OPTIBASE LTD.

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- ________

Attached hereto and incorporated by way of reference herein is a report issued by the Registrant and entitled “Optibase Monitoring Report June 2019 by Midroog”.

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

MIDROOG

Key Financial Indicators

Optibase Ltd.2

USD in thousands | 31.12.2018 | 31.12.2017 | 31.12.2016 |

| Debt/cap | 62% | 63% | - |

| Unencumbered asset value/total assets | - | - | - |

Detailed Rating Considerations

Activity in the income-producing real estate sector in geographical areas characterized by stability and financial robustness, contributing to the risk profile

As of the report date, the Company's activity is concentrated in Switzerland, the U.S. and Germany, countries rated Aaa by Moody's, characterized by stability and financial robustness.

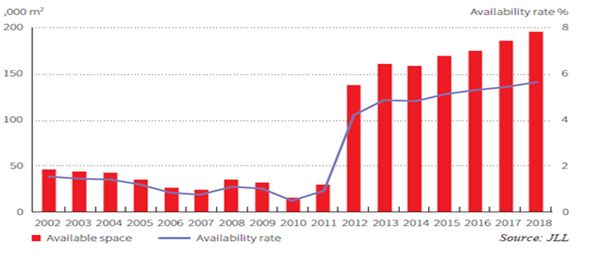

The office sector in Switzerland, and particularly in Geneva, is characterized by relatively high occupancy rates (94%), which, however, have been steadily declining due to the large supply of office space, as shown in Diagram 1. This trend is not expected to reverse in the medium term, and is contributing to a decline in rental prices for office properties in the area. However, Switzerland's economic strength includes an unemployment rate of less than 3% (as of January 2019), and a continuing surplus in the government’s balance of payments current account in a way that supports the stability of the area of activity.

Diagram 1: Supply and Occupancy Rates in the Office Sector – Geneva, Switzerland

Source: JLL-Switzerland-office-market-2019

2 The table includes the value of assets on fair value basis in accordance with IFRS, rather than as presented in the financial statements according to U.S. GAAP, after inclusion of the Company's share of the debt on assets presented according to the equity method.

4 | | Optibase Ltd. - Monitoring Report |

MIDROOG

one of the Company's major investments is an income producing office building located in Chicago's CBD area. Thus, Chicago's CBD area is presenting rising rental prices and occupancy rates in recent years, in keeping with the level of the property (Class A) and the limited supply of land. However, it should be noted that the occupancy rates for properties with a high finishing level in strong demand areas are still relatively low, standing at 89%.

Concentration of properties and tenants, along with legal dispute with a major tenant negatively impact on the stability of the current cash flow and the risk profile

The Company's activity is characterized by high properties and tenants concentration. Thus, the Company's key property, CTN, which is located in Switzerland, accounts for 30% of its total NOI, while the three principal properties generate 63% of the total NOI (based on the Company's share of the properties). Additionally, the Company has a major tenant who accounts for 17% of its total revenues, while its three principal tenants account for 43% of the total revenues, impacting negatively on the Company's risk profile and on the stability of its current cash flow. This high concentration, especially considering the legal dispute with the tenant LEM who accounts for 17% of the company's total revenues, impacts negatively on the Company's business profile and exposes its financial indicators, primarily the coverage ratios and the FFO, to significant changes within a short time.

As mentioned, the Company is currently in litigation with the key tenant in the CTN property, who accounts for 17% of its revenues. Midroog's base scenario applies various sensitivity tests, given the uncertainty as to the stability of the Company's revenues and asset value in the medium term, in view of this issue, taking into account the Company's ability to lease the space vacated in the event of the tenant's departure within a reasonable time, considering the condition of the property and the state of the office market in Switzerland. Thus, in the event that the tenant's part of the property is not occupied within a year, then, without factoring in reduced revenues from other properties, the Company is liable to be in breach of the debt-to-EBITDA financial covenant, which constitutes as grounds for immediate repayment of the bonds. Hence, in Midroog's assessment, the Company's financial and risk profiles may be significantly impacted in the event of the above scenario. The company does not anticipate a breach of this covenant even in case of non-occupancy for a long time and this scenario is not part of Midroog's base assessment.

Good financial strength and coverage ratios for the rating level, contributing to the Company's business profile

As of December 31, 2018, the debt-to-cap ratio stands at a favorable 62% for the rating level (this leverage ratio takes into account the value of assets on fair basis value in accordance with IFRS, rather than as presented in the financial statements according to U.S. GAAP, after inclusion of the Company's share of the debt on assets presented at equity). Midroog's base scenario assumes a certain deterioration in the financial strength ratios, based on sensitivity tests performed on the value of the CTN property and the value of the residential units in Miami. Thus, according to the base scenario, the financial strength ratios are expected to be in the range of 64%-65%, which, it should be noted, remains favorable for the rating level.

5 | | Optibase Ltd. - Monitoring Report |

MIDROOG

According to the base scenario, after full occupancy and yield is achieved in the Chicago property, which was occupied during 2018 and as of December 31, 2018 presents an occupancy rate of 95%, the debt-to-FFO ratio is expected to move within a range of 23-24 years during the forecast period. This is a fast ratio for the rating level, that contributes to the Company's business profile.

Good liquidity relative to the bonds debt service, due to a signed credit facility, a significant liquidity balance and a comfortable bond amortization schedule, contributing to the risk profile; risk of refinancing of the Company's loans, along with limited flexibility due to the lack of unencumbered properties, impacts negatively on the risk profile

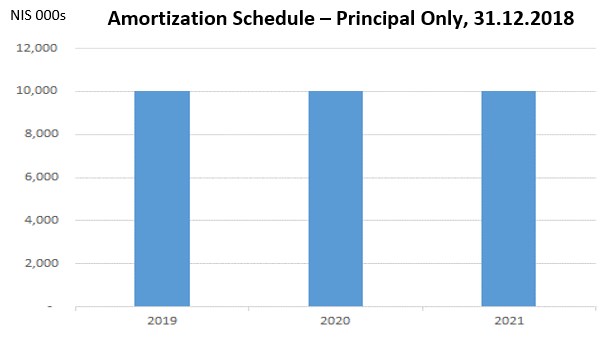

As of December 31, 2018, the Company has liquidity reserves of $14 million, which compares favorably with the outstanding value of the bonds. However, it should be noted that out of these reserves, approximately $7 million are attributed to the property CTN and cannot be withdrawn without the approval of the partner in the property, Phoenix (49%). As of December 31, 2018, the Company's bonds are valued at NIS 30 million. Repayment of the bonds is spread equally over the coming years, reducing the risk and contributing to the Company's ability to make current payments on the bonds. The Company also has an undrawn confirmed credit facility amounting to $7 million, contributing to its debt repayment ability. On the other hand, in 2020 loans are expected to be repaid in amount of €18 million and $9 million, in respect of the portfolio of supermarkets in Germany and the residential properties in Miami, respectively. The Company does not foresee any significant difficulty in refinancing these loans. However, realization of the residential properties in Miami is not in compliance with the forecast of timetables that were previously presented to Midroog, a factor which impacts negatively on the risk profile and on the Company's ability to refinance the properties. It should be noted that the payment of the loan on the properties in Miami was to have taken place in July 2018, and the deadline was extended by two years. Additionally, all the Company's properties are encumbered, limiting its financial flexibility.

6 | | Optibase Ltd. - Monitoring Report |

MIDROOG

Following is the bond principal amortization schedule:

7 | | Optibase Ltd. - Monitoring Report |

MIDROOG

Additional Rating Considerations

The Company's actual rating, Baa1.il, is one notch below the rating derived from the rating matrix – A3.il, due to the low holding rate in the properties who impact negatively on the business profile.

A low holding rate in properties, impacting negatively on the business profile and on the Company's ability to generate additional flexibility from its properties in case of need

As of December 31, 2018, the Company has a weighted holding rate of 44%, which impacts negatively on the business profile, this excludes a 4% holding in the portfolio of commercial properties in Texas. As a result of the low holding rate, the Company is not the deciding or managing party in its major investment in Chicago. In addition, in its major property in Switzerland (CTN), the company is dependent on the consent of the partner (Phoenix) in order to make decisions that are not part of current operations, such as refinancing, realization or withdrawing funds (as noted, as of December 31, 2018, the property company has cash balances of $7 million). These factors impact negatively on the Company's business profile and on its ability to generate additional flexibility from its properties.

8 | | Optibase Ltd. - Monitoring Report |

MIDROOG

Rating Matrix

| | | | As of December 31, 2018 | | Midroog Forecast |

| Category | Parameters | | Measurement | Score | | Measurement | Score |

| Operating environment | Business sector and economic environment | | --- | A.il | | --- | A.il |

| Business profile | Total assets ($ in millions)3 | | - | - | | 330-360 | Baa.il |

| Quality of assets, diversification of assets and tenants | | --- | Baa.il | | --- | Baa.il |

| Financial profile | Financial debt/cap1 | | 62% | A.il | | 64%-65% | A.il |

FFO ($ in thousands)4 | | 9,000 | Baa.il | | 8,500-9,000 | Baa.il |

| Financial debt/FFO | | 23 | A.il | | 23-24 | A.il |

| Unencumbered asset value/ total assets | | - | Ba.il | | - | Ba.il |

Secured financial debt/ investment properties5 | | 60% | Baa.il | | 60%-70% | Baa.il |

Liquidity reserves and credit facilities/unsecured debt principal service for two representative years6 | | 275% | Aaa.il | | 250%-270% | Aaa.il |

| Total derived rating | | | | | | | A3.il |

| Actual rating | | | | | | | Baa1.il |

* The metrics shown in the table are after adjustments by Midroog and are not necessarily identical to those presented by the Company. Midroog's forecast includes its own assessments regarding the issuer according to the Midroog base scenario, and not those of the issuer. Midroog's base scenario is for a period of 12-18 months.

3 According to Midroog’s estimate, after adjustment of the value of assets on fair value basis in accordance with IFRS, rather than the carrying amount as presented in the financial statements according to U.S. GAAP, and after inclusion of the Company's share of the debt on assets presented at equity.

4 After inclusion of the Company's share of the cash flow and of the debt on assets held at equity.

5 Secured financial debt to investment properties ratio includes the Company's share of the debt of companies accounted for by the equity method as well as stress tests on the value of the Company's assets as mentioned above.

6 Excluding cash balances in the CTN property.

9 | | Optibase Ltd. - Monitoring Report |

MIDROOG

Company Profile

The Company was incorporated and registered in Israel in 1990 under the name Optibase Advanced Systems (1990) Ltd. In 1993 the Company changed its name to Optibase Ltd., and it operates by that name to this day (the Company is a public company whose shares are traded on Nasdaq.) As of the report date, the Company is controlled by a trust fund called The Capri Family Foundation. Until 2012 the Company's controlling shareholder was Mr. Shlomo Wyler, who currently serves as CEO of the wholly owned subsidiary Optibase Inc., which manages the Company's operations in the U.S. The Company engaged in video streaming from its establishment until 2009, when it expanded its range of operations to include income-producing property. In 2010 the Company sold its video streaming business, and today it engages in the acquisition and management of income-producing properties in various sectors, in Switzerland, the U.S. and Germany.

Rating History

Related Reports

Optibase Ltd. – Related Reports

Rating of Income-Producing Real Estate Companies – Methodology Report, January 2019

Table of Relationships and Holdings, in Hebrew

Midroog Rating Scales and Definitions

10 | | Optibase Ltd. - Monitoring Report |

MIDROOG

The reports are published on the Midroog website at www.midroog.co.il

General Information

| Rating report date: | June 04, 2019 |

| Most recent rating update date: | May 28, 2018 |

| Initial rating issue date: | May 06, 2015 |

| Rating commissioned by: | Optibase Ltd. |

| Rating paid for by: | Optibase Ltd. |

Information from the Issuer

Midroog relies in its ratings inter alia on information received from competent personnel at the issuer.

11 | | Optibase Ltd. - Monitoring Report |

MIDROOG

Long-Term Rating Scale

| Aaa.il | Issuers or issues rated Aaa.il are those that, in Midroog judgment, have highest creditworthiness relative to other local issuers. |

| Aa.il | Issuers or issues rated Aa.il are those that, in Midroog judgment, have very strong creditworthiness relative to other local issuers. |

| A.il | Issuers or issues rated A.il are those that, in Midroog judgment, have relatively high creditworthiness relative to other local issuers. |

| Baa.il | Issuers or issues rated Baa.il are those that, in Midroog judgment, have relatively moderate credit risk relative to other local issuers, and could involve certain speculative characteristics. |

| Ba.il | Issuers or issues rated Ba.il are those that, in Midroog judgment, have relatively weak creditworthiness relative to other local issuers, and involve speculative characteristics. |

| B.il | Issuers or issues rated B.il are those that, in Midroog judgment, have relatively very weak creditworthiness relative to other local issuers, and involve significant speculative characteristics. |

| Caa.il | Issuers or issues rated Caa.il are those that, in Midroog judgment, have extremely weak creditworthiness relative to other local issuers, and involve very significant speculative characteristics. |

| Ca.il | Issuers or issues rated Ca.il are those that, in Midroog judgment, have extremely weak creditworthiness and very near default, with some prospect of recovery of principal and interest. |

| C.il | Issuers or issues rated C are those that, in Midroog judgment, have the weakest creditworthiness and are usually in a situation of default, with little prospect of recovery of principal and interest. |

Note: Midroog appends numeric modifiers 1, 2, and 3 to each rating category from Aa.il to Caa.il. The modifier '1' indicates that the obligation ranks in the higher end of its rating category, which is denoted by letters. The modifier '2' indicates that it ranks in the middle of its rating category and the modifier '3' indicates that the obligation ranks in the lower end of that category, denoted by letters.

12 | | Optibase Ltd. - Monitoring Report |

MIDROOG

Copyright © All rights reserved to Midroog Ltd. (hereinafter: “Midroog”).

This document, including this paragraph, is copyrighted by Midroog, and is protected by copyright and by intellectual property law. This document may not be copied, or otherwise scanned, amended repackaged, further transmitted, transferred, disseminated, redistributed, duplicated, displayed, translated, resold, or stored for subsequent use for any such purpose, in whole or in part, in any form or manner or by any means whatsoever, by any person, without advance written consent from Midroog.

Caveat regarding the limitations of a rating and the risks of relying on a rating, and caveats and reservations in respect to the activity of Midroog Ltd. and the information appearing on its website

Ratings and/or publications issued by Midroog are or contain Midroog’s subjective opinions about the relative future credit risk of entities, credit obligations, debts and/or debt-like financial instruments, that apply on the date of their publication, and as long as Midroog has not changed the rating or withdrawn it. Midroog's publications may contain assessments based on quantitative models of credit risks, as well as related opinions. Ratings and publications by Midroog do not constitute a statement about the accuracy of the facts at the time of the publication or in general. Midroog makes use of rating scales to issue its opinions, according to definitions detailed in the scale itself. The choice of a symbol to reflect Midroog’s opinion with respect to credit risk reflects solely a relative assessment of that risk. Midroog’s ratings are issued on a national scale and, as such, are opinions of the relative creditworthiness of issuers and financial obligations within Israel. National scale ratings are not designed to be compared between countries; rather, they address relative credit risk within a given country.

Midroog defines credit risk as the risk that an entity may fail to meet its contractual financial obligations on schedule and the estimated financial loss in the event of default. Midroog's ratings do not address any other risk, such as risks relating to liquidity, market value, change in interest rates, and fluctuation in prices or any other element that influences the capital market.

The ratings and/or publications issued by Midroog do not constitute a recommendation to buy, hold, and/or sell bonds and/or other financial instruments and/or make any other investment and/or forgo any of these actions.

Nor do the ratings and/or publications issued by Midroog constitute investment advice or financial advice, nor do they address the appropriateness of any given investment for any specific investor. Midroog issues ratings on the assumption that anybody making use of the information therein and of the ratings will exercise due caution and make his own assessment (himself and/or through authorized professionals) of the merit of any investment in a financial asset that he is thinking of buying, holding or selling. Every investor should obtain professional advice in respect to his investments, to the applicable law, and/or to any other professional issue.

NO WARRANTY, EXPRESS OR IMPLIED, AS TO THE ACCURACY, TIMELINESS, COMPLETENESS, MERCHANTABILITY OR FITNESS FOR ANY PARTICULAR PURPOSE OF ANY SUCH RATING OR OTHER OPINION OR INFORMATION IS GIVEN OR MADE BY MIDROOG IN ANY FORM OR MANNER WHATSOEVER.

Midroog’s credit ratings and publications are not intended for use by retail investors and it would be reckless and inappropriate for retail investors to use Midroog’s credit ratings or publications when making an investment decision. If in doubt you should contact your financial or other professional adviser.

All the information contained in Midroog ratings and/or publications, and on which it relied (hereinafter: "the Information") was delivered to Midroog by sources (including the rated entity) that it considers credible. Midroog is not responsible for the accuracy of the Information and presents it as provided by the sources. Midroog exercises reasonable means, to the best of its understanding, so that the Information is of sufficient quality and that it originates from sources Midroog considers to be credible, including information received from independent third parties, if and when appropriate. However, Midroog does not carry out audits and cannot therefore verify or validate the Information.

The provisions of any Midroog publication other than one expressly stated as a methodology do not constitute part of any Midroog methodology. Midroog may change its position regarding the content of such publications at any time.

Subject to applicable law, Midroog, its directors, its officers, its employees and/or anybody on its behalf involved in the rating shall not be held responsible under law, for any damage and/or loss, financial or other, direct, indirect, special, consequential, associated or related, incurred in any way or in connection with the Information or a rating or a rating process, including not issuing a rating, including if they were advised in advance of the possibility of damage or a loss as said above, including but not confined to (a) any loss of profit in present or future, including the loss of other investment opportunities; (b) any loss or damage caused consequential to holding, acquisition and/or selling of a financial instrument, whether it is a subject of a rating issued by Midroog or not; (c) any loss or damage caused consequential to the relevant financial asset, that was caused, inter alia and not exclusively, as a result of or in respect to negligence (except for fraud, a malicious action or any other action for which the law does not permit exemption from responsibility) by directors, officers, employees and/or anybody acting on Midroog's behalf, whether by action or omission.

Midroog maintains policies and procedures in respect to the independence of the rating and the rating processes.

A rating issued by Midroog may change as a result of changes in the information on which it was based and/or as a result of new information and/or for any other reason. Updates and/or changes in ratings are presented on Midroog’s website at http://www.midroog.co.il.

13 | | Optibase Ltd. - Monitoring Report |