Caption in Compliance with D.N.J. LBR 9004-1(b) UNITED STATES BANKRUPTCY COURT DISTRICT OF NEW JERSEY In Re: BOWFLEX INC., et al.,1 Debtors. FINDINGS OF FACT, CONCLUSIONS OF LAW, AND ORDER CONFIRMING THE SECOND AMENDED JOINT CHAPTER 11 PLAN OF LIQUIDATION OF BOWFLEX INC. AND ITS DEBTOR AFFILIATE The relief set forth on the following pages, numbered three (3) through seventy (70), is hereby ORDERED. 1 The Debtors in these chapter 11 cases, together with the last four digits of each Debtor’s federal tax identification number, are: BowFlex Inc. (2667) and BowFlex New Jersey LLC (3679). The Debtors’ service address is 2114 Main Street, Suite 100-341, Vancouver, Washington 98660. Chapter 11 Case No. 24-12364 (ABA) (Jointly Administered) DATED: August 19, 2024 Order Filed on August 19, 2024 by Clerk U.S. Bankruptcy Court District of New Jersey Case 24-12364-ABA Doc 614 Filed 08/19/24 Entered 08/19/24 14:14:13 Desc Main Document Page 1 of 134

Caption in Compliance with D.N.J. LBR 9004-1(b) SIDLEY AUSTIN LLP Matthew A. Clemente (admitted pro hac vice) One South Dearborn Chicago, Illinois 60603 Telephone: (312) 853-7000 Facsimile: (312) 853-7036 mclemente@sidley.com Maegan Quejada (admitted pro hac vice) 1000 Louisiana Street, Suite 5900 Houston, Texas 77002 Telephone: (713) 495-4500 Facsimile: (713) 495-7799 mquejada@sidley.com Michael A. Sabino (admitted pro hac vice) 787 Seventh Avenue New York, New York 10019 Telephone: (212) 839-5300 Facsimile: (212) 839-5599 msabino@sidley.com FOX ROTHSCHILD LLP Joseph J. DiPasquale, Esq. Mark E. Hall, Esq. Michael R. Herz, Esq. 49 Market Street Morristown, NJ 07960 Telephone: (973) 992-4800 Facsimile: (973) 992-9125 jdipasquale@foxrothschild.com mhall@foxrothschild.com mherz@foxrothschild.com Co-Counsel to the Debtors and Debtors in Possession Case 24-12364-ABA Doc 614 Filed 08/19/24 Entered 08/19/24 14:14:13 Desc Main Document Page 2 of 134

(Page | 3) Debtors: BOWFLEX INC., et al. Case No. 24-12364 (ABA) Caption of Order: Findings of Fact, Conclusions of Law, and Order Confirming the First Amended Joint Chapter 11 of Liquidation of BowFlex Inc. and Its Debtor Affiliate BowFlex Inc. and its debtor affiliate (collectively, the “Debtors”)2 in the above-captioned chapter 11 cases (the “Chapter 11 Cases”) having: 1. commenced, on March 4, 2024 (the “Petition Date”), these Chapter 11 Cases by each filing a voluntary petition for relief under chapter 11 of title 11 of the United States Code (the “Bankruptcy Code”) in the United States Bankruptcy Court for the District of New Jersey (the “Court”); 2. continued to operate their businesses and manage their properties during these Chapter 11 Cases as debtors in possession pursuant to sections 1107(a) and 1108 of the Bankruptcy Code; 3. obtained, on March 8, 2024, entry of the Order (I) (A) Approving the Auction and Bidding Procedures, (B) Approving Stalking Horse Bid Protections, (C) Scheduling Bid Deadlines and an Auction, (D) Approving the Form and Manner of Notice Thereof, (E) Authorizing the Debtors to Enter Into the Stalking Horse Agreement, and (II) (A) Establishing Notice and Procedures for the Assumption of Contracts and Leases, (B) Authorizing the Assumption and Assignment of Assumed Contracts, (C) Authorizing the Sale of Assets and (D) Granting Related Relief [Docket No. 35] (as amended by the Court’s order on March 18, 2024 [Docket No. 131] the “Bidding Procedures Order”) 4. filed, on April 8, 2024, their Schedules of Assets and Liabilities and Statement of Financial Affairs [Docket Nos. 225–28] (collectively, the “Schedules and Statements”); 5. filed, on April 9, 2024, the Notice of Successful Bidder and Proposed Sale Order [Docket No. 233], designating the Stalking Horse Bidder as the Successful Bidder; 6. obtained, on April 12, 2024, entry of the Order (I) Setting Bar Dates for Filing Proofs of Claim, Including Requests for Payment Under Section 503(b)(9), (II) Setting a Bar Date for the Filing of Proofs of Claim by Governmental Units, (III) Setting a Bar Date for Allowance of Administrative Expense Claims, (IV) Establishing Amended Schedules Bar Date and Rejection Damages Bar Date, (V) Approving the Form and Manner for Filing Proofs of Claim, (VI) Approving Notice of Bar Dates, and (VII) Granting Related Relief [Docket No. 253] (the “Bar Date Order”), 2 Capitalized terms used but not defined herein shall have the meanings ascribed to such terms in the Plan (as defined herein). Case 24-12364-ABA Doc 614 Filed 08/19/24 Entered 08/19/24 14:14:13 Desc Main Document Page 3 of 134

(Page | 4) Debtors: BOWFLEX INC., et al. Case No. 24-12364 (ABA) Caption of Order: Findings of Fact, Conclusions of Law, and Order Confirming the First Amended Joint Chapter 11 of Liquidation of BowFlex Inc. and Its Debtor Affiliate thereby establishing certain bar dates (each, a “Bar Date,” and, collectively, the “Bar Dates”). 7. obtained, on April 15, 2024, entry of the Order (I) Approving the Sale of the Acquired Assets Free and Clear of All Liens, Claims and Encumbrances, (II) Authorizing the Debtors to Enter Into and Perform Their Obligations Under the Asset Purchase Agreement, and (III) Granting Related Relief [Docket No. 288] (the “Sale Order”); 8. obtained, on April 18, 2024, entry of the orders approving the De Minimis Procedures [Docket No. 301] (as amended by this Court’s order on May 15, 2024 [Docket No. 375]) and authorizing the Debtors to abandon the Employee Laptops [Docket No. 300]; 9. filed, on May 23, 2024, the Joint Chapter 11 Plan of Liquidation of BowFlex Inc. and Its Debtor Affiliate [Docket No. 400] and the Disclosure Statement for the Joint Chapter 11 Plan of Liquidation of BowFlex Inc. and Its Debtor Affiliate [Docket No. 401] 10. filed, on June 18, 2024, the Revised Joint Chapter 11 Plan of Liquidation of BowFlex Inc. and Its Debtor Affiliate [Docket No. 467] and the Revised Disclosure Statement for the Joint Chapter 11 Plan of Liquidation of BowFlex Inc. and Its Debtor Affiliate [Docket No. 466]; 11. obtained, on June 21, 2024, entry of the Order (I) Approving the Adequacy of the Disclosure Statement, (II) Approving the Solicitation and Voting Procedures With Respect to Confirmation of the Proposed Joint Chapter 11 Plan of Liquidation of BowFlex Inc. and Its Debtor Affiliates, (III) Approving the Forms of Ballots and Notices in Connection Therewith, (IV) Scheduling Certain Dates With Respect Thereto, and (V) Granting Related Relief [Docket No. 474] (the “Solicitation Order”), approving the Disclosure Statement, the confirmation timeline, the Solicitation and Voting Procedures, the Solicitation Packages, and the notices of the (i) hearing(s) conducted by the Court to consider confirmation of the proposed Plan under section 1129 of the Bankruptcy Code, as such hearing may be adjourned from time to time (the “Confirmation Hearing,” and, such notice, the “Confirmation Hearing Notice”) and (ii) Notice of Non-Voting Status Package; 12. caused the Solicitation Packages and the Confirmation Hearing Notice to be distributed on June 24–25, 2024, in accordance with the Bankruptcy Code, the Federal Rules of Bankruptcy Procedures (the “Bankruptcy Rules”), the Local Rules of the United States Bankruptcy Court for the Case 24-12364-ABA Doc 614 Filed 08/19/24 Entered 08/19/24 14:14:13 Desc Main Document Page 4 of 134

(Page | 5) Debtors: BOWFLEX INC., et al. Case No. 24-12364 (ABA) Caption of Order: Findings of Fact, Conclusions of Law, and Order Confirming the First Amended Joint Chapter 11 of Liquidation of BowFlex Inc. and Its Debtor Affiliate District of New Jersey (the “Bankruptcy Local Rules”), the Solicitation Order, and the Solicitation and Voting Procedures, as evidenced by, among other things, the Certificate of Service of Solicitation Documents [Docket No. 509], dated July 5, 2024; 13. caused publication of the Confirmation Hearing Notice on June 28, 2024, in USA Today and The Seattle Times, as evidenced by the Verification of Publication [Docket Nos. 529–30], respectively; 14. filed, on July 29, 2024, the Plan Supplement [Docket No. 551] and caused the notice of the filing of the Plan Supplement to be distributed in accordance with the Solicitation Order, as evidenced by, among other things, the Certificate of Service [Docket No. 566]; 15. filed, on August 2, 2024, the Declaration of Stephenie Kjontvedt of Epiq Corporate Restructuring, LLC Regarding the Solicitation and Tabulation of Ballots Cast on the Joint Chapter 11 Plan of Liquidation of BowFlex Inc. and Its Debtor Affiliate [Docket No. 563] (the “Voting Affidavit”); 16. filed, on August 13, 2024, the First Amended Joint Chapter 11 Plan of Liquidation of BowFlex Inc. and Its Debtor Affiliate [Docket No. 584]; 17. filed, on August 13, 2024, the Declaration of Robert D. Hoge, General Counsel and Chief Wind-Down Officer, in Support of Confirmation of the First Amended Joint Chapter 11 Plan of Liquidation of BowFlex and Its Debtor Affiliate [Docket No. 587] (the “Hoge Declaration”), which was admitted into evidence at the Confirmation Hearing; 18. filed, on August 13, 2024, the Debtors’ Memorandum of Law in Support of Confirmation of the First Amended Joint Chapter 11 Plan of Liquidation of BowFlex Inc. and Its Debtor Affiliate [Docket No. 588] (the “Confirmation Brief”); 19. filed, on August 18, 2024, the Second Amended Joint Chapter 11 Plan of Liquidation of BowFlex Inc. and Its Debtor Affiliate [Docket No. 607] (as may be altered, amended, modified, or supplemented from time to time, including all exhibits and schedules thereto, the “Plan”); and 20. filed, on August 18, 2024, an amended Plan Supplement [Docket No. 609]. The Court having: Case 24-12364-ABA Doc 614 Filed 08/19/24 Entered 08/19/24 14:14:13 Desc Main Document Page 5 of 134

(Page | 6) Debtors: BOWFLEX INC., et al. Case No. 24-12364 (ABA) Caption of Order: Findings of Fact, Conclusions of Law, and Order Confirming the First Amended Joint Chapter 11 of Liquidation of BowFlex Inc. and Its Debtor Affiliate a. entered, on June 21, 2024, the Solicitation Order, approving, inter alia, the Disclosure Statement as containing “adequate information” pursuant to section 1125 of the Bankruptcy Code; b. set June 20, 2024, as the Voting Record Date; c. set July 30, 2024, at 4:00 p.m. (prevailing Eastern Time) as the Voting Deadline; d. set July 30, 2024, at 4:00 p.m. (prevailing Eastern Time) as the Objection Deadline; e. set August 5, 2024, at 12:00 p.m. (prevailing Eastern Time) as the Voting Affidavit Deadline; f. set August 13, 2024, as the Confirmation Materials Deadline; g. set August 19, 2024, at 10:00 a.m. (prevailing Eastern Time) as the date and time for the Confirmation Hearing, pursuant to Bankruptcy Rules 3017 and 3018 and sections 1125, 1126, 1128, and 1129 of the Bankruptcy Code; h. reviewed the Plan, the Disclosure Statement, the Plan Supplement, the Confirmation Brief, the Hoge Declaration, the Voting Affidavit, and all filed pleadings, exhibits, statements, and comments regarding confirmation, including all objections, statements, and reservations of rights filed by parties in interest on the dockets of the Chapter 11 Cases; i. held the Confirmation Hearing beginning on August 19, 2024, at 10:00 a.m. (prevailing Eastern Time); j. heard the statements and arguments made by counsel with respect to the confirmation of the Plan; k. considered all oral representations, live testimony, written direct testimony, exhibits, documents, filings, and other evidence presented at the Confirmation Hearing; l. overruled any and all objections to the Plan and the confirmation thereof, and all statements and reservations of rights not consensually resolved or withdrawn unless otherwise indicated in this Confirmation Order or on the record at the Confirmation Hearing; Case 24-12364-ABA Doc 614 Filed 08/19/24 Entered 08/19/24 14:14:13 Desc Main Document Page 6 of 134

(Page | 7) Debtors: BOWFLEX INC., et al. Case No. 24-12364 (ABA) Caption of Order: Findings of Fact, Conclusions of Law, and Order Confirming the First Amended Joint Chapter 11 of Liquidation of BowFlex Inc. and Its Debtor Affiliate m. taken judicial notice of all pleadings and other documents filed, all orders entered, and all evidence and arguments presented in these Chapter 11 Cases; and n. the Court having issued an oral opinion, which is incorporated herein. NOW, THEREFORE, after due deliberation thereon and good cause appearing therefor, the Court makes and issues the following findings of fact and conclusions of law, and orders: FINDINGS OF FACT AND CONCLUSIONS OF LAW 1. Findings and Conclusions. The findings and conclusions set forth herein and in the record of the Confirmation Hearing constitute the Court’s findings of fact and conclusions of law under rule 52 of the Federal Rules of Civil Procedure, as made applicable herein by Bankruptcy Rules 7052 and 9014. To the extent any of the following conclusions of law constitute findings of fact, or vice versa, they are adopted as such. 2. Jurisdiction, Venue, and Core Proceeding. This Court has jurisdiction over these Chapter 11 Cases pursuant to 28 U.S.C. §§ 157 and 1334. Consideration of whether the Disclosure Statement and the Plan comply with the applicable provisions of the Bankruptcy Code constitutes a core proceeding as defined in 28 U.S.C. § 157(b)(2). This Court may enter a final order consistent with Article III of the United States Constitution. Venue is proper in this district pursuant to sections 1408 and 1409 of title 28 of the United States Code. 3. Judicial Notice. The Court takes judicial notice of (and deems admitted into evidence for purposes of confirmation of the Plan) the docket of these Chapter 11 Cases maintained by the clerk of the Court or its duly appointed agent, including all pleadings and other documents on file, all orders entered, all hearing transcripts, and all evidence and arguments made, Case 24-12364-ABA Doc 614 Filed 08/19/24 Entered 08/19/24 14:14:13 Desc Main Document Page 7 of 134

(Page | 8) Debtors: BOWFLEX INC., et al. Case No. 24-12364 (ABA) Caption of Order: Findings of Fact, Conclusions of Law, and Order Confirming the First Amended Joint Chapter 11 of Liquidation of BowFlex Inc. and Its Debtor Affiliate proffered, or adduced at the hearings held before the Court during the pendency of these Chapter 11 Cases. 4. Eligibility for Relief. The Debtors were and are entities eligible for relief under section 109 of the Bankruptcy Code. 5. Commencement and Joint Administration of These Chapter 11 Cases. On the Petition Date, each of the debtors commenced a voluntary case under chapter 11 of the Bankruptcy Code. In accordance with the Order (I) Directing Joint Administration of the Chapter 11 Cases and (II) Granting Related Relief [Docket No. 58], these Chapter 11 Cases have been consolidated for procedural purposes only and are being jointly administered pursuant to Bankruptcy Rule 1015(b). The Debtors continue to operate their businesses and manage their properties as debtors in possession pursuant to sections 1107(a) and 1108 of the Bankruptcy Code. No party has requested the appointment of a trustee or examiner. 6. Appointment of the Committee. On March 15, 2024, pursuant to section 1102(a)(1) of the Bankruptcy Code, the U.S. Trustee filed the Notice of Appointment of Official Committee of Unsecured Creditors [Docket No. 116]. No other statutory committee has been requested or appointed in these Chapter 11 Cases. 7. The Bar Dates. On April 12, 2024, the Court entered the Bar Date Order, setting: (a) May 14, 2024, as the last day for filing Proofs of Claim (including Proofs of Claim for Claims arising under section 503(b)(9) of the Bankruptcy Code) against the Debtors that arose (or were deemed to have arisen) before the Petition Date; (b) September 3, 2024, as the last day for filing Proofs of Claim for Governmental Units (as defined in section 101(27) of the Bankruptcy Code); Case 24-12364-ABA Doc 614 Filed 08/19/24 Entered 08/19/24 14:14:13 Desc Main Document Page 8 of 134

(Page | 9) Debtors: BOWFLEX INC., et al. Case No. 24-12364 (ABA) Caption of Order: Findings of Fact, Conclusions of Law, and Order Confirming the First Amended Joint Chapter 11 of Liquidation of BowFlex Inc. and Its Debtor Affiliate (c) May 14, 2024, as the Administrative Claims Bar Date (solely for administrative claims arising on or before April 22, 2024); and (d) the Amended Schedules Bar Date and the Rejection Damages Bar Date, each as applicable. 8. Plan Supplement. On July 29, 2024, the Debtors filed the Plan Supplement with the Court. The Plan Supplement (including as it may be subsequently altered, amended, modified, or supplemented from time to time), complies with the Bankruptcy Code and the terms of the Plan, and the Debtors provided good and proper notice of the filing in accordance with the Bankruptcy Code, the Bankruptcy Rules, the Bankruptcy Local Rules, and the facts and circumstances of these Chapter 11 Cases. The notice parties and Holders of Claims and Interests were provided due, adequate, and sufficient notice of the Plan Supplement. No other or further notice is or will be required with respect to the Plan Supplement. The Plan Supplement consists of the following documents: (a) the schedule of Retained Causes of Action; (b) the identity of the Liquidating Trustee; (c) the form of the Liquidating Trust Agreement; (d) the schedule of assumed Executory Contracts and Unexpired Leases; and (e) any additional documents Filed with the Court prior to the Effective Date as amendments to the Plan Supplement. All documents included in the Plan Supplement are integral to, part of, and incorporated by reference into the Plan. Subject to the terms of the Plan and this Confirmation Order, the Debtors shall have the right to alter, amend, modify, or supplement the Plan Supplement through the Effective Date. 9. Plan Modifications. Pursuant to section 1127 of the Bankruptcy Code, any modifications to the Plan, including those set forth in the amended Plan, filed on August 13, 2024, and any additional modifications to the Plan set forth in this Confirmation Order or in any Plan Case 24-12364-ABA Doc 614 Filed 08/19/24 Entered 08/19/24 14:14:13 Desc Main Document Page 9 of 134

(Page | 10) Debtors: BOWFLEX INC., et al. Case No. 24-12364 (ABA) Caption of Order: Findings of Fact, Conclusions of Law, and Order Confirming the First Amended Joint Chapter 11 of Liquidation of BowFlex Inc. and Its Debtor Affiliate filed prior to the entry of this Confirmation Order (collectively, the “Plan Modifications”) constitute technical or clarifying changes, changes with respect to particular Claims by agreement with Holders of such Claims, or modifications that do not otherwise materially and adversely affect or change the treatment of any other Claim or Interest under the Plan. These Plan Modifications are consistent with the disclosures previously made pursuant to the Disclosure Statement and Solicitation Packages served pursuant to the Scheduling Order, and notice of these Plan Modifications was adequate and appropriate under the facts and circumstances of these Chapter 11 Cases. 10. In accordance with Bankruptcy Rule 3019, the Plan Modifications do not require additional disclosure under section 1125 of the Bankruptcy Code or the re-solicitation of votes under section 1126 of the Bankruptcy Code, and they do not require that Holders of Claims or Interests be afforded an opportunity to change previously cast acceptances or rejections of the Plan. Accordingly, the Plan, as modified, is properly before this Court and all votes cast with respect to the Plan prior to such modification shall be binding and shall apply with respect to the Plan. 11. Objections Overruled. All parties have had a full and fair opportunity to litigate all issues raised or that might have been raised in the objections to Confirmation of the Plan, and the objections have been fully and fairly litigated or resolved, including, if applicable, by agreed- upon reservations of rights as set forth in this Confirmation Order. 12. Solicitation Order. On June 21, 2024, the Court entered the Solicitation Order, which, among other things, fixed July 30, 2024, at 4:00 p.m. (prevailing Eastern Time) as the Objection Deadline and the Voting Deadline, and fixed August 19, 2024, at 10:00 a.m. (prevailing Case 24-12364-ABA Doc 614 Filed 08/19/24 Entered 08/19/24 14:14:13 Desc Main Document Page 10 of 134

(Page | 11) Debtors: BOWFLEX INC., et al. Case No. 24-12364 (ABA) Caption of Order: Findings of Fact, Conclusions of Law, and Order Confirming the First Amended Joint Chapter 11 of Liquidation of BowFlex Inc. and Its Debtor Affiliate Eastern Time) as the date and time for the Confirmation Hearing. The Debtors’ use of the Disclosure Statement to solicit votes to accept or reject the Plan was authorized by the Solicitation Order. 13. Notice. As evidenced by the Voting Affidavit, the Debtors provided due, adequate, and sufficient notice of the commencement of these Chapter 11 Cases, the Disclosure Statement, the Plan, the Confirmation Hearing, and the opportunity to opt-out of the Third-Party Releases, together with all deadlines for voting to accept or reject the Plan, as well as objecting to the Disclosure Statement and the Plan, to the full creditor matrix and the Core/2002 list. Further, the Confirmation Notice was published in USA Today and The Seattle Times on June 28, 2024, in compliance with Bankruptcy Rule 2002(l), as evidenced by the Verification of Publication [Docket No. 529] and Verification of Publication [Docket No. 530], each dated July 17, 2024. Such notice was adequate and sufficient under the facts and circumstances of these Chapter 11 Cases in compliance with the Bankruptcy Code, the Bankruptcy Rules—including Bankruptcy Rules 2002 and 3017—the Bankruptcy Local Rules, and the Solicitation Order. No other or further notice is or shall be required. 14. Solicitation. The Debtors solicited votes for acceptance and rejection of the Plan in good faith, and the Solicitation Packages provided the opportunity for the voting creditors to opt out of the releases included in the Plan. Such solicitation complied with sections 1125, 1126, and all other applicable sections of the Bankruptcy Code, Bankruptcy Rules 3017, 3018, and 3019, the Solicitation Order, the Bankruptcy Local Rules, and all other applicable rules, laws, and regulations. The period during which Holders in the Voting Class were required to submit Case 24-12364-ABA Doc 614 Filed 08/19/24 Entered 08/19/24 14:14:13 Desc Main Document Page 11 of 134

(Page | 12) Debtors: BOWFLEX INC., et al. Case No. 24-12364 (ABA) Caption of Order: Findings of Fact, Conclusions of Law, and Order Confirming the First Amended Joint Chapter 11 of Liquidation of BowFlex Inc. and Its Debtor Affiliate acceptances or rejections to the Plan was reasonable and sufficient for such Holders to make an informed decision to accept or reject the Plan. 15. Service of Opt-Out Form. The process described in the Voting Affidavit that the Debtors and the Notice and Claims Agent followed to identify the relevant parties on which to serve and/or notice the applicable Ballot or Non-Voting Status Notice and Opt-Out Form: (a) is consistent with the industry standard; and (b) was reasonably calculated to ensure that each Holder of Claims and Interest in each Class was informed of its ability to opt-out of the Third-Party Releases and the consequences for failing to do so. For the avoidance of doubt, any party that elected in the Non-Voting Status Notice and Opt-Out Form to opt-out of the Third-Party Releases and timely submitted such election to the Notice and Claims Agent in accordance with the applicable Solicitation Packages prior to any deadline to submit a Ballot, whether under any original or extended deadline, shall be neither a Released Party nor a Releasing Party under the Plan. 16. Voting Affidavit. Prior to the Confirmation Hearing, the Debtors filed the Voting Affidavit. The Voting Affidavit was admitted into evidence during the Confirmation Hearing. As described in the Voting Affidavit, the solicitation of votes on the Plan complied with the Solicitation and Voting Procedures. Further, the votes to accept or reject the Plan have been solicited and tabulated fairly, in good faith, and in compliance with the Bankruptcy Code, the Bankruptcy Rules, the Bankruptcy Local Rules, the Disclosure Statement, and any applicable non-bankruptcy law. Case 24-12364-ABA Doc 614 Filed 08/19/24 Entered 08/19/24 14:14:13 Desc Main Document Page 12 of 134

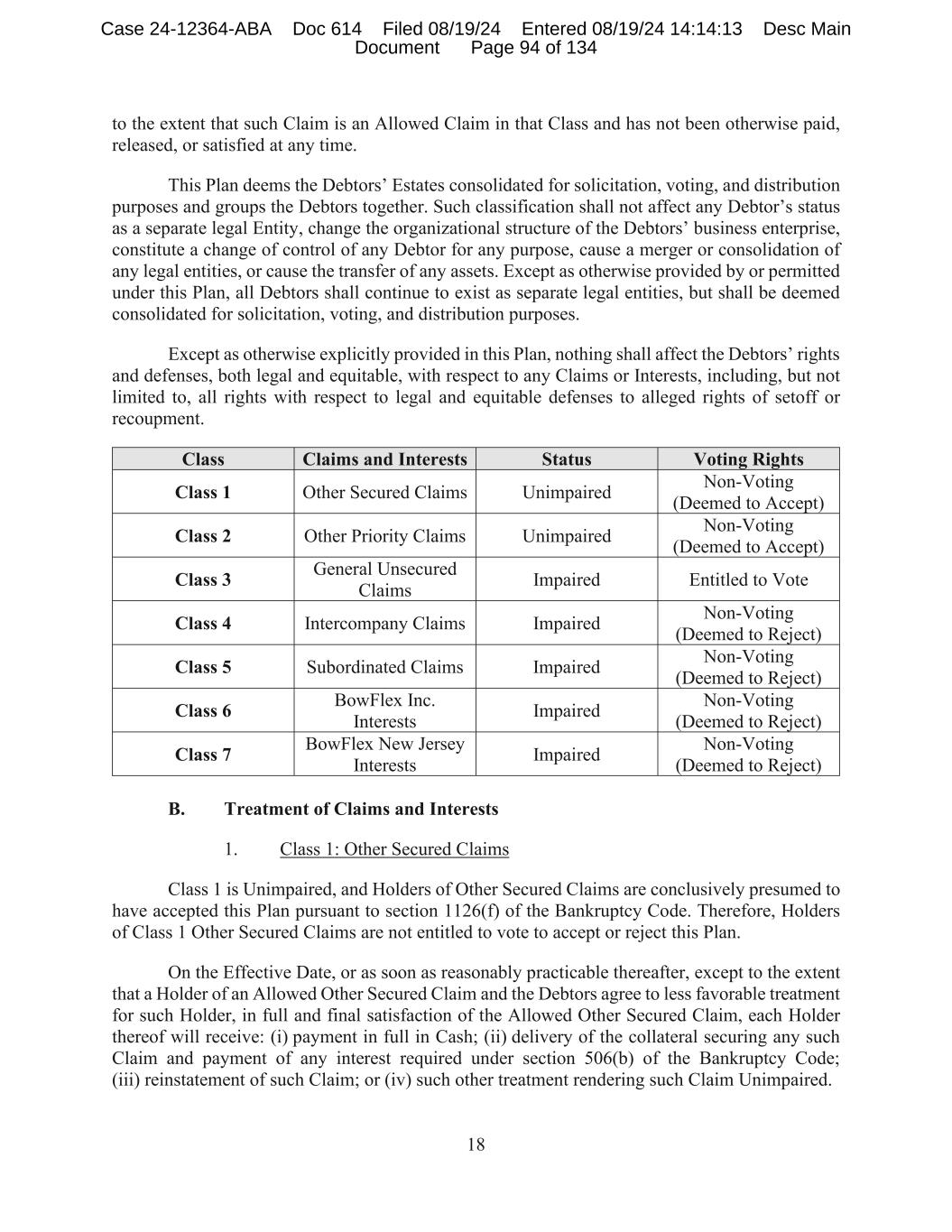

(Page | 13) Debtors: BOWFLEX INC., et al. Case No. 24-12364 (ABA) Caption of Order: Findings of Fact, Conclusions of Law, and Order Confirming the First Amended Joint Chapter 11 of Liquidation of BowFlex Inc. and Its Debtor Affiliate 17. As set forth in the Plan, Holders of Claims in Class 3 (the “Voting Class”) were eligible to vote on the Plan in accordance with the Solicitation and Voting Procedures. Holders of Claims in Classes 1 and 2 (collectively, the “Deemed Accepting Classes”) are Unimpaired and conclusively presumed to accept the Plan and, therefore, did not vote to accept or reject the Plan. Holders of Claims in Classes 4, 5, 6, and 7 (collectively, the “Deemed Rejecting Classes”) are Impaired and entitled to no recovery under the Plan and are, therefore, deemed to have rejected the Plan. 18. Based on the foregoing, and as evidenced by the Voting Affidavit, at least one Impaired Class of Claims (excluding the acceptance by any insiders of the Debtor) has voted to accept the Plan in accordance with the requirements of sections 1124 and 1126 of the Bankruptcy Code. 19. Bankruptcy Rule 3016. The Plan and all modifications thereto were dated and identified the entities submitting such modifications, thus satisfying Bankruptcy Rule 3016(a). The Debtors appropriately filed the Disclosure Statement and the Plan with the Court, thereby satisfying Bankruptcy Rule 3016(b). The injunction, release, and exculpation provisions in the Disclosure Statement and the Plan describe, in bold font and with specific and conspicuous language, all acts to be enjoined, released, and exculpated and identify the entities that will be subject to the injunction, releases, and exculpations, thereby satisfying Bankruptcy Rule 3016(c). 20. Burden of Proof. The Debtors, as proponents of the Plan, have met their burden of proving the applicable elements under sections 1129(a) and 1129(b) of the Bankruptcy Code by a preponderance of the evidence, which is the applicable standard for Confirmation. Each witness Case 24-12364-ABA Doc 614 Filed 08/19/24 Entered 08/19/24 14:14:13 Desc Main Document Page 13 of 134

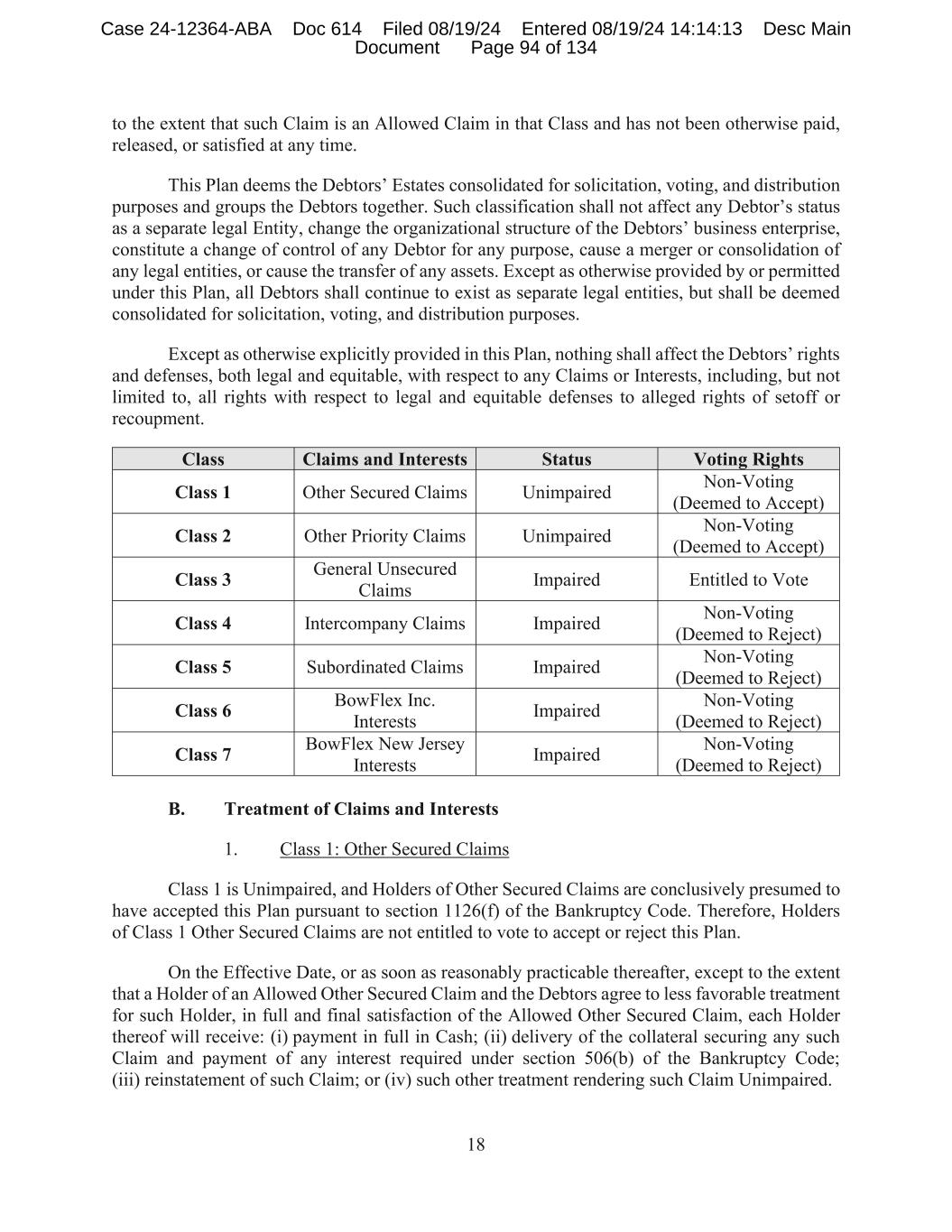

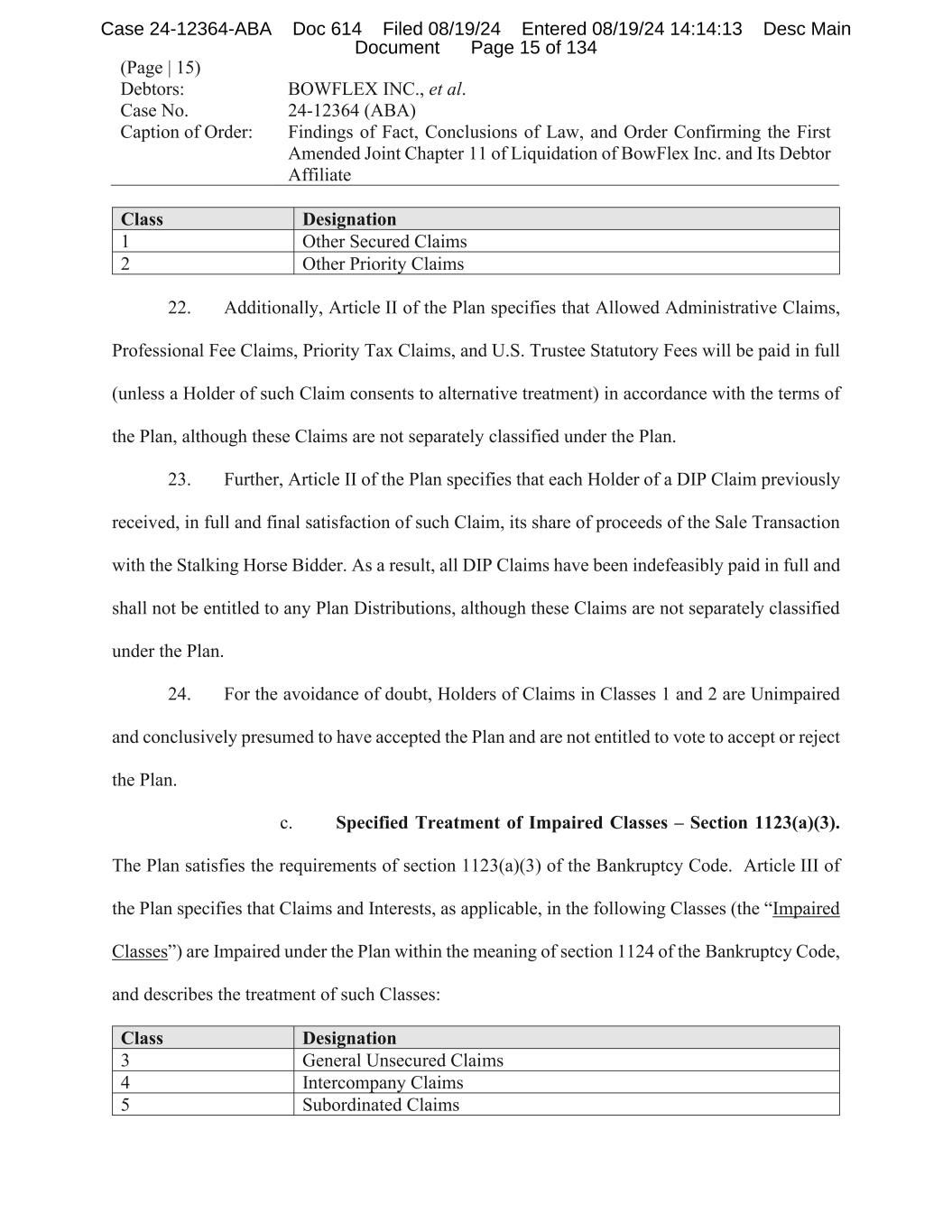

(Page | 14) Debtors: BOWFLEX INC., et al. Case No. 24-12364 (ABA) Caption of Order: Findings of Fact, Conclusions of Law, and Order Confirming the First Amended Joint Chapter 11 of Liquidation of BowFlex Inc. and Its Debtor Affiliate who testified on behalf of the Debtors in connection with confirmation of the Plan, including those who testified via written declaration, was credible, reliable, and qualified to testify as to the topics addressed in his or her testimony. In addition, and to the extent applicable, the Plan is confirmable under the clear and convincing evidentiary standard. 21. Compliance with Bankruptcy Code Requirements – Section 1129(a)(1). The Plan complies with all applicable provisions of the Bankruptcy Code, as required by section 1129(a)(1) of the Bankruptcy Code, including sections 1122 and 1123 thereof. Additionally, the Plan and all modifications thereto are dated and identify the entities submitting them, thereby satisfying Bankruptcy Rule 3016(a). a. Proper Classification – Sections 1122 and 1123. The Plan satisfies the requirements of sections 1122(a) and 1123(a)(1) of the Bankruptcy Code. Article III of the Plan provides for the separate classification of Claims and Interests into seven (7) Classes. Valid business, factual, and legal reasons exist for the separate classification of such Classes of Claims and Interests. The classifications were not implemented for any improper purpose and do not unfairly discriminate between, or among, Holders of Claims or Interests. Each Class of Claims and Interests contains only Claims or Interests that are substantially similar to the other Claims or Interests within that Class. b. Specified Unimpaired Classes – Section 1123(a)(2). The Plan satisfies the requirements of section 1123(a)(2) of the Bankruptcy Code. Article III of the Plan specifies that Claims in the following Classes (the “Unimpaired Classes”) are Unimpaired under the Plan within the meaning of section 1124 of the Bankruptcy Code. Case 24-12364-ABA Doc 614 Filed 08/19/24 Entered 08/19/24 14:14:13 Desc Main Document Page 14 of 134

(Page | 15) Debtors: BOWFLEX INC., et al. Case No. 24-12364 (ABA) Caption of Order: Findings of Fact, Conclusions of Law, and Order Confirming the First Amended Joint Chapter 11 of Liquidation of BowFlex Inc. and Its Debtor Affiliate Class Designation 1 Other Secured Claims 2 Other Priority Claims 22. Additionally, Article II of the Plan specifies that Allowed Administrative Claims, Professional Fee Claims, Priority Tax Claims, and U.S. Trustee Statutory Fees will be paid in full (unless a Holder of such Claim consents to alternative treatment) in accordance with the terms of the Plan, although these Claims are not separately classified under the Plan. 23. Further, Article II of the Plan specifies that each Holder of a DIP Claim previously received, in full and final satisfaction of such Claim, its share of proceeds of the Sale Transaction with the Stalking Horse Bidder. As a result, all DIP Claims have been indefeasibly paid in full and shall not be entitled to any Plan Distributions, although these Claims are not separately classified under the Plan. 24. For the avoidance of doubt, Holders of Claims in Classes 1 and 2 are Unimpaired and conclusively presumed to have accepted the Plan and are not entitled to vote to accept or reject the Plan. c. Specified Treatment of Impaired Classes – Section 1123(a)(3). The Plan satisfies the requirements of section 1123(a)(3) of the Bankruptcy Code. Article III of the Plan specifies that Claims and Interests, as applicable, in the following Classes (the “Impaired Classes”) are Impaired under the Plan within the meaning of section 1124 of the Bankruptcy Code, and describes the treatment of such Classes: Class Designation 3 General Unsecured Claims 4 Intercompany Claims 5 Subordinated Claims Case 24-12364-ABA Doc 614 Filed 08/19/24 Entered 08/19/24 14:14:13 Desc Main Document Page 15 of 134

(Page | 16) Debtors: BOWFLEX INC., et al. Case No. 24-12364 (ABA) Caption of Order: Findings of Fact, Conclusions of Law, and Order Confirming the First Amended Joint Chapter 11 of Liquidation of BowFlex Inc. and Its Debtor Affiliate 6 BowFlex Inc. Interests 7 BowFlex New Jersey Interests 25. For the avoidance of doubt, at the time of solicitation, Holders of Claims in Classes 4, 5, 6, and 7 were Impaired and deemed to reject the Plan. Accordingly, such Holders were not entitled to vote to accept or reject the Plan. d. No Discrimination – Section 1123(a)(4). The Plan satisfies the requirements of section 1123(a)(4) of the Bankruptcy Code. The Plan provides for the same treatment by the Debtors for each Claim or Interest in each respective Class unless the Holder of a particular Claim or Interest has agreed to a less favorable treatment of such Claim or Interest. e. Adequate Means for Plan Implementation – Section 1123(a)(5). The Plan satisfies the requirements of section 1123(a)(5) of the Bankruptcy Code. The provisions in Article IV and elsewhere in the Plan provide in detail adequate and proper means for the Plan’s implementation, including, but not limited to: (a) Post-Effective Date Transactions, including the De Minimis Sale Transactions, the Wind-Down, and the Liquidating Trust; (b) the sources of consideration for Plan Distributions; (c) the vesting of Liquidating Trust Assets in the Liquidating Trust; (d) the preservation of and vesting in the Liquidating Trust of certain Retained Causes of Action; and (e) the authorization for the Debtors and/or Liquidating Trust, as applicable, to take all actions contemplated under or necessary, advisable, or appropriate to implement or effectuate the Plan. f. Non-Voting Equity Securities – Section 1123(a)(6). The Plan satisfies the requirements of section 1123(a)(6) of the Bankruptcy Code. The Plan does not provide for the issuance of equity or other securities of the Debtors, including non-voting equity securities. Case 24-12364-ABA Doc 614 Filed 08/19/24 Entered 08/19/24 14:14:13 Desc Main Document Page 16 of 134

(Page | 17) Debtors: BOWFLEX INC., et al. Case No. 24-12364 (ABA) Caption of Order: Findings of Fact, Conclusions of Law, and Order Confirming the First Amended Joint Chapter 11 of Liquidation of BowFlex Inc. and Its Debtor Affiliate g. Directors and Officers – Section 1123(a)(7). The Plan satisfies the requirements of section 1123(a)(7) of the Bankruptcy Code. In accordance with Section IV.F of the Plan, as of the Effective Date, the existing directors and officers of the Debtors shall be deemed to have resigned and the employees or officers of the Debtors terminated without any further action required. From and after the Effective Date, the Liquidating Trust or the Liquidating Trustee, as applicable, shall be authorized to act on behalf of the Estates, provided that neither the Liquidating Trust nor the Liquidating Trustee shall have duties other than as expressly set forth in the Plan, the Liquidating Trust Agreement, or this Confirmation Order, as applicable. The identity of the Liquidating Trustee is disclosed in the Plan Supplement. The creation of the Liquidating Trust is consistent with the interests of creditors and with public policy. h. Debtors Are Not Individuals – Sections 1123(a)(8) and 1123(c). The Debtors are not individuals. Accordingly, the requirements of sections 1123(a)(8) and 1123(c) of the Bankruptcy Code are inapplicable. 26. Discretionary Contents of the Plan – Section 1123(b). The Plan’s discretionary provisions comply with section 1123(b) of the Bankruptcy Code and are not inconsistent with the applicable provisions of the Bankruptcy Code. Thus, the Plan satisfies section 1123(b) of the Bankruptcy Code. a. Impairment/Unimpairment of Classes – Section 1123(b)(1). The Plan is consistent with section 1123(b)(1) of the Bankruptcy Code. Article III of the Plan leaves each Class of Claims and Interests Impaired or Unimpaired. Case 24-12364-ABA Doc 614 Filed 08/19/24 Entered 08/19/24 14:14:13 Desc Main Document Page 17 of 134

(Page | 18) Debtors: BOWFLEX INC., et al. Case No. 24-12364 (ABA) Caption of Order: Findings of Fact, Conclusions of Law, and Order Confirming the First Amended Joint Chapter 11 of Liquidation of BowFlex Inc. and Its Debtor Affiliate b. Treatment of Executory Contracts and Unexpired Leases – Section 1123(b)2). The Plan is consistent with section 1123(b)(2) of the Bankruptcy Code. Article V of the Plan provides for the automatic rejection of the Debtors’ Executory Contracts and Unexpired Leases that were not previously rejected, assumed, or assumed and assigned pursuant to an order of the Court nor assumed under the Plan according to the Plan Supplement. The Debtors’ determinations regarding the assumption and rejection of Executory Contracts and Unexpired Leases are based on and within the sound business judgment of the Debtors, are necessary to the implementation of the Plan, and are in the best interests of the Debtors, their Estates, Holders of Claims, and other parties in interest in these Chapter 11 Cases. c. Settlement, Release, Exculpation, Injunction, and Preservation of Claims and Causes of Action – Section 1123(b)(3). To the greatest extent permissible under the Bankruptcy Code and the Bankruptcy Rules, and in consideration for the classification, distributions, releases, and other benefits provided under the Plan, upon the Effective Date, the provisions of the Plan shall constitute a good-faith compromise and settlement of all Claims, Interests, Causes of Action, and other controversies released, settled, compromised, satisfied, or otherwise resolved pursuant to the Plan. The Plan shall be deemed a motion to approve the good- faith compromise and settlement of all such Claims, Interests, Causes of Action, and other controversies, and the entry of this Confirmation Order shall constitute the Court’s approval of such compromise and settlement, as well as a finding by the Court that such settlement and compromise is fair, equitable, reasonable, and in the best interests of the Debtors, their Estates, Case 24-12364-ABA Doc 614 Filed 08/19/24 Entered 08/19/24 14:14:13 Desc Main Document Page 18 of 134

(Page | 19) Debtors: BOWFLEX INC., et al. Case No. 24-12364 (ABA) Caption of Order: Findings of Fact, Conclusions of Law, and Order Confirming the First Amended Joint Chapter 11 of Liquidation of BowFlex Inc. and Its Debtor Affiliate and Holders of Claims and Interests. Subject to Article VI of the Plan, all Plan Distributions made to Holders of Allowed Claims in any Class are intended to be and shall be final. 27. In accordance with section 1123(b) of the Bankruptcy Code, the Liquidating Trust, acting by and through the Liquidating Trustee, is the representative of the Debtors’ estates and shall hold and may enforce all rights to commence and pursue, as appropriate, any and all Retained Causes of Action, whether arising before or after the Petition Date, and the Liquidating Trust’s rights to commence, prosecute, or settle such Retained Causes of Action shall be preserved notwithstanding the occurrence of the Effective Date, other than the Causes of Action released by the Debtors pursuant to the releases and exculpations contained in the Plan, including in Article IX thereof, which shall be deemed released and waived by the Debtors as of the Effective Date. No Entity (other than the Released Parties) may rely on the absence of a specific reference in the Plan or the Plan Supplement to any Cause of Action against it as any indication that the Liquidating Trust will not pursue any and all available Retained Causes of Action against it. 28. The release and discharge of mortgages, deeds of trust, Liens, pledges, or other security interest against any property of the Estates, as described in Section IX.E. of the Plan (the “Lien Release”) is necessary to implement the Plan. The provisions of the Lien Release are appropriate, fair, equitable, reasonable, and in the best interests of the Debtors, the Estates, and Holders of Claim and Interests. 29. The releases, injunctions, and exculpations set forth in the Plan, as implemented by this Confirmation Order, are fair, equitable, reasonable, and in the best interests of the Debtors, their Estates, and all Holders of Claims or Interests. The record at the Confirmation Hearing and Case 24-12364-ABA Doc 614 Filed 08/19/24 Entered 08/19/24 14:14:13 Desc Main Document Page 19 of 134

(Page | 20) Debtors: BOWFLEX INC., et al. Case No. 24-12364 (ABA) Caption of Order: Findings of Fact, Conclusions of Law, and Order Confirming the First Amended Joint Chapter 11 of Liquidation of BowFlex Inc. and Its Debtor Affiliate in these Chapter 11 Cases is sufficient to support the releases, injunctions, and exculpations provided for in Article IX of the Plan. Accordingly, the Plan is consistent with section 1123(b)(3) of the Bankruptcy Code. i. Debtors’ Releases. The releases of Claims and Causes of Action by the Debtors, as described in Section IX.A of the Plan in accordance with section 1123(b) of the Bankruptcy Code (the “Debtors’ Releases”), represent a valid exercise of the Debtors’ business judgment. The Debtors’ Releases are integral to the Plan and are fair, reasonable, and in the best interests of the Debtors, the Estates, and Holders of Claims and Interests. Also, the Debtors’ Releases are: (a) in exchange for good and valuable consideration provided by the Released Parties; (b) a good-faith settlement and compromise of the Claims released in Section IX.A of the Plan; (c) given, and made, after due notice and opportunity for a hearing; and (d) a bar to the Debtors asserting a Claim or Cause of Action released by Section IX.A of the Plan. The scope of the Debtors’ Releases is appropriately tailored under the facts and circumstances of these Chapter 11 Cases. Moreover, the Debtors’ Releases are appropriate in light of, among other things, the value provided by the Released Parties to the Debtors’ Estates and the critical nature of the Debtors’ Releases to the Plan. The Debtors’ Releases appropriately offer protection to parties that participated in the Debtors’ restructuring process. Each of the Released Parties made significant concessions and contributions to these Chapter 11 Cases. The Debtors’ Releases for the Debtors’ current directors and officers are appropriate because the Debtors’ directors and officers share an identity of interest with the Debtors, supported the Plan and these Chapter 11 Cases, actively participated in meetings and negotiations during these Chapter 11 Cases, and have Case 24-12364-ABA Doc 614 Filed 08/19/24 Entered 08/19/24 14:14:13 Desc Main Document Page 20 of 134

(Page | 21) Debtors: BOWFLEX INC., et al. Case No. 24-12364 (ABA) Caption of Order: Findings of Fact, Conclusions of Law, and Order Confirming the First Amended Joint Chapter 11 of Liquidation of BowFlex Inc. and Its Debtor Affiliate provided other valuable consideration to the Debtors to facilitate the negotiation and consummation of the transactions contemplated by the Plan. ii. Third-Party Releases. The release of Claims and Causes of Action by the Releasing Parties, as described in Section IX.B of the Plan (the “Third-Party Releases”), was consensually provided after due notice and an opportunity for a hearing and is an essential provision of the Plan. The Third-Party Releases were negotiated as a result of extensive arms’-length and good faith negotiations among parties. They provide finality for the Debtors, their Estates, the Liquidating Trust, and the other Released Parties regarding the parties’ respective obligations under the Plan and the transactions contemplated therein. The Third-Party Releases were instrumental in developing a Plan that maximized value for all of the Debtors’ stakeholders. As such, the Third-Party Releases appropriately offer certain protections to parties who constructively participated in the Debtors’ chapter 11 process by, among other things, supporting the Plan. Notice of the Third-Party Releases was provided to all Holders of Claims and Interests and such notice was adequate and appropriate under the facts and circumstances of these Chapter 11 Cases. The Third-Party Releases provide appropriate and specific disclosure with respect to the Claims and Causes of Action that are subject to the Third-Party Releases, and no other disclosure or notice is necessary. The Third-Party Releases are: (i) in exchange for the good and valuable consideration provided by the Released Parties; (ii) a good faith settlement and compromise of the Claims released by the Third-Party Releases; (iii) in the best interests of the Debtors and all Holders of Claims and Interests; (iv) fair, equitable, and reasonable; (v) given and made after due notice and opportunity for hearing; (vi) a bar to any of the Releasing Parties’ Case 24-12364-ABA Doc 614 Filed 08/19/24 Entered 08/19/24 14:14:13 Desc Main Document Page 21 of 134

(Page | 22) Debtors: BOWFLEX INC., et al. Case No. 24-12364 (ABA) Caption of Order: Findings of Fact, Conclusions of Law, and Order Confirming the First Amended Joint Chapter 11 of Liquidation of BowFlex Inc. and Its Debtor Affiliate asserting any Claim or Cause of Action released pursuant to the Third-Party Releases; (vii) specific in language and scope; and (viii) consistent with sections 105, 524, 1123, 1129 and 1141 and other applicable provisions of the Bankruptcy Code. Therefore, the Third-Party Releases are reasonable, appropriate, and consistent with the provisions of the Bankruptcy Code and applicable law. iii. Exculpation. The exculpation provision described in Section IX.C of the Plan (the “Exculpation”) is necessary and appropriate to the Plan. The Exculpation is narrowly tailored to protect estate fiduciaries from inappropriate litigation and to exclude actions found to have constituted actual fraud, willful misconduct, or gross negligence. The Exculpated Parties subject to the Exculpation have, and upon entry of this Confirmation Order, will be deemed to have participated in good faith and in compliance with all applicable laws with regard to the negotiation and implementation of, among others, these Chapter 11 Cases, the Disclosure Statement, the Plan, the DIP Loan Documents, or the Sale Transaction, including any contract, instrument, release or other agreement or document (including providing any legal opinion requested by any Entity regarding any transaction, contract, instrument, document, or other agreement contemplated by the Plan or the reliance by any Exculpated Party on the Plan or this Confirmation Order in lieu of such legal opinion) created or entered into in connection with the Disclosure Statement or the Plan, the DIP Loan Documents, the Sale Transaction, the filing of the Chapter 11 Cases, the pursuit of confirmation, the administration and implementation of the Plan, or the distribution of property under the Plan or any other related agreement, except for claims related to any act or omission that is determined in a Final Order of a court of competent jurisdiction to have constituted actual fraud, willful misconduct, or gross negligence but in all Case 24-12364-ABA Doc 614 Filed 08/19/24 Entered 08/19/24 14:14:13 Desc Main Document Page 22 of 134

(Page | 23) Debtors: BOWFLEX INC., et al. Case No. 24-12364 (ABA) Caption of Order: Findings of Fact, Conclusions of Law, and Order Confirming the First Amended Joint Chapter 11 of Liquidation of BowFlex Inc. and Its Debtor Affiliate respects such Entities shall be entitled to reasonably rely upon the advice of counsel with respect to their duties and responsibilities pursuant to the Plan. The Exculpation, including its carve-out for actual fraud, gross negligence, or willful misconduct, is consistent with established practice in this jurisdiction and others. iv. Injunction. The injunction provision set forth in Section IX.D of the Plan is essential to the Plan and necessary to preserve and enforce the Debtors’ Releases, the Third-Party Releases, and the Exculpation, each as set forth in the Plan. v. Gatekeeper Provision. Section IX.G of the Plan contains a provision (the “Gatekeeper Provision”) that states no party may commence, continue, amend, or otherwise pursue, join in, or otherwise support any other party commencing, continuing, amending, or pursuing, a Cause of Action of any kind against the Debtors, the Liquidating Trust, the Exculpated Parties, or the Released Parties, and, in each case, each of their Related Parties without first: (1) requesting a determination from the Court, after notice and a hearing, that such Cause of Action represents a colorable claim against a Debtor, Liquidating Trust, Exculpated Party, or Released Party and is not a Claim that the Debtors released under the Plan, which request must attach the complaint or petition proposed to be filed by the requesting party and (2) obtaining from the Court specific authorization for such party to bring such Cause of Action against any such Debtor, Liquidating Trust, Exculpated Party, or Released Party. For the avoidance of doubt, any party that obtains such determination and authorization and subsequently wishes to amend the authorized complaint or petition to add any Causes of Action not explicitly included in the authorized complaint or petition must obtain authorization from the Court before filing any such Case 24-12364-ABA Doc 614 Filed 08/19/24 Entered 08/19/24 14:14:13 Desc Main Document Page 23 of 134

(Page | 24) Debtors: BOWFLEX INC., et al. Case No. 24-12364 (ABA) Caption of Order: Findings of Fact, Conclusions of Law, and Order Confirming the First Amended Joint Chapter 11 of Liquidation of BowFlex Inc. and Its Debtor Affiliate amendment in the court where such complaint or petition is pending. The Court will have sole and exclusive jurisdiction to determine whether a Cause of Action is colorable and, only to the extent legally permissible, will have jurisdiction to adjudicate the underlying colorable Cause of Action; provided, however, that nothing in Section IX.G of the Plan requires, precludes, and/or prohibits an Insurer from administering, handling, defending, settling, and/or paying claims covered by any Insurance Policies in accordance with and subject to the terms and conditions of such Insurance Policies and/or applicable non-bankruptcy law. The Court finds that the Gatekeeper Provision is material, necessary, appropriate, and critical to the effective and efficient administration, implementation, and consummation of the Plan. d. Treatment of Rights of Holders of Claims – Section 1123(b)(5). The Plan is consistent with section 1123(b)(5) of the Bankruptcy Code. Article III of the Plan modifies or leaves unaffected, as is applicable, the rights of certain Holders of Claims, as permitted by section 1123(b)(5) of the Bankruptcy Code. e. Additional Plan Provisions – Section 1123(b)(6). The other discretionary provisions in the Plan are appropriate and consistent with the applicable provisions of the Bankruptcy Code, thereby satisfying section 1123(b)(6) of the Bankruptcy Code. 30. Compliance with the Bankruptcy Code Requirements – Section 1129(a)(2). The Debtors complied with the applicable provisions of the Bankruptcy Code, except as otherwise provided or permitted by orders of the Court, and thus, satisfied the requirements of section 1129(a)(2) of the Bankruptcy Code. Specifically, each Debtor: Case 24-12364-ABA Doc 614 Filed 08/19/24 Entered 08/19/24 14:14:13 Desc Main Document Page 24 of 134

(Page | 25) Debtors: BOWFLEX INC., et al. Case No. 24-12364 (ABA) Caption of Order: Findings of Fact, Conclusions of Law, and Order Confirming the First Amended Joint Chapter 11 of Liquidation of BowFlex Inc. and Its Debtor Affiliate a. is an eligible debtor under section 109 of the Bankruptcy Code and a proper proponent of the Plan under section 1121(a) of the Bankruptcy Code; b. has complied with applicable provisions of the Bankruptcy Code, except as otherwise provided or permitted by orders of the Court; and c. complied with the applicable provisions of the Bankruptcy Code, including sections 1125 and 1126, the Bankruptcy Rules, the Bankruptcy Local Rules, any applicable non-bankruptcy law, rule and regulation, the Solicitation Order, and all other applicable law, in transmitting the Solicitation Packages and the Non-Voting Status Notice and Opt-Out Forms, and related documents and notices, and in soliciting and tabulating the votes on the Plan. 31. Good Faith – Section 1129(a)(3). The Plan satisfies the requirements of section 1129(a)(3) of the Bankruptcy Code. The Debtors proposed the Plan in good faith and not by any means forbidden by law. In so determining, the Court has examined the totality of the circumstances surrounding the filing and effectuation of the Chapter 11 Cases, the Plan, the Sale Transaction, and the process leading to confirmation, including the support of Holders of Claims and Interests for the Plan, and the transactions to be implemented pursuant thereto. These Chapter 11 Cases were filed, and the Plan was proposed, with the legitimate purpose of allowing the Debtors to implement the Post-Effective Date Transactions for the maximum benefit of all parties in interest and to maximize the value of the Estates and the recoveries to Holders of Claims and Interests. 32. Payment for Services and for Costs and Expenses – Section 1129(a)(4). The procedures set forth in the Plan for the Court’s review and ultimate determination of the fees and Case 24-12364-ABA Doc 614 Filed 08/19/24 Entered 08/19/24 14:14:13 Desc Main Document Page 25 of 134

(Page | 26) Debtors: BOWFLEX INC., et al. Case No. 24-12364 (ABA) Caption of Order: Findings of Fact, Conclusions of Law, and Order Confirming the First Amended Joint Chapter 11 of Liquidation of BowFlex Inc. and Its Debtor Affiliate expenses to be paid by the Debtors in connection with these Chapter 11 Cases, or in connection with the Plan and incident to these Chapter 11 Cases, satisfy the objectives of, and are in compliance with, section 1129(a)(4) of the Bankruptcy Code. 33. Directors, Officers, and Insiders – Section 1129(a)(5). Because the Plan provides for the dissolution of the existing board of directors of the Debtors and that any remaining directors or officers of the Debtors shall be dismissed, section 1129(a)(5) of the Bankruptcy Code does not apply to the Debtors. To the extent section 1129(a)(5) applies to the Liquidating Trust, it has satisfied the requirements of this provision by, among other things, disclosing the identity of the Liquidating Trustee. 34. No Rate Change – Section 1129(a)(6). Section 1129(a)(6) of the Bankruptcy Code is not applicable to these Chapter 11 Cases. The Plan proposes no rate change subject to the jurisdiction of any governmental regulatory commission. 35. Best Interest of Creditors – Section 1129(a)(7). The Plan satisfies the requirements of section 1129(a)(7) of the Bankruptcy Code. The Liquidation Analysis included in the Disclosure Statement, and any other evidence related thereto in support of the Plan that was proffered or adduced in the Declarations in Support or at, prior to, or in connection with the Confirmation Hearing: (a) are reasonable, persuasive, credible, and accurate as of the dates such analysis or evidence was prepared, presented, or proffered; (b) utilize reasonable and appropriate methodologies and assumptions; (c) have not been controverted by other evidence; and (d) establish that Holders of Allowed Claims and Interests in each Class will recover more under the Plan on account of such Claim or Interest, as of the Effective Date, than such Holder would Case 24-12364-ABA Doc 614 Filed 08/19/24 Entered 08/19/24 14:14:13 Desc Main Document Page 26 of 134

(Page | 27) Debtors: BOWFLEX INC., et al. Case No. 24-12364 (ABA) Caption of Order: Findings of Fact, Conclusions of Law, and Order Confirming the First Amended Joint Chapter 11 of Liquidation of BowFlex Inc. and Its Debtor Affiliate receive if the Debtors were liquidated, on the Effective Date, under chapter 7 of the Bankruptcy Code. 36. Acceptance by Certain Classes – Section 1129(a)(8). Classes 1 and 2 are Unimpaired under the Plan and are deemed to have accepted the Plan pursuant to section 1126(f) of the Bankruptcy Code. Class 3 is Impaired under the Plan and has voted to accept the Plan pursuant to section 1126(c) of the Bankruptcy Code. Nevertheless, because the Plan has not been accepted by the Deemed Rejecting Classes, the Debtors seek confirmation under section 1129(b), solely with respect to the Deemed Rejecting Classes, rather than section 1129(a)(8) of the Bankruptcy Code. Although section 1129(a)(8) has not been satisfied with respect to the Deemed Rejecting Classes, the Plan is confirmable because the Plan does not discriminate unfairly and is fair and equitable with respect to the Deemed Rejecting Classes and thus satisfies section 1129(b) of the Bankruptcy Code with respect to such Classes as described further below. As a result, the requirements of section 1129(b) of the Bankruptcy Code are satisfied. 37. Treatment of Claims Entitled to Priority Under Section 507(a) – Section 1129(a)(9). The Plan satisfies the requirements of section 1129(a)(9) of the Bankruptcy Code. The treatment of Allowed Administrative Claims, DIP Claims, Professional Fee Claims, and Priority Tax Claims under Article II of the Plan and of Other Priority Claims under Article III of the Plan satisfies the requirements of, and complies in all respects with the treatment required by section 1129(a)(9) of the Bankruptcy Code for each of the various claims specified in sections 507(a)(1)–(8) of the Bankruptcy Code. Case 24-12364-ABA Doc 614 Filed 08/19/24 Entered 08/19/24 14:14:13 Desc Main Document Page 27 of 134

(Page | 28) Debtors: BOWFLEX INC., et al. Case No. 24-12364 (ABA) Caption of Order: Findings of Fact, Conclusions of Law, and Order Confirming the First Amended Joint Chapter 11 of Liquidation of BowFlex Inc. and Its Debtor Affiliate 38. Acceptance by at Least One Impaired Class – Section 1129(a)(10). The Plan satisfies the requirements of section 1129(a)(10) of the Bankruptcy Code. As evidenced in the Voting Affidavit, Class 3 voted to accept the Plan by the requisite numbers and amounts of Claims specified under section 1126(c) of the Bankruptcy Code, determined without including any acceptance of the Plan by any insider (as that term is defined in section 101(31) of the Bankruptcy Code). 39. Feasibility – Section 1129(a)(11). The Plan satisfies section 1129(a)(11) of the Bankruptcy Code. The evidence supporting the Plan proffered or adduced by the Debtors at or before the Confirmation Hearing: (a) is reasonable, persuasive, credible, and accurate as of the dates such evidence was prepared, presented, or proffered; (b) has not been controverted by other persuasive evidence; (c) establishes that the Plan is feasible and confirmation of the Plan is not likely to be followed by liquidation or the need for further financial reorganization; (d) establishes that the Plan may be implemented and has a reasonable likelihood of success; (e) establishes that the Debtors or the Liquidating Trust, as applicable, will have sufficient funds available to meet their obligations under the Plan; and (f) establishes that the Liquidating Trust will have the financial wherewithal to satisfy its obligations following the Effective Date. 40. Payment of Statutory Fees – Section 1129(a)(12). The Plan satisfies the requirements of section 1129(a)(12) of the Bankruptcy Code. Section II.E of the Plan provides for the payment of all fees and charges assessed against the Estates under 28 U.S.C. § 1930. 41. Continuation of Employee Benefits – Section 1129(a)(13). The Debtors do not have any obligation to pay retiree benefits (as defined in section 1114 of the Bankruptcy Code). Case 24-12364-ABA Doc 614 Filed 08/19/24 Entered 08/19/24 14:14:13 Desc Main Document Page 28 of 134

(Page | 29) Debtors: BOWFLEX INC., et al. Case No. 24-12364 (ABA) Caption of Order: Findings of Fact, Conclusions of Law, and Order Confirming the First Amended Joint Chapter 11 of Liquidation of BowFlex Inc. and Its Debtor Affiliate Therefore, section 1129(a)(13) of the Bankruptcy Code is inapplicable to these Chapter 11 Cases or the Plan. 42. Non-Applicability of Certain Sections – Sections 1129(a)(14)–(16). Sections 1129(a)(14), 1129(a)(15), and 1129(a)(16) of the Bankruptcy Code do not apply to these Chapter 11 Cases. The Debtors owe no domestic support obligations, are not individuals, and are not nonprofit corporations. 43. Cram-Down Requirements – Section 1129(b). The Plan satisfies the requirements of section 1129(b) of the Bankruptcy Code. Notwithstanding the fact that the Deemed Rejecting Classes have not accepted the Plan, the Plan may be confirmed pursuant to section 1129(b)(1) of the Bankruptcy Code. First, all of the requirements of section 1129(a) of the Bankruptcy Code other than section 1129(a)(8) have been met. Second, the Plan is fair and equitable with respect to the Deemed Rejecting Classes. The Plan has been proposed in good faith, is reasonable and meets the requirements that no Holder of any Claim or Interest that is junior to each such Class will receive or retain any property under the Plan on account of such junior Claim or Interest, and no Holder of a Claim or Interest in a Class senior to such Classes is receiving more than payment in full on account of its Claim or Interest. Accordingly, the Plan is fair and equitable towards all Holders of Claims and Interests in the Deemed Rejecting Classes. Third, the Plan does not discriminate unfairly with respect to the Deemed Rejecting Classes because similarly situated Claim and Interest Holders will receive substantially similar treatment on account of their Claims or Interests, as applicable, in such class. Therefore, the Plan may be confirmed despite the fact that not all Impaired Classes have voted to accept the Plan. Case 24-12364-ABA Doc 614 Filed 08/19/24 Entered 08/19/24 14:14:13 Desc Main Document Page 29 of 134

(Page | 30) Debtors: BOWFLEX INC., et al. Case No. 24-12364 (ABA) Caption of Order: Findings of Fact, Conclusions of Law, and Order Confirming the First Amended Joint Chapter 11 of Liquidation of BowFlex Inc. and Its Debtor Affiliate 44. Only One Plan – Section 1129(c). The Plan satisfies the requirements of section 1129(c) of the Bankruptcy Code. The Plan is the only chapter 11 plan filed in these Chapter 11 Cases. 45. Principal Purpose of the Plan – Section 1129(d). The Plan satisfies the requirements of section 1129(d) of the Bankruptcy Code. The principal purpose of the Plan is not the avoidance of taxes or the avoidance of the application of section 5 of the Securities Act. 46. No Small Business Cases – Section 1129(e). The Chapter 11 Cases are not small business cases and, accordingly, section 1129(e) of the Bankruptcy Code does not apply. 47. Good Faith Solicitation – Section 1125(e). The Debtors acted in “good faith” within the meaning of section 1125(e) of the Bankruptcy Code and in compliance with the applicable provisions of the Bankruptcy Code and the Bankruptcy Rules in connection with all of their activities relating to support and consummation of the Plan, including the solicitation and receipt of acceptances of the Plan, and they are entitled to the protections afforded by section 1125(e) of the Bankruptcy Code. 48. Disclosure of All Material Facts. The Debtors disclosed all material facts regarding the Disclosure Statement, the Plan, the Plan Supplement, and the adoption, execution, and implementation of the other matters provided for under the Plan involving corporate action to be taken by or required of the Debtors or the Liquidating Trust, as applicable. 49. Likelihood of Satisfaction of Conditions Precedent to the Effective Date. Each of the conditions precedent to the Effective Date, as set forth in Section VIII.A of the Plan, has Case 24-12364-ABA Doc 614 Filed 08/19/24 Entered 08/19/24 14:14:13 Desc Main Document Page 30 of 134

(Page | 31) Debtors: BOWFLEX INC., et al. Case No. 24-12364 (ABA) Caption of Order: Findings of Fact, Conclusions of Law, and Order Confirming the First Amended Joint Chapter 11 of Liquidation of BowFlex Inc. and Its Debtor Affiliate been or is reasonably likely to be satisfied or, as applicable, waived in accordance with Section VIII.C of the Plan. 50. Implementation. All documents and agreements necessary to implement the transactions contemplated by the Plan, including those contained or summarized in the Plan Supplement, and all other relevant and necessary documents have been negotiated in good faith and at arms’ length, are in the best interests of the Debtors and their Estates, and shall, upon completion of documentation and execution, be valid, binding, and enforceable agreements and shall not be in conflict with any federal, state, or local law. The Debtors and the Liquidating Trust are authorized to take any action reasonably necessary, advisable, or appropriate to consummate such agreements and the transactions contemplated thereby. 51. Treatment of Executory Contracts and Unexpired Leases. Pursuant to sections 365 and 1123(b)(2) of the Bankruptcy Code, the Plan provides for the assumption, assumption and assignment, or rejection of certain Executory Contracts and Unexpired Leases, effective as of the Effective Date, except as otherwise provided therein or in a prior or pending notice, motion, and/or order. The Debtors’ determinations regarding the assumption, assumption and assignment, or rejection of Executory Contracts and Unexpired Leases are based on and within the sound business judgment of the Debtors, are necessary to the implementation of the Plan, and are in the best interests of the Debtors, their Estates, Holders of Claims and Interests, and other parties in interest in the Chapter 11 Cases. Case 24-12364-ABA Doc 614 Filed 08/19/24 Entered 08/19/24 14:14:13 Desc Main Document Page 31 of 134

(Page | 32) Debtors: BOWFLEX INC., et al. Case No. 24-12364 (ABA) Caption of Order: Findings of Fact, Conclusions of Law, and Order Confirming the First Amended Joint Chapter 11 of Liquidation of BowFlex Inc. and Its Debtor Affiliate 52. Satisfaction of Confirmation Requirements. Based on the foregoing, the Declarations in Support, and all other pleadings and evidence proffered or adduced at or prior to the Combined Hearing, the Plan satisfies the requirements of section 1129 of the Bankruptcy Code. ORDER BASED ON THE FOREGOING FINDINGS OF FACT AND CONCLUSIONS OF LAW, IT IS ORDERED, ADJUDGED, DECREED, AND DETERMINED THAT: 53. Findings of Fact and Conclusions of Law. The above-referenced findings of fact and conclusions of law are hereby incorporated by reference as though fully set forth herein and constitute findings of fact and conclusions of law pursuant to Bankruptcy Rule 7052, made applicable herein by Bankruptcy Rule 9014. To the extent that any finding of fact is determined to be a conclusion of law, it is deemed so, and vice versa. 54. Confirmation of the Plan. The Plan, attached hereto as Exhibit A, as and to the extent modified by this Confirmation Order, is approved and CONFIRMED in its entirety pursuant to section 1129 of the Bankruptcy Code. All Plan documents necessary for implementation of the Plan, including those in the Plan Supplement, are hereby approved and incorporated herein by reference as an integral part of this Confirmation Order. The failure to include or refer to any particular article, section, or provision of the Plan, the Plan Supplement, or any related document, agreement, or exhibit does not impair the effectiveness of that article, section, or provision, it being the intent of this Confirmation Order that the Plan, the Plan Supplement, and any related document, agreement, or exhibit are approved in their entirety. Case 24-12364-ABA Doc 614 Filed 08/19/24 Entered 08/19/24 14:14:13 Desc Main Document Page 32 of 134

(Page | 33) Debtors: BOWFLEX INC., et al. Case No. 24-12364 (ABA) Caption of Order: Findings of Fact, Conclusions of Law, and Order Confirming the First Amended Joint Chapter 11 of Liquidation of BowFlex Inc. and Its Debtor Affiliate 55. Objections. All objections (including any reservations of rights contained therein) to approval of confirmation of the Plan that have not been withdrawn, waived, or settled prior to entry of this Confirmation Order, are not cured by the relief granted herein, or are not otherwise resolved as stated by the Debtors on the record of the Confirmation Hearing, are OVERRULED and DENIED on the merits and in their entirety, and all withdrawn objections are deemed withdrawn with prejudice. 56. Headings. Headings utilized in this Confirmation Order are for convenience of reference only and do not constitute a part of the Plan or this Confirmation Order for any other purpose. 57. Deemed Acceptances of the Plan. In accordance with section 1127 of the Bankruptcy Code and Bankruptcy Rule 3019, all Holders of Claims and Interests who voted to accept the Plan or who are conclusively presumed to accept the Plan are deemed to have accepted the Plan, as modified by the Plan Modifications and this Confirmation Order. No Holder of a Claim or Interest shall be permitted to change its vote as a consequence of the Plan Modifications. 58. No Action Required. Under section 1142(b) of the Bankruptcy Code and any other comparable provisions under applicable law, no action of the respective directors, equity holders, managers, or members of the Debtors is required to authorize the Debtors to enter into, execute, deliver, File, adopt, amend, restate, consummate, or effectuate, as the case may be, the Plan, and any contract, assignment, certificate, instrument, or other document to be executed, delivered, adopted, or amended in connection with the implementation of the Plan. Case 24-12364-ABA Doc 614 Filed 08/19/24 Entered 08/19/24 14:14:13 Desc Main Document Page 33 of 134

(Page | 34) Debtors: BOWFLEX INC., et al. Case No. 24-12364 (ABA) Caption of Order: Findings of Fact, Conclusions of Law, and Order Confirming the First Amended Joint Chapter 11 of Liquidation of BowFlex Inc. and Its Debtor Affiliate 59. Immediate Binding Effect. Notwithstanding Bankruptcy Rules 3020(e), 6004(h), 7062, or otherwise, upon the occurrence of the Effective Date, the terms of the Plan shall be immediately effective and enforceable and deemed binding upon and inure to the benefit of the Debtors, the Liquidating Trust, the Holders of Claims and Interests, the Released Parties, and each of their respective successors and assigns. Any action to be taken on the Effective Date may be taken on or as soon as reasonably practicable thereafter. 60. Pursuant to section 1141 of the Bankruptcy Code, subject to the occurrence of the Effective Date and subject to the terms of the Plan and this Confirmation Order, all prior orders entered in these Chapter 11 Cases, all documents and agreements executed by the Debtors as authorized and directed thereunder, and all motions or requests for relief by the Debtors pending before this Court as of the Effective Date shall be binding upon and shall inure to the benefit of the Debtors and the Liquidating Trust, as applicable, and their respective successors and assigns. 61. Post-Confirmation Modification of the Plan. Following the entry of this Confirmation Order, the Debtors or the Liquidating Trust may, upon order of the Court, amend or modify the Plan, in accordance with section 1127(b) of the Bankruptcy Code, or remedy any defect or omission or reconcile any inconsistency in the Plan in such manner as may be necessary to carry out the purpose and intent of the Plan. 62. Classification and Treatment. The Plan’s classification scheme is approved. The terms of the Plan shall govern the classification and treatment of Claims and Interests for purposes of the distributions to be made thereunder. The terms of the Plan shall solely govern the classification of Claims and Interests for purposes of the Plan Distributions and the classifications Case 24-12364-ABA Doc 614 Filed 08/19/24 Entered 08/19/24 14:14:13 Desc Main Document Page 34 of 134

(Page | 35) Debtors: BOWFLEX INC., et al. Case No. 24-12364 (ABA) Caption of Order: Findings of Fact, Conclusions of Law, and Order Confirming the First Amended Joint Chapter 11 of Liquidation of BowFlex Inc. and Its Debtor Affiliate set forth on the ballots tendered to or returned to the Holders of Claims or Interests in connection with voting on the Plan: (a) were set forth thereon solely for purposes of voting to accept or reject the Plan; (b) do not necessarily represent and in no event shall be deemed to modify or otherwise affect the actual classification of Claims and Interests under the Plan for Plan Distribution purposes; (c) may not be relied upon by any Holder of a Claim or Interest as representing the actual classification of such Claim or Interest under the Plan for Plan Distribution purposes; and (d) shall not be binding on the Debtors or the Liquidating Trust, as applicable, except for voting purposes. For the avoidance of doubt, any Claim that was included on a Ballot in the amount of $1.00 solely for the purposes of satisfy the dollar amount provisions of section 1126(c) of the Bankruptcy Code shall be deemed temporarily allowed in such amount solely for voting purposes and not for purposes of Allowance or Plan Distribution. 63. Subordination of Claims. The allowance, classification, and treatment of all Allowed Claims and Interests and the respective distributions and treatments under the Plan shall take into account and conform to the relative priority and rights of the Claims and Interests in each Class in connection with any contractual, legal, and equitable subordination rights relating thereto, whether arising under general principles of equitable subordination, contract, section 510(b) of the Bankruptcy Code, or otherwise. Pursuant to section 510 of the Bankruptcy Code, the Debtors or the Liquidating Trust (as applicable) reserve the right to re-classify any Allowed Claim or Allowed Interest in accordance with any contractual, legal, or equitable subordination relating thereto. 64. General Settlement of Claims and Controversies. To the greatest extent permissible under the Bankruptcy Code and the Bankruptcy Rules, and in consideration for the Case 24-12364-ABA Doc 614 Filed 08/19/24 Entered 08/19/24 14:14:13 Desc Main Document Page 35 of 134

(Page | 36) Debtors: BOWFLEX INC., et al. Case No. 24-12364 (ABA) Caption of Order: Findings of Fact, Conclusions of Law, and Order Confirming the First Amended Joint Chapter 11 of Liquidation of BowFlex Inc. and Its Debtor Affiliate classification, distributions, releases, and other benefits provided under the Plan, upon the Effective Date, the provisions of the Plan shall constitute a good-faith compromise and settlement of all Claims, Interests, Causes of Action, and other controversies released, settled, compromised, satisfied, or otherwise resolved pursuant to the Plan. The Plan shall be deemed a motion to approve the good-faith compromise and settlement of all such Claims, Interests, Causes of Action, and other controversies, and the entry of this Confirmation Order shall constitute the Court’s approval of such compromise and settlement, as well as a finding by the Court that such settlement and compromise is fair, equitable, reasonable, and in the best interests of the Debtors, their Estates, and Holders of Claims and Interests. Subject to Article VI of the Plan, all Plan Distributions made to Holders of Allowed Claims in any Class are intended to be and shall be final. 65. Post-Effective Date Transactions. On the Effective Date, or as soon as reasonably practicable thereafter, the Debtors or the Liquidating Trust, as applicable, shall enter into and take any actions that may be necessary or appropriate to effectuate the De Minimis Sale Transaction(s) or the Wind-Down of the Debtors, as applicable, including, but not limited to, and as described more fully in Section IV.B of the Plan: (a) the execution and delivery of appropriate agreements or other documents of consolidation, conversion, disposition, transfer, or dissolution containing terms that are consistent with the terms of the Plan and that satisfy the requirements of applicable law; (b) the execution and delivery of any appropriate instruments of transfer, assignment, assumption, or delegation of any asset, property, right, liability, debt, duty, or obligation on terms consistent with the Plan; (c) the commencement of litigation on any of the Retained Causes of Action; (d) the filing of appropriate documents with the appropriate governmental authorities Case 24-12364-ABA Doc 614 Filed 08/19/24 Entered 08/19/24 14:14:13 Desc Main Document Page 36 of 134

(Page | 37) Debtors: BOWFLEX INC., et al. Case No. 24-12364 (ABA) Caption of Order: Findings of Fact, Conclusions of Law, and Order Confirming the First Amended Joint Chapter 11 of Liquidation of BowFlex Inc. and Its Debtor Affiliate pursuant to applicable law; and (e) any and all other actions that the Debtors or the Liquidating Trust, as applicable, determine are necessary or appropriate to effectuate the Plan. 66. Sources of Consideration for Plan Distributions. Subject to the provisions of the Plan concerning the Professional Fee Reserve Account, the Debtors or the Liquidating Trust (as applicable) shall fund Plan Distributions with Cash on hand, the proceeds from the Sale Transaction, the De Minimis Sale Transaction(s), and the collection, liquidation, prosecution or settlement of the Liquidating Trust Assets including, but not limited to, the Retained Causes of Action. 67. Vesting of the Liquidating Trust Assets in the Liquidating Trust. Except as otherwise provided in the Plan or the Sale Order, on and after the Effective Date, pursuant to sections 1141(b) and (c) of the Bankruptcy Code, all Remaining Assets, including all claims, rights, Retained Causes of Action, Causes of Action, and any property acquired by the Debtors under or in connection with the Plan, shall automatically and irrevocably vest in the Liquidating Trust free and clear of all Claims, Liens, encumbrances, charges, and other interests, and shall become Liquidating Trust Assets for all purposes. Subject to the terms of the Plan, on or after the Effective Date, the Liquidating Trust may use, acquire, and dispose of the Liquidating Trust Assets, and may prosecute, compromise, or settle any Claims and Retained Causes of Action without supervision of or approval by the Court and free and clear of any restrictions of the Bankruptcy Code or the Bankruptcy Rules other than restrictions expressly imposed by the Plan, this Confirmation Order, or the Liquidating Trust Agreement. Case 24-12364-ABA Doc 614 Filed 08/19/24 Entered 08/19/24 14:14:13 Desc Main Document Page 37 of 134