Stephens Fall Investment Conference Investor Presentation November 10, 2015 Exhibit 99.1

Factors affecting future performance… …and use of Non-GAAP financial measures The statements in this presentation that relate to guidance, pro forma presentations, future plans, goals, business opportunities, events or performance are forward-looking statements that involve risks and uncertainties, including risks associated with business and economic conditions, failure to achieve expected benefits of acquisitions, failure to comply with Food and Drug Administration regulations, customer and/or supplier contract cancellations, manufacturing risks, competitive factors, ability to successfully introduce new products, uncertainties pertaining to customer orders, demand for products and services, growth and development of markets for the Company's products and services, and other risks identified in our filings made with the Securities and Exchange Commission. Actual results, events and performance may differ materially. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. The Company disclaims any obligation to update these forward-looking statements as a result of developments occurring after the date of this presentation. Readers are encouraged to refer to the risk disclosures described in the Company’s Form 10-K for the year ended December 31, 2014 and subsequent filings with the SEC, as applicable. Please see “Safe Harbor and Forward-Looking Information” in the Appendix to this presentation for more information. In this presentation, we present the non-GAAP financial measures of Adjusted Revenue, Adjusted EPS, Adjusted EBITDA , free cash flow and net debt . Please see “Use of Non-GAAP Financial Measures” and our third quarter 2015 earnings press release for the reasons we use these measures, a reconciliation of these measures to the most directly comparable GAAP measures and other information relating to these measures. The Company neither updates nor confirms any guidance regarding the future operating results of the Company which may have been given prior to this presentation.

Leading provider of laser, precision motion, and vision technologies Canadian company founded in 1968, with U.S. Headquarters in Massachusetts ~$365M in annual revenue and +$60M in annual Adjusted EBITDA Serving global addressable market of ~$2 billion, growing 5-7% per year Approximately 1,300 employees for continuing operations Trade on NASDAQ (GSIG) We are a leading supplier… …of Medical and Advanced Industrial technologies A Leading Precision Technology Company

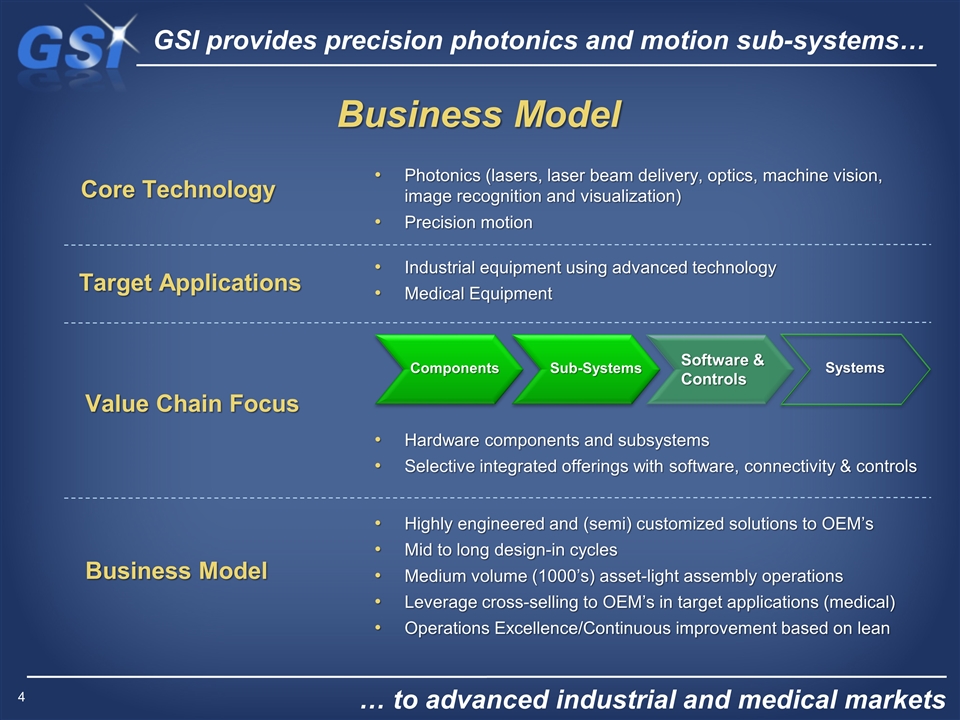

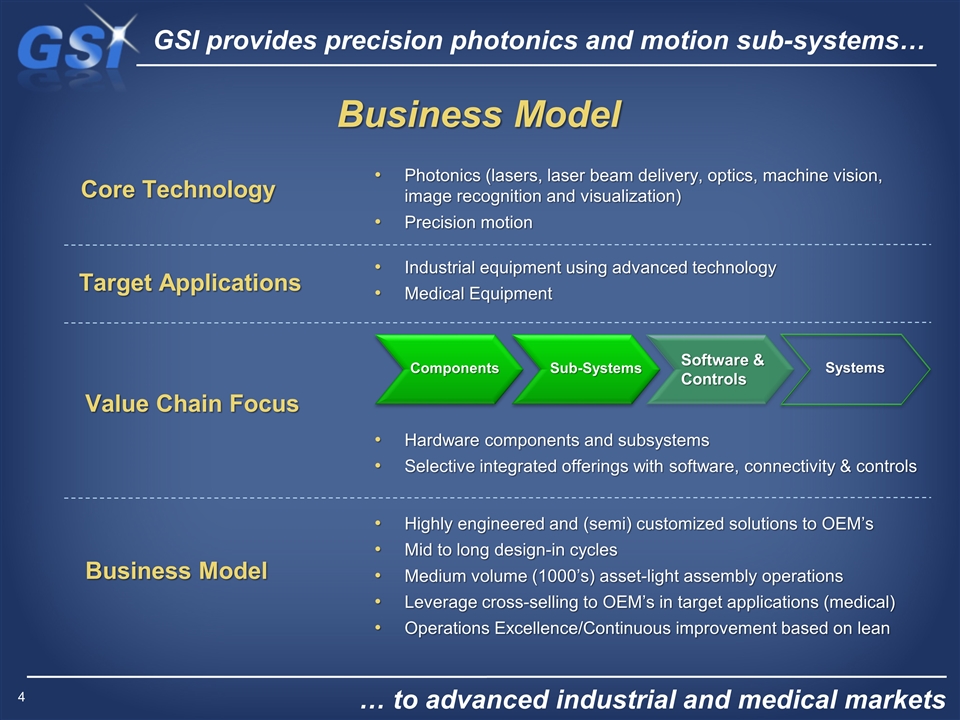

Business Model Highly engineered and (semi) customized solutions to OEM’s Mid to long design-in cycles Medium volume (1000’s) asset-light assembly operations Leverage cross-selling to OEM’s in target applications (medical) Operations Excellence/Continuous improvement based on lean Value Chain Focus Business Model Target Applications Industrial equipment using advanced technology Medical Equipment Hardware components and subsystems Selective integrated offerings with software, connectivity & controls Core Technology Photonics (lasers, laser beam delivery, optics, machine vision, image recognition and visualization) Precision motion GSI provides precision photonics and motion sub-systems… … to advanced industrial and medical markets Components Sub-Systems Software & Controls Systems

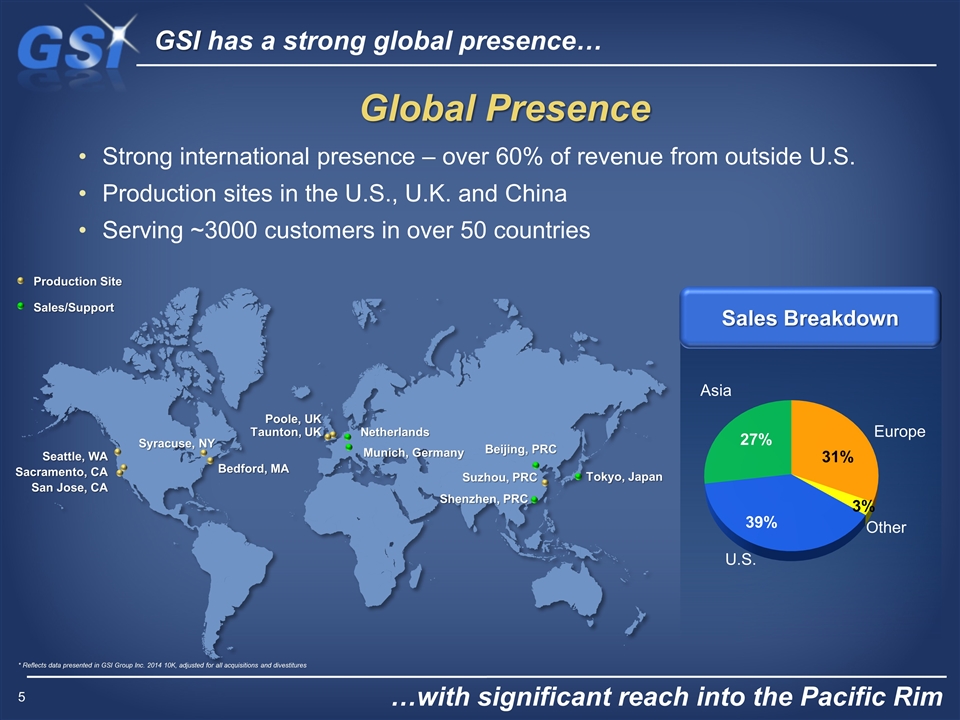

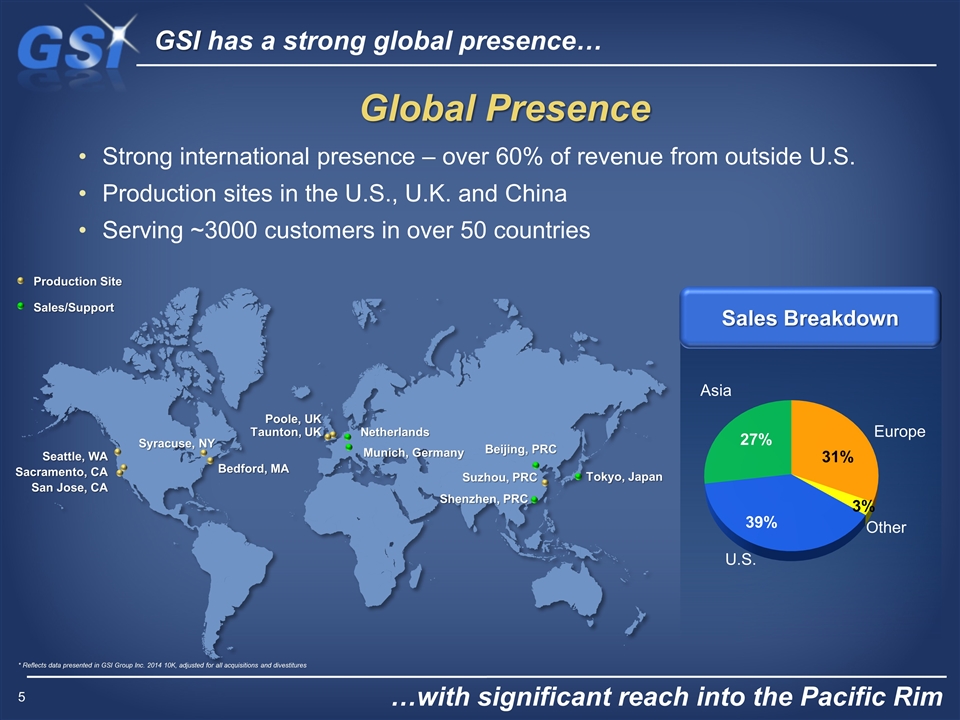

GSI has a strong global presence… …with significant reach into the Pacific Rim Strong international presence – over 60% of revenue from outside U.S. Production sites in the U.S., U.K. and China Serving ~3000 customers in over 50 countries Sales Breakdown Europe Other U.S. Asia Seattle, WA Sacramento, CA San Jose, CA Bedford, MA Poole, UK Taunton, UK Suzhou, PRC Tokyo, Japan Munich, Germany Global Presence * Reflects data presented in GSI Group Inc. 2014 10K, adjusted for all acquisitions and divestitures Netherlands Production Site Sales/Support Syracuse, NY Beijing, PRC Shenzhen, PRC

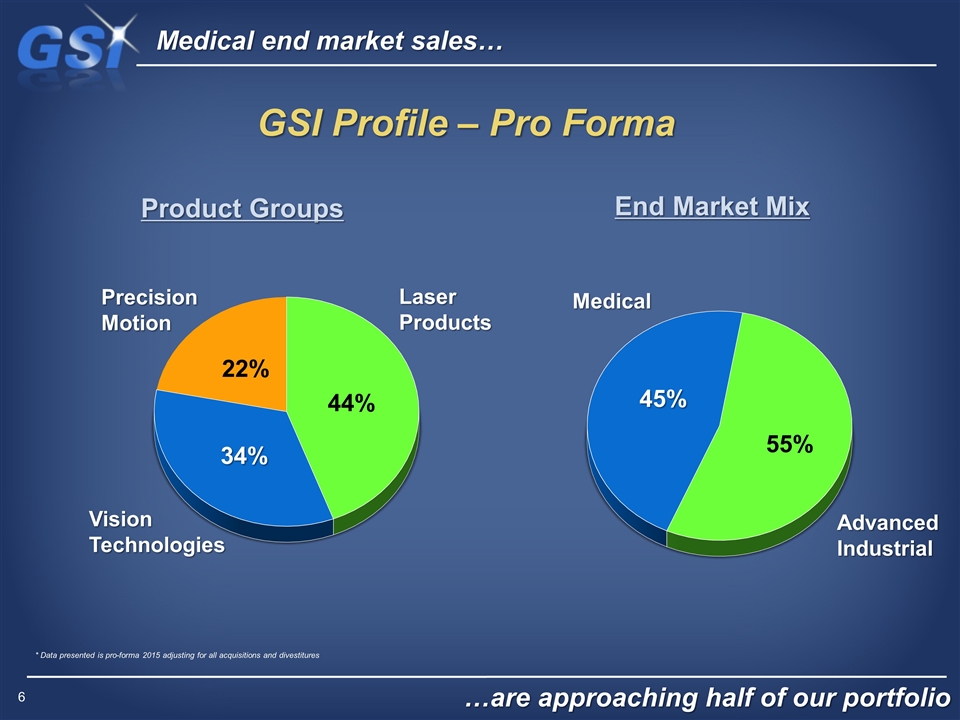

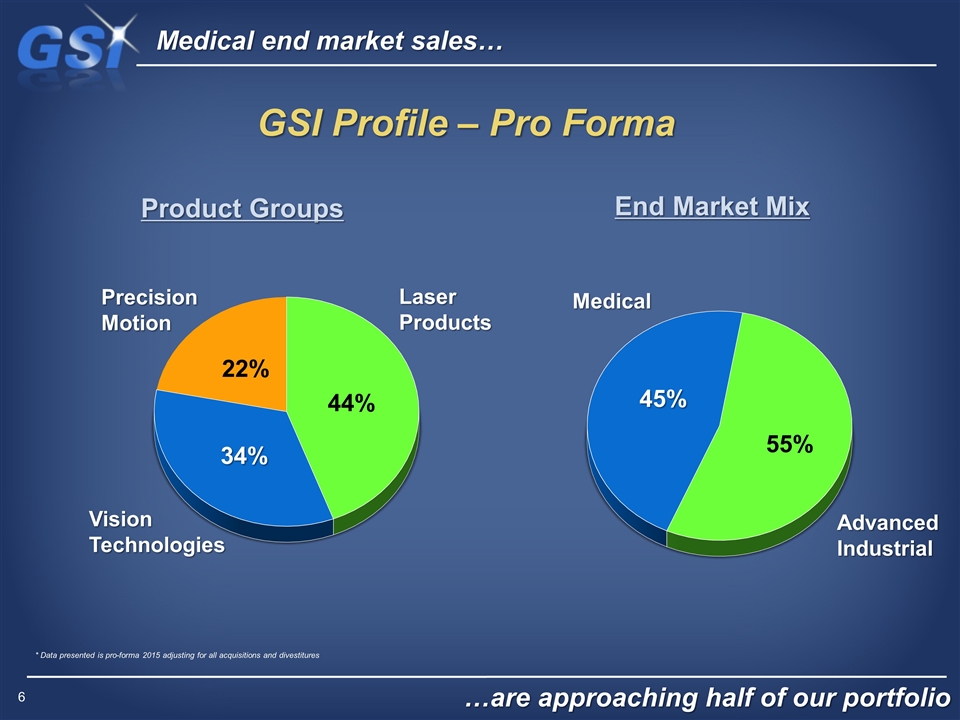

Medical end market sales… …are approaching half of our portfolio Medical GSI Profile – Pro Forma Advanced Industrial Product Groups End Market Mix * Data presented is pro-forma 2015 adjusting for all acquisitions and divestitures 55% 45% 35% 47% 18% Laser Products Vision Technologies Precision Motion

Our Advanced Industrial business… …is focused on high performance applications GSI Advanced Industrial Business CO2 Lasers Optical Encoders Color Analyzers Laser Scanheads Enabling Technologies Major Applications LCD Testing Laser Marking Laser Cutting Robotics Wire Bonding Laser Welding Measurement Via Hole Drilling 3D Printing Advanced Applications Robust Quality System Precision Technologies OEM Design-in Expertise Air Bearing Spindles Galvonometers Precision Motors Ultrafast Polygon Scanners Machine Vision

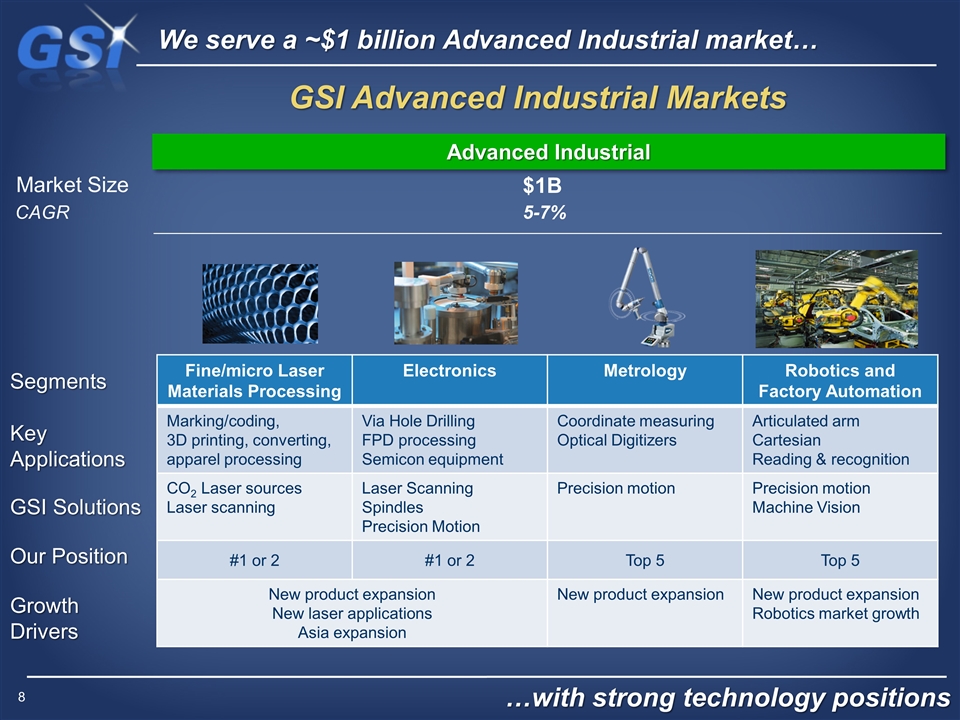

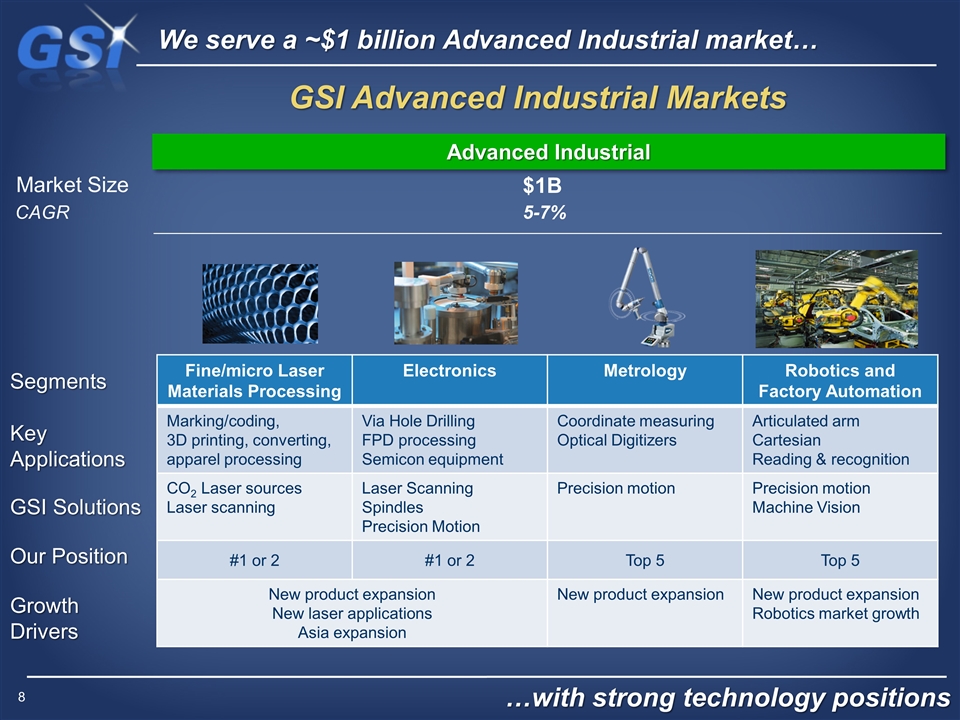

We serve a ~$1 billion Advanced Industrial market… …with strong technology positions GSI Advanced Industrial Markets Advanced Industrial Fine/micro Laser Materials Processing Electronics Metrology Robotics and Factory Automation Marking/coding, 3D printing, converting, apparel processing Via Hole Drilling FPD processing Semicon equipment Coordinate measuring Optical Digitizers Articulated arm Cartesian Reading & recognition CO2 Laser sources Laser scanning Laser Scanning Spindles Precision Motion Precision motion Precision motion Machine Vision #1 or 2 #1 or 2 Top 5 Top 5 New product expansion New laser applications Asia expansion New product expansion New product expansion Robotics market growth Market Size $1B Segments Key Applications GSI Solutions Our Position Growth Drivers CAGR 5-7%

Our Medical market presence is gaining scale… …and offers significant growth potential GSI Medical Business Bar Code Scanning RFID Machine Vision Surgical Displays Wireless Networking Optical Encoders Thermal Printers Software Informatics Laser Scanning Enabling Technologies Major Applications Blood Analysis Robotic Surgery Minimally Invasive Surgery Endo/GI Glucose Monitoring Drug Delivery Patient Monitoring Life Sciences Laser Surgery Retinal Diagnostics Precision Technologies Key Account Sales Force Medical Quality System OEM Design-in Expertise Precision Motors High Speed Polygon Scanners

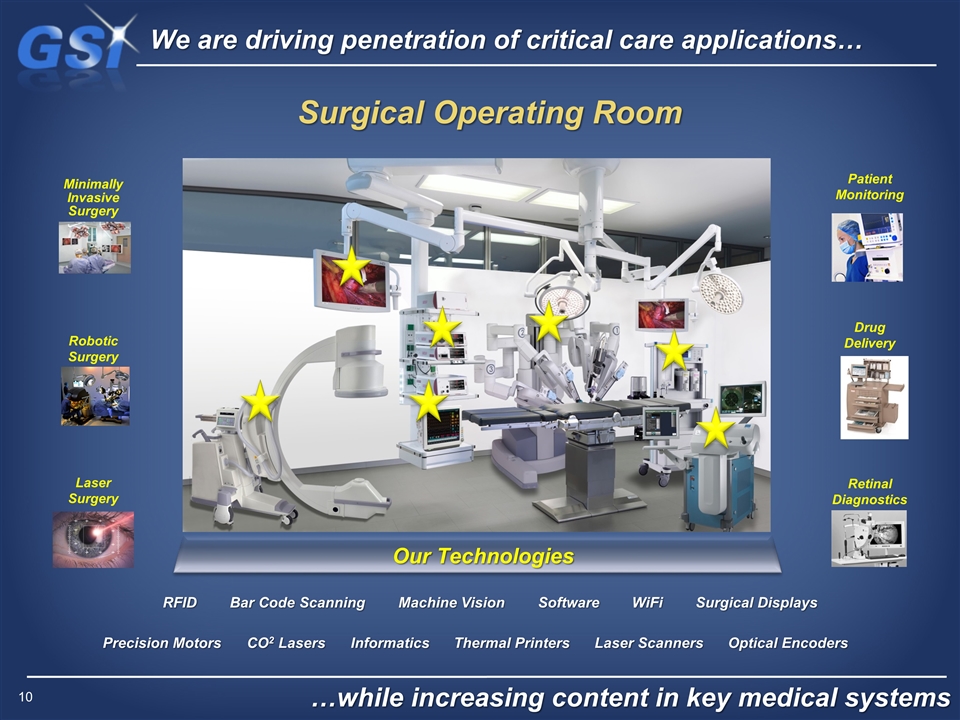

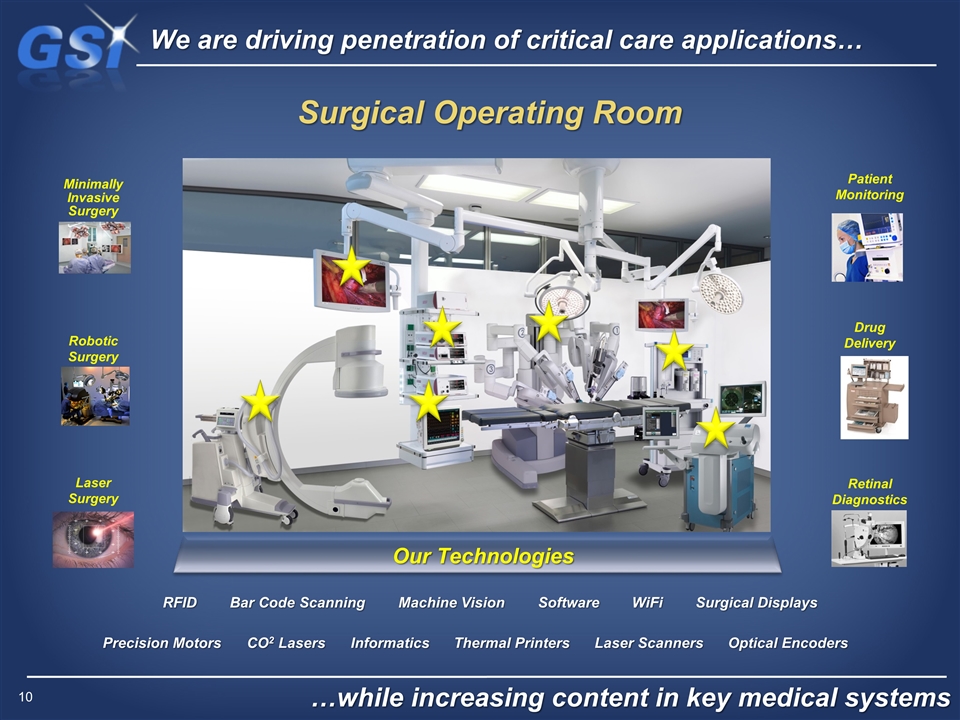

We are driving penetration of critical care applications… …while increasing content in key medical systems Robotic Surgery Minimally Invasive Surgery Drug Delivery Patient Monitoring Laser Surgery Retinal Diagnostics Surgical Operating Room Our Technologies RFID Bar Code Scanning Machine Vision WiFi Surgical Displays Optical Encoders Laser Scanners Thermal Printers Informatics Precision Motors CO2 Lasers Software

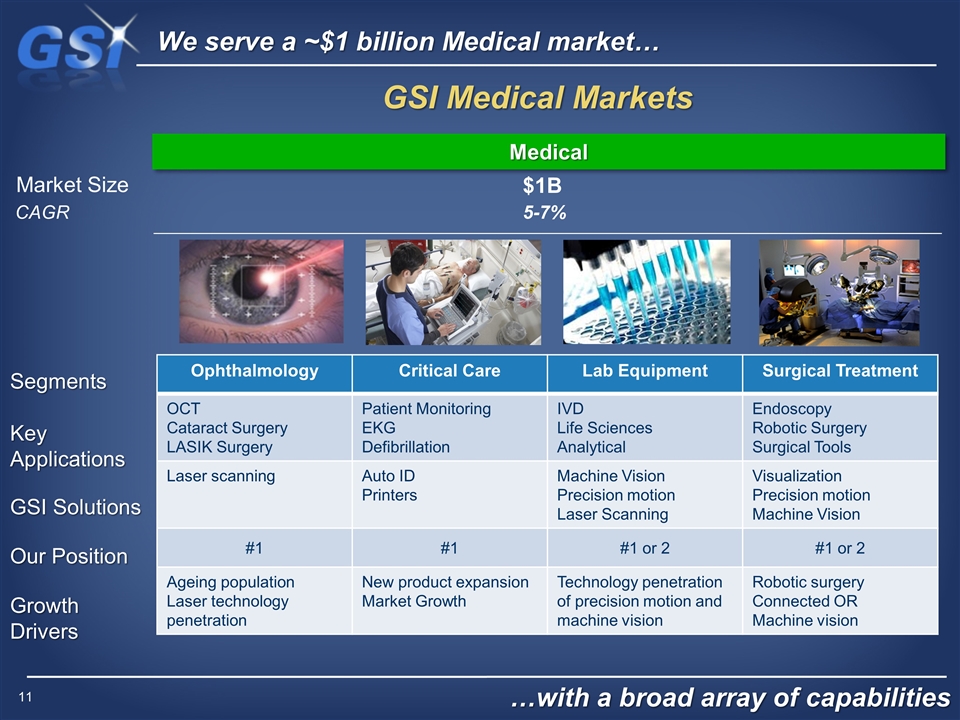

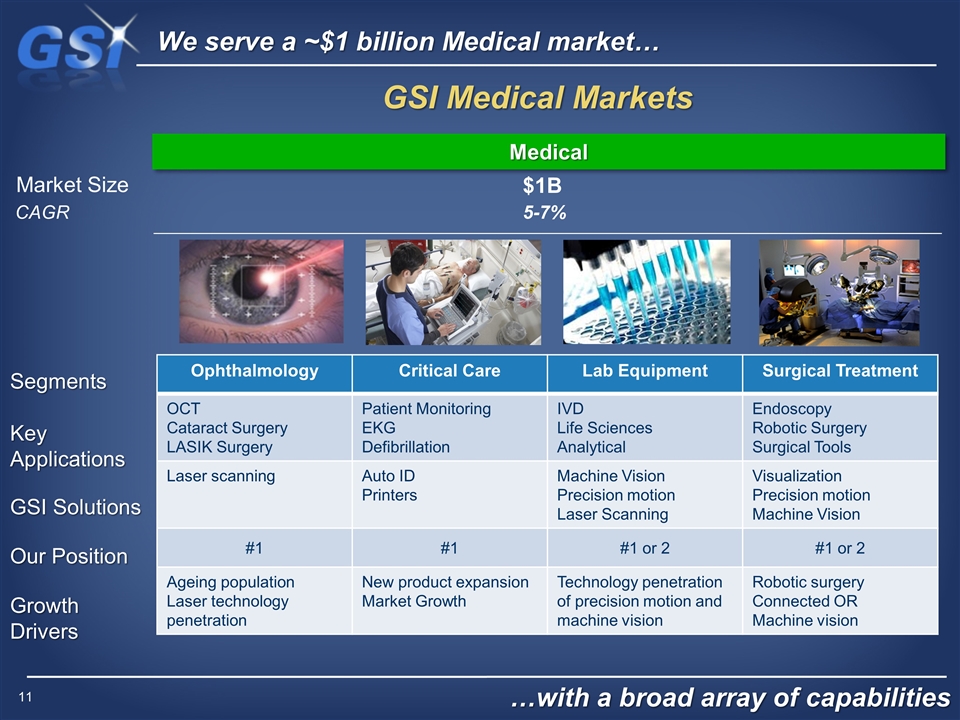

We serve a ~$1 billion Medical market… …with a broad array of capabilities GSI Medical Markets Medical Ophthalmology Critical Care Lab Equipment Surgical Treatment OCT Cataract Surgery LASIK Surgery Patient Monitoring EKG Defibrillation IVD Life Sciences Analytical Endoscopy Robotic Surgery Surgical Tools Laser scanning Auto ID Printers Machine Vision Precision motion Laser Scanning Visualization Precision motion Machine Vision #1 #1 #1 or 2 #1 or 2 Ageing population Laser technology penetration New product expansion Market Growth Technology penetration of precision motion and machine vision Robotic surgery Connected OR Machine vision Market Size $1B Segments Key Applications GSI Solutions Our Position Growth Drivers CAGR 5-7%

Our vision targets consistent profitable growth… …and recognized leadership in our space 5 Year Strategic Vision “Building a Leading Precision Technology Company Through Innovation at the Intersection of Photonics & Motion” Breakthrough Scale Double in size to $750 million in revenue Deliver 20% EBITDA margins Superior Profitability Substantial Value Creation Attain $1 Billion market capitalization Consistent Growth Realize 50% of revenue from medical applications Market Leadership “Top 3” share position (technologies & applications) Globalization Reputation for Excellence Support customers with global capabilities Widely recognized as a world class operating company

…to deepen our relationships with medical OEM’s Medical Cross Selling Initiative Approach Team selling within OEM accounts Cross training on product offering Communication forums for sales teams Sharing insights into customer roadmaps and product requirements Holding “Tech Days” at major OEM’s Broadening relationships with customer decision makers and influencers Joint presence at medical trade shows Opportunities identified, tracked monthly and included in sales incentive plans 14 new potential projects added to revenue funnel 6 more opportunities being qualified Several million of annualized revenue potential identified – more in process First revenue impact late 2015 We are working across GSI… Impact

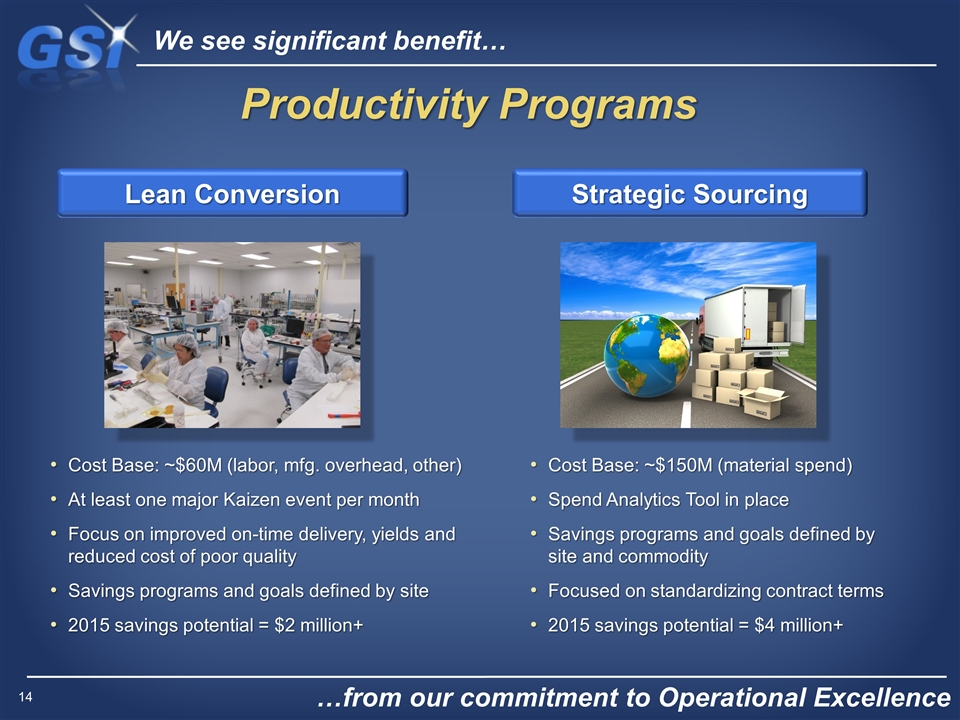

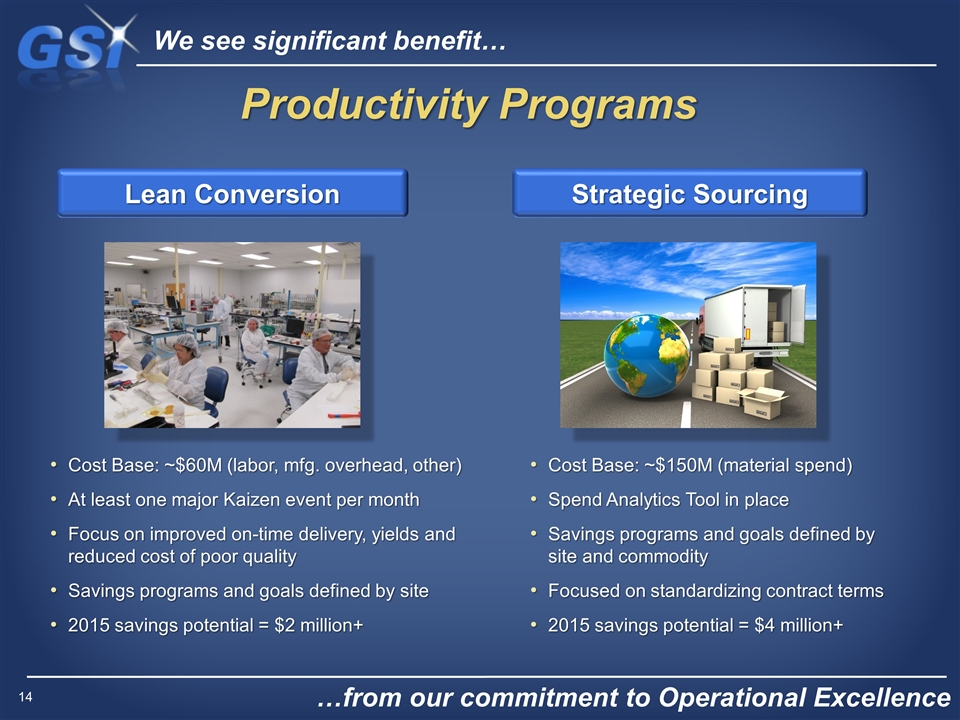

We see significant benefit… …from our commitment to Operational Excellence Productivity Programs Strategic Sourcing Lean Conversion Cost Base: ~$150M (material spend) Spend Analytics Tool in place Savings programs and goals defined by site and commodity Focused on standardizing contract terms 2015 savings potential = $4 million+ Cost Base: ~$60M (labor, mfg. overhead, other) At least one major Kaizen event per month Focus on improved on-time delivery, yields and reduced cost of poor quality Savings programs and goals defined by site 2015 savings potential = $2 million+

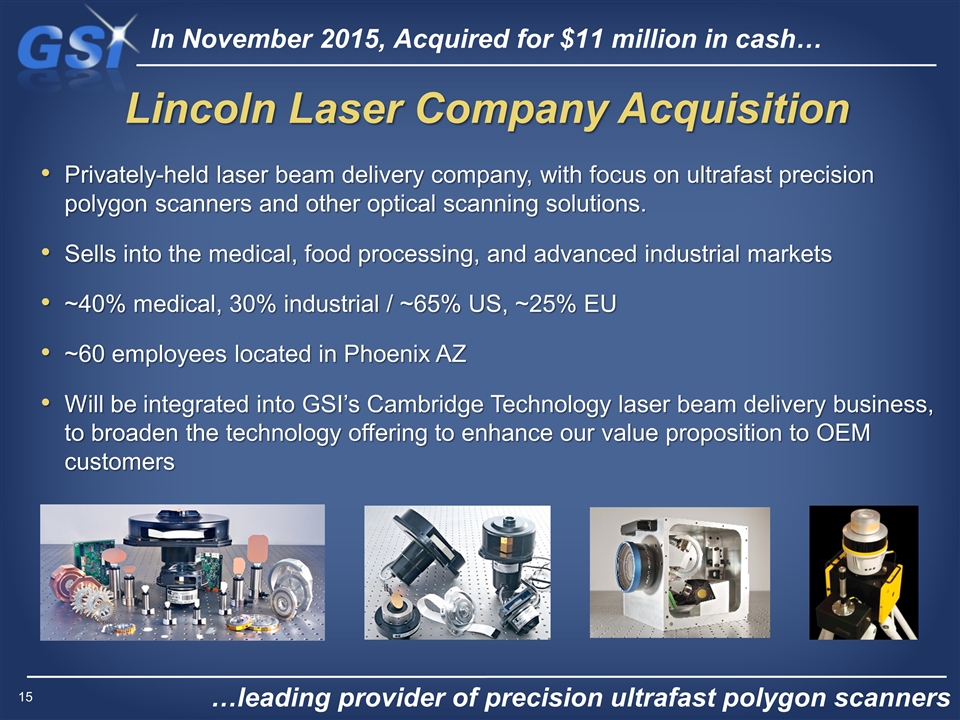

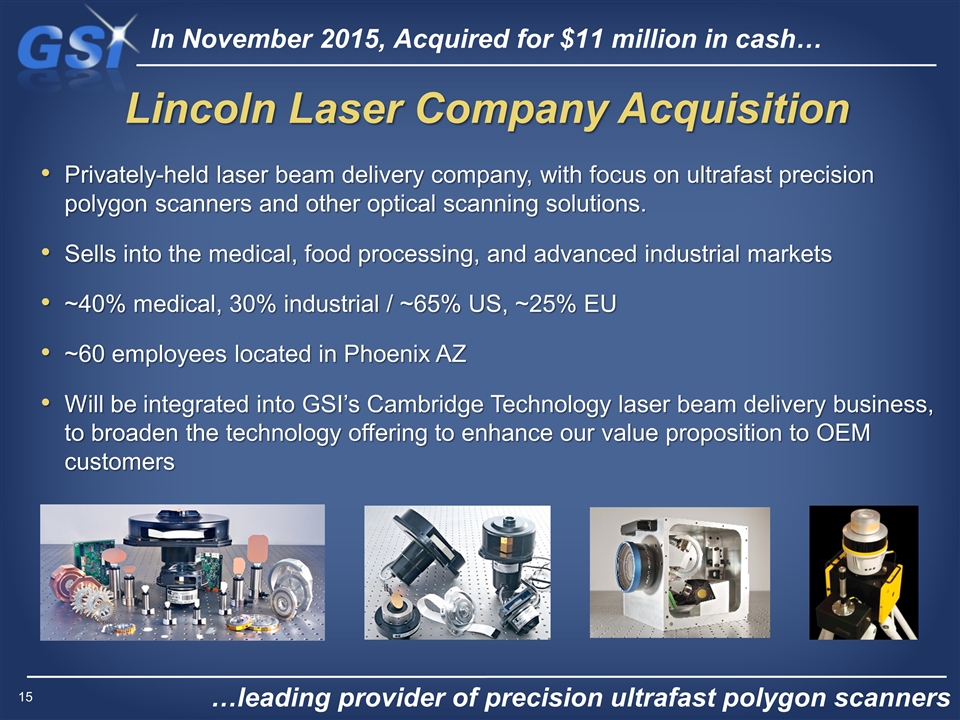

In November 2015, Acquired for $11 million in cash… …leading provider of precision ultrafast polygon scanners Lincoln Laser Company Acquisition Privately-held laser beam delivery company, with focus on ultrafast precision polygon scanners and other optical scanning solutions. Sells into the medical, food processing, and advanced industrial markets ~40% medical, 30% industrial / ~65% US, ~25% EU ~60 employees located in Phoenix AZ Will be integrated into GSI’s Cambridge Technology laser beam delivery business, to broaden the technology offering to enhance our value proposition to OEM customers

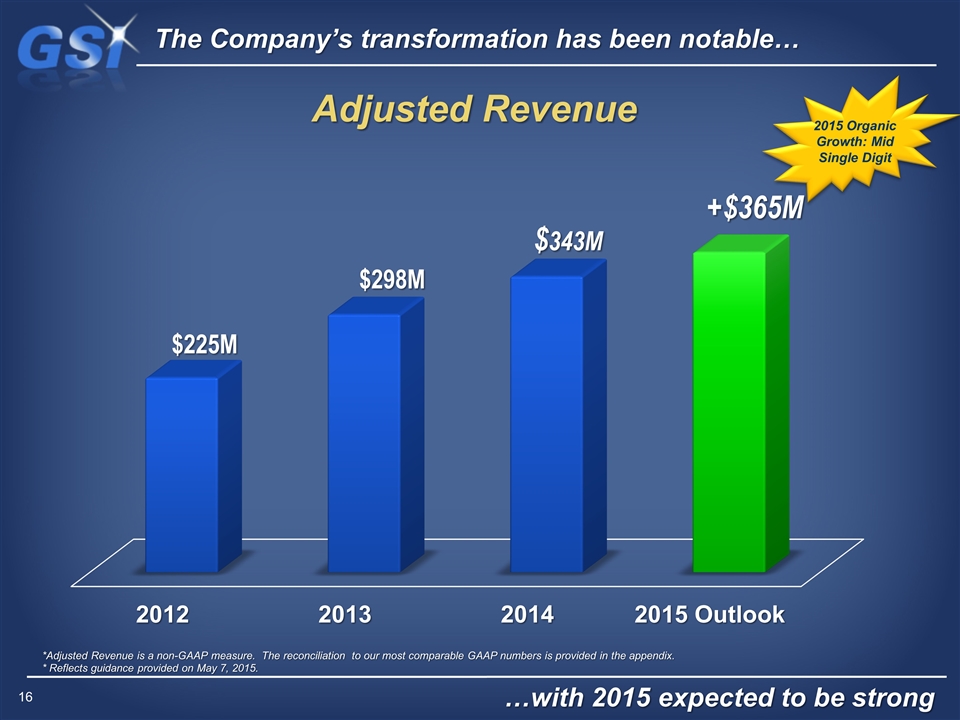

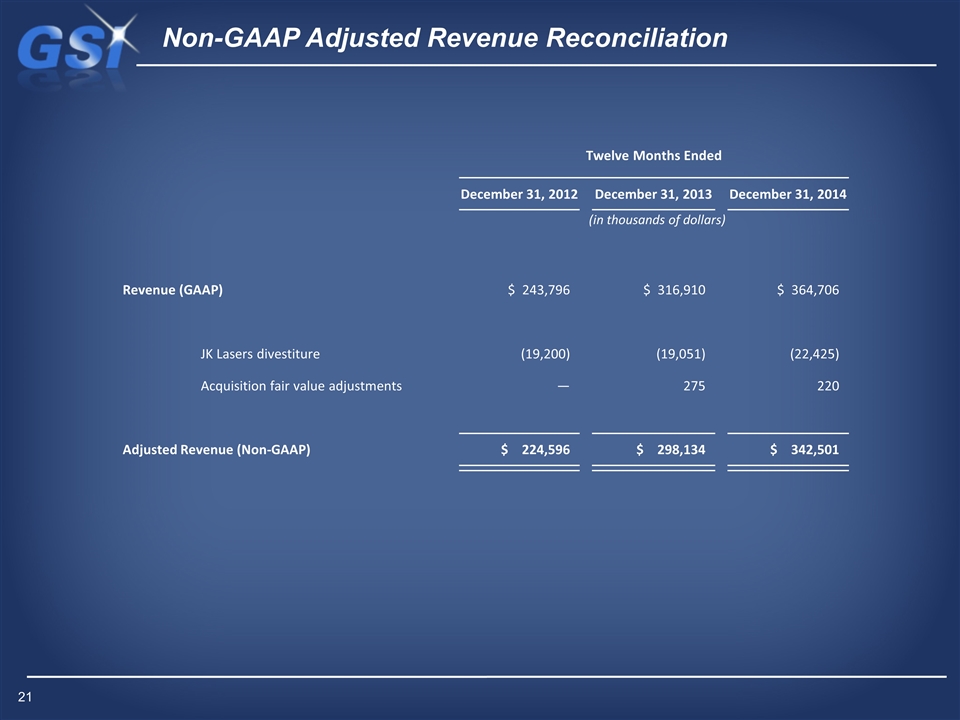

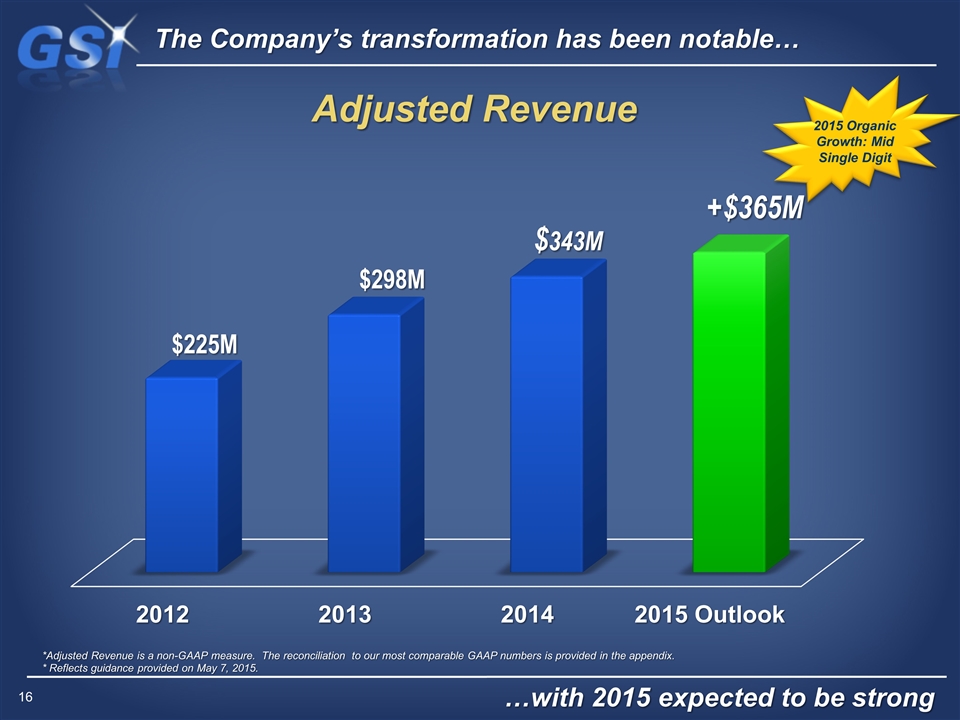

The Company’s transformation has been notable… …with 2015 expected to be strong $225M Adjusted Revenue $298M $343M * Reflects guidance provided on May 7, 2015. +$365M 2015 Organic Growth: Mid Single Digit *Adjusted Revenue is a non-GAAP measure. The reconciliation to our most comparable GAAP numbers is provided in the appendix.

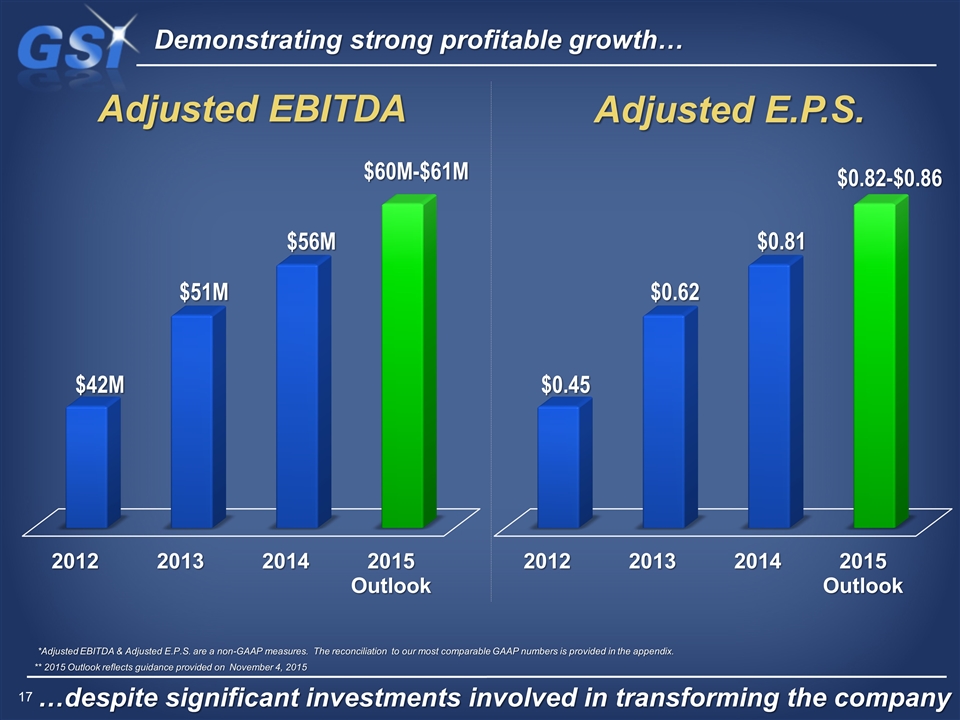

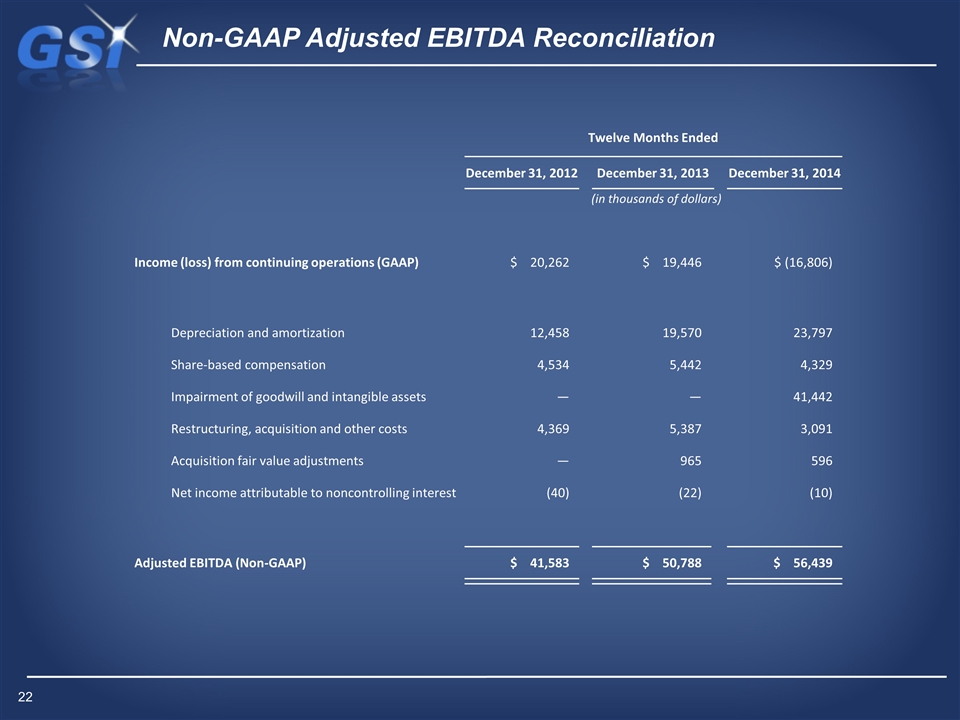

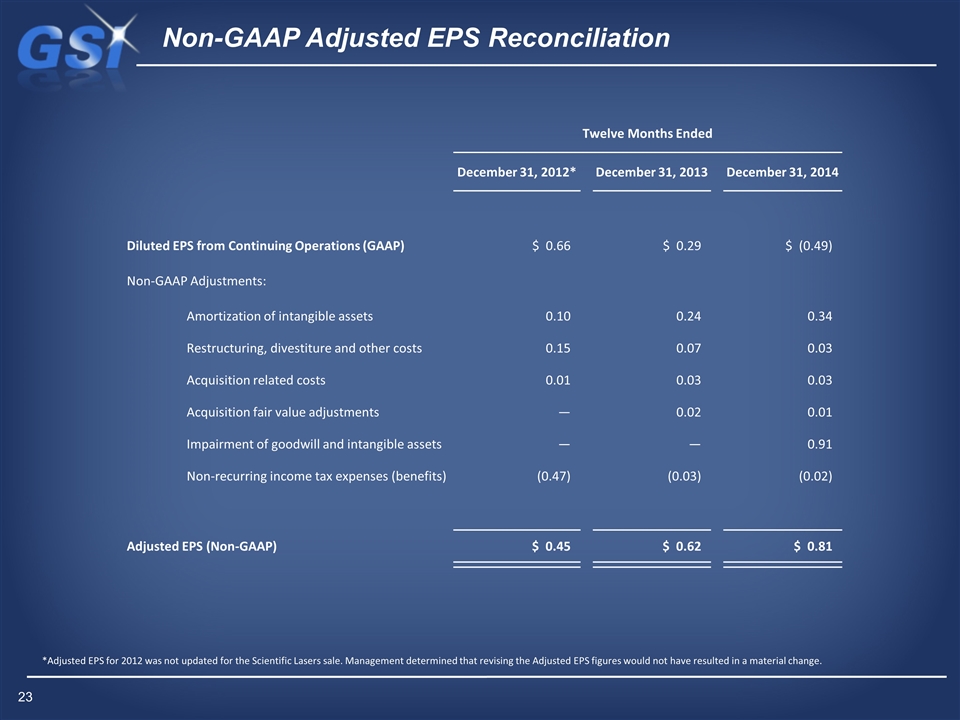

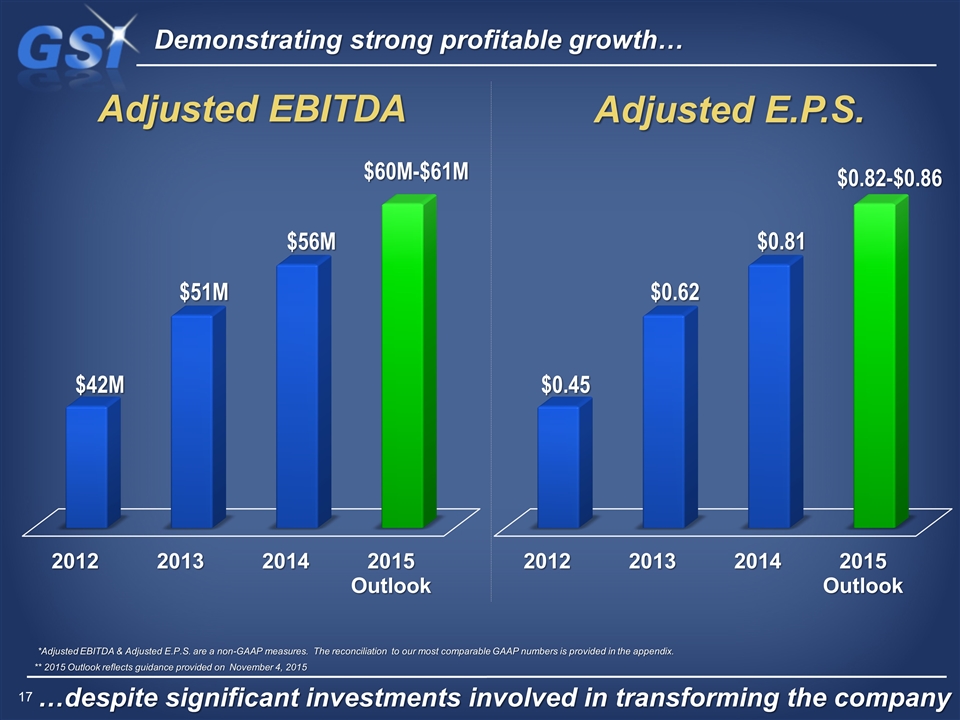

Demonstrating strong profitable growth… …despite significant investments involved in transforming the company $42M Adjusted EBITDA $51M $60M-$61M *Adjusted EBITDA & Adjusted E.P.S. are a non-GAAP measures. The reconciliation to our most comparable GAAP numbers is provided in the appendix. ** 2015 Outlook reflects guidance provided on November 4, 2015 $56M Adjusted E.P.S. $0.45 $0.62 $0.81 $0.82-$0.86

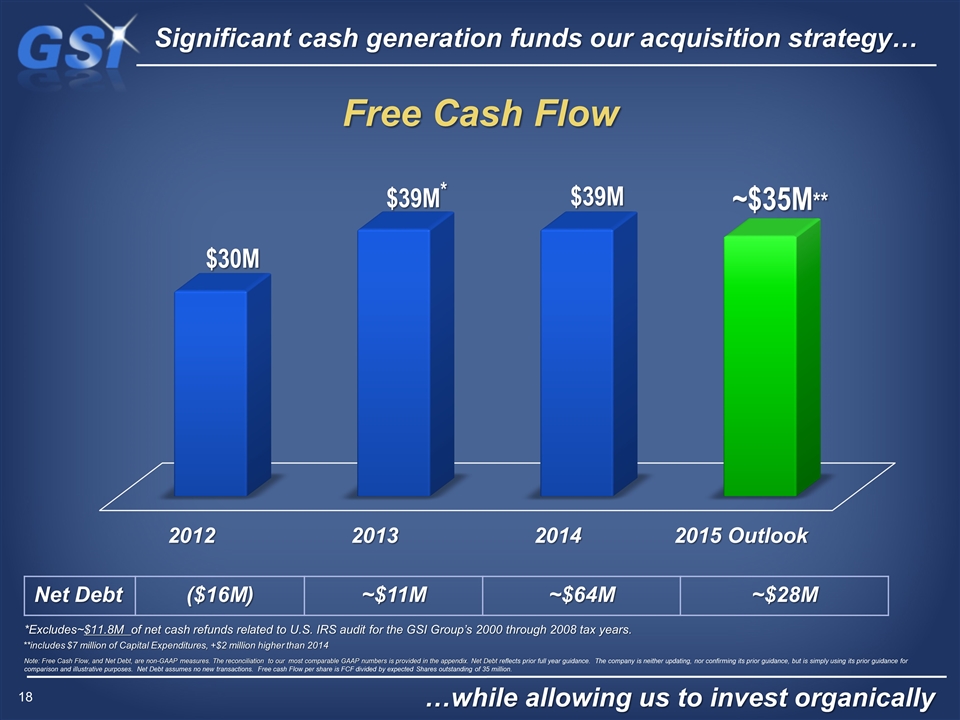

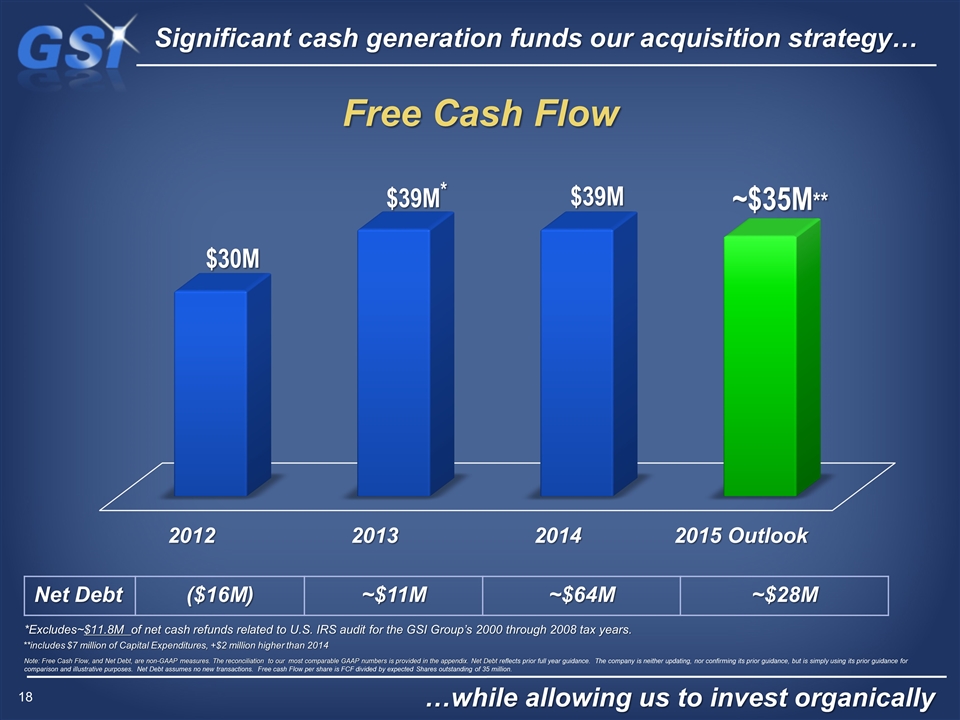

Significant cash generation funds our acquisition strategy… …while allowing us to invest organically $30M Free Cash Flow $39M* ~$35M** Net Debt ($16M) ~$11M ~$64M ~$28M *Excludes~$11.8M of net cash refunds related to U.S. IRS audit for the GSI Group’s 2000 through 2008 tax years. $39M **includes $7 million of Capital Expenditures, +$2 million higher than 2014 Note: Free Cash Flow, and Net Debt, are non-GAAP measures. The reconciliation to our most comparable GAAP numbers is provided in the appendix. Net Debt reflects prior full year guidance. The company is neither updating, nor confirming its prior guidance, but is simply using its prior guidance for comparison and illustrative purposes. Net Debt assumes no new transactions. Free cash Flow per share is FCF divided by expected Shares outstanding of 35 million.

Appendix

About GSI GSI Group Inc. designs, develops, manufactures and sells precision photonics and motion control components and subsystems to Original Equipment Manufacturers (“OEM”) in the medical equipment and advanced industrial technology markets. The Company’s highly engineered enabling technologies include laser sources, laser scanning and beam delivery products, optical data collection and machine vision technologies, medical visualization and informatics solutions, and precision motion control products. It specializes in collaborating with OEM customers to adapt its component and subsystem technologies to deliver highly differentiated performance in their customers’ applications. GSI Group Inc.’s common shares are quoted on NASDAQ under the ticker symbol “GSIG”.

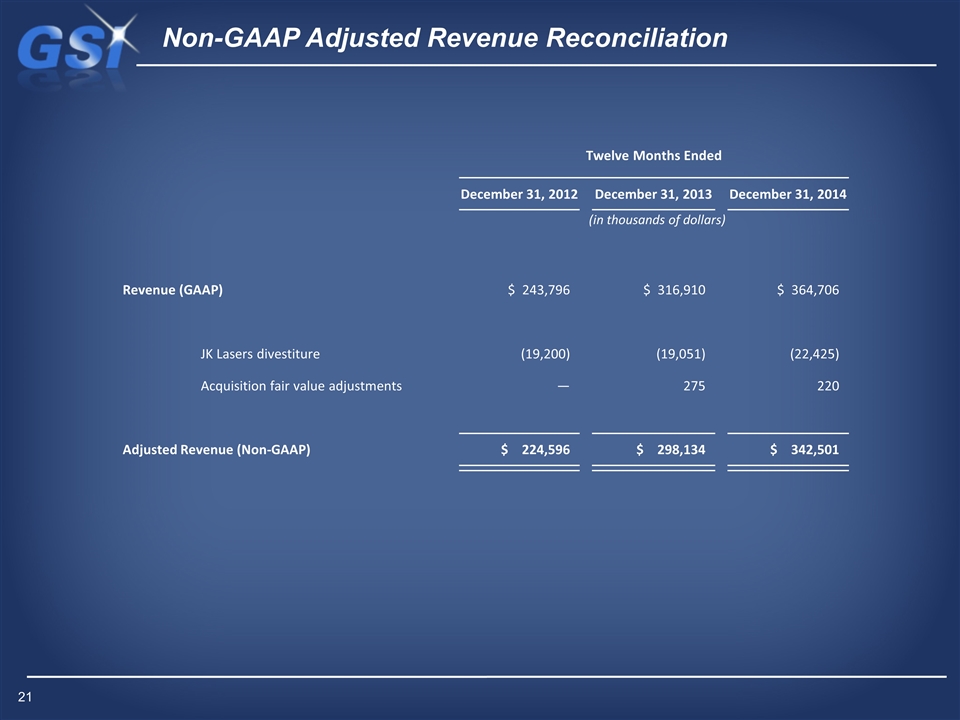

Non-GAAP Adjusted Revenue Reconciliation Twelve Months Ended December 31, 2012 December 31, 2013 December 31, 2014 (in thousands of dollars) Revenue (GAAP) $ 243,796 $ 316,910 $ 364,706 JK Lasers divestiture (19,200) (19,051) (22,425) Acquisition fair value adjustments — 275 220 Adjusted Revenue (Non-GAAP) $ 224,596 $ 298,134 $ 342,501

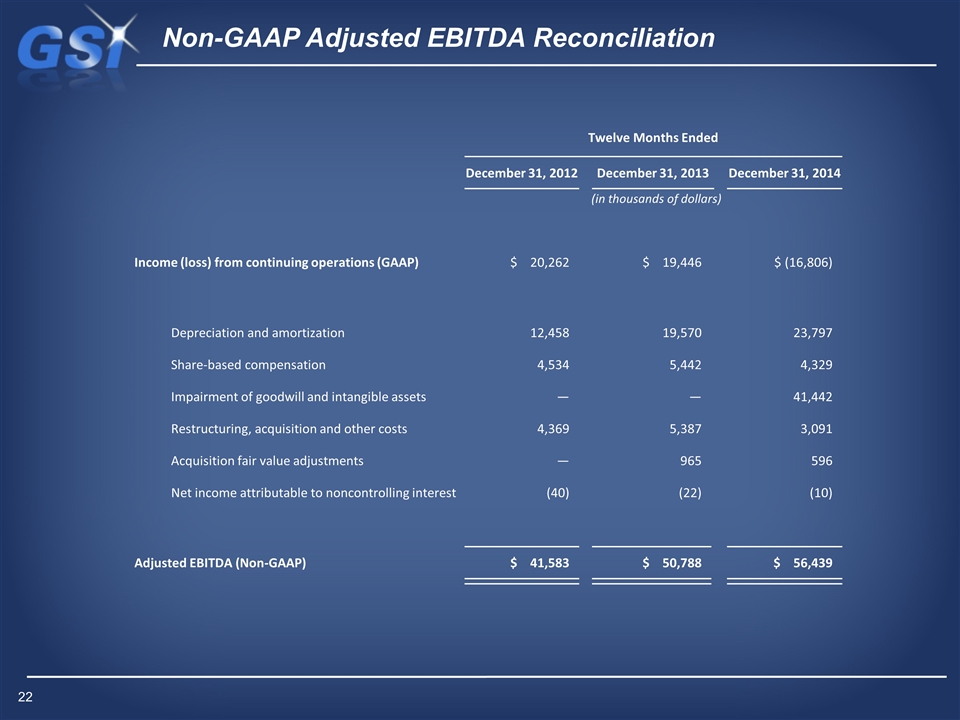

Non-GAAP Adjusted EBITDA Reconciliation Twelve Months Ended December 31, 2012 December 31, 2013 December 31, 2014 (in thousands of dollars) Income (loss) from continuing operations (GAAP) $ 20,262 $ 19,446 $ (16,806) Depreciation and amortization 12,458 19,570 23,797 Share-based compensation 4,534 5,442 4,329 Impairment of goodwill and intangible assets — — 41,442 Restructuring, acquisition and other costs 4,369 5,387 3,091 Acquisition fair value adjustments — 965 596 Net income attributable to noncontrolling interest (40) (22) (10) Adjusted EBITDA (Non-GAAP) $ 41,583 $ 50,788 $ 56,439

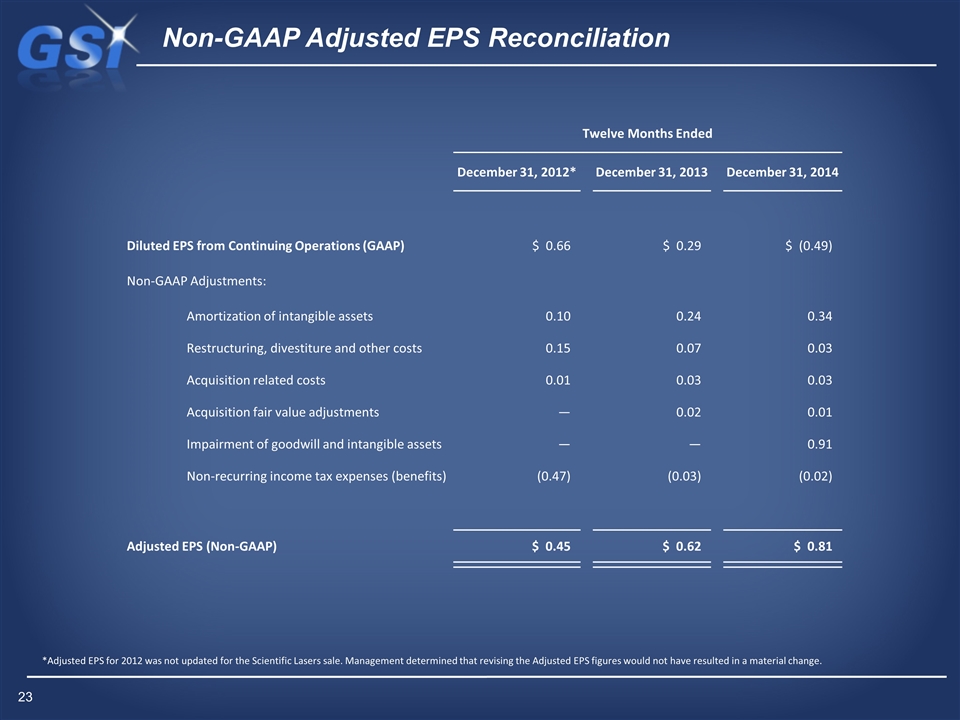

Non-GAAP Adjusted EPS Reconciliation Twelve Months Ended December 31, 2012* December 31, 2013 December 31, 2014 Diluted EPS from Continuing Operations (GAAP) $ 0.66 $ 0.29 $ (0.49) Non-GAAP Adjustments: Amortization of intangible assets 0.10 0.24 0.34 Restructuring, divestiture and other costs 0.15 0.07 0.03 Acquisition related costs 0.01 0.03 0.03 Acquisition fair value adjustments — 0.02 0.01 Impairment of goodwill and intangible assets — — 0.91 Non-recurring income tax expenses (benefits) (0.47) (0.03) (0.02) Adjusted EPS (Non-GAAP) $ 0.45 $ 0.62 $ 0.81 *Adjusted EPS for 2012 was not updated for the Scientific Lasers sale. Management determined that revising the Adjusted EPS figures would not have resulted in a material change.

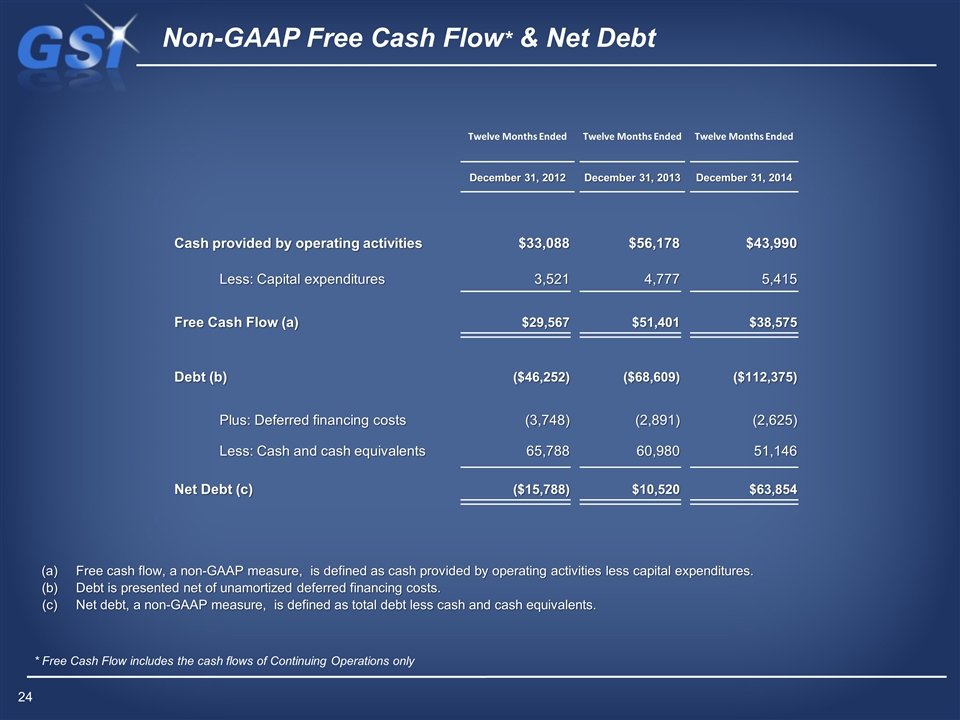

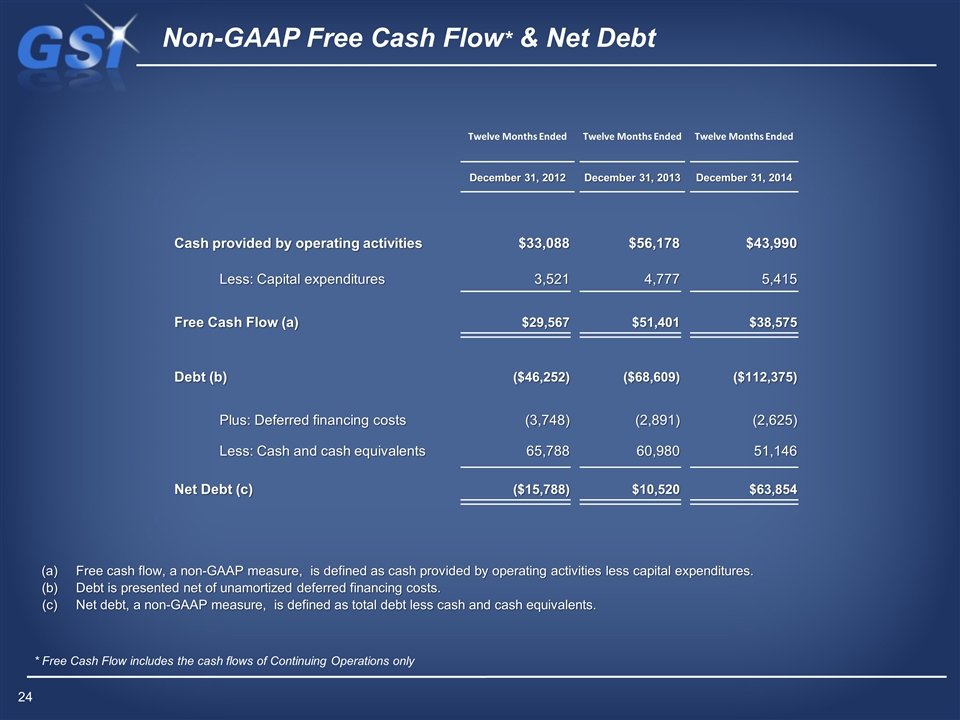

Non-GAAP Free Cash Flow* & Net Debt (a) Free cash flow, a non-GAAP measure, is defined as cash provided by operating activities less capital expenditures. (b) Debt is presented net of unamortized deferred financing costs. (c) Net debt, a non-GAAP measure, is defined as total debt less cash and cash equivalents. Twelve Months Ended Twelve Months Ended Twelve Months Ended December 31, 2012 December 31, 2013 December 31, 2014 Cash provided by operating activities $33,088 $56,178 $43,990 Less: Capital expenditures 3,521 4,777 5,415 Free Cash Flow (a) $29,567 $51,401 $38,575 Debt (b) ($46,252) ($68,609) ($112,375) Plus: Deferred financing costs (3,748) (2,891) (2,625) Less: Cash and cash equivalents 65,788 60,980 51,146 Net Debt (c) ($15,788) $10,520 $63,854 * Free Cash Flow includes the cash flows of Continuing Operations only

The non-GAAP financial measures used in this presentation are non-GAAP Adjusted Revenue, Adjusted EBITDA, Adjusted EPS from Continuing Operations, free cash flow, and net debt. The Company believes that the non-GAAP financial measures provide useful and supplementary information to investors regarding the Company’s operating performance. It is management’s belief that these non-GAAP financial measures would be particularly useful to investors because of the significant changes that have occurred outside of the Company’s day-to-day business in accordance with the execution of the Company’s strategy. This strategy includes streamlining the Company’s existing operations through site and functional consolidations, strategic divestitures, expanding the Company’s business through significant internal investments, and broadening the Company’s product and service offerings through acquisition of innovative and complementary technologies and solutions. The financial impact of certain elements of these activities, particularly acquisitions, divestitures, and site and functional restructurings, are often large relative to the Company’s overall financial performance, which can adversely affect the comparability of its operating results and investors’ ability to analyze the business from period to period. Adjusted Revenue excludes the JK Lasers business to only show the results of ongoing operations of the Company as the JK Lasers business was sold in April 2015. We excluded JK Lasers sales from Adjusted Revenue because divestiture activities can vary between reporting periods and between us and our peers, which we believe make comparisons of long-term performance trends difficult for management and investors, and could result in overstating or understating to our investors the performance of our operations. Additionally, we include estimated revenue from contracts acquired with business acquisitions that will not be fully recognized due to business combination rules. Because GAAP accounting rules require the elimination of this revenue, GAAP results alone do not fully capture all of our economic activities. These non-GAAP adjustments are intended to reflect the full amount of such revenue. The Company defines Adjusted EBITDA as income (loss) from continuing operations before deducting depreciation, amortization, non-cash share-based compensation, restructuring, acquisition, divestiture and other costs, and acquisition fair value adjustments. The Company’s Adjusted EBITDA is used by management to evaluate operating performance, communicate financial results to the Board of Directors, benchmark results against historical performance and the performance of peers, and evaluate investment opportunities including acquisitions and divestitures. In addition, Adjusted EBITDA is used to determine bonus payments for senior management and employees. Accordingly, the Company believes that this non-GAAP measure provides greater transparency and insight into management’s method of analysis. Adjusted EPS from Continuing Operations excludes amortization of acquired intangible assets and revenue fair value adjustments related to business acquisitions, restructuring, acquisition, divestiture, and other costs, impairment of goodwill and intangible assets, significant non-recurring income tax expenses (benefits) related to releases of valuation allowance, effects of changes in tax laws, effects of acquisition related tax planning actions on our effective tax rate, and the income tax effect of non-GAAP adjustments. Non-GAAP financial measures should not be considered as substitutes for, or superior to, measures of financial performance prepared in accordance with GAAP. They are limited in value because they exclude charges that have a material effect on the Company’s reported results and, therefore, should not be relied upon as the sole financial measures to evaluate the Company’s financial results. The non-GAAP financial measures are meant to supplement, and to be viewed in conjunction with, GAAP financial measures. Investors are encouraged to review the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures as provided in the tables accompanying this document. Use of Non-GAAP Financial Measures