© 2021 Texas Capital Bank Member FDIC October 20, 2021 Q3-2021 Earnings

2 Forward-looking Statements This communication contains “forward-looking statements” within the meaning of and pursuant to the Private Securities Litigation Reform Act of 1995 regarding, among other things, our financial condition, results of operations, business plans and future performance. These statements are not historical in nature and may often be identified by the use of words such as “expect,” “estimate,” “anticipate,” “plan,” “may,” “will,” “forecast,” “could,” “should,” “projects,” “targeted,” “continue,” “become,” “intend” and similar expressions. Because forward-looking statements relate to future results and occurrences, they are subject to inherent and various uncertainties, risks, and changes in circumstances that are difficult to predict, may change over time, are based on management’s expectations and assumptions at the time the statements are made and are not guarantees of future results. A number of factors, many of which are beyond our control, could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. These factors include, but are not limited to, (1) the credit quality of our loan portfolio, (2) general economic conditions and related material risks and uncertainties in the United States, globally and in our markets and the impact they may have on us and our customers, including the continued impact on our customers from volatility in oil and gas prices as well as the continued impact of the COVID-19 pandemic (and any other pandemic, epidemic or health-related crisis), (3) technological changes, including the increased focus on information technology and cybersecurity and our ability to manage such information systems and the effects of cyber-incidents (including failures, disruptions or security breaches) or those of third-party providers, (4) changes in interest rates and changes in the value of commercial and residential real estate securing our loans, (5) adverse economic or market conditions that could affect the credit quality of our loan portfolio or our operating performance, (6) expectations regarding rates of default and credit losses and the appropriateness of our allowance for credit losses and provision for credit losses, (7) unexpected market conditions, regulatory changes or changes in our credit ratings that could, among other things, cause access to capital market transactions and other sources of funding to become more difficult, (8) the inadequacy of our available funds to meet our obligations, (9) the failure to effectively balance our funding sources with cash demands by depositors and borrowers, (10) material failures of our accounting estimates and risk management processes based on management judgment, (11) failure of our risk management strategies and procedures, including failure or circumvention of our controls, (12) the failure to effectively manage risk, (13) uncertainty regarding alternatives to the London Interbank Offered Rate and our ability to successfully implement any new interest rate benchmarks, (14) the impact of changing regulatory requirements and legislative changes on our business, (15) the failure to successfully execute our business strategy, including completing planned merger, acquisition or sale transactions, (16) the failure to identify, attract and retain key personnel or the loss of such personnel, (17) increased or more effective competition from banks or other financial service providers in our markets, (18) structural changes in the markets for origination, sale and servicing of residential mortgages, (19) certainty in the pricing of mortgage loans that we purchase, and later sell or securitize, (20) volatility in the market price of our common stock, (21) credit risk resulting from our exposure to counterparties, (22) an increase in the incidence or severity of fraud, illegal payments, security breaches and other illegal acts impacting us, (23) the failure to maintain adequate regulatory capital to support our business, (24) environmental liability or other environmental, social or governance factors that may materially negatively impact the company, (25) severe weather, natural disasters, acts of war or terrorism and other external events and (26) our success at managing the risk and uncertainties involved in the foregoing factors. These and other factors that could cause results to differ materially from those described in the forward-looking statements, as well as a discussion of the risks and uncertainties that may affect our business, can be found in our Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q and in other filings we make with the Securities and Exchange Commission. The information contained in this communication speaks only as of its date. Except to the extent required by applicable law or regulation, we disclaim any obligation to update such factors or to publicly announce the results of any revisions to any of the forward-looking statements included herein to reflect future events or developments.

3 Serving strong core Texas markets with expanded coverage and a complete set of capabilities Improving client relevance and diversifying our revenue base Attracting high-quality talent with significant experience Our Distinct Opportunity Operating from a de-risked position of financial strength

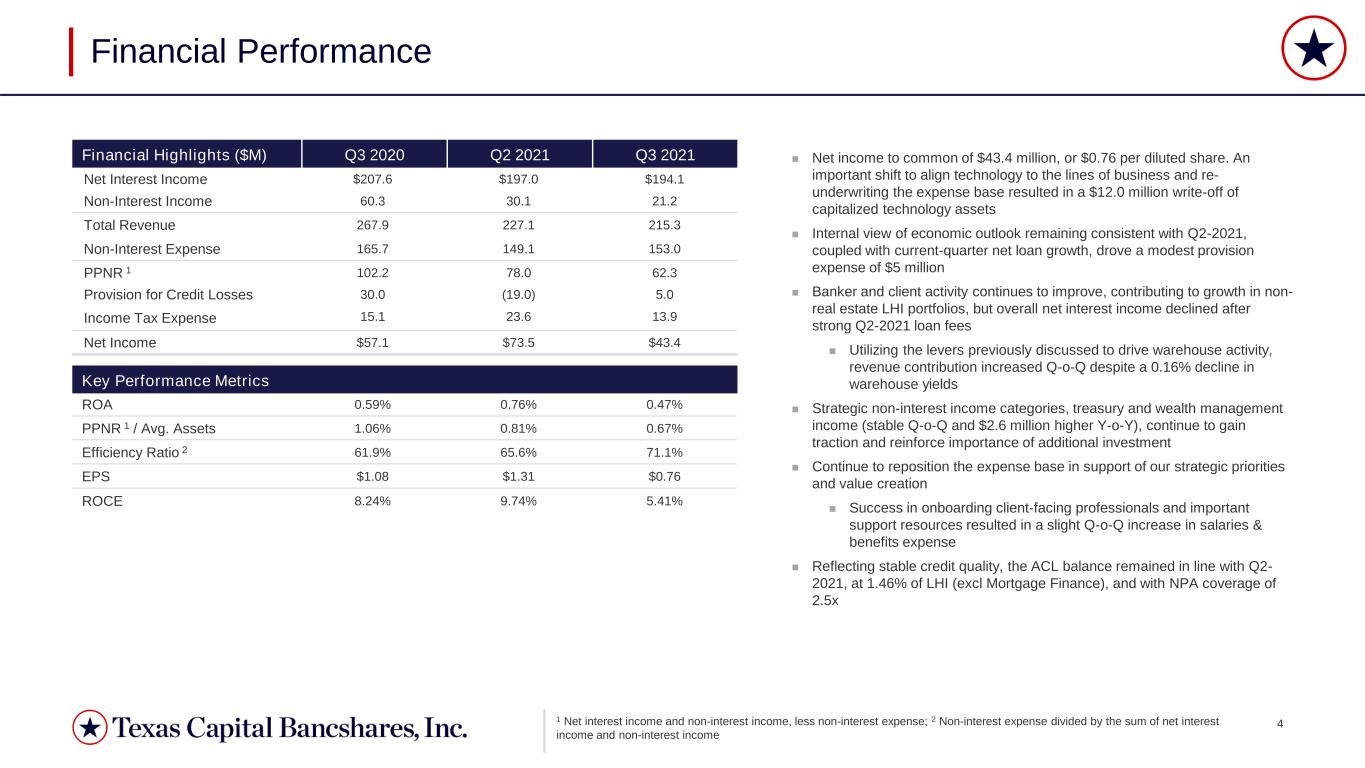

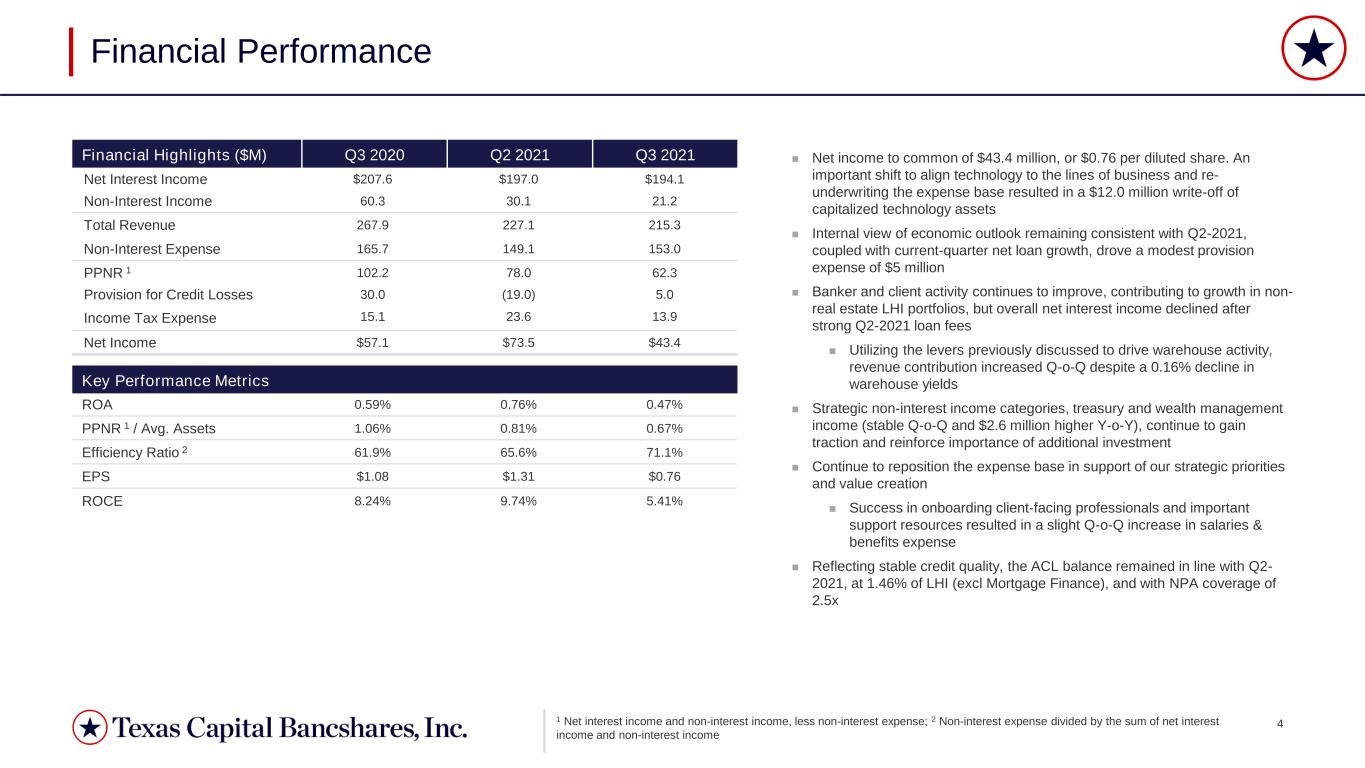

4 Financial Performance Net Interest Income Non-Interest Income Total Revenue Non-Interest Expense PPNR 1 Provision for Credit Losses Income Tax Expense Net Income PPNR 1 / Avg. Assets Efficiency Ratio 2 EPS ROA ROCE $207.6 60.3 267.9 165.7 102.2 15.1 1.06% 61.9% $1.08 8.24% 30.0 0.59% $57.1 $197.0 30.1 227.1 78.0 (19.0) 23.6 0.81% 65.6% $1.31 9.74% 149.1 0.76% $73.5 $194.1 21.2 215.3 62.3 5.0 13.9 0.67% 71.1% $0.76 5.41% 153.0 0.47% $43.4 Financial Highlights ($M) Q3 2020 Q2 2021 Q3 2021 Key Performance Metrics 1 Net interest income and non-interest income, less non-interest expense; 2 Non-interest expense divided by the sum of net interest income and non-interest income ◼ Net income to common of $43.4 million, or $0.76 per diluted share. An important shift to align technology to the lines of business and re- underwriting the expense base resulted in a $12.0 million write-off of capitalized technology assets ◼ Internal view of economic outlook remaining consistent with Q2-2021, coupled with current-quarter net loan growth, drove a modest provision expense of $5 million ◼ Banker and client activity continues to improve, contributing to growth in non- real estate LHI portfolios, but overall net interest income declined after strong Q2-2021 loan fees ◼ Utilizing the levers previously discussed to drive warehouse activity, revenue contribution increased Q-o-Q despite a 0.16% decline in warehouse yields ◼ Strategic non-interest income categories, treasury and wealth management income (stable Q-o-Q and $2.6 million higher Y-o-Y), continue to gain traction and reinforce importance of additional investment ◼ Continue to reposition the expense base in support of our strategic priorities and value creation ◼ Success in onboarding client-facing professionals and important support resources resulted in a slight Q-o-Q increase in salaries & benefits expense ◼ Reflecting stable credit quality, the ACL balance remained in line with Q2- 2021, at 1.46% of LHI (excl Mortgage Finance), and with NPA coverage of 2.5x

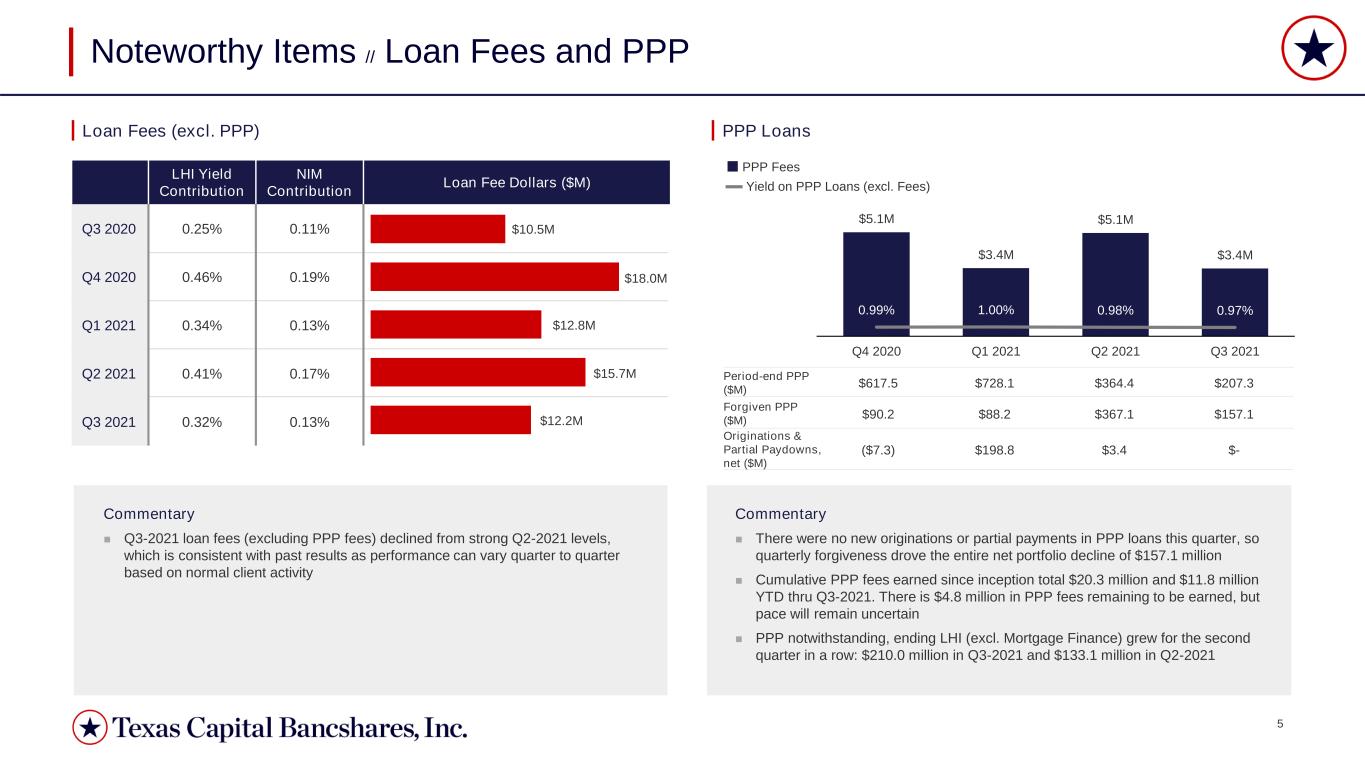

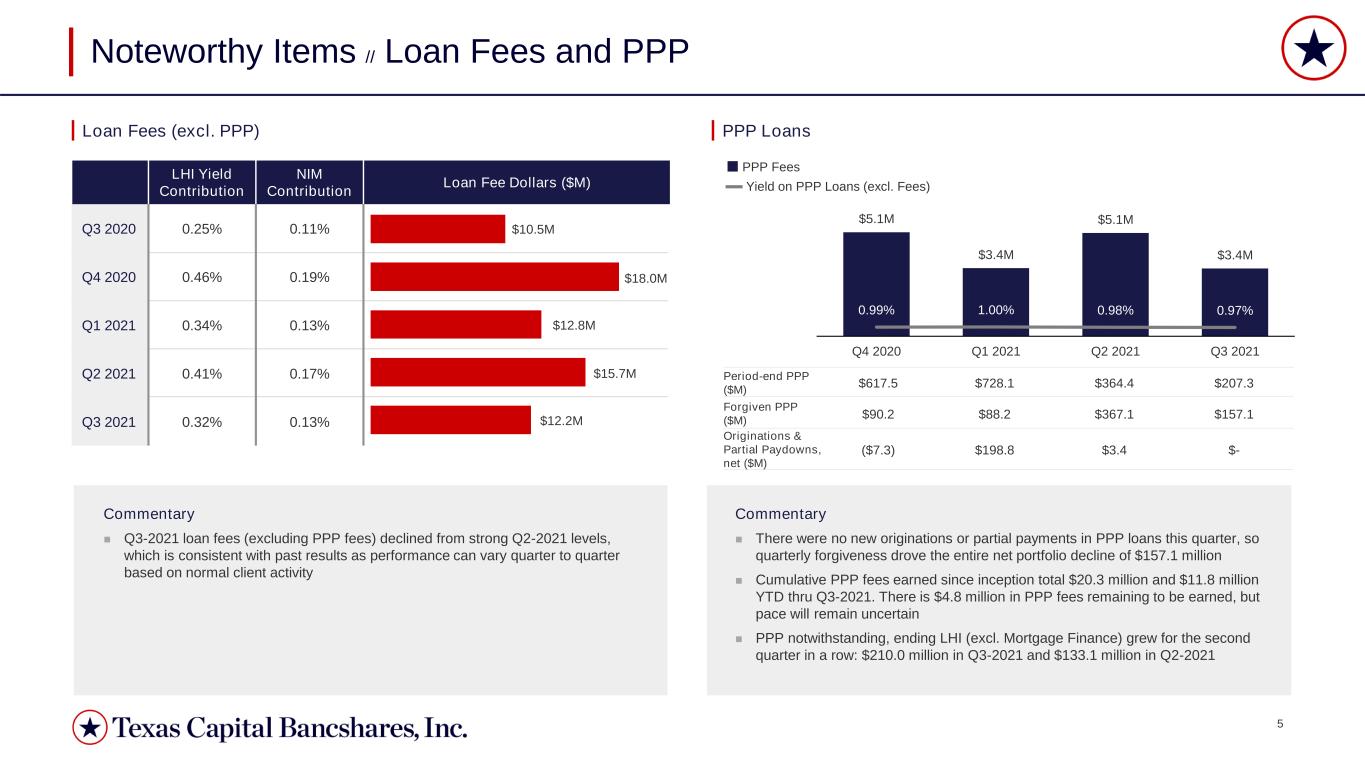

5 LHI Yield Contribution NIM Contribution Loan Fee Dollars ($M) Q3 2020 0.25% 0.11% Q4 2020 0.46% 0.19% Q1 2021 0.34% 0.13% Q2 2021 0.41% 0.17% Q3 2021 0.32% 0.13% $5.1M $3.4M $5.1M $3.4M 0.99% 1.00% 0.98% 0.97% Q4 2020 Q1 2021 Q2 2021 Q3 2021 Commentary ◼ Q3-2021 loan fees (excluding PPP fees) declined from strong Q2-2021 levels, which is consistent with past results as performance can vary quarter to quarter based on normal client activity Noteworthy Items // Loan Fees and PPP Loan Fees (excl. PPP) PPP Loans Period-end PPP ($M) $617.5 $728.1 $364.4 $207.3 Forgiven PPP ($M) $90.2 $88.2 $367.1 $157.1 Originations & Partial Paydowns, net ($M) ($7.3) $198.8 $3.4 $- PPP Fees Yield on PPP Loans (excl. Fees) Commentary ◼ There were no new originations or partial payments in PPP loans this quarter, so quarterly forgiveness drove the entire net portfolio decline of $157.1 million ◼ Cumulative PPP fees earned since inception total $20.3 million and $11.8 million YTD thru Q3-2021. There is $4.8 million in PPP fees remaining to be earned, but pace will remain uncertain ◼ PPP notwithstanding, ending LHI (excl. Mortgage Finance) grew for the second quarter in a row: $210.0 million in Q3-2021 and $133.1 million in Q2-2021 $10.5M $18.0M $12.8M $15.7M $12.2M

6 $70.6M $75.5M $95.3M $105.4M $121.1M $1.3M $1.2M Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 MSR (Period-end) Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 LHS (Average) LHS (Period-end) Noteworthy Items // Correspondent Lending Risk Weighted ~50% Risk Weighted 250% 1 Based on Correspondent Lending’s results during final full-quarter operations (Q1-2021) Historical Contribution (in $ millions) Q1 2020 Q2 2020 Q3 2020 Q4 2020 FY 2020 Q1 2021 Q2 2021 Q3 2021 YTD 2021 Net Interest Income 24.5 1.5 2.8 1.4 30.2 0.9 0.3 0.0 1.2 Non-interest Income Brokered Loan Fees 2.6 2.8 5.8 3.9 15.1 2.2 0.7 0.0 2.9 Servicing Fee Income 4.6 5.9 7.1 8.6 26.2 8.8 5.7 0.0 14.5 Gain/(Loss) on Sale of LHS (13.0) 39.0 25.2 6.8 58.0 5.6 (3.1) (1.2) 1.3 Non-Interest Expense Salaries & Benefits 3.6 3.5 4.5 3.4 15.0 3.0 3.1 0.4 6.5 Marketing 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Legal & Professional 0.8 0.6 0.8 0.9 3.1 1.0 0.8 0.3 2.1 Communications & Tech 0.7 1.4 1.0 1.0 4.1 0.4 0.3 1.3 2.0 Servicing Related Expenses 16.4 20.1 12.3 15.9 64.7 13.0 12.4 2.4 27.8 Other Expense 0.5 0.5 0.4 0.7 2.1 0.7 0.6 0.6 1.9 Commentary ◼ Transition activities substantially completed in Q3-2021 and contributions to Q3-2021 results declined materially, as expected. Repositioning the expense base (~$70 million1) to more profitable, strategically-aligned areas is well underway and will continue at a prudent pace ◼ A modest loss on sale of LHS weighed slightly on non-interest income ($1.2 million). Salaries & benefits expense was largely extinguished this quarter, while servicing-related expense continued to add $2.4 million to total non-interest expense ◼ With only minor LHS remaining, coupled with the Q4-2021 sale of remaining MSRs, Correspondent Lending’s net expense in Q4-2021 is expected to be negligible

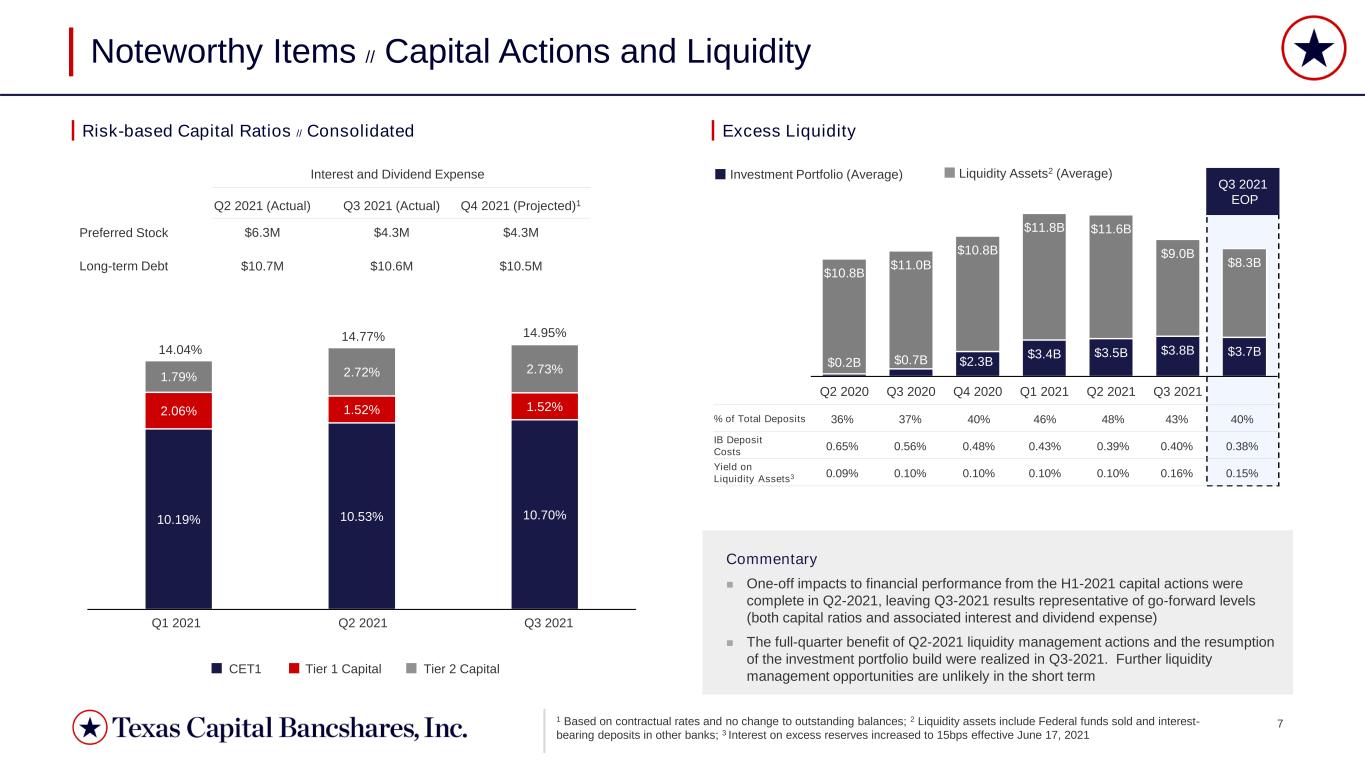

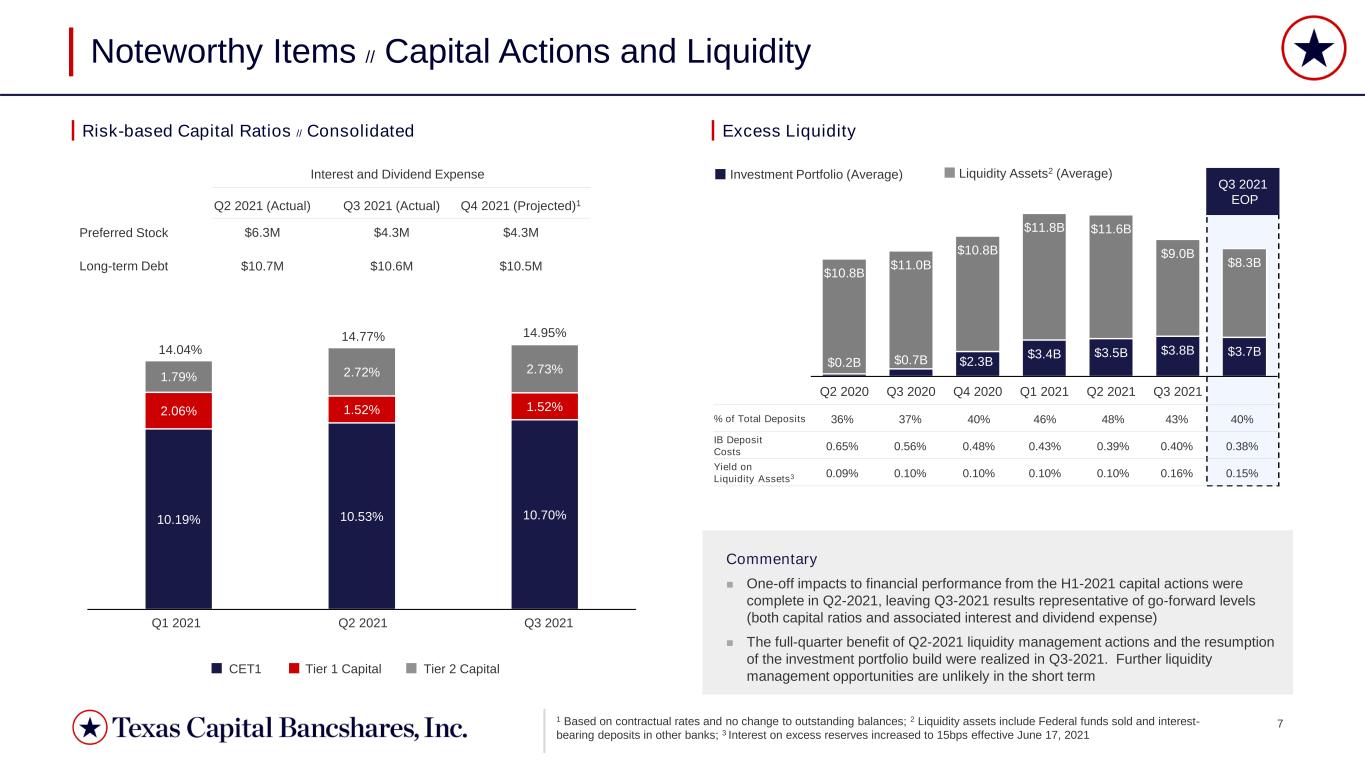

7 Q3 2021 EOP $0.2B $0.7B $2.3B $3.4B $3.5B $3.8B $3.7B $10.8B $11.0B $10.8B $11.8B $11.6B $9.0B $8.3B Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 10.19% 10.53% 10.70% 2.06% 1.52% 1.52% 1.79% 2.72% 2.73% % of Total Deposits 36% 37% 40% 46% 48% 43% 40% IB Deposit Costs 0.65% 0.56% 0.48% 0.43% 0.39% 0.40% 0.38% Yield on Liquidity Assets3 0.09% 0.10% 0.10% 0.10% 0.10% 0.16% 0.15% Investment Portfolio (Average) Liquidity Assets2 (Average) Noteworthy Items // Capital Actions and Liquidity Q1 2021 Q2 2021 Preferred Stock Long-term Debt 14.04% Q3 2021 CET1 Tier 1 Capital Tier 2 Capital 14.95%14.77% Q3 2021 (Actual) $10.6M $4.3M Risk-based Capital Ratios // Consolidated Excess Liquidity 1 Based on contractual rates and no change to outstanding balances; 2 Liquidity assets include Federal funds sold and interest- bearing deposits in other banks; 3 Interest on excess reserves increased to 15bps effective June 17, 2021 Q4 2021 (Projected)1 $10.5M Interest and Dividend Expense $4.3M Q2 2021 (Actual) $10.7M $6.3M Commentary ◼ One-off impacts to financial performance from the H1-2021 capital actions were complete in Q2-2021, leaving Q3-2021 results representative of go-forward levels (both capital ratios and associated interest and dividend expense) ◼ The full-quarter benefit of Q2-2021 liquidity management actions and the resumption of the investment portfolio build were realized in Q3-2021. Further liquidity management opportunities are unlikely in the short term

8 37% 37% 37% 26% 11% 11% 37% 52% 52% Q3 2020 Q2 2021 Q3 2021 Commercial Energy Real Estate $1,076M $892M $729M 1.84% 1.8x 0.43% 1.46% 2.6x 0.25% 1.46% 2.5x 0.25% ACL on Loans / Loans HFI excl MFLs ACL on Loans / NPAs NPAs / Earning Assets Credit Risk Management ◼ Credit Trends ◼ Credit performance was stable reflecting economic improvements, client selection, underwriting and prior de-risking strategies ◼ Positive economic activity resulted in improved credit quality particularly in the CRE and Energy sectors ◼ Net charge-offs of $3.1 million in Q3-2021, in line with prior two quarters ◼ COVID-19 Update ◼ All sectors showed overall stable to improving performance ◼ The longer-term impact of COVID-19, the delta variant, and macroeconomic pressures on client performance are watch items ◼ Economic View for CECL: Quarterly forecasts and outlook are consistent with the Q2-2021 view in light of macroeconomic uncertainties Q3 2020 Q2 2021 Q3 2021 Criticized Composition1 | Y-o-Y & Q-o-Q Highlights Credit Quality Commentary ◼ The quarter reflects further improvement in the criticized portfolio, particularly in CRE. Balances are more than 30% lower than year-ago levels ◼ Criticized assets declined largely due to payoffs at par and upgrades to pass of CRE loans in the Hotel and Senior Housing segments ◼ The mix of criticized assets continues to be comprised of loans with tangible secondary repayment valuations with a lower risk of loss ◼ Non-accrual loans are stable ◼ Enhanced risk management practices, analytics, and adherences continue to strengthen risk assessment accuracy ◼ Client selection and underwriting standards are key success factors aligned with the bank’s financial priorities, strategy and goals 1 Period-end balances

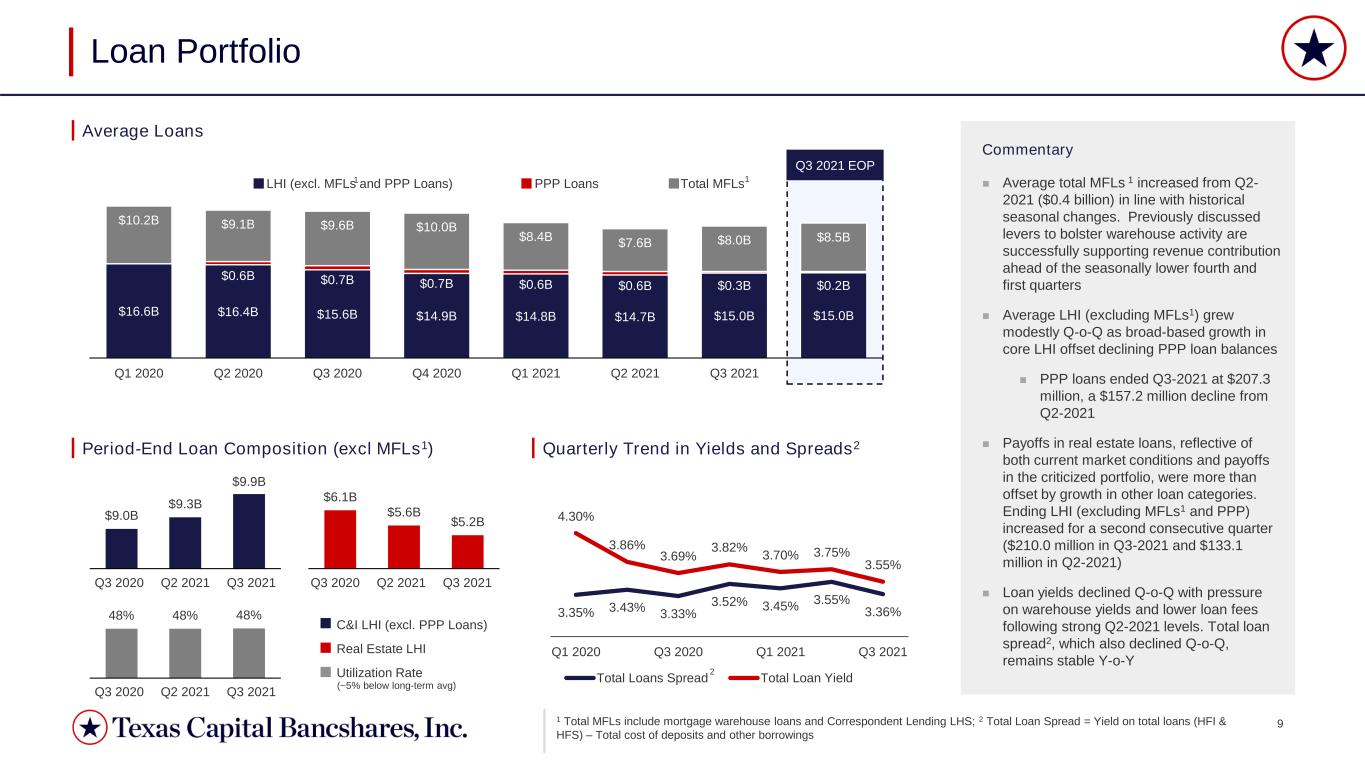

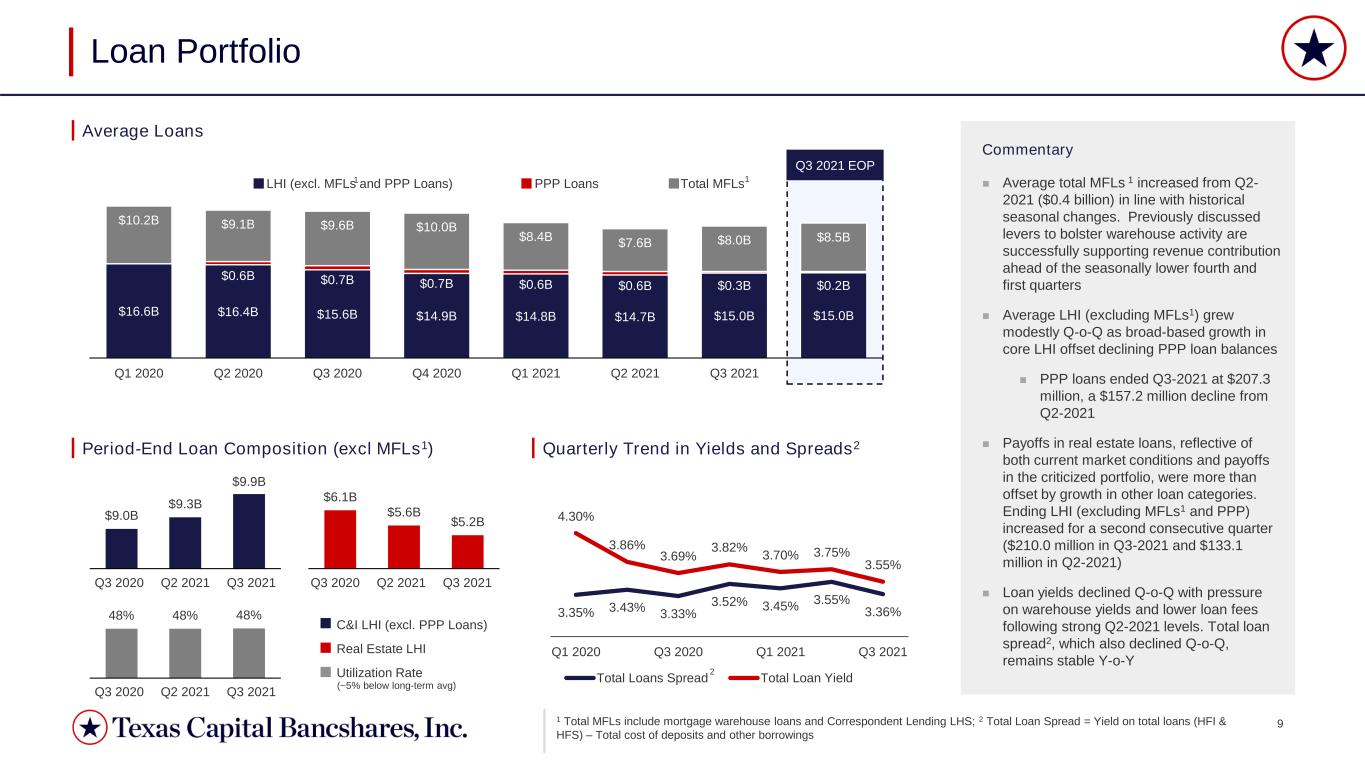

9 3.35% 3.43% 3.33% 3.52% 3.45% 3.55% 3.36% 4.30% 3.86% 3.69% 3.82% 3.70% 3.75% 3.55% Q1 2020 Q3 2020 Q1 2021 Q3 2021 Total Loans Spread Total Loan Yield Q3 2021 EOP $16.6B $16.4B $15.6B $14.9B $14.8B $14.7B $15.0B $15.0B $0.6B $0.7B $0.7B $0.6B $0.6B $0.3B $0.2B $10.2B $9.1B $9.6B $10.0B $8.4B $7.6B $8.0B $8.5B Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 LHI (excl. MFLs and PPP Loans) PPP Loans Total MFLs Loan Portfolio 1 Period-End Loan Composition (excl MFLs1) Quarterly Trend in Yields and Spreads2 1 Total MFLs include mortgage warehouse loans and Correspondent Lending LHS; 2 Total Loan Spread = Yield on total loans (HFI & HFS) – Total cost of deposits and other borrowings Average Loans Commentary ◼ Average total MFLs 1 increased from Q2- 2021 ($0.4 billion) in line with historical seasonal changes. Previously discussed levers to bolster warehouse activity are successfully supporting revenue contribution ahead of the seasonally lower fourth and first quarters ◼ Average LHI (excluding MFLs1) grew modestly Q-o-Q as broad-based growth in core LHI offset declining PPP loan balances ◼ PPP loans ended Q3-2021 at $207.3 million, a $157.2 million decline from Q2-2021 ◼ Payoffs in real estate loans, reflective of both current market conditions and payoffs in the criticized portfolio, were more than offset by growth in other loan categories. Ending LHI (excluding MFLs1 and PPP) increased for a second consecutive quarter ($210.0 million in Q3-2021 and $133.1 million in Q2-2021) ◼ Loan yields declined Q-o-Q with pressure on warehouse yields and lower loan fees following strong Q2-2021 levels. Total loan spread2, which also declined Q-o-Q, remains stable Y-o-Y 48% 48% 48% $9.0B $9.3B $9.9B $6.1B $5.6B $5.2B Q3 2020 Q2 2021 Q3 2021 C&I LHI (excl. PPP Loans) Real Estate LHI Utilization Rate Q3 2020 Q2 2021 Q3 2021 (~5% below long-term avg) Q3 2020 Q2 2021 Q3 2021 1 2

10 47% 50% 65% 70% 71% Interest-bearing Deposit Beta Federal Funds Target (Max) Q3 2021 EOP $15.4B $17.0B $17.5B $17.9B $17.5B $15.7B $13.6B $13.9B $2.3B $2.9B $2.4B $1.8B $1.6B $1.2B $1.1B $1.0B $10.0B $10.9B $12.2B $13.2B $14.4B $15.1B $15.4B $15.0B Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 Interest-bearing (excluding Brokered CDs) Brokered CDs DDAs Deposits and Fundings Funding Costs Deposit Mix (Average) Average Deposits Balances Commentary ◼ Average Interest-bearing deposits continue to decline meaningfully as a result of targeted actions to reduce higher-cost indexed deposits. Average interest-bearing balances (excluding brokered CDs) are $3.9 billion lower than Q1-2021 levels ◼ Brokered CD balances continue to mature without replacement (Y-o-Y reduction of $1.3 billion) ◼ Average DDA balances increased Q-o-Q ($0.3 billion) and Y-o-Y ($3.2 billion). Ending balance is below the quarterly average due to normal quarter-end activity ◼ Y-o-Y improvements in both average deposit costs and total funding costs reflect efforts to improve deposit composition ahead of next tightening cycle ◼ Higher-cost indexed portfolios will continue to be aggressively managed towards long-term target (<15%) ◼ Though interest-bearing deposit rates have absorbed more than 70%1 of Fed rate reductions during this loosening cycle, a strategic focus on treasury and operating accounts will result in lower sensitivity as rates rise 64% 72% 77% 36% 28% 23% Non-Indexed Indexed 1 Includes interest-bearing deposits only and compares the change in monthly interest-bearing deposit rates to the change in the Fed Funds Target range’s maximum. Percentages (betas) for each period are estimated based on total change since June 2019 % of Fed Rate Reductions Reflected in Deposit Costs1 0.34% 0.29% 0.24% 0.20% 0.19% 0.38% 0.33% 0.29% 0.29% 0.28% Avg Cost of Deposits Total Funding Costs 1

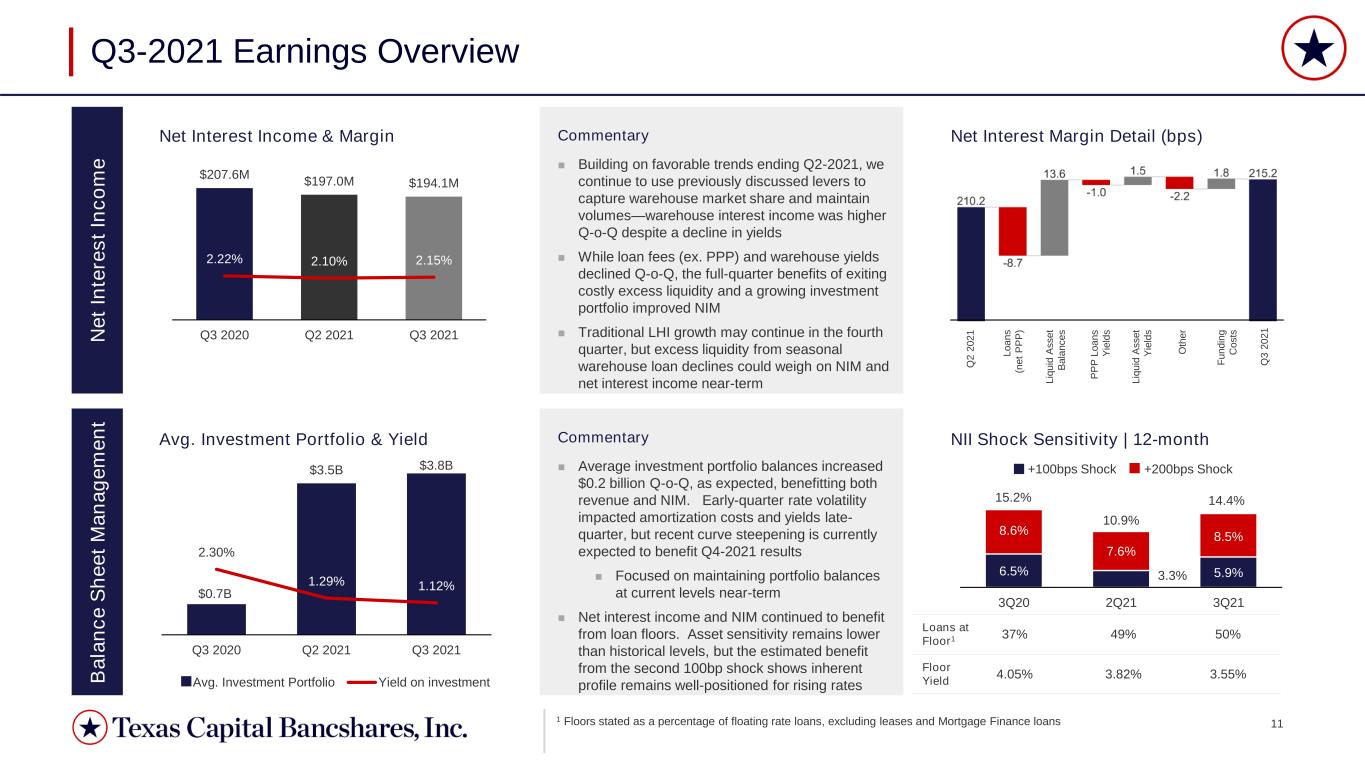

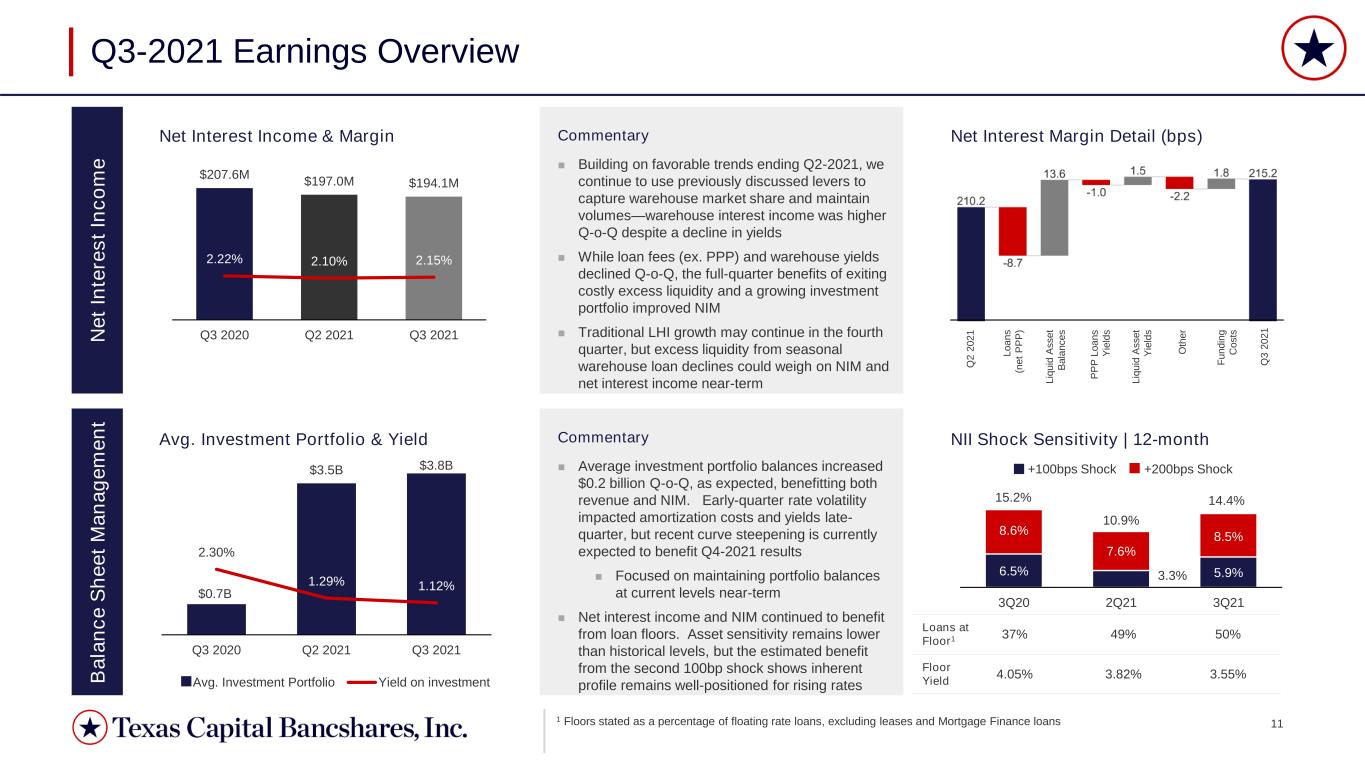

11 8.6% 7.6% 8.5% 6.5% 3.3% 5.9% 3Q20 2Q21 3Q21 $0.7B $3.5B $3.8B 2.30% 1.29% 1.12% Q3 2020 Q2 2021 Q3 2021 Avg. Investment Portfolio Yield on investment $207.6M $197.0M $194.1M 2.22% 2.10% 2.15% Q3 2020 Q2 2021 Q3 2021 Q3-2021 Earnings Overview N e t In te re s t In c o m e B a la n c e S h e e t M a n a g e m e n t Avg. Investment Portfolio & Yield NII Shock Sensitivity | 12-month Net Interest Income & Margin Net Interest Margin Detail (bps) Q 2 2 0 2 1 Q 3 2 0 2 1 L o a n s (n e t P P P ) L iq u id A s s e t B a la n c e s L iq u id A s s e t Y ie ld s P P P L o a n s Y ie ld s O th e r F u n d in g C o s ts 15.2% Loans at Floor1 37% 49% 50% Floor Yield 4.05% 3.82% 3.55% +100bps Shock +200bps Shock 1 Floors stated as a percentage of floating rate loans, excluding leases and Mortgage Finance loans 10.9% 14.4% Commentary ◼ Building on favorable trends ending Q2-2021, we continue to use previously discussed levers to capture warehouse market share and maintain volumes—warehouse interest income was higher Q-o-Q despite a decline in yields ◼ While loan fees (ex. PPP) and warehouse yields declined Q-o-Q, the full-quarter benefits of exiting costly excess liquidity and a growing investment portfolio improved NIM ◼ Traditional LHI growth may continue in the fourth quarter, but excess liquidity from seasonal warehouse loan declines could weigh on NIM and net interest income near-term Commentary ◼ Average investment portfolio balances increased $0.2 billion Q-o-Q, as expected, benefitting both revenue and NIM. Early-quarter rate volatility impacted amortization costs and yields late- quarter, but recent curve steepening is currently expected to benefit Q4-2021 results ◼ Focused on maintaining portfolio balances at current levels near-term ◼ Net interest income and NIM continued to benefit from loan floors. Asset sensitivity remains lower than historical levels, but the estimated benefit from the second 100bp shock shows inherent profile remains well-positioned for rising rates

12 $60.3M $30.1M $21.2M Q3 2020 Q2 2021 Q3 2021 $165.7M $149.1M $153.0M Q3 2020 Q2 2021 Q3 2021 $84.1M $86.8M $87.5M Q3 2020 Q2 2021 Q3 2021 $2.9M $4.6M $4.6M $2.5M $3.1M $3.4M $0.5M $0.5M $0.6M Q3 2020 Q2 2021 Q3 2021 Deposit Service Charges Wealth Management Swap Fees $5.9M $8.3M $8.6M Q3-2021 Earnings Overview N o n -i n te re s t in c o m e N o n -i n te re s t e x p e n s e Non-interest Expense Salary & Employee Benefits Non-interest Income Fee Income Details $12.0M Write-off Expense % of Revenue 23% 13% 10% % of NIE 51% 58% 57% $141.0M $15.4M $150.3M Commentary ◼ Appropriately aligning technology to the lines of business and re-underwriting our capitalized technology investment to align with our long-term strategy led to a write-off of $12.0 million ◼ Salaries and employee benefits increased modestly Q-o-Q. Correspondent Lending transition reductions, which are now largely complete, have started (and will continue) supporting new-hire costs and other investments over the near-term ◼ Correspondent Lending expense declined by $12.1 million Q-o-Q Commentary ◼ Mortgage Finance fee income, including brokered loan fees and Correspondent Lending-related items, declined $4.7 million Q-o-Q. Seasonal Warehouse loan declines may weigh on Q4-2021 and Q1-2022 results as well ◼ Contributions from treasury-related fees and swap fees remained stable this quarter, while wealth management fees provided a fifth consecutive quarter of steady Q-o-Q growth ◼ While quarterly results may vary, strategic investments in products and services will drive sustainable long-term improvements in non- interest income’s contribution to total revenue

13 Focused on the Future Current Financial Priorities Building Tangible Book Value // Reinvesting organically generated capital to improve client relevance and create a more valuable franchise Investment // Re-aligning the expense base to directly support the business and investing aggressively to take advantage of market opportunities that we are uniquely positioned to serve Revenue Growth // Growing top- line revenue as a result of expanded banking capabilities for best-in-class clients in our Texas and national markets Flagship Results Proactive, disciplined engagement with the best clients in our markets to provide the talent, products, and offerings they need through their entire life-cycles Structurally higher, more sustainable earnings driving greater performance and lower annual variability Consistent communication, enhanced accountability, and a bias for action ensure execution and delivery Commitment to financial resilience allowing us to serve clients, access markets, and support communities through all cycles