Exhibit 99.1

Annual Information Form

For the year ended December 31, 2013

March 3, 2014

TABLE OF CONTENTS

| CORPORATE STRUCTURE | 5 |

| | |

| GENERAL DEVELOPMENT OF THE BUSINESS | 6 |

| Three Year History | 6 |

| | |

| DESCRIPTION OF THE BUSINESS | 8 |

| General | 8 |

| Markets, Sales and Refining | 8 |

| Competitive Conditions | 9 |

| Operating Results | 9 |

| Employees and Labour Relations | 10 |

| Sustainability Practice | 10 |

| Environmental Protection and Policies | 10 |

| Social Policies | 11 |

| | |

| MINERAL PROPERTIES | 12 |

| Mineral Reserve and Mineral Resource Estimates | 12 |

| Young-Davidson Mine | 15 |

| El Chanate Mine | 21 |

| Kemess Underground Project | 27 |

| Other Mineral Properties | 35 |

| | |

| DIVIDENDS | 36 |

| | |

| DESCRIPTION OF CAPITAL STRUCTURE | 36 |

| | |

| MARKET FOR SECURITIES | 37 |

| | |

| RISK FACTORS | 38 |

| | |

| CORPORATE GOVERNANCE | 50 |

| Directors | 50 |

| Officers | 53 |

| Cease Trade Orders, Bankruptcies, Penalties or Sanctions | 55 |

| Conflicts of Interest | 56 |

| Interest of Management & Others in Material Transactions | 56 |

| | |

| AUDIT COMMITTEE | 56 |

| Audit Committee Mandate | 56 |

| Composition | 56 |

| Pre-Approval Policies and Procedures | 57 |

| External Auditor Service Fees | 57 |

| | |

| MATERIAL CONTRACTS | 57 |

| | |

| LEGAL PROCEEDINGS | 57 |

| | |

| TRANSFER AGENT AND REGISTRAR | 58 |

| | |

| INTERESTS OF EXPERTS | 58 |

| | |

| ADDITIONAL INFORMATION | 58 |

| | |

| SCHEDULE “A” MANDATE OF THE AUDIT COMMITTEE | 60 |

In this Annual Information Form (“AIF”), AuRico Gold Inc., together with its subsidiaries (as the context requires) is referred to as “AuRico”, “AuRico Gold” or the “Company”. All information contained in this AIF is as at December 31, 2013, unless otherwise stated.

FORWARD-LOOKING INFORMATION

This AIF contains certain “forward-looking statements” and “forward-looking information” as defined under applicable Canadian and U.S. securities laws. All statements, other than statements of historical fact, are , or may be deemed to be, forward-looking statements. The words "expect", "believe", "anticipate", "will", "intend", "estimate", "forecast", "budget", "schedule" and similar expressions identify forward-looking statements. Forward-looking statements in this AIF include, without limitation: information as to strategy, plans or future financial or operating performance, such as the Company’s expansion plans, project timelines, production plans, projected cash flows or capital expenditures, cost estimates, mining or milling methods, projected exploration results, resource and reserve estimates and other statements that express management’s expectations or estimates of future performance.

Forward-looking statements are necessarily based upon a number of factors and assumptions that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties and contingencies. Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking statements. Such factors include, but are not limited to: uncertainty of production and cost estimates; fluctuations in the price of gold; changes in foreign exchange rates (particularly the Canadian dollar, Mexican peso and U.S. dollar); the uncertainty of replacing depleted reserves; the risk that the Young-Davidson and El Chanate mine may not perform as planned; changes in national and local government legislation in Canada, Mexico and other jurisdictions in which the Company may carry on business in the future; risks of obtaining necessary licenses, permits, authorizations and/or approvals from the appropriate regulatory authorities for the Kemess Underground project; contests over title to properties; the speculative nature of mineral exploration and development; risks related to aboriginal title claims; compliance risks with respect to current and future environmental laws and regulations; disruptions affecting operations; business opportunities that may be pursued by the Company; employee relations; availability of and increased costs associated with mining inputs and labor; uncertainty with the Company's ability to secure capital to execute its business plans; volatility of the Company’s share price; any decision to declare a quarterly dividend; the effect of future financings; litigation; risk of loss due to sabotage and civil disturbances; the impact of global liquidity and credit availability and the values of assets and liabilities based on projected future cash flows; risks arising from holding derivative instruments; risks arising from the absence of hedging; adequacy of internal control over financial reporting; changes in our credit rating; and the impact of inflation.

Actual results and developments are likely to differ, and may differ materially, from those expressed or implied by the forward-looking statements contained in this AIF. Such statements are based on a number of assumptions which may prove to be incorrect, including, but not limited to, assumptions about: general business and economic conditions; commodity prices and the price of key inputs such as labour, fuel and electricity; credit market conditions and conditions in financial markets generally; production levels, development rates and the costs for each; our ability to procure equipment and supplies in sufficient quantities and on a timely basis; the timing of the receipt of permits and other regulatory and governmental approvals for our projects and operations; our ability to obtain, comply with and renew permits in a timely manner; our ability to attract and retain skilled employees and contractors for our operations; the accuracy of our mineral reserve and mineral resource estimates and the geological, development and operational decisions that are derived therefrom; the impact of changes in currency exchange rates on our costs and results; interest rates; tax benefits and tax rates; and our ongoing relations with our employees and business partners.

Readers are cautioned that forward-looking statements are not guarantees of future performance. All of the forward-looking statements made in this AIF qualified by these cautionary statements. The Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by applicable law.

| 3 |

CAUTIONARY NOTE TO U.S. INVESTORS CONCERNING MEASURED, INDICATED AND INFERRED RESOURCES

Unless otherwise indicated, all reserve and resource estimates included in this AIF have been prepared in accordance with National Instrument 43-101 –Standards of Disclosure for Mineral Projects(“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum classification system. NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects.

Canadian standards, including NI 43-101, differ significantly from the requirements of the Securities and Exchange Commission (“SEC”) and reserve and resource information included herein may not be comparable to similar information disclosed by U.S. companies. In particular, and without limiting the generality of the foregoing, this document uses the terms “measured resources,” “indicated resources” and “inferred resources”. Investors are advised that, while such terms are recognized and required by Canadian securities laws, the SEC does not recognize them. The requirements of NI 43-101 for identification of “reserves” are also not the same as those of the SEC, and reserves reported by the Company in compliance with NI 43-101 may not qualify as “reserves” under SEC standards. Under U.S. standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. U.S. investors are cautioned not to assume that any part of a “measured resource” or “indicated resource” will ever be converted into a “reserve”. U.S. investors should also understand that “inferred resources” have a great amount of uncertainty as to their existence and as to their economic and legal feasibility. It cannot be assumed that all or any part of “inferred resources exist, are economically or legally mineable or will ever be upgraded to a higher category. Under Canadian rules, estimated “inferred resources” may not form the basis of feasibility or pre-feasibility studies except in rare cases. In addition, disclosure of “contained ounces” in a mineral resource is permitted disclosure under Canadian regulations. However, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in place tonnage and grade, without reference to unit measures. Accordingly, information concerning mineral deposits set forth in this AIF may not be comparable with information made public by companies that report in accordance with U.S. standards.

CURRENCY AND EXCHANGE RATE INFORMATION

All currency amounts in this AIF for the financial year ended December 31, 2013 are expressed in United States dollars (“USD”), unless otherwise indicated. References to “CAD” are to Canadian dollars, and references to “Pesos” are to Mexican Pesos. For CAD to USD, the average exchange rate for 2013 and the exchange rate at December 31, 2013 were 1.03 and 1.06 CAD per one USD, respectively, calculated at the Bank of Canada daily noon rate. For Pesos to USD, the average exchange rate for 2013 and the exchange rate at December 31, 2013, were 12.8 and 13.1 Pesos per one USD, respectively. The consolidated financial statements of the Company for the financial year ended December 31, 2013 have been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board. The consolidated financial statements for the financial year ended December 31, 2013 are available electronically from the Canadian System for Electronic Document Analysis and Retrieval (“SEDAR”) atwww.sedar.comand from the U.S. Securities and Exchange Commission’s (the “SEC”) Electronic Document Gathering and Retrieval System atwww.sec.gov.

TECHNICAL INFORMATION

The scientific and technical information in this AIF has been reviewed and approved by Chris Bostwick, FAusIMM, Senior Vice President for AuRico Gold Inc. Mr. Bostwick is a Qualified Person under NI 43-101 but he is not “independent” of AuRico within the meaning of the instrument.

| 4 |

CORPORATE STRUCTURE

AuRico Gold Inc. has its registered and executive office located at 110 Yonge Street, Suite 1601, Toronto, Ontario, M5C 1T4. The Company’s common shares are listed on the Toronto Stock Exchange (TSX: AUQ) and the New York Stock Exchange (NYSE: AUQ).

The Company was incorporated under Part 1A of theCompanies Act (Quebec) on February 25, 1986 under the name Golden Rock Explorations Inc. By Articles of Amendment dated April 17, 1998, the Company changed its name to Gammon Lake Resources Inc., and consolidated its common shares on a 15:1 basis. By Articles of Amendment dated June 7, 2007, the Company changed its name to Gammon Gold Inc. By Articles of Amendment dated June 9, 2011, the Company changed its name to its current name, AuRico Gold Inc., and by Articles of Continuance dated August 26, 2011, the Company changed its province of jurisdiction to Ontario. AuRico was amalgamated with Northgate Minerals Corporation (“Northgate”) under theBusiness Corporations Act (Ontario) (the “OBCA”) pursuant to Articles of Amalgamation dated October 31, 2011.

The following chart lists the Company’s material subsidiaries and assets. The percentage ownership is indicated for each entity.

| 5 |

GENERAL DEVELOPMENT OF THE BUSINESS

Three Year History

The following is a summary of key developments over the past three years:

2011

Capital Gold Acquisition– On April 8, 2011, AuRico acquired Capital Gold Corporation (“Capital Gold”) for total consideration of $422 million, which owned and operated the El Chanate gold mine in Sonora, Mexico and the Orion gold and silver project in Nayarit, Mexico. This acquisition significantly increased AuRico’s gold production and nearly doubled its gold mineral reserves.

Northgate Acquisition– On October 26, 2011, AuRico acquired Northgate Minerals Corporation (“Northgate”) for total consideration paid of $1,049 million. Northgate owned the Young-Davidson mine in Ontario, Canada (now AuRico’s flagship asset, which declared commercial production in September 2012), the Kemess Underground project in British Columbia, Canada, as well as the Stawell and Fosterville mines in Australia. The Northgate acquisition was carried out by way of a plan of arrangement under theBusiness Corporations Act(British Columbia).

2012

Credit Facility– On April 25, 2012, the Company increased its revolving credit facility to $250 million.

Sale of Stawell and Fosterville– In May 2012, the Company completed the sale of the Stawell and Fosterville mines to Crocodile Gold Corporation for consideration consisting of CAD$55 million in cash, CAD$10 million in shares of Crocodile Gold Corporation and potential participation in future free cash flows from the mines.

Sale of El Cubo– In July 2012, the Company completed the sale of the El Cubo mine and the Guadalupe y Calvo project to Endeavour Silver Corporation for consideration consisting of $100 million in cash, $100 million in shares of Endeavour Silver Corporation and up to $50 million in future contingent payments.

Commercial Production at Young-Davidson– On September 1, 2012, the Young-Davidson open pit mine declared commercial production, having achieved previously established commissioning thresholds. The commissioning thresholds included a 30-day period whereby the mill throughput averaged at least 5,100 tonnes per day (subsequent to the commissioning of the flotation and gravity circuits) and the open pit averaging 29,750 tonnes per day of ore and waste mining.

Litigation Settlement– On October 5, 2012, the Company reached an agreement to settle a class action initiated in 2008 by Edward J. McKenna. The settlement does not contain any admission of wrongdoing and provides for the payment by the Company of $13.3 million which is largely offset by an insurance receivable.

Sale of Equity Interests– In October 2012, the Company sold its equity interests in Endeavour Silver Corporation and Crocodile Gold Corporation on a block trade basis for gross proceeds of $104.6 million.

Sale of Ocampo– On December 14, 2012, the Company completed the sale of the Ocampo mine and the Venus and Los Jarros exploration properties, as well as a 50% interest in the Orion development project, to Minera Frisco, S.A.B. de C.V., for cash consideration of $750 million. The Company retained a 50% interest over the Orion project and is now a joint venture partner with Minera Frisco with respect to this project.

| 6 |

2013

Substantial Issuer Bid– On January 29, 2013, the Company announced the successful repurchase and cancellation of 36,144,578 common shares at a price of $8.30 per share under the Company’s ‘modified Dutch auction’ substantial issuer bid, for a total purchase price of $300 million.

Credit Facility– On January 31, 2013, the Company completed an amendment to the revolving credit facility, which reduced borrowing capacity from $250 million to $150 million. The amended credit facility carries the same interest rate and terms as the previous facility.

Dividend Policy– On February 21, 2013, the Company announced an inaugural dividend policy, whereby the Company paid a dividend of $0.16 per share in 2013 (payable quarterly). Subsequent to 2013, the Company’s dividend will be linked to operating cash flow, whereby the Company intends to pay out 20% of the operating cash flow generated in the preceding quarter.

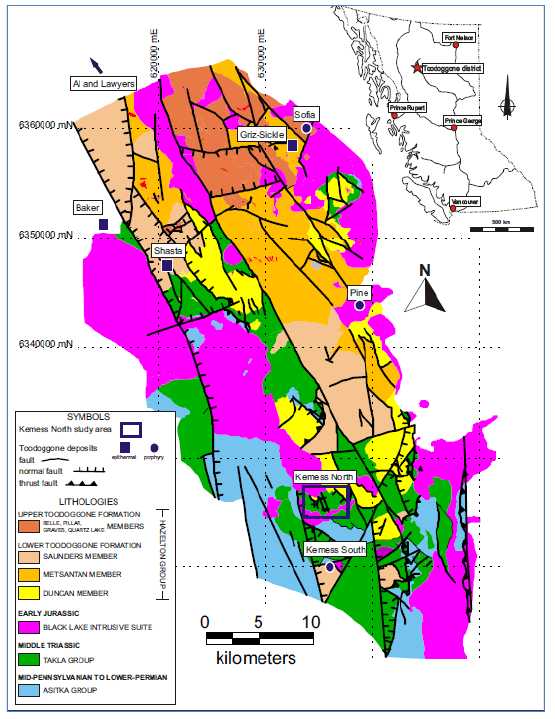

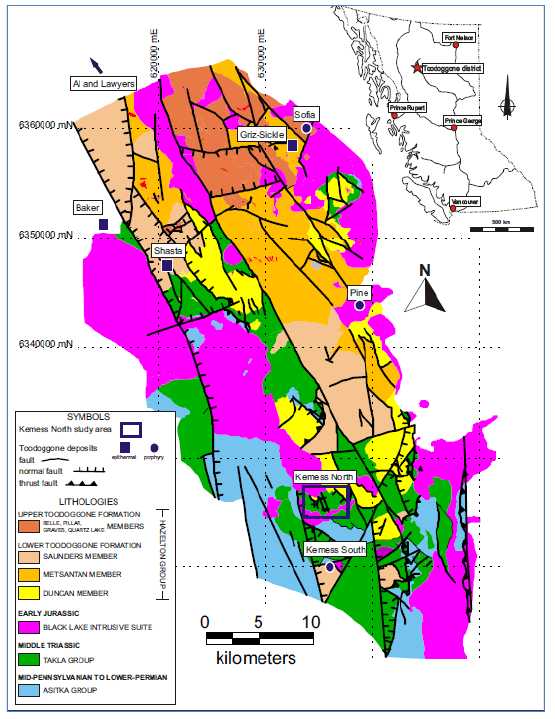

Kemess Underground Project– On March 25, 2013, the Company reported a 2012 Mineral Reserve & Mineral Resource update and the results of a feasibility study for the Kemess Underground project, which added 1.8 million ounces to the Company’s consolidated proven and probable gold reserves. The feasibility study outlines the development of an underground block cave operation with average annual production of 105,000 ounces of gold and 44 million pounds of copper at cash costs of $213 per ounce of gold, net of by-product credits, over a mine-life of approximately 12 years.

Dividend Reinvestment Plan– On June 11, 2013, the Company announced that its Board of Directors had approved the introduction of a dividend reinvestment plan, effective June 10, 2013. Common shares issued under this plan are issued at a 5% discount from the average market price of the common shares over the five day period preceding the relevant dividend payment date.

Appointment of Non-Executive Chairman– On June 27, 2013, the Company announced that Mr. Alan Edwards had been appointed as non-executive Chairman of the Board of Directors effective July 1, 2013. This appointment followed the resignation, for health reasons, of Mr. Colin Benner as Executive Chairman.

Underground Commercial Production at Young-Davidson– On October 31, 2013, the Company announced that the Young-Davidson underground mine had achieved commercial production. Commissioning of the shaft hoisting infrastructure is a key project milestone that unlocks the potential of the Young-Davidson underground mine and will support increased underground productivities and favourable unit cost efficiencies over the life of the mine.

| 7 |

DESCRIPTION OF THE BUSINESS

General

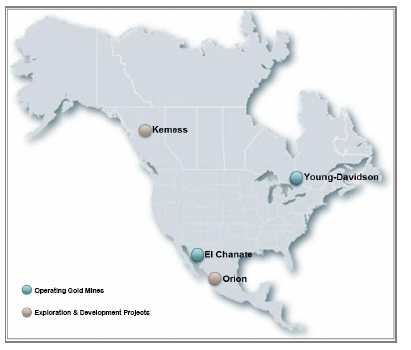

AuRico Gold Inc. is a Canadian gold producer with mines and projects in North America and a head office in Toronto. The Company’s core operations include the Young-Davidson mine in Ontario, Canada, which declared commercial production on September 1, 2012, and the El Chanate mine in Sonora, Mexico. The Company’s project pipeline also includes advanced exploration opportunities in Mexico and Canada. Projects include the Kemess Underground project, a gold-copper deposit in northern British Columbia, Canada, and a 50% joint venture interest in the Orion Project in Nayarit, Mexico.

AuRico – Property Locations

The profitability and operating cash flow performance of the Company are affected by numerous factors, including the price of gold, foreign exchange rates, production levels, capital expenditures, and operating performance. While the Company attempts to manage these and other risks, many of the factors affecting these risks are beyond the Company’s control. For additional information on factors that may affect theCompany, see the Forward-Looking Information disclosure at the beginning of this document and the discussion of risks and uncertainties under the heading entitled “Risk Factors”.

Product fabrication and bullion investment are two principal uses of gold. The introduction of more readily accessible and more liquid gold investment vehicles (such as gold exchange traded funds) has further facilitated investment in gold. Within the fabrication category, there are a wide variety of end uses, the largest of which is the manufacture of jewelry. Other fabrication purposes include coins, electronics, miscellaneous industrial and decorative uses, dentistry, medals, and medallions.

Markets, Sales and Refining

The Company produces doré bars at its mine sites, which are sent to third parties for refining. Gold can be readily sold on markets throughout the world and market price can be easily ascertained at any particular time. The Company is not dependent upon any one customer or group of customers for the sale of gold or silver. During 2013, the price of gold averaged $1,411 per ounce, a 15% decrease from the London PM Fix average of $1,669 during 2012. During 2013, daily London PM Fix prices ranged between $1,694 and $1,192 per ounce.

| 83 |

Competitive Conditions

Competition in the precious metals mining industry is primarily for: (i) mineral properties that can be developed and produced economically; (ii) technical experts that can find, develop, and mine such properties; (iii) labour to operate the properties; and (iv) capital to finance operations.

The Company competes with other mining and exploration companies in the acquisition of mining claims and leases and in connection with the recruitment and retention of qualified employees. There is significant competition for mining claims and leases. Many larger competitors conduct business globally and thus have greater financial and technical resources available to them.

Operating Results

The following table is a summary of the Company’s annual financial and operating results for the fiscal year ended December 31, 2013:

| (in thousands, except ounces, per share amounts, total cash costs and total all-in sustaining costs) | |

| | | Year Ended | |

| | | December 31, 2013 | |

| Gold ounces produced | | | |

| Gold ounces produced(2) | | 161,100 | |

| Pre-production gold ounces produced(2) | | 31,502 | |

| Total gold ounces produced | | 192,602 | |

| Revenue from mining operations | $ | 227,631 | |

| Loss from operations | $ | (178,087 | ) |

| Net loss | $ | (176,770 | ) |

| Net loss per share, basic | $ | (0.71 | ) |

| Total cash | $ | 142,652 | |

| Operating cash flow | $ | 63,266 | |

| Net free cash flow(1) | $ | (186,156 | ) |

| Cash costs per gold ounce, net of by-product revenues and NRV adjustments(1)(2)(3)(4) | $ | 676 | |

| All-in sustaining costs per gold ounce sold, net of by-product revenues and NRV adjustments(1)(2)(4) | $ | 1,181 | |

| |

Notes: |

| 1. | See the Non-GAAP Measures section on page 23 of the Management’s Discussion and Analysis for the year ended December 31, 2013. |

| 2. | The Young-Davidson underground mine declared commercial production on October 31, 2013, and therefore was excluded from consolidated cash costs and consolidated all-in sustaining costs prior to this date. Pre-production ounces produced are excluded from consolidated ounces produced as these ounces are credited against capitalized project costs. |

| 3. | Gold ounces used to calculate cash costs include ounces sold at the El Chanate mine and ounces produced at the Young- Davidson mine. |

| 4. | For further discussion on the net realizable value (“NRV”) adjustments recognized on ore in-process inventories at the El Chanate and Young-Davidson mines during the year, refer to pages 13 and 15 of the Management’s Discussion and Analysis for the year ended December 31, 2013. |

| 9 |

Employees and Labour Relations

As at December 31, 2013, the Company had 586direct full-time employees, and 823individuals employed on a contract basis.

Despite generally good labour relations, competition for skilled workers in the resource sector results in employee turnover at the Company’s operations and a need to constantly recruit and train new employees. This competition for qualified employees occasionally results in workforce shortages, which can often be supplemented with more costly contract labour.

Sustainability Practice

The Company has adopted a Sustainability Management System (SMS), which is a set of management processes aligned to recognized international standards to help AuRico continuously improve its environmental, economic and social sustainability performance. The purpose of the SMS is to provide a consistent approach to sustainability management across all of the operations.

A central element to SMS is the AuRico Sustainability Charter, which establishes the overarching vision for sustainable management within AuRico and is supported by three core policies:

| | 1. | Health & Safety Policy |

| | 2. | Environmental Policy |

| | 3. | Corporate Social Responsibility Policy |

Sustainable practices are important because they help ensure quality of life for the workforce, the communities in which the Company operates and future generations. AuRico also believes that sustainable business practices are a part of its social license to operate.

Each mine site must develop and implement a SMS that is consistent with these policies and the Sustainability Charter and the principles contained within the framework. Once implemented, compliance with this standard is mandatory. Annual performance reviews take into account the quality of a site’s SMS and steps taken to enhance compliance with both the processes and procedures in the SMS and the spirit of sustainable practices.

The Company’s Board of Directors has established a Sustainability Committee that, as part of its mandate, is responsible for reviewing sustainability, environmental, health and safety policies and programs of the Company and overseeing AuRico’s performance in these areas. The Sustainability Committee reports to the Board of Directors on a regular basis.

Having a common set of principles to manage sustainable business practices helps reduce risks to the business. By tailoring these principles to the specific needs and issues facing each operation, the site SMS is flexible enough to meet local requirements relating to health, safety, environment, and the community.

On an annual basis, the Company publishes a Sustainability Report on its website summarizing the Company’s environmental, health, safety, and social programs and performance at its operations, which can be accessed at the following link:

http://www.auricogold.com/responsibility/sustainability-reports/default.aspx

Environmental Protection and Policies

The Company’s mining and exploration activities are subject to various governmental laws and regulations relating to the protection of the environment. These environmental regulations are continually changing, and the Company has made, and intends to make in the future, expenditures to comply with such laws and regulations. The timing of these expenditures is dependent upon a number of factors including the life of the mine, the operating licence conditions, and the laws, regulations, and environment in which the mine operates.

| 10 |

The Company will be obliged to carry out site reclamation on its current properties at the end of their mine life and expects to be able to finance this from the revenues generated by such projects. In addition, as at December 31, 2013, the Company had $26.2 million in restricted cash in closure bonds in place, consisting of cash and short-term deposits pledged by the Company relating to site closure and reclamation obligations at the former producing Kemess South property and Young-Davidson.

Reclamation provisions are recognized at the time an environmental disturbance occurs and are measured at the Company’s best estimate of the expected value of future cash flows required to reclaim the disturbance upon mine closure, which are discounted to their present value for each mine operation.

Social Policies

With approximately 1400 employees and contractors, the Company and its subsidiaries play an important role in the economic life of its stakeholders. Wages, taxes and royalties have a positive impact on the lives of the Company’s employees and in the communities where the Company operates. AuRico sources goods and services used in operations from the local, regional and national business communities in Mexico and Northern Ontario, Canada, which provides significant economic benefit to the region.

The Company can have a significant social impact on the communities adjacent to its operations. AuRico strives to be a good neighbor and corporate citizen by both actively contributing to local community life and by ensuring that local stakeholders have an opportunity for input and dialogue. The Company achieves this through the presence of Community Relations personnel who are responsible for engaging with local stakeholders, identifying areas of concern, and relaying those concerns to management.

The Company entered into an Impact Benefit Agreements with the Matachewan First Nation on July 2, 2009 and with the Temagami First Nation / Teme Augama Anishnabai on July 14, 2012, as the Young-Davidson mine is situated within the traditional territory of these two First Nations. On June 22, 2012, the Company signed an Interim Measures Agreement with the Tse Key Nay, a group comprised of three aboriginal groups whose traditional territories overlap the Kemess project location: the Kwadacha, Tsay Keh Dene, and Takla Lake. Among other things, the agreement addresses project permitting, environmental studies, business opportunities, employment, and training.

| 11 |

MINERAL PROPERTIES

At December 31, 2013, AuRico’s total proven and probable gold mineral reserves were 6.5 million gold ounces, a 0.29 million ounce decrease from 2012. This decrease in proven and probable mineral reserves is attributable to depletion at the Company’s operating mines. The Company’s mineral reserve and mineral resource estimates have been calculated as at December 31, 2013 in accordance with definitions adopted by the Canadian Institute of Mining, Metallurgy and Petroleum and incorporated into NI 43-101. U.S. readers should refer to the Cautionary Note to U.S. Investors Concerning Measured, Indicated and Inferred Resources on page 4 of this AIF.

Although the Company has carefully prepared and verified the mineral reserve figures presented below and elsewhere in this AIF, such figures are estimates, which are, in part, based on forward-looking information and certain assumptions, and no assurance can be given that the indicated level of mineral will be produced. Estimated reserves may have to be recalculated based on actual production experience. Market price fluctuations of gold, copper and silver, as well as increased production costs or reduced recovery rates and other factors, may render the present proven and probable reserves unprofitable to develop at a particular site or sites. See “Risk Factors” and “Forward-Looking Information” for additional details concerning factors and risks that could cause actual results to differ from those set out below.

Mineral Reserve and Mineral Resource Estimates

The following tables set forth the estimated mineral reserves and mineral resources attributable to interests held by AuRico for each of its properties as at December 31, 2013:

| Mineral Reserve Estimates - Gold |

| | | | Tonnes | Grade | Ounces |

| | | Category | (000's) | (g/t) | (000's) |

| Young-Davidson | Surface | Proven | 3,298 | 1.01 | 107 |

| | | Probable | 686 | 1.52 | 33 |

| | | P&P | 3,984 | 1.10 | 140 |

| | Underground | Proven | 10,626 | 2.90 | 990 |

| | | Probable | 28,669 | 2.78 | 2,566 |

| | | P&P | 39,296 | 2.81 | 3,556 |

| | Total | P&P | 43,280 | 2.66 | 3,696 |

| El Chanate | | Proven | 29,223 | 0.72 | 676 |

| | | Probable | 16,115 | 0.67 | 346 |

| | Total | P&P | 45,337 | 0.70 | 1,023 |

| Kemess Underground | | Proven | - | - | - |

| | | Probable | 100,373 | 0.56 | 1,805 |

| | Total | P&P | 100,373 | 0.56 | 1,805 |

| AuRico Total | | P&P | 188,990 | 1.07 | 6,524 |

| 12 |

| Mineral Resource Estimates - Gold |

| | | | Tonnes | Grade | Ounces |

| | | Category | (000's) | (g/t) | (000's) |

| Young-Davidson | Surface | Measured | 233 | 0.96 | 7 |

| | | Indicated | 535 | 1.41 | 24 |

| | | M&I | 769 | 1.28 | 32 |

| | Underground | Measured | 5,300 | 2.95 | 504 |

| | | Indicated | 11,659 | 2.62 | 981 |

| | | M&I | 16,960 | 2.72 | 1,484 |

| | Total | M&I | 17,729 | 2.66 | 1,516 |

| | Surface | Inferred | 31 | 0.99 | 1 |

| | Underground | Inferred | 3,689 | 2.72 | 323 |

| | Total | Inferred | 3,720 | 2.71 | 324 |

| El Chanate | | Measured | 2,158 | 0.31 | 22 |

| | | Indicated | 2,129 | 0.40 | 27 |

| | Total | M&I | 4,287 | 0.36 | 49 |

| | | Inferred | 579 | 0.75 | 14 |

| Kemess Underground | | Measured | - | - | - |

| | | Indicated | 65,432 | 0.41 | 854 |

| | Total | M&I | 65,432 | 0.41 | 854 |

| | | Inferred | 9,969 | 0.39 | 125 |

| Orion (50%) | | Measured | - | - | - |

| | | Indicated | 554 | 3.66 | 65 |

| | Total | M&I | 554 | 3.66 | 65 |

| | | Inferred | 91 | 3.33 | 10 |

| AuRico Total | | M&I | 88,001 | 0.88 | 2,484 |

| | | Inferred | 14,357 | 1.02 | 472 |

| Mineral Reserve and Resource Estimates - Copper and Silver |

| | | | Grade | Contained Metal |

| | | Tonnes | Ag | Cu | Ag | Cu |

| | Category | (000's) | (g/t) | (%) | (000's) oz | (000's) lbs |

| Kemess Underground | Probable Reserves | 100,373 | 2.0 | 0.28 | 6,608 | 619,151 |

| | Indicated Resources | 65,432 | 1.8 | 0.24 | 3,811 | 346,546 |

| | Inferred Resources | 9,969 | 1.6 | 0.21 | 503 | 46,101 |

| Orion (50%) | Indicated Resources | 554 | 309 | - | 5,503 | - |

| | Inferred Resources | 91 | 95 | - | 275 | - |

| 13 |

Notes to Mineral Reserve and Resource tables:

- Mineral Reserves and Resources have been stated as at December 31, 2013.

- Mineral Resources are exclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- Mineral Reserves assume the following cutoff grades and process recoveries:

Young-Davidson – Surface: 0.50 grams per tonne cutoff, 91% mill recovery

Young-Davidson – Underground: 2.05 grams per tonne cutoff, 91% mill recovery

El Chanate: 0.15 grams per tonne cutoff, 30%-65% leach recovery

Kemess Underground: $15 NSR cutoff, mill recovery of 72% for gold and 91% for copper

- Reserves have been reported in accordance with NI 43-101, as required by Canadian securities regulatory authorities. In addition, while the terms “Measured”, “Indicated and “Inferred” Mineral Resources are required pursuant to NI 43-101, the SEC does not recognize such terms. Canadian standards differ significantly from the requirements of the SEC, and mineral resource information contained herein is not comparable to similar information regarding mineral reserves disclosed in accordance with the requirements of the SEC. Investors should understand that “Inferred” Mineral Resources have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. In addition, investors are cautioned not to assume that any part or all of AuRico’s Mineral Resources constitute or will be converted into Reserves.

- Orion Mineral Resources are reflected on a 50% basis. Following the completion of a joint venture agreement, Minera Frisco, S.A.B. de C.V. will have a 50% interest in the Orion project.

- Mineral Reserve and Resource tonnage and contained metal have been rounded to reflect the accuracy of the estimate, and numbers may not add due to rounding.

- Mineral Resources were prepared under the supervision of Jeffrey Volk, CPG, FAusIMM, the Director of Reserves and Resources, for AuRico Gold Inc. Mineral Reserves were prepared under the supervision of Chris Bostwick, FAusIMM, the Senior Vice President Technical Services, for AuRico Gold Inc. Both Messrs. Volk and Bostwick are “Qualified Persons” as defined by National Instrument 43-101

The following metal prices were used for the calculation of Mineral Reserves and Resources:

| | Reserves | Resources |

| | Au $/oz | Ag $/oz | Cu $/lb | Au $/oz | Ag $/oz | Cu $/lb |

| El Chanate | $1,250 | - | - | $1,450 | - | - |

| Young Davidson | $1,250 | - | - | $1,450 | - | - |

| Kemess Underground | $1,300 | $23.00 | $3.00 | $13.00 NSR |

| Orion | - | - | - | $850 | $13.00 | - |

The following table presents a year-over-year reconciliation of Mineral Reserves based on contained metal:

| | | Mineral Reserves | | | Processed | | | Increase / | | | Mineral Reserves | |

| | | 31-Dec-12 | | | in 2013 | | | (Decrease) | | | 31-Dec-13 | |

| Gold (000's ounces) | | | | | | | | | | | | |

| El Chanate | | 1,204 | | | 165 | | | (16 | ) | | 1,023 | |

| | | | | | | | | | | | | |

| Young-Davidson - Surface | | 271 | | | 87 | | | (43 | ) | | 140 | |

| | | | | | | | | | | | | |

| Young-Davidson - Underground | | 3,534 | | | 56 | | | 78 | | | 3,556 | |

| | | | | | | | | | | | | |

| Kemess Underground | | 1,805 | | | 0 | | | 0 | | | 1,805 | |

| | | | | | | | | | | | | |

| Copper (000's lbs) | | | | | | | | | | | | |

| Kemess Underground | | 619,151 | | | 0 | | | 0 | | | 619,151 | |

| 14 |

Young-Davidson Mine

The Young-Davidson gold mine is located near the town of Matachewan, approximately 60 km west of Kirkland Lake in Northern Ontario. The property consists of contiguous mineral leases and claims totalling 11,000 acres and is situated on the site of two past producing mines that produced almost one million ounces from 1934-1957.

The Company owns 100% of the mineral rights to all of the mineral resource related claims at the former Young-Davidson mine and the adjoining Matachewan Consolidated Mines Limited Mine (the “MCM Mine”), which together comprise the modern day Young-Davidson Mine. The Company also holds the mineral rights to 200 tenures from mining leases to exploration claims covering 4,734 hectares surrounding and including the Young-Davidson Mine. The contiguous claim block that covers the Young-Davidson Mine, is hereinafter referred to as “Young-Davidson”. Hereinafter, references to work completed by the Company with respect to Young-Davidson includes work completed by Northgate.

Property Description and Location

Young-Davidson is located immediately west of the village of Matachewan, Ontario, and approximately 60 km west of the town of Kirkland Lake, Ontario. Young-Davidson is comprised of 200 tenures related to mining claims, mining leases, patents, and licenses of occupation that were acquired either through staking, application, or option agreements. Collectively, it is subject to nine separate agreements with different obligations and royalties for each agreement. Based on the currently defined mineral reserves and resources, the only royalties to apply are:

| | (i) | a sliding scale royalty held by Matachewan Consolidated Mines Limited that relates to the eastern portion of the open pit and a small portion of the underground resource, which together total approximately 600,000 tonnes; and |

| | | |

| | (ii) | a per ton royalty held by the Welsh Estate that affects almost 400,000 tonnes. |

Through these agreements the Company controls sufficient surface rights to cover the sites required for all project buildings and fixed installations for the life of mine. AuRico believes it has all of the necessary surface rights to dispose of waste rock and tailings on additional areas of the property. AuRico’s land ownership and mineral tenures are registered with the Government of Ontario. All permits required to operate the mine are currently in place.

As Young-Davidson was the site of two former producing gold mines there is existing surface disturbance in the form of old workings, building foundations and tailings sites. Although there is no clean up order on these sites, AuRico designed infrastructure to incorporate these sites where possible so that they are remediated as part of the mine closure plan.

Other than as described above, the Company is not aware of any rights, agreements or encumbrances to which Young-Davidson is subject, which would adversely affect the value of the property or AuRico’s ownership.

The Company entered into Impact Benefit Agreements with the Matachewan First Nation on July 2, 2009 and with the Temagami First Nation / Teme Augama Anishnabai on July 14, 2012, as the Young-Davidson mine is situated within the traditional territory of these two First Nations.

| 15 |

Young-Davidson Property Location

Accessibility, Climate, Local Resources, Infrastructure and Physiography

Young-Davidson is located in northern Ontario, Canada, centrally located between Timmins, Kirkland Lake, North Bay and Sudbury, each of which have businesses that service the mining industry. The property is accessed by paved Highway 566, 5 kilometres west of the town of Matachewan.

The daily average mean temperature in nearby Kirkland Lake, Ontario is 1.7°C. The extreme maximum recorded temperature is 38.9°C and the extreme minimum temperature is -47°C. The average annual precipitation is 884 millimetres, comprising 590 millimetres as rainfall and 294 millimetres as snowfall. Given this climate, exploration and mining development activities can be carried out at all times of the year.

The surface rights possessed by the Company are sufficient for mining operations, availability of sources of power, water, mining personnel, potential tailings storage areas, potential waste disposal areas and potential processing plant sites. Electricity is provided from the provincial grid through a transmission line that was upgraded by the Company prior to commercial production.

The property is typical of northern Ontario with forest covered low rolling hills, small lakes and wetlands with numerous gravel roads providing access to all areas of the property. Average elevation on the property is 330 metres above sea level.

History

The initial discovery of gold in the project area was made by prospector Jake Davidson in 1916 on what became the former Young-Davidson mine. This sparked a staking rush that resulted in a second discovery by Samuel Otisse on what became the MCM Mine property. Surface prospecting, trenching and outcrop stripping continued intermittently for the next seventeen years on both properties. During this time a joint venture was established between Hollinger Corporation and Young-Davidson Mines Limited and underground mine production was initiated in 1934 and continued until 1957, over which time a total of 5.6 million tonnes were mined producing 585,690 ounces of gold (3.22 g/t recovered grade). Production from the MCM mine property over the period 1934-1954 totaled 3.2 million tonnes, 378,101 ounces of gold (3.67 g/t recovered grade). Following closure of the mines, the properties remained dormant until 1980 at which time Pamour Mines concluded option/joint venture agreements on both properties with the aim of establishing an open pit operation. Approximately 96,000 tonnes of ore were mined and trucked to the Pamour mill facility east of Timmins.

| 16 |

In 1995, Royal Oak Mines Inc. (“Royal Oak”), a successor company to Pamour Mines initiated extensive diamond drilling to define an open pit resource, initiated shaft dewatering with a view to underground exploration, conducted shaft rehabilitation as well as engineering studies and environmental assessment studies with a view to re-opening the mines. Following the bankruptcy of Royal Oak Mines, the property was dormant for several years before being acquired by a private company in 2000. This private company undertook limited exploration and, in 2002, vended the asset into Young-Davidson Mines Limited, the same company that had discovered the property. Young-Davidson Mines Limited re-initiated exploration with 9,312 metres of drilling in 58 diamond drill holes.

In late 2005, Northgate amalgamated with Young-Davidson Mines Limited through a Plan of Arrangement, and proceeded with surface exploration, particularly diamond drilling, environmental and engineering studies and underground exploration and development.

In 2011, AuRico acquired Northgate, which included Young-Davidson.

Geological Setting and Mineralization

Young-Davidson is situated within the southwestern part of the Abitibi Greenstone Belt. The Abitibi Greenstone Belt consists of a complex and diverse array of volcanic, sedimentary, and plutonic rocks typically metamorphosed to greenschist facies grade, but locally attaining amphibolite facies grade. Volcanic rocks range in composition from rhyolitic to komatiitic and commonly occur as mafic to felsic volcanic cycles. Sedimentary rocks consist of both chemical and clastic varieties and occur as both intravolcanic sequences and as uncomformably overlying sequences. A wide spectrum of mafic to felsic, pre-tectonic, syn-tectonic and post-tectonic intrusive rocks are present. All lithologies are cut by late, generally northeast-trending proterozoic diabase dikes.

The Abitibi Greenstone Belt rocks have undergone a complex sequence of deformation events ranging from early folding and faulting through later upright folding, faulting and ductile shearing resulting in the development of large, dominantly east-west trending, crustal-scale structures that form a lozenge-like pattern. The regional Larder Lake-Cadillac Fault Zone (“LLCFZ”) cuts across the Young-Davidson project area. The LLCFZ has a sub-vertical dip and generally strikes east-west. The LLCFZ is characterized by chlorite-talc-carbonate schist and the deformation zone can be followed for over 120 miles from west of Kirkland Lake to Val d’Or.

There are three important groups of archean sedimentary rocks in the district. The oldest are Pontiac Group quartz greywacke and argillite, which occur as thick assemblages in Québec, while interbedded within the Larder Lake Group volcanic rocks are turbiditic siltstones and greywackes of the Porcupine Group. Uncomformably overlying is Timiskiming Group Conglomerate, turbidite and iron formation with minor interbedded alkalic volcaniclastic units.

Archean intrusive rocks are numerous in the district but are largely manifested as small stocks, dikes and plugs of augite syenite, syenite and feldspar porphyry occurring in close temporal and spatial association with the distribution of Timiskiming Group sediments. The main syenite mass, which hosts most of the gold mineralization on Young-Davidson, measures almost 3,000 ft. east-west by 1,000 ft. north-south.

Huronian proterozoic sedimentary rocks onlap and define the southern limit of the Abitibi in Ontario. In the project area these rocks are correlative to the Gowganda Formation tillite. Post-Archean dike rocks include Matachewan diabase and younger Nipissing diabase, which respectively bracket the Huronian unconformity in the project area.

| 17 |

Essentially all of the historical production at the former Young-Davidson Mine and approximately 60% of the production from the MCM Mine was from syenite-hosted gold mineralization. Most of the current open pit and underground resources are also related to syenite-hosted gold. The syenite-hosted gold mineralization consists of a stockwork of quartz veinlets and narrow quartz veins, rarely greater than a few inches in thickness, situated within a broader halo of disseminated pyrite and potassic alteration. Visible gold is common in the narrower, glassy-textured quartz veinlets. In general, gold grades increase with quartz veinlet abundance, pyrite abundance, and alteration intensity. Mineralized areas are visually distinctive and are characterized by brick red to pink K-feldspar-rich syenite containing two to three percent disseminated pyrite and several orientations of quartz extension veinlets and veins. The quartz veins and veinlets commonly contain accessory carbonate, pyrite, and feldspar.

Drilling

Since the discovery of gold in the project area until October 14, 2008 a total of 293,774 metres of surface and underground diamond drill holes were completed. With the exception of the holes pre-dating 1980 (324 holes, 20,236 metres), all of the drill logs have been preserved. All holes have been plotted on historic records and these hole traces and assays have now been entered into the database. All holes since 1988 have been surveyed for their collar co-ordinates and it is assumed that all underground hole collars were surveyed as per industry practice at the time of production. Since 1980 all holes have been surveyed using a tropari instrument or acid test and since 2006 all drill holes have been surveyed using FLEXIT and/or a gyroscopic instrument in order to measure down hole deviation.

Underground drill holes were AQ core (27 mm diameter) as was the practice of the day, surface holes pre-dating the Company were, with one exception, BQ core (36.5 mm diameter) and all holes by the Company (and the one exception) have been NQ core (47.6 mm diameter) except where a reduction to BQ (36.5 mm diameter) has been required to complete the hole in problematic ground conditions. Core recovery and rock quality designations have not been noted in historic drill logs, however in all the holes by the Company core recovery has been excellent and the rock quality designation (“RQD”) factor has been very high indicating very competent rock.

Sampling Method and Approach

Drill core is transported directly from the drill rigs to the secure core logging facility. Core is logged with geological information being recorded, including rock type, degree of alteration, estimated percentage of sulfide minerals and vein intensity. Zones of interest are marked out and assigned a sample number and assay tags are stapled into the box as well as being inserted into the sample base. Most of the core has been split with a hydraulic splitter, with a small number of samples cut with a diamond bladed core saw. The majority of the samples are 1.5 metres in core length and most of the historic samples are in five foot lengths. Assay procedures were not well documented prior to 2003, but it is assumed that conventional crushing, pulverizing and classical fire assay techniques were used.

Sample Preparation, Analyses and Security

Prior to sample shipment, a number of measures have been implemented which were designed to maintain a high level of security at the core logging facility, at the mine property and while the samples are in transit.

For exploration drill core, a number of measures have been implemented which were designed to maintain a high level of security at the core logging facility and while the samples are in transit.

Upon arrival at the ALS Global laboratory, samples are logged into the laboratory tracking system and weighed. Each core sample is entirely crushed to better than 70% -2 millimetre (minus 10 mesh). A 250 gram split of crushed material is taken and pulverized. Certified reference material and blanks are inserted with samples prior to analysis. Fifty gram aliquots are weighed for fire assay. Fire assay fusion was by lead flux with a silver collector and atomic absorption finish. Each sample was also submitted for a 34 element analysis, by aqua-regia acid digestion and ICP-AES. This process quantitatively dissolves base metals for the majority of geological materials. Major rock forming elements and more resistive metals are only partially dissolved. All sample batches were subjected to the laboratory’s internal quality control procedures.

| 18 |

All mine samples, including blasthole underground channel and drill core are assayed at the on-site laboratory operated the Company. We have been advised by ALS Global that the laboratory is well-equipped, fully ventilated, and staffed by experienced personnel. Samples are prepared and analyzed as described above.

Quality Control and Quality Assurance

No information has been compiled that describes the quality control (“QC”) and quality assurance (“QA”) procedures for the pre-2003 drilling, however it is unlikely that blanks and CRM’s were used as this did not become standard industry practice until the early 2000’s. The main form of QA/QC would have been periodic re-assaying of anomalous samples with introduction of blanks in the early 1980s and 1990s.

The QA/QC for the 2006, 2007 and 2008 programs is documented in the technical documents filed on the Canadian System for Electronic Document Analysis and Retrieval (“SEDAR”) website atwww.sedar.com. In essence this amounted to four percent of the entire population of samples submitted for analysis, including blanks, standards, and duplicates. Additionally, about 15-20% of pulp replicates and 2.5% of reject duplicates were analyzed and incorporated into final assay grade to improve overall precision. The QA/QC data is monitored as the samples are being processed at the laboratories and where analytical problems are identified the laboratory is required to reanalyze the samples.

Based on this work it was concluded that the data is reliable and suitable for supporting mineral resource and mineral reserve estimation work in the opinion of the Qualified Person.

Data Verification

The project data base has been subject to verification or audit by Micon International Inc. (2004), Scott Wilson Roscoe Postle Associates Inc. (2006), AMEC plc (2008) and Company geologists (2006, 2007 and 2008) who had no direct involvement with the project. Collar co-ordinates, down hole survey tests and assay intervals were verified against a variety of supporting documentation. Where errors have been identified these were corrected and procedures put in place to prevent re-occurrence and to expedite future data verification programs. In each case the third party audit has concluded that the database is valid and acceptable for supporting resource estimation work on the project.

Mine Development and Mine Plan

The open pit has been in operation for over two years and will cease production in the first half of 2014. Mining is conducted by a contractor using conventional methods on 8 metre benches, using 8 metre3 front-end loaders, 77 tonne haul trucks, appropriately sized drills and support equipment. The open pit mining contractor commenced mobilization and mining in November 2011.

A historical open stope exists at the east end of the existing pit design. In order to remove the safety risks of working near an open stope, and to minimize dilution and mining loss, the stope was filled with waste rock early in the open pit mine life. The waste rock backfill will then be mined out as part of regular bench mining activities.

The open pit mining plan has been generated to feed the mill at a rate of 2.16 Mt/yr. The plan includes the stockpiling of lower grade ore so that the head grade is higher during the first two years of the project. Approximately 18.9 Mt of waste rock will be generated by the open pit and will be placed in the waste dump to the north of the pit.

The underground deposit is located approximately 210 m to 1,500 metres below surface. During 2013, the Company completed the sinking of the shaft down to the mid-shaft loading pocket, which accesses the first eight years of mine production. The Company also completed the mid-shaft ore and waste haulage systems, an underground crushing facility, surface ventilation fans and booster fans at the 9590 level. The Company continues to work on developing vertical access in the underground mine below that of the mid-shaft loading pocket, to an eventual depth of 1,500 metres; this work will continue in 2014. The existing MCM #3 shaft is being extended to a depth of 1,500 metres to provide for the hoisting of men, materials, ore and waste. The mine will also be accessed by a ramp, which will be extended to the bottom of the mine from the existing exploration ramp, currently at a depth of 900 metres below surface. The mine design has taken into consideration the existing MCM #3 and the Young-Davidson shafts and other existing openings for ventilation and early works.

| 19 |

The underground mine has been designed for low operating costs through the use of large modern equipment, gravity transport of ore and waste through raises, shaft hoisting, minimal ore and waste rehandling, high productivity bulk mining methods and paste backfill. The mine will operate scooptrams to load, haul and transfer stope production to the ore pass system from where it will be hoisted to the surface via 18 Mt skips.

At the current design production rates of 2.92 million tonnes per year (8,000 tonnes per day) at full production, the underground will have a mine life of approximately 20 years based on the current reserve. Production from the underground mine will be complemented by open pit or stockpiled mill feed until it can provide the entire mill feed. For the last 17 years of the currently projected underground mine life, mill feed will be provided almost exclusively from the underground mine.

Lateral development of the underground mine will average approximately 12,000 metres per year including capital, operating and ore categories for the first 12 years of the underground mine operation. In the last 8 years of the underground mine life, the development requirements drop off sharply as the mine is close to being fully developed.

The average underground personnel requirements at 8,000 tonnes per day are estimated to be 300 persons. The mine will operate seven days a week with two 10.5 hour shifts per day working a five days on and four days off followed by four days on five days off schedule. Once in full production, the mine will be owner operated with only diamond drilling and raising being contracted.

Exploration and Development

The Young-Davidson open pit mine and mill declared commercial production effective September 1, 2012. Commercial production was declared once the mine achieved previously established commissioning thresholds. The commissioning thresholds included a 30-day period whereby the mill throughput averaged at least 5,100 tonnes per day (subsequent to the commissioning of the flotation and gravity circuits) and the open pit averaging 29,750 tonnes per day of ore and waste mining.

During October 2013, the Company commissioned the midshaft loading pocket and shaft hoisting infrastructure, and began hoisting underground ore to surface. Prior to October 2013, the Company was trucking ore to surface through the exploration ramp. On October 31, 2013, the Company declared commercial production at the Young-Davidson underground mine.

A significant portion of the 2013 capital budget was focused on the completion of the shaft and hoisting system, the underground waste and ore pass system and crusher. The Company also completed the construction of the paste backfill plant, which was commissioned in January 2014. Capital works in 2014 will include the continued lateral and vertical development of the underground mine, continued installation of underground ventilation infrastructure and the purchase of new mobile equipment as the underground operation expands. Total lateral and vertical development are expected to be 14,300 metres and 1,000 metres respectively. Lateral development will consist of continuing to establish the levels spaced every 30 metres in the orebody consisting of footwall drives, drawpoints and stope development. Main ramp development will also continue from 9590 level towards the eventual bottom of the mine at 8900 level.

The Company completed 17,789 metres of surface drilling in 2013, directed at a number of target areas and a number of geophysical targets across key parts of the geology. The primary target was the YD West Sherriff area, where drilling in 2012 intersected anomalous gold in the same rock with similar alteration to that in the main zones at the Young-Davidson mine. Results of these holes are incorporated in the overall Mineral Reserve and Mineral Resource estimate.

| 20 |

Mining Operations

The metallurgical testwork programs considered for feasibility study were completed in 2008 and early 2009 at SGS Lakefield. Results of these tests provided the data used for the design criteria.

The tests were conducted on samples from 32 holes selected across the mineralization from which five zone composites and a master composite were prepared. Flowsheet optimization was conducted on the master composite. Once the metallurgical parameters were optimized, the five zone composite and 32 individual samples were tested used for variability testing.

The grinding characteristics of the design mineralized material, an equal mixture of Upper Boundary Zone, Lower Boundary Zone and Pit Zone material as combined material for pilot plant feed gives an average Bond Work Index of 15.6 kilowatt hours per tonne (“kWh/t”) at 100 mesh (106 micrometer (“µm”)) of grind. The selected six zone samples work index ranged from 14.7 to 18.3 kWh/t or an average of 16.5 kWh/t. Most samples tested fell in the medium to hard range of hardness with respect to impact breakage and Bond rod mill/ball mill grindability work indices while there was one waste sample which fell in the very hard range of hardness. All samples have been classified as abrasive or very abrasive.

The gravity recoverable gold was determined to be about 25% of the gold contained in the composite sample tested when cleaning of the primary centrifugal concentrator product on a Mozley table was completed to a target 0.05% weight recovery of the initial feed material.

The metallurgical test programs supported the selection of single stage semi-autogenous grinding circuit with a gravity circuit followed by flotation. The flotation concentrate is further ground and leached in a conventional carbon-in-leach. The flotation tailings are also leached in a carbon-in-leach circuit. The gold is recovered from the carbon followed by electro-winning and pouring doré bars.

A gold recovery of 92.5% is indicated for the head grade of the samples on which the test work was performed and was the basis for the feasibility phase.

The combined leach tailings were used for the cyanide destruction testwork. The Young-Davidson carbon-in-leach tailings are treated with the SO2/Air cyanide destruction method.

El Chanate Mine

The El Chanate Mine is located 37 km northeast of Caborca in Sonora State, Mexico. The mine consists of an open pit, crusher, heap leach pads, process plant and supporting infrastructure located on 4,618 hectares encompassed within 22 mineral concessions.

The Company acquired El Chanate through the acquisition of Capital Gold in April 2011. Hereinafter, references to work completed by the Company with respect to El Chanate, includes work completed by Capital Gold.

Property Description and Location

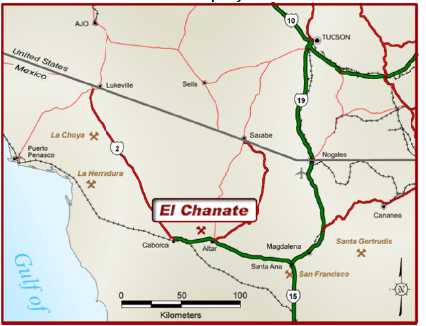

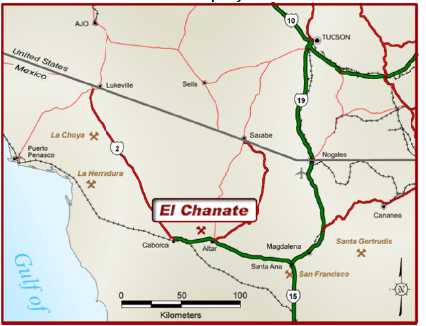

El Chanate is located in northern Mexico in the northwest corner of the State of Sonora, Municipality of Altar (see map below). The mine site is 25 kilometres northeast of Caborca, 280 kilometres northwest of Hermosillo, 150 kilometres southeast of Sonoyta, and 170 kilometres southwest of Tucson, Arizona at UTM geographical coordinates of 412,150E, 3,407,880N (Lat 30°48’10”N, Long 111°55’00”W). Caborca, with a population of 100,000, is the largest town in the area. Pitiquito and Altar are smaller nearby towns located off Highway 2 west and east of the El Chanate, respectively. All permits required to operate the mine are currently in place.

| 21 |

El Chanate Property Location

Minimum Investment and Mining Duty

All concessions are subject to an annual minimum investment and an annual mining tax that must be paid to keep the concessions in good standing. The amount of the minimum investment or assessment work varies based on the size, age and type of the concession, and changes each year with the Department of Mines publishing a new list at the beginning of the year and varies with the consumer price index. The rate of the mining duty depends on the concession type and the age of the concession. The rate changes bi-annually with the Department of Mines publishing the new rates in January and July. The mining duty is due in both January and July. The total mining duty required annually to keep El Chanate’s 22 titled concessions (4,618 hectares) is approximately 500,000 pesos.

Accessibility, Climate, Local Resources, Infrastructure and Physiography

Geographically, El Chanate is on the south-eastern margin of the NW-SE mountain range formed by Sierras La Gloria, El Alamo, Batamote and El Chanate. Locally, El Chanate resides on the Escalante cattle ranch ground.

The project is located on the north west corner of the state of Sonora, in the Altar desert (a subset of the Sonoran Desert). Topography is typical of the Basin and Range province with Sierra El Batamote and Sierra El Chanate as prominent steep mountain ranges emerging from the flat basin. Elevation at the project area is 500 metres above sea level; the El Chanate Range is 900 metres high and El Batamote 850 metres high.

The working area lies on the southern pediment of El Chanate Range, a flat plateau covered by thin layers of unconsolidated gravel and dissected by sharp shallow creeks, gently dipping into the gravel filled valley of the Sásabe (dry) and Altar rivers.

From Hermosillo, the property can be accessed by driving 173km north to Santa Ana on Highway 15, then approximately 95km west on Highway 2 to Caborca. The mine access road is approximately 13km east of Caborca on Highway 2. The project area is easily accessible from Mexican Highway 2 by driving north 11km on a nearly level dirt road through the Ejido 16 de Septiembre and onto the Escalante cattle ranch where the El Chanate mine is located.

| 22 |

Vegetation consists of typical Mexican desert species composed primarily of various cacti, shrubs and brush.

According to the Köppen climate classification system, the project is described as having a BWh, or desert climate where the coldest month has an average high temperature above 0°C. The average annual temperature is 21.5°C. July is the hottest month with an average maximum temperature of 44.6°C. The hottest month on record was July 1998 with an average temperature of 48.0°C. January is the coldest month with an average low temperature of -2.2°C. The coldest month on record was January 1971 with an average temperature of -11.0°C. The mine operates year round.

Annual average precipitation as measured at the nearby Pitiquito station (about 15 kilometres away) is 259 millimetres. Rainfall occurs due to the normal “monsoon” rains and the effects of Pacific storms.

Equipment and infrastructure include: a three stage crushing plant, a leach pad and solution holding ponds, four Adsorption, Desorption, Refinery (“ADR”) processing plants, a refinery, a fleet of haul trucks, loaders and mining support equipment. In addition, there are numerous ancillary support facilities including warehouses, maintenance shops, roadways, administrative offices, power and water supply systems, and a fully equipped assay and metallurgical laboratory. The open pit operations are conducted by a local mining contractor.

History

Historical workings suggest the area has been mined for gold since the early 19th century. The current open-pit mine has now been developed below the level of those historical small-scale mine workings. The open-pit mine plan covers an area approximately 1,700 metres long, 845 metres wide, and 300 metres deep. El Chanate utilizes conventional three stage crushing and heap leaching, with gold bearing solutions being processed in an ADR plant, followed by electro-winning and refining.

Geological Setting and Mineralization

El Chanate is located between the northern flank of Sierra El Batamote and the southern flank of Sierra El Chanate. These ranges are tectonic blocks derived from Late Mesozoic compressional events modified by Early Cenozoic extension. The area is underlain by Mesozoic, meta-sedimentary rocks intruded by Late Cretaceous andesites. All of these units are cut by Tertiary felsic to mafic rocks. The post mineral San Jacinto andesite flow located north of the mine is the youngest bedrock unit dated at 51Ma. The dominant controls on gold mineralization are structural channeling along faults and development of veins by dilation and hydraulic fracturing. Gold precipitation is dependent on a chemically favorable environment but is not strongly influenced by rock composition. Relatively deep seated regional structures appear to have been active at the time of mineralization and have played a vital role in the structural preparation of the host rocks and channeling of the mineralizing fluids. The fluids and their contained metals are believed to have been derived either from a deeper magmatic source rock or from deep metamorphic processes associated with the Laramide Orogeny.

Drilling

From 2001 to 2009, the Company conducted surface mapping, surface sampling, geophysics, diamond drilling and reverse circulation drilling on the property. The results of this work delineated anomalous gold mineralization along a northwest striking fault zone traceable for 4.5 kilometres on strike and still open at depth. The mineralized zone had been drill tested by 819 holes for a total of 140,224 metres. There are 754 reverse circulation holes and 65 core holes. The deposit remains open in several directions.

From 2010 to 2013, the Company has drilled 681 reverse circulation holes totaling approximately 124,320 metres and 32 core holes for 11,101 metres.

| 23 |

Sampling, Analysis, Quality Control and Quality Assurance

An analytical quality assurance program has been established for all of the Company’s mineral properties to control and assure the analytical quality of assays in all of the Company’s exploration programs. This program includes the systematic addition of blank samples, duplicate samples and certified standards to each batch of samples sent for analysis to commercial accredited laboratories. Blank samples are used to check for possible contamination in laboratories, duplicate samples quantify overall precision, while certified standards determine the analytical accuracy. The split core samples are sent directly from the project sites to ALS Global, an ISO-17025 accredited laboratory with facilities in Hermosillo, that performs gold and silver analyses at its laboratory in Vancouver, British Columbia.

For reverse circulation drill holes one standard and one blank are included in each batch of 20 samples. For core holes, duplicates (1%), blanks (4%) and standards (5%) are inserted into the sample intervals.

ALS Global performed well on inserted blanks and standards in 2013. We have been advised by ALS Global that there is no evidence of systematic contamination and accuracy is acceptable based on standards in the grade range 0.2 to 2.6 g/t gold.

Blasthole samples are assayed at the on-site mine laboratory operated by the Company. The laboratory is well-ventilated, procedures are fully documented, and there are 25 employees to cover operations 24 hours a day and analyze 12,000 samples per month.

Samples are crushed to 85% passing ¼ inch and a 250 gram split is pulverized to 80% passing 106 microns.

Gold is determined by industry-standard fire assay on a 30 gram aliquot with an atomic absorption finish. Silver is analyzed on the same solution and the final silver assays are adjusted for both silver losses in cupellation and for the silver added to improve gold collection. A laboratory review in October 2013 by Analytical Solutions Ltd. recommended changes to the silver assay method to improve precision of the results.

The onsite mine laboratory includes 15% blanks, standards and duplicates for gold determinations. We have been advised by ALS Global that there is no indication of systematic contamination, and accuracy is acceptable for the mine operations. A check assay program and participation in an international round robin are planned for 2014.

Data Verification

The project database has been subject to verification by independent sources, primarily Independent Mining Consultants (“IMC”) and SRK Consulting (“SRK”). The electronic database was first verified by IMC in 2003. The IMC drill hole database has incorporated substantial verification procedures for the data in most of the critical areas. IMC reported that they found that the assay database was consistent with assay certificates. They also reported that there was no evidence of significant contamination of reverse circulation samples during drilling. In 2007, IMC compared the 2007 drilling database with Chemex assay certificates for about 25% of new holes and noted no significant errors. In 2009, IMC was provided with a database of the Company’s 2008 analytical results and the original Chemex assay certificates. The database was validated to the certificates and no problems were noted.

In preparation of the feasibility study, SRK also received the electronic database from the Company which included all of the data verification procedures conducted by IMC, as mentioned previously. SRK performed spot checks on the 2009 drill hole assays by comparing them to the original Chemex assay certificates and noted no exceptions.

Exploration and Development

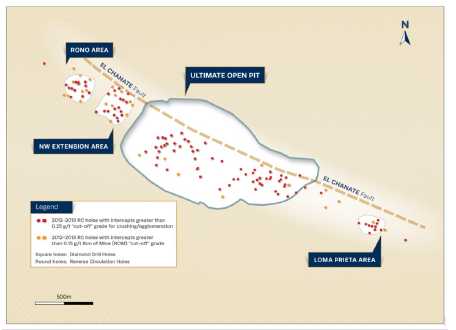

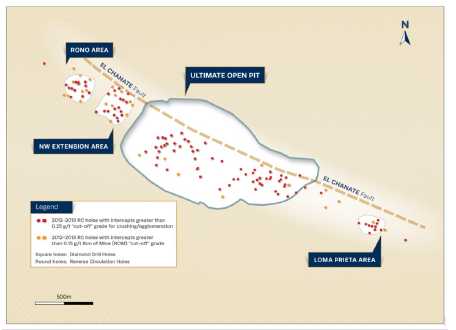

The 2013 exploration program followed up on identified two new discoveries from 2012 that are directly on trend of the open pit as well as the extension of the previously identified north west zone located approximately 50 metres northwest of the open pit. The Rono zone is approximately 600 metres northwest of the open pit and the Loma Prieta zone is approximately 1.2 kilometres southeast from the ultimate pit boundary.

| 24 |

During 2013, the Company completed 45,697 metres of reverse circulation drilling and 980 metres of diamond core holes. The drilling program within the current open pit has intersected a new type of mineralization below the ultimate open pit bottom floor, which is a higher grade than the current reserve grade. Drilling outside of the open pit focused on the northwest and southeast extension, within the Rono and Loma Prieta targets. Detailed drill results are included in the Company’s September 12, 2013 press release.

Drill Results

On June 28, 2013, the Company completed an option/joint venture agreement with Highvista Gold Inc. to explore approximately 11,600 hectares of claims located to the northwest of the open pit that provides access to an additional 15 to 20 kilometres of the El Chanate fault. The agreement grants AuRico the option to earn a 51% undivided interest in the El Chanate Extension by incurring an aggregate of $3,000,000 in exploration expenditures over the next three years. The Company can earn a further 19% interest (bringing its aggregate interest to 70%) by funding the preparation of a feasibility study or prefeasibility study on the property.

The exploration plan for 2014 is to continue with mapping, aeromagnetic geophysical, geochemical and drilling along the property.

On June 13, 2013, the Company signed an option agreement with Minera Goldzone S.A. de C.V. to acquire a 100% interest in the Las Lajas Project, an 8,145 hectare property consisting of 6 contiguous mining concessions located in southern Sonora State, Mexico. Field work during 2013 consisted of twelve bulldozer trenches (1,277 metres) in two areas. This work is ongoing and a drilling program will be initiated toward the end of the first quarter of 2014.

Mining Operations

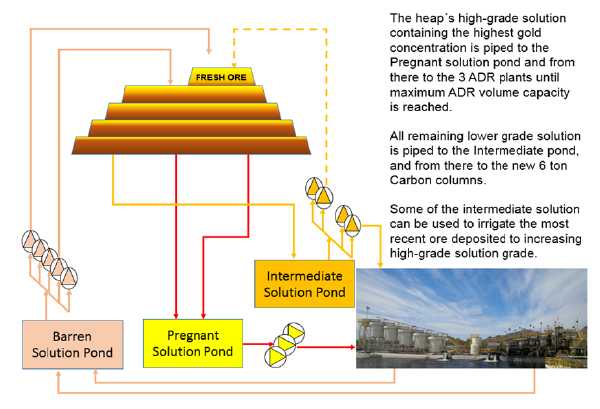

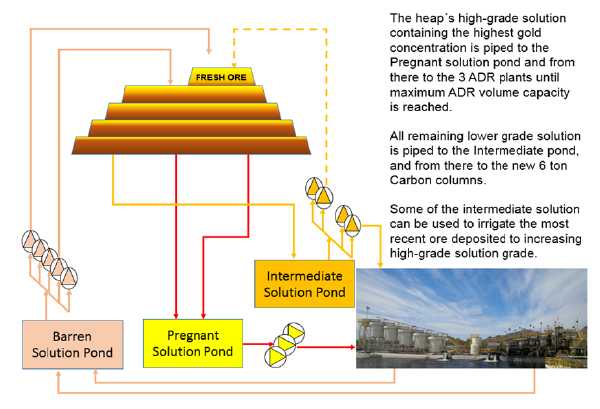

El Chanate is an open pit mining and heap leach processing operation. Ore is hauled, via a mining contractor, by truck from the pit to the crushing plant. The recovery of gold is achieved through the heap leaching process. Under this method, ore is placed on impermeable leach pads where it is treated with an alkaline cyanide bearing solution, which dissolves gold and silver contained within the ore. The resulting “pregnant” solution is further processed in a plant where the gold and silver is recovered. The processing is a closed circuit, zero-discharge operation where solution is continuously re-used. The smaller of the four ADR processing plants was purchased used and refurbished by the Company. Recent mobile equipment additions and all other equipment and infrastructure at El Chanate were new when procured. Management continuously analyzes production results and considers improvements and modernizations as deemed necessary.

| 25 |

In 2010, the Company engaged an independent consultant with respect to heap leaching optimization, which has resulted in recommendations to increase the barren solution flow to the leach pad, increase the pregnant solution flow to the recovery plant, and redirect the low grade solution to the leach pads. When fully implemented, these operational changes combined with the agglomeration with cement and barren solution resulted in improvements in leaching time.

In April 2011, after the acquisition by AuRico, an expansion plan was executed which included the following improvements:

Changing the crusher liners from fine to medium coarse resulting in lower power consumption, and higher crushing capacity, while the 3/8” crush size obtained an average P80 of 0.24 to 0.29”. The further installation of programmable logic controls resulted in approximately a 40% increase in the crushed tonnage.

Belts were sped up by 20% to allow adequate conveying, while a heavy duty conversion of the entire conveying system resulted in an additional 25% productivity improvement and higher reliability. The newly installed programmable logic controls included an automated start and stop capability which together with a new stacker and its 10 metre lifts greatly reduced the duration of any occurring production interruptions.

New leach pads were added as well as a third ADR plant to accommodate the higher productivity rates while pumped solution volume was augmented to ensure that the incremental tonnage deposited on the leach pads could be leached with identical or better cyanide solution to ore ratios ensuring leach kinetics and recovery in 2012.

As area and pumped volume increased, an intermediate pond was added to improve cyanide solution to ore ratios and improving the head grade to the ADRs.

In order to leach the increased tonnages deposited on the leach pads, the original single 8” water supply piping was replaced with 16” piping in 2012, thus doubling available water volume and reducing power consumption per m3by 50%. Prior to this, the Company had procured additional water rights that enabled the drilling of another water supply well.