|

Exhibit 99.1

|

INVESTOR + ANALYST DAY

September 28, 2015

Welcome

Dirk van den Boom, PhD Interim President and CEO Chief Scientific & Strategy Officer

2

Forward-looking statements

Except for historical information, matters set forth in this presentation, including statements regarding Sequenom’s plans, potential, opportunities, financial or other expectations, projections, goals, objectives, milestones, strategies, market growth, timelines, product pipeline, clinical studies, product development, and the potential benefits of its products and products under development, are forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995.

These forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially, including the risks and uncertainties associated with Sequenom’s operating performance and financial position, the market demand for and acceptance of Sequenom’s and Sequenom Laboratories’ products and services, research, development and commercialization of new products, reliance upon the collaborative efforts of others, competition, intellectual property rights, government regulation, obtaining or maintaining regulatory approvals, litigation, and other risks detailed in Sequenom’s SEC filings.

These forward-looking statements are based on current information that is likely to change, speak only as of the date hereof, and Sequenom undertakes no obligation to revise or update such statements.

3

Today’s agenda

Opening remarks

Dirk van den Boom

Corporate vision + overview

Dirk van den Boom

Reproductive health + genetic testing

Mathias Ehrich, Rob Lozuk

Coffee break

Oncology

Mathias Ehrich, Daniel Grosu

Closing remarks

Dirk van den Boom

4

Speakers

Mathias Ehrich, MD Rob Lozuk Daniel Grosu, MD

Senior Vice President, Senior Vice President, Senior Vice President, Research and Development Commercial Operations Chief Medical Officer

5

Corporate vision and overview

Sequenom: positioning for 2020

Prenatal market is rapidly evolving creating both challenges and opportunities

Recent performance does not reflect Sequenom’s potential

Entire organization understands the challenges

Sequenom is focused on driving value, leading innovation, and creating a sustainable business which delivers long-term value to shareholders

Strategic plan is in place to capture value from reproductive health market opportunities and testing beyond traditional noninvasive prenatal testing

We are laying the foundation / building blocks for future growth in oncology

7

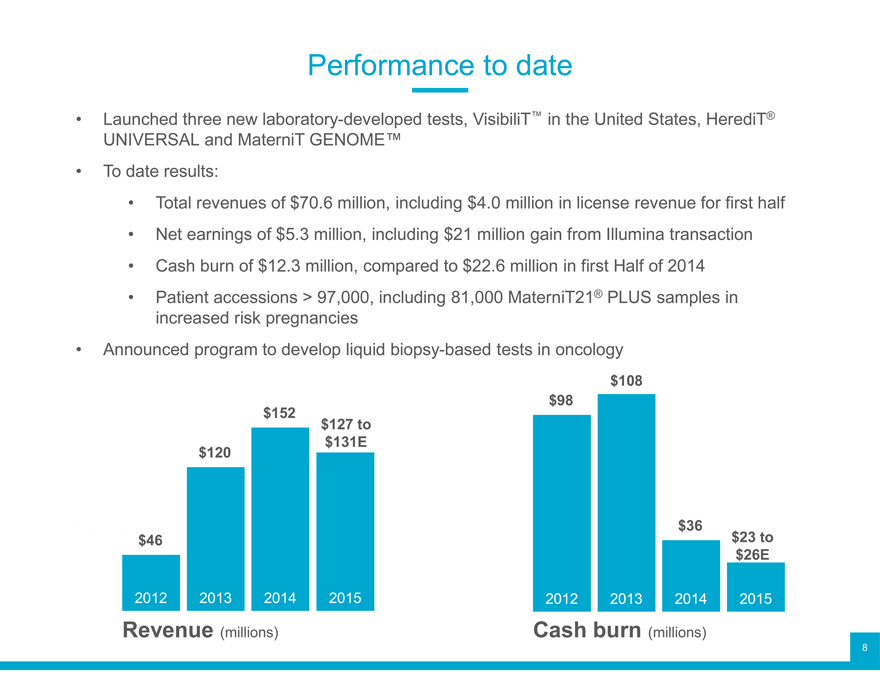

Performance to date

Launched three new laboratory-developed tests, VisibiliT™ in the United States, HerediT®

UNIVERSAL To date results: and MaterniT GENOME™

Total Net earnings revenues of of $5.3 $70.6 million, million, including including $21 $ 4.0 million million gain in from license Illumina revenue transaction for first half

Cash burn of $12.3 million, compared to $22.6 million in first Half of 2014

Patient accessions > 97,000, including 81,000 MaterniT21® PLUS samples in

Announced increased program risk to pregnancies develop liquid biopsy-based tests in oncology

$108 $152 $98 $127 to $120 $131E

$36 $23 to $46 $26E

2012 2013 2014 2015 2012 2013 2014 2015 Revenue (millions) Cash burn (millions)

8

Providing unique insights into your health all starts with a simple blood draw…

Our vision

Interpreting the genome to improve your life

Sequenom’s distinction

Innovator Committed to excellence. Responsible for new standard for noninvasive prenatal testing and the largest new global diagnostic category.

Trusted Peer-reviewed publications and transparency in medical education, billing and commercialization.

Comprehensive Most advanced noninvasive offerings of genetic testing solutions for clinicians and their patients.

Dedicated Customer service, genetic counselors and medical directors. Every patient matters.

11

Sequenom evolution

Research to commercial

[ 2014 ]

NIPT innovator Focused operation NIPT licensing pools

Discovery/clinical validation of Divested biosciences business Established global patent pool NIPT1 with Illumina for broad NIPT

Launched MaterniT21 technology access laboratory-developed test (LDT)

Gained positive technology assessments2 [ Now ]

Expanded access Growing portfolio ® Growth programs

Broad partnership and MaterniT21 PLUS Enhanced Reproductive health + oncology licensing agreements in Sequencing Series, VisibiliT®, MaterniT™ GENOME US, EU + Asia HerediT® UNIVERSAL and Average-risk NIPT

NextView™ LDTs • Liquid biopsy ctDNA technology, RUO test

12

Reproductive health

High risk pregnancies MaterniT21® PLUS Market opportunity

Invasive procedures Noninvasive prenatal test Annual births

97% of procedures have normal Laboratory-developed test 750K high-risk US births annually results (LDT) to identify pregnancies at 3.5M average risk US births

Costly and introduces additional increased risk for fetal annually risk chromosomal abnormalities

130M+ births globally

13

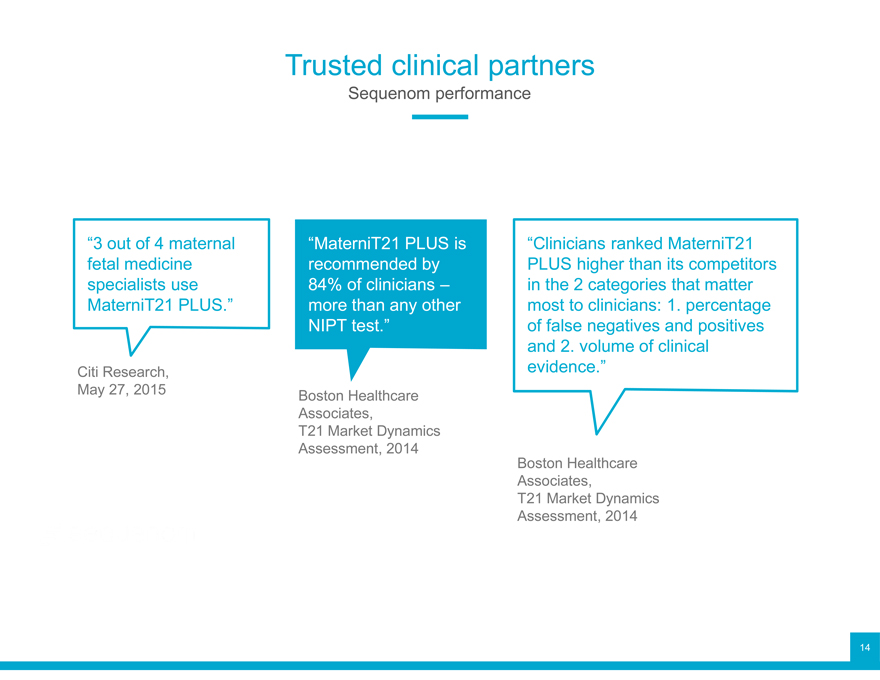

Trusted clinical partners

Sequenom performance

“3 out of 4 maternal “MaterniT21 PLUS is “Clinicians ranked MaterniT21 fetal medicine recommended by PLUS higher than its competitors specialists use 84% of clinicians – in the 2 categories that matter MaterniT21 PLUS.” more than any other most to clinicians: 1. percentage NIPT test.” of false negatives and positives and 2. volume of clinical

Citi Research, evidence.” May 27, 2015 Boston Healthcare Associates, T21 Market Dynamics Assessment, 2014 Boston Healthcare Associates, T21 Market Dynamics Assessment, 2014

14

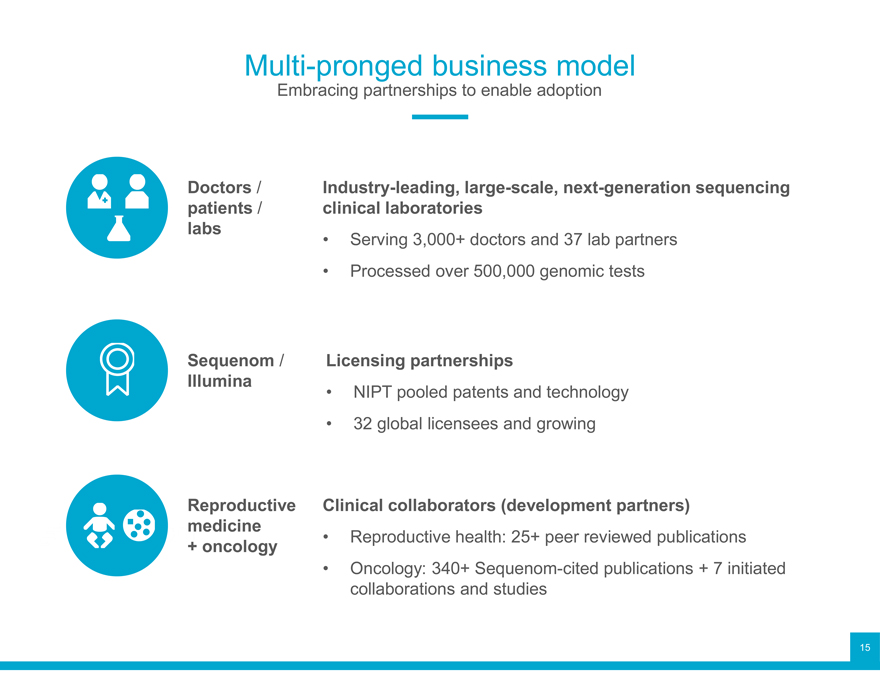

Multi-pronged business model

Embracing partnerships to enable adoption

Doctors / Industry-leading, large-scale, next-generation sequencing patients / clinical laboratories labs • Serving 3,000+ doctors and 37 lab partners

Processed over 500,000 genomic tests

Sequenom / Licensing partnerships

Illumina NIPT pooled patents and technology

32 global licensees and growing

Reproductive Clinical collaborators (development partners) medicine • Reproductive health: 25+ peer reviewed publications

+ oncology

Oncology: 340+ Sequenom-cited publications + 7 initiated collaborations and studies

15

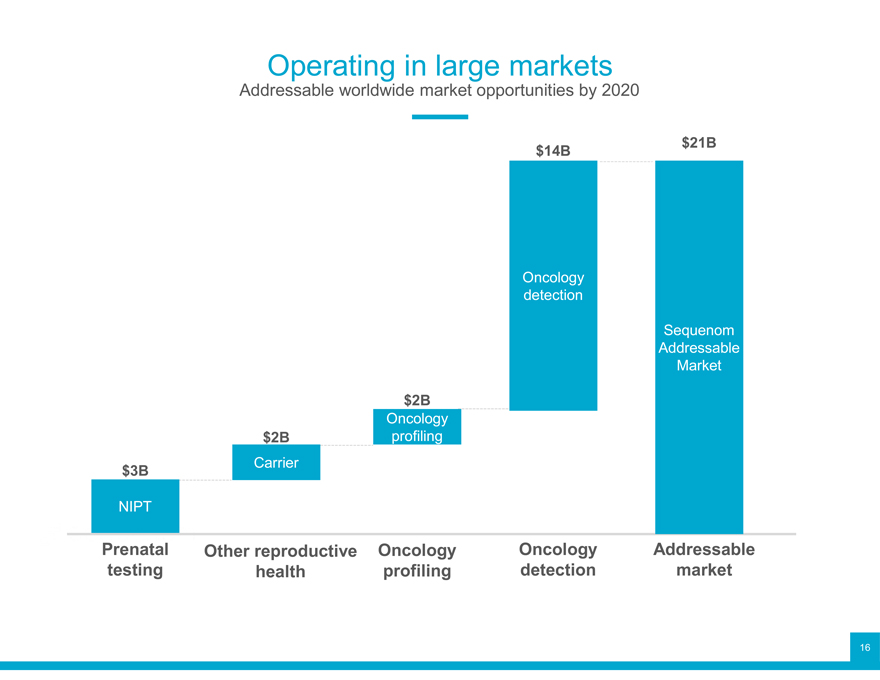

Operating in large markets

Addressable worldwide market opportunities by 2020

$14B $21B

Oncology detection

Sequenom Addressable Market $2B

Oncology Carrier $2B profiling $3B

NIPT

Prenatal Other reproductive Oncology Oncology Addressable testing health profiling detection market

16

Translating to results

Over $500M revenues by 2020

+$50M/yr NIPT test fees and royalties, with continued adoption of pooled patent globally and NIPT growth in international

Oncology markets

Patents extend beyond 2030

NIPT Liquid biopsy franchise in cancer profiling Royalty and detection Other 2020 revenue drivers reproductive Assumes average risk adoption and health reimbursement in US, growing adoption for whole genome NIPT and liquid biopsy commercialization with coverage and adoption of profiling component

17

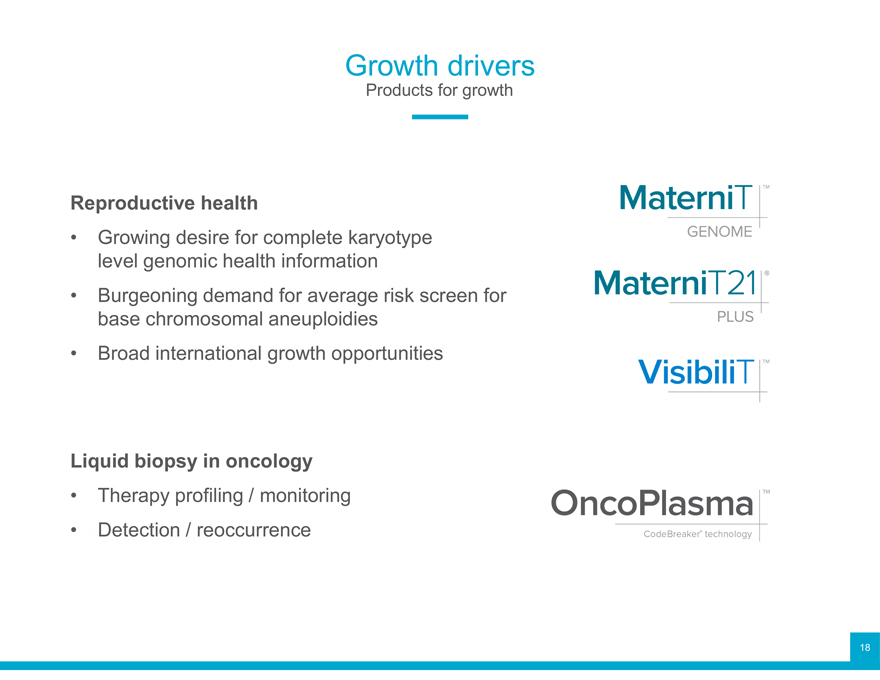

Growth drivers

Products for growth

Reproductive health

Growing desire for complete karyotype level genomic health information

Burgeoning demand for average risk screen for base chromosomal aneuploidies

Broad international growth opportunities

Liquid biopsy in oncology

Therapy profiling / monitoring

Detection / reoccurrence

18

Key takeaways

Innovation Trusted clinical Strong product Focused leader partner pipeline execution

Provides innovative Products and practices Addresses major unmet Growing top-line solutions to the most trusted by physicians, needs and aims to revenue through a pressing and complex patients, and payers increase shareholder diversified business issues in healthcare value model

19

Reproductive health and genetic testing

Mathias Ehrich, MD Senior Vice President Research and Development

Reproductive health and genetic testing

Care continuum

Reproductive health and genetic testing

Pre-pregnancy

“I want to become pregnant.”

Pregnancy

“I am pregnant.”

“Provider of choice”

Post-pregnancy

“Is my baby healthy?

Leaders in noninvasive prenatal testing

Shaping the field

First to show robust clinical validation with over 200 trisomy 21 samples First to create robust, high-throughput clinical laboratory using next generation sequencing First to market in noninvasive prenatal testing using cell-free DNA with breakthrough technology and innovations Industry-leading clinical performance

Leading in scientific breakthroughs

Sequenom accomplishments

Breakthrough innovations

Foundational technology for all current NIPT

Cell-free fetal DNA in maternal blood

Next-generation sequencing of circulating cell-free DNA (ccfDNA) allows for accurate identification of fetal chromosomal abnormalities

Continuous and responsible innovation

Over 225 patents / patent applications added to joint NIPT patent pool with Illumina

relationship ID rId2 was not found in the file.

Leading in innovation

Sequenom accomplishments

R&D advances

Pioneering biochemistry and bioinformatics solutions

Detection of balanced translocations

High accuracy at low no-call rates

Industry leading low false positive rates for reporting of sub-chromosomal events

Genome-wide analysis of deletions / duplications 7 Mb or larger

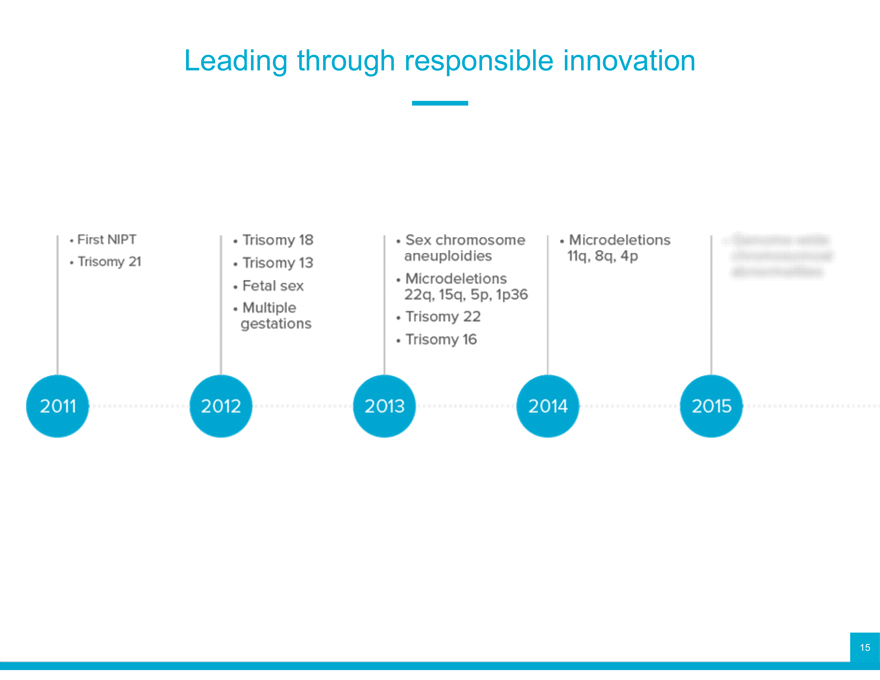

Leading through responsible innovation

Foundational technology

Breakthrough innovations

Leading clinical validation

Leading clinical performance

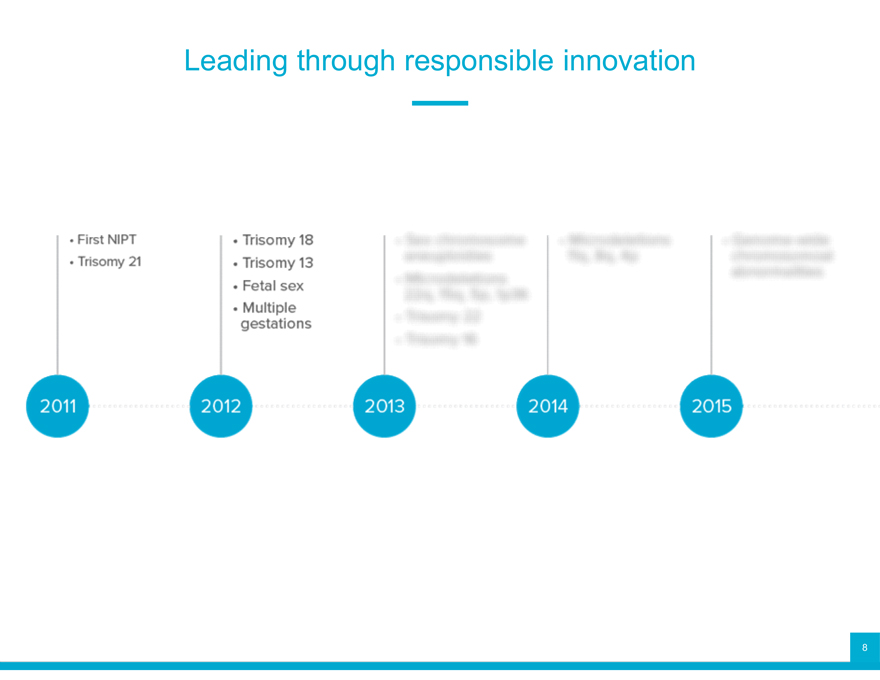

Leading through responsible innovation

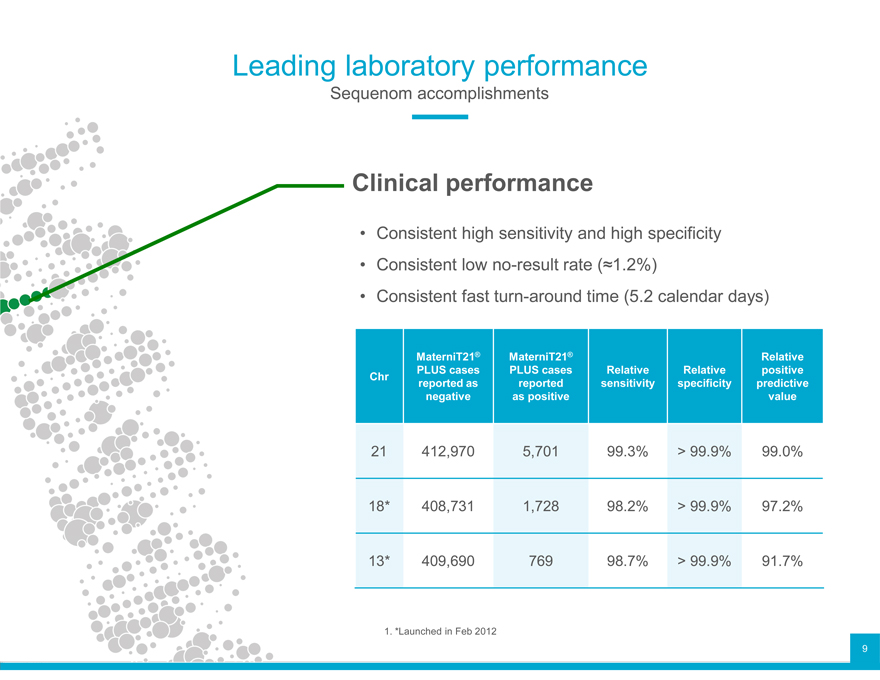

Leading laboratory performance

Sequenom accomplishments

Clinical performance

Consistent Consistent high low no-result sensitivity rate and (?1.2%) high specificity

Consistent fast turn-around time (5.2 calendar days)

MaterniT21® MaterniT21® Relative

Chr PLUSreportedcases as PLUS reported cases sensitivity Relative specificity Relative predictive positive

negative as positive value

21 412,970 5,701 99.3% > 99.9% 99.0%

18* 408,731 1,728 98.2% > 99.9% 97.2%

13* 409,690 769 98.7% > 99.9% 91.7%

1. *Launched in Feb 2012

9

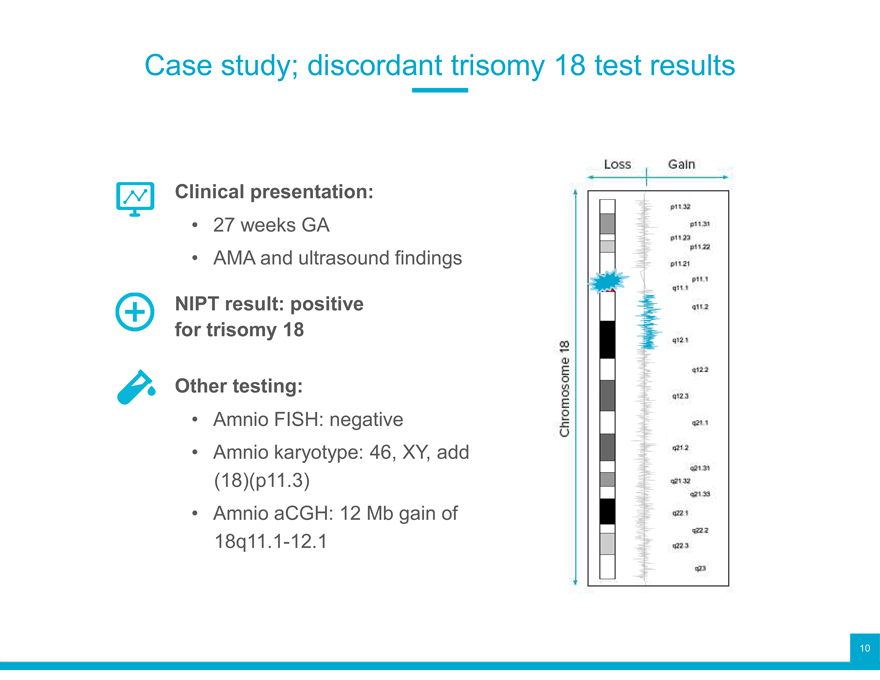

Case study; discordant trisomy 18 test results

Clinical presentation:

27 weeks GA

AMA and ultrasound findings

NIPT result: positive for trisomy 18 Other testing:

Amnio FISH: negative

Amnio karyotype: 46, XY, add (18)(p11.3)

Amnio aCGH: 12 Mb gain of 18q11.1-12.1

10

“Invasive diagnostic testing for

aneuploidy should be available

for all women, regardless of

maternal age.”

Screening for fetal

chromosomal abnormalities ACOG Practice Bulletin 88, December 2007

Number 77, January 2007

Invasive prenatal testing for

aneuploidy

Number 88, December 2007

11

Key innovations

12

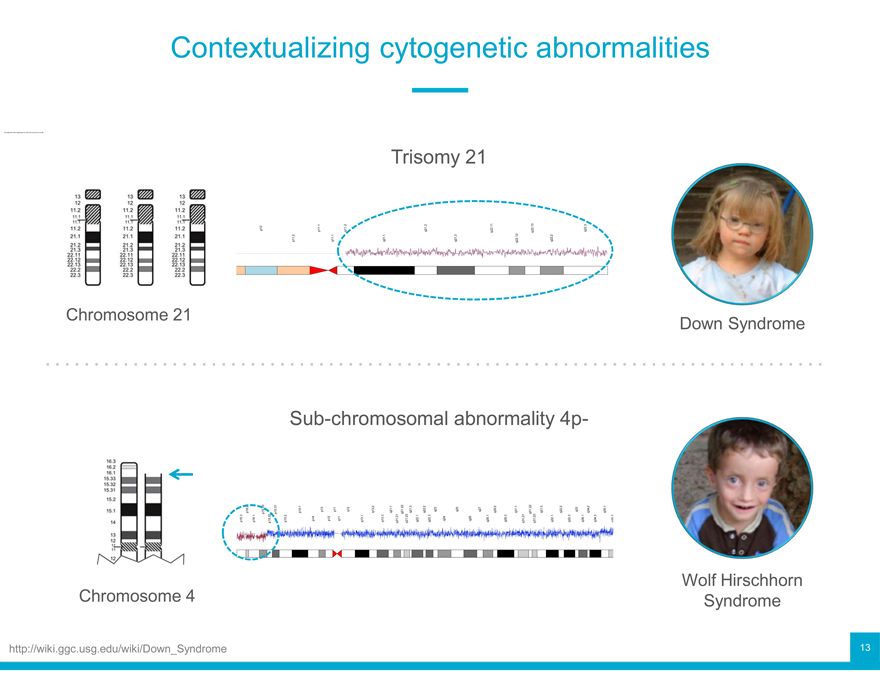

Contextualizing cytogenetic abnormalities

Trisomy 21

Chromosome 21 Down Syndrome

Sub-chromosomal abnormality 4p-

Chromosome 4 Wolf Hirschhorn Syndrome

ggc.usg.edu/wiki/Down_Syndrome 13

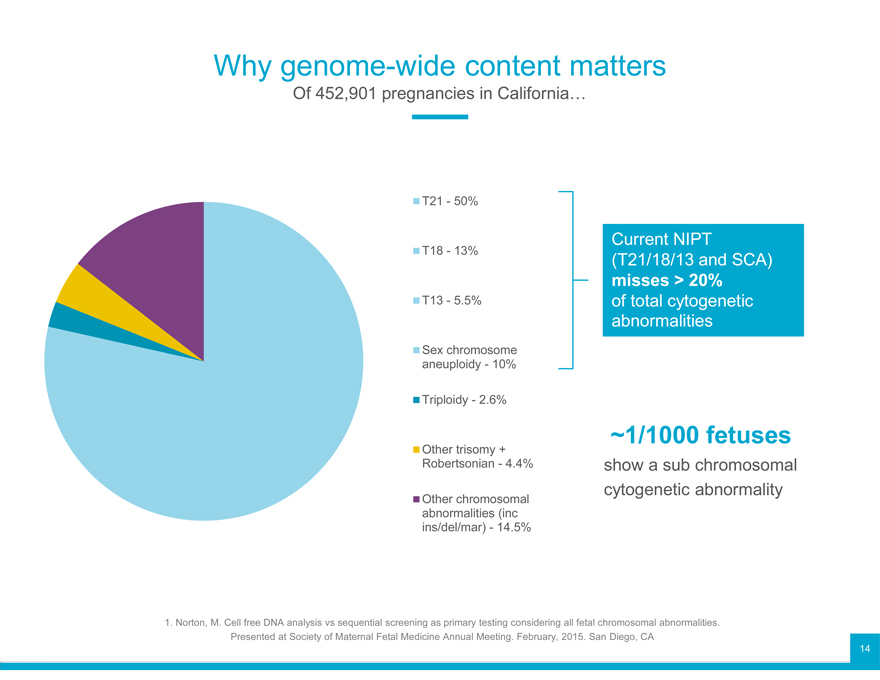

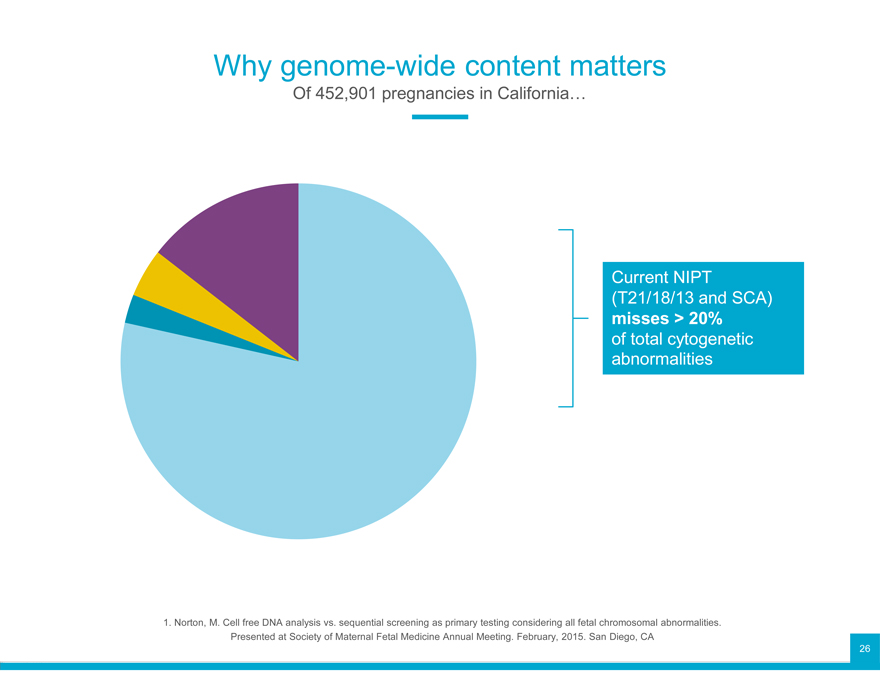

Why genome-wide content matters

Of 452,901 pregnancies in California…

T21—50%

Current NIPT

T18—13% (T21/18/13 and SCA)

misses > 20%

T13—5.5% of total cytogenetic

abnormalities

Sex chromosome

aneuploidy—10%

Triploidy—2.6%

Other trisomy + ~1/1000 fetuses

Robertsonian—4.4% show a sub chromosomal

Other chromosomal cytogenetic abnormality

abnormalities (inc

ins/del/mar)—14.5%

1. Norton, M. Cell free DNA analysis vs sequential screening as primary testing considering all fetal chromosomal abnormalities.

Presented at Society of Maternal Fetal Medicine Annual Meeting. February, 2015. San Diego, CA 14

Leading through responsible innovation

15

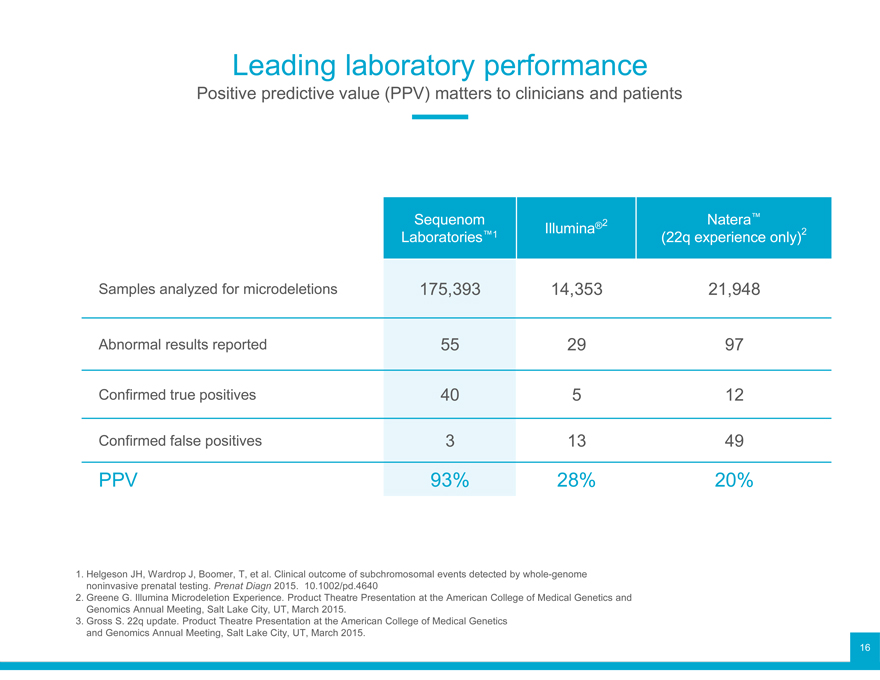

Leading laboratory performance

Positive predictive value (PPV) matters to clinicians and patients

Laboratories Sequenom™1 Illumina®2 (22q experience Natera™ only)2

Samples analyzed for microdeletions 175,393 14,353 21,948

Abnormal results reported 55 29 97

Confirmed true positives 40 5 12

Confirmed false positives 3 13 49

PPV 93% 28% 20%

1. Helgeson JH, Wardrop J, Boomer, T, et al. Clinical outcome of subchromosomal events detected by whole-genome

noninvasive prenatal testing. Prenat Diagn 2015. 10.1002/pd.4640

2. Greene G. Illumina Microdeletion Experience. Product Theatre Presentation at the American College of Medical Genetics and

Genomics Annual Meeting, Salt Lake City, UT, March 2015.

3. Gross S. 22q update. Product Theatre Presentation at the American College of Medical Genetics

and Genomics Annual Meeting, Salt Lake City, UT, March 2015.

16

Unmet needs for broad genome-wide coverage

A key opinion leader’s perspective

Ronald J. Wapner, MD

Board-certified in Maternal-Fetal Medicine and Obstetrics and Gynecology New York-Presbyterian/Columbia

17

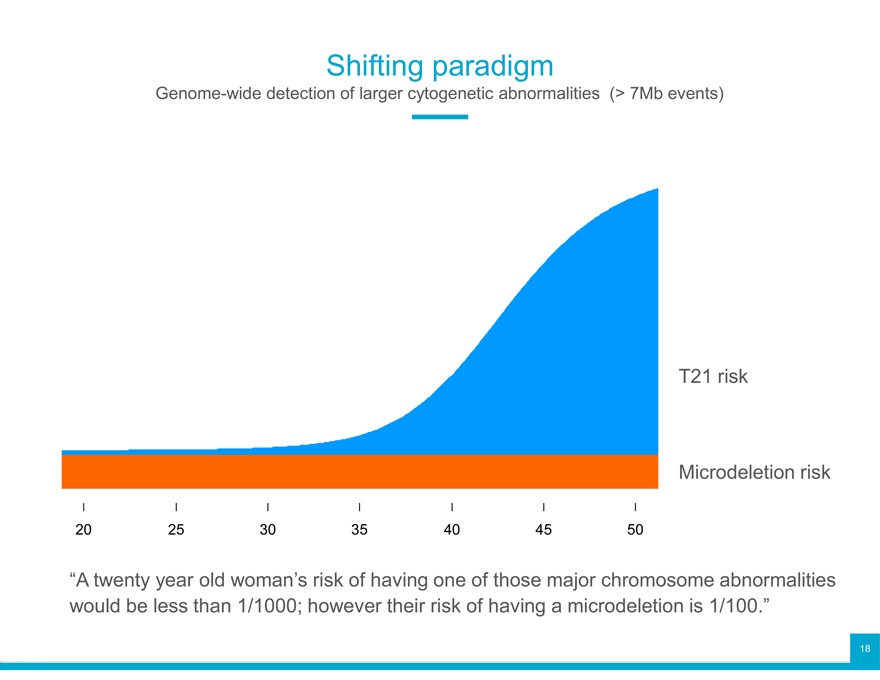

Shifting paradigm

Genome-wide detection of larger cytogenetic abnormalities (> 7Mb events)

T21 risk

Microdeletion risk

20 25 30 35 40 45 50

“A twenty year old woman’s risk of having one of those major chromosome abnormalities

would be less than 1/1000; however their risk of having a microdeletion is 1/100.”

18

relationshipIDrId2wasnotfoundinthefile.

Shifting paradigm

Genome-wide detection of larger cytogenetic abnormalities (> 7Mb events)

Identification of clinically relevant sub-chromosomal aberrations otherwise missed by NIPT

Aids in assessment of potential pregnancy complications/ risk of adverse events

Early recognition can change pre- and postnatal medical management

Allows for appropriate specialist referral

Reduces the “Diagnostic odyssey”

Children with sub-chromosomal deletions / duplications or a microdeletion syndrome may not be diagnosed for years after birth

Can provide peer group access, support, and information

Allows for timely patient support

15

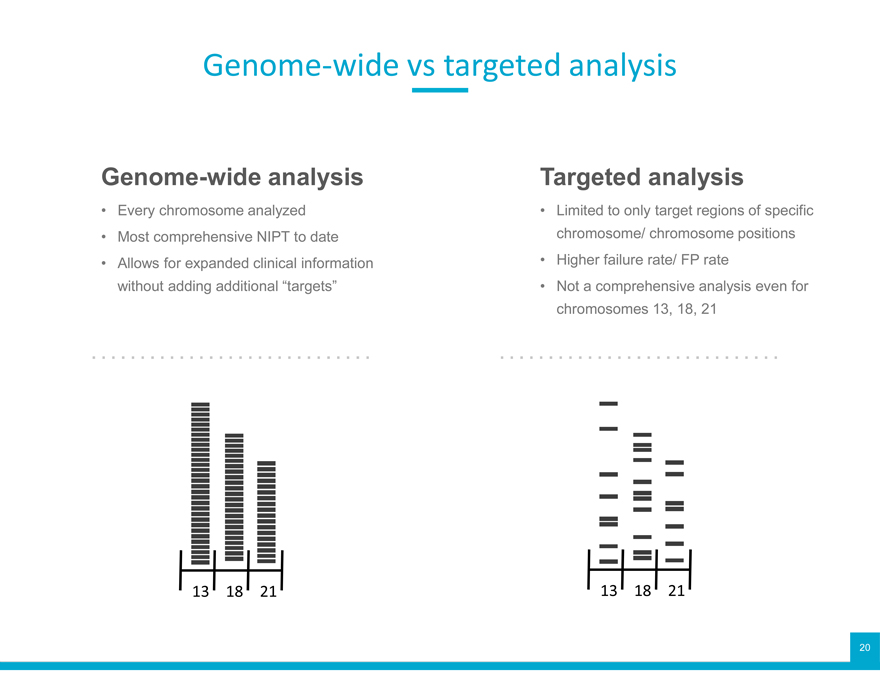

Genome-wide vs targeted analysis

Genome-wide analysis

Every chromosome analyzed

Most comprehensive NIPT to date

Allows for expanded clinical information without adding additional “targets”

Targeted analysis

Limited to only target regions of specific chromosome/ chromosome positions

Higher failure rate/ FP rate

Not a comprehensive analysis even for chromosomes 13, 18, 21

13 18 21 13 18 21

20

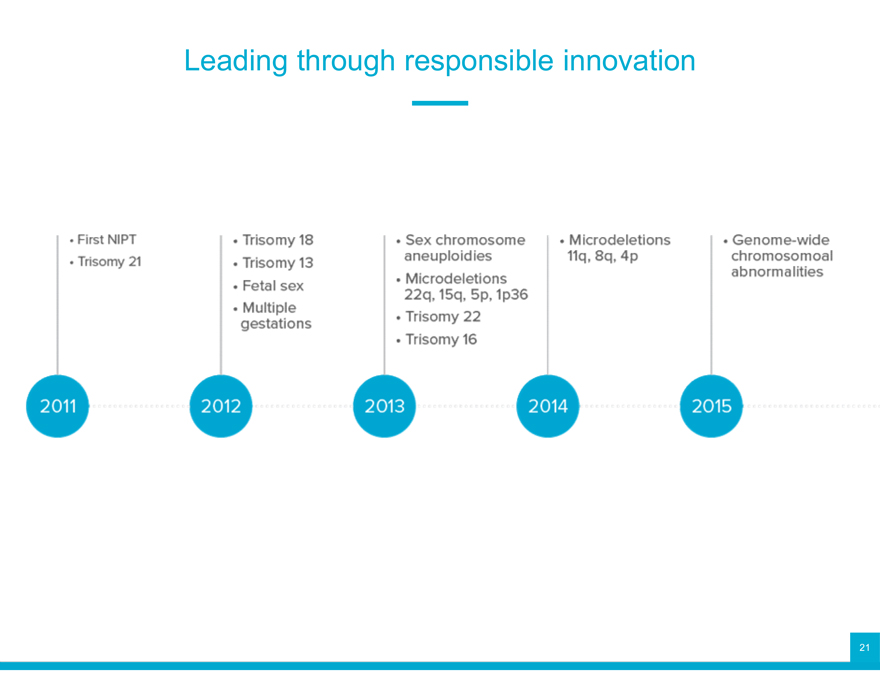

Leading through responsible innovation

21

Genome-wide content

22

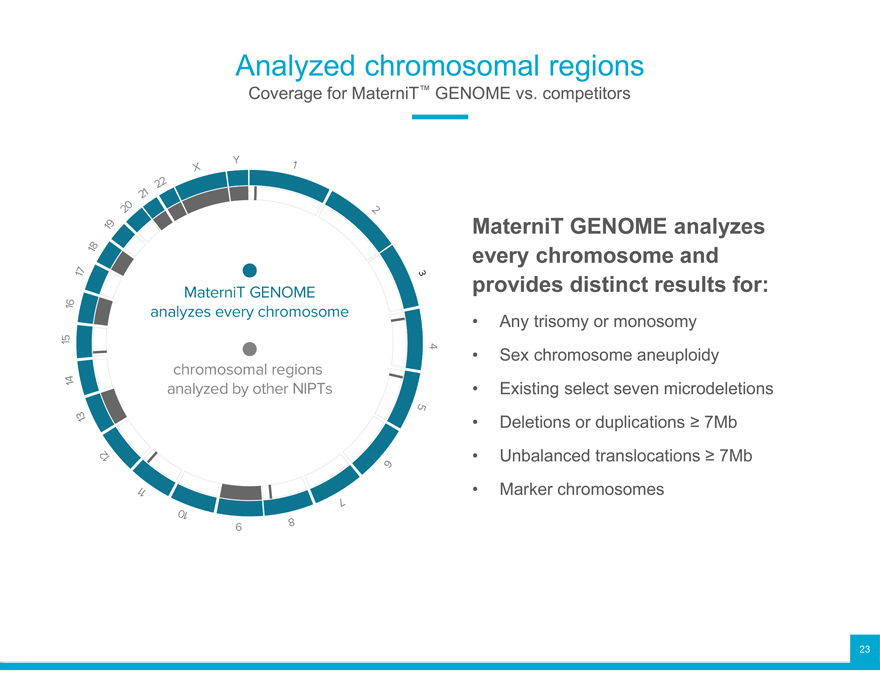

Analyzed chromosomal regions

Coverage for MaterniT™ GENOME vs. competitors

MaterniT GENOME analyzes every chromosome and provides distinct results for:

Any trisomy or monosomy

Sex chromosome aneuploidy

Existing select seven microdeletions

Deletions or duplications ? 7Mb

Unbalanced translocations ? 7Mb

Marker chromosomes

23

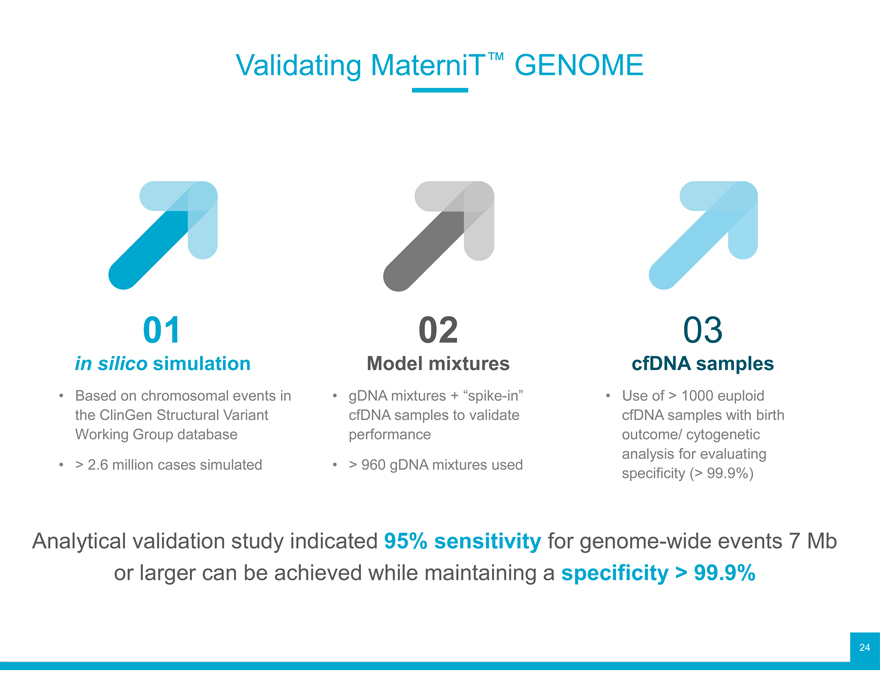

Validating MaterniT™ GENOME

in silico 01simulation

Based on chromosomal events in the ClinGen Structural Variant Working Group database

> 2.6 million cases simulated

02

Model mixtures

gDNA mixtures + “spike-in” cfDNA samples to validate performance

> 960 gDNA mixtures used

03

cfDNA samples

Use of > 1000 euploid cfDNA samples with birth outcome/ cytogenetic analysis for evaluating specificity (> 99.9%)

Analytical validation study indicated 95% sensitivity for genome-wide events 7 Mb or larger can be achieved while maintaining a specificity > 99.9%

24

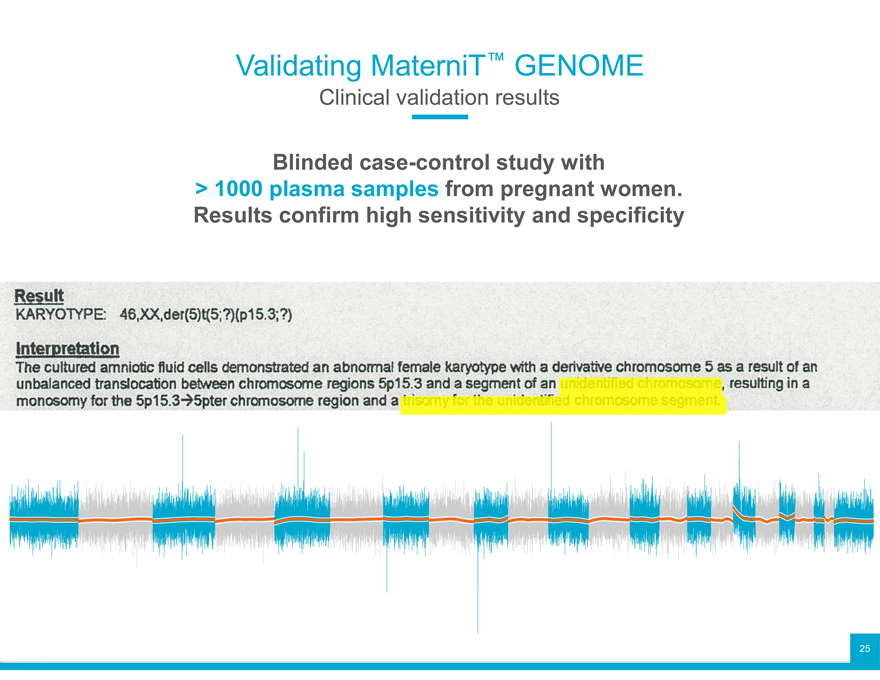

Validating MaterniT™ GENOME

Clinical validation results

Blinded case-control study with > 1000 plasma samples from pregnant women. Results confirm high sensitivity and specificity

25

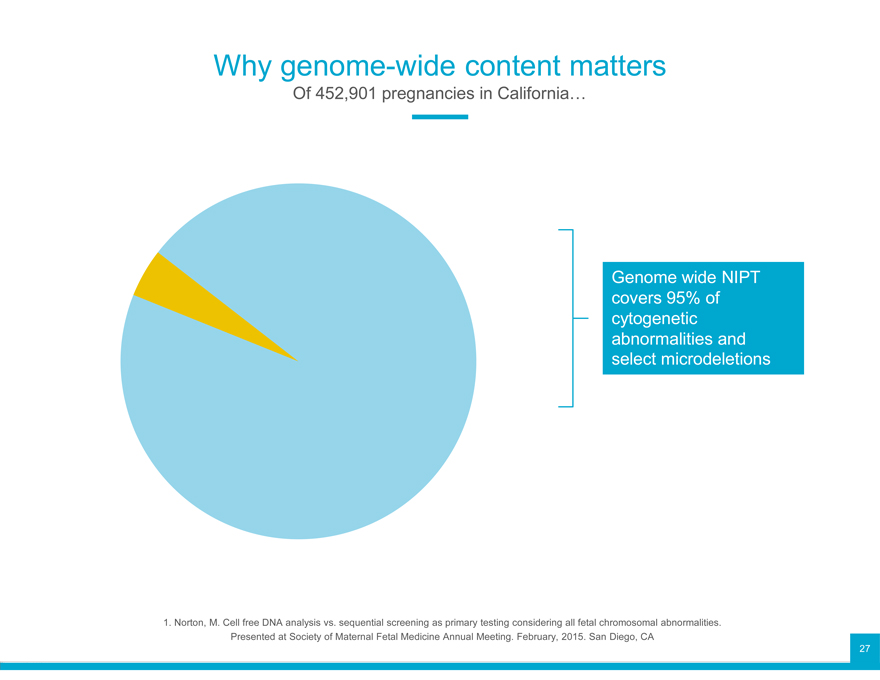

Why genome-wide content matters

Of 452,901 pregnancies in California…

Current NIPT

(T21/18/13 and SCA)

misses > 20%

of total cytogenetic

abnormalities

1. Norton, M. Cell free DNA analysis vs. sequential screening as primary testing considering all fetal chromosomal abnormalities.

Presented at Society of Maternal Fetal Medicine Annual Meeting. February, 2015. San Diego, CA

26

Why genome-wide content matters

Of 452,901 pregnancies in California…

Genome wide NIPT covers 95% of cytogenetic abnormalities and select microdeletions

1. Norton, M. Cell free DNA analysis vs. sequential screening as primary testing considering all fetal chromosomal abnormalities.

Presented at Society of Maternal Fetal Medicine Annual Meeting. February, 2015. San Diego, CA

27

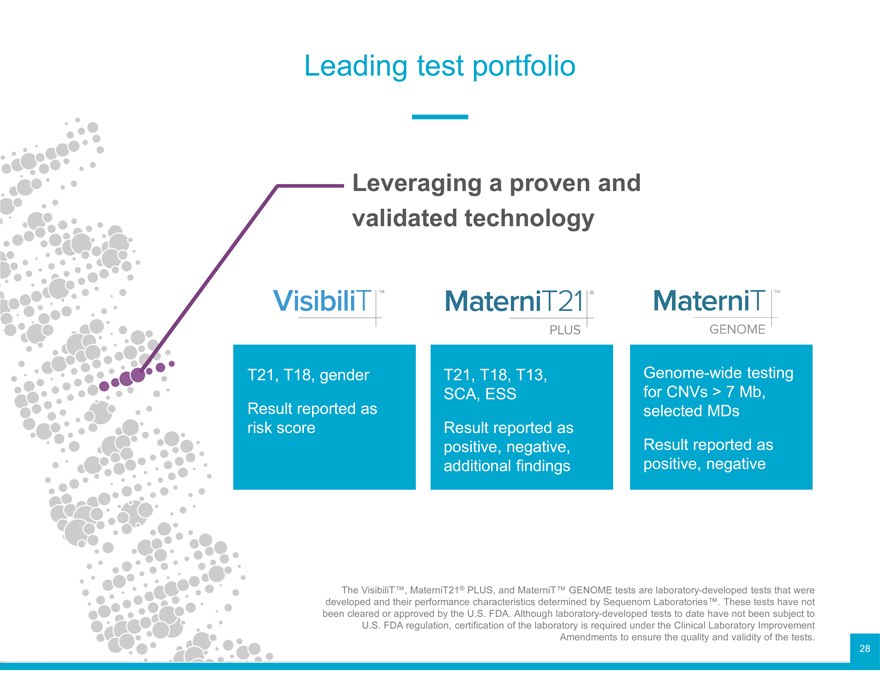

Leading test portfolio

Leveraging a proven and validated technology

T21, T18, gender T21, T18, T13, Genome-wide testing

SCA, ESS for CNVs > 7 Mb,

Result reported as selected MDs

risk score Result reported as

positive, negative, Result reported as

additional findings positive, negative

The VisibiliT™, MaterniT21® PLUS, and MaterniT™ GENOME tests are laboratory-developed tests that were

developed and their performance characteristics determined by Sequenom Laboratories™. These tests have not

been cleared or approved by the U.S. FDA. Although laboratory-developed tests to date have not been subject to

U.S. FDA regulation, certification of the laboratory is required under the Clinical Laboratory Improvement

Amendments to ensure the quality and validity of the tests. 28

Take-home messages

Shaping the future of NIPT

Best-in-class technology

Robust product portfolio spanning high content needs and cost effective requirements

Continuous and responsible innovation

29

Reproductive health and genetic testing

Rob Lozuk Senior Vice President Commercial Operations

1

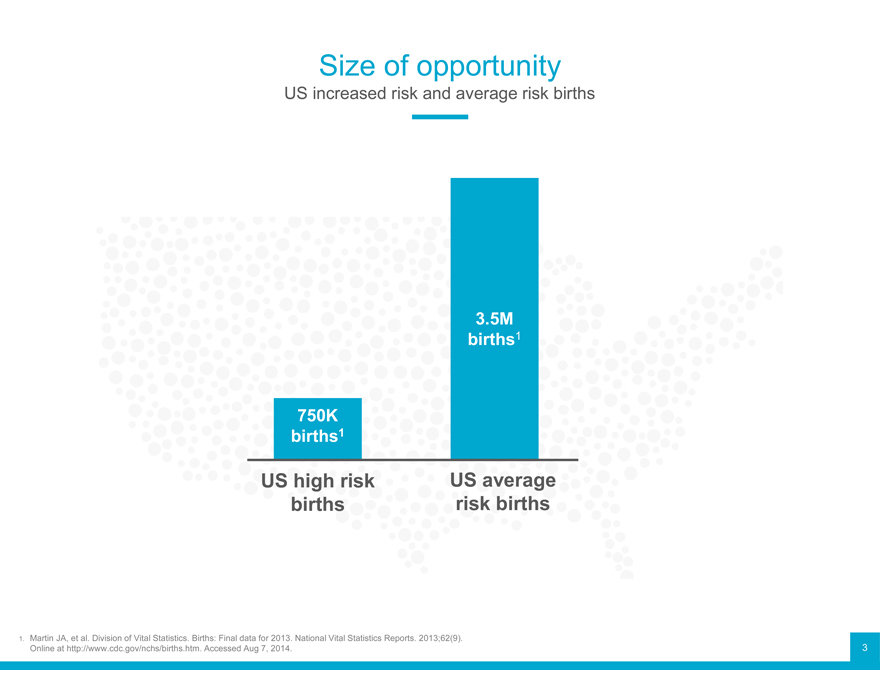

Commercial execution

Size of opportunity

US increased risk and average risk births

3.5M births1

750K births1

US high risk US average births risk births

1. Martin JA, et al. Division of Vital Statistics. Births: Final data for 2013. National Vital Statistics Reports. 2013;62(9). 3 Online at http://www.cdc.gov/nchs/births.htm. Accessed Aug 7, 2014.

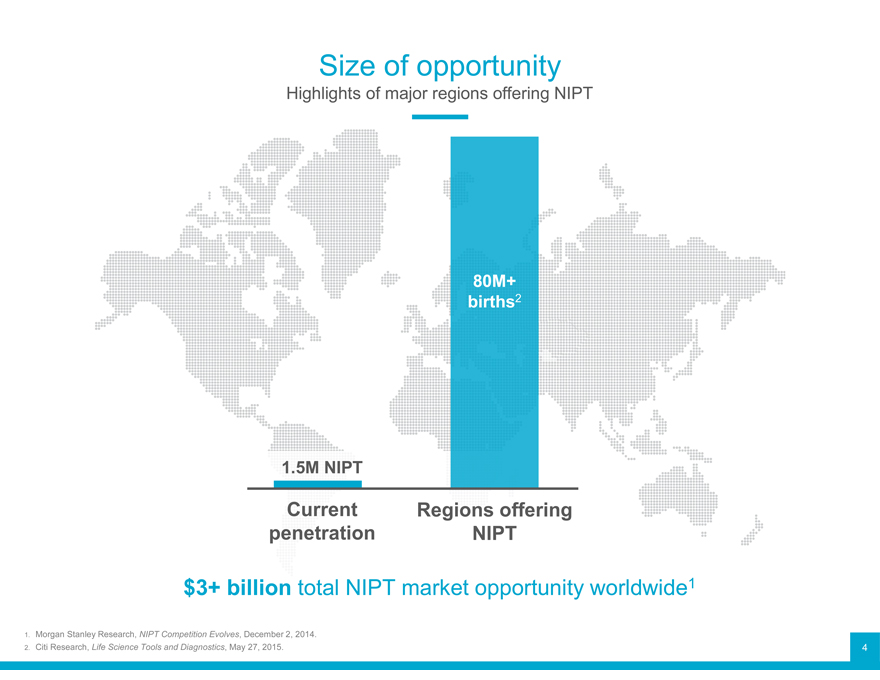

Size of opportunity

Highlights of major regions offering NIPT

80M+ births2

1.5M NIPT

Current Regions offering penetration NIPT

$3+ billion total NIPT market opportunity worldwide1

1. 2. Morgan Stanley Research, NIPT Competition Evolves, December 2, 2014.

Citi Research, Life Science Tools and Diagnostics, May 27, 2015. 4

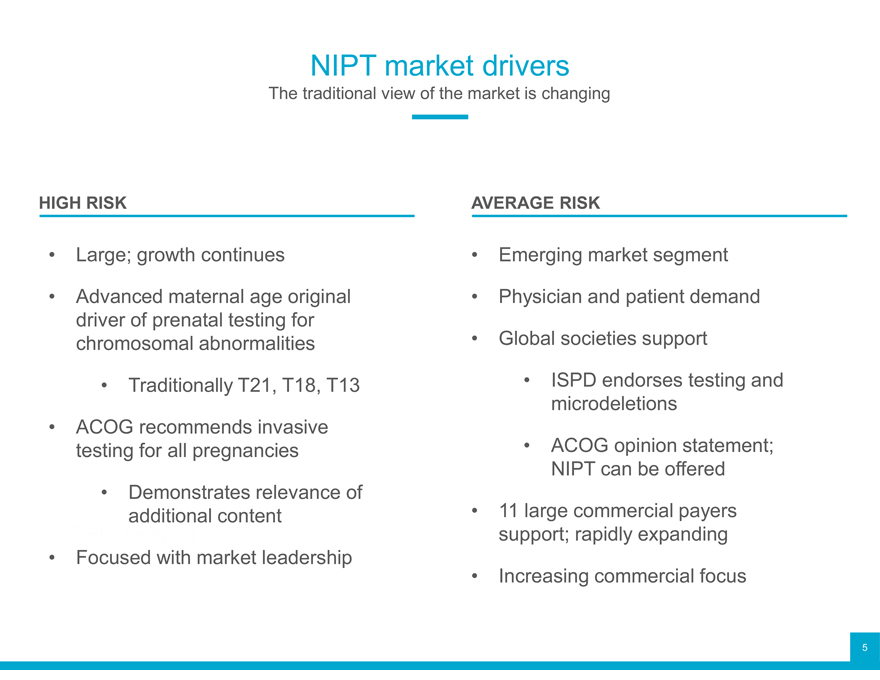

NIPT market drivers

The traditional view of the market is changing

HIGH RISK AVERAGE RISK

Large; growth continues Emerging market segment

Advanced maternal age original Physician and patient demand

driver of prenatal testing for

chromosomal abnormalities Global societies support

Traditionally T21, T18, T13 ISPD endorses testing and

ACOG recommends invasive microdeletions

testing for all pregnancies ACOG opinion statement;

Demonstrates relevance of NIPT can be offered

additional content 11 large commercial payers

support; rapidly expanding

Focused with market leadership Increasing commercial focus

5

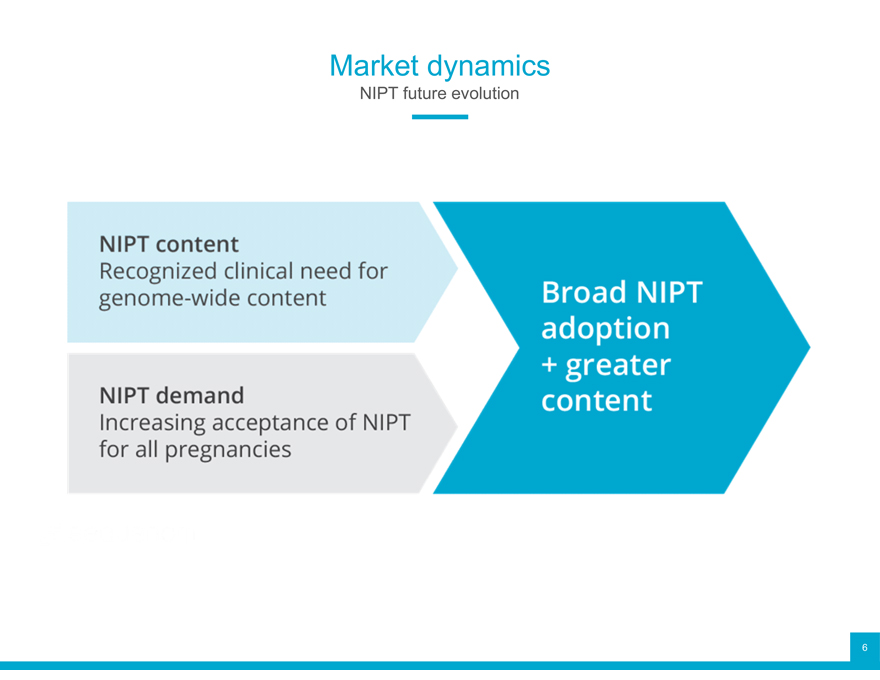

Market dynamics

NIPT future evolution

6

Positioned to serve the MFM + OB customer groups

Growing our reproductive health franchise

Large whole-genome Broad and differentiated sequencing footprint product portfolio

Comprehensive Focused commercial customer solutions organization

Trusted partner Enabling the global market

7

Large whole-genome sequencing footprint

Broad and differentiated product portfolio Comprehensive customer solutions Focused commercial organization Trusted partners Enabling the global market

Large whole-genome sequencing footprint

Sequenom Laboratories

CAP-accredited First clinical Capacity to

+ CLIA-certified laboratory to accommodate molecular operationalize significant diagnostics and scale NGS growth laboratories

9

Large whole-genome sequencing footprint

Broad and differentiated product portfolio

Comprehensive customer solutions Focused commercial organization Trusted partners Enabling the global market

Our portfolio today

Comprehensive reproductive health franchise to service the MFM and OB communities

Carrier HerediT screen ® UNIVE that d Genome-wide MaterniT™ GENOME fetal aneuploidies

> 250 disorders

HerediT Carrier screen ® CF that MaterniT21® PLUS

Select fetal aneuploidies detects > 136 cystic fibrosis mutations VisibiliT Risk assessment ™ for chromosomes 21 and 18 SensiGene RhD genotype ® in RHD RhD-sensitized mothers CVS NextView and amniocentesis ®

Newborn + pediatric

Opportunity for further expansion

11

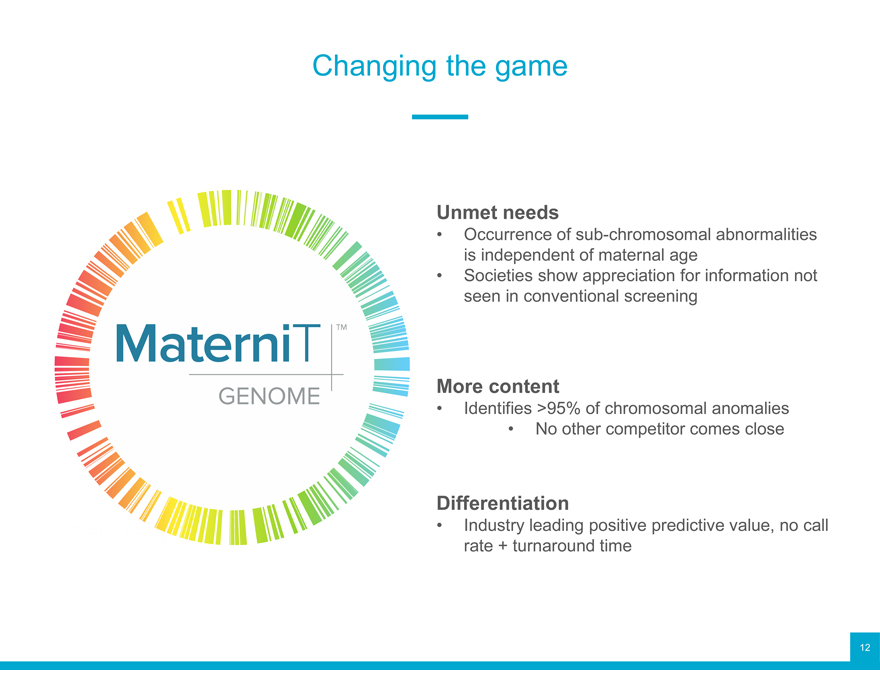

Changing the game

Unmet needs

Occurrence of sub-chromosomal abnormalities is independent of maternal age

Societies show appreciation for information not seen in conventional screening

More content

Identifies >95% of chromosomal anomalies

No other competitor comes close

Differentiation

Industry leading positive predictive value, no call rate + turnaround time

12

Large whole-genome sequencing footprint Broad and differentiated product portfolio

Comprehensive customer solutions

Focused commercial organization Trusted partners Enabling the global market

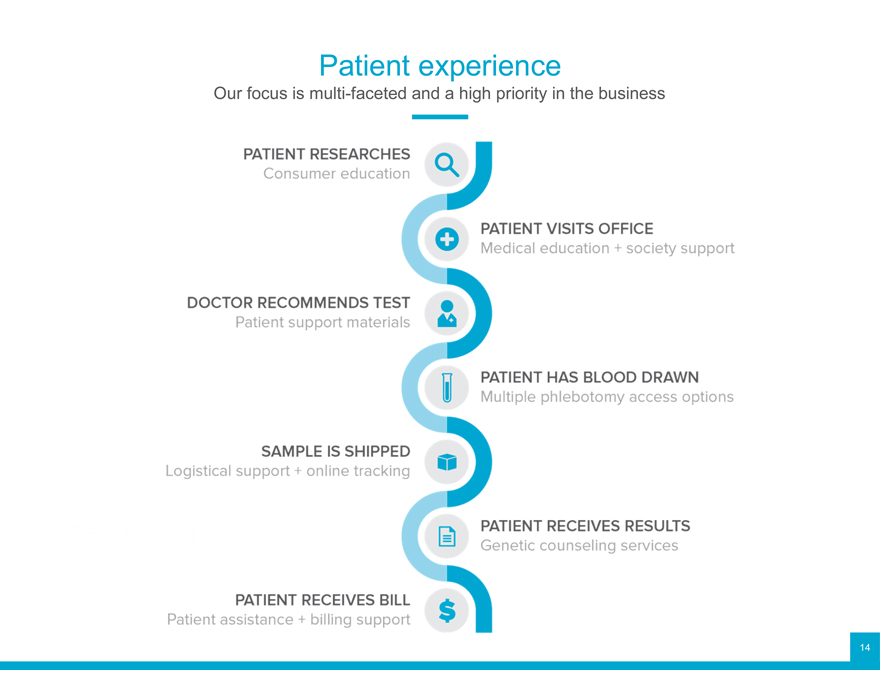

Patient experience

Our focus is multi-faceted and a high priority in the business

14

Large whole-genome sequencing footprint Broad and differentiated product portfolio Comprehensive customer solutions

Focused commercial organization

Trusted partners Enabling the global market

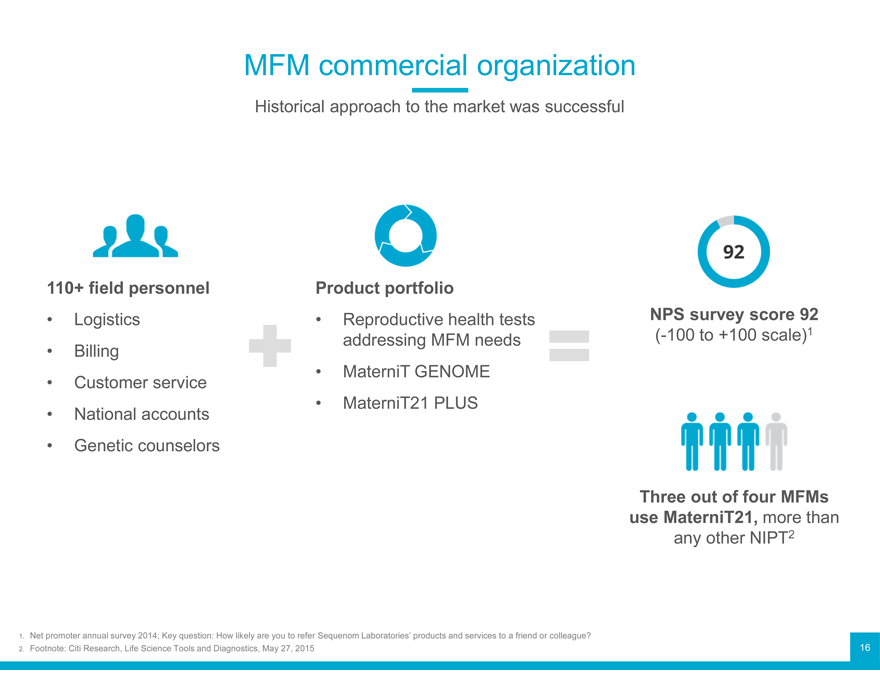

MFM commercial organization

Historical approach to the market was successful

110+ f nnel Product portfolio

Logistics Reproductive health tests NPS survey score 92 addressing MFM needs (-100 to +100 scale)1

Billing

Customer service MaterniT21 MaterniT GENOME PLUS

National Genetic counselors accounts

Thre FMs use MaterniT21, more than any other NIPT2

1. Net promoter annual survey 2014; Key question: How likely are you to refer Sequenom Laboratories’ products and services to a friend or colleague?

2. Footnote: Citi Research, Life Science Tools and Diagnostics, May 27, 2015 16

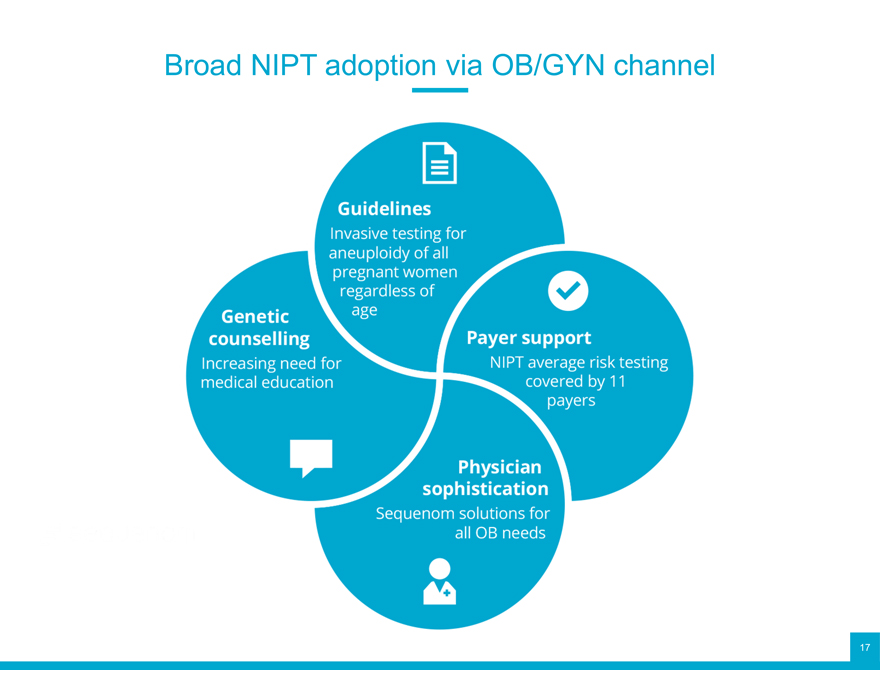

Broad NIPT adoption via OB/GYN channel

17

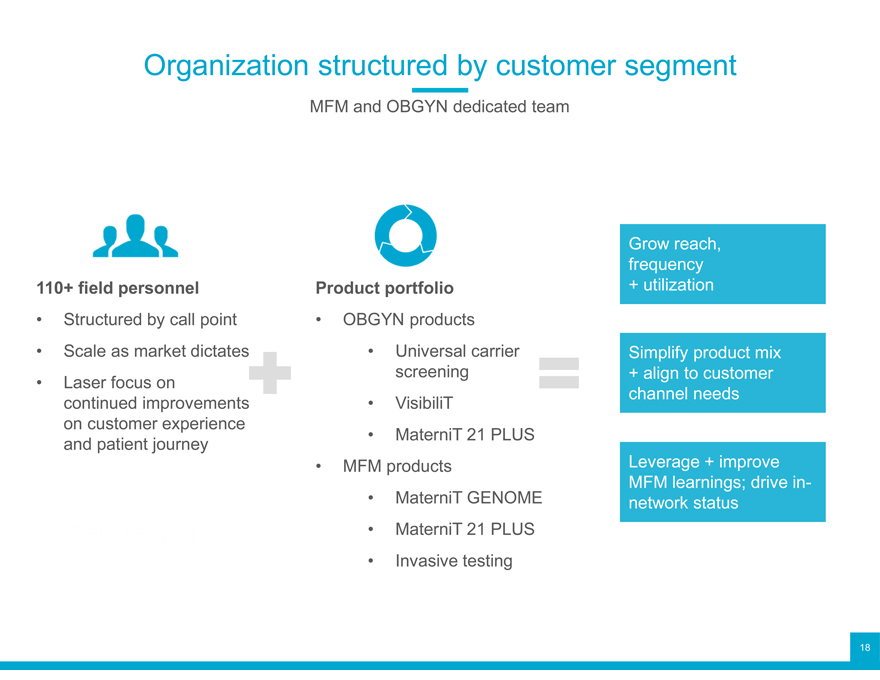

Organization structured by customer segment

MFM and OBGYN dedicated team

Grow reach, frequency

110+ fi nel Product portfolio + utilization Scale Structured as market by call dictates point OBGYN Universal products carrier Simplify product mix

Laser focus on screening + align to customer continued improvements VisibiliT channel needs on customer experience MaterniT 21 PLUS and patient journey

MFM products Leverage + improve

MaterniT GENOME MFM learnings; drive in-network status Invasive MaterniT testing 21 PLUS

18

Large whole-genome sequencing footprint Broad and differentiated product portfolio Comprehensive customer solutions Focused commercial organization

Trusted partners

Enabling the global market

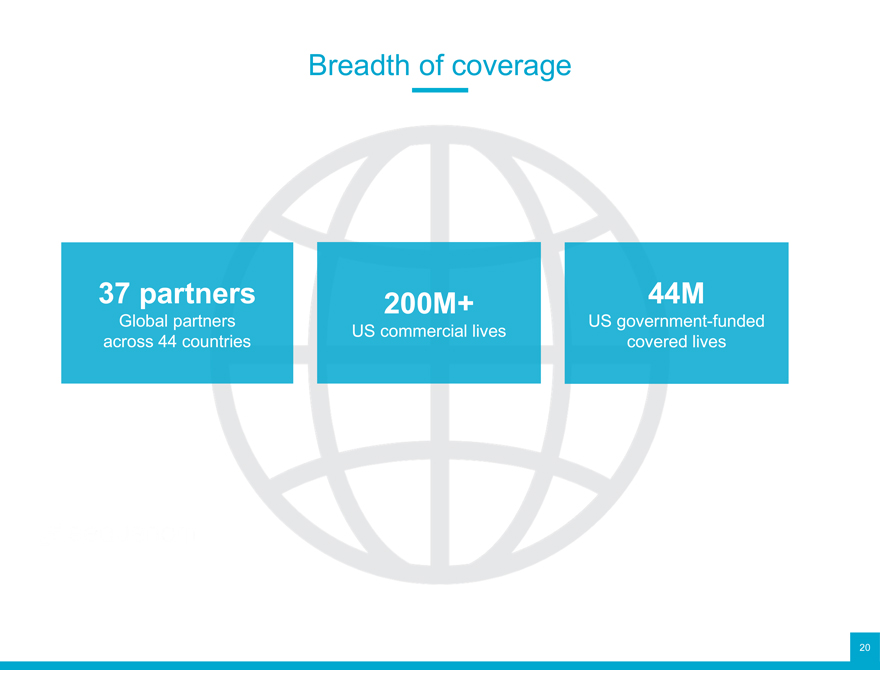

Breadth of coverage

37 partners 200M+ 44M

Global partners US commercial lives US government-funded across 44 countries covered lives

20

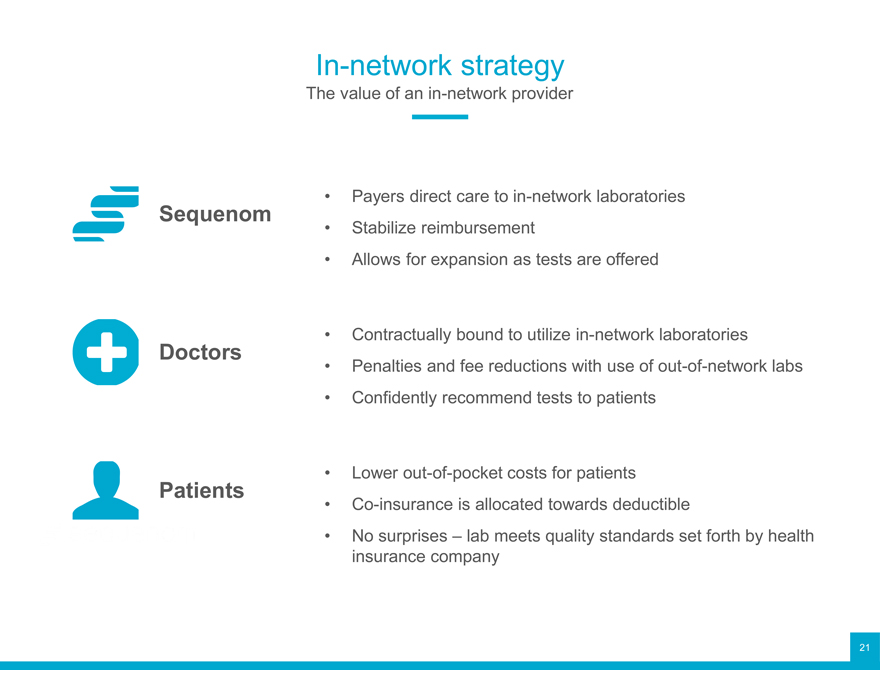

In-network strategy

The value of an in-network provider

Sequenom Stabilize Payers direct reimbursement care to in-network laboratories

Allows for expansion as tests are offered

Doctors Penalties Contractually and bound fee reductions to utilize with in-network use of out-of-network laboratories labs

Confidently recommend tests to patients

Patients Co-insurance Lower out-of-pocket is allocated costs towards for patients deductible

No surprises – lab meets quality standards set forth by health insurance company

21

Large whole-genome sequencing footprint Broad and differentiated product portfolio Comprehensive customer solutions Focused commercial organization Trusted partners

Enabling the global market

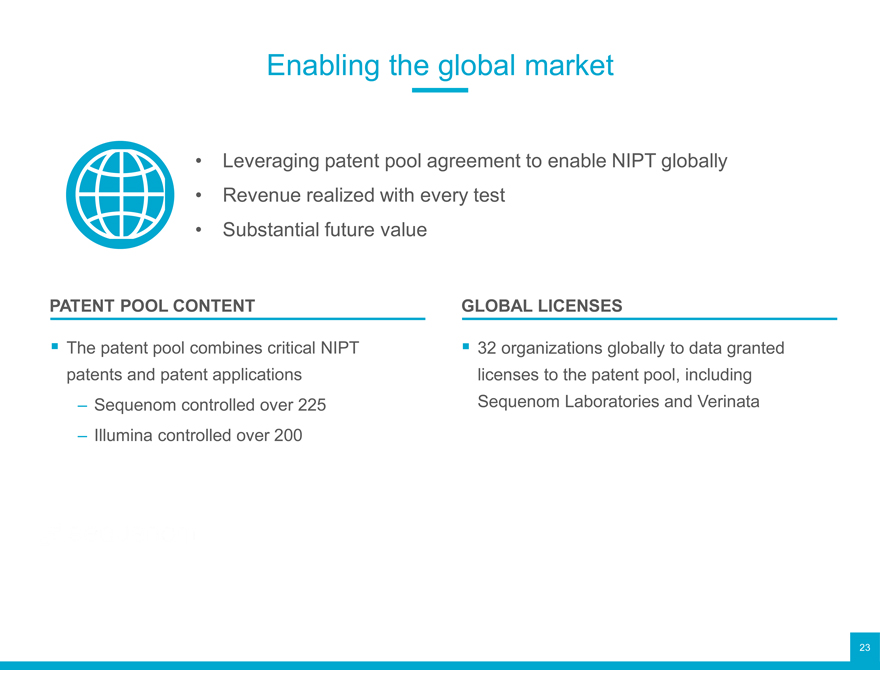

Enabling the global market

Leveraging patent pool agreement to enable NIPT globally

Revenue realized with every test

Substantial future value

PATENT POOL CONTENT GLOBAL LICENSES

The patent pool combines critical NIPT ? 32 organizations globally to data granted patents and patent applications licenses to the patent pool, including

Sequenom controlled over 225 Sequenom Laboratories and Verinata

Illumina controlled over 200

23

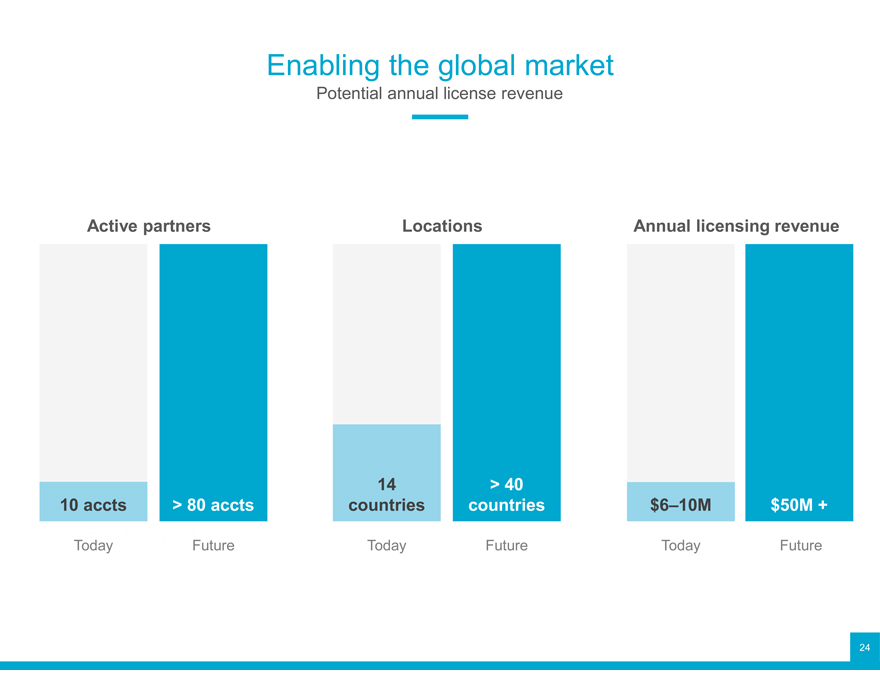

Enabling the global market

Potential annual license revenue

Active partners Locations Annual licensing revenue

14 > 40

10 accts > 80 accts countries countries $6–10M $50M +

Today Future Today Future Today Future

24

Key takeaways

Well positioned for future growth

Unparalleled in-network footprint

Expansive product portfolio and commercial focus that aligns to customer needs Commitment to the patient experience Numerous revenue streams that monetize the rapidly expanding global marketplace

25

Oncology

Mathias Ehrich, MD Senior Vice President Research and Development

1

Experience and expertise in oncology

Sequenom milestones

EpiTYPER® OncoCARTA™ UltraSEEK™

First in methylation First in mutation First in sensitivity

Oncology expertise

Sequenom

oncology today

Reproductive health experience

MaterniT21® PLUS NIPT + cancer MaterniT™ GENOME

First in NIPT First case First genome-wide

Note: EpiTYPER, OncoCARTA, and UltraSEEK are products of Agena Bioscience 2

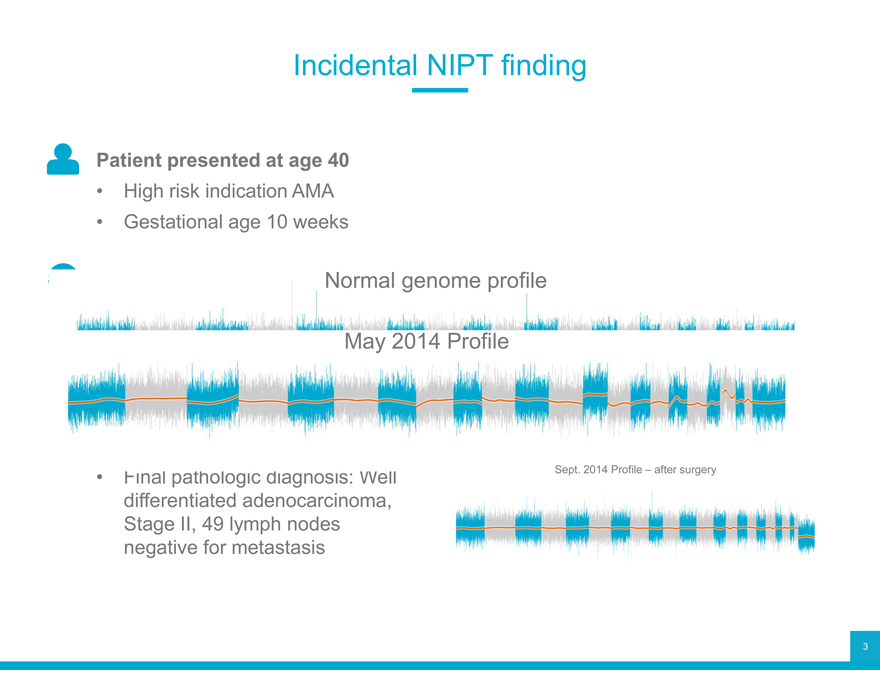

Incidental NIPT finding

Patient presented at age 40

High risk indication AMA

Gestational age 10 weeks

Normal genome profile May 2014 Profile

Sept. 2014 Profile – after surgery

differentiated adenocarcinoma, Stage II, 49 lymph nodes negative for metastasis

3

Patient story

Video

Eunice Lee, M.D.

4

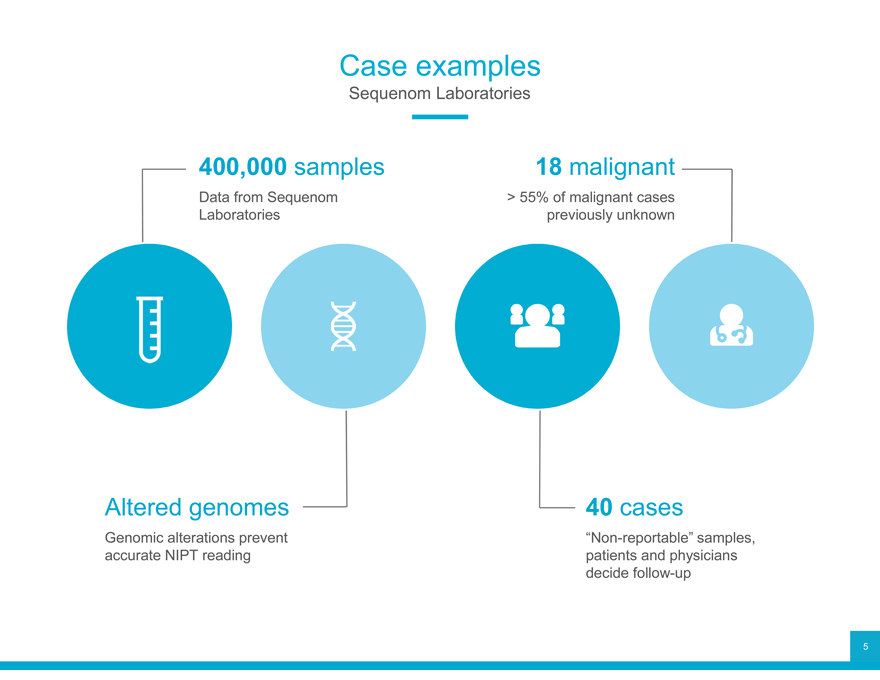

Case examples

Sequenom Laboratories

400,000 Data from Sequenom samples > 55% 18 of malignant malignant cases Laboratories previously unknown

Altered Genomic alterations genomes prevent 40 “Non-reportable” cases samples, accurate NIPT reading patients and physicians decide follow-up

5

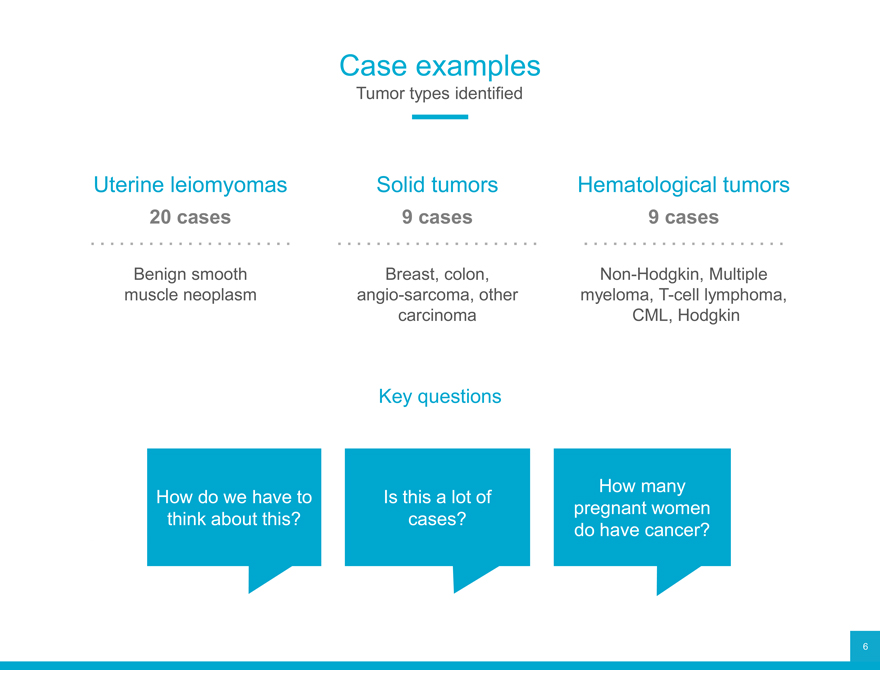

Case examples

Tumor types identified

Uterine leiomyomas Solid tumors Hematological tumors

20 cases 9 cases 9 cases

Benign smooth Breast, colon, Non-Hodgkin, Multiple muscle neoplasm angio-sarcoma, other myeloma, T-cell lymphoma, carcinoma CML, Hodgkin

Key questions

How do we have to Is this a lot of How many think about this? cases? pregnant women do have cancer?

6

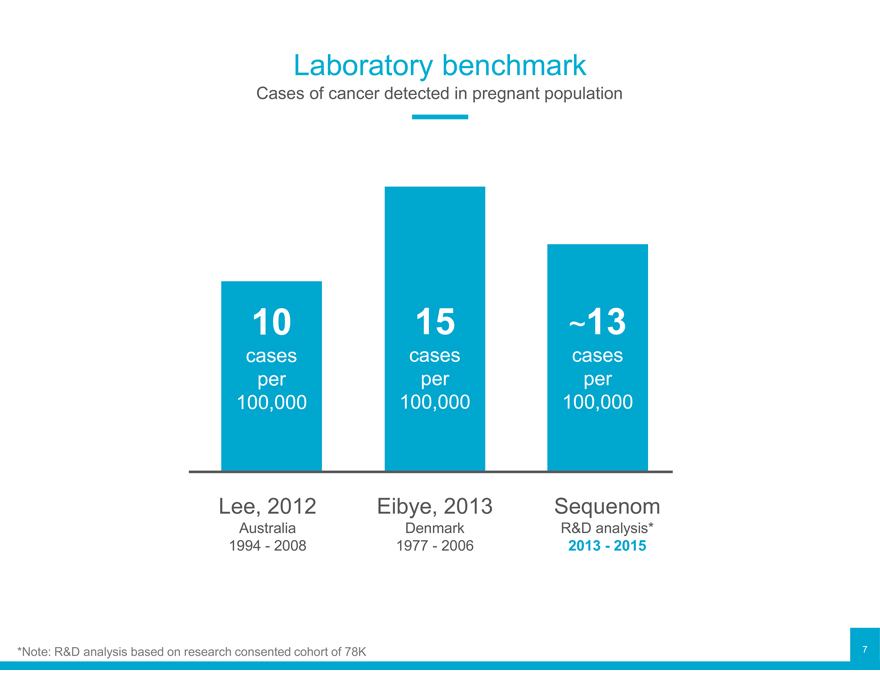

Laboratory benchmark

Cases of cancer detected in pregnant population

10 15 ~13

cases cases cases per per per 100,000 100,000 100,000

Lee, 2012 Eibye, 2013 Sequenom

Australia Denmark R&D analysis* 1994—2008 1977—2006 2013—2015

*Note: R&D analysis based on research consented cohort of 78K

7

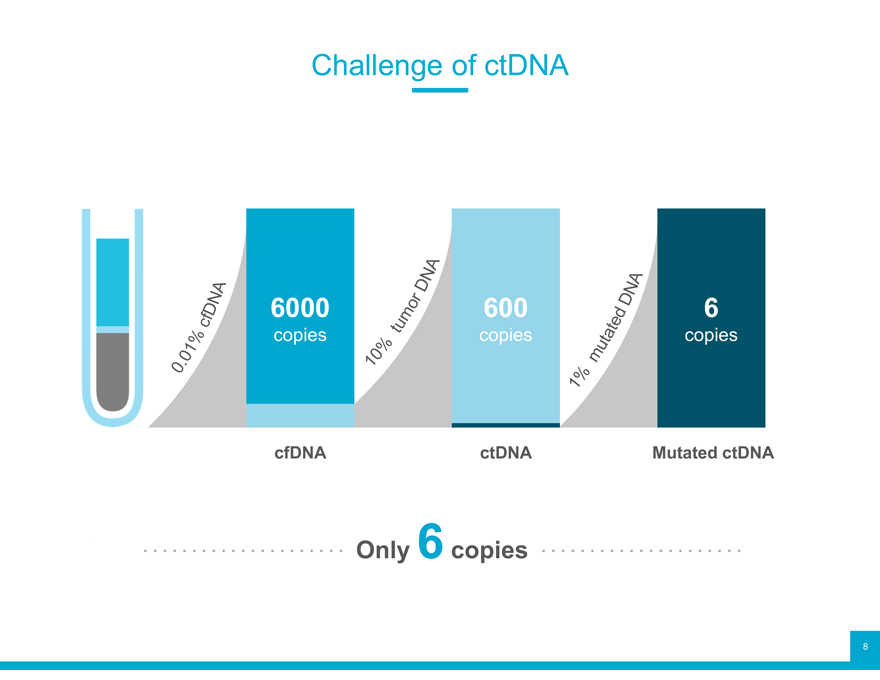

Challenge of ctDNA

6000 600 6

copies copies copies

cfDNA ctDNA Mutated ctDNA

Only 6copies

8

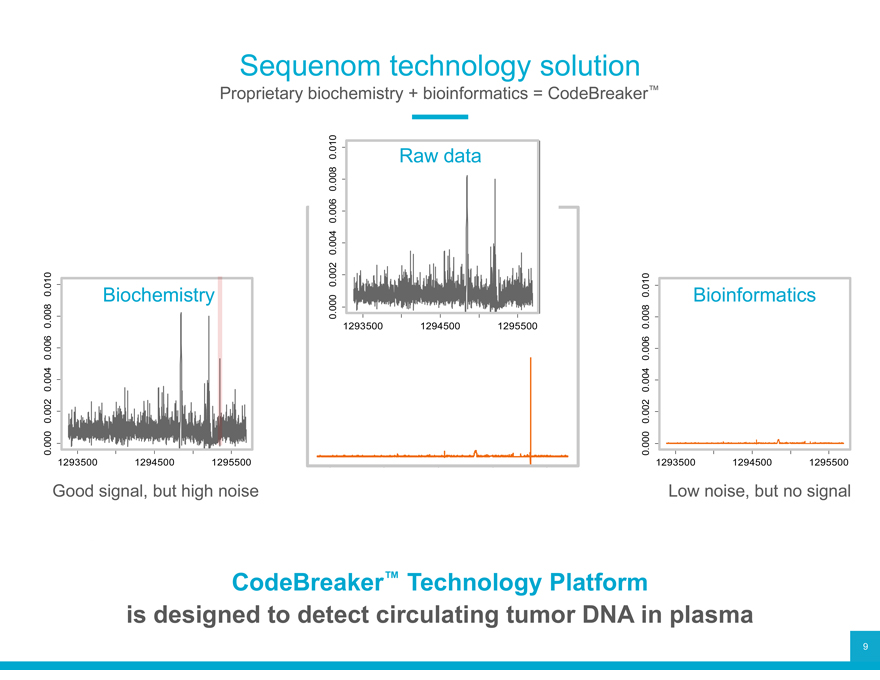

Sequenom technology solution

Proprietary biochemistry + bioinformatics = CodeBreaker™

0.010 Raw data

0.008

0.010 0.006 CodeBreaker™

0.004

0.008 0.002

0.010 Biochemistry 0.010 Bioinformatics

0.008 0.000 0.008

0.006 1293500 1294500 1295500

0.006 0.004 0.006 0.004 0.004 0.002 0.002 0.002 0.000 0.000

1293500 1294500 1295500 0.000 1293500 1294500 1295500

Good signal, but high noise 1293500 1294500 1295500 Low noise, but no signal

CodeBreaker™ Technology Platform is designed to detect circulating tumor DNA in plasma

9

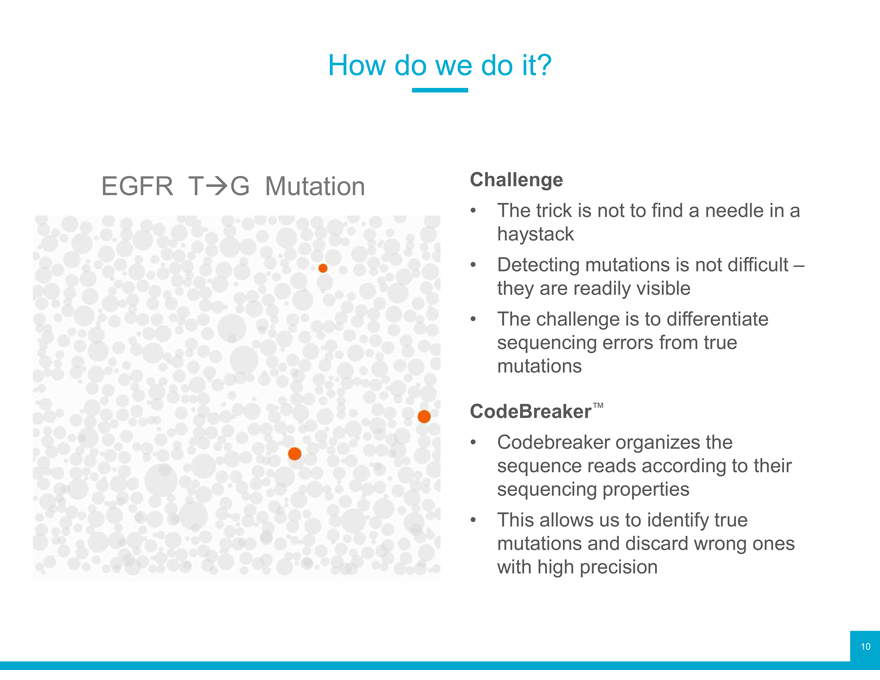

How do we do it?

EGFR T G Mutation Challenge

The trick is not to find a needle in a

haystack

Detecting mutations is not difficult –

they are readily visible

The challenge is to differentiate

sequencing errors from true

mutations

CodeBreaker™

Codebreaker organizes the

sequence reads according to their

sequencing properties

This allows us to identify true

mutations and discard wrong ones

with high precision

10

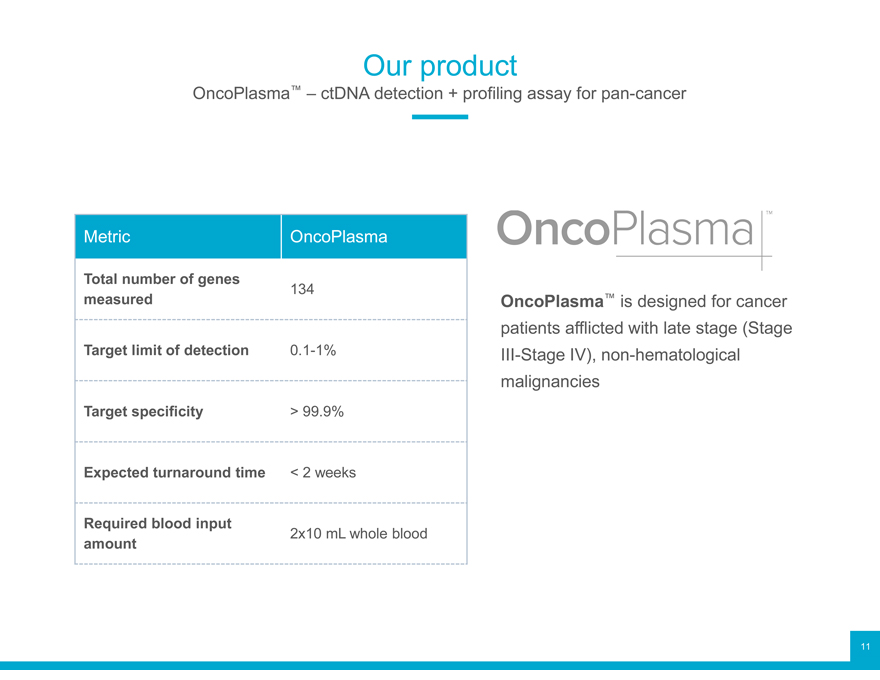

Our product

OncoPlasma™ – ctDNA detection + profiling assay for pan-cancer

Metric OncoPlasma

Total number of genes 134

measured OncoPlasma™ is designed for cancer

patients afflicted with late stage (Stage

Target limit of detection 0.1-1% III-Stage IV), non-hematological

malignancies

Target specificity > 99.9%

Expected turnaround time < 2 weeks

Required blood input 2x10 mL whole blood

amount

11

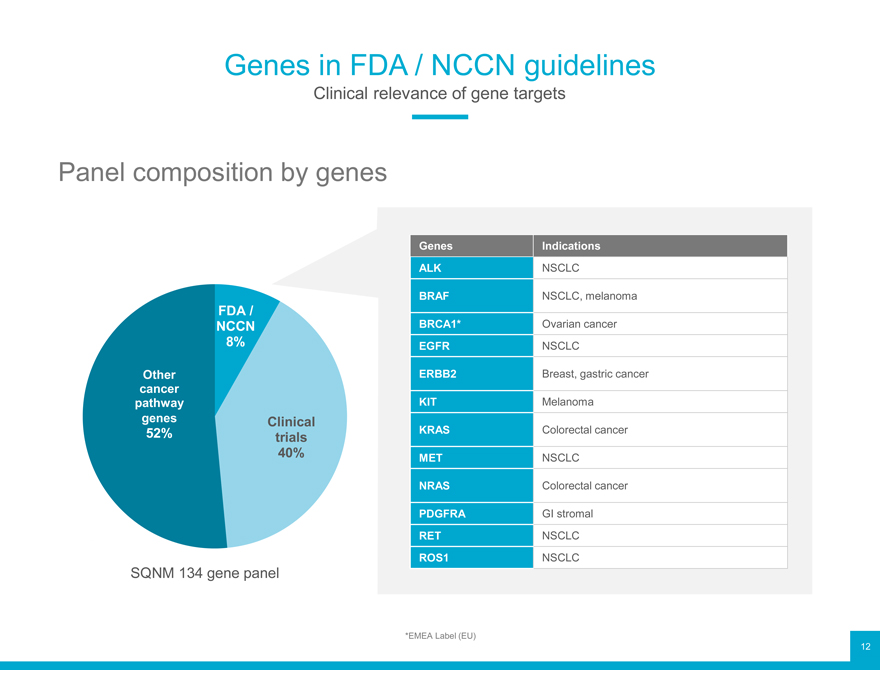

Genes in FDA / NCCN guidelines

Clinical relevance of gene targets

Panel composition by genes

Genes Indications

ALK NSCLC

FDA / BRAF NSCLC, melanoma

NCCN BRCA1* Ovarian cancer

8% EGFR NSCLC

Other ERBB2 Breast, gastric cancer

cancer

pathway KIT Melanoma

genes 52% Clinical trials KRAS Colorectal cancer

40% MET NSCLC

NRAS Colorectal cancer

PDGFRA GI stromal

RET NSCLC

SQNM 134 gene panel ROS1 NSCLC

*EMEA Label (EU) 12

12

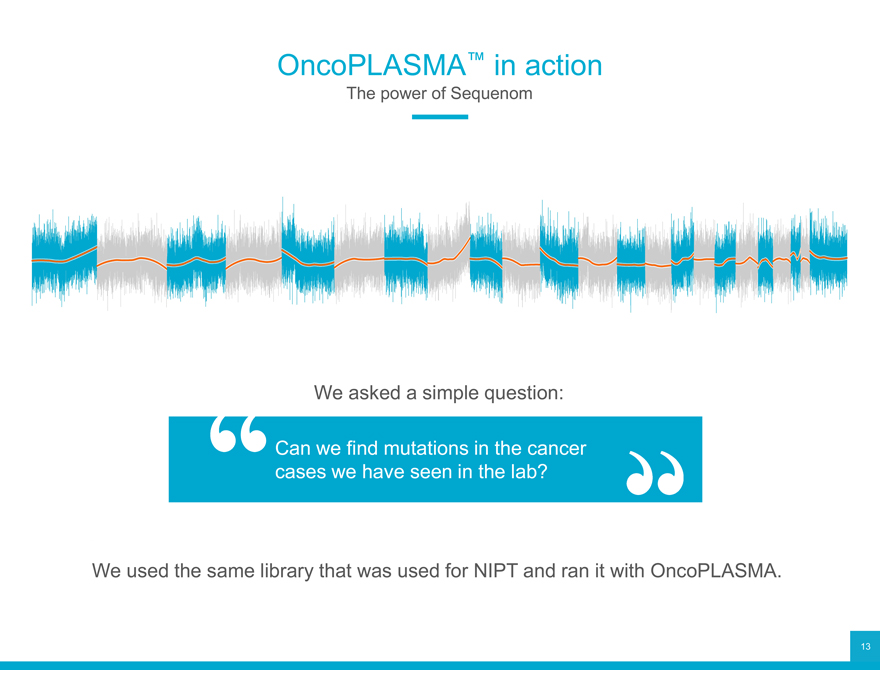

OncoPLASMA™ in action

The power of Sequenom

We asked a simple question: Can we find mutations in the cancer cases we have seen in the lab?

We used the same library that was used for NIPT and ran it with OncoPLASMA.

13

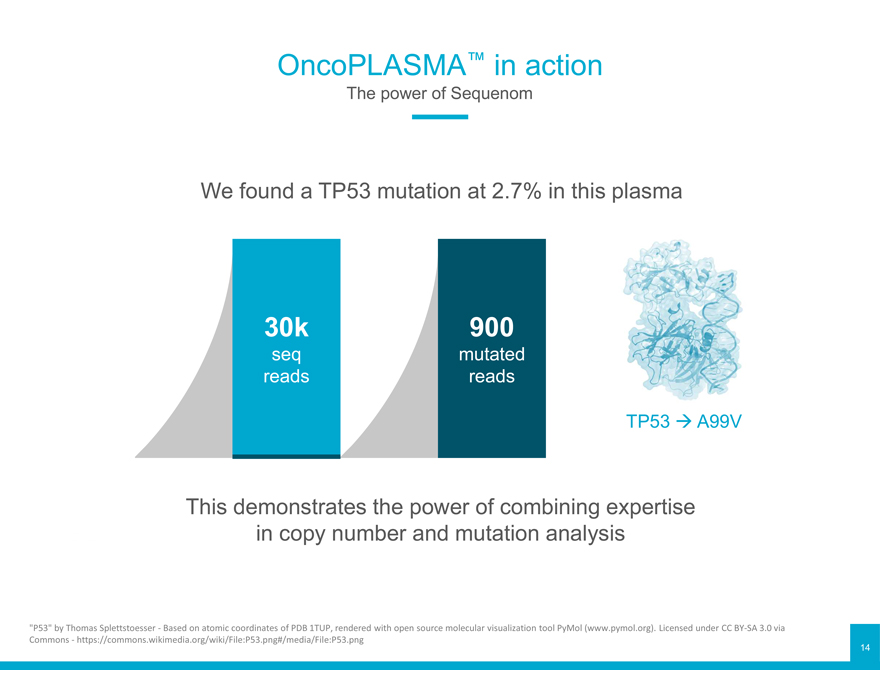

OncoPLASMA™ in action

The power of Sequenom

We found a TP53 mutation at 2.7% in this plasma

30k 900

seq mutated reads reads

TP53 A99V

This demonstrates the power of combining expertise in copy number and mutation analysis

“P53” by Thomas Splettstoesser -Based on atomic coordinates of PDB 1TUP, rendered with open source molecular visualization toolPyMol (www.pymol.org). Licensed under CC BY-SA 3.0 via Commons -https://commons.wikimedia.org/wiki/File:P53.png#/media/File:P53.png

14

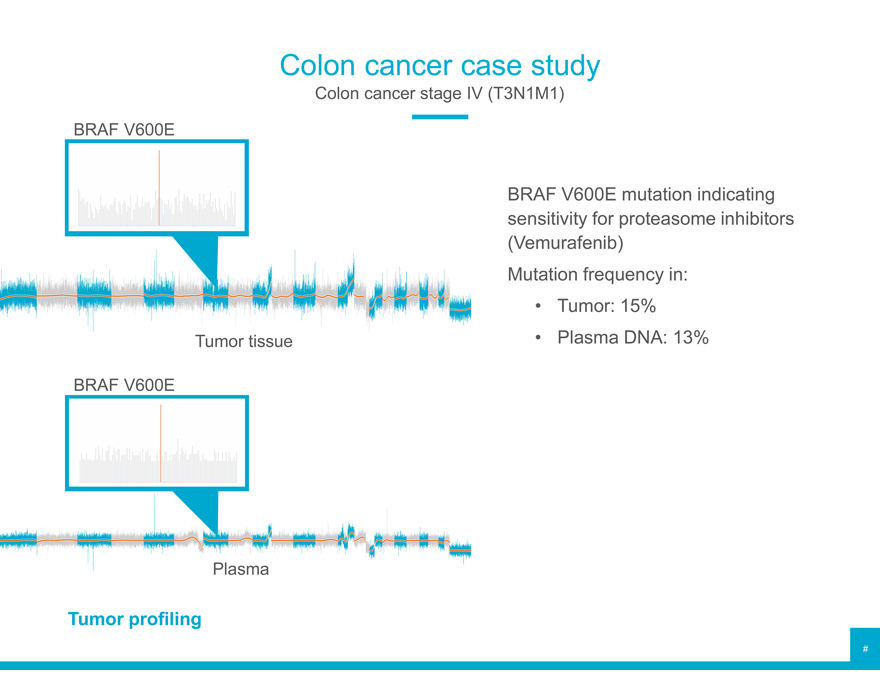

Colon cancer case study

Colon cancer stage IV (T3N1M1) BRAF V600E

BRAF V600E mutation indicating sensitivity for proteasome inhibitors (Vemurafenib) Mutation frequency in:

Tumor: 15% Tumor tissue Plasma DNA: 13%

BRAF V600E

Plasma

Tumor profiling

#

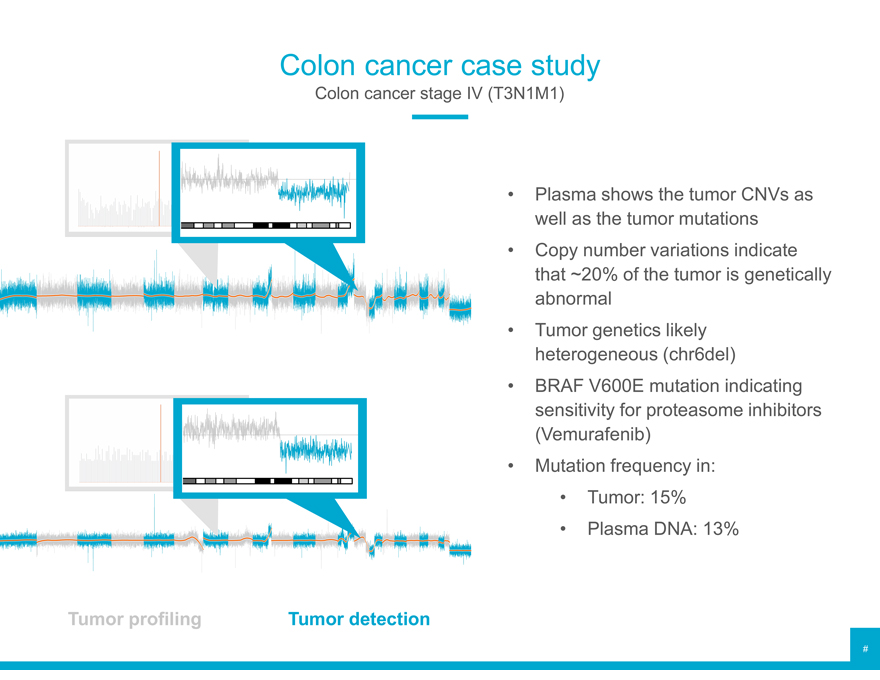

Colon cancer case study

Colon cancer stage IV (T3N1M1)

Plasma shows the tumor CNVs as well as the tumor mutations

Copy number variations indicate that ~20% of the tumor is genetically abnormal

Tumor genetics likely heterogeneous (chr6del)

BRAF V600E mutation indicating sensitivity for proteasome inhibitors (Vemurafenib)

Mutation frequency in:

Tumor: 15%

Plasma DNA: 13%

Tumor profiling Tumor detection

#

Market opportunity for early detection cancer

Copy number variations and mutations are important CNVs Mutation Copy number analysis is unique to Sequenom

17

Market opportunity for early detection cancer

The addition of DNA methylation analysis can provide superior results CNVs Mutation Sequenom has world-leading expertise in DNA methylation analysis:

Tech + application development Methylation Functional research in developmental biology

Fetal fraction pioneer

Fetal methylome

Methylation biomarker discovery in lung cancer, colon cancer, AML and pan-cancer

18

Market opportunity for early detection cancer

These programs can potentially be targeted towards CNVs Mutation • General population screening for colon cancer

Follow-up testing for node positive CT scan in lung cancer screening Methylation Or general cancer recurrence monitoring

19

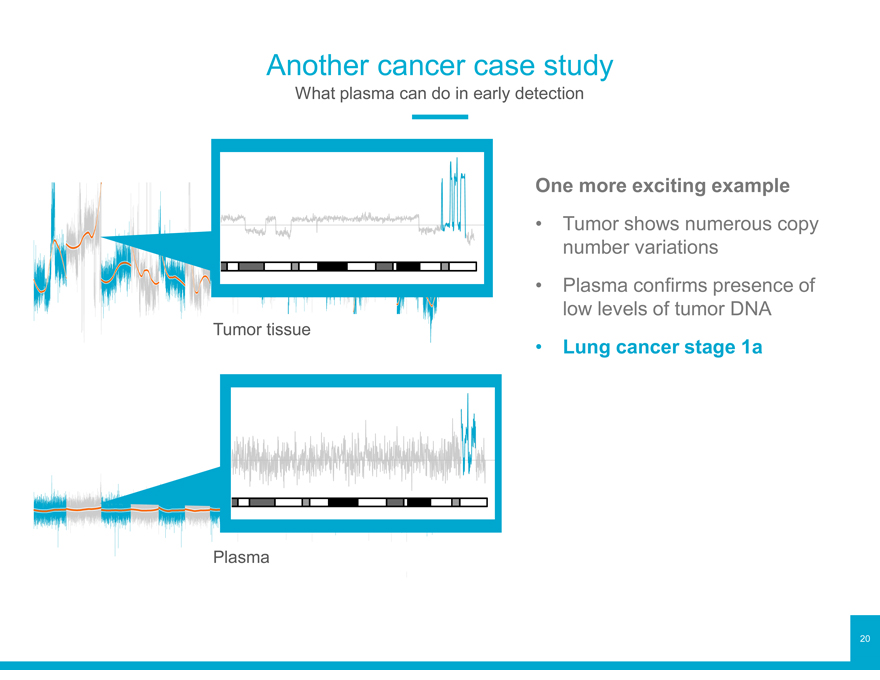

Another cancer case study

What plasma can do in early detection

One more exciting example

Tumor shows numerous copy number variations

Plasma confirms presence of low levels of tumor DNA

Tumor tissue • Lung cancer stage 1a

Plasma

20

Oncology

Daniel Grosu, MD Senior Vice President, Chief Medical Officer

1

Sequenom liquid biopsy collaboration

A key opinion leader’s perspective

Eric Topol, M.D.

Chief Academic Officer, Scripps Health Director, Scripps Translational Science Institute

2

Diversity of cancer

One name… many diseases

Glioblastoma Lung adenocarcinoma Breast

200+

types of cancer

Melanoma Colorectal Ovarian Uterine

3

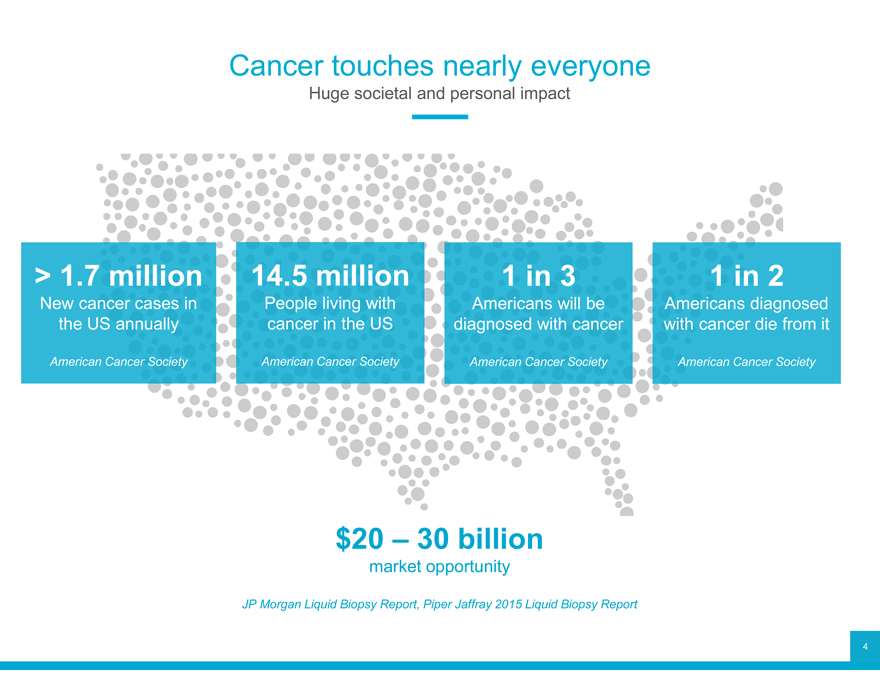

Cancer touches nearly everyone

Huge societal and personal impact

> 1.7 million 14.5 million 1 in 3 1 in 2

New cancer cases in People living with Americans will be Americans diagnosed the US annually cancer in the US diagnosed with cancer with cancer die from it

American Cancer Society American Cancer Society American Cancer Society American Cancer Society

$20 – 30 billion

market opportunity

JP Morgan Liquid Biopsy Report, Piper Jaffray 2015 Liquid Biopsy Report

4

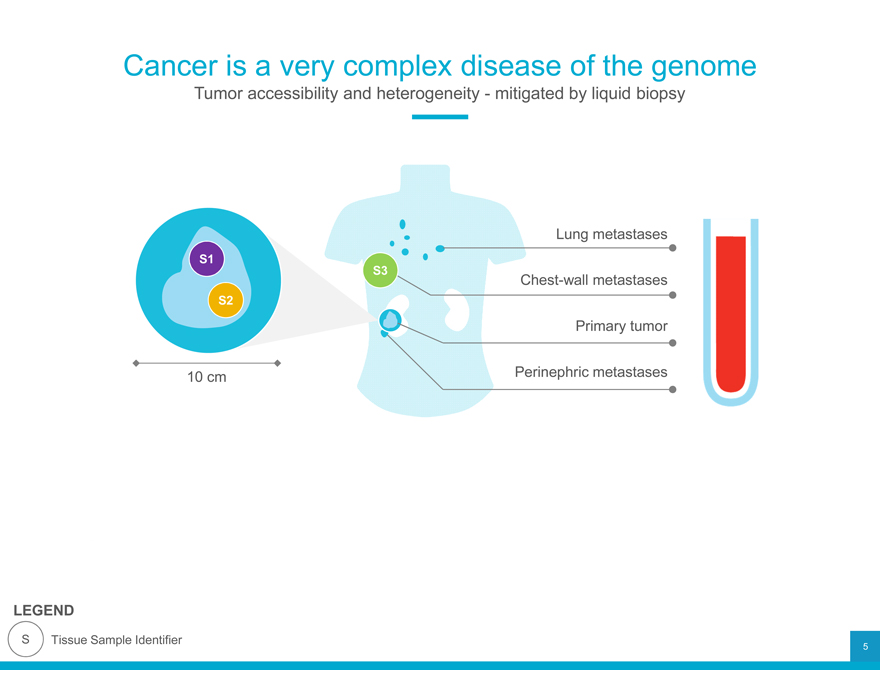

Cancer is a very complex disease of the genome

Tumor accessibility and heterogeneity—mitigated by liquid biopsy

Lung metastases

S1

S3 Chest-wall metastases

S2

Primary tumor 10 cm Perinephric metastases

LEGEND

S Tissue Sample Identifier

5

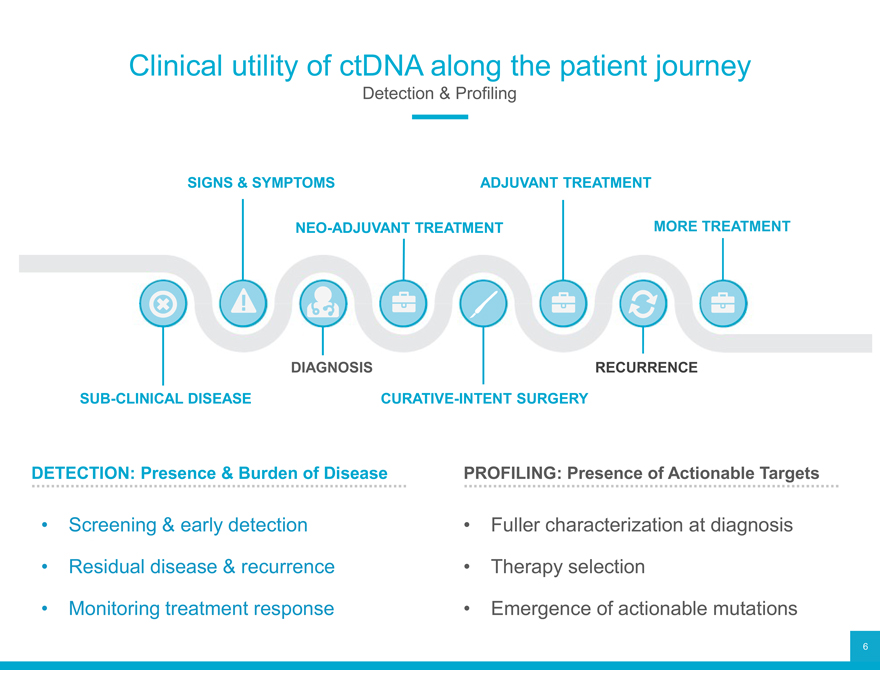

Clinical utility of ctDNA along the patient journey

Detection & Profiling

SIGNS & SYMPTOMS ADJUVANT TREATMENT

NEO-ADJUVANT TREATMENT MORE TREATMENT

DIAGNOSIS RECURRENCE

SUB-CLINICAL DISEASE CURATIVE-INTENT SURGERY

DETECTION: Presence & Burden of Disease PROFILING: Presence of Actionable Targets

Screening & early detection Fuller characterization at diagnosis

Residual disease & recurrence Therapy selection

Monitoring treatment response Emergence of actionable mutations

6

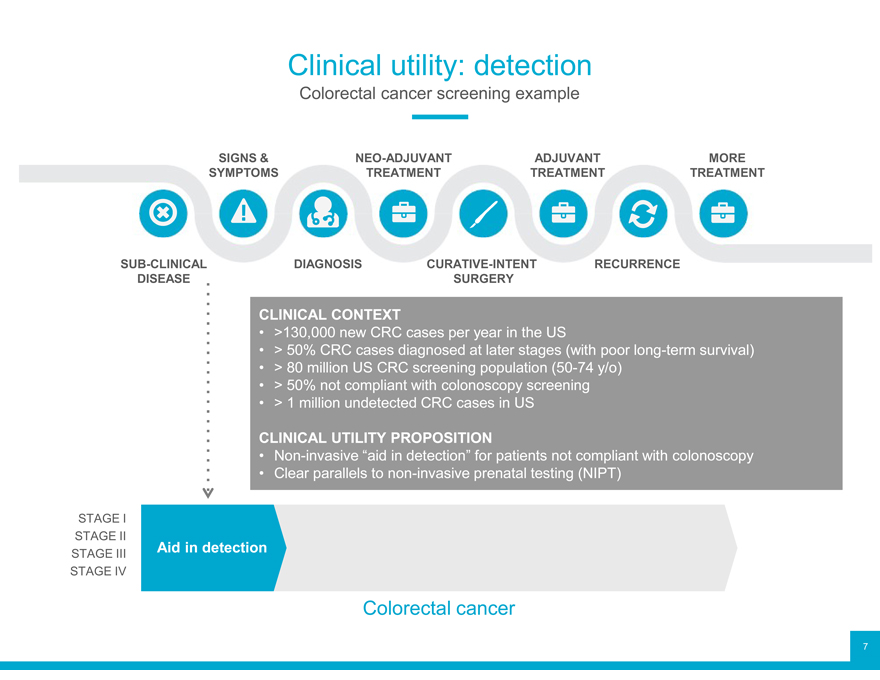

Clinical utility: detection

Colorectal cancer screening example

SIGNS & NEO-ADJUVANT ADJUVANT MORE SYMPTOMS TREATMENT TREATMENT TREATMENT

SUB-CLINICAL DIAGNOSIS CURATIVE-INTENT RECURRENCE DISEASE SURGERY

CLINICAL CONTEXT

>130,000 new CRC cases per year in the US

> 50% CRC cases diagnosed at later stages (with poor long-term survival)

> 80 million US CRC screening population (50-74 y/o)

> 50% not compliant with colonoscopy screening

> 1 million undetected CRC cases in US

CLINICAL UTILITY PROPOSITION

Non-invasive “aid in detection” for patients not compliant with colonoscopy

Clear parallels to non-invasive prenatal testing (NIPT)

STAGE I

STAGE II Aid in detection

STAGE III STAGE IV

Colorectal cancer

7

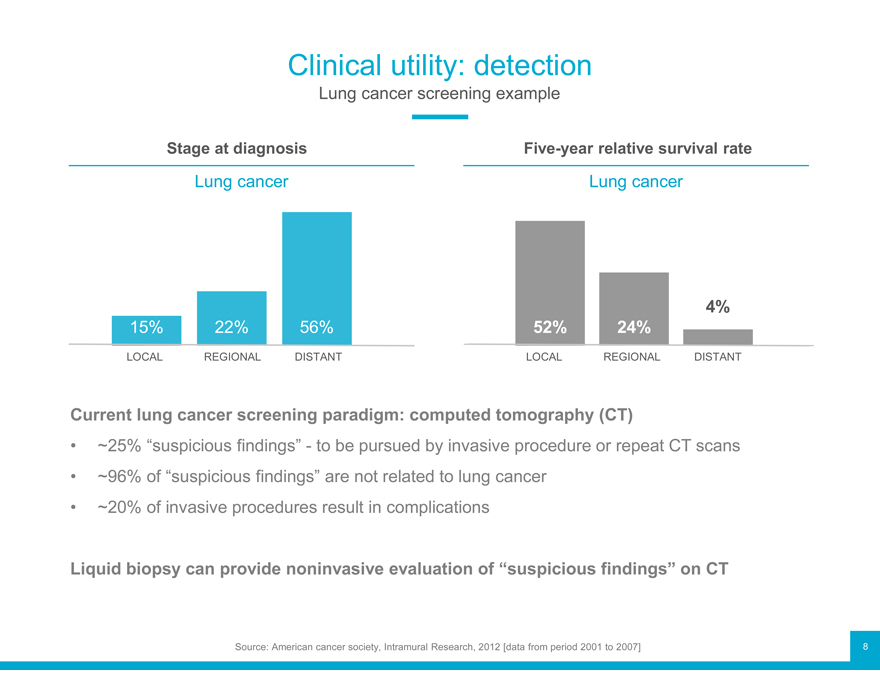

Clinical utility: detection

Lung cancer screening example

Stage at diagnosis Five-year relative survival rate

Lung cancer Lung cancer

4%

15% 22% 56% 52% 24%

LOCAL REGIONAL DISTANT LOCAL REGIONAL DISTANT

Current lung cancer screening paradigm: computed tomography (CT)

~25% “suspicious findings”—to be pursued by invasive procedure or repeat CT scans

~96% of “suspicious findings” are not related to lung cancer

~20% of invasive procedures result in complications

Liquid biopsy can provide noninvasive evaluation of “suspicious findings” on CT

Source: American cancer society, Intramural Research, 2012 [data from period 2001 to 2007]

8

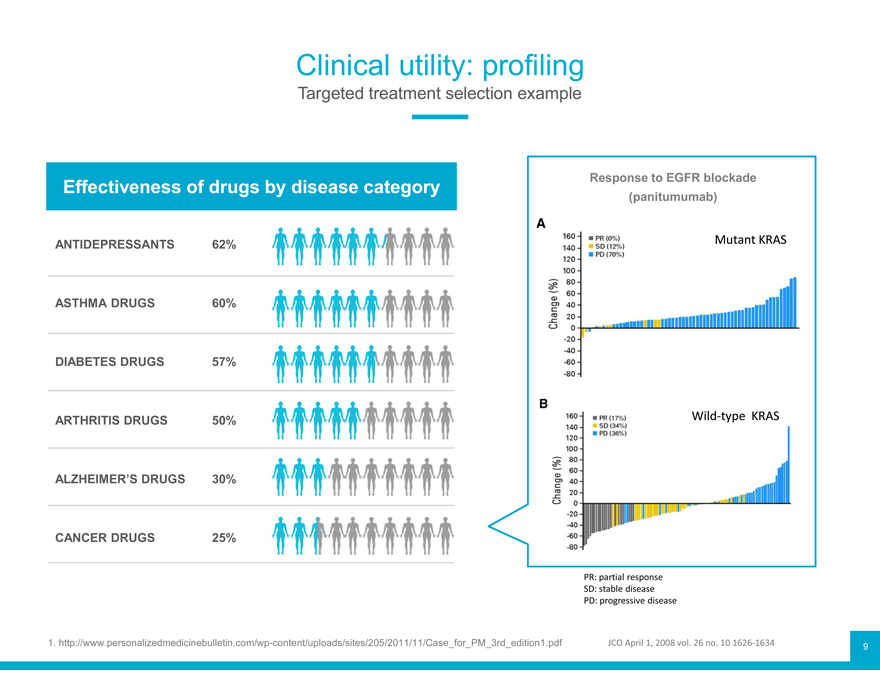

Clinical utility: profiling

Targeted treatment selection example

Effectiveness of drugs by disease category Response (panitumumab) to EGFR blockade

ANTIDEPRESSANTS 62% Mutant KRAS

ASTHMA DRUGS 60%

DIABETES DRUGS 57%

ARTHRITIS DRUGS 50% Wild-type KRAS

ALZHEIMER’S DRUGS 30%

CANCER DRUGS 25%

PR: partial response

SD: stable disease

PD: progressive disease

1. http://www.personalizedmedicinebulletin.com/wp-content/uploads/sites/205/2011/11/Case_for_PM_3rd_edition1.pdf JCO April 1, 2008 vol. 26 no. 10 1626-1634

9

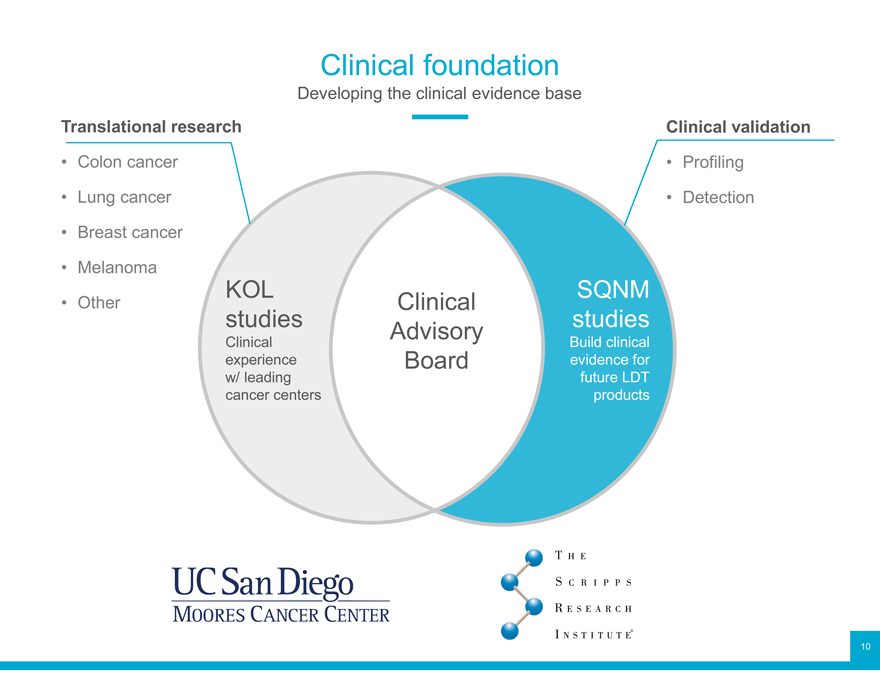

Clinical foundation

Developing the clinical evidence base

Translational research Clinical validation

Colon cancer Profiling

Lung cancer Detection

Breast cancer

Melanoma KOL SQNM

Other studies Clinical studies

Clinical Advisory Build clinical experience Board evidence for w/ leading future LDT cancer centers products

10

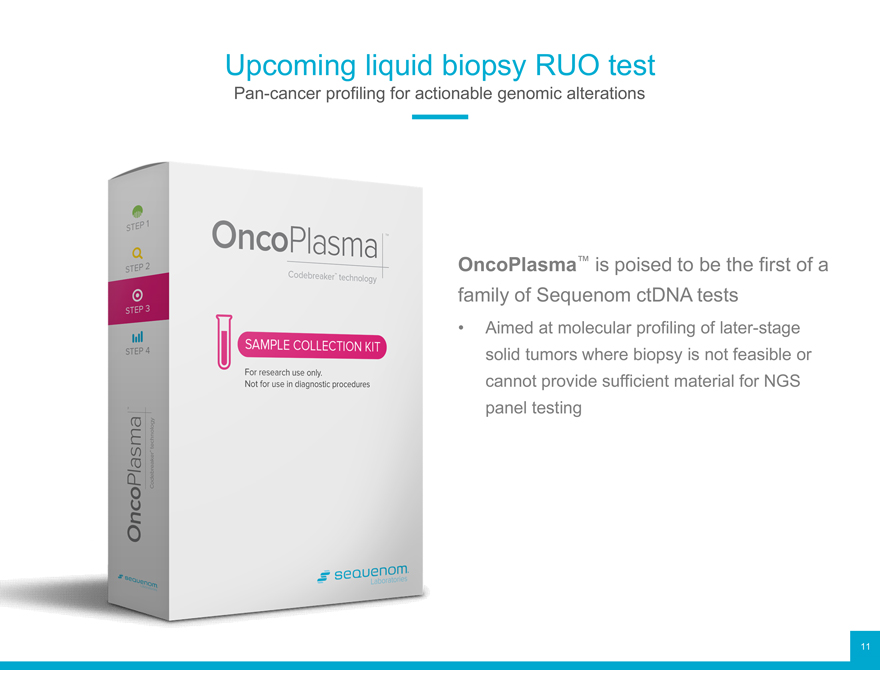

Upcoming liquid biopsy RUO test

Pan-cancer profiling for actionable genomic alterations

OncoPlasma family of Sequenom ™ is poised ctDNA to tests be the first of a

Aimed at molecular profiling of later-stage solid tumors where biopsy is not feasible or cannot provide sufficient material for NGS panel testing

11

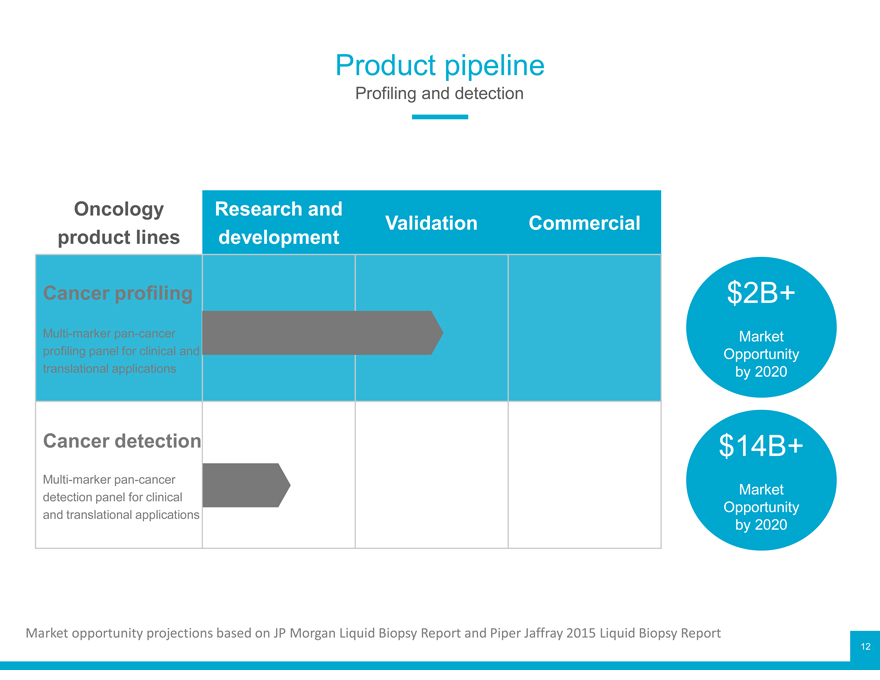

Product pipeline

Profiling and detection

Oncology Research and

product lines development Validation Commercial

Cancer profiling $2B+

Multi-marker pan-cancer Market

Opportunity

translational applications by 2020

Cancer detection $14B+

Multi-marker pan-cancer Market

detection panel for clinical Opportunity

and translational applications by 2020

Market opportunity projections based on JP Morgan Liquid Biopsy Report and Piper Jaffray2015 Liquid Biopsy Report

12

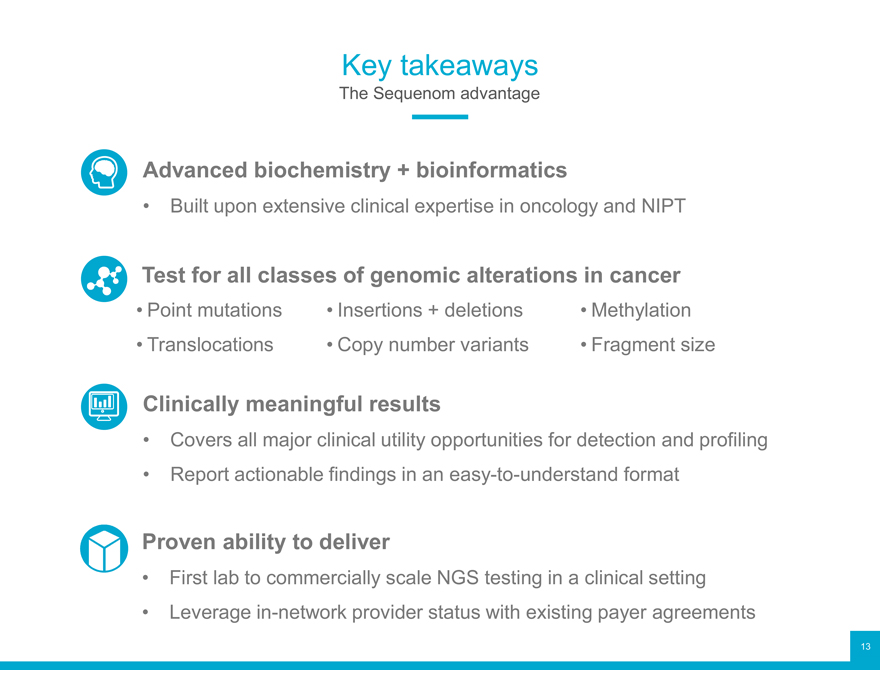

Key takeaways

The Sequenom advantage

Advanced biochemistry + bioinformatics

Built upon extensive clinical expertise in oncology and NIPT

Test for all classes of genomic alterations in cancer

Point mutations Insertions + deletions Methylation Translocations Copy number variants Fragment size

Clinically meaningful results

Covers all major clinical utility opportunities for detection and profiling

Report actionable findings in an easy-to-understand format

Proven ability to deliver

First lab to commercially scale NGS testing in a clinical setting

Leverage in-network provider status with existing payer agreements

13

Wrap-up

Dirk van den Boom, PhD Interim President and CEO Chief Scientific & Strategy Officer

1

Positioning for Growth

Positioned to capitalize on Average Risk market

MaterniT™ GENOME paves the way for comprehensive information

Opportunity for proprietary and potentially “kitable” assays in Oncology

Significant opportunity in oncology through circulating tumor DNA detection and profiling

New opportunities are leveraging established commercial infrastructure, contracts and in-network strategy

2

Dirk van den Boom, PhD Carolyn Beaver

Interim President and CEO Senior Vice President, Chief Scientific & Strategy Officer Chief Financial Officer

Mathias Ehrich, MD Rob Lozuk Daniel Grosu, MD

Senior Vice President, Senior Vice President, Senior Vice President, Research and Development Commercial Operations Chief Medical Officer

3