SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | |

¨ | | Preliminary Proxy Statement | | ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2) ) |

| |

x | | Definitive Proxy Statement |

| |

¨ | | Definitive Additional Materials |

| |

¨ | | Soliciting Material Pursuant to Section 14a-11(c) or Section 240.14a-12 |

LOOKSMART, LTD.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | ¨ | | Fee paid previously with preliminary materials. |

| | ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

Notes:

NOTICE OF ANNUAL MEETING

LOOKSMART, LTD.

625 Second Street

San Francisco, California 94107

Dear Stockholder:

You are cordially invited to attend the annual meeting of stockholders of LookSmart, Ltd. (“LookSmart” or the “Company”) to be held at our headquarters at 625 Second Street, San Francisco, California, on Tuesday, June 8, 2004, at 9:00 a.m. local time. The annual meeting is being held for the following purposes:

| | (1) | | To elect three directors for three-year terms expiring at the annual meeting of stockholders in 2007; |

| | (2) | | To ratify the appointment of the accounting firm PricewaterhouseCoopers LLP as the Company’s independent auditors for the current fiscal year; and |

| | (3) | | To transact any other business that may properly come before the annual meeting and any adjournment or postponement thereof. |

These items are fully discussed in the following pages, which are made part of this notice. Only stockholders of record on the books of the Company at the close of business on April 15, 2004, are entitled to vote at the annual meeting. A list of stockholders entitled to vote will be available for inspection at the offices of LookSmart, 625 Second Street, San Francisco, California, during ordinary business hours for the 10 days prior to the annual meeting.

Whether or not you plan to attend, please promptly complete, sign, date and return your proxy card in the enclosed envelope, so that we may vote your shares in accordance with your wishes and so that enough shares are represented to allow us to conduct the business of the annual meeting. If you hold shares in “street name”, you may be able to vote over the internet or by telephone by following the instructions on your proxy card. Mailing your proxy(ies) or voting over the internet or by telephone does not affect your right to vote in person if you attend the annual meeting.

A copy of LookSmart’s annual report for the year ended December 31, 2003, is enclosed with this notice. The annual report, proxy statement and enclosed proxy are being furnished to holders of common stock and Chess Depository Interests (CDIs) on or about April 30, 2004.

By order of the board of directors,

Erik F. Riegler, Esq.

General Counsel and Secretary

April 30, 2004

Your vote is very important. Even if you plan to attend the meeting,

PLEASE SIGN, DATE AND RETURN THE ENCLOSED PROXY PROMPTLY.

PROXY STATEMENT

FOR THE

ANNUAL MEETING OF STOCKHOLDERS

LookSmart, Ltd.

625 Second Street

San Francisco, California 94107

INFORMATION ABOUT SOLICITATION AND VOTING

General

The enclosed proxy is solicited by the board of directors of LookSmart for use in voting at the annual meeting of stockholders to be held at 9:00 a.m., local time, on Tuesday, June 8, 2004, at our headquarters located at 625 Second Street, San Francisco, California, and any postponement or adjournment of that meeting. The Company’s telephone number is (415) 348-7000. The purpose of the annual meeting is to consider and vote upon the proposals outlined in this proxy statement and the attached notice.

LookSmart’s common stock is traded on the Nasdaq National Market and its Chess Depository Interests (CDIs) are traded on the Australian Stock Exchange (ASX). CDIs are exchangeable, at the option of the holder, into shares of common stock at a rate of 20 CDIs per share of common stock. Please see Exhibit A for additional disclosures required by the ASX.

These proxy solicitation materials were mailed on or about April 30, 2004, together with the Company’s annual report, to all holders of common stock or CDIs entitled to vote at the meeting.

Record Date and Outstanding Shares

Only stockholders of record on the books of the Company at the close of business on the record date, April 15, 2004, will be entitled to vote at the annual meeting. As of the close of business on the record date, there were 109,315,620 shares of common stock outstanding and held of record by approximately 444 stockholders.

Voting and Solicitation

Each stockholder may vote in person at the annual meeting or by proxy. If you are the record holder of your shares and attend the meeting in person, you may deliver your completed proxy card to us at the meeting. If your shares are held in “street name,” please check your proxy card or contact your broker or nominee to determine whether you will be able to vote by telephone or on the internet.

When proxies are properly dated, executed and returned, the shares they represent will be voted at the annual meeting in accordance with the instructions of the stockholder. If no specific instructions are given, the shares will be voted FOR the election of the nominees for directors set forth herein and FOR ratification of the appointment of auditors. In addition, if other matters come before the annual meeting, the persons named in the accompanying form of proxy will vote in accordance with their best judgment with respect to such matters. On all matters to be voted on, each share has one vote.

The cost of soliciting proxies will be borne by the Company. Proxies may be solicited by the Company’s officers, directors and regular employees, without compensation, personally or by telephone or facsimile.

Required Vote

The three candidates for election as directors at the annual meeting who receive the highest number of affirmative votes entitled to vote at the annual meeting will be elected. The ratification of the independent auditors for the Company for the current year will require the affirmative vote of a majority of the shares of the Company’s common stock present or represented and entitled to vote at the annual meeting.

1

Revocability of Proxies

A proxy given pursuant to this solicitation may be revoked at any time before its use by delivering a written revocation to the Secretary of the Company, delivering a duly executed proxy bearing a later date or attending and voting in person at the annual meeting.

Quorum; Abstentions; Broker Non-Votes

A quorum is required for the transaction of business during the annual meeting. A quorum is present when a majority of stockholder votes are present in person or by proxy. Shares that are voted “FOR”, “AGAINST” or “WITHHELD” on a matter are treated as being present at the meeting for purposes of establishing a quorum and are also treated as votes cast by the common stock present in person or represented by proxy at the annual meeting and entitled to vote on the subject matter.

The Company will count abstentions for purposes of determining both (i) the presence or absence of a quorum for the transaction of business and (ii) the total number of votes cast with respect to a proposal (other than the election of directors). As a result, abstentions will have the same effect as a vote against the proposal.

Broker non-votes (i.e., shares held of record by brokers as to which the beneficial owners have given no voting instructions) will be counted for purposes of determining the presence or absence of a quorum for the transaction of business. Broker non-votes will not be counted for purposes of determining the number of votes cast with respect to the particular proposal. Thus, a broker non-vote will not have any effect on the outcome of the voting on a proposal.

PROPOSAL ONE — ELECTION OF DIRECTORS

Our board of directors consists of seven directors, three of whom are standing for election: Anthony Castagna, Teresa Dial and Mark Sanders. In addition to the directors standing for election, we have three incumbent directors with terms expiring in 2005 and one incumbent director with a term expiring in 2006. Our bylaws provide that the board of directors be divided into three classes. There is no difference in the voting rights of the members of each class of directors. Each class of directors serves a term of three years, with the term of one class expiring at the annual meeting of stockholders in each successive year. There are no family relationships among any directors or executive officers of the Company, except that Evan Thornley, Chairman, is married to Tracey Ellery, a member of the board of directors. The names, ages, principal occupations and current terms of office of our directors as of April 15, 2004 are as follows:

| | | | | | |

Name

| | Age

| | Position

| | Expiration

of Term

|

Anthony Castagna (1)(3) | | 56 | | Director, Macquarie Technology Funds Management Pty Ltd. | | 2004 |

Teresa Dial (2)(3) | | 54 | | Director, LookSmart | | 2004 |

Mark Sanders (2)(3) | | 60 | | Chairman, Pinnacle Systems | | 2004 |

Evan Thornley | | 39 | | Chairman, LookSmart | | 2005 |

Tracey Ellery | | 41 | | Director, LookSmart | | 2005 |

Edward West (1) | | 51 | | President and Chief Executive Officer, Colarity Corporation | | 2005 |

Greg Santora (1)(2) | | 53 | | Chief Financial Officer, Shopping.com | | 2006 |

| (1) | | Member of Audit Committee |

| (2) | | Member of Compensation Committee |

| (3) | | Member of Nominating and Governance Committee |

Unless marked otherwise, proxies received will be voted FOR the election of the three nominees. All of the nominees are presently directors whose terms will expire at the annual meeting. The nominees are willing to be elected and to serve for the three-year term. If a nominee is unable or unwilling to serve as a director at the time

2

of the annual meeting, the proxies may be voted either (i) for a substitute nominee who shall be designated by the proxy holders or by the incumbent board of directors to fill the vacancy or (ii) for the other nominee, leaving a vacancy. Alternatively, the size of the board of directors may be reduced accordingly. The board of directors has no reason to believe that any of the nominees will be unwilling or unable to serve if elected as a director. Such persons have been nominated to serve for three-year terms until the annual meeting of stockholders in 2007 or until their successors, if any, are elected or appointed.

Nominees for Election to the Board of Directors

The nominees for election to the board of directors are Anthony Castagna, Teresa Dial and Mark Sanders.

Anthony Castagnahas served as one of our directors since March 1999. Dr. Castagna currently serves as a non-executive director of Macquarie Technology Funds Management Pty Limited, an Australian venture capital fund. From 1997 to present, Dr. Castagna has served as an independent advisor to the Macquarie Technology Investment Banking Division of Macquarie Bank Limited, an investment banking company, and other technology-based companies in Australia, Asia and the United States. Dr. Castagna served as a non-executive director of BT LookSmart, the joint venture between LookSmart and British Telecommunications, until December 2002. Dr. Castagna holds a Bachelor of Commerce from the University of Newcastle, Australia, and an M.B.A. and Ph.D. in finance from the University of New South Wales, Australia.

Teresa Dialhas served as one of our directors since January 2003. From November 1998 to March 2001, Ms. Dial was Chief Executive Officer of Wells Fargo Bank and Group Executive Vice President and a member of the management committee of Wells Fargo & Co. From 1996 to November 1998, Ms. Dial was Vice Chair of Consumer and Business Banking and a member of the office of the Chairman of Wells Fargo & Company. From September 1991 to March 1996, she was Executive Vice President, Business Banking, of Wells Fargo. Prior to that time, Ms. Dial held various other management roles with Wells Fargo since 1980. Ms. Dial serves on the boards of directors of NDCHealth Corporation and Onyx Software Corporation. Ms. Dial also serves on the boards of Blue Shield of California and the Community Colleges Foundation, both of which are non-public entities. Ms. Dial is a graduate of the Graduate School of Credit and Financial Management and received her B.A. in Political Science from Northwestern University.

Mark Sandershas served as one of our directors since January 2003. Mr. Sanders has served as Chairman of Pinnacle Systems, a supplier of video creation, storage, distribution and streaming solutions, since July 2002 and as a director since January 1990. Mr. Sanders also served as President and Chief Executive Officer from January 1990 to July 2002. Prior to that time, Mr. Sanders served in a variety of management positions, most recently as Vice President and General Manager of the Recording Systems Division of Ampex, Inc., a manufacturer of video broadcast equipment. Mr. Sanders also serves on the board of directors of Bell Microproducts Inc., a computer storage and semiconductor company. Mr. Sanders holds a B.S. in Electrical Engineering from California Polytechnic University, Pomona and an M.B.A. from Golden Gate University.

The board of directors unanimously recommends that you vote FOR election of all nominees as directors.

Incumbent Directors Whose Terms Continue After the Annual Meeting

The following persons are incumbent directors whose terms expire at the annual meeting of stockholders in 2005:

Tracey Elleryco-founded LookSmart and has served as a director since September 1997. Ms. Ellery served as President of LookSmart from June 1999 to March 2001 and Senior Vice President of Product from July 1996 to June 1999. From 1991 to 1994, Ms. Ellery was Chief Executive Officer of Student Services Australia, an Australian college publishing and retail company. Ms. Ellery studied drama and legal studies at Deakin University, Australia. Ms. Ellery is married to Mr. Thornley.

Evan Thornley co-founded LookSmart and served as its Chairman since July 1996. Mr. Thornley served as Chief Executive Officer of LookSmart from July 1996 to October 2002 and as President from July 1996 to June 1999. From 1991 to 1996, Mr. Thornley was a consultant at McKinsey & Company, a global consulting

3

company, in their New York, Kuala Lumpur and Melbourne offices. Mr. Thornley holds a Bachelor of Commerce and a Bachelor of Laws from the University of Melbourne, Australia. Mr. Thornley is married to Ms. Ellery.

Edward F. West has served as one of our directors since November 2001, and as Managing Director of Sage Partners LLC, an advisory services firm in strategic leadership, since January 2004. Mr. West has served as Chief Executive Officer of Colarity Corporation, a customer knowledge management company, since January 2001. From December 1999 to December 2000, Mr. West served as Chief Executive Officer of RealNames International, the global development subsidiary of RealNames Corporation, an Internet names and navigation platform provider. From May 1998 to December 1999, Mr. West served as Executive Vice President, Business Development, Sales and Marketing, at RealNames Corporation. From January 1996 to April 1998, Mr. West served as Chief Operating Officer of Softbank Interactive Marketing, a provider of marketing services and sales representation to Internet sites seeking interactive advertisers. Mr. West holds an M.B.A. from Harvard Business School and an A.B. in Architecture/Urban Planning from Princeton University.

The following person is an incumbent director whose term expires at the annual meeting of stockholders in 2006:

Greg Santorahas served as one of our directors since September 2002 and as Chief Financial Officer of Shopping.com, a web-based shopping services provider, since December 2003. From February 2003 to November 2003, Mr. Santora was not employed, but served on the boards of several public and private companies. From 1996 to February 2003, Mr. Santora served in several roles at Intuit, Inc., a business and financial management software company, including senior vice president and chief financial officer. Mr. Santora currently serves on the boards of Align Technology, Inc. and Digital Insight Corporation. Mr. Santora holds a B.A. in accounting from the University of Illinois and an M.B.A. from San Jose State University.

Board Committees and Meetings

In March 1999, the board of directors established two standing committees: the audit committee and the compensation committee. Prior to that time, the functions of these two standing committees were performed by the board of directors. In June 2002, the board of directors established the nominating and governance committee.

In 2003, the board of directors held eight regular meetings, three special meetings, and took action by written consent on four occasions. Each of the directors attended 75% or more of the aggregate of (i) the total number of meetings of the board of directors and (ii) the total number of meetings held by all committees of the board of directors on which he or she served (during the periods that he or she served). The Company has a policy of encouraging board members’ attendance at annual stockholder meetings. In 2003, seven members of the board of directors attended the annual stockholder meeting.

Audit Committee. The audit committee operates under a written charter adopted by the board of directors and recommends to the board of directors the selection of independent accountants, approves the nature and scope of services to be performed by the independent accountants and reviews the range of fees for such services, confers with the independent accountants and reviews the results of the annual audit and quarterly financial statements, reviews with the management and independent accountants our accounting and financial controls and reviews policies and practices regarding compliance with laws and conflicts of interest. Currently, the audit committee consists of directors Castagna, Santora and West, all of whom are “independent” directors as defined in Rule 4200(a)(15) of the National Association of Securities Dealers’ listing standards. Mr. Santora was appointed as Chairman of the audit committee in October 2002 and is an “audit committee financial expert” within the meaning of applicable SEC rules. In 2003, the audit committee held eight regular meetings and three special meetings.

Compensation Committee. The compensation committee is responsible for reviewing and recommending to the board of directors the timing and amount of compensation for the Chief Executive Officer and other key employees, including salaries, bonuses and other benefits. The compensation committee also is responsible for administering the Company’s stock option and other equity-based incentive plans. Currently, the compensation committee consists of directors Dial, Sanders and Santora, all of whom are “independent” directors

4

as defined in Rule 4200(a)(15) of the National Association of Securities Dealers’ listing standards. Ms. Dial was appointed as Chairperson of the compensation committee in May 2003. Prior to that time, Mr. Castagna served as Chairman of the compensation committee. In 2003, the compensation committee held six regular meetings, one special meeting, and took action by written consent on one occasion.

Nominating and Governance Committee. The nominating and governance committee develops and implements policies and processes regarding corporate governance matters, assesses board membership needs and makes recommendations regarding potential director candidates to the board of directors. The board of directors established the nominating and governance committee in June 2002. Currently, the nominating and governance committee is composed of directors Castagna, Dial and Sanders, all of whom are “independent” directors as defined in Rule 4200(a)(15) of the National Association of Securities Dealers’ listing standards. Mr. Castagna was appointed Chairman of the nominating and governance committee in June 2002. In 2003, the nominating and governance committee held one meeting. The nominating and governance committee will consider nominees recommended by stockholders. Such recommendations should be submitted to the attention of the chairman of the nominating committee. The charter of the nominating and governance committee is attached as Exhibit B.

Nomination of Directors

The nominating and governance committee has in the past, and may in the future, use third party executive search firms to help identify prospective director nominees. In evaluating the suitability of each candidate, the nominating and governance committee will consider issues of character, judgment, independence, age, expertise, diversity of experience, length of service, other commitments and the like. While there are no specific minimum qualifications for director nominees, the ideal candidate should exhibit (i) independence, (ii) integrity, (iii) qualifications that will increase overall board effectiveness and (iv) meet other requirements as may be required by applicable rules, such as financial literacy or expertise for audit committee members. The nominating and governance committee uses the same process for evaluating all nominees, regardless of the original source of the nomination.

LookSmart stockholders may recommend individuals to the nominating and governance committee for consideration as potential director candidates by submitting their names and appropriate background and biographical information to: LookSmart Nominating and Governance Committee, 625 Second Street, San Francisco, CA 94107. The recommendation must include any relevant information, including the candidate’s name, home and business contact information, detailed biographical data and qualifications, and information regarding any relationships between the candidate and the Company within the last three years. LookSmart stockholders also have the right to nominate director candidates without any action on the part of the nominating and governance committee or the board, by following the advance notice provisions of LookSmart’s bylaws as described below under “Advance Notice Procedures”.

Compensation of Directors

Starting in June 2002, members of the board of directors have received the following compensation: (i) new non-employee directors are granted an option to purchase 50,000 shares of common stock upon joining the board of directors, which option vests monthly over 36 months, (ii) each year, non-employee directors are granted an option to purchase 30,000 shares of common stock, based upon the continued service of the director during the prior year, which vests immediately, (iii) $1,250 per quarter for members of the audit committee if the member attends 100% of meetings held by the committee during the quarter, (iv) $1,250 per quarter for members of the compensation committee if the member attends 100% of meetings held by the committee during the quarter, (v) $500 per meeting for members of the nominating and governance committee, (vi) $5,000 per quarter for members of the board of directors if the member attends 100% of meetings held by the board of directors during the quarter, (vii) $1,250 per quarter for the chairman of each of the audit and compensation committees, and (viii) $1,250 per quarter for service as a member of the board of directors of BT LookSmart, our joint venture with British Telecommunications. In addition, starting in January 2003, the chairman of the board received $12,500 per quarter. Directors may elect to take part or all of their cash compensation in the form of fully vested non-qualified stock options. If a director makes such election, the number of stock options granted will be three times the amount of cash compensation divided by the closing price of LookSmart stock on the date of grant. The options have an exercise price equal to the closing price of LookSmart stock on the date of grant. For all unvested options held by directors, vesting accelerates 100% in the event of involuntary termination of the director’s membership on the board of directors within 12 months after a change of control of the Company. For any

5

quarter or year in which a director has not served as a board or committee member for the entire period, the compensation described above (except for the initial grant) is prorated for the period of time served.

From February 2000 until June 2002, directors received grants of stock options as follows: (i) new non-employee directors were automatically granted an option to purchase 50,000 shares of common stock upon joining the board of directors, and (ii) each year, non-employee directors were granted an option to purchase 20,000 shares of common stock, based upon the continued service of the director during the prior year. These stock options vested at a rate of 1/36th per month over the three years following the commencement of vesting, based on continued service as a director. Vesting accelerates 100% in the event of involuntary termination of the director’s membership on the board of directors within 12 months after a change of control of the Company. Effective in June 2002, directors’ compensation was revised as described above.

Directors received no other compensation for their services as directors in 2003, other than reimbursement of reasonable out-of-pocket expenses for attendance at board meetings.

Compensation Committee Interlocks and Insider Participation

The compensation committee consists of directors Dial, Sanders and Santora, none of whom is or has been an officer or employee of the Company. Damian Smith, Chief Executive Officer of the Company, is not a member of the board of directors and cannot vote on matters decided by the committee. Mr. Smith participates in compensation committee discussions regarding salaries and incentive compensation for all employees of and consultants to the Company, but Mr. Smith is excluded from discussions regarding his own salary and incentive compensation.

No interlocking relationship exists between the Company’s board of directors or compensation committee and the board of directors or compensation committee of any other party, nor has such relationship existed in the past.

Communications to the Board

The board of directors provides a process for LookSmart stockholders to send communications to the board of directors. Any stockholder who desires to contact the board of directors may do so by writing to: LookSmart Board of Directors, 625 Second Street, San Francisco, CA 94107. Communications received by mail will be forwarded to the chairman of the board who will, in his discretion, forward such communications to other directors, members of LookSmart management or such other persons as he deems appropriate.

Code of Conduct

LookSmart has adopted a code of ethics (referred to as the LookSmart Code of Business Conduct and Ethics) applicable to all directors, officers and employees of the Company and has established a hotline available to all employees on a confidential basis. The LookSmart Code of Business Conduct and Ethics is publicly available at www.looksmart.com/aboutus.

Board Independence

LookSmart’s board of directors has a majority of “independent” directors (Anthony Castagna, Teresa Dial, Mark Sanders, Greg Santora, and Edward West), as defined in SEC regulations and the NASD listing standards.

PROPOSAL TWO — RATIFICATION OF APPOINTMENT OF INDEPENDENT ACCOUNTANTS

The board of directors has reappointed the firm of PricewaterhouseCoopers LLP, certified public accountants, as independent accountants of LookSmart for the current fiscal year. Stockholder ratification of the selection of PricewaterhouseCoopers LLP as LookSmart’s independent accountants is not required by LookSmart’s bylaws, Delaware corporate law or otherwise. The board of directors has elected to seek such ratification as a matter of good corporate practice. Should the stockholders fail to ratify the selection of PricewaterhouseCoopers LLP as independent accountants, the board of directors will consider whether to retain that firm for the year ending December 31, 2004 and will consider the appointment of other certified public accountants. PricewaterhouseCoopers LLP audited the financial statements of LookSmart and its subsidiaries for the fiscal year ended December 31, 2003. Representatives of PricewaterhouseCoopers LLP are expected to be present at the annual meeting, will have an opportunity to make a statement if they desire to do so and are expected to be available to respond to appropriate questions from stockholders.

The board of directors recommends that you vote FOR ratification of the appointment of PricewaterhouseCoopers LLP.

6

STOCK OWNERSHIP OF PRINCIPAL STOCKHOLDERS AND MANAGEMENT

To the Company’s knowledge, the following table sets forth the number of shares of LookSmart common stock beneficially owned as of April 15, 2004, by

| | • | | each beneficial owner of 5% or more of the Company’s outstanding common stock, |

| | • | | each of LookSmart’s directors and nominees for director, |

| | • | | each of the named executive officers, and |

| | • | | all of LookSmart’s directors, nominees for director and named executive officers as a group. |

Except as otherwise indicated below and subject to applicable community property laws, each owner has sole voting and sole investment powers with respect to the stock issued. Beneficial ownership is determined in accordance with SEC regulations and generally includes voting or investment power with respect to securities. Beneficial ownership also includes securities issuable upon exercise of warrants or stock options exercisable within 60 days of April 15, 2004. Percentage ownership is based on 109,315,620 shares of common stock outstanding as of April 15, 2004. Stock options or warrants exercisable within 60 days of April 15, 2004 are deemed outstanding for computing the percentage of the person holding such options but are not deemed outstanding for computing the percentage of any other person. Unless otherwise indicated below, the address of the persons listed is c/o LookSmart, Ltd., 625 Second Street, San Francisco, 94107.

| | | | | |

Name and Address of Beneficial Owner

| | Shares

Beneficially

Owned(1)

| | | Percent

Beneficially

Owned

|

Named Executive Officers and Directors | | | | | |

Brian Cowley | | — | | | * |

Anthony Castagna | | 222,673 | | | * |

Teresa Dial | | 64,349 | | | * |

Dianne Dubois | | — | | | * |

Tracey Ellery (2) | | 14,442,000 | | | 13.2 |

Jason Kellerman | | 485,412 | (3) | | * |

Martin Roberts | | — | | | * |

Mark Sanders | | 20,555 | | | * |

Greg Santora | | 99,365 | | | * |

Evan Thornley (2) | | 14,442,000 | | | 13.2 |

Garret Vreeland | | 5,000 | | | * |

Edward West | | 85,059 | | | * |

All directors and executive officers as a group (12 persons) | | 16,061,087 | | | 14.5 |

| (1) | | Includes shares that may be acquired by the exercise of stock options granted under the Company’s stock option plans within 60 days after April 15, 2004. The number of shares subject to stock options exercisable within 60 days after April 15, 2004, for each of the named executive officers and directors is shown below: |

| | |

Anthony Castagna | | 222,673 |

Teresa Dial | | 64,349 |

Jason Kellerman | | 462,720 |

Mark Sanders | | 20,555 |

Greg Santora | | 99,365 |

Edward West | | 85,059 |

| (2) | | Mr. Thornley and Ms. Ellery are husband and wife and, accordingly, each is the beneficial owner of shares held by the other. Mr. Thornley and Ms. Ellery each hold 1,100,000 shares in their own name and jointly hold 12,242,000 shares by trust. |

| (3) | | Includes 22,692 shares registered in the name of Mr. Kellerman and his former spouse. |

7

EXECUTIVE COMPENSATION

Executive Officers

Our executive officers, and their respective ages as of April 15, 2004, are as follows:

| | | | |

Name

| | Age

| | Position

|

Damian Smith | | 36 | | Chief Executive Officer |

William Lonergan | | 47 | | Chief Financial Officer |

Anthony Mamone | | 30 | | Senior Vice President, Sales and Field Operations |

Brian Goler | | 32 | | Senior Vice President, Product |

Joan Dauria | | 50 | | Vice President, Human Resources |

Erik Riegler | | 36 | | General Counsel and Secretary |

Damian Smithhas served as our Chief Executive Officer since January 2004 and as the Chief Executive Officer of our Australian subsidiary since July 2001. He also served as Vice President, International Operations from July 2001 to January 2004. Prior to that time, he served as Director, Business Development from July 1998 to July 2001. Mr. Smith holds a Masters in Public Policy from Harvard University and a B.A. in History and English from the University of Sydney, Australia.

William Lonerganhas served as our Chief Financial Officer since August 2003. Mr. Lonergan served as Chief Financial Officer of Tacit Knowledge Systems, Inc., a provider of enterprise collaboration management solutions, from July 2000 to August 2003. Prior to that time, Mr. Lonergan served in the auditing and consulting practices at KPMG LLP, a professional auditing firm, in a variety of roles for more than 20 years, most recently as a senior partner. Mr. Lonergan is a C.P.A., a Chartered Accountant, and holds a B.A. degree in Geography from the University of Durham, England.

Anthony Mamonehas served as our Senior Vice President, Sales and Field Operations since December 2003. Prior to that time, he served as Vice President, Sales and Marketing from April 2002 to December 2003, Vice President, Product Development from January 2001 to April 2002, Director, Business Research & Development from January 2000 to December 2000, and Manager, eCommerce from March 1999 to January 2000. Mr. Mamone holds a B.E. degree in Engineering from the Thayer School of Engineering and a B.A. degree in Engineering from Dartmouth College.

Brian Golerhas served as our Senior Vice President, Product since January 2001. Prior to that time, he served as Vice President, Product from October to December 2000. Mr. Goler served as co-founder and Chief Executive Officer of Zeal Media, a community-based online directory company acquired by LookSmart, from January 1999 to October 2000. Mr. Goler holds an A.B. degree in Chemistry from Harvard College and an M.S. in Economics from the London School of Economics.

Joan Dauriahas served as our Vice President, Human Resources since September 2002. Prior to that time, Ms. Dauria served as Vice President, Human Resources at CNET Media (formerly ZDNet), an online content publisher, from January 2000 to June 2001 and as Group Director of Human Resources at Time Inc., a division of Time Warner, from 1986 to January 2000. Ms. Dauria holds a B.S. degree in Psychology and Education from Rhode Island College.

Erik Rieglerhas served as our General Counsel and Secretary since February 2004. Prior to that time, he served as our Assistant General Counsel from February 2000 to January 2004. He served as an Associate Attorney in the Corporate and Securities group at Wilson Sonsini Goodrich & Rosati, a law firm, from October 1996 to February 2000. Mr. Riegler holds a J.D. and a B.A. in Social Sciences from the University of California, Berkeley and an M.S. in Politics of the World Economy from the London School of Economics.

8

Summary Compensation Table

The following table shows information concerning the compensation earned during each of the last three full fiscal years by (i) the Chief Executive Officer in 2003, and (ii) the four other most highly compensated executive officers of the Company in 2003. The persons listed below are referred to throughout this proxy statement as the “named executive officers.”

| | | | | | | | | | | | | | |

| | | Year

| | Annual Compensation

| | | Long-Term

Compensation

Awards

| | All Other

Compensation

($)(1)

|

Name and Principal Position

| | | Salary ($)

| | Bonus ($)

| | | Other Annual

Compensation ($)

| | | Number of

Shares

Underlying

Options

| |

Jason Kellerman (2) Former Chief Executive Officer and director | | 2003

2002

2001 | | 297,885

243,750

187,260 | | 97,500

183,750

— |

| | 51,223

74,213

33,647 | (3)

(3)

(3) | | 1,500,000

1,500,000

1,020,000 | | 13,693

13,258

11,199 |

Dianne Dubois (4) Former Chief Financial Officer | | 2003

2002

2001 | | 226,010

225,000

79,327 | | —

65,625

96,875 |

(5)

(5) | | 87,582

—

— | (5)

| | —

—

750,000 | | 13,693

13,258

5,146 |

Martin Roberts (6) Former Vice President and General Counsel | | 2003

2002

2001 | | 198,590

182,500

153,750 | | 35,657

12,500

— |

| | —

—

— |

| | —

125,000

325,000 | | 13,693

12,383

8,857 |

Garret Vreeland (7) Former Senior Vice President, Sales | | 2003

2002

2001 | | 198,590

180,662

— | | 125,001

173,457

— |

| | —

—

— |

| | 150,000

350,000

— | | 20,789

17,916

— |

Brian Cowley (8) Former Senior Vice President, Business Development | | 2003

2002

2001 | | 223,414

124,219

73,557 | | 46,875

62,500

— |

| | —

—

56,250 |

(8) | | —

750,000

— | | 9,799

4,201

9,863 |

| (1) | | The amounts in this column consist of (a) health insurance premiums paid by the Company on behalf of the named executive officer and (b) matching contributions made by the Company to the accounts of the named executive officers under the Company’s 401(k) plan. Under the 401(k) plan, matching contributions are 50% vested after the first year of employment and 100% vested after the second year of employment. |

| (2) | | Mr. Kellerman served as Chief Executive Officer from October 2002 to January 2004. |

| (3) | | Consists of payments for housing, relocation, tax preparation, and tax equalization in connection with Mr. Kellerman’s relocation to Australia in September 2000 and to the United States in June 2001. |

| (4) | | Ms. Dubois worked for the Company from August 2001 to August 2003. Amounts shown for 2001 reflect compensation for services rendered for less than the full fiscal year. |

| (5) | | Amounts shown in the ‘Bonus’ column reflect annual bonuses, as well as performance-based forgiveness of $15,625 in 2002 and $46,875 in 2001 of principal on a loan by the Company. Amount shown in the ‘Other Annual Compensation’ column consists of $7,190 in tax preparation expenses, $53,909 in tax gross-up payments in connection with the loan, and $26,483 in imputed interest on the loan. |

| (6) | | Mr. Roberts worked for the Company from July 1999 to February 2004. |

| (7) | | Mr. Vreeland worked for the Company from January 2002 to January 2004. Amounts shown for 2002 reflect compensation for services rendered for less than the full fiscal year. |

| (8) | | Mr. Cowley worked for the Company from June 2002 to January 2004 and from September 1996 to January 2001. Amounts shown for 2001 and 2002 reflect compensation for services rendered for less than the full fiscal year. Amount shown in the ‘Other Annual Compensation’ column consists of a severance payment made in January 2001. |

9

Stock Option Grants in the Last Fiscal Year

The following table sets forth information regarding stock options granted to the named executive officers in 2003 and the values of those options:

| | | | | | | | | | | | | | | | |

| | | Individual Grants

| | Potential Realizable Value

at Assumed Annual Rate of

Stock Price Appreciation for

Option Term ($)

|

Name

| | Number of

Securities

Underlying

Options

Granted

| | Percent of

Total

Options

Granted to

Employees

in 2003

| | | Exercise

Price

Per Share

| | Expiration

Date (1)

| | 5%

| | 10%

|

Jason Kellerman | | 1,500,000 | | 25.2 | % | | $ | 2.62 | | 1/3/13 | | $ | 2,471,556 | | $ | 6,263,408 |

Garret Vreeland | | 150,000 | | 2.5 | % | | $ | 3.33 | | 1/14/13 | | $ | 314,133 | | $ | 796,074 |

| (1) | | Denotes date of expiration of stock option grant. Messrs. Kellerman and Vreeland no longer work for the Company and, accordingly, the last date of exercise of these stock options is January 20, 2005 and June 12, 2004, respectively. |

The amounts shown in the column entitled “Potential Realizable Value at Assumed Annual Rate of Stock Price Appreciation for Option Term” are based on the fair market value per share of common stock on the date of grant, compounded annually at 5% or 10% per annum over an assumed 10-year term, minus the exercise price per share, multiplied by the number of shares subject to the stock option. The real value of the options depends on the actual performance of the Company’s stock during the applicable period. The use of this valuation method should not be construed as an endorsement of its accuracy in valuing LookSmart options or common stock.

Stock options noted above granted to Mr. Vreeland are exercisable with respect to 1/48th of the shares on each month with full vesting occurring on the fourth anniversary of the vesting commencement date. Stock options noted above granted to Mr. Kellerman are exercisable with respect 1/60th of the shares on each month with full vesting occurring on the fifth anniversary of the vesting commencement date. Both stock options included terms providing that vesting may be partially or fully accelerated upon certain events relating to a change in control of the Company. Stock options granted in 2003 under the Amended and Restated Plan generally: (i) expire after a term of ten years, (ii) terminate, with limited exercise provisions for a period of time, in the event of death, retirement or other termination of employment, and (iii) permit the optionee to pay the exercise price by delivery of cash or shares of the Company’s common stock.

Aggregated Option Exercises and Fiscal Year-End Values

The following table provides information concerning option exercises in 2003 and unexercised in-the-money options held as of December 31, 2003 by the named executive officers. The amounts shown in the column entitled “Value Realized” are based on the market price of the purchased shares on the exercise date minus the exercise price of the option, multiplied by the number of shares subject to the option. The amounts shown in the column entitled “Value of Unexercised In-the-Money Options at Fiscal Year End” are based on the closing sales price of the Company’s common stock on the Nasdaq National Market on December 31, 2003 ($1.55) minus the exercise price of the option (if less than $1.55), multiplied by the number of shares subject to the option.

| | | | | | | | | | | | | | | |

| | | Number of

Shares Acquired

on Exercise

| | Value Realized

| | Number of Securities Underlying Unexercised Options at Fiscal Year End

| | Value of Unexercised

In-the-Money Options at

Fiscal Year-End

|

Name

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Brian Cowley | | — | | | — | | 375,000 | | 375,000 | | $ | 33,750 | | $ | 33,750 |

Dianne Dubois | | 562,499 | | $ | 690,827 | | 20,834 | | — | | $ | 19,167 | | | — |

Jason Kellerman | | 449,800 | | $ | 805,318 | | 698,952 | | 1,921,548 | | $ | 176,539 | | $ | 845,805 |

Martin Roberts | | 74,929 | | $ | 123,841 | | 34,757 | | 100,314 | | $ | 13,490 | | $ | 17,156 |

Garret Vreeland | | — | | | — | | 193,750 | | 156,250 | | $ | 3,875 | | $ | 3,125 |

10

Employment, Severance and Change of Control Agreements

Other than as set forth below, the Company has no written employment agreements governing the length of service of its executive officers, or any severance or change of control agreements with its executive officers. Except as set forth below, each of its executive officers serves on an at-will basis.

In January 2003, the Company paid severance to Robert Goldberg, its former Senior Vice President, Sales, in the form of a lump sum payment of $87,500 and health benefits for three months after the date of termination.

In May 2003, the Company entered into a settlement agreement with Dianne Dubois, its former Chief Financial Officer, providing for continued employment through August 2003 and, thereafter, for continued provision of salary and benefits through December 2003.

In January 2004, in connection with the termination of employment of Scott Stanford, its former Vice President, Business Development, the Company agreed to provide six months of continued base salary at the annual rate of $250,000 and up to six months of health benefits (not including accrued vacation, 401(k) matching or stock option vesting).

In February 2004, the Company entered into a separation agreement with Jason Kellerman, its former Chief Executive Officer, providing for (a) a lump sum payment of $487,500, (b) an extension of time for the exercise of vested stock options until January 20, 2005, and (c) continued health benefits until the earlier to occur of January 31, 2005 or Mr. Kellerman’s acceptance of other employment.

In February 2004, the Company entered into a settlement agreement with Peter Adams, its Chief Technical Officer, providing for continued provision of services by Mr. Adams until at least May 2004 and, after the termination of employment, for a lump sum payment of $69,231 and continued health benefits for four months.

In March 2004, the Company entered into a separation agreement with Brian Cowley, its former Senior Vice President, Business Development, providing for a lump sum payment of $87,500 and health benefits for up to three months.

In March 2004, the Company entered into a separation agreement with Garret Vreeland, its former Senior Vice President, Sales, providing for a lump sum payment of $102,965.

The Company has a severance agreement with Damian Smith, its interim Chief Executive Officer, providing that in the event of termination without cause, the Company will provide a severance payment equal to 50% of his then-current annual base salary and a prorated portion of his annual incentive compensation at plan.

The Company has a severance agreement with William B. Lonergan, its Chief Financial Officer, providing that in the event of termination without cause, the Company will provide a severance package consisting of: (a) a lump sum payment equal to 50% of his then-current annual base salary plus 100% of his annual performance bonus, and (b) up to six months of continued benefits coverage.

The Company has a severance agreement with Anthony Mamone, its Senior Vice President, Sales, providing that in the event of termination without cause, the Company will provide a severance package consisting of: (a) a lump sum payment equal to 50% of his then-current annual base salary and annual performance bonus, and (b) up to six months of continued benefits coverage.

Stock Options. Pursuant to individual stock option agreements with the Company, the stock options held by executive officers are subject to accelerated vesting in the event of termination without cause following a change in control of the Company. In such event, the vesting of stock options will be accelerated in amounts between 25% and 100% of the shares subject to the stock option. A “change of control” is generally defined in the agreements as a merger or acquisition of the Company in which the stockholders of the Company prior to the transaction do not retain 50% of the voting securities of the surviving corporation or a sale of all or substantially all of the assets of the Company. Generally, under the stock option agreements for newly hired executive officers, 25% or 33% of each option becomes exercisable on the first anniversary of the date of grant and 1/48th

11

or 1/33rd of the shares become exercisable each month thereafter, so that all options are vested after four or three years. For additional grants to executive officers, 1/60th, 1/48th or 1/36th of the shares become exercisable each month, so that all options are vested after five, four or three years.

Indemnity Agreements. The Company has entered into indemnity agreements with its directors and officers providing for indemnification of each director and officer against expenses incurred in connection with any action or investigation involving the director or officer by reason of his or her position with the Company (or with another entity at the Company’s request). The directors and officers will also be indemnified for costs, including judgments, fines and penalties, indemnifiable under Delaware law or under the terms of any current or future liability insurance policy maintained by the Company that covers directors and officers. A director or officer involved in a derivative suit will be indemnified for expenses and amounts paid in settlement. Indemnification is dependent in each instance on the director or officer meeting the standards of conduct set forth in the indemnity agreements.

Certain Relationships and Related Transactions

In April 2002, the Company loaned $250,000 to Dianne Dubois, its former Chief Financial Officer, in connection with the purchase of a personal residence. The loan is due and payable upon the earliest to occur of: (a) 120 days after Ms. Dubois’s resignation from the Company; (b) 180 days after termination of Ms. Dubois’s employment, provided that if at that time, the realizable post-tax gain from the stock options held by Ms. Dubois is less than the amount required to repay the loan in full, then the amount of loan due and payable at that time shall equal the amount of the realizable post-tax gain, and the remainder of the loan shall remain outstanding and shall mature upon the next anniversary of the date the loan was made; or (c) 30 days after the sale of the residence. The loan is interest-free and includes provisions for the Company’s payment of taxes due related to forgiveness of the loan and imputed interest. The loan also includes provisions for forgiveness annually in the first four years after the loan date, subject to performance measures being met. For the first year of the loan, the Company forgave $62,500 pursuant to this provision.

Shopping.com, a web-based shopping service, purchased $6.8 million of listings services from LookSmart in 2003. Greg Santora, a member of our board of directors, became the Chief Financial Officer of Shopping.com in December 2003. All transactions between Shopping.com and LookSmart, both before and after Mr. Santora’s appointment as an officer of Shopping.com, were made at prevailing market prices and were the result of arms-length negotiations.

Equity Compensation Plan Information

The following table provides information concerning our equity compensation plans as of December 31, 2003 under which common stock of the Company is authorized for issuance.

| | | | | | | | | |

| | | Number of Shares

of Common Stock

to be Issued upon

Exercise of

Outstanding

Options,

Warrants and

Rights (1)

| | | Weighted Average

Exercise Price of Outstanding

Options, Warrants

and Rights

| | Number of Shares

Remaining Available for Future Issuance

under our equity

compensation plans

(excluding shares

reflected in

column 1) (2)

| |

Equity Plans Approved by Stockholders | | 17,063,257 | | | $ | 1.99 | | 5,249,337 | (3) |

Equity Plans not Approved by Stockholders | | 28,120 | (4) | | | 5.14 | | — | |

| | |

|

| |

|

| |

|

|

Total | | 17,091,377 | | | | 2.00 | | 5,249,337 | |

| | |

|

| |

|

| |

|

|

| (1) | | Does not include 78,296 shares reserved for issuance upon exercise of stock options assumed in connection with our acquisition of Zeal Media, Inc., for which the weighted average exercise price is $5.34 per share, and 86,178 shares reserved for issuance upon exercise of stock options assumed in connection with our acquisition of WiseNut, Inc., for which the weighted average exercise price is $0.87 per share. The Company will not grant any further options under these plans. |

12

| (2) | | The maximum number of shares of common stock that may be issued under the Amended and Restated 1998 Stock Plan is subject to an annual increase in June of each year equal to the lesser of (i) 2,500,000 shares, (ii) 4% of the total number of shares of common stock outstanding on the last day of the immediately preceding fiscal year or (iii) a lesser amount determined by the board of directors. The Company anticipates that the automatic annual increase of 2,500,000 shares will occur in June 2004. |

| (3) | | Includes 386,323 shares reserved for issuance in connection with our Employee Stock Purchase Plan. |

| (4) | | Consists of warrants granted to (a) two employees of the Company in June 1999, subject to monthly vesting based upon continued employment over a period of 22 months from the date of grant, and (b) seven employees, directors or consultants of Zeal Media, Inc. prior to its acquisition by LookSmart, all fully vested on the date of issuance. All warrants are currently fully exercisable and entitle the holder to purchase shares of common stock of the Company at a fixed price. The warrants generally have a term of five years from the date of issuance. |

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The compensation committee is composed of directors Dial, Santora and Sanders, none of whom is a current or former employee of the Company or its subsidiaries. The compensation committee reviews and recommends to the board of directors the compensation policies of the Company. The compensation committee also administers the Company’s compensation plans and recommends for approval by the board of directors the compensation to be paid to the Chief Executive Officer and, with the advice of the Chief Executive Officer, the compensation of the other executive officers of the Company.

General Compensation Policy

The basic compensation philosophy of the compensation committee and the Company is to provide competitive salaries as well as competitive incentives to achieve superior financial performance. The Company’s executive compensation policies are designed to achieve four primary objectives:

| | • | | Attract and retain well-qualified executives who will lead the Company and achieve and inspire superior performance; |

| | • | | Provide incentives for achievement of specific short-term individual, business unit and corporate goals; |

| | • | | Provide incentives for achievement of longer-term financial goals; and |

| | • | | Align the interests of management with those of the stockholders to encourage achievement of continuing increases in stockholder value. |

Executive compensation at LookSmart consists primarily of the following components:

| | • | | base salary and benefits; |

| | • | | amounts paid, if any, under individual-specific discretionary bonus plans designed to encourage achievement of individual goals; and |

| | • | | participation in the Company’s stock option and equity-based incentive plans. |

Each component of compensation is designed to accomplish one or more of the compensation objectives described above.

The participation of specific executive officers and other key employees in the stock option and equity-based incentive plans of the Company is recommended by management and such recommendations (including the level of participation) are reviewed, modified (to the extent appropriate) and approved by the compensation committee. Senior executive officers are normally eligible to receive a greater percentage of their potential compensation in the form of awards under these incentive plans to reflect the compensation committee’s belief that the percentage of an executive’s total compensation that is “at risk” should increase as the executive’s corporate responsibilities and ability to influence profits increase.

13

Base Salary

To attract and retain well-qualified executives, it is the compensation committee’s policy to establish base salaries, benefit packages and equity compensation at levels that have been confirmed to be, in the aggregate, competitive within similarly situated companies. The Company generally provides its officers with base salaries that are comparable to similarly situated companies, while its bonus and incentive programs rely more on stock options and less on cash payments. Base salaries of senior executives are determined by the compensation committee by comparing each executive’s position with similar positions in companies of similar type, size and financial performance. In making that comparison, the compensation committee uses independent surveys of companies of a comparable stage of development. Included in the survey are some, but not all, of the companies included in the RDG Internet Composite Index, with the primary focus on Internet companies at a similar stage in the San Francisco Bay Area which may compete for the same pool of employees. In general, the compensation committee has targeted base salaries to be at the median to slightly below the median percentile of base salaries paid for comparable positions by companies included in the surveys. Other factors considered by the compensation committee are the executive’s performance, the executive’s current compensation and the Company’s or the applicable business unit’s performance (determined by reference to revenues, costs and other quantitative measures of performance). Although the compensation committee does not give specific weight to any particular factor, the most weight is given to the executive’s performance (in determining whether to adjust above or below the current salary level), and a significant but lesser weight is generally given to the comparative salary levels in the industry.

In general, base salaries for the Company’s executive officers in 2003 were near or slightly below the median of salaries paid by comparable companies. The 2003 average base salary of senior executives increased over the previous year’s level as a result of a combination of factors, including improved individual performance, improved or continued excellent performance by the applicable business unit and Company, promotions and increased responsibilities.

Stock-Based Incentive Compensation

Awards under the Company’s stock option and employee stock purchase plans are designed to encourage long-term investment in the Company by participating executives, more closely align executive and stockholder interests and reward executives and other key employees for building stockholder value. The compensation committee believes stock ownership by management has been demonstrated to be beneficial to all stockholders. Periodic grants of stock options are generally made annually to all eligible employees based on performance, with additional grants made to certain employees following a significant change in job responsibility.

Under the Company’s stock option plan, the compensation committee may grant to executives and other key employees options to purchase shares of stock. The compensation committee reviews and approves grants to executives and exceptional grants to employees. The compensation committee reviews and approves a standard structure for grants to new non-executive employees and discretionary grants to eligible employees. The compensation committee grants both incentive stock options and nonqualified options within the meaning of the Internal Revenue Code. All of the options granted in 2003 were nonqualified stock options with an exercise price equal to the closing price of LookSmart common stock on the last trading day before the grant. Under the terms and conditions of the plan, the compensation committee may, however, grant nonqualified options with an exercise price above or below the market price on the date of grant.

In determining the number of stock options to be awarded to an executive, the compensation committee generally takes into consideration the levels of responsibility and compensation practices of similar companies. The compensation committee also considers the recommendations of management, the individual performance of the executive and the number of shares previously awarded to the executive. As a general practice, the number of options granted increases in proportion to each executive’s responsibilities.

Cash Incentive Compensation

Cash incentive compensation awards are designed to more closely align executive and stockholder interests and reward executives and other key employees for building stockholder value. The compensation committee believes cash incentives have been demonstrated to be beneficial to all stockholders. The annual cash incentive

14

amounts were set based on the compensation committee’s evaluation of the levels of responsibility and compensation practices of similar companies, the recommendations of management, the individual performance of the executive, and the overall compensation awarded to the executive. The cash bonuses granted to the named executive officers (other than the Chief Executive Officer, discussed below) in 2003 were based on (1) the Company’s achievement of financial goals (primarily revenue and profit), (2) the achievement of departmental goals which the compensation committee determined to be prerequisites to the Company’s revenue growth and profitability, and (3) the achievement of individual performance goals.

Chief Executive Officer Compensation

Mr. Kellerman was promoted to Chief Executive Officer in October 2002 at a base salary of $300,000 and annual performance incentive of up to $150,000. Mr. Kellerman’s compensation in 2003 was consistent with the compensation policy of LookSmart described above and the compensation committee’s evaluation of his overall leadership and management of the Company. In setting Mr. Kellerman’s base salary and total annual cash compensation, the compensation committee compared Mr. Kellerman’s cash compensation with that of chief executive officers in a group of companies of similar general type and size. The compensation committee determined to grant 52.5% of Mr. Kellerman’s annual performance incentive for 2003, based on the committee’s evaluation of the following performance criteria: (1) Company strategic and product development, including diversification and growth of the Company’s distribution network, (2) employee development, including development of senior leadership and succession plans, and (3) Company financial performance, including earnings and cash flow. Mr. Kellerman had a portion of his total compensation “at risk” in 2003 because some of his potential compensation was based upon the stock option plan described above. Mr. Kellerman’s equity position in the Company consisted of stock options subject to vesting and common stock. Mr. Kellerman resigned from service with the Company in January 2004.

Compliance with Internal Revenue Code Section 162(m)

Section 162(m) of the Internal Revenue Code provides that a company may not deduct compensation paid to certain executive officers in excess of $1,000,000 per officer in any one year, except for “performance-based” compensation. The cash compensation paid to the Company’s executive officers in 2003 did not exceed the $1,000,000 limit per officer, nor is the cash compensation to be paid to executive officers in 2004 expected to reach that level. Because it is very unlikely that the cash compensation payable to any of the Company’s executive officers in the foreseeable future will approach the $1,000,000 limitation, the compensation committee has decided not to take any action at this time to limit or restructure the elements of cash compensation payable to the Company’s executive officers. The compensation committee will reconsider this decision should the individual compensation of any executive officer ever approach the $1,000,000 level.

The foregoing report has been submitted by the undersigned in our capacity as members of the compensation committee of the Company’s board of directors.

Respectfully submitted,

Teresa Dial

Mark Sanders

Greg Santora

15

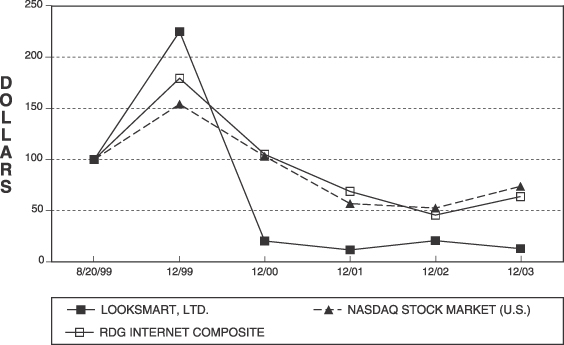

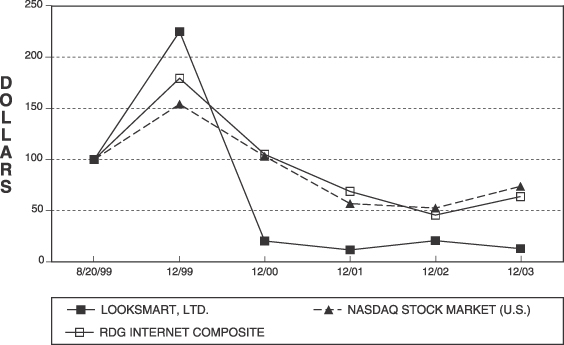

STOCK PERFORMANCE GRAPH

The following graph compares the cumulative total stockholder return on LookSmart common stock to the Nasdaq Stock Market (U.S.) Index, JP Morgan H&Q Internet 100 Index and RDG Internet Index. The graph covers the period from August 20, 1999, the first trading date of LookSmart’s common stock, to December 31, 2003. The graph assumes that $100 was invested on August 20, 1999 in LookSmart common stock and in each index, and that all dividends were reinvested. LookSmart has not paid or declared any cash dividends on its common stock. Stockholder returns over the indicated period should not be considered indicative of future stockholder returns.

| * | | $100 invested on August 20, 1999 in stock or index, including reinvestment of dividends. |

The dollar values for total stockholder return plotted in the graph above are shown in the table below:

| | | | | | | | | | | | | | | | | | |

| | | Cumulative Total Return

|

| | | 8/20/99

| | 12/99

| | 12/00

| | 12/01

| | 12/02

| | 12/03

|

LookSmart, Ltd. | | $ | 100.00 | | $ | 225.00 | | $ | 20.32 | | $ | 11.67 | | $ | 20.67 | | $ | 12.92 |

Nasdaq Stock Market (U.S.) | | | 100.00 | | | 154.14 | | | 92.79 | | | 73.62 | | | 50.89 | | | 73.79 |

JP Morgan H & Q Internet 100 | | | 100.00 | | | 225.60 | | | 86.80 | | | 55.85 | | | ** | | | ** |

RDG Internet | | | 100.00 | | | 183.27 | | | 106.47 | | | 65.76 | | | 43.36 | | | 63.75 |

| ** | | Discontinued after 2001. |

The preceding stock performance graph and the Compensation Committee Report are not considered proxy solicitation materials, are not deemed filed with the Securities and Exchange Commission, and are not deemed to be incorporated by reference into any filing under the Securities Act or the Exchange Act. Notwithstanding anything to the contrary set forth in any of LookSmart’s previous filings made under the Securities Act of 1933 or the Securities Exchange Act of 1934 that incorporate future filings made by the Company under those statutes, neither the above stock performance graph nor the Compensation Committee Report is to be incorporated by reference into any prior filings, nor shall the graph or report be incorporated by reference into any future filings made by the Company under those statutes.

16

REPORT OF THE AUDIT COMMITTEE

The audit committee is composed of directors Castagna, Santora and West. The role of the audit committee is to assist the board of directors in its oversight of the Company’s financial reporting process. The audit committee performs the duties set forth in its charter.

The audit committee’s role includes the oversight of our financial, accounting and reporting processes, our system of internal accounting and financial controls and our compliance with related legal and regulatory requirements, the appointment, engagement, termination and oversight of our independent auditors, including conducting a review of their independence, reviewing and approving the planned scope of our annual audit, overseeing the independent auditors’ audit work, reviewing and pre-approving any audit and non-audit services that may be performed by them, reviewing with management and our independent auditors the adequacy of our internal financial controls, and reviewing our critical accounting policies and the application of accounting principles.

Each member of the audit committee meets the independence criteria prescribed by applicable law and the rules of the SEC for audit committee membership and is an “independent director” within the meaning of the Nasdaq listing standards.

The audit committee has reviewed and discussed with PricewaterhouseCoopers LLP (“PWC”) matters required to be discussed pursuant to Statement on Auditing Standards No. 61 (Communications with Audit Committees). We have received from PWC a formal written statement describing the relationships between the auditor and LookSmart that might bear on the auditor’s independence consistent with Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees). We have discussed with PWC matters relating to its independence, including a review of both audit and non-audit fees, and considered the compatibility of non-audit services with the auditors’ independence.

The audit committee has reviewed and discussed with management and PWC the audited financial statements. The audit committee met with PWC, with and without management present, to discuss results of its examinations, its evaluation of LookSmart’s internal controls, and the overall quality of LookSmart’s financial reporting.

Based on the reviews and discussions referred to above and the review of LookSmart’s audited financial statements for 2003, the audit committee recommended to the board of directors that the audited financial statements be included in the Annual Report on Form 10-K for the year ended December 31, 2003, for filing with the SEC.

The preceding Audit Committee Report is not considered proxy solicitation materials, is not deemed filed with the Securities and Exchange Commission, and is not deemed to be incorporated by reference into any filing under the Securities Act or the Exchange Act.

AUDIT COMMITTEE

Anthony Castagna

Greg Santora

Edward West

17

INDEPENDENT PUBLIC ACCOUNTANTS

The board of directors has reappointed PricewaterhouseCoopers LLP (“PWC”) to examine the financial statements of LookSmart for fiscal year 2004. In addition to audit services, PWC also provided certain non-audit services to LookSmart in 2003.

Audit Fees

During fiscal years 2003 and 2002, we retained PWC to provide services in the following categories and amounts:

| | | | | | |

Fee Category

| | 2003

| | 2002

|

Audit Fees | | $ | 519,524 | | $ | 339,204 |

Audit Related Fees | | $ | 90,861 | | $ | 29,834 |

Tax Fees | | $ | 209,179 | | $ | 82,058 |

All Other Fees | | $ | 10,135 | | $ | 42,240 |

| | |

|

| |

|

|

Total All Fees | | $ | 829,699 | | $ | 493,336 |

| | |

|

| |

|

|

“Audit-related fees” consist of fees for assurance and related services that are reasonably related to the performance of the audit or review of the Company’s financial statements. This category includes fees for due diligence related to an acquisition and related correspondence with regulatory agencies.

“Tax fees” consist of fees for professional services for tax planning related to tax credits and international tax planning and tax return preparation.

“All other fees” consist of international consulting, Sarbanes-Oxley compliance planning and an accounting research subscription.

The audit committee has considered whether the provision of non-audit services is compatible with maintaining the independence of PWC and has concluded that it is.

Policy on Pre-Approval by Audit Committee of Services Performed by Independent Auditors

The policy of the audit committee is to pre-approve all audit and permissible non-audit services to be performed by the independent auditors during the fiscal year. The audit committee pre-approves services by authorizing specific projects within the categories outlined above, subject to the budget for each category. The audit committee’s charter delegates to its chairman the authority to address any requests for pre-approval of services between audit committee meetings, and the chairman must report any pre-approval decisions to the audit committee at its next scheduled meeting.

The aggregate amount of services related to the fees described above that was approved by the audit committee pursuant to the pre-approval provisions set forth in the applicable SEC rules represented approximately 95% of the total Audit Fees and 26% of Audit-Related Fees, Tax Fees or All Other Fees paid by LookSmart to PWC in 2003.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires LookSmart’s directors, officers and persons who beneficially own more than 10% of the outstanding shares of common stock to file with the SEC initial reports of ownership and reports of changes in ownership. Directors, officers and 10% stockholders are required by SEC regulations to furnish the Company with copies of all Section 16(a) reports they file.

To the Company’s knowledge, based solely on review of the reports the Company has received, or written representations that no other reports were required for those persons, the Company believes that its officers and directors complied with all applicable filing requirements applicable in 2003.

18

ADVANCE NOTICE PROCEDURES

Under LookSmart’s bylaws, nominations for a director may be made only by the board of directors, a proxy committee of the board of directors, or by a stockholder entitled to vote who has delivered notice to the principal executive offices of LookSmart (containing certain information specified in the bylaws) (i) not less than 120 days prior to the anniversary date of the mailing of the Company’s proxy statement to stockholders in connection with the previous year’s annual meeting of stockholders, or (ii) if the annual meeting is called for a date not within thirty days before or after such anniversary date, not later than the close of business on the tenth day following the date notice of such meeting is mailed or made public, whichever is earlier.

The bylaws also provide that no business may be brought before an annual meeting except as specified in the notice of the meeting or as otherwise brought before the meeting by or at the direction of the board of directors, the presiding officer or by a stockholder entitled to vote at such annual meeting who has delivered notice to the principal executive offices of LookSmart (containing certain information specified in the bylaws) (i) not less than 120 days prior to the anniversary date of the mailing of the Company’s proxy statement to stockholders in connection with the previous year’s annual meeting of stockholders, or (ii) if the annual meeting is called for a date not within thirty days before or after such anniversary date, not later than the close of business on the tenth day following the date notice of such meeting is mailed or made public, whichever is earlier.

These requirements are separate and apart from the requirements that a stockholder must meet in order to have a stockholder proposal included in LookSmart’s proxy statement under Rule 14a-8 of the Securities Exchange Act of 1934, as amended. Stockholder proposals should be addressed to the attention of the Company’s General Counsel, 625 Second Street, San Francisco, California 94107.

SOLICITATION OF PROXIES

Solicitation of proxies will be made initially by mail. In addition, directors, officers and employees of the Company and its subsidiaries may solicit proxies by telephone or facsimile or personally without additional compensation. Proxies may be solicited by nominees and other fiduciaries who may mail materials to or otherwise communicate with the beneficial owners of shares held by them. The Company will bear all costs of solicitation of proxies, including the charges and expenses of brokerage firms, banks, trustees or other nominees for forwarding proxy materials to beneficial owners.

ANNUAL REPORT ON FORM 10-K

A copy of LookSmart’s annual report for 2003 accompanies this proxy statement. An additional copy will be furnished without charge to beneficial stockholders or stockholders of record upon request to LookSmart Investor Relations, 625 Second Street, San Francisco, CA 94107, or by calling (415) 348-7000. It is also available in digital form for download or review by visitingwww.stockholder.com/looksmart/.

DELIVERY OF THIS PROXY STATEMENT