SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | |

| ¨ | | Preliminary Proxy Statement | | ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | | |

| x | | Definitive Proxy Statement | | | | |

| | | |

| ¨ | | Definitive Additional Materials | | | | |

| | | |

| ¨ | | Soliciting Material Pursuant to Section 240.14a-12 | | | | |

LOOKSMART, LTD.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | ¨ | Fee paid previously with preliminary materials. |

| | ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

NOTICE OF ANNUAL MEETING

LOOKSMART, LTD.

625 Second Street

San Francisco, California 94107

Dear Stockholder (including a holder of a Chess Depositary Interest (“CDI”)):

The annual meeting of stockholders of LookSmart, Ltd. (“LookSmart” or the “Company”) will be held at our headquarters at 625 Second Street, San Francisco, California, on Wednesday, June 14, 2006, at 10:00 a.m. local time. The annual meeting is being held for the following purposes:

| | (1) | To elect two directors, each for a three-year term expiring at the annual meeting of stockholders in 2009; |

| | (2) | To ratify the appointment of the accounting firm PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the current fiscal year; and |

| | (3) | To transact any other business that may properly come before the annual meeting and any adjournment or postponement thereof. |

These items are fully discussed in the following pages, which are made part of this notice. Only stockholders and CDI holders of record on the books of the Company at the close of business on April 19, 2006, are entitled to vote at, or with respect to CDI holders, to direct CHESS Depositary Nominees Pty Ltd. how to vote at, the annual meeting.

All stockholders are cordially invited to attend the annual meeting in person. Whether or not you plan to attend,please promptly complete, sign, date and return your proxy card in the enclosed envelope, so that shares may be voted in accordance with your wishes and so that enough shares are represented to allow us to conduct the business of the annual meeting. If you hold shares in “street name”, you may be able to vote over the Internet or by telephone by following the instructions on your proxy card. Mailing your proxy(ies) or voting over the Internet or by telephone does not affect your right to vote in person if you attend the annual meeting. You may still vote in person if you are a stockholder entitled to vote and you attend the meeting, even if you have returned your proxy, provided that you affirmatively indicate your intention to vote your shares in person. Please note, however, that if a brokerage firm, bank or other nominee holds your shares of record and you wish to vote at the meeting, you must obtain from the record holder a valid legal proxy issued in your name.

A copy of LookSmart’s annual report for the year ended December 31, 2005, is enclosed with this notice. The annual report, proxy statement and enclosed proxy are being given to holders of common stock and Chess Depositary Interests (CDIs) on or about May 5, 2006.

|

| By Order of the Board of Directors, |

|

|

| Stacey A. Giamalis |

| Senior Vice President, General Counsel and Secretary |

April 27, 2006

Your vote is very important. Even if you plan to attend the meeting,

PLEASE SIGN, DATE AND RETURN THE ENCLOSED PROXY PROMPTLY.

PROXY STATEMENT

FOR THE

ANNUAL MEETING OF STOCKHOLDERS

LookSmart, Ltd.

625 Second Street

San Francisco, California 94107

All share information provided in this proxy statement, including historical information, has been restated to give effect to the Company’s 1-for-5 reverse stock split effected at the close of business October 26, 2005.

INFORMATION ABOUT SOLICITATION AND VOTING

General

The enclosed proxy is solicited by the board of directors of LookSmart for use in voting at the annual meeting of stockholders to be held at 10:00 a.m., local time, on Wednesday, June 14, 2006, at our headquarters located at 625 Second Street, San Francisco, California, and any postponement or adjournment of that meeting. The purpose of the annual meeting is to consider and vote upon the proposals outlined in this proxy statement and the attached notice. The Company’s telephone number is (415) 348-7000.

LookSmart’s common stock is traded on the Nasdaq National Market and its CHESS Depositary Interests (“CDIs”) are traded on the Australian Stock Exchange (“ASX”). CDIs are exchangeable, at the option of the holder, into shares of our common stock at a ratio of 1:1. Please see Exhibit A for additional disclosures required by the ASX.

These proxy solicitation materials are first being mailed on or about May 5, 2006, together with the Company’s annual report, to all holders of common stock or CDIs entitled to vote at the meeting.

Record Date and Outstanding Shares

Only holders of record of LookSmart common stock or CDIs at the close of business on the record date, April 19, 2006, are entitled to receive notice of and to vote at the annual meeting. As of the close of business on the record date, there were 22,800,933 shares of common stock outstanding and held of record by approximately 133 stockholders. Stockholders are entitled to one vote for each share of common stock they held as of the record date. CDI holders are entitled to direct CHESS Depositary Nominees Pty Ltd. (“CHESS”) how it should vote with respect to one share of common stock for each share of common stock into which the CDI(s) held by such holder as of the record date could be converted.

Voting and Solicitation

Each CDI holder may direct CHESS how it should vote at the annual meeting. Each stockholder may vote in person at the annual meeting or by proxy. If you are the record holder of your shares of common stock and attend the meeting in person, you may deliver your completed proxy card to us at the meeting. If your shares are held in “street name,” please check your proxy card or contact your broker or nominee to determine whether you will be able to vote by telephone or on the Internet.

When proxies are properly dated, executed and returned, the shares they represent will be voted at the annual meeting in accordance with the instructions of the stockholder (proxies cannot be voted for a greater number of persons than the number of nominees named). If no specific instructions are given, the shares will be voted FOR the election of the nominees for director set forth herein and FOR ratification of the appointment of independent auditors. In addition, if other matters come before the annual meeting, the persons named in the accompanying form of proxy will vote in accordance with their best judgment with respect to such matters. On all matters to be voted on, each share and each CDI has one vote.

1

We are making this proxy solicitation by and on behalf of the Board of Directors. The cost of preparing, assembling, printing and mailing this proxy statement and the proxies solicited hereby will be borne by us. Proxies may be solicited personally or by telephone, electronic mail or facsimile by the Company’s officers, directors and regular employees, none of whom will receive additional compensation for assisting with solicitation.

Holders of CDIs

Holders of CDIs have a right to direct CHESS how it should vote with respect to the proposals described in this proxy statement. Holders of CDIs must provide their duly executed directions, via the enclosed proxy card, to CHESS by 10 a.m. (Australian Eastern Standard Time) on June 10, 2006 in accordance with the instructions they receive with these proxy materials.

Quorum; Required Vote

A quorum is required for the transaction of business during the annual meeting. A quorum is present when a majority of stockholder votes are present in person or by proxy. Shares that are voted “FOR”, “AGAINST” or “WITHHELD” on a matter are treated as being present at the meeting for purposes of establishing a quorum and are also treated as votes cast by the common stock present in person or represented by proxy at the annual meeting and entitled to vote on the subject matter.

The candidates for election as directors at the annual meeting who receives the highest number of affirmative votes present or represented by proxy and entitled to vote at the annual meeting, will be elected. The ratification of the independent registered public accounting firm for the Company for the current year will require the affirmative vote of a majority of the shares of the Company’s common stock present or represented by proxy and entitled to vote at the annual meeting.

Revocability of Proxies

If you are a stockholder entitled to vote and you have submitted a proxy, you may revoke your proxy at any time before it is voted by delivering a written revocation to the Secretary of the Company, delivering a duly executed proxy bearing a later date or attending and voting in person at the annual meeting. If you hold your shares through a broker, custodian or through CHESS, you will need to contact them to revoke your proxy.

Abstentions; Broker Non-Votes

The Company will count abstentions for purposes of determining both (i) the presence or absence of a quorum for the transaction of business and (ii) the total number of votes cast with respect to a proposal (other than the election of directors). A “broker non-vote” occurs when a broker or other nominee does not have discretion to vote shares with respect to a particular proposal and has not received instructions from the beneficial owner of the shares. Generally, brokers have discretion to vote shares on what are deemed to be routine matters. Broker non-votes will be counted for purposes of determining the presence or absence of a quorum for the transaction of business. Broker non-votes will not be counted for purposes of determining the number of votes cast with respect to a proposal.

For Proposal One (election of directors), which requires a plurality of the votes cast, abstentions and broker non-votes will have no effect on determining the number of votes cast nor on whether the director is elected. For Proposal Two (the ratification of the appointment of the independent registered public accounting firm), which requires the affirmative approval of a majority of the votes present or represented and entitled to vote, broker non-votes will have no effect on the number of votes cast nor on whether the appointment is ratified, but abstentions will have the same effect as a vote against Proposal Two because they will be counted as a vote cast with respect to the proposal but not counted as a vote for ratification.

2

PROPOSAL ONE — ELECTION OF DIRECTORS

Our board of directors consists of seven directors, two of whom are standing for election: David B. Hills and Gary A. Wetsel. In addition to the two directors standing for election, we have three incumbent directors with terms expiring in 2007 and two incumbent directors with terms expiring in 2008. Our bylaws provide that the board of directors is divided into three classes. There is no difference in the voting rights of the members of each class of directors. Each class of directors serves a term of three years, with the term of one class expiring at the annual meeting of stockholders in each successive year. There are no family relationships among any directors, nominees for director or executive officers of the Company. The names, ages, position with the Company and current terms of office of our directors as of April 19, 2006 are as follows:

| | | | | | |

Name | | Age | | Position | | Expiration

of Term |

Anthony Castagna (1)(2) | | 58 | | Director | | 2007 |

Teresa Dial (1)(2) | | 56 | | Director | | 2007 |

David B. Hills | | 50 | | Chief Executive Officer, President and Director | | 2006 |

Mark Sanders (2)(3) | | 62 | | Director | | 2007 |

Edward F. West (2) | | 53 | | Chair of the Board | | 2008 |

Gary A. Wetsel (1)(3) | | 60 | | Director | | 2006 |

Timothy J. Wright (3) | | 41 | | Director | | 2008 |

| (1) | Member of Audit Committee |

| (2) | Member of Nominating and Governance Committee |

| (3) | Member of Compensation Committee |

Unless marked otherwise, proxies received will be voted FOR the election of the nominees, David B. Hills and Gary A. Wetsel. Mr. Hills and Mr. Wetsel are presently directors whose terms will expire at the annual meeting. Mr. Hills and Mr. Wetsel are willing to be elected and to serve for the three-year term. If Mr. Hills or Mr. Wetsel are unable or unwilling to serve as a director at the time of the annual meeting, the proxies may be voted either (i) for a substitute nominee who shall be designated by the proxy holders or by the incumbent board of directors to fill the vacancy or (ii) for no one, leaving a vacancy. Alternatively, the size of the board of directors may be reduced accordingly. The board of directors has no reason to believe that Mr. Hills or Mr. Wetsel will be unwilling or unable to serve if elected as a director. Each of Mr. Hills and Mr. Wetsel has been nominated to serve for a three-year term until the annual meeting of stockholders in 2009 or until his successor, if any, is elected or appointed.

Nominees for Election to the Board of Directors

David B. Hillshas served as our Chief Executive Officer and President and as a director since October 2004. Mr. Hills served as President, Media Solutions, at 24/7 Real Media, Inc., an online marketing and technology company, with responsibility for all North American media and technology sales, from August 2003 to October 2004. From July 2001 to August 2003, Mr. Hills served as Chief Operating Officer and President of Sales for About Inc., an Internet search engine company. Prior to that time, Mr. Hills held various executive positions for subsidiaries of Cox Enterprises, including Vice President of Sales for Cox Interactive Media, an online provider of local content, from July 1999 to July 2001; Vice President and director of Cox Interactive Sales, an Internet advertising network, from May 1994 to July 1999; and Vice President for Telerep, a television and radio advertising sales representation firm and division of Cox Broadcasting, from 1987 to 1994. Mr. Hills holds a B.A. in Communications from Bethany College, West Virginia, and an M.S. in Communications from Boston University.

Gary A. Wetselhas served as one of our directors since September 2004. Mr. Wetsel is an independent consultant. Mr. Wetsel served as Executive Vice President, Finance, Chief Financial Officer, and Chief

3

Administrative Officer of Aspect Communications Corporation, a provider of enterprise customer contact solutions, from April 2002 to March 2005. Prior to joining Aspect, Mr. Wetsel served as Vice President and Chief Financial Officer at Zhone Technologies, a telecommunications vendor, from 2000 to 2002. From 1998 to 2000, Mr. Wetsel served as Chief Executive Officer of WarpSpeed Communications, a broadband Internet provider. From 1996 to 1998, Mr. Wetsel was Executive Vice President and Chief Operating Officer at Wyse Technology, a computer terminal provider. Mr. Wetsel is a Certified Public Accountant and holds a B.S. in Accounting from Bentley College.

Mr. Hills and Mr. Wetsel are current directors of the Company. Mr. Hills also serves as our Chief Executive Officer and President. Mr. Wetsel was elected by the Board of Directors in September 2004. Prior to his election to the Board, a third-party search firm that was paid for its services was used to assist the Nominating and Governance Committee in identifying potential candidates.

The board of directors unanimously recommends that you vote FOR the election of Mr. Hills and Mr. Wetsel as directors.

Incumbent Directors Whose Terms Continue After the Annual Meeting

The following persons are incumbent directors whose terms expire at the annual meeting of stockholders in 2007:

Anthony Castagnahas served as one of our directors since March 1999. Since 1997, Dr. Castagna has served as a non-executive director of Macquarie Technology Ventures Pty Limited, an Australian venture capital fund and wholly owned subsidiary of Macquarie Bank Limited, Australia’s largest investment bank, and as an independent advisor to the Macquarie Technology Investment Banking Division of Macquarie Bank Limited, an investment banking company. He is also a non-executive director of early-stage private technology-based companies in Australia, Asia and the United States. Dr. Castagna served as a non-executive director of BT LookSmart, the joint venture between LookSmart and British Telecommunications, until December 2002. Dr. Castagna holds a Bachelor of Commerce from the University of Newcastle, Australia, and an M.B.A. and Ph.D. in finance from the University of New South Wales, Australia.

Teresa Dialhas served as one of our directors since January 2003 and was Chair of the Board from July 2004 to June 2005. In June 2005, she became Group Executive Director of Lloyds TSB’s retail bank. Prior to that time, Ms. Dial held various management roles with Wells Fargo since 1973. Ms. Dial serves on the boards of directors of Lloyds TSB and Onyx Software Corporation. Ms. Dial received her B.A. in Political Science from Northwestern University and is a graduate of the Graduate School of Credit and Financial Management.

Mark Sandershas served as one of our directors since January 2003. Mr. Sanders served as Chairman of Pinnacle Systems, a supplier of video creation, storage, distribution and streaming solutions, from July 2002 to March 2004. Mr. Sanders also served as a Director of Pinnacle Systems from January 1990 to March 2004 and as its President and Chief Executive Officer from January 1990 to July 2002. Prior to that time, Mr. Sanders served in a variety of management positions, most recently as Vice President and General Manager of the Recording Systems Division of Ampex, Inc., a manufacturer of video broadcast equipment. Mr. Sanders also serves on the board of directors of Bell Microproducts Inc., a computer storage and semiconductor company. Mr. Sanders holds a B.S. in Electrical Engineering from California Polytechnic University, Pomona and an M.B.A. from Golden Gate University.

The following persons are incumbent directors whose terms expire at the annual meeting of stockholders in 2008:

Edward F. West has served as one of our directors since November 2001 and as Chair of the Board since June 2005. Mr. West currently serves as Managing Director of Sage Partners LLC, an advisory services firm in

4

venture development and strategic leadership. Mr. West served as Chief Executive Officer of Colarity Corporation, a customer knowledge management company, from January 2001 to December 2003. From December 1999 to December 2000, Mr. West served as Chief Executive Officer of RealNames International, the global development subsidiary of RealNames Corporation, an Internet names and navigation platform provider. From May 1998 to December 1999, Mr. West served as Executive Vice President, Business Development, Sales and Marketing, at RealNames Corporation. From January 1996 to April 1998, Mr. West served as Chief Operating Officer of Softbank Interactive Marketing, a provider of marketing services and sales representation to Internet sites seeking interactive advertisers. Mr. West received an A.B. in Architecture/Urban Planning from Princeton University and an M.B.A. from Harvard Business School.

Timothy J. Wrighthas served as one of our directors since August 2005. Mr. Wright served as Chief Executive of the EMEA and Asia-Pacific operations of Geac Computer Corporation Limited and as its Chief Technology Officer from May 2004 to March 2005. He also served as Geac’s Senior Vice President, Chief Technology Officer and Chief Information Officer from January 2003 to May 2006. Prior to joining Geac, Mr. Wright served for just over three years as Senior Vice President, Chief Technology Officer and Chief Information Officer at Terra Lycos, a provider of Internet access and content to users worldwide. Prior to working at Terra Lycos, Mr. Wright spent seven years at The Learning Company, a provider of consumer educational and home productivity software, until it was acquired by Mattel, Inc. in 1999. Mr. Wright received a B.S. in Computer Science from City University in London.

Board Committees and Meetings

In 2005, the board of directors held eight meetings. Each of the directors attended 75% or more of the aggregate of (i) the total number of meetings of the board of directors and (ii) the total number of meetings held by all committees of the board of directors on which he or she served (during the periods that he or she served). The Company has a policy of encouraging board members’ attendance at annual stockholder meetings. In 2005, six members of the board of directors attended the annual stockholder meeting.

In March 1999, the board of directors established two standing committees: the audit committee and the compensation committee. Prior to that time, the functions of these two standing committees were performed by the board of directors. In June 2002, the board of directors established an additional standing committee: the nominating and governance committee.

Audit Committee. The audit committee functions in accordance with section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (“Exchange Act”), by overseeing the accounting and financial reporting processes of the Company, as well as audits of the Company’s financial statements. The audit committee operates under a written charter adopted by the board of directors and has the authority to select, and is directly responsible for the selection of, the Company’s independent registered public accounting firm. The audit committee approves the nature and scope of services to be performed by the independent registered public accounting firm, reviews the range of fees for such services, confers with the independent registered public accounting firm, reviews the results of the annual audit and quarterly reviews of the Company’s financial statements, reviews the Company’s annual and quarterly financial statements, reviews with the management and independent registered public accounting firm the Company’s accounting and financial controls, and reviews policies and practices regarding compliance with laws and the avoidance of conflicts of interest. Currently, the audit committee consists of directors Castagna, Dial and Wetsel, all of whom are “independent” directors as defined in applicable listing standards of the National Association of Securities Dealers and applicable rules and regulations of the Securities and Exchange Commission. Mr. Wetsel was appointed as Chair of the audit committee in June 2005 and prior to that time Mr. West served as Chair of the committee. Mr. Wetsel is an “audit committee financial expert” within the meaning of applicable SEC rules. Ms. Dial was appointed to the committee in October 2005. In 2005, the audit committee held nine meetings. The charter of the audit committee is available for viewing and download atwww.looksmart.com/aboutusand is attached hereto as Exhibit B.

5

Compensation Committee. The compensation committee is responsible for reviewing and recommending to the board of directors the timing and amount of compensation for the Chief Executive Officer and other key employees, including salaries, bonuses and other benefits. The compensation committee is also responsible for administering the Company’s stock option and other equity-based incentive plans. Currently, the compensation committee consists of directors Wright, Sanders and Wetsel, all of whom are “independent” directors as defined in applicable listing standards of the National Association of Securities Dealers and applicable rules and regulations of the Securities and Exchange Commission. Mr. Sanders was appointed Chair of the compensation committee in July 2004. Prior to that time, Ms. Dial served as Chair of the compensation committee. Mr. Wright was appointed to the committee in October 2005. In 2005, the compensation committee held five meetings. The charter of the compensation committee is available for viewing and download atwww.looksmart.com/aboutus.

Nominating and Governance Committee. The nominating and governance committee develops and implements policies and processes regarding corporate governance matters, assesses board membership needs and makes recommendations regarding potential director candidates to the board of directors. Currently, the nominating and governance committee is composed of directors Castagna, Dial, Sanders and West, all of whom are “independent” directors as defined in applicable listing standards of the National Association of Securities Dealers and applicable rules and regulations of the Securities and Exchange Commission. Mr. Castagna was appointed Chair of the nominating and governance committee in June 2002. In 2005, the nominating and governance committee held two meetings. The nominating and governance committee will consider nominees recommended by stockholders as described further below in “Nomination of Directors.” The charter of the nominating and governance committee is available for viewing and download atwww.looksmart.com/aboutus.

Nomination of Directors

The nominating and governance committee has in the past, and may in the future, use third party executive search firms to help identify prospective director nominees. In evaluating the suitability of each candidate, the nominating and governance committee will consider issues of character, judgment, independence, age, expertise, diversity of experience, length of service, other commitments and the like. While there are no specific minimum qualifications for director nominees, the ideal candidate should exhibit (i) independence, (ii) integrity, (iii) qualifications that will increase overall board effectiveness and (iv) meet other requirements as may be required by applicable rules, such as financial literacy or expertise for audit committee members. The nominating and governance committee uses the same process for evaluating all nominees, regardless of the original source of the nomination.

LookSmart stockholders may recommend individuals to the nominating and governance committee for consideration as potential director candidates by submitting their names and appropriate background and biographical information to: LookSmart Nominating and Governance Committee, c/o General Counsel, 625 Second Street, San Francisco, CA 94107. The recommendation must include any relevant information, including the candidate’s name, home and business contact information, detailed biographical data and qualifications, and information regarding any relationships between the candidate and the Company within the last three years. LookSmart stockholders also have the right to nominate director candidates without any action on the part of the nominating and governance committee or the board, by following the advance notice provisions of LookSmart’s bylaws as described below under “Advance Notice Procedures for Stockholder Proposals”.

Compensation of Directors

Starting in July 2005, members of the board of directors received the following compensation: (i) new non-employee directors are granted an option to purchase 17,000 shares of common stock upon joining the board of directors, which option vests monthly over 36 months, (ii) each year, non-employee directors are granted an option to purchase 9,000 shares of common stock, based upon the continued service of the director during the prior year, which vests immediately, (iii) $2,500 per quarter for members of the audit committee if the member

6

attends 100% of meetings held by the committee during the quarter, (iv) $1,500 per quarter for members of the compensation committee if the member attends 100% of meetings held by the committee during the quarter, (v) $500 per quarter for members of the nominating and governance committee if the member attends 100% of meetings held by the committee during the quarter, (vi) $7,500 per quarter for members of the board of directors if the member attends 100% of meetings held by the board of directors during the quarter, (vii) $3,750 per quarter for the Chair of the audit committee, (viii) $2,250 per quarter for the Chair of the compensation committee, (ix) $1,250 per quarter for the Chair of the nominating and governance committee, and (x) $7,500 per quarter for the Chair of the board. Directors may elect to take part or all of their cash compensation in the form of fully vested non-qualified stock options. If a director makes such an election, the number of stock options granted will be three times the amount of cash compensation divided by the closing price of LookSmart stock on the date of grant. The options have an exercise price equal to the closing price of LookSmart stock on the date of grant. For all unvested options held by directors, vesting accelerates 100% in the event of involuntary termination of the director’s membership on the board of directors within 12 months after a change of control of the Company. For any quarter or year in which a director has not served as a board or committee member for the entire period, the compensation described above (except for the initial grant) is prorated for the period of time served.

From June 2002 until July 2005, members of the board of directors received the following compensation: (i) new non-employee directors were granted an option to purchase 10,000 shares of common stock upon joining the board of directors, which option vested monthly over 36 months, (ii) each year, non-employee directors were granted an option to purchase 6,000 shares of common stock, based upon the continued service of the director during the prior year, which vested immediately, (iii) $1,250 per quarter for members of the audit committee if the member attended 100% of meetings held by the committee during the quarter, (iv) $1,250 per quarter for members of the compensation committee if the member attended 100% of meetings held by the committee during the quarter, (v) $500 per meeting for members of the nominating and governance committee, (vi) $5,000 per quarter for members of the board of directors if the member attended 100% of meetings held by the board of directors during the quarter, (vii) $1,250 per quarter for the chair of each of the audit and compensation committees, and (viii) $1,250 per quarter for service as a member of the board of directors of BT LookSmart, our joint venture with British Telecommunications. In addition, from January 2003 until July 2005, the chair of the board received $12,500 per quarter. Directors could elect to take part or all of their cash compensation in the form of fully vested non-qualified stock options. If a director made such election, the number of stock options granted would have been three times the amount of cash compensation divided by the closing price of LookSmart stock on the date of grant. The options had an exercise price equal to the closing price of LookSmart stock on the date of grant. For all unvested options held by directors, vesting accelerated 100% in the event of involuntary termination of the director’s membership on the board of directors within 12 months after a change of control of the Company. For any quarter or year in which a director had not served as a board or committee member for the entire period, the compensation described above (except for the initial grant) was prorated for the period of time served. In October 2004, directors Dial, Sanders and West were each also granted an additional option to purchase 8,670 shares in connection with their additional services as directors, particularly their assistance in recruiting a new Chief Executive Officer and a new director in 2004.

Directors received no other compensation for their service as directors in 2005, other than reimbursement of reasonable out-of-pocket expenses for attendance at board meetings.

Compensation Committee Interlocks and Insider Participation

The compensation committee consists of directors Wright, Sanders and Wetsel, none of whom is or has been an officer or employee of the Company. David B. Hills, Chief Executive Officer of the Company, is a member of the board of directors, but is not a member of the compensation committee and cannot vote on matters decided by the committee. Mr. Hills participates in compensation committee discussions regarding salaries and incentive compensation for all employees of and consultants to the Company, but Mr. Hills is excluded from discussions regarding his own salary and incentive compensation.

7

No interlocking relationship exists between the Company’s board of directors or compensation committee and the board of directors or compensation committee of any other party.

Communications to the Board

The board of directors provides a process for LookSmart stockholders to send communications to the board of directors. Any stockholder who desires to contact the board of directors may do so by writing to: LookSmart Board of Directors, 625 Second Street, San Francisco, CA 94107. Communications received by mail will be forwarded to the chair of the board who will, in his discretion, forward such communications to other directors, members of LookSmart management or such other persons as he deems appropriate.

Code of Conduct

LookSmart has adopted a code of ethics (referred to as the LookSmart Code of Business Conduct and Ethics) applicable to all directors, officers and employees of the Company and has established a hotline available to all employees on a confidential basis. The LookSmart Code of Business Conduct and Ethics is publicly available atwww.looksmart.com/aboutus.

Board Independence

Six of the seven members of LookSmart’s board of directors are “independent” (Anthony Castagna, Teresa Dial, Mark Sanders, Edward F. West, Gary A. Wetsel and Timothy J. Wright), as defined in applicable listing standards of the National Association of Securities Dealers.

PROPOSAL TWO — RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The audit committee of the board of directors has reappointed PricewaterhouseCoopers LLP, as the independent registered public accounting firm of LookSmart for fiscal year 2006. Stockholder ratification of the selection of PricewaterhouseCoopers LLP as LookSmart’s independent registered public accounting firm is not required by LookSmart’s bylaws, Delaware corporate law or otherwise. The board of directors has elected to seek such ratification as a matter of good corporate practice. Should the stockholders fail to ratify the selection of PricewaterhouseCoopers LLP as LookSmart’s independent registered public accounting firm, the audit committee of the board of directors will consider whether to retain that firm for the year ending December 31, 2006 and will consider the appointment of other independent registered public accounting firms. PricewaterhouseCoopers LLP audited the financial statements of LookSmart and its subsidiaries for the fiscal year ended December 31, 2005. Representatives of PricewaterhouseCoopers LLP are expected to be present at the annual meeting, will have an opportunity to make a statement if they desire to do so and are expected to be available to respond to appropriate questions from stockholders.

The board of directors unanimously recommends that you vote FOR ratification of the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm of LookSmart.

8

STOCK OWNERSHIP OF PRINCIPAL STOCKHOLDERS AND MANAGEMENT

To the Company’s knowledge, the following table sets forth the number of shares of LookSmart common stock beneficially owned as of April 19, 2006, by

| | • | | each beneficial owner of 5% or more of the Company’s outstanding common stock, |

| | • | | each of LookSmart’s directors and nominees for director, |

| | • | | each of the named executive officers, and |

| | • | | all of LookSmart’s directors and executive officers as a group. |

Except as otherwise indicated below and subject to applicable community property laws, each owner has sole voting and sole investment powers with respect to the stock issued. Shares beneficially owned include securities issuable upon exercise of warrants or stock options exercisable within 60 days of April 19, 2006. Percentage ownership is based on 22,800,933 shares of common stock outstanding as of April 19, 2006 and is computed in accordance with SEC requirements. Unless otherwise indicated below, the address of the persons listed is c/o LookSmart, Ltd., 625 Second Street, San Francisco, CA 94107.

| | | | | |

Name and Address of Beneficial Owner | | Shares

Beneficially

Owned(1) | | Percent

Beneficially

Owned | |

Five Percent Shareholders | | | | | |

Tracey Ellery (2) P.O. Box 617 North Melbourne, Victoria Australia 3051 | | 2,264,854 | | 9.9 | % |

| | |

Evan Thornley (3) P.O. Box 617 North Melbourne, Victoria Australia 3051 | | 2,264,854 | | 9.9 | % |

| | |

S Squared Technology LLC (4) 515 Madison Avenue New York, NY 10022 | | 1,944,240 | | 8.5 | % |

| | |

Sidus Investment Management LLC (5) 767 Third Avenue, 15th Floor New York, NY 10017 | | 1,736,700 | | 7.6 | % |

| | |

Named Executive Officers and Directors | | | | | |

Anthony Castagna | | 96,647 | | * | |

Teresa Dial | | 109,439 | | * | |

Bryan Everett | | 28,749 | | * | |

Stacey Giamalis | | 2,500 | | * | |

Michael Grubb | | 47,586 | | * | |

David B. Hills | | 192,498 | | * | |

William B. Lonergan | | — | | — | |

Deborah Richman | | 20,462 | | * | |

Erik Riegler | | — | | — | |

Mark Sanders | | 36,670 | | * | |

Edward F. West | | 47,182 | | * | |

Gary A. Wetsel | | 23,333 | | * | |

Timothy J. Wright | | 9,269 | | * | |

All directors and executive officers as a group (12 persons) (6) | | 593,998 | | 2.6 | % |

9

| (1) | Includes shares that may be acquired by the exercise of stock options granted under the Company’s stock option plans within 60 days after April 19, 2006. The number of shares subject to stock options exercisable within 60 days after April 19, 2006, for each of the named executive officers and directors is shown below: |

| | |

Anthony Castagna | | 96,647 |

Teresa Dial | | 109,439 |

Bryan Everett | | 28,749 |

Stacey Giamalis | | 2,500 |

Michael Grubb | | 47,186 |

David B. Hills | | 187,498 |

Deborah Richman | | 20,312 |

Mark Sanders | | 36,670 |

Edward F. West | | 47,182 |

Gary A. Wetsel | | 13,333 |

Timothy J. Wright | | 9,269 |

| (2) | This information is based solely on information as of December 31, 2005, as set forth in a Schedule 13G/A dated February 9, 2006, filed by Tracey Ellery with the Securities and Exchange Commission. According to the Schedule 13G/A, the reporting person has sole voting power and sole dispositive power with respect to 1,296,921 shares and shared voting power with respect to 30,000 shares. Includes 937,933 shares held by Ms. Ellery’s husband, Evan Thornley. |

| (3) | This information is based solely on information as of December 31, 2005, as set forth in a Schedule 13G/A dated February 9, 2006, filed by Evan Thornley with the Securities and Exchange Commission. According to the Schedule 13G/A, the reporting person has sole voting power and sole dispositive power with respect to 937,933 shares and shared voting power with respect to 30,000 shares. Includes 1,296,921 shares held by Mr. Thornley’s wife, Tracey Ellery. |

| (4) | This information is based solely on information as of December 31, 2005, as set forth in a Schedule 13G dated February 9, 2006, filed by S Squared Technology, LLC with the Securities and Exchange Commission. According to the Schedule 13G, the reporting person has sole voting power and sole dispositive power with respect to all of the listed shares. |

| (5) | This information is based solely on information as of December 31, 2005, as set forth in a Schedule 13G/A dated January 30, 2006, filed by Sidus Investment Management LLC with the Securities and Exchange Commission. According to the Schedule 13G/A, the reporting person has shared voting power and shared dispositive power with respect to all of the listed shares. |

| (6) | Please see footnote (1). Also includes 125 shares issuable upon the exercise of options exercisable within 60 days of April 19, 2006 for Thomas J. Kelly, Vice President, Marketing. |

10

EXECUTIVE COMPENSATION

Executive Officers

Our executive officers, and their respective ages as of April 19, 2006, are as follows:

| | | | |

Name | | Age | | Position |

David B. Hills | | 50 | | Chief Executive Officer and director |

John Simonelli | | 42 | | Chief Financial Officer |

Bryan Everett | | 36 | | Senior Vice President, Sales |

Stacey Giamalis | | 41 | | Senior Vice President, General Counsel, and Secretary |

Michael Grubb | | 41 | | Senior Vice President, Chief Technology Officer |

Thomas J. Kelly | | 34 | | Vice President, Marketing |

David B. Hillshas served as our Chief Executive Officer and as a director since October 2004. Mr. Hills served as President, Media Solutions, at 24/7 Real Media, Inc., an online marketing and technology company, with responsibility for all North American media and technology sales, from August 2003 to October 2004. From July 2001 to August 2003, Mr. Hills served as Chief Operating Officer and President of Sales for About Inc., an Internet search engine company. Prior to that time, Mr. Hills held various executive positions for subsidiaries of Cox Enterprises, including Vice President of Sales for Cox Interactive Media, an online provider of local content, from July 1999 to July 2001; Vice President and director of Cox Interactive Sales, an Internet advertising network, from May 1994 to July 1999; and Vice President for Telerep, a television advertising sales representation firm and division of Cox Broadcasting, from 1987 to 1994. Mr. Hills holds a B.A. in Communications from Bethany College, West Virginia, and an M.S. in Communications from Boston University.

John Simonellihas served as our Chief Financial Officer since November 2005. He served as Chief Financial Officer at Gap Inc. Direct, from October 2002 to November 2005. Prior to that time, from March 2000 to September 2002, Mr. Simonelli was the Chief Operating Officer and Chief Financial Officer at Business.com. Mr. Simonelli began his career at Deloitte, Haskins & Sells in 1985, and has held positions since that time at Citicorp Securities and The Walt Disney Company. Mr. Simonelli holds a B.S. in Business Administration from the University of Notre Dame.

Bryan Everetthas served as our Senior Vice President, Sales since December 2004. Prior to that time, Mr. Everett served as Vice President, Sales for Twelve Horses, an online marketing company, from September 2003 to December 2004 and as Regional Vice President, West Coast Sales from March 2003 to September 2003. Prior to that time, Mr. Everett served as Vice President, West Coast Sales for 24/7 Real Media, Inc., an online advertising network, from November 2000 to March 2003 and as Director, West Coast Sales from March 1999 to November 2000. Mr. Everett holds a B.A. in International Business from Lehigh University and an M.B.A. from Pepperdine University.

Stacey Giamalishas served as our Senior Vice President, General Counsel, and Secretary since July 2005. She has sixteen years of experience as a corporate attorney representing companies in technology and other industries. As LookSmart’s General Counsel, Ms. Giamalis is responsible for advising on all legal matters, including corporate/securities, contractual, intellectual property, product, and international matters. Prior to joining LookSmart, Ms. Giamalis was Vice President, General Counsel and Secretary of QRS Corporation, which offered hosted network services for retail e-commerce. Before QRS, she was the Vice President, General Counsel and Secretary of CrossWorlds Software, an enterprise software company that went public during her tenure. She was previously in private practice. Ms. Giamalis received a B.A. in Psychology from the University of California, Davis and a J.D. from the University of California, Berkeley (Boalt Hall).

Michael Grubbhas served as our Senior Vice President and Chief Technology Officer since April 2005 and as our Vice President, Technical Operations since September 2002. Prior to that time, Mr. Grubb served in

11

various positions at Akamai Technologies, a web content delivery service company, most recently as Vice President, Operations and Chief Systems Architect, from March 1999 to September 2002. Mr. Grubb holds an A.B. in Philosophy from Duke University and a J.D. from the University of North Carolina.

Thomas J. Kelly has served as our Vice President, Marketing since December 2005. In this role, Mr. Kelly leads the Company’s marketing and communications efforts. He brings with him more than 10 years of experience in marketing, sales and business development. Prior to LookSmart, Mr. Kelly served as Vice President of Sales and Marketing for Clear Capital, a privately held company that, like LookSmart, markets to a variety of channels. His past experience includes both business and consumer marketing for companies like Anheuser-Busch and Intrawest. Mr. Kelly has also executed advertising campaigns in a wide range of industries. He holds a B.S. in business and marketing from Chicago State University and an M.S. in business and marketing from San Francisco State University.

Summary Compensation Table

The following table provides certain summary information concerning the compensation earned for all services rendered in all capacities to the Company and its subsidiaries for the 2005, 2004 and 2003 fiscal years, by the Company’s Chief Executive Officer and the four other most highly compensated executive officers of the Company in fiscal year 2005 whose salary and bonus for the 2005 fiscal year exceeded $100,000. In addition, Messrs. Lonergan and Riegler are included in the table because they each would have been among the four most highly compensated executive officers of the Company but for the fact that they were not serving as executive officers of the Company on the last day of the 2005 fiscal year.

The persons listed in the table below are referred to throughout this proxy statement as the “named executive officers.”

| | | | | | | | | | | | |

| | | | | Annual Compensation | | Long-Term

Compensation

Awards | | |

Name and Principal Position | | Year | | Salary

($) | | Bonus

($) | | Other Annual

Compensation

($) | | Number of

Shares

Underlying

Options | | All Other

Compensation

($) |

David B. Hills (1) Chief Executive Officer | | 2005

2004

2003 | | 350,000

53,846

— | | 154,438

25,000

— | | 205,372

30,631

— | | 100,000

400,000

— | | 798

140

— |

| | | | | | |

Bryan Everett (2) Senior Vice President, Sales | | 2005

2004

2003 | | 160,000

6,154

— | | 111,979

10,416

— | | —

—

— | | 15,000

60,000

— | | 3,397

—

— |

| | | | | | |

Stacey Giamalis (3) Senior Vice President, General Counsel | | 2005

2004

2003 | | 88,462

—

— | | 29,918

—

— | | —

—

— | | 40,000

—

— | | 2,660

—

— |

| | | | | | |

Michael Grubb (4) Senior Vice President, Chief Technology Officer | | 2005

2004

2003 | | 189,423

160,000

155,795 | | 55,625

54,000

— | | —

—

— | | 20,000

15,000

— | | 3,365

3,278

6,274 |

| | | | | | |

William B. Lonergan (5) Former Chief Financial Officer | | 2005

2004

2003 | | 246,716

250,000

62,500 | | 133,125

42,500

20,548 | | —

—

— | | 30,000

—

150,000 | | 92,671

3,435

— |

| | | | | | |

Deborah Richman (6) Former Senior Vice President, Consumer Products | | 2005

2004

2003 | | 191,539

—

— | | 93,250

—

— | | 15,000

—

— | | 75,000

—

— | | 456

—

— |

| | | | | | |

Erik Riegler (7) Former Vice President, General Counsel | | 2005

2004

2003 | | 121,573

170,731

132,973 | | —

10,000

— | | —

—

— | | —

20,000

— | | 80,273

3,301

6,691 |

| (1) | Mr. Hills joined the Company in October 2004. Amounts shown for 2004 reflect compensation for less than the full fiscal year. Amount shown in the column entitled “Other Annual Compensation” for 2005 and 2004 reflects payments for relocation expenses. Amount shown in column entitled “All Other Compensation” for 2005 reflects the life insurance premiums paid by the Company on behalf of Mr. Hills. |

12

| (2) | Mr. Everett joined the Company in December 2004. Amounts shown for 2004 reflect compensation for less than the full fiscal year. Amount shown in column entitled “All Other Compensation” for 2005 consists of (a) life insurance premiums paid by the Company on behalf of Mr. Everett in the amount of $397, and (b) matching contributions made by the Company to the account of Mr. Everett under the Company’s 401(k) plan in the amount of $3,000. Under the 401(k) plan, matching contributions are 50% vested after the first year of employment and 100% vested after the second year of employment. |

| (3) | Ms. Giamalis joined the Company in July 2005. Amounts shown for 2005 reflect compensation for less than the full fiscal year. Amount shown in column entitled “All Other Compensation” for 2005 consists of (a) life insurance premiums paid by the Company on behalf of Ms. Giamalis in the amount of $198, and (b) matching contributions made by the Company to the account of Ms. Giamalis under the Company’s 401(k) plan in the amount of $2,462. Under the 401(k) plan, matching contributions are 50% vested after the first year of employment and 100% vested after the second year of employment. |

| (4) | Mr. Grubb joined the Company in September 2002. Amount shown in column entitled “All Other Compensation” for 2005 consists of (a) life insurance premiums paid by the Company on behalf of Mr. Grubb in the amount of $365, and (b) matching contributions made by the Company to the account of Mr. Grubb under the Company’s 401(k) plan in the amount of $3,000. Under the 401(k) plan, matching contributions are 50% vested after the first year of employment and 100% vested after the second year of employment. |

| (5) | Mr. Lonergan worked for the Company from September 2003 to November 2005. Amounts shown for 2003 reflect compensation for less than the full fiscal year. Amount shown in column entitled “All Other Compensation” for 2005 consists of (a) severance payment made in December 2005 in the amount of $87,500, (b) life insurance premiums paid by the Company on behalf of Mr. Lonergan in the amount of $525, (c) matching contributions made by the Company to the account of Mr. Lonergan under the Company’s 401(k) plan in the amount of $3,000, and (d) COBRA payments made by the Company on behalf of Mr. Lonergan in the amount of $1,646. Under the 401(k) plan, matching contributions are 50% vested after the first year of employment and 100% vested after the second year of employment. |

| (6) | Ms. Richman worked for the Company from January 2005 to April 2006. Amount shown for 2005 reflect compensation for less than the full fiscal year. Amount shown in column entitled “All Other Compensation” for 2005 reflects the life insurance premiums paid by the Company on behalf of Ms. Richman. |

| (7) | Mr. Riegler worked for the Company from February 2000 to July 2005. Amounts shown for 2005 reflect compensation for less than the full fiscal year. Amount shown in column entitled “All Other Compensation” for 2005 consists of (a) severance payment made in August 2005 in the amount of $77,000, (b) life insurance premiums paid by the Company on behalf of Mr. Riegler in the amount of $273, and (c) matching contributions made by the Company to the account of Mr. Riegler under the Company’s 401(k) plan in the amount of $3,000. Under the 401(k) plan, matching contributions are 50% vested after the first year of employment and 100% vested after the second year of employment. |

Stock Option Grants in the Last Fiscal Year

The following table sets forth information regarding stock options granted to the named executive officers in 2005 and the values of those options.

The amounts shown in the column entitled “Potential Realizable Value at Assumed Annual Rate of Stock Price Appreciation for Option Term” are based on the fair market value per share of common stock on the date of grant, compounded annually at 5% or 10% per annum over the initial term of the option, minus the exercise price per share, multiplied by the number of shares subject to the stock option. The real value of the options depends on the actual performance of the Company’s stock during the applicable period. The use of this valuation method should not be construed as an endorsement of its accuracy in valuing LookSmart options or common stock.

| | | | | | | | | | | | | |

| | | Individual Grants | | | | | | | |

Name | | Number of

Securities

Underlying

Options

Granted | | Percent of

Total

Options

Granted to

Employees

in 2005 | | Exercise

Price

Per Share

($) | | | | | Potential Realizable Value

at Assumed Annual Rate of

Stock Price Appreciation for

Option Term ($) |

| | | | | Expiration Date | | 5% | | 10% |

David B. Hills | | 100,000 | | 10.73 | | 3.10 | | | 8/5/2015 | | 194,957 | | 494,060 |

Bryan B. Everett | | 15,000 | | 1.6 | | 3.10 | | | 8/5/2015 | | 29,244 | | 74,109 |

Stacey A. Giamalis | | 40,000 | | 4.3 | | 3.10 | | | 8/5/2015 | | 77,983 | | 197,624 |

Michael Grubb | | 20,000 | | 2.1 | | 3.85 | | | 4/27/2015 | | 48,425 | | 122,718 |

William B. Lonergan | | 30,000 | | 3.2 | | 3.10 | (1) | | 8/5/2015 | | 58,487 | | 148,218 |

Deborah Richman | | 60,000 | | 6.4 | | 6.80 | (1) | | 1/26/2015 | | 256,589 | | 650,247 |

| | 15,000 | | 1.6 | | 3.10 | (1) | | 8/5/2015 | | 29,244 | | 74,109 |

Erik Riegler | | — | | — | | — | | | — | | — | | — |

| (1) | Mr. Lonergan and Ms. Richman no longer work for the Company. Mr. Lonergan’s stock options terminated in February 2006. Ms. Richman’s options will terminate, if not exercised sooner, in July 2006. |

13

Stock options granted in 2005 generally: (i) expire after a term of ten years, (ii) terminate, with limited exercise provisions for a period of time, in the event of death, retirement or termination of employment, and (iii) permit the optionee to pay the exercise price by delivery of cash or shares of the Company’s common stock.

Fiscal Year-End Option Values

The following table provides information concerning unexercised in-the-money options held as of December 31, 2005 by the named executive officers. No stock options were exercised by the named executive officers during 2005. The amounts shown in the column entitled “Value of Unexercised In-the-Money Options at Fiscal Year End” are based on the closing sales price of the Company’s common stock on the Nasdaq National Market on December 31, 2005 ($3.76) minus the exercise price of the option (if less than $3.76), multiplied by the number of shares subject to the option.

| | | | | | | | |

| | | Number of Securities

Underlying Unexercised

Options at Fiscal Year End | | Value of Unexercised In-the-

Money

Options at Fiscal Year-End |

Name | | Exercisable | | Unexercisable | | Exercisable ($) | | Unexercisable ($) |

David B. Hills | | 127,082 | | 372,918 | | 6,875 | | 59,125 |

Bryan B. Everett | | 16,562 | | 58,438 | | 1,031 | | 8,869 |

Stacey A. Giamalis | | — | | 40,000 | | — | | 26,400 |

Michael Grubb | | 37,082 | | 32,918 | | — | | — |

William Lonergan | | 80,625 | | — | | 1,650 | | — |

Deborah Richman | | 1,562 | | 73,438 | | 1,031 | | 8,869 |

Erik Riegler | | — | | — | | — | | — |

Employment, Severance and Change of Control Agreements

Other than as set forth below, the Company has no written employment agreements governing the length of service of its executive officers, or any severance or change of control agreements with its executive officers and each of its executive officers serves on an at-will basis.

In November 2005, pursuant to the terms and conditions of his severance arrangement, the Company entered into a separation agreement with William Lonergan, its former Chief Financial Officer, providing for a lump sum payment of $182,500 and continued health benefits for a period of six months. In April 2006, pursuant to the terms and conditions of her severance arrangement, the Company entered into a separation agreement with Debby Richman, its former Senior Vice President, Consumer Products, providing for a lump sum payment of $150,000.

The Company has a severance arrangement with David B. Hills, its Chief Executive Officer, providing that in the event of termination without cause or voluntary resignation for “good reason,” the Company will provide a severance package consisting of: (a) continued payment of his base salary for 12 months, (b) incentive bonus in an aggregate amount equal to 100% of his actual, earned incentive bonus for the fiscal year prior to the fiscal year in which the termination occurs; and (c) up to 12 months of continued health insurance from the date of the termination for him and his eligible dependents. If any termination without cause or voluntary resignation for “good reason” occurs within 12 months after a change of control of the Company, the Company will provide a severance package consisting of: (a) lump sum payment of 100% of his then-current annual base salary (200% if such termination occurs before October 25, 2006), (b) an amount equal to the greater of (i) 100% of his annual incentive bonus for the year in which the change of control occurs (200% if such termination occurs before October 25, 2006) or (ii) 100% of his annual incentive bonus for the year prior to which the termination occurs (200% if such termination occurs before October 25, 2006), and (c) up to 12 months of continued health insurance from the date of the termination for him and his eligible dependents. A “change of control” is defined in the severance arrangement as a merger or acquisition of the Company in which the stockholders of the Company prior to the transaction do not retain 50% of the voting securities of the surviving corporation or a sale

14

of all or substantially all of the assets of the Company. “Good reason” is defined in the severance arrangement as any of the following without Mr. Hills’ consent: a significant reduction of his duties, title, authority or responsibilities, relative to his duties, title, authority or responsibilities as in effect at the measuring time; a reduction by the Company in his base salary as in effect at the measuring time except for a one-time reduction, in an amount of up to 10%, that also is applied to substantially all of the Company’s other senior executives; a reduction by the Company in the aggregate level of employee benefits, including bonuses, to which he was entitled at the measuring time with the result that his aggregate benefits package is materially reduced; the failure of the Company to put forth its best efforts to elect him to the Board at every opportunity during his employment; or the failure of the Company to grant him the option grant specified in the Stock Options section of his letter.

The Company has severance arrangements with each of Bryan B. Everett, its Senior Vice President, Sales, Stacey Giamalis, its Senior Vice President and General Counsel, John Simonelli, its Chief Financial Officer, and Michael Grubb, its Chief Technology Officer, providing that in the event of termination without cause or voluntary resignation for “good reason”, the Company will provide a severance package consisting of a lump sum payment equal to 50% of their then-current respective annual base salaries plus 50% of their respective incentive compensation (at 100% of “plan”). “Good reason” is generally defined in the severance arrangements as (i) a significant change or reduction in job duties or a reduction in cash compensation of more than 10%, or (ii) a change in job location of more than 50 miles from its previous location.

Stock Options. Generally, (1) under the stock option agreements for newly hired executive officers, 25% of each option becomes exercisable on the first anniversary of the date of grant and1/48th of the shares become exercisable each month thereafter, so that all options are vested after four years, and (2) for additional grants,1/48th of the shares become exercisable each month, so that all options are vested after four years.

Pursuant to individual stock option agreements with the Company, the stock options held by its Chief Executive Officer and Senior Vice Presidents are generally subject to accelerated vesting in the event of termination without cause or voluntary resignation for “good reason” within twelve months following a change in control of the Company. In such event, 50% of all stock options will vest and become immediately exercisable or if fewer than 50% of the stock options are unvested, then all remaining unvested stock options will vest and become immediately exercisable. However, with respect to David Hills, in such event the greater of 50% or 100,000 shares of his remaining unvested option shares will vest and become immediately exercisable. A “change of control” is generally defined in the option agreements as a merger or acquisition of the Company in which the stockholders of the Company prior to the transaction do not retain 50% of the voting securities of the surviving corporation or a sale of all or substantially all of the assets of the Company.

Indemnity Agreements. The Company has entered into indemnity agreements with its directors and officers providing for indemnification of each director and officer against expenses incurred in connection with any action or investigation involving the director or officer by reason of his or her position with the Company (or with another entity at the Company’s request). The directors and officers will also be indemnified for costs, including judgments, fines and penalties, indemnifiable under Delaware law or under the terms of any current or future liability insurance policy maintained by the Company that covers directors and officers. A director or officer involved in a derivative suit will be indemnified for expenses and amounts paid in settlement. Indemnification is dependent in each instance on the director or officer meeting the standards of conduct set forth in the indemnity agreements.

Certain Relationships and Related Transactions

In November 2005, the Company hired director Gary Wetsel’s son-in-law as an at-will employee in our Publisher Products group. Mr. Wetsel’s son-in-law has base salary and bonus compensation arrangements that the Company believes reflect current market compensation arrangements for persons in comparable positions, and no such arrangements were based on, or affected by, his relationship to Mr. Wetsel. Mr. Wetsel’s son-in-law is not an executive officer of the Company, he does not reside in Mr. Wetsel’s house, and he and Mr. Wetsel are not financially dependent on each other. Mr. Wetsel was not, and is not, involved in compensation decisions

15

affecting his son-in-law except to the extent of broad-based decisions of the Compensation Committee and/or Board of Directors affecting our employees and/or consultants generally, and we believe that Mr. Wetsel does not have a direct or indirect material interest in his son-in-law’s employment relationship with us. The Company’s Board of Directors has also concluded that our employment relationship with his son-in-law does not interfere with Mr. Wetsel’s exercise of independent judgment in carrying out his responsibilities as a director and that Mr. Wetsel therefore remains “independent” within the meaning of applicable Nasdaq and SEC rules.

Equity Compensation Plan Information

The following table provides information concerning our equity compensation plans as of December 31, 2005 under which common stock of the Company is authorized for issuance.

| | | | | | | | |

| | | Number of Shares

of Common Stock

to be Issued upon

Exercise of

Outstanding

Options,

Warrants and

Rights | | | Weighted Average

Exercise Price

of Outstanding

Options, Warrants

and Rights ($) | | Number of Shares

Remaining Available

for Future Issuance

under our equity

compensation plans

(excluding shares

reflected in

column 1) (2) | |

Equity Plans Approved by Stockholders | | 1,819,610 | (1) | | 7.32 | | 2,349,456 | (3) |

Equity Plans not Approved by Stockholders | | — | | | — | | — | |

| | | | | | | | |

Total | | 1,819,610 | | | 7.32 | | 2,349,456 | |

| | | | | | | | |

| (1) | Does not include 3,290 shares reserved for issuance upon exercise of stock options assumed in connection with our acquisition of Zeal Media, Inc., for which the weighted average exercise price is $3.02 per share, and 914 shares reserved for issuance upon exercise of stock options assumed in connection with our acquisition of WiseNut, Inc., for which the weighted average exercise price is $4.16 per share. The Company does not intend to grant any further options under these plans. Also excludes no more than 17,500 shares that the Company expects to issue at the May 31, 2006 end of its current purchase period under its 1999 Employee Stock Purchase Plan. |

| (2) | The number of shares of common stock that may be issued under the Amended and Restated 1998 Stock Plan is subject to an annual increase in June of each year equal to the lesser of (i) 500,000 shares, (ii) 4% of the total number of shares of common stock outstanding on the last day of the immediately preceding fiscal year or (iii) a lesser amount determined by the board of directors. The Company anticipates that the allowed annual increase of 500,000 shares, or a lesser amount as determined by the board of directors, will be added to the Amended and Restated 1998 Stock Plan in June 2006. |

| (3) | Includes 43,999 shares reserved for issuance in connection with our 1999 Employee Stock Purchase Plan. The number of shares of common stock that may be issued under the 1999 Employee Stock Purchase Plan is subject to an annual increase in June of each year equal to the lesser of (i) 500,000 shares, (ii) 3% of the total number of shares of common stock outstanding on the last day of the immediately preceding fiscal year or (iii) a lesser amount determined by the board of directors. The Company anticipates that an amount less than the allowed annual increase of 500,000 shares, as determined by the board of directors, will be added to the 1999 Employee Stock Purchase Plan in June 2006. |

16

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The Compensation Committee is composed of directors Wright, Sanders and Wetsel, none of whom is a current or former employee of the Company or its subsidiaries. The Compensation Committee reviews and sets, subject to the approval of the Board of Directors, the compensation policies of the Company. The Compensation Committee also administers the Company’s compensation plans and reviews and sets, subject to the approval of the Board of Directors, the Chief Executive Officer’s compensation and, with the advice of the Chief Executive Officer, the Company’s other executive officers’ compensation.

General Compensation Policy

The basic compensation philosophy of the Compensation Committee and the Company is to provide competitive compensation to achieve superior financial performance and enhance stockholder value. Executive compensation consists of annual compensation, including salary and bonus awards, and long-term compensation, consisting of stock options and other equity based compensation. The Company’s executive compensation guidelines are designed to achieve four primary objectives:

| | • | | Attract and retain well-qualified executives to lead the Company and achieve and inspire superior performance; |

| | • | | Provide incentives for achievement of specific short-term individual, department and Company goals; |

| | • | | Provide incentives for achievement of longer-term Company financial goals; and |

| | • | | Align the interests of management with those of the stockholders to encourage achievement of continuing increases in stockholder value. |

Executive compensation at LookSmart consists primarily of the following components:

| | • | | base salary and benefits; |

| | • | | bonus plans with payouts designed to encourage achievement of individual and Company goals; and |

| | • | | participation in the Company’s stock option plan. |

Each component of compensation is designed to accomplish one or more of the compensation objectives described above.

The participation of specific executive officers and other key employees in the stock option and equity-based incentive plans of the Company is recommended by management and such recommendations (including the level of participation) are reviewed, modified (to the extent appropriate) and approved by the Compensation Committee to be recommended to the Board of Directors for approval. Senior executive officers are normally eligible to receive a greater percentage of their potential compensation in the form of awards under incentive plans to reflect the Compensation Committee’s belief that the percentage of an executive’s total compensation that is “at risk” should increase as the executive’s corporate responsibilities and ability to influence profits increase.

Base Salary

To attract and retain well-qualified executives, the Compensation Committee’s policy is to establish base salaries at levels that have been confirmed to be, in the aggregate, competitive among similarly situated companies. The Compensation Committee determined the base salaries of executives by comparing each executive’s position with similar positions in companies of similar type, size and financial performance. In making that comparison, the Compensation Committee uses internal and independent surveys of companies of a comparable stage of development including Internet companies at a similar stage in the San Francisco Bay Area which may compete for the same pool of employees. Factors considered by the Compensation Committee in

17

determining base salaries for executives include the executive’s performance, the executive’s current compensation and the Company’s or the applicable department’s performance (determined by reference to revenues, costs and other quantitative measures of performance). Although the Compensation Committee does not give specific weight to any particular factor, significant weight is given to the executive’s performance (in determining whether to adjust above or below the current salary level), and to the comparative salary levels in the industry. In general, base salaries for the Company’s executives in 2005 were near the median of salaries paid by comparable companies. The 2005 average base salary of senior executives is generally consistent with the previous year’s levels, with some differences for specific individuals that were the result of changes in the executives employed by the Company, differences in individual experience and performance levels, and changes in senior executive responsibilities.

Stock-Based Incentive Compensation

Awards under the Company’s stock option and employee stock purchase plans are designed to encourage long-term investment in the Company, more closely align executive and stockholder interests and reward executives and other key employees for enhancing stockholder value. The Compensation Committee believes stock ownership by management has been demonstrated to be beneficial to stockholders. Periodic grants of stock options are generally made annually to all eligible employees based on performance, with additional grants made to certain employees following a significant change in job responsibility.

Under the Company’s stock option plan, the Compensation Committee may grant to executives and other key employees restricted stock and/or stock options. The Compensation Committee reviews and approves grants to executives and exceptional grants to employees. The Compensation Committee reviews and approves a standard structure for grants to new non-executive employees and discretionary grants to eligible employees. The Compensation Committee generally grants nonqualified options within the meaning of the Internal Revenue Code. Under the terms and conditions of the plan, the Compensation Committee may, however, grant nonqualified options with an exercise price above or below the market price on the date of grant. All of the options granted in 2005 were nonqualified stock options with an exercise price equal to the closing price of LookSmart stock on the day of the grant.

In determining the number of stock options to be awarded to an executive, the Compensation Committee generally takes into consideration the level of responsibility of the executive and compensation practices of similar companies. The Compensation Committee also considers the recommendations of management, the individual performance of the executive and the number of shares previously awarded to the executive. As a general practice, the number of options granted increases in proportion to each executive’s responsibilities.

Cash Incentive Compensation

Cash incentive compensation awards are designed to more closely align executive and stockholder interests and reward executives and other key employees for enhancing stockholder value. The Compensation Committee believes cash incentives to executives have been demonstrated to be beneficial to increasing stockholder value. The annual cash incentive amounts were set based on the Compensation Committee’s evaluation of the level of responsibility of each executive and compensation practices of similar companies, the recommendations of management, the individual performance of the executive, and the overall compensation awarded to the executive. The cash bonuses granted to the named executive officers (other than the Chief Executive Officer, discussed below) in 2005 were based on (1) the Company’s achievement of financial goals (primarily revenue and operating expense targets), and (2) the achievement of individual performance goals.

Chief Executive Officer Compensation

Mr. Hills has been Chief Executive Officer of the Company since October 2004. His base salary in 2005 was $350,000 and his annual performance incentive target was $175,000 at 100% attainment. Mr. Hills’s compensation level is consistent with the Company’s compensation policy described above and the

18

Compensation Committee’s evaluation of his overall leadership skills and experience. In setting Mr. Hills’s base salary and total annual cash compensation, the Compensation Committee compared Mr. Hills’s cash compensation with that of chief executive officers of similar age and experience and with those of companies of similar type and size. In the first quarter of 2006, the Compensation Committee awarded Mr. Hills a bonus of $154,437.50 for 2005, based on its evaluation of Mr. Hills’s performance in 2005. Mr. Hills had a portion of his total compensation “at risk” in 2005 because some of his potential compensation was based upon the stock option plan described above. Mr. Hills’s equity position in the Company consists of stock options subject to vesting and shares he acquired in the open market.

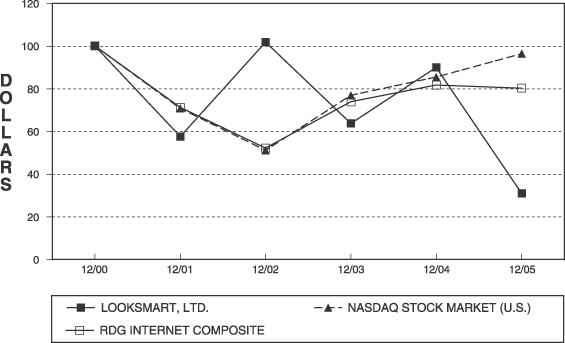

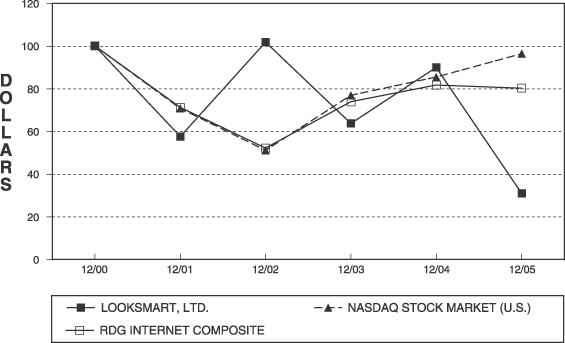

Compliance with Internal Revenue Code Section 162(m)