China 3C Group

368 HuShu Nan Road

HangZhou City, Zhejiang Province, China 310014

May 16, 2012

Andrew D. Mew

Accounting Branch Chief

Division of Corporate Finance

Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

| Re: | China 3C Group (the “Company” or “China 3C”) |

Form 10-K for the Fiscal Year Ended December 31, 2010

Filed May 18, 2011

Amendment No. 1 to Form 10-K for Fiscal Year Ended December 31, 2010

Filed March 23, 2012

File No. 000-28767

Dear Mr. Mew:

We hereby provide responses to comments issued in a letter dated April 3, 2012 (the “Staff’s Letter”) regarding the Company’s Annual Report on Form 10-K, filed on May 18, 2011, as amended on March 23, 2012 (the “Form 10-K/A”). The discussion below reflects our responses to the Staff’s Letter on a point by point basis.

Form 10-K/Amendment No. 1 for the Fiscal Year Ended December 31, 2010

General

1. We note your Amendment No.1 to Form 10-K for the Fiscal Year Ended December 31,

2010 filed on March 23, 2012. Please address the following additional comments.

| · | Please revise the explanatory note on the cover page to further explain the nature of the various revisions and restatements. |

| · | Please label the columns of the income statements on page F-4 and the various affected footnote amounts such as those within the segment financial information footnote as “restated”. Please also label other similarly affected amounts as such throughout MD&A section and elsewhere, as applicable, in the filing. |

| · | Please provide a separate restatement footnote providing the “as reported” and “as restated” amounts of the affected line items within the income statements and the segment financial information footnote as well as the nature of their restatements. |

| · | Please file amendments to FY 2011 Forms 10-Q to restate their corresponding financial statements for the similar accounting errors as we previously requested. |

| · | Given the significance of the restatements on the affected income statement line items and the gross profit margins, we believe you should file an Item 4.02 of Form 8-K as soon as possible to disclose that your previously issued financial statements cannot be relied upon or explain to us why you are not required to do so. |

COMPANY RESPONSE: We are submitting Amendment No. 2 to the Form 10-K/A for the year ended December 31, 2010 (“Form 10-K/A”), Amendment No. 1 to the Form 10-Q for the period ended March 31, 2011, Amendment No. 1 to the Form 10-Q for the period ended June 30, 2011, and Amendment No. 1 to the Form 10-Q for the period ended September 30, 2011 (“Form 10-Q/As”) with this response letter for the Staff’s review as Annex A, Annex B, Annex C and Annex D, respectively. We have incorporated the Staff’s requested disclosure and revisions as instructed by the Staff’s Letter therein. To avoid filing multiple amendments, we will await for the Staff to complete its review before the Company makes its filing of Form 10-K/A and Form 10-Q/As on Edgar.

The Company will file a Form 8-K under Item 4.02 to disclose that its previously issued financial statements cannot be relied upon.

Financial Statements and Notes

Note 13. Segment Information, page F-23

2. Please reconcile for us the FY 2010 loss from operations amounts as disclosed here

within the Home Electronic, Consumer Electronics and Logistics reportable segments to those you disclosed in MD&A from pages 20 to 22 or revise.

COMPANY RESPONSE: Please see the Company’s response to Comment No. 1.

[Signature Page Follows]

Your prompt attention to this filing would be greatly appreciated. Should you have any questions concerning any of the foregoing please contact Angela Dowd, legal counsel to the Company, at 212-407-4097.

Sincerely,

| /s/ Weiping Wang |

| Weiping Wang |

| Chief Financial Officer |

Annex A

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K/A

(Amendment No. 2)

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year endedDecember 31, 2010

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____________ to ____________

Commission file number 000-28767

CHINA 3C GROUP

(Exact name of registrant as specified in its charter)

| Nevada | | 88-0403070 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

368 HuShu Nan Road

HangZhou City, Zhejiang Province, China 310014

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: 086-0571-88381700

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.001 par value

Title of class

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ |

Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨No x

The aggregate market value of the 44,861,327 shares of voting and non-voting common equity stock held by non-affiliates of the registrant was approximately $13,458,398 as of June 30, 2010, the last business day of the registrant’s most recently completed second fiscal quarter, based on the last sale price of the registrant’s common stock on such date of $0.30 per share, as reported on the OTC Bulletin Board.

As of May 17, 2011, there were 58,511,327 shares of the registrant’s common stock outstanding.

Documents incorporated by reference: None.

EXPLANATORY NOTE

This Amendment No. 2 to our Annual Report on Form 10-K/A ("Form 10-K/A") is being filed to amend our Annual Report on 10-K for the year ended December 31, 2010 ("Form 10-K"), which was originally filed with the Securities and Exchange Commission (the "SEC") on May 18, 2011, as amended on March 23, 2012. We are filing this Amendment No. 2 to include disclosure consistent with comments received by the SEC. We are amending and restating Items 1, 7, 8, 9 and 15 in this Form 10-K/A.

Below is a summary of these errors and the related corrections:

| · | The Company amended Item 1 to clarify the fact that Capital did not sell its equity ownership in Zhejiang upon executing the contractual agreements in 2007. Capital remains as the owner of 100% equity of Zhejiang through shareholding entrustment agreements. |

| · | The Company reclassified fees paid to department stores from a contra revenue account to selling, general and administrative expenses. The amount of $9,740, $10,505 and $12,687 were previously classified in contra-revenue account as a deduction to net sales for the year ended December 31, 2010, 2009 and 2008. The Company moved the amount to selling expenses, and it is reported as selling, general and administrative expenses in the statement of operations and comprehensive loss. The reclassification caused a $9,740 increase in net sales from $148,354 to $158,094 and a corresponding increase of $9,740 in Selling, general and administrative expenses from $32,523 to $42,263 in 2010; a $10,505 increase in net sales from $208,489 to $218,994 and a corresponding increase of $10,505 in Selling, general and administrative expenses from $21,621 to $32,126 in 2009; a $12,687 increase in net sales from $310,644 to $323,331 and a corresponding increase of $12,687 in Selling, general and administrative expenses from $14,132 to $26,819 in 2008. The gross profit increased $9,740, $10,505 and $12,687 respectively in 2010, 2009 and 2008. The loss from operations and net loss remained unchanged. The impact of the restatement was limited to the presentation of the consolidated statements of operations and comprehensive income (loss). The consolidated balance sheets, the consolidated statements of stockholders’ equity and the related consolidated statements of cash flows remained unaffected. See changes in Item 15. |

| · | The restatement above also affected the disclosure of segment reporting. As a result, we have amended Note 13 - SEGMENT INFORMATION and ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. |

| · | The Company amended Item 9 revising our conclusions on the effectiveness of disclosure controls and procedures and internal control over financial reporting to “ineffective.” |

In addition, as required by Rule 12b-15 of the Securities Exchange Act of 1934, this Amendment No. 2 contains new certifications by our Chief Executive Officer and our Chief Financial Officer, filed as exhibits hereto.

CHINA 3C GROUP

Table of Contents

| | | | PAGE |

| PART I | | | 4 |

| | | | |

| Item 1 | Business | | 4 |

| | | | |

| PART II | | | 13 |

| | | | |

| Item 7 | Management’s Discussion and Analysis of Financial Condition and Results of Operations | | 13 |

| | | | |

| Item 8 | Financial Statements and Supplementary Data | | 32 |

| | | | |

| Item 9 | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | | 32 |

| | | | |

| Item 9A(T) | Controls and Procedures | | 32 |

| | | | |

| Item 9B | Other Information | | |

| | | | |

| PART IV | | | 34 |

| | | | |

| Item 15 | Exhibits, Financial Statement Schedules | | 34 |

| | | | |

| | Index to Consolidated Financial Statements | | F-1 |

Forward Looking Statements

We have included and from time to time may make in our public filings, press releases or other public statements, certain statements, including, without limitation, those under ��Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II, Item 7. In some cases these statements are identifiable through the use of words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “project,” “target,” “can,” “could,” “may,” “should,” “will,” “would” and similar expressions. You are cautioned not to place undue reliance on these forward-looking statements. In addition, our management may make forward-looking statements to analysts, investors, representatives of the media and others. These forward-looking statements are not historical facts and represent only our beliefs regarding future events, many of which, by their nature, are inherently uncertain and beyond our control.

PART I

ITEM 1. BUSINESS

Overview

China 3C Group (including our subsidiaries unless the context indicates otherwise, the “Company”, “China 3C,” “China 3C Group,” “we,” or “us”) was incorporated on August 20, 1998 under the laws of the State of Nevada. Before July 2009, we were only engaged in the resale and distribution of third party products and generated 100% of our revenue from resale of items such as mobile phones, facsimile machines, DVD players, stereos, speakers, MP3 and MP4 players, iPods, electronic dictionaries, CD players, radio Walkmans and audio systems. On July 6, 2009, we acquired Jinhua Baofa Logistic Ltd. (“Jinhua”). At that point, we started providing transportation logistics services to businesses in Eastern China.

In 2007 we began operating under a “store in store” business model. As of December 31, 2010 we established and operated 821 “stores in stores.” We operate under the brand names Hangzhou Wang Da, Yiwu YongXin, Shanghai Joy & Harmony and Hangzhou Sanhe. The “store in store” business operation model resulted in expanded marketing channels, thus, positively stimulated the growth of sales in 2007 and 2008. However, starting in 2009, we had declining sales under the “stores in stores” model due to increased competition from direct stores and large department stores as well as the impact of the economic slow down. Therefore, we decided to open direct stores and franchises. As of December 31, 2010, Zhejiang has three direct and two franchise stores in operation.

On July 6, 2009, China 3C and its subsidiary Zhejiang (as defined below) and Yiwu (as defined below) acquired 100% of Jinhua. Jinhua provides transportation logistics services to businesses.

Under the stores in stores model, we distribute our products mainly via so-called concessionaire agreements with larger department stores, supermarkets, large electronics retail stores, and other retailers. The retail distribution of many products in China, including those we sell, is conducted through the concessionaire model. Under this model, companies such as China 3C own their own outlets within larger stores and in so doing assume responsibility for most financial and operational aspects of those outlets including capital cost, inventory, wages, selection, pricing, and general management. Our retail partners are compensated via margin they earn on the products we sell. This model is similar to that employed by many department stores in the US. However, this model is different from the model found at large electronic retailers like Best Buy and general retailers like Wal-Mart. We have found that many investors are curious as to why the model in China differs from the one found in the US. We believe the main reasons are:

| ¨ | We decrease the financial risk for our retail partners by assuming responsibility for the inventory and capital expense associated with distributing our products. |

| ¨ | We decrease operational risk for our retail partners by hiring and managing employees and handling logistics issues such as wholesale purchase and delivery and returns and after-sales service. |

| ¨ | We decrease merchandising risk for our retail partners by bringing product expertise and specific market knowledge that is difficult for large retailers to develop on their own across a broad range of product categories. |

| ¨ | China’s size, regional differences, logistical difficulties, managerial challenges, underdeveloped credit markets, and rapid growth rate increases risk for all retailers and drive the need to mitigate risk which is why our retail partners rely on us. |

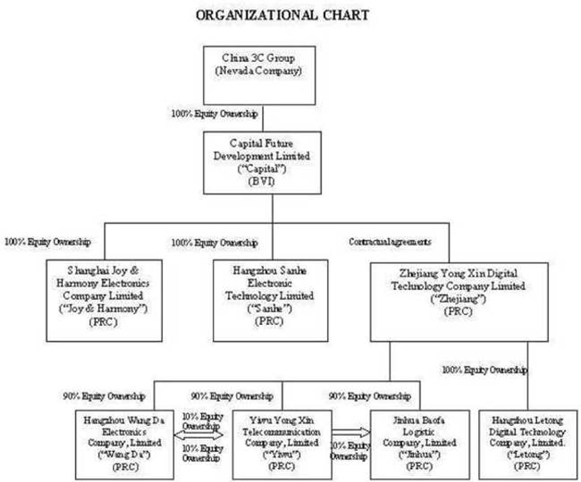

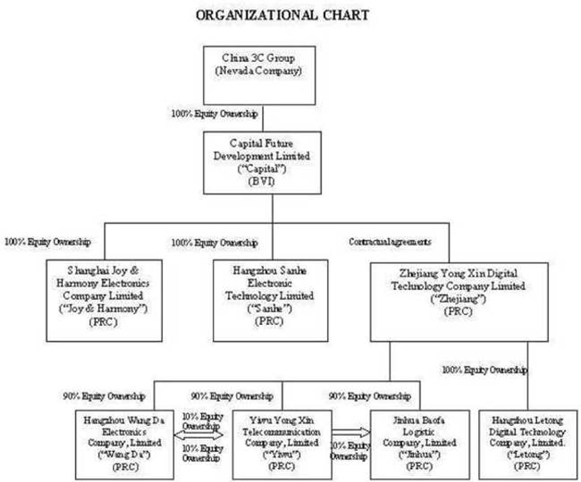

Organizational Structure

(All dollar amounts in thousands)

China 3C was incorporated on August, 20, 1998 under the laws of the State of Nevada. Capital Future Developments Limited (“CFDL”) was incorporated on July 22, 2004 under the laws of the British Virgin Islands. Zhejiang Yong Xin Digital Technology Company Limited (“Zhejiang”), Yiwu Yong Xin Communication Limited (“Yiwu”), Hangzhou Wandda Electronics Company Limited (“Wang Da”), Hangzhou Sanhe Electronic Technology, Limited (“Sanhe”), and Shanghai Joy & Harmony Electronic Development Company Limited (“Joy & Harmony”) were incorporated under the laws of the Peoples Republic of China (“PRC” or “China”) on July 11, 2005, July 18, 1997, March 30, 1998, April 12, 2004, and August 25, 2003, respectively. China 3C owns 100% of CFDL and CFDL own 100% of the capital stock of Joy & Harmony and Sanhe. Until August 14, 2007, when it made the change to its ownership structure described in the next paragraph in order to comply with certain requirements of PRC law, CFDL owned 100% of the capital stock of Zhenjiang. Zhejiang owns 90% and Yiwu owns 10% of Wang Da. Zhejiang owns 90% and Wang Da owns 10% of Yiwu. On March 10, 2009 Zhejiang set up a new operating entity, Hangzhou Letong Digital Technology Co., Ltd. (“Letong”) to establish an electronic retail franchise operation for China 3C Group. On July 6, 2009, Zhejiang and Yiwu acquired Jinhua. Jinhua was incorporated under the laws of PRC on December 27, 2001.

On December 21, 2005, CFDL became a wholly owned subsidiary of China 3C through a merger with a wholly owned subsidiary of the Company (the “Merger Transaction”). China 3C acquired all of the issued and outstanding capital stock of CFDL pursuant to a Merger Agreement dated at December 21, 2005 by and among China 3C, XY Acquisition Corporation, CFDL and the shareholders of CFDL (the “Merger Agreement”). Pursuant to the Merger Agreement, CFDL became a wholly owned subsidiary of China 3C and, for the CFDL shares, China 3C issued 35,000,000 shares of its common stock to the shareholders of CFDL, representing 93% of the issued and outstanding capital stock of China 3C at that time and cash of $500.

On August 3, 2006, Capital acquired a 100% interest in Sanhe for a cash and stock transaction valued at approximately $8,750. The consideration consisted of 915,751 newly issued shares of the Company’s common stock and $5,000 in cash.

On November 28, 2006, Capital acquired a 100% interest in Joy & Harmony for a cash and stock transaction valued at approximately $18,500. The consideration consisted of 2,723,110 shares of the Company’s common stock and $7,500 in cash.

On August 15, 2007, we executed a series of contractual agreements between Capital and Zhejiang. The contractual agreements give Capital and its equity owners an obligation, and having ability to absorb, any losses, and rights to receive returns; however, these contractual agreements did not change the equity ownership of Zhejiang. We did not dispose Capital’s actual equity ownership of Zhejiang when we execute the contractual agreements. Capital entered into share-holding entrustment agreements with five individuals: Zhenggang Wang, Yimin Zhang, Huiyi Lv, Xiaochun Wang and Zhongsheng Bao to hold 35%, 20%, 20%, 15% and 10%, respectively, of the equity interest of Zhejiang on behalf of Capital on November 21, 2005. The entrustment agreements confirm that CFDL is the actual owner of Zhejiang. CFDL enjoys the actual shareholder’s rights and has the right to obtain any benefits received by the nominal holders. Zhenggang Wang is the CEO and shareholder of China 3C Group. Yimin Zhang, Huiyi Lv, Xiaochun Wang and Zhongsheng Bao have no other relationship with China 3C Group. No consideration was given to these individuals who held the equity of Zhejiang on behalf of CFDL.

On July 6, 2009, China 3C’s subsidiaries, Zhejiang and Yiwu acquired Jinhua, a company organized under the laws of the PRC. Zhejiang acquired 90% and Yiwu acquired 10% of the entire equity interests in Jinhua from the shareholders of Jinhua for a purchase price of RMB 120,000,000 ($17,500) in cash.

Yiwu, Wangda, Sanhe, Joy & Harmony are engaged in the business of resale and distribution of third party products and generate approximately 100% of their revenue from resale of items such as mobile phones, facsimile machines, DVD players, stereos, speakers, MP3 and MP4 players, iPod, electronic dictionaries, CD players, radios, Walkmans, and audio systems. We sell and distribute products through retail stores and secondary distributors. We operate most of our retail operations through our “store in store” model. Under this model, the Company leases space in major department stores and retailers. Leasing costs can vary based on a percentage of sales, or can be fixed. In 2010, 2009 and 2008, all of our stores in stores leases were variable based on sales.

In 2009, Zhejiang started establishing direct electronic retail stores and franchise operation.

Following the acquisition of Jinhua, the Company began providing logistic service to businesses in addition to its traditional business of resale and distribution of third party products such as mobile phones, facsimile machines, DVD players, stereos, speakers, MP3 and MP4 players, iPods, electronic dictionaries, CD players, radio Walkmans and audio systems.

Our corporate structure as of December 31, 2010 is as follows:

Our Business

Information About Our Segments

During fiscal 2010, we operated in five reportable segments:

| a. | Yiwu Yong Xin Telecommunication Company, Limited, or “Yiwu,” focuses on the selling, circulation and modern logistics of fax machines and cord phone products. |

| b. | Hangzhou Wang Da Electronics Company, Limited, or “Wang Da,” focuses on the selling, circulation and modern logistics of cell phones, cell phones products, and digital products, including digital cameras, digital camcorders, PDAs, flash disks, and removable hard disks. |

| c. | Hangzhou Sanhe Electronic Technology Limited “Sanhe,” focuses on the selling, circulation and modern logistics of home electronics, including DVD players, audio systems, speakers, televisions and air conditioners. |

| d. | Shanghai Joy & Harmony Electronics Company Limited or “Joy & Harmony,” focuses on the selling, circulation and modern logistics of consumer electronics, including MP3 players, MP4 players, iPod, electronic dictionary, radios, and Walkmans. |

| e. | Jinhua Baofa Logistic Company Litmited or “Jinhua” provides transportation logistics services to businesses. Jinhua operates primarily in Eastern China and covers many of the most developed cities in the Eastern China such as Shanghai, Hangzhou and Nanjing |

Financial information about our segments is included in Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations, and Note 13, Segment Information, of the Notes to Consolidated Financial Statements, included in Item 8, Financial Statements and Supplementary Data, of this Annual Report on Form 10-K.

Yiwu Yong Xin Telecommunication Company, Limited (“Yiwu”)

Yiwu is an authorized sales agent, focusing on the selling, circulation and modern logistics of fax machines and cord phone products in China. Yiwu mainly distributes Philips fax machines and China’s local brands Feng Da and CJT fax machines. Yiwu sells its products through retail “stores in stores” in major department stores throughout the Huadong Region of China (consisting of the Chinese provinces of Zhejiang, Jiangsu and Anhui). Yiwu had 211 retail locations in 2010. Yiwu contributed 12.6% of the Company’s revenue in 2010.

The five largest suppliers and customers of Yiwu for 2010 are as follows:

| Top 5 suppliers | | Top 5 customers |

| Yiwu are Fengda Technology Company Limited | | Zhejiang Suning Appliance Company Limited |

| | | |

| Ninbo Zhongxun Electronics Company Limited | | Shanghai Suning Appliance Company Limited |

| | | |

| Shanghai Zhongfang Electronics Company Limited | | Suning Appliance Company Limited |

| | | |

| Hangzhou Senruida Trade Company Limited | | Yongle China Appliance Company Limited |

| | | |

| Shanghai Hongyi Office Supplies Company Limited | | Shanghai GOME Electrical Appliances Limited |

The top five suppliers contributed 84.2% of purchases of Yiwu in 2010 and the top five customers contributed 32.9% of revenue of Yiwu in 2010.

Yiwu has a diverse customer base and, the loss of any single customer is not expected to have a material adverse affect on its business and operations. Yiwu did not spend a material amount of money on research and development in 2010.

The main competitors of Yiwu are Hangzhou Xinfeng Office Equipment Co, Ltd., Hangzhou Sihai Office Equipment Co, Ltd. and Shanghai Xunbo Office Equipment Co, Ltd.

Hangzhou Wang Da Electronics Company, Limited (“Wang Da”)

Wang Da is an authorized sales agent focusing on the selling, circulation and modern logistics of cell phones, cell phone products, IT products (including notebook or laptop computers), and digital products (including digital cameras, digital camcorders, MP3 players, PDAs, flash disks, and removable hard disks) in China. Wang Da mainly distributes its products through retail “stores in stores” located in major department stores throughout the “Huadong” region of China (consisting of the Chinese provinces of Zhejiang, Jiangsu and Anhui). Wang Da had 215 retail locations in 2010. Wang Da contributed 28.5% of the Company’s revenue in 2010.

The five largest suppliers and customers for Wang Da in 2010 are as follows:

| Top 5 suppliers | | Top 5 customers |

| Shenzhen Tianyin Telecommunication Company Limited | | Zhejiang Suning Appliance Company Limited |

| | | |

| Hangzhou Weihua Telecommunication Company Limited | | Shanghai Jiadeli Supermarket Group |

| | | |

| Hangzhou Tianchen Digital Telecommunication Company Limited | | Shanghai Guangda Comunication Terminal Products Sales Company Limited |

| | | |

| Hangzhou Liandong Telecommunication Equipment Company Limited | | Suzhou Meijia Supermarket Group |

| | | |

| Shanghai Post&Telecom Appliances Company (Hangzhou) | | Huarun Vanguard Supermarket (Zhejiang) Company Limited |

The five largest suppliers contributed 60.9% of the purchases of Wang Da in 2010 and the five largest customers contributed 15.7% of revenue of Wang Da in 2010.

Wang Da has a diverse customer base and the loss of any single customer is not expected to have a material adverse affect on the Company’s business and operations. Wang Da did not spend a material amount of money on research and development and did not have a significant backlog as of December 31, 2010.

The main competitors of Wang Da include Telephone World, Hangzhou Yindun, Shanghai Guangda, Changjiang Tianyin and Hangzhou Zhenghua. Additionally, there are Ningbo Haishu and Zhongyu. Wang Da has many years of experiences in mobile phone sales. Wang Da has a wide distribution network in Zhejiang, Shanghai, Jiangsu and other regions. These competitors use a variety of business models such as “store in stores”, free standing stores and distribution channels. The competitors have smaller scale of operation and smaller distribution regions compared to Wang Da. Therefore, these competitors typically have only a fraction of our sales.

Hangzhou Sanhe Electronic Technology Limited (“Sanhe”)

Sanhe is a home electronics retail chain in Eastern China, headquartered in HangZhou City. In 2010, it had 210 retail “store in stores” in Shanghai City, Zhejiang Province and Jiangsu Province. Sanhe specializes in the sale of home electronics, including air conditioners, audio systems, speakers, DVD players and TV. Sanhe contributed 27.7% of the Company’s revenue in 2010.

The five largest suppliers and customers for Sanhe in 2010 are as follows:

| Top 5 suppliers | | Top 5 customers |

| Hangzhou Xietong Trade Company Limited | | Lianhua Supermarket Group |

| | | |

| Zhejiang Zhuocheng Digital Electronics Company Limited | | Hangzhou Lianhua Huashang Group |

| | | |

| Shanghai Haier Industrial and Trade Company | | Shanghai Lotus Supercenter |

| | | |

| Shenzhen Chuangwei-RGB Electronics Company | | Jiangsu Times Supermarket Company Limited |

| | | |

| TCL Electronics Company Limited | | Huarun Vanguard Supermarket (Zhejiang) Company Limited |

The five largest suppliers contributed 68.8% of the purchases of Sanhe in 2010 and the top five customers contributed 31.9% of revenue of Sanhe in 2010.

Sanhe has a diverse customer base and, the loss of any one customer would not likely have an adverse effect on the Company’s sales. The Company did not spend a material amount of money on research and development, and did not have a significant backlog as of December 31, 2010.

The main competitors of Sanhe include Hangzhou Meidi, Hangzhou Danong, Nanjing Mingci, Shanghai Feitong and Jiangshu Huayi. Sanhe has many years of experience in the sale of home electronics which has allowed it to build good relationships with brand name companies such as TCL, Skyworth, Meidi, Longdi and Galanz. In addition, Sanhe has the competitive advantage of maintaining an extensive distribution network.

Shanghai Joy & Harmony Electronics Company Limited (“Joy & Harmony”)

Joy & Harmony is a consumer electronics retail chain in Eastern China. It had 196 retail locations in Shanghai City and Jiangsu Province in 2010. Joy & Harmony specializes in the sale of consumer electronics, including MP3 players, MP4 players, iPods, electronic dictionaries, CD players, radios, Walkmans, audio systems and speakers. The company is the authorized sales agent for well-known manufacturers in China, including Tecsun Radio and Changhong ZARVA. Joy & Harmony contributed 23.5% of the Company’s revenue in 2010.

The five largest suppliers and customers for Joy & Harmony in 2010 are as follows:

| Top 5 suppliers | | Top 5 customers |

| SONY (China) Company Limited (Shanghai) | | Shanghai Xinzehui Digital Technology Company Limited |

| | | |

| Shanghai Ganshun Trade Company Limited | | Shanghai Sanmen Tesco Company Limited |

| | | |

| Huaqi Information Digital Technology Company Limited (Shanghai) | | Shanghai Jiading Tesco Company Limited |

| | | |

| Shanghai Caitong Digital Technology Company Limited | | Shanghai Jinshan Tesco Company Limited |

| | | |

| Shanghai Bohui Electronics Company Limited | | Suzhou Auchan Supermarket Company Limited |

The five largest suppliers contributed 65.2% of the purchases of Joy & Harmony in 2010and the top five customers contributed 3.7% of revenue of Joy & Harmony in 2010.

As a retailer with hundreds of locations, the Company is not reliant on any one customer or on a few customers. The loss of any one customer would not likely have an adverse effect on Joy & Harmony’s sales. Joy & Harmony did not have any material backlog of orders at December 31, 2010. Joy & Harmony did not spend a material amount of money on research and development in 2010.

The main competitors of Joy & Harmony include Zhejiang Yifeng Technology Co., Ltd, Shanghai Yuanmai Trade Co, Ltd and Shanghai Like Digital Technology Co, Ltd. Joy & Harmony has a large number of retail locations compared to its competitors. In addition, Joy & Harmony has built good relationships with suppliers of well-known brands such as Apple, Sony, Meizu, Tecsun and Aigo.

Jinhua Baofa Logistic Litmited (“Jinhua”)

Jinhua has been in operation since 2001. Jinhua transports electronics, machinery and equipment, metal products, chemical materials, garments and handcrafted goods for businesses in the Eastern China region in which China 3C operates, such as Shanghai, Hangzhou and Nanjing. Jinhua contributed 7.2% of revenue to the Company in 2010.

The five largest vendors and customers for Jinhua in 2010 are as follows:

| Top 5 suppliers | | Top 5 customers |

| Zhejiang Sheng Tong Logistic Company Limited | | Xiamen Shida Transportation Company Limited |

| | | |

| Hangzhou Shenzhou Transportation Company Limited | | Guangzhou Shuntong Transportation Company Limited |

| | | |

| Shanghai Sheng Hui Transportation Company Limited | | Wuhan Tianda Express Company Limited |

| | | |

| Shanghai Hong Wei Transportation Company Limited | | Fuzhou Zhilian Logistics Company Limited |

| | | |

| Jiaxingshi Guohong Vehicle Transportation Company Limited | | Suzhou Auchan Supermarket Company Limited Zhuhai Zhijie Express Company Limited |

The five largest vendors contributed to 34.0% of direct cost of Jinhua in 2010 and the top five customers contributed 8.3% of revenue of Jinhua in 2010.

The main competitors of Jinhua include Hangzhou Hongrun Transportation Co., Ltd, Hangzhou Tianzhao Logistics Co., Ltd, Hangzhou Huishen Logistics Co., Ltd, Terry Logistics Group Co., Ltd, Shanghai Yanfu Logistics Co., Ltd, Shanghai Zhicheng Logistics Co., Ltd and Shanghai Jiaje Express Co., Ltd.

Intellectual Property

We consider our logos important to our business. We applied to register 10 logos with the State Administration of Industry and Commerce in China in 2007 and are currently awaiting the administration’s approval.

Seasonality and Quarterly Fluctuations

Our businesses experience fluctuations in quarterly performance. Traditionally, the first quarter has a greater amount of sales reflected by our electronics business due to the New Year holidays in China occurring during that period. Nevertheless, at times, China can experience particularly inclement weather in January and February which can disrupt the Company’s supply chain management systems. As our business model is to operate only on several days of inventory, the effects of such weather disruptions can be severe in certain years.

Working Capital

We fund our business operations through a combination of available cash and equivalents, short-term investments and cash flows generated from operations. We believe our currently available working capital, primarily cash from operations, is adequate to execute our current business plan.

Customers

We do not have a significant concentration of sales to any individual customer and, therefore, the loss of any one customer would not have a material impact on our business. No single customer has accounted for 10% or more of our total revenue in 2010 and 2009.

Backlog

We do not have a material amount of backlog orders.

Government Contracts

No material portion of our business is subject to renegotiation of profits or termination of contracts or subcontracts at the election of the Chinese government.

Competition

We compete against other consumer electronics retailers and wholesalers. We compete principally on the basis of product assortment and availability and value pricing, customer service; store location and convenience and after-sales services. We believe our broad product assortment, competitive pricing and convenient store locations differentiate us from most competitors. Our stores compete by emphasizing a complete product and service solution and value pricing. In addition, our trained and knowledgeable sales and service staffs allow us to tailor the offerings to meet the needs of our customers.

Research and Development

We have not engaged in any material research and development activities during the past two fiscal years.

Environmental Matters

We are subject to China’s National Environmental Protection Law, as well as a number of other national and local laws and regulations regulating air, water and noise pollution and setting pollutant discharge standards. We believe that all our operations are in material compliance with all applicable environmental laws. We did not incur any costs to comply with environmental laws in 2010 and 2009.

Employees

The Company currently has 2,271 employees, all of which are full time employees located in China. Zhejiang has 52 employees, Yiwu has 297 employees, Wang Da has 525 employees, Sanhe has 521 employees, Joy & Harmony has 352 employees and Jinhua has 524 employees.

The Company has no collective bargaining agreements with any unions.

Part II

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with the Consolidated Financial Statements and Notes thereto appearing elsewhere in this Form 10-K. The following discussion contains forward-looking statements. Our actual results may differ significantly from those projected in the forward-looking statements. Factors that may cause future results to differ materially from those projected in the forward-looking statements include, but are not limited to, those discussed in “Risk Factors” and elsewhere in this Form 10-K/A.

Overview (All dollar amounts in thousands)

China 3C owns 100% of CFDL and CFDL own 100% of the capital stock of Joy & Harmony and Sanhe. Until August 14, 2007, when it made the change to its ownership structure described in the next paragraph in order to comply with certain requirements of PRC law, CFDL owned 100% of the capital stock of Zhenjiang. Zhejiang owns 90% and Yiwu owns 10% of Wang Da. Zhejiang owns 90% and Wang Da owns 10% of Yiwu. On March 10, 2009 Zhejiang set up a new operating entity, Hangzhou Letong Digital Technology Co., Ltd. (“Letong”) to establish an electronic retail franchise operation for China 3C Group. On July 6, 2009, Zhejiang and Yiwu completed the acquisition of Jinhua Baofa Logistic Ltd (“Jinhua”). Jinhua was incorporated under the laws of PRC on December 27, 2001.

On December 21, 2005, CFDL became a wholly owned subsidiary of China 3C through a merger with a wholly owned subsidiary of the Company (the “Merger Transaction”). China 3C acquired all of the issued and outstanding capital stock of CFDL pursuant to a the Merger Agreement dated at December 21, 2005 by and among China 3C, XY Acquisition Corporation, CFDL and the shareholders of CFDL (the “Merger Agreement”). Pursuant to the Merger Agreement, CFDL became a wholly owned subsidiary of China 3C and, in exchange for the CFDL shares, China 3C issued 35,000,000 shares of its common stock to the shareholders of CFDL, representing 93% of the issued and outstanding capital stock of China 3C at that time and cash of $500. On August 15, 2007, we executed a series of contractual agreements between Capital and Zhejiang. The contractual agreements give Capital and its equity owners an obligation, and having ability to absorb, any losses, and rights to receive returns; however, these contractual agreements did not change the equity ownership of Zhejiang. We did not dispose Capital’s actual equity ownership of Zhejiang when we execute the contractual agreements. Capital entered into share-holding entrustment agreements with five individuals: Zhenggang Wang, Yimin Zhang, Huiyi Lv,Xiaochun Wang and Zhongsheng Bao to hold 35%, 20%, 20%, 15% and 10%, respectively, of the equity interest of Zhejiang on behalf of Capital on November 21, 2005. The entrustment agreements confirm that CFDL is the actual owner of Zhejiang. CFDL enjoys the actual shareholder rights and has the right to obtain any benefits received by the nominal holders. Zhenggang Wang is the CEO and shareholder of China 3C Group. Yimin Zhang, Huiyi Lv, Xiaochun Wang and Zhongsheng Bao have no other relationship with China 3C Group. No consideration was given to these individuals who held the equity of Zhejiang on behalf of CFDL.

As a result of the Merger Agreement, the reorganization was treated as an acquisition by the accounting acquiree that is being accounted for as a recapitalization and as a reverse merger by the legal acquirer for accounting purposes. Pursuant to the recapitalization, all capital stock shares and amounts and per share data have been retroactively restated. Accordingly, the financial statements include the following:

(1) The balance sheet consists of the net assets of the accounting acquirer at historical cost and the net assets of the legal acquirer at historical cost.

(2) The statements of operations include the operations of the accounting acquirer for the period presented and the operations of the legal acquirer from the date of the merger.

Pursuant to a share exchange agreement, dated August 3, 2006, we issued 915,751 shares of restricted common stock to the former shareholders of Sanhe, valued at $3,750, which was the fair value of the shares at the date of the share exchange agreement. This amount is included in the cost of net assets and goodwill purchased.

Pursuant to a share exchange agreement, dated November 28, 2006, we issued 2,723,110 shares of newly issued shares of common stock to the former shareholders of Joy & Harmony, valued at $11,000, which was the fair value of the shares at the date of exchange agreement. This amount is included in the cost of net assets and goodwill purchased.

On July 6, 2009, China 3C’s subsidiaries, Zhejiang and Yiwu completed acquisition of Jinhua, a company organized under the laws of the PRC. Zhejiang acquired 90% and Yiwu acquired 10% of the entire equity interests in Jinhua from the shareholders of Jinhua for a purchase price of RMB 120,000 ($17,500) in cash.

Yiwu, Wangda, Sanhe, Joy & Harmony are engaged in the business of resale and distribution of third party products and generates approximately 100% of its revenue from resale of items such as mobile phones, facsimile machines, DVD players, stereos, speakers, MP3 and MP4 players, iPod, electronic dictionaries, CD players, radios, Walkmans, and audio systems. We sell and distribute products through retail stores and secondary distributors. We operate most of our retail operations through our “store in store” model. Under this model, the Company leases space in major department stores and retailers. Leasing costs can vary based on a percentage of sales, or can be fixed. In 2010 and 2009, all of our stores in stores leases were variable based on sales.

In 2009, Zhejiang started establishing direct electronic retail stores and franchise operation. As of December 31, 2010, the Company has two franchise stores and three direct retail stores in operation, all of which are located in Zhejiang province. For the years ended December 31, 2010 and 2009, the direct stores and franchise stores had revenue of $138 and $258. The direct store and franchise operation is still in the early stage and does not represent a significant part of our business as of December 31, 2010.

Following the acquisition of Jinhua, the Company began providing logistic service to businesses in addition to its traditional business of resale and distribution of third party products such as mobile phones, facsimile machines, DVD players, stereos, speakers, MP3 and MP4 players, iPods, electronic dictionaries, CD players, radio Walkmans and audio systems.

Results of Operations

Year Ended December 31, 2010 compared to Year Ended December 31, 2009

Reportable Operating Segments

The Company reports financial and operating information in the following five segments:

| a) | Yiwu Yong Xin Telecommunication Company, Limited or “Yiwu” |

| b) | Hangzhou Wang Da Electronics Company, Limited or “Wang Da” |

| c) | Hangzhou Sanhe Electronic Technology Limited or “Sanhe” |

| d) | Shanghai Joy & Harmony Electronics Company Limited or “Joy & Harmony” |

| e) | Jinhua Baofa Logistic Limited or “Jinhua” |

| a) | Yiwu Yong Xin Telecommunication Company, Limited or “Yiwu” |

Yiwu focuses on the selling, circulation and modern logistics of fax machines and cord phone products.

All amounts, except percentage of revenues, in thousands of US dollars.

| | | Year Ended December 31, | | | Percentage | |

| Yiwu | | 2010 | | | 2009 | | | Change | |

| Revenue (restated) | | $ | 20,251 | | | $ | 44,375 | | | | (54.4 | )% |

| Gross Profit (restated) | | $ | 2,328 | | | $ | 5,129 | | | | (54.6 | )% |

| Gross Margin (restated) | | | 11.5 | % | | | 11.6 | % | | | (0.1 | )% |

| Operating (Loss) | | $ | (2,456 | ) | | $ | (612 | ) | | | (301.3 | )% |

For the year ended December 31, 2010, Yiwu generated revenue of $20,251, a decrease of $24,124 or 54.4% compared to $44,375 for the year ended December 31, 2009. Gross profit decreased $2,801 or 54.6% from $5,129 for the year ended 2009 to $2,328 for the year ended 2010. Such decrease in revenue was primarily due to the shrinking market in office communication products. The decrease in revenue was also a result of closing 73 stores in stores in 2010. Operating losses was $2,456 in 2010; operating loss increased $1,844 or 301.3% compared to $612 in 2009. The increase in operating losses was primarily a result of higher labor cost and management fees paid to department stores as a percentage of sales.

Gross profit margin decreased from 11.6% in 2009 to 11.5% in 2010, a decrease of 0.1%. Such decrease is primarily due to the more competitive fax machines and telephone market in China compared to 2009. To maintain market share, we had to launch more promotions which negatively affected our gross margin. In addition, purchase rebate paid to suppliers, accounted for as an addition to cost of sales, as a percentage of sales increased in 2010, which led to lower gross margin of Yiwu.

| b) | Hangzhou Wang Da Electronics Company, Limited or “Wang Da” |

Wang Da focuses on the selling, circulation and modern logistics of cell phones, cell phones products, and digital products, including digital cameras, digital camcorders, PDAs, flash disks, and removable hard disks.

All amounts, except percentage of revenues, in thousands of US dollars.

| | | Year Ended December 31, | | | Percentage | |

| Wang Da | | 2010 | | | 2009 | | | Change | |

| Revenue (restated) | | $ | 43,801 | | | $ | 58,744 | | | | (25.4 | )% |

| Gross Profit (restated) | | $ | 3,728 | | | $ | 6,600 | | | | (43.5 | )% |

| Gross Margin (restated) | | | 8.5 | % | | | 11.2 | % | | | (2.7 | )% |

| Operating (Loss) | | $ | (3,156 | ) | | $ | (262 | ) | | | (1,104.6 | )% |

For the year ended December 31, 2010, Wang Da generated revenue of $43,801, a decrease of $14,943 or 25.4% compared to $58,744 for the year ended December 31, 2009. Gross profit decreased $2,872 or 43.5% from $6,600 for the year ended 2009 to $3,728 for the year ended 2010. The decrease in revenue was primarily due to increased competition from government-owned large telecommunication service providers. Telecommunication service providers opened their direct operating stores to sell communication products. The number of electronics stores opened in the same area where Wang Da’s stores are located has increased in 2010. These government-owned companies also launched promotions such as “free phone with service contract” which drove the Wang Da’s revenue further down. Operating losses was $3,156 in 2010, increased $2,894 or 1,104.6% compared to operating loss of $262 in 2009. The increase in operating losses was primarily a result of higher labor cost and management fees paid to department stores as a percentage of sales.

Gross profit margin decreased from 11.2% in 2009 to 8.5% in 2010. The decrease was due to lower unit price of old model mobile phones as a result of the introduction of the 3G phones.

| c) | Hangzhou Sanhe Electronic Technology Limited or “Sanhe” |

Sanhe focuses on the selling, circulation and modern logistics of home electronics, including DVD players, audio systems, speakers, televisions and air conditioners.

All amounts, except percentage of revenues, in thousands of US dollars.

| | | Year Ended December 31, | | | Percentage | |

| Sanhe | | 2010 | | | 2009 | | | Change | |

| Revenue (restated) | | $ | 42,427 | | | $ | 53,385 | | | | (20.5 | )% |

| Gross Profit (restated) | | $ | 4,426 | | | $ | 8,627 | | | | (48.7 | )% |

| Gross Margin (restated) | | | 10.4 | % | | | 16.2 | % | | | (5.8 | )% |

| Operating (Loss) | | $ | (5,469 | ) | | $ | (741 | ) | | | (638.1 | )% |

For the year ended December 31, 2010, Sanhe generated revenue of $42,427, a decrease of $10,958 or 20.5% compared to $53,385for the year ended December 31, 2009. Gross profit decreased $4,201 or 48.7% from $8,627 for the year ended 2009 to $4,426 for the year ended 2010. The decrease in revenue was primarily due to the shrinking market in DVD players and small home electronics as well as the closing of 11 stores in 2010. Operating losses was $5,469 in 2010, increased $4,728 or 638.1% compared to $741 in 2009. The increase in operating losses was primarily a result of non-cash goodwill impairment charge of $1,347, higher labor cost and management fees paid to department stores as a percentage of sales.

Gross profit margin decreased from 16.2% in 2009 to 10.4% in 2010. The decrease in gross profit and operation income was primarily due to the change in sales revenue mix. Due to the lesser sales of DVD players and other small home electronics, we increased sales volume of TV sets, which has a lower margin, to maintain the market share. Therefore, gross margin for Sanhe decreased in 2010.

Goodwill Impairment

We recorded non-cash goodwill impairment charge of $1,347 for the year ended December 31, 2010 to reduce the carrying amount of Sanhe’s goodwill to its estimated fair value based upon the impairment test conducted during the fourth quarter of 2010. For further discussion of goodwill impairment charges see Note 2 – “SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES – Impairment of Goodwill” to the Consolidated Financial Statements.

| d) | Shanghai Joy & Harmony Electronics Company Limited or “Joy & Harmony” |

Joy & Harmony focuses on the selling, circulation and modern logistics of consumer electronics, including MP3 players, MP4 players, iPod, electronic dictionary, radios, and Walkman.

All amounts, except percentage of revenues, in thousands of US dollars.

| | | Year Ended December 31, | | | Percentage | |

| Joy & Harmony | | 2010 | | | 2009 | | | Change | |

| Revenue (restated) | | $ | 40,247 | | | $ | 56,660 | | | | (29.0 | )% |

| Gross Profit (restated) | | $ | 5,460 | | | $ | 9,421 | | | | (42.0 | )% |

| Gross Margin (restated) | | | 13.6 | % | | | 16.6 | % | | | (3.0 | )% |

| Operating Income (Loss) | | $ | (11,395 | ) | | $ | 1,012 | | | | (1,226.0 | )% |

For the year ended December 31, 2010, Joy & Harmony generated revenue of $40,247, a decrease of $16,413 or 29.0% compared to $56,660 for the year ended December 31, 2009. Gross profit decreased $3,961 or 42.0% from $9,421 for the year ended 2009 to $5,460 for the year ended 2010. The decrease in revenue was primarily due to a more competitive consumer electronics market as well as closing of 22 stores in 2010. The number of electronics stores located in the area where Joy & Harmony’s stores are located has increased in 2010. In addition, many small manufacturers closed down and large manufacturers raised the price of consumer electronics, which forced Joy & Harmony to discontinue some of its products. This caused sales to decline. Operating losses was $11,395 in 2010, a decrease of $12,407 or 1,226.0% compared to operating income of $1,012 in 2009, the decrease was primarily due to the non-cash goodwill impairment loss of $8,243 and an increase in management fees paid to department stores.

Gross profit margin decreased from 16.6% in 2009 to 13.6% in 2010. The global financial crisis caused many small electronics manufacturers to exit the market and large manufacturers to raise the price of consumer electronics. Therefore, the cost for Joy & Harmony increased, which led to a significant decline in gross margin.

Goodwill Impairment

We recorded non-cash goodwill impairment charge of $8,243 for the year ended December 31, 2010 to reduce the carrying amount of Joy & Harmony’s goodwill to its estimated fair value based upon the impairment test conducted during the fourth quarter of 2010. For further discussion of goodwill impairment charges see Note 2 – “SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES – Impairment of Goodwill” to the Consolidated Financial Statements.

| e) | Jinhua Baofa Logistic Limited or “Jinhua” |

Jinhua provides transportation service to business and transports freight, including electronics, machinery and equipment, metal products, chemical materials, garments and handicraft goods, in more than 20 cities in Eastern China. Its transportation services cover many of the most developed cities in Eastern China such as Shanghai, Hangzhou and Nanjing.

China 3C acquired Jinhua on July 6, 2009. Therefore, the consolidated statement of income (loss) and comprehensive income (loss) of China 3C for the year ended December 31, 2009 includes Jinhua’s operating results from the date of acquisition to December 31, 2009.

All amounts, except percentages of revenues, are in thousands of US dollars.

| Jinhua | | Year Ended December

31, 2010 | | | For the period from July 1

to December 31, 2009 | |

| Revenue | | $ | 10,691 | | | $ | 5,573 | |

| Gross Profit | | $ | 1,402 | | | $ | 1,713 | |

| Gross Margin | | | 13.1 | % | | | 30.7 | % |

| Operating Income (Loss) | | $ | (1,448 | ) | | $ | 1,098 | |

Gross margin decreased 17.6% from 30.7% in 2009 to 13.1% in 2010 primarily due to the increased fuel cost. Operating income decreased primarily due to decreased gross margin. Higher operating expenses, in particular, also caused operating income to decrease. The labor cost of Jinhua increased 30% or $1,080 in 2010 due to the mandated government policy as well as higher inflation.

Net sales

Net sales for 2010 totaled $158,094 (restated), a year-over-year decrease of $60,900 or 27.8% compared to $218,994 (restated) for 2009. The decrease was attributable to the closing of 107 stores in stores in 2010 as well as the increased competition in the electronics market in China.

Percentage of sales

In 2010, the Company earned 68.8% of its sales from its retail operations and 31.2% from its wholesale operations compared to 68.9% from retail operations and 31.1% from wholesale in 2009.

Percentage of sales from retail and wholesale operations for each segment is as follows:

| | | Yiwu | | | Wang Da | | | Sanhe | | | Joy &

Harmony | | | Total | |

| Retail | | | 66.2 | % | | | 68.3 | % | | | 70.1 | % | | | 70.6 | % | | | 68.8 | % |

| Wholesale | | | 33.8 | % | | | 31.7 | % | | | 29.9 | % | | | 29.4 | % | | | 31.2 | % |

Cost of Sales

Cost of sales for 2010 totaled $140,668, or 89.0% of net sales compared to $187,476, or 85.6% for 2009. The decrease in the cost of sales was a result of the decrease in sales. The cost of sales as a percentage increased during 2010 primarily due to increased costs of electronics products. The increase in purchase rebate paid to supplier, accounted for as an addition to cost of sales, also contributed to the increase in cost of sales.

Top Ten Suppliers of Each of Our Subsidiaries in 2010

| | Yiwu | | Wang Da | | Sanhe | | Joy & Harmony | | Jinhua |

| 1 | Fengda Technology Company Limited | | Shenzhen Tianyin Telecommunication Company Limited | | Hangzhou Xietong Trade Company Limited | | SONY(China) Company Limited (Shanghai) | | Zhejiang Sheng Tong Logistic Company Limited |

| | | | | | | | | | |

| 2 | Ninbo Zhongxun Electronics Company Limited | | Hangzhou Weihua Telecommunication Company Limited | | Zhejiang Zhuocheng Digital Electronics Company Limited | | Shanghai Ganshun Trade Company Limited | | Hangzhou Shenzhou Transportation Company Limited |

| | | | | | | | | | |

| 3 | Shanghai Zhongfang Electronics Company Limited | | Hangzhou Tianchen Digital Telecommunication Company Limited | | Shanghai Haier Industrial and Trade Company | | Huaqi Information Digital Technology Company Limited (Shanghai) | | Shanghai Sheng Hui Transportation Company Limited |

| | | | | | | | | | |

| 4 | Hangzhou Senruida Trade Company Limited | | Hangzhou Liandong Telecommunication Equipment Company Limited | | Shenzhen Chuangwei-RGB Electronics Company | | Shanghai Caitong Digital Technology Company Limited | | Shanghai Hong Wei Transportation Company Limited |

| 5 | Shanghai Hongyi Office Supplies Company Limited | | Shanghai Post&Telecom Appliances Company (Hangzhou) | | TCL Electronics Company Limited | | Shanghai Bohui Electronics Company Limited | | Jiaxingshi Guohong Vehicle Transportation Company Limited |

| | | | | | | | | | |

| 6 | Shanghai Guangdian Equipment Company Limited | | Hangzhou Qiuxin Internet Equipment Company Limited | | Qingdao Haixin Electronics Limited Hangzhou branch | | Shanghai Yiqike Industrial and Trade Company Limited | | Guangzhou Shuntong Transportation Company Limited |

| | | | | | | | | | |

| 7 | Yiwu Wantong Telecom Equipment Company Limited | | Shenzhen Liansheng Technology Company Limited | | Shenzhen Asicer Electronics Company Limited | | Shanghai Tande Electronics Technology Company Limited | | Shanghai Shenghui Transportation Company Limited |

| | | | | | | | | | |

| 8 | Jiaxing Yage Electronics Company Limited | | Hangzhou Jiuxin Telecommunication Appliances Company Limited | | Dongguang Lebang Electronics Limited | | Shenzhen Dejing Electronics Company Limited | | Hefei Yuan Shun Da Transportation Company Limited |

| | | | | | | | | | |

| 9 | Shanghai Huoke Electronics Company Limited | | Hangzhou Fuyin Trade Company Limited | | Zhejiang Saixin Technology Limited | | Chongqing Zhaohua Digital Technology Company Limited | | Zhuhai Zhijie Transportation Company Limited |

| | | | | | | | | | |

| 10 | Shanghai Rongduo Business Company Limited | | Shenzhen Jinfeng Datong Technology Company Limited | | Zhongshan Longdi Electronics Limited | | Dongguan Gemei Technology Company Limited | | Sanming Yunlin Vehicle Transportation Company Limited |

Gross Profit Margin

Gross profit margin in 2010 decreased to 11.0% compared to 14.4% in 2009. The gross profit margin decrease was mainly attributed to the fact that many small manufacturers of computers, communication and consumer products exited the market and large manufacturers raised the cost of goods due to the global economic slowdown. In addition, the increased competition led the Company to launch more promotional sales to attract customers. These events caused gross margin to decrease. The decrease in gross margin was also due to the increase in sales rebate paid to suppliers.

Because the Company does not include the costs for its distribution network in cost of sales, its gross profit and gross profit as a percentage of net sales (“gross profit margin”) may not be comparable to those of other retailers that may include distribution costs in cost of sales and in gross profit and gross margin.

General and Administrative Expenses

General and administrative expenses for 2010 totaled $42,263 (restated), or 26.7% of net sales, compared to $32,126(restated), or 14.7% of net sales for 2009. General and administration expense increased 31.6% primarily due to a 16.4% increase in labor cost, increase in management fees paid to department stores and goodwill impairment of $9,591 charged in 2010.

Income (Loss) from Operations

Operating loss for 2010 was $24,837, or (16.7)% of net sales compared to $608, or (0.3)% of net sales for 2009. Declined sales and gross margin and increased general and administration expenses led to the decline in income from operations.

Provision for income taxes

Provision for income taxes for 2010 was $52, representing year-over-year decrease of 92.7% compared to $714 for 2009. The decrease in income tax expenses was due to Yiwu, Wang Da and Sanhe and Joy & Harmony having net losses in 2010 and therefore not having income tax expenses. Zhejiang was the only subsidiary having net income but the tax expense was not significant. Although Jinhua had net losses, Jinhua paid a small amount of income taxes based on the simplified tax system.

Net Income (loss)

Net loss was $(24,927) or (16.8)% of net sales for 2010 compared to $1,213 or (0.6) % of net sales for 2009. Net income decreased primarily due to a decrease in sales and gross margin and an increase in general administration expenses.

Foreign currency translation adjustments

The impact of foreign translation from our accounts in RMB to US dollar on China 3C’s operating results was not material. During the translation process, the assets and liabilities of all PRC subsidiaries are translated into US dollars at period-end exchange rates. The revenues and expenses are translated into US dollars at average exchange rates of the periods. Resulting translation adjustments are recorded as a component of accumulated other comprehensive income within stockholders’ equity.

| | | 2010 | | | 2009 | |

| RMB/US$ exchange rate at year end | | | 0.15170 | | | | 0.14626 | |

| Average RMB/US$ exchange rate for the years | | | 0.14792 | | | | 0.14618 | |

Transaction gains or losses arising from exchange rate fluctuation on transactions denominated in a currency other than the functional currency were included in the consolidated results of operations. As a result of the translation, China 3C recorded a foreign currency gain of $1,526 in 2010 and loss of $92 thousand in 2009, which is a separate line item on the Statements of Operations.

Year Ended December 31, 2009 compared to Year Ended December 31, 2008

The Company reports financial and operating information in the following five segments:

| a) | Yiwu Yong Xin Telecommunication Company, Limited or “Yiwu” |

| b) | Hangzhou Wang Da Electronics Company, Limited or “Wang Da” |

| c) | Hangzhou Sanhe Electronic Technology Limited or “Sanhe” |

| d) | Shanghai Joy & Harmony Electronics Company Limited or “Joy & Harmony” |

| e) | Jinhua Baofa Logistic Limited or “Jinhua” |

| a) | Yiwu Yong Xin Telecommunication Company, Limited or “Yiwu” |

Yiwu focuses on the selling, circulation and modern logistics of fax machines and cord phone products.

All amounts, except percentage of revenues, in thousands of US dollars.

| | | Year Ended December 31, | | | Percentage | |

| Yiwu | | 2009 | | | 2008 | | | Change | |

| Revenue | | $ | 44,375 | | | $ | 63,370 | | | | (30.0 | )% |

| Gross Profit | | $ | 5,129 | | | $ | 9,978 | | | | (48.6 | )% |

| Gross Margin | | | 11.6 | % | | | 15.8 | % | | | (4.2 | )% |

| Operating Income (Loss) | | $ | (612 | ) | | $ | 7,615 | | | | (108.0 | )% |

For the year ended December 31, 2009, Yiwu generated revenue of $44,375, a decrease of $18,995 or 30.0% compared to $63,370 for the year ended December 31, 2008. Gross profit decreased $4,849 or 48.6% from $9,978 for the year ended 2008 to $5,129 for the year ended 2009. Operating losses was $612 in 2009, a decrease of $8,227 or 108.0% compared to operating income of $7,615 in 2008. Such decrease in revenue was primarily due to the shrinking market in office communication products. The decrease in revenue was also a result of closing 23 stores in stores in 2009.

Gross profit margin decreased from 15.8% in 2008 to 11.6% in 2009, a decrease of 4.2%. Such decrease is primarily due to of the more competitive fax machines and telephone market in China as compared to 2008. In order to maintain market shares, we had to launch more promotions which negatively affected the gross margin. In addition, sales rebate paid to suppliers as a percentage of sales increased in 2009, which led to lower gross margin of Yiwu.

| b) | Hangzhou Wang Da Electronics Company, Limited or “Wang Da” |

Wang Da focuses on the selling, circulation and modern logistics of cell phones, cell phones products, and digital products, including digital cameras, digital camcorders, PDAs, flash disks, and removable hard disks.

All amounts, except percentage of revenues, in thousands of US dollars.

| | | Year Ended December 31, | | | Percentage | |

| Wang Da | | 2009 | | | 2008 | | | Change | |

| Revenue | | $ | 58,744 | | | $ | 102,935 | | | | (42.9 | )% |

| Gross Profit | | $ | 6,600 | | | $ | 16,313 | | | | (59.5 | )% |

| Gross Margin | | | 11.2 | % | | | 15.9 | % | | | (4.7 | )% |

| Operating Income (Loss) | | $ | (262 | ) | | $ | 11,527 | | | | (102.3 | )% |

For the year ended December 31, 2009, Wang Da generated revenue of $58,744, a decrease of $44,191 or 42.9% compared to $102,935 for the year ended December 31, 2008. Gross profit decreased $9,713 or 59.5% from $16,313 for the year ended 2008 to $6,600 for the year ended 2009. Operating losses was $262 in 2009, a decrease of $8,227 or 102.3% compared to operating income of $11,527 in 2008. The decrease in revenue was primarily due to the high competition from government-owned large telecommunication service providers. Telecommunication service providers started to open their direct operating stores to sell communication products and also launched promotions such as “free phone with service contract” in 2009. In addition, the introduction of 3G phones caused lower demand for the old model mobile phones. Meanwhile, the 3G network is still in the trial period, customers are waiting to upgrade to 3G phones until the 3G network is complete. The decrease in revenue was also attributed to the closing of 42 stores in stores in 2009.

Gross profit margin decreased from 15.9% in 2008 to 11.2% in 2009. The decrease was due to lower unit price of old model mobile phones as a result of the introduction of the 3G phones.

| c) | Hangzhou Sanhe Electronic Technology Limited or “Sanhe” |

Sanhe focuses on the selling, circulation and modern logistics of home electronics, including DVD players, audio systems, speakers, televisions and air conditioners.

All amounts, except percentage of revenues, in thousands of US dollars.

| | | Year Ended December 31, | | | Percentage | |

| Sanhe | | 2009 | | | 2008 | | | Change | |

| Revenue | | $ | 53,385 | | | $ | 70,243 | | | | (24.0 | )% |

| Gross Profit | | $ | 8,627 | | | $ | 12,444 | | | | (30.7 | )% |

| Gross Margin | | | 16.2 | % | | | 17.7 | % | | | (1.5 | )% |

| Operating Income (Loss) | | $ | (741 | ) | | $ | 7,509 | | | | (109.9 | )% |

For the year ended December 31, 2009, Sanhe generated revenue of $53,385, a decrease of $16,858 or 24.0% compared to $70,243 for the year ended December 31, 2008. Gross profit decreased $3,817 or 30.7% from $12,444 for the year ended 2008 to $8,627 for the year ended 2009. Operating losses was $741 in 2009, a decrease of $8,250 or 109.9% compared to operating income of $7,509 in 2008. The increase in revenue was primarily due to the shrinking market in DVD players and small home electronics as well as the closing of 24 stores in 2009.

Gross profit margin decreased from 17.7% in 2008 to 16.2% in 2009. The decrease in gross profit and operating income was primarily due to the change in sales revenue mix. In 2009, due to the lesser sales of DVD players and other small home electronics, sales volume of TV sets, which has a lower margin, comparatively increased. Therefore, gross margin for Sanhe decreased in 2009.

| d) | Shanghai Joy & Harmony Electronics Company Limited or “Joy & Harmony” |

Joy & Harmony focuses on the selling, circulation and modern logistics of consumer electronics, including MP3 players, MP4 players, iPod, electronic dictionary, radios, and Walkman.

All amounts, except percentage of revenues, in thousands of US dollars.

| | | Year Ended December 31, | | | Percentage | |

| Joy & Harmony | | 2009 | | | 2008 | | | Change | |

| Revenue | | $ | 56,660 | | | $ | 74,096 | | | | (23.5 | )% |

| Gross Profit | | $ | 9,421 | | | $ | 9,906 | | | | (57.1 | )% |

| Gross Margin | | | 16.6 | % | | | 13.4 | % | | | 3.2 | % |

| Operating Income | | $ | 1,012 | | | $ | 7,406 | | | | (86.3 | )% |

For the year ended December 31, 2009, Joy & Harmony generated revenue of $56,660, a decrease of $17,436 or 23.5% compared to $74,096 for the year ended December 31, 2008. Gross profit decreased $485 or 4.9% from $9,906 for the year ended 2008 to $9,421 for the year ended 2009. Operating income was $1,012 in 2009, a decrease of $6,394 or 86.3% compared to $7,406 in 2008. The decrease in revenue was primarily due to closing of 12 stores in 2009. In addition, manufacturers have been introducing new products at a slower rate and the old products currently on the market have become out-dated. This has caused the unit price of consumer electronics to drop and sales to decline.

Gross profit margin increased from 13.4% in 2008 to 16.6% in 2009.

| e) | Jinhua Baofa Logistic Limited or “Jinhua” |

Jinhua provides transportation service to business and transports freight, including electronics, machinery and equipment, metal products, chemical materials, garments and handicraft goods, in more than 20 cities in Eastern China. Its transportation services cover many of the most developed cities in Eastern China such as Shanghai, Hangzhou and Nanjing.

China 3C acquired Jinhua on July 6, 2009. Therefore, the consolidated statement of income (loss) and comprehensive income (loss) of China 3C for the year ended December 31, 2009 includes Jinhua’s operating results from the date of acquisition to December 31, 2009.

All amounts, except percentages of revenues, are in thousands of US dollars.

| Jinhua | | For the period

from July 1 to

December 31, 2009 | |

| Revenue | | $ | 5,573 | |

| Gross Profit | | $ | 1,713 | |

| Gross Margin | | | 30.7 | % |

| Operating Income | | $ | 1,098 | |

Net sales

Net sales for 2009 totaled $218,994, representing a year-over-year decrease of 29.5% compared to $310,645 for 2008. The decrease was attributable to the closing of 101 stores in stores in 2009 as well as the negative effect of global economic slowdown.

Percentage of sales

In 2009, the Company earned 68.9% of its sales from its retail operations and 31.1% from its wholesale operations compared to 68.7% from retail operations and 31.3% from wholesale in 2008.

Percentage of sales from retail operations and wholesale operations for each segment is as follows:

| | | Yiwu | | | Wang Da | | | Sanhe | | | Joy & Harmony | |

| Retail | | | 68.7 | % | | | 69.9 | % | | | 67.6 | % | | | 69.7 | % |

| Wholesale | | | 31.3 | % | | | 30.1 | % | | | 32.4 | % | | | 30.3 | % |

Cost of Sales

Cost of sales for 2009 totaled $187,476, or 85.6% of net sales compared to $262,003, or 84.3% for 2008. The decrease in the cost of sales was a direct result of the corresponding decrease in sales. The cost of sales as a percentage increased during 2009 primarily due to increased costs of electronics products as well as increase in sales rebate paid to suppliers.

Top Ten Suppliers of Each of Our Subsidiaries in 2009

| | Yiwu | | Wang Da | | Sanhe | | Joy & Harmony | | Jinhua |

| 1 | Fengda Technology Company Limited | | Shanghai Post & Telecom Appliances Co - Hangzhou | | Zhejiang Zhuocheng Digital Electronics Company Limited | | Shanghai Ganshun Trade Company Limited | | Zhejiang Sheng Tong Logistic Company Limited |

| | | | | | | | | | |

| 2 | Hangzhou Shenruida Trade Company Limited | | Shenzhen Tianyin Telecommunication Company Limited | | Hangzhou Xietong Trade Co., Limited | | Huaqi Information Digital Technology Company Limited (aigo) – Shanghai | | Shanghai Hong Wei Transportation Company Limited |

| | | | | | | | | | |

| 3 | Shanghai Zhongfang Electronics Company Limited | | Hangzhou Tianchen Digital Telecommunication Company Limited | | Shanghai Haier Industrial and Trade Company | | SONY- Shanghai Company Limited | | Hangzhou Shenzhou Transportation Company Limited |

| | | | | | | | | | |

| 4 | Wenzhou Jingwei Company | | Hangzhou Qiuxin Internet Equipment Company Limited | | Zhejiang Saixin Technology Limited | | Shanghai Jingming Technology Company Limited | | Jiaxingshi Guohong Vehicle Transportation Company Limited |

| | | | | | | | | | |

| 5 | Ninbo Zhongxun Electronics Company Limited | | Hangzhou Weihua Telecommunication Company Limited | | Shenzhen Chuangwei-RGB Electronics Company | | Shanghai China-tex Electronic System Company Limited | | Shanghai Sheng Hui Transportation Company Limited |

| | | | | | | | | | |

| 6 | Shanghai Hongyi Office Supplies Company Limited | | Hangzhou Chaoyue Telecommunication Company Limited | | TCL Electronics Company Limited | | Shanghai Caitong Digital Technology Company Limited | | Guangzhou Shuntong Transportation Company Limited |

| | | | | | | | | | |

| 7 | Shanghai Guangdian Equipment Company Limited | | Shenzhen Liansheng Technology Company Limited | | Qingdao Haixin Electronics Limited Hangzhou branch | | Beijing Broadcom Information Technology Company Limited | | Shanghai Shenghui Transportation Company Limited |

| 8 | Yiwu Wantong Telecom Equipment Company Limited | | Hangzhou Huayu Telecommunication Appliances Company Limited | | Dongguang Lebang Electronics Limited | | Chongqing Zhaohua Digital Technology Company Limited | | Hefei Yuan Shun Da Transportation Company Limited |

| | | | | | | | | | |

| 9 | Shanghai Rongduo Business Company Limited | | Shenzhen Jinfeng Datong Technology Company Limited | | Zhongshan Longdi Electronics Limited | | Shanghai Jinling Network Equipment Company Limited | | Zhuhai Zhijie Transportation Company Limited |

| | | | | | | | | | |

| 10 | Shanghai Huoke Electronics Company Limited | | Shenzhen Jiepulin Company Limited | | Shenzhen Aosike Electronics Company Limited | | Shenzhen Dejing Electronics Company Limited | | Sanming Yunlin Vehicle Transportation Company Limited |

Gross Profit Margin

Gross profit margin in 2009 decreased to 14.4% compared to 15.7% in 2008. The gross profit margin decrease was mainly attributed to the fact that many small manufacturers of computers, communication and consumer products exited the market and current manufacturers raised the cost of goods due to the global economic slowdown. The decrease in gross margin was also due to the increase in sales rebate paid to suppliers.

Because the Company does not include the costs related to its distribution network in cost of sales, its gross profit and gross profit as a percentage of net sales (“gross profit margin”) may not be comparable to those of other retailers that may include all costs related to their distribution network in cost of sales and in the calculation of gross profit and gross margin.

General and Administrative Expenses

General and administrative (“G&A”) expenses for 2009 totaled $32,126, or 14.7% of net sales, compared to $14,132, or 4.6% of net sales for 2008. G&A expenses as a percentage of net sales increased 10.1% due to salary increase of $4,600 in 2009 compared to 2008, additional $1,116 G&A expenses due to acquisition of Jinhua, increase in management fee and additional expenses in relation to the new direct stores and franchise stores.

Income (Loss) from Operations

Operating loss for 2009 was $608, or (0.3)% of net sales compared to Operating income of $34,509, or 11.1% of net sales for 2008, a decrease of 101.8%. Declined sales and gross margin and increased G&A expenses led to the decline in income from operations.

Provision for income taxes

Provision for income taxes for 2009 was $714, representing year-over-year decrease of 91.7% compared to $8,611 for 2008. The decrease in income tax expenses was due to Yiwu, Wang Da and Sanhe having net losses in 2009 and therefore not having income tax expenses. In addition, Joy & Harmony’s income from operations also declined in 2009 compared to 2008, therefore, had a lesser income tax expense. Although we added one subsidiary - Jinhua in 2009, Jinhua’s income tax expense was not significant.

Net Income (loss)

Net loss was $1,213 or (0.6) % of net sales for 2009 compared to $26,834 net income or 8.6% of net sales for 2008. Net income decreased primarily due to sales decline and increase in general administration expenses.

Retail locations

The following table reflects a roll forward during the fiscal years ended December 31, 2008, 2009 and 2010 of our retail locations during each year (i.e. number of stores opened, number of stores closed and number of stores open at the end of the period). “Store in store” refers to the sales counter where the Company’s products are displayed for sale within large-scale supermarket stores, department stores and other operation sites for the Company. At present, we have “store in stores” in four main areas, Shanghai, Zhejiang, Jiangsu and Anhui. The Company’s retail locations are all “store in store” locations in 2008, 2009 and 2010 with the exception of 3 director stores and 2 franchise stores.

| | | Wang Da | | | Yiwu | | | Sanhe | | | Joy &

Harmony | | | Total | |

| Locations at Jan. 1, 2008 | | | 237 | | | | 274 | | | | 211 | | | | 186 | | | | 908 | |

| Opened during year 2008 | | | 37 | | | | 34 | | | | 24 | | | | 43 | | | | 138 | |

| Closed during year 2008 | | | (18 | ) | | | (13 | ) | | | (1 | ) | | | - | | | | (32 | ) |

| Locations at Dec. 31, 2008 | | | 256 | | | | 295 | | | | 234 | | | | 229 | | | | 1014 | |

| | | | | | | | | | | | | | | | | | | | | |

| Opened during year 2009 | | | - | | | | 1 | | | | - | | | | 1 | | | | 2 | |

| Closed during year 2009 | | | (23 | ) | | | (42 | ) | | | (24 | ) | | | (12 | ) | | | (101 | ) |

| Locations at Dec. 31, 2009 | | | 233 | | | | 254 | | | | 210 | | | | 218 | | | | 915 | |

| | | | | | | | | | | | | | | | | | | | | |

| Opened during year 2010 | | | 11 | | | | 2 | | | | - | | | | - | | | | 13 | |

| Closed during year 2010 | | | (73 | ) | | | (1 | ) | | | (11 | ) | | | (22 | ) | | | (107 | ) |

| Locations at Dec. 31, 2010 | | | 171 | | | | 255 | | | | 199 | | | | 196 | | | | 821 | |

The following table reflects the square footage of each store space during the fiscal years ended December 31, 2008, 2009 and 2010.

| (In square feet) | | Wang Da | | | Yiwu | | | Sanhe | | | Joy &

Harmony | | | Total | |

| Areas at Jan. 1, 2008 | | | 26,928 | | | | 40,708 | | | | 29,295 | | | | 21,001 | | | | 117,932 | |

| Opened during year 2008 | | | 5,698 | | | | 5,270 | | | | 3,888 | | | | 6,020 | | | | 20,876 | |