Table of Contents

United States

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTIONS 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 27, 2007

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 1-3657

WINN-DIXIE STORES, INC.

(Exact name of registrant as specified in its charter)

| Florida | 59-0514290 | |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) | |

| 5050 Edgewood Court, Jacksonville, Florida | 32254-3699 | |

| (Address of principal executive offices) | (Zip Code) | |

(904) 783-5000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

| Common Stock, par value $0.001 per share | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:

Title of each class | ||||

| None |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (check one):

Large accelerated filer ¨ Accelerated filer x Non-accelerated filer ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the common stock held by non-affiliates of the registrant on January 10, 2007, was approximately $543.6 million.

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes x No ¨

As of August 10, 2007, 53,901,473 shares of Winn-Dixie Stores, Inc. common stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE: Portions of the registrant’s Proxy Statement for the 2007 Annual Meeting of Shareholders are incorporated by reference in Part III hereof.

Table of Contents

ANNUAL REPORT ON FORM 10-K FOR THE YEAR ENDED JUNE 27, 2007

TABLE OF CONTENTS

Table of Contents

The following should be read in conjunction with the Consolidated Financial Statements and Notes thereto included in Item 8 of this Annual Report on Form 10-K. Unless specified to the contrary, all information herein is reported as of June 27, 2007, which was the end of our most recently completed fiscal year.

As a result of the application of fresh-start reporting as discussed below, the Company’s financial statements for periods prior to November 16, 2006, are not comparable to its financial statements for periods on or after November 16, 2006. References to the “Successor” refer to Winn-Dixie on or after November 16, 2006, after application of fresh-start reporting. References to the “Predecessor” refer to Winn-Dixie prior to November 16, 2006. References such as the “Company,” “we,” “our” and “us” refer to Winn-Dixie Stores, Inc. and its consolidated subsidiaries, whether Predecessor and/or Successor, as appropriate.

Forward-Looking Statements

Certain statements made in this report, and other written or oral statements made by us or on our behalf, may constitute “forward-looking statements” within the meaning of the federal securities laws. Statements regarding future events and developments and our future performance, as well as management’s expectations, beliefs, plans, estimates or projections related to the future, are forward-looking statements within the meaning of these laws. These forward-looking statements include and may be indicated by words or phrases such as “anticipate,” “estimate,” “plans,” “expects,” “projects,” “should,” “will,” “believes” or “intends” and similar words and phrases.

All forward-looking statements, as well as our business and strategic initiatives, are subject to certain risks and uncertainties that could cause actual results to differ materially from expected results. Management believes that these forward-looking statements are reasonable. However, you should not place undue reliance on such statements. These statements are based on current expectations and speak only as of the date of such statements. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of future events, new information or otherwise. Additional information concerning the risks and uncertainties that you may wish to consider are described in “Item 1A: Risk Factors” of this Annual Report on Form 10-K and elsewhere in our filings with the Securities and Exchange Commission (the “SEC”). A number of factors, many of which are described in “Item 1A: Risk Factors” could cause our actual results to differ materially from the expected results described in our forward-looking statements.

| ITEM 1: | BUSINESS |

General

Founded in 1925, Winn-Dixie Stores, Inc. is a major food retailer operating primarily under the “Winn-Dixie” and “Winn-Dixie Marketplace” banners. As of June 27, 2007, we operated 520 stores in five states in the southeastern United States.

1

Table of Contents

We generate revenues and cash as we sell products to customers in our stores. We earn a profit by selling these products at price levels in excess of our costs, which include procurement, distribution, occupancy and overhead expenses. Our operations are within one reportable segment. The Consolidated Financial Statements set forth in Item 8 below present our results of operations, financial position and cash flows.

On November 21, 2006, we emerged from bankruptcy protection. See “Proceedings Under Chapter 11 of the Bankruptcy Code” below for further information.

Proceedings Under Chapter 11 of the Bankruptcy Code

Emergence from Bankruptcy Protection:On February 21, 2005 (the “Petition Date”), Winn-Dixie Stores, Inc. and 23 then-existing direct and indirect wholly-owned subsidiaries (collectively, the “Debtors”) filed voluntary petitions for reorganization under Chapter 11 of the United States Bankruptcy Code (“Chapter 11” or the “Bankruptcy Code”) in the United States Bankruptcy Court (the “Court”). Two of the then-existing wholly-owned subsidiaries of Winn-Dixie Stores, Inc. (collectively with the Debtors, the “Company” or “Winn-Dixie”) did not file petitions under Chapter 11. On November 9, 2006, the Court entered its order confirming the Debtors’ modified plan of reorganization (the “Plan” or the “Plan of Reorganization”; see Item 15, Exhibits 2.1 and 2.2). Although certain objecting parties appealed the confirmation order, they did not seek a stay of the order. In the absence of a stay, the Debtors were free to implement the Plan notwithstanding the pendency of the appeals. The Plan became effective and the Debtors emerged from bankruptcy protection on November 21, 2006 (the “Effective Date”). The appeals remain pending.

Fresh-Start Reporting:Upon emergence from bankruptcy protection, we adopted the “fresh-start reporting” provisions of the American Institute of Certified Public Accountants’ Statement of Position 90-7 “Financial Reporting by Entities in Reorganization under the Bankruptcy Code” (“SOP 90-7”), effective November 15, 2006, which was the end of our immediately preceding accounting period. Under fresh-start reporting, a new reporting entity was deemed to have been created, and all assets and liabilities were revalued to their fair values (see Item 8, Note 1 for further information).Accordingly, our financial statements for periods prior to November 16, 2006, are not comparable to our financial statements for periods on or after November 16, 2006.

Discharge and Treatment of Claims and Interests:As of the Effective Date, the Debtors were discharged and released from all claims and interests in accordance with the provisions of the Plan. The Plan provided for payment in full in cash, satisfaction on deferred payment terms or reinstatement of allowed administrative, priority and secured claims, and the distribution of shares of new Winn-Dixie common stock in satisfaction of allowed unsecured claims. During the course of the Chapter 11 proceedings, we successfully reached settlements with most of our creditors and resolved most pending claims against the Debtors. However, the claims resolution process continues for certain claims. For details, see Item 8, Note 1.

Under the Plan, 400 million shares of new common stock were authorized under the amended and restated articles of incorporation of Winn-Dixie Stores, Inc. Pursuant to the terms of the Plan, 54 million shares of new common stock were issued to the Company’s disbursing agent for distribution to unsecured creditors. All such shares were issued without registration under the Securities Act of 1933, as amended, or state securities laws, in reliance on Section 1145 of

2

Table of Contents

the Bankruptcy Code. In addition, 5.4 million shares were reserved for issuance under the Company’s equity incentive plan. The Successor’s common stock trades on the NASDAQ Global Market under the symbol “WINN.”

Pursuant to the Plan, on the Effective Date, all shares of the Predecessor’s common stock were canceled and no distribution was made to holders thereof.

Exit Financing:On the Effective Date, we closed on a $725.0 million senior secured revolving credit facility (the “Credit Agreement”). See Item 7, “—Liquidity and Capital Resources,” below for further discussion of the Credit Agreement.

Stores

The following chart identifies each of our markets by state and retail market area, the number of stores in each market area and the banners under which they operate as of June 27, 2007. We operate our grocery warehouse stores under the “SaveRite” banner.

| Total | Winn Dixie/ Marketplace | SaveRite | ||||

Florida | 358 | 350 | 8 | |||

Orlando / Daytona | 79 | 75 | 4 | |||

Miami / Fort Lauderdale | 77 | 77 | — | |||

Tampa /St. Petersburg | 62 | 61 | 1 | |||

Jacksonville | 49 | 46 | 3 | |||

West Palm Beach / Fort Pierce | 36 | 36 | — | |||

Mobile / Pensacola | 14 | 14 | — | |||

Fort Myers / Naples | 16 | 16 | — | |||

Tallahassee | 10 | 10 | — | |||

Panama City | 10 | 10 | — | |||

Gainesville | 5 | 5 | — | |||

Alabama | 73 | 73 | — | |||

Birmingham | 27 | 27 | — | |||

Mobile / Pensacola | 20 | 20 | — | |||

Montgomery | 16 | 16 | — | |||

Other | 10 | 10 | — | |||

Georgia | 22 | 22 | — | |||

Albany | 6 | 6 | — | |||

Other | 16 | 16 | — | |||

Louisiana | 51 | 51 | — | |||

New Orleans | 32 | 32 | — | |||

Baton Rouge | 11 | 11 | — | |||

Lafayette | 8 | 8 | — | |||

Mississippi | 16 | 13 | 3 | |||

Biloxi / Gulfport | 6 | 6 | ||||

Other | 10 | 7 | 3 | |||

Total stores as of June 27, 2007 | 520 | 509 | 11 | |||

3

Table of Contents

The following chart provides selected information related to our stores for the last five fiscal years:

| 2007 | 2006 | 2005 | 2004 | 2003 | ||||||

Opened during fiscal year | 2 | — | 3 | 11 | 13 | |||||

Closed or sold during fiscal year | 21 | 374 | 139 | 35 | 13 | |||||

In operation at fiscal year-end | 520 | 539 | 913 | 1,049 | 1,073 | |||||

Year-end average store square footage (in thousands) | 46.8 | 46.3 | 45.2 | 44.6 | 44.4 |

Merchandising

Substantially all of our stores offer grocery, meat, seafood, produce, deli, bakery, floral, health and beauty, and other general merchandise items. We had 401 pharmacies, 59 liquor stores and 5 fuel centers at our stores as of June 27, 2007.

We offer national brands as well as many of our own private-label products. These products are delivered from our distribution centers or directly to stores from manufacturers and wholesalers.

Competition

We compete directly with national, regional and local supermarket chains in addition to independent supermarkets. We also compete with super-centers and other non-traditional grocery retailers such as dollar-discount stores, drug stores, convenience stores, warehouse club stores and conventional department stores. We compete based on price, product quality, variety, location, service, convenience, and store condition. In addition to retailers, we also face competition from restaurants and fast-food chains due to the increasing trend of consumers purchasing and consuming food away from home. The number and type of competitors varies by location, as does our competitive position across our markets.

Suppliers and Raw Materials Sources

We receive the products sold in our stores and the raw materials used in our manufacturing operations from a number of sources. We are not dependent on a single or relatively few suppliers. We believe that the products we sell and the raw materials we use are available in sufficient quantities to meet customer demand adequately. As with any supermarket, many brands have high consumer recognition. Though we may be able to find alternate suppliers for a particular type of product, we would likely experience negative customer response if we were unable to supply a particular brand of product.

Trademarks

We actively enforce and defend our rights related to our intellectual property portfolio. In addition to the Winn-Dixie trademark, we own approximately 80 other trademarks that are registered or pending as applications in the United States Patent and Trademark Office.

4

Table of Contents

Seasonality

Due to the influx of winter residents to the Southeast, particularly Florida, and increased purchases of food items for the holidays that occur from November through April, our sales are typically higher during these months as compared to the rest of the year.

Working Capital

As of June 27, 2007, working capital was comprised of $1.0 billion of current assets and $542.3 million of current liabilities. Normal operating fluctuations in these substantial balances can result in changes to cash flows from operating activities as presented in the Consolidated Statements of Cash Flows that are not necessarily indicative of long-term operating trends. There are no unusual industry practices or requirements related to working capital items.

Environmental Matters

We are subject to federal, state and local environmental laws that apply to store operations, property ownership and property development. We may be subject to certain environmental regulations regardless of whether we lease or own stores or land, or whether environmental conditions were created by the owner, a prior tenant or us. We believe that compliance with such laws and regulations has not had a material effect on our capital expenditures, operating results or competitive position.

Employees

As of June 27, 2007, we employed approximately 52,000 associates, of whom approximately 57% were employed on a part-time basis. None of our associates is covered by a collective bargaining agreement.

Additional Information

We are a Florida corporation, headquartered at 5050 Edgewood Court, Jacksonville, Florida 32254-3699. Our telephone number is 904-783-5000.

Our web site,www.winn-dixie.com, provides additional information about our Company. There you can obtain, free of charge, Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all of our other filings with the SEC, including amendments thereto. You can also obtain copies of all of our recent press releases. Our web site also contains important information about our corporate governance practices, including our Code of Conduct, information on the members of our Board of Directors, our Governance Principles and our Board Committee Charters. The information on our web site is not part of and is not incorporated by reference into this Annual Report on Form 10-K.

| ITEM 1A: | RISK FACTORS |

Our business and strategic initiatives are subject to certain risks and uncertainties that could cause actual results to differ materially from expected results. Additional information concerning the risks and uncertainties listed below, and other factors that you may wish to consider, are contained elsewhere in our filings with the SEC.

5

Table of Contents

Our store remodeling initiative is at an early stage of implementation and the program may not be effective in improving customer count trends, sales and profitability.

For the past several years, we have had limited store remodeling activity. Stores in need of remodeling are at risk of sales erosion, particularly when they compete with newer or better-maintained competitor facilities. During fiscal 2008 and in future fiscal years, we plan to remodel approximately 75 stores per year. At that rate of remodel activity, given that we believe the substantial majority of our stores require a remodel, it will take several years for us to complete this current remodel initiative.

Our remodel initiative is a key element in our business plan. We believe remodels are necessary to enhance our brand image, improve our merchandising mix and customer count trends and ultimately to improve sales and profitability. We opened 20 remodeled stores in fiscal 2007, most in the fourth quarter, and we are monitoring initial results. Because the initiative is still at an early stage of implementation, it is impossible to definitively assess the long-term impact the remodel initiative will have on these key financial and business metrics. If the remodel initiative were not successful in achieving these goals, this would have a significant negative impact on our business.

We operate in a highly competitive industry and actions taken by our competitors can negatively impact our results of operations.

We face competition from both traditional grocery stores and non-traditional grocery retailers such as mass merchandisers, super-centers, warehouse club stores, dollar-discount stores, drug stores, convenience stores and restaurants. Actions of our competitors can negatively impact our business, particularly competitor investments in their store base and increased competitor promotional activity.

Over the past several years, we have experienced a significant number of competitor store openings in our operating regions. In fiscal 2007, a significant number of grocery stores and super-centers opened in locations that we believe negatively impacted sales levels at one or more of our stores. We expect competitor store openings to continue to significantly impact our business in fiscal 2008, although at a slightly lower level than the prior fiscal year.

Pricing is a significant driver of consumer choice in our industry and we regularly engage in price competition, particularly through our promotional programs. To the extent that our competitors lower prices, through increased promotional activity or otherwise, our ability to maintain gross margin rates and sales levels may be negatively impacted. Several of our primary competitors are larger than we are, have greater financial resources available to them and, therefore, may be able to devote greater resources to invest in pricing and promotional programs.

There can be no assurance that increased competitor activity will not negatively impact our business or that we will have sufficient resources to respond to competitor investments in their store base and pricing and promotional programs.

Improving our gross margin rate, particularly in the first half of our fiscal year, is a significant element in our plan to increase overall profitability. Furthermore, given our current level of operating profitability, a relatively small reduction in gross profit margin can have a material, negative impact on our financial condition and results of operations.

6

Table of Contents

During fiscal 2007, we realized a lower gross margin rate in the first half of the fiscal year than in the second half of the fiscal year. The improved gross margin rate in the second half of the fiscal year, a trend consistent with our most recent operating performance in the last several years, significantly impacted our profitability in the second half of the fiscal year. Our business plan anticipates that we will improve our gross margin rate in fiscal 2008, with the most significant improvement occurring in the first half of the fiscal year.

Given our current level of earnings from continuing operations, relatively small fluctuations in gross margin rate can have a significant impact on our profitability. Our inability to manage our gross margin rate effectively could have a material, negative impact on our profitability and liquidity.

To achieve levels of profitability consistent with most of our industry peers will require us to increase significantly our average sales-per-store.

Our sales-per-store are significantly less than that of our competitors. Because many operating costs – such as rent, utilities and minimum labor staffing levels – are largely fixed, low levels of sales productivity negatively impact profitability. To achieve levels of profitability consistent with most of our industry peers will require us to increase our average sales-per-store, while at the same time improving gross margin rates (as discussed above).

Our sales increases in fiscal 2007 resulted from increasing basket size, which offset a declining transaction count. To improve transaction count, we believe we must enhance our brand image through implementation of our remodel initiative, improved merchandising programs and improved customer service in our stores. These initiatives, in particular the remodel initiative, are multi-year initiatives. There can be no assurance that we can implement these initiatives successfully or that they will be effective in attracting new customers into our stores and ultimately improving our transaction counts and sales-per-store.

Failure to attract, train and retain qualified associates could adversely affect our financial performance.

The retail food industry is labor intensive. Our ability to meet our labor needs, while controlling wage and labor related costs, is subject to numerous external factors, including the availability of a sufficient number of qualified persons in the work force of the markets in which we are located, unemployment levels within those markets, prevailing wage rates, changing demographics, health and other insurance costs, and changes in employment legislation.

Furthermore, to improve our brand image we believe we must enhance in-store merchandising, customer service and other programs. To achieve these goals, we believe we must upgrade some of our store-level leadership teams. In addition, certain planned initiatives, such as enhancements to our deli and prepared foods offerings, will require new skill sets. As a result, our future business success is dependent upon our ability to effectively train our existing associates and to hire new associates possessing the necessary skill sets.

7

Table of Contents

The concentration of our locations in the southeast increases our vulnerability to severe storm damage, which could adversely affect our operations and financial results.

Our operations are concentrated in Florida and in other states along the Gulf of Mexico and the Atlantic Ocean, which increases the likelihood of being affected negatively by hurricanes and windstorm activity. Specific risks that we face include the following:

| • | while we have targeted placement of generators in stores we believe are most likely to be impacted by hurricanes, we have not implemented a comprehensive program to place generators in every store; |

| • | we have named windstorm insurance limits of $125 million per occurrence in excess of a $10 million named windstorm deductible per occurrence; |

| • | our ability to collect on insurance coverage, which is subject to the solvency of our insurance carriers, their approval of our claims and the timing of claims processing and payment; |

| • | our ability to fund losses of inventory and other costs in advance of receipt of insurance payments; and |

| • | our ability to re-open stores that may close as a result of damage to the store and/or the operating area. |

Food safety issues could negatively impact our brand image, operations and financial results.

We could be adversely affected if consumers lose confidence in the safety and quality of our food products. Adverse publicity about these types of concerns, whether or not valid, may discourage consumers from buying our products or cause production and delivery disruptions. The real or perceived sale of contaminated food products by us could result in product liability claims and a loss of consumer confidence, which could have a significant negative effect on our sales and operations.

Additionally, to the extent we are unable to maintain appropriate sanitation and quality standards in our stores, food safety and quality issues could involve expense and damage to our brand names.

Our net operating loss carry forwards may be limited.

We currently have a material amount of net operating loss carry forwards (“NOLs”) for federal income tax purposes that will begin to expire in eighteen years. Additionally, as we settle the remaining bankruptcy claims, our NOLs will increase by an amount equal to the market value of shares distributed as of the date of distribution. If we were to undergo a subsequent change of ownership within the meaning of §382 of the Internal Revenue Code (the “IRC”), our ability to utilize our federal NOLs could be further limited or eliminated entirely.

To avoid a potential adverse effect on our ability to utilize our NOLs for federal income tax purposes, we amended our Articles of Incorporation to include certain restrictions on the transfer of our stock that may apply in certain circumstances and for a limited period of time. While the purpose of these transfer restrictions is to prevent a subsequent change of ownership within the meaning of §382 of the IRC from occurring, no assurance can be given that such an ownership change will not occur, in which case the availability of our NOLs and other federal income tax attributes would be significantly limited or eliminated entirely.

8

Table of Contents

Unsuccessful implementation of information technology could limit our ability to operate efficiently and compete effectively.

We are dependent on large, complex information technology systems for many of our core business processes. During fiscal 2008, we will be implementing a new information technology system to support our retail pricing policies and practices. Unsuccessful upgrades or implementations of this or other information technology systems could have an adverse effect on our financial condition and results of operations. Additionally, any internal or external disruptions (i.e. natural or other disaster) to our information technology infrastructure could significantly impact our operations.

If we do not maintain the security of customer-related information, we could damage our reputation with customers, incur substantial additional costs and become subject to litigation.

As do most retailers, we receive certain personal information about our customers, some of which depends upon the secure transmission of confidential information over public networks. A compromise of our security systems that results in customer personal information being obtained by unauthorized persons could adversely affect our reputation with our customers and others, as well as our operations, results of operations, financial condition and liquidity, and could result in litigation against us or the imposition of penalties.

Variability in self-insurance liability estimates could significantly impact our financial results.

We self-insure for workers’ compensation, general liability, business interruptions, automobile liability, property losses and employee medical coverage up to a set retention level, beyond which we maintain excess insurance coverage. Liabilities are determined using actuarial estimates of the aggregate liability for claims incurred and an estimate of incurred but not reported claims, on an undiscounted basis. Our accruals for insurance reserves reflect certain actuarial assumptions and management judgments, which are subject to a high degree of variability. The variability is caused by factors external to us such as:

| • | historical claims experience; |

| • | medical inflation; |

| • | legislative changes to benefit levels; |

| • | jury verdicts; and |

| • | claim settlement patterns. |

Any significant variation in these factors could cause a material change to our reserves for self-insurance liabilities as well as earnings.

Litigation or legal proceedings could expose us to significant liabilities and thus negatively affect our financial results.

9

Table of Contents

We are party to various litigation claims and legal proceedings, including personnel and employment issues, personal injury, and other claims and proceedings arising in the ordinary course of business. We evaluate these litigation claims and legal proceedings to assess the likelihood of unfavorable outcomes and to estimate, if possible, the amount of potential losses. Based on these assessments and estimates, if any, we establish reserves and/or disclose the relevant litigation claims or legal proceedings as appropriate. These assessments and estimates are based on the information available to management at the time and involve a significant amount of management judgment. Actual outcomes or losses may differ materially from those envisioned by our current assessments and estimates, which could adversely affect our results of operations and financial condition.

Changes in laws and other regulations affecting our industry could increase our compliance costs.

We are subject to numerous federal, state and local laws and regulations affecting food manufacturing, distribution, retailing, accounting standards and taxation requirements. Any changes in these laws or regulations could significantly increase our compliance costs and adversely affect our results of operations, financial condition and liquidity.

| ITEM 1B: | UNRESOLVED STAFF COMMENTS |

None.

| ITEM 2: | PROPERTIES |

Our corporate headquarters are located in Jacksonville, Florida. Our stores are located in the southeastern United States, as further detailed in Item 1. We believe that all of our properties are in adequate condition for their intended use. We lease substantially all of our facilities. Each lease provides for a minimum annual rent, while certain store leases also require contingent rental payments if sales volumes exceed specified amounts.

The following table details the properties utilized in our operations as of June 27, 2007:

| Owned | Leased | Total | ||||

Retail Stores | 8 | 512 | 520 | |||

Manufacturing Operations | 1 | 2 | 3 | |||

Distribution Centers | 1 | 5 | 6 | |||

Corporate Headquarters | — | 1 | 1 | |||

Total | 10 | 520 | 530 | |||

A more detailed description of our leasing arrangements appears in Item 8, Note 14.

| ITEM 3: | LEGAL PROCEEDINGS |

See Note 17 to the Consolidated Financial Statements included in Item 8 of this Report for a discussion of legal proceedings.

10

Table of Contents

| ITEM 4: | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

No matters were submitted to a vote of security holders during the fourth quarter of the fiscal year covered by this report.

11

Table of Contents

| ITEM 5: | MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Winn-Dixie’s common stock is currently traded on the NASDAQ Global Market (“NASDAQ”) under the symbol WINN. The shares were listed for trading on NASDAQ on December 21, 2006. From our emergence from bankruptcy on November 21, 2006, until December 21, 2006, the shares traded on NASDAQ on a “when-issued” basis. The number of holders of record of our common stock as of August 10, 2007, was 1,457. Approximately 78% of our outstanding common stock is held in “street name” by depositories or nominees on behalf of beneficial holders.

We did not pay dividends during fiscal 2007 or fiscal 2006. Under the terms of our Credit Agreement, we are restricted substantially from paying dividends.

The following table shows the high and low closing prices of the Company’s common stock for each fiscal quarter subsequent to our emergence from bankruptcy:

| High | Low | ||||

Fiscal 2007: | |||||

Second Quarter, subsequent to November 21, 2006 | $ | 15.99 | 10.95 | ||

Third Quarter | $ | 19.58 | 13.19 | ||

Fourth Quarter | $ | 32.14 | 17.35 | ||

We did not repurchase any of our equity securities during the fourth quarter of fiscal 2007.

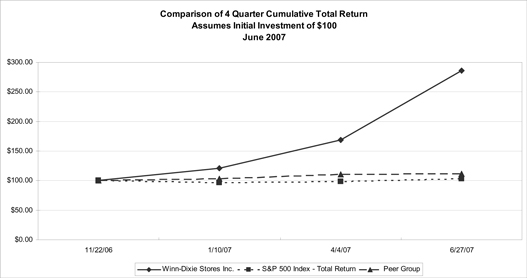

The following graph shows the cumulative total shareholder return for the Company’s common stock during the period from November 22, 2006, to June 27, 2007. Five-year historical data is not presented because the Predecessor’s stock was cancelled upon our emergence from Chapter 11.

The graph also shows the cumulative returns of the Standard & Poor’s 500 Index and a peer group of food retailers, comprised of: Supervalu Inc., The Kroger Co., Safeway Inc., and The Great Atlantic & Pacific Tea Company, Inc. The comparison assumes $100 was invested on November 22, 2006 (the date WINN began trading on NASDAQ), in the Company’s common stock and in each of the indices shown and assumes that all dividends paid were reinvested.

12

Table of Contents

13

Table of Contents

| ITEM 6: | SELECTED FINANCIAL DATA |

We derived the financial data below from our audited Consolidated Financial Statements included in Item 8 of this report and from our previously issued audited financial statements. We reclassified all necessary data to reflect discontinued operations, as described in Note 15 of the Consolidated Financial Statements. The following table should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our Consolidated Financial Statements, included in Item 7 and Item 8, respectively, of this report. As a result of the application of fresh-start reporting in accordance with SOP 90-7, the Company’s financial statements for period prior to November 16, 2006 are not comparable to its financial statements for periods on or after November 16, 2006.

| Successor | Predecessor | ||||||||||||||||

In millions, except per share data | 32 weeks ended June 27, 2007 | 20 weeks ended Nov. 15, 2006 | Fiscal | ||||||||||||||

| 2006 | 2005 | 20041 | 2003 | ||||||||||||||

Results of continuing operations: | |||||||||||||||||

Net sales | $ | 4,524 | 2,677 | 7,133 | 6,945 | 7,305 | 7,516 | ||||||||||

Gross profit | $ | 1,229 | 707 | 1,851 | 1,813 | 1,985 | 2,190 | ||||||||||

Other operating and administrative expenses | $ | 1,188 | 776 | 1,991 | 1,929 | 1,966 | 1,947 | ||||||||||

Impairment and restructuring charges, net | $ | — | 22 | 7 | 190 | 22 | — | ||||||||||

Earnings (loss) before reorganization items and income taxes | $ | 45 | (97 | ) | (159 | ) | (339 | ) | (17 | ) | 256 | ||||||

Reorganization items, net gain | $ | — | (334 | ) | (251 | ) | (148 | ) | — | — | |||||||

Earnings (loss) from continuing operations | $ | 28 | 252 | 102 | (381 | ) | (8 | ) | 200 | ||||||||

Earnings (loss) per share from continuing operations: | |||||||||||||||||

Basic and diluted | $ | 0.53 | 1.78 | 0.72 | (2.70 | ) | (0.05 | ) | 1.42 | ||||||||

Cash dividends per share: | $ | — | — | — | — | 0.15 | 0.20 | ||||||||||

| Successor | Predecessor | ||||||||||||||||

| 32 weeks ended June 27, 2007 | 20 weeks ended Nov. 15, 2006 | 2006 | 2005 | 20041 | 2003 | ||||||||||||

Financial data as of fiscal period end: | |||||||||||||||||

Capital expenditures | $ | 69 | 24 | 31 | 111 | 204 | 177 | ||||||||||

Working capital2 | $ | 480 | 469 | 421 | 810 | 412 | 455 | ||||||||||

Total assets | $ | 1,671 | 1,692 | 1,608 | 1,987 | 2,619 | 2,790 | ||||||||||

Liabilities subject to compromise | $ | — | — | 1,118 | 1,111 | — | — | ||||||||||

Long-term debt2 | $ | — | — | — | 245 | 301 | 311 | ||||||||||

Capital lease obligations - long term | $ | 19 | 9 | 5 | 11 | 13 | 21 | ||||||||||

Shareholders’ equity (deficit) | $ | 797 | 759 | (282 | ) | 59 | 917 | 1,029 | |||||||||

1 | Fiscal 2004 was comprised of 53 weeks. |

2 | For fiscal 2006 and fiscal 2005, working capital and long-term debt excluded liabilities subject to compromise. Long-term debt included long-term borrowings under the DIP Credit Facility. |

14

Table of Contents

| ITEM 7: | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” contains forward-looking statements and statements of our business strategies, all of which are subject to certain risks. Item 7 should be read in conjunction with the information contained in “Forward-Looking Statements” at the beginning of this report and with the Consolidated Financial Statements and Notes thereto included in Item 8. When multiple factors are provided as the explanation for business results, we quantify the approximate effect of each factor to the extent that it is practical for us to do so.

COMBINED FINANCIAL RESULTS OF THE PREDECESSOR AND SUCCESSOR

As a result of the application of fresh-start reporting in accordance with SOP 90-7, the Company’s financial statements for periods prior to November 16, 2006, are not comparable to its financial statements for periods on or after November 16, 2006. References to the “Successor” refer to Winn-Dixie on or after November 16, 2006, after application of fresh-start reporting. References to the “Predecessor” refer to Winn-Dixie prior to November 16, 2006. References such as the “Company,” “we,” “our” and “us” refer to Winn-Dixie Stores, Inc. and its consolidated subsidiaries, whether Predecessor and/or Successor, as appropriate. See Item 8, Note 1 for further information.

Management’s discussion and analysis of the results of operations and of liquidity compare the fiscal year ended June 27, 2007, to the fiscal year ended June 28, 2006. Presentation of the combined financial information of the Predecessor and Successor for the fiscal year ended June 27, 2007, is not in accordance with generally accepted accounting principles. However, we believe that for purposes of discussion and analysis in this Form 10-K, the combined financial results are useful for management and investors to assess the Company’s on-going financial and operational performance and trends.

PROCEEDINGS UNDER CHAPTER 11 OF THE BANKRUPTCY CODE

On November 21, 2006, Winn-Dixie Stores, Inc., and 23 of our then-existing subsidiaries emerged from bankruptcy protection. For further discussion of the Chapter 11 cases see “Item 1: Business – Proceedings Under Chapter 11 of the Bankruptcy Code” above.

RESULTS OF OPERATIONS

Continuing Operations

Fiscal year ended June 27, 2007 (“fiscal 2007”), as compared to fiscal year ended June 28, 2006 (“fiscal 2006”)

Net Sales. Net sales were $7.2 billion for fiscal 2007, an increase of $68.1 million or 1.0%, as compared to fiscal 2006. Net sales primarily related to grocery and supermarket items. In aggregate, pharmacy, fuel and floral department sales comprised approximately 10% of net sales in both fiscal 2007 and fiscal 2006.

15

Table of Contents

We define identical store sales as sales from continuing operations stores, including stores that we remodeled or enlarged during the year and excluding stores that opened or closed during the year. Identical store sales increased 1.6% for fiscal 2007 as compared to fiscal 2006.

The increase in our identical store sales for fiscal 2007 as compared to fiscal 2006 was the result of an increase in basket size (average sales per customer visit on identical store sales) of 3.4%, offset by a decrease in transaction count (number of customer visits on identical store sales) of 1.7%.

Competition remains a key factor that negatively affects our identical store sales, particularly on the opening of a new competitor store. Based on our knowledge of competitor activity in our operating areas, we anticipate that competitor store openings will continue to affect our identical store sales negatively, but will be slightly lower in fiscal 2008 than in fiscal 2007. We consider competitive activity as we determine the schedule of stores to be remodeled.

Identical store sales for fiscal 2008 are expected to be slightly positive.

Gross Profit on Sales. Gross profit on sales increased $85.8 million for fiscal 2007 as compared to fiscal 2006. As a percentage of net sales, gross margin was 26.9% and 25.9% for fiscal 2007 and fiscal 2006, respectively.

The gross margin improvement of approximately 100 basis points in fiscal 2007 as compared to fiscal 2006 was attributable to cost reductions in procurement, warehousing and transportation (60 basis points), reduced inventory shrink (30 basis points), and increases in vendor allowances (10 basis points).

We expect that gross margin in fiscal 2008 will be higher than gross margin in fiscal 2007, with most of the increase occurring in the first two quarters of the fiscal year.

Other Operating and Administrative Expenses. Other operating and administrative expenses decreased $26.3 million for fiscal 2007 as compared to fiscal 2006. As a percentage of net sales, other operating and administrative expenses were 27.3% and 27.9% for fiscal 2007 and fiscal 2006, respectively.

16

Table of Contents

The table below details the increases (decreases) in other operating and administrative expenses for fiscal 2007 as compared to fiscal 2006:

Increase (decrease) related to (in millions): | ||||

Bankruptcy-related costs: | ||||

Cancellation of Predecessor share-based compensation | $ | 9.2 | ||

Directors’ and officers’ liability insurance | 8.1 | |||

Post-emergence bankruptcy-related legal and professional fees | 11.7 | |||

Favorable settlements of claims, net | (8.9 | ) | ||

Bankruptcy-related costs | 20.1 | |||

Other than bankruptcy-related: | ||||

Depreciation and amortization | (29.1 | ) | ||

Vacant store lease expense | (13.3 | ) | ||

Rent | (8.3 | ) | ||

Payroll and related costs | (5.6 | ) | ||

Property and casualty insurance | (2.0 | ) | ||

Utilities | 7.4 | |||

Other, net | 4.5 | |||

Other cost decreases, net | (46.4 | ) | ||

Net decrease in other operating and administrative expenses | $ | (26.3 | ) | |

We expect legal and professional fees related to our emergence from bankruptcy to decline as we complete claims resolution and other emergence processes over approximately the next two fiscal years. The decrease in depreciation and amortization was caused by lower aggregate asset values, which resulted from fresh-start reporting revaluations, prior impairments and recent low levels of capital expenditures. We anticipate that depreciation and amortization will continue to be lower than the comparable prior period until the comparable prior period is subsequent to November 15, 2006, or until capital expenditures significantly increase. Vacant store lease expense incurred in fiscal 2006 related to closed stores did not occur to the same magnitude in fiscal 2007. We do not expect vacant store lease expense to be significant in fiscal 2008. The decrease in rent was primarily due to equipment rent reductions that resulted from renegotiations of leases. Utilities expense increased due to higher rates in fiscal 2007. The decrease in payroll and related costs primarily related to reductions in retail payroll, benefits and bonuses. Property and casualty insurance expense decreased, as higher premium rates were more than offset by favorable claims development of $17.4 million recognized in the fourth quarter of fiscal 2007 based on the results of our actuarial study performed and primarily related to self-insured workers’ compensation claims (see Item 8, Note 16).

Impairment Charges.Impairment charges were $20.8 million and $14.8 million in fiscal 2007 and fiscal 2006, respectively, all of which were recorded by the Predecessor. See Item 8, Note 8 for further discussion of impairment charges.

Reorganization Items.Reorganization items resulted in net gains of $334.4 million and $251.2 million in fiscal 2007 and fiscal 2006, respectively, all of which were recorded by the Predecessor. See Item 8, Note 1 for further discussion of reorganization items.

17

Table of Contents

Interest (Income) Expense, net. Interest (income) expense, net, is primarily interest on long-term and short-term debt and capital leases, offset by interest income. For fiscal 2007, net interest expense was $1.4 million, as compared to net interest expense of $12.0 million for fiscal 2006. The improvement was due to $4.5 million of interest income on cash and marketable securities balances, a $3.9 million reduction in interest expense on our credit facilities due to decreased borrowings in fiscal 2007, a $2.9 million reduction of amortization of debt issue costs on our credit facilities, and $1.8 million of interest income related to an income tax refund. These improvements were partially offset by $2.3 million of interest expense on amounts owed for pre-petition property taxes. In accordance with SOP 90-7, from the Petition Date through the Effective Date, interest income was classified within reorganization items rather than in interest (income) expense, net.

Income Taxes. Income tax expense for fiscal 2007 was $3.0 million, as compared to an income tax benefit of $9.6 million for fiscal 2006. The expense will not result in significant cash payments due to the availability of NOLs, as further described below. The effective tax rate on continuing operations was a provision of 37.4% for the 32 weeks ended June 27, 2007, and a benefit of 5.9% for the 20 weeks ended November 15, 2006, as compared to a benefit of 10.5% for fiscal 2006. The rate for the 32 weeks ended June 27, 2007, reflected the provision of tax expense for the period subsequent to our emergence from bankruptcy. The rate for the 20 weeks ended November 15, 2006, reflected the maintenance of a full valuation allowance, our ability to carry back certain NOLs and an $11.6 million benefit associated with the resolution of a state tax matter. The fiscal 2006 rate reflected the maintenance of a full valuation allowance against our deferred tax assets, as well as our ability to carry back certain NOLs and certain refundable credits.

We maintain a full valuation allowance against substantially all of our net deferred tax assets. The valuation allowance will be maintained until there is sufficient positive evidence to conclude that it is more likely than not that the net deferred tax assets will be realized.

As of June 27, 2007, we had $479.6 million of NOL carryforwards for federal income tax purposes. As we settle the remaining bankruptcy claims, our NOL carryforwards will increase by an amount equal to the market value of shares distributed as of the date of distribution. If all remaining claims had been settled and all 8 million shares held by the disbursing agent had been distributed in satisfaction of pending claims as of June 27, 2007, we estimate our NOL carryforwards would have increased by approximately $240 million (the market price of our common stock was approximately $30.00 per share as of such date). See Item 8, Note 1 for additional information related to the claims resolution process.

The ultimate utilization of our NOL carryforwards and other tax attributes will depend on several factors, including our future financial performance and certain federal income tax qualifications and elections under §382 of the IRC. Management currently expects to qualify under §382(l)(5) and make this election in its fiscal 2007 return. Under §382(l)(5), we will have unlimited use of our NOLs if there is not a change of ownership (as defined by the IRC) before November 9, 2008. If we do not qualify under, or elect out of, §382(1)(5), we will be subject to an annual limitation on the use of our NOLs and certain deductions under §382(l)(6), which may limit our ability to fully utilize the NOL carryforwards discussed above. To preserve the NOL carryforwards available to us after emergence, the Successor’s Articles of Incorporation impose certain restrictions on the transfer of our common stock.

18

Table of Contents

The benefits associated with any future recognition of tax attributes that existed at the time of emergence do not reduce income tax expense. Instead, the benefits first reduce intangible assets to $0 and then increase shareholders’ equity. For the 32 weeks ended June 27, 2007, we recognized tax attributes that existed as of November 15, 2006, totaling $19.8 million and thereby reduced intangible assets by this amount.

Effective November 15, 2006, we adopted FASB Interpretation No. 48, “Accounting for Uncertainty in Income Taxes – An Interpretation of FASB Statement No. 109” (“FIN 48”), which prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. This interpretation also provides guidance on derecognition, classification, interest and penalties, accounting in interim periods, disclosure and transition. As of June 27, 2007, we had $21.5 million of unrecognized tax benefits; if recognized, none of this amount would change our effective income tax rate. We do not anticipate that we will record any significant change in the unrecognized tax benefit during fiscal 2008.

We are in the process of executing a settlement with the Internal Revenue Service (“IRS”) in connection with its examination of our federal income tax returns for fiscal years 2003 and 2004. While the IRS’ examination of these tax returns will result in approximately $11 million of total net adjustments to income for these two years, these adjustments to income will be fully offset by a portion of our net operating losses and no additional tax should be incurred.

Other than the IRS examination referenced above, we are not currently subject to any pending examinations of our federal or state income tax returns. Generally, the statute of limitations remains open for our federal and state income tax returns for our fiscal 2003 through 2006 tax years.

Net Income From Continuing Operations. Net income from continuing operations was $280.3 million for fiscal 2007, as compared to $101.6 million for fiscal 2006. The improved results were primarily due to increases in gross profit on sales and reorganization gains and a decrease in other operating and administrative expenses, all as previously discussed.

Fiscal year ended June 28, 2006 (“fiscal 2006”), as compared to fiscal year ended June 29, 2005 (“fiscal 2005”)

Net Sales. Net sales for fiscal 2006 were $7.1 billion, an increase of $188.0 million, or 2.7%, as compared to fiscal 2005. Net sales primarily related to grocery and supermarket items. In aggregate, pharmacy, fuel and floral department sales comprised approximately 10% of net sales in both fiscal 2006 and fiscal 2005.

We define identical store sales as sales from continuing operations stores, including stores that we remodeled or enlarged during the year and excluding stores that opened or closed during the year. Identical store sales increased 5.9% for fiscal 2006 as compared to fiscal 2005.

Identical store sales improved throughout the Company due to increased basket size. We believe this increase was due in part to improved store execution and customer service, the introduction of merchandising initiatives, which included pricing and promotional programs, and new brand marketing initiatives, in addition to the positive impact from sales in the area affected by Hurricane Katrina, as described below. Transaction count in fiscal 2006 was approximately the same as in fiscal 2005.

19

Table of Contents

Areas significantly affected by Hurricane Katrina reported substantially greater increases in identical store sales because of fewer open competitor stores and restaurants, the influx of relief and construction workers to the areas, and, along the Gulf Coast, population shifts to Baton Rouge and other less-affected areas.

Gross Profit on Sales. Gross profit on sales increased $37.4 million for fiscal 2006 as compared to fiscal 2005. As a percentage of net sales, gross margin was 25.9% and 26.1% for fiscal 2006 and fiscal 2005, respectively.

Gross margin declined by approximately 20 basis points for fiscal 2006 as compared to fiscal 2005, because of both positive and negative factors. Pricing and promotional programs accounted for 50 basis points of the decline. A reduction in vendor allowances and cash discounts accounted for 20 basis points of the decline, primarily because many vendors shifted from slotting fees to promotional programs tied to purchase volumes (due to store closures, our total purchase volumes declined). Higher labor, fuel and energy costs accounted for 20 basis points of the decline. Operational improvements that reduced inventory shrink offset the negative factors and improved gross margin by 63 basis points.

Other Operating and Administrative Expenses. Other operating and administrative expenses increased $62.2 million for fiscal 2006 as compared to fiscal 2005. As a percentage of net sales, other operating and administrative expenses were 27.9% and 27.8% for fiscal 2006 and fiscal 2005, respectively.

The increase in other operating and administrative expenses was due to increases in salaries and employee-related costs of $49.7 million resulting from an investment in retail labor hours in our efforts to improve customer service, partially offset by decreases in administrative areas. We also incurred $17.5 million of additional utility costs due to rate and consumption increases and $13.8 million in increased insurance costs. The increased expenses were partially offset by a decrease of $20.8 million in professional fees that were unrelated to our bankruptcy. Certain prior year items did not recur in the current year, including $9.7 million related to the severance of our former Chief Executive Officer. Other increases and decreases in the components of this expense substantially offset each other.

Impairment Charges.Impairment charges were $14.8 million and $155.9 million in fiscal 2006 and fiscal 2005, respectively, all of which were recorded by the Predecessor. See Item 8, Note 8 for further discussion of impairment charges.

Reorganization Items.Reorganization items resulted in net gains of $251.2 million and $148.3 million in fiscal 2006 and fiscal 2005, respectively, all of which were recorded by the Predecessor. See Item 8, Note 1 for further discussion of reorganization items.

Interest Expense. Interest expense is primarily interest on long-term and short-term debt and capital leases. Net interest expense was $12.0 million for fiscal 2006, as compared to $33.1 million for fiscal 2005. The decrease in interest expense related primarily to interest on our Notes, for which interest was not recognized subsequent to the Petition Date in accordance with SOP 90-7. Prior to the Petition Date, in fiscal 2005 we recognized $18.0 million of

20

Table of Contents

interest expense related to these Notes. Also in fiscal 2005, as of the Petition Date, we expensed the $5.2 million unamortized balance of debt issue costs related to our pre-petition credit facility. In accordance with SOP 90-7, from the Petition Date through the Effective Date, interest income was classified within reorganization items rather than offsetting interest expense.

Income Taxes. The effective tax rate on continuing operations was a benefit of 10.5% for fiscal 2006 as compared to a provision of 100.0% for fiscal 2005. The fiscal 2006 rate reflected the maintenance of a full valuation allowance on our deferred tax assets as well as our ability to carry back certain NOLs and certain refundable credits. In fiscal 2006, we recorded a benefit of $4.5 million to correct fiscal 2005 errors, including a benefit of $11.7 million related to additional refunds from NOL carrybacks, partially offset by an expense of $7.2 million that was primarily related to depreciation and LIFO errors. The errors were insignificant to fiscal 2006 and fiscal 2005.

The fiscal 2005 rate reflected the establishment of a full valuation allowance against our net deferred tax assets. We evaluated the future realization of our net deferred tax assets during fiscal 2005 and determined that it was more likely than not that our net deferred tax assets would not be realized. As a result, in fiscal 2005 we recognized a full valuation allowance against our net deferred tax assets. We recognized no tax benefit or expense during the remainder of fiscal 2005.

Net Income (Loss) From Continuing Operations. Net income from continuing operations was $101.6 million for fiscal 2006, as compared to a net loss of $380.7 million for fiscal 2005. The improvement was due to decreases in income tax expense and impairment charges, as well as an increase in reorganization gains, all as previously discussed.

Discontinued Operations and Restructuring

In evaluating whether elements of our restructuring plans qualify for discontinued operations classification, we consider each store to be a component of a business, as this is the lowest level at which the operations and cash flows can be clearly distinguished, operationally and for financial reporting purposes. If the cash flows of a store to be exited will not be significant to our ongoing operations and cash inflows of our nearby stores are not expected to increase significantly because of the exit, the results of operations of the store are reported in discontinued operations. Other components, including distribution centers and manufacturing operations, are classified as discontinued operations only if we determine that the related continuing cash flows will not be significant to our ongoing operations. Costs incurred to dispose of a location are included in gain (loss) on disposal of discontinued operations only if the location qualifies for discontinued operations classification.

Fiscal 2007 Sales and Closures.In early fiscal 2007, we closed seven U.S. stores and sold our 78% ownership interest in Bahamas Supermarkets Limited, which owned all of our operations in The Bahamas. The sale of the Bahamian operations resulted in proceeds of $54.0 million and a gain on sale of $31.5 million, which was included in gain on disposal of discontinued operations. Results of operations for six of the seven U.S. stores and the twelve stores and distribution center in The Bahamas were classified as discontinued operations.

21

Table of Contents

2005 Restructure Plan.In June 2005, we announced our intention to exit 326 stores and three distribution centers (the “2005 Restructure Plan”). We later expanded this plan by an additional 35 stores and one distribution center. In all, during fiscal 2006 we closed 374 stores, 4 distribution centers and all manufacturing operations except 2 dairies and the Chek beverage operation. We also restructured our field and administrative support staff to support the planned configuration of the retail business.

We classified results of operations of 2 distribution centers and 357 of the 374 stores exited during fiscal 2006 as discontinued operations. We determined that the closure of the remaining stores, the manufacturing operations and two of the distribution centers did not eliminate the cash flows for the stores, similar manufactured goods and warehousing, respectively, and thus the results of those facilities were reported in continuing operations.

Financial Information.The following summarizes the results of our discontinued operations (in thousands), all of which were recorded by the Predecessor:

20 weeks ended Nov. 15, 2006 | Fiscal 2006 | Fiscal 2005 | |||||||

Net sales from discontinued operations | $ | 24,180 | 745,058 | 3,264,796 | |||||

Earnings (loss) from discontinued operations | $ | 2,333 | (145,654 | ) | (322,448 | ) | |||

Gain (loss) on disposal of discontinued operations | 17,922 | (320,846 | ) | (129,456 | ) | ||||

Net earnings (loss) from discontinued operations | $ | 20,255 | (466,500 | ) | (451,904 | ) | |||

The following tables detail the net restructuring charge (gain) and (gain) loss on disposal of discontinued operations (in thousands), all of which were recorded by the Predecessor:

20 weeks ended Nov. 15, 2006 | Fiscal 2006 | Fiscal 2005 | ||||||||

Restructuring: | ||||||||||

(Gain) loss on sale/retirement, net | $ | (465 | ) | (50,435 | ) | (4,661 | ) | |||

Lease termination costs | 154 | 32,804 | 34,950 | |||||||

Employee termination costs | 228 | 5,385 | 2,226 | |||||||

Other location closing costs | 869 | 4,547 | 1,724 | |||||||

Restructuring charge (gain), net | $ | 786 | (7,699 | ) | 34,239 | |||||

(Gain) loss on disposal of discontinued operations: | ||||||||||

(Gain) loss on sale/retirement, net | $ | (30,296 | ) | (60,450 | ) | (13,014 | ) | |||

LIFO liquidation | — | (39,820 | ) | (20,349 | ) | |||||

Lease termination costs | 10,691 | 373,328 | 134,891 | |||||||

Employee termination (gain) costs | (11 | ) | 21,524 | 17,983 | ||||||

Other location closing costs | 1,694 | 26,264 | 9,945 | |||||||

Net (gain) loss on disposal | $ | (17,922 | ) | 320,846 | 129,456 | |||||

22

Table of Contents

The following table summarizes the changes in liabilities recorded for the restructuring plans (in thousands):

| Total | Employee Termination Costs | Other Location Closing Costs | ||||||||

Predecessor: | ||||||||||

Balance as of June 30, 2004 | $ | 7,024 | 3,760 | 3,264 | ||||||

Additions | 19,127 | 16,106 | 3,021 | |||||||

Utilizations | (21,484 | ) | (16,448 | ) | (5,036 | ) | ||||

Adjustments | (4,507 | ) | (3,258 | ) | (1,249 | ) | ||||

Balance as of June 29, 2005 | $ | 160 | 160 | — | ||||||

Additions | 48,633 | 34,033 | 14,600 | |||||||

Utilizations | (33,404 | ) | (23,319 | ) | (10,085 | ) | ||||

Adjustments | (11,765 | ) | (9,515 | ) | (2,250 | ) | ||||

Balance as of June 28, 2006 | $ | 3,624 | 1,359 | 2,265 | ||||||

Additions | 663 | 368 | 295 | |||||||

Utilizations | (2,991 | ) | (1,155 | ) | (1,836 | ) | ||||

Adjustments | (175 | ) | (175 | ) | — | |||||

Balance as of Nov. 15, 2006 | $ | 1,121 | 397 | 724 | ||||||

Successor: | ||||||||||

Balance as of Nov. 15, 2006 | $ | 1,121 | 397 | 724 | ||||||

Utilizations | (662 | ) | (278 | ) | (384 | ) | ||||

Adjustments | (459 | ) | (119 | ) | (340 | ) | ||||

Balance as of June 27, 2007 | $ | — | — | — | ||||||

In the Consolidated Balance Sheets, employee termination costs are included in accrued wages and salaries, while other location closing costs are included in accrued expenses.

LIQUIDITY AND CAPITAL RESOURCES

Summary

As of June 27, 2007, we had $592.9 million of liquidity, comprised of $391.0 million of borrowing availability under the Credit Agreement and $201.9 million of cash and cash equivalents. We anticipate that our liquidity will decrease during fiscal 2008, due primarily to increased capital expenditures, partially offset by anticipated cash flows from operating activities. We believe that we have sufficient liquidity through borrowing availability, available cash and cash flows from operating activities to fund our cash requirements for existing operations and capital expenditures through fiscal 2008. Based on anticipated improvement in operating results and borrowing availability, we believe that we will have sufficient resources beyond fiscal 2008 to operate our business and fund our capital-spending program.

Credit Agreement

On the Effective Date, Winn-Dixie Stores, Inc., and certain of our subsidiaries entered into an Amended and Restated Credit Agreement (“Credit Agreement”). The Credit Agreement, which is to be used for working capital and general corporate purposes, provides for a $725.0 million

23

Table of Contents

senior secured revolving credit facility, of which a maximum of $300.0 million may be utilized for letters of credit. The Credit Agreement matures November 21, 2011, at which time all amounts then outstanding under the agreement will be due and payable. At our request, under certain conditions the facility may be increased by up to $100.0 million. Obligations under the Credit Agreement are guaranteed by substantially all of our subsidiaries and are secured by senior liens on substantially all of our assets. Debt issuance costs of $9.2 million are being amortized over the term of the Credit Agreement. This Form 10-K contains only a general description of the terms of the Credit Agreement and is qualified in its entirety by reference to the full Credit Agreement (filed as Exhibit 10.1 to the Form 8-K filed on November 28, 2006). The following capitalized terms have specific meanings as defined in the Credit Agreement: Agent, Borrowing Base, Capital Expenditures, EBITDA, Excess Availability and Reserves.

As of the Effective Date, existing letters of credit under the DIP Credit Facility (as defined below) were rolled over as letters of credit under the Credit Agreement. We had no material borrowings on the Credit Agreement, other than fees charged by the lender, during the 32 weeks ended June 27, 2007. As of June 27, 2007, $14 thousand was outstanding.

Borrowing availability was $391.0 million as of June 27, 2007, as summarized below (in thousands):

| June 27, 2007 | ||||

Lesser of Borrowing Base or Credit Agreement capacity1 | $ | 441,036 | ||

Outstanding borrowings | (14 | ) | ||

Excess Availability | 441,022 | |||

Limitation on Excess Availability | (50,000 | ) | ||

Borrowing availability | $ | 391,022 | ||

1 | Net of Reserves of $253.5 million, including $234.5 million related to outstanding letters of credit. |

As shown above, availability under the Credit Agreement is determined net of Reserves, which are subject to revision by the Agent to reflect events or circumstances that adversely affect the value of the Borrowing Base assets. Accordingly, a determination by the Agent to increase Reserves would reduce availability.

Letters of credit are considered reserves against the borrowing availability. As of June 27, 2007, letters of credit totaling $234.5 million were issued under the Credit Agreement. Substantially all outstanding letters of credit related to workers’ compensation programs. As of June 27, 2007, an additional $3.0 million in letters of credit were issued outside of the Credit Agreement and secured by marketable securities owned by the Company.

Debtor-In-Possession Credit Facility

Subsequent to the Petition Date, the Court authorized Winn-Dixie Stores, Inc. and five specified debtor subsidiaries to enter into an $800.0 million credit facility (the “DIP Credit Facility”). As of both the Effective Date and June 28, 2006, the outstanding balance on the DIP Credit Facility was $40.0 million under the term loan portion of the facility. On the Effective Date, we repaid the DIP Credit Facility, which was then terminated. In addition to the DIP Credit Facility, the Predecessor had $300.0 million of outstanding Notes, which were included

24

Table of Contents

in liabilities subject to compromise in the Predecessor’s balance sheet. In accordance with the Plan, the Notes were cancelled and the holders thereof received shares of the Successor’s common stock. In accordance with SOP 90-7, as of the Petition Date, the Predecessor ceased accruing interest on all unsecured debt subject to compromise, primarily the Notes. See our Annual Report on Form 10-K for the fiscal year ended June 28, 2006, for more information about the DIP Credit Facility and the Notes.

Historical Cash Flow Data

Cash flows from discontinued operations are reported with cash flows from continuing operations within operating, investing and financing activities. The table below presents certain Consolidated Statements of Cash Flow data for fiscal 2007 and fiscal 2006 (in thousands):

| Fiscal 2007 | Fiscal 2006 | Fiscal 2005 | ||||||||

Cash provided by (used in): | ||||||||||

Operating activities | $ | 22,607 | 195,224 | (228,136 | ) | |||||

Investing activities | 30,103 | 149,405 | 3,368 | |||||||

Financing activities | (38,307 | ) | (202,492 | ) | 230,091 | |||||

Operating Activities.For fiscal 2007, net cash provided by operating activities was $22.6 million, primarily due to proceeds from insurance of $42.0 million and income tax refunds of $28.5 million, offset by bankruptcy-related payments made subsequent to emergence and operating losses.

For fiscal 2005 and fiscal 2006, our cash flows from operating activities were significantly affected by our Chapter 11 filing. In fiscal 2005, cash used in operations of $228.1 million resulted substantially from the withdrawal of credit by many of our vendors due to our Chapter 11 filing and operating losses from underperforming stores. Cash provided by operations of $195.2 million in fiscal 2006 was primarily due to the resumption of vendor credit and accounts receivable collections lost during fiscal 2005 due to our Chapter 11 filing, as well as inventory liquidation upon closing underperforming stores.

Investing Activities.In fiscal 2007, cash provided by investing activities primarily related to the receipt of $54.0 million in proceeds from the sale of Bahamas Supermarkets Limited. Capital expenditures were $92.4 million, which included repairs to locations damaged by hurricanes, store remodeling and improvements, and equipment acquisition.

Financing Activities. In fiscal 2007, cash used in financing activities related primarily to payments on credit facilities of $52.6 million.

Capital Expenditures.In fiscal 2008, we expect capital expenditures to total approximately $250 million, of which approximately $140 million is budgeted for our store-remodeling program. We initiated this program during fiscal 2007, and as of June 27, 2007, had completed 20 remodels. In fiscal 2008 and future fiscal years, we plan to remodel approximately 75 stores annually. We believe we can achieve at least a 10% increase in identical store sales (or corresponding mitigation of the anticipated negative effect of a competitive store opening) during the first 12 months for all remodeled stores.

25

Table of Contents

In addition to the store-remodeling program, we anticipate that during fiscal 2008 we will spend approximately $110 million on other capital expenditures, including maintenance and other store-related projects, information technology projects, and back-up generators.

CONTRACTUAL OBLIGATIONS AND COMMERCIAL COMMITMENTS

We assume various financial obligations and commitments in the normal course of our operating and financing activities. Contractual obligations represent known future cash payments that we will be required to make under existing arrangements, such as debt and lease agreements. The table below presents the scheduled payments due under our contractual obligations as of June 27, 2007:

Contractual Obligations

| Payment due by period | |||||||||||

(in millions) | Total | Less than 1 year | 1-3 years | 3-5 years | More than 5 years | ||||||

Long-term debt1 | $ | — | — | — | — | — | |||||

Capital leases | 29.3 | 8.1 | 13.7 | 7.4 | 0.1 | ||||||

Operating leases | 1,861.4 | 208.2 | 391.3 | 344.2 | 917.7 | ||||||

Purchase obligations2 | 333.2 | 232.3 | 84.6 | 12.0 | 4.3 | ||||||

Retirement plans3 | 22.7 | 2.1 | 4.2 | 3.7 | 12.7 | ||||||

Other | 22.5 | 18.6 | 3.9 | — | — | ||||||

Total | $ | 2,269.1 | 469.3 | 497.7 | 367.3 | 934.8 | |||||

1 | Excludes: $234.5 million of letters of credit outstanding under the Credit Agreement; $3.0 million of letters of credit outstanding outside of the Credit Agreement; and Borrowing Availability of $391.0 million. |

2 | We enter into supply contracts to purchase products for resale in the ordinary course of business. These contracts may include specific merchandising obligations related to the products and, if so, typically include either a volume commitment or a fixed expiration date; pricing terms based on the vendor’s published list price; termination provisions; and other standard contractual considerations. Contracts that are cancelable, typically upon return of the related vendor allowances, are not included above. Contracts that are either non-cancelable or are less specific as to our obligations upon cancellation are included above. When applicable, we used anticipated purchase volumes to allocate the purchase obligation to the indicated periods. The amounts above include open purchase orders of $127.3 million. |

3 | Payments for retiree plans are based on actuarial projections related to our post-retirement benefits. |

IMPACT OF INFLATION

Inflation impacts our operating costs including, but not limited to, cost of goods and supplies, utilities, occupancy costs, and labor expenses. We typically seek to mitigate these effects by passing along inflationary increases in costs through increases in the selling prices of our products. To the extent we pass through cost increases in the form of higher selling prices, our sales are positively impacted. If we are unable to pass through cost increases, we may experience pressure on our gross margins. We also seek to mitigate cost inflation through strategically managing pricing and promotions, lowering overhead costs, and/or by increasing productivity.

CRITICAL ACCOUNTING ESTIMATES

The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions about future events that affect the reported amounts of assets, liabilities, revenues, and expenses, as well as disclosure of contingent assets and liabilities. We believe that the policies below are our critical accounting policies, as they are most important to the portrayal of our financial condition and results, and require management’s most difficult, subjective or complex judgments, often because of the need to make estimates about the effect of inherently uncertain matters. See Item 8, Note 3 for further discussion of our accounting policies.

26

Table of Contents

Fresh-Start Reporting. We emerged from Chapter 11 protection on November 21, 2006. We adopted fresh-start reporting in accordance with SOP 90-7 as of the close of business on November 15, 2006.

We applied various valuation methods to calculate the reorganization value of the Successor. These methods included (i) a guideline company approach, in which valuation multiples observed from industry participants were considered and comparisons were made between our expected performance relative to other industry participants to determine appropriate multiples to apply to our financial metrics; (ii) review and analysis of several recent transactions of companies determined to be similar to us; and (iii) a calculation of the present value of the future cash flows based on our projections as included in the disclosure statement related to the Plan. The cash flows, taken from the Plan, were projected over five years, using discount rates of 15% to 25% and an assumed tax rate of 35%. In the disclosure statement related to the Plan, the reorganization value of Winn-Dixie was determined to be approximately $625 million to $890 million, with an approximate midpoint of $759 million. The reorganization value was determined using numerous projections and assumptions that are inherently subject to significant uncertainties and the resolution of contingencies beyond our control. Accordingly, there can be no assurance that the estimates, assumptions and amounts reflected in the valuation will be realized.