UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| | | |

| x | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2008

OR

| | | |

| o | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ________________ to ________________

Commission file number: 001-15643

SKYSTAR BIO-PHARMACEUTICAL COMPANY

(Exact name of registrant as specified in its charter)

| | | |

| Nevada | | 33-0901534 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | |

Rm. 10601, Jiezuo Plaza, No.4, Fenghui Road South, Gaoxin District, Xian Province, P.R. China | | N/A |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number: (8629) 8819-3188

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, no par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained herein, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o | Accelerated filer o |

Non-accelerated filer o | Smaller reporting company þ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No þ

As of June 25, 2008, the aggregate market value of the voting stock held by non-affiliates of the Registrant was approximately $9.4 million based on a closing price of $1.05 per share of common stock as reported on the Over-the-Counter Bulletin Board on such date.

On March 25, 2009, we had 18,665,189 shares of common stock issued and outstanding.

TO ANNUAL REPORT ON FORM 10-K

FOR YEAR ENDED DECEMBER 31, 2008

| PART I | | Page |

| Item 1. | Business | 1 |

| Item 1A. | Risk Factors | 7 |

| Item 1B. | Unresolved Staff Comments | 20 |

| Item 2. | Properties | 21 |

| Item 3. | Legal Proceedings | 22 |

| Item 4. | Submission of Matters to a Vote of Security Holders | 22 |

| | | |

| PART II | | |

| Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 22 |

| Item 6. | Selected Financial Data | 23 |

| Item 7. | Management’s Discussion and Analysis of Financial Conditions and Results of Operations | 23 |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 30 |

| Item 8. | Financial Statements and Supplementary Data | 30 |

| Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 30 |

| Item 9A(T). | Controls and Procedures | 30 |

| Item 9B. | Other Information | 32 |

| | | |

| PART III | | 32 |

| Item 10. | Directors, Executive Officers and Corporate Governance | 32 |

| Item 11. | Executive Compensation | 35 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 39 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 41 |

| Item 14. | Principal Accounting Fees and Services | 43 |

| | | |

| PART IV | | |

| Item 15. | Exhibits, Financial Statement Schedules | 43 |

| | | |

| Signatures | | 47 |

CAUTION REGARDING FORWARD-LOOKING INFORMATION

This report contains forward-looking statements. All forward-looking statements are inherently uncertain as they are based on current expectations and assumptions concerning future events or future performance of the Company. Readers are cautioned not to place undue reliance on these forward-looking statements, which are only predictions and speak only as of the date hereof. Forward-looking statements usually contain the words “estimate,” “anticipate,” “believe,” “expect,” or similar expressions, and are subject to numerous known and unknown risks and uncertainties. In evaluating suc h statements, prospective investors should carefully review various risks and uncertainties identified in this Report, including the matters set forth under the captions “Risk Factors” and in the Company’s other SEC filings. These risks and uncertainties could cause the Company’s actual results to differ materially from those indicated in the forward-looking statements. The Company undertakes no obligation to update or publicly announce revisions to any forward-looking statements to reflect future events or developments.

Although forward-looking statements in this annual report on Form 10-K reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known by us. Consequently, forward-looking statements are inherently subject to risks and uncertainties, and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, without limitation, those specifically addressed under the heading “Risks Relating to Our Business” below, as well as those discussed elsewhere in this annual report on Form 10-K. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this annual report on Form 10-K. We file reports with the Securities and Exchange Commission (“SEC”). You can read and copy any materials we file with the SEC at the SEC’s Public Reference Room, 100 F. Street, NE, Washington, D.C. 20549 on official business days during the hours of 10 a.m. to 3 p.m. You can obtain additional information about the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet site (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, including the Company.

We undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this annual report on Form 10-K. Readers are urged to carefully review and consider the various disclosures made throughout the entirety of this annual report, which attempt to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

PART I

ITEM 1. BUSINESS

Overview

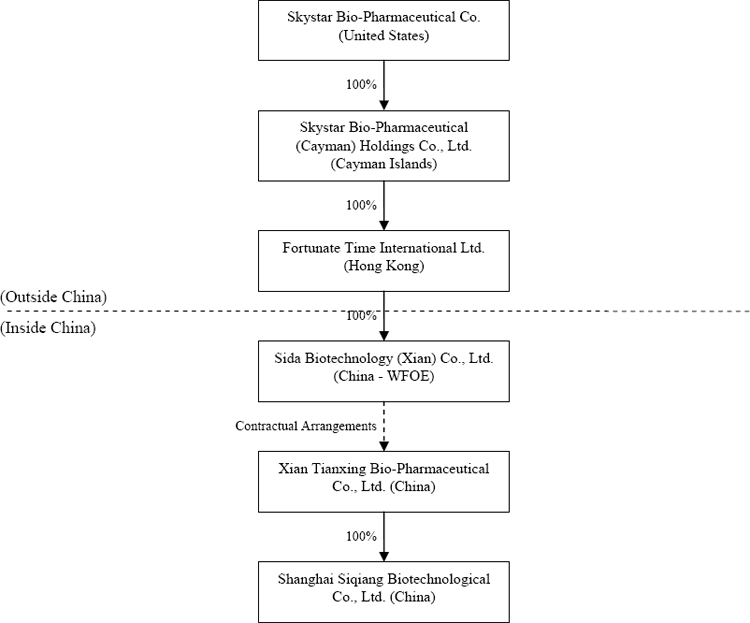

Skystar Bio-Pharmaceutical Company (sometimes referred to in this annual report as “Skystar”, “Company”, “we” or “our”) is a holding company that, through its variable interest entity (“VIE”) Xian Tianxing Bio-Pharmaceutical Co., Ltd. (“Xian Tianxing”), develops, manufactures and distributes medicines, vaccines and other health care and medical care products for poultry, livestock and domestic pets in the People’s Republic of China (“PRC”). We have four product lines, including a vaccine line, a veterinary medicine line, a fodder and feed additives line, and a micro-organism line. All four product lines are developed, manufactured and distributed by Xian Tianxing, which we operate and control through contractual arrangements between our indirect wholly-owned subsidiary Sida Biotechnology (Xian) Co., Ltd. (“Sida”) and Xian Tianxing. These contractual arrangements enable Sida to control and receive the profits of Xian Tianxing. Sida is the wholly owned subsidiary of Fortunate Time International Ltd. (“Fortunate Time”), which is wholly owned by Skystar Bio-Pharmaceutical (Cayman) Holdings Co., Ltd. (“Skystar Cayman”), our wholly owned subsidiary. Xian Tianxing has a wholly owned subsidiary, Shanghai Siqiang Biotechnological Co., Ltd. (“Shanghai Siqiang”), which we also control. Other than our interests in the contractual arrangements with Xian Tianxing, neither we nor our direct and indirect subsidiaries have any equity interests in Xian Tianxing.

Corporate Organization and History

We were originally incorporated in Nevada under the name “Hollywood Entertainment Network, Inc.” on September 24, 1998 with a principal business objective to operate as an independent film company in the business of motion picture production and distribution. On May 23, 2000, we underwent a reverse merger and became a developer of computer security software and hardware and changed our name to “The Cyber Group Network Corporation” to reflect this change in business. Effective February 15, 2006, in connection with the share exchange transaction described below, we changed our name to our present name “Skystar Bio-Pharmaceutical Company.”

On September 20, 2005, we executed a Share Exchange Agreement (“Exchange Agreement”) by and among R. Scott Cramer, Steve Lowe, David Wassung (all hereinafter collectively referred to as the “CGPN Shareholders”) and the Company on the one hand, and Skystar Cayman, and the shareholders of 100% of Skystar Cayman’s common stock (the “Skystar Cayman Shareholders”), on the other hand. (This transaction is referred to hereinafter as the “Share Exchange Transaction”). Under the Exchange Agreement, on the closing date, we issued shares of the our series B preferred stock (the “CGPN Shares”) to the Skystar Cayman Shareholders in exchange for 100% of the common stock of Skystar Cayman. The CGPN Shares were convertible, in the aggregate, into a number of shares of our common stock that would equal 89.5% of our outstanding common shares if the CGPN Shares were to be converted on the closing date of the Share Exchange Transaction. In addition, on the closing date, Skystar Cayman was to pay the Company an amount equal to $120,000, which was used to pay liabilities of the Company.

The Share Exchange Transaction closed on November 7, 2005. From and after the closing date, our primary operations consist of the operations of Skystar Cayman. The Share Exchange Transaction was accounted for as a reverse merger (recapitalization) with Skystar Cayman deemed to be the accounting acquirer, and us as the legal acquirer. Accordingly, the historical financial information presented in the financial statements are those of Skystar Cayman as adjusted to give effect to any difference in the par value of ours and Skystar Cayman’s stock with an offset to capital in excess of par value. The basis of the assets, liabilities and retained earnings of Skystar Cayman, the accounting acquirer, have been carried over in the recapitalization.

Skystar Cayman was incorporated under the laws of the Cayman Islands on January 24, 2005. Since incorporation, Skystar Cayman has not conducted any substantive operations of its own and has conducted its primary business operations through its VIE, Xian Tianxing. Xian Tianxing holds the licenses and approvals necessary to operate our bio-pharmaceutical business in China. We have contractual arrangements with Xian Tianxing and its stockholders pursuant to which we provide technology consulting and other general business operation services to Xian Tianxing. Through these contractual arrangements, we also have the ability to substantially influence Xian Tianxing’s daily operations and financial affairs, appoint its senior executives and approve all matters requiring stockholder approval. As a result of these contractual arrangements, which enable us to control Xian Tianxing, we are considered the primary beneficiary of Xian Tianxing. Accordingly, we consolidate Xian Tianxing’s results, assets and liabilities in our financial statements. For a description of these contractual arrangements, see “Contractual Arrangements with Xian Tianxing and its Stockholders” below.

Xian Tianxing was incorporated on July 3, 1997 in the PRC as a limited liability company without shares, but restructured as a joint stock company limited by shares on December 31, 2003. The paid-in capital of Xian Tianxing was funded by individuals who were majority stockholders of Skystar Cayman immediately prior to the closing of the Share Exchange Transaction. All of our veterinary products are developed and produced, and marketed and distributed, by Xian Tianxing. On August 21, 2007, Xian Tianxing invested $66,700 (RMB 500,000) to establish Shanghai Siqiang. Shanghai Siqiang was established in Putuo District, Shanghai, with a registered capital of $66,700 (RMB 500,000) and Xian Tianxing is the 100% shareholder. We established Shanghai Siqiang as a research and development center for Xian Tianxing to engage in research, development, production and sales of feed additives and veterinary disease diagnosis equipments.

On October 16, 2007, all of the issued and outstanding capital stock of Fortunate Time, a Hong Kong company, was acquired from one of our directors, R. Scott Cramer, and Fortunate Time became Skystar Cayman’s wholly owned subsidiary. Fortunate Time has a wholly owned subsidiary, Sida, a PRC limited liability company with registered capital of $5,000,000. $2,000,000 of the registered capital has been paid through funding from Skystar Cayman, with the remaining balance of $3,000,000 due by July 9, 2009. For a description of these companies’ activities as of the date of this annual report, see “Recent Developments with Respect to the Contractual Arrangements with Xian Tianxing and its Shareholders” below.

Name Change and Changes in Authorized Shares of Common Stock

On December 19, 2005, our board of directors and the majority holders of the Company’s capital stock jointly approved amendments to our Articles of Incorporation by written consent, including: (1) a change of our corporate name to our current name, Skystar Bio-Pharmaceutical Company, (2) a 1-for-397 reverse stock split; and a (3) decrease in the authorized common stock of the Company from 500,000,000 to 50,000,000 shares. The Certificate of Amendment and Certificate of Change to our Articles of Incorporation to effect the name change, reverse split and decrease of authorized shares was filed with Nevada’s Secretary of State on February 15, 2006.

On July 11, 2008, we filed another Certificate of Amendment to our Articles of Incorporation with Nevada’s Secretary of State after stockholders approved a proposal at a special meeting of the stockholders held on June 30, 2008, to increase the number of authorized shares of common stock from 50,000,000 to 200,000,000.

Contractual Arrangements with Xian Tianxing and Its Stockholders

Our relationships with Xian Tianxing and its stockholders are governed by a series of contractual arrangements, as we (including our direct and indirect subsidiaries) do not own any equity interests in Xian Tianxing. PRC law currently has limits on foreign ownership of certain companies. To comply with these restrictions, Skystar Cayman entered into the following contractual arrangements with Xian Tianxing and its owners on October 28, 2005:

Consulting Services Agreement. Pursuant to the consulting services agreement with Xian Tianxing, Skystar Cayman has the exclusive right to provide to Xian Tianxing general services related to veterinary healthcare and medical care products business operations as well as consulting services related to the technological research, development, design and manufacturing of veterinary healthcare and medical care products (the “Services”). Skystar Cayman also sends employees to Xian Tianxing for whom Xian Tianxing bears the costs and expenses. Under this agreement, Skystar Cayman owns the intellectual property rights developed or discovered through research and development providing the Services for Xian Tianxing. Xian Tianxing pays a quarterly consulting service fees in Renminbi (“RMB”) to Skystar Cayman that is equal to all of Xian Tianxing’s revenue for such quarter. The consulting services agreement is in effect unless and until terminated by written notice of either party in the event that: (a) the other party causes a material breach of this agreement, provided that if the breach does not relate to a financial obligation of the breaching party, that party may attempt to remedy the breach within 14 days following the receipt of the written notice; (b) the other party becomes bankrupt, insolvent, is the subject of proceedings or arrangements for liquidation or dissolution, ceases to carry on business, or becomes unable to pay its debts as they become due; (c) Skystar Cayman terminates its operations; (d) Xian Tianxing’s business license or any other license or approval for its business operations is terminated, cancelled or revoked; or (e) circumstances arise which would materially and adversely affect the performance or the objectives of the consulting services agreement. Additionally, Skystar Cayman may terminate the consulting services agreement without cause.

Operating Agreement. Pursuant to the operating agreement with Xian Tianxing and the stockholders of Xian Tianxing who collectively hold the majority of the outstanding shares of Xian Tianxing (collectively “Tianxing Majority Stockholders”), Skystar Cayman provides guidance and instructions on Xian Tianxing’s daily operations, financial management and employment issues. The Tianxing Majority Stockholders must designate the candidates recommended by Skystar Cayman as their representatives on Xian Tianxing’s board of directors. Skystar Cayman has the right to appoint senior executives of Xian Tianxing. In addition, Skystar Cayman agrees to guarantee Xian Tianxing’s performance under any agreements or arrangements relating to Xian Tianxing’s business arrangements with any third party. Xian Tianxing, in return, agrees to pledge its accounts receivable and all of its assets to Skystar Cayman. Moreover, Xian Tianxing agrees that without the prior consent of Skystar Cayman, Xian Tianxing will not engage in any transactions that could materially affect the assets, liabilities, rights or operations of Xian Tianxing, including, without limitation, incurrence or assumption of any indebtedness, sale or purchase of any assets or rights, incurrence of any encumbrance on any of its assets or intellectual property rights in favor of a third party or transfer of any agreements relating to its business operation to any third party. The term of this agreement is ten (10) years from October 28, 2005 and may be extended only upon Skystar Cayman’s written confirmation prior to the expiration of the this agreement, with the extended term to be mutually agreed upon by the parties.

Equity Pledge Agreement. Under the equity pledge agreement with the Tianxing Majority Stockholders, the Tianxing Majority Stockholders pledged all of their equity interests in Xian Tianxing to Skystar Cayman to guarantee Xian Tianxing’s performance of its obligations under the consulting services agreement. If Xian Tianxing or the Tianxing Majority Stockholders breaches their respective contractual obligations, Skystar Cayman, as pledgee, will be entitled to certain rights, including but not limited to the right to sell the pledged equity interests, the right to vote and control the pledged assets. The Xian Majority Stockholders also agreed that upon occurrence of any event of default, Skystar Cayman shall be granted an exclusive, irrevocable power of attorney to take actions in the place and stead of the Tianxing Majority Stockholders to carry out the security provisions of the equity pledge agreement and take any action and execute any instrument that Skystar Cayman may deem necessary or advisable to accomplish the purposes of the equity pledge agreement. The Tianxing Majority Stockholders agreed not to dispose of the pledged equity interests or take any actions that would prejudice Skystar Cayman’s interest. The equity pledge agreement will expire two (2) years after Xian Tianxing obligations under the exclusive consulting services agreement have been fulfilled.

Option Agreement. Under the option agreement with the Tianxing Majority Stockholders, the Tianxing Majority Stockholders irrevocably granted Skystar Cayman or its designee an exclusive option to purchase, to the extent permitted under Chinese law, all or part of the equity interests in Xian Tianxing for the cost of the initial contributions to the registered capital or the minimum amount of consideration permitted by applicable Chinese law. Skystar Cayman or its designee has sole discretion to decide when to exercise the option, whether in part or in full. The term of this agreement is ten (10) years from October 28, 2005 and may be extended prior to its expiration by written agreement of the parties.

Proxy Agreement. Pursuant to the proxy agreement with the Tianxing Majority Stockholders and Xian Tianxing, the Tianxing Majority Stockholders agreed to irrevocably grant a designee of Skystar Cayman with the right to exercise their voting and other rights, including the rights to attend and vote at stockholder’s meetings (or by written consent in lieu of such meetings) in accordance with applicable laws and Xian Tianxing’s Article of Association, as well as the rights to sell or transfer all or any of their equity interests of the Company. The term of this Proxy Agreement is ten (10) years from October 28, 2005 and may be extended prior to its expiration by written agreement of the parties.

Recent Developments with Respect to the Contractual Arrangements with Xian Tianxing and its Shareholders

On March 10, 2008, we were made a party to a series of agreements (collectively the “Transfer Agreements”) transferring the contractual arrangements governing the relationship among Skystar Cayman, Xian Tianxing and the Tianxing Majority Stockholders. Pursuant to the Transfer Agreements, from and after March 10, 2008, all of the rights and obligations of Skystar Cayman under the contractual arrangements were transferred to Sida. We were made a party to the Transfer Agreements for the sole purpose of acknowledging the Transfer Agreements. In effect, Skystar Cayman assigned the contractual rights it had with Xian Tianxing to an indirectly wholly-owned subsidiary, Sida.

Under our corporate structure with the contractual arrangements, the ability to transfer funds to and from Xian Tianxing expeditiously through a foreign currency bank account is necessary for the running of our business operations. Under current applicable Chinese law, only a company that is classified as either a wholly foreign owned enterprise (WFOE) or a Sino-foreign joint venture may maintain a foreign currency bank account. Because Sida is wholly owned by Fortunate Time, a Hong Kong company, Sida is deemed a WFOE and may therefore maintain a foreign currency account. The Transfer Agreements amend the contractual arrangements so that funds are required to be transferred to and from Xian Tianxing through Sida’s foreign currency account and, through Sida, allow the Company to continue to control Xian Tianxing and its business operations.

The Transfer Agreements have transferred all of the rights and obligations of Skystar Cayman under the contractual arrangements to Sida. Thus, pursuant to the Amendment to Consulting Services Agreement, Sida now provides exclusive technology and general business consulting services to Xian Tianxing in exchange of a consulting fee equivalent to all of Xian Tianxing’s revenue; pursuant to the Amendment to Equity Pledge Agreement, the Tianxing Majority Stockholders now pledge their equity interests in Xian Tianxing to Sida; pursuant to the Agreement to Transfer of Operating Agreement, Sida now provides guidance and instructions on Xian Tianxing’s daily operations, financial management and employment issues; pursuant to the Designation Agreement, the Tianxing Majority Stockholders have entrusted all the rights to exercise their voting power to appointee(s) of Sida; and pursuant to the Agreement to Transfer of Option Agreement, the Tianxing Majority Stockholders have irrevocably granted Sida an exclusive option to purchase, to the extent permitted under PRC law, all or part of their equity interests in Xian Tianxing.

The Transfer Agreements and the transfer of the rights and obligations of Skystar Cayman under the contractual arrangements to Sida comply with applicable PRC law and do not in any way affect our business operations. Additionally, we believe that Xian Tianxing’s status as a VIE under FASB Interpretation No. 46R (“FIN 46R”), “Consolidation of Variable Interest Entities, an Interpretation of ARB No. 51,” is unaffected by the Transfer Agreements. Under the contractual arrangements, we viewed Xian Tianxing as a VIE of Skystar Cayman because the contractual arrangements obligated Skystar Cayman to absorb a majority of the risk of loss from Xian Tianxing’s activities and enabled Skystar Cayman to receive a majority of its expected residual returns. The Transfer Agreements merely substitute Skystar Cayman with Sida, an indirect wholly owned subsidiary of Skystar Cayman, such that the equity investors of Xian Tianxing continue to not have the characteristics of a controlling financial interest (just as under the contractual arrangements) and we continue to be the primary beneficiary of Xian Tianxing. Accordingly, we continue to consolidate Xian Tianxing’s results, assets and liabilities in the financial statements accompanying this annual report.

Current Corporate Structure

As a result of the Contractual Arrangements and the Transfer Agreements, our current organizational structure is as follows (the percentages depict the current equity interests):

Our Business

As discussed above, we conduct our business through Xian Tianxing. After nine (9) years of development, we have become a high-tech enterprise with registered capital of RMB 42,000,000 (approximately $5,758,200), and are engaged in research, development, production, marketing and sales of bio-pharmaceutical and veterinary products. Our business divisions currently include a bio-pharmaceutical products division, a veterinary drugs division, a fodder and feed additive division, and a microorganism preparation division.

Our Products

As of December 31, 2008:

| | 1. | Our bio-pharmaceutical veterinary vaccine line included over 10 products and accounted for 3.9% of our total revenues in 2008; |

| | 2. | Our veterinary medicine line for poultry and livestock included over 140 products and accounted for 68.5% of our total revenues in 2008; |

| | 3. | Our fodder and feed additives line included over 10 products and accounted for 4.6% of our total revenues in 2008; and |

| | 4. | Our micro-organism products line included over 13 products and accounted for 22.9% of our total revenues in 2008. |

Distribution Methods of Our Products and Our Customers

As of December 31, 2008, we had over 1,412 customers in 29 provinces in China, including 1,036 distributors and 376 direct customers. Of the 1,036 distribution agents, 336 are physical stores which have outer signage with our logo and sell products in our four product lines exclusively (“Franchise Distributors”). We intend to enter into agreements with additional distributors in order to strengthen our distribution network and convert some of these distributors to Franchise Distributors.

We recognize the importance of branding as well as packaging. All of our products have uniform branding while being specifically designed to differentiate our four product lines.

We conduct promotional marketing activities within the provinces we operate to publicize and enhance our image as well as to reinforce the recognition of our brand name, including:

| | 1. | publishing advertisements and articles in national as well as specialized and provincial newspapers, magazines, and in other media, including the Internet; |

| | 2. | participating in national meetings, seminars, symposiums, exhibitions for bio-pharmaceutical and other related industries; |

| | 3. | organizing cooperative promotional activities with distributors; and |

| | 4. | direct mail campaigns to major livestock farms. |

None of our customers accounted for 10% or more of our total revenues in 2008.

Competition

We have three major competitors in China: Jielin Bio-Tech Production Co., Ltd., Qilu Animal Health Production Co., Ltd., and Zhongmu Industrial Joint Stock Co., Ltd. These companies have more assets and have a larger market share. Nevertheless, we believe we are able to compete with these competitors because of our location in northwestern China, a full range of product offerings, and lower prices. Other than these three competitors, most of our other competitors produce only one or two products.

Sources and Availability of Raw Materials and Our Principal Suppliers

Xi’an Yanghua Chemical Co., Ltd.,Xi’an Nanchen Trading Co., Ltd. and Xi’an Fandike Chemical Technology Co., Ltd. collectively supplied over 53.60% of the raw materials we used to manufacture our products. Our principal raw materials include both chemical ingredients and Chinese herbs. The prices for these raw materials are subject to market forces largely beyond our control, including our supplier’s energy costs, organic chemical feedstock, market demand, and freight costs. The prices for these raw materials have varied significantly in the past and may vary significantly in the future.

As a result of our R&D efforts in 2007 we now also internally produce microbial strains, which are key components of our micro-organism products. Our ability to produce microbial strains has translated into a significant cost reduction for these raw materials.

Intellectual Properties and Licenses

We rely on a combination of trademark, copyright and trade secret protection laws in China and other jurisdictions, as well as confidentiality procedures and contractual provisions to protect our intellectual property and our brand.

We intend to seek other licenses or apply for exclusivity as necessary in order to protect our rights, and we also enter into confidentiality, non-compete and invention assignment agreements with our employees and consultants and nondisclosure agreements with third parties. The Chinese characters which transliterate as “Jia Teng Jun”, “Liao Xiao Wang”, “An Jian”, “Hao Shou Yi” and “Xing Ge” are our registered trademarks in China.

Bio-pharmaceutical companies are at times involved in litigation based on allegations of infringement or other violations of intellectual property rights. Furthermore, the application of laws governing intellectual property rights in China and abroad is uncertain and evolving and could involve substantial risks to us.

Government Approval and Regulation of Our Principal Products or Services

Government approval is required for the production of bio-pharmaceutical products. The Chinese Ministry of Agriculture has granted the Company three government permits to produce the following products: Forage Additive Products, Additive and Mixed Forage Products and Veterinary Medicine Products. For the production of the veterinary medicine, there is a national standard known as the Good Manufacturing Practice (“GMP”) standard. A company must establish its facility according to GMP standards, including both the facility and the production process. After establishing such facility, the Company files an application to operate the facility with the PRC Ministry of Agriculture, which then sends a team of specialists to conduct an on-site inspection of the facility. A company cannot start production at the facility until it receives approval from the Ministry of Agriculture to begin operations. Xian Tianxing currently has the requisite approval and licenses from the Ministry of Agriculture in order to operate our production facilities.

Research and Development

We place great emphasis on product research and development (“R&D”).

In July 2005, we entered into a cooperation agreement with Shaanxi Microbial Institute pursuant to which we established a R&D center at our Huxian plant to facilitate opportunities for us to develop commercially viable products based on the Institute’s research conducted at our research center. Under the cooperation agreement, we provide for the running and operation of the research center, including research equipment and materials. In exchange, we have exclusive rights to any technology derived from any research project that we solely fund. The cooperation agreement also provides for our mutual staffing of research personnel at, and joint-appointment of the director for, the research center. The Institute, however, is not obligated to us with respect to a specific amount of time or a specific project under the cooperation agreement. Currently, we are undertaking the following projects at this research center:

| | 1. | Development of protein technology and enzyme mechanism |

| | 2. | Development of non-pathogenic micro-organisms |

At the Skystar Research and Development Center in Shanghai, we have an arrangement with Shanghai Poultry Verminosis Institution, which is a part of the Chinese Academy of Agricultural Sciences, that is similar to our agreement with Shaanxi Microbial Institute, although we have not entered into any written agreement with the Institution. Currently, we are undertaking the following projects at this research center:

| | 1. | Development of new products for animal immunization by employing new technologies in micro-organism and bacterium |

| | 2. | Development of veterinary medicines for pets |

In 2008, we entered into an agreement with Northwestern Agricultural Technology University on a joint R&D project concerning the application of nano-technology in the prevention of major milk cow disease.

In 2008, we spent approximately $549,000, or approximately 2.1%, of our revenue on R&D. In 2007, we spent approximately $268,000, or approximately 1.8%, of our revenue on R&D.

Employees

In 2008, we had approximately 229 employees, of which 226 were full time employees. In 2007, we had 196 employees, of which 193 were full time employees. None of these employees are represented by any collective bargaining agreements. We have not experienced a work stoppage. Management believes that our relations with our employees are good.

ITEM 1A. RISK FACTORS

You should carefully consider the risks described below together with all of the other information included in this report before making an investment decision with regard to our securities. The statements contained in or incorporated into this report that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Relating to Our Business

Our limited operating history makes it difficult to evaluate our future prospects and results of operations.

We have a relatively limited operating history. Xian Tianxing, the variable interest entity through which we operate our business, commenced operations in 1997 and first achieved profitability in the quarter ended September 30, 1999. Accordingly, you should consider our future prospects in light of the risks and uncertainties typically experienced by companies such as ours in evolving industries such as the bio-pharmaceutical industry in China. Some of these risks and uncertainties relate to our ability to:

| · | offer new and innovative products to attract and retain a larger customer base; |

| | · | attract additional customers and increase spending per customer; |

| | · | increase awareness of our brand and continue to develop user and customer loyalty; |

| | · | raise sufficient capital to sustain and expand our business; |

| | · | maintain effective control of our costs and expenses; |

| | · | respond to changes in our regulatory environment; |

| | · | respond to competitive market conditions; |

| | · | manage risks associated with intellectual property rights; |

| | · | attract, retain and motivate qualified personnel; and |

| | · | upgrade our technology to support additional research and development of new products. |

If we are unsuccessful in addressing any of these risks and uncertainties, our business may be materially and adversely affected.

If we fail to obtain additional financing we will be unable to execute our business plan.

The revenues from the production and sale of bio-pharmaceutical products and the projected revenues from these products are not adequate to support our expansion and product development programs. We may need additional funds to build our new production facilities; pursue further research and development; obtain regulatory approvals; file, prosecute, defend and enforce our intellectual property rights; and market our products. Should such needs arise, we intend to seek additional funds through public or private equity or debt financing, strategic transactions and/or from other sources.

There are no assurances that future funding will be available on favorable terms or at all. If additional funding is not obtained, we will need to reduce, defer or cancel development programs, planned initiatives or overhead expenditures, to the extent necessary. The failure to fund our capital requirements would have a material adverse effect on our business, financial condition and results of operations.

Our business will be materially and adversely affected if our collaborative partners, licensees and other third parties over whom we are very dependent fail to perform as expected.

Due to the complexity of the process of developing bio-pharmaceuticals, our core business depends on arrangements with bio-pharmaceutical institutes, corporate and academic collaborators, licensors, licensees and others for the research, development, clinical testing, technology rights, manufacturing, marketing and commercialization of our products. We are currently collaborating with Shanghai Poultry Verminosis Institution, Shaanxi Microbial Institute and Northwestern Agricultural Technology University on joint R&D projects. However, we do not have any written agreement with Shanghai Poultry Verminosis Institution regarding ongoing collaborations, and under our cooperation agreement with Shaanxi Microbial Institute, the Institute is not obligated to us with respect to any specific period of time or research projects. There are no assurances that we will be able to maintain our present collaborations or establish new ones in the future. We could enter into collaborative arrangements for the development of particular products that may lead to our relinquishing some or all rights to the related technology or products. Moreover, product development and commercialization efforts could be adversely affected if any collaborative partner:

| | · | terminates or suspends its agreement with us; |

| | · | fails to timely develop or manufacture in adequate quantities a substance needed in order to conduct clinical trials; |

| | · | fails to adequately perform clinical trials; |

| | · | determines not to develop, manufacture or commercialize a product to which it has rights; |

| | · | pursue other technologies or develop alternative products that compete with the products we are developing; or |

| | · | otherwise fails to meet its contractual obligations. |

Our collaborative partners could pursue other technologies or develop alternative products that could compete with the products we are developing.

Our products will be adversely affected if we are unable to protect proprietary rights or operate without infringing the proprietary rights of others.

The profitability of our products will depend in part on our ability to obtain and maintain protection for our intellectual property rights and the period our intellectual property remains exclusive. We must also operate without infringing on the proprietary rights of third parties and without third parties circumventing our rights. The proprietary rights of enterprises such as ours are uncertain and involve complex legal and factual questions for which important legal principles are largely unresolved. For example, no consistent policy has emerged regarding the breadth of biotechnology patent claims that are granted by the U.S. Patent and Trademark Office or enforced by the U.S. federal courts. In addition, the scope of the originally claimed subject matter in a patent application can be significantly reduced before a patent is issued. The biotechnology patent situation outside the U.S. is even more uncertain, is currently undergoing review and revision in many countries, and may not protect our intellectual property rights to the same extent as the laws of the U.S. Because applications for exclusive rights are maintained in secrecy in some cases, we cannot be certain that we or our licensors are the first creators of inventions to which we claim proprietary rights, or the first to seek exclusivity for such inventions.

Additionally, the length of time that our intellectual property may remain exclusive is at times beyond our control. For example, we have exclusive rights to the DLV chicken vaccine only until such time that the vaccine is formally listed on the Chinese Pharmacopoeia by the Chinese Pharmacopoeia Commission (“CPC”), after which other companies may apply to the Chinese Ministry of Agriculture for approval to manufacture and distribute the vaccine. Thus, while we remain the only company in China legally permitted to produce and sell the vaccine until the listing occurs, we cannot prevent the CPC from proceeding with such listing or deter other companies from seeking approval from the Chinese Ministry of Agriculture after such listing. Moreover, other companies may independently develop similar products and design around any proprietary products we develop. We cannot assure you that:

| | · | any of our applications for exclusivity will result in their issuance; |

| | · | we will develop additional proprietary products; |

| | · | the exclusive rights we have been issued will provide us with any competitive advantages; |

| | · | the exclusive rights of others will not impede our ability to do business; or |

| | · | third parties will not be able to circumvent our proprietary rights. |

A number of pharmaceutical, biotechnology, research and academic companies and institutions have developed technologies, filed applications for exclusivity or received proprietary rights on technologies that may relate to our business. If these technologies, applications or rights conflict with ours, the scope of our current or future proprietary rights could be limited or our applications for exclusivity could be denied. Our business may be adversely affected if competitors independently develop competing technologies, especially if we do not obtain, or obtain only narrow, proprietary rights protection. If proprietary rights that cover our activities are issued to other companies, we may not be able to obtain licenses at a reasonable cost, or at all; develop our technology; or introduce, manufacture or sell the products we have planned.

Intellectual property litigation is becoming widespread in the biotechnology industry. Such litigation may affect our efforts to form collaborations, to conduct research or development, to conduct clinical testing or to manufacture or market any products under development. There are no assurances that our proprietary rights would be held valid or enforceable by a court or that a competitor’s technology or product would be found to infringe our exclusive rights. Our business could be materially affected by an adverse outcome to such litigation. Similarly, we may need to participate in interference proceedings declared by the U.S. Patent and Trademark Office or equivalent international authorities to determine priority of invention. We could incur substantial costs and devote significant management resources to defend our position or to seek a declaration that another company’s patents or proprietary rights are invalid.

Much of our know-how and technology may not be exclusive, though it may constitute trade secrets. There are no assurances that we will be able to meaningfully protect our trade secrets. We cannot assure you that any of our existing confidentiality agreements with employees, consultants, advisors or collaborators will provide meaningful protection for our trade secrets, know-how or other proprietary information in the event of any unauthorized use or disclosure. Collaborators, advisors or consultants may dispute the ownership of proprietary rights to our technology, for example by asserting that they developed the technology independently.

Implementation of China’s intellectual property-related laws has historically been lacking, primarily because of ambiguities in China’s laws and difficulties in enforcement. Accordingly, intellectual property rights and confidentiality protections in China may not be as effective as in the United States or other countries.

Difficulties in manufacturing our products could have a material adverse effect on our profitability.

Before our products can be profitable, they must be produced in commercial quantities in a cost-effective manufacturing process that complies with regulatory requirements, including China’s Good Manufacturing Practice (GMP), production and quality control regulations. If we cannot arrange for or maintain commercial-scale manufacturing on acceptable terms, or if there are delays or difficulties in the manufacturing process, we may not be able to conduct clinical trials, obtain regulatory approval or meet demand for our products.

Failure or delays in obtaining an adequate amount of raw material or other supplies would materially and adversely affect our revenue.

While our current products use raw materials that are readily available presently, we cannot give assurance that these raw materials will not become scarce in the future. Additionally, we may produce products in the future that require raw materials which are scarce or which can be obtained only from a limited number of sources. If we are unable to obtain adequate supplies of such raw materials, the development, regulatory approval and marketing of our products could be delayed.

Our ability to generate more revenue would be adversely affected if we need more clinical trials or take more time to complete our clinical trials than we have planned.

Clinical trials vary in design by factors including dosage, end points, length, and controls. We may need to conduct a series of trials to demonstrate the safety and efficacy of our products. The results of these trials may not demonstrate safety or efficacy sufficiently for regulatory authorities to approve our products. Further, the actual schedules for our clinical trials could vary dramatically from the forecasted schedules due to factors including changes in trial design, conflicts with the schedules of participating clinicians and clinical institutions, and changes affecting product supplies for clinical trials.

We rely on collaborators, including academic institutions, governmental agencies and clinical research organizations, to conduct, supervise, monitor and design some or all aspects of clinical trials involving our products. Since these trials depend on governmental participation and funding, we have less control over their timing and design than trials we sponsor. Delays in or failure to commence or complete any planned clinical trials could delay the ultimate timelines for our product releases. Such delays could reduce investors’ confidence in our ability to develop products, likely causing the price of our common stock to decrease.

China and other countries impose significant statutory and regulatory obligations upon the manufacture and sale of bio-pharmaceutical products. Each regulatory authority typically has a lengthy approval process in which it examines pre-clinical and clinical data and the facilities in which the product is manufactured. Regulatory submissions must meet complex criteria to demonstrate the safety and efficacy of the ultimate products. Addressing these criteria requires considerable data collection, verification and analysis. We may spend time and money preparing regulatory submissions or applications without assurances as to whether they will be approved on a timely basis or at all.

Our product candidates, some of which are currently in the early stages of development, will require significant additional development and pre-clinical and clinical testing prior to their commercialization. These steps and the process of obtaining required approvals and clearances can be costly and time-consuming. If our potential products are not successfully developed, cannot be proven to be safe and effective through clinical trials, or do not receive applicable regulatory approvals and clearances, or if there are delays in the process:

| | · | the commercialization of our products could be adversely affected; |

| | · | any competitive advantages of the products could be diminished; and |

| | · | revenues or collaborative milestones from the products could be reduced or delayed. |

Governmental and regulatory authorities may approve a product candidate for fewer indications or narrower circumstances than requested or may condition approval on the performance of post-marketing studies for a product candidate. Even if a product receives regulatory approval and clearance, it may later exhibit adverse side effects that limit or prevent its widespread use or that force us to withdraw the product from the market.

Any marketed product and its manufacturer, including us, will continue to be subject to strict regulation after approval. Results of post-marketing programs may limit or expand the further marketing of products. Unforeseen problems with an approved product or any violation of regulations could result in restrictions on the product, including its withdrawal from the market and possible civil actions.

In manufacturing our products we will be required to comply with applicable good manufacturing practices regulations, which include requirements relating to quality control and quality assurance, as well as the maintenance of records and documentation. We cannot comply with regulatory requirements, including applicable good manufacturing practice requirements, we may not be allowed to develop or market the product candidates. If we or our manufacturers fail to comply with applicable regulatory requirements at any stage during the regulatory process, we may be subject to sanctions, including fines, product recalls or seizures, injunctions, refusal of regulatory agencies to review pending market approval applications or supplements to approve applications, total or partial suspension of production, civil penalties, withdrawals of previously approved marketing applications and criminal prosecution.

Competitors may develop and market bio-pharmaceutical products that are less expensive, more effective or safer, making our products obsolete or uncompetitive.

We have three major competitors in China: Jielin Bio-Tech Production Co., Ltd., Qilu Animal Health Production Co., Ltd., and Zhongmu Industrial Joint Stock Co., Ltd. These companies and other potential competitors have greater product development capabilities and financial, scientific, marketing and human resources than we do. Technological competition from biopharmaceutical companies and biotechnology companies is intense and is expected to increase. Other companies have developed technologies that could be the basis for competitive products. Some of these products have an entirely different approach or means of accomplishing the desired curative effect than products we are developing. Alternative products may be developed that are more effective, work faster and are less costly than our products. Competitors may succeed in developing products earlier than us, obtaining approvals and clearances for such products more rapidly than us, or developing products that are more effective than ours. In addition, other forms of treatment may be competitive with our products. Over time, our technology or products may become obsolete or uncompetitive.

Our revenue will be materially and adversely affected if our products are unable to gain market acceptance.

Our products may not gain market acceptance in the agricultural community. The degree of market acceptance of any product depends on a number of factors, including establishment and demonstration of clinical efficacy and safety, cost-effectiveness, clinical advantages over alternative products, and marketing and distribution support for the products. Limited information regarding these factors is available in connection with our products or products that may compete with ours.

To directly market and distribute our bio-pharmaceutical products, we or our collaborators require a marketing and sales force with appropriate technical expertise and supporting distribution capabilities. We may not be able to further establish sales, marketing and distribution capabilities or enter into arrangements with third parties on acceptable terms. If we or our partners cannot successfully market and sell our products, our ability to generate revenue will be limited.

Our operations and the use of our products could subject us to damages relating to injuries or accidental contamination and thus reduce our earnings or increase our losses.

Our research and development processes involve the controlled use of hazardous materials. We are subject to national, provincial and local laws and regulations governing the use, manufacture, storage, handling and disposal of such materials and waste products. The risk of accidental contamination or injury from handling and disposing of such materials cannot be completely eliminated. In the event of an accident involving hazardous materials, we could be held liable for resulting damages. We are not insured with respect to this liability. Such liability could exceed our resources. In the future we could incur significant costs to comply with environmental laws and regulations.

If we were sued for product liability, we could face substantial liabilities that may exceed our resources.

We may be held liable if any product we develop, or any product which is made using our technologies, causes injury or is found unsuitable during product testing, manufacturing, marketing, sale or use. These risks are inherent in the development of agricultural and bio-pharmaceutical products. We currently do not have product liability insurance. If we cannot obtain sufficient insurance coverage at an acceptable cost or otherwise protect against potential product liability claims, the commercialization of products that we develop may be prevented or inhibited. If we are sued for any injury caused by our products, our liability could exceed our total assets, whether or not we are successful.

We have no business liability or disruption insurance coverage and therefore we are susceptible to catastrophic or other events that may disrupt our business.

The insurance industry in China is still at an early stage of development. Insurance companies in China offer limited business insurance products. We do not have any business liability or disruption insurance coverage for our operations in China. Any business disruption, litigation or natural disaster may result in our incurring substantial costs and the diversion of our resources.

We will be unsuccessful if we fail to attract and retain qualified personnel.

We depend on a core management and scientific team. The loss of any of these individuals could prevent us from achieving our business objective of commercializing our product candidates. Our future success will depend in large part on our continued ability to attract and retain other highly qualified scientific, technical and management personnel, as well as personnel with expertise in clinical testing and government regulation. We face competition for personnel from other companies, universities, public and private research institutions, government entities and other organizations. If our recruitment and retention efforts are unsuccessful, our business operations could suffer.

Downturn in the global economy may slow domestic growth in China, which in turn may affect our business.

Due to the global downturn in the financial markets, China may not be able to maintain its recent growth rates mainly due to the lack of demand of exports to countries that are in recessions. Although we do not presently export any of our products, our earnings may become unstable if China’s domestic growth slows significantly and the demand for meats and poultry declines.

Risks Related to Our Corporate Structure

Chinese laws and regulations governing our businesses and the validity of certain of our contractual arrangements are uncertain. If we are found to be in violation, we could be subject to sanctions. In addition, changes in such Chinese laws and regulations may materially and adversely affect our business.

There are substantial uncertainties regarding the interpretation and application of Chinese laws and regulations, including, but not limited to, the laws and regulations governing our business, or the enforcement and performance of our contractual arrangements with our affiliated Chinese entity, Xian Tianxing, and its stockholders. We are considered a foreign person or foreign invested enterprise under Chinese law. As a result, we are subject to Chinese law limitations on foreign ownership of Chinese companies. These laws and regulations are relatively new and may be subject to change, and their official interpretation and enforcement may involve substantial uncertainty. The effectiveness of newly enacted laws, regulations or amendments may be delayed, resulting in detrimental reliance by foreign investors. New laws and regulations that affect existing and proposed future businesses may also be applied retroactively.

The Chinese government has broad discretion in dealing with violations of laws and regulations, including levying fines, revoking business and other licenses and requiring actions necessary for compliance. In particular, licenses and permits issued or granted to us by relevant governmental bodies may be revoked at a later time by higher regulatory bodies. We cannot predict the effect of the interpretation of existing or new Chinese laws or regulations on our businesses. We cannot assure you that our current ownership and operating structure would not be found in violation of any current or future Chinese laws or regulations. As a result, we may be subject to sanctions, including fines, and could be required to restructure our operations or cease to provide certain services. Any of these or similar actions could significantly disrupt our business operations or restrict us from conducting a substantial portion of our business operations, which could materially and adversely affect our business, financial condition and results of operations.

We may be adversely affected by complexity, uncertainties and changes in Chinese regulation of bio-pharmaceutical business and companies, including limitations on our ability to own key assets.

The Chinese government regulates the bio-pharmaceutical industry including foreign ownership of, and the licensing and permit requirements pertaining to, companies in the bio-pharmaceutical industry. These laws and regulations are relatively new and evolving, and their interpretation and enforcement involve significant uncertainty. As a result, in certain circumstances it may be difficult to determine what actions or omissions may be deemed to be a violation of applicable laws and regulations. Issues, risks and uncertainties relating to Chinese government regulation of the bio-pharmaceutical industry include the following:

| | · | we only have contractual control over Xian Tianxing. We do not own it due to the restriction of foreign investment in Chinese businesses; and |

| | · | uncertainties relating to the regulation of the bio-pharmaceutical business in China, including evolving licensing practices, means that permits, licenses or operations at our company may be subject to challenge. This may disrupt our business, or subject us to sanctions, requirements to increase capital or other conditions or enforcement, or compromise enforceability of related contractual arrangements, or have other harmful effects on us. |

The interpretation and application of existing Chinese laws, regulations and policies and possible new laws, regulations or policies have created substantial uncertainties regarding the legality of existing and future foreign investments in, and the businesses and activities of, bio-pharmaceutical businesses in China, including our business.

In order to comply with Chinese laws limiting foreign ownership of Chinese companies, we conduct our bio-pharmaceutical business through Xian Tianxing by means of contractual arrangements. If the Chinese government determines that these contractual arrangements do not comply with applicable regulations, our business could be adversely affected.

The Chinese government restricts foreign investment in bio-pharmaceutical businesses in China. Accordingly, we operate our business in China through Xian Tianxing. Xian Tianxing holds the licenses and approvals necessary to operate our bio-pharmaceutical business in China. We have contractual arrangements with Xian Tianxing and its stockholders that allow us to substantially control Xian Tianxing. We cannot assure you, however, that we will be able to enforce these contracts.

Although we believe we comply with current Chinese regulations, and have been advised by our PRC counsel that in their opinion, the structure for operating our business in China (including our corporate structure and contractual arrangements with Xian Tianxing) complies with all applicable PRC laws, rules and regulations, and does not violate, breach, contravene or otherwise conflict with any applicable PRC laws, rules or regulations, we cannot assure you that the Chinese government would agree that these operating arrangements comply with Chinese licensing, registration or other regulatory requirements, with existing policies or with requirements or policies that may be adopted in the future. If the Chinese government determines that we do not comply with applicable law, it could revoke our business and operating licenses, require us to discontinue or restrict our operations, restrict our right to collect revenues, require us to restructure our operations, impose additional conditions or requirements with which we may not be able to comply, impose restrictions on our business operations or on our customers, or take other regulatory or enforcement actions against us that could be harmful to our business.

Our contractual arrangements with Xian Tianxing and its stockholders may not be as effective in providing control over it as direct ownership.

Since Chinese law limits foreign equity ownership in bio-pharmaceutical companies in China, We control Xian Tiaxing through contractual arrangements. We have no equity ownership interest in Xian Tianxing and rely on contractual arrangements to control and operate Xian Tianxing. These contractual arrangements may not be as effective in providing control over Xian Tianxing as direct ownership. For example, Xian Tianxing could fail to take actions required for our business despite its contractual obligation to do so. If Xian Tianxing fails to perform under their agreements with us, we may have to rely on legal remedies under Chinese law, which may not be effective. In addition, we cannot assure you that either of Xian Tianxing’s stockholders will act in our best interests.

Because we rely on the consulting services agreement with Xian Tianxing for our revenue, the termination of this agreement will severely and detrimentally affect our continuing business viability under our current corporate structure.

We are a holding company and do not have any assets or conduct any business operations other than the contractual arrangements between Sida and Xian Tianxing. As a result, we currently rely entirely for our revenues on dividends payments from Sida after it receives payments from Xian Tianxing pursuant to the consulting services agreement which forms a part of the contractual arrangements between Sida and Xian Tianxing. The consulting services agreement may be terminated by written notice of Sida or Xian Tianxing in the event that: (a) one party causes a material breach of the agreement, provided that if the breach does not relate to a financial obligation of the breaching party, that party may attempt to remedy the breach within 14 days following the receipt of the written notice; (b) one party becomes bankrupt, insolvent, is the subject of proceedings or arrangements for liquidation or dissolution, ceases to carry on business, or becomes unable to pay its debts as they become due; (c) Sida terminates its operations; (d) Xian Tianxing’s business license or any other license or approval for its business operations is terminated, cancelled or revoked; or (e) circumstances arise which would materially and adversely affect the performance or the objectives of the agreement. Additionally, Sida may terminate the consulting services agreement without cause.

Because neither we nor our direct and indirect subsidiaries own equity interests of Xian Tianxing, the termination of the consulting services agreement would sever our ability to continue receiving payments from Xian Tianxing under our current holding company structure. While we are currently not aware of any event or reason that may cause the consulting services agreement to terminate, we cannot assure you that such an event or reason will not occur in the future. In the event that the consulting services agreement is terminated, this may have a severe and detrimental effect on our continuing business viability under our current corporate structure, which in turn may affect the value of your investment.

Members of Xian Tianxing’s management have potential conflicts of interest with us, which may adversely affect our business and your ability for recourse.

Weibing Lu, our Chief Executive Officer, is also the Chief Financial Officer and Chairman of the Board of Directors of Xian Tianxing. Mr. Wei Wen, who is Xian Tianxing’s Vice-General Manager and Director, is a member of Skystar’s board of directors. Conflicts of interests between their respective duties to our company and Xian Tianxing may arise. As our directors and executive officer (in the case of Mr. Lu), they have a duty of loyalty and care to us under U.S. and Cayman Islands law when there are any potential conflicts of interests between our company and Xian Tianxing. We cannot assure you, however, that when conflicts of interest arise, every one of them will act completely in our interests or that conflicts of interests will be resolved in our favor. For example, they may determine that it is in Xian Tianxing’s interests to sever the contractual arrangements with Sida, irrespective of the effect such action may have on us. In addition, any one of them could violate his or her legal duties by diverting business opportunities from us to others, thereby affecting the amount of payment Xian Tianxing is obligated to remit to us under the consulting services agreement.

Our board of directors is comprised of a majority of independent directors (including two based in the United States). These independent directors may be in a position to deter and counteract the actions of our officers or non-independent directors that are against our interests, as the independent directors do not have any position with, or interests in, our affiliate entities, and should therefore not have any conflicts of interests such as those potentially of our officers and directors who are management members of Xian Tianxing. Additionally, the independent directors have fiduciary duties to act in our best interests, and failure on their part to do so may subject them to personal liabilities for breach of such duties. We cannot, however, give any assurance as to how the independent directors will act. Further, if we or the independent directors cannot resolve any conflicts of interest between us and those of our officers and directors who are management members of Xian Tianxing, we would have to rely on legal proceedings, which could result in the disruption of our business.

In the event that you believe that your rights have been infringed under the securities laws or otherwise as a result of any one of the circumstances described above, it may be difficult or impossible for you to bring an action against Xian Tianxing or our officers or directors who are members of its management, the majority of whom reside within China. Even if you are successful in bringing an action, the laws of China may render you unable to enforce a judgment against the assets of Xian Tianxing and its management, all of which are located in China.

Risks Related to Doing Business in China

Adverse changes in economic and political policies of the Chinese government could have a material adverse effect on the overall economic growth of China, which could adversely affect our business.

Substantially all of our business operations are conducted in China. Accordingly, our results of operations, financial condition and prospects are subject to a significant degree to economic, political and legal developments in China. China’s economy differs from the economies of most developed countries in many respects, including with respect to the amount of government involvement, level of development, growth rate, control of foreign exchange and allocation of resources. While the Chinese economy has experienced significant growth in the past 20 years, growth has been uneven across different regions and among various economic sectors of China. The Chinese government has implemented various measures to encourage economic development and guide the allocation of resources. Some of these measures benefit the overall Chinese economy, but may also have a negative effect on us. For example, our financial condition and results of operations may be adversely affected by government control over capital investments or changes in tax regulations that are applicable to us. Since early 2004, the Chinese government has implemented certain measures to control the pace of economic growth. Such measures may cause a decrease in the level of economic activity in China, which in turn could adversely affect our results of operations and financial condition.

If Chinese law were to phase out the preferential tax benefits currently being extended to foreign invested enterprises and “new or high-technology enterprises” located in a high-tech zone, we would have to pay more taxes, which could have a material and adverse effect on our financial condition and results of operations.

Under Chinese laws and regulations, a foreign invested enterprise may enjoy preferential tax benefits if it is registered in a high-tech zone and also qualifies as “new or high-technology enterprise”. As a foreign invested enterprise as well as a certified “new or high-technology enterprise” located in a high-tech zone in Xian, we have been approved as a new technology enterprise and under Chinese Income Tax Laws and are entitled to a preferential tax rate of 15%. If Chinese law were to phase out preferential tax benefits currently granted to “new or high-technology enterprises”, we would be subject to the standard statutory tax rate, which currently is 25%, and we would be unable to obtain business tax refunds for our provision of technology consulting services. Loss of these preferential tax treatments could have a material and adverse effect on our financial condition and results of operations.

Xian Tianxing is subject to restrictions on making payments to us.

We are a holding company incorporated in Nevada and do not have any assets or conduct any business operations other than our indirect investments in our affiliated entity in China, Xian Tianxing. As a result of our holding company structure, we rely entirely on payments from Xian Tianxing under our contractual arrangements. The Chinese government also imposes controls on the conversion of the Chinese currency, Renminbi, into foreign currencies and the remittance of currencies out of China. We may experience difficulties in completing the administrative procedures necessary to obtain and remit foreign currency. See “Government control of currency conversion may affect the value of your investment.” Furthermore, if our affiliated entity in China incurs debt on their own in the future, the instruments governing the debt may restrict their ability to make payments. If we are unable to receive all of the revenues from our operations through these contractual or dividend arrangements, we may be unable to pay dividends on our ordinary shares.

Uncertainties with respect to the Chinese legal system could adversely affect us.

We conduct our business primarily through our affiliated Chinese entity, Xian Tianxing. Our operations in China are governed by Chinese laws and regulations. We are generally subject to laws and regulations applicable to foreign investments in China and, in particular, laws applicable to wholly foreign-owned enterprises. The Chinese legal system is based on written statutes. Prior court decisions may be cited for reference but have limited precedential value.

Since 1979, Chinese legislation and regulations have significantly enhanced the protections afforded to various forms of foreign investments in China. However, China has not developed a fully integrated legal system and recently enacted laws and regulations may not sufficiently cover all aspects of economic activities in China. In particular, because these laws and regulations are relatively new, and because of the limited volume of published decisions and their nonbinding nature, the interpretation and enforcement of these laws and regulations involve uncertainties. In addition, the Chinese legal system is based in part on government policies and internal rules (some of which are not published on a timely basis or at all) that may have a retroactive effect. As a result, we may not be aware of our violation of these policies and rules until some time after the violation. In addition, any litigation in China may be protracted and result in substantial costs and diversion of resources and management attention.

You may experience difficulties in effecting service of legal process, enforcing foreign judgments or bringing original actions in China based on United States or other foreign laws against us, our management or the experts named in this report.

We are a holding company and do not have any assets or conduct any business operations other than the contractual arrangements between Sida and Xian Tianxing. In addition, all of Xian Tianxing’s assets are located in, and other than our chief financial officer, all of our other senior executive officers reside within, China. As a result, it may not be possible to effect service of process within the United States or elsewhere outside China as the majority of senior executive officers and directors do not reside in the United States, including with respect to matters arising under U.S. federal securities laws or applicable state securities laws. Moreover, our Chinese counsel has advised us that China does not have treaties with the United States or many other countries providing for the reciprocal recognition and enforcement of judgment of courts. As a result, our public shareholders may have substantial difficulty in protecting their interests through actions against our management or directors than would shareholders of a corporation with assets and a majority of its management members located in the United States.

Governmental control of currency conversion may affect the value of your investment.