Tel Aviv, December 22, 2014

Our ref: 10108/1004

VIA EDGAR

Mr. Daniel L. Gordon

Senior Assistant Chief Accountant

Securities and Exchange Commission

Division of Corporation Finance

100 F Street, NE

Washington, D.C. 20549

Re: Optibase Ltd.

Form 20-F for the Year Ended December 31, 2013

Filed April 30, 2014

File No. 000-29992

Dear Mr. Gordon:

We enclose herewith, on our client's behalf, responses to the comments raised by the Staff of the Securities and Exchange Commission (the “Staff”) in its comment letter dated November 24, 2014 with respect to the Form 20-F filed by Optibase Ltd. (the “Company”) on April 30, 2014. Below we have noted the Staff's comments in bold face type and the Company’s responses in regular type. The numbering corresponds to the comment numbers in the Staff’s above referenced letter.

The enclosed responses are written on behalf of the Company, and reference in the responses to “we” and “our” refer to the Company.

Form 20-F for the Year Ended December 31, 2013

Consolidated Statements of Operations, F-5

| | 1. | In future filings please disclose the basic and diluted earnings per share amounts from discontinued operations either on the face of the financial statements or in a footnote to the financial statements, if applicable. Additionally, please explain to us how you calculated EPS from continuing operations for the year ended December 31, 2011. |

In response to comment No. 1, the Company has re-examined the calculation of EPS from continuing operations for the year ended December 31, 2011 and advises the Staff that EPS from continuing operations for the year ended December 31, 2011 was calculated as the net loss attributable to the Company, divided by the weighted average number of shares, as follows:

The following table sets forth the computing of basic and diluted net earnings per share amount from continuing operation for the year ended December 31, 2011 as presented in the financial statements:

| | | US$ in thousands | |

| | | | | |

| Net income | | | 1,799 | |

| Net income attributable to non-controlling interest | | | (2,038 | ) |

| | | | | |

| Loss attributable to the Company’s shareholders | | | (239 | ) |

| | | | | |

| Denominator for basic and diluted net earnings (loss) per share – | | | | |

| Weighted average number of shares | | | 3,642 | |

| | | | | |

| Basic and diluted loss per share from continuing operations for | | | | |

| the year ended December 31, 2011 as presented in 2013 consolidated | | | | |

| financial statements | | | (0.07 | ) |

| | | | | |

The following table sets forth the correct computing of basic and diluted net earnings per share amount from continuing operation for the year ended December 31, 2011: | | | | |

| | | | | |

| Net income from continuing operations | | | 1,850 | |

| Net income attributable to non-controlling interest | | | (2,038 | ) |

| | | | | |

| Loss attributable to the Company’s shareholders | | | (188 | ) |

| | | | | |

| Denominator for basic and diluted net earnings (loss) per share – | | | | |

| Weighted average number of shares | | | 3,642 | |

| | | | | |

| Basic and diluted loss per share from continuing operations | | | (0.05 | ) |

In respect to the calculation presented, we believe that the difference of 0.02 loss per share is not material to the reader of the financial statements due to the following reasons:

| | a. | The loss per share presented in the 2011 financial statements was correct and the mistake appears only in the presentation of 2011 results in the 2012 and 2013 financial statements. |

| | b. | The Company had loss per share and not earning per share in 2011 and therefore the amount is not comparable to the results of the years 2012 and 2013 that had earning per share. |

| | c. | The difference did not change the Company's results from earnings to losses and the Company would have presented loss per share also in case the correct number was presented. In addition, the loss per share presented was higher and therefore the actual results of the Company were better than presented. |

Due to the above, we do not believe that the financial statements for the year ended December 31, 2013 should be revised. We will present the correct number in future filings, in the event such number will be presented. In addition, in future filings, we will disclose the basic and diluted earnings per share amounts from discontinued operations, if applicable.

Note 1: General

b. Acquisitions and investments in associates, page F-10

| 2. | We note that you have 19.66% beneficial interest in Two Penn Center Plaza and approximately 4% beneficial interest in a portfolio of shopping centers located in Texas. |

Please explain to us and disclose in future filings how you determined the accounting for these investments. In your response please cite the applicable guidance.

In respect to comment No.2, the Company advises the Staff that the accounting for the investments was as follows:

Two Penn Center Plaza

The investment in Two Penn Center Plaza is accounted for using the equity method of accounting in accordance with 323-30-S99 SEC Materials and ASC 970-323 Real estate "Investments - Equity Method and Joint Ventures". As the Company's indirect beneficial interest in Two Penn Center Plaza was 19.66% and therefore is considered to be more than minor (more than 3 to 5 percent), the equity method was applied.

Texas Shopping Centers Portfolio

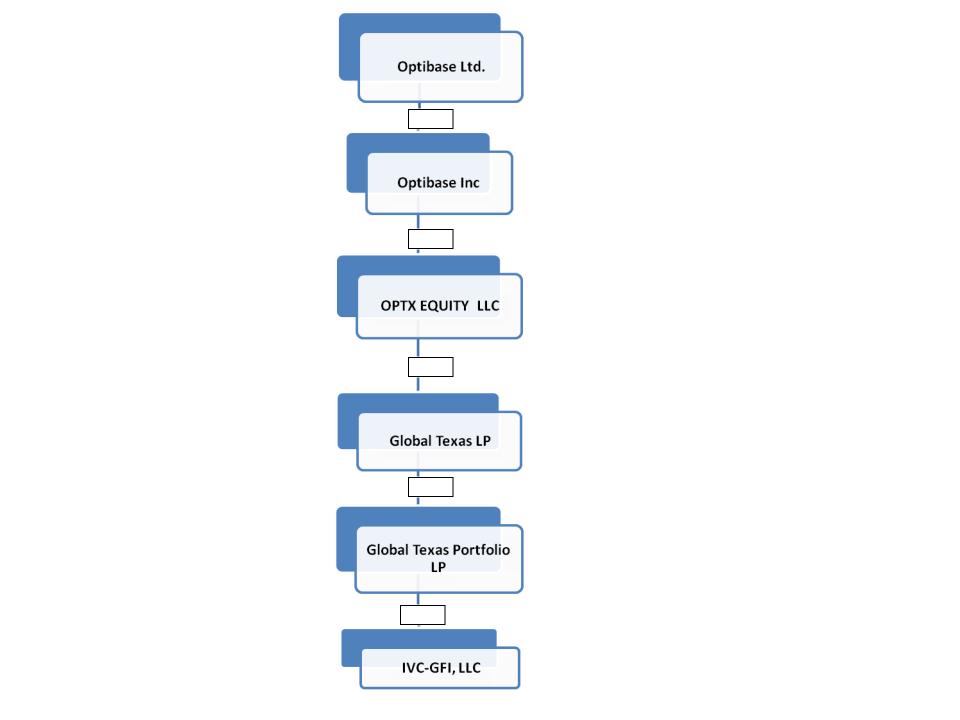

Given the SEC Staff's position as described in ASC 323-30-S99 and ASC 970-323-25-6, the Company's management determined that the approximately 4% indirect beneficial interests in Texas shopping centers portfolio (the “Real Estate Asset”) are considered to be so minor that the limited partner has virtually no influence over the operating and financial policies over the Real Estate Asset LLC ("IVC-GFI, LLC") and therefore believes the application of the cost method for this investment was the most appropriate. This conclusion was based on the following:

| | i. | The Company indirectly acquired an approximately 4% beneficial interest in a portfolio of Texas shopping centers as described in Annex A. This investment holding structure is designed to meet the tax needs of the investors in the portfolio. The total indirect effective holding percentages of each partner and of the limited partnership holding the Real Estate Asset were determined in the partnerships agreements, for example, as stated in the limited partnership agreement of Global Texas, LP: "The purpose of the LP is to be one of the limited partners of Global Texas Portfolio, LP, a Delaware limited partnership (the "Limited Partnership"), which Limited Partnership will indirectly own a forty nine (49%) percent interest in IVC-GFI, LLC, a Delaware limited liability company, which will indirectly own 22 retail shopping centers located in Texas". |

| | ii. | Global Texas, LP is controlled by a general partner which is unrelated to the Company. The partnership agreement of Global Texas, LP provides that the general partner has full control and authority to make decisions on behalf of the partnership, subject to a very limited list of decisions that are protective of the investment structure and do not impact business and financing decision making of the partnership that require the approval of partners owning ninety percent (90%) of the partnership interests. Being a limited partner, the Company has no right to exercise significant influence over this partnership. This lack of influence is a result of having no voting agreement with other investors, no control right and no right to cause the removal of the general partner. |

Accordingly, and following the 3-5% threshold prescribed by the SEC staff, the Company believes that its beneficial interests in IVC-GFI, LLC are considered to be so minor that they create virtually no influence over the operating and financial policies of the Real Estate Asset and therefore it should account for this investment using the cost method of accounting.

* * * *

If you have any questions or concerns, please call the undersigned at 972-3-607-4464.

| | Very truly yours,

/s/ Adva Bitan /s/ Shachar Hadar Adva Bitan, Adv. Shachar Hadar, Adv. | |

cc: Amir Philips, Chief Executive Officer, Optibase Ltd.

Yakir Ben-Naim, Chief Financial Officer, Optibase Ltd.

Annex A