elsewhere in the body) Paxalisib (GDC-0084) Funded by Kazia Funded Primarily Through Partnerships and External Funding DIPG Highly aggressive childhood brain tumour Phase I NCT03696355 Primary CNS Lymphoma Treatment-resistant brain cancer Phase II TBD

Data read-outs this year have been highly encouraging Note: figures for existing therapy are for temozolomide, per Hegi et al. (2005); comparison between different studies is never perfectly like-for-like Progression-Free Survival (PFS) Overall Survival (OS) 8.5 months Median PFS 5.3 months Median PFS Paxalisib Existing Therapy 12.7 months Median OS Paxalisib Existing Therapy 17.7 months Median OS Part A + Part B (n=30) Part A (n=9)

GBM AGILE is the planned pivotal study for paxalisib in glioblastoma What is GBM AGILE? Who is Behind It? A ‘platform study’, designed by the leading experts in brain cancer to expedite the approval of new drugs for glioblastoma Multiple drugs can be evaluated in parallel, saving time and money; Bayer’s Stivarga (regorafenib) is the first drug to participate, and Kazia’s paxalisib will be the second FDA has provided strong endorsement, saying that positive data from GBM AGILE will be suitable for product registration The study is currently active at approximately 31 hospitals in the United States and Canada and recruiting very well; expansion to Europe and China is expected in 1H CY2021 Cutting-edge ‘adaptive design’ ensures that the study will only recruit the number of patients needed to reach an answer (up to 200 on paxalisib), avoiding redundancy and ensuring the fastest possible path to market GBM AGILE is sponsored by the Global Coalition for Adaptive Research (GCAR), a not-for-profit entity based in the United States The study’s scientific leadership includes world-leading experts in glioblastoma, among them several clinicians who have participated in clinical trials of paxalisib GBM AGILE has received substantial grant funding, substantially reducing the cost of participation for companies such as Kazia

GBM AGILE is an adaptive multi-drug registrational study, with strong FDA support Randomization Drug #2 Drug #3, etc… Drug #1 Common Control Arm Comparison against a common control arm reduces overall subject numbers, saving time and cost (no drug vs. drug comparison) Adaptive study design limits number of subjects to that required to demonstrate efficacy, eliminating redundancy Economies of scale due to multiple participating drugs allows for large site pool, robust study infrastructure, and reduced cost 1 2 3 Primary endpoint is overall survival (OS), the ‘gold standard’ for approval of new cancer drugs 4

Limited Funding Many biotech companies cannot afford world-class phase III studies More Cost-Effective Approach AGILE achieves huge efficiencies, and is partly grant-funded GBM AGILE directly addresses the key challenges faced by small biotechs and their investors Challenge Approach Long Study Timelines Phase III studies can sometimes take many years to deliver a result Adaptive Study Design AGILE is an ‘adaptive’ study, only recruiting the patients needed Regulatory Uncertainty Small biotechs can struggle to get regulatory support for study design Strong FDA Endorsement FDA has provided written backing to the GBM AGILE study design Clinician Engagement Competition for top hospitals and clinicians can be intense Top-Tier Clinical Leadership Many of the world-leading experts in this disease are part of GBM AGILE Execution Risk Small companies can struggle to operationalise a complex trial Live Study GBM AGILE is already underway, recruiting well, and run by IQVIA Primary patient population essentially identical to Kazia’s successful phase II study Recruitment of up to 200 patients on paxalisib (but likely fewer due to adaptive design) Approximately equivalent number of patients in control group, making for a ~400 patient dataset Approximately 2-3 years to completion Approximately one-third cost of a comparable company-sponsored study Indicative Parameters

GBM AGILE is currently operational at 31 sites in US and Canada, and will open EU and China in CY2021 Source: www.gcaresearch.org

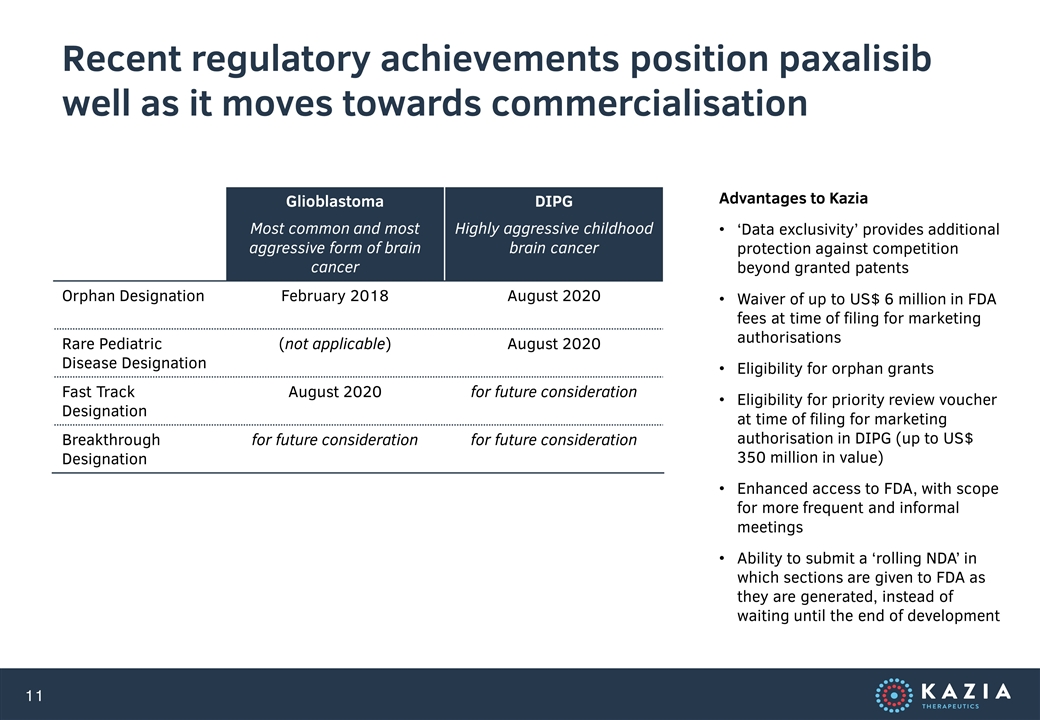

Recent regulatory achievements position paxalisib well as it moves towards commercialisation Glioblastoma Most common and most aggressive form of brain cancer DIPG Highly aggressive childhood brain cancer Orphan Designation February 2018 August 2020 Rare Pediatric Disease Designation (not applicable) August 2020 Fast Track Designation August 2020 for future consideration Breakthrough Designation for future consideration for future consideration Advantages to Kazia ‘Data exclusivity’ provides additional protection against competition beyond granted patents Waiver of up to US$ 6 million in FDA fees at time of filing for marketing authorisations Eligibility for orphan grants Eligibility for priority review voucher at time of filing for marketing authorisation in DIPG (up to US$ 350 million in value) Enhanced access to FDA, with scope for more frequent and informal meetings Ability to submit a ‘rolling NDA’ in which sections are given to FDA as they are generated, instead of waiting until the end of development

Brain cancer represents a significant commercial opportunity for paxalisib, with limited competition ~$1.5B+ market opportunity INDICATIVE Glioblastoma 12,500 patients p.a. in the US Brain Metastases (secondary brain cancer) Childhood Brain Cancers Other Adult Primary Brain Cancers Other Cancers with Disordered PI3K Pathway (e.g. breast, lung, blood) Path to Market Expansion Opportunities ‘Blue Sky’ Potential

Agenda Operational Report Financial Report Looking Ahead

Kazia has raised a total of ~AU$ 42 million to drive forward the paxalisib program $3.4 million Institutional Placement October 2018 $0.8 million SPP $4.0 million Institutional Placement October 2019 $7.2 million Institutional Placement April 2020 $1.8 million SPP $22.4 million Institutional Entitlements October 2020 $2.8 million Retail Entitlements Safety data from P2 GBM study (May 2019) Collaboration with MSK in brain metastases (July 2019) Efficacy data from P2 GBM study (Nov 2019) Preparatory activities for GBM AGILE (Dec 2019) Award of INN by WHO (Dec 2019) Efficacy data from P2 GBM study (June 2020) Award of FDA special designations (FTD, RPDD, ODD) (Aug 2020) Collaboration with DFCI in PCNSL (Sept 2020 Fund GBM AGILE (Oct 2020)

Almost $0.75 in every dollar the company spends is invested directly into R&D activity AU$ million 4.4 5.9 6.9 5.1 4.5 Expense → ← Income G&A % 44.9% 37.8% 44.1% 27.1% 36.0% bar totals = net expenditure 38.0% 4.1 6.0 6.4 36.0% 20.0%

In the last 12 months, Kazia has achieved a 70% total shareholder return Source: Bloomberg; period is 1 Nov 2019 to 30 Oct 2020 -11% 19% 70%

Kazia’s enterprise value has grown from $4M to $36M in four years, and is now ~$80M Source: Company Annual Reports; 1Q FY21 Appendix 4C $37M $20M $19M $20M $44M $86M

The company is well covered by sector-leading analysts

Ongoing UMP facility is part of a long-term program of optimal capital management 5,048 126,166,264 51.2% of holders own 0.3% of shares Cost to company (listing fees, report mailing, etc.) Cost to shareholder (brokerage fees to exit position) Unmarketable parcel (UMP) facility is a common capital management approach Parcels under $500 are purchased and re-sold, with proceeds going to the holder Reduces number of shareholders Provides UMP holders an opportunity to exit without incurring brokerage Places stock in hands of active investors Individual shareholders may opt out

Agenda Operational Report Financial Report Looking Ahead

Key Objectives for CY2021 Execute on GBM AGILE study Drive data from broader paxalisib program Intensify partnering activity Commence ‘rolling NDA’ filing activities

The partnering market for new oncology drugs remains active, with a premium for late-stage assets Licensee Licensor Stage Asset(s) Deal Value (US$) Discovery CAR-T platform $900M Discovery T-cell engagers $1,680M Discovery CAR-NK & CAR-T platform $3.1B Phase I CD47 antibody $2,940M Phase I Pralsetinib (RET inhibitor) $1,702M Phase I CD37 & CD3x5T4 antibodies $3.9B Phase II PI3K delta inhibitor $683M Phase II Ladiratuzumab vedotin $4.2B Phase III CD19 antibody $2.0B Select CY2020 Licensing Transactions

Key Milestones and Anticipated Newsflow Execution of definitive agreement with GCAR for GBM AGILE pivotal study October 2020 Further interim data from Kazia phase II glioblastoma trial November 2020 Initial interim data from phase I DIPG trial at St Jude November 2020 Initial interim data from phase II BCBM trial at Dana-Farber Q4 CY2020 Commencement of recruitment to GBM AGILE pivotal study in glioblastoma Q4 CY2020 Commencement of recruitment to phase II PCNSL study at Dana-Farber Q1 CY2021 Half-Year Report Q1 CY2021 Initial interim data from phase II brain mets study by Alliance Group H1 CY2021 Initial interim data from phase I brain mets study at Sloan-Kettering H1 CY2021 Final data from Kazia phase II glioblastoma trial H1 CY2021 Note: all guidance is indicative, and subject to amendment in light of changing conference schedules, operational considerations, etc. ü