UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November, 2021

Commission File Number

Kazia Therapeutics Limited

(Translation of registrant’s name into English)

Three International Towers Level 24 300 Barangaroo Avenue Sydney NSW 2000

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☑ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark if the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes ☐ No ☑

If “yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b)

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Kazia Therapeutics Limited (Registrant)

Kate Hill

Kate Hill

Company Secretary

Date 10 November 2021

ASX RELEASE

10 November 2021

KAZIA ANNUAL GENERAL MEETING MATERIALS

Sydney, 10 November 2021 – Kazia Therapeutics Limited (ASX: KZA; NASDAQ: KZIA), an Australian oncology-focused biotechnology company, is pleased to provide the Chairman’s Address and CEO presentation which will be discussed at our Annual General Meeting at 10am this morning.

[ENDS]

About Kazia Therapeutics Limited

Kazia Therapeutics Limited (NASDAQ: KZIA; ASX: KZA) is an oncology-focused drug development company, based in Sydney, Australia.

Our lead program is paxalisib, a brain-penetrant inhibitor of the PI3K / Akt / mTOR pathway, which is being developed to treat glioblastoma, the most common and most aggressive form of primary brain cancer in adults. Licensed from Genentech in late 2016, paxalisib commenced recruitment to GBM AGILE, a pivotal study in glioblastoma, in January 2021. Eight additional studies are active in various forms of brain cancer. Paxalisib was granted Orphan Drug Designation for glioblastoma by the US FDA in February 2018, and Fast Track Designation for glioblastoma by the US FDA in August 2020. In addition, paxalisib was granted Rare Pediatric Disease Designation and Orphan Designation by the US FDA for DIPG in August 2020.

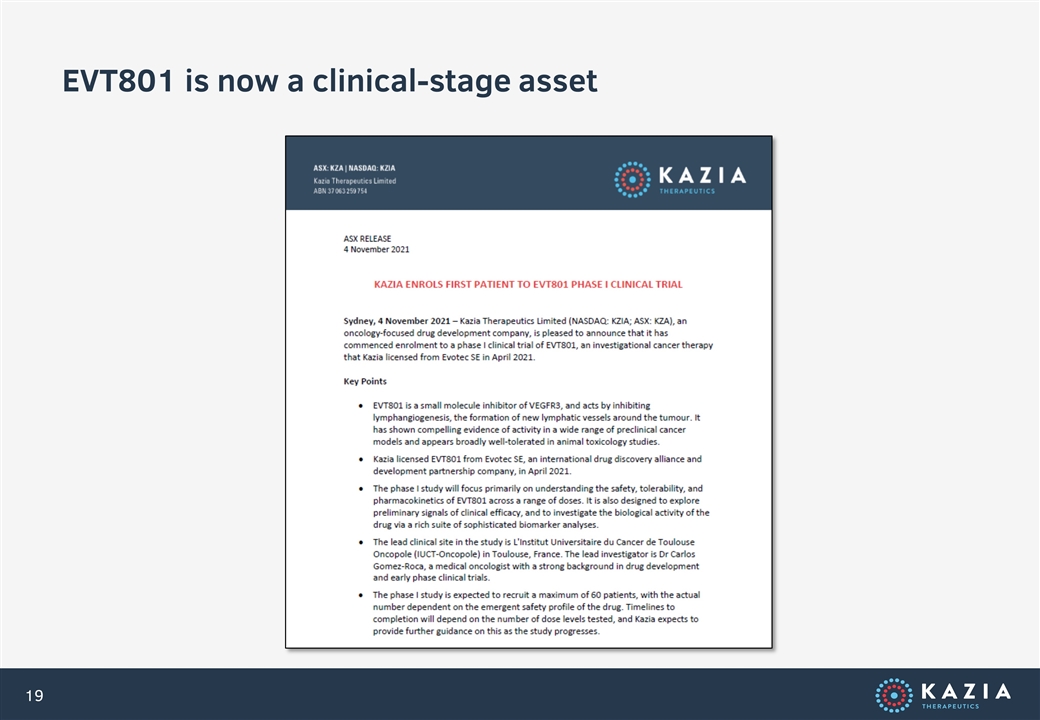

Kazia is also developing EVT801, a small-molecule inhibitor of VEGFR3, which was licensed from Evotec SE in April 2021. Preclinical data has shown EVT801 to be active against a broad range of tumour types and has provided compelling evidence of synergy with immuno-oncology agents. A phase I study commenced recruitment in November 2021.

For more information, please visit www.kaziatherapeutics.com or follow us on Twitter @KaziaTx.

This document was authorized for release to the ASX by James Garner, Chief Executive Officer, Managing Director.

KAZIA ANNUAL GENERAL MEETING

10 NOVEMBER 2021

CHAIRMAN’S ADDRESS

Ladies and Gentlemen,

I am delighted to welcome you to the Annual General Meeting for Kazia Therapeutics Limited. Once again, the AGM is being conducted in a virtual format this year due to the ongoing COVID-19 pandemic. I am sure I echo the sentiments of many shareholders when I say that I very much hope for some return to normality in the year ahead.

When I spoke to you this time last year, I referred at length to the imminent commencement of the GBM AGILE pivotal study for paxalisib. We have since done exactly as we said we would do, and the study began recruitment in January. As you know, GBM AGILE will serve as the pivotal study for registration of paxalisib in the most common form of brain cancer, glioblastoma. Commencement of recruitment therefore marks a watershed moment for Kazia. We are now a late-stage oncology company, with a lead program potentially just a few years away from a marketing approval. Indeed, we are one of only a few companies in the world to have reached such an advanced stage in the fight against glioblastoma. The journey is far from over, but we take great satisfaction in the extraordinary progress that has been made with paxalisib over the past five years.

We expect that we will shortly be able to share final data from the phase II study of paxalisib in glioblastoma. In addition, there are no fewer than eight other clinical trials of paxalisib currently in various stages of operation. It therefore goes without saying that we will continue to report a regular flow of data as these studies progress.

However, both the company and its shareholders must begin to focus their attention on more practical questions. Whether paxalisib works is no longer the primary consideration for investors. For now, that question has been answered to the best of our ability, and the answer is unambiguously positive. We must now all address ourselves to the question of how paxalisib will be brought to market. You will hear much from us in the year ahead about our plans and objectives in this area, as Kazia moves inexorably from a development-stage company to a profitable commercial organisation.

We took one of the first significant steps in this transition in March of this year, when we licensed the Greater China rights for paxalisib to Simcere Pharmaceutical. Simcere is one of China’s most dynamic pharmaceutical companies. Our partnership with them will substantially accelerate the entry of paxalisib into the world’s second-largest pharmaceutical market. The Kazia and Simcere teams have already been working closely together to submit the initial regulatory application to the Chinese agency. We expect that GBM AGILE will open there next year. In the meantime, the upfront payment from the transaction has provided valuable and largely non-dilutive funds which are being invested directly into the broader paxalisib program.

The timing of future partnering transactions will be driven by a careful consideration of how to maximise value for shareholders. In China, the unique regulatory environment has made it appropriate to move early. In other territories, a later transaction may achieve superior economics. The Board will continue to diligently evaluate all options. We can take great confidence in the fact that paxalisib has already been highly valued by very experienced and well-established partners in a highly competitive process. We retain approximately 90% of the drug’s global economic opportunity, and we will continue to evaluate opportunities to partner other territories in due course.

It is fitting that this rapid progress of our lead asset is mirrored by other key developments in the company this year. When we licensed paxalisib from Genentech in 2016, we did not fully anticipate what a large role it would play in the company’s evolution. That it has done so is a reflection of its exceptional pedigree and the enormous potential that the drug has since demonstrated. Quite simply, it has proven to be a much more promising asset than even we realised at the time. Nevertheless, we always envisaged a diversified pipeline of high-quality clinical assets. With paxalisib safely launched into a pivotal study, it seemed timely for Kazia to revisit those aspirations. The Board considers it vital that the company not become a ‘one trick pony’, even if that pony is in fact a thoroughbred racehorse.

To that end, we have brought a second asset into the company: EVT801. You will be familiar by now with the history of this drug candidate. It was invented by Sanofi, one of the top five pharmaceutical companies in the world, and its early development has been steered by Evotec, an organisation which partners with many large pharmaceutical companies to support the development of their pipeline. For those who are familiar with Evotec and their outstanding reputation, it is no surprise at all that the work which has been done to date on EVT801 is absolutely first-class.

Our task is now to take it through clinical development, and to bring to that project all the creativity, expertise, and passion that we have brought to the development of paxalisib. As you will have seen, the phase I study of EVT801 is now underway, with the first patient successfully enrolled to the study just six months or so after completion of our in-licensing transaction. EVT801 is now a clinical stage oncology asset. No less importantly, Kazia is now a diversified clinical stage oncology company, with two world-class assets in human trials.

Any commentary on our pipeline would be incomplete without noting a final transaction that was accomplished this year. In March, we licensed Cantrixil to Oasmia Pharmaceutical of Sweden, and in doing so closed the last chapter of Kazia’s Novogen legacy. We remain strong believers in Cantrixil, and our conviction has been strengthened by the very encouraging final data from the phase I study. We could not have found a better partner than Oasmia, whose achievements and credentials in this disease area are first-class. We will continue to follow their progress with great interest and pride, and we very much hope that Cantrixil will ultimately make a substantial difference in the lives of patients with ovarian cancer.

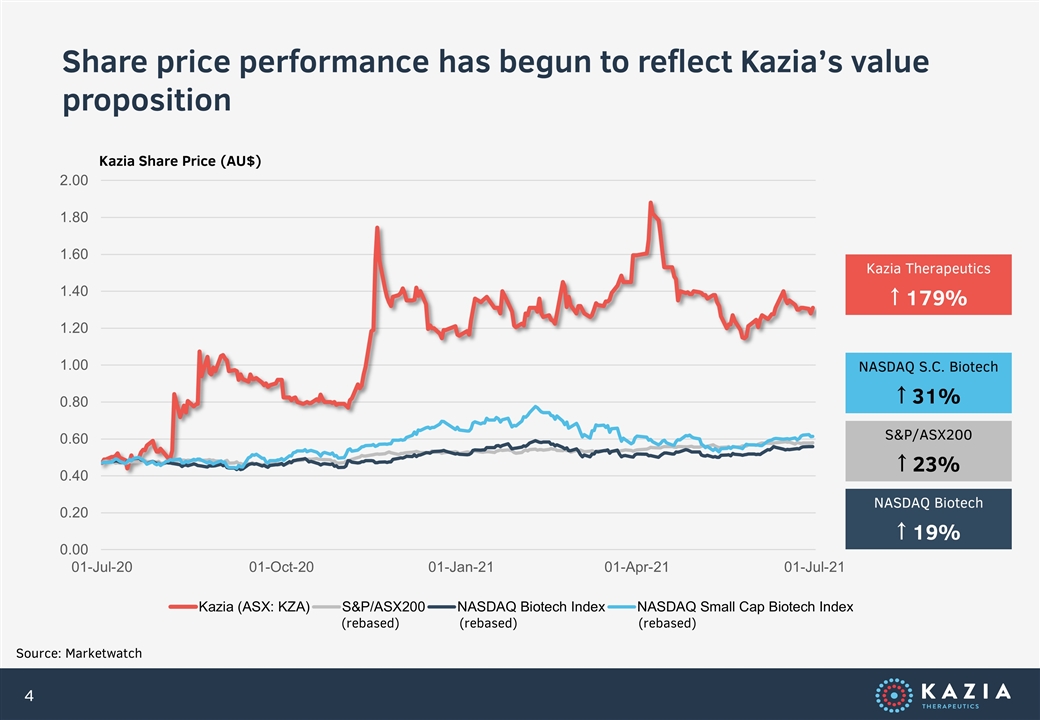

As I noted last year, it is pleasing to see these many achievements reflected in the company’s share price. On the day of our AGM last year, the company’s stock closed at $0.82 on the ASX. Yesterday, it was at $1.575, representing a 92% appreciation in twelve months. We are grateful to all our shareholders for their ongoing support and, as significant shareholders ourselves, the Board is committed to driving fundamental shareholder value as the company matures.

In conclusion, I want to commend once again our CEO, James Garner, and his management team, for all their efforts and achievements throughout the year. Kazia today is hardly recognisable from the company it was just one year ago. We have become a diversified, clinical-stage oncology company, with two world-class assets in our pipeline. Our lead program, paxalisib, is rapidly approaching potential commercialisation and the company itself has been validated by multiple international partnering transactions. The year ahead provides many, many reasons for optimism.

Presentation to Annual General Meeting of Shareholders Dr James Garner Chief Executive Officer Sydney, NSW 10 November 2021

Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995. Such statements involve substantial risks and uncertainties, not all of which may be known at the time. All statements contained in this presentation, other than statements of historical fact, including statements regarding our strategy, research and development plans, collaborations, future operations, future financial position, future revenues, projected costs, prospects, plans, and objectives of management, are forward-looking statements. Not all forward-looking statements in this presentation are explicitly identified as such. Many factors could cause the actual results of the Company to differ materially from the results expressed or implied herein, and you should not place undue reliance on the forward-looking statements. Factors which could change the Company’s expected outcomes include, without limitation, our ability to: advance the development of our programs, and to do so within any timelines that may be indicated herein; the safety and efficacy of our drug development candidates; our ability to replicate experimental data; the ongoing validity of patents covering our drug development candidates, and our freedom to operate under third party intellectual property; our ability to obtain necessary regulatory approvals; our ability to enter into and maintain partnerships, collaborations, and other business relationships necessary to the progression of our drug development candidates; the timely availability of necessary capital to pursue our business objectives; and our ability to attract and retain qualified personnel; changes from anticipated levels of customer acceptance of existing and new products and services and other factors. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, there can therefore be no assurance that such expectations will prove to be correct. The Company has no obligation as a result of this presentation to clinical trial outcomes, sales, partnerships, future international, national or regional economic and competitive conditions, changes in relationships with customers, access to capital, difficulties in developing and marketing new products and services, or marketing existing products. In addition, the extent to which the COVID-19 outbreak continues to impact our workforce and our discovery research, supply chain and clinical trial operations activities, and the operations of the third parties on which we rely, will depend on future developments, which are highly uncertain and cannot be predicted with confidence, including the duration and severity of the outbreak, additional or modified government actions, and the actions that may be required to contain the virus or treat its impact. Any forward-looking statements contained in this presentation speak only as of the date this presentation is made, and we expressly disclaim any obligation to update any forward-looking statements, whether because of new information, future events or otherwise.

2021 in Review A Year of Achievements 3 Major cross-border licensing deals in FY2021 Phase III Paxalisib pivotal study commenced in Jan ‘21 Phase I EVT801 commenced human trials in Nov 2021 11 Ongoing clinical studies across two clinical programs >200 Patients now treated with paxalisib 3 New paxalisib trial partnerships executed in FY2021 $15M Revenue in FY2021 179% Total shareholder return (TSR) (Jul 20 to Jun 21)

Financial Performance Building sustainable shareholder value

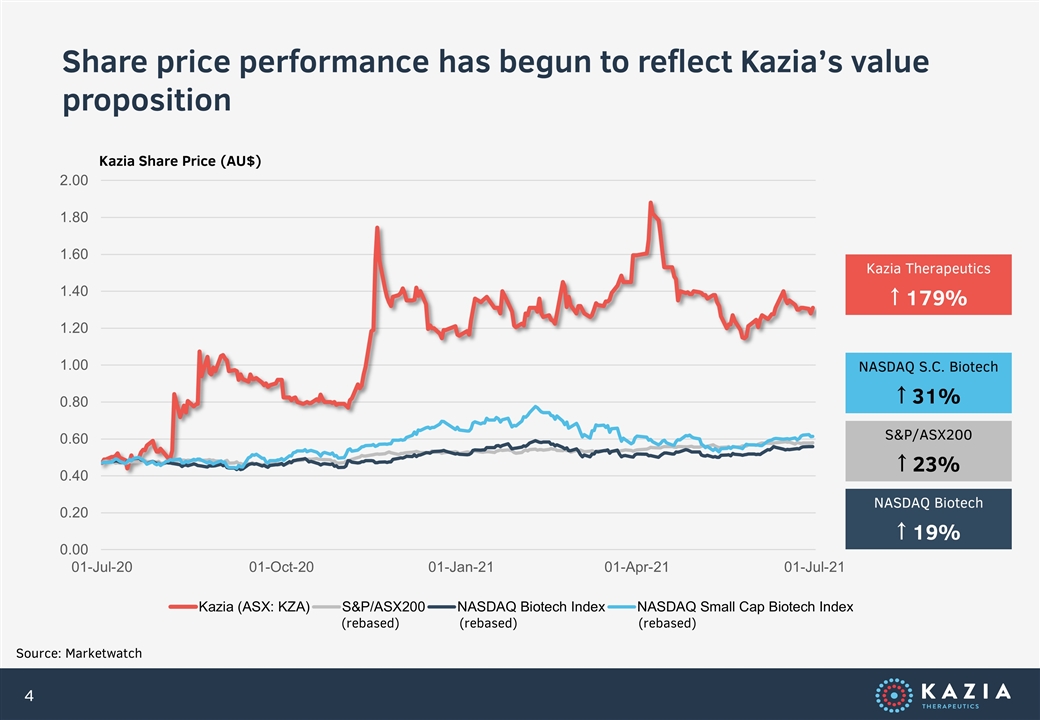

Share price performance has begun to reflect Kazia’s value proposition Source: Marketwatch (rebased) (rebased) Kazia Share Price (AU$) (rebased) Kazia Therapeutics ↑ 179% NASDAQ S.C. Biotech ↑ 31% S&P/ASX200 ↑ 23% NASDAQ Biotech ↑ 19%

Kazia’s enterprise value has increased by approximately 37x in the last five years Source: Company Annual Reports; Marketwatch $37M $20M $19M $20M $44M $173M

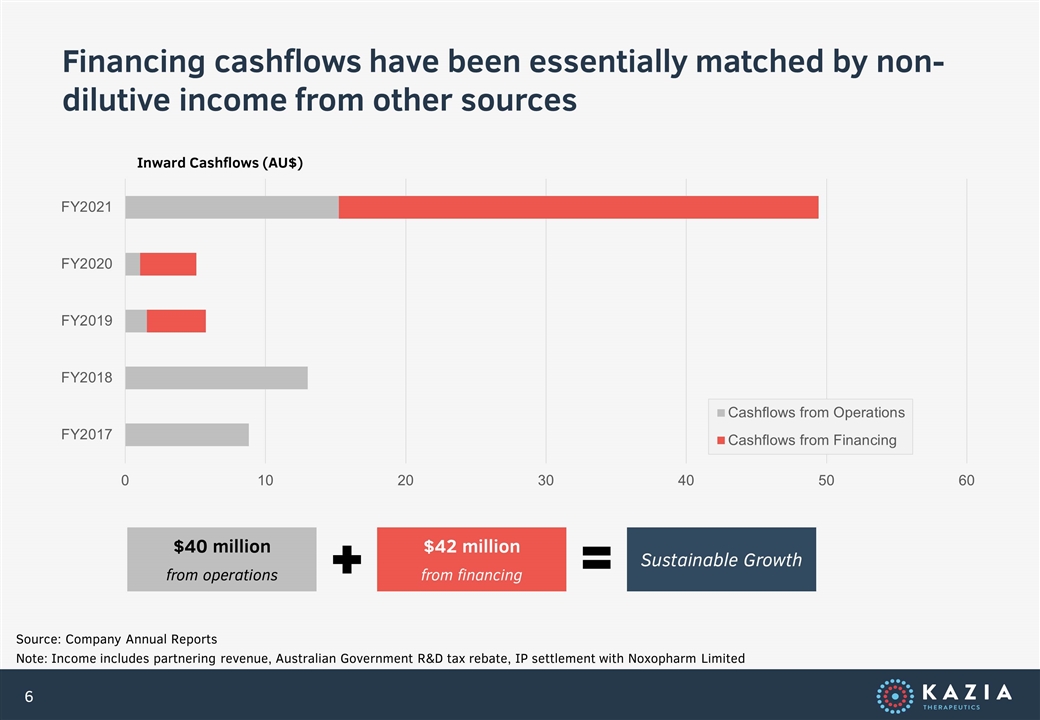

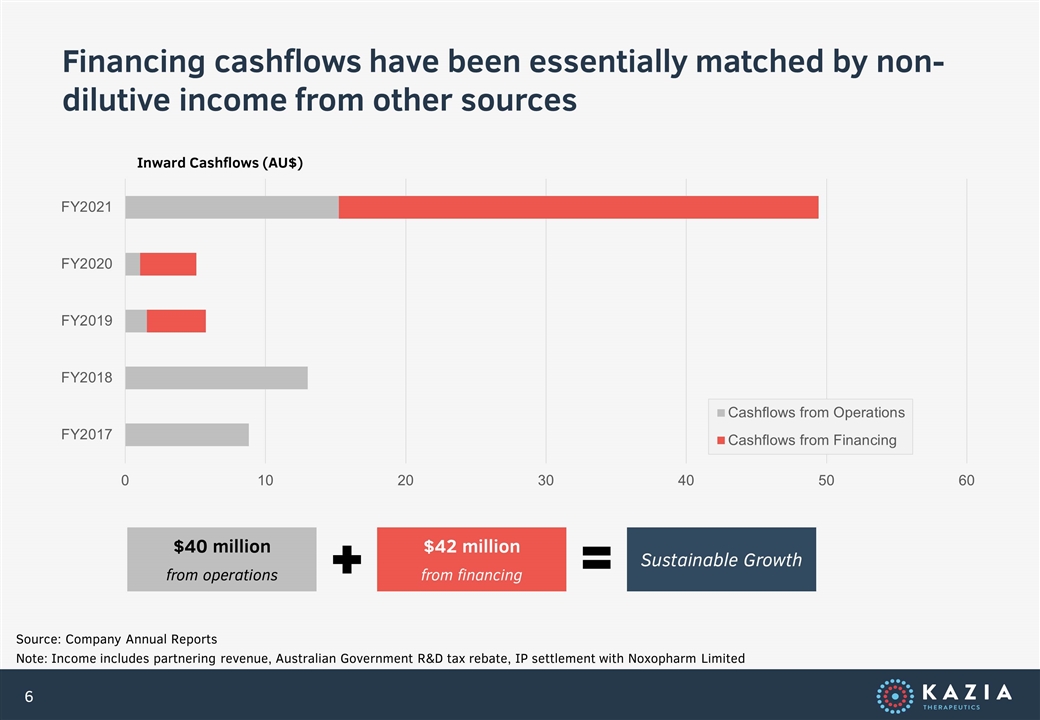

Financing cashflows have been essentially matched by non-dilutive income from other sources Source: Company Annual Reports Note: Income includes partnering revenue, Australian Government R&D tax rebate, IP settlement with Noxopharm Limited Inward Cashflows (AU$) $40 million from operations $42 million from financing Sustainable Growth

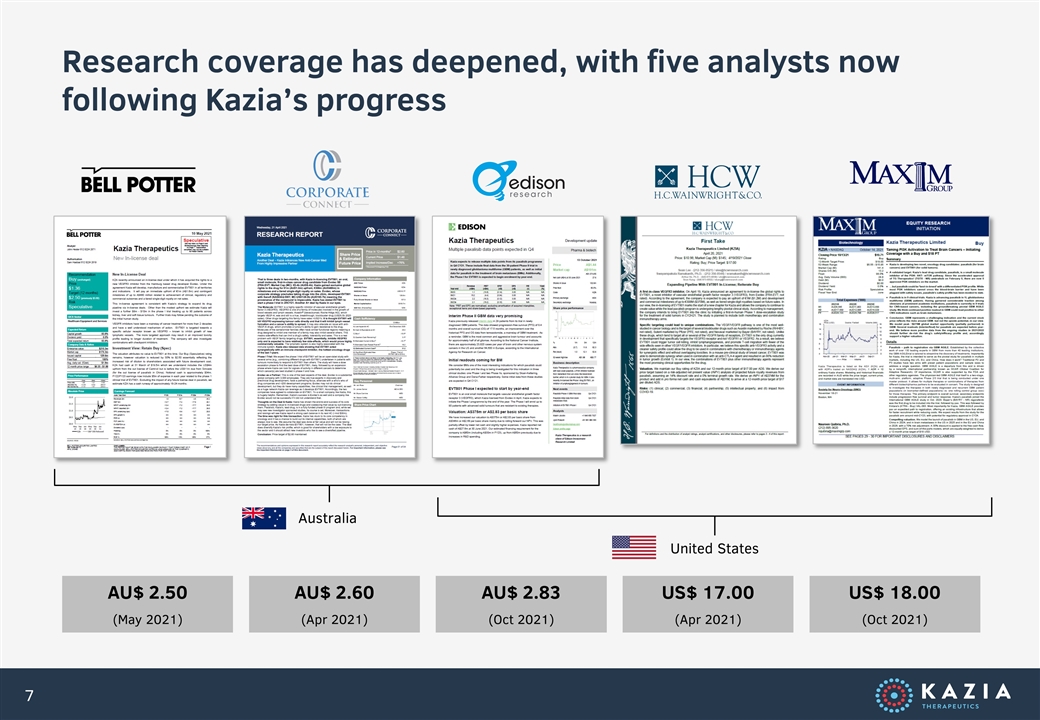

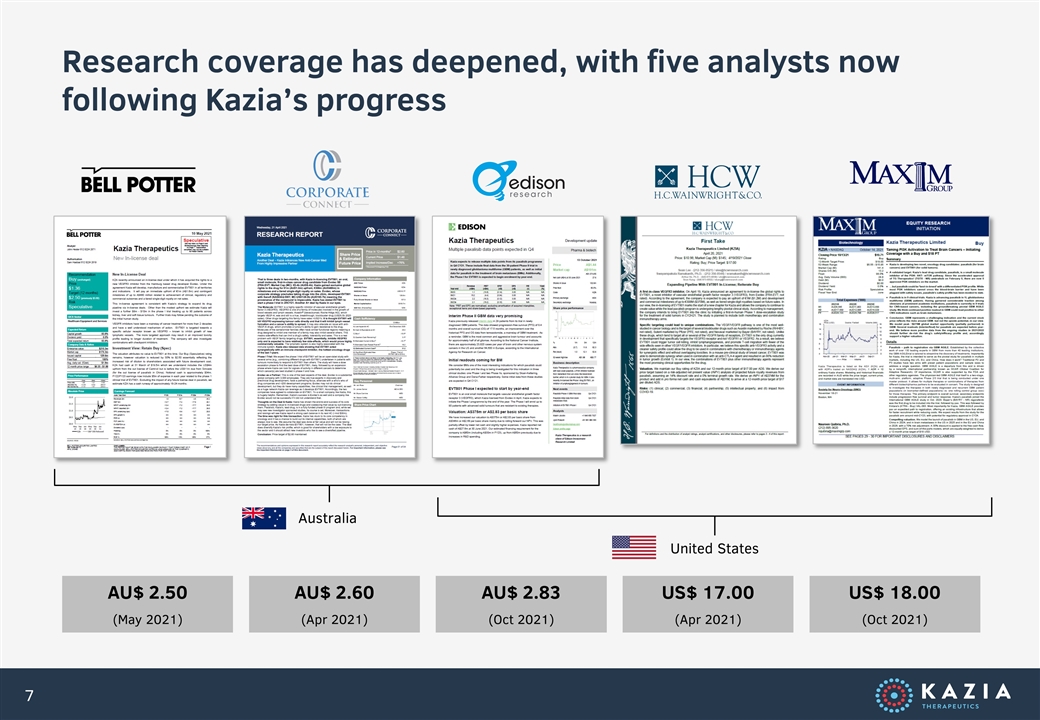

Research coverage has deepened, with five analysts now following Kazia’s progress Australia United States AU$ 2.50 (May 2021) AU$ 2.60 (Apr 2021) AU$ 2.83 (Oct 2021) US$ 17.00 (Apr 2021) US$ 18.00 (Oct 2021)

Paxalisib Progressing towards commercialisation

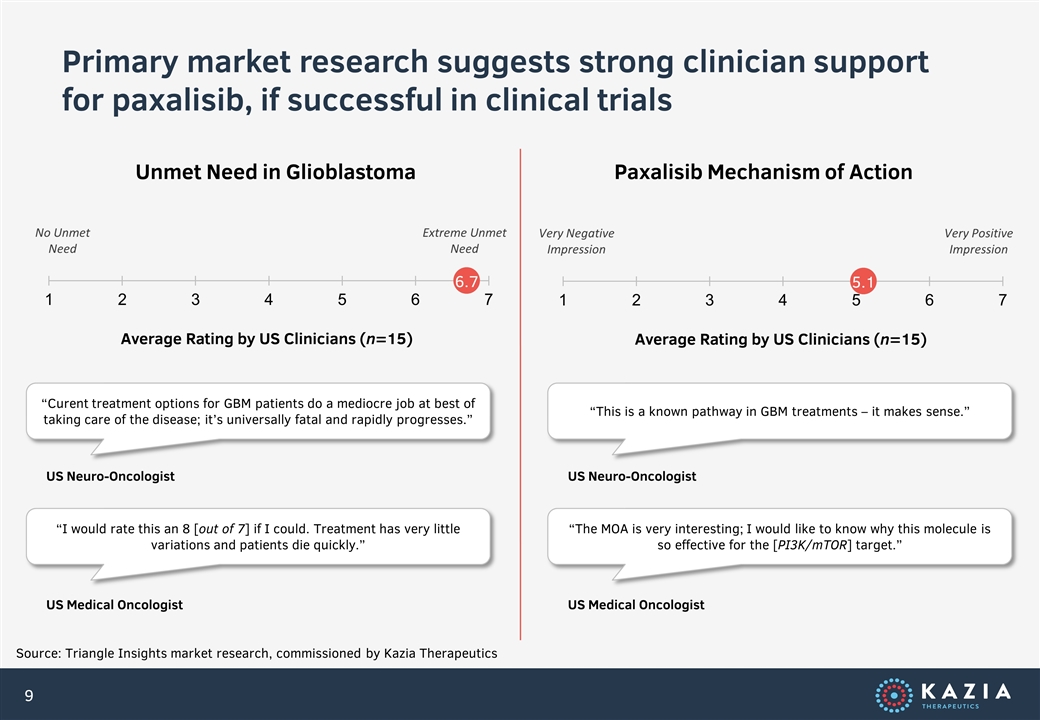

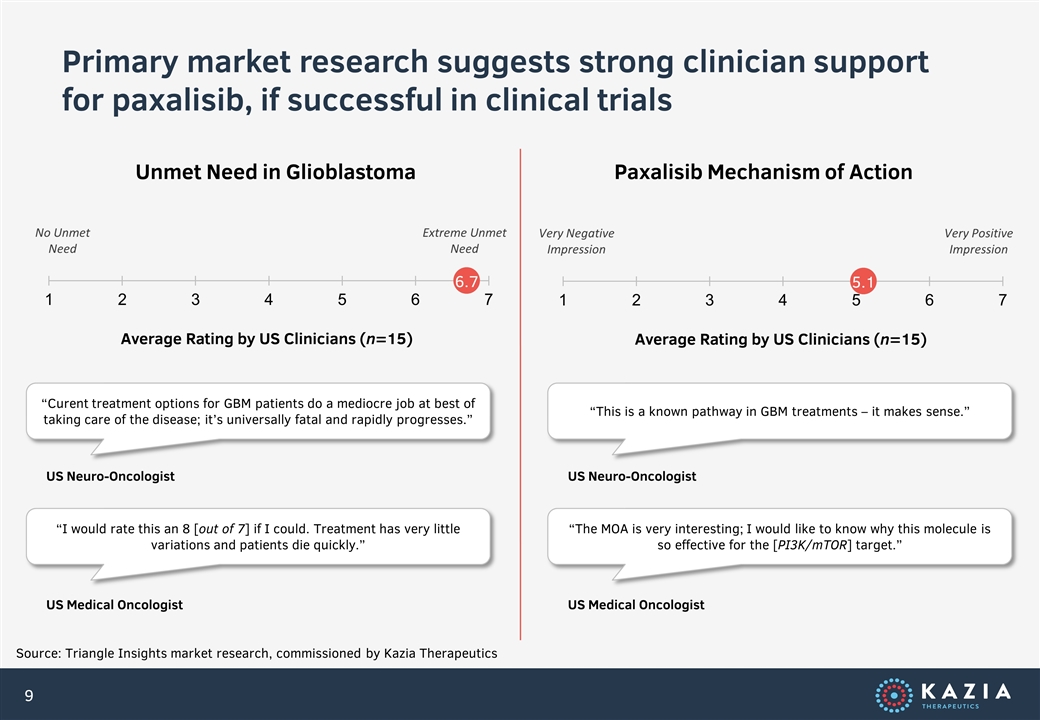

Primary market research suggests strong clinician support for paxalisib, if successful in clinical trials Source: Triangle Insights market research, commissioned by Kazia Therapeutics Unmet Need in Glioblastoma Paxalisib Mechanism of Action Average Rating by US Clinicians (n=15) No Unmet Need Extreme Unmet Need “Curent treatment options for GBM patients do a mediocre job at best of taking care of the disease; it’s universally fatal and rapidly progresses.” US Neuro-Oncologist “I would rate this an 8 [out of 7] if I could. Treatment has very little variations and patients die quickly.” US Medical Oncologist Average Rating by US Clinicians (n=15) Very Negative Impression Very Positive Impression “This is a known pathway in GBM treatments – it makes sense.” US Neuro-Oncologist “The MOA is very interesting; I would like to know why this molecule is so effective for the [PI3K/mTOR] target.” US Medical Oncologist

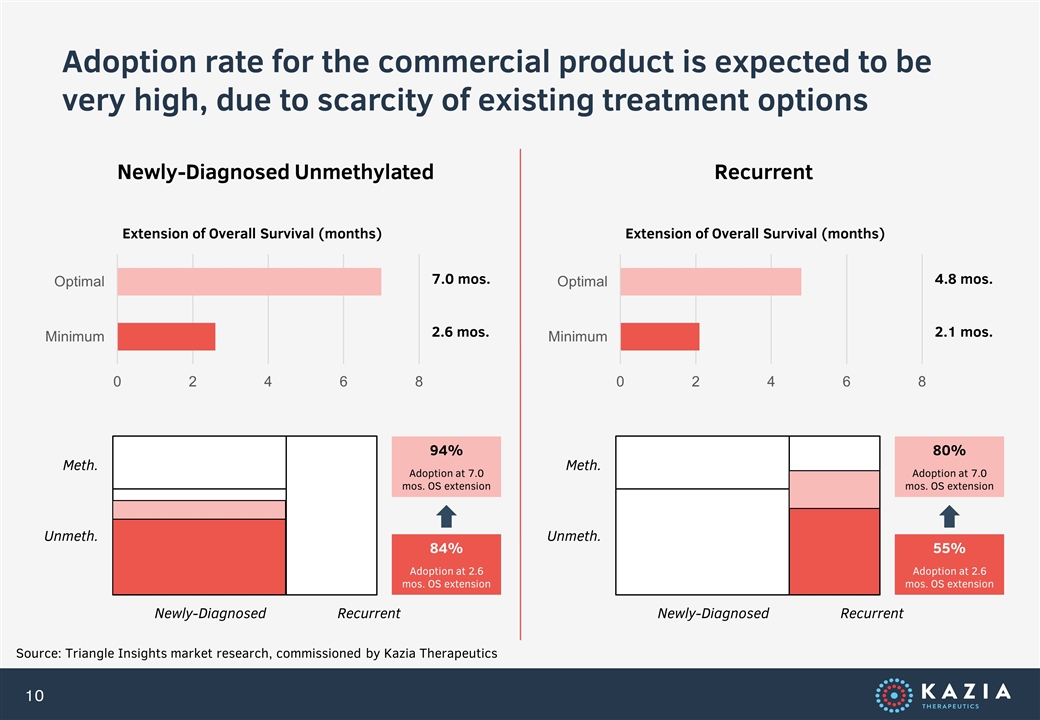

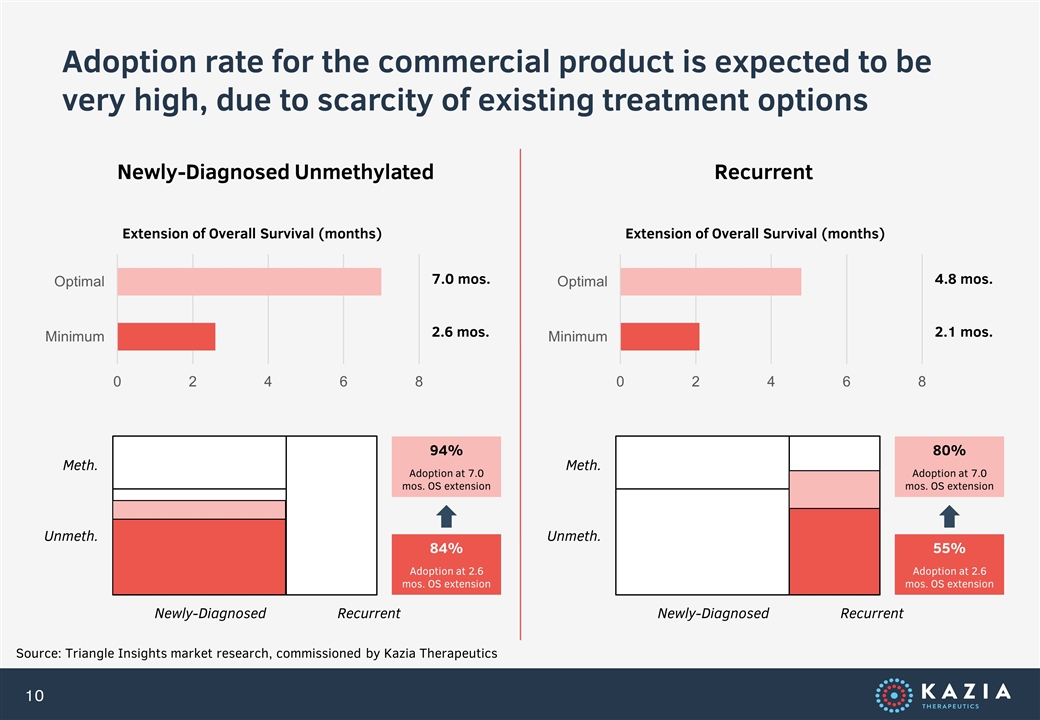

Adoption rate for the commercial product is expected to be very high, due to scarcity of existing treatment options Source: Triangle Insights market research, commissioned by Kazia Therapeutics Newly-Diagnosed Unmethylated Recurrent Extension of Overall Survival (months) 7.0 mos. 2.6 mos. Meth. Unmeth. Newly-Diagnosed Recurrent 84% Adoption at 2.6 mos. OS extension 94% Adoption at 7.0 mos. OS extension Extension of Overall Survival (months) 4.8 mos. 2.1 mos. Meth. Unmeth. Newly-Diagnosed Recurrent 55% Adoption at 2.6 mos. OS extension 80% Adoption at 7.0 mos. OS extension

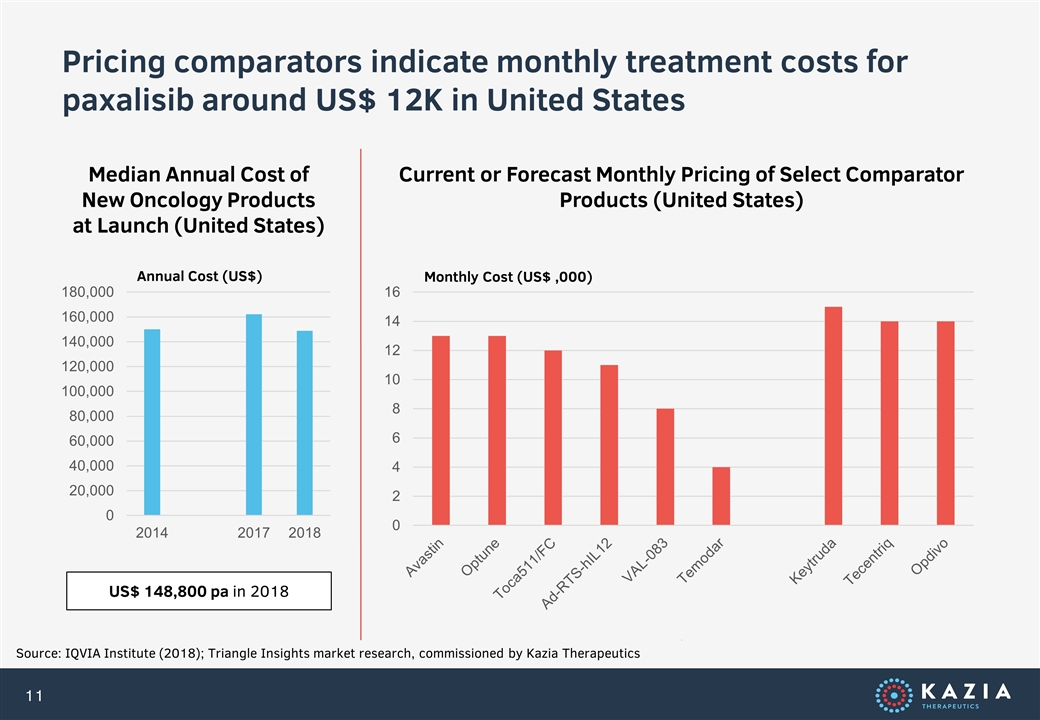

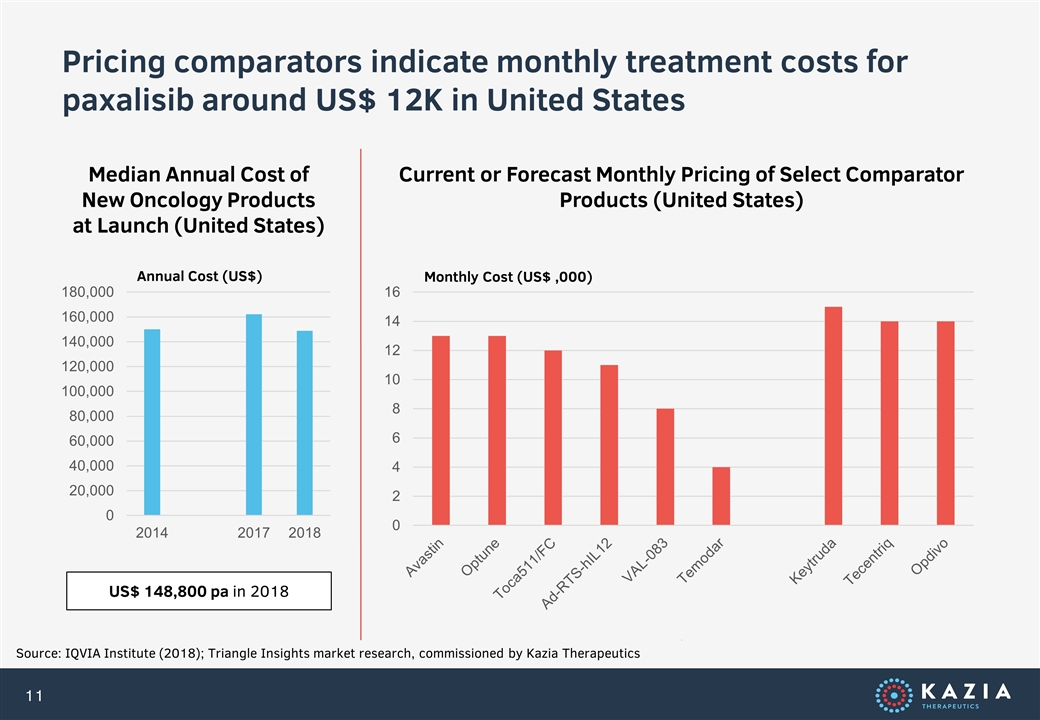

Pricing comparators indicate monthly treatment costs for paxalisib around US$ 12K in United States Source: IQVIA Institute (2018); Triangle Insights market research, commissioned by Kazia Therapeutics Median Annual Cost of New Oncology Products at Launch (United States) Current or Forecast Monthly Pricing of Select Comparator Products (United States) Annual Cost (US$) US$ 148,800 pa in 2018 Monthly Cost (US$ ,000)

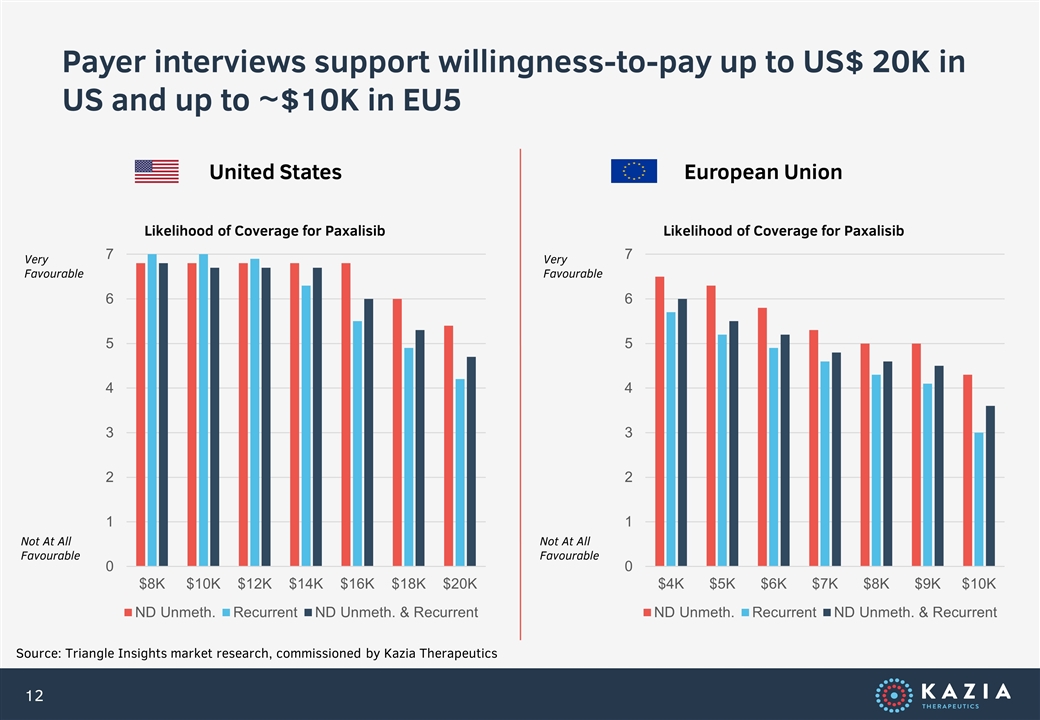

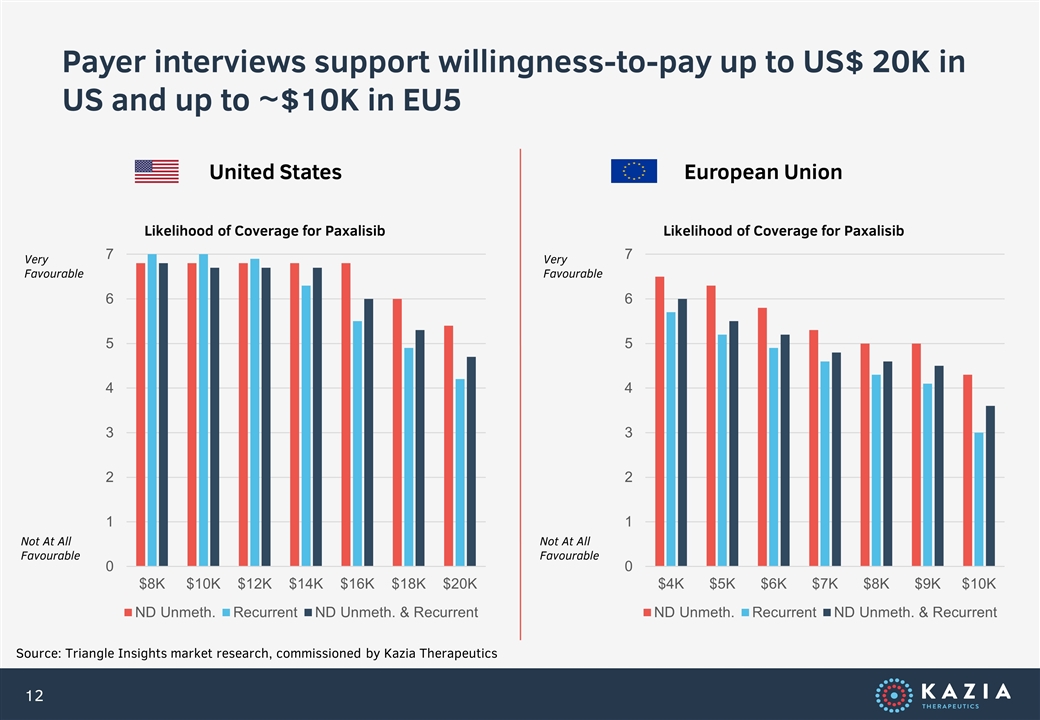

Payer interviews support willingness-to-pay up to US$ 20K in US and up to ~$10K in EU5 Source: Triangle Insights market research, commissioned by Kazia Therapeutics United States European Union Likelihood of Coverage for Paxalisib Very Favourable Not At All Favourable Likelihood of Coverage for Paxalisib Very Favourable Not At All Favourable

Paxalisib A strong competitive position

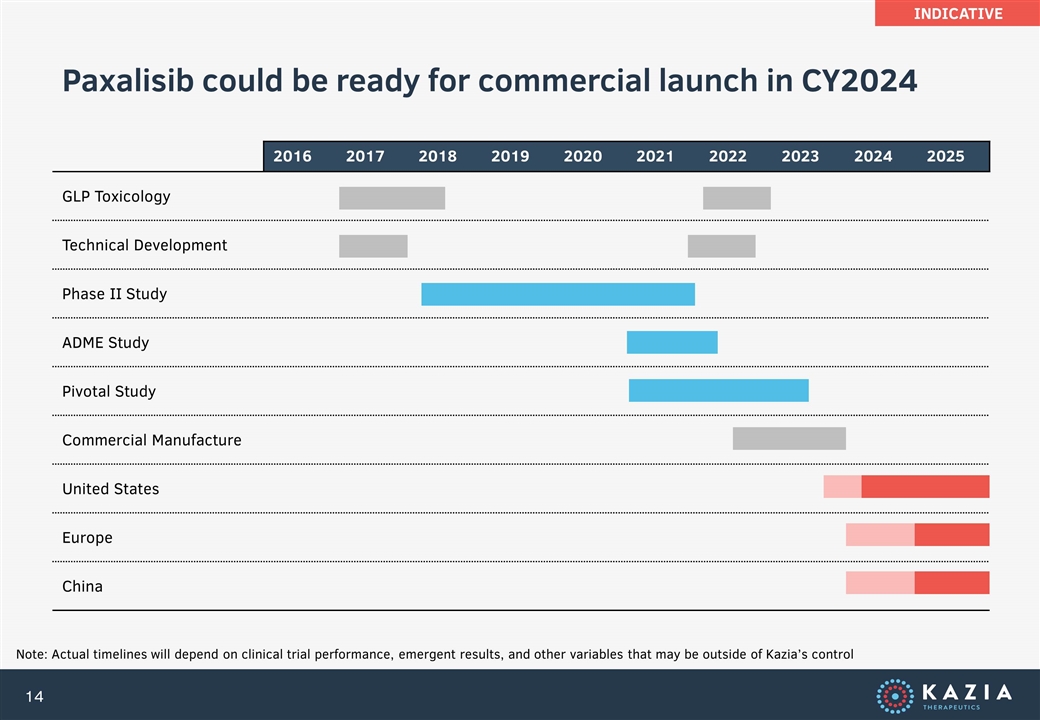

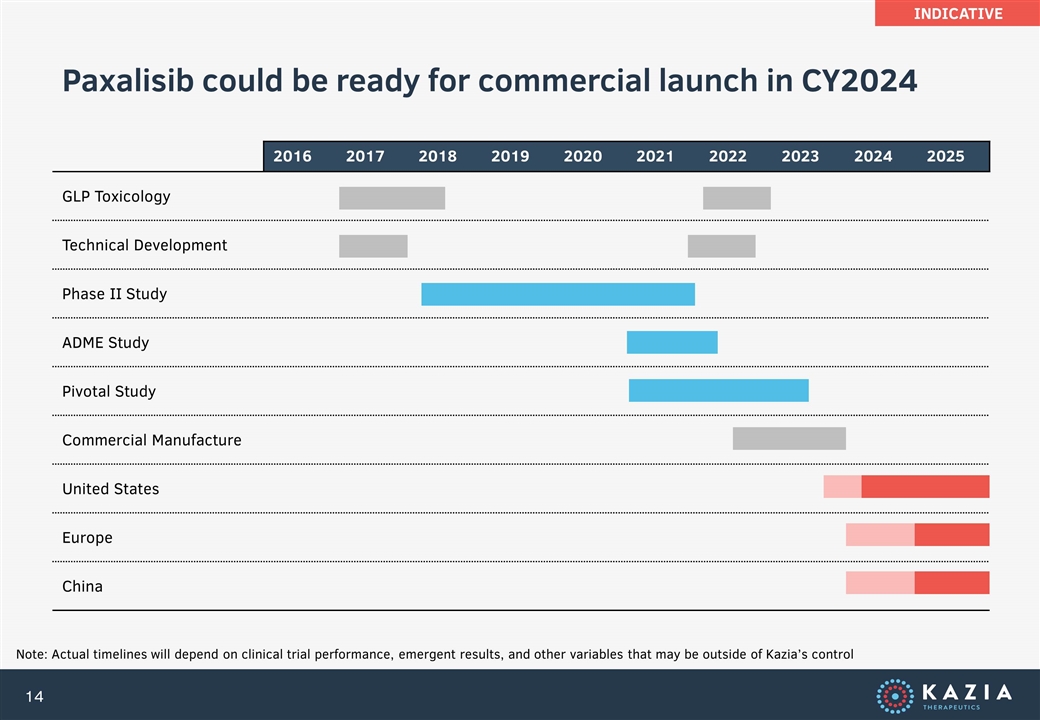

Paxalisib could be ready for commercial launch in CY2024 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 GLP Toxicology Technical Development Phase II Study ADME Study Pivotal Study Commercial Manufacture United States Europe China Note: Actual timelines will depend on clinical trial performance, emergent results, and other variables that may be outside of Kazia’s control INDICATIVE

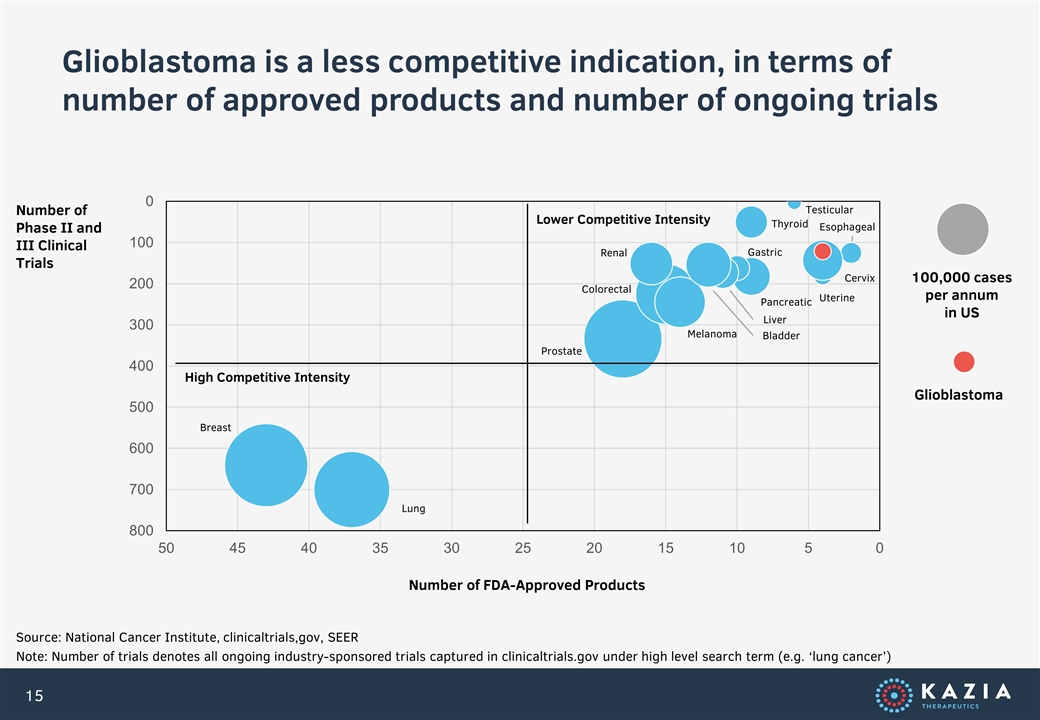

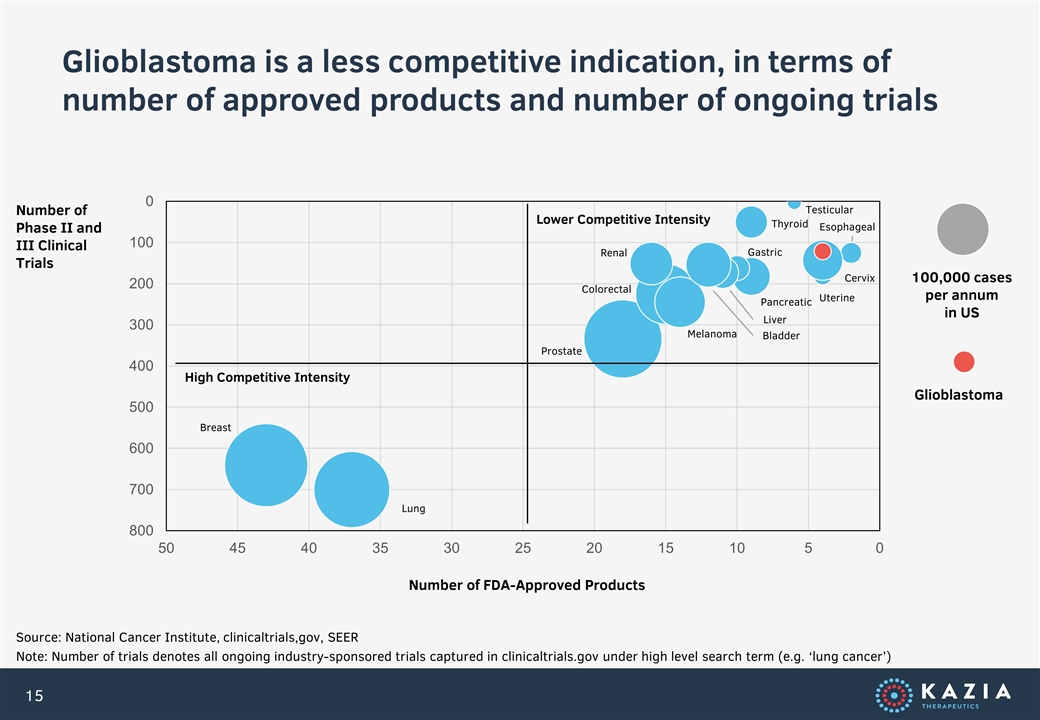

Glioblastoma is a less competitive indication, in terms of number of approved products and number of ongoing trials Source: National Cancer Institute, clinicaltrials,gov, SEER Note: Number of trials denotes all ongoing industry-sponsored trials captured in clinicaltrials.gov under high level search term (e.g. ‘lung cancer’) High Competitive Intensity Lower Competitive Intensity Number of Phase II and III Clinical Trials Number of FDA-Approved Products Breast Lung Prostate Colorectal Renal Melanoma Testicular Uterine Cervix Esophageal Pancreatic Thyroid Gastric Liver Bladder 100,000 cases per annum in US Glioblastoma

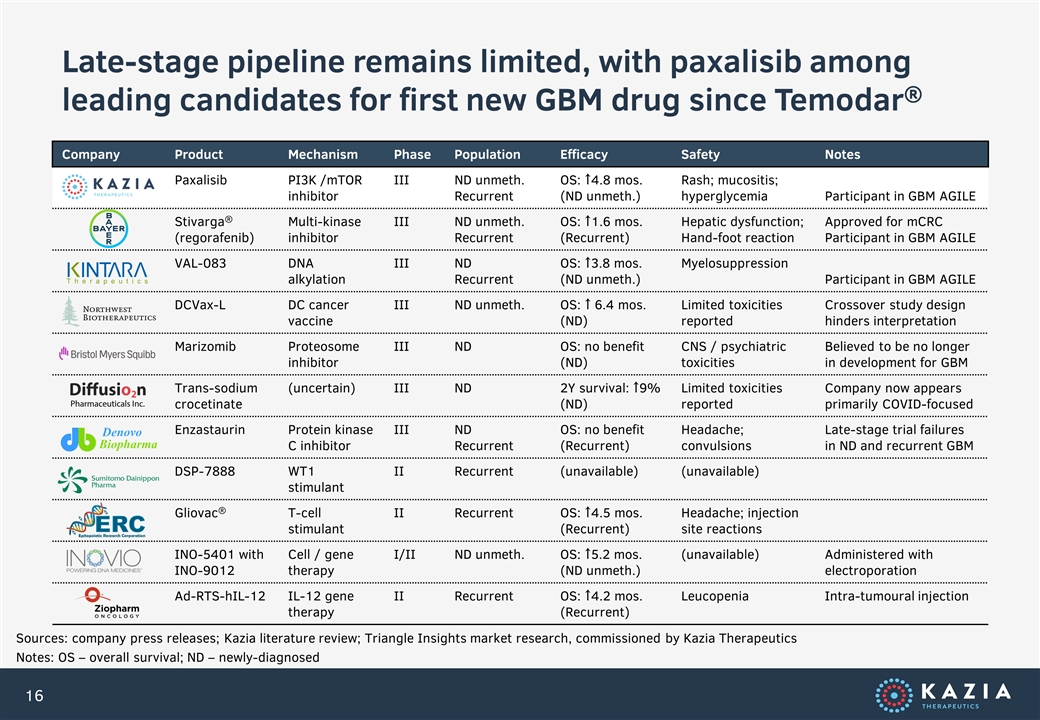

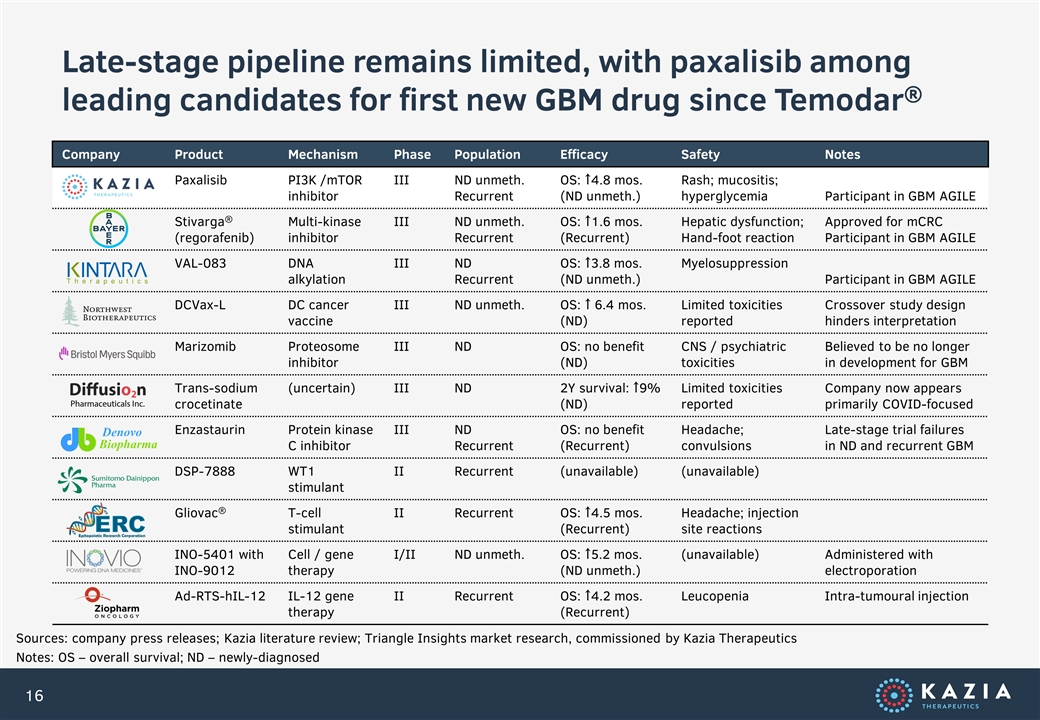

Late-stage pipeline remains limited, with paxalisib among leading candidates for first new GBM drug since Temodar® Company Product Mechanism Phase Population Efficacy Safety Notes Paxalisib PI3K /mTOR inhibitor III ND unmeth. Recurrent OS: ↑4.8 mos. (ND unmeth.) Rash; mucositis; hyperglycemia Participant in GBM AGILE Stivarga® (regorafenib) Multi-kinase inhibitor III ND unmeth. Recurrent OS: ↑1.6 mos. (Recurrent) Hepatic dysfunction; Hand-foot reaction Approved for mCRC Participant in GBM AGILE VAL-083 DNA alkylation III ND Recurrent OS: ↑3.8 mos. (ND unmeth.) Myelosuppression Participant in GBM AGILE DCVax-L DC cancer vaccine III ND unmeth. OS: ↑ 6.4 mos. (ND) Limited toxicities reported Crossover study design hinders interpretation Marizomib Proteosome inhibitor III ND OS: no benefit (ND) CNS / psychiatric toxicities Believed to be no longer in development for GBM Trans-sodium crocetinate (uncertain) III ND 2Y survival: ↑9% (ND) Limited toxicities reported Company now appears primarily COVID-focused Enzastaurin Protein kinase C inhibitor III ND Recurrent OS: no benefit (Recurrent) Headache; convulsions Late-stage trial failures in ND and recurrent GBM DSP-7888 WT1 stimulant II Recurrent (unavailable) (unavailable) Gliovac® T-cell stimulant II Recurrent OS: ↑4.5 mos. (Recurrent) Headache; injection site reactions INO-5401 with INO-9012 Cell / gene therapy I/II ND unmeth. OS: ↑5.2 mos. (ND unmeth.) (unavailable) Administered with electroporation Ad-RTS-hIL-12 IL-12 gene therapy II Recurrent OS: ↑4.2 mos. (Recurrent) Leucopenia Intra-tumoural injection Sources: company press releases; Kazia literature review; Triangle Insights market research, commissioned by Kazia Therapeutics Notes: OS – overall survival; ND – newly-diagnosed

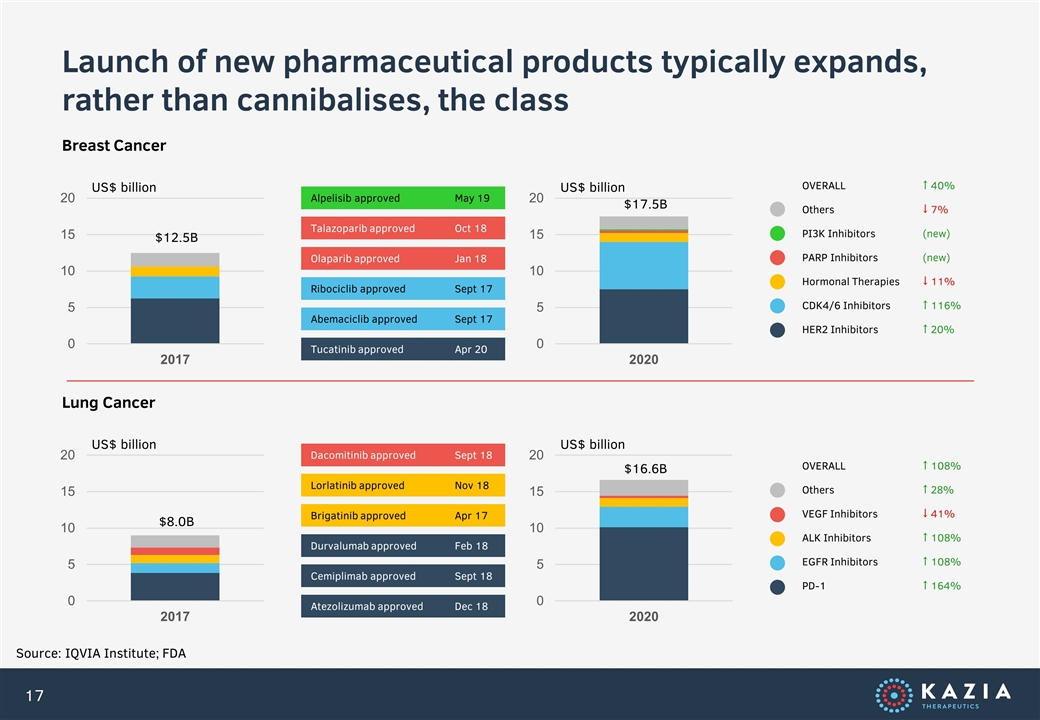

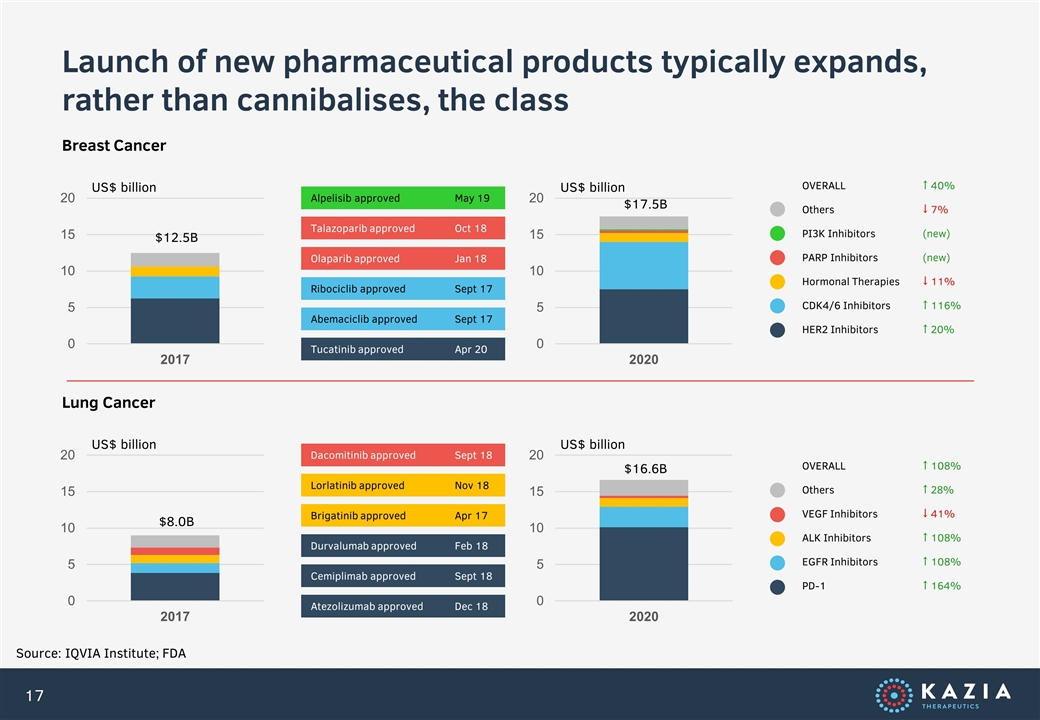

Launch of new pharmaceutical products typically expands, rather than cannibalises, the class Source: IQVIA Institute; FDA US$ billion Breast Cancer US$ billion Abemaciclib approvedSept 17 Ribociclib approvedSept 17 Olaparib approvedJan 18 Talazoparib approvedOct 18 Alpelisib approvedMay 19 OVERALL ↑ 40% Others ↓ 7% PI3K Inhibitors (new) PARP Inhibitors (new) Hormonal Therapies ↓ 11% CDK4/6 Inhibitors ↑ 116% HER2 Inhibitors ↑ 20% Tucatinib approvedApr 20 US$ billion Lung Cancer US$ billion Cemiplimab approvedSept 18 Durvalumab approvedFeb 18 Brigatinib approvedApr 17 Lorlatinib approvedNov 18 Dacomitinib approvedSept 18 OVERALL ↑ 108% Others ↑ 28% VEGF Inhibitors ↓ 41% ALK Inhibitors ↑ 108% EGFR Inhibitors ↑ 108% PD-1 ↑ 164% Atezolizumab approvedDec 18 $12.5B $17.5B $8.0B $16.6B

EVT801 Entering an exciting and rapidly-evolving new domain

EVT801 is now a clinical-stage asset

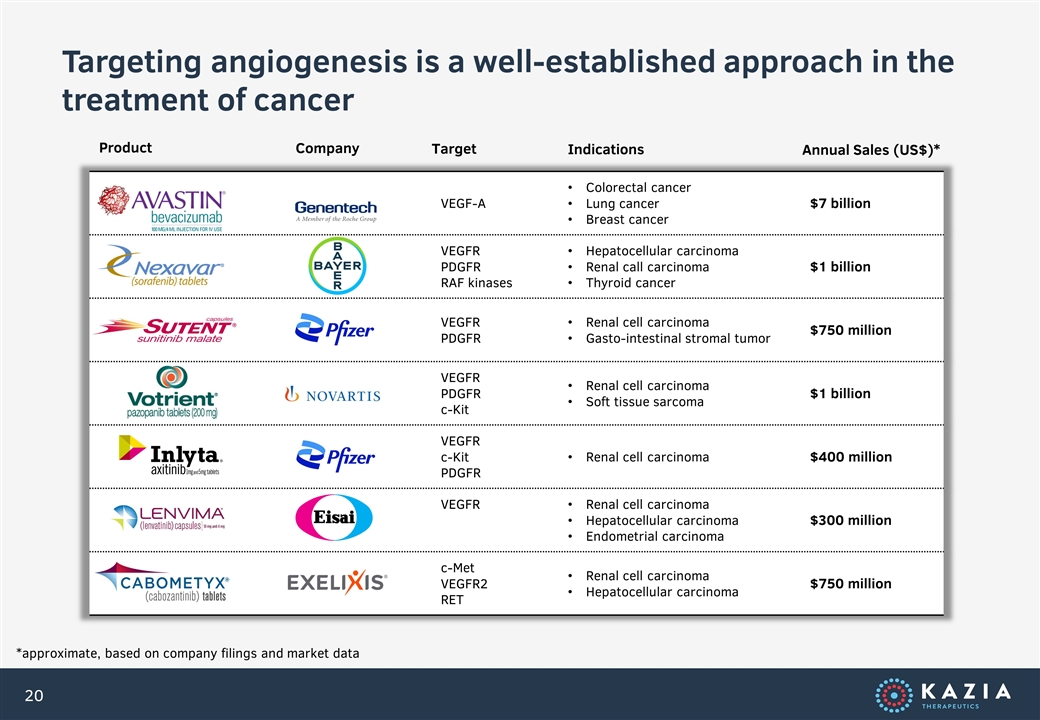

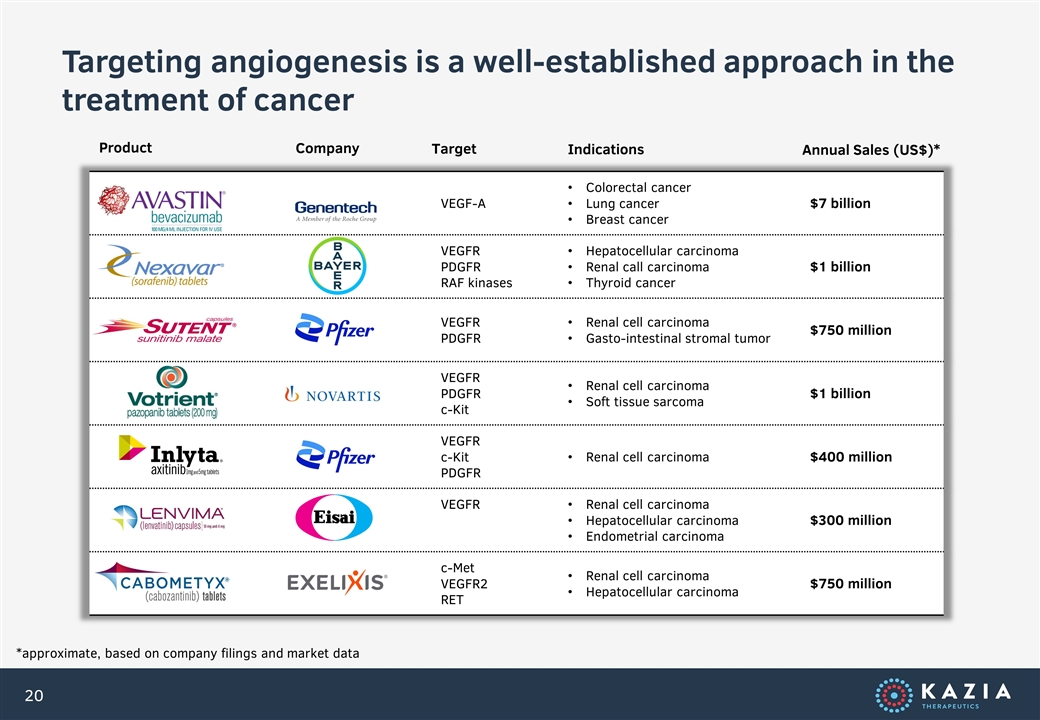

Targeting angiogenesis is a well-established approach in the treatment of cancer VEGF-A Colorectal cancer Lung cancer Breast cancer $7 billion VEGFR PDGFR RAF kinases Hepatocellular carcinoma Renal call carcinoma Thyroid cancer $1 billion VEGFR PDGFR Renal cell carcinoma Gasto-intestinal stromal tumor $750 million VEGFR PDGFR c-Kit Renal cell carcinoma Soft tissue sarcoma $1 billion VEGFR c-Kit PDGFR Renal cell carcinoma $400 million VEGFR Renal cell carcinoma Hepatocellular carcinoma Endometrial carcinoma $300 million c-Met VEGFR2 RET Renal cell carcinoma Hepatocellular carcinoma $750 million *approximate, based on company filings and market data Product Company Target Indications Annual Sales (US$)*

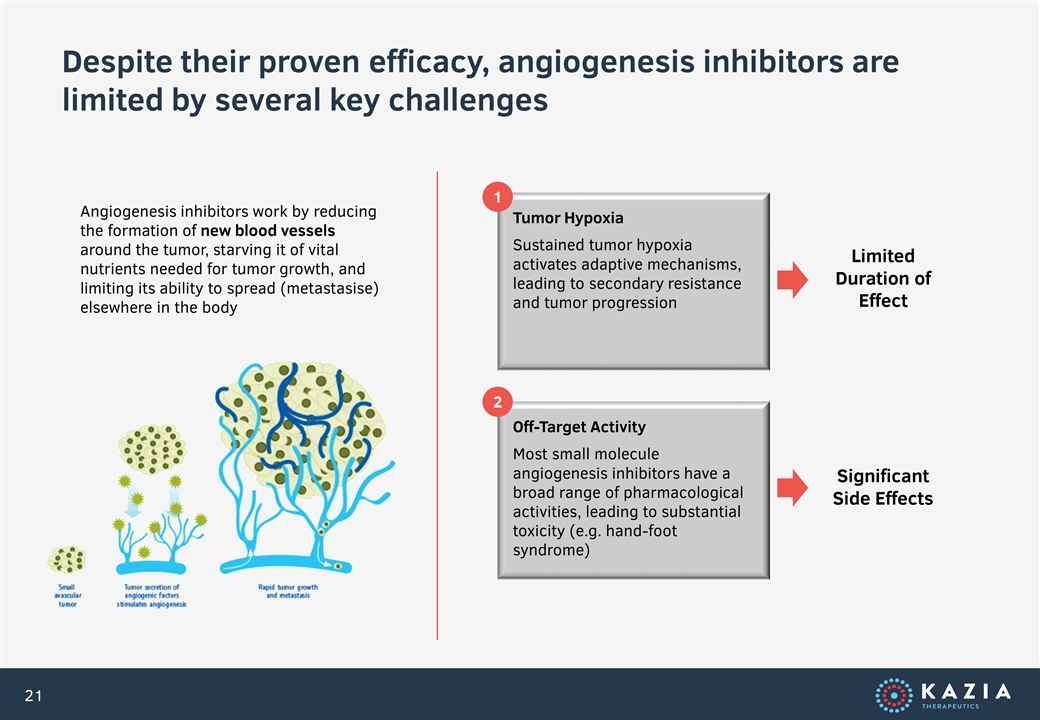

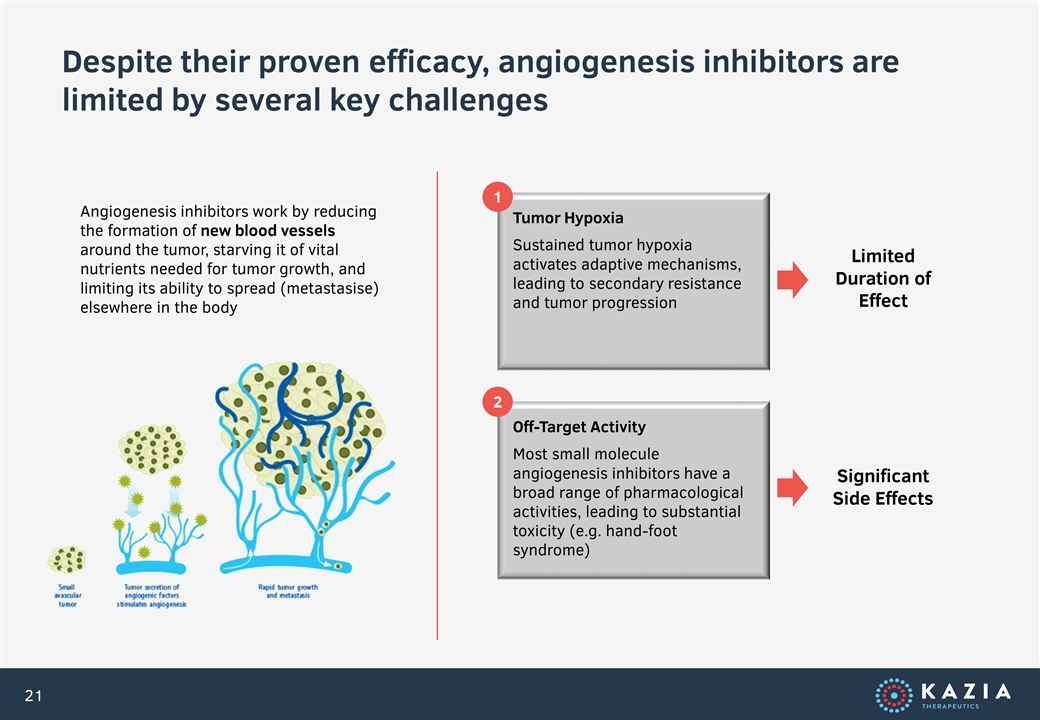

Despite their proven efficacy, angiogenesis inhibitors are limited by several key challenges Angiogenesis inhibitors work by reducing the formation of new blood vessels around the tumor, starving it of vital nutrients needed for tumor growth, and limiting its ability to spread (metastasise) elsewhere in the body Tumor Hypoxia Sustained tumor hypoxia activates adaptive mechanisms, leading to secondary resistance and tumor progression Off-Target Activity Most small molecule angiogenesis inhibitors have a broad range of pharmacological activities, leading to substantial toxicity (e.g. hand-foot syndrome) 1 2 Limited Duration of Effect Significant Side Effects

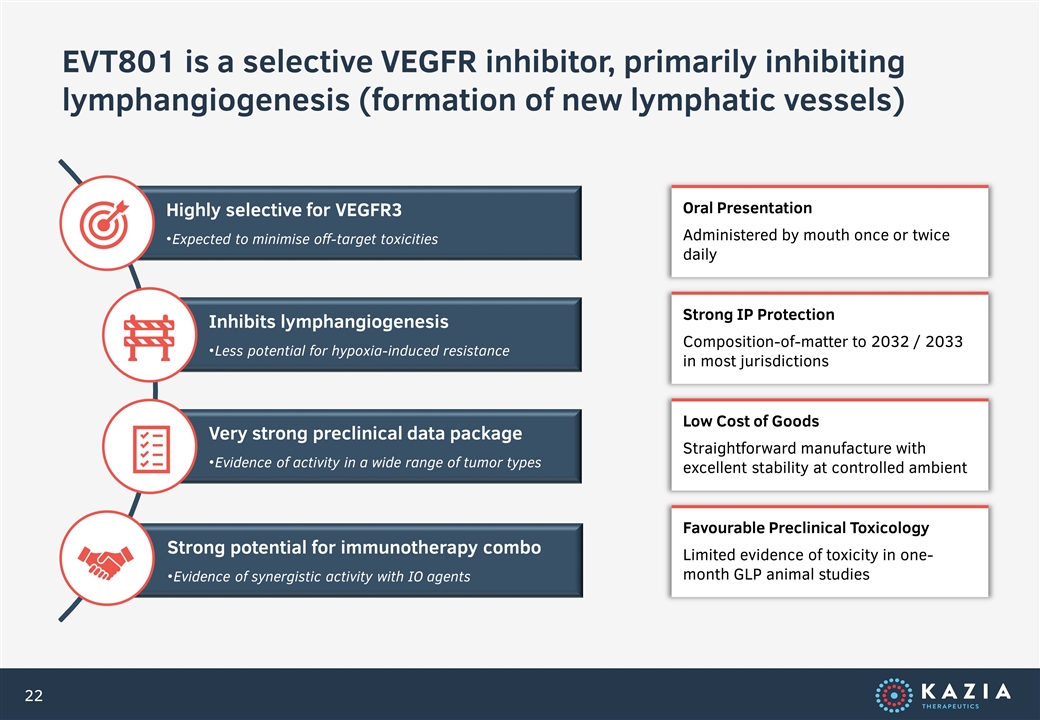

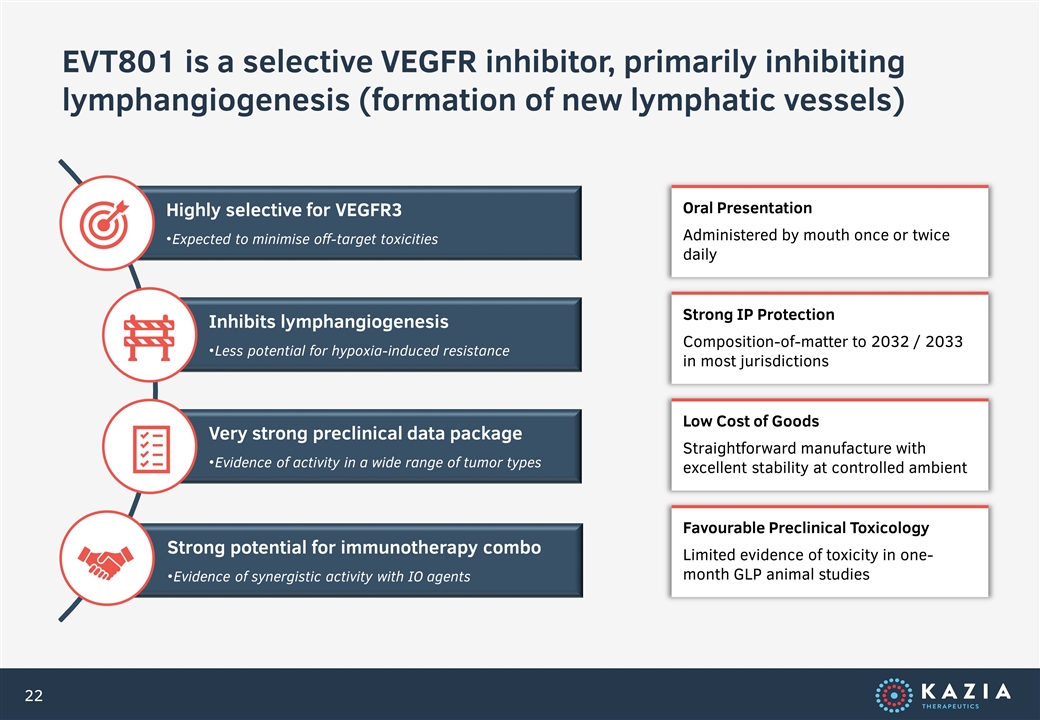

EVT801 is a selective VEGFR inhibitor, primarily inhibiting lymphangiogenesis (formation of new lymphatic vessels) Oral Presentation Administered by mouth once or twice daily Strong IP Protection Composition-of-matter to 2032 / 2033 in most jurisdictions Low Cost of Goods Straightforward manufacture with excellent stability at controlled ambient Favourable Preclinical Toxicology Limited evidence of toxicity in one-month GLP animal studies Highly selective for VEGFR3 Very strong preclinical data package Strong potential for immunotherapy combo Inhibits lymphangiogenesis Expected to minimise off-target toxicities Less potential for hypoxia-induced resistance Evidence of activity in a wide range of tumor types Evidence of synergistic activity with IO agents

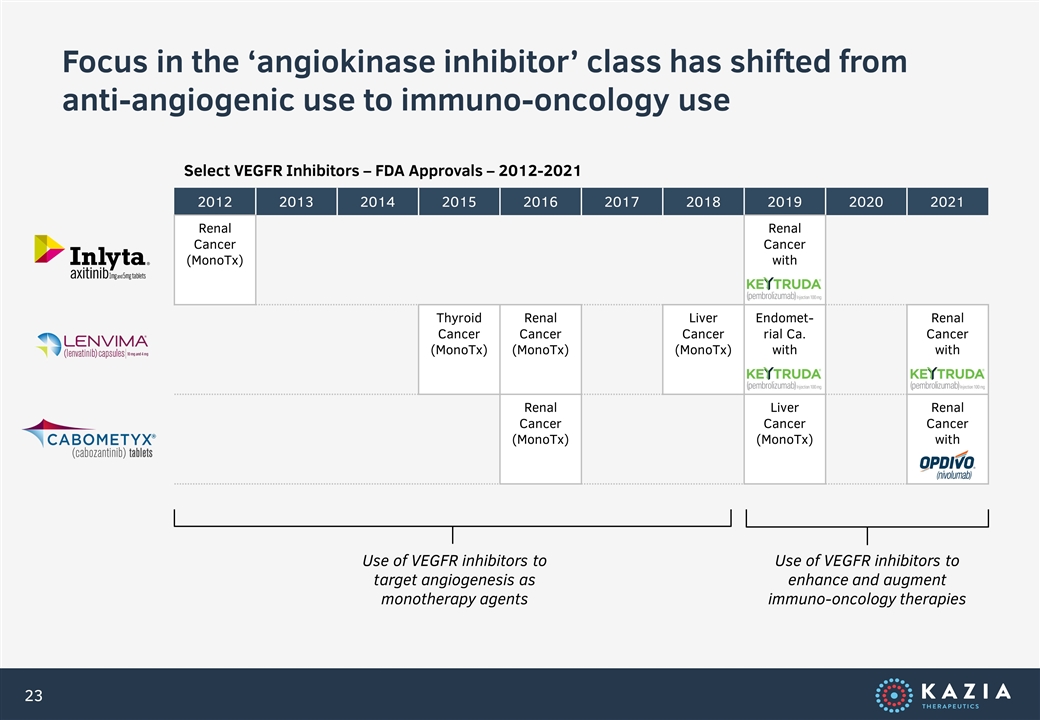

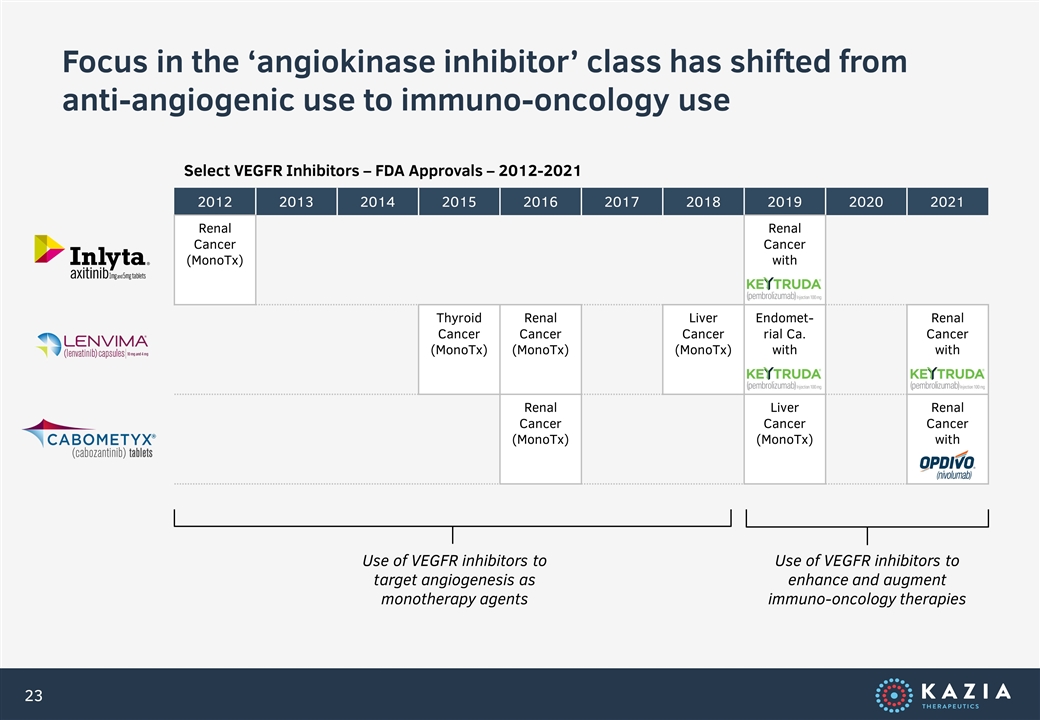

Focus in the ‘angiokinase inhibitor’ class has shifted from anti-angiogenic use to immuno-oncology use 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Renal Cancer (MonoTx) Renal Cancer with Thyroid Cancer (MonoTx) Renal Cancer (MonoTx) Liver Cancer (MonoTx) Endomet-rial Ca. with Renal Cancer with Renal Cancer (MonoTx) Liver Cancer (MonoTx) Renal Cancer with Use of VEGFR inhibitors to target angiogenesis as monotherapy agents Use of VEGFR inhibitors to enhance and augment immuno-oncology therapies Select VEGFR Inhibitors – FDA Approvals – 2012-2021

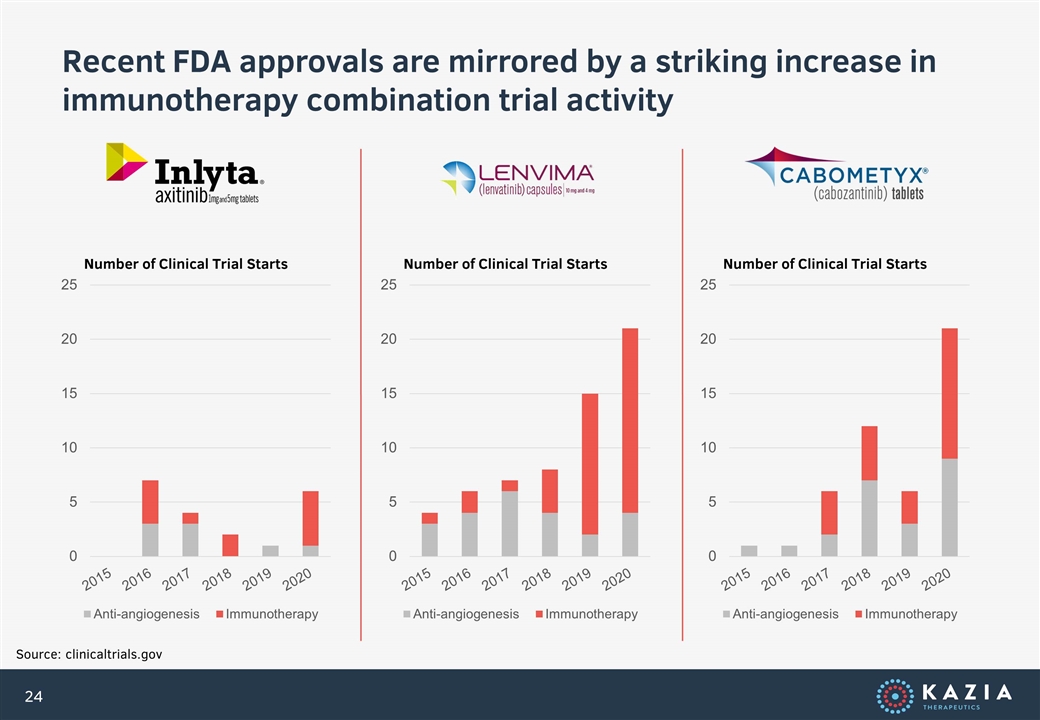

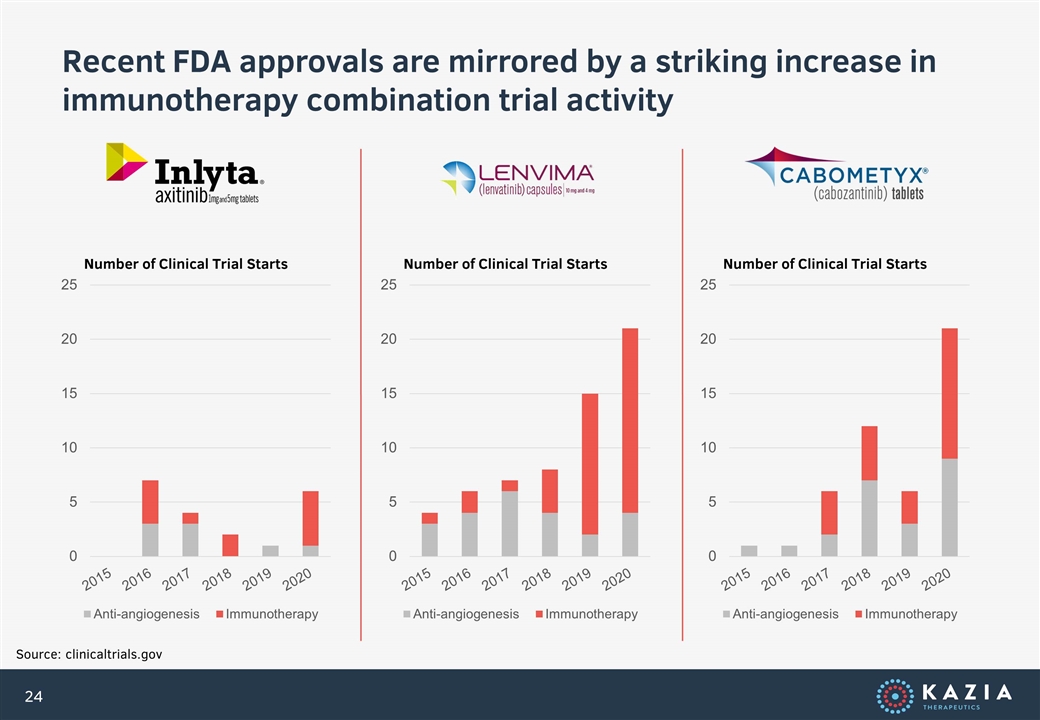

Recent FDA approvals are mirrored by a striking increase in immunotherapy combination trial activity Source: clinicaltrials.gov Number of Clinical Trial Starts Number of Clinical Trial Starts Number of Clinical Trial Starts

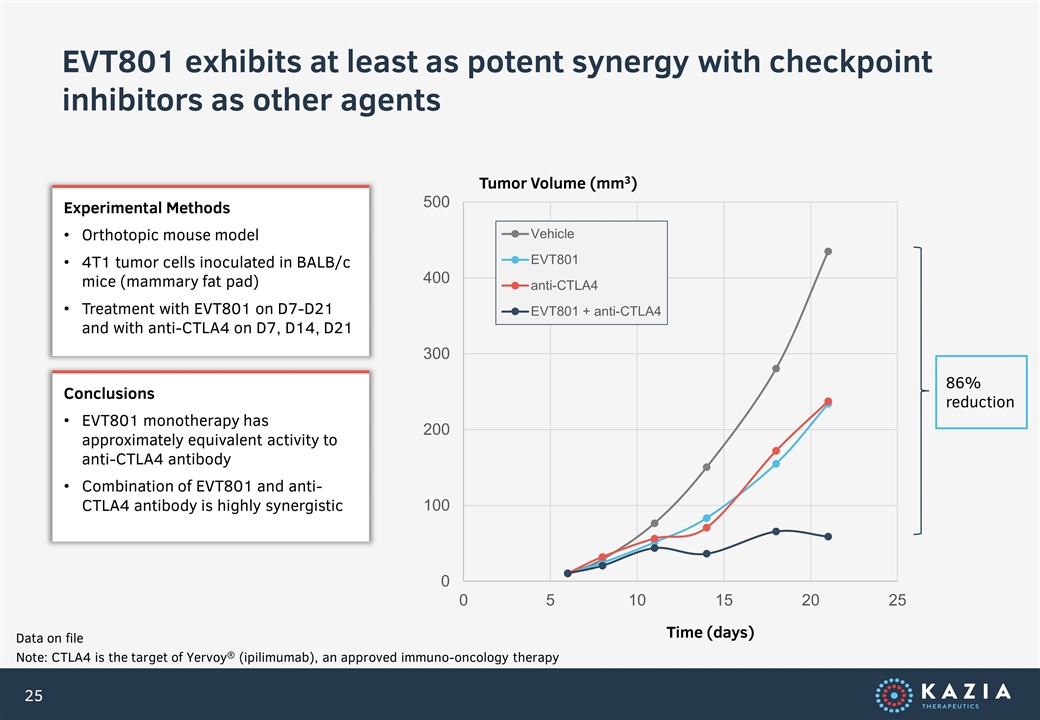

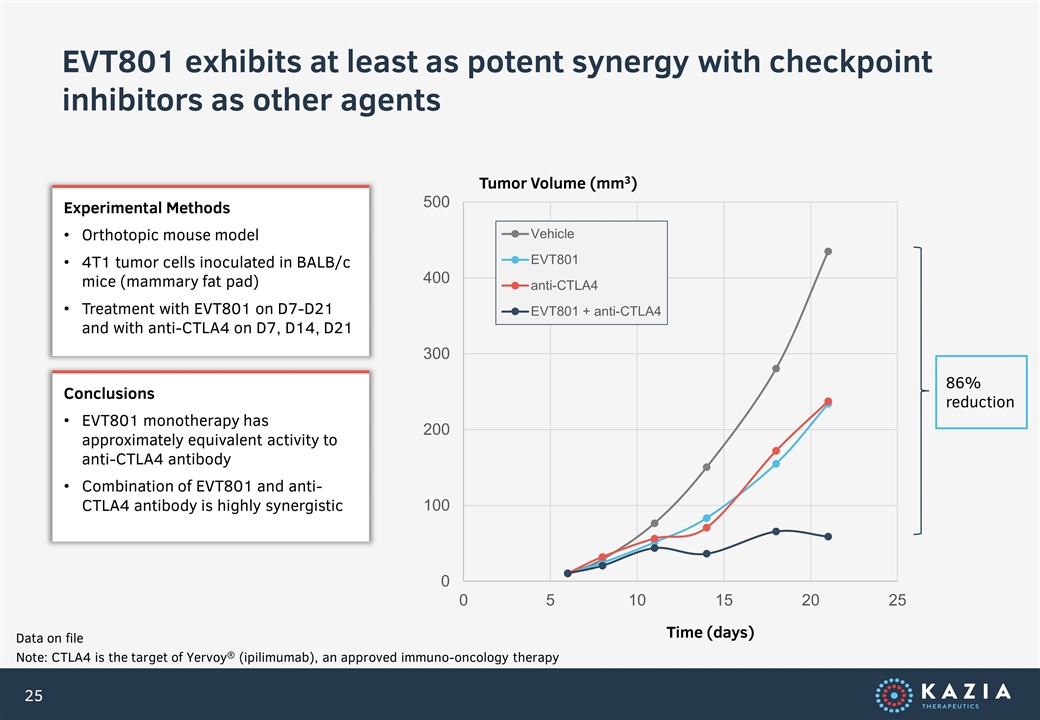

EVT801 exhibits at least as potent synergy with checkpoint inhibitors as other agents Data on file Note: CTLA4 is the target of Yervoy® (ipilimumab), an approved immuno-oncology therapy Experimental Methods Orthotopic mouse model 4T1 tumor cells inoculated in BALB/c mice (mammary fat pad) Treatment with EVT801 on D7-D21 and with anti-CTLA4 on D7, D14, D21 Tumor Volume (mm3) Time (days) Conclusions EVT801 monotherapy has approximately equivalent activity to anti-CTLA4 antibody Combination of EVT801 and anti-CTLA4 antibody is highly synergistic 86% reduction

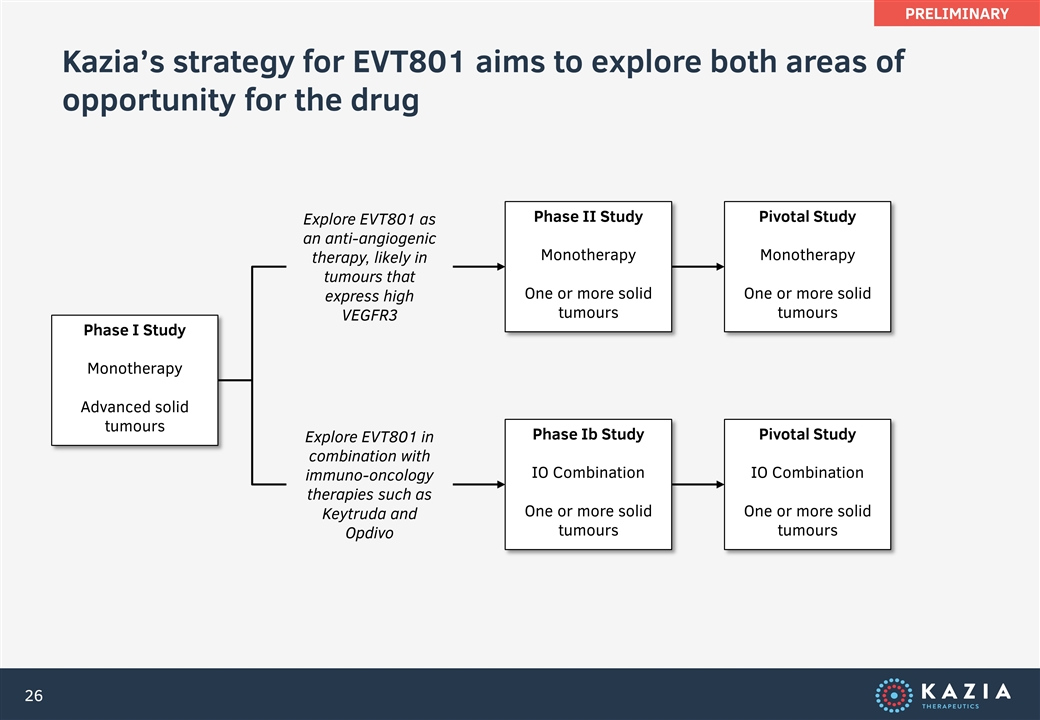

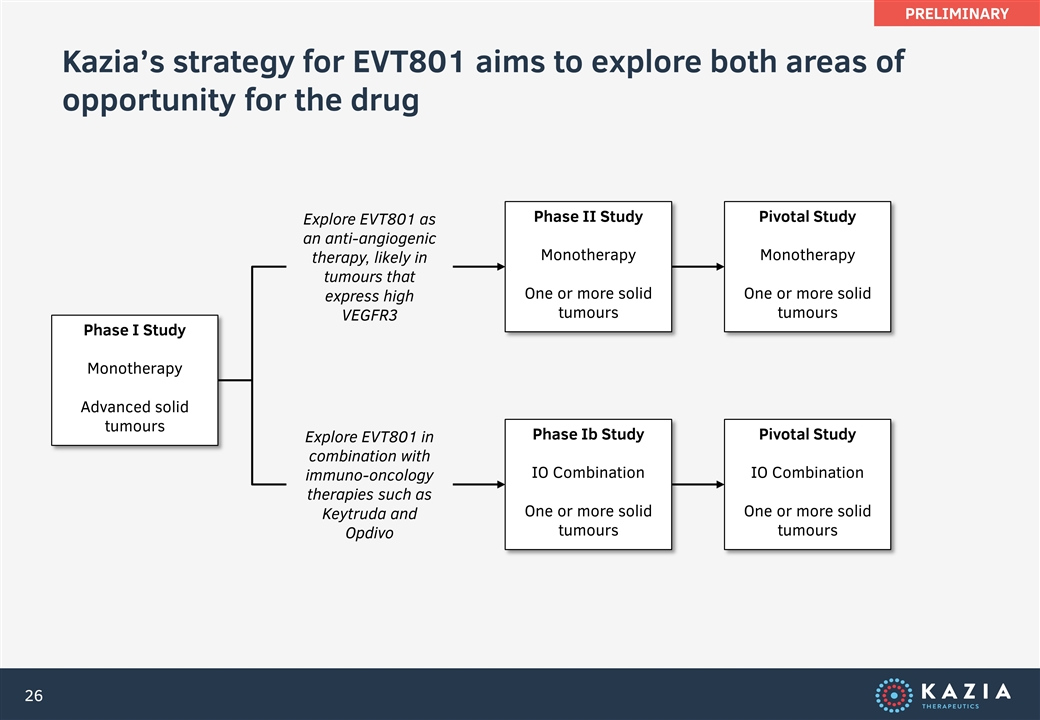

Kazia’s strategy for EVT801 aims to explore both areas of opportunity for the drug Phase I Study Monotherapy Advanced solid tumours Phase II Study Monotherapy One or more solid tumours Phase Ib Study IO Combination One or more solid tumours Explore EVT801 as an anti-angiogenic therapy, likely in tumours that express high VEGFR3 Pivotal Study Monotherapy One or more solid tumours Pivotal Study IO Combination One or more solid tumours Explore EVT801 in combination with immuno-oncology therapies such as Keytruda and Opdivo PRELIMINARY