UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant x | |||

Filed by a Party other than the Registrant o | |||

| Check the appropriate box: | |||

| o | Preliminary Proxy Statement | ||

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

| x | Definitive Proxy Statement | ||

| o | Definitive Additional Materials | ||

| o | Soliciting Material Pursuant to §240.14a-12 | ||

| (Name of Registrant as Specified In Its Charter) | |||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | |||

| Payment of Filing Fee (Check the appropriate box): | |||

| x | No fee required. | ||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

| (1) | Title of each class of securities to which transaction applies: | ||

| (2) | Aggregate number of securities to which transaction applies: | ||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

| (4) | Proposed maximum aggregate value of transaction: | ||

| (5) | Total fee paid: | ||

| o | Fee paid previously with preliminary materials. | ||

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||

| (1) | Amount Previously Paid: | ||

| (2) | Form, Schedule or Registration Statement No.: | ||

| (3) | Filing Party: | ||

| (4) | Date Filed: | ||

Dear Stockholder:

This year’s annual meeting of stockholders will be held on June 14, 2013, at 9:00 a.m. local time, at 10850 Gold Center Dr. Suite 250, Rancho Cordova, CA, 95670. You are cordially invited to attend.

The Notice of Annual Meeting of Stockholders and a Proxy Statement, which describe the formal business to be conducted at the meeting, follow this letter.

After reading the Proxy Statement, please promptly mark, sign and return the enclosed proxy card in the postage-paid envelope to assure that your shares will be represented. Your shares cannot be voted unless you date, sign, and return the enclosed proxy card or attend the annual meeting in person. Regardless of the number of shares you own, your careful consideration of, and vote on, the matters before our stockholders are important.

A copy of Internet Patents Corporation’s (“IPC”) Annual Report to Stockholders is also enclosed for your information. At the annual meeting we will review IPC’s activities over the past year and our plans for the future. The Board of Directors and management look forward to seeing you at the annual meeting.

Very truly yours, | ||

| /s/ Hussein A. Enan | ||

| Hussein A. Enan | ||

Chairman of the Board and Chief Executive Officer |

TO THE STOCKHOLDERS:

Please take notice that the annual meeting of the stockholders of Internet Patents Corporation, a Delaware corporation (“IPC” or the “Company”), will be held on June 14, 2013, at 9:00 am local time, at 10850 Gold Center Dr., Suite 250, Rancho Cordova, CA, 95670 for the following purposes:

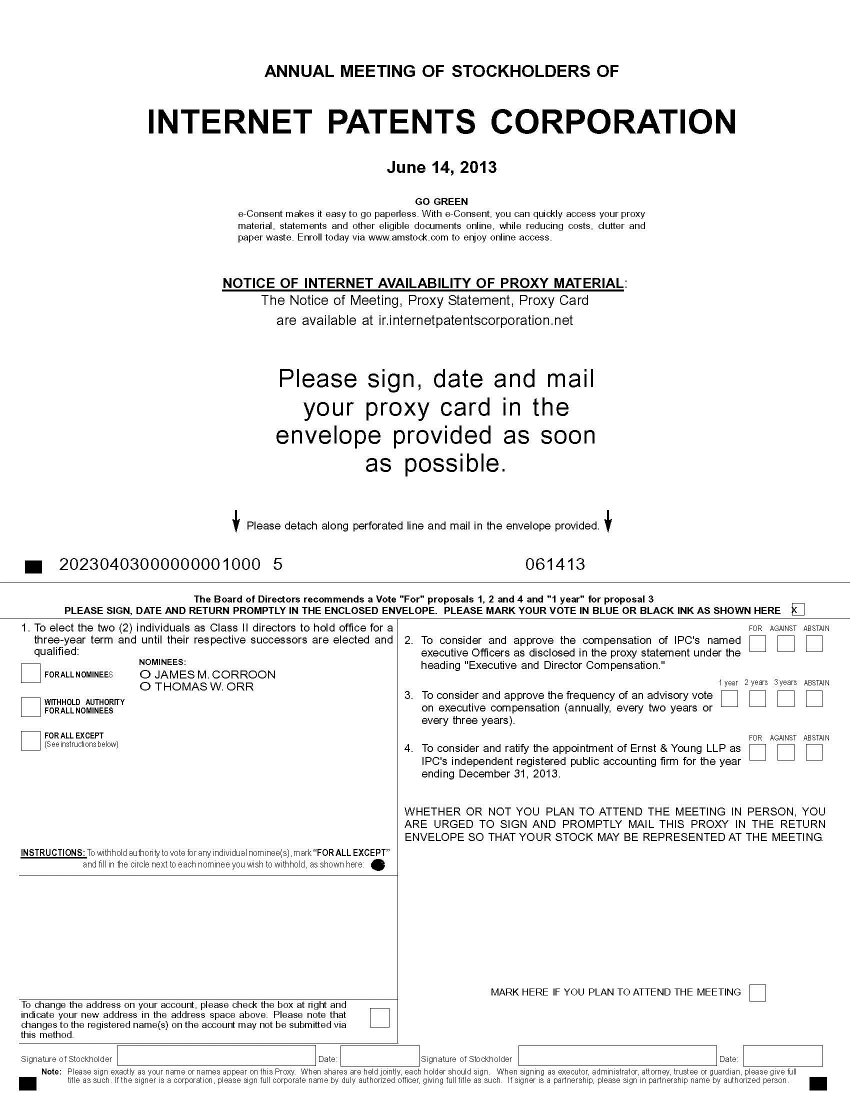

| 1. | To elect two Class II directors to hold office for three year terms and until their successors are elected and qualified; |

| 2. | Holding an advisory vote on executive compensation; |

| 3. | Holding an advisory vote on the frequency with which an advisory vote on executive compensation should be held; |

| 4. | To consider and ratify the appointment of Ernst & Young LLP as IPC’s independent registered public accounting firm for the year ending December 31, 2013; and |

| 5. | To transact such other business as may properly be considered at the annual meeting. |

Stockholders of record at the close of business on April 22, 2013 are entitled to notice of, and to vote at, this meeting and any adjournment or postponement. For ten days prior to the meeting, a complete list of stockholders entitled to vote at the meeting will be available for examination by any stockholder, for any purpose relating to the meeting, during ordinary business hours at IPC’s principal offices located at 10850 Gold Center Dr., Suite 250, Rancho Cordova, California 95670.

By Order of the Board of Directors, | |

| /s/ L. Eric Loewe | |

| L. Eric Loewe | |

Senior Vice President, Secretary and General Counsel |

Rancho Cordova, California

May 3, 2013

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

THE PROXY STATEMENT AND ANNUAL REPORT ON FORM 10-K TO STOCKHOLDERS ARE AVAILABLE

AT:http://ir.internetpatentscorporation.net

PROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERS

The accompanying proxy is solicited by the Board of Directors of Internet Patents Corporation, a Delaware corporation (“IPC” or the “Company”), for use at its annual meeting of stockholders to be held on June 14, 2013, or any adjournment or postponement thereof, for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders. The date of this Proxy Statement is May 3, 2013, the approximate date on which this Proxy Statement and the accompanying form of proxy were first sent or given to stockholders.

SOLICITATION AND VOTING OF PROXIES

The cost of soliciting proxies will be borne by IPC. In addition to soliciting stockholders by mail, IPC will request banks and brokers, and other custodians, nominees and fiduciaries, to solicit their customers who have stock of IPC registered in the names of such persons and will reimburse them for their reasonable, out-of-pocket costs. IPC may use the services of its officers, directors and others to solicit proxies, personally or by telephone, without additional compensation. In addition, IPC has retained American Stock Transfer & Trust Co., a registrar and transfer agent firm, for assistance in connection with the annual meeting at no additional cost except for reasonable out-of-pocket expenses.

On April 22, 2013, there were 7,751,952shares of IPC’s common stock outstanding, all of which are entitled to vote with respect to all matters to be acted upon at the annual meeting. Each stockholder of record as of that date is entitled to one vote for each share of Common Stock held by him or her. IPC’s bylaws provide that a majority of all of the shares of the stock entitled to vote, whether present in person or represented by proxy, shall constitute a quorum for the transaction of business at the meeting. Votes for and against, abstentions and “broker non-votes” will each be counted as present for purposes of determining the presence of a quorum.

All valid proxies received before the meeting will be exercised. All shares represented by a proxy will be voted, and where a stockholder specifies by means of his or her proxy a choice with respect to any matter to be acted upon, the shares will be voted in accordance with that specification. If no choice is indicated on the proxy, the shares will be voted as recommended by our Board of Directors. A stockholder giving a proxy has the power to revoke his or her proxy at any time before the time it is exercised by delivering to the Secretary of IPC a written instrument revoking the proxy or a duly executed proxy with a later date, or by attending the meeting and voting in person.

If a broker does not receive instructions from the beneficial owner of shares held in street name for certain types of proposals it must indicate on the proxy that it does not have authority to vote such shares (a “broker non-vote”) as to such proposals. As a result of recent changes to how brokers may vote your stock, please note that if your broker does not receive instructions from you, your broker will not be able to vote your shares in the election of directors. See each of the proposals set forth herein for additional information regarding how broker non-votes will affect the outcome of each proposal. If your shares are held in street name, we strongly encourage you to provide your broker with voting instructions and exercise your right to vote for these important proposals.

1

INFORMATION ABOUT INTERNET PATENTS CORPORATION

General Corporate Governance Matters

Available Information

You may obtain free copies of our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K and amendments to those reports, as well as other Corporate Governance Materials on our website at http://ir.internetpatentscorporation.net, or by contacting our corporate office by calling (916) 853-1529, or by sending an e-mail message to info@internetpatentscorporation.net.

We electronically file our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K with the Securities and Exchange Commission (“SEC”) pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934. Any materials we file with the SEC are accessible to the public at the SEC’s Public Reference Room at 450 Fifth Street, NW, Washington, DC 20549. The public may also utilize the SEC’s Internet website, which contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The address of the SEC website is http://www.sec.gov.

Results of 2013 Annual Meeting

We will announce preliminary voting results at the annual meeting and will publish final results in a Current Report on Form 8-K that we expect to file with the SEC within four business days after the 2013 annual meeting. If final voting results are not available to us in time to file a Form 8-K with the SEC within four business days after the 2013 annual meeting, we intend to file a Form 8-K to disclose preliminary voting results and, within four business days after the final results are known, we will file an additional Form 8-K with the SEC to disclose the final voting results.

Related Person Transaction Review Policies

The Audit Committee is provided authority under its charter to review and approve any related-party transactions, after reviewing each such transaction for potential conflicts of interests and other improprieties. There were no related-party transactions in the year ended December 31, 2012.

Board Structure and Role

By resolution adopted by the Company’s Board of Directors on September 26, 2012, the size of the Company’s board was reduced and fixed at four effective as of November 30, 2012, with one Class I director, two Class II directors and one Class III director.

Mr. Enan serves as Chief Executive Officer and Chairman of the Board of Directors. He is the founder of the Company and owns approximately 24.9% of the Company's stock. Beginning December 21, 2011, the Company began a new business in which it expects to license and otherwise enforce its portfolio of ecommerce and online insurance distribution patents. At this stage of development of this new business, the Board believes that the Company is best served by a Chairman who is involved with the Company on a full-time basis and is therefore able to bring great depth of knowledge about the Company to this role. The Board does not have a designated lead independent director.

The Board of Directors and its committees have an active role in overseeing the management of the Company’s risks. At each regularly scheduled board meeting, management presents to the Board of Directors relevant information regarding the risks associated with our current operations. In addition, each of the committees considers the risks within its areas of responsibility. The Board and the Audit Committee each receive regular reports on the status of the Company's internal controls and each reviews key operational risks periodically. The Audit Committee regularly meets in executive session without the executive officers. The Compensation Committee and the Board review senior executive officer compensation arrangements and the Company’s compensation policies and practices for its non-executive employees and analyze the compensation incentives, potential risks, and factors to mitigate such potential risks. The Compensation Committee and the Board have determined that the Company’s executive compensation program, as well as its compensation policies and practices for its non-executive employees, do not encourage either its senior executives or its non-executive employees to take unnecessary and excessive risks that threaten the value of the Company. Based on this review, the Compensation Committee and the Board concluded that the Company’s programs, policies and practices do not create risks that are reasonably likely to have a material adverse effect on the Company

2

Board Meetings and Committees

During the year ended December 31, 2012, the Board of Directors of IPC held five meetings. During that period, the Audit Committee of the Board held five meetings, the Compensation Committee of the Board held two meetings, and the Nominating Committee of the Board held one meeting. All directors attended or participated in more than 75% of the total number of meetings of the Board and any of the committees of the Board on which such director served during that period.

Audit Committee. The current members of the Audit Committee are Messrs. Orr, Corroon and Chookaszian. Mr. Orr is chairman of the committee. The Board of Directors has determined that each of the members of the Audit Committee is independent for purposes of the Nasdaq Marketplace Rules as they apply to audit committee members. The Board of Directors has also determined that Mr. Orr is an “audit committee financial expert,” as defined in the rules of the SEC.

The functions of the Audit Committee include overseeing the quality of our financial reports and other financial information, retention of the independent registered public accounting firm, reviewing and approving the planned scope, proposed fee arrangements and results of IPC’s annual audit, reviewing our critical accounting policies and the adequacy of our accounting and financial controls, and reviewing the independence of IPC’s independent registered public accounting firm.

Compensation Committee. The current members of the Compensation Committee are Messrs. Chookaszian, Corroon and Orr. Mr. Chookaszian is chairman of the committee. The Compensation Committee reviews and determines the salary and bonus criteria of and stock option grants to all executive officers. The Board of Directors has determined that all members of the Compensation Committee are independent for purposes of the Nasdaq Marketplace Rules.

For additional information about the Compensation Committee, see “Executive and Director Compensation” below.

Nominating Committee. The current members of the Nominating Committee are Messrs. Corroon, Chookaszian and Orr. The Board of Directors has determined that all members of the Nominating Committee are independent for purposes of the Nasdaq Marketplace Rules. Mr. Corroon currently is chairman of the committee.

The functions of the Nominating Committee include selecting, evaluating and recommending to the Board of Directors qualified candidates for election or appointment to the Board of Directors, and recommending corporate governance principles, codes of conduct and compliance mechanisms applicable to IPC.

3

Director Nominations

The Nominating Committee is responsible for the selection, and recommendation to the Board of Directors, of nominees for election as director. When considering the nomination of directors for election at an annual meeting, the Nominating Committee reviews the needs of the Board of Directors for various skills, background, experience and expected contributions and the qualification standards established from time to time by the Nominating Committee, and considers nominations in light of those needs. When reviewing potential nominees, including incumbents, the Nominating Committee also considers the candidate’s relevant background, experience and skills and expected contributions to the Board of Directors. The Nominating Committee evaluates its selection criteria and evaluation process periodically, and may in the future include additional qualifications, such as the diversity of backgrounds of candidates. The Nominating Committee also seeks appropriate input from the Chief Executive Officer from time to time in assessing the needs of the Board of Directors for relevant background, experience and skills of its members.

The Nominating Committee’s goal is to assemble a Board of Directors that brings to IPC a diversity of experience at policy-making levels in business and technology, and in areas that are relevant to IPC’s activities. Directors should possess the highest personal and professional ethics, integrity and values and be committed to representing the long-term interests of our stockholders. They must have an inquisitive and objective outlook and mature judgment. They must also have experience in positions with a high degree of responsibility and be leaders in the companies or institutions with which they are and have been affiliated. Director candidates must have sufficient time available in the judgment of the Nominating Committee to perform all Board and committee responsibilities that will be expected of them. Members of the Board of Directors are expected to rigorously prepare for, attend and participate in all meetings of the Board of Directors and applicable committees. Other than the foregoing, there are no specific minimum criteria for director nominees, although the Nominating Committee believes that it is preferable that at least one member of the Board of Directors should meet the criteria for an “audit committee financial expert” as defined by SEC rules. Under applicable Nasdaq listing requirements, at least a majority of the members of the Board of Directors must meet the definition of “independent director” set forth in such requirements. The Nominating Committee also believes it appropriate for one or more key members of IPC’s management, including the Chief Executive Officer, to serve on the Board of Directors.

The Nominating Committee will consider candidates for director proposed by directors or management, and will evaluate any such candidates against the criteria and pursuant to the policies and procedures set forth above. If the Nominating Committee believes that the Board of Directors requires additional candidates for nomination, the Nominating Committee may engage, as appropriate, a third party search firm to assist in identifying qualified candidates. All incumbent directors and nominees will be required to submit a completed directors’ and officers’ questionnaire as part of the nominating process. The process may also include interviews and additional background and reference checks for non-incumbent nominees, at the discretion of the Nominating Committee.

The Nominating Committee will also consider candidates for director recommended by a stockholder, provided that any such recommendation is sent in writing to General Counsel, Internet Patents Corporation, 10850 Gold Center Dr., Suite 250, Rancho Cordova, CA 95670 at least 120 days prior to the anniversary of the date definitive proxy materials were mailed to stockholders in connection with the prior year’s annual meeting of stockholders and contains the following information:

| · | the candidate’s name, age, contact information and present principal occupation or employment; and |

| · | a description of the candidate’s qualifications, skills, background and business experience during at least the last five years, including his or her principal occupation and employment and the name and principal business of any company or other organization where the candidate has been employed or has served as a director. |

The Nominating Committee will evaluate any candidates recommended by stockholders against the same criteria and pursuant to the same policies and procedures applicable to the evaluation of candidates proposed by directors or management.

4

In addition, stockholders may make direct nominations of directors for election at an annual meeting, provided the advance notice requirements set forth in our Bylaws have been met. Under our Bylaws, written notice of any such nomination, including certain information and representations specified in the Bylaws, must be delivered to our principal executive offices, addressed to the General Counsel, at least 120 days prior to the anniversary of the date definitive proxy materials were mailed to stockholders in connection with the prior year’s annual meeting of stockholders, except that if no annual meeting was held in the previous year or the date of the annual meeting has been advanced by more than 30 days from the date contemplated at the time of the previous year’s proxy statement, such notice must be received not later than the close of business on the tenth day following the day on which the public announcement of the date of such meeting is first made.

Stockholder Communications with Directors; Director Attendance at Annual Meetings

Stockholders may communicate with any and all members of our Board of Directors by transmitting correspondence by mail or facsimile addressed to one or more directors by name (or to the Chairman, for a communication addressed to the entire Board) at the following address and phone number:

Name of the Director(s)

c/o Corporate Secretary

Internet Patents Corporation

10850 Gold Center Dr., Suite 250

Rancho Cordova, CA 95670

916-853-1529

Communications from our stockholders received as indicated above will be forwarded to the indicated director or directors unless the communication is primarily commercial in nature or relates to an improper or irrelevant topic.

We do not have a policy regarding directors’ attendance at annual meetings. All directors attended the 2012 Annual Meeting.

Committee Charters and Other Corporate Governance Materials

The Board has adopted a Code of Business Conduct and Ethics that applies to all of our employees and officers and members of the Board of Directors. A copy of the Code of Business Conduct and Ethics is available on the Company’s website at http://ir.internetpatentscorporation.net.

The Board has also adopted a written charter for each of the Audit Committee, Compensation Committee and Nominating Committee. Each charter is available on the Company’s website at http://ir.internetpatentscorporation.net.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires IPC’s executive officers, directors and persons who beneficially own more than 10% of IPC’s common stock to file initial reports of ownership and reports of changes in ownership with the SEC. Such persons are required by SEC regulations to furnish IPC with copies of all Section 16(a) forms filed by such persons. Based on IPC’s review of reports furnished to IPC and representations from certain reporting persons, IPC believes that all reports required under Section 16(a) during the year ended December 31, 2012 were timely filed.

5

EXECUTIVE AND DIRECTOR COMPENSATION

The Compensation Committee is authorized by the Board of Directors to review and approve annual performance objectives and goals relevant to compensation for the Chief Executive Officer and evaluate the performance of the Chief Executive Officer in light of these goals and objectives. In setting such objectives, the Compensation Committee is directed to consider the Company’s performance and relative stockholder return, the value of similar incentive awards to chief executive officers at comparable companies, and the awards given to the Company’s Chief Executive Officer in past years. The Compensation Committee is also directed to periodically review and advise the Board concerning both regional and industry wide compensation practices and trends in order to assess the adequacy and competitiveness of the Company’s compensation programs for the CEO, other executive officers and directors relative to comparable companies in the Company’s industry. Neither management nor the Compensation Committee engaged the services of a compensation consultant during the years ended December 31, 2012 and December 31, 2011.

Summary Compensation Information

The following table presents certain summary information concerning compensation paid or accrued by IPC for services rendered in all capacities during the years ended December 31, 2012 and December 31, 2011 for the Chief Executive Officer, the Senior Vice President, General Counsel and Secretary and the Chief Financial Officer and Chief Accounting Officer (the “Named Executive Officers”).

Executive officers other than the CEO are eligible to participate in the IPC Executive Retention and Severance Plan approved by the Board of Directors on June 14, 2004 and revised on December 22, 2008. Participants in the Plan are entitled to receive cash severance payments and health and medical benefits in the event their employment is terminated in connection with a change in control. IPC is not obligated to make any cash payments to these executives if their employment is terminated by us for cause or by the executive not for good reason. No severance or benefits are provided for any of the executive officers in the event of death or disability. A change in control does not affect the amount or timing of these cash severance payments.

Name and Principal Position | Year | Salary | Bonus | Option Awards(1) | All other Compensation(2) | Total | |||||||||||||||||

| Hussein A. Enan | 2012 | $ | 300,000 | $ | 100,000 | $ | — | $ | 8,001 | $ | 408,001 | ||||||||||||

| Chairman of the Board, Chief Executive Officer and former interim Chief Financial Officer(3) | 2011 | $ | 300,000 | $ | — | $ | 266,511 | $ | 11,266 | $ | 577,777 | ||||||||||||

| L. Eric Loewe | 2012 | $ | 218,360 | $ | 50,000 | $ | — | $ | 3,974 | $ | 272,334 | ||||||||||||

| Senior Vice President, Secretary and General Counsel | 2011 | $ | 218,360 | $ | 8,000 | $ | 134,956 | $ | 17,167 | $ | 378,483 | ||||||||||||

| Steven J. Yasuda | 2012 | $ | 198,045 | $ | 10,000 | $ | — | $ | 258,571 | $ | 466,616 | ||||||||||||

| Chief Financial Officer and Chief Accounting Officer | 2011 | $ | 169,753 | $ | 4,000 | $ | 86,943 | $ | 13,021 | $ | 273,717 | ||||||||||||

| (1) | Valuation based on the dollar amount of option grants recognized for reporting the aggregate fair value of the award computed in accordance with ASC 718 with respect to the 2011 year. As there were no outstanding and unvested options on December 31, 2011 and there were no options granted during 2012, the Company had no stock-based compensation in 2012. The assumptions used by IPC with respect to the valuation of option grants are set forth in “Internet Patents Corporation Consolidated Financial Statements—Notes to Financial Statements—Note 4—Share-Based Payments” in the IPC Annual Report on Form 10-K. | ||||||||||||||||||

| (2) | Represents employer contributions to IPC’s 401(k) plan and group term life benefits. For Mr. Yasuda, also includes a retention bonus of $255,000 awarded on June 30, 2012. | ||||||||||||||||||

| (3) | Mr. Enan served as interim Chief Financial Officer from October 7, 2011 through June 10, 2012. | ||||||||||||||||||

6

Outstanding Equity Awards at Fiscal Year-End

The following table summarizes the number of securities underlying outstanding option plan awards for each of the named executive officers at the fiscal year-end as of December 31, 2012.

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END TABLE

| Option Awards | ||||||||||||||

| Name | Number of Securities Underlying Options (#) Exercisable | Number of Securities Underlying Options (#) Unexercisable | Option Exercise Price ($) | Option Expiration Date | ||||||||||

| Hussein A. Enan | 16,006 | — | $ | 7.00 | 12/15/2015 | |||||||||

| 28,570 | — | $ | 7.70 | 12/15/2015 | ||||||||||

| L. Eric Loewe | 1,900 | — | $ | 5.25 | 3/30/2015 | |||||||||

| Steven J. Yasuda | — | — | $ | — | — | |||||||||

Director Compensation

The following table presents the compensation paid to each member of the Board of Directors during the year ended December 31, 2012:

DIRECTOR COMPENSATION TABLE

| Name | Fees Earned or Paid in Cash | Option Awards(2) | All other Compensation | Total | ||||||||||||

| Dennis H. Chookaszian | $ | 20,000 | $ | — | $ | — | $ | 20,000 | ||||||||

| James M. Corroon | $ | 20,000 | $ | — | $ | — | $ | 20,000 | ||||||||

Elisabeth DeMarse(1) | $ | 20,000 | $ | — | $ | — | $ | 20,000 | ||||||||

| Thomas W. Orr | $ | 30,000 | $ | — | $ | — | $ | 30,000 | ||||||||

Robert A. Puccinelli(1) | $ | 20,000 | $ | — | $ | — | $ | 20,000 | ||||||||

| (2) | Each non-employee director waived the right to receive an annual option award for 2012. |

Additional Information Regarding Director Compensation

Each non-employee director receives an annual cash retainer of $20,000 relating to the period from January 1 to December 31. Mr. Orr, as Chair of the Audit Committee, receives an additional cash retainer of $2,500 for each regularly scheduled Audit Committee meeting attended. In addition, the InsWeb/IPC Corporation 2008 Stock Option Plan grants each non-employee director an annual option grant to purchase 5,000 shares, with the date of grant being on or about July 1 of each year that they serve. These options are fully vested. In 2012, each non-employee director waived his/her right to receive the annual option grant for 2012. Directors are also reimbursed for their reasonable expenses incurred in connection with attending Board of Directors or Committee meetings.

7

Equity Compensation Plan Information

IPC currently maintains two equity compensation plans that provide for the issuance of IPC common stock to employees, officers, directors, independent contractors and consultants of IPC and its subsidiaries. These consist of the Internet Patents Corporation 2008 Stock Option Plan and the 1999 Employee Stock Purchase Plan, each of which have been approved by the stockholders. The following table sets forth information regarding outstanding options and shares reserved for future issuance under the foregoing plans as of December 31, 2012:

| Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) | Weighted average exercise price of outstanding options, warrants and rights(b) | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))(c) | ||||||

| Equity compensation plans approved by security holders | 231,000 | $ | 8.12 | 1,079,000 | |||||

| Equity compensation plans not approved by security holders | — | — | — | ||||||

Stock Ownership of Certain Beneficial Owners and Management

The following table sets forth, as of April 22, 2013, certain information with respect to the beneficial ownership of IPC’s common stock by (i) each stockholder known by IPC to be the beneficial owner of more than 5% of IPC’s common stock, (ii) each director of IPC, (iii) the executive officers of IPC, and (iv) all current directors and executive officers of IPC as a group.

Number of Shares Beneficially Owned | Percent of Common Stock Outstanding(2) | |||||||

| 5% Stockholders | ||||||||

| Osmium Capital Partners (3) | 1,111,392 | 14.3 | % | |||||

| Lusman Capital Management, LLC(4) | 550,000 | 7.1 | % | |||||

| Directors and Executive Officers | ||||||||

| Hussein A. Enan(5) | 1,940,231 | 24.9 | % | |||||

| James M. Corroon(6) | 66,105 | * | % | |||||

| Dennis H. Chookaszian(7) | 199,288 | 2.6 | % | |||||

| Thomas W. Orr(8) | 87,703 | 1.1 | % | |||||

| L. Eric Loewe(9) | 116,335 | 1.5 | % | |||||

| Steven J. Yasuda | 33,732 | * | % | |||||

Current directors and executive officers as a group (6 persons )(10) | 2,443,394 | 31.1 | % | |||||

*Less than one percent

| (1) | The persons named in the table above have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them, subject to community property laws where applicable and to the information contained in the footnotes to this table. The address of all officers and directors is c/o Internet Patents Corporation, 10850 Gold Center Drive, Suite 250, Rancho Cordova, CA 95670 |

8

| (2) | Percent of Common Stock Outstanding is calculated utilizing7,866,012which is the sum of the number of the Company's outstanding shares as of April 22, 2013, and the number of options held by the named beneficial owners, if any, that become exercisable within 60 days thereafter. |

| (3) | Based on information contained in a Schedule 13D/A No.1 filed by John H. Lewis, Osmium Partners, LLC (“Osmium Partners”), Osmium Capital, LP (“Fund I”), Osmium Capital II, LP (“Fund II”) and Osmium Spartan, LP (“Fund III,” together with Mr. Lewis, Osmium Partners, Fund I, Fund II and Fund III, the “Osmium Stockholders”) with the SEC on October 12, 2010. Osmium Partners, as the general partner of each of Fund I, Fund II and Fund III and may be deemed to beneficially own the 1,047,659 shares of common stock held by each of the funds and together with Mr. Lewis have shared voting and dispositive power over 1,047,659 shares of the Company’s common stock. Mr. Lewis has the sole power to vote and dispose of 63,733 shares of the Company’s common stock. The address for the Osmium Stockholders is 388 Market Street, Suite 920, San Francisco, California 94111. |

| (4) | Based on information contained in a Schedule 13G/A No. 1 filed by Joel Lusman and Lusman Capital Management, LLC (“Lusman Capital”) with the SEC on February 11, 2013. Joel Lusman and Lusman Capital have shared voting and dispositive power with respect to 550,000 shares of the Company’s common stock. The address for Joel Lusman and Lusman Capital is 717 Fifth Avenue, 14th Floor, New York, NY 10022. |

| (5) | Includes 41,250 shares held by Mr. Enan’s spouse. Also includes 44,576 shares subject to options exercisable within 60 days following April 22, 2013. The address for Mr. Enan is c/o Internet Patents Corporation, 10850 Gold Center Dr. Suite 250 Rancho Cordova, California 95670. |

| (6) | Includes 57,584 shares subject to options exercisable within 60 days following April 22, 2013. |

| (7) | Includes 416 shares held by Mr. Chookaszian’s spouse, which he disclaims beneficial ownership of. Also includes 5,000 shares subject to options exercisable within 60 days following April 22, 2013. |

| (8) | Includes 5,000 shares subject to options exercisable within 60 days following April 22, 2013. |

| (9) | Includes 1,900 shares subject to options exercisable within 60 days following April 22, 2013. |

| (10) | Includes 114,060 shares subject to options exercisable within 60 days following April 22, 2013. |

Executive Officers of Internet Patents Corporation

As of May 3, 2013, IPC’s executive officers were as follows:

| Name | Position With IPC | Age | |||||

| Hussein A. Enan | Chairman of the Board and Chief Executive Officer | 67 | |||||

| L. Eric Loewe | Senior Vice President, General Counsel and Secretary | 55 | |||||

| Steven J. Yasuda | Chief Financial Officer and Chief Accounting Officer | 45 |

9

Hussein A. Enan co-founded IPC in February 1995 and has served as its Chairman of the Board since its inception. Mr. Enan served as IPC’s Chief Executive Officer from February 1995 to June 2002 and was reinstated to that position in August 2004. From October 2011 through June 2012, Mr. Enan also served as the Company’s interim Chief Financial Officer. Mr. Enan also served as IPC’s President from May 1999 to June 2000. From March 1992 to November 1994, Mr. Enan was a general partner at E.W. Blanch, a reinsurance intermediary that merged with his own wholly owned company, Enan & Company, a reinsurance intermediary, in March 1992. Mr. Enan founded Enan & Company in February 1979. The fact that Mr. Enan is a founder of IPC, brings historic knowledge and continuity to the Board and is its largest stockholder led the board to conclude that he should serve as a director.

L. Eric Loewe joined IPC in October 1998 as Corporate Counsel, Legal and Regulatory, responsible for all regulatory compliance issues, and has served as Senior Vice President and General Counsel since September 2000 and as Secretary since July 2001. Mr. Loewe held various positions with the National Association of Independent Insurers (the “NAII”) from January 1980 to September 1998. As Senior Counsel for the NAII, Mr. Loewe was responsible for legislation and regulations affecting its 570 member companies. Mr. Loewe is a member of the Illinois and California bars.

Steven J. Yasuda joined IPC in December 1999 as Manager, Budget and Reporting and has been the Corporate Controller since September 2001. On September 2004, he was promoted to Vice President, Corporate Controller. On April 16, 2007, Mr. Yasuda took on the additional role of Chief Accounting Officer and in June 2012 was appointed as the Company’s Chief Financial Officer. Mr. Yasuda is responsible for all accounting and finance related functions of the Company. From 1997 to 1999, Mr. Yasuda worked in the operations accounting department of Electronic Arts. Mr. Yasuda has been licensed as a CPA since August 1994, but has an inactive status, as permitted by the California Board of Accountancy.

None of IPC’s executive officers have been involved in a legal proceeding described in Item 401 of Regulation S-K within the last ten years.

Directors of Internet Patents Corporation

IPC’s Board of Directors is as follows:

| Name | Position with IPC | Age | Director Since | |||||||

| Class I director whose term expires at the 2015 Annual Meeting of Stockholders: | ||||||||||

| Hussein A. Enan | Chairman of the Board | 67 | 1995 | |||||||

| Class II directors whose term expires at the 2013 Annual Meeting of Stockholders: | ||||||||||

James M. Corroon(1)(2)(3) | Vice Chairman of the Board | 73 | 1996 | |||||||

Thomas W. Orr(1)(2)(3) | Director | 79 | 2003 | |||||||

| Class III directors whose terms expire at the 2014 Annual Meeting of Stockholders: | ||||||||||

Dennis H. Chookaszian(1)(2)(3) | Director | 69 | 2003 |

| (1) | Member of the Audit Committee. |

| (2) | Member of the Compensation Committee. |

| (3) | Member of the Nominating Committee. |

10

James M. Corroon has been a director of IPC since August 1996 and has served as Vice Chairman of the Board since May 1999. Since September 2004, Mr. Corroon has served as Vice Chairman of Fort Point Insurance Services, Inc., an insurance brokerage firm. From July 1999 to December 2000, he was a full-time employee of IPC and a member of the senior management team. Mr. Corroon has been a director of Willis Corroon of California, an insurance services firm, since January 1996. From October 1966 to December 1995, Mr. Corroon held various management positions with Willis Corroon and its predecessor entity, Corroon & Black Corporation. The Board of Directors concluded that Mr. Corroon provides the Board of Directors with a valuable perspective gained from his long-term service as an executive officer and as a director.

Thomas W. Orr has been a director of IPC since January 2003. Mr. Orr was a partner in the accounting firm of Bregante and Company from January 1992 to June 2002. From 1987 to 1991, Mr. Orr was Chief Financial Officer of Scripps League Newspaper, Inc. Prior to 1987, Mr. Orr worked for the accounting firm of Arthur Young & Company (predecessor to Ernst & Young, LLP) from 1958 until he retired as an audit partner in 1986. He is a director of AeroCentury Corporation, an aircraft operating lessor and finance company. Mr. Orr’s extensive experience in accounting and financial reporting led the Board to conclude that he should serve as a director.

Dennis H. Chookaszian has been a director of IPC since April 2003. From November 1999 until he retired in February 2001, Mr. Chookaszian was Chairman and Chief Executive Officer of mPower Advisors, L.L.C., a financial advice provider focused on the online management of 401(k) plans. From September 1992 to February 1999, Mr. Chookaszian served as Chairman and Chief Executive Officer of the CNA insurance company, and prior to that held the positions of President and Chief Operating Officer (1990-1992) and Chief Financial Officer (1975-1990), respectively, of that company. Mr. Chookaszian serves on the boards of the Chicago Mercantile Exchange, Career Education Corporation, a postsecondary education provider, and AllScripts Healthcare Solutions, Inc., a provider of information and services to the healthcare industry. Mr. Chookaszian served as chairman of the Financial Accounting Standards Advisory Council from January 2007 to December 2011. Mr. Chookaszian’s experience as a director of other public companies, combined with his knowledge of financial reporting, led the Board to conclude that he should serve as a director.

The Board of Directors has determined that, other than Mr. Enan, each of the members of the Board is an independent director for purposes of the Nasdaq Marketplace Rules. None of IPC’s directors have been involved in a legal proceeding described in Item 401 of Regulation S-K within the last ten years.

REPORT OF THE AUDIT COMMITTEE

OF IPC

The current members of the Audit Committee are Mr. Orr, Mr. Corroon, and Mr. Chookaszian. The Audit Committee acts pursuant to a written charter that has been adopted by the Board of Directors.

The Audit Committee oversees the quality of IPC’s financial statements and financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for the financial statements and the reporting process, including the system of internal control. In fulfilling its oversight responsibilities, the Audit Committee reviewed and discussed the audited financial statements in the Annual Report for the period ending December 31, 2012 with management, including a discussion of the quality, not just the acceptability, of the accounting principles; the reasonableness of significant judgments; and the clarity of disclosures in the financial statements.

The Audit Committee reviewed with the independent registered public accounting firm, Ernst & Young LLP, who are responsible for expressing an opinion on the conformity, in all material respects, of those audited financial statements with United States generally accepted accounting principles, their judgments as to the quality, not just the acceptability, of the Company’s accounting principles and such other matters as are required to be discussed with the committee under generally accepted auditing standards including Statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1. AU Section 380) as adopted by the Public Company Accounting Oversight Board in Rule 3200T. In addition, the Audit Committee has discussed with the independent registered public accounting firm the auditors’ independence from management and the Company, including the matters in the written disclosures required by the Independence Standards Board No. 1 (Independence Discussions with Audit Committees ), and considered the compatibility of non-audit services with the auditors’ independence.

11

The Audit Committee discussed with the Company’s independent registered public accounting firm the overall scope and plans for their respective audits. The Audit Committee meets with the independent registered public accounting firm, with and without management present, to discuss the results of their examinations, their evaluations of the Company’s internal control, and the overall quality of the Company’s financial reporting.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors (and the board has approved) that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2012 filed with the SEC.

| AUDIT COMMITTEE | |

| Thomas W. Orr (Chair) | |

James M. Corroon Dennis Chookaszian |

INDEPENDENT AUDITOR FEE INFORMATION

The following table sets forth the aggregate fees billed to IPC for the years ended December 31, 2012 and 2011 by IPC’s principal accounting firm, Ernst & Young LLP:

| 2012 | 2011 | |||||||

| Audit Fees(1) | $ | 177,900 | $ | 535,000 | ||||

| Audit-Related Fees(2) | — | 140,000 | ||||||

| Tax Fees(3) | 134,200 | 291,000 | ||||||

| All Other Fees | — | 7,000 | ||||||

| $ | 312,100 | $ | 973,000 | |||||

| (1) | Audit fees consist of fees billed for services related to the audit of IPC’s consolidated financial statements (including required quarterly reviews) and accounting consultations. |

| (2) | Audit-related fees consist of fees billed for services related to assurance and related services that are reasonably related to the performance of the audit or review of the Company’s financial statements or that are traditionally performed by the independent registered public accounting firm. |

| (3) | Tax fees consist of fees billed for services related to tax return preparation, tax compliance, tax planning and tax advice. |

The Audit Committee considered the role of Ernst & Young LLP in providing non-audit services to IPC and has concluded that such services are compatible with Ernst & Young’s independence as IPC’s independent registered public accounting firm.

Pre-Approval Policies and Procedures

The Audit Committee has adopted a policy that requires advance approval of all audit, audit-related, tax services, and other services performed by the independent registered public accounting firm. The policy provides for pre-approval by the Audit Committee of specifically defined audit and non-audit services. Unless the specific service has been pre-approved with respect to that year, the Audit Committee must approve the permitted service before the independent registered public accounting firm is engaged to perform it. The Audit Committee has delegated to the chair of the Audit Committee the authority to approve permitted services, provided that the chair reports any decisions to the Audit Committee at its next scheduled meeting.

12

PROPOSAL NO. 1

ELECTION OF DIRECTORS

IPC has a classified Board of Directors that is divided into three classes. At each annual meeting of stockholders, directors are elected for a term of three years to succeed those directors whose terms expire at the annual meeting date. Currently, there are one Class I director, two Class II directors and one Class III director who shall each serve until the annual meeting of stockholders to be held in 2015, 2013 and 2014, respectively, and until their respective successors are duly elected and qualified.

The term of the current Class II directors shall expire on the date of the 2013 annual meeting. The Nominating Committee nominated Mr. Corroon and Mr. Orr, the current Class II directors, to serve as Class II directors for a three year term and until their successors are duly elected and qualified.

Vote Required and Board of Directors’ Recommendation

If a quorum is present, the nominees for the Class II directors receiving the highest number of votes will be elected as Class II directors. Abstentions and broker non-votes will not be counted as votes cast and therefore will have no effect on the election of directors.

The Board of Directors recommends a vote “FOR” the nominees named above.

13

PROPOSAL 2

ADVISORY VOTE ON EXECUTIVE COMPENSATION

IPC asks that you indicate your approval of the compensation of our named executive officers as disclosed in this proxy statement under the heading “Executive and Director Compensation.” We are providing this vote as required by Section 14A of the Securities Exchange Act and Rule 14a-21 thereunder. Because your vote is advisory, it will not be binding on the board of directors. However, the board of directors and the Compensation Committee will review the voting results and take them into consideration when making future decisions regarding executive compensation.

The goals of IPC’s executive compensation program are to:

| · | Attract and retain top quality executives whose talent and leadership are critical to the accomplishment of our business objectives; |

| · | Create and sustain a sense of priority surrounding strategic execution and accountability for achieving key business objectives; |

| · | Align the interests of executives, employees and stockholders by granting equity as part of our executives’ total compensation; and |

| · | Provide executives with reasonable security and a long-term employment focus through a combination of 401(k) retirement benefits, and severance and other termination benefits that motivate them to continue employment and help IPC achieve its strategic goals. |

In structuring our executive compensation program, the Compensation Committee considers how each component motivates performance and promotes retention and sound long-term business decisions. The Compensation Committee also considers the requirements of IPC’s strategic plan and the short-term and mid-term needs of IPC’s business situation.

Recommendation of IPC Board of Directors

If a quorum is present, in order to approve the advisory vote on executive compensation, a majority of the shares present in person or by proxy at the Annual Meeting and entitled to vote on such proposal must vote in favor of it. Abstentions will not be considered votes cast on the proposal but are counted as shares entitled to vote on the proposal. Broker non-votes will not be considered votes cast, or as shares entitled to vote, on the proposal, and therefore will not be counted for purposes of determining the outcome of the proposal.

We are asking our stockholders to indicate their support for our named executive officer compensation as disclosed in this proxy statement. Accordingly, the board of directors recommends that stockholders vote to approve, on an advisory, non-binding basis, the following resolution:

RESOLVED, that the compensation of the named executive officers of IPC, as disclosed in this proxy statement under the heading “Executive and Director Compensation,” is hereby approved.

Our board of directors recommends a vote FOR the resolution approving the compensation of our named executive officers as disclosed in this Proxy Statement under the heading “Executive and Director Compensation.”

14

PROPOSAL 3

ADVISORY VOTE ON THE FREQUENCY WITH WHICH

AN ADVISORY VOTE ON EXECUTIVE COMPENSATION SHOULD BE HELD

Section 14A of the Securities and Exchange Act, and Rule 14a-21 thereunder, requires IPC to include in its proxy statement an advisory vote on executive compensation not less frequently than once every three years. Section 14A and Rule 14a-21 also requires the Company to provide stockholders, at least every six years, with the opportunity to vote on whether the advisory vote on executive compensation should be held every year, every two years or every three years. Our board of directors currently plans to seek an advisory vote on executive compensation annually. Our board of directors believes that holding such a vote every year is advisable in that it would enable our stockholders to provide the Company, on a regular basis, with input regarding our named executive officer compensation program. Additionally, an annual advisory vote on executive compensation is consistent with our goal to seek input from, and engage in discussions with, our stockholders on corporate governance matters and our executive compensation philosophy, policies and practices. IPC asks that you indicate your support for the advisory vote on executive compensation to be held annually.

Because your vote is advisory, it will not be binding on the board of directors. However, the board of directors will review the voting results and take them into consideration when making future decisions regarding the frequency with which the advisory vote on executive compensation will be held.

Recommendation of IPC Board of Directors

The option of one year, two years or three years that receives the highest number of votes cast by stockholders will be the frequency for the advisory vote on executive compensation that has been selected by stockholders. Abstentions and broker non-votes will not be considered votes cast on the proposal, and therefore will not be counted for purposes of determining the outcome of the proposal. Because this vote is advisory and not binding on the board of directors in any way, the board of directors may decide that it is in the best interests of our stockholders and the Company to hold an advisory vote on executive compensation more or less frequently than the option approved by our stockholders.

Our board of directors recommends a vote FOR holding an advisory vote on executive compensation annually.

15

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

The Audit Committee of IPC’s Board of Directors has selected Ernst & Young LLP as IPC’s independent registered public accounting firm to audit the consolidated financial statements of IPC for the fiscal year ending December 31, 2013. Ernst & Young LLP has acted in such capacity since its appointment in fiscal year 2001. A representative of Ernst & Young LLP is expected to be present at the annual meeting, with the opportunity to make a statement if the representative desires to do so, and is expected to be available to respond to appropriate questions.

Vote Required and Board of Directors’ Recommendation

Ratification of Ernst & Young LLP as IPC’s independent registered public accounting firm to audit the consolidated financial statements of IPC for the fiscal year ending December 31, 2013, requires the affirmative vote of the holders of a majority of the voting power represented at the meeting in which a quorum is present. The presence, in person or by proxy duly authorized, of the holders of a majority of the shares of common stock outstanding on the record date of April 22, 2013 shall constitute a quorum for the transaction of business.

Abstentions and broker non-votes will each be counted as present for purposes of determining the presence of a quorum. Neither abstentions nor broker non-votes will have any effect on the outcome of the proposal.

The Board of Directors recommends a vote “FOR” ratification of the appointment of Ernst & Young LLP as IPC’s independent registered public accounting firm for the fiscal year ending December 31, 2013.

16

STOCKHOLDER PROPOSALS TO BE PRESENTED

AT NEXT ANNUAL MEETING

Under IPC’s bylaws, in order for a stockholder proposal to be properly brought before a meeting by a stockholder, such stockholder must have given timely notice thereof in writing to the Secretary of IPC at 10850 Gold Center Dr., Suite 250, Rancho Cordova, CA 95670. To be timely for the 2014 annual meeting, such notice must be delivered to or mailed and received at IPC’s principal executive offices, not less than 120 calendar days in advance of the date that IPC’s proxy statement was released to stockholders in connection with the 2013 annual meeting, except that if the 2014 annual meeting date has been changed by more than 30 days from the date contemplated at the time of the proxy statement for the 2013 annual meeting, notice by a stockholder to be timely must be received not later than the close of business on the 10th calendar day following the day on which public announcement of the date of the 2014 meeting is first made. A stockholder’s notice to the Secretary shall set forth, as to each matter the stockholder proposes to bring before the annual meeting, (a) a brief description of the business to be brought before the annual meeting and the reasons for conducting such business at the annual meeting, (b) the name and record address of the stockholder proposing such business, (c) the class and number of shares of the corporation which are beneficially owned by the stockholder, and (d) any material interest of the stockholder in such business.

Proposals of stockholders intended to be included in IPC’s proxy statement for the2014 annual meeting of the stockholders of IPC must be received by IPC at its offices at 10850 Gold Center, Suite 250, Rancho Cordova, California 95670, no later than February 14, 2014, and satisfy the conditions established by the SEC for stockholder proposals to be included in IPC’s proxy statement for that meeting.

TRANSACTION OF OTHER BUSINESS

At the date of this Proxy Statement, the Board of Directors knows of no business that will be conducted at the 2013 Annual Meeting of Stockholders of IPC other than as described in this Proxy Statement. If any other matter or matters are properly brought before the meeting, or any adjournment or postponement of the meeting, it is the intention of the persons named in the accompanying form of proxy to vote the proxy on such matters in accordance with their best judgment.

| By Order of the Board of Directors | |

| /s/ L. Eric Loewe | |

| L. Eric Loewe | |

Senior Vice President, Secretary and General Counsel | |

| May 3, 2013 |

17