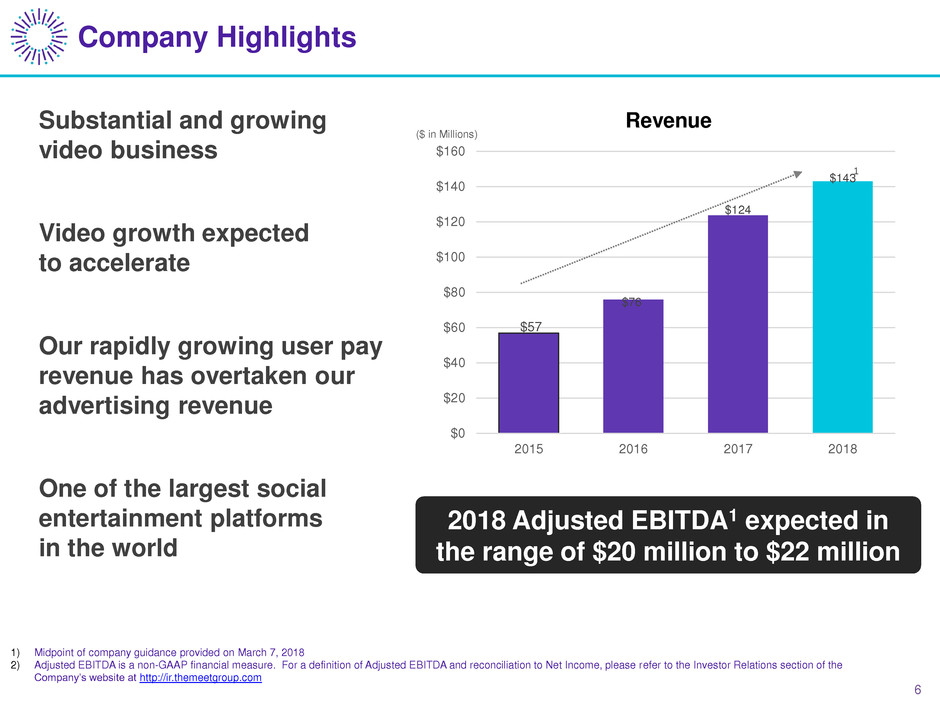

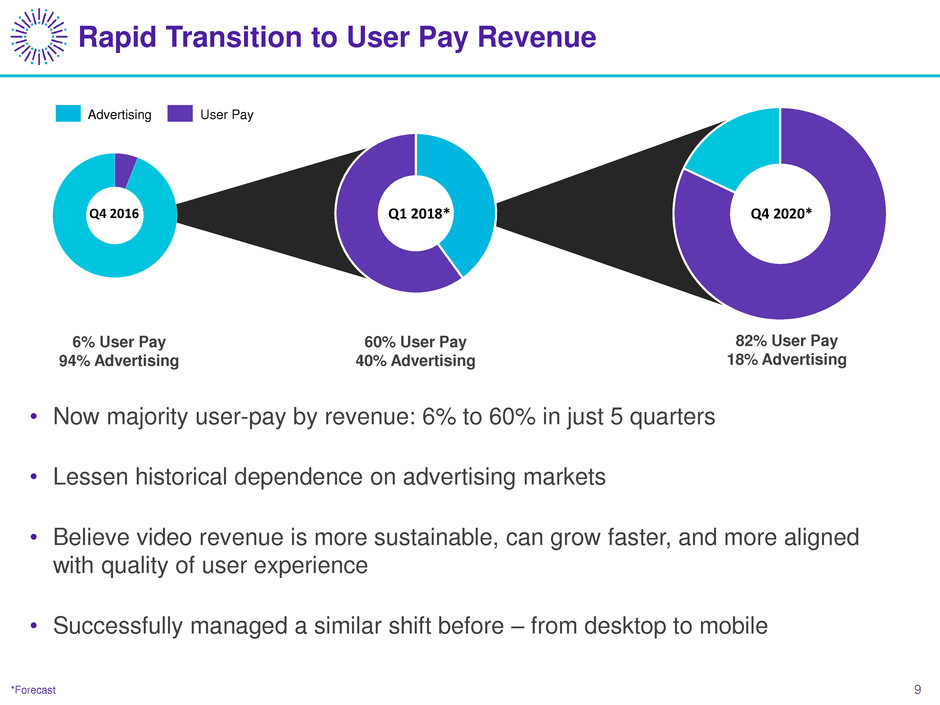

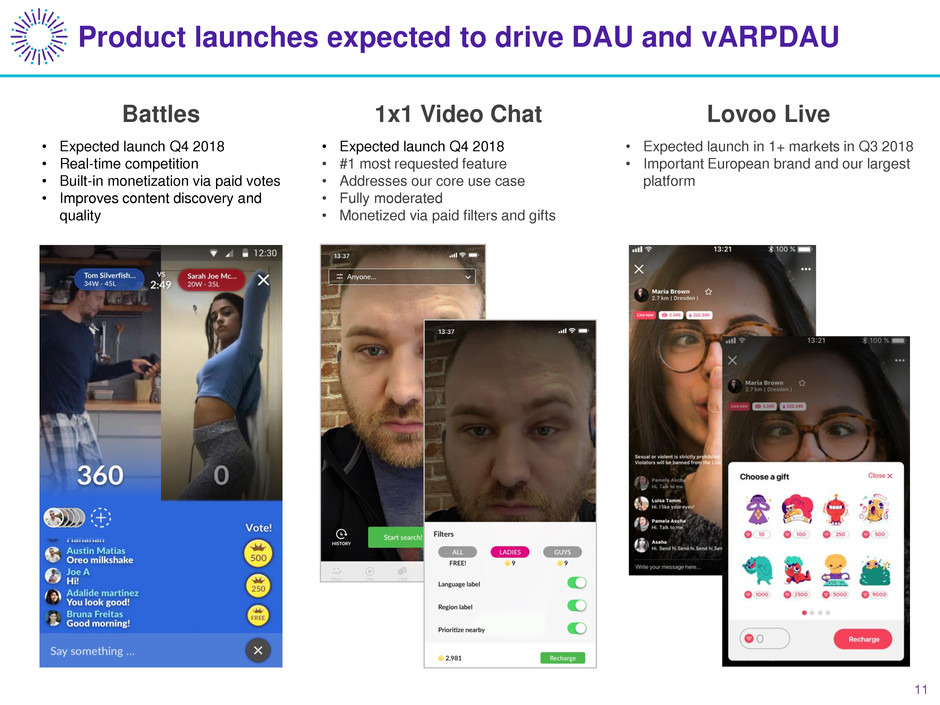

Cautionary Note Regarding Forward Looking Statements Certain statements in this presentation are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding whether video growth will accelerate as expected; whether user pay revenue will continue to grow and advertising revenue will continue to decrease as expected; whether we will meet our 2018 Adjusted EBITDA expectations; whether and when we will meet our video revenue projections based on our assumptions of continued vDAU and vARPDAU growth; whether and when we will launch Tagged Live with gifting and monetization and rewards; whether and when we will launch Lovoo Live with gifting; whether and when we will launch 1x1 live video chat; and whether and when we will launch Battles. The words “believe,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “could,” “target,” “potential,” “is likely,” “expect” and similar expressions, as they relate to us, are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. Important factors that could cause actual results to differ from those in the forward-looking statements include the risk that our applications will not function easily or otherwise as anticipated, the risk that we will not launch additional features and upgrades as anticipated, the risk that unanticipated events affect the functionality of our applications with popular mobile operating systems, any changes in such operating systems that degrade our mobile applications’ functionality and other unexpected issues which could adversely affect usage on mobile devices. Further information on our risk factors is contained in our filings with the Securities and Exchange Commission (the “SEC”), including the Form 10-K for the year ended December 31, 2016 filed with the SEC on March 9, 2017 and our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2017, June 30, 2017 and September 30, 2017 filed with the SEC on May 10, 2017, August 4, 2017 and November 9, 2017. Any forward-looking statement made by us herein speaks only as of the date on which it is made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law. Regulation G – Non-GAAP Measures The Company defines mobile traffic and engagement metrics (including MAU, DAU, vDAU, vARPDAU chats per day, and new users per day) to include mobile app traffic for all properties and mobile web traffic for MeetMe and Skout. The Company uses Adjusted EBITDA, which is not calculated and presented in accordance with U.S. generally accepted accounting principles (“GAAP”), in evaluating its financial and operational decision making and as a means to evaluate period-to period comparison. The Company uses this non-GAAP financial measure for financial and operational decision-making and as a means to evaluate period-to-period comparisons. The Company presents this non-GAAP financial measure because it believes it to be an important supplemental measure of performance that is commonly used by securities analysts, investors and other interested parties in the evaluation of companies in our industry. The Company defines Adjusted EBITDA as earnings (or loss) from operations before interest expense, benefit or provision for income taxes, depreciation and amortization, stock-based compensation, warrant obligations, non-recurring acquisition, restructuring or other expenses, gain or loss on cumulative foreign currency translation adjustment, gain on sale of asset, bad debt expense outside the normal range, and goodwill and long-lived asset impairment charges. The Company excludes stock-based compensation because it is non-cash in nature. Non-GAAP financial measures should not be considered as an alternative to net income, operating income, cash flow from operating activities, as a measure of liquidity or any other financial measure. They may not be indicative of the historical operating results of the Company nor is it intended to be predictive of potential future results. Investors should not consider non-GAAP financial measures in isolation or as a substitute for performance measures calculated in accordance with GAAP. This presentation shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or other jurisdiction. © 2018 The Meet Group, Inc. All trademarks and service marks are the property of their respective owners.