UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1O-K

ANNUAL REPORT PURSUANT TO SECTIONS 13 OR 15 (d) OF THE

SECURITIES AND EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2010

Commission file number: 000-25997

China Holdings Group, Inc.

(Exact Name of Registrant as Specified in its Charter)

Nevada 91-1939533

______________________ _______________

(State or Other Jurisdiction of (IRS Employer

Incorporation or Organization) Identification No.)

73726 Alessandro Drive, Suite 103

Palm Desert, CA 92260

(Address of Principal Executive Offices)

Registrant's telephone number, including area code: (760) 776-8899

Securities registered pursuant to Section 12(b) of the Act: None

Common Stock, $0.001 par value

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act.

Yes * NoS

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

Yes * No S

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes S No*

1

Indicate by check whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes S No*

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. S

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or smaller reporting company. See the definitions of "large accelerated filer," "acceleratedfiler" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated Filer* Accelerated Filer*

Non-accelerated filer* Smaller reporting companyS

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes S No*

For the year ended December 31, 2010, the issuer had no revenues.

As of June 30, 2010, there was no active trading market for the issuer's common stock, $.001 par value and therefore the value of shares held by affiliates cannot be ascertained.

The number of shares outstanding of the issuer's common stock, $.001 par value, as of December 31, 2010 was 3,190,400 shares.

DOCUMENTS INCORPORATED BY REFERENCE

None.

2

China Holdings Group, Inc.

Form 10-K Annual Report

Table of Contents

PART I

Item 1. Business 5

Item 1A. Risk Factors 6

Item 1B. Unresolved Staff Comments 6

Item 2. Properties 6

Item 3. Legal Proceedings 6

Item 4. Removed and Reserved 6

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity 7

Securities.

Item 6. Selected Financial Data 6

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations 7

Item 7A. Quantitative and Qualitative Disclosures about Market Risk 8

Item 8. Financial Statements and Supplementary Data 8

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure. 9

Item 9A. Controls and Procedures 9

Item 9B. Other Information 10

PART III

Item 10. Directors, Executive Officers, and Corporate Governance 10

Item 11. Executive Compensation 11

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters 12

Item 13. Certain Relationships and Related Transactions, and Director Independence 12

Item 14. Principal Accounting Fees and Services. 12

PART IV

Item 15. Exhibits and Financial Statement Schedules 13

3

FORWARD LOOKING STATEMENT INFORMATION

Certain statements made in this Annual Report on Form 10-K are 'forward-looking statements"regarding the plans and objectives of management for future operations. Such statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. The forward-looking statements included herein are based on current expectations that involve numerous risks and uncertainties. Our plans and objectives are based, in part, on assumptions involving judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond our control. Although we believe that our assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove inaccurate and, therefore, there can be no assurance that the forward-looking statements included in this report will prove to be accurate. in light of the significant uncertainties inherent in the forward looking statements included herein particularly in view of the current state of our operations, the inclusion of such information should not be regarded as a statement by us or any other person that our objectives and plans will be achieved. Factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements include, but are not limited to, the factors set forth herein under the headings "Business,""Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Risk Factors".We undertake no obligation to revise or update publicly any forward-looking statements for any reason. The terms "we","our","us",or any derivative thereof, as used herein refer to China Holdings Group, Inc.

4

PART 1

ITEM 1. BUSINESS.

CORPORATE BACKGROUND

China Holdings Group, Inc. was incorporated pursuant to the laws of the State of Nevada on April 28, 1994, under the name “Silver Bow Antique Aviation.” The Company was incorporated primarily to engage in the restoration and maintenance of antique aircraft.

Our Business

On October 6, 2005, the shareholders of Silver Bow Antique Aviation, voted to change its name to China Holdings Group, Inc. for the purpose of engaging in any lawful corporate business, including but not limited to, participating in mergers with and acquisitions of other companies. The Company has been in the developmental stage since inception and has no operating history other than organizational matters. Prior to 2010, the primary activity of the Company involved seeking a company or companies that it could acquire or with whom it could merge. The Company was not successful in finding a merger or acquisition candidate, and therefore reverted to its original business plan which was to create an on line antique aircraft spare parts business.

However, during the latter part of December 2010, it became apparent that the market for aircraft parts, in particular the more specialized antique aircraft parts in which we have the most expertise, had become extremely depressed due to the continuing economic downturn.

Therefore, the Company has now decided on a complete change of approach, and intends to use the Company as an operating entity for a new financial services business. In essence the Company will capitalize on the past experience of its senior management in the fields of investment banking, financial consulting and litigation management. The Company will seek those small businesses and individuals looking for advice on the re-structuring of their financial affairs, which might also include debt settlement and loan modification services. Although the Company will from time to time employ the services of legal counsel, it will not hold itself out as a law firm, nor will it proffer legal advice to its clients.

Our Competition

We have many competitors, most of which are better capitalized and all of which have longer operating histories.

Proprietary Rights

We currently have no proprietary rights.

Our Research and Development

We are not currently conducting any research and development activities.

Government Regulation

See the Risk Factors section of this prospectus for a discussion relevant government regulation and the legal uncertainties related to our business activities.

Employees

As of December 31, 2010 we have no employees other than our sole officer and two directors. We anticipate that we will not hire any employees in the next twelve months, unless we generate significant revenues, raise capital, or make a complete change of course from our current business plan.

5

Item 1A. Risk Factors

As a smaller reporting company, as defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), we are not required to provide the information required by this item.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

As a smaller reporting company, as defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), we are not required to provide the information required by this item.

ITEM 2. PROPERTIES

The Company does not own any property at the present time and has no agreements to acquire any property. Our executive offices are located at 73726 Alessandro Dr. Suite 103, Palm Desert, CA 92260. This space, along with other nominal office services which might be required, is provided by a third party company affiliated with our officer at no charge. We believe that this space is adequate for our needs at this time, and we believe that we will be able to locate additional space in the future, if needed, on commercially reasonable terms.

ITEM 3. LEGAL PROCEEDINGS

None.

ITEM 4. REMOVED AND RESERVED

PART II

ITEM 5. MARKET FOR OUR COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

(a) Market Information. China Holdings Group, Inc’s common stock is not included in the pink sheets or in the OTC Bulletin Board maintained by the NASD. China Holdings Group, Inc. plans to apply to the OTC Bulletin Board. There is no public trading market for China Holdings Group, Inc.’s common stock and there is no guarantee any trading market will develop.

(b) Holders. As of December 31, 2010, there were 54 record holders of all of our issued and outstanding shares of Common Stock.

(c) Dividend Policy. We have not declared or paid any cash dividends on our Common Stock and do not intend to declare or pay any cash dividend in the foreseeable future. The payment of dividends, if any, is within the discretion of the Board of Directors and will depend on our earnings, if any, our capital requirements and financial condition and such other factors as the Board of Directors may consider.

6

Equity Compensation PlanInformationn as of December 31, 2010

Plan Category |

(a) Number of Securities To be issued upon Exercise of existing Options, warrants And rights |

(b) Weighted Average Exercise price of Outstanding options, Warrants and rights | Number of Securities Remaining available For future issuance under equity compensation plans (excluding Securities Reflected in Column (a) |

Equity compensation Approved by Security holders | -- | -- | -- |

| | | | |

Equity compensation Not approved by Security holders | -- | -- | -- |

| | | | |

Total | -- | -- | -- |

(e) Sales of Unregistered Securities during the year ended December 31, 2010

None.

(f) Company repurchasesof common stock during the year ended December 31, 2010.

None.

ITEM 6. SELECTED FINANCIAL DATA.

As a smaller reporting company, as defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), we are not required to provide the information required by this item.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

Certain statements in this report and elsewhere (such as in other filings by the Company with the Securities and Exchange Commission ("SEC"), press releases, presentations by the Company of its management and oral statements) may constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as "expects," "anticipates," "intends," "plans," "believes," "seeks," "estimates," and "should," and variations of these words and similar expressions, are intended to identify these forward-looking statements. Actual results may materially differ from any forward-looking statements. Factors that might cause or contribute to such differences include, among others, competitive pressures and constantly changing technology and market acceptance of the Company's products and services. The Company undertakes no obligation to publicly release the result of any revisions to these forward-looking statements, which may be made to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

China Holdings Group, Inc. was incorporated on April 28, 1994. As of the date of this document, we have generated no revenues and substantial expenses. This has resulted in a net loss of $62,860 since inception, which is attributable to

general and administrative expenses.

Since incorporation, we have financed our operations primarily through minimal initial capitalization. We do not expect to conduct any research and development. We do not own any plant or equipment. Our management does not anticipate any significant changes in the number of employees in the next 12 months. Currently, we believe the services provided by our officers and directors are sufficient at this time. We have not paid for expenses on behalf of any director. Additionally, we believe that this practice will not materially change.

Results of Operations

The Company has earned no revenue or profits to date, and the Company anticipates that it will continue to incur net losses for the foreseeable future. The Company incurred a net loss of $3,670 for the year ended December 31, 2010, as compared to a net loss of $6,000 for 2009. From the date of inception April 28, 1994, to December 31, 2010 the Company lost a total of $62,860. Most labor and services have been compensated with issuances of stock, or cash payment has been deferred.

7

Liquidity and Capital Resources

The Company has financed its expenses and costs thus far through financing and through the increase in its accounts payable, payments made by others for the company and by the settlement of the payable amounts with shares of common stock of the Company. As of December 31, 2010, the Company had a cash of $235 compared to cash of $0 as of December 31, 2009.

For the most recent fiscal year, 2010, the Company incurred a loss in the amount of $3,670 and $6,000 for 2009. Both years' losses are a result of organizational expenses and expenses associated with setting up a Company structure in order to begin implementing its business plan. The Company anticipates that until these procedures are completed, it will not generate revenues, and may continue to operate at a loss thereafter, depending upon the performance of the business.

During the period from July 14, 2008 (date of inception) through December 31, 2010, the Company has incurred an

accumulated net loss of $62,860 and has not attained profitable operations. The Company is dependent upon obtaining

adequate financing to enable it to pursue its business plan and manage its operations so that they are profitable.

The Company has limited financial resources available, which has had an adverse impact on the Company's liquidity, activities and operations. These limitations have adversely affected the Company's ability to obtain certain projects and pursue additional business. There is no assurance that the Company will be able to raise sufficient funding to enhance the Company's financial resources sufficiently to generate volume for the Company, or to engage in any significant research and development, or purchase plant or significant equipment.

Management has been successful in raising sufficient funds to cover the Company's compliance expenses including the cost of auditing and filing required documents for 2010.

The Company as a whole may continue to operate at a loss for an indeterminate period thereafter, depending upon the

performance of its new businesses. In the process of carrying out its business plan, the Company will continue to

identify new financial partners and investors. However, it may determine that it cannot raise sufficient capital to

support its business on acceptable terms, or at all. Accordingly, there can be no assurance that any additional funds will be available on terms acceptable to the Company or at all. As of December 31, 2010, the company was authorized to issue 99,990,000 shares of common stock.

Commitments.

We do not have any commitments which are required to be disclosed in tabular form as of December 31, 2010.

Off-Balance Sheet Arrangements

As of December 31, 2010, we have no off-balance sheet arrangements such as guarantees, retained or contingent interest in assets transferred, obligation under a derivative instrument and obligation arising out of or a variable interest in an unconsolidated entity.

Subsequent Events

There were no reportable subsequent events from December 31, 2010 through the date this report is filed.

ITEM7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

As a smaller reporting company, as defined in Rule 12b-2 of the Exchange Act, we are not required to provide the information required by this item.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

See the index to the Financial Statements below in Item 15.

8

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE.

On January 6, 2010, Board of Directors of the Registrant dismissed The Blackwing Group, LLC, its independent registered public account firm. The PCAOB revoked the registration of Blackwing on December 22, 2009 because of violations of PCAOB rules and auditing standards in auditing the financial statements of two issuers, PCAOB rules and quality controls standards and Section 10(b) of the Securities Exchange Act of 1934 and Rule 10b-5 thereunder, and non cooperation with a Board Investigation. The Board of Directors of the Registrant and the Registrant's Audit Committee approved of the dismissal of The Blackwing Group, LLC as its independent auditor. The audit reports of The Black Wing Group, LLC on the Company’s financial statements for the fiscal years ending December 31, 2008 and 2007 did not contain any adverse opinion or disclaimer of opinion, nor was it qualified or modified as to uncertainty, audit scope, or accounting principles, except such report was modified to include an explanatory paragraph for a going concern uncertainty. In connection with the audits of the fiscal years ending December 31, 2008 and 2007, including the subsequent interim periods since engagement through September 30, 2009, the date of resignation, the Company had no disagreements with The Black Wing Group, LLC with respect to accounting or auditing issues of the type discussed in Item 304(a)(iv) of Regulation S-K. Had there been any disagreements that were not resolved to their satisfaction, such disagreements would have caused The Black Wing Group, LLC to make reference in connection with their opinion to the subject matter of the disagreement. In addition, during that time there were no reportable events (as defined in Item 304(a)(1)(v) of Regulation S-K).

During the fiscal year ending December 31, 2008, including the subsequent interim periods since engagement through January 6, 2010, the date of The Black Wing Group, LLC’s termination, the Company (or anyone on its behalf) did not consult with any other accounting firm regarding any of the accounting or auditing concerns stated in Item 304(a)(2) of Regulation S-K. Since there were no disagreements or reportable events (as defined in Item 304(a)(2) of Regulation S-K), the Company did not consult any other firm in respect to these matters during the time periods detailed herein. The registrant has requested that The Blackwing Group, LLC furnish it with a letter addressed to the Securities and Exchange Commission stating whether it agrees with the above statements. The letter is attached as an exhibit to a Form 8-K filed on February 25, 2010.

On February 23, 2010, the registrant engaged Sam Kan and Company CPA as its independent accountant. During the two most recent fiscal years and the interim periods preceding the engagement, the registrant has not consulted Sam Kan and Company CPA regarding any of the matters set forth in Item 304 (a) (2) (i) or (ii) of Regulation S-K.

.

ITEM 9A. CONTROLS AND PROCEDURES.

Disclosure Controls and Procedures. We maintain disclosure controls and procedures designed to ensure that information required to be disclosed in our reports filed under the Securities Exchange Act of 1934, as amended (the Exchange Act), is recorded, processed, summarized, and reported accurately, in accordance with U.S. Generally Accepted Accounting Principles and within the required time periods, and that such information is accumulated and communicated to our management, including our Chief Executive Officer and our Chief Financial Officer, as appropriate, to allow for timely decisions regarding disclosure. As of the end of the period covered by this report (December 31, 2010) , we carried out an evaluation, under the supervision and with the participation of our management, including our Chief Executive Officer, and our Chief Financial Officer, of the effectiveness of the design and operation of our disclosure controls and procedures (as defined in Exchange Act Rule 13a-15(e) and 15d-15(e)). Based upon that evaluation, our Chief Executive Officer and our Chief Financial Officer concluded that as of the end of the period covered by this Annual Report on Form 10-K our disclosure controls and procedures were effective to enable us to accurately record, process, summarize and report certain information required to be included in the Company’s periodic SEC filings within the required time periods, and to accumulate and communicate to our management, including the Chief Executive Officer and Chief Financial Officer, to allow timely decisions regarding required disclosure.

Internal Control Over Financial Reporting. Our management is responsible for establishing and maintaining adequate internal control over financial reporting, as such term is defined in Exchange Act Rule 13a-15(f). Management conducted an evaluation of the effectiveness of our internal control over financial reporting based on the criteria set forth in Internal Control—Integrated Framework issued by the Committee of Sponsoring Organizations ("COSO"). Based upon that evaluation, our Chief Executive Officer and our Chief Financial Officer concluded that as of the end of the period covered by this Annual Report on Form 10-K our internal control over financial reporting was effective as of the fiscal year ended December 31, 2010.

9

This annual report does not include an attestation report of our registered public accounting firm regarding internal control over financial reporting. Management's report was not subject to attestation by our registered public accounting firm pursuant to temporary rules of the SEC that permit us to provide only management's report in this annual report.

There were no changes in our internal controls over financial reporting that occurred during the last fiscal quarter covered by this report that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

ITEM 9B. OTHER INFORMATION

None.

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE.

The following table sets forth information concerning our officers and directors as of December 31, 2010:

Name Age Positions(s) Period of Service

Dempsey K. Mork 69 President, Secretary, Treasurer January 2004 to date

And Director

Our officers and directors are elected to hold office until the next annual meeting of shareholders and until their respective successors have been elected and qualified, or until prior resignation or removal.

Business Experience

Mr. Mork is the majority shareholder, Chief Financial Officer/President/Sec./Treas/Director of China Holdings Group, Inc. He has been an officer/director of the Company since its formation in 1994. For the past seven years, he has been officer/director of Magellan Capital Corporation, Bancorp Energy, Knickerbocker Capital, Apex Capital, Asian Financial and North Star Ventures. Mr. Mork has experience in start-up companies, business reorganizations and cross border business transactions. He will spend approximately 20 hours per month on China Holdings Group, Inc. business.

Significant Employees

The Company has no employees who are not executive officers, but who are expected to make a significant contribution to the Company's business.

Compensation and Audit Committees

As we only have one board member and given our limited operations, we do not have separate or independent audit or compensation committees. Our Board of Directors has determined that it does not have an "audit committee financial expert," as that term is defined in Item 407(d)(5) of Regulation S-K. In addition, we have not adopted any procedures by which our shareholders may recommend nominees to our Board of Directors.

10

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our directors and executive officers and persons who beneficially own more than ten percent of our Common Stock (collectively, the "Reporting Persons") to report their ownership of, and transactions in our Common Stock to the SEC. Copies of these reports are also required to be supplied to us. To our knowledge, during the fiscal year ended December 31, 2010 the Reporting Persons complied with all applicable Section 16(a) reporting requirements.

Code of Ethics

We have not adopted a Code of Ethics given our limited operations We have no plans to adopt a Code of Ethics due to our limited operations.

ITEM 11. EXECUTIVE COMPENSATION.

SUMMARY COMPENSATION TABLE |

Name and Principal Position

(a) | Year

(b) | Salary

($)

(c) | Bonus

($)

(d) | Stock

Awards

($)

(e) | Option

Awards

($)

(f) | NonEquity

Incentive

Plan

Compensation

($)

(g) | Nonqualified

Deferred

Compensation

Earnings

($)

(h) | All

Other

Compensation

($)

(i) | Total

($)

(j) | | |

Dempsey Mork, CEO and CFO |

2010 2009 |

0 0 |

0 0 |

0 0 |

0 0 |

0 0 |

0 0 |

0 0 |

0 0 | | |

Our sole Director and Officer did not receive any compensation for his services rendered on our behalf. He did not receive any compensation during the years ended December 31, 2010 and 2009. No officer or director is required to make any specific amount or percentage of his business time available to us.

Director Compensation

We do not currently pay any cash fees to our sole director, nor do we pay director's expenses in attending board meetings.

Employment Agreements

We are not a party to any employment agreements.

11

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS.

The following table sets forth certain information as of December 31, 2010 regarding the number and percentage of our Common Stock (being our only voting securities) beneficially owned by each officer, director, each person (including

any "group" as that term is used in Section 13(d)(3) of the Exchange Act) known by us to own 5% or more of our

Common Stock, and all officers and directors as a group.Unless otherwise indicated, we have been advised that all individuals or entities listed have the sole power to vote and dispose of the number of shares set forth opposite their names. For purposes of computing the number and percentage of shares beneficially owned by a security holder, any shares which such person has the right to acquire within 60 days of December 31, 2010 are deemed to be outstanding, but those shares are not deemed to be outstanding for the purpose of computing the percentage ownership of any other security holder.

Name and Address of Number of

Beneficial Owner Shares Percent of Class

Dempsey K. Mork(1)

900,000 28.21%

President/CFO/Director

Magellan Capital Corporation (1) 597,600 18.73%

Pension Benefit Plan & Trust

c/o 55 South Valle Verde Dr. Suite 235-174

Henderson, NV 89012

Magellan Capital Corporation (1) 900,000 28.21%

Profit Sharing Plan & Trust

(1) The address is c/o the Company. Mr. Mork is an officer of Magellan Capital Corporation, which owns 900,000 shares of the Company. Although Mr. Mork is also a beneficiary of the pension plans listed in the above table, their ownership of Company shares is not attributed to him since Mr. Mork is one of several beneficiaries of these plans and he does not have any control over the trustees of these plans.

We currently do not maintain any equity compensation plans.

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE.

For the year ended December 31, 2008, the Company’s President advanced $50,000 to the Company for working capital. In 2010, the Company’s President paid $7,600 for professional fees for filing compliance purposes. These advances will be reimbursed once the Company starts generating cash flows.

Currently, the Company does not have any independent directors. Since the Company’s Common Stock is not currently listed on a national securities exchange, we have used the definition of “independence” of The NASDAQ Stock Market to make this determination.

Under NASDAQ Listing Rule 5605(a)(2), an "independent director" is a "person other than an officer or employee of the company or any other individual having a relationship which, in the opinion of the company's board of directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director."

ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

Sam Kan & Associates, 1151 Harbor Bay Parkway, Ste. 101, Alameda CA 94502, (510) 355-0492 is our independent

registered public accounting firm.

12

Audit Fees

The aggregate fees billed by Sam Kan & Associates for professional services rendered for the audit of our annual financial statements and review of financial statements included in our annual report on Form 10-K or services that are normally provided in connection with statutory and regulatory filings was $2,000 for the fiscal year ended December31, 2010.

Audit-Related Fees

There were no fees billed by Sam Kan & Associates for assurance and related services that are reasonably related to the performance of the audit or review of our financial statements for the fiscal year ended December 31, 2010.

Tax Fees

The aggregate fees billed by Sam Kan & Associates for professional services for tax compliance, tax advice, and tax planning were $0 for the fiscal year ended December 31, 2010.

Pre-Approval Policy

We do not currently have a standing audit committee. The above services were approved by our Board of Directors.

PART IV

Item 15. Exhibits and Financial Statement Schedules

(a) The following financial statements are filed as part of this Report:

o Report of independent Registered Public Accounting Firm (Sam Kan & Associates-2010 and 2009)

o Consent to inclusion of Audit Report in Form 10-K

o Balance Sheets at December 31, 2010 and 2009

o Statements of Operations for the years ended December 31, 2010 and 2009 and for the cumulative period from April 28,

1994 (Date of Inception) to December 31, 2010.

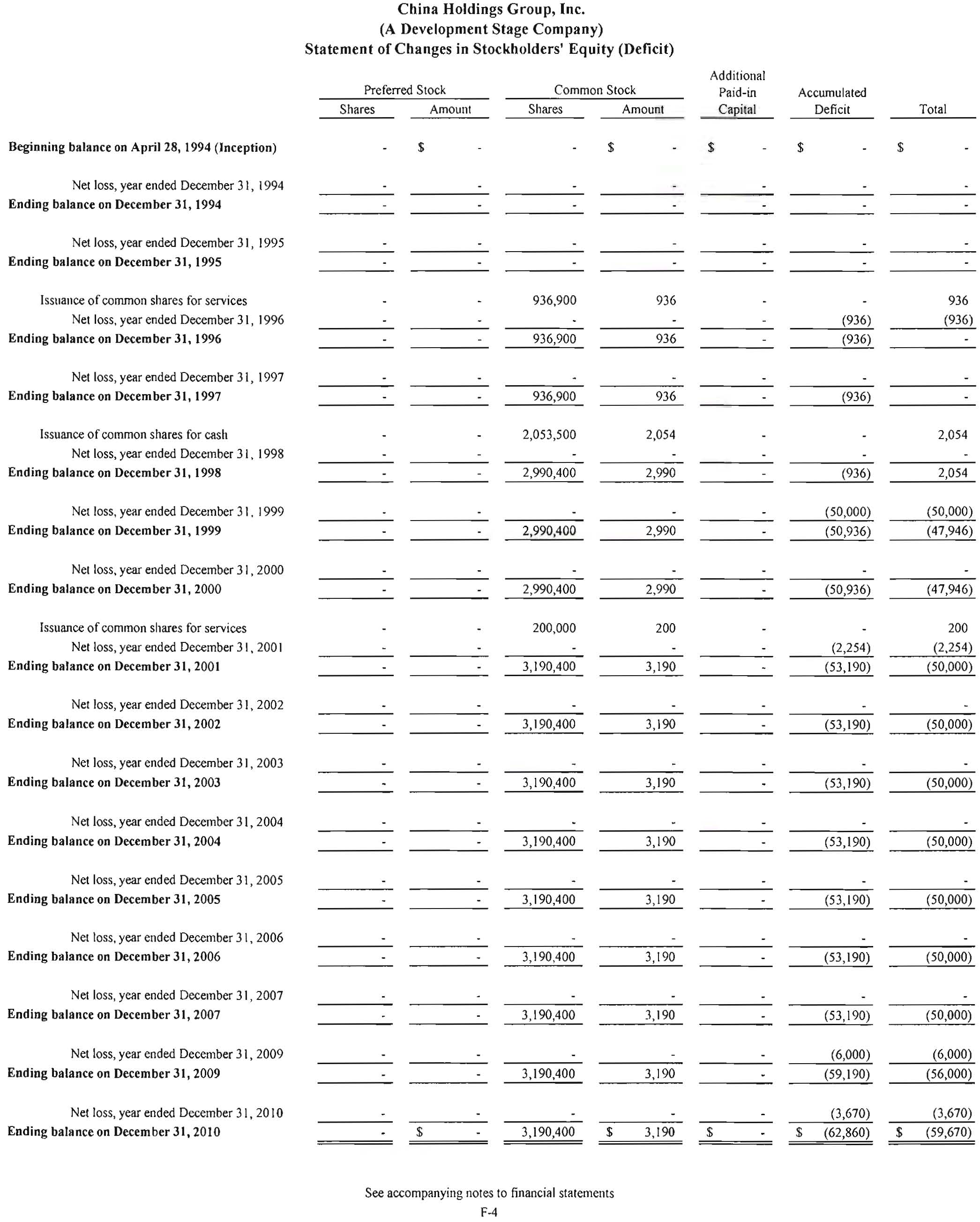

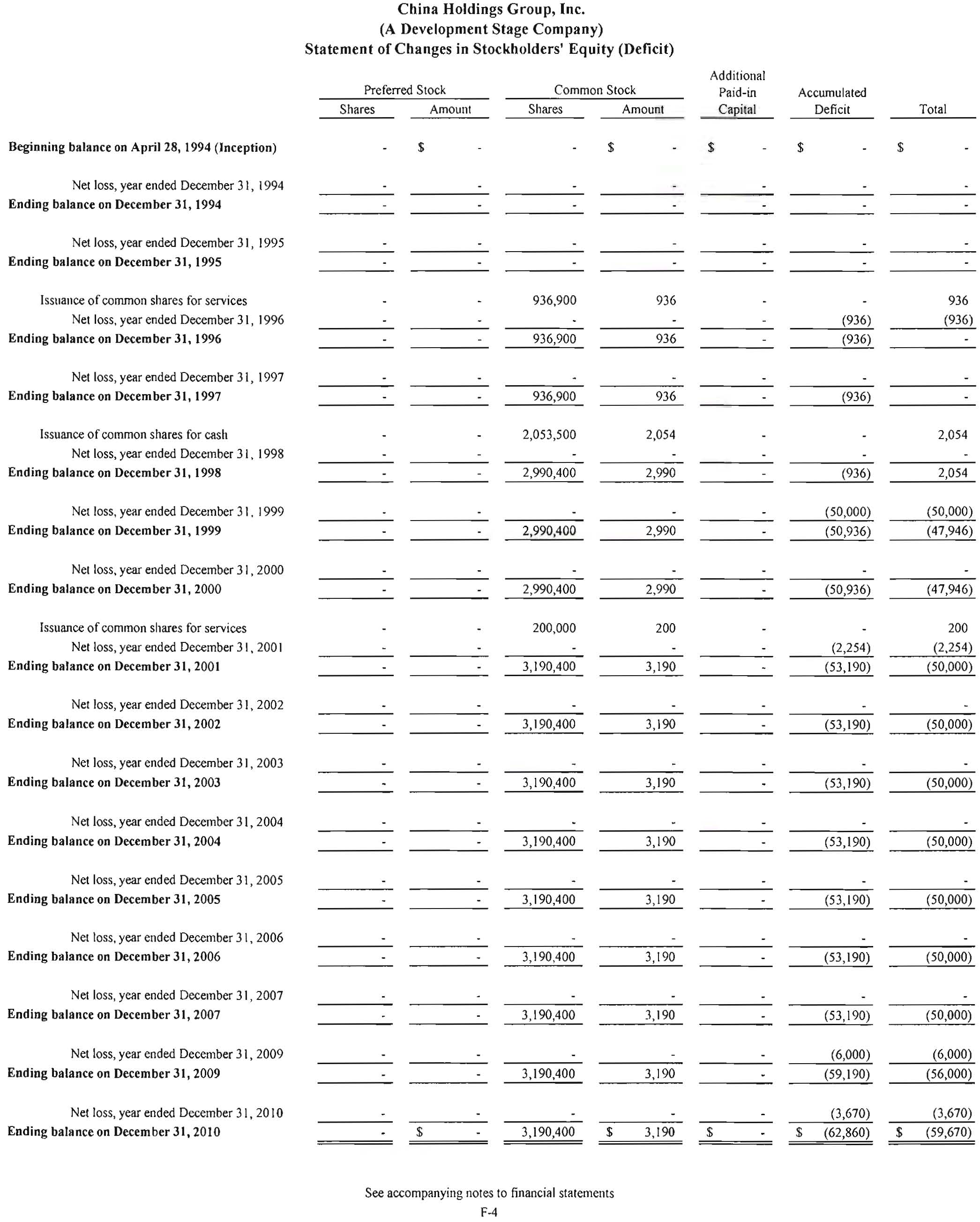

o Statements of Changes in Shareholders' Deficiency for the period from April 28, 1994 (Date of Inception) to December 31,

2010.

o Statements of Cash Flows for the years ended December 31, 2010 and 2009, and for the cumulative period from April

28, 1994 (Date of Inception) to December 31, 2010.

o Notes to Financial Statements

Financial statement schedules are omitted because the information required is not applicable or the required information is shown in the financial statements or notes thereto.

3. Exhibits Incorporated by Reference or Filed with this Report.

Exhibit No. Description

31.1 Chief Executive Officer Certification pursuant to section 302 of the Sarbanes-Ox1ey Act of2002*

31.2 Chief Financial Officer Certification pursuant to section 302 of the Sarbanes-Oxley Act of2002*

32.1 Chief Executive Officer Certification pursuant to section 906 of the Sarbanes-Oxley Act of2002.*

32.2 Chief Financial Officer Certification pursuant to section 906 of the Sarbanes-Oxley Act of2002.*

13

*included herewith

14

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

China Holdings Group, Inc.

Date: August 10, 2011

By: /s/ Dempsey Mork

Dempsey Mork, President

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

.

Date: August 10, 2011

By: /s/ Dempsey Mork

Dempsey Mork, President/CEO/Secretary/CFO/Director

(Principal Executive Officer and Accounting and Financial Officer)

15

Sam Kan & Company

1151 Harbor Bay Pkwy., Suite 101

Alameda, CA 94502 Phone: 510.517.7874 Fax: 866.848.1224

http://www.skancpa.com

Report of Independent Registered Public Accounting Firm

To the Board of Directors of China Holdings Group, Inc.

We have audited the accompanying balance sheets of China Holdings Group, Inc. (hereinafter the “Company”) as of December 31, 2010 and 2009, and the related statements of operations, stockholders' equity (deficit), and cash flows for the years then ended, and for the period from inception on April 28, 1994 to December 31, 2010. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of the Company as of December 31, 2010 and 2009, and the results of its operations and cash flows for the years then ended, and for the period from inception on April 28, 1994 to December 31, 2010 are in conformity with U.S. generally accepted accounting principles.

We were not engaged to examine management's assessment of the effectiveness of the Company’s internal control over financial reporting as of December 31, 2010 and 2009, and accordingly, we do not express an opinion thereon.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note B to the financial statements, the Company has suffered recurring losses and has experienced negative cash flows from operations, which raises substantial doubt about the Company's ability to continue as a going concern. Management's plans in regard to those matters are also described in Note B to the financial statements. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Sam Kan & Company May 20, 2011 Alameda, California

16

Sam Kan & Company

1151 Harbor Bay Pkwy., Suite 101

Alameda, CA 94502 Phone: 510.517.7874 Fax: 866.848.1224

http://www.skancpa.com

We consent to the inclusion in the Annual Report (Form 10-K) of China Holdings Group, Inc. (hereinafter the “Company”) of our report dated May 20, 2011, with respect to the balance sheets as of December 31, 2010 and 2009, and the related statements of operations, stockholders’ (deficit) equity, and cash flows for the years then ended, and for the period from inception on April 28, 1994 to December 31, 2010 to be included in this Annual Report (Form 10-K).

Firm’s Manual Signature Alameda, CA City, State June 30, 2011 Date

17

CHINA HOLDINGS GROUP, INC.

(A Development Stage Company)

Financial Statements

For the period from the inception on April 28, 1994 to December 31, 2010

18

| | | Page(s) |

Report of Independent Registered Public Accounting Firm | F-1 |

| | | |

Balance Sheets as of December 31, 2010 and 2009 | F-2 |

| | | |

Statements of Operations for the years ended December 31 2010 and 2009, and the period from April 28, 1994 (inception) to December 31, 2010 | F-3 |

| | | |

Statement of Changes in Stockholders' Equity (Deficit) for the period from April 28, 1994 (inception) to December 31, 2010 | F-4 |

| | | |

Statements of Cash Flows for the years ended December 31 2010 and 2009, and the period from April 28, 1994 (inception) to December 31, 2010 | F-5 |

| | | |

Notes to Financial Statements | F6-13 |

19

China Holdings Group, Inc.

(A Development Stage Company)

Balance Sheets

December

2010

2009

Assets

Current assets

Cash and cash equivalents

$

235

$

--

Total assets (all current)

$

235

$

--

Liabilities and Stockholders' Equity (Deficit)

Current Liabilities

Loan payable - related party

$

57,600

$

56,000

Accrued interest

305

--

Accrued expense and other liabilities

2,000

--

Total liabilities (all current)

59,905

56,000

Stockholders' equity (deficit)

Preferred stock, par value $.001; 10,000 shares

authorized; no share issued and outstanding on

December 31, 2010 and 2009

--

--

Common stock, par value $.001; 99,990,000 shares

authorized; 3,190,400 shares issued and outstanding

on December 31, 2010 and 2009

3,190

3,190

Additional paid in capital

--

--

Accumulated deficit

(62,860)

(59,190)

Total stockholders' equity (deficit)

(59,670)

(56,000)

Total liabilities and stockholders' equity (deficit)

$

235

$

--

See accompanying notes to financial statements.

F-2

20

China Holdings Group, Inc. |

(A Development Stage Company) |

Statements of Operations |

| | | Year Ended December 31, | | For the Period from Inception on April 28, 1994 to December 31, 2010 |

| | | 2010 | | 2009 | |

| | | | | | | |

Revenue | $ - | | $ - | | $ - |

Cost of goods sold | - | | - | | - |

| | | | | | | |

Gross profit | - | | - | | - |

| | | | | | | |

Operating expenses | | | | | |

| | General and administrative | 3,365 | | 6,000 | | 62,555 |

Total operating expenses | 3,365 | | 6,000 | | 62,555 |

| | | | | | | |

Loss from operations | (3,365) | | (6,000) | | (62,555) |

| | | | | | | |

Other income / (expense) | | | | | |

| | Interest expense | (305) | | - | | (305) |

Total other income / (expense) | (305) | | - | | (305) |

| | | | | | | |

Loss before income taxes | (3,670) | | (6,000) | | (62,860) |

| | | | | | | |

Provision for income taxes | - | | - | | - |

| | | | | | |

Net loss | $ (3,670) | | $ (6,000) | | $ (62,860) |

| | | | | | | |

Net loss per share of common stock: | | | | | |

| | Basic | $ - | | $ - | | |

Weighted average shares outstanding | 3,190,400 | | 2,438,055 | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

See accompanying notes to financial statements |

F-3 |

21

China Holdings Group, Inc. |

(A Development Stage Company) |

Statements of Cash Flows |

| | | Year Ended December 31, | | For the Period from Inception on April 28, 1994 to December 31, 2010 |

| | | 2010 | | 2009 | |

Cash flows from operating activities | | | | | |

| | Net loss | $ (3,670) | | $ (6,000) | | $ (62,860) |

| | Adjustments to reconcile net loss to net cash used in operating activities: | | | | | |

| | Issuance of securities for services rendered | - | | - | | 1,136 |

| | Changes operating assets and liabilities: | | | | | |

| | Loan payable - related party | 1,600 | | 6,000 | | 57,600 |

| | Accrued interest | 305 | | - | | 305 |

| | Accrued expense and other liabilities | 2,000 | | - | | 2,000 |

Net cash provided by (used in) operating activities | 235 | | - | | (1,819) |

| | | | | | | |

Net cash used in investing activities | - | | - | | - |

| | | | | | | |

Cash flows from financing activities | | | | | |

| | Proceeds from issuance of common stock | - | | - | | 2,054 |

Net cash provided by financing activities | - | | - | | 2,054 |

| | | | | | | |

| | Net change in cash | 235 | | - | | 235 |

| | | | | | | |

| | Cash and cash equivalent at beginning of year | - | | - | | - |

| | | | | | | |

| | Cash and cash equivalent at end of year | $ 235 | | $ - | | $ 235 |

Supplemental disclosure of non-cash investing and financing activities: | | | | | |

| | Issuance of securities for services rendered | $ - | | $ - | | $ 1,136 |

Supplemental disclosures of cash flow Information: | | | | | |

| | Cash paid for interest | $ - | | $ - | | $ - |

| | Cash paid for taxes | $ - | | $ - | | $ - |

| | | | | | | |

| | | | | | | |

| | | | | | |

See accompanying notes to financial statements |

| | F-5 22 China Holdings Group, Inc. (A Development Stage Company) Notes to Financial Statements For the period from inception on April 28, 1994 to December 31, 2010

23

NOTE A – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

A summary of significant accounting policies of China Holdings Group, Inc. (a development stage company, hereinafter the “Company”) is presented to assist in understanding the Company’s financial statements. The accounting policies presented in these footnotes conform to accounting principles generally accepted in the United States of America and have been consistently applied in the preparation of the accompanying financial statements. These financial statements and notes are representations of the Company’s management who are responsible for their integrity and objectivity. The Company has not realized revenues from its planned principal business purpose and is considered to be in its development state in accordance with ASC 915, “Development Stage Entities”, formerly known as SFAS 7, “Accounting and Reporting by Development State Enterprises.”

Organization, Nature of Business and Trade Name

The Company was incorporated in the State of Nevada on April 28, 1994 under the name of Silver Bow Antique Aviation. The Company was incorporated to engage in any lawful activities.

The Company’s articles initially authorized 1,000 shares of Preferred Stock and 10,000 shares of Common Stock, both at a par value of $.001 per share.

The Company has been in the developmental stage since inception and has no operating history other than organizational matters.

On October 7, 1998, the Company filed a certificate of amendment amending resident agent and stock. The Company is now authorized 99,990,000 shares of Common Stock and 10,000 shares of Preferred Stock both at a par value of $.001.

On October 6, 2005, Silver Bow Antique Aviation, voted to change its name to China Holdings Group, Inc for the purpose of engaging in any lawful corporate business, including but not limited to, participating in mergers with and acquisitions of other companies. The Company has been in the developmental stage since inception and has no operating history other than organizational matters.

Prior to 2010, the primary activity of the Company involved seeking a company or companies that it could acquire or with whom it could merge. The Company was not successful in finding a merger or acquisition candidate, and therefore reverted to its original business plan which was to create an on line antique aircraft spare parts business. 24

China Holdings Group, Inc. (A Development Stage Company) Notes to Financial Statements For the period from inception on April 28, 1994 to December 31, 2010

However, during the latter part of December 2010, it became apparent that the market for aircraft parts, in particular the more specialized antique aircraft parts in which we have the most expertise, had become extremely depressed due to the continuing economic downturn.

Therefore, the Company has now decided on a complete change of approach, and intends to use the Company as an operating entity for a new financial services business. In essence the Company will capitalize on the past experience of its senior management in the fields of Investment Banking, Financial Consulting and Litigation Management. The Company will seek those small businesses and individuals looking for advice on the re-structuring of their financial affairs, which might also include debt settlement and loan modification services. Although the Company will from time to time employ the services of legal counsel, it will not hold itself out as a law firm, nor will it proffer legal advice to its clients.

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reported period. Actual results could differ from those estimates. Management further acknowledges that it is solely responsible for adopting sound accounting practices, establishing and maintaining a system of internal accounting control and preventing and detecting fraud. The Company’s system of internal accounting control is designed to assure, among other items, that (1) recorded transactions are valid; (2) all valid transactions are recorded and (3) transactions are recorded in the period in a timely manner to produce financial statements which present fairly the financial condition, results of operations and cash flows of the company for the respective periods being presented.

Use of Estimates

The preparation of financial statements in accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. A change in managements’ estimates or assumptions could have a material impact on China Holdings Group, Inc.’s financial condition and results of operations during the period in which such changes occurred. Actual results could differ from those estimates. China Holdings Group, Inc.’s financial statements reflect all adjustments that management believes are necessary for the fair presentation of their financial condition and results of operations for the periods presented.

25 Cash and Cash Equivalents

For purposes of the statement of cash flows, the Company considers all short-term debt securities purchased with maturity of

China Holdings Group, Inc. (A Development Stage Company) Notes to Financial Statements For the period from inception on April 28, 1994 to December 31, 2010

three months or less to be cash equivalents.

Property and Equipment

Property and equipment are carried at cost. Expenditures for maintenance and repairs are charged against operations. Renewals and betterments that materially extend the life of the assets are capitalized. When assets are retired or otherwise disposed of, the cost and related accumulated depreciation are removed from the accounts, and any resulting gain or loss is reflected in income for the period.

Depreciation is computed for financial statement purposes on a straight-line basis over estimated useful lives of the related assets. The estimated useful lives of depreciable assets are:

Estimated Useful Lives Office Equipment 5-10 years Copier 5-7 years Vehicles 5-10 years

For federal income tax purposes, depreciation is computed under the modified accelerated cost recovery system. For financial statement purposes, depreciation is computed under the straight-line method.

The Company has been in the developmental stage since inception and has no operation to date. The Company currently does not have any property and equipment. The above accounting policies will be adopted upon the Company maintains property and equipment. 26

Revenue and Cost Recognition

China Holdings Group, Inc. (A Development Stage Company) Notes to Financial Statements For the period from inception on April 28, 1994 to December 31, 2010

The Company has been in the developmental stage since inception and has no operations to date. The Company currently does not have a means for generating revenue. Revenue and Cost Recognition procedures will be implemented based on the type of company acquired in a merger or acquisition.

Cost of Goods Sold

Since the Company is still in the development stage, formal applications of certain procedures have not been implemented. Generally, job costs include all direct materials, and labor costs and those indirect costs related to operations of the Company. Selling, general and administrative costs are charged to expense as incurred. However, Cost of Goods Sold procedures will be dependent on the industry that the identified merger or acquisition candidate is in.

Advertising

Advertising expenses related to specific jobs are allocated and classified as costs of goods sold. Advertising expenses not related to specific jobs are recorded as general and administrative expenses. There was no advertising expense for the years ended December 31, 2010 and 2009.

Research and Development

Research and development costs are expensed as incurred.

Provision for Income Taxes

The Company accounts for income taxes under ASC 740"Income Taxes" which codified SFAS 109,"Accounting for Income Taxes" and FIN 48“Accounting for Uncertainty in Income Taxes – an Interpretation of FASB Statement No. 109.” Under the asset and liability method of ASC 740, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statements carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. Under ASC 740, the effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period the enactment occurs. A valuation allowance is provided for certain deferred tax assets if it is more likely than not that the Company will not realize tax assets through future operations. 27

China Holdings Group, Inc. (A Development Stage Company) Notes to Financial Statements For the period from inception on April 28, 1994 to December 31, 2010

Earnings Per Share

FASB ASC 260, “Earnings Per Share” provides for calculation of "basic" and "diluted" earnings per share. Basic earnings per share includes no dilution and is computed by dividing net income (loss) available to common shareholders by the weighted average common shares outstanding for the period. Diluted earnings per share reflect the potential dilution of securities that could share in the earnings of an entity similar to fully diluted earnings per share. Basic and diluted loss per share was the same, at the reporting dates, as there were no common stock equivalents outstanding.

Recently Issued Accounting Pronouncements

ASC 105, “Generally Accepted Accounting Principles” (ASC 105) (formerly Statement of Financial Accounting Standards No. 168, “The FASB Accounting Standards Codification and the Hierarchy of Generally Accepted Accounting Principles a replacement of FASB Statement No. 162)” reorganized by topic existing accounting and reporting guidance issued by the Financial Accounting Standards Board ("FASB") into a single source of authoritative generally accepted accounting principles ("GAAP") to be applied by nongovernmental entities. All guidance contained in the Accounting Standards Codification ("ASC") carries an equal level of authority. Rules and interpretive releases of the Securities and Exchange Commission ("SEC") under authority of federal securities laws are also sources of authoritative GAAP for SEC registrants. Accordingly, all other accounting literature will be deemed "non-authoritative". ASC 105 is effective on a prospective basis for financial statements issued for interim and annual periods ending after September 15, 2009. The Company has implemented the guidance included in ASC 105 as of July 1, 2009. The implementation of this guidance changed the Company's references to GAAP authoritative guidance but did not impact the Company's financial position or results of operations.

ASC 855, “Subsequent Events” (ASC 855) (formerly Statement of Financial Accounting Standards No. 165,Subsequent Events) includes guidance that was issued by the FASB in May 2009, and is consistent with current auditing standards in defining a subsequent event. Additionally, the guidance provides for disclosure regarding the existence and timing of a company's evaluation of its subsequent events. ASC 855 defines two types of subsequent events, "recognized" and "non-recognized". Recognized subsequent events provide additional evidence about conditions that existed at the date of the balance sheet and are required to be reflected in the financial statements. Non-recognized subsequent events provide evidence about conditions that did not exist at the date of the balance sheet but arose after that date and, therefore; are not required to be reflected in the financial statements. However, certain non-recognized subsequent events may require disclosure to prevent the financial statements from being misleading. This guidance was effective prospectively for interim or annual financial periods ending after June 15, 2009. The Company implemented the guidance included in ASC 855 as of April 1, 2009. The effect of implementing this guidance was not material to the Company's financial position or results of operations. In August 2009, the FASB issued Accounting Standards Update No. 2009-05, “Measuring Liabilities at Fair Value,” (“ASU 2009-05”). ASU 2009-05 provides guidance on measuring the fair value of liabilities and is effective for the first interim or annual reporting period beginning after its issuance. The Company’s adoption of ASU 2009-05 did not have an effect on its disclosure of the fair value of its liabilities. 28

In September 2009, the FASB issued ASC Update No. 2009-12,Fair Value Measurements and Disclosures (Topic 820): Investments China Holdings Group, Inc. (A Development Stage Company) Notes to Financial Statements For the period from inception on April 28, 1994 to December 31, 2010

in Certain Entities that Calculate Net Asset Value per Share (or Its Equivalent) ("ASC Update No. 2009-12"). This update sets forth guidance on using the net asset value per share provided by an investee to estimate the fair value of an alternative investment. Specifically, the update permits a reporting entity to measure the fair value of this type of investment on the basis of the net asset value per share of the investment (or its equivalent) if all or substantially all of the underlying investments used in the calculation of the net asset value is consistent with ASC 820. The update also requires additional disclosures by each major category of investment, including, but not limited to, fair value of underlying investments in the major category, significant investment strategies, redemption restrictions, and unfunded commitments related to investments in the major category. The amendments in this update are effective for interim and annual periods ending after December 15, 2009 with early application permitted. The Company does not expect that the implementation of ASC Update No. 2009-12 will have a material effect on its financial position or results of operations.

In June 2009, FASB issued Statement of Financial Accounting Standards No. 167,Amendments to FASB Interpretation No. 46(R)("Statement No. 167"). Statement No. 167 amends FASB Interpretation No. 46R,Consolidation of Variable Interest Entities an interpretation of ARB No. 51 ("FIN 46R") to require an analysis to determine whether a company has a controlling financial interest in a variable interest entity. This analysis identifies the primary beneficiary of a variable interest entity as the enterprise that has a) the power to direct the activities of a variable interest entity that most significantly impact the entity's economic performance and b) the obligation to absorb losses of the entity that could potentially be significant to the variable interest entity or the right to receive benefits from the entity that could potentially be significant to the variable interest entity. The statement requires an ongoing assessment of whether a company is the primary beneficiary of a variable interest entity when the holders of the entity, as a group, lose power, through voting or similar rights, to direct the actions that most significantly affect the entity's economic performance. This statement also enhances disclosures about a company's involvement in variable interest entities. Statement No. 167 is effective as of the beginning of the first annual reporting period that begins after November 15, 2009. Although Statement No. 167 has not been incorporated into the Codification, in accordance with ASC 105, the standard shall remain authoritative until it is integrated. The Company does not expect the adoption of Statement No. 167 to have a material impact on its financial position or results of operations

In June 2009, the FASB issued Statement of Financial Accounting Standards No. 166,Accounting for Transfers of Financial Assets an amendment of FASB Statement No. 140 ("Statement No. 166"). Statement No. 166 revises FASB Statement of Financial Accounting Standards No. 140,Accounting for Transfers and Extinguishment of Liabilities a replacement of FASB Statement 125 ("Statement No. 140") and requires additional disclosures about transfers of financial assets, including securitization transactions, and any continuing exposure to the risks related to transferred financial assets. It also eliminates the concept of a "qualifying special-purpose entity", changes the requirements for derecognizing financial assets, and enhances disclosure requirements. Statement No. 166 is effective prospectively, for annual periods beginning after November 15, 2009, and interim and annual periods thereafter.

Although Statement No. 166 has not been incorporated into the Codification, in accordance with ASC 105, the standard shall remain authoritative until it is integrated. The Company does not expect the adoption of Statement No. 166 will have a material impact on its financial position or results of operations. 29

In February 2010, the FASB issued amended guidance on subsequent events to alleviate potential conflicts between FASB guidance and SEC requirements. Under this amended guidance, SEC filers are no longer required to disclose the date through

China Holdings Group, Inc. (A Development Stage Company) Notes to Financial Statements For the period from inception on April 28, 1994 to December 31, 2010

which subsequent events have been evaluated in originally issued and revised financial statements. This guidance was effective immediately and we adopted these new requirements for the period ended June 30, 2010. The adoption of this guidance did not have a material impact on our financial statements.

In April 2010, the FASB codified the consensus reached in Emerging Issues Task Force Issue No. 08-09,“Milestone Method of Revenue Recognition.” FASB ASU No. 2010-17 provides guidance on defining a milestone and determining when it may be appropriate to apply the milestone method of revenue recognition for research and development transactions. FASB ASU No. 2010-17 is effective for fiscal years beginning on or after June 15, 2010, and is effective on a prospective basis for milestones achieved after the adoption date. The Company does not expect this ASU will have a material impact on its financial position or results of operations when it adopts this update on October 1, 2010. Management believes recently issued accounting pronouncements will have no impact on the financial statements of the Company.

NOTE B – GOING CONCERN

The Company's financial statements are prepared using accounting principles generally accepted in the United States of America applicable to a going concern, which contemplates the realization of assets and liquidation of liabilities in the normal course of business. However, the Company does not have significant cash or other current assets, nor does it have an established source of revenues sufficient to cover its operating costs and to allow it to continue as a going concern.

Under the going concern assumption, an entity is ordinarily viewed as continuing in business for the foreseeable future with neither the intention nor the necessity of liquidation, ceasing trading, or seeking protection from creditors pursuant to laws or regulations. Accordingly, assets and liabilities are recorded on the basis that the entity will be able to realize its assets and discharge its liabilities in the normal course of business.

Management expects to seek potential business opportunities for merger or acquisition of existing companies. Currently the Company has yet to locate any merger of acquisition candidates. Management is not currently limiting their search for merger or acquisition candidates to any industry or locations. Management, while not especially experienced in matters relating to public company management, will rely upon their own efforts and, to a much lesser extent, the efforts of the Company’s shareholders, in accomplishing the business purposes of the Company. The ability of the Company to continue as a going concern is dependent upon its ability to successfully accomplish the plan described in the preceding paragraph and eventually attain profitable operations. The accompanying financial statements do not include any adjustments that may be necessary if the Company is unable to continue as a going concern. 30

During the next year, the Company’s foreseeable cash requirements will relate to continual development of the operations of its business, maintaining its good standing and making the requisite filings with the Securities and Exchange Commission, and the payment of expenses associated with reviewing or investigating any potential business ventures. The Company may experience a cash shortfall and be required to raise additional capital. Historically, it has relied upon internally generated funds and funds from the sale of shares of stock to finance its operations and growth. Management may raise additional capital through future public or China Holdings Group, Inc. (A Development Stage Company) Notes to Financial Statements For the period from inception on April 28, 1994 to December 31, 2010

private offerings of the Company’s stock or through loans from private investors, although there can be no assurance that it will be able to obtain such financing. The Company’s failure to do so could have a material and adverse affect upon it and its shareholders.

In the past year, the Company funded operations by using cash proceeds received through loans from a related party. For the coming year, the Company plans to continue to fund the Company through debt and securities sales and issuances, focus on a possible joint venture or merger until the company generates revenues through the operations of such merged company or joint venture as stated above.

NOTE C – INCOME TAXES The Company accounts for income taxes using the liability method; under which deferred tax liabilities and assets are determined based on the difference between the financial statement carrying amounts and the tax basis of assets and liabilities using enacted tax rates in effect in the years in which the differences are expected to reverse. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized. Deferred tax assets and liabilities are adjusted for the effect of changes in tax laws and rates on the date of enactment.

Due to the change in ownership provisions of the Tax Reform Act of 1986, net operating loss carry-forwards for Federal income tax reporting purposes are subject to annual limitations. Should a change in ownership occur, net operating loss carry forwards may be limited as to use in the future.

Due to the inherent uncertainty in forecasts and future events and operating results, the Company has provided for a valuation allowance in an amount equal to gross deferred tax assets resulting in no net deferred tax assets or liabilities for the periods audited.

On December 31, 2010, the Company had an operating loss carry forward of $21,372 that can be used as an offset against future taxable income. No tax benefit has been reported in the December 31, 2010 financial statements since the potential tax benefit is offset by a valuation allowance of the same amount. 31 Net deferred tax assets consist of the following components from Inception on April 28, 1994 to December 31, 2010:

Net operating loss carryforward $ 62,860 Income tax rate 34% Deferred income tax asset $ 21,372

China Holdings Group, Inc. (A Development Stage Company) Notes to Financial Statements For the period from inception on April 28, 1994 to December 31, 2010

NOTE D – STOCKHOLDERS’ EQUITY

The Company’s articles initially authorized the Company to issue a total of 11,000 (Eleven Thousand) shares of stock, consisting of 1,000 (One Thousand) shares of preferred stock and 10,000 (Ten Thousand) shares of common stock, both with a par value of $.001 per share.

During 1996, certain consulting services were rendered to the Company by the majority stockholder, Magellan Capital Corporation, (a Nevada Corporation doing business in California) and four (4) other individuals. The value of such services were at the stated par value for 1,041 shares issued on July 15, 1995 and have been stated on the Balance Sheet and Statement of Operations and Cash Flow Statement at $936 for the year ending December 31, 1996, which amount reflects the par value of the original issue on the date of the 1 to 900 forward stock split on the 1,041 shares. Revised number of shares issued and outstanding after the foregoing split were 936,900, with a total value of $936 as of the end of year December 31, 1996.

An amendment to the Articles of Incorporation of the Company on October 7, 1998 increased its authorized shares to a total of 100,000,000 (One Hundred Million) shares, consisting of 99,990,000 (Ninety Nine Million Nine Hundred Ninety Thousand) shares of common stock and 10,000 (Ten Thousand) shares of preferred stock, all with a par value of $.001 per share. As of December 31, 2010, there is no share of preferred stock being issued. There are Three Million One Hundred Ninety Thousand Four Hundred (3,190,400) shares of common stock being issued and outstanding as of December 31, 2010.

NOTE E – NET LOSS PER COMMON SHARE

Basic net loss per common share is based on the weighted-average number of share of common stock of Three Million One Hundred Ninety Thousand Four Hundred (3,190,400) outstanding in the development period ending December 31, 2010 and 2009. 32

Loss

Shares

Per Share

(Numerator)

(Denominator)

Amount From Inception on April 28, 1994 to The Year Ended December 31, 2010

($ 62,860)

3,190,400

($ 0.02)

China Holdings Group, Inc. (A Development Stage Company) Notes to Financial Statements For the period from inception on April 28, 1994 to December 31, 2010

NOTE F – NOTES PAYABLE

The Company issued a note payable to Dempsey Mork, a related party, on September 30, 2003 in the amount of $50,000. The note is non-interest bearing and it is due on demand. As of December 31, 2010, this note is still outstanding.

The Company issued a second note payable to Mr. Mork on February 25, 2010 in the amount of $6,000. This note bears an interest of 6% per annum and it is payable with the principal on December 31, 2010, its maturity date. This note was not paid as of December 31, 2010. As a result, management has negotiated with Mr. Mork to amend the maturity date to December 31, 2011 and that interests shall be accrued on the same basis. The Company has also issued a note payable to Mr. Mork during 2010 for his cash contribution in funding the Company’s daily operations. This note is non-interest bearing and it is due on demand. As of December 31, 2010, this note is still outstanding.

NOTE G- RELATED PARTY TRANSACTIONS The following individuals and entities are related:

§ Dempsey Mork Sole Director, President, CEO, CFO, Treasurer, and Secretary. § Patricia Mork Spouse of Dempsey Mork § Magellan Capital Corporation (MCC) Wholly owned by Dempsey Mork § MCC Pension Benefit Plan & Trust Sole beneficiary – Dempsey Mork § MCC Profit Sharing Plan & Trust Sole beneficiary – Dempsey Mork

For the year ended December 31, 2008, the Company’s President advanced $50,000 to the Company for the working capital. In 2010, the Company’s President paid $7,600 for professional fees for filing compliance purposes. These advances will be reimbursed once the Company starts generating cash flows.

NOTE H - SUBSEQUENT EVENTS

Management has reviewed material events subsequent of the year ended December 31, 2010 and prior to the filing of financial statements in accordance with FASB ASC 855 “Subsequent Events”. No additional disclosures required. | | | | | | | |

33

5