Zazove Convertible

Securities Fund, Inc.

Semi-Annual Report

June 30, 2020 (Unaudited)

ZAZOVE CONVERTIBLE SECURITIES FUND, INC.

TABLE OF CONTENTS

| | Page |

| HISTORICAL RETURNS | 1-2 |

| FINANCIAL STATEMENTS: | |

| Statement of Assets and Liabilities | 3 |

| Schedule of Investments | 4-9 |

| Statement of Operations | 10 |

| Statements of Changes in Net Assets | 11 |

| Statement of Cash Flows | 12 |

| Notes to Financial Statements | 13-22 |

| Financial Highlights | 23 |

| PROXY VOTING POLICIES AND DIVIDEND REINVESTMENT PLAN | 24 |

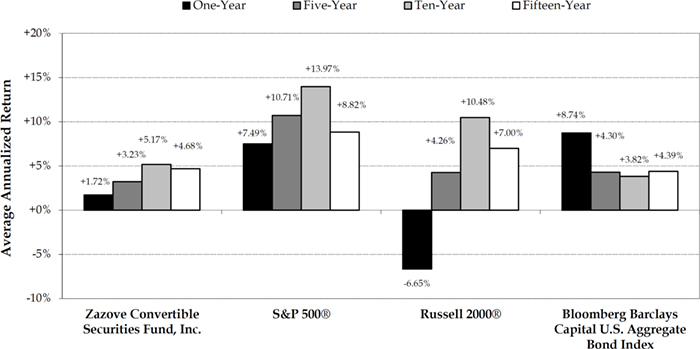

Zazove Convertible Securities Fund, Inc.

Relative Historical Returns (Unaudited)

For the Periods Ended June 30, 2020

Average Annualized Returns

The returns for Zazove Convertible Securities Fund, Inc. are presented after all fees and expenses. The returns of the S&P 500®, the Russell 2000® Index and the Bloomberg Barclays Capital U.S. Aggregate Bond Index are presented after the reinvestment of dividends and interest. Past results are not a guarantee of future performance.

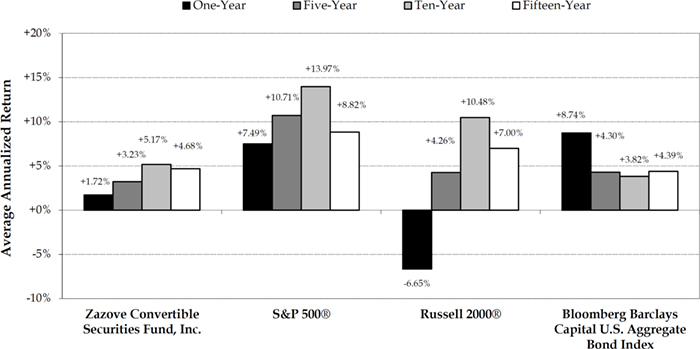

Zazove Convertible Securities Fund, Inc.

Relative Historical Returns (Unaudited)

For the Period Ended June 30, 2020

The returns for Zazove Convertible Securities Fund, Inc. are presented after all fees and expenses. The returns of the S&P 500®, the Russell 2000® Index and the Bloomberg Barclays Capital U.S. Aggregate Bond Index are presented after the reinvestment of dividends and interest. Past results are not a guarantee of future performance.

ZAZOVE CONVERTIBLE SECURITIES FUND, INC.

STATEMENT OF ASSETS AND LIABILITIES

JUNE 30, 2020 (UNAUDITED)

| ASSETS | | | |

| | | | |

| Investments, at fair value (cost $48,062,880) | | $ | 42,738,290 | |

| Cash and cash equivalents, at fair value (cost $43,981) | | | 43,981 | |

| Receivables: | | | | |

| Interest | | | 177,039 | |

| Dividends | | | 8,281 | |

| Securities sold | | | 2,838,572 | |

| Other assets | | | 3,464 | |

| | | | | |

| Total assets | | | 45,809,627 | |

| | | | | |

| LIABILITIES | | | | |

| Payables: | | | | |

| Capital shares redeemed | | $ | 184,021 | |

| Securities sold short, at fair value (proceeds $645,621) | | | 568,191 | |

| Due to broker | | | 4,710,373 | |

| Securities purchased | | | 1,843,088 | |

| Transfer agency fees | | | 17,676 | |

| Custody fees | | | 650 | |

| Professional fees | | | 30,923 | |

| Other | | | 1,500 | |

| | | | | |

| Total liabilities | | | 7,356,422 | |

| | | | | |

| NET ASSETS | | $ | 38,453,205 | |

| | | | | |

| ANALYSIS OF NET ASSETS: | | | | |

| Common stock ($.01 par value; 25,000,000 shares authorized; 2,090,777 shares issued and outstanding) | | $ | 20,908 | |

| Paid-in surplus | | | 40,323,921 | |

| Accumulated net realized gain on investments and securities sold short | | | 3,578,854 | |

| Accumulated net investment gain | | | (223,318 | ) |

| Net unrealized depreciation on investments and securities sold short | | | (5,247,160 | ) |

| | | | | |

| NET ASSETS | | $ | 38,453,205 | |

| | | | | |

| NET ASSET VALUE PER SHARE (based on 2,090,777 shares outstanding) | | $ | 18.39 | |

See notes to financial statements.

ZAZOVE CONVERTIBLE SECURITIES FUND, INC.

SCHEDULE OF INVESTMENTS

JUNE 30, 2020 (UNAUDITED)

| | | Principal/ Shares/ Contracts | | | Fair Value | |

| INVESTMENTS - 111% | | | |

| Convertible Preferred Stock - 9% | | | | | | | | |

| United States - 9% | | | | | | | | |

| Affiliated Managers Group, Inc. 5.150% Due 10-15-37 | | | 4,500 | | | $ | 195,435 | |

| Blueknight Energy Partners 11.000% | | | 80,000 | | | | 457,600 | |

| Braemar Hotels & Resorts 1.375% | | | 64,450 | | | | 657,390 | |

| Chesapeake Energy Series A 5.750% | | | 1,450 | | | | 4,720 | |

| Cowen Group, Inc. 5.625% | | | 1,020 | | | | 846,600 | |

| Stanley Black & Decker Inc. 5.000% | | | 1,060 | | | | 1,204,160 | |

| | | | | | | | | |

| Total Convertible Preferred Stock (cost $3,625,757) | | | | | | | 3,365,905 | |

| | | | | | | | | |

| Convertible Bonds - 92% | | | | | | | | |

| Bermuda - 1% | | | | | | | | |

| Teekay (144A) 5.000% Due 01-15-23 (b) | | | 586,000 | | | | 489,676 | |

| | | | | | | | | |

| Canada - 2% | | | | | | | | |

| Colliers International Group (144A) 4.000 % Due 06-01-25 (b) | | | 540,000 | | | | 667,575 | |

| First Majestic Silver 1.875 % Due 03-01-23 | | | 120,000 | | | | 148,050 | |

| | | | | | | | | |

| Total Canada | | | | | | | 815,625 | |

| | | | | | | | | |

| France - 4% | | | | | | | | |

| Vinci S.A. (Reg S) 0.375% Due 02-16-22 (e) | | | 1,200,000 | | | | 1,386,000 | |

| | | | | | | | | |

| Germany - 5% | | | | | | | | |

| Deutsche Bank AG London (JPM) 1.000% Due 05-01-23 (d) | | | 1,780,000 | | | | 1,752,188 | |

| | | | | | | | | |

| Ghana - 2% | | | | | | | | |

| Tullow Oil Jersey Ltd. (Reg S) 6.625% Due 07-12-21 (e) | | | 800,000 | | | | 656,000 | |

| | | | | | | | | |

| India - 1% | | | | | | | | |

| Bharti Airtel Limited (144A) 1.500% Due 02-17-25 (b) | | | 400,000 | | | | 459,000 | |

| | | | | | | | | |

| Switzerland - 3% | | | | | | | | |

| Credit Suisse AG London (Siemens) (144A) 0.125% Due 03-25-24 (b) | | | 1,050,000 | | | | 1,192,905 | |

| See notes to financial statements. | (continued) |

ZAZOVE CONVERTIBLE SECURITIES FUND, INC.

SCHEDULE OF INVESTMENTS

JUNE 30, 2020 (UNAUDITED)

| | | Principal/ Shares/ Contracts | | | Fair Value | |

| INVESTMENTS - 111% | | | |

| Convertible Bonds - 92% | | | | | | | | |

| United Kingdom - 4% | | | | | | | | |

| GlaxoSmithKline (TBPH) (144A) 0.000% Due 06-22-23 (b) | | | 1,500,000 | | | $ | 1,626,525 | |

| | | | | | | | | |

| United States - 70% | | | | | | | | |

| Air Transport Services Group (144A) 1.125% Due 10-15-24 (b)(d) | | | 590,000 | | | | 561,267 | |

| American Airlines Group 6.500% Due 07-01-25 | | | 690,000 | | | | 652,050 | |

| Atlanticus Holdings 5.875% Due 11-30-35 | | | 700,000 | | | | 490,000 | |

| BioMarin Pharmaceutical, Inc. (144A) 1.250% Due 05-15-27 (b) | | | 290,000 | | | | 340,626 | |

| Burlington Stores (144A) 2.250% Due 04-15-25 (b) | | | 610,000 | | | | 698,069 | |

| Callaway Golf Company (144A) 2.750% Due 05-01-26 (b) | | | 470,000 | | | | 578,394 | |

| Carnival Corporation (144A) 5.750% Due 04-01-23 (b) | | | 100,000 | | | | 162,880 | |

| Chart Industries, Inc. 1.000% Due 11-15-24 | | | 400,000 | | | | 422,000 | |

| Cleveland-Cliffs 1.500% Due 01-15-25 | | | 390,000 | | | | 356,850 | |

| CNX Resources (144A) 2.250% Due 05-01-26 | | | 470,000 | | | | 433,575 | |

| Cowen Group, Inc. (144A) 3.000% Due 12-15-22 (b) | | | 205,000 | | | | 225,244 | |

| CyberArk Software (144A) 0.000% Due 11-15-24 (b) | | | 400,000 | | | | 373,000 | |

| Exact Sciences 0.375% Due 03-01-28 | | | 250,000 | | | | 240,290 | |

| Extra Space Storage, Inc. (144A-Seasoned) 3.125% Due 10-01-35 (b) | | | 1,800,000 | | | | 1,937,250 | |

| Flexion Therapeutics (144A) 3.375% Due 05-01-24 (b)(d) | | | 1,100,000 | | | | 937,750 | |

| Halozyme Therapeutics (144A) 1.250% Due 12-01-24 (b) | | | 290,000 | | | | 367,003 | |

| HC2 Holdings (144A) 7.500% Due 06-01-22 (b) | | | 750,000 | | | | 700,373 | |

| Helix Energy Solutions Group 4.125% Due 09-15-23 | | | 430,000 | | | | 351,525 | |

| Hope Bancorp (144A) 2.000% Due 05-15-38 (b)(d) | | | 570,000 | | | | 463,125 | |

| Insmed 1.750% Due 01-15-25 | | | 550,000 | | | | 537,281 | |

| Jazz Investments I (144A) 2.000% Due 06-15-26 (b) | | | 800,000 | | | | 806,500 | |

| JPMorgan Chase Bank (Tencent) (Reg S) 0.000% Due 08-07-22 (d)(e) | | | 800,000 | | | | 1,007,000 | |

| JPMorgan Chase Bank NA (BABA) (144A) 0.125% Due 01-01-23 (b)(d) | | | 470,000 | | | | 507,500 | |

| Kaman Corporation 3.250% Due 05-01-24 (d) | | | 1,260,000 | | | | 1,207,080 | |

| KBR (144A) 2.500% Due 11-01-23 (b) | | | 490,000 | | | | 553,087 | |

| Liberty Media (LSXMA) 1.375% Due 10-15-23 | | | 985,000 | | | | 1,047,794 | |

| Microchip Technology, Inc. (144A) 1.625% Due 02-15-27 (b)(d) | | | 230,000 | | | | 339,537 | |

| NantHealth 5.500% Due 12-15-21 (d) | | | 620,000 | | | | 569,356 | |

| NCL Corporation (144A) 6.000% Due 05-15-24 (b) | | | 260,000 | | | | 349,388 | |

| NRG Energy, Inc. 2.750% Due 06-01-48 (d) | | | 950,000 | | | | 964,844 | |

| ON Semiconductor Corporation 1.625% Due 10-15-23 (d) | | | 500,000 | | | | 608,125 | |

| Par Pacific Holdings, Inc. 5.000% Due 06-15-21 | | | 690,000 | | | | 641,700 | |

| See notes to financial statements. | (continued) |

ZAZOVE CONVERTIBLE SECURITIES FUND, INC.

SCHEDULE OF INVESTMENTS

JUNE 30, 2020 (UNAUDITED)

| | | Principal/ Shares/ Contracts | | | Fair Value | |

| INVESTMENTS - 111% | | | |

| Convertible Bonds - 92% | | | | | | | | |

| United States - 70% | | | | | | | | |

| PRA Group, Inc. 3.500% Due 06-01-23 | | | 90,000 | | | $ | 93,769 | |

| RH 0.000% Due 07-15-20 | | | 100,000 | | | | 131,440 | |

| Royal Caribbean Cruises (144A) 4.250% Due 06-15-23 (b)(d) | | | 880,000 | | | | 818,400 | |

| Sabre GLBL (144A) 4.000% Due 04-15-25 (b) | | | 200,000 | | | | 254,750 | |

| Silicon Laboratories 1.375% Due 03-01-22 | | | 490,000 | | | | 525,549 | |

| Smart Global Holdings (144A) 2.250% Due 02-15-26 (b) | | | 740,000 | | | | 670,625 | |

| Southwest Airlines 1.250% Due 05-01-25 | | | 530,000 | | | | 637,325 | |

| Splunk (144A) 1.125% Due 09-15-25 (b)(d) | | | 1,119,000 | | | | 1,195,395 | |

| Tandem Diabetes Care (144A) 1.500% Due 05-01-25 (b) | | | 80,000 | | | | 93,539 | |

| Team 5.000% Due 08-01-23 | | | 620,000 | | | | 430,882 | |

| The RealReal (144A) 3.000% Due 06-15-25 (b) | | | 160,000 | | | | 159,000 | |

| Theravance Biopharma 3.250% Due 11-01-23 | | | 470,000 | | | | 459,425 | |

| Unisys 5.500% Due 03-01-21 | | | 366,000 | | | | 467,565 | |

| Varex Imaging (144A) 4.000% Due 06-01-25 (b) | | | 930,000 | | | | 905,587 | |

| Workday, Inc. 0.250% Due 10-01-22 | | | 500,000 | | | | 689,375 | |

| | | | | | | | | |

| Total United States | | | | | | | 26,963,089 | |

| | | | | | | | | |

| Total Convertible Bonds (cost $35,637,529) | | | | | | | 35,341,008 | |

| | | | | | | | | |

| Corporate Bonds - 0% | | | | | | | | |

| United States - 0% | | | | | | | | |

| Global Brokerage 7.000% Due 02-08-23 (a) | | | 1,468,926 | | | | 4,407 | |

| | | | | | | | | |

| Total Corporate Bonds (cost $715,898) | | | | | | | 4,407 | |

| | | | | | | | | |

| Common Stock - 7% | | | | | | | | |

| China - 0% | | | | | | | | |

| Emerald Plantation Holdings (c) | | | 180,362 | | | | 5,411 | |

| See notes to financial statements. | (continued) |

ZAZOVE CONVERTIBLE SECURITIES FUND, INC.

SCHEDULE OF INVESTMENTS

JUNE 30, 2020 (UNAUDITED)

| | | Principal/ Shares/ Contracts | | | Fair Value | |

| INVESTMENTS - 111% | | | |

| Common Stock - 7% | | | | | | | | |

| United States - 7% | | | | | | | | |

| Bristow Group (c) | | | 960 | | | $ | 13,373 | |

| Clear Channel Holdings, Inc (c) | | | 285,000 | | | | 296,400 | |

| Cumulus Media, Inc. (c) | | | 200,000 | | | | 791,000 | |

| Daseke (c) | | | 16,720 | | | | 65,710 | |

| Emmis Communication (c) | | | 199,730 | | | | 329,554 | |

| School Specialty, Inc. (c) | | | 26,500 | | | | 3,763 | |

| Urban One, Inc. (c) | | | 588,944 | | | | 1,130,772 | |

| | | | | | | | | |

| Total United States | | | | | | | 2,630,572 | |

| | | | | | | | | |

| Total Common Stock (cost $6,076,338) | | | | | | | 2,635,983 | |

| | | | | | | | | |

| Mutual Funds - 0% | | | | | | | | |

| United States - 0% | | | | | | | | |

| Kayne Anderson MLP Investment Company | | | 21,958 | | | | 115,938 | |

| | | | | | | | | |

| Total Mutual Funds (cost $105,600) | | | | | | | 115,938 | |

| | | | | | | | | |

| Warrants - 3% | | | | | | | | |

| United States - 3% | | | | | | | | |

| Ashland Global Holdings, Inc., $1,000 strike price, expire 3-31-29 (c) | | | 2,260 | | | | 15,242 | |

| Avaya Holdings, $25.55 strike price, expire 12-15-22 (c) | | | 45,995 | | | | 57,494 | |

| Hostess Brands, $11.50 strike price, expire 11-14-21 (c) | | | 447,970 | | | | 389,734 | |

| US Ecology, $58.67 strike price, expire 10-17-23 (c) | | | 62,000 | | | | 294,500 | |

| Verra Mobility, $11.50 strike price, expire 10-17-23 (c) | | | 170,000 | | | | 512,550 | |

| | | | | | | | | |

| Total United States | | | | | | | 1,269,520 | |

| | | | | | | | | |

| Total Warrants (cost $1,892,892) | | | | | | | 1,269,520 | |

| | | | | | | | | |

| Escrow - 0% | | | | | | | | |

| China - 0% | | | | | | | | |

| Sino Forest Corporation escrow | | | 1,180,000 | | | | 2,950 | |

| See notes to financial statements. | (continued) |

ZAZOVE CONVERTIBLE SECURITIES FUND, INC.

SCHEDULE OF INVESTMENTS

JUNE 30, 2020 (UNAUDITED)

| | | Principal/ Shares/ Contracts | | | Fair Value | |

| INVESTMENTS - 111% | | | |

| Escrow - 0% | | | | | | | | |

| Georgia - 0% | | | | | | | | |

| MIG LLC escrow | | | 5,158,766 | | | $ | 2,579 | |

| | | | | | | | | |

| Total Escrow (cost $8,867) | | | | | | | 5,529 | |

| | | | | | | | | |

| TOTAL INVESTMENTS (cost $48,062,880) | | | | | | $ | 42,738,290 | |

| | | | | | | | | |

| SECURITIES SOLD SHORT - (1%) | | | | | | | | |

| Short Stock - (1%) | | | | | | | | |

| Canada - (0%) | | | | | | | | |

| First Majestic Silver | | | (8,140 | ) | | $ | (80,993 | ) |

| | | | | | | | | |

| United States - (1%) | | | | | | | | |

| Atlanticus Holdings | | | (6,617 | ) | | | (68,420 | ) |

| Carnival Corp | | | (9,900 | ) | | | (162,558 | ) |

| NantHealth | | | (12,355 | ) | | | (56,586 | ) |

| PRA Group Inc | | | (1,170 | ) | | | (45,232 | ) |

| US Ecology | | | (2,800 | ) | | | (94,864 | ) |

| Verra Mobility | | | (5,709 | ) | | | (58,688 | ) |

| | | | | | | | | |

| Total United States | | | | | | | (486,348 | ) |

| | | | | | | | | |

| Total Short Stock (cost $633,874) | | | | | | | (567,341 | ) |

| | | | | | | | | |

| Call Options - (0%) | | | | | | | | |

| United States - (0%) | | | | | | | | |

| Willscot Corporation | | | (170 | ) | | | (850 | ) |

| | | | | | | | | |

| Total Call Options (proceeds $11,747) | | | | | | | (850 | ) |

| | | | | | | | | |

| TOTAL SECURITIES SOLD SHORT (proceeds $645,621) | | | | | | $ | (568,191 | ) |

| See notes to financial statements. | (continued) |

ZAZOVE CONVERTIBLE SECURITIES FUND, INC.

SCHEDULE OF INVESTMENTS

JUNE 30, 2020 (UNAUDITED)

| (a) | This security is in default or deferral and interest or dividends are not being accrued on the position. |

| (b) | 144A securities are those which are exempt from registration under Rule 144A of the U.S. Securities Act of 1933. These securities are subject to contractual or legal restrictions on their sale. |

| (c) | Non-income producing securities. |

| (d) | All or a portion of these securities are pledged as collateral for the margin account held by the broker. |

| (e) | Reg S securities are those offered and sold outside of the United States and thus are exempt from registration under Regulation S of the U.S. Securities Act of 1933. These securities are subject to restrictions on their sale. |

Percentages are based upon the fair value as a percent of net assets as of June 30, 2020.

| See notes to financial statements. | (concluded) |

ZAZOVE CONVERTIBLE SECURITIES FUND, INC.

STATEMENT OF OPERATIONS

SIX MONTHS ENDING JUNE 30, 2020 (UNAUDITED)

| INVESTMENT INCOME: | | | |

| Interest | | $ | (70,219 | ) |

| Dividends | | | 103,204 | |

| Other | | | 204 | |

| | | | | |

| Total investment income | | | 33,189 | |

| | | | | |

| EXPENSES: | | | | |

| Custody fees | | | 7,386 | |

| Director fees | | | 9,750 | |

| Insurance expense | | | 2,461 | |

| Management fees | | | 284,721 | |

| Margin interest | | | 31,654 | |

| Professional fees | | | 33,501 | |

| Transfer agency fees | | | 62,667 | |

| Other | | | 3,468 | |

| | | | | |

| Total expenses | | | 435,608 | |

| | | | | |

| NET INVESTMENT LOSS | | | (402,419 | ) |

| |

| NET REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND SECURITIES SOLD SHORT: |

| Net realized gain on investments | | | 3,861,630 | |

| Net realized loss on securities sold short | | | (282,726 | ) |

| Net change in unrealized appreciation of investments and securities sold short | | | (4,993,717 | ) |

| | | | | |

| Net realized and unrealized loss from investments and securities sold short | | | (1,414,813 | ) |

| | | | | |

| NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (1,817,232 | ) |

See notes to financial statements.

ZAZOVE CONVERTIBLE SECURITIES FUND, INC.

STATEMENTS OF CHANGES IN NET ASSETS

SIX MONTHS ENDING JUNE 30, 2020 (UNAUDITED)

| NET INCREASE IN NET ASSETS RESULTING FROM: | | | | |

| | | | | |

| OPERATIONS: | | | | |

| Net investment loss | | $ | (402,419 | ) |

| Net realized gain (loss) on investments and securities sold short | | | 3,578,904 | |

| Net change in unrealized appreciation of investments and securities sold short | | | (4,993,717 | ) |

| | | | | |

| Net increase in net assets resulting from operations | | | (1,817,232 | ) |

| | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | |

| From net investment income and net capital gains | | | 0 | |

| Return of capital | | | 0 | |

| | | | | |

| Net decrease in net assets resulting from distributions to shareholders | | | 0 | |

| | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | |

| Proceeds from shares sold | | | 755,847 | |

| Reinvestment of distributions | | | 0 | |

| Payments for shares redeemed | | | (1,291,756 | ) |

| | | | | |

| Net decrease in net assets resulting from capital share transactions | | | (535,909 | ) |

| | | | | |

| NET INCREASE IN NET ASSETS | | | (2,353,141 | ) |

| | | | | |

| NET ASSETS- Beginning of the year | | | 40,806,346 | |

| | | | | |

| NET ASSETS - End of period | | $ | 38,453,205 | |

See notes to financial statements.

ZAZOVE CONVERTIBLE SECURITIES FUND, INC.

STATEMENT OF CASH FLOWS

SIX MONTHS ENDING JUNE 30, 2020 (UNAUDITED)

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| Net decrease in net assets resulting from operations | | $ | (1,817,232 | ) |

| Adjustments to reconcile net decrease in net assets resulting from operations to net cash provided by operating activities: | | | | |

| Net change in unrealized appreciation of investments and securities sold short | | | 4,993,717 | |

| Net realized gain on investments and securities sold short | | | (3,578,904 | ) |

| Net amortization and accretion | | | 411,171 | |

| Purchases of investment securities | | | (56,912,207 | ) |

| Proceeds from sale of investment securities | | | 53,532,285 | |

| Purchases of securities sold short | | | (6,139,276 | ) |

| Proceeds from sale of securities sold short | | | 6,180,942 | |

| Changes in assets and liabilities: | | | | |

| Decrease in receivables | | | (47,029 | ) |

| Decrease in other assets | | | (2,460 | ) |

| Decrease in due to broker | | | 4,549,588 | |

| Increase in payables | | | (20,236 | ) |

| | | | | |

| Net cash provided by operating activities | | | 1,150,359 | |

| | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | |

| Proceeds from shares sold | | | 755,847 | |

| Payments for shares redeemed | | | (1,863,302 | ) |

| Payments for distributions to shareholders | | | - | |

| | | | | |

| Net cash used in financing activities | | | (1,107,455 | ) |

| | | | | |

| NET INCREASE IN CASH AND CASH EQUIVALENTS | | | 42,904 | |

| | | | | |

| CASH AND CASH EQUIVALENTS—Beginning of year | | | 1,077 | |

| | | | | |

| CASH AND CASH EQUIVALENTS—End of year | | $ | 43,981 | |

| | | | | |

| SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION: | | | | |

| Cash paid during the period for interest | | $ | 31,654 | |

See notes to financial statements.

ZAZOVE CONVERTIBLE SECURITIES FUND, INC.

NOTES TO FINANCIAL STATEMENTS

SIX MONTHS ENDED JUNE 30, 2020 (UNAUDITED)

Zazove Convertible Securities Fund, Inc., a Maryland corporation (the “Fund”) is registered under the Investment Company Act of 1940 as a diversified investment company that operates as a closed-end interval fund. The Fund’s investment objective is to realize long-term growth, current income and the preservation of capital. The Fund pursues this objective primarily through investing in a portfolio of convertible securities. The convertible strategy focuses primarily on opportunities in the United States of America, although the Fund may hold foreign securities. Zazove Associates, L.L.C. is the Fund’s investment advisor (the “Investment Advisor”). The Fund initially acquired its portfolio pursuant to a merger whereby Zazove Convertible Fund, L.P., a Delaware limited partnership registered under the Investment Company Act of 1940, was merged into the Fund on January 1, 1999.

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

Basis of Presentation—The Fund’s financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America and are stated in United States dollars. The Fund is an investment company and follows accounting and reporting guidance within Financial Accounting Standards Board ("FASB") Accounting Standard Codification ("ASC") Topic 946, Financial Services – Investment Companies. The following is a summary of the significant accounting and reporting policies used in preparing the financial statements.

Use of Estimates—The preparation of financial statements requires the Fund’s management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Valuation of Investments—The valuation of the Fund's investments is in accordance with policies and procedures adopted by and under the supervision of the Board of Directors. Investments are recorded at fair value.

Common stock, certain convertible preferred securities and certain derivatives that are traded on national securities exchanges are valued at the last reported sales price or, if there are no sales, at the mean between the bid and ask prices. Common stock, certain convertible preferred securities and certain derivatives traded over the counter are valued at the average of the highest current independent bid and lowest current independent offer reported upon the close of trading on that day.

Convertible bond securities, corporate bond securities, certain convertible preferred securities and certain derivatives are valued at the mid-point of independent bid and offer quotes received from dealers or brokers who make markets in such securities.

Securities for which market quotations are not available are valued at fair value as determined in good faith by the Investment Advisor with the oversight of the Board of Directors pursuant to Board of Directors’ approved procedures. In such cases, fair value is derived based on all relevant facts and circumstances including, among other things, fixed income and option pricing models, enterprise valuation analysis, comparable security analysis and conversion value.

Cash and Cash Equivalents—Cash and cash equivalents represents cash held by the Fund’s custodian in the amount of $43,891. Since the Fund does not clear its own investment transactions, it has established an account with a third-party custodian (UMB Bank, N.A.) for this purpose.

Broker Balances—The Fund has established an account with a prime broker (Citigroup) for the purpose of purchasing securities on margin. At June 30, 2020, the Fund had a margin account balance in the amount of $(4,702,516) for securities purchased on margin, which is included in due to broker on the statement of assets and liabilities. The Fund pledges sufficient cash and securities as collateral for the margin account, if any, held by the custodian. As the valuation of such securities fluctuates, the Fund may be required to pledge additional securities as collateral.

Investment Transactions and Income—Security transactions are recorded on the trade date. Realized gains or losses from sales of securities (including securities sold short) are determined on an identified cost basis. Dividend income and expense is recognized on the ex-dividend date. Interest income and expense are recognized on the accrual basis. Bond discount is accreted and bond premium is amortized over the expected maturity of each applicable security using the effective interest method, as long as the collectability is not in doubt and the security is performing in accordance with its contractual terms.

Indemnifications—Under the Fund’s organizational documents, the Fund is obligated to indemnify its directors, officers and Investment Advisor against certain liabilities relating to the business or activities undertaken by them on behalf of the Fund. In addition, in the normal course of business, the Fund enters into contracts that provide for general indemnification to other parties. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, the Fund has not had prior claims or losses pursuant to these indemnification provisions and expects the risk of loss to be remote.

| 3. | FAIR VALUE MEASUREMENTS |

FASB ASC Topic 820, Fair Value Measurement (“Topic 820”), defines fair value, establishes a framework for measuring fair value and expands disclosures about fair value measurements.

Various inputs are used to determine the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

| ● | Level 1 – quoted prices in active markets for identical securities |

| ● | Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| ● | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following table summarizes the inputs used to value the Fund’s investments as of June 30, 2020:

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Convertible Preferred Stock | | $ | 457,600 | | | $ | 2,908,305 | | | $ | 0 | | | $ | 3,365,905 | |

| Convertible Bonds | | | 0 | | | | 35,341,008 | | | | 0 | | | | 35,341,008 | |

| Corporate Bonds | | | 0 | | | | 4,407 | | | | 0 | | | | 4,407 | |

| Common Stock | | | 1,482,664 | | | | 1,153,319 | | | | 0 | | | | 2,635,983 | |

| Mutual Funds | | | 115,938 | | | | 0 | | | | 0 | | | | 115,938 | |

| Warrants | | | 1,254,278 | | | | 0 | | | | 15,242 | | | | 1,269,520 | |

| Escrow | | | 0 | | | | 0 | | | | 5,529 | | | | 5,529 | |

| Total Investments | | $ | 3,310,480 | | | $ | 39,407,039 | | | $ | 20,771 | | | $ | 42,738,290 | |

The following table summarizes the Fund’s common stock industry concentrations as of June 30, 2020:

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Advertising | | $ | 296,400 | | | $ | 0 | | | $ | 0 | | | $ | 296,400 | |

| Cable & Satellite TV | | | 1,120,554 | | | | 0 | | | | 0 | | | | 1,120,554 | |

| Forestry/Paper | | | 0 | | | | 5,411 | | | | 0 | | | | 5,411 | |

| Media Content | | | 0 | | | | 1,130,772 | | | | 0 | | | | 1,130,772 | |

| Oil Field Equipment & Services | | | 0 | | | | 13,373 | | | | 0 | | | | 13,373 | |

| Specialty Retail | | | | | | | 3,763 | | | | 0 | | | | 3,763 | |

| Trucking & Delivery | | | 65,710 | | | | 0 | | | | 0 | | | | 65,710 | |

| Total Common Stock | | $ | 1,482,664 | | | $ | 1,153,319 | | | $ | 0 | | | $ | 2,635,983 | |

The following table summarizes the inputs used to value the Fund’s securities sold short as of June 30, 2020:

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stock | | | | | | | | | | | | | | | | |

| Chemicals | | $ | 94,864 | | | $ | 0 | | | $ | 0 | | | $ | 94,864 | |

| Cons/Comm/Lease Financing | | | 113,652 | | | | 0 | | | | 0 | | | | 113,652 | |

| Health Services | | | 56,586 | | | | 0 | | | | 0 | | | | 56,586 | |

| Metals/Mining Excluding Steel | | | 80,993 | | | | 0 | | | | 0 | | | | 80,993 | |

| Recreation & Travel | | | 162,558 | | | | 0 | | | | 0 | | | | 162,558 | |

| Software/Services | | | 58,689 | | | | 0 | | | | 0 | | | | 58,689 | |

| Call Options | | | 850 | | | | 0 | | | | 0 | | | | 850 | |

| Total securities sold short | | $ | 568,191 | | | $ | 0 | | | $ | 0 | | | $ | 568,191 | |

The following is a reconciliation of Level 3 assets for which significant unobservable inputs were used to determine fair value:

| | | Warrants | | | Escrow | |

| Balance as of December 31, 2019 | | $ | 11,604 | | | $ | 9,301 | |

| Realized gain (loss) | | | 0 | | | | 0 | |

| Net change in appreciation (depreciation) | | | 3,638 | | | | (3,772 | ) |

| Purchases | | | 0 | | | | 0 | |

| Sales/return of capital | | | 0 | | | | 0 | |

| Transfers into Level 3 | | | 0 | | | | 0 | |

| Transfers out of Level 3 | | | 0 | | | | 0 | |

| | | | | | | | | |

| Balance as of June 30, 2020 | | $ | 15,242 | | | $ | 5,529 | |

For the six months ended June 30, 2020, the net change in appreciation (depreciation) included in net assets related to Level 3 investments still held at the reporting date are as follows:

| | | Warrants | | | Escrow | |

| | | $ | 3,638 | | | $ | (3,772 | ) |

Topic 820 requires the following disclosures about fair value measurements of assets and liabilities classified as Level 3 within the fair value hierarchy: quantitative information about the unobservable inputs used in a fair value measurement.

The following table presents the quantitative information about the significant unobservable inputs and valuation techniques utilized to determine the fair value of the Fund's Level 3 investments as of June 30, 2020. The table includes Level 3 investments with values derived from third parties. Such investments may be based on broker/dealer quotes for which there is a lack of transparency as to inputs used to develop the valuations. The quantitative detail of these unobservable inputs is neither provided nor reasonably available to the Fund.

Description

Assets: | | Fair Value as of

June 30, 2020 | | Valuation

Technique | | Unobservable

Inputs | | Amount/

Range |

| Warrant | | $ 15,242 | | Discount to Black-Sholes pricing model | | Liquidity discount | | 50% |

| Escrow | | $ 2,579 | | Broker quote | | | | |

| Escrow | | $ 2,950 | | Bankruptcy Plan | | | | |

The significant unobservable input used in the fair value measurement of the Fund's Level 3 warrants is a liquidity discount. A significant and reasonable increase or decrease in the unobservable inputs for any of these Level 3 investments would result in a significant decrease or increase in the fair value measurement.

The valuation process of Level 3 securities follows the valuation of investments policy as disclosed in footnote 2.

| 4. | DERIVATIVES AND HEDGING |

The Fund follows the provisions of FASB ASC Topic 815, Derivatives and Hedging (“Topic 815”), which requires qualitative disclosures about objectives and strategies for using derivatives, quantitative disclosures about fair value amounts of gains and losses on derivative instruments and disclosures about credit risk related to contingent features in derivative agreements.

As of and for the six months ended June 30, 2020, the Fund held warrants which are considered derivative instruments under Topic 815. Warrants are convertible at the holder's option into a fixed number of shares of the issuer's common stock upon payment of the exercise price and are treated as convertible securities by the Fund. Warrants held by the Fund were either purchased or received pursuant to a restructuring or exchange transaction. Equity price is the primary risk exposure of warrants. The fair value of warrants as of June 30, 2020 was $1,269,520 and is included in investments on the statement of assets and liabilities.

As of and for the six months ended June 30, 2020, the Fund held call options which are considered derivative instruments under Topic 815. Call options are an agreement that gives the Fund the right (but not the obligation) to buy a common stock, bond, commodity or other instrument at a specified price within a specified time period. Equity price is the primary risk exposure of call options. The fair value of call options as of June 30, 2020 was $(850) and is included in securities sold short on the statement of assets and liabilities.

Realized gains and losses on derivative instruments are included in net realized gain on investments on the statement of operations. Change in unrealized appreciation (depreciation) on derivative instruments is included in net change in unrealized depreciation of investments and securities sold short on the statement of operations.

The following table summarizes the net realized gain (loss) and net change in unrealized appreciation (depreciation) on derivative instruments for the six months ended June 30, 2020:

| Derivative | | Net Realized

Gain (Loss) | | | Change in Net

Unrealized Appreciation

(Depreciation) | |

| Warrants | | $ | 12,632 | | | $ | (947,336 | ) |

| Call options | | | (47,759 | ) | | | 209,399 | |

| | | | | | | | | |

| | | $ | (35,127 | ) | | $ | (737,937 | ) |

The following table summarizes transactions in derivative contracts for the six months ended June 30, 2020:

| | Warrants | | Call

Options |

| Held as of December 31, 2019 | 927,590 | | (715) |

| Purchased | 62,210 | | 1,090 |

| Sold/exercised | (261,575) | | (545) |

| Held as of June 30, 2020 | 728,225 | | (170) |

FASB ASU No. 2011-11, Balance Sheet (Topic 210): Disclosures about Offsetting Assets and Liabilities (“ASU 2011-11”), requires entities to disclose both gross and net information for recognized derivative instruments and financial instruments that are either offset in the statement of assets and liabilities or subject to an enforceable master netting arrangement or similar agreement. ASU No. 2013-01, Clarifying the Scope of Disclosures about Offsetting Assets and Liabilities (“ASU 2013-01”), clarifies that the scope of ASU 2011-11 applies to derivatives accounted for in accordance with ASC Topic 815, Derivatives and Hedging, including bifurcated embedded derivatives, repurchase agreements and reverse repurchase agreements, and securities borrowing and securities lending transactions. As of and for the six months ended June 30, 2020, the Fund did not hold any derivative instruments that would require disclosure under ASU 2013-01.

| 5. | CAPITAL SHARE TRANSACTIONS |

The Fund is authorized to issue up to 25,000,000 shares of common stock, $0.01 par value. Shareholders are entitled to one vote per share on all corporate issues put to vote of the shareholders, although the Fund does not contemplate holding annual meetings to elect directors or for any other purpose.

Upon approval of the Board of Directors, shares may be purchased as of the first business day of each month at the then net asset value per share. All subscription funds received after the first business day of the month will be tracked as subscriptions received in advance until the beginning of the following month, at which time shares will be issued and the subscription will be recorded as a component of net assets.

On a quarterly basis, the Fund will offer to repurchase no less than 5% and no more than 25% of the Fund’s outstanding shares at the then net asset value per share. Notice of the terms and conditions of each quarterly repurchase offer are sent to the shareholders in advance of the offer. On May 20, 2020, the Fund offered to repurchase shares as of June 30, 2020, which are reflected as capital shares redeemed on the statement of assets and liabilities. The Fund may impose a 2% fee on the redemption of fund shares held for less than one year. This fee is intended to compensate the Fund for expenses related to such redemption. Shares are redeemed by treating the shares first acquired by a shareholder as being redeemed prior to shares acquired by such shareholders thereafter. There have been no redemption fees charged during 2020.

Distributions from the Fund are recorded on the ex-distribution date. All ordinary and capital gain distributions are automatically reinvested in shares at the net asset value on the ex-distribution date unless Shareholders elect in writing to receive such distributions in cash.

In the case of the termination of the Fund, distributions to the shareholders will be made in proportion to their respective share ownership after the payment of all Fund creditors.

| Changes in Shares Outstanding | |

| Shares sold | 43,457 |

| Shares redeemed | (84,753) |

| Net decrease | (41,296) |

| Shares outstanding at the beginning of year | 2,132,073 |

| Shares outstanding at the end of period | 2,090,777 |

| 6. | MANAGEMENT AGREEMENT AND OTHER TRANSACTIONS WITH AFFILIATES |

Zazove Associates, L.L.C. has been engaged as the Fund’s Investment Advisor and fund accountant pursuant to the terms of an Investment Advisory Agreement. As Investment Advisor and fund accountant of the Fund, Zazove Associates, L.L.C. received management fees for the six months ended June 30, 2020 based on the following management fee schedule. Management fees are computed and paid on a monthly basis based on the net assets of the Fund as of the beginning of the month.

| Net Assets | First $20,000,000

in Net Assets | Net Assets in

Excess of

$20,000,000 |

| Annual management fee rate | 2.00% | 1.00% |

As of June 30, 2020, certain employees and affiliates of the Investment Advisor held 15.19% of the outstanding shares of the Fund.

Transactions with related parties were conducted on terms equivalent to those prevailing in an arm’s length transaction.

The Fund bears all normal direct costs and expenses of its operations including: management fees; brokerage commissions; custodian fees; transfer agency fees; legal, audit, accounting and tax preparation expenses; applicable state taxes and other operating expenses such as regulatory filing fees and costs for communications with shareholders. The custodian fees and transfer agent fees are paid to UMB Bank, N.A.

The overall responsibility for the management and operation of the Fund is vested in the Board of Directors (the “Board”). The Board consists of four directors: Gene T. Pretti, Andrew J. Goodwin III, Jack L. Hansen, and Peter A. Lechman. Each of the three directors who are not affiliated with the Investment Advisor will receive $6,500 for their service to the Fund during 2020.

Gene T. Pretti, President, and Steven M. Kleiman, Secretary and Treasurer, are the principal officers of the Fund and are responsible for the day-to-day supervision of the business and affairs of the Fund. Steven M. Kleiman is the Fund’s Chief Compliance Officer and is responsible for administering the Fund’s compliance policies and procedures. Except for certain actions requiring the approval of the shareholders or the Board of Directors, the principal officers of the Fund have the power and authority to take all actions deemed necessary and appropriate to pursue the Fund’s objective.

Shareholders in the Fund will be unable to exercise any management functions. There will not be any shareholder vote unless required by the Investment Company Act of 1940.

FASB ASC Topic 740, Income Taxes (“Topic 740”), provides guidance for how uncertain tax positions should be recognized, measured, presented and disclosed in the financial statements. Topic 740 prescribes the minimum recognition threshold a tax position must meet in connection with accounting for uncertainties in income tax positions taken or expected to be taken by an entity before being measured and recognized in the financial statements. Topic 740 requires the evaluation of tax positions taken in the course of preparing the Fund’s tax returns to determine whether the tax positions are “more-likely-than-not” of being sustained by the applicable tax authority. Tax benefits of positions not deemed to meet the more-likely-than-not threshold would be recorded as a tax expense in the current year. The Fund has not taken any tax positions that do not meet the more-likely-than-not threshold. The tax years 2016 – 2019 remain subject to examination by the Internal Revenue Service.

It is the Fund’s policy to meet the requirements for qualification as a registered investment company as defined in Subchapter M of the Internal Revenue Code and to distribute substantially all of its taxable income and capital gains to the Fund’s shareholders. Therefore, no provision for federal income taxes has been made.

At December 31, 2019, the Fund had no undistributed ordinary income, undistributed short term capital gains or undistributed long term capital gains for federal income tax purposes.

At June 30, 2020, the cost and related gross unrealized appreciation and depreciation for federal income tax purposes are as follows:

| Cost of investments on Statement of Assets and Liabilities | | $ | 48,062,880 | |

| Amortization and accretion cost adjustments not included in tax cost basis | | | (823,788 | ) |

| | | | | |

| Cost of investments for tax purposes | | $ | 47,239,092 | |

| | | | | |

| Proceeds of securities sold short on Statement of Assets and Liabilities | | $ | 645,621 | |

| | | | | |

| Gross tax unrealized appreciation | | $ | 2,788,776 | |

| Gross tax unrealized depreciation | | | (7,212,148 | ) |

| | | | | |

| Net tax unrealized depreciation on investments | | $ | (4,423,372 | ) |

| 8. | INVESTMENT TRANSACTIONS |

For the six months ended June 30, 2020, the cost of purchases and proceeds from sales of investments were $62,461,391 and $64,894,572, respectively. There were no purchases or sales of long-term U.S. government securities.

| 9. | OFF-BALANCE-SHEET AND CONCENTRATION OF RISKS |

The Fund may engage in the short sale of securities. Securities sold short represent obligations of the Fund that result in off-balance-sheet risk as the ultimate obligation may exceed the amount shown in the accompanying financial statements due to increases in the market values of these securities. These short positions are generally hedged positions against portfolio holdings and, as a result, any increase in the Fund’s obligation related to these short positions will generally be offset by gains in the related long positions.

At June 30, 2020, the Fund’s investments by industry concentrations (as a percentage of net assets) were as follows:

| Pharmaceuticals | 10.0% |

| Banking | 9.7% |

| Software/Services | 8.6% |

| Support-Services | 6.8% |

| Media Content | 5.7% |

| Medical Products | 5.0% |

| Personal & Household Products | 4.6% |

| Aerospace/Defense | 4.6% |

| Electronics | 4.2% |

| Building & Construction | 3.6% |

| Recreation & Travel | 3.5% |

| Air Transportation | 3.4% |

| Diversified Capital Goods | 3.1% |

| Cable & Satellite TV | 2.9% |

| Health Services | 2.9% |

| Energy - Exploration & Production | 2.8% |

| Brokerage | 2.8% |

| Specialty Retail | 2.6% |

| Electric-Generation | 2.5% |

| Telecom - Wireline Integrated & Services | 1.8% |

| RealEstate Dev & Mgt | 1.7% |

| REITs | 1.7% |

| Oil Refining & Marketing | 1.7% |

| Trucking & Delivery | 1.6% |

| Cons/Comm/Lease Financing | 1.5% |

| Tech Hardware & Equipment | 1.4% |

| Metals/Mining Excluding Steel | 1.3% |

| Transport Infrastructure/Services | 1.3% |

| Telecom - Wireless | 1.2% |

| Gas Distribution | 1.2% |

| Machinery | 1.1% |

| Food - Wholesale | 1.0% |

| Oil Field Equipment & Services | 0.9% |

| Chemicals | 0.8% |

| Advertising | 0.8% |

| Investments & Misc Financial Services | 0.5% |

| Mutual Funds | 0.3% |

| Forestry/Paper | 0.0% |

| Media - Diversified | 0.0% |

At June 30, 2020, the Fund’s securities sold short by industry concentrations (as a percentage of net assets) were as follows:

| Recreation & Travel | -0.4% |

| Cons/Comm/Lease Financing | -0.3% |

| Chemicals | -0.2% |

| Metals/Mining Excluding Steel | -0.2% |

| Software/Services | -0.2% |

| Health Services | -0.1% |

| Building & Construction | 0.0% |

In accordance with FASB ASC Topic 855, Subsequent Events, management has evaluated the impact of all subsequent events on the Fund through the date the financial statements were issued.

Management has determined that there are no material events that would require disclosure in the Fund’s financial statements.

* * * * * *

ZAZOVE CONVERTIBLE SECURITIES FUND, INC.

FINANCIAL HIGHLIGHTS

FIVE-YEAR PERIOD ENDED JUNE 30, 2020 (UNAUDITED)

| | | Six Months

Ended

June 30, 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

| NET ASSET VALUE—Beginning of year | | $ | 19.14 | | | $ | 16.79 | | | $ | 18.76 | | | $ | 16.69 | | | $ | 14.93 | |

| | | | | | | | | | | | | | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) (a) | | | (0.19 | ) | | | (0.15 | ) | | | (0.13 | ) | | | (0.18 | ) | | | (0.03 | ) |

| Net realized and unrealized gains or losses on investments | | | (0.56 | ) | | | 3.88 | | | | (0.97 | ) | | | 2.30 | | | | 1.92 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total from investment operations | | | (0.75 | ) | | | 3.73 | | | | (1.10 | ) | | | 2.12 | | | | 1.89 | |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

| From net investment income and net capital gains | | | 0.00 | | | | (0.73 | ) | | | (0.85 | ) | | | (0.00 | )* | | | (0.13 | ) |

| Return of capital | | | 0.00 | | | | (0.65 | ) | | | (0.02 | ) | | | (0.05 | ) | | | 0.00 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total distributions to shareholders | | | 0.00 | | | | (1.38 | ) | | | (0.87 | ) | | | (0.05 | ) | | | (0.13 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| NET ASSET VALUE—End of period or year | | $ | 18.39 | | | $ | 19.14 | | | $ | 16.79 | | | $ | 18.76 | | | $ | 16.69 | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL RETURN (b) | | | (3.92 | )% | | | 22.39 | % | | | (6.13 | )% | | | 12.71 | % | | | 12.68 | % |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | |

| Net assets—end of period or year | | $ | 38,453,205 | | | $ | 40,806,346 | | | $ | 39,773,471 | | | $ | 54,342,928 | | | $ | 53,825,244 | |

| Ratio of expenses to average net assets (c) | | | 1.11 | % | | | 2.36 | % | | | 2.47 | % | | | 2.42 | % | | | 2.18 | % |

| Ratio of net investment income (loss) to average net assets | | | (1.03 | )% | | | (0.81 | )% | | | (0.68 | )% | | | (1.04 | )% | | | (0.21 | )% |

| Portfolio turnover rate | | | 154 | % | | | 127 | % | | | 182 | % | | | 132 | % | | | 126 | % |

| (a) | Net investment income (loss) allocated based on average shares method. |

| (b) | Total return assumes reinvestment of all dividends and distributions. |

| (c) | Ratio of expenses to average net assets is determined including margin interest. The ratio excluding margin interest, which is a cost of capital, was 1.03% for the six months ended June 30, 2020 and 1.15%, 2.26%, 2.22% and 2.09% for the years ended December 31, 2019, 2018, 2017 and 2016, respectively. |

| (*) | Distribution is less than $0.005 per share. |

See notes to financial statements.

ZAZOVE CONVERTIBLE SECURITIES FUND, INC.

PROXY VOTING POLICIES (UNAUDITED)

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available (i) without charge, upon request, by calling 847.239.7100 and (ii) on the Commission's website at http://www.sec.gov.

DIVIDEND REINVESTMENT PLAN (UNAUDITED)

Distributions from the Fund are recorded on the ex-distribution date. Pursuant to the Fund's Dividend Reinvestment Plan ("DRIP"), all ordinary and capital gain distributions are reinvested in Shares at the then prevailing net asset value. Each Shareholder is automatically included in the DRIP unless the Fund receives a written request from the Shareholder to receive such distributions in cash, or cash and stock. In order to determine the number of shares to be received by each Shareholder that participates in the DRIP, the aggregate ordinary and capital gain distribution allocated to the Shareholder that is to be reinvested is divided by the Fund's Net Asset Value per share immediately after giving effect to the aggregate amount of the dividend distribution declared by the Fund. For federal income tax purposes, dividends paid by the Fund are taxable whether received in cash or reinvested in additional Shares pursuant to the DRIP. There are no fees, commissions or expenses associated with participation in the DRIP and Shareholders may elect to terminate their participation in the DRIP by written request to the Fund. Additional information regarding the Dividend Reinvestment Plan may be obtained by contacting the Investment Advisor at 847.239.7100.

ZAZOVE CONVERTIBLE SECURITIES FUND, INC.

| DIRECTORS | Andrew J. Goodwin, III Jack L. Hansen Peter A. Lechman Gene T. Pretti |

| | |

| OFFICERS | Gene T. Pretti Steven M. Kleiman |

| | |

| INVESTMENT ADVISOR | Zazove Associates, LLC 1001 Tahoe Blvd. Incline Village, NV 89451 |

| | |

| CUSTODIAN | UMB Bank N.A. 928 Grand Avenue Kansas City, MO 64106 |

| | |

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | Deloitte & Touche LLP 111 S. Wacker Drive Chicago, IL 60606 |

| | |

DIVIDEND-DISBURSING AND TRANSFER AGENT | UMB Fund Services, Inc. 235 W. Galena Street Milwaukee, WI 53212 |