SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| x | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Section 240.14a-12 |

LOOKSMART, LTD.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

NOTICE OF ANNUAL MEETING

LOOKSMART, LTD.

55 Second Street

San Francisco, California 94105

Dear Stockholder:

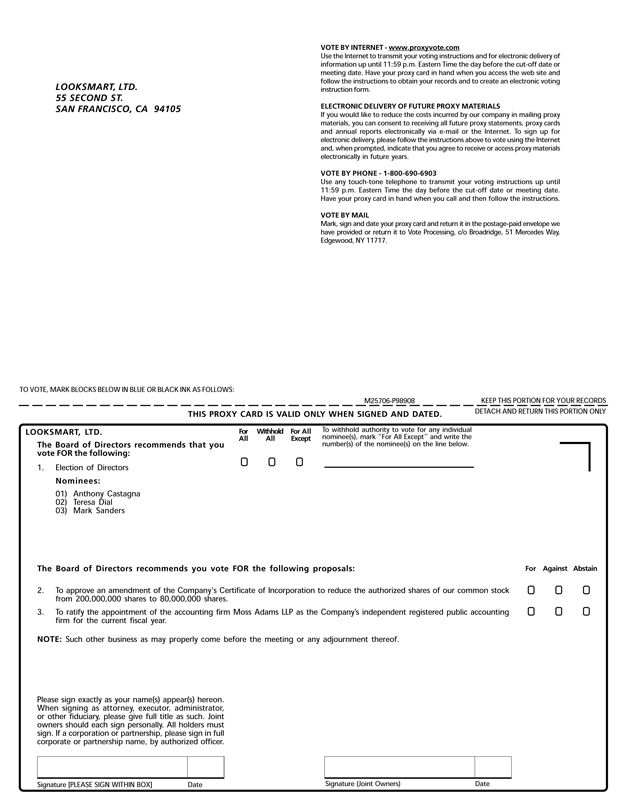

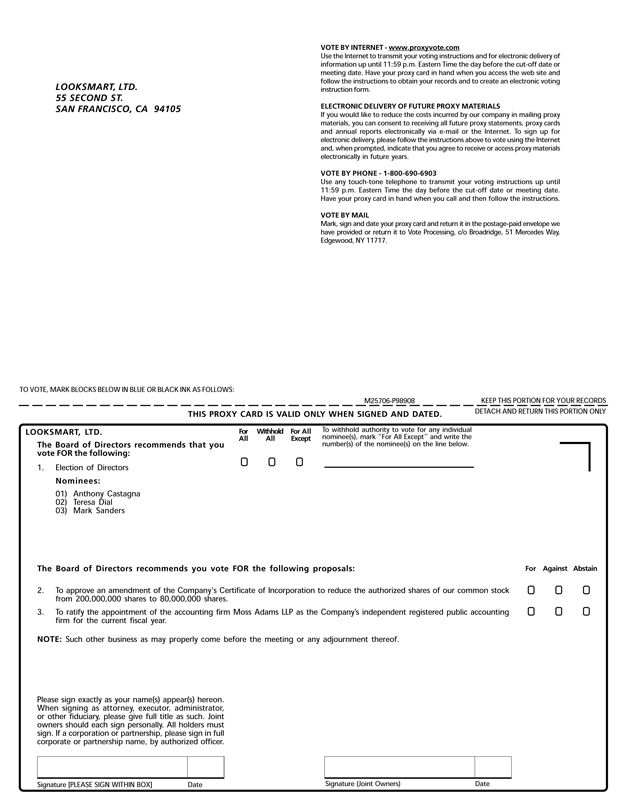

The annual meeting of stockholders of LookSmart, Ltd. (“LookSmart” or the “Company”) will be held at 55 Second Street, 7th floor, San Francisco, California 94105, on Wednesday, July 28, 2010, at 9:00 a.m. local time. The annual meeting is being held for the following purposes:

| | (1) | To elect three directors for a three-year term expiring at the annual meeting of stockholders in 2013; |

| | (2) | To approve an amendment of the Company’s Certificate of Incorporation to reduce the authorized shares of our common stock from 200,000,000 shares to 80,000,000 shares; |

| | (3) | To ratify the appointment of the accounting firm Moss Adams LLP as the Company’s independent registered public accounting firm for the current fiscal year; and |

| | (4) | To transact any other business that may properly come before the annual meeting and any adjournment or postponement thereof. |

These items are fully discussed in the following pages, which are made part of this notice. Only stockholders of record on the books of the Company at the close of business on May 31, 2010 are entitled to vote at the annual meeting.

All stockholders are cordially invited to attend the annual meeting in person. Whether or not you plan to attend,please vote your proxy promptly, either via the Internet, by telephone or, if this proxy statement was mailed to you, by completing, signing, dating and returning your proxy card in the enclosed envelope, so that shares may be voted in accordance with your wishes and so that enough shares are represented to allow us to conduct the business of the annual meeting. If you hold shares in “street name,” you may be able to vote over the Internet or by telephone by following the instructions on your Notice of Internet Availability of Proxy Materials or your proxy card, whichever you receive. Voting over the Internet or by telephone, or mailing your proxy(ies) does not affect your right to vote in person if you attend the annual meeting. You may still vote in person if you are a stockholder entitled to vote and you attend the meeting, even if you have returned your proxy, provided that you affirmatively indicate your intention to vote your shares in person.Please note, however, that if a brokerage firm or bank holds your shares of record and you wish to vote at the meeting, you must obtain from the record holder a valid legal proxy issued in your name.

This year, we will be using “Notice and Access” method of providing proxy materials to you via the Internet. We believe that this process should provide you with a convenient and quick way to access your proxy materials and vote your shares, while allowing us to reduce the costs of printing and distributing the proxy materials and conserve natural resources. On or about June 18, 2010, we will mail to many of our stockholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy statement and our annual report on Form 10-K (as amended by our Form 10-K/A), and vote electronically, via the Internet. If you received a notice by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials included in the Notice. We will not be mailing the Notice to stockholders who had previously elected either to receive notices and access the proxy materials and vote completely electronically via the Internet or to receive paper copies of the proxy materials.

|

| By Order of the Board of Directors, |

|

| Stephen C. Markowski |

| Chief Financial Officer |

June 18, 2010

Your vote is very important. Even if you plan to attend the meeting,

VOTE YOUR PROXY PROMPTLY.

PROXY STATEMENT

FOR THE

ANNUAL MEETING OF STOCKHOLDERS

LookSmart, Ltd.

55 Second Street

San Francisco, California 94105

INFORMATION ABOUT SOLICITATION AND VOTING

General

The enclosed proxy is solicited by the board of directors of LookSmart for use in voting at the annual meeting of stockholders to be held at 9:00 a.m., local time, on Wednesday, July 28, 2010, at the Company’s offices at 55 Second Street, 7th floor, San Francisco, California 94105, and any postponement or adjournment of that meeting. The purpose of the annual meeting is to consider and vote upon the proposals outlined in this proxy statement and the attached notice. The Company’s telephone number is (415) 348-7000.

LookSmart’s common stock is traded on the NASDAQ Global Market.

On or about June 18, 2010, we will mail to many of our stockholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy statement and our annual report on Form 10-K (as amended by our Form 10-K/A), and vote electronically, via the Internet. We will not be mailing the Notice to stockholders who had previously elected either to receive notices and access the proxy materials and vote completely electronically via the Internet or to receive paper copies of the proxy materials. With respect to stockholders who had previously elected to receive paper copies of the proxy materials, those will be mailed on or about June 18, 2010.

Record Date and Outstanding Shares

Only holders of record of LookSmart common stock at the close of business on the record date, May 31, 2010, are entitled to receive notice of and to vote at the annual meeting. As of the close of business on the record date, there were 17,157,442 shares of common stock outstanding and held of record by approximately 4,853 stockholders. Stockholders are entitled to one vote for each share of common stock they held as of the record date.

Voting and Solicitation

Each stockholder may vote in person at the annual meeting or by proxy. Many of our stockholders will vote electronically via the Internet. Those stockholders will receive a Notice of Internet Availability of Proxy Materials containing instructions on how to vote electronically via the Internet. However, stockholders who had previously elected to receive paper copies of our proxy materials will receive a proxy card, and those stockholders may vote by completing, signing, dating and returning the proxy card provided to them in accordance with its instructions. If you are the record holder of your shares of common stock and attend the meeting in person, you may deliver your completed proxy card to us at the meeting.If your shares are held in “street name,” please check your Notice of Internet Availability of Proxy Materials or your proxy card, whichever you receive, or contact your broker or nominee to determine whether you will be able to vote by telephone or on the Internet.

When proxies are properly voted in accordance with instructions, the shares they represent will be voted at the annual meeting in accordance with the instructions of the stockholder (proxies cannot be voted for a greater

1

number of persons than the number of nominees named). If no specific instructions are given, the shares will be voted FOR the election of the nominees for director set forth herein, FOR approval of the amendment of the Company’s Certificate of Incorporation to decrease the number of authorized shares of our common stock, and FOR ratification of the appointment of independent auditors. In addition, if other matters come before the annual meeting, the persons named in the accompanying form of proxy will vote in accordance with their best judgment with respect to such matters. On all matters to be voted on, each share has one vote.

We are making this proxy solicitation by and on behalf of the board of directors. The cost of preparing, assembling, printing and mailing this proxy statement and the proxies solicited hereby will be borne by us. Proxies may be solicited personally or by telephone, electronic mail or facsimile by the Company’s officers, directors and regular employees, none of whom will receive additional compensation for assisting with solicitation.

Quorum; Required Vote

A quorum is required for the transaction of business during the annual meeting. A quorum is present when a majority of stockholder votes are present in person or by proxy. Shares that are voted “FOR”, “AGAINST” or “WITHHELD” on a matter are treated as being present at the meeting for purposes of establishing a quorum and are also treated as votes cast by the common stock present in person or represented by proxy at the annual meeting and entitled to vote on the subject matter.

The candidates for election as a director at the annual meeting who receive the highest number of affirmative votes present or represented by proxy and entitled to vote at the annual meeting will be elected. Stockholders do not have the right to cumulate their votes in the election of directors. The approval of the amendment of the Company’s Certificate of Incorporation to decrease the number of authorized shares of our common stock requires the affirmative vote of a majority of the outstanding shares of the Company’s common stock. The ratification of the independent registered public accounting firm for the Company for the current year requires the affirmative vote of a majority of the shares of the Company’s common stock present or represented by proxy and entitled to vote at the annual meeting.

Revocability of Proxies

If you are a stockholder entitled to vote and you have submitted a proxy via the Internet, mail or by telephone, you may revoke your proxy at any time before it is voted by delivering a written revocation to the Secretary of the Company, providing a proxy bearing a later date that is duly voted in accordance with its instructions, or attending and voting in person at the annual meeting.If you hold your shares through a broker or custodian, you will need to contact them to revoke your proxy.

Abstentions; Broker Non-Votes

The Company will count abstentions for purposes of determining both (i) the presence or absence of a quorum for the transaction of business and (ii) the total number of votes cast with respect to a proposal (other than the election of directors). A “broker non-vote” occurs when a broker or other nominee does not have discretion to vote shares with respect to a particular proposal and has not received instructions from the beneficial owner of the shares. Generally, brokers have discretion to vote shares on what are deemed to be “routine” matters but not with respect to “non-routine” matters. Under the rules and interpretations of the New York Stock Exchange (“NYSE”), “non-routine” matters are matters that may substantially affect the rights or privileges of stockholders, such as mergers, stockholder proposals and, for the first time, under a new amendment to the NYSE rules, elections of directors, even if not contested. Broker non-votes will be counted for purposes of determining the presence or absence of a quorum for the transaction of business. Broker non-votes will not be counted for purposes of determining the number of votes cast with respect to a proposal.

2

For Proposal One (election of directors), which requires a plurality of the votes cast, abstentions and broker non-votes will have no effect on determining the number of votes cast nor on whether the director is elected. For Proposal Two (the approval of the amendment of the Company’s Certificate of Incorporation), which requires the affirmative approval of a majority of the outstanding shares, broker non-votes and abstentions will have the same effect as a vote against Proposal Two. For Proposal Three (the ratification of the appointment of the independent registered public accounting firm), which requires the affirmative approval of a majority of the votes present or represented and entitled to vote, broker non-votes will have no effect on the number of votes cast nor on whether the appointment is ratified, but abstentions will have the same effect as a vote against Proposal Three because they will be counted as a vote cast with respect to the proposal but not counted as a vote for ratification.

Results of the Voting at the Annual Meeting

Preliminary voting results will be announced at the annual meeting. In addition, final voting results will be published in a current report on Form 8-K that we expect to file within four business days after the annual meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an amended Form 8-K to publish the final results.

PROPOSAL ONE — ELECTION OF DIRECTORS

Our board of directors consists of five directors, three of whom are standing for election: Anthony Castagna, Teresa Dial and Mark Sanders. In addition to the directors standing for election, we have two incumbent directors, one with a term expiring in 2011 and one with a term expiring in 2012. Our bylaws provide that the board of directors is divided into three classes. There is no difference in the voting rights of the members of each class of directors. Each class of directors serves a term of three years, with the term of one class expiring at the annual meeting of stockholders in each successive year. There are no family relationships among any directors, nominees for director or executive officers of the Company. The names, ages, positions with the Company and current terms of office of our directors as of April 30, 2010 are as follows:

| | | | | | |

Name | | Age | | Position | | Expiration

of Term |

Anthony Castagna (1)(2)(3) | | 62 | | Director | | 2010 |

Teresa Dial (2)(3) | | 60 | | Director | | 2010 |

Mark Sanders (1)(2)(3) | | 66 | | Lead Independent Director | | 2010 |

Timothy J. Wright (1)(2)(3) | | 45 | | Director | | 2011 |

Jean-Yves Dexmier | | 58 | | Executive Chairman and Chief Executive Officer | | 2012 |

| (1) | Member of audit committee |

| (2) | Member of nominating and governance committee |

| (3) | Member of compensation committee |

Our authorized number of directors is six, unchanged following the resignation last December of one of our board members. The board has left the vacancy as it evaluates whether to conduct a candidate search. Proxies cannot be voted for a greater number of persons than the number of nominees named.

Unless marked otherwise, proxies received will be voted FOR the election of the nominees, Anthony Castagna, Teresa Dial and Mark Sanders. These nominees are presently directors and their term will expire at the annual meeting. The nominees are willing to be elected and to serve for the three-year term. If a nominee is unable or unwilling to serve as a director at the time of the annual meeting, the proxies may be voted either (i) for a substitute nominee who shall be designated by the proxy holders or by the incumbent board of directors to fill the vacancy or (ii) for no one, leaving a vacancy. Alternatively, the size of the board of directors may be reduced

3

accordingly. The board of directors has no reason to believe that the nominees will be unwilling or unable to serve if elected as a director. Anthony Castagna, Teresa Dial and Mark Sanders have been nominated to serve for a three-year term until the annual meeting of stockholders in 2013 or until their successors, if any, are elected or appointed.

The nominating and governance committee seeks to assemble a board that, as a whole, possesses the appropriate balance of professional and industry knowledge, financial expertise and high-level management experience necessary to oversee and direct the Company’s business. To that end, the nominating and governance committee has identified and evaluated nominees in the broader context of the board’s overall composition, with the goal of recruiting members who complement and strengthen the skills of other members and who also exhibit integrity, collegiality, sound business judgment and other qualities that the nominating and governance committee views as critical to effective functioning of the board. The brief biographies below include information, as of the date of this proxy statement, regarding the specific and particular experience, qualifications, attributes or skills of each director or nominee that led the nominating and governance committee to recommend that person as a nominee. However, each of the members of the nominating and governance committee may have a variety of reasons why he or she believes a particular person would be an appropriate nominee for the board, and these views may differ from the views of other members.

Nominees for Election to the Board of Directors

Anthony Castagnahas served as one of our directors since March 1999. Since 1997, Dr. Castagna has served as a non-executive director of Macquarie Technology Ventures Pty Limited, an Australian venture capital fund and wholly owned subsidiary of Macquarie Bank Limited, Australia’s largest investment bank, and as an independent advisor to the Macquarie Technology Investment Banking Division of Macquarie Bank Limited, an investment banking company. He is also a non-executive director of early-stage private technology-based companies in Australia, Asia and the United States. Dr. Castagna served as a non-executive director of BT LookSmart, the joint venture between LookSmart and British Telecommunications, until December 2002. Dr. Castagna holds a Bachelor of Commerce from the University of Newcastle, Australia, and an M.B.A. and Ph.D. in finance from the University of New South Wales, Australia. The nominating and governance committee recommended Dr. Castagna for reelection based upon his extensive experience in technology focused venture capital in Australia, the United States, China, and Europe, and his 25 years of experience negotiating, structuring and developing international arrangements in information services and data analytics, medical devices and biotechnology, education services, application software, contract manufacturing, wireless technologies, online and ecommerce services, and e-discovery. The nominating and governance committee believes that Dr. Castagna’s deep international financial background and eclectic interests and experience provide a valuable multi-disciplinary and multi-cultural perspective.

Teresa Dialhas served as one of our directors since 2003 and was Chair of the board from July 2004 to June 2005. From 2008 to 2009 she was Chief Executive Officer of Consumer Banking, North America, and Global Head of Consumer Strategy for Citigroup, where she is currently serving as a special advisor. From 2005 to 2008 she was Group Executive Director of Lloyds TSB and Chief Executive of Lloyds TSB Retail Bank. Ms. Dial also served as a director for NDC Health Corporation from 2002 to 2005 and as a director for Onyx Software Corporation from 2001 to 2005. From 1973 until her retirement in 2001, Ms. Dial held various management roles at Wells Fargo & Co. including CEO of its subsidiary Wells Fargo Bank. She serves as a director of Citibank N.A., a subsidiary of Citigroup. She serves on the advisory board or the Judge School of Management at Cambridge University and the College of Arts and Science at Northwestern. The nominating and governance committee recommended Mr. Dial for reelection because of her 37 years of financial experience and more than 15 years of internet marketing experience, which enable her to contribute rich financial insight with pertinent market application, to the benefit of the board.

Mark Sanderswas Chair of the board from July 2008 to October 2009. He has served as one of our directors since January 2003 and served as our Lead Director from October 2007 to July 2008 and again starting in April 2010. Mr. Sanders served as Chairman of Pinnacle Systems, a supplier of video creation, storage,

4

distribution and streaming solutions, from July 2002 to March 2004. Mr. Sanders also served as a Director of Pinnacle Systems from January 1990 to March 2004 and as its President and Chief Executive Officer from January 1990 to July 2002. Prior to that time, Mr. Sanders served in a variety of management positions, most recently as Vice President and General Manager of the Recording Systems Division of Ampex, Inc., a manufacturer of video broadcast equipment. Mr. Sanders also serves on the board of directors of Bell Microproducts Inc., a computer storage and semiconductor company. Mr. Sanders holds a B.S. in Electrical Engineering from California Polytechnic University, Pomona and an M.B.A. from Golden Gate University. The nominating and governance committee believes that Mr. Sanders’ extensive experience as a technology executive and demonstrated leadership skills in entrepreneurial environments position him to make effective contributions to the board of directors. Mr. Sanders has more than 30 years of successful senior management experience, most recently as CEO of Pinnacle Systems, and brings extensive boardroom experience, including chairman of several technology organizations, to the board of directors. This experience and his abilities as a consensus-builder are highly valued by the board.

Incumbent Directors Whose Terms Continue After the 2009 Annual Meeting

The following person is an incumbent director whose term expires at the annual meeting of stockholders in 2011:

Timothy J. Wrighthas served as one of our directors since August 2005. Mr. Wright is currently a General Partner at GrandBanks Capital, an early stage venture capital company based in Newton, Massachusetts. Mr. Wright currently represents GrandBanks on the board of Exit41 Inc. where he also serves as Chairman. From November 2007 until May 2010, Mr. Wright represented GrandBanks Capital on the board of directors of xkoto, Inc before its sale to Teradata Corp. Mr. Wright served as Chief Executive of the EMEA and Asia-Pacific operations of Geac Computer Corporation Limited and as its Chief Technology Officer from May 2004 until the company’s sale in March 2006. He also served as Geac’s Senior Vice President, Chief Technology Officer and Chief Information Officer from January 2003 to May 2004. Prior to joining Geac, Mr. Wright served for just over three years as Senior Vice President, Chief Technology Officer and Chief Information Officer at Terra Lycos, a provider of Internet access and content to users worldwide. Prior to working at Terra Lycos, Mr. Wright spent seven years at The Learning Company, a provider of consumer educational and home productivity software, until it was acquired by Mattel, Inc. in 1999. Mr. Wright received a B.S. in Computer Science from City University in London. Mr. Wright’s 25 years of technical experience, including building and running one of the world’s largest collections of web properties for Terra Lycos, enables him to bring deep, relevant technical experience to the board of directors.

The following person is an incumbent director whose term expires at the annual meeting of stockholders in 2012:

Jean-Yves Dexmier has served as our CEO since December 14, 2009, as Executive Chairman since October 28, 2009 and as one of our directors since April 2007. Dr. Dexmier served as Chief Financial Officer for Openwave Systems, Inc. from August 2007 through January 2008. Prior to that, Dr. Dexmier served as Chief Executive and Chair of the Board of Agentis Software from 2001 to 2005. He served as Chief Executive Officer, President and Chief Financial Officer of Informix Software from 1997 to 2000. Dr. Dexmier also served as the Chief Financial Officer of Octel Corporation from 1995 to 1997. From 1994 to 1995 he served as Chief Financial Officer of Air Liquide Americas and from 1991 to 1994 he served as Chief Financial Officer of Thomson Consumer Electronics U.S. Dr. Dexmier received a B.A. in Fundamental Mathematics from Lycee Pasteur, an M.B.A. from Ecole Polytechnique and a Ph.D. in Electronics from Ecole Nationale Superieure de l’Aeronautique et de l’Espace, all located in France. Dr. Dexmier’s prior history as chief executive officer and chief financial officer of several publicly traded technology companies positions him to contribute extensive operational and financial expertise, as well as leadership skills that are important to the board of directors. In particular, his experience guiding Thomson Consumer Electronics, Octel Communications and Informix Software through a successful turn-around is especially valuable in view of the Company’s needs to restore profitability and growth.

5

Board Committees and Meetings

In 2009, the board of directors held ten meetings. Each of the directors attended 80% or more of the aggregate of (i) the total number of meetings of the board of directors and (ii) the total number of meetings held by all committees of the board of directors on which he or she served (during the periods that he or she served). The Company has a policy of encouraging board members’ attendance at annual stockholder meetings. In 2009, five of our directors attended the annual stockholder meeting.

In March 1999, the board of directors established two standing committees: the audit committee and the compensation committee. Prior to that time, the functions of these two standing committees were performed by the board of directors. In June 2002, the board of directors established an additional standing committee: the nominating and governance committee. In October 2007, the board of directors established an additional standing committee: the strategic direction committee, which was disbanded in October 2009.

Audit Committee. The audit committee functions in accordance with section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (“Exchange Act”), by overseeing the accounting and financial reporting processes of the Company, as well as audits of the Company’s financial statements. The audit committee operates under a written charter adopted by the board of directors and has the authority to select, and is directly responsible for the selection of, the Company’s independent registered public accounting firm. The audit committee approves the nature and scope of services to be performed by the independent registered public accounting firm, reviews the range of fees for such services, confers with the independent registered public accounting firm, reviews the results of the annual audit and the Company’s annual and quarterly financial statements, reviews with management and the independent registered public accounting firm the Company’s accounting and financial controls, and reviews policies and practices regarding compliance with laws and the avoidance of conflicts of interest. Currently, the audit committee consists of directors Castagna, Sanders and Wright all of whom are “independent” directors as defined in applicable listing standards of the National Association of Securities Dealers and applicable rules and regulations of the Securities and Exchange Commission. Dr. Castagna was appointed as Chair of the audit committee in October 2009. Dr. Castagna is an “audit committee financial expert” within the meaning of applicable SEC rules. In 2009, the audit committee held seven meetings. The charter of the audit committee is available for viewing and download athttp://www.looksmart.com/corporate-governance.html#/corporate_governance.

Compensation Committee. The compensation committee has the authority to review and approve compensation for the Chief Executive Officer and other key employees, including cash, bonus incentives, executive perquisites, employment contracts, retention bonuses, and all other forms of compensation. The compensation committee is also responsible for administering the Company’s equity incentive plans and has the authority to delegate this responsibility to the Chief Executive Officer. Currently, the compensation committee consists of directors Castagna, Dial, Sanders and Wright, all of whom are “independent” directors as defined in applicable listing standards of the National Association of Securities Dealers and applicable rules and regulations of the Securities and Exchange Commission. Mr. Wright was appointed as Chair of the compensation committee in March 2010. In 2009, the compensation committee held nine meetings. The charter of the compensation committee is available for viewing and download athttp://www.looksmart.com/corporate-governance.html#/corporate_governance.

Compensation Committee Processes and Procedures.Typically, the compensation committee meets at least once a quarter and with greater frequency if necessary. The agenda for each meeting is usually developed by Company personnel (i.e. Chief Executive Officer, General Counsel up until September 2009, Chief Financial Officer after September 2009, and Human Resources Director) with direction from the Chair of the compensation committee prior to the meeting.The compensation committee meets regularly with members of management and outside counsel, as well as in executive session. However, from time to time, outside advisors or consultants may be invited by the compensation committee to make presentations, to provide financial or other background information or advice or to otherwise participate in compensation committee meetings. The Chief Executive

6

Officer may not participate in, or be present during, any deliberations or determinations of the compensation committee regarding his compensation or individual performance objectives. The charter of the compensation committee grants the compensation committee full access to all books, records, facilities and personnel of the Company, as well as authority to obtain, at the expense of the Company, advice and assistance from internal and external legal, accounting or other advisors and consultants and other external resources that the compensation committee considers necessary or appropriate in the performance of its duties. In particular, the compensation committee has the sole authority to retain compensation consultants to assist in its evaluation of executive and director compensation, including the authority to approve the consultant’s reasonable fees and other retention terms.

During the past fiscal year, the compensation committee did not engage compensation consultants. However, based on the Company’s continuing challenge to reach profitability, the compensation committee reviewed a report from publicly available sources and determined that the base pay of executive management should be reduced effective June 1, 2009. This reduction is effective until such time as the Company meets certain profitability targets, which had not been met during the remainder of fiscal 2009.

Nominating and Governance Committee. The nominating and governance committee develops and implements policies and processes regarding corporate governance matters, assesses board membership needs and makes recommendations regarding potential director candidates to the board of directors. Currently, the nominating and governance committee is composed of directors Castagna, Dial, Sanders and Wright, all of whom are “independent” directors as defined in applicable listing standards of the National Association of Securities Dealers and applicable rules and regulations of the Securities and Exchange Commission. Mr. Sanders was appointed Chair of the nominating and governance committee in March 2010. In 2009, the nominating and governance committee held one meeting. The nominating and governance committee will consider nominees recommended by stockholders as described further below in “Nomination of Directors.” The charter of the nominating and governance committee is available for viewing and download athttp://www.looksmart.com/corporate-governance.html#/corporate_governance.

Strategic Direction Committee. The strategic direction committee reviews and advises the Board of Directors regarding the Company’s overall strategy. The strategic direction committee was composed of directors Dexmier and Sanders, both of whom were, during the time period the strategic direction committee existed, “independent” directors as defined in applicable listing standards of the National Association of Securities Dealers and applicable rules and regulations of the Securities and Exchange Commission. Dr. Dexmier was appointed Chair of the strategic direction committee in October 2007. In 2009, the strategic direction committee met thirteen times and was disbanded on October 28, 2009.

Nomination of Directors

The nominating and governance committee has in the past, and may in the future, use third party executive search firms to help identify prospective director nominees. In evaluating the suitability of each candidate, the nominating and governance committee will consider issues of character, judgment, independence, age, expertise, diversity of experience, length of service, other commitments and the like. While there are no specific minimum qualifications for director nominees, the ideal candidate should exhibit (i) independence, (ii) integrity, (iii) qualifications that will increase overall board effectiveness and (iv) meet other requirements as may be required by applicable rules, such as financial literacy or expertise for audit committee members. The nominating and governance committee uses the same process for evaluating all nominees, regardless of the original source of the nomination.

LookSmart stockholders may recommend individuals to the nominating and governance committee for consideration as potential director candidates by submitting their names and appropriate background and biographical information to: LookSmart Nominating and Governance Committee, c/o Chief Financial Officer,

7

55 Second Street, San Francisco, CA 94105. The recommendation must include any relevant information, including the candidate’s name, home and business contact information, detailed biographical data and qualifications, and information regarding any relationships between the candidate and the Company within the last three years. LookSmart stockholders also have the right to nominate director candidates without any action on the part of the nominating and governance committee or the board, by following the advance notice provisions of LookSmart’s bylaws as described below under “Advance Notice Procedures for Stockholder Proposals”. The nominating and governance committee did not receive any director nominations from any stockholders.

Compensation of Directors

Members of the board of directors receive the following compensation: (i) new non-employee directors are granted an option to purchase 17,000 shares of common stock upon joining the board of directors, which option vests monthly over 36 months, (ii) each year, non-employee directors are granted an option to purchase 9,000 shares of common stock, based upon the continued service of the director during the prior year, which vests immediately, (iii) $2,500 per quarter for members of the audit committee if the member attends at least 80% of the regularly scheduled meetings held by the committee during the quarter, (iv) $1,500 per quarter for members of the compensation committee if the member attends at least 80% of the regularly scheduled meetings held by the committee during the quarter, (v) $500 per quarter for members of the nominating and governance committee if the member attends at least 80% of the regularly scheduled meetings held by the committee during the quarter, (vi) $4,000 per quarter for members of the strategic direction committee if the member attends at least 80% of the meetings held by the committee during the quarter, (vii) $7,500 per quarter for members of the board of directors if the member attends at least 80% of the regularly scheduled meetings held by the board of directors during the quarter, (viii) $3,750 per quarter for the Chair of the audit committee, (ix) $2,250 per quarter for the Chair of the compensation committee, (x) $1,250 per quarter for the Chair of the nominating and governance committee, (xi) $7,500 per quarter for the Chair of the board and (xii) where applicable, $3,750 per quarter for the lead independent director. During 2009 directors had the option to elect to take part or all of their cash compensation in the form of fully vested non-qualified stock options. If a director makes such an election, the number of stock options granted will be determined based on the grant date fair value. The options have an exercise price equal to the closing price of LookSmart stock on the date of grant. For all unvested options held by directors, vesting accelerates 100% in the event of involuntary termination of the director’s membership on the board of directors within 12 months after a change of control of the Company. Directors were also given the option to convert any or all of their cash fees into fully vested stock, with the conversion methodology being based on the fair market value of Company stock on the date of grant, plus an additional 15% of that amount as “uplift”. The 15% uplift is provided in consideration of each director’s commitment to hold the stock for at least one year. For any quarter or year in which a director has not served as a board or committee member for the entire period, the compensation described above (except for the initial grant) is prorated for the period of time served.

In January 2009, the compensation committee of our board of directors determined, in light of his role in developing strategic growth initiatives and in addition to any of the above fees which may be applicable, to compensate the Chair of the board’s strategic direction committee at the rate of $45,000 per quarter. In May 2009, our compensation committee determined to increase such compensation to $135,000 per quarter. Also in May 2009, each of our outside board members who receive their board fees in cash determined to accept a 20% reduction in their board fees effective June 1, 2009. Dr. Dexmier was named Executive Chairman on October 28, 2009 at the same time the strategic direction committee was disbanded, and was named CEO on December 14, 2009. The compensation committee determined that the quarterly compensation of $135,000 (less the 20% reduction) would remain unchanged as a result of the last two role changes Directors received no other compensation for their service as directors in 2009, other than reimbursement of reasonable out-of-pocket expenses for attendance at board meetings.

8

2009 DIRECTOR COMPENSATION TABLE

| | | | | | | | | | |

Name | | Fees Earned or

Paid in Cash

($) (1) | | Stock Awards

($) (2) | | Option Awards

($) (3) | | All other

Compensation

($) | | Total

($) |

Anthony Castagna (4) | | 31,886 | | — | | 26,087 | | — | | 57,973 |

Teresa A. Dial (5) | | — | | — | | 53,184 | | — | | 53,184 |

Mark Sanders (6) | | 75,296 | | — | | 14,417 | | — | | 89,713 |

Timothy Wright (7) | | — | | 52,897 | | 14,417 | | — | | 67,314 |

| (1) | In 2009, directors could elect to receive all or part of their cash fees in either fully vested stock options or fully vested stock. Directors who elected to take fully vested stock in lieu of cash were entitled to a 15% increase in the value of the stock received provided that the director agreed to hold the stock for a one year period. This column reflects only the amount a director received in cash. The value of fees taken in stock, or stock options in lieu of cash, are reflected in the Stock Award and Option Award columns, respectively. |

| (2) | The amounts reflect the aggregate grant date fair value of the restricted stock computed in accordance with Statement of Financial Accounting Standards (“FASB”) Accounting Standards Codification (“ASC”) Topic 718, Stock Compensation (formerly, FASB Statement. 123R) (“ASC 718”). |

| (3) | These amounts reflect the aggregate grant date fair value of options computed in accordance with ASC 718. All options granted to directors vest immediately and expire after ten years for grants issued prior to July 1, 2009 and seven years for those issued after June 30, 2009. No estimated forfeiture rate has been applied in valuing the option grants. |

| (4) | Dr. Castagna was entitled to receive $43,636 in fees for his membership on the board, his membership on the audit committee, and membership on and service as chair of the nominating and governance committee. Dr. Castagna elected to receive $31,886 in cash and the remainder in the form of fully-vested non-qualified stock options as follows: On March 31, 2009, Dr. Castagna received 17,029 options, and all such options were outstanding as of December 31, 2009. Dr. Castagna also received 18,000 options during 2009 representing the annual grants for both 2008 and 2009. The aggregate grant date fair value of these options computed in accordance with ASC 718 was $26,087. |

| (5) | Ms. Dial was entitled to receive $38,000 in fees for her membership on the board and her memberships on the compensation committee and nominating and governance committee. Ms. Dial elected to receive all of her director compensation in the form of fully-vested non-qualified stock options as follows: On March 31, 2009, June 20, 2009, September 30, 2009 and December 31, 2009, Ms. Dial received 13,768, 11,446, 15,323 and 17,925 options, respectively, and all such options were outstanding as of December 31, 2009. Ms. Dial also received 18,000 options during 2009 representing annual grants for both 2008 and 2009. The aggregate grant date fair value of these options computed in accordance with ASC 718 was $53,184. |

| (6) | Mr. Sanders was entitled to receive $75,296 in fees for his membership on and service as Chair of the board, his membership on and service as Chair of the compensation committee, and his membership on the strategic direction committee. Mr. Sanders elected to receive all of his director compensation in cash. Mr. Sanders also received 18,000 options during 2009 representing annual grants for both 2008 and 2009. The aggregate grant date fair value of these options computed in accordance with ASC 718 was $14,417. |

| (7) | Mr. Wright was entitled to receive $46,000 in fees for his membership on the board, his membership on the compensation committee, and his membership on the audit committee. Mr. Wright elected to receive all of his director compensation in the form of fully-vested stock as follows: On March 31, 2009, June 30, 2009, September 30, 2009 and December 31, 2009, Mr. Wright received 12,965, 9,943, 11,400 and 12,965 shares, respectively. Mr. Wright also received 18,000 options during 2009 representing annual grants for both 2008 and 2009. The aggregate grant date fair value of these options and stock computed in accordance with ASC 718 was $67,314. |

Communications to the Board

The board of directors provides a process for LookSmart stockholders to send communications to the board of directors. Any stockholder who desires to contact the board of directors may do so by writing to: LookSmart Board of Directors, 55 Second Street, San Francisco, CA 94105. Communications received by mail will be forwarded to the chair of the board who will, in his discretion, forward such communications to other directors, members of LookSmart management or such other persons as he deems appropriate.

9

Code of Ethics

LookSmart has adopted a code of ethics (referred to as the LookSmart Code of Business Conduct and Ethics) applicable to all directors, officers and employees of the Company and has established a hotline available to all employees on a confidential basis. The LookSmart Code of Business Conduct and Ethics is publicly available athttp://www.looksmart.com/corporate-governance.html#/corporate_governance.

Information Regarding the Board of Directors and Corporate Governance

Board Independence

Four of the five members of LookSmart’s board of directors are “independent” (Anthony Castagna, Teresa Dial, Mark Sanders, and Timothy J. Wright), as defined in applicable listing standards of the National Association of Securities Dealers. In making this determination, the Board found that none of these directors or nominees for director had a material or other disqualifying relationship with the Company.

Board Leadership Structure

The Company’s Board of Directors is currently chaired by the Chief Executive Officer of the Company, Dr. Dexmier, and its lead independent director is Mark Sanders.

Dr. Dexmier was appointed Executive Chairman at the end of October 2009 and accepted the temporary role as Chief Executive Officer in mid-December 2009 when the then Chief Executive Officer left the Company. The Company believes that this combined role of Chief Executive Officer and Board Chair helps to ensure that the Board and management act with a common purpose on the Company’s current remediation plan. In the Company’s view, separating the positions of Chief Executive Officer and Board Chair at this time has the potential to give rise to divided leadership, which could interfere with good decision-making or weaken the Company’s ability to develop and implement its strategy. Instead, the Company believes that combining the positions of Chief Executive Officer and Board Chair provides a single, clear chain of command to execute the Company’s strategic initiatives and business plans. In addition, the Company believes that a combined Chief Executive Officer/Board Chair is better positioned to act as a bridge between management and the Board, facilitating the regular flow of information. The Company also believes that it is advantageous to have a Board Chair with day-to-day knowledge of the Company’s operations (as is the case with the Company’s Chief Executive Officer) as compared to an independent Board Chair that lacks this information. In addition, the Board expects to separate the two roles once the remediation plan is complete and a new Chief Executive Officer is hired.

Mr. Sanders was appointed to the board in January 2003 and was the lead independent director from October 2007 to July 2008, and again starting April 2010. The position of lead independent director has been structured to serve as an effective balance to a combined Chief Executive Officer/Board Chair. The lead independent director is empowered to, among other duties and responsibilities, approve agendas and meeting schedules for regular Board meetings, preside over Board meetings in the absence of the Chair, preside over and establish the agendas for meetings of the independent directors, act as liaison between the Chair and the independent directors, approve information sent to the Board, preside over any portions of Board meetings at which the evaluation or compensation of the Chief Executive Officer is presented or discussed and, as appropriate upon request, act as a liaison to stockholders. In addition, it is the responsibility of the lead independent director to coordinate between the Board and management with regard to the determination and implementation of responses to any problematic risk management issues. As a result, the Company believes that the lead independent director can help ensure the effective independent functioning of the Board in its oversight responsibilities. In addition, the Company believes that the lead independent director is better positioned to build a consensus among directors and to serve as a conduit between the other independent directors and the Board Chair, for example, by facilitating the inclusion on meeting agendas of matters of concern to the independent directors. In light of the Chief Executive Officer’s history and knowledge of the Company, and because the Board’s lead independent director is empowered to play a significant role in the Board’s leadership and in reinforcing the independence of the Board, the Company believes that it is currently advantageous for the Company to combine the positions of Chief Executive Officer and Board Chair.

10

Role of the Board in Risk Oversight

One of the board’s key functions is informed oversight of the Company’s risk management process. The Board does not have a standing risk management committee, but rather administers this oversight function directly through the Board as a whole, as well as through various Board standing committees that address risks inherent in their respective areas of oversight. In particular, our Board is responsible for monitoring and assessing strategic risk exposure, including a determination of the nature and level of risk appropriate for the Company. Our audit committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. The audit committee also monitors compliance with legal and regulatory requirements. Our nominating and governance committee monitors the effectiveness of our corporate governance guidelines, including whether they are successful in preventing illegal or improper liability-creating conduct. Our compensation committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking. Both the Board as a whole and the various standing committees receive incidental reports as matters may arise. It is the responsibility of the committee chairs to report findings regarding material risk exposures to the Board as quickly as possible.

The candidates for election as a director at the annual meeting who receive the highest number of affirmative votes present or represented by proxy and entitled to vote at the annual meeting will be elected. Abstentions and broker non-votes will have no effect on determining the number of votes cast nor on whether the director is elected.

The board of directors unanimously recommends that you vote FOR approval of Anthony Castagna, Teresa Dial and Mark Sanders as members of the Company’s board of directors.

PROPOSAL TWO — APPROVAL OF AN AMENDMENT OF

OUR CERTIFICATE OF INCORPORATION TO DECREASE THE NUMBER OF AUTHORIZED SHARES OF OUR COMMON STOCK

Our board of directors has adopted, subject to stockholder approval, an amendment of our Certificate of Incorporation to decrease the number of authorized shares of our common stock, $0.0001 par value per share, from 200,000,000 shares to 80,000,000 shares. As of May 31, 2010, 17,157,442 shares of our common stock were issued and outstanding.

As a Delaware corporation, we are required to pay Delaware franchise tax. Delaware franchise tax is calculated based upon several variables, including a company’s number of total outstanding shares as compared to the company’s number of authorized shares of capital stock. The greater the difference between the number of shares outstanding and the number of shares authorized, the greater the tax liability. Our Certificate of Incorporation currently authorizes the issuance of up to 200,000,000 shares of our common stock. The currently authorized 200,000,000 shares of our common stock greatly exceeds the 17,157,442 shares outstanding as of May 31, 2010. In order to reduce our Delaware franchise tax liability, our board of directors has determined that it is in our best interest and that of our stockholders to amend our Certificate of Incorporation to decrease the number of authorized shares of our common stock from 200,000,000 shares to 80,000,000 shares. If our authorized shares were set at 80,000,000 shares in 2009, we would have lowered our Delaware franchise tax liability in 2009 by approximately $90,000. Subject to changes in the franchise tax rates by Delaware, we believe this proposed amendment of our Certificate of Incorporation will result in similar annual Delaware franchise tax savings in the future.

If our stockholders approve this proposal, our board of directors currently intends to file an amendment of our Certificate of Incorporation with the Secretary of State of the State of Delaware to decrease the number of authorized shares of our common stock immediately following stockholder approval. If this proposal is not approved by our stockholders, our Certificate of Incorporation will continue as currently in effect.

11

Our board of directors believes that it is prudent to decrease the authorized number of shares of our common stock from 200,000,000 shares to 80,000,000 shares in order to reduce our Delaware tax liability while maintaining an adequate reserve of authorized but unissued shares to save time and money in responding to future events requiring the issuance of additional shares of our common stock, such as acquisitions or equity offerings. All authorized but unissued shares of our common stock will be available for issuance from time to time for any proper purpose approved by our board of directors (including issuance in connection with stock-based employee benefit plans, future stock splits by means of a dividend and issuances to raise capital or effect acquisitions). Other than issuing sufficient shares to cover future equity grants under our 2007 Equity Incentive Plan and 2009 Employee Stock Purchase Plan, there are currently no arrangements, agreements or understandings for the issuance of the additional shares of authorized common stock.

The affirmative vote of the holders of a majority of the outstanding shares of our common stock entitled to vote on this matter at the annual meeting is required to approve the amendment of our Certificate of Incorporation to decrease the number of authorized shares of our common stock. Broker non-votes and abstentions will have the same effect as a vote against Proposal Two.

The board of directors unanimously recommends that you vote FOR the amendment of the Company’s Certificate of Incorporation to reduce the authorized shares of our common stock.

PROPOSAL THREE — RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The audit committee of our board of directors has re-appointed Moss Adams LLP as the independent registered public accounting firm of LookSmart for fiscal year 2010. Stockholder ratification of the selection of Moss Adams LLP as LookSmart’s independent registered public accounting firm is not required by LookSmart’s bylaws, Delaware corporate law or otherwise. The board of directors has elected to seek such ratification as a matter of good corporate practice. Should the stockholders fail to ratify the selection of Moss Adams LLP as LookSmart’s independent registered public accounting firm, the audit committee of the board of directors will consider whether to retain that firm for the year ending December 31, 2010 and will consider the appointment of other independent registered public accounting firms. Moss Adams LLP audited the financial statements of LookSmart and its subsidiaries for the fiscal year ended December 31, 2009. Representatives of Moss Adams LLP are expected to be present at the annual meeting, will have an opportunity to make a statement if they desire to do so and are expected to be available to respond to appropriate questions from stockholders.

Fees Incurred by LookSmart for Independent Registered Accounting Firm

The following table presents fees and expenses rendered by our principal accountants, Moss Adams LLP (“Moss Adams”) for fiscal years 2008 and 2009.

| | | | | | |

Fee Category | | 2009 | | 2008 |

Audit Fees | | | 487,179 | | $ | 552,000 |

Audit-Related Fees | | | — | | | — |

Tax Fees | | | — | | | — |

All Other Fees | | | 14,750 | | | — |

Total All Fees | | $ | 501,929 | | $ | 552,000 |

Audit Fees represent fees for professional services provided in connection with the audit of our financial statements and the review of our quarterly financial statements. All Other Fees consist of fees for consents related to registration statements on Form S-8 and financial due diligence services related to a potential strategic transaction. Our audit committee considered whether the provision of non-audit services was compatible with maintaining the independence of external public accounting firm and has concluded that it was.

12

Policy on Pre-Approval by Audit Committee of Services Performed by Independent Registered Public Accounting Firms

The policy of the audit committee is to pre-approve all audit and permissible non-audit services to be performed by the independent auditors during the fiscal year. The audit committee pre-approves services by authorizing specific projects within the categories outlined above. The audit committee’s charter delegates to its Chair the authority to address any requests for pre-approval of services between audit committee meetings, and the Chair must report any pre-approval decisions to the audit committee at its next scheduled meeting. All of the services related to the fees described above were approved by the audit committee pursuant to the pre-approval provisions set forth in the applicable SEC rules and the audit committee’s charter.

The ratification of the independent registered public accounting firm for the Company for the current year requires the affirmative vote of a majority of the shares of the Company’s common stock present or represented by proxy and entitled to vote at the annual meeting. Broker non-votes will have no effect on the number of votes cast nor on whether the appointment is ratified, but abstentions will have the same effect as a vote against Proposal Three because they will be counted as a vote cast with respect to the proposal but not counted as a vote for ratification.

The board of directors unanimously recommends that you vote FOR ratification of the appointment of Moss Adams LLP as the independent registered public accounting firm of LookSmart.

13

STOCK OWNERSHIP OF PRINCIPAL STOCKHOLDERS AND MANAGEMENT

To the Company’s knowledge, the following table sets forth the number of shares of LookSmart common stock beneficially owned as of May 17, 2010, by

| | • | | each beneficial owner of 5% or more of the Company’s outstanding common stock, |

| | • | | each of LookSmart’s directors and nominees for director, |

| | • | | each of the named executive officers, and |

| | • | | all of LookSmart’s directors and executive officers as a group. |

Except as otherwise indicated below and subject to applicable community property laws, each owner has sole voting and sole investment powers with respect to the stock issued. Shares beneficially owned include securities issuable upon exercise of warrants or stock options exercisable within 60 days of May 17, 2010. Percentage ownership is based on 17,157,442 shares of common stock outstanding as of May 17, 2010 and is computed in accordance with SEC requirements. Unless otherwise indicated below, the address of the persons listed is c/o LookSmart, Ltd., 55 Second Street, San Francisco, CA 94105.

| | | | | |

Name and Address of Beneficial Owner | | Shares

Beneficially

Owned (1) | | Percent

Beneficially

Owned | |

Five Percent Stockholders | | | | | |

Mercury Fund VII, Ltd., Mercury Fund VIII, Ltd., Mercury Ventures II, Ltd., Mercury Management, L.L.C., and Kevin C. Howe (2) 501 Park Lake Drive McKinney, TX 75070 | | 1,693,119 | | 9.87 | % |

| | |

Kennedy Capital Management, Inc. (3) 10829 Olive Blvd. St. Louis. MO 63141 | | 1,302,569 | | 7.59 | % |

| | |

Great Oaks Capital Management, LLC Andrew K. Boszhardt, Jr., Zoltan H. Zsitvay, GOCP, LLC, and Great Oaks Strategic Investment Partners, LP (4) 660 Madison Avenue, 14th Floor New York, NY 10065 | | 1,227,700 | | 7.16 | % |

| | |

Dimensional Fund Advisors LP (5) Palisades West, Building One 6300 Bee Cave Road Austin, TX 78746 | | 1,088,444 | | 6.34 | % |

| | |

Renaissance Technologies LLC and James H. Simons (6) 800 Third Avenue New York, NY 10022 | | 1,065,800 | | 6.21 | % |

| | |

S Squared Technology, LLC, S Squared Technology Partners, L.P., Seymour L. Goldblatt and Kenneth A. Goldblatt (7) 515 Madison Avenue New York, NY 10022 | | 872,240 | | 5.08 | % |

| | |

Named Executive Officers and Directors | | | | | |

Eltinge Brown | | 10,666 | | * | |

Anthony Castagna | | 252,785 | | 1.45 | % |

Jean-Yves Dexmier | | 41,750 | | * | |

Teresa Dial | | 358,560 | | 2.06 | % |

Jonathan Ewert | | 102 | | * | |

Stacey Giamalis | | 3,732 | | * | |

Stephen Markowski | | 78,638 | | * | |

Mark Sanders | | 150,013 | | * | |

Edward F. West | | 13,159 | | * | |

Timothy J. Wright (8) | | 213,478 | | 1.23 | % |

All directors and executive officers as a group (12 persons) (9) | | 1,277,876 | | 7.36 | % |

14

| (1) | Includes shares that may be acquired by the exercise of stock options granted under the Company’s stock option plans within 60 days after May 17, 2010. The number of shares subject to stock options exercisable within 60 days after May 17, 2010, for each of the named executive officers and directors is shown below: |

| | |

Eltinge Brown | | 10,666 |

Anthony Castagna | | 252,785 |

Jean-Yves Dexmier | | 41,750 |

Teresa Dial | | 289,560 |

Jonathan Ewert | | — |

Stacey Giamalis | | — |

Stephen Markowski | | 77,500 |

Mark Sanders | | 133,863 |

Edward F. West | | — |

Timothy J. Wright | | 140,202 |

| (2) | This information is based solely on information as of December 31, 2009, as set forth in Schedule 13G/A, filed on February 9, 2010 by the following parties. Mercury Fund VII, Ltd. has sole voting and dispositive power with respect to 395,119 shares, Mercury Fund VIII, Ltd. has sole voting and dispositive power with respect to 1,298,000 shares, Mercury Ventures II, Ltd. has sole voting and dispositive power with respect to 1,693,119 shares, Mercury Management, L.L.C. has sole voting and dispositive power with respect to 1,693,119 shares and Kevin C. Howe has sole voting and dispositive power with respect to 1,693,119 shares. Mr. Howe exercises voting and disposition power over such shares on behalf of Mercury Management, the General Partner of Mercury Ventures II. Mercury Ventures II is the General Partner of Mercury VII and Mercury VIII. |

| (3) | This information is based solely on information as of December 31, 2009, as set forth in Schedule 13G/A, filed on February 12, 2010 by Kennedy Capital Management, Inc. The reporting person has sole voting power with respect to 1,137,583 shares and sole dispositive power with respect to all the shares. |

| (4) | This information is based solely on information as of May 17, 2010, as set forth in Schedule 13G, filed on May 26, 2010 by the following parties. Andrew K. Boszhardt, Jr. has sole voting and dispositive power with respect to 413,950 shares, shared voting and dispositive power with respect to 813,750 shares and aggregate beneficial ownership with respect to 1,227,700 shares; Zoltan H. Zsitvay has sole voting and dispositive power with respect to 67,000 shares, shared voting and dispositive power with respect to 758,750 shares and aggregate beneficial ownership with respect to 825,750 shares; Great Oaks Capital Management, LLC has shared voting and dispositive power with respect to 813,750 shares; GOCP, LLC has shared voting and dispositive power with respect to 758,750 shares and Great Oaks Strategic Investment Partners, LP has shared voting and dispositive power with respect to 758,750 shares. Each filer disclaims beneficial ownership with respect to any shares other than the shares owned directly by such filer. |

| (5) | This information is based solely on information as of December 31, 2009, as set forth in Schedule 13G, filed on February 8, 2010 by Dimensional Fund Advisors LP. The reporting person has sole voting power with respect to 1,066,234 shares and sole dispositive power with respect to all the shares. |

| (6) | This information is based solely on information as of December 31, 2009, as set forth in Schedule 13G/A, filed on February 12, 2010 by Renaissance Technologies LLC and James H. Simons with the Securities and Exchange Commission. Each reporting person has sole voting power and sole dispositive power with respect to all the shares. |

| (7) | This information is based solely on information as of December 31, 2009, as set forth in a Schedule 13G/A dated February 10, 2010, filed with the Securities and Exchange Commission. S Squared Technology, LLC has sole voting and dispositive power with respect to 713,140 shares and S Squared Technology Partners, L.P. has sole voting and dispositive power with respect to 159,100 shares. Each of Seymour L. Goldblatt and Kenneth A. Goldblatt has sole voting and dispositive power with respect to 872,240 shares and disclaim any beneficial ownership interest of any of these shares held by any funds for which S Squared Technology, LLC or S Squared Technology Partners, L.P. acts as an investment adviser, except for that portion of such shares that relates to his economic interest in such shares, if any. |

| (8) | Of the total shares beneficially owned by Mr. Wright, 4,000 shares are held indirectly by his trust. |

| (9) | Please see footnote (1). Also includes a total of 179,769 shares issuable upon the exercise of options exercisable within 60 days of May 17, 2010 for Bert Knorr. Also includes 1,111 shares owned by Mr. Knorr. |

15

EXECUTIVE COMPENSATION

Executive Officers

Our executive officers, and their respective ages as of May 15, 2010, are as follows. Each executive officer is appointed by the board of directors until his or her successor is duly appointed or until his or her resignation or removal.

| | | | |

Name | | Age | | Position |

Jean-Yves Dexmier | | 58 | | Executive Chairman and CEO |

Stephen Markowski | | 50 | | Chief Financial Officer |

Bert Knorr | | 61 | | Vice President, Technology |

Eltinge Brown | | 43 | | Vice President, Advertiser Network Sales |

Scott Hauswirth | | 40 | | Vice President, Distribution Network |

Jean-Yves Dexmier Biographical information with regard to Dr. Dexmier is provided in Proposal One above.

Stephen Markowski has served as our Chief Financial Officer since August of 2008 and is responsible for leading the company’s finance, accounting and administrative activities. Prior to joining LookSmart, he spent seventeen years with Symantec Corporation, a global security and availability software and services provider, most recently as Vice President of Finance and Chief Accounting Officer. Prior to that, he served in a variety of positions with Symantec, including Vice President of Accounting, Tax & Treasury from October 2001 to July 2005 and as Tax Director from August 1990 to June 1998. Prior to joining Symantec, Mr. Markowski spent nine years with KPMG LLP, a public accounting firm, as a senior manager. He holds a Bachelor of Science degree in Commerce, Accounting from Santa Clara University.

Bert Knorr has served as our Vice President, Technology since September 2007. Mr. Knorr is responsible for Engineering, Operations, and Information Technology. Mr. Knorr joined LookSmart as VP, Engineering for Ad Products in June 2005. From December 2004 to June 2005, Mr. Knorr worked as a consultant. From the fall of 2003 to December 2004, Mr. Knorr was Vice President of Operations for Lycos.

Eltinge G. Brown has served as our Vice President, Advertiser Network Sales since April 2009. He joined the Company in February 2009 as Vice President, Sales. He brings over 15 years of radio, print and online advertising sales and sales management experience to LookSmart. Mr. Brown currently leads LookSmart’s Sales and Managed Services groups, directly responsible for LookSmart’s revenue development and customer service. Prior to joining LookSmart, Mr. Brown most recently served as the Vice President of Sales, West for Tribal Fusion. From 2000 to 2007, Mr. Brown was a Director of Sales at GoTo.com, Overture Services, and Yahoo! Search Marketing. Before joining Goto.com, Mr. Brown held senior sales, and sales leadership positions with Deja.com, CMP Media, and three Northern California Radio Stations. Mr. Brown holds a B.A. in Broadcast Communication from San Francisco State University.

Scott Hauswirth has served as Vice President, Distribution Network since March 2010. He oversees traffic acquisition, traffic quality, and partner management. Mr. Hauswirth brings over ten years of online business development experience to LookSmart, most recently serving as Vice President, Business Development for travel start-up Zonder. Previously, he was Senior Director, Business Development at Yahoo!. Prior to Yahoo!, Mr. Hauswirth worked for the Australian company SEEK, where he initially ran the New Zealand operations, and then headed their online distribution and marketing for the New Zealand and Australian markets. He earned his J.D. from University of California, Hastings College of the Law, and his B.A. in Political Economy from University of California, Berkeley.

16

Summary Compensation Table

The following table provides certain summary information concerning the compensation earned for all services rendered in all capacities to the Company and its subsidiaries for the 2009 fiscal year, by the Company’s Chief Executive Officer, and two other most highly compensated executive officers of the Company in fiscal year 2009 whose salary and bonus for the 2009 fiscal year exceeded $100,000. In addition, Mr. Ewert and Ms. Giamalis are included in the table because they would have been among the two most highly compensated executive officers of the Company, but for the fact that they were not serving as an executive officer on the last day of the 2009 fiscal year. The persons listed in the table below are referred to throughout this proxy statement as the “named executive officers.”

2009 SUMMARY COMPENSATION TABLE

| | | | | | | | | | | | | | | | |

Name and Principal Position | | Year | | Salary

($) (1) | | Bonus

($) (2) | | Stock

Awards

($) (3) | | Option

Awards

($) (4) | | Non-Equity

Incentive Plan

Compensation

($) (5) | | All Other

Compensation

($) (6) | | Total

($) |

Jean-Yves Dexmier (7) | | 2009 | | — | | — | | — | | 17,501 | | — | | 445,662 | | 463,163 |

Executive Chairman & CEO | | | | | | | | | | | | | | | | |

| | | | | | | | |

Edward F. West (8) | | 2009 | | 271,266 | | — | | — | | 34,365 | | — | | 232,123 | | 537,754 |

Chief Executive Officer and President | | 2008 | | 302,308 | | — | | 22,481 | | 1,404,045 | | 48,360 | | 487 | | 1,777,681 |

| | | | | | | | |

Stephen Markowski (9) | | 2009 | | 258,958 | | — | | — | | 20,619 | | — | | 33,439 | | 313,016 |

Chief Financial Officer | | 2008 | | 101,538 | | — | | 1,149 | | 270,030 | | 8,435 | | 10,144 | | 391,296 |

| | | | | | | | |

Stacey Giamalis (10) | | 2009 | | 152,568 | | — | | — | | — | | — | | 256,803 | | 409,371 |

SVP, General Counsel & Secretary | | 2008 | | 225,271 | | — | | 1,563 | | — | | 46,809 | | 3,374 | | 277,017 |

| | | | | | | | |

Jonathan Ewert (11) | | 2009 | | 93,250 | | — | | — | | — | | 16,008 | | 171,638 | | 280,896 |

SVP, Corporate Development | | 2008 | | 202,265 | | — | | 454 | | — | | 109,616 | | 3,337 | | 315,672 |

| | | | | | | | |

Eltinge Brown (12) | | 2009 | | 126,250 | | — | | 16,934 | | — | | 85,039 | | 197 | | 228,420 |

VP, Advertiser Network Sales | | | | | | | | | | | | | | | | |

| (1) | Includes amounts earned but deferred at the election of the executive officer under the Company’s 401(k) Plan established under Section 401(k) of the Internal Revenue Code. |

| (2) | Includes non-equity guaranteed or discretionary bonuses, hiring bonuses and relocation bonuses. Annual cash incentive payments are reported under “Non-Equity Incentive Plan Compensation.” |

| (3) | Executive officers could elect to receive part of their non-equity incentive payments in the form of fully vested restricted stock. The Plan provides that if an executive elects to take part of their incentive payment in stock, they will receive additional restricted stock valued at 15% of the election amount. These amounts reflect the dollar value of the fully vested stock in accordance with ASC 718. |

| (4) | Reference is made to Note 13 “Stockholders Equity” to the financial statements in our Annual Report on Form 10-K (as amended by our Form 10-K/A) for the year ended December 31, 2009, which identifies assumptions made in the valuation of option awards in accordance with ASC 718. |

| (5) | Consists of bonuses or commissions earned in 2008 and 2009. |

| (6) | Amounts include employer contributions credited under the Company’s 401(k) Plan which is open to all Company employees. Under the 401(k) Plan, the Company makes matching contributions based on each participant’s voluntary salary deferrals, subject to plan and Internal Revenue Code limits. The maximum employer matching contribution in any given year is $3,000. Under the 401(k) Plan, matching contributions are 50% vested after the first year of employment and 100% vested after the second year of employment. Amounts also include the value of life insurance premiums paid by the Company on behalf of the employee, the value of any tax reimbursement, and any post termination payments such as severance payments. |

| (7) | In January 2009, the compensation committee of our board of directors determined, in light of Dr. Dexmier’s role in developing strategic growth initiatives to compensate the Chair of the board’s strategic direction committee at the rate of $45,000 per quarter. In May 2009, our compensation committee determined to increase such compensation to $135,000 per quarter. This cash compensation, along with the regular board and committee fees, was reduced by 20% effective June 1, 2009. Dr. Dexmier was named Executive Chairman on October 28, 2009 at the same time the strategic direction committee was disbanded, and was named CEO on December 14, 2009. The compensation committee determined that the quarterly compensation of $135,000 (less the 20% reduction) would remain unchanged as a result of these last two |

17

| | role changes. Dr. Dexmier was entitled to receive $445,663 in fees for his membership on and service as Chair of the board, his membership on and service as Chair of the audit committee, and his membership on and service as Chair of the strategic direction committee and other services as outlined above. Dr. Dexmier elected to receive all of his compensation in cash. Dr. Dexmier did not receive any stock options in 2008. In 2009 he received 18,000 options representing the annual grants for both 2008 and 2009, as well as 4,500 options for his role as Chair of the strategic direction committee. The aggregate grant date fair value of the 2009 options computed in accordance with ASC 718 was $17,501. |

| (8) | $225,000 of severance was accrued in conjunction with Mr. West’s departure on December 14, 2009 and is reflected in “All Other Compensation”. Mr. West was entitled to a cash incentive payment of $81,600 pursuant to the Company’s 2008 Executive Team Incentive Plan (ETIP). Mr. West elected to receive $48,360 of his incentive payment in cash and $33,240 in 11,159 shares of fully vested restricted stock valued at $22,481. Mr. West was entitled to receive 450,000 options upon becoming interim Chief Executive Officer and President in August 2007. The options were granted on February 4, 2008. He was also granted 150,000 options on March 7, 2008. The aggregate grant date fair value of the 2008 and 2009 options computed in accordance with ASC 718 was $1,404,045 and $34,365, respectively. All of Mr. West’s options expired unexercised in March 2010. |

| (9) | Mr. Markowski was entitled to receive a cash incentive payment of $9,435 pursuant to the Company’s 2008 ETIP. He elected to receive $1,000 of his incentive payment in 1,138 shares of restricted stock valued at $1,149. He also received 150,000 options upon becoming Chief Financial Officer which were granted on September 4, 2008. He was also granted 30,000 options on May 22, 2009. The aggregate grant date fair value of the 2008 and 2009 options computed in accordance with ASC 718 was $270,030 and $20,619, respectively. Upon joining the Company Mr. Markowski received a $2,500 per month housing allowance for six months which is reflected in the column entitled “All Other Compensation.” The housing allowance was extended through January 31, 2010. |

| (10) | Ms. Giamalis was paid $235,872 of severance in conjunction with her departure from the Company on September 15, 2009 and is reflected in “All Other Compensation”. Ms. Giamalis was entitled to receive a cash incentive payment in the amount of $48,509 pursuant to the 2008 ETIP. She elected to receive $1,700 of her incentive in 1,231 shares of fully vested restricted stock valued at $1,563. |