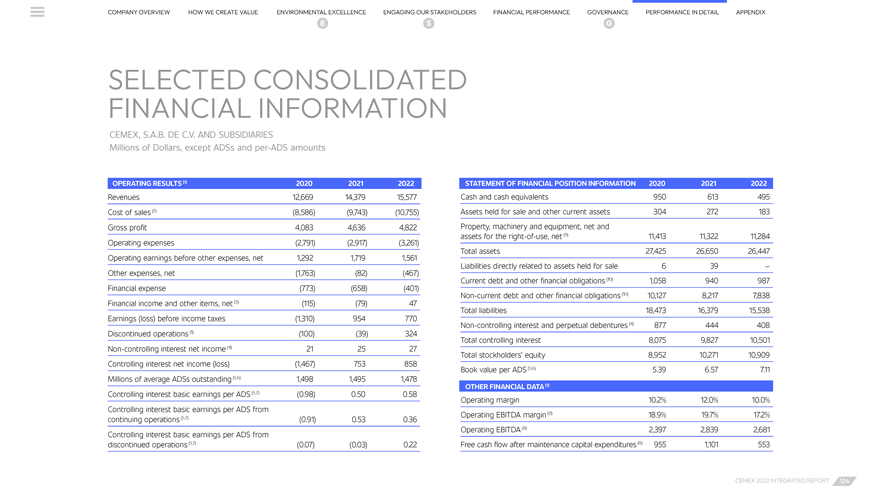

COMPANY OVERVIEWHOW WE CREATE VALUEENVIRONMENTAL EXCELLENCEENGAGING OUR STAKEHOLDERSFINANCIAL PERFORMANCEGOVERNANCEPERFORMANCE IN DETAILAPPENDIX E S G CAUTIONARY STATEMENT Regarding Forward-Looking Statements This report contains forward-looking statements within • availability of raw materials and related fluctuating • the availability of short-term credit lines or working • terrorist and organized criminal activities as well as the meaning of the U.S. federal securities laws. We prices of raw materials, as well as of goods and capital facilities, which can assist us in connection geopolitical events, such as war and armed conflicts, intend these forward-looking statements to be covered services in general, in particular increases in prices with market cycles; including the current war between Russia and by the safe harbor provisions for forward-looking state- as a result of inflation; • the impact of our below investment grade debt Ukraine; ments within the meaning of the U.S. federal securities • volatility in pension plan asset values and liabilities, rating on our cost of capital and on the cost of the • declarations of insolvency or bankruptcy, or becom-laws. In some cases, these statements can be identified which may require cash contributions to the pension products and services we purchase; ing subject to similar proceedings; and natural disas-by the use of forward-looking words such as “may,” plans; • loss of reputation of our brands; ters and other unforeseen events (including global “assume,” “might,” “should,” “could,” “continue,” “would,”• the impact of environmental cleanup costs and • our ability to consummate asset sales, fully inte- health hazards such as COVID-19). “can,” “consider,” “anticipate,” “estimate,” “expect,” “envi- other remedial actions, and other liabilities relating grate newly acquired businesses, achieve cost-sav-sion,” “plan,” “believe,” “foresee,” “predict,” “potential,” to existing and/or divested businesses; ings from our cost-reduction initiatives, implement Readers are urged to read this report and carefully “target,” “strategy,” “intend,” “aimed” or other similar • our ability to secure and permit aggregates reserves our pricing initiatives for our products, and generally consider the risks, uncertainties, and other factors that words. These forward-looking statements reflect, as of in strategically located areas; meet our business strategy’s goals; affect Cemex’s business and operations. The information the date such forward-looking statements are made, or • the timing and amount of federal, state and local • the increasing reliance on information technology contained in this report is subject to change without unless otherwise indicated, Cemex’s current expecta- funding for infrastructure; infrastructure for our sales, invoicing, procurement, notice, and we are not obligated to publicly update tions and projections about future events based on • changes in the level of spending for private residen- financial statements, and other processes that or revise forward-looking statements after the date Cemex’s knowledge of present facts and circumstances, tial and private can adversely affect our sales and operations in hereof or to reflect the occurrence of anticipated or and assumptions about future events. These statements • nonresidential construction; the event that the infrastructure does not work unanticipated events or circumstances. Readers should necessarily involve risks and uncertainties that could • changes in our effective tax rate; as intended, experiences technical difficulties, or is review future reports filed by us with the U.S. Securities cause actual results to differ materially from Cemex’s • competition in the markets in which we offer our subjected to cyber-attacks; and Exchange Commission and the Mexican Stock expectations. Some of the risks, uncertainties, and other products and services; • changes in the economy that affect demand for Exchange (Bolsa Mexicana de Valores). This report also important factors that could cause results to differ, or • general political, social, health, economic, and busi- consumer goods, consequently affecting demand includes statistical data, but not limited to, regarding the that otherwise could have an impact on us or our con- ness conditions in the markets in which we operate for our products and services; production, distribution, marketing, and sale of cement, solidated entities include, but are not limited to: that affect our operations and any significant • climate change, in particular reflected in weather ready-mix concrete, clinker, aggregates, and urbaniza-economic, health, political, or social developments conditions, including but not limited to excessive rain tion solutions. Unless the context indicates otherwise, • the impact of pandemics, epidemics, or outbreaks in those markets, as well as any inherent risks to and snow, and disasters such as earthquakes and all references to pricing initiatives, price increases or of infectious diseases and the response of govern- international operations; floods, that could affect our facilities or the markets decreases refer to Cemex’s prices for Cemex’s products. ments and other third parties, which could adversely • the regulatory environment, including environmental, in which we offer our products and services or from We generated some of this data internally, and some affect, among other matters, the ability of our energy, tax, antitrust, and acquisition-related rules where we source our raw materials; were obtained from independent industry publications operating facilities to operate at full or any capacity, and regulations; • trade barriers, including tariffs or import taxes and and reports that we believe to be reliable sources that supply chains, international operations, availability of • our ability to satisfy our obligations under our mate- changes in existing trade policies or changes to, or were available as of the date of this report. We have not liquidity, investor con?dence and consumer spend- rial debt agreements, the indentures that govern our withdrawals from, free trade agreements, including independently veri?ed this data nor sought the consent ing, as well as the availability of, and demand for, our outstanding notes, and our other debt instruments the United States-Mexico-Canada Agreement; of any organizations to refer to their reports in this products and services; and financial obligations, including our subordinated • availability and cost of trucks, railcars, barges and report. • the cyclical activity of the construction sector; notes with no fixed maturity and other financial ships, as well as their licensed operators and drivers, • our exposure to other sectors that impact our and obligations; for transport of our materials; our clients’ businesses, such as, but not limited to, • labor shortages and constraints; the energy sector; CEMEX 2022 INTEGRATED REPORT 267