Exhibit 99.1

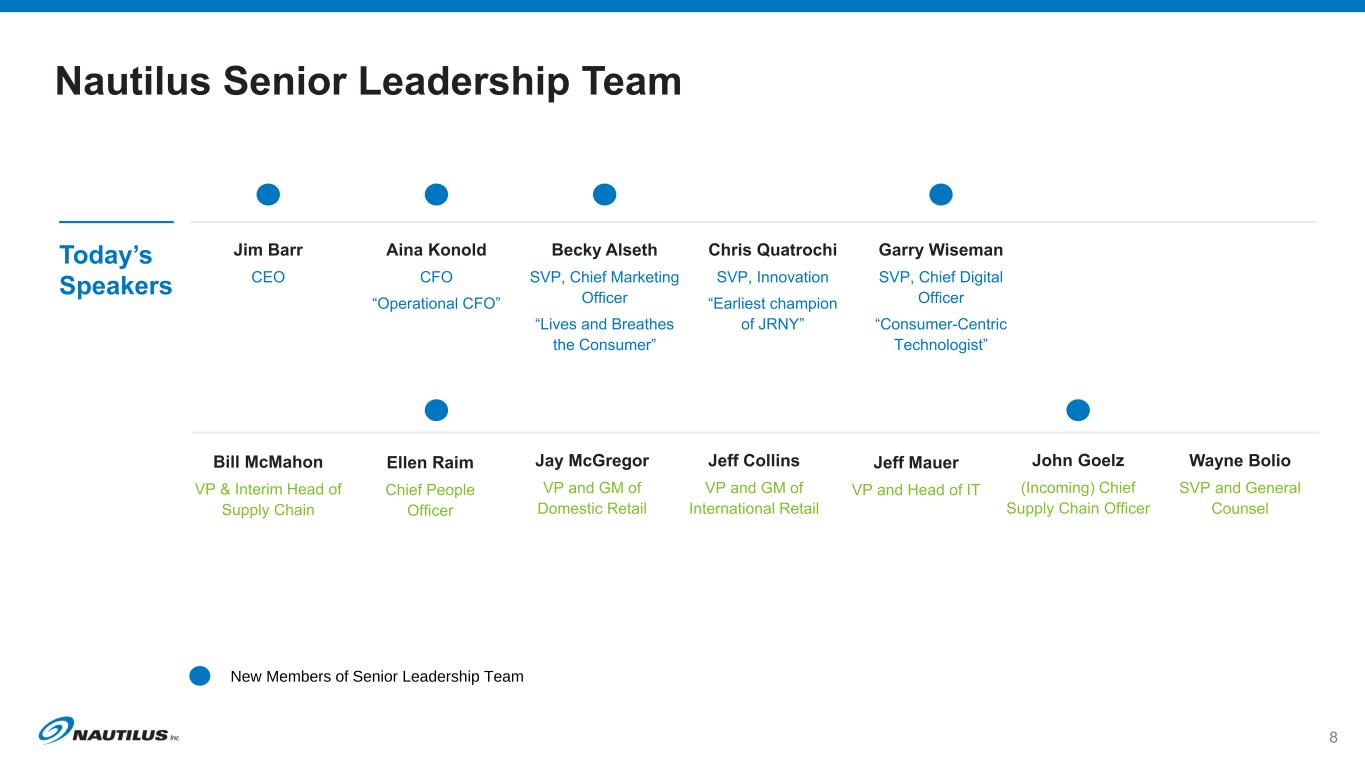

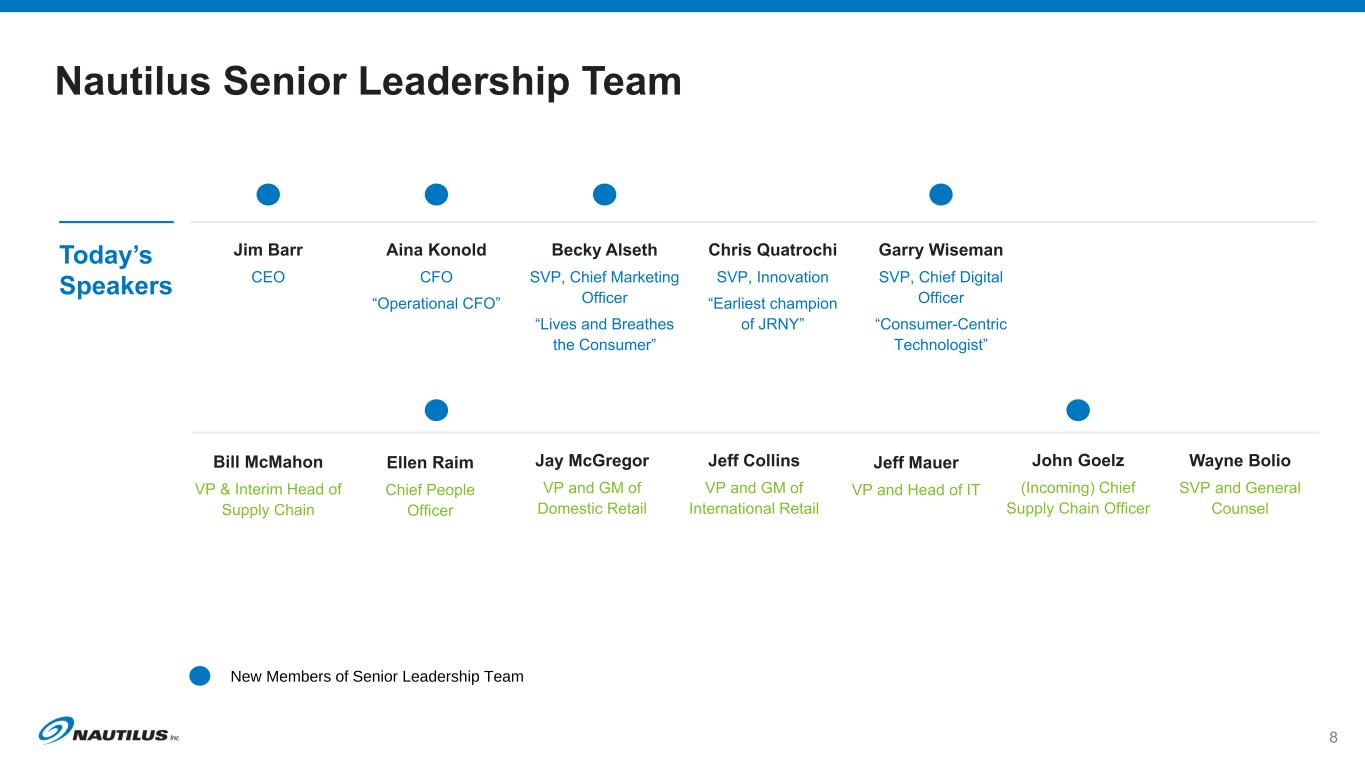

New Members of Senior Leadership Team

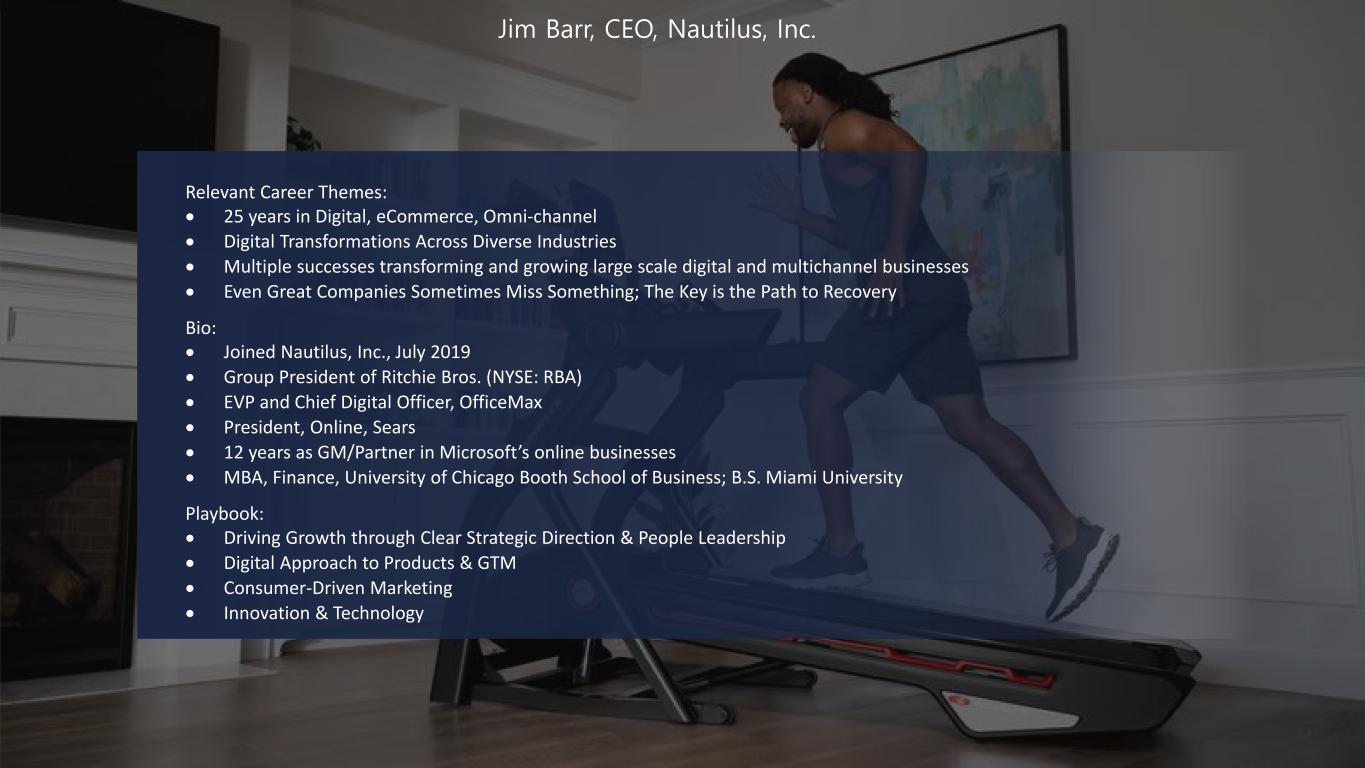

Relevant Career Themes: • 25 years in Digital, eCommerce, Omni-channel • Digital Transformations Across Diverse Industries • Multiple successes transforming and growing large scale digital and multichannel businesses • Even Great Companies Sometimes Miss Something; The Key is the Path to Recovery Bio: • Joined Nautilus, Inc., July 2019 • Group President of Ritchie Bros. (NYSE: RBA) • EVP and Chief Digital Officer, OfficeMax • President, Online, Sears • 12 years as GM/Partner in Microsoft’s online businesses • MBA, Finance, University of Chicago Booth School of Business; B.S. Miami University Playbook: • Driving Growth through Clear Strategic Direction & People Leadership • Digital Approach to Products & GTM • Consumer-Driven Marketing • Innovation & Technology Jim Barr, CEO, Nautilus, Inc.

Brand Product Portfolio Market Presence Know-how People Strategic Partners Consumers’ pursuit of a healthy life through enhanced personalized, in-home experience Consumer

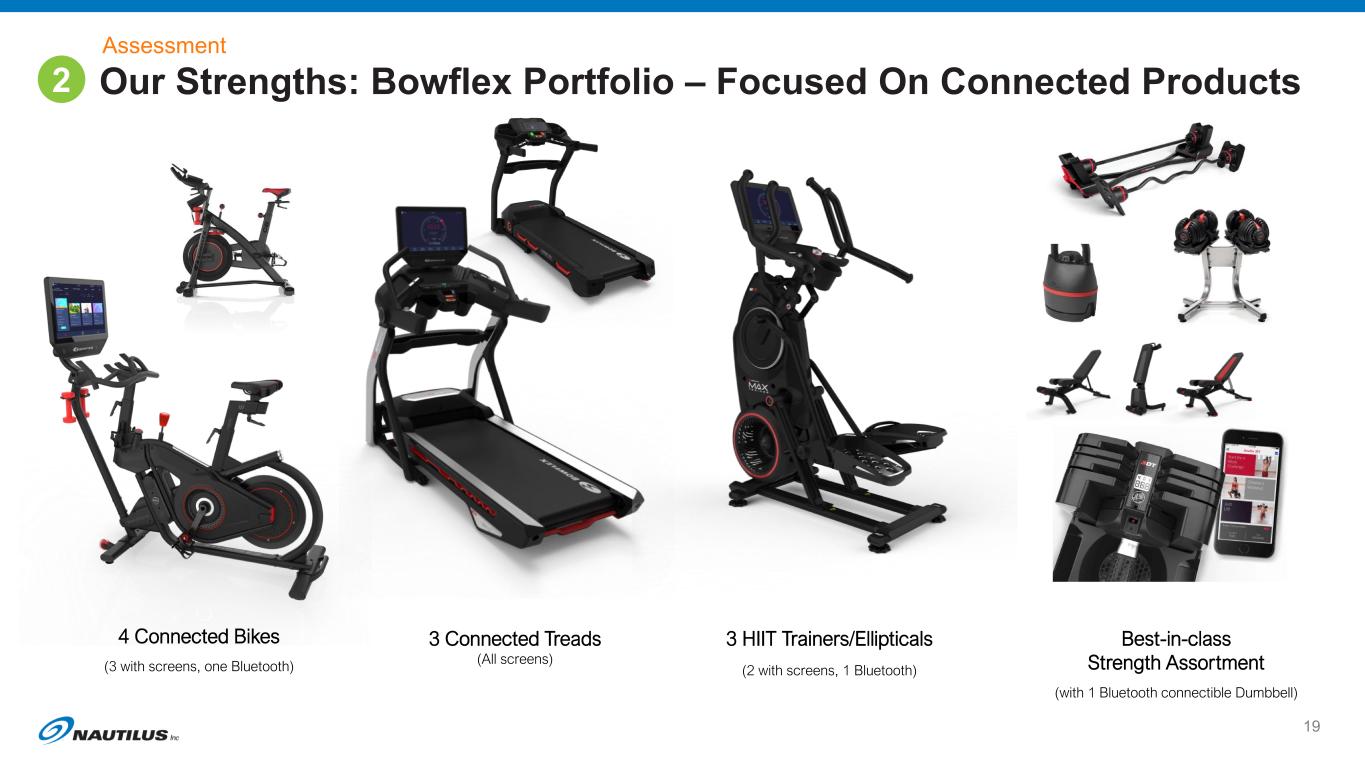

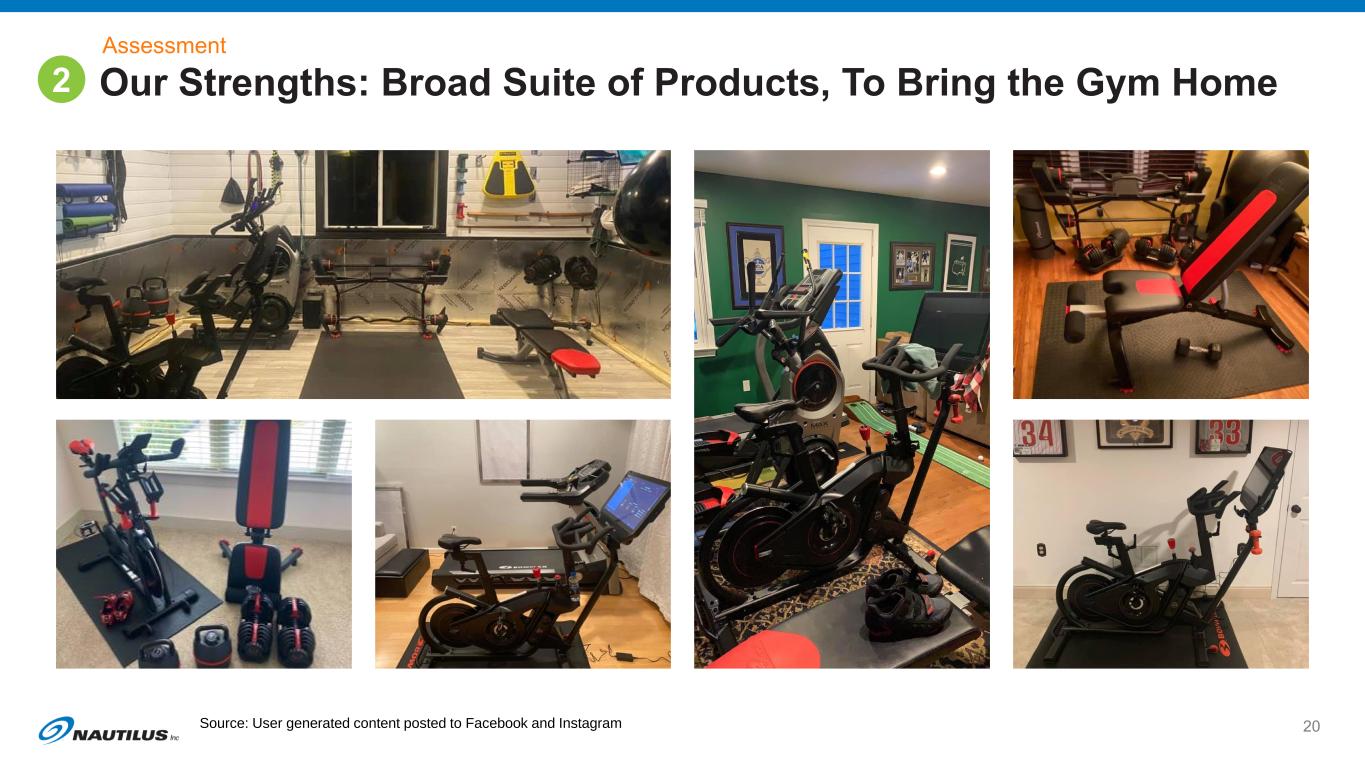

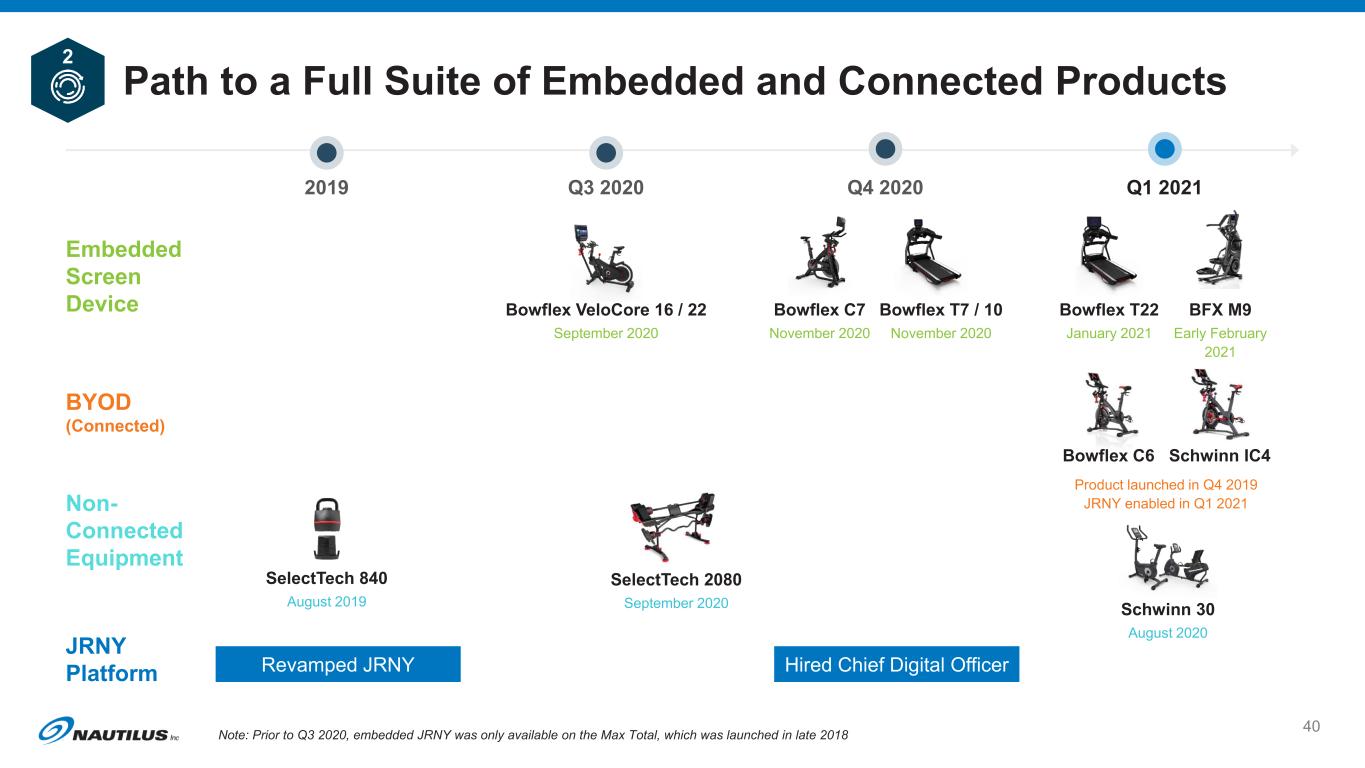

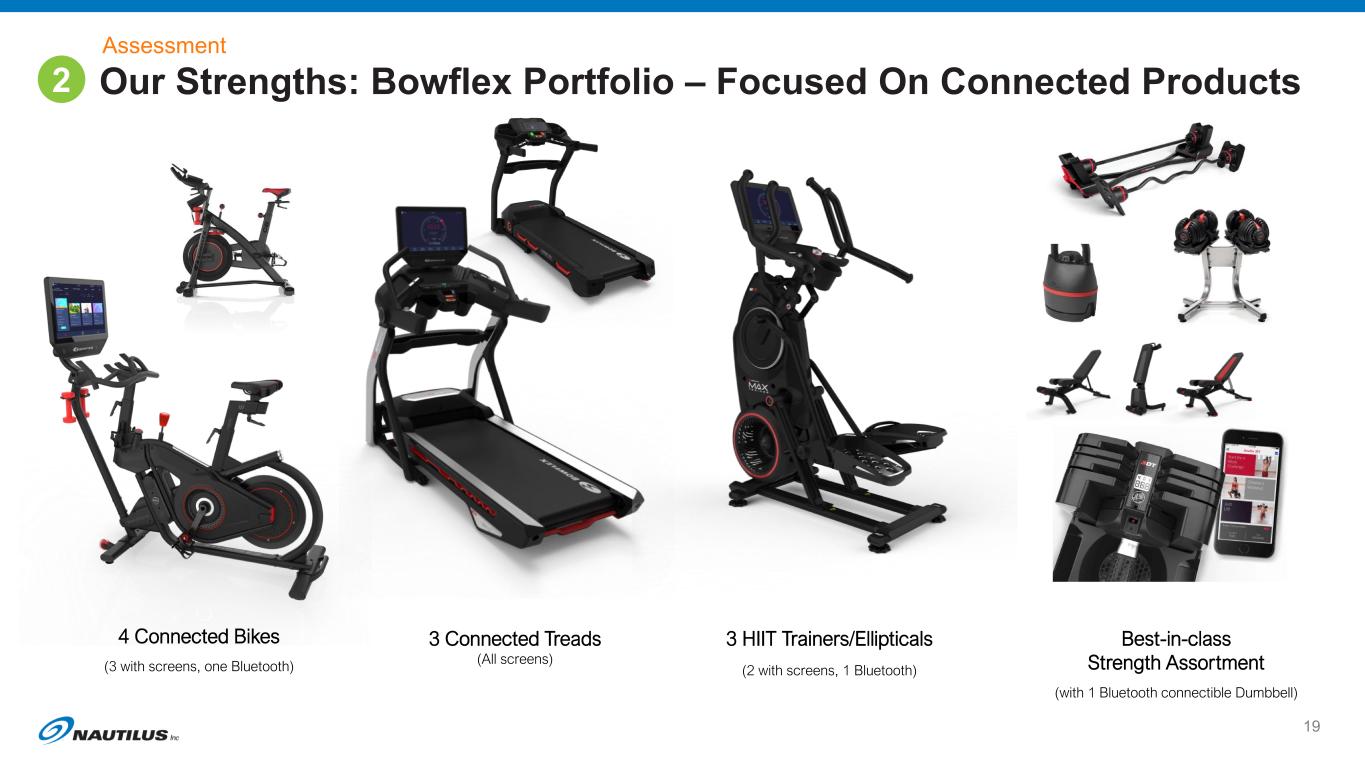

4 Connected Bikes (3 with screens, one Bluetooth) 3 Connected Treads (All screens) 3 HIIT Trainers/Ellipticals (2 with screens, 1 Bluetooth) Best-in-class Strength Assortment (with 1 Bluetooth connectible Dumbbell)

Source: User generated content posted to Facebook and Instagram

1 12 months ending 12/31/20

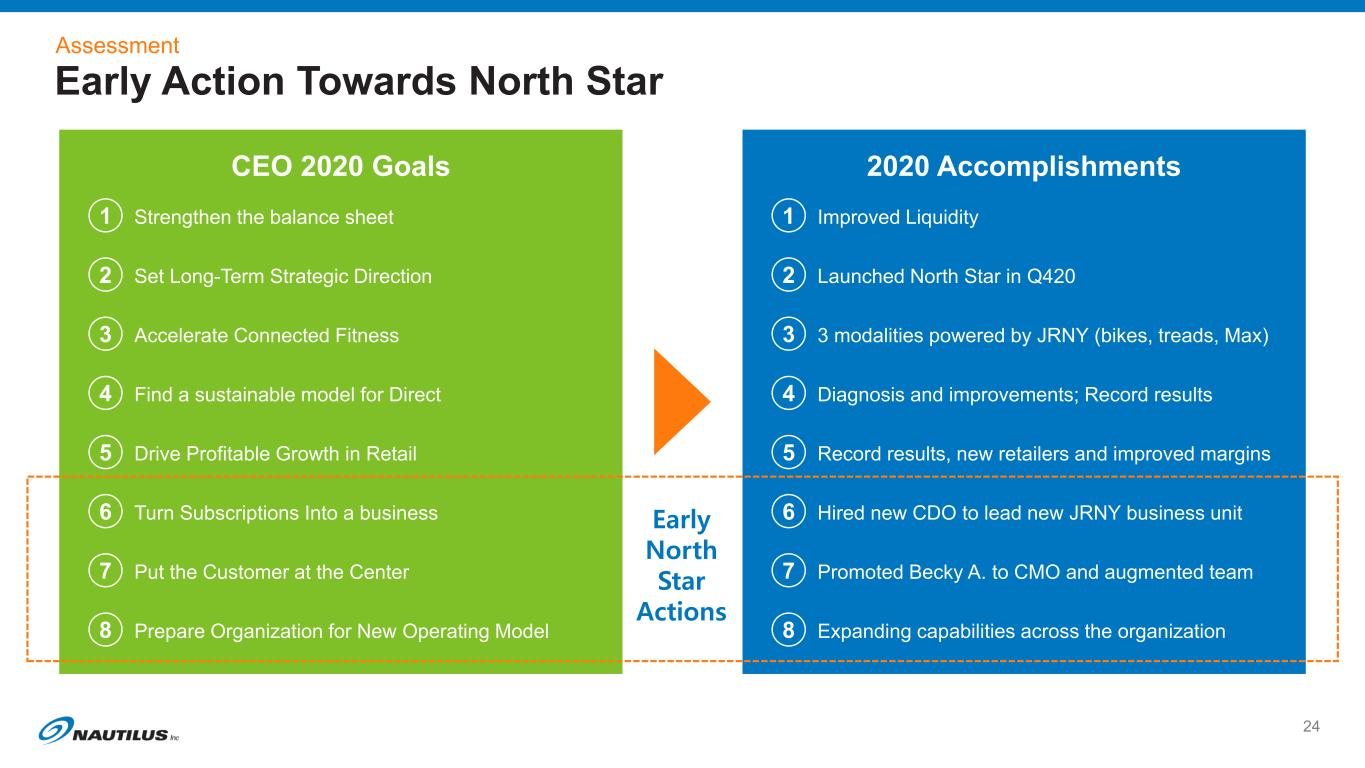

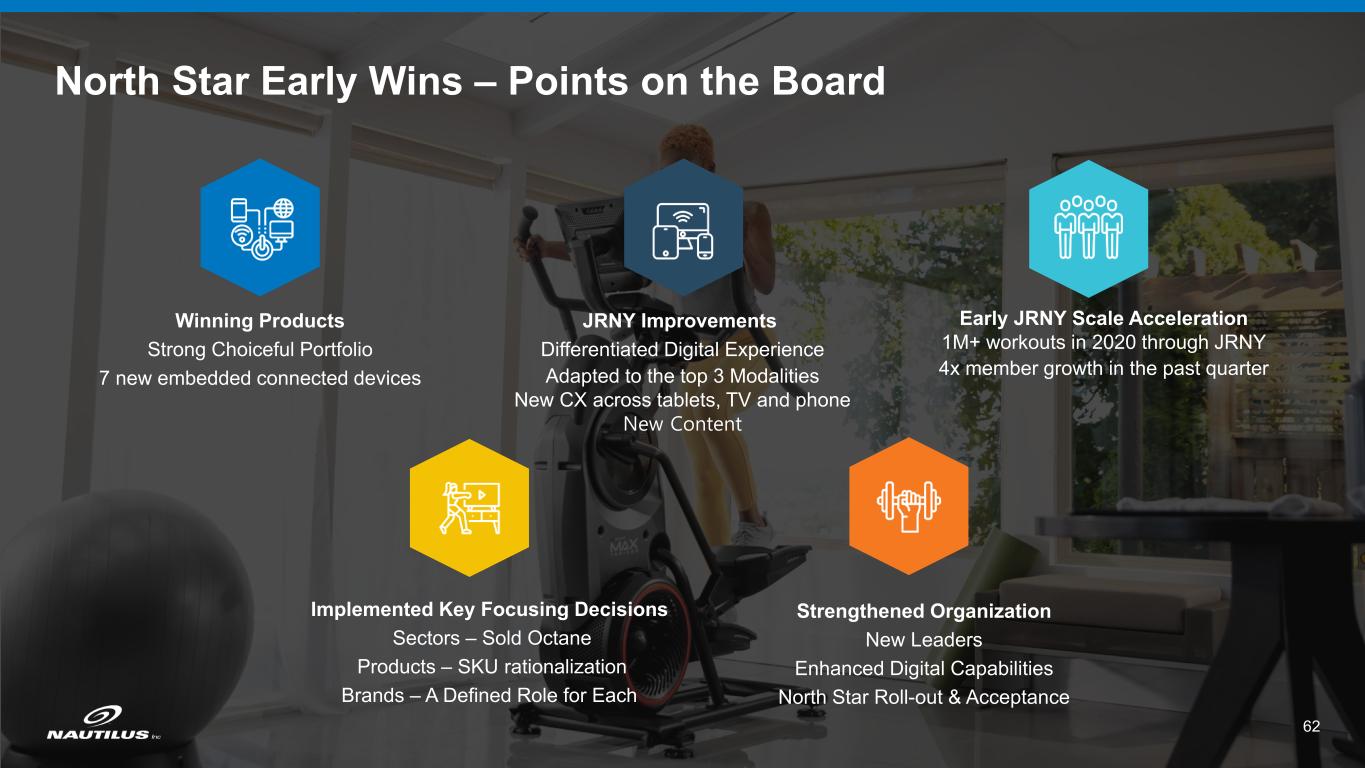

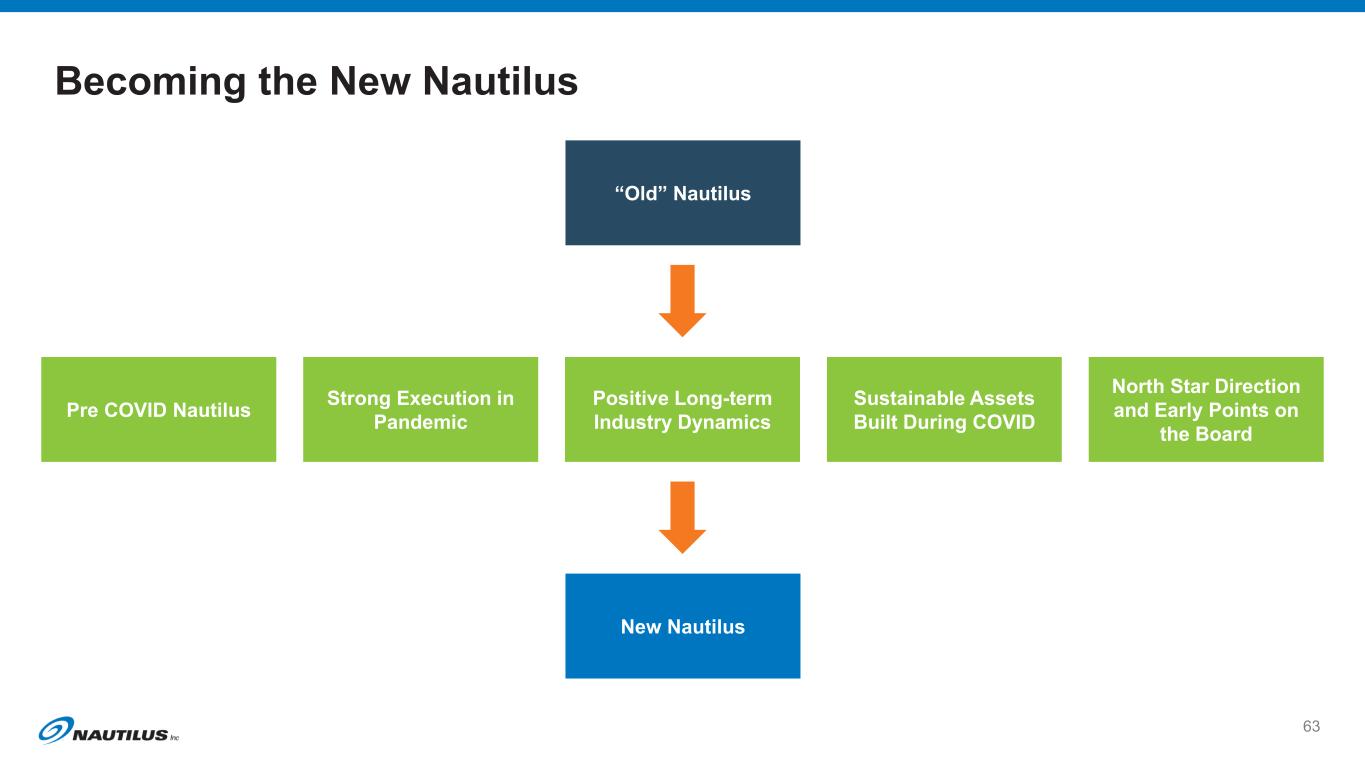

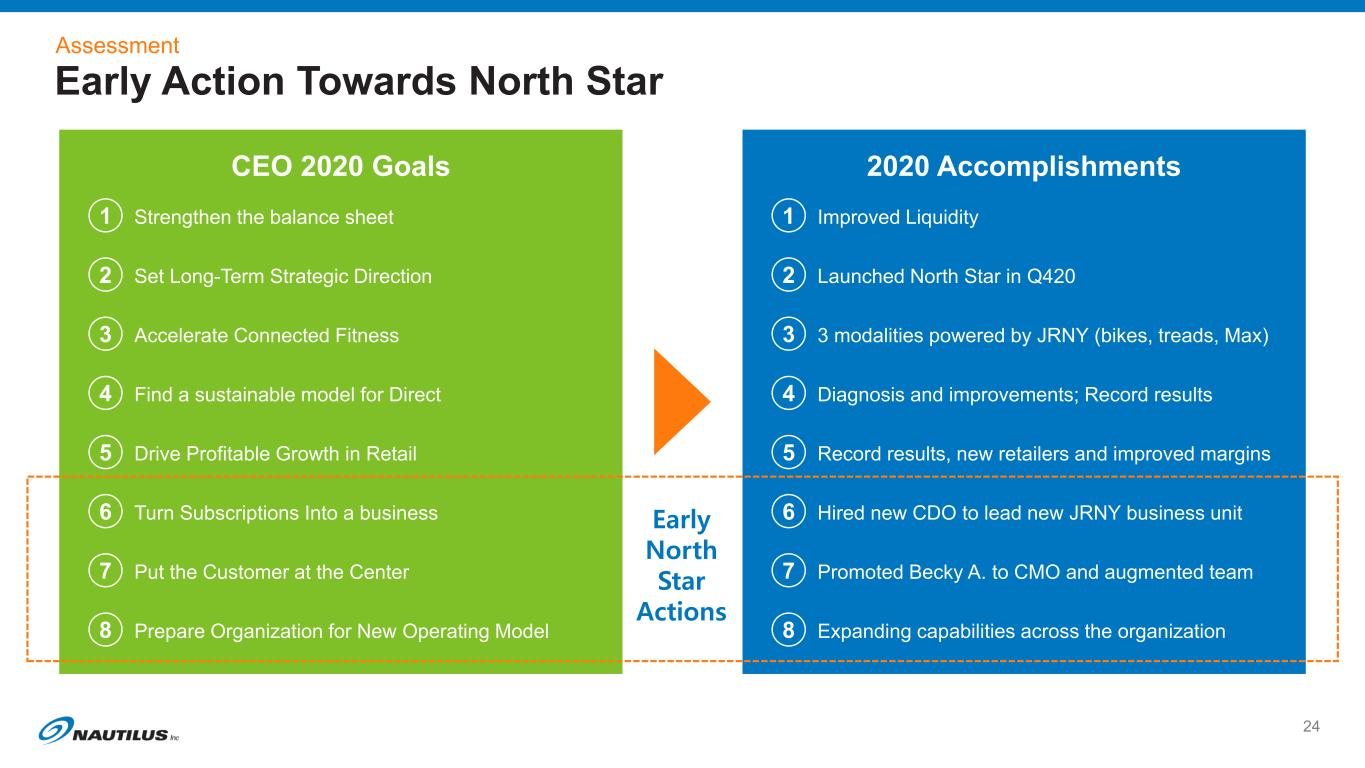

Early North Star Actions

Conclusions: 1. Incredible growth in home fitness SAM as dollars shifted from gym memberships 2. New fitness needs and habits behind the at-home trend suggest long-lasting favorable change

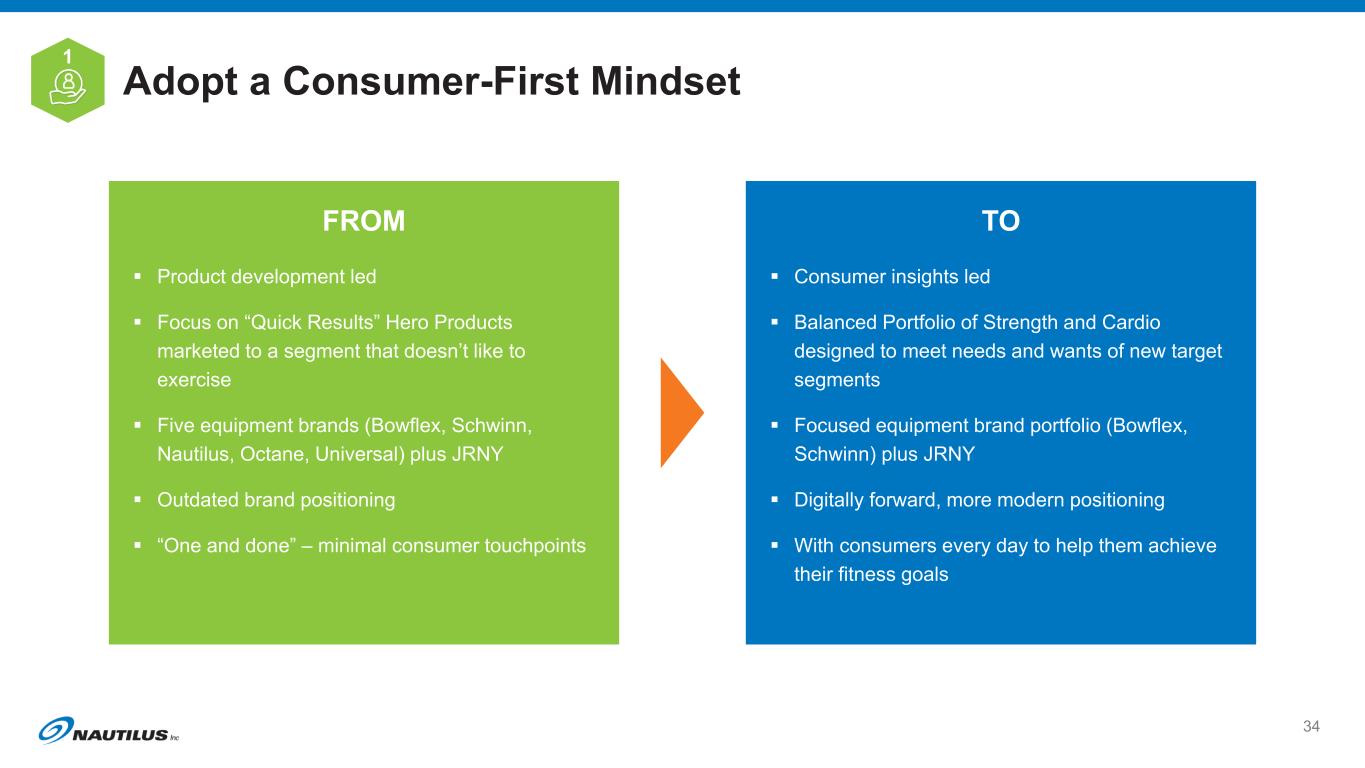

Our Path to Digital Transformation

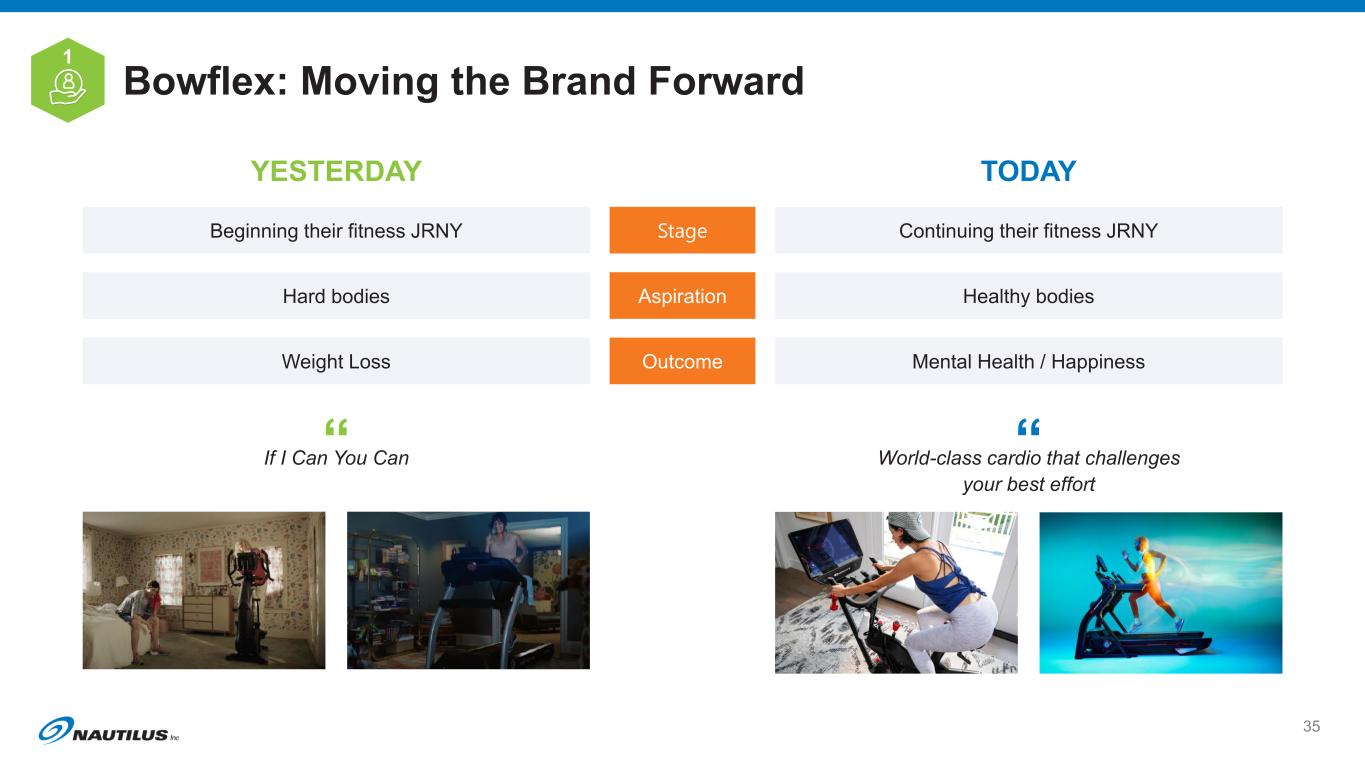

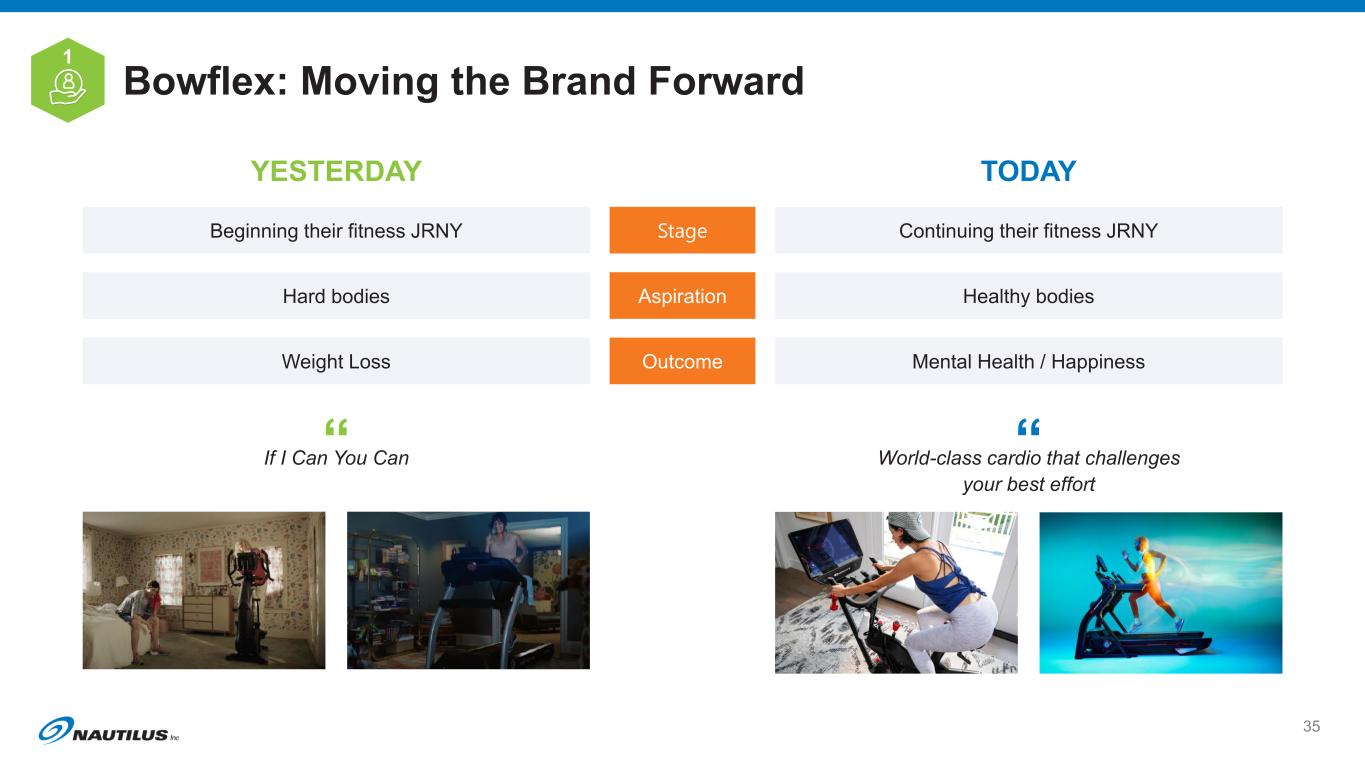

Stage

Sep-20 Oct-20 Nov-20 Dec-20 Jan-21 Feb-21 Mar-21

1 2 3

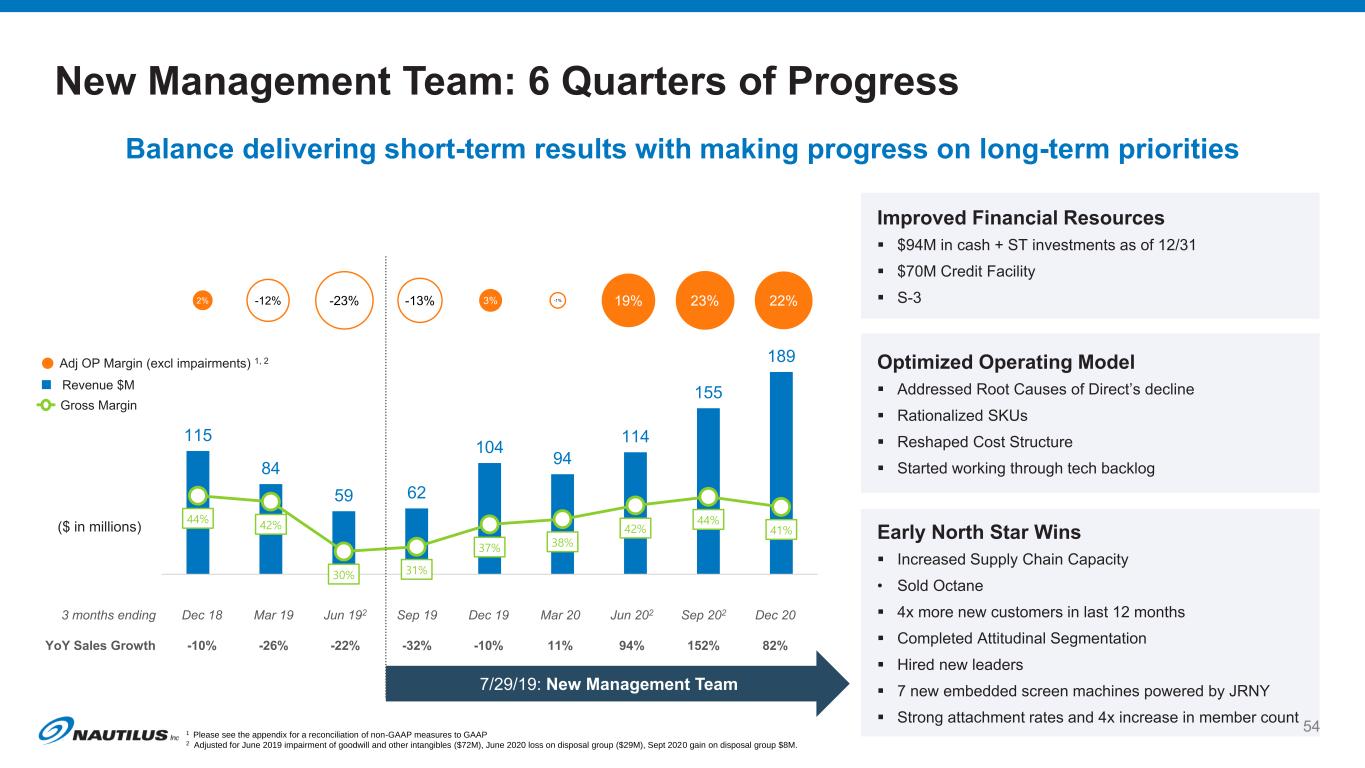

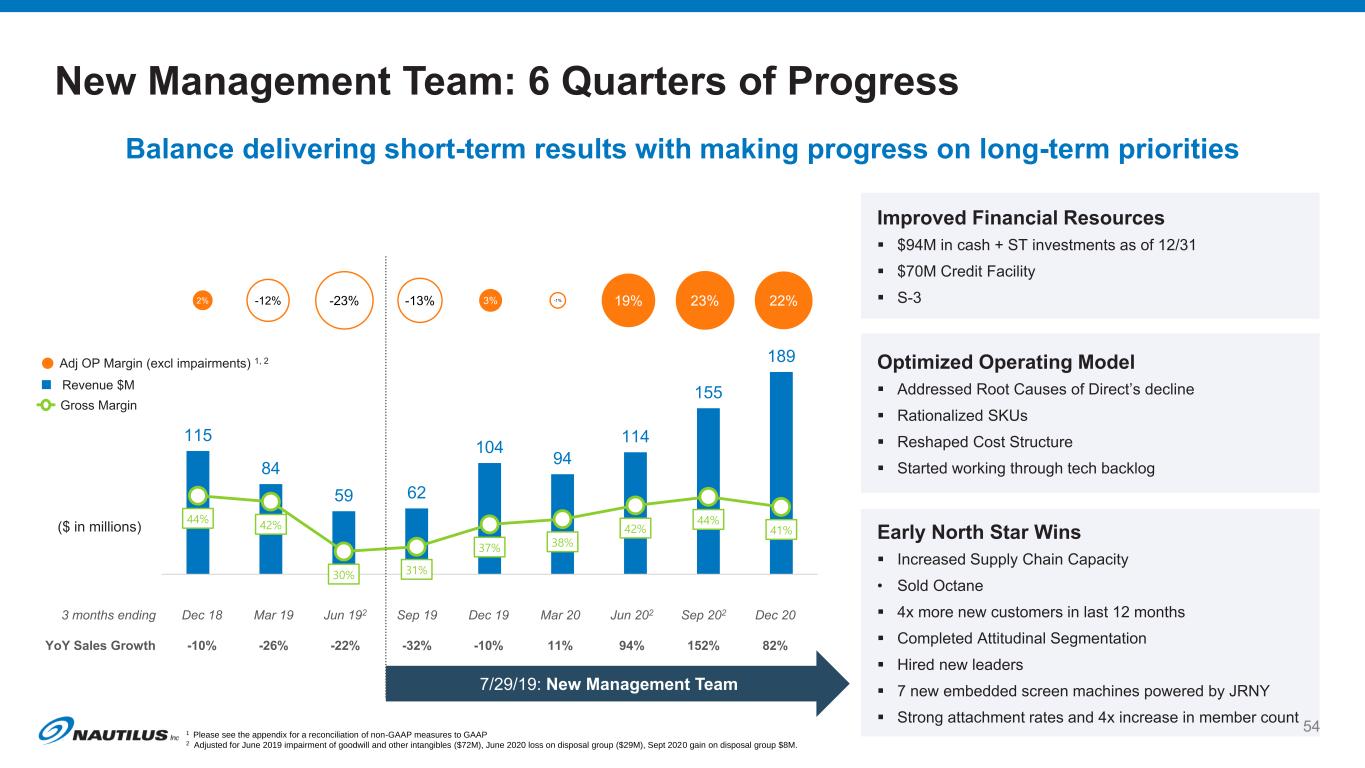

1 Please see the appendix for a reconciliation of non-GAAP measures to GAAP 2 Adjusted for June 2019 impairment of goodwill and other intangibles ($72M), June 2020 loss on disposal group ($29M), Sept 2020 gain on disposal group $8M.

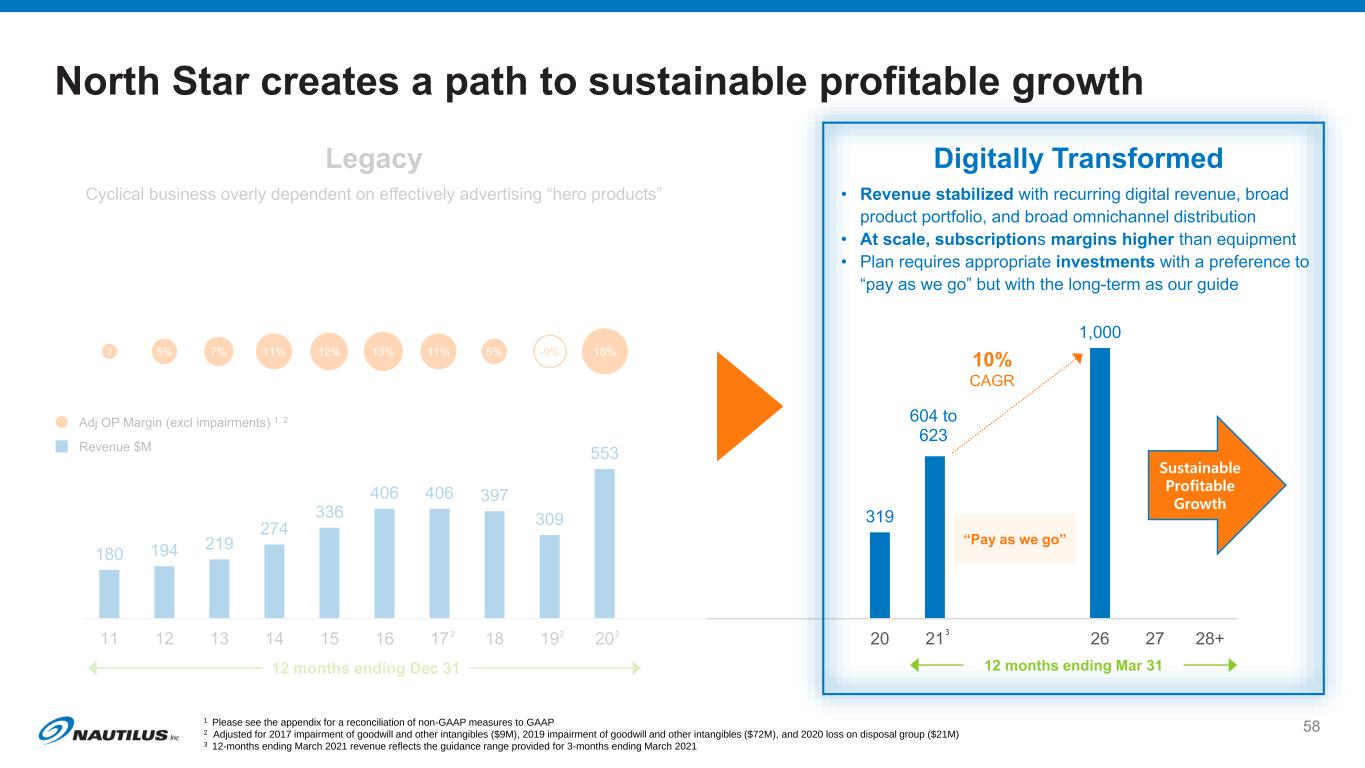

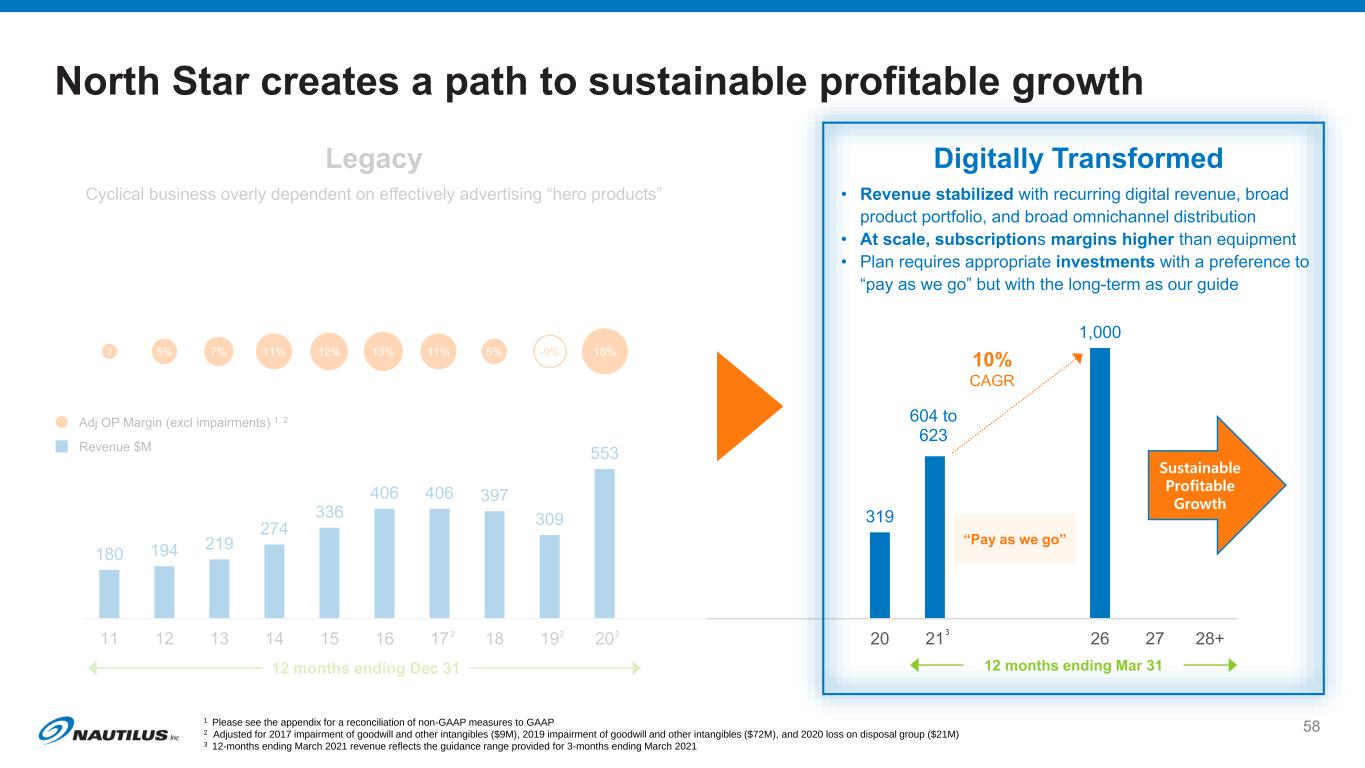

Note: Fiscal Year 2022 begins on April 1, 2021. FYE 2026 is the 12-months ending 3/31/26

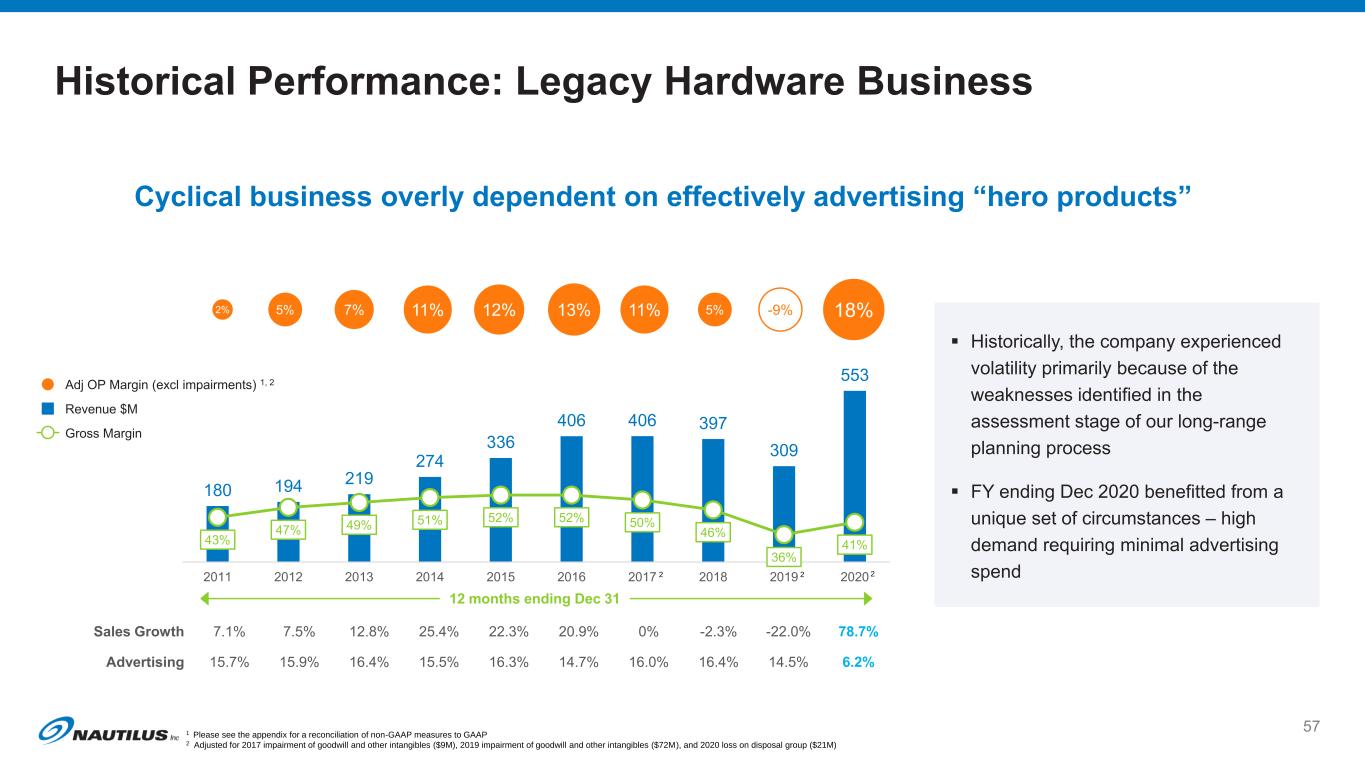

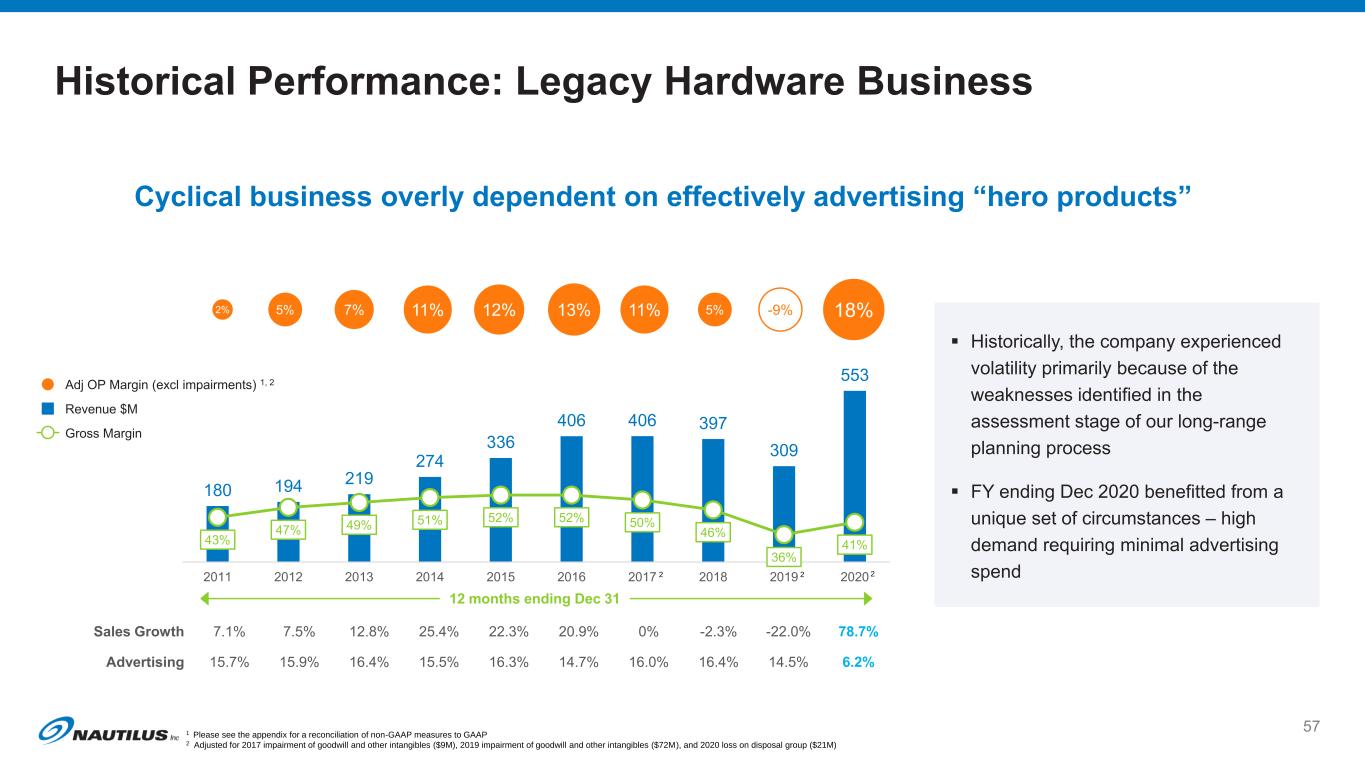

1 Please see the appendix for a reconciliation of non-GAAP measures to GAAP 2 Adjusted for 2017 impairment of goodwill and other intangibles ($9M), 2019 impairment of goodwill and other intangibles ($72M), and 2020 loss on disposal group ($21M) 22 2

Sustainable Profitable Growth 1 Please see the appendix for a reconciliation of non-GAAP measures to GAAP 2 Adjusted for 2017 impairment of goodwill and other intangibles ($9M), 2019 impairment of goodwill and other intangibles ($72M), and 2020 loss on disposal group ($21M) 3 12-months ending March 2021 revenue reflects the guidance range provided for 3-months ending March 2021 2 2 2 3

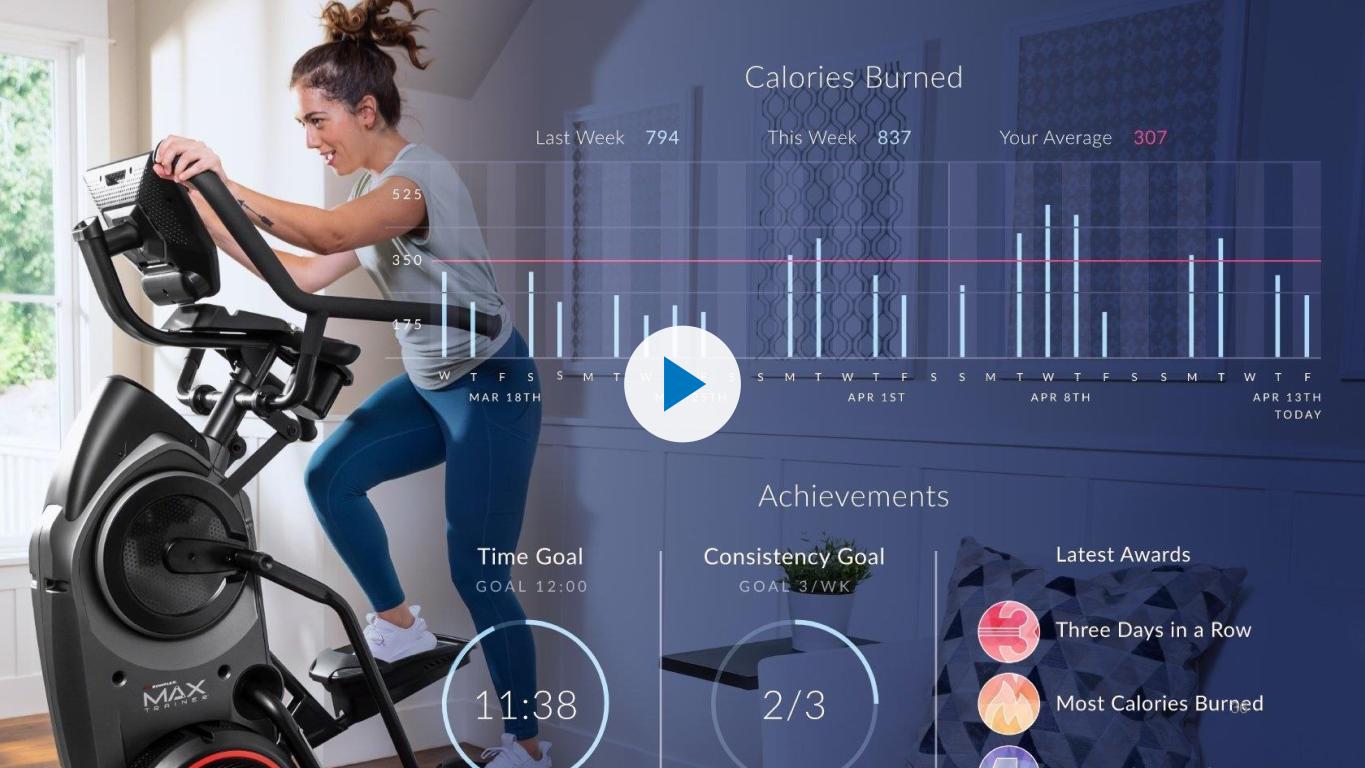

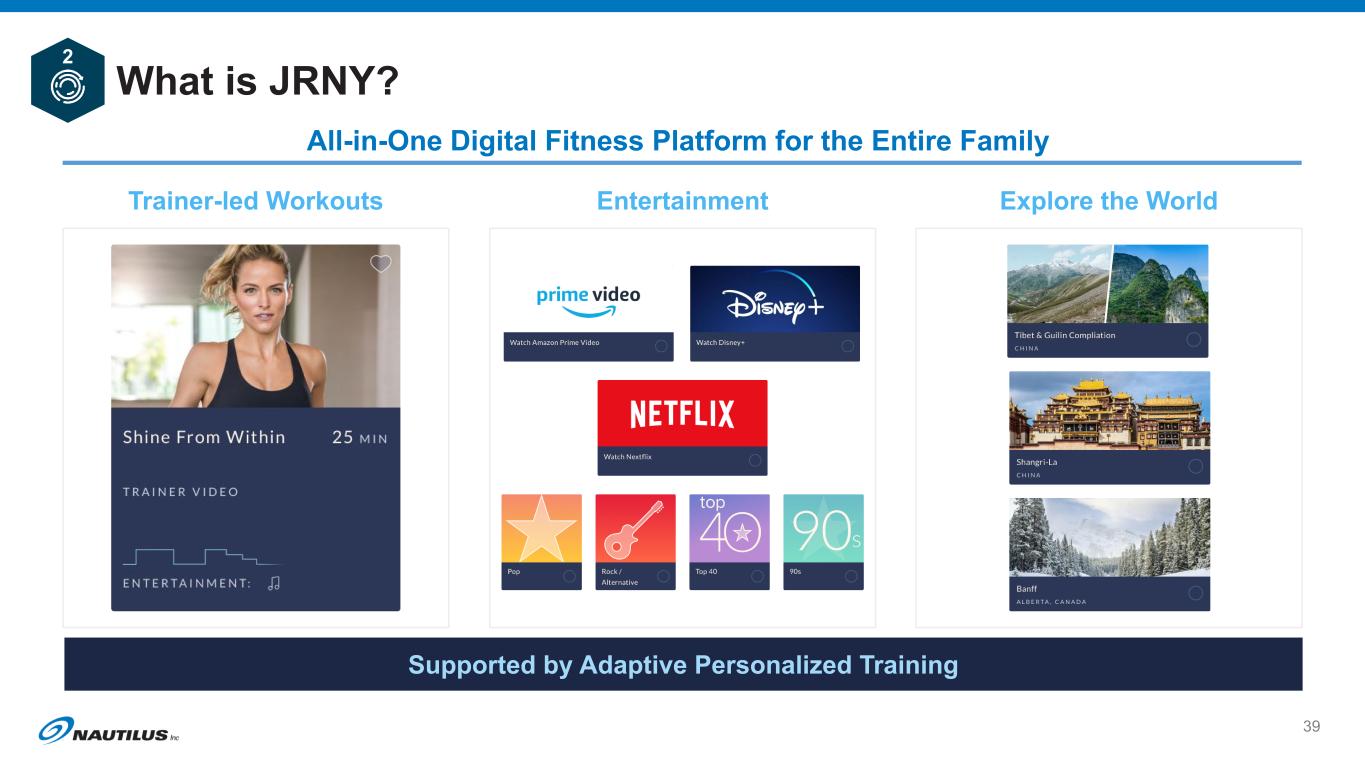

For the Transition Period 1/1/2021 to 3/31/2021: ▪ We expect net sales growth of 55% to 75% versus the same period last year. ▪ Due to pressure from increased logistics costs, higher commodity prices, and continued foreign exchange headwinds, we expect gross margins to be relatively flat to the same period last year. ▪ We expect operating expenses to be higher in dollars but achieve leverage as these expenses are expected to be lower as a percent of sales than the same period last year, driven by increased marketing and investments in JRNY® and North Star.

Source: Factset market data as of March 10, 2021

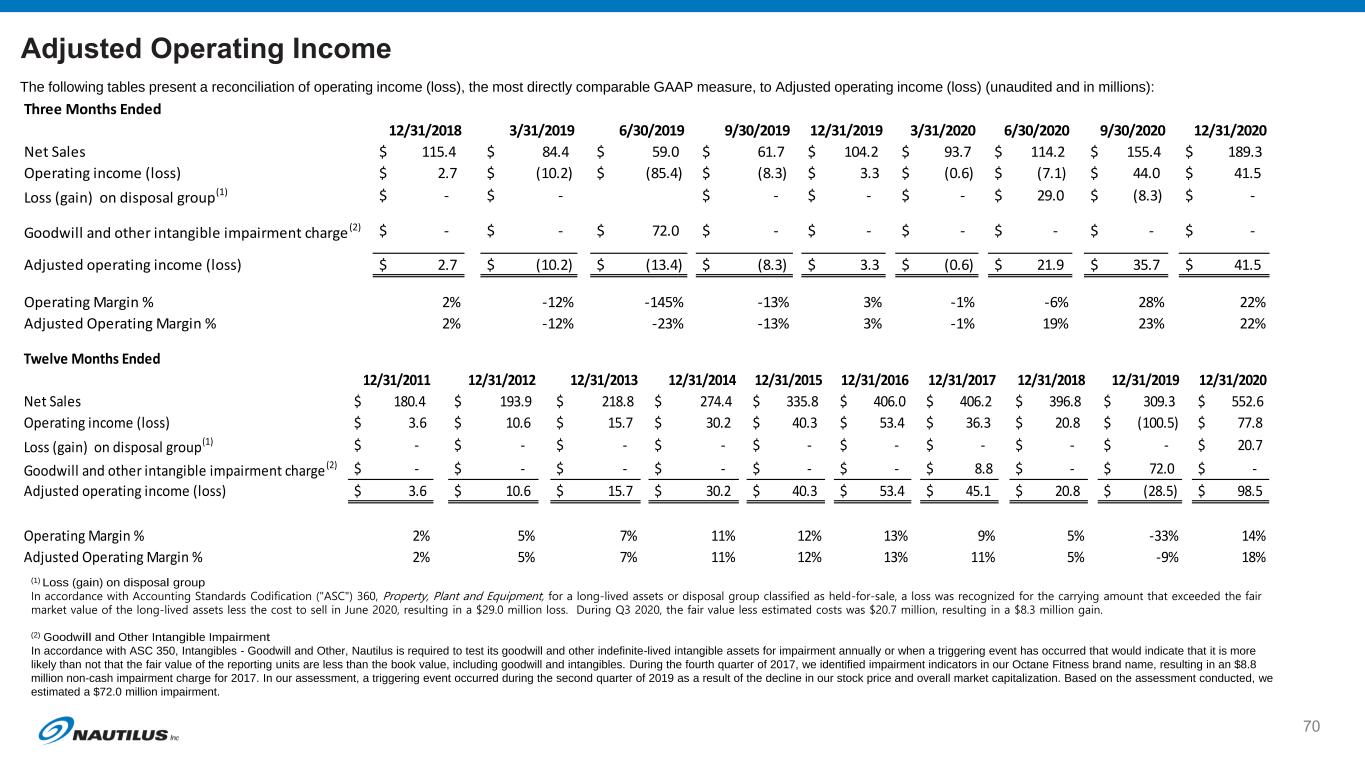

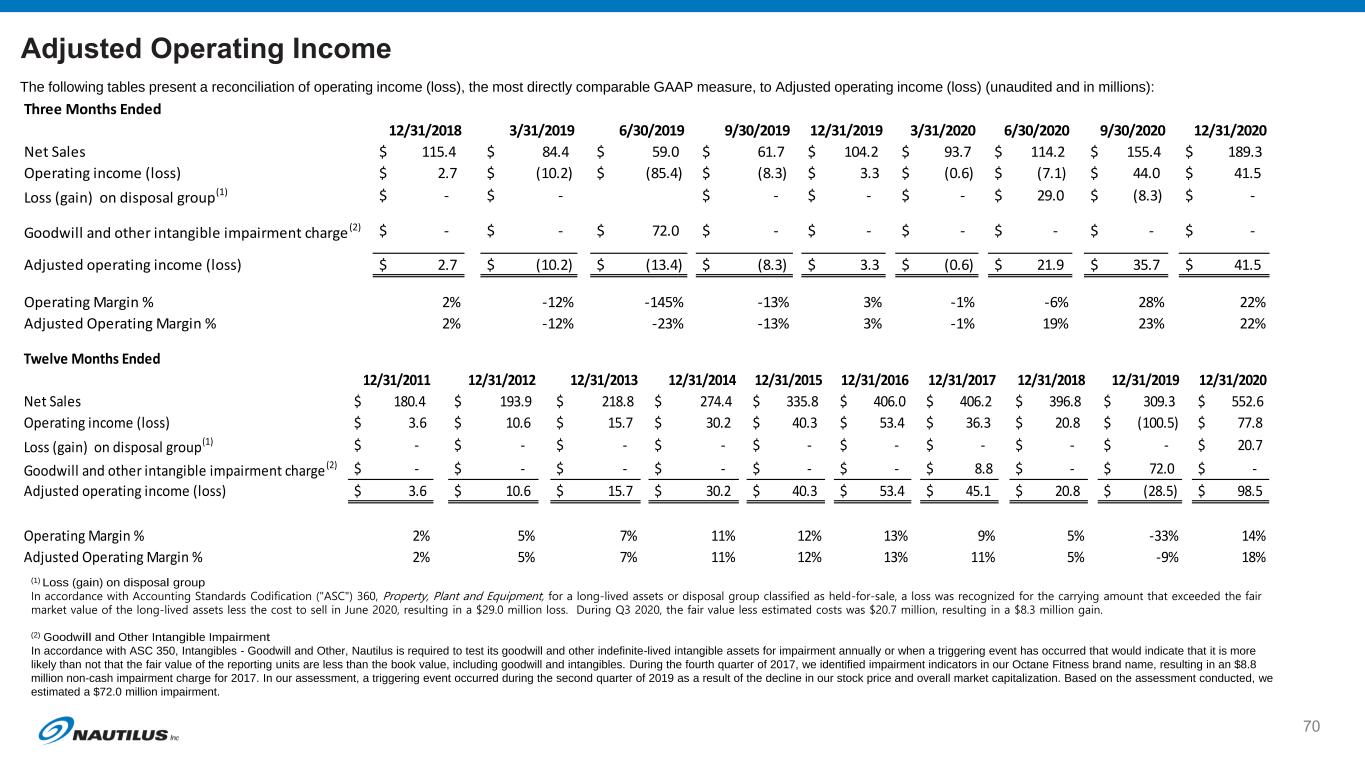

Non-GAAP Presentation In addition to disclosing its financial results determined in accordance with GAAP, Nautilus has presented in this presentation certain non-GAAP financial measures, which exclude the impact of certain items (as further described below) and provide supplemental information regarding operating performance. Nautilus presents non-GAAP financial measures as a complement to results provided in accordance with GAAP, and the non-GAAP financial measures should not be regarded as a substitute for GAAP. By disclosing these non-GAAP financial measures, management intends to provide investors with a supplemental comparison of operating results and trends for the periods presented. Management believes these measures are also useful to investors as such measures allow investors to evaluate performance using the same metrics that management uses to evaluate past performance and prospects for future performance. Nautilus strongly encourages you to review all its financial statements and publicly filed reports in their entirety and to not rely on any single financial measure. Adjusted Results In addition to disclosing the comparable GAAP results, Nautilus has presented its operating income on an adjusted basis. Adjusted operating income excludes non-cash charges related to the loss on the disposal group held-for-sale, goodwill and the Octane Fitness® trade name intangible asset impairment. We believe that the adjustment of these charges, which are inconsistent in amount and frequency, supplements the GAAP information with a measure that can be used to assess the sustainability of our operating performance.

(1) Loss (gain) on disposal group In accordance with Accounting Standards Codification ("ASC") 360, Property, Plant and Equipment, for a long-lived assets or disposal group classified as held-for-sale, a loss was recognized for the carrying amount that exceeded the fair market value of the long-lived assets less the cost to sell in June 2020, resulting in a $29.0 million loss. During Q3 2020, the fair value less estimated costs was $20.7 million, resulting in a $8.3 million gain. (2) Goodwill and Other Intangible Impairment In accordance with ASC 350, Intangibles - Goodwill and Other, Nautilus is required to test its goodwill and other indefinite-lived intangible assets for impairment annually or when a triggering event has occurred that would indicate that it is more likely than not that the fair value of the reporting units are less than the book value, including goodwill and intangibles. During the fourth quarter of 2017, we identified impairment indicators in our Octane Fitness brand name, resulting in an $8.8 million non-cash impairment charge for 2017. In our assessment, a triggering event occurred during the second quarter of 2019 as a result of the decline in our stock price and overall market capitalization. Based on the assessment conducted, we estimated a $72.0 million impairment. The following tables present a reconciliation of operating income (loss), the most directly comparable GAAP measure, to Adjusted operating income (loss) (unaudited and in millions): Three Months Ended 12/31/2018 3/31/2019 6/30/2019 9/30/2019 12/31/2019 3/31/2020 6/30/2020 9/30/2020 12/31/2020 Net Sales $ 115.4 $ 84.4 $ 59.0 $ 61.7 $ 104.2 $ 93.7 $ 114.2 $ 155.4 $ 189.3 Operating income (loss) $ 2.7 $ (10.2) $ (85.4) $ (8.3) $ 3.3 $ (0.6) $ (7.1) $ 44.0 $ 41.5 Loss (gain) on disposal group (1) $ - $ - $ - $ - $ - $ 29.0 $ (8.3) $ - Goodwill and other intangible impairment charge (2) $ - $ - $ 72.0 $ - $ - $ - $ - $ - $ - Adjusted operating income (loss) $ 2.7 $ (10.2) $ (13.4) $ (8.3) $ 3.3 $ (0.6) $ 21.9 $ 35.7 $ 41.5 Operating Margin % 2% -12% -145% -13% 3% -1% -6% 28% 22% Adjusted Operating Margin % 2% -12% -23% -13% 3% -1% 19% 23% 22% Twelve Months Ended 12/31/2011 12/31/2012 12/31/2013 12/31/2014 12/31/2015 12/31/2016 12/31/2017 12/31/2018 12/31/2019 12/31/2020 Net Sales $ 180.4 $ 193.9 $ 218.8 $ 274.4 $ 335.8 $ 406.0 $ 406.2 $ 396.8 $ 309.3 $ 552.6 Operating income (loss) $ 3.6 $ 10.6 $ 15.7 $ 30.2 $ 40.3 $ 53.4 $ 36.3 $ 20.8 $ (100.5) $ 77.8 Loss (gain) on disposal group (1) $ - $ - $ - $ - $ - $ - $ - $ - $ - $ 20.7 Goodwill and other intangible impairment charge (2) $ - $ - $ - $ - $ - $ - $ 8.8 $ - $ 72.0 $ - Adjusted operating income (loss) $ 3.6 $ 10.6 $ 15.7 $ 30.2 $ 40.3 $ 53.4 $ 45.1 $ 20.8 $ (28.5) $ 98.5 Operating Margin % 2% 5% 7% 11% 12% 13% 9% 5% -33% 14% Adjusted Operating Margin % 2% 5% 7% 11% 12% 13% 11% 5% -9% 18%