UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

| ¨ | | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2009.

Commission file number: 001-30134

OR

| ¨ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ¨ | | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

CDC Corporation

(Exact name of Registrant as specified in its charter)

Cayman Islands

(Jurisdiction of incorporation or organization)

11/F ING Tower

308 Des Voeux Road

Central Hong Kong

852-2893-8200

email: investor_relations@cdccorporation.net

Attn: Peter Yip

(Address of principal executive offices and name and telephone number of contact person)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

Class A Common Shares

Indicate the number of outstanding shares of each of the Issuer’s classes of capital or common stock as of the close of the period covered by this Annual Report:

| | | | |

Class of shares | | | | Number of outstanding shares as of December 31, 2009 |

| | |

| Class A common shares, $0.00025 par value per share | | | | 105,761,946 |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ Nox

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer x Non-accelerated filer ¨

Indicate by check mark whether the registrant has submitted electronically and posted to its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statement included in this filing.

U.S. GAAPx International Financial Reporting Standards as issued by the International Accounting Standards Board ¨ Other ¨

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ¨ Item 18 ¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

TABLE OF CONTENTS

PART I.

General Introduction

In April 2005, we changed our name from “chinadotcom corporation” to “CDC Corporation.” Concurrently, in April 2005, our then 81%-owned subsidiary listed on the Growth Enterprise Market of the Stock Exchange of Hong Kong Limited changed its name from “hongkong.com Corporation” to “China.com, Inc.” Throughout this Annual Report, we use the new names of these companies.

Except where the context otherwise requires and for the purposes of this Annual Report only:

| | • | | all references herein to “China.com” refer to China.com, Inc. and its subsidiaries, as applicable; |

| | • | | all references in this Annual Report to Xinhua are to Xinhua News Agency; |

| | • | | all numbers discussed in this Annual Report are approximated to the closest round number. Discrepancies in tables between totals and sums of the amounts listed are due to rounding; |

| | • | | all references to “ADRs” are to the American depositary receipts that evidence the publicly-traded ADSs of our subsidiary, CDC Software Corporation; |

| | • | | all references to “ADSs” are to the American depositary shares, each of which represents one class A ordinary share of CDC Software Corporation; |

| | • | | all references to “we,” “us,” “our,” “the Company” or “CDC Corporation” refer to CDC Corporation and its subsidiaries, as applicable; |

| | • | | all references to “CDC Software International” refer to our subsidiary, CDC Software International Corporation; |

| | • | | all references to “CDC Software” refer to our subsidiary, CDC Software Corporation; |

| | • | | all references to “China” refer to the People’s Republic of China, including Hong Kong; |

| | • | | all references to “Greater China” refer to the People’s Republic of China, including Taiwan, Hong Kong and Macau; |

| | • | | all references to “the PRC” refer to the People’s Republic of China, excluding Taiwan, Hong Kong and Macau; |

| | • | | all references to the “Middle East,” “Africa” and “Latin America” do not include Iran, Syria, the Sudan, Cuba or any other countries designated as state sponsors of terrorism under applicable laws, rules and regulations; |

| | • | | all references to “U.S. GAAP” means the United States generally accepted accounting principles. The consolidated financial statements provided herein have been prepared in accordance with U.S. GAAP; |

| | • | | all references to “U.S. dollars” or “$” are to the legal currency of the United States; all references to “RMB” or “renminbi” are to the legal currency of the PRC; and all references to “HK$” are to the legal currency of Hong Kong; |

| | • | | all references to “NASDAQ” refer to the NASDAQ Global Market; and |

| | • | | all references to the SEC refer to the United States Securities and Exchange Commission. |

Several of our affiliated entities and subsidiaries have been organized under the laws of the PRC with Chinese names and do not have official English names. Some of these entities that are organized under the laws of the PRC are referred to in this Annual Report with their English names, such as Beijing Newpalm Technology Co., Ltd., or Beijing Newpalm; Beijing Wisecom Technology Co., Ltd., or Beijing Wisecom; Beijing China.com Technology Services Co., Ltd., or Beijing

China.com; Beijing He He Technology Co., Ltd., or Beijing He He; Shenzhen KK Technology Ltd., or Shenzhen KK; Beijing TimeHeart Information Technology Limited, or Beijing Timeheart; Beijing Hulian Jingwei Technology Development Co., Ltd., or Beijing Inter Connected; and Guangzhou Optic Communications Ltd. Guangzhou Optic Communications Ltd., or Guangzhou Optic.

SPECIAL NOTE ON FORWARD-LOOKING STATEMENTS

Many statements made in this Annual Report contain forward-looking statements that reflect our current expectations and views of future events. These forward-looking statements can be identified by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “is/are likely to” or other similar expressions. We have based these forward-looking statements largely on current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements include, among other things, statements relating to:

| | • | | our goals and strategies; |

| | • | | our competitive strengths; |

| | • | | expectations and targets for our results of operations; |

| | • | | our business prospects; |

| | • | | our beliefs regarding our sales and distribution networks, the outcome of litigation matters and our compliance with all applicable regulations and policies; |

| | • | | our business prospects and the results of our strategic partnerships; |

| | • | | our development capabilities and our ability to build and maintain relationships with licensors; |

| | • | | the expected growth of the enterprise software, IT services, online games and internet and media markets, and the expectations of the customers and consumers in these industries; |

| | • | | the pace of change in the enterprise software, IT services, online games, internet and media markets, and the need for research and development; |

| | • | | the demand for, and utility, flexibility and characteristics of, our enterprise software, IT services, online games, internet and media products and services; |

| | • | | our relationships with our present and future customers, as well as our cross-selling opportunities; and |

| | • | | our acquisition and expansion strategy. |

The forward-looking statements included in this Annual Report are subject to risks, uncertainties and assumptions about our company. Our actual results of operations may differ materially from the forward-looking statements as a result of risk factors described under “Risk Factors” and elsewhere in this Annual Report.

These risks are not exhaustive. Other sections of this Annual Report include additional factors that could adversely impact our business and financial performance. Moreover, we operate in an evolving environment and new risk factors emerge from time to time. It is not possible for our management to predict all risk factors, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause our actual results to differ materially from those contained in any forward-looking statement.

In addition, the relatively new and rapidly changing nature of these markets in several foreign jurisdictions in which we operate, including China and India, subjects any projections or estimates relating to the growth prospects or future condition of these markets to significant uncertainties. Furthermore, if any one or more of the assumptions underlying the market data turns out to be incorrect, actual results may differ from the projections based on those assumptions. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.”

2

You should not rely upon forward-looking statements as predictions of future events. Except as required by law, we undertake no obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

3

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS |

Not applicable.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

| A. | Selected Financial Data |

The following selected consolidated financial data of CDC Corporation and our subsidiaries should be read in conjunction with the consolidated balance sheets as of December 31, 2008 and 2009, and the related consolidated statements of operations, cash flows and shareholders’ equity for the years then ended and the notes thereto, together referred to as the Consolidated Financial Statements, included in “Item 18, Financial Statements”, and the information included in “Item 5, Operating and Financial Review and Prospects”. The Consolidated Financial Statements have been prepared and presented in accordance with US GAAP.

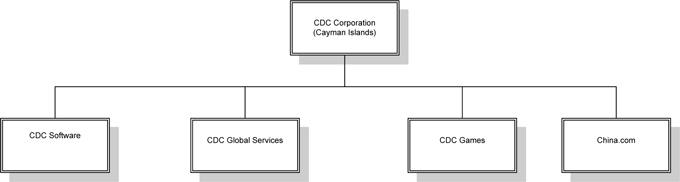

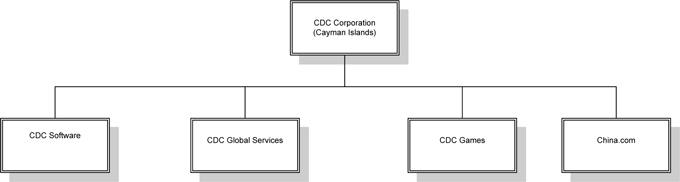

During 2005, we reorganized our business into two core business units, CDC Software and China.com, and during 2006 we further reorganized our business to add a third core business unit, CDC Games. We currently report operating results in four business segments, “CDC Software,” “CDC Global Services,” “CDC Games,” and “China.com”.

In March 2009, CDC Software Corporation (“CDC Software”) was incorporated as an exempted company with limited liability under the Companies law of the Cayman Islands as a wholly owned subsidiary of CDC Software International to operate the enterprise software applications business of CDC Corporation in the Americas, Europe, Middle East, Africa and Asia, comprising the CDC Software segment. In August 2009, CDC Software became a stand-alone public company upon completion of an initial public offering on NASDAQ. Proceeds net of expenses were $52.1 million for this offering and are presented separately in the consolidated statements of shareholders’ equity. CDC Software is comprised of Ross Systems, Inc., or Ross Systems, Pivotal Corporation, or Pivotal, Saratoga Systems, Inc., or Saratoga, Industri-Matematik International Corp., or IMI, Respond Group Limited, or Respond, MVI Holdings Limited, or MVI, c360 Solutions, Inc., or c360, and portions of Catalyst International, or Catalyst.

Following the initial public offering, the paid in capital of CDC Software is comprised of class A ordinary shares each having one vote per share and class B ordinary shares each having ten votes per share. All issued and outstanding class B ordinary shares are held by CDC Software International. As of December 31, 2009, we indirectly owned 100% of CDC Software’s issued and outstanding class B ordinary shares through its 100% ownership of CDC Software International, representing 98.1% of the combined voting power of issued and outstanding ordinary shares and 83.9% of the economic interest in outstanding ordinary shares.

In addition, during 2008, we discontinued the operations of our Mobile Value Added Services, or MVAS business, and CDC Games International, or our CGI businesses. The operating results of these discontinued businesses were retroactively reclassified as a loss from operations of discontinued subsidiaries, net of tax, in all periods presented in this Annual Report.

The following selected consolidated financial data of CDC Corporation and our subsidiaries is derived from our audited financial data, after adjustment for the reclassification of discontinued operations for the years ended December 31, 2007, 2008 and 2009.

4

CONSOLIDATED INCOME STATEMENT DATA:

| | | | | | | | | | | | | | | | | | | | |

| | | Years ended December 31, | |

| | | 2005 | | | 2006 | | | 2007 | | | 2008 | | | 2009 | |

| | | (in thousands, except share and per share data) | |

Revenue: | | | | | | | | | | | | | | | | | | | | |

CDC Software and Global Services (1) | | $ | 195,894 | | | $ | 234,523 | | | $ | — | | | $ | — | | | $ | — | |

CDC Software | | | — | | | | — | | | | 239,897 | | | | 240,787 | | | | 203,899 | |

CDC Global Services | | | — | | | | — | | | | 103,230 | | | | 109,700 | | | | 75,149 | |

China.com | | | 8,995 | | | | 10,064 | | | | 11,409 | | | | 13,682 | | | | 12,180 | |

CDC Games | | | — | | | | 26,780 | | | | 33,575 | | | | 44,901 | | | | 28,890 | |

| | | | | | | | | | | | | | | | | | | | |

| | | 204,889 | | | | 271,367 | | | | 388,111 | | | | 409,070 | | | | 320,118 | |

| | | | | | | | | | | | | | | | | | | | |

Cost of Revenue: | | | | | | | | | | | | | | | | | | | | |

CDC Software and Global Services (1) | | | 92,233 | | | | 116,115 | | | | — | | | | — | | | | — | |

CDC Software | | | — | | | | — | | | | 100,506 | | | | 110,830 | | | | 93,183 | |

CDC Global Services | | | — | | | | — | | | | 79,008 | | | | 84,012 | | | | 62,294 | |

China.com | | | 3,449 | | | | 4,095 | | | | 4,283 | | | | 6,531 | | | | 5,077 | |

CDC Games | | | — | | | | 10,631 | | | | 19,698 | | | | 26,453 | | | | 24,431 | |

| | | | | | | | | | | | | | | | | | | | |

| | | 95,682 | | | | 130,841 | | | | 203,495 | | | | 227,826 | | | | 184,985 | |

| | | | | | | | | | | | | | | | | | | | |

Gross profit | | | 109,207 | | | | 140,526 | | | | 184,616 | | | | 181,244 | | | | 135,133 | |

Sales and marketing expenses | | | 41,761 | | | | 48,300 | | | | 73,426 | | | | 73,830 | | | | 46,380 | |

Research and development expenses | | | 22,788 | | | | 19,842 | | | | 22,743 | | | | 25,909 | | | | 18,019 | |

General and administrative expenses | | | 47,298 | | | | 58,321 | | | | 88,645 | | | | 83,941 | | | | 66,080 | |

Exchange (gain) loss on deferred tax assets | | | — | | | | — | | | | (3,762 | ) | | | 3,271 | | | | (3,427 | ) |

Amortization expenses | | | 5,021 | | | | 7,236 | | | | 10,918 | | | | 11,663 | | | | 7,927 | |

Restructuring and other charges | | | 1,588 | | | | 4,750 | | | | 4,226 | | | | 7,255 | | | | 5,510 | |

Goodwill impairment | | | — | | | | — | | | | — | | | | 50,201 | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total operating expenses | | | 118,456 | | | | 138,449 | | | | 196,196 | | | | 256,070 | | | | 140,489 | |

| | | | | | | | | | | | | | | | | | | | |

Operating income (loss) from continuing operations | | | (9,249 | ) | | | 2,077 | | | | (11,580 | ) | | | (74,826 | ) | | | (5,356 | ) |

Other income (expense), net | | | 5,969 | | | | 12,356 | | | | (14,495 | ) | | | (37,277 | ) | | | 30,160 | |

| | | | | | | | | | | | | | | | | | | | |

Income (loss) before income taxes | | | (3,280 | ) | | | 14,433 | | | | (26,075 | ) | | | (112,103 | ) | | | 24,804 | |

Income tax expense | | | (3,986 | ) | | | (2,373 | ) | | | (9,843 | ) | | | (1,168 | ) | | | (11,438 | ) |

| | | | | | | | | | | | | | | | | | | | |

Income (loss) from continuing operations | | | (7,266 | ) | | | 12,060 | | | | (35,918 | ) | | | (113,271 | ) | | | 13,366 | |

Income (loss) from operations of discontinued subsidiaries, net of tax | | | 5,161 | | | | 1,222 | | | | (66,968 | ) | | | (2,295 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Net income (loss) | | | (2,105 | ) | | | 13,282 | | | | (102,886 | ) | | | (115,566 | ) | | | 13,366 | |

Net (income) loss attributable to noncontrolling interest | | | (1,409 | ) | | | (2,442 | ) | | | (2,147 | ) | | | 1,364 | | | | (1,505 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net income (loss) | | $ | (3,514 | ) | | $ | 10,840 | | | $ | (105,033 | ) | | $ | (114,202 | ) | | $ | 11,861 | |

| | | | | | | | | | | | | | | | | | | | |

Basic and diluted earnings (loss) per share from continuing operations attributable to controlling interest | | $ | (0.08 | ) | | $ | 0.09 | | | $ | (0.36 | ) | | $ | (1.05 | ) | | $ | 0.10 | |

Basic and diluted earnings (loss) per share attributable to controlling interest (2) | | $ | (0.03 | ) | | $ | 0.10 | | | $ | (0.98 | ) | | $ | (1.07 | ) | | $ | 0.10 | |

Weighted average number of shares: | | | | | | | | | | | | | | | | | | | | |

Basic | | | 111,085,657 | | | | 107,950,544 | | | | 107,160,474 | | | | 107,221,587 | | | | 106,208,492 | |

Diluted | | | 111,085,657 | | | | 109,079,391 | | | | 107,160,474 | | | | 107,221,587 | | | | 107,433,573 | |

| (1) | Prior to CDC Software’s initial public offering in August 2009, Software and Global Services operations were included in the CDC Software business unit. For Selected Financial Data only, CDC Software and Global Services is presented on a combined basis for the years ended December 31, 2005 and 2006. |

| (2) | The computation of the diluted earnings (loss) per share did not assume the conversion of the Company’s stock options for 2005, 2007 and 2008 because their inclusion would have been anti-dilutive. 16,200,579, 16,199,656, and 12,047,913 weighted average shares related to the convertible notes were not included in the 2007, 2008 and 2009 respectively, due to the required two class method that would make them anti-dilutive. |

5

CONSOLIDATED BALANCE SHEET DATA:

| | | | | | | | | | | | | | | | |

| | | December 31, |

| | | 2005 | | 2006 | | 2007 | | 2008 | | | 2009 |

| | | (in thousands, except share data) |

Cash and cash equivalents | | $ | 93,719 | | $ | 223,548 | | $ | 142,218 | | $ | 165,693 | | | $ | 115,290 |

Restricted cash | | $ | 1,886 | | $ | 1,996 | | $ | 9,066 | | $ | 4,275 | | | $ | 790 |

Available-for-sale securities (1) | | $ | 115,881 | | $ | 122,914 | | $ | 76,157 | | $ | 45,225 | | | $ | 2,418 |

Working capital (2) | | $ | 75,447 | | $ | 240,878 | | $ | 152,660 | | $ | (50,165 | ) | | $ | 2,133 |

Total assets | | $ | 619,326 | | $ | 857,433 | | $ | 803,601 | | $ | 643,895 | | | $ | 546,687 |

Total Debt (3) | | $ | 26,249 | | $ | 186,636 | | $ | 208,797 | | $ | 210,415 | | | $ | 64,859 |

Total Shareholders’ equity | | $ | 446,705 | | $ | 454,623 | | $ | 358,824 | | $ | 240,496 | | | $ | 274,545 |

| (1) | Available-for-sale securities include short and long-term available-for-sale securities. |

| (2) | Working capital represents current assets less current liabilities. |

| (3) | Total debt includes short and long-term bank loans, and convertible notes. |

| B. | Capitalization and Indebtedness |

Not applicable.

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

Investing in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below, together with the other information contained in this Annual Report, as well as in our press releases and in other filings we may make with the SEC from time to time, before making any investment decision. Any of the following risks and uncertainties could have a material adverse effect on our business, financial condition, results of operations and prospects. The market price of our common stock could decline due to any of these risks and uncertainties, and you could lose all or part of your investment.

Risks Relating to Our Overall Business

Because our business model and strategy have evolved, we lack experience and have a limited operating history in several of our markets and we may not be successful in meeting the needs of customers in these markets. Our operating results could fall below expectations, resulting in a decrease in our stock price.

We began in June 1997 as a pan-Asian integrated Internet company. Our business model and strategy have evolved with a new focus and goal to be a global company focused on enterprise software applications and services through our CDC Software business, IT consulting services, outsourced applications development and IT staffing through our CDC Global Services business, on online games through our CDC Games business and on internet portals for the Greater China market through our China.com business. You will not be able to evaluate our prospects solely by reviewing our past businesses and results, but should consider our prospects in light of the changes in our business focus. Each of our targeted markets is rapidly changing, and we may not successfully address the challenges in our new lines of business or adapt our business model and strategy to meet the needs of customers in these markets. If we fail to modify our business model or strategy to adapt to these markets, our business could suffer.

We have incurred losses in prior periods, may incur losses in the future and cannot provide any assurance that we can achieve or sustain profitability.

We have incurred operating losses in four of our last five fiscal years and net losses in three of our last five fiscal years as follows:

| | | | | | | | | | | | | | | | | | | |

| | | 2005 | | | 2006 | | 2007 | | | 2008 | | | 2009 | |

Operating income (loss) | | $ | (9,249 | ) | | $ | 2,077 | | $ | (11,580 | ) | | $ | (74,826 | ) | | $ | (5,536 | ) |

Net income (loss) attributable to controlling interest. | | $ | (3,514 | ) | | $ | 10,840 | | $ | (105,033 | ) | | $ | (114,202 | ) | | $ | 11,861 | |

6

Our operating losses and net losses may increase in the future, and we may not achieve or sustain operating profitability or net profitability. We may continue to incur operating losses and post net losses in the future due to several factors, including:

| | • | | planned acquisition activities related to the growth and development of our three core businesses, CDC Software, CDC Global Services and CDC Games; |

| | • | | continuing effects of acquisition-related adjustments including intangible asset amortization, stock compensation and deferred tax expense; and |

| | • | | increased investment activities related to our new businesses as we seek to achieve organic growth, which may include: |

| | • | | increased sales and marketing costs; and |

| | • | | increased levels of product development expenses. |

In addition, while, from time to time, we have experienced sequential quarterly increases in revenues, we cannot be certain that revenue growth will occur or continue in the future. We may see a reversal of any sequential growth in quarterly revenues due to several factors, including:

| | • | | any decisions to dispose of business units, subsidiaries, products or services which we no longer believe to be central to our new business model and strategy, which would decrease our revenue base; |

| | • | | a substantial portion of our software license revenue is recognized in the last month of a quarter, and often in the last weeks or days of a quarter, which may result in increased volatility in quarterly revenues if customers decide to defer or cancel orders or implementations, particularly large orders or implementations, from one quarter to the next; |

| | • | | the delay of new software product releases which can result in a customer’s decision to delay execution of a contract or, for contracts that include the new software release as an element of the contract, will result in deferral of revenue recognition until such release; |

| | • | | the potential or actual loss of key clients and key personnel; |

| | • | | our failure to increase market awareness of our company, our brands and our products and services; and |

| | • | | a continued slowdown in the U.S., European, Asian and/or other economic markets. |

These factors could also adversely affect our ability to achieve or sustain profitability. We may not generate sufficient revenue to achieve or sustain profitability, or that we can sustain or increase profitability on a quarterly or annual basis. Even though our revenue is difficult to predict, we base our decisions regarding our operating expenses on anticipated revenue trends. Many of our expenses are relatively fixed, and we may not be able to quickly reduce spending in response to lower than expected revenue growth. As a result, revenue shortfalls could result in significantly lower income or result in a greater loss than anticipated for any given period, which could result in a decrease in our stock price. If revenue does not meet our expectations, or if operating expenses exceed what we anticipate or cannot be reduced accordingly, our business, results of operations and financial condition will be materially and adversely affected.

Our strategy of expansion through acquisitions or investments has been and will continue to be costly, may not be effective, and we may realize losses on our investments.

As a key component of our business and growth strategy, we have acquired and invested in, and may continue to acquire and invest in, companies and assets that we believe will enhance our business model, revenue base, operations and

7

profitability, particularly relating to our strategy in enterprise software, global services and online games. Our acquisitions and investments have resulted in, and will continue to result in, the use of significant amounts of cash, the incurrence of debt, dilutive issuances of our common shares and amortization expenses related to certain intangible assets, each of which could materially and adversely affect our business, results of operations and financial condition.

In recent years, we have depended on acquisitions to increase our revenues. We may not be successful in increasing our revenues through organic growth, which may result in decreased revenues and profitability.

Our ability to achieve organic growth in our businesses is subject to a number of risks and uncertainties, including the following:

| | • | | our investments in sales and marketing, research and development and personnel training could require significant resources and may not ultimately prove successful in generating organic growth; |

| | • | | we may not be successful in introducing our products and services into new and emerging markets, such as China and India; and |

| | • | | our strategy to sell new products to our existing customer base, which has expanded through acquisitions, may not be successful or as profitable as we expect. |

Our customers sometimes do not find our other enterprise software applications to be as attractive. In addition, the revenues generated are often less than that of an independent third-party software supplier. The lower revenues are the result of the customer viewing the purchase of the cross-sold software product as only a module to its existing enterprise software solution, rather than a complete stand-alone software product and, therefore, being less willing to pay the full market price for the product than if the sale had been made by an independent third party.

In recent years, we depended more on acquisitions to increase our revenues than on the organic growth of our businesses. Our inability to achieve organic growth in our businesses could have a material and adverse effect on our business, results of operations and financial condition.

We have acquired several companies during the past several years and intend to continue to evaluate and pursue strategic acquisitions. We may incur significant costs in our efforts to engage in strategic transactions and these expenditures may not result in successful acquisitions. Furthermore, we may be unable to integrate our past or future acquisitions successfully, which could result in increased costs, divert management’s attention and materially and adversely affect our business, results of operations and financial condition.

We intend to continue to evaluate and pursue strategic acquisitions that can, among other things, broaden our customer base, provide enhanced geographic presence and provide new and complementary technical and commercial capabilities. Our growth strategy also involves the acquisition of, and investments in, new technologies, businesses, products and services, as well as the creation of strategic alliances in areas in which we may not currently operate.

We believe that attractive acquisition candidates currently exist in our target markets, and we continuously consider a number of transactions, some of which would be material to our operations and financial condition if consummated. We enter into discussions with other companies and assess opportunities on an on-going basis. Any such acquisitions or joint ventures, if consummated, may be funded through the use of proceeds from the operating cash flows, the incurrence of debt or issuance of our class A common shares.

Our ability to complete future acquisitions depends upon a number of factors that are not entirely within our control, including our ability to identify suitable acquisition candidates, negotiate acceptable terms, conclude satisfactory agreements and secure financing. We may incur significant costs arising from our efforts to engage in strategic transactions and these expenditures may not result in the successful completion of acquisitions. Acquisitions and investments expose us to many potential risks and challenges, including:

| | • | | the assimilation of new operations, technologies and personnel; |

| | • | | unforeseen or hidden liabilities or expenses; |

8

| | • | | the diversion of resources from our existing businesses, sites and technologies; |

| | • | | the inability to generate sufficient revenues to offset the costs and expenses of acquisitions; and |

| | • | | the potential loss of, or harm to, our relationships with our or the acquired company’s employees, users, licensors and other suppliers as a result of integration of new businesses. |

Furthermore, we also may be unable to integrate our past or future acquisitions successfully and our acquisitions and investments may have an adverse effect on our ability to manage our business. In order to realize the benefits anticipated from each acquisition, we need to conform the operational, managerial and financial controls, procedures and policies between our corporate headquarters and the businesses we have acquired. In some instances we may acquire or invest in new technologies, businesses, products and services, or create a strategic alliance in areas in which we may not currently operate. Accordingly, acquisition integration has required, and we expect that it will continue to require, significant attention from our management and could require our management to develop expertise in new areas and manage new business relationships, which may divert management’s attention, increase transaction costs and reduce employee morale.

Our ability to integrate past and future acquisitions is subject to a number of risks and uncertainties, including:

| | • | | our ability to retain and integrate key employees and manage employee morale; |

| | • | | our ability to integrate or combine different corporate cultures; |

| | • | | our ability to effectively integrate products, research and development, sales, marketing, accounting and finance functions and other support operations; |

| | • | | our ability to maintain focus on our day-to-day operations; |

| | • | | the discovery of unanticipated liabilities or other contingencies that we did not identify during the course of our due diligence investigations; |

| | • | | potential claims filed by terminated employees or contractors; and |

| | • | | our ability to adapt to local market conditions and business practices. |

We could be prevented from, or significantly delayed in, achieving our strategic goals if we are unable to complete strategic transactions or successfully integrate acquired businesses. Our failure to complete strategic transactions or to integrate and manage acquired businesses successfully may materially and adversely affect our business, results of operations and financial condition.

Rapid growth and a rapidly changing operating environment may strain our limited resources. Our failure to effectively manage such growth could adversely affect our ability to earn profits.

We have limited operational, administrative and financial resources, which may be inadequate to sustain the growth we want to achieve. As the demands of our customers change and if our business expands, we will need to increase our investment in our network infrastructure, facilities and other areas of operations. If we are unable to manage our growth and expansion effectively, the quality of our products and services could deteriorate and our business may suffer. Our future success will depend on, among other things, our ability to:

| | • | | adapt our products and services and maintain and improve the quality of our products and services; |

| | • | | continue training, motivating and retaining our existing employees and attract and integrate new employees; and |

| | • | | develop and improve our operational, financial, accounting and other internal systems and controls. |

Several of the products and services we offer are quite disparate and have very different uses and functionalities, and it is difficult to discern significant synergies between and among them, which limits the amount of integration, cost savings and cross-selling we may be able to achieve among our business segments.

9

We began in June 1997 as a pan-Asian integrated Internet company. Our business model and strategy have evolved with a new focus and goal to be a global company focused on enterprise software applications and services through our CDC Software business, IT consulting services, outsourced applications development and IT staffing through our CDC Global Services business, on online games through our CDC Games business and on internet portals for the Greater China market through our China.com business Several of our products and services are quite disparate and have very different uses and functionalities. As such, it is difficult to discern significant synergies between and among some of our business segments. Because our segments are quite distinct, there may be limits to the amount of integration, cost savings and cross-selling we may be able to achieve among our business segments.

As of December 31, 2009, we had cash and cash equivalents of $115.3 million. Of such amounts, $48.0 million was held at China.com. China.com is a 79% owned subsidiary listed on the Growth Enterprise Market of the Hong Kong Stock Exchange. Although we have the ability to appoint a majority of the board of directors of China.com, the board of directors of China.com owes fiduciary duties to all of the shareholders of China.com to act in the best interests of and use the assets of China.com, including the cash and cash equivalents balance and debt securities, for the benefit of such shareholders. In the past, the China.com board of directors has declared dividends, in which we have received a pro rata portion as a 79% shareholder of China.com. Otherwise, we have limited ability to transfer or move the cash, cash equivalents, held-for-trading investments and available-for-sale investments balance to us at the parent entity level, or to use the amounts of cash, cash equivalents and held-for-trading investments and available-for-sale investments balance for the benefit of entities other than China.com and its subsidiaries. Any inability to access funds at China.com may have a material adverse effect on our financial condition.

We have significant fixed operating expenses, which may be difficult to adjust in response to unanticipated fluctuations in revenues, and therefore could have a material adverse effect on our operations.

A significant part of our operating expenses, particularly personnel, rent, depreciation and amortization, are fixed in advance of any particular quarter. As a result, an unanticipated decrease in the number or average size of, or an unanticipated delay in the scheduling for, our engagements may cause significant variations in operating results in any particular quarter and could have a material adverse effect on operations for that quarter. In the near-term, we believe our costs and operating expenses may increase in certain areas as we fund new initiatives and continue to pay for costs related to compliance with the Sarbanes-Oxley Act of 2002, mergers and acquisitions and other corporate initiatives we may undertake. Although we intend to strive to keep our costs and operating expenses in the near-term to a level that is in line with our expected revenue, we may not be able to increase our revenue sufficiently to keep pace with any growth in expenditures.

Material weaknesses could be identified in our internal control over financial reporting in the future. New material weaknesses could impact our ability to report timely and accurate financial information could be materially and adversely affected.

A material weakness is defined as a deficiency or combination of deficiencies in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the company’s annual or interim financial statements would not be prevented or detected on a timely basis. The material weaknesses in our internal controls over financial reporting that existed in the past resulted from, among other things, our inability to attract and retain sufficient resources with the appropriate level of expertise in the accounting and finance departments of our organization to ensure appropriate application of U.S. GAAP, particularly in the areas of accounting for income taxes, foreign currency translation adjustments related to goodwill and intangible assets and the accounting for certain of our non-routine transactions. These material weaknesses resulted in the restatement of our financial statements for certain periods. The primary cause of the material weaknesses was lack of sufficient personnel in each of these areas with appropriate expertise to ensure proper accounting and treatment in accordance with U.S. GAAP.

We cannot be certain that additional material weaknesses will not be identified in the future. If the control deficiencies we have identified recur, or if we identify additional deficiencies, we may be unable to issue timely and accurate financial reports and investors could lose confidence in the reliability of our consolidated financial statements, and such conclusion could negatively impact the trading price of our class A common shares.

10

Our subsidiary, CDC Software Corporation, and certain of its subsidiaries, have entered into a $30 million four-year credit facility, and we and our subsidiaries may incur additional debt in the future, which may adversely affect our financial condition and future financial results and the financial condition and future financial results of our subsidiaries, including CDC Software Corporation.

Our subsidiary, CDC Software Corporation and certain of its subsidiaries, have entered into a $30.0 million four-year credit facility with Wells Fargo Capital Finance. In connection with the closing of this credit facility, CDC Software was required to request an advance of $15 million. CDC Software may use the proceeds of its borrowings for general corporate purposes, for future acquisitions or expansion of its business, and, subject to certain conditions, up to $15.0 million under the credit facility may be provided by CDC Software to us.

This debt may adversely affect CDC Software’s and our financial condition and future financial results by, among other things:

| | • | | increasing vulnerability to downturns in business, to competitive pressures and to adverse economic and industry conditions; |

| | • | | requiring the dedication of a portion of CDC Software’s expected cash from operations to service its indebtedness, thereby reducing the amount of expected cash flow available for other purposes, including capital expenditures and acquisitions; and |

| | • | | limiting CDC Software’s flexibility in planning for, or reacting to, changes in its business and industry. |

The credit facility imposes certain financial and operational restrictions on CDC Software, including restrictions on it and certain of its subsidiaries’ ability to create liens on its or their assets, and the ability of CDC Software and certain of its subsidiaries to incur indebtedness. The covenants in the credit facility also require CDC Software and certain of its subsidiaries to maintain compliance with specified financial ratios. CDC Software’s ability to comply with these ratios may be affected by events beyond its control. In addition, the credit facility imposes limitations on CDC Software’s ability to transfer funds to us and certain of our subsidiaries, as well as between CDC Software and certain of its subsidiaries, which could materially and adversely affect our operations and financial condition and those of certain of our subsidiaries and affiliates. If CDC Software breaches any of the covenants under its credit facility and does not obtain a waiver from the lenders, then, subject to applicable cure periods, any outstanding indebtedness may be declared immediately due and payable.

Risks Relating to Our International Operations

A large part of our business is international and, as a consequence, there are a number of factors beyond our control associated with international operations that could materially and adversely affect our business, results of operations and financial condition.

Approximately 46%, 49% and 48% of our total revenues in 2007, 2008, and 2009 were derived from customers outside of North America. We anticipate that revenues from customers outside the United States will continue to account for a significant portion of our total revenues in the future, particularly as we intend to expand into targeted emerging markets, such as China, Russia, Brazil and India. Our operations outside the United States are subject to additional risks, including:

| | • | | changes in, or interpretations of, U.S. or foreign law that may materially and adversely affect our ability to sell our products, perform services or repatriate profits to the United States; |

| | • | | the imposition of tariffs and other trade barriers; |

| | • | | hyperinflation or economic or political instability in foreign countries; |

| | • | | imposition of limitations on or increase of withholding and other taxes on remittances and other payments by foreign subsidiaries; |

11

| | • | | conducting business in places where business practices and customs are unfamiliar and unknown or prohibited by applicable law; |

| | • | | adverse changes in regulatory requirements, including the imposition of restrictive trade policies, including changes in export restrictions; |

| | • | | potentially adverse tax consequences; |

| | • | | worldwide political conditions and political instability; |

| | • | | fluctuations in currency exchange rates; |

| | • | | the imposition of inconsistent laws or regulations; |

| | • | | the imposition or increase of investment requirements and other restrictions by foreign governments; |

| | • | | difficulty in staffing and managing our operations; |

| | • | | different seasonal and other trends in business activities; |

| | • | | differences in cultures which may be less accepting of our business; |

| | • | | differences in accounting practices and investment requirements; |

| | • | | longer collection cycles for accounts receivable; |

| | • | | uncertainties relating to foreign laws and legal proceedings and compliance with such laws, rules and regulations; |

| | • | | having to comply with a variety of U.S. laws, including the Foreign Corrupt Practices Act; |

| | • | | having to comply with U.S. export control regulations and policies that restrict our ability to communicate with non-U.S. employees and supply foreign affiliates and customers with products and services; and |

| | • | | adverse determinations or findings by applicable export control authorities restricting our ability to export goods and services. |

We are required to comply with U.S. export control laws and regulations. Noncompliance with those laws and regulations could have a material adverse effect on our business.

The export and re-export of certain of our products to, and the provision of our services to customers in, certain countries are subject to U.S. export control laws and related regulations, including the Export Administration Regulations (“EAR”), 15 C.F.R. Parts 730 et seq., administered by the U.S. Department of Commerce. Accordingly, our products and services may be subject to pre-export filings; licensing requirements for certain restricted countries, parties and end users; post-export reporting; and documentation and other requirements. Although we strive to comply with applicable export requirements, we have advised the U.S. Department of Commerce of potential violations of the U.S. export control laws and regulations involving the sale of software to a customer in Syria by a reseller. We believe this sale was isolated and remediable through strengthened internal controls and procedures. Violations of export control regulations can lead to administrative, civil monetary or criminal penalties. Based on the information available at this time, we do not believe that the matters we have disclosed will result in material sanctions or penalties, and accordingly have recorded an accrual that is not material to our financial condition or results of operations. However, we cannot assure you that the U.S. Department of Commerce will not pursue penalties for any violations ultimately found to have occurred or that any penalties will not have a material adverse impact on our business, financial condition or results of operations.

A change in currency exchange rates could increase our costs relative to our revenues.

Our revenues, expenses, assets and liabilities are denominated in a number of currencies, including Australian dollars, British pounds, Canadian dollars, Euros, renminbi, South Korean won, Swedish kronas and U.S. dollars. However, our

12

quarterly and annual financial results are reported in U.S. dollars. In the future, we may also conduct business in additional foreign countries and generate revenues, expenses and liabilities in other foreign currencies. As a result, we are subject to the effects of exchange rate fluctuations with respect to any of these currencies and the related interest rate fluctuations. We have not entered into agreements or purchased instruments to hedge our exchange rate risks, although we may do so in the future. Any hedging policies implemented by us may not be successful, and the cost of these hedging techniques may have a negative impact on our business, results of operations and financial condition.

Disruptions in the financial and credit markets and economic downturns may adversely affect our business, results of operations and financial condition.

Demand for our products depends in large part upon the level of capital and maintenance expenditures by many of our customers. Decreased capital and maintenance spending could have a material adverse effect on the demand for our products and our business, results of operations and financial condition. Disruptions in the financial markets, including the bankruptcy or restructuring of certain financial institutions, such as the events that occurred in the second half of 2008 and have continued into and through 2009 and the present, may adversely impact the availability of credit already arranged and the availability and cost of credit in the future, which could result in the delay or cancellation of projects or capital programs on which our business depends.

In addition, continuing weakness or further deterioration in regional economies, in particular Euro-zone based countries or the world economy could negatively impact the capital and maintenance expenditures of our customers and end users. There can be no assurance that government responses to the disruptions in the financial markets or to weakening economies will restore confidence, stabilize markets or increase liquidity and the availability of credit. These conditions may reduce the willingness or ability of our customers and prospective customers to commit funds to purchase our products and services, or their ability to pay for our products and services after purchase.

Risks Relating to Our Software Business Unit

Revenues from our Software business fluctuate significantly from quarter to quarter, which may cause volatility in the trading price of our class A common shares.

Many factors have caused, and may continue to cause, our revenues to fluctuate significantly, including:

| | • | | the recognition of a substantial portion of our software license revenues in the last month of a quarter due to the buying trends of our customers, which may result in increased volatility in quarterly revenues if customers decide to defer or cancel orders or implementations, particularly large orders or implementations, from one quarter to the next; |

| | • | | the gain or loss of any significant customer; |

| | • | | the number, timing and significance of new product announcements and releases by us or our competitors; |

| | • | | our ability to acquire or develop products, independently or through strategic relationships with third parties, or introduce and market new and enhanced versions of our products on a timely basis, which may result in a customer delaying the execution of a contract or, for contracts that include a new software release as an element of the contract, the deferral of revenue recognition until such release; |

| | • | | reductions in the historical rate at which opportunities in our pipeline develop into license agreements; |

| | • | | patterns of capital spending and changes in budgeting cycles by our customers. For example, in 2008 and continuing through 2009 and the present, capital spending for enterprise software applications was negatively impacted by challenging economic conditions in the United States, Europe and Asia; |

| | • | | market acceptance of new and enhanced versions of our products; |

| | • | | changes in the pricing and the mix of our products and services; |

| | • | | seasonal variations in our sales cycle; |

13

| | • | | the level of product and price competition; |

| | • | | exchange rate fluctuations; and |

| | • | | changes in personnel and related costs. |

In addition, we expect that a substantial portion of our enterprise software application revenues will continue to be derived from renewals of maintenance contracts from customers of our software applications. These maintenance contracts typically expire on an annual basis, and if they are not renewed, the timing of cash collections from related revenues will vary from quarter to quarter, which could adversely affect our business and results of operations.

Some customers are reluctant to make large purchases before they have had the opportunity to evaluate the performance of our software applications in their business and opt to purchase our products in stages or subject to certain conditions. Additional purchases, if any, may follow only if the software performs as expected. To the extent the number of customers who opt to purchase in stages or subject to conditions remains significant or increases, our revenues could be materially and adversely affected.

Our future revenues depend in part on our installed customer base continuing to license additional products, renew customer support agreements and purchase additional services.

Recently, our installed customer base has generated increasing proportions of our license, support and service revenues. In addition, our success depends significantly on our ability to cross-sell products to our installed base of customers. Our ability to cross-sell new products may depend in part on the degree to which new products have been integrated with our existing applications, which may vary with the timing of new product acquisitions or releases. In future periods, customers may not necessarily license additional products or contract for additional support or other services. Customer support agreements are generally renewable annually at a customer’s option, and there are generally no mandatory payment obligations or obligations to license additional software. Customer support revenues are primarily influenced by the number and size of new support contracts sold in connection with software licenses and the renewal rate (both pricing and participation) of existing support contracts. If our customers decide to cancel their support agreements or fail to license additional products or contract for additional services, or if they reduce the scope of their support agreements, revenues could decrease and our operating results could be adversely affected.

Our ability to sell our products is highly dependent on the quality of our service and support offerings, and our failure to offer high quality service could have a material adverse effect on our ability to market and sell our products.

Our customers depend upon our customer service and support staff to resolve issues relating to our products. High-quality support services are critical for the successful marketing and sale of our products. If we fail to provide high-quality support on an ongoing basis, our customers may react negatively and we may be materially and adversely affected in our ability to sell additional products to these customers. This could also damage our reputation and prospects with potential customers. Our failure to maintain high-quality support services could have a material and adverse effect on our business, results of operations and financial condition.

If we are unable to successfully grow our direct and indirect sales channels, our ability to organically grow our business will be harmed, which may lead to decreased revenue growth and adversely affect our profitability.

To date, we have sold our products primarily through our direct sales force, particularly in North America. Our future revenue growth will depend in large part on recruiting, training and retaining direct sales personnel and expanding our indirect distribution channels. These indirect channels include value-added resellers, or VARs, original equipment manufacturers, or OEMs, partners, systems integrators and consulting firms.

We may experience difficulty in recruiting and retaining qualified sales personnel and in establishing third-party relationships with VARs, OEMs, partners, systems integrators and consulting firms, in part because our products are designed for certain targeted vertical industries, which means we seek persons with significant experience and expertise in these markets who may be difficult to locate and retain. If we are unable to successfully grow our direct and indirect sales channels, our ability to organically grow our business will be harmed. In addition, we are exposed to the risk that the third parties through which we indirectly sell our products and services will not devote sufficient time, attention and resources to learning our products, markets and potential customers, which could materially and adversely affect our reputation and the reputation of our products in the market.

14

Our strategy of developing and acquiring products for specific industry segments, or targeted vertical industries, may not be successful, which could materially and adversely affect our business, results of operations and financial condition.

Our strategy focuses on the development of industry-specific enterprise software applications. This strategy may not be successful due to numerous risks and uncertainties, including the following:

| | • | | companies in our targeted vertical industries may not select our products; |

| | • | | many of our targeted vertical industries are subject to their own economic cycles, regulatory considerations and other factors beyond our control. For example, the homebuilding and real estate vertical industry is sensitive to interest rate movements and general economic conditions, and the healthcare vertical industry is subject to significant governmental regulations; |

| | • | | some of our products have only been recently introduced, so they have neither a significant installed base of users nor significant recognition in their targeted vertical industry; |

| | • | | development of industry-specific products is time-consuming and requires significant expertise; |

| | • | | we may experience difficulty in recruiting sales, business and technical personnel who have experience in a particular targeted vertical industry; |

| | • | | due to resource constraints, we have a limited number of developers who can focus on product development for our targeted vertical industries; and |

| | • | | if we decide to devote our limited resources to a targeted vertical industry, such as by dedicating a sales representative to a particular market, then that resource may not be available to focus on sales to our other targeted vertical industries. |

If our strategy of developing products for specific vertical industries is not successful, our business, results of operations and financial condition could be materially and adversely affected.

We dedicate a significant amount of resources to research and development activities and our failure to successfully develop, market or sell new products or adopt new technology platforms could have a material and adverse effect on our ability to generate revenues and sustain our profitability.

Our enterprise software applications compete in a market characterized by rapid technological advances in hardware and software development, evolving standards in computer hardware and software technology and frequent new product introductions and enhancements that may render existing products and services obsolete. We cannot assure you that we will be able to compete effectively or respond to rapid technological changes in our industry. In addition, the introduction of new products or updated versions of existing products has inherent risks, including, but not limited to, risks concerning:

| | • | | product quality, including the possibility of software defects, which could result in claims against us or the inability to sell our software products; |

| | • | | the fit of the new products and features with a customer’s needs; |

| | • | | the need to educate our sales, marketing and consulting personnel to work with the new products and features, which may strain our resources and lengthen sales cycles; |

| | • | | market acceptance of initial product releases; |

| | • | | marketing effectiveness; and |

| | • | | the accuracy of research or assumptions about the nature and extent of customer demand. |

In addition, we may need to adopt newer technology platforms for our enterprise software products as older technologies become obsolete. We cannot assure you that we will be successful in making the transition to new technology platforms for our products in the future. We may be unable to adapt to the new technology, may encounter errors resulting

15

from a significant rewrite of the software code for our products or may be unable to complete the transition in a timely manner. In addition, as we transition to newer technology platforms for our products, our customers may encounter difficulties in the upgrade process, delay decisions about upgrading our products or review their alternatives with another supplier or competitor. Any of these risks could materially and adversely affect our business, results of operations and financial condition.

Because we commit substantial resources to developing new software products and services, if the markets for these new products or services do not develop as anticipated, or demand for our products and services in these markets does not materialize or materializes later than we expect, we will have expended substantial resources and capital without realizing sufficient offsetting or resulting revenues, and our business and operating results could be materially and adversely affected. Developing, enhancing and localizing software is expensive, and the investment in product development may involve a long payback cycle. Our future plans include significant additional investments in software research and development and related product opportunities. We believe that we must continue to dedicate a significant amount of resources to our research and development efforts to maintain our competitive position. However, we do not expect to receive significant revenues from these investments for several years, if at all. In 2007, 2008 and 2009, our research and development expense was $22.7 million, or approximately 5.9%, $25.9 million, or approximately 6.3%, and $18.0 million, or approximately 5.6%, of our total revenues, respectively. In addition, as we or our competitors introduce new or enhanced products, the demand for our older products and older versions of such products is likely to decline. If we are unable to provide continued improvements in the functionality of our older products or move customers with our older products to our newer products, maintenance and license revenues from older products may decline, which could have a material and adverse effect on our business, results of operations and financial condition.

The market for enterprise software applications and services is highly competitive, and any failure by us to compete effectively in such a market could result in price reductions, reduced margins or loss of market share, which may have an adverse effect on our revenues and profitability.

The business information systems industry in general, and the enterprise software industry in particular, are highly competitive and subject to rapid technological change. Many of our current and potential competitors have longer operating histories, significantly greater financial, technical and marketing resources, greater name recognition, larger technical staffs and a larger installed customer base than we do. A number of companies offer products that are similar to our products and target the same markets as we do. In addition, many of these competitors may be able to respond more quickly to new or emerging technologies and changes in customer requirements, and devote greater resources to the development, promotion and sale of their products than we can. Furthermore, because there are relatively low barriers to entry in the software industry, we expect additional competition from other established and emerging companies. Such competitors may develop products and services that compete with our products and services or may acquire companies, businesses and product lines that compete with us. It is also possible that competitors may create alliances and rapidly acquire significant market share. Accordingly, our current or potential competitors may develop or acquire products or services comparable or superior to those that we develop, combine or merge to form significant competitors or adapt more quickly than we can to new technologies, evolving industry trends and changing customer requirements. Competition could result in price reductions, reduced margins or loss of market share, any of which could materially and adversely affect our strategy in this market. If we are unable to compete effectively, our business, results of operations and financial condition could be materially and adversely affected.

We have been increasingly moving software development capabilities for our enterprise software applications to India and China which subjects us to risks that may result in certain staffing and management difficulties which, if not effectively addressed, could delay development of upgrades and new products that, in turn, could reduce revenues and net income and increase research and development costs.

We have established a CRM-focused software development center in Bangalore, India and an ERP and SCM-focused software development center in Shanghai, China and Nanjing, China, respectively. Such off-shoring subjects us to various risks, including the following:

| | • | | inability to hire sufficient qualified programmers and developers in these markets; |

| | • | | risks associated with turnover of programmers and developers, particularly where we have devoted significant time and resources to train such persons to be familiar with our enterprise software applications; |

16

| | • | | challenges related to the need to remotely manage developers and programmers in India and China, particularly when the persons most familiar with the needs of the customer and the desired new functionality and features are not located in India and China; |

| | • | | language and other communications barriers, particularly with software development in China; and |

| | • | | time zone differences, which make communicating with persons in India and China more difficult. |

If we are unable to adequately staff and manage our offshore research and development operations we may not realize, in full or in part, the anticipated benefits from this initiative. In addition, other events and circumstances, such as difficulties, delays or unexpected costs, may occur which could result in us not realizing all or any of the anticipated benefits, which could have a material adverse effect on our business, financial condition, and operating results.

Future revenue growth depends in part upon our ability to adapt to technological change and successfully introduce new and enhanced products and services.

The Software as a Service (SaaS) industry is characterized by rapidly changing technology, evolving industry standards and frequent new product introductions. As we continue to grow our SaaS and other offerings, we must continue to innovate and develop new products and features to meet changing customer needs and attract and retain talented software developers. We need to continue to develop our skills, tools and capabilities to capitalize on existing and emerging technologies.

In some cases, we may expend a significant amount of resources and management attention on products or services that do not ultimately succeed in their markets. We have encountered difficulty in launching new products and services in the past. If we misjudge customer needs in the future, our new products and services may not succeed, our revenues and earnings may be harmed and our operations and financial condition could be materially and adversely affected.

Interruptions or delays in service from our third-party data center hosting facilities could impair the delivery of our service and harm our business.

We currently serve certain of our customers from third-party data center hosting facilities. Any damage to, or failure of, our systems generally could result in interruptions in our service. As we continue to add data centers and add capacity in our existing data centers, we may move or transfer our data and our customers’ data. Despite precautions taken during this process, any unsuccessful data transfers may impair the delivery of our service. Further, any damage to, or failure of, our systems generally could result in interruptions in our service. Interruptions in our service may reduce our revenue, cause us to issue credits or pay penalties, cause customers to terminate their subscriptions and adversely affect our renewal rates and our ability to attract new customers. Our business will also be harmed if our customers and potential customers believe our service is unreliable.

As part of our current disaster recovery arrangements, our production environment and all of our customers’ data is currently replicated in near real-time in a facility. Features added through acquisitions are temporarily served through alternate facilities. We do not control the operation of any of these facilities, and they are vulnerable to damage or interruption from earthquakes, floods, fires, power loss, telecommunications failures and similar events. They may also be subject to break-ins, sabotage, intentional acts of vandalism and similar misconduct. Despite precautions taken at these facilities, the occurrence of a natural disaster or an act of terrorism, a decision to close the facilities without adequate notice or other unanticipated problems at these facilities could result in lengthy interruptions in our service. Even with the disaster recovery arrangements, our service could be interrupted and our operations and financial condition could be materially and adversely affected.

Our hosting, collection, use and retention of personal customer information create risk that may harm our business.

A number of our businesses collect, use and retain personal customer information, including credit card numbers, bank account numbers and passwords, personal and business financial data, social security numbers and other payroll information. We may also develop new business models that use personal information, or data derived from personal information, in innovative and novel ways. In addition, we collect and maintain personal information of our employees in the ordinary course of our business. Some of this personal customer and employee information is held and some transactions are executed by third parties. In addition, as several of our products and services are Web based, the amount of data we store for our users on our servers (including personal information) has been increasing. We and our vendors use commercially available security technologies to protect transactions and personal information. We use security and business

17

controls to limit access and use of personal information. However, a third party may be able to circumvent these security and business measures, and errors in the storage, use or transmission of personal information may result in a breach of customer or employee privacy or theft of assets, which may require notification under applicable data privacy regulations. We employ contractors and temporary employees who may have access to the personal information of customers and employees or who may execute transactions in the normal course of their duties. It is possible that one or more of these individuals may circumvent our controls, resulting in a security breach.

The ability to execute transactions and the possession and use of personal information in conducting our business subjects us to legislative and regulatory burdens that may require notification to customers or employees of a security breach, restrict our use of personal information and hinder our ability to acquire new customers or market to existing customers. As our business continues to expand to new industry segments that may be more highly regulated for privacy and data security, and to countries outside the U.S. that have more strict data protection laws, our compliance requirements and costs may increase and our operations and financial condition could be materially and adversely affected.

Risks Relating to Our Global Services Business Unit

Because most of our global services contracts can be cancelled with limited notice and without significant penalty, we could suffer a significant loss of business service revenues if our clients were to unexpectedly terminate their contracts.

The standard terms for many of our global service contracts do not require any payments or only include an up-front payment of a relatively low percentage of the total fee of the contract with the balance of the payments subject to our achieving specific milestones and deliverables. We generally do not require collateral for accounts receivable and generally, final payments are not due until completion of successful user acceptance testing. However, most of our business services contracts can be cancelled by the client with limited advance notice and without significant penalty. Termination by any client of a contract for our services could result in a loss of expected revenues, additional expenses for redeployment of staff and resources that were allocated to the terminated engagement, and underutilized employees and resources. Any unexpected cancellations or significant reductions in the scope of any of our large global services projects could have a material and adverse effect on the business of our global services companies, particularly those companies that depend upon a relatively small number of key clients for a substantial portion of their revenues. Should any of those key clients unexpectedly terminate their contracts for our services, we may suffer a significant loss of revenues for such companies which, in turn, could have a material and adverse effect on our business, results of operations and financial condition.

If our CDC Global Services business fails to compete effectively, our business, results of operations and financial condition could be materially and adversely affected.

Our CDC Global Services business, which consists primarily of many smaller, regionally-focused subsidiaries that operate primarily in Australia and parts of the United States, faces intense competition. Many of our existing competitors, as well as a number of potential new competitors, have longer operating histories, greater name recognition, larger customer bases and greater financial, technical and marketing resources than we do. We also face competition from many of the large Asia Pacific based outsourcing firms. Any of our present or future competitors may provide services that provide significant performance, price, creative or other advantages over those offered by CDC Global Services. We may not be able to compete successfully against our current or future competitors, particularly as markets continue to consolidate, change or mature.

If we fail to accurately estimate the resources and time required for any engagements we enter into on a fixed-price basis, we could experience cost overruns and be subjected to penalties.

Several of CDC Global Services’ engagements consist of individual, non-recurring, short-term projects billed on a fixed-price basis, as distinguished from billing on a time and materials basis. In addition, while most of our professional services engagements associated with the sale and implementation of our enterprise software applications are billed on a time and materials basis, some of our engagements are also contracted on a fixed-price basis. These fixed-price engagements require us at times to commit unanticipated additional resources to complete these engagements, which may result, and has in the past resulted, in losses on certain engagements. Clients may also change the scope of the projects on which we are engaged. Our failure to accurately estimate the resources and time required for a particular engagement or to effectively manage client expectations and changes regarding the timing and scope of the services to be delivered could expose us to risks associated with cost overruns and penalties, any of which could have a material and adverse effect on our business, results of operations and financial condition.

18

Because some of CDC Global Services contracts do not have disclaimers of, or limitations on, liability for special, consequential and incidental damages, we may be exposed to potential litigation and liabilities.