August 10, 2012

Securities and Exchange Commission 100 F Street, N.E. Washington, D.C. 20549 Attention: Ms. Tia Jenkins Senior Assistant Chief Accountant Office of Beverages, Apparel, and Mining | |

| | Re: | Responses to the Securities and Exchange Commission |

| | Staff Comments dated July 27, 2012, regarding |

| | Form 40 F for the Fiscal Year Ended December 31, 2011 |

| | Response dated July 11, 2012 |

Dear Sirs and Mesdames:

On behalf of our client, AuRico Gold Inc. (the “Company” or “AuRico”), and pursuant to the Securities Exchange Act of 1934, as amended (the “Act”), and the rules and regulations thereunder, we transmit for your review the Company’s responses, as we have been informed by the Company, to the Staff’s letter of comments, dated July 27, 2012 (the “Comment Letter”), in respect of the above noted filings. The Company’s responses below are keyed to the headings and comment numbers contained in the Comment Letter.

Form 40-F for the Fiscal Year Ended December 31, 2011

Exhibit 99.3

Consolidated Financial Statements

Notes to the Consolidated Financial Statements, page 6

3. Summary of significant accounting policies, page 6

(f) Long-lived assets, page 8

Mining interests, page 9

| 1. | We note the percentage and amount of measured and indicated, and inferred resources that were included in the portion of mineralization expected to be classified as reserves during fiscal year 2011 in your response to comment three of our letter dated June 12, 2012. Please also provide us with this information for fiscal years 2009 and 2010, and include a discussion of the reason(s) for any significant changes in measured and indicated, and inferred resources between 2009 and 2011 in your response. |

Securities and Exchange Commission

August 10, 2012

Page 2

AuRico Gold’s response:

During the 2009 and 2010 fiscal years, the following percentage and amount of Measured and Indicated, and Inferred resources were included in the portion of mineralization expected to be classified as reserves:

2009(1) (in thousands of ounces) | Measured & Indicated | Inferred |

| Mine | % | Ounces | % | Ounces |

| Ocampo | 100% | 415 | 25% | 617 |

| El Cubo | 100% | 51 | 50% | 336 |

2010(2) (in thousands of ounces) | Measured & Indicated | Inferred |

| Mine | % | Ounces | % | Ounces |

| Ocampo | 100% | 212 | 25% | 529 |

| El Cubo | 100% | 36 | 50% | 292 |

| (1) | Gold equivalent ounces have been calculated using a silver to gold ratio of 55.05:1. |

| (2) | Gold equivalent ounces have been calculated using a silver to gold ratio of 60:1. |

The following table presents the Measured and Indicated, and Inferred gold equivalent ounces at year end for each of the primary mining assets. Measured and Indicated, and Inferred resources as of year end are used in the determination of the portion of mineralization expected to be classified as reserves for the subsequent year.

Measured & Indicated (in thousands of ounces) | December 31, 2009(1) | December 31, 2010(1) | December 31, 2011(1) |

| Ocampo - OP | 133 | 333 | 441 |

| Ocampo - UG | 86 | 69 | 81 |

El Cubo(3) | 285 | 338 | 420 |

El Chanate(2) | 69 | 69 | 38 |

| | | | |

Inferred (in thousands of ounces) | December 31, 2009(1) | December 31, 2010(1) | December 31, 2011(1) |

| Ocampo - OP | 604 | 446 | 671 |

| Ocampo - UG | 1,587 | 1,437 | 1,035 |

El Cubo(3) | 723 | 857 | 1,031 |

El Chanate(2) | 157 | 157 | 8 |

| (1) | Gold equivalent ounces have been calculated using the Company’s long-term silver to gold ratio of 55:1. The actual silver to gold ratios used in the determination of reserves were 60:1, 55:1, and 55.03:1 for 2009, 2010 and 2011 respectively. |

| (2) | The El Chanate mine was acquired by the Company on April 8, 2011. |

| (3) | Includes all Measured and Indicated and Inferred ounces for El Cubo. Areas not expected to result in conversion are excluded from the determination of the portion of mineralization expected to be classified as reserves in the tables above. |

The following is a discussion of the significant changes:

Ocampo Open Pit

| ● | The increase of 200 thousand ounces of Measured and Indicated in 2010 as compared to 2009 was attributable to both the conversion of Inferred material, through drilling, to Measured and Indicated, and to the addition of new Measured and Indicated material in previously undrilled areas, |

Securities and Exchange Commission

August 10, 2012

Page 3

| | most notably the Los Molinas area. Note that in 2010 and 2011, as discussed in our previous letter, an additional 341 thousand ounces were converted from Measured, Indicated, Inferred and unclassified into Proven and Probable, through a combination of drilling and higher metal prices. |

| ● | The decrease of 158 thousand ounces of Inferred in 2010 as compared to 2009 was attributable to both the conversion to Measured and Indicated, as discussed above, and the conversion directly to Proven and Probable. |

| ● | The increase in Measured and Indicated and in Inferred in 2011 is primarily attributable to the addition of the Upper Belen/San Jose resource pit through the 2011 drilling program. |

Ocampo Underground

| ● | The reduction in Inferred ounces in 2011 is attributable to the conversion of Inferred to underground Proven and Probable through drilling. In addition, some material previously classified as underground Inferred was reclassified as open pit Proven and Probable in the Upper Belen/San Jose resource pit after drilling in 2011. |

El Cubo

| ● | The increase in Measured, Indicated and Inferred ounces in 2011 is due to the discovery and subsequent infill drilling program on the Dolores/Capulin vein system. In addition to the Measured, Indicated and Inferred ounces, 45 thousand ounces of Proven and Probable were added at Dolores/Capulin in 2011. |

El Chanate

| ● | The decrease in Inferred ounces in 2011 is partially due to the conversion to Measured and Indicated through drilling and then into Proven and Possible after application of an economic pit shell and partially due to the conversion to unclassified material after drill spacing was tightened up. |

| 2. | We note the table of changes in reserves at your current operations between 2009 and 2011 in your response to comment three of our letter dated June 12, 2012; and that increases in reserves have been a result of conversion of inferred material to measured and indicated, and proven and probable, and the discovery of new mineralization that has been directly brought into proven and probable. Please advise us of the following: |

| a. | Tell us whether you have any specific information as to the conversion of inferred resources to measured and indicated resources, and proven and probable reserves for each mine during fiscal years 2009 to 2011 and, if so, provide us with this information. |

AuRico Gold’s response:

The Qualified Person responsible for reserves and resources visually inspects the final resource classifications within the model to test for reasonableness, using such qualitative assessments as geologic continuity, sample spacing and closeness of the informing or grade determining samples. It is difficult for the Company to quantify spatially, on a block by block basis, exactly what Inferred resources are converted to Measured and Indicated resources and Proven and Probable reserves on a year over year basis, and it is not a practice that the Company, nor the industry, usually undertakes. It may be possible to quantify block by block conversion when an entire vein or zone was previously classified as Inferred in one year and after additional drilling, a portion is converted to Measured and Indicated and/or Proven and Probable.

Securities and Exchange Commission

August 10, 2012

Page 4

In recent operating history, the Company has never reported as resources a vein or zone comprised entirely of Inferred material at its operating mines. Even then the inference that 100% of the Measured and Indicated and/or Proven and Probable came directly from prior year Inferred resources is likely incorrect as some material may have been directly converted from unclassified or un-mineralized to Measured and Indicated and/or Proven and Probable. Complicating such a reconciliation is the fact that with new drilling information, mineralized envelopes or wireframes often shift laterally or vertically as the new information is re-interpreted by the geologists.

| b. | Also further explain to us the specific factors that you considered for each mine to determine the percentage of inferred resources that were included in the portion of mineralization expected to be classified as reserves. |

AuRico Gold’s response:

At El Cubo, Inferred resources are usually defined as being 40 to 175 metres from sampling. The majority of sampling at El Cubo is undertaken with channel sampling of the face and/or back of extraction and exploration drifts. These samples are taken on 2.5 metre intervals resulting in a very dense sample population. A drive along the strike of vein can only define reserves to a point 40 metres horizontally beyond the last drift round, although material 40 metres above and below the drift can be potentially classified as Proven and Probable. During 2008 and 2009, the last two full years of mining at El Cubo, 60% and 58% respectively of the annual ounces mined were outside of reserves. In the first six months of 2012, 22% of mining was outside of reserves. Given these high percentages of mining outside reserves and the high density of data used to define Proven and Probable reserves, Management is very comfortable in assuming that 50% of El Cubo’s Inferred resources will be ultimately be extracted within the mine life.

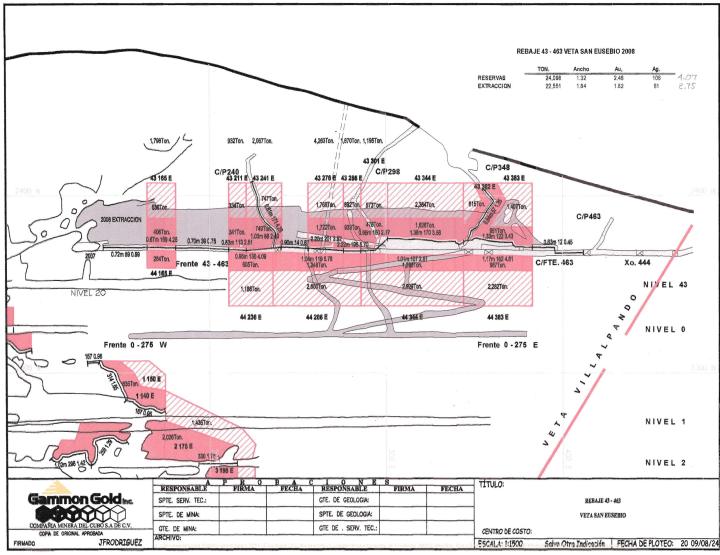

An example of a 2008 stoping block from the San Eusebio vein at El Cubo is attached. The solid pink blocks represent Proven and Probable in the reserve while the hatched pink blocks represent Inferred in the resource. Actual ore extracted is represented by the solid grey polygon. It is evident that above the access drift all of the Proven and Probable material mined, approximately 30% of the Inferred is mined, and a substantial portion of material not classified as reserves or resources is mined. Of note, as well, is that stoping in the block was not fully completed in 2008.

At the Ocampo mine, the predominate method of sampling for resources is diamond drilling, and Inferred resources are usually defined as being 50 to 120 metre from sampling. Ocampo has had measurable success in adding to and/or replacing reserves at Ocampo through its ongoing drill program. Ocampo has increased its 2009 reserve base by 38% or 755 thousand ounces (before depletion) in a two year period, and continues to drill infill and step-out holes at the same pace. As such Management is confident that a conservative further 25% or 529 thousand ounce conversion assumption of Inferred resources to Proven and Probable will be achieved over the life of the mine.

El Chanate successfully added 56,000 ounces to Proven and Probable reserves through its limited drill program since the Company acquired the mine in April 2011. These Proven and Probable ounces came from Inferred resources within the existing ultimate pit shape, as the ultimate pit shape has not changed materially year over year. Again a 25% (representing 39 thousand ounces of the 2010 Inferred inventory) conversion of Inferred resources to Proven and Probable reserves is deemed by Management to be a suitably conservative factor. As the mine drills identified, but unclassified ore zones below the pit, it is expected that additional material in all classes will be added to resource and reserve inventory.

Securities and Exchange Commission

August 10, 2012

Page 5

* * * * *

Closing Comments

On behalf of the Company, we hereby confirm to the Staff the Company’s acknowledgment of the following:

| | ● | AuRico is responsible for the adequacy and accuracy of the disclosure in the filings; |

| | ● | Staff comments or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the filings; and |

| | ● | AuRico may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

Please do not hesitate to contact the undersigned at (604) 630-5199 should you have any questions about the contents of this letter.

| | Yours truly, /s/ Daniel M. Miller Daniel M. Miller |

| | |

| | |

cc: Scott Perry

AuRico Gold Inc.