© 2022 Texas Capital Bank Member FDIC July 21, 2022 Q2-2022 Earnings

2 Forward-looking Statements This communication contains “forward-looking statements” within the meaning of and pursuant to the Private Securities Litigation Reform Act of 1995 regarding, among other things, our financial condition, results of operations, business plans and future performance. These statements are not historical in nature and may often be identified by the use of words such as “expect,” “estimate,” “anticipate,” “plan,” “may,” “will,” “forecast,” “could,” “should,” “projects,” “targeted,” “continue,” “become,” “intend” and similar expressions. Because forward-looking statements relate to future results and occurrences, they are subject to inherent and various uncertainties, risks, and changes in circumstances that are difficult to predict, may change over time, are based on management’s expectations and assumptions at the time the statements are made and are not guarantees of future results. A number of factors, many of which are beyond our control, could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. These factors include, but are not limited to, credit quality and risk, the COVID-19 pandemic, industry and technological changes, cyber incidents or other failures, disruptions or security breaches, interest rates, commercial and residential real estate values, economic conditions, including inflation and the threat of recession, as well as market conditions in Texas, the United States or internationally, as well as governmental and consumer responses to those economic and market conditions, fund availability, accounting estimates and risk management processes, the transition away from the London Interbank Offered Rate (LIBOR), legislative and regulatory changes, business strategy execution, key personnel, competition, mortgage markets, fraud, environmental liability and severe weather, natural disasters, acts of war or terrorism or other external events. These and other factors that could cause results to differ materially from those described in the forward-looking statements, as well as a discussion of the risks and uncertainties that may affect our business, can be found in our Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q and in other filings we make with the Securities and Exchange Commission. The information contained in this communication speaks only as of its date. Except to the extent required by applicable law or regulation, we disclaim any obligation to update such factors or to publicly announce the results of any revisions to any of the forward-looking statements included herein to reflect future events or developments.

3 Serving strong core Texas markets with expanded coverage and a complete set of capabilities Improving client relevance and diversifying our revenue base Attracting high-quality talent with significant experience Our Distinct Opportunity Operating from a de-risked position of financial strength

4 Performance Metrics Return on Average Assets 0.18% 0.67% 0.45% >1.10% Return on Average Tangible Common Equity5 2.1% 8.4% 4.7% >12.5% CET1 9.4% 11.1% 10.5% 9%–10% Where We Started Where We Are Going Balance Sheet 2020 2021 YTD 2022 2025 FY Average Liquidity Assets4 (% of Total Average Assets) 28% 37% 29% >20% FY Average Indexed Deposits (% of Total Deposits) 36% 27% 22% <15% Where We Started Where We Are Going Income Statement 2020 2021 YTD 2022 2025 Investment Banking and Trading Income (% of Total Revenue)1 2.5% 2.8% 3.5% ~10% Treasury Product Fees2 (% of Total Revenue)1 1.6% 2.6% 3.4% ~5% Non-interest Income3 (% of Total Revenue)1 11.2% 13.4% 10.7% 15%–20% Strategic Performance Drivers Announced September 1st Talent Frontline Talent Growth 1.0x 1.4x 1.6x 2.3x

5 Our Path Forward Operating Model Aligned to our Vision, Grounded in our Values Clear Strategic Direction and Fortitude to Deliver Organized Around Client Delivery Product & Industry Specialization Frontline Growth Technology New Products and Services Treasury Solutions Private Wealth Investment Banking Expanding Coverage Business Banking Middle Market Banking Corporate Banking Evaluating Opportunities for Growth Disciplined Capital Management Structured Criteria Guiding Programmatic Investment Optimizing Capital Allocation Across the Portfolio Committed to Financial Resilience Resulting business model poised to generate structurally higher, more sustainable earnings through enhanced fee income and decreased thru-cycle asset sensitivity Our ability to serve our clients, access markets, and support our community through cycles is a strategic multiplier Risk Management Granular Risk Rating System Values Driven Culture Improved Portfolio Positioning Capital and Liquidity 2Q22 CET1: 10.5% 2Q22 Avg. Liquidity Assets4: 23% of Avg. Assets YoY TBV6 per Share Growth: -2.5%

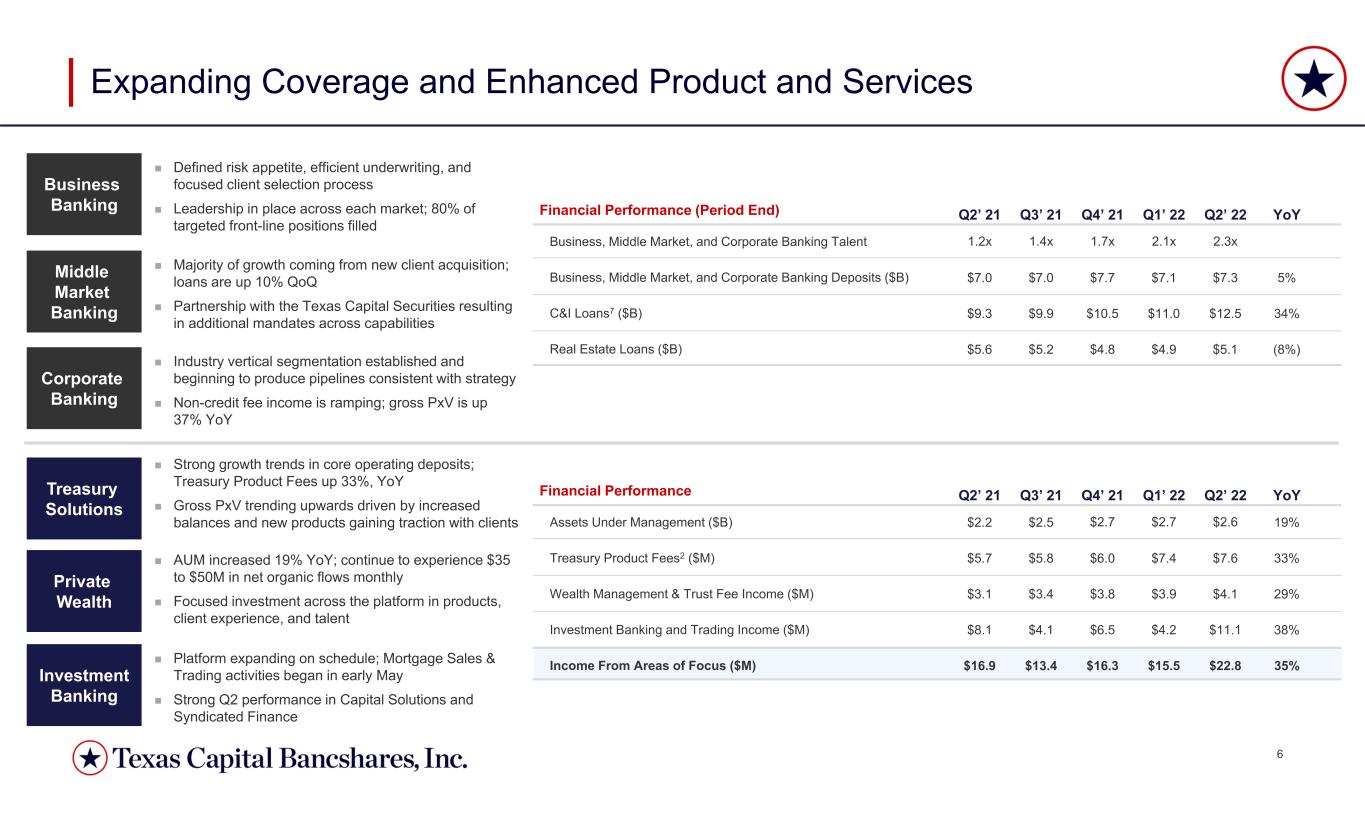

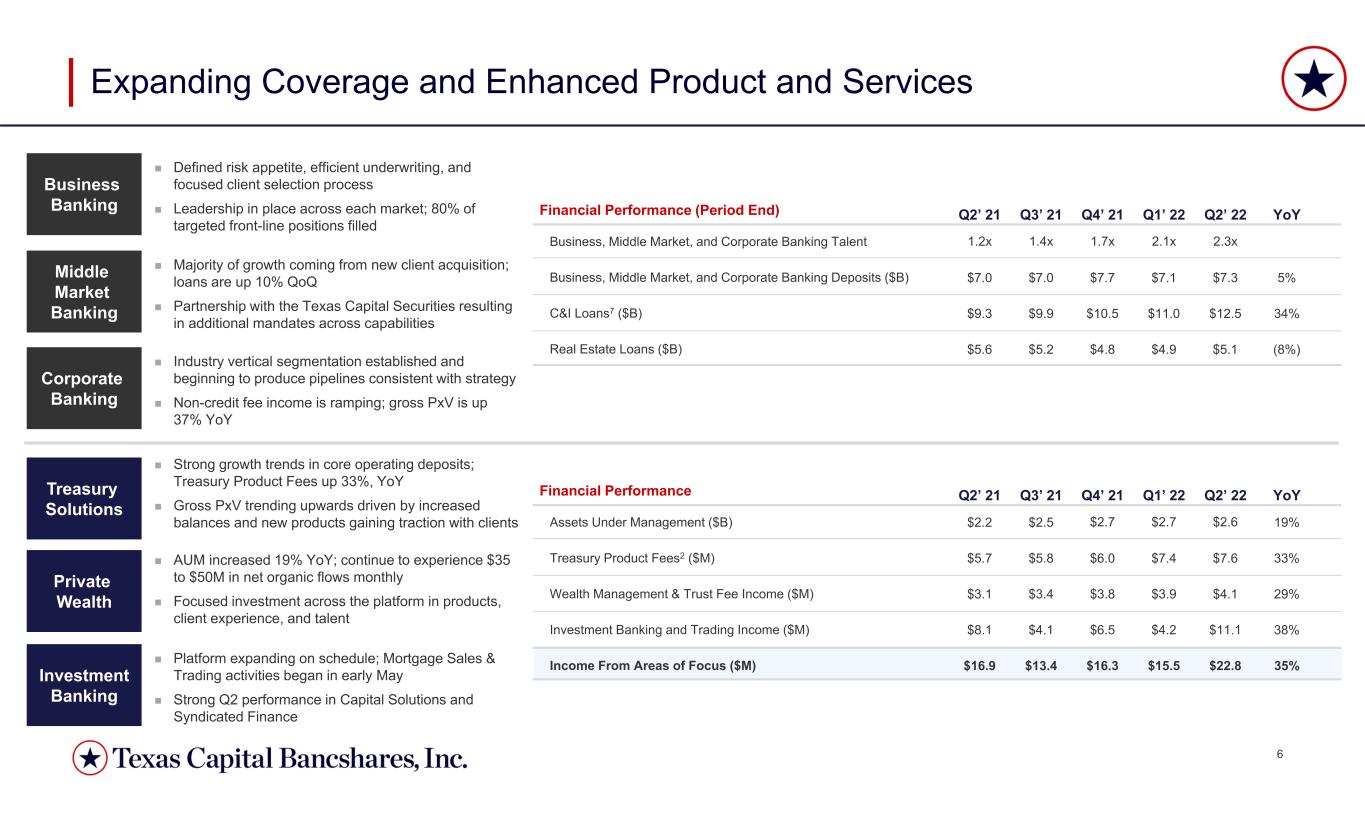

6 Expanding Coverage and Enhanced Product and Services Financial Performance Q2’ 21 Q3’ 21 Q4’ 21 Q1’ 22 Q2’ 22 YoY Assets Under Management ($B) $2.2 $2.5 $2.7 $2.7 $2.6 19% Treasury Product Fees2 ($M) $5.7 $5.8 $6.0 $7.4 $7.6 33% Wealth Management & Trust Fee Income ($M) $3.1 $3.4 $3.8 $3.9 $4.1 29% Investment Banking and Trading Income ($M) $8.1 $4.1 $6.5 $4.2 $11.1 38% Income From Areas of Focus ($M) $16.9 $13.4 $16.3 $15.5 $22.8 35% Financial Performance (Period End) Q2’ 21 Q3’ 21 Q4’ 21 Q1’ 22 Q2’ 22 YoY Business, Middle Market, and Corporate Banking Talent 1.2x 1.4x 1.7x 2.1x 2.3x Business, Middle Market, and Corporate Banking Deposits ($B) $7.0 $7.0 $7.7 $7.1 $7.3 5% C&I Loans7 ($B) $9.3 $9.9 $10.5 $11.0 $12.5 34% Real Estate Loans ($B) $5.6 $5.2 $4.8 $4.9 $5.1 (8%) Treasury Solutions Private Wealth Investment Banking Business Banking Middle Market Banking Corporate Banking Strong growth trends in core operating deposits; Treasury Product Fees up 33%, YoY Gross PxV trending upwards driven by increased balances and new products gaining traction with clients AUM increased 19% YoY; continue to experience $35 to $50M in net organic flows monthly Focused investment across the platform in products, client experience, and talent Platform expanding on schedule; Mortgage Sales & Trading activities began in early May Strong Q2 performance in Capital Solutions and Syndicated Finance Defined risk appetite, efficient underwriting, and focused client selection process Leadership in place across each market; 80% of targeted front-line positions filled Majority of growth coming from new client acquisition; loans are up 10% QoQ Partnership with the Texas Capital Securities resulting in additional mandates across capabilities Industry vertical segmentation established and beginning to produce pipelines consistent with strategy Non-credit fee income is ramping; gross PxV is up 37% YoY

7 Focused on the Future Current Financial Priorities Building Tangible Book Value // Reinvesting organically generated capital to improve client relevance and create a more valuable franchise Investment // Re-aligning the expense base to directly support the business and investing aggressively to take advantage of market opportunities that we are uniquely positioned to serve Revenue Growth // Growing top- line revenue as a result of expanded banking capabilities for best-in-class clients in our Texas and national markets Flagship Results Proactive, disciplined engagement with the best clients in our markets to provide the talent, products, and offerings they need through their entire life-cycles Structurally higher, more sustainable earnings driving greater performance and lower annual variability Consistent communication, enhanced accountability, and a bias for action ensure execution and delivery Commitment to financial resilience allowing us to serve clients, access markets, and support communities through all cycles Higher quality earnings and a lower cost of capital drive a significant expansion in incremental shareholder returns

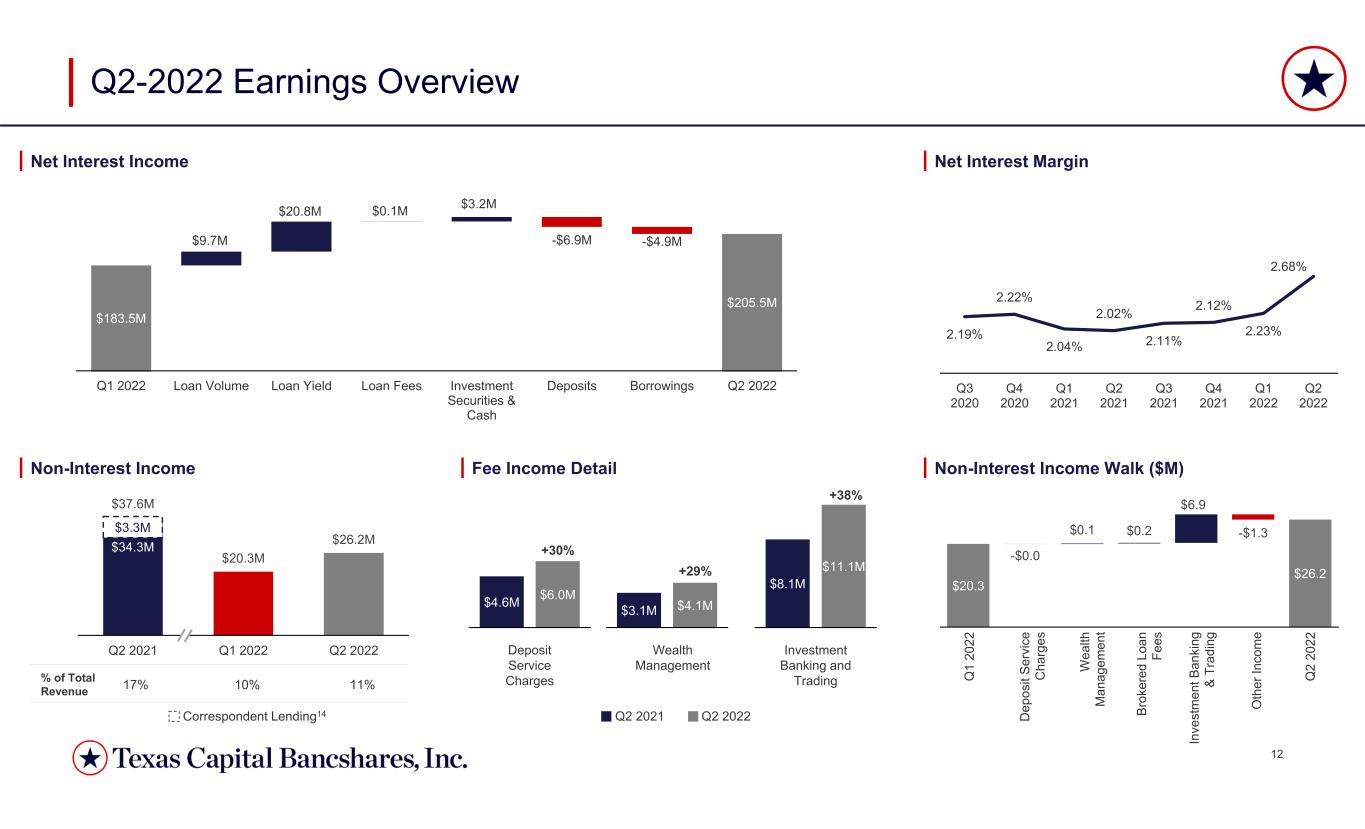

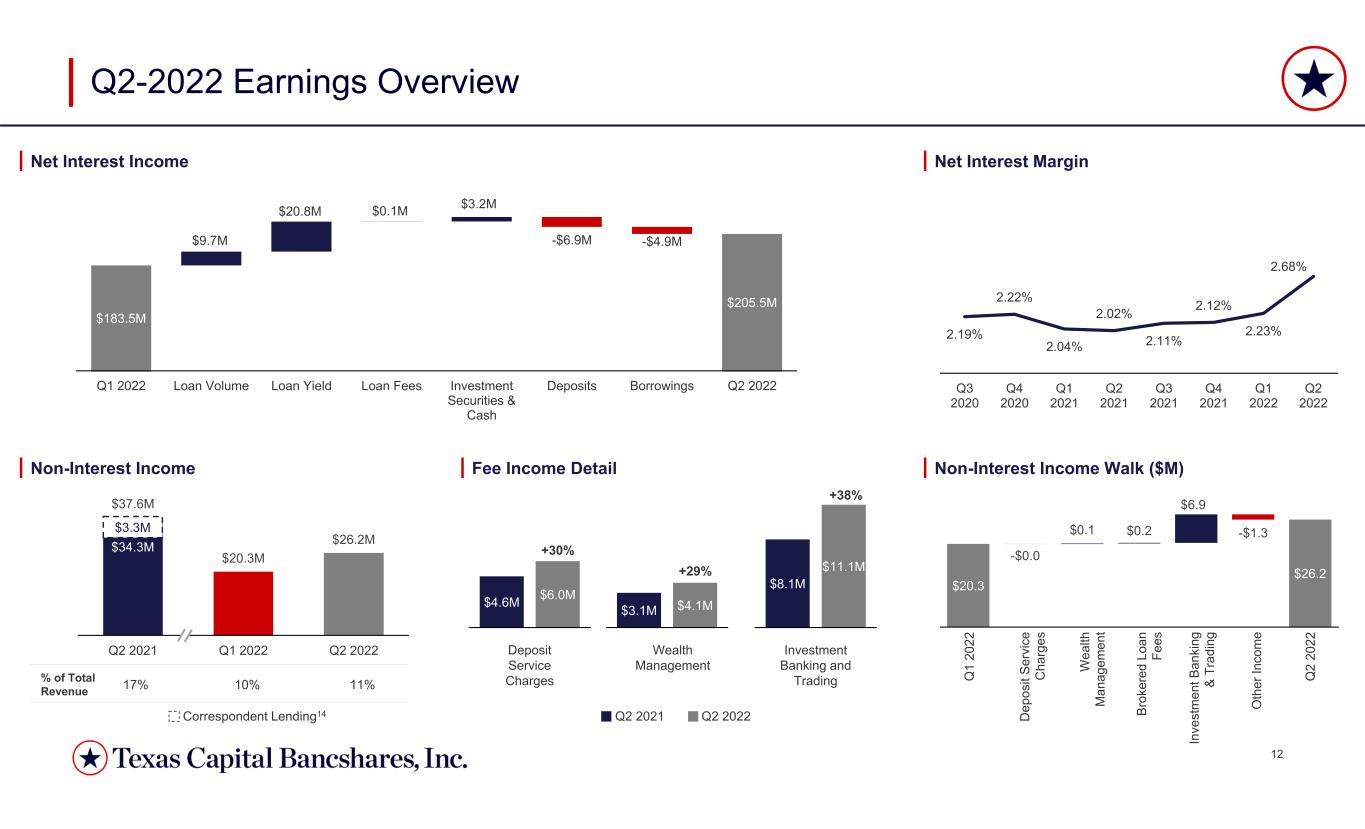

8 Financial Performance Financial Highlights ($M) Q2 2021 Q1 2022 Q2 2022 Net Interest Income $189.5 $183.5 $205.5 Non-Interest Revenue 37.6 20.3 26.2 Total Revenue 227.1 203.8 231.8 Non-Interest Expense 149.1 153.1 164.3 PPNR8 78.0 50.7 67.5 Provision for Credit Losses (19.0) (2.0) 22.0 Income Tax Expense 23.6 13.1 11.3 Net Income 73.5 39.7 34.2 Preferred Stock Dividends 6.3 4.3 4.3 Net Income to Common 67.2 35.3 29.8 Key Performance Metrics Return on Average Assets 0.76% 0.47% 0.44% PPNR8 / Average Assets 0.81% 0.60% 0.86% Efficiency Ratio9 65.6% 75.1% 70.9% Return on Average Common Equity 9.74% 4.97% 4.35% Earnings per Share $1.31 $0.69 $0.59 Tangible Book Value per Share $55.29 $54.68 $53.93 Continued execution on defined growth initiatives coupled with rising market rates drove an increase in total revenue of 14% QoQ Strategic focus on expanding products and services producing growth in several fee categories Wealth management fees and investment banking fees are higher both QoQ and YoY (29% and 38% YoY, respectively) Service charges on deposits flat QoQ but up 30% YoY as growth in operating accounts comes from both new and existing clients Non-interest expense continues to grow as anticipated, with a larger-portion increasingly allocated to higher-value activities directly supporting our defined strategy including compensation and technology supporting both infrastructure and new product development Total NIE up $15.2 million, or 10% YoY, with salaries and benefits up $17.1 million, or 20%, as front-line C&I banking talent up 2.3x Marketing expense increased $3.5 million attributable to business development and digitally-focused deposit initiatives Provision expense of $22.0 million was predominantly related to QoQ LHI growth of $2.4 billion Exclusive of one $144.6 million downgraded Mortgage Finance relationship, criticized loan balances and non-performing assets remain stable near cyclical lows Overall, criticized loans increased $127.5 million QoQ to 2.51% of LHI; excluding the $144.6 million downgraded credit, criticized loans decreased $17.1 million QoQ to 1.91% of LHI Non-performing assets declined $8.8 million QoQ to 0.21% of LHI as legacy problem credits slowly work through the system Book value impacted both by a QoQ decline in AOCI of $66.8 million due primarily to the accelerated rise in the mid-range of the treasury yield curve and share repurchases totaling $50.0 million during the quarter

9 Q2 2022 EOP $10.0B $8.4B $7.6B $8.0B $7.9B $5.7B $5.9B $6.6B Q4 2020 Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 MFLs $5.6B $5.2B $4.8B $4.9B $5.1B Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 $9.3B $9.9B $10.5B $11.0B $12.5B Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Loan Portfolio 11 Average Mortgage Finance Loans11 Period End Loan Trends (excl. PPP) Utilization Rates10 C&I7 Loans grew 14% QoQ reflecting continued realization of client-focused coverage buildout; pipelines remain strong, however, quarterly growth should moderate over the remainder of the year Real Estate Loans grew modestly at 4% QoQ and were tempered by increasing paydowns QoQ which are expected to be elevated for the remainder of the year In the contracting market, average MFLs11 rose 2% QoQ through market share gains and modestly higher dwell times C&I Loans7 Real Estate Loans 50% LTM Average 52% 47% 49% 51% 53% 55% 57% 59% 61%

10 Q2 2022 EOP $17.9B $17.5B $15.7B $13.6B $13.9B $13.2B $10.7B $11.7B $1.8B $1.6B $1.2B $1.1B $0.9B $0.7B $0.6B $1.2B $13.2B $14.4B $15.1B $15.4B $15.8B $14.2B $13.7B $12.5B Q4 2020 Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Interest-bearing Core Interest-bearing Brokered Non-interest Bearing Q2 2022 EOP $15.1B $14.2B $13.7B $12.5B $7.8B $6.9B $6.6B $8.4B $9.1B $7.0B $4.7B $4.5B Q2 2021 Q1 2022 Q2 2022 0.20% 0.19% 0.19% 0.20% 0.33% 0.29% 0.28% 0.28% 0.30% 0.47% Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Avg Cost of Deposits Total Cost of Funds Deposits and Fundings Funding CostsDeposit Composition (Average) Non-interest Bearing Indexed Funding base continuing multi-year transition to target state composition NIB balances began gradual repositioning into interest-bearing accounts Mortgage Finance deposits remain depressed with lower refinance rates High-beta indexed deposits were further reduced during the quarter by $1.5B Average Cost of deposits increased 13 bps QoQ; a beta of 18% since the 1st rate increase 57% cumulative beta in the last tightening cycle (Sep-15 to Jun-19) Interest Bearing Average Deposit Trends 29% 24% 47% 18% 33% 49% $32.0B $28.1B $25.0B $25.4B $32.9B $33.5B $32.0B $30.1B $30.6B $28.1B $25.0B $25.4B 0.0% 0.5% 1.0% 1.5% 2.0% Jan-22 Feb-22 Mar-22 Apr-22 May-22 Jun-22 Current Cycle Rates Paid Betas12 IB Rate IB excl. Indexed Rate Fed Funds Upper Target 42% Cumulative Beta 25% Cumulative Beta Q1 2022 Q2 20 Total Deposit Rate 18% Cumulative Beta 25% 24% 51% 19% 26% 55%

11 3.3% 9.5% 9.9%10.9% 20.0% 17.7% Q2 2021 Q1 2022 Q2 2022 +100bps Shock +200bps Shock Net Interest Income Sensitivity Standard Model Assumptions 100bp & 200bp Parallel Shocks Loan Balances: Static Deposit Balances: Static Indexed Deposits: Ratio held constant at 18% Loan Spreads: Current Levels Total Deposit Beta: ~50% Investment Portfolio: Ratio held constant Loan Repricing Detail // Gross LHI Excl. MFLs11 TCBI NII Sensitivity The asset sensitivity profile of the bank has increased QoQ as a majority of loans rose off their floors during the quarter $750 million in fixed rate swaps added during the quarter reduced asset sensitivity by approximately 1% LHI excl. MFLs11: 18% fixed / 82% variable $5.0 billion (28%) of LHI excl. MFLs11 have contractual floors Approximately $600 million of these loans remain at their floors ($17.6B) Q2 2022 Fixed 18% Prime 18% 1 Month 52% 3 Month 3% 6 Month 1% 12+ Month 8% Variable 82% Total 100% MFLs11 represent 27% of the total loan portfolio with the majority tied to 1 month LIBOR which rose 133 bps in Q2 2022 Overall Mortgage Finance NII will not be as sensitive to changes in index rates as the rest of the portfolio Bank’s overall NII sensitivity (9.9%, $91M and 17.7%, $163M for Q2 2022) inclusive of Mortgage Finance NII impact $24M $79M $71M $149M $91M $163M Base NII13 $729M $745M $920M

12 2.19% 2.22% 2.04% 2.02% 2.11% 2.12% 2.23% 2.68% Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 $8.1M $11.1M $3.1M $4.1M$4.6M $6.0M $37.6M $20.3M $26.2M Q2 2021 Q1 2022 Q2 2022 Non-Interest Income Walk ($M)Fee Income DetailNon-Interest Income Q2-2022 Earnings Overview % of Total Revenue 17% 10% 11% Deposit Service Charges Investment Banking and Trading Wealth Management Q2 2021 Q2 2022 Q 1 20 22 D ep os it Se rv ic e C ha rg es W ea lth M an ag em en t Q 2 20 22 Br ok er ed L oa n Fe es In ve st m en t B an ki ng & Tr ad in g O th er In co m e +30% +29% +38% Net Interest Income $3.3M Correspondent Lending14 $34.3M Net Interest Margin $20.3 $26.2 -$0.0 $0.1 $0.2 $6.9 -$1.3 $183.5M $9.7M $20.8M $0.1M $3.2M -$6.9M -$4.9M $205.5M Q1 2022 Loan Volume Loan Yield Loan Fees Investment Securities & Cash Deposits Borrowings Q2 2022

13 10.53% 11.46% 10.46% 10.00% 1.52% 1.57% 1.45% 2.72% 2.65% 2.51% 37% 54% 38% 24% 11% 6% 4% 52% 40% 34% Q2 2021 Q1 2022 Q2 2022 Commercial Mortgage Energy Real Estate $83.7M $100.1M $103.9M $48.1M $53.0M $60.4M$17.3M Q2 2021 Q1 2022 Q2 2022 Criticized Composition | YoYCredit Quality Q2-2022 Earnings Overview 32%$892M $604M Expense base continues to be repositioned into front, middle, and back-office structure consistent with future scale Capital remains above historical averages with Total Capital Ratio and TCE6/total assets in excess of peer15 medians Repurchased 942K shares (2% of common stock) at a weighted average price of $53.11 Organization realignment and new enterprise disciplines supporting a values-driven credit culture, driving criticized loans down 32% YoY despite the $144.6 million mortgage finance downgrade CET1 Tier 1 Capital Tier 2 Capital $149.1M $153.1M $164.3M Salaries & Benefits Other NIE Correspondent Lending NIE14 Non-interest Expense $476M Regulatory Capital Levels 63%56% 37% 32% 12% 65% 35% Q2 2021 Q1 2022 Q2 2022 Medium-term CET1 Target 14.77% 14.42% Q2 2021 Q2 2022 1.43% 2.6x 1.27% 3.6x 1.20% 4.5x ACL on Loans / Loans HFI excl MFLs ACL on Loans / NPAs 0.25% 0.25% 0.21% 0.20% 0.16% 2.60% 2.05% 1.72% 1.57% 1.92% Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 NPAs / Earning Assets Criticized / Earning Assets Asset Quality Ratios Q1 2022 15.68%

14 Full Year Guidance Full Year 2022 Guidance Average MFLs11 Decline Low 30s Decline Revenue Growth Mid to High Single Digit Non-interest Expense Growth Low to Mid Double Digit Achieve Quarterly Operating Leverage (YoY Growth in Quarterly PPNR8) Q4 2022 Forward curve assuming 2022 terminal rate of 3.75% Fed Funds The expected realization of financial targets ahead of prior guidance is due to: The balance sheet transformation weighted toward C&I clients The rising rate environment benefiting net interest margin Offset by the industry-wide adverse results the tightening actions had on the mortgage industry We will continue to reposition and accelerate the required investments in support of our Strategic Plan

15 1. Total Revenue in 2020 and 2021 excludes Correspondent Lending; See slide: Appendix // Correspondent Lending Historical Contribution 2. Includes service charges on deposit accounts, as well as fees related to our commercial card program, merchant transactions, wire fees, and FX transactions, all of which are included in other non-interest income and totaled $3.1M for FY 2020, $4.4M for 2021, $2.9M for Q2-YTD 2022 and $1.1M, $1.2M, $1.3M, $1.3M, and $1.6M for Q2 2021, Q3 2021, Q4 2021, Q1 2022, and Q2 2022 respectively 3. Non-interest Income for 2020 and 2021 excludes Correspondent Lending; See slide: Appendix // Correspondent Lending Historical Contribution 4. Includes interest-bearing cash and cash equivalents, available-for-sale debt securities, and equity securities 5. See slide: Appendix // Return on Average Tangible Common Equity (ROTCE) 6. Stockholders’ equity excluding preferred stock, less goodwill and intangibles 7. C&I Loans includes Commercial and Energy loans and excludes PPP loans 8. Net interest income and non-interest income, less non-interest expense 9. Non-interest expense divided by the sum of net interest income and non-interest income 10. Outstanding loans divided by total commitments excluding Mortgage Finance Loans and leases 11. Total Mortgage Finance Loans (MFLs) include Mortgage Warehouse loans and Correspondent Lending LHS 12. Beta taken as the difference of June 2022 and January 2022 cost of total deposits, cost of interest-bearing deposits, and cost of indexed deposits divided by the change in fed funds upper target over the same period 13. Baseline scenarios hold constant balances, market rates, and assumptions as of period end reporting 14. See slide: Appendix // Correspondent Lending Historical Contribution 15. Compared to peer banks with $20-100B in assets for Q1 2022 results Source: S&P Capital IQ Pro Appendix // Footnotes

16 Appendix // Correspondent Lending Historical Contribution Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 Q4 2021 LHS (Average) LHS (Period-end) $70.6M $75.5M $95.3M $105.4M $121.1M $1.3M $1.2M $0.0M Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 Q4 2021 MSR (Period-end) Risk Weighted ~50% Risk Weighted 250% ($M) Q1 2020 Q2 2020 Q3 2020 Q4 2020 FY 2020 Q1 2021 Q2 2021 Q3 2021 Q4 2021 FY 2021 Net Interest Income 24.5 1.5 2.8 1.4 30.2 0.9 0.3 0.0 0.0 1.2 Non-interest Income Brokered Loan Fees 2.6 2.8 5.8 3.9 15.1 2.2 0.7 0.0 0.0 2.9 Servicing Income 4.6 5.9 7.1 8.6 26.2 8.8 5.7 0.0 0.0 14.5 Gain/(Loss) on Sale of LHS (13.0) 39.0 25.2 6.8 58.0 5.6 (3.1) (1.2) 0.0 1.3 Non-Interest Expense Salaries & Benefits 3.6 3.5 4.5 3.4 15.0 3.0 3.1 0.4 0.3 6.8 Marketing 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Legal & Professional 0.8 0.6 0.8 0.9 3.1 1.0 0.8 0.3 0.2 2.3 Communications & Tech 0.7 1.4 1.0 1.0 4.1 0.4 0.3 1.3 0.5 2.5 Servicing-Related Expenses 16.4 20.1 12.3 15.9 64.7 13.0 12.4 2.4 0.0 27.8 Other Expense 0.5 0.5 0.4 0.7 2.1 0.7 0.6 0.6 0.2 2.1

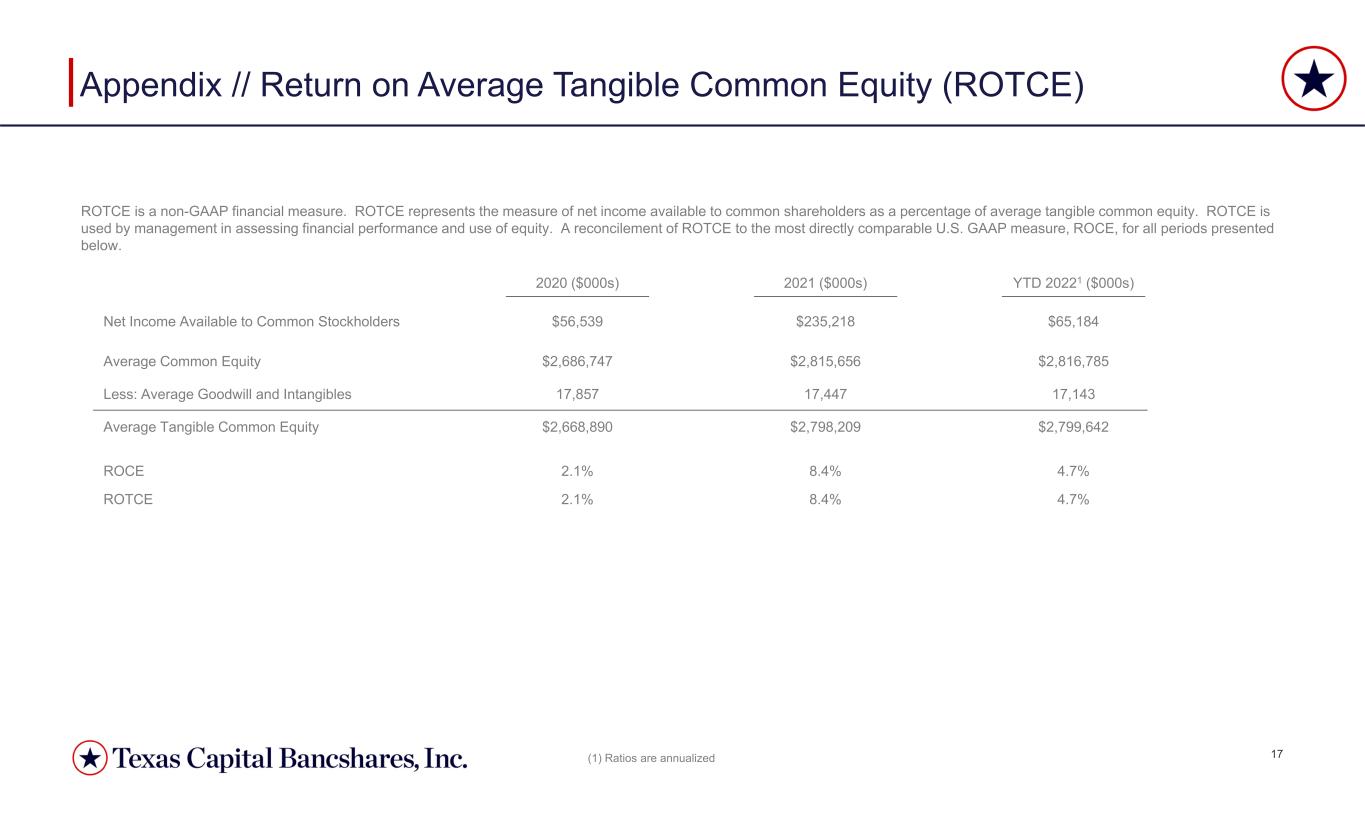

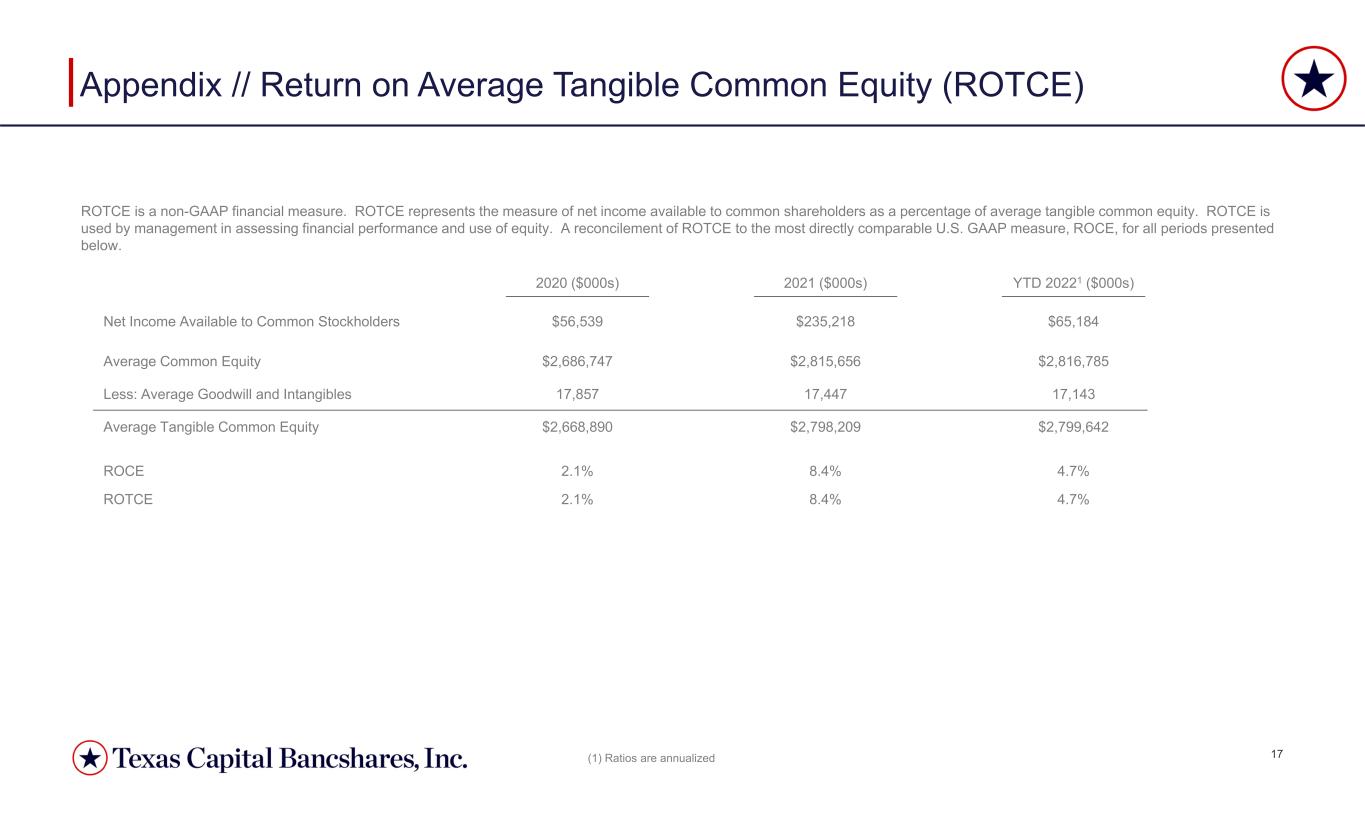

17 Appendix // Return on Average Tangible Common Equity (ROTCE) ROTCE is a non-GAAP financial measure. ROTCE represents the measure of net income available to common shareholders as a percentage of average tangible common equity. ROTCE is used by management in assessing financial performance and use of equity. A reconcilement of ROTCE to the most directly comparable U.S. GAAP measure, ROCE, for all periods presented below. (1) Ratios are annualized 2020 ($000s) YTD 20221 ($000s) Net Income Available to Common Stockholders Average Common Equity Less: Average Goodwill and Intangibles Average Tangible Common Equity ROCE ROTCE $56,539 $2,686,747 17,857 $2,668,890 2.1% 2.1% $65,184 $2,816,785 17,143 $2,799,642 4.7% 4.7% 2021 ($000s) $235,218 $2,815,656 17,447 $2,798,209 8.4% 8.4%