SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 |

SEQUENOM, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box)

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | 1. | Title of each class of securities to which transaction applies: |

| | 2. | Aggregate number of securities to which transaction applies: |

| | 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4. | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1. | Amount Previously Paid: |

| | 2. | Form, Schedule or Registration Statement No.: |

SEQUENOM, INC.

3595 John Hopkins Court

San Diego, California 92121

(858) 202-9000

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 15, 2007

To the Stockholders of Sequenom, Inc.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Sequenom, Inc., a Delaware corporation (the “Company”), will be held on Friday, June 15, 2007 at 9:00 a.m. local time at the corporate headquarters of the Company located at 3595 John Hopkins Court, San Diego, California 92121 for the following purposes:

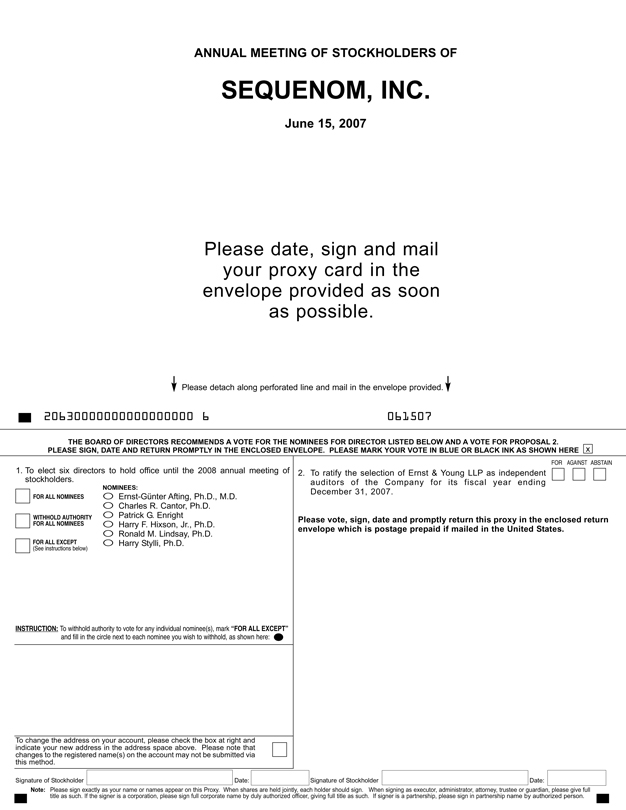

| | 1. | to elect six directors to hold office until the annual meeting of stockholders in 2008; |

| | 2. | to ratify our Audit Committee’s selection of Ernst & Young LLP to be our independent registered public accounting firm for 2007; and |

| | 3. | to conduct any other business properly brought before the meeting or any adjournment or postponement thereof. |

These items of business are more fully described in the Proxy Statement accompanying this Notice of Annual Meeting.

The record date for the Annual Meeting is April 27, 2007. Only stockholders of record at the close of business on that date may vote at the meeting or any adjournment thereof.

BY ORDER OF THE BOARD OF DIRECTORS

Harry Stylli

President and Chief Executive Officer

San Diego, California

May 17, 2007

ALL STOCKHOLDERS ARE CORDIALLY INVITED TO ATTEND THE MEETING IN PERSON. WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY AS PROMPTLY AS POSSIBLE IN ORDER TO ENSURE YOUR REPRESENTATION AT THE MEETING. A RETURN ENVELOPE (WHICH IS POSTAGE PREPAID IF MAILED IN THE UNITED STATES) IS ENCLOSED FOR THAT PURPOSE. EVEN IF YOU HAVE GIVEN YOUR PROXY, YOU MAY STILL VOTE IN PERSON IF YOU ATTEND THE MEETING. PLEASE NOTE, HOWEVER, THAT IF YOUR SHARES ARE HELD OF RECORD BY A BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO VOTE AT THE MEETING, YOU MUST OBTAIN FROM THE RECORD HOLDER A PROXY ISSUED IN YOUR NAME.

Table Of Contents

SEQUENOM, INC.

3595 John Hopkins Court

San Diego, California 92121

(858) 202-9000

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

June 15, 2007

QUESTIONS AND ANSWERS ABOUT THIS PROXY MATERIAL AND VOTING

Why am I receiving these materials?

We sent you this proxy statement and the enclosed proxy card because the Board of Directors of Sequenom, Inc. (sometimes referred to as the “Company” or “Sequenom”) is soliciting your proxy to vote at our 2007 Annual Meeting of Stockholders. You are invited to attend the annual meeting to vote on the proposals described in this proxy statement. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card.

We intend to mail this proxy statement and accompanying proxy card on or about May 17, 2007 to all stockholders of record entitled to vote at the annual meeting.

What am I voting on?

There are two matters scheduled for a vote at the annual meeting:

| | • | | Election of six directors; and |

| | • | | Ratification of the selection by the Audit Committee of our Board of Directors of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2007. |

If any other matter is properly presented at the meeting or any adjournment or postponement thereof, your proxy (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

Who can vote at the annual meeting?

Only stockholders of record at the close of business on April 27, 2007 will be entitled to vote at the annual meeting. At the close of business on this record date, there were 38,134,321 shares of common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If at the close of business on April 27, 2007 your shares were registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, then you are a stockholder of record. As a stockholder of record, you may vote in person at the meeting or vote by proxy. Whether or not you plan to attend the meeting, we urge you to complete and return the enclosed proxy card to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If at the close of business on April 27, 2007 your shares were held in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in street name, and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited

1

to attend the annual meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the meeting unless you request and obtain a valid proxy from your broker or other agent.

How do I vote?

You may either vote “For” all the nominees to the Board of Directors or you may abstain from voting for any nominee you specify. You cannot vote for a greater number of persons than the number of nominees to the Board of Directors named. For each of the other matters to be voted on, you may vote “For” or “Against” or abstain from voting. The procedures for voting are fairly simple:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the annual meeting or vote by proxy using the enclosed proxy card. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting and vote in person if you have already voted by proxy.

| | • | | To vote using the proxy card, simply complete, sign and date the enclosed proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the annual meeting, we will vote your shares as you direct. |

| | • | | To vote in person, come to the annual meeting, and we will give you a ballot when you arrive. |

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received a proxy card and voting instructions with these proxy materials from that organization rather than from us. Simply complete and mail the proxy card to ensure that your vote is counted.

To vote in person at the annual meeting, you must obtain a valid proxy from your broker, bank or other agent. Follow the instructions from your broker or bank included with these proxy materials or contact your broker or bank to request a proxy form.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of the close of business on April 27, 2007.

What if I return a proxy card but do not make specific choices?

If you return a signed and dated proxy card without marking any voting selections, your shares will be voted “For” the election of all nominees for director and “For” all other matters described in this proxy statement. If any other matter is properly presented at the meeting, your proxy will vote your shares using his or her best judgment.

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, your shares are registered in more than one name or are registered in different accounts. Please complete, sign and return each proxy card to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the meeting. You may revoke your proxy in any one of three ways:

| | • | | You may submit another properly completed proxy card with a later date. |

2

| | • | | You may send a written notice that you are revoking your proxy to Sequenom’s Secretary at 3595 John Hopkins Court, San Diego, California 92121. |

| | • | | You may attend the annual meeting and vote in person. Simply attending the meeting will not, by itself, revoke your proxy. |

How are votes counted?

Votes will be counted by the inspector of election appointed for the meeting, who will separately count “For” and, with respect to proposals other than the election of directors, “Against” votes, abstentions and broker non-votes. Abstentions will be counted towards the vote total for each proposal (other than the election of directors) and will have the same effect as “Against” votes. Broker non-votes are counted towards a quorum and depending on the proposal will have the same effect as an “Against” vote on the proposal or have no effect. Please see the more detailed description of the effect of broker non-votes on specific proposals in the answer to “How many votes are needed to approve each proposal?” below.

If your shares are held by your broker as your nominee (that is, in street name), you will need to obtain a proxy card from the institution that holds your shares and follow the instructions included on that proxy card regarding how to instruct your broker to vote your shares. If you do not give instructions to your broker, your broker can vote your shares with respect to “discretionary” items but not with respect to “non-discretionary” items. Discretionary items are proposals considered routine under the rules of the New York Stock Exchange on which your broker may vote shares held in street name in the absence of your voting instructions. On non-discretionary items for which you do not give your broker instructions, the shares will be treated as broker non-votes.

How many votes are needed to approve each proposal?

| | • | | For the election of directors, the six nominees receiving the most “For” votes from the shares present and entitled to vote at the annual meeting, either in person or by proxy, will be elected. Broker non-votes will have no effect. |

| | • | | To be approved, Proposal 2 must receive “For” votes from a majority of the shares present and entitled to vote at the annual meeting, either in person or by proxy. If you select “Abstain” on your proxy card or you attend the meeting and abstain from voting, it will have the same effect as an “Against” vote. Broker non-votes will have no effect. |

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if at least a majority of the outstanding shares are represented by stockholders present at the meeting or by proxy. On April 27, 2007, the record date, there were 38,134,321 shares outstanding and entitled to vote. As a result 19,067,161 of these shares must be represented by stockholders present at the meeting or by proxy to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy vote or vote at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, a majority of the votes present at the meeting may adjourn the meeting to another date.

How can I find out the results of the voting at the annual meeting?

Preliminary voting results will be announced at the annual meeting. Final voting results will be published in our quarterly report on Form 10-Q for the second quarter of 2007.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these mailed proxy materials, our directors, officers and other employees may also solicit proxies in person, by telephone or by other means of

3

communication. Directors, officers and other employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

When are stockholder proposals due for next year’s annual meeting?

The deadline for submitting a stockholder proposal for inclusion in our proxy statement and form of proxy for the 2008 annual meeting of stockholders is January 18, 2008. Stockholders wishing to submit proposals or director nominations that are not to be included in such proxy statement and proxy must also do so by January 18, 2008. Stockholders are advised to review our Bylaws, which contain additional requirements with respect to advance notice of stockholder proposals and director nominations. Our current Bylaws are available at the SEC’s website,www.sec.gov, or upon written request to Secretary, Sequenom, Inc., 3595 John Hopkins Court, San Diego, California 92121.

4

PROPOSAL 1

ELECTION OF DIRECTORS

Our Board of Directors is currently comprised of seven members and is nonclassified. Each director serves for a one-year term. At the annual meeting, the term of office of all seven directors will expire.

The Nominating and Corporate Governance Committee of the Board of Directors has nominated Ernst-Gunter Afting, Ph.D., M.D., Charles R. Cantor, Ph.D., Patrick G. Enright, Harry F. Hixson, Jr., Ph.D., Ronald M. Lindsay, Ph.D., and Harry Stylli, Ph.D. for re-election to the Board of Directors. There will be one vacancy on the Board of Directors following the decision on May 9, 2007 of Larry E. Lenig, Jr. not to stand for re-election. If re-elected at the annual meeting, each nominee would serve until the 2008 annual meeting and his successor is elected and qualified.

Directors are elected by a plurality of the votes present in person or represented by proxy and entitled to vote at the annual meeting. Stockholders may not vote for a greater number of nominees than six. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of Dr. Afting, Dr. Cantor, Mr. Enright, Dr. Hixson, Dr. Lindsay and Dr. Stylli. In the event that any nominee should be unavailable for election as a result of an unexpected occurrence, such shares will be voted for the election of such substitute nominee as the Nominating and Corporate Governance Committee may propose. Each of the nominees has agreed to serve if elected, and we have no reason to believe that any nominee will be unable to serve.

Set forth below is biographical information for each person nominated.

Ernst-Günter Afting, Ph.D., M.D.

Dr. Afting,64, has served as a director since 1996. From 1995 until his retirement in 2006, Dr. Afting served as President and Chief Executive Officer of the National Research Center for Environment and Health, GSF-Forschungszentrom für Umwelt und Gesundheit GmbH, in Munich, one of the biggest governmental research centers in Germany. From 1993 to 1995, he served as President and Chief Executive Officer of Roussel UCLAF, Paris. He was also a member of the board of the Pharmaceutical Division of Hoechst Group from 1984 to 1993 and was Chairman and Chief Executive Officer of the Divisional Pharmaceutical Board of Hoechst from 1992-1993. Dr. Afting was a member of the advisory committee on Science and Technology to German Chancellor Helmut Kohl from 1996 to 1997 and from 1996 to 2005 has been a member of the German National Advisory Committee on Health Research to the State Secretaries of Science, Technology and Health. Dr. Afting has been a member of the medical faculty at the University of Goettingen since 1985. Dr. Afting currently serves on the boards of Intercell AG, Vienna, Enanta Pharmaceuticals, Inc., and Olympus Europa GmbH, Hamburg. He received his Ph.D. in Chemistry and M.D. from the University of Freiburg/Breisgau, Germany.

Charles R. Cantor, Ph.D.

Dr. Cantor, 64, joined us as Chief Scientific Officer and Chairman of the Scientific Advisory Board in August 1998. Since 1992 Dr. Cantor has served as a professor in the Department of Biomedical Engineering and Co-Director of the Center for Advanced Biotechnology at Boston University. Prior to that time, Dr. Cantor held positions at Columbia University and the University of California, Berkeley. He was also Director of the Human Genome Center of the Department of Energy at Lawrence Berkeley Laboratory. Dr. Cantor published the first textbook on genomics,The Science and Technology of the Human Genome Project, and remains active in the Human Genome Project through his membership in a number of the project’s advisory committees and review boards. Dr. Cantor is a member of the National Academy of Sciences. He is also a scientific advisor to 12 biotech and life science companies and one venture capital firm. Dr. Cantor currently serves as a director of ExSAR, Inc., Human BioMolecular Research Institute, and Retrotrope, Inc. Dr. Cantor received his Ph.D. in Chemistry from the University of California, Berkeley.

5

Patrick G. Enright

Mr. Enright, 45, has served as a director since June 2006. Mr. Enright is a founder and Managing Director of Longitude Capital, a life sciences venture capital firm specializing in medical devices and biotechnology. From 2002 through 2006, Mr. Enright was a Managing Director of Pequot Ventures, the direct venture investment arm of Pequot Capital Management, Inc., and has been a member of various general partnerships of Pequot’s venture capital and private equity funds since June 2002. Mr. Enright is currently a consultant for Pequot Capital Management, Inc. From 1998 to 2001, Mr. Enright was a Managing Member of Diaz & Atschul Group, LLC, a principal investment group. From 1995 to 1998, he served in various executive positions at Valentis, Inc., a biotechnology company engaged in the development of products for peripheral arterial disease, including as Senior Vice President, Corporate Development, and Chief Financial Officer. From 1993 to 1994, he was Senior Vice President of Finance and Business Development for Boehringer Mannheim Therapeutics, a pharmaceutical company and a subsidiary of Corange Ltd. From 1989 to 1993, Mr. Enright was employed at PaineWebber Incorporated, an investment banking firm, where he became a Vice President in 1992. Mr. Enright currently serves on the boards of Threshold Pharmaceuticals, Inc., DiObex, Codexis, Horizon Therapeutics, MAP Pharmaceuticals, Prestwick Pharmaceuticals, Raven biotechnologies and InfaCare Pharmaceuticals. Mr. Enright earned a B.S. in Biological Sciences from Stanford University and a M.B.A. from the Wharton School of Business at the University of Pennsylvania.

Harry F. Hixson, Jr., Ph.D.

Dr. Hixson, 68, has served as Chairman of our Board of Directors since January 2003. Dr. Hixson has also served as a director of Arena Pharmaceuticals, Inc. since 2004, and currently serves as the Chairman of the Board of BrainCells, Inc., a privately held biopharmaceutical company focused on central nervous system drug development. He has served as Chairman of BrainCells since December 2003. Dr. Hixson serves as a member of the Board of Directors of Infinity Pharmaceuticals, Inc., a cancer drug discovery and development company. Dr. Hixson previously served as chairman of the Board of Directors of Discovery Partners International, Inc. prior to its merger with Infinity Pharmaceuticals. Dr. Hixson served as Chief Executive Officer of BrainCells from July 2004 until September 2005. Dr. Hixson served as Chief Executive Officer of Elitra Pharmaceuticals, Inc., a privately held biopharmaceutical company focused on anti-infective drug development, from February 1998 until May 2003. He served as Amgen’s President and Chief Operating Officer and as a member of its Board of Directors from 1988 to 1991. Prior to Amgen, Dr. Hixson held various management positions with Abbott Laboratories, including Vice President, Diagnostic Products Business Group, and Vice President, Research and Development, in the Diagnostics Division. He has been involved with the start-up of several biopharmaceutical companies, including Neurocrine Biosciences and Signal Pharmaceuticals, now part of Celgene. Dr. Hixson received his Ph.D. in Physical Biochemistry from Purdue University and an M.B.A. from the University of Chicago. He also received an Honorary Doctor of Science degree from Purdue University.

Ronald M. Lindsay, Ph.D.

Dr. Lindsay, 59, has been a director since May 2003. He currently operates Milestone Consulting, a biopharmaceutical consulting enterprise. He served as Vice President, Research and Development, and Chief Science Officer of diaDexus Inc., a privately held biotechnology company, from 2000 to January 2004. From 1997 through 2000, Dr. Lindsay served in various roles with Millennium Pharmaceuticals, Inc., a publicly traded biopharmaceutical company, including Senior Vice President, Biotherapeutics and Vice President, Preclinical Research and Development, of its subsidiary Millennium Biotherapeutics Inc. From 1989 to 1997, Dr. Lindsay served in various roles with Regeneron Pharmaceuticals Inc., of which he was a founding scientist, holding the position of Vice President, Neurobiology. He is a director of Arqule Inc., HistoRx Inc., and Neuro3D, a member of the scientific advisory board of Serono S.A. and a Senior Advisor to TVM Capital, Munich. Dr. Lindsay is the author of more than 150 scientific publications and holder of multiple patents. Dr. Lindsay received his Ph.D. in Biochemistry from the University of Calgary.

6

Harry Stylli, Ph.D.

Dr. Stylli, 45, joined us in June 2005 as President and Chief Executive Officer and a director. From November 2004 to February 2005, Dr. Stylli served as President and Chief Executive Officer of Xencor, Inc., a privately held, next-generation antibody platform company. From May 2002 to July 2003, Dr. Stylli served as President and Chief Executive Officer for CovX Pharmaceuticals, a biopharmaceutical company of which Dr. Stylli was a co-founder. From 1995 to 2001, Dr. Stylli served in various capacities, including Senior Vice President of Screening Technology and New Ventures, Senior Vice President of Commercial Development and most recently President, for Aurora Biosciences Corporation, a drug discovery systems company of which Dr. Stylli was a co-founder. Dr. Stylli currently serves as a director of Molecular Insight Pharmaceuticals, Inc., a publicly held biotechnology company, and is an advisor to Nanosyn, a privately held medicinal chemistry company. Dr. Stylli received his Ph.D. from London University’s Faculty of Medicine and an M.B.A. from the United Kingdom’s Open University.

THE BOARD OF DIRECTORS RECOMMENDS A

VOTE IN FAVOR OF EACH NAMED NOMINEE.

Director Whose Term Expires at the Annual Meeting

Larry E. Lenig, Jr.

Mr. Lenig, 58, has served as a director since June 2006. Mr. Lenig currently serves as Senior Partner of ComVest Investment Partners, a private equity capital fund group, and as the portfolio manager of ComVest Capital LLC, an affiliated fund initiated by ComVest Investment Partners in 2006. Mr. Lenig joined ComVest Investment Partners in August 2004. From 1994 to 2004, Mr. Lenig acted as a consultant and advisor to a number of public and private businesses in a diverse range of industries, including oil and gas, software and related services, metal products manufacturers and restaurant chains. During that period, Mr. Lenig also served as Chief Executive Officer and directed turnarounds at two public companies, Grant Geophysical, Inc., an international geophysical services provider, and Seitel, Inc., which owns and offers for license one of the world’s largest U.S. and Canadian focused 3D and 2D seismic data libraries, and consulted to other private companies during reorganizations and restructuring of those enterprises. Prior to entering private consulting, Mr. Lenig spent 19 years with and served as Chief Operating Officer, President and a director of Digicon Inc. (now called Veritas DGC, Inc., a New York Stock Exchange-listed integrated oil service company specializing in onshore and offshore geophysical data acquisition, advanced data processing and the ownership of data libraries), following an initial career as a commercial lender for a Houston banking institution. Mr. Lenig served as a director of Fischer Imaging Corporation, a public company engaged in mammography, radiology and associated healthcare device manufacturing prior to the sale of its principal intellectual property positions in late 2005. Mr. Lenig currently serves as a director and chairman of the audit committee of Deep Marine Technology, Inc., a privately held oil and gas services company. Mr. Lenig received a B.B.A. in Accounting from the University of Houston and is currently a member of the University’s Advisory Counsel to the Dean of the College of Natural Sciences and Mathematics.

Vacancies on the Board of Directors

Currently, vacancies on the Board of Directors may be filled only by at least a two-thirds majority of the directors then in office. A director elected by the Board of Directors to fill a vacancy, including a vacancy created by an increase in the number of directors, shall serve until the next annual meeting of stockholders and the director’s successor is elected and qualified.

Independence of the Board of Directors

As required under applicable Nasdaq Marketplace Rules, a majority of the members of a listed company’s board of directors must qualify as “independent,” as affirmatively determined by the board of directors. Our

7

Board of Directors consults with our counsel to ensure that the Board of Directors’ determinations are consistent with all relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in pertinent Nasdaq Marketplace Rules, as in effect time to time.

Consistent with these considerations, after review of all relevant transactions and relationships between each director or any of his family members, and our senior management, our independent registered public accounting firm and us, the Board of Directors affirmatively has determined that all of the directors are independent directors within the meaning of the applicable Nasdaq Marketplace Rules, except for Dr. Stylli, our Chief Executive Officer, and Dr. Cantor, our Chief Scientific Officer.

As required under applicable Nasdaq Marketplace Rules, in 2006 our independent directors met in regularly scheduled executive sessions at which only independent directors were present.

Meetings of the Board of Directors

The Board of Directors met thirteen times during 2006. Each director attended 75% or more of the aggregate of the meetings of the Board of Directors and of the committees on which he served, held during the period for which he was a director or committee member.

Attendance at Annual Meetings

We have adopted a policy encouraging our directors and nominees for directors to attend our annual meetings of stockholders. The following directors attended our annual meeting in 2006: Dr. Afting, Dr. Cantor, Dr. Hixson, Dr. Lindsay, John E. Lucas, and Dr. Stylli.

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics that applies to all of our officers, directors and employees. The Code of Business Conduct and Ethics is available in the Corporate Governance section under “Investors” on our website at www.sequenom.com. If we make any substantive amendments to the Code of Business Conduct and Ethics or grant any waiver from a provision of the Code to the principal executive, financial or accounting officers, we will promptly disclose the nature of the amendment or waiver on our website.

Communication with the Board of Directors

Persons interested in communicating with our Board of Directors regarding their concerns or issues may send written correspondence to the Board of Directors in care of the Secretary at Sequenom, Inc., 3595 John Hopkins Court, San Diego, California 92121 or by email at “board@sequenom.com”. The Secretary will screen communications for spam, junk mail, mass mailings, product complaints, product inquiries, new product suggestions, resumes, job inquiries, surveys, business solicitations and advertisements, as well as unduly hostile, threatening, illegal, unsuitable, frivolous, patently offensive or otherwise inappropriate material before forwarding to the Board of Directors. The process regarding security holder communications with the Board of Directors may be found under the Investors section on our website atwww.sequenom.com.

8

Board Committees

The Board of Directors has three standing committees: an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. The following table provides current and former membership and meeting information for 2006 for each of the committees:

| | | | | | | | | |

Name | | Audit | | | Compensation | | | Nominating

and

Corporate

Governance | |

Ernst-Gunter Afting | | X | | | | | | X | * |

Charles R. Cantor | | | | | | | | | |

Patrick G. Enright(1) | | | | | X | | | | |

Paul Hawran(2) | | X | | | | | | | |

Harry F. Hixson, Jr. | | X | * | | X | | | X | |

Larry E. Lenig(3) | | | | | | | | X | |

Ronald M. Lindsay | | X | | | X | * | | | |

John E. Lucas(4) | | X | | | X | | | X | |

Lawrence R. Moreau(5) | | X | | | | | | | |

Harry Stylli | | | | | | | | | |

| | | |

Total meetings in 2006 | | 8 | | | 7 | | | 3 | |

| (1) | Mr. Enright was elected to the Board of Directors and appointed to the Compensation Committee in June 2006. |

| (2) | Mr. Hawran was elected to the Board of Directors and appointed chairman of the Audit Committee in August 2006. Mr. Hawran resigned from the Board of Directors in February 2007. |

| (3) | Mr. Lenig was elected to the Board of Directors and appointed to the Nominating and Corporate Governance Committee in June 2006. He is not standing for re-election in 2007, and his term will expire at the annual meeting. |

| (4) | Mr. Lucas resigned from the Board of Directors in June 2006. |

| (5) | Mr. Moreau did not stand for re-election in 2006. His term expired on May 31, 2006. |

Below is a description of each committee of the Board of Directors. Each of the committees has authority to engage legal counsel or other experts or consultants, as it deems appropriate to carry out its responsibilities. The Board of Directors has determined that each current member of each committee meets the applicable rules and regulations regarding independence and that each member is free of any relationship that would interfere with his individual exercise of independent judgment.

Nominating and Corporate Governance Committee

Three directors comprise the Nominating and Corporate Governance Committee: Dr. Afting (chair), Dr. Hixson and Mr. Lenig. The Nominating and Corporate Governance Committee is responsible for identifying, reviewing and evaluating candidates to serve as directors consistent with criteria approved by the Board of Directors, reviewing and evaluating incumbent directors; selecting candidates for election to the board of directors; making recommendations to the Board of Directors regarding the membership of the committees of the Board of Directors; assessing the performance of management and the Board of Directors, and overseeing corporate governance matters. Our Nominating and Corporate Governance Committee charter may be found in the Corporate Governance section under “Investors” on our website atwww.sequenom.com. All members of the Nominating and Corporate Governance Committee are independent (as currently defined in Nasdaq Marketplace Rule 4200(a)(15)).

The Nominating and Corporate Governance Committee believes that candidates for director should have certain minimum qualifications, including being able to read and understand basic financial statements, being over 21 years of age and having the highest personal integrity and ethics. The Committee also considers such

9

factors as possessing relevant expertise upon which to be able to offer advice and guidance to management, having sufficient time to devote to our affairs, demonstrated excellence in his or her field, having the ability to exercise sound business judgment and having the commitment to rigorously represent the long-term interests of our stockholders. The Committee retains the right to modify these qualifications from time to time. Candidates for director nominees are reviewed in the context of the current composition of the Board of Directors, our operating requirements and the long-term interests of stockholders. In conducting this assessment, the Committee considers diversity, age, skills, and such other factors as it deems appropriate given the current needs of the Board of Directors to maintain a balance of knowledge, experience and capability. In the case of incumbent directors, the Nominating and Corporate Governance Committee reviews such directors’ overall service during their term, including the number of meetings attended, level of participation, quality of performance, and any other relationships and transactions that might impair such directors’ independence. In the case of new director candidates, the Committee also determines whether the nominee must be independent under applicable Nasdaq and SEC rules. The Committee uses its network of contacts to compile a list of potential candidates, but may also engage, if it deems appropriate, a professional search firm. The Committee conducts any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of the Board of Directors. The Committee meets to discuss and consider such candidates’ qualifications and then selects a nominee by majority vote. During 2006, the Nominating and Corporate Governance Committee did not pay a fee to any third party to assist in the process of identifying or evaluating director candidates. The Committee may engage a third party to assist in this process in 2007. To date, the Nominating and Corporate Governance Committee has not received any director nominee from a stockholder or stockholders other than the individuals designated by ComVest and Pequot in connection with the closing of our private placement of common stock in June 2006. Pursuant to the purchase agreement for our 2006 private placement, each purchaser that holds at least 10% of outstanding shares of common stock has the right to nominate one individual for election to the Board of Directors provided such nominee has been approved by the Nominating and Corporate Governance Committee and complies with any relevant Nasdaq rule.

The Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders. The Committee does not intend to alter the manner in which it evaluates candidates, including the minimum criteria set forth above, based on whether the candidate was recommended by a stockholder. Stockholders who wish to recommend individuals for consideration by the Nominating and Corporate Governance Committee to become nominees for election to the Board of Directors may do so by delivering a written recommendation to the Nominating and Corporate Governance Committee at the following address: Sequenom, Inc., 3595 John Hopkins Court, San Diego, California 92121. Such recommendations must be received by the Nominating and Corporate Governance Committee at least 120 days prior to the anniversary date of the mailing of our proxy statement for the last annual meeting of stockholders. Submissions must include the full name of the proposed nominee, a description of the proposed nominee’s business experience for at least the previous five years, complete biographical information, a description of the proposed nominee’s qualifications as a director and a representation that the nominating stockholder is a beneficial or record owner of our stock. Any such submission must be accompanied by the written consent of the proposed nominee to be named as a nominee and to serve as a director if elected.

Audit Committee

Three directors comprise the Audit Committee: Dr. Hixson (chair), Dr. Afting and Dr. Lindsay. The Audit Committee oversees our corporate accounting and financial reporting process. The Audit Committee evaluates the performance and assesses the qualifications of the independent registered public accounting firm that audits our financial statements; determines and approves the engagement of the independent registered public accounting firm; determines whether to retain or terminate the existing independent registered public accounting firm or to appoint and engage a new independent registered public accounting firm; reviews and approves the retention of the independent registered public accounting firm to perform any proposed permissible non-audit services; monitors the rotation of partners of the independent registered public accounting firm on our audit engagement team as required by law; confers with management and the independent registered public accounting

10

firm regarding the effectiveness of internal controls over financial reporting; establishes procedures, as required under applicable law, for the receipt, retention and treatment of complaints regarding accounting, internal accounting controls or auditing matters and the confidential and anonymous submission by employees of concerns regarding questionable accounting or auditing matters; reviews and approves or rejects related-person transactions; reviews the financial statements to be included in our Annual Report on Form 10-K; and discusses with management and the independent registered public accounting firm the results of the annual audit and our quarterly financial statements. The Audit Committee has adopted a written charter that may be found in the Corporate Governance section under “Investors” on our website atwww.sequenom.com.

All communications directed to the Audit Committee in accordance with the Open Door Policy for Reporting Complaints that relate to questionable accounting or auditing matters involving the Company will be promptly and directly forwarded to the Audit Committee. The Open Door Policy for Reporting Complaints is available in the Corporate Governance section under “Investors” on our website atwww.sequenom.com.

The Board of Directors annually reviews the Nasdaq listing standards definition of independence for Audit Committee members and has determined that all members of the Audit Committee are independent (as independence is currently defined in Nasdaq Marketplace Rule 4200(a)(15) and SEC Rule 10A-3).The Board of Directors has determined that Dr. Hixson qualifies as an “audit committee financial expert,” as defined in applicable SEC rules. The Board of Directors made a qualitative assessment of Dr. Hixson’s level of knowledge and experience based on a number of factors, including his formal education and experience as a chief executive officer or other senior executive officer for several companies.

11

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS*

The Audit Committee of the Board of Directors is currently comprised of Dr. Hixson (chair), Dr. Afting and Dr. Lindsay. Each member of the Audit Committee is an independent director as determined by the Board of Directors based on applicable Nasdaq rules. Each member of the Audit Committee also satisfies the SEC additional independence requirements for members of audit committees. The Audit Committee selects the Company’s independent registered public accounting firm and submits the selection to the stockholders for ratification. The Audit Committee oversees the Company’s financial reporting process on behalf of the Board of Directors and operates under a written charter approved by the Board of Directors. The Committee’s function is more fully described in its charter, which may be found in the Corporate Governance section under “Investors” on the Company’s website atwww.sequenom.com.

Management is responsible for the preparation, presentation and integrity of the Company’s financial statements, accounting and reporting principles, and the financial reporting process and procedures designed to ensure compliance with accounting standards, applicable laws and regulations, including establishing and maintaining disclosure controls and procedures (as defined in SEC Rule 13a-15(e)), establishing and maintaining internal control over financial reporting (as defined in SEC Rule 13a-15(f)), evaluating the effectiveness of disclosure controls and procedures, evaluating the effectiveness of internal control over financial reporting, and evaluating any change in internal control over financial reporting that has materially affected, or is reasonably likely to materially affect, internal control over financial reporting.

The Company’s independent registered public accounting firm is responsible for performing an independent audit of the Company’s financial statements in accordance with generally accepted auditing standards and issuing a report thereon. The Company’s independent registered public accounting firm understands that they are accountable to the Audit Committee, not the Company’s management.

In this context, the Audit Committee has met and held discussions with management and the Company’s independent registered public accounting firm, including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments, the clarity of disclosures in the financial statements. Management represented to the Audit Committee that the Company’s financial statements were prepared in accordance with generally accepted accounting principles, and the Audit Committee has reviewed and discussed the financial statements, including the audited financial statements, with management and the Company’s independent registered public accounting firm, including whether there were any off-balance sheet financing transactions or any transactions with related parties. The Audit Committee discussed with the Company’s independent auditors matters required to be discussed by the Statement on Auditing Standards No. 61, as amended (AICPA,Professional Standards Vol. 1. AU Section 380), as adopted by the Public Company Accounting Oversight Board (“PCAOB”) in Rule 3200T.

The Audit Committee has received from the Company’s independent accountants the written disclosures and the letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees). In addition, the Audit Committee discussed with the Company’s independent registered public accounting firm that firm’s independence from the Company and its management, and the results of their examinations. The Audit Committee has also concluded that Ernst & Young LLP’s provision of audit and non-audit services to the Company and its affiliates is compatible with Ernst & Young LLP’s independence.

Based on the Audit Committee’s discussion with management and the Company’s independent registered public accounting firm and the Audit Committee’s review of the representation of management and the report of

| * | The material in this report is not “soliciting material,” is not deemed “filed” with the SEC and is not to be incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended (the “1933 Act”), or the Securities Exchange Act of 1934, as amended (the “1934 Act”), whether made before or after the date of this proxy statement and without regard to any general incorporation language therein. |

12

the Company’s independent registered public accounting firm to the Audit Committee, the Audit Committee recommended that the Board of Directors include the audited financial statements in the Company’s Annual Report on Form 10-K for the year ended December 31, 2006 filed with the SEC. The Committee has selected Ernst & Young LLP as the Company’s independent registered public accounting firm and recommended that its selection be submitted to the stockholders for ratification.

Audit Committee

Harry F. Hixson, Jr.

Ernst-Günter Afting

Ronald M. Lindsay

Compensation Committee

Three directors comprise the Compensation Committee: Dr. Lindsay (chair), Dr. Hixson and Mr. Enright. The Compensation Committee establishes our executive compensation philosophy and reviews and approves our overall compensation strategy and policies. All members of the Compensation Committee are independent (as currently defined in Nasdaq Marketplace Rule 4200(a)(15)). The Compensation Committee’s charter may be found in the Corporate Governance section under “Investors” on our website atwww.sequenom.com. The functions of the Compensation Committee include, among other things:

| | • | | reviewing and approving the compensation and other terms of employment of our Chief Executive Officer; |

| | • | | reviewing and approving the compensation and other terms of employment of the other executive officers; |

| | • | | reviewing and approving corporate performance goals and objectives relevant to the compensation of our executive officers and other senior management; and |

| | • | | administration of our equity incentive and stock purchase plans and other benefit plans and programs. |

Commencing this year, the Compensation Committee also began to review with management the Company’s Compensation Discussion and Analysis and to consider whether to recommend that it be included in proxy statements and other filings.

Compensation Committee Processes and Procedures

Typically, the Compensation Committee meets in person in connection with regularly scheduled meetings of the Board of Directors at least four times annually and holds telephonic meetings with greater frequency if necessary. The Compensation Committee met seven times during 2006. The agenda for each meeting is usually developed by the Chair of the Compensation Committee, in consultation with our Chief Executive Officer. The Compensation Committee meets regularly in executive session. However, from time to time, various members of management and other employees as well as outside advisors or consultants may be invited by the Compensation Committee to make presentations, provide financial or other background information or advice or otherwise participate in Compensation Committee meetings. The Chief Executive Officer may not participate in or be present during any deliberations or determinations of the Compensation Committee regarding his compensation or individual performance objectives. The charter of the Compensation Committee grants the Compensation Committee full access to all books, records, facilities and personnel of the Company, as well as authority to obtain, at the expense of the Company, advice and assistance from internal and external legal, accounting or other advisors and consultants and other external resources that the Compensation Committee considers necessary or appropriate in the performance of its duties. In particular, the Compensation Committee has the sole authority to retain compensation consultants to assist in its evaluation of chief executive officer and other senior executive compensation, including the authority to approve the consultant’s reasonable fees and other retention terms.

13

Under its charter, each member of the Compensation Committee must be a “non-employee director” within the meaning of Rule 16b-3 under the 1934 Act and an “outside director” within the meaning of Section 162(m) of the Internal Revenue Code (the “Code”), and each of Dr. Lindsay, Dr. Hixson and Mr. Enright meets these requirements. Under its charter, the Committee is responsible for establishing the Company’s compensation policies, plans and programs for all executive officers, for overseeing the overall compensation strategy for the Company and for administering the Company’s benefit plans. The Committee provides guidance with respect to the purpose and principles behind the company’s compensation decisions and overall compensation philosophy and objectives, oversees our compensation policies, plans and programs, and reviews and determines executive officer compensation. The Committee annually evaluates the performance and determines the compensation of the Chief Executive Officer and the other executive officers of the Company based upon a mix of factors including the achievement of corporate goals, individual performance and comparisons with other biotechnology companies. The Chief Executive Officer was not present during the voting or deliberations by the Committee on his compensation

Historically, the Compensation Committee has typically made adjustments to annual compensation, determined bonus and equity awards and set new performance objectives consistent with the performance goals established by the Board of Directors at one or more meetings held during the first quarter of the year. However, the Compensation Committee also considers matters related to individual compensation, such as compensation for new executive hires, as well as high-level strategic issues, such as the efficacy of the Company’s compensation strategy, potential modifications to that strategy and new trends, plans or approaches to compensation, at various meetings throughout the year. Generally, each year our Board of Directors with input from our executive officers, defines measurable performance goals for the Company. Based upon these performance goals, our Compensation Committee, with input from our Board of Directors, weights each goal in view of each goal’s overall importance to the Company and establishes incentive compensation parameters that reward achievement of those goals. The Compensation Committee’s process comprises two related elements: the determination of specific individual compensation levels and the establishment of performance objectives for the Company and the executives for the current year. For executives other than the Chief Executive Officer, the Compensation Committee solicits and considers evaluations and recommendations submitted to the Committee by the Chief Executive Officer. In the case of the Chief Executive Officer, the evaluation of his performance is conducted by the Compensation Committee, which determines any adjustments to his compensation as well as awards to be granted. For all executives, as part of its deliberations, the Compensation Committee may review and consider, as appropriate, materials such as financial reports and projections, operational data, tax and accounting information, tally sheets that set forth the total compensation that may become payable to executives in various hypothetical scenarios, executive stock ownership information, company stock performance data, analyses of current Company-wide compensation levels, and recommendations from any compensation consultant that the Compensation Committee may have retained, including analyses of executive compensation paid at other companies identified by the consultant.

The specific determinations of the Compensation Committee with respect to executive compensation for fiscal year 2006 as well as additional information regarding the role of the Compensation Committee and its processes and procedures are described in greater detail in the Compensation Discussion and Analysis section of this proxy statement.

Compensation Committee Interlocks and Insider Participation

As indicated above, the Compensation Committee consists of Dr. Lindsay, Dr. Hixson and Mr. Enright. No member of the Compensation Committee has ever been our officer or employee. None of our executive officers currently serves, or has served during the last completed fiscal year, on the compensation committee or board of directors of any other entity that has one or more executive officers serving as a member of our Board of Directors or Compensation Committee.

14

COMPENSATION COMMITTEE REPORT *

The Compensation Committee has reviewed and discussed with management the Compensation Discussion and Analysis contained in this proxy statement. Based on the review and discussion, the Compensation Committee has recommended to our Board of Directors that the Compensation Discussion and Analysis be included in this proxy statement and incorporated into our Annual Report on Form 10-K for the fiscal year ended December 31, 2006, as amended.

Compensation Committee

Ronald M. Lindsay

Harry F. Hixson, Jr.

Patrick G. Enright

| * | The material in this report is not “soliciting material,” is not deemed “filed” with the SEC and is not to be incorporated by reference in any filing of the Company under the 1933 Act or the 1934 Act, whether made before or after the date of this proxy statement and without regard to any general incorporation language therein. |

15

PROPOSAL 2

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board of Directors has selected Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2007 and has further directed that management submit the selection of our independent registered public accounting firm for ratification by the stockholders at the Annual Meeting. Ernst & Young LLP has audited our financial statements since 1997. Representatives of Ernst & Young LLP are expected to be present at the Annual Meeting. They will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Neither our Bylaws nor our other governing documents or law require stockholder ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm. However, our Audit Committee is submitting the selection of Ernst & Young LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Audit Committee will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee in its discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if they determine that such a change would be in our best interests or in the best interests of our stockholders.

The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the annual meeting will be required to ratify the selection of Ernst & Young LLP. Abstentions will be counted toward the tabulation of votes cast on proposals presented to the stockholders and will have the same effect as negative votes. Broker non-votes are counted towards a quorum, but are not counted for any purpose in determining whether this matter has been approved.

Principal Accountant Fees and Services

The following table represents aggregate fees billed to us for fiscal years ended December 31, 2006 and 2005, by Ernst & Young LLP, our principal independent registered public accounting firm.

| | | | | | |

| | | 2006

Actual Fees | | 2005

Actual Fees |

Audit Fees(1) | | | | | | |

Audit of consolidated financial statements, including subsidiary statutory audits and services associated with attestation of management’s assertion over internal controls required by Section 404 of Sarbanes Oxley Act | | $ | 582,885 | | $ | 842,232 |

Timely quarterly reviews | | | 85,610 | | | 82,207 |

SEC filings, including comfort letters, consents and comment letters | | | 12,034 | | | — |

Accounting consultations on matters addressed during the audit or interim reviews | | | 13,020 | | | — |

| | | | | | |

Total Audit Fees | | $ | 693,549 | | $ | 924,439 |

Audit Related Fees(2) | | | | | | |

Employee benefit plans | | | — | | | — |

General assistance with implementation of the requirements of SEC rules or listing standards promulgated pursuant to the Sarbanes Oxley Act | | | 13,759 | | | 1,500 |

Accounting consultation in connection with acquisitions | | | — | | | — |

| | | | | | |

Total Audit Related Fees | | $ | 13,759 | | | 1,500 |

Tax Fees(2) | | | | | | |

Tax compliance services | | $ | 76,175 | | | 93,066 |

Tax Planning | | | — | | | — |

| | | | | | |

Total Tax Fees | | $ | 76,175 | | | 93,066 |

| | | | | | |

Total Fees | | $ | 783,483 | | $ | 1,019,005 |

| | | | | | |

16

| (1) | Includes fees and expenses related to the fiscal year audit and interim reviews, notwithstanding when the fees and expenses were billed or when the services were rendered. Fiscal year 2006 audit fees are preliminary, and subject to final settlement based upon actual hours incurred versus budgeted. |

| (2) | Includes fees and expenses for services rendered from January through December of the fiscal year, notwithstanding when the fees and expenses were billed. Fiscal year 2006 tax compliance fees are preliminary, and subject to final settlement based upon actual hours incurred versus budgeted. |

All fees described above were approved by the audit committee.

During the fiscal year ended December 31, 2006, none of the total hours expended on our financial audit by Ernst & Young LLP were provided by persons other than Ernst & Young LLP’s full-time permanent employees.

Pre-Approval Policies and Procedures.

The Audit Committee pre-approves all audit and non-audit services rendered by our independent registered public accounting firm. The Audit Committee generally pre-approves specified services up to specified amounts. Under its charter, the Audit Committee may delegate the pre-approval of services to one or more of its members. Any such pre-approval must be reported to the full Audit Committee at its next meeting.

The Audit Committee has determined that the rendering of the services other than audit services by Ernst & Young LLP is compatible with maintaining the principal accountant’s independence.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF PROPOSAL 2.

17

SECURITY OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of our common stock as of April 30, 2007 by: (i) each director and nominee for director; (ii) each of the named executive officers listed in the Summary Compensation Table; (iii) all of our executive officers and directors as a group; and (iv) each person, or group of affiliated persons, known by us to beneficially own more than five percent of our common stock.

Beneficial ownership has been determined in accordance with Rule 13d-3 under the 1934 Act. Under this rule, certain shares may be deemed to be beneficially owned by more than one person (if, for example, persons share the power to vote or the power to dispose of the shares). Shares are deemed to be beneficially owned by a person if the person has the right to acquire shares (for example, upon exercise of an option or warrant) within 60 days of the date of the information provided. In computing the percentage ownership of any person, the number of shares is deemed to include the number of shares beneficially owned by such person (and only such person) by reason of such acquisition rights. As a result, the percentage of outstanding shares of any person as shown in the following table does not necessarily reflect the person’s actual voting power at any particular date.

Except as otherwise noted below, the address for each person or entity listed in the table is c/o Sequenom, Inc., 3595 John Hopkins Court, San Diego, California 92121.

| | | | | |

| | | Beneficial Ownership(1) | |

Beneficial Owner | | Number of Shares | | Percent

of Total | |

ComVest Investment Partners II LLC(2) One North Clematis Street, Suite 300 West Palm Beach, Florida 33401 | | 8,057,374 | | 18.33 | % |

Pequot Private Equity Fund IV, L.P.(3) c/o Pequot Capital Management, Inc. 500 Nyala Road, Westport, Connecticut 06880 | | 7,333,333 | | 16.62 | % |

LB I Group Inc.(4) c/o Lehman Brothers Inc., 399 Park Avenue, Ninth Floor New York, New York 10022 | | 6,272,726 | | 14.64 | % |

Siemens Venture Capital GMBH(5) 801 Boylston Street, 5th Floor Boston, Massachusetts 02116 | | 3,878,787 | | 9.33 | % |

Stephens Investment Management, LLC One Sansome Street, Suite 2900 San Francisco, CA 94104 | | 2,212,123 | | 5.5 | % |

Directors, Nominees and Executive Officers | | | | | |

Harry Stylli, Ph.D.(6) | | 532,493 | | 1.31 | % |

Charles R. Cantor, Ph.D.(7) | | 299,678 | | * | |

Clarke Neumann(8) | | 56,102 | | * | |

John Sharp(9) | | 12,333 | | * | |

Ernst-Günter Afting, Ph.D., M.D.(10) | | 73,333 | | * | |

Harry F. Hixson, Jr., Ph.D.(11) | | 31,667 | | * | |

Ronald M. Lindsay, Ph.D.(12) | | 33,334 | | * | |

Patrick Enright | | 14,105 | | * | |

Paul Hawran | | 10,000 | | — | |

Larry F. Lenig, Jr.(13) | | 8,073,939 | | 18.37 | % |

Elizabeth A. Dragon(14) | | 27,718 | | * | |

All directors and executive officers as a group (11 persons)(15) | | 9,164,702 | | 20.48 | % |

18

| (1) | This table is based upon information supplied by officers, directors and principal stockholders and Schedules 13D and 13G filed with the SEC. To our knowledge, except as indicated in the footnotes to this table and pursuant to applicable community property laws, the persons named in the table have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them. Applicable percentages are based on 40,127,154 shares outstanding on April 30, 2007, adjusted as required by SEC rules. |

| (2) | Includes 3,818,181 shares of our common stock issuable pursuant to warrants exercisable within 60 days of April 30, 2007 by ComVest Investment Partners II LLC. ComVest Investment Partners II LLC, a Delaware limited liability company (“ComVest”) is a private investment company. The managing member of ComVest is ComVest II Partners LLC, a Delaware limited liability company (“ComVest II Partners”), the managing member of which is ComVest Group Holdings, LLC, a Delaware limited liability company (“CGH”). Michael Falk (“Falk”) is the Chairman and principal member of CGH. Robert Priddy (“Priddy”) is a member of ComVest II Partners. Falk and Priddy, by virtue of their status as managing members of ComVest II Partners (the managing member of ComVest) and as the principal members of ComVest and ComVest II Partners, may be deemed to have indirect beneficial ownership of the shares of common stock beneficially owned by ComVest. However, Falk and Priddy disclaim any beneficial ownership of such shares. Larry Lenig, an employee of ComVest, is one of our directors. |

| (3) | Includes 4,000,000 shares of our common stock issuable pursuant to warrants exercisable within 60 days of April 30, 2007 by Pequot Private Equity Fund IV, L.P. Excludes 771 shares of common stock held by Mr. Enright directly. Pequot Capital Management, Inc. holds voting and investment power for all shares held by Pequot Private Equity Fund IV, L.P. (the “Fund”). Mr. Enright, a member of our Board of Directors, is a Managing Director of Longitude Capital, Inc., a consultant to Pequot Capital Management, Inc. and a member of the General Partner of the Fund. Mr. Enright may be deemed to beneficially own the securities held of record by the Fund. Mr. Enright disclaims beneficial ownership of the shares held by the Fund except to the extent of his pecuniary interest. |

| (4) | Includes 2,727,272 shares of our common stock issuable pursuant to warrants exercisable within 60 days of April 30, 2007 by LB I Group Inc. LB I Group Inc. is a wholly owned subsidiary of Lehman Brothers Inc., a registered broker-dealer. Lehman Brothers Inc. is a wholly owned subsidiary of Lehman Brothers Holdings Inc., a public reporting company. |

| (5) | Includes 1,454,545 shares of our common stock issuable pursuant to warrants exercisable within 60 days of April 30, 2007 by Siemens Venture Capital GmbH. Siemens Venture Capital GmbH, a company with limited liability organized under the laws of the Federal Republic of Germany, is a wholly owned subsidiary of Siemens Aktiengesellschaft, a public reporting stock corporation organized under the laws of the Federal Republic of Germany. |

| (6) | Includes 443,720 shares of common stock that Mr. Stylli has the right to acquire from us upon the exercise of outstanding stock options within 60 days after April 30, 2007. Also includes 22,807 restricted shares of common stock that are subject to a repurchase option in favor of the Company in the event Dr. Stylli’s employment is terminated prior to January 17, 2008. |

| (7) | Includes 143,846 shares of common stock held of record by trusts related to Dr. Cantor and beneficially owned by Dr. Cantor and 155,832 shares of common stock that Dr. Cantor has the right to acquire from us upon the exercise of outstanding stock options within 60 days after April 30, 2007. Also includes 6,444 restricted shares of common stock that are subject to a repurchase option in favor of the Company in the event Dr. Cantor’s employment is terminated prior to January 17, 2008. |

| (8) | Includes 43,726 shares of common stock that Mr. Neumann has the right to acquire from us upon the exercise of outstanding stock options within 60 days after April 30, 2007. Also includes 5,044 restricted shares of common stock that are subject to a repurchase option in favor of the Company in the event Mr. Neumann’s employment is terminated prior to January 17, 2008. |

| (9) | Includes 12,333 shares of common stock that Mr. Sharp has the right to acquire from us upon the exercise of outstanding stock options within 60 days after April 30, 2007. Excludes 3,219 shares of restricted common stock repurchased by the Company upon Mr. Sharp’s departure in April 2007. |

| (10) | Includes 38,334 shares of common stock that Dr. Afting has the right to acquire from us upon the exercise of outstanding stock options within 60 days after April 30, 2007. |

19

| (11) | Includes 31,667 shares of common stock that Dr. Hixson has the right to acquire from us upon the exercise of outstanding stock options within 60 days after April 30, 2007. |

| (12) | Includes 28,334 shares of common stock that Dr. Lindsay has the right to acquire from us upon the exercise of outstanding stock options within 60 days after April 30, 2007. |

| (13) | Includes 4,239,193 shares of common stock owned by ComVest and includes 3,818,181 shares of our common stock issuable pursuant to warrants exercisable within 60 days of April 30, 2007 by ComVest. Mr. Lenig disclaims beneficial ownership of these shares except to the extent of his pecuniary interest in ComVest entities. |

| (14) | Includes 24,827 shares of common stock that Dr. Dragon has the right to acquire from us upon the exercise of outstanding stock options within 60 days of April 30, 2007. Also includes 2,891 restricted shares of common stock that are subject to a repurchase option in favor of the Company in the event Dr. Dragon’s employment is terminated prior to January 17, 2008. |

| (15) | Includes the 4,596,954 aggregate shares of common stock referred to in footnotes (6), (7), (8), (9), (10), (11), (12), (13) and (14) that such persons have the right to acquire from us upon the exercise of outstanding options and warrants within 60 days after April 30, 2007. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires our directors and executive officers, and persons who own more than ten percent of a registered class of our equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of our common stock and other equity securities. Our officers, directors and greater than ten percent stockholders are required by SEC regulations to furnish us with copies of all Section 16(a) forms they file.

To our knowledge, based solely on a review of the copies of such reports furnished to us and written representations that no other reports were required, during the fiscal year ended December 31, 2006, all Section 16(a) filing requirements applicable to our officers, directors and greater than ten percent beneficial owners were complied with.

20

EXECUTIVE COMPENSATION

The following discussion covers the compensation arrangements for the named executive officers identified in the Summary Compensation Table (the “NEOs”) and our directors and includes a general discussion and analysis of our executive compensation program as well as a series of tables containing specific compensation information for our NEOs and directors. This discussion contains forward looking statements that are based upon our current executive compensation program, policies and methodologies. We may make changes in this program and these policies and methodologies in the future, and if made, we could have materially different compensation arrangements in the future.

Compensation Discussion and Analysis

Executive compensation philosophy

Our Compensation Committee establishes the executive compensation philosophy for our Company. The Compensation Committee has designed our executive compensation program to help us achieve our goals and objectives, including:

| | • | | Aligning our executive compensation with our business objectives; |

| | • | | Making payments or providing other incentives based on our performance as measured against annual company goals set by our full Board of Directors; |

| | • | | Attracting, retaining, motivating and rewarding executive officers (including the NEOs) and maintaining a stable management team comprised of individuals with substantial industry experience; and |

| | • | | Aligning the financial interests of our executives with the long-term financial interests of our shareholders. |

To accomplish these goals and objectives, we have created an executive compensation program comprised of three primary elements: base pay, an annual bonus program and a long term incentive program which uses equity awards.

Although it is not our policy or routine practice to enter into employment agreements with executive officers, employment agreements are used from time to time on a case by case basis, to attract and/or to retain executives. We currently maintain employment agreements with three of our NEOs; Dr. Stylli, Dr. Cantor and Mr. Neumann.

Additionally, we have created a change in control severance benefit plan which provides additional benefits for executive officers in the event that there is a change in control of our Company and an executive loses his or her job. Dr. Cantor, Mr. Neumann, Dr. Dragon participate in that plan and, prior to his departure in April 2007, Mr. Sharp also participated in the plan. Dr. Stylli has change in control provisions in his employment contract. We believe that these change in control benefits help us retain executive talent and, in the event of a potential change of control, allow the executives to focus on the potential transaction without concern for their personal near-term financial future. The potential for a participating executive to receive these change in control benefits will expire June 6, 2007, unless a protected termination of the executive occurs before that date. These change in control benefits are discussed in more detail in the “Change in Control Arrangements” section below and in the “Post-Employment Payments” section and table below.

The Compensation Committee’s role in the executive compensation process

The Compensation Committee of our Board of Directors is comprised of three independent directors: Dr. Lindsay, Chairman of the Committee; Dr. Hixson; and Mr. Enright. The Committee has responsibilities vested in it by our Board of Directors as set forth in the Charter of the Compensation Committee which may be found in the Corporate Governance section under “Investors” on our website atwww.sequenom.com. Among its

21

responsibilities, the Committee provides guidance with respect to the purpose and principles behind the company’s compensation decisions and overall compensation philosophy and objectives, and the Committee oversees our compensation policies, plans, and programs, and reviews and determines executive officer compensation.

Our Compensation Committee is actively involved in our executive compensation process. The Committee met seven times during 2006. During these meetings the Committee explored various alternatives to portions of the executive compensation program in addition to its regular duties of monitoring and approving compensation levels, approving the terms of compensation arrangements for new executives, and reviewing corporate goals as they relate to executive compensation. In addition to these meetings, throughout 2006 our Chief Executive Officer, Compensation Committee members, and other members of our Board of Directors were involved in numerous discussions regarding compensation matters. The Compensation Committee maintains a calendar to make sure that selected matters (such as compensation strategy, base pay, variable pay and equity awards) are reviewed on an annual basis. The Compensation Committee did not use the services of an outside compensation consultant in 2006.

With respect to the annual bonus program, our Board of Directors, with input from our executive officers, defines measurable performance goals for the Company each year. Our Compensation Committee considers input from the full Board of Directors, applies weighting to each goal in view of each goals overall importance to the Company and establishes incentive compensation parameters that reward performance goal achievement.

The components of our executive compensation program

Our executive compensation program consists of three main components: base pay; a cash and/or stock based annual incentive program (“annual bonus”); and stock options granted at fair market value to provide longer term incentives through appreciation in our stock. We also provide our executive officers, including NEOs, with the same package of employee benefits that are provided to all full time employees, including such programs as health insurance, group term life and disability insurance, and a discretionary matching contribution to our 401(k) plan, although no matching contributions were made in 2006. From time to time, NEOs may receive additional perquisites, as discussed further below and referenced in the Summary Compensation Table.

We have selected each of the executive compensation components for the following reasons:

| | • | | Taken as a whole, the components of the executive compensation program (base pay, annual bonus and equity grants) are comparable to the programs offered by other companies of our size in the life sciences industry; therefore, our program helps us attract new executive talent and retain, motivate, and reward the executives that we currently employ. |

| | • | | The annual bonus program rewards executives for the satisfaction of Company goals that are established by the full Board of Directors. Compensation under this program directly reflects the Company’s satisfaction of corporate objectives and reflects individual overall performance in the opinion of our Chief Executive Officer and the Compensation Committee members. Evaluation of individual overall performance for our Chief Executive Officer is performed solely by the Compensation Committee and in executive session deliberations without the Chief Executive Officer present. Payments under this program, partially paid in restricted stock for 2006, underscores our desire to have our executives focus their efforts on annual and longer-term company goals and to take actions that maximize shareholder value. Our Compensation Committee rewards executives only in the event of satisfactory Company and personal performance. |

| | • | | Stock option grants to purchase our common stock serve three purposes: first, they are a retention device, as the executive must continue employment with us to vest his or her options and to exercise the options to realize value; second, they align the interests of management with those of our shareholders with the goal of creating long term growth and value for the Company; and third they allow us to attract and recruit new executives. |

22

How the amount of each component of compensation is determined

Base Pay

The Compensation Committee reviews the base salary of each NEO as well as other executives on an annual basis. It is the Compensation Committee’s intent to maintain base salary levels for executives within a salary range that has as its midpoint, the average level of pay for executives with similar duties at similarly sized companies in the life sciences industry. We maintain salary ranges for each executive position.