Exhibit 99.2

|

| |

| |

| Notice of Annual and Special |

| Meeting of Shareholders |

Management Proxy Circular

March 19, 2015

| TSX: AUQ / NYSE: AUQ |

March 19, 2015

Dear Shareholder:

On behalf of the Board of Directors and Management of AuRico Gold Inc. (the “Company”), we would like to invite you to attend the annual and special meeting of Shareholders as per the following details:

| | Date: | Thursday, May 7, 2015 |

| | Time: | 10:00 a.m. (Toronto time) |

| | Location: | Toronto Region Board of Trade, 77 Adelaide Street West, Toronto, Ontario |

During 2014, the Company executed on a number of strategic initiatives that have positioned AuRico for long-term success and shareholder value creation. The most notable accomplishment was the continued development and productivity ramp-up of the underground mine at the Company’s cornerstone Young-Davidson mine. The success of the ramp-up to date underpinned the transition to positive net free cash flow status at Young-Davidson in the fourth quarter of the year, a significant milestone for the Company. Highlights since the last meeting of Shareholders include the following:

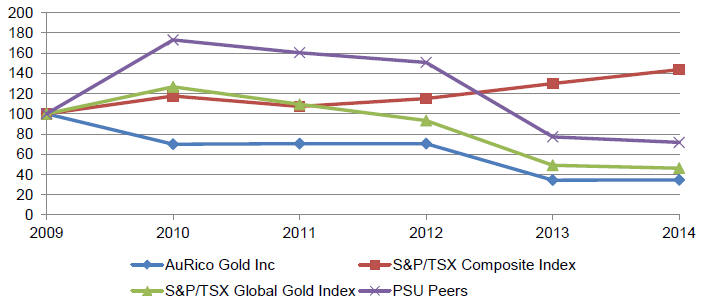

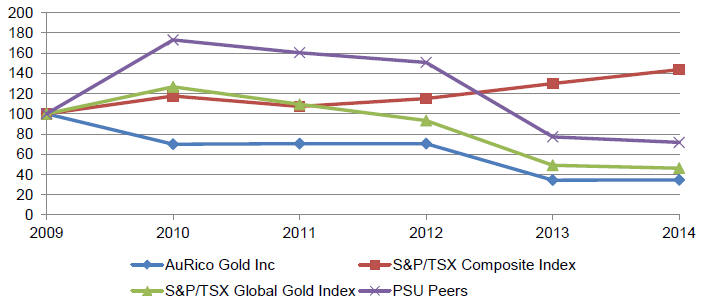

| We provided a positive return to Shareholders in 2014 compared to losses for major gold mining indices and the majority of our peer group; |

| | |

| We reported the eleventh consecutive quarter of production growth at Young-Davidson and full year production that was at the very high-end of guidance; |

| | |

| We achieved net free cash flow at Young-Davidson in the fourth quarter; |

| | |

| We identified a significant new gold-copper deposit at Kemess East; |

| | |

| We established a joint venture arrangement at the promising Lynn Lake Gold Camp; |

| | |

| We appointed Janice Stairs to the Board of Directors, which broadened our board’s competencies, increased board independence and addressed gender representation; |

| | |

| We reduced cash-based administrative costs during the year by 17%; and |

| | |

| We realized a premium share price valuation versus our peer group. |

The enclosed management proxy circular contains information about voting instructions, the business of the meeting, the nominated directors, corporate governance practices, and how the Company compensates its executives and directors. At the meeting, we will also discuss highlights from 2014 and some of our plans for the future. Management and members of the Board of Directors will be available to meet you and answer any questions that you may have.

1

|

| If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder |

| Services at 1-888-518-1562 or call collect at (416) 867-2272 or emailcontactus@kingsdaleshareholder.com |

Your participation in the affairs of the Company is important to us. Please take this opportunity to exercise your vote, either in person at the meeting or by completing and returning your proxy form no later than 10:00 a.m. (Toronto time) on May 5, 2015 or no later than 10:00 a.m. (Toronto time), two full business days before the time of an adjourned or postponed meeting. If you have any questions or need assistance completing your proxy or voting instruction form, please contact our proxy solicitation agent, Kingsdale Shareholder Services (“Kingsdale”), toll free in North America at 1-888-518-1562, or call collect from outside North America at 416-867-2272, or by email at contactus@kingsdaleshareholder.com.

We look forward to seeing you at the meeting.

|  |

| Alan R. Edwards | Scott G. Perry |

| Chairman | President and Chief Executive Officer |

PLEASE TAKE A MOMENT TO VOTE

YOUR PARTICIPATION IS IMPORTANT TO US

2

|

| If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder |

| Services at 1-888-518-1562 or call collect at (416) 867-2272 or emailcontactus@kingsdaleshareholder.com |

NOTICE OF ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVENthat the annual and special meeting (the “Meeting”) of the holders of common shares (the “Common Shares” and the holders of the Common Shares, the (“Shareholders”)) of AuRico Gold Inc. (the “Company”) will be held at the Toronto Region Board of Trade, 77 Adelaide Street West, Toronto, Ontario on Thursday, May 7, 2015, at 10:00 a.m. (Toronto time), in order to:

| i. | | Receive and consider the consolidated financial statements of the Company for its financial year ended December 31, 2014, and the auditors’ report thereon; |

| | | |

| ii. | | Elect the Company’s directors who will serve until the next annual meeting of Shareholders; |

| | | |

| iii. | | Appoint KPMG LLP, Chartered Accountants, as auditors for the Company, and to authorize the directors of the Company to set the auditors’ remuneration; |

| | | |

| iv. | | Consider and, if deemed advisable, pass an ordinary resolution of Shareholders ratifying, confirming and approving amendments to the Company’s 2014 ESPP as more fully described in the accompanying management proxy circular (the ��Circular”); |

| | | |

| v. | | Consider and, if deemed advisable, pass a non-binding, advisory resolution accepting the Company’s approach to executive compensation; and |

| | | |

| vi. | | Transact such other business as may properly be brought before the Meeting or any adjournment or postponement thereof. |

The Circular forms part of this Notice and provides additional information relating to the matters to be dealt with at the Meeting.

You are entitled to vote at the Meeting, and any postponement or adjournment thereof, if you owned Common Shares of the Company at the close of business on March 19, 2015 (the record date). For information on how you may vote, please refer to Part 1 of this Circular.

Toronto, Ontario

March 19, 2015

By Order of the Board of Directors,

Alan R. Edwards

Chairman of the Board

3

|

| If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder |

| Services at 1-888-518-1562 or call collect at (416) 867-2272 or emailcontactus@kingsdaleshareholder.com |

TABLE OF CONTENTS

4

|

| If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder |

| Services at 1-888-518-1562 or call collect at (416) 867-2272 or emailcontactus@kingsdaleshareholder.com |

MANAGEMENT PROXY CIRCULAR

This management proxy circular (the “Circular”) is provided in connection with the solicitation of proxies by the management (“Management”) of AuRico Gold Inc. (the “Company” or “AuRico”) for use at the annual and special meeting (the “Meeting”) of the holders of common shares of the Company (the “Common Shares” and the holders of the Common Shares, the “Shareholders”) to be held on Thursday, May 7, 2015 at the time and place, and for the purposes set forth in the accompanying Notice of Meeting and at any adjournment or postponement thereof. Unless otherwise noted, information in this Circular is given as at March 19, 2015.

Part 1: VOTING INFORMATION

Solicitation of Proxies

The solicitation of proxies will be primarily by mail, but proxies may also be solicited personally by telephone by regular employees of the Company for which no additional compensation will be paid. In addition, AuRico has retained Kingsdale Shareholder Services (“Kingsdale”) to assist in the solicitation of proxies by mail and telephone in the United States and Canada for estimated fees of $50,000 in addition to certain out-of-pocket expenses. The costs of preparing, assembling, and mailing this Circular (as required), the Notice of Meeting, the proxy form, the voting instruction form and any other materials relating to the Meeting and the cost of soliciting proxies will be paid by AuRico. The Company will reimburse third parties for costs incurred by them in mailing soliciting materials to the beneficial Shareholders of Common Shares. If you have any questions or need assistance completing your proxy or voting instruction form, please contact our proxy solicitation agent, Kingsdale, toll free in North America at 1-888-518-1562 or call collect from outside North America at 416-867-2272 or by email at contactus@kingsdaleshareholder.com

Who Can Vote?

Registered and Non-Registered Shareholders

You have the right to vote if you owned Common Shares of the Company on March 19, 2015, which is known as the record date. Each Common Share you own entitles you to one vote.

You are a registered Shareholder if the Common Shares are registered in your name. This means that your name appears in the Shareholders’ register maintained by our transfer agent, Computershare Investor Services Inc. You are a non-registered (or beneficial) Shareholder if your bank, trust company, securities broker or other financial institution or intermediary (your nominee) holds your Common Shares for you in a nominee account.

How Many Common Shares are Eligible to Vote?

On March 19, 2015, the Company had 253,488,335 Common Shares issued and outstanding.

To the knowledge of the Board of Directors and officers of the Company, the only person or company that beneficially owns, or controls or directs, directly or indirectly, more than 10% of the outstanding Common Shares is:

5

|

| If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder |

| Services at 1-888-518-1562 or call collect at (416) 867-2272 or emailcontactus@kingsdaleshareholder.com |

| Name of Beneficial Owner | | Number of Common

Shares(1) | | | Proportion of Class(2) | |

| Van Eck Global | | 46,572,361 | | | 18.37% | |

| | |

Notes: |

| (1) | Based upon public filings with securities regulatory authorities in Canada on the System for Electronic Document Analysis and Retrieval (SEDAR). |

| (2) | Calculated on the basis of 253,488,335 Common Shares outstanding as of March 19, 2015. |

Quorum for the Meeting

Quorum is needed to transact business at the Meeting. The Company’s by-laws require two or more Shareholders present or represented by proxy representing in aggregate not less than 25% of the total number of issued and outstanding shares entitled to vote at the meeting.

How to Vote?

Completing the proxy form or voting instruction form

This package includes either a form of proxy (for registered Shareholders) or voting instruction form (for non-registered Shareholders) that includes the names of AuRico nominees who are proxyholders.

You can also appoint someone or an entity to be your proxyholder by printing his or her name in the space provided on the form, or by completing another proxy form. The person or an entity does not need to be a Shareholder. Your vote can only be counted if he, she or it attends the meeting and votes on your Common Shares according to your instructions. If you do not specify how you want to vote your Common Shares, your proxyholder can vote as he or she sees fit.

When you vote by proxy, the Common Shares represented by the proxy will be voted or withheld from voting in accordance with the instructions of the Shareholder on any ballot that may be called for and if the Shareholder specifies a choice with respect to any matter to be acted upon, the Common Shares will be voted accordingly.

Exercise of discretion

The proxy will confer discretionary authority on the nominee with respect to matters identified in the proxy form for which a choice is not specified and any other matter that may properly come before the Meeting or any postponement or adjournment thereof, whether or not the matter is routine or contested.

With respect to any matter specified in the proxy, if no voting instructions are provided, the nominees named in the accompanying form of proxy will vote Common Shares represented by the proxy FOR the approval of such matter.

As of the date of this Circular, Management is not aware of any amendment, variation or other matter that may come before the Meeting. If any amendment, variation or other matter properly comes before the Meeting, the nominee intends to vote in accordance with the nominee’s best judgment.

Returning your proxy form

To be effective, we must receive your completed proxy form or voting instruction no later than 10:00 a.m. (Toronto time) on May 5, 2015.

6

|

| If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder |

| Services at 1-888-518-1562 or call collect at (416) 867-2272 or emailcontactus@kingsdaleshareholder.com |

If the Meeting is postponed or adjourned, we must receive your completed form by 10:00 a.m. (Toronto time), two full business days before the time of the adjourned or postponed meeting. Late proxies may be accepted or rejected by the Chairman of the Meeting at his discretion and he is under no obligation to accept or reject a late proxy. The Chairman of the Meeting may waive or extend the proxy cut-off without notice.

Registered Shareholders and Canadian Non-Objecting Beneficial Owners (Non-registered Shareholders)

Registered Shareholders and Canadian non-objecting beneficial owners can vote in one of the following ways:

Voting by proxy

Telephone

For registered Shareholders, call toll-free in North America at 1-866-732-8683 or direct at 1-312-588-4290 and follow the instructions. For Canadian non-objecting beneficial owners, call toll-free in North America 1-866-734-8683 or direct at 1-312-588-4291 and follow the instructions. You will need to enter your 15-digit control number, which appears below your name and address on the proxy form.

Internet

Go towww.investorvote.com and follow the instructions on screen. You will need to enter your 15-digit control number, which appears below your name and address on the proxy form.

Fax

Complete both sides of the proxy form, sign and date it and fax both sides to our transfer agent, Computershare, Attention: Proxy Department, at 1-416-263-9524 or 1-866-249-7775 (North America).

Mail

Complete, sign and date the form and return it in the envelope provided, or send it to: Computershare Investor Services Inc., Attention: Proxy Department, 100 University Avenue, 8th Floor, Toronto, Ontario, M5J 2Y1, Canada.

By appointing someone to attend in person

This person does not need to be a Shareholder. Strike out the two names that are printed on the form and print the name of the person you are appointing as your proxyholder in the space provided. Then complete your voting instructions, sign and date the form. Make sure the person you are appointing is aware that he or she has been appointed and attends the meeting on your behalf. Your proxyholder should see a representative of Computershare when he or she arrives at the Meeting.

Attending the Meeting in person

If you are a registered shareholder, when you arrive at the Meeting, see a representative of Computershare to register your attendance. Voting in person will automatically cancel any completed proxy form you previously submitted.

7

|

| If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder |

| Services at 1-888-518-1562 or call collect at (416) 867-2272 or emailcontactus@kingsdaleshareholder.com |

Canadian Objecting Beneficial Owners (Non-registered Shareholders)

Canadian objecting beneficial Shareholders can vote in one of the following ways:

Voting Instruction Form

If you received a voting instruction form from Broadridge or from your nominee, follow the instructions provided on the form. Complete the form and choose the method you prefer for submitting your voting instructions. If you return your form and do not specify how you want to vote your shares, the AuRico nominees named in the form will vote your shares “for” the matters.

Telephone Voting:

Shareholders who wish to vote by phone should call 1-800-474-7493 (or 1-800-474-7501 if you speak French). You will require a 16-digit Control Number located on the front of your voting instruction form to identify yourself on the system.

Internet Voting:

If you want to vote online, you may do so atwww.proxyvote.com You will require a 16-digit Control Number located on the front of your voting instruction form to identify yourself on the system.

U.S. Non-Objecting Beneficial Owners and U.S. Objecting Beneficial Owners (Non-registered Shareholders)

U.S. non-objecting beneficial owners and U.S. objecting beneficial owners can vote in one of the following ways:

Voting Instruction Form

If you received a voting instruction form from Broadridge or from your nominee, follow the instructions provided on the form. Complete the form and choose the method you prefer for submitting your voting instructions. If you return your form and do not specify how you want to vote your shares, the AuRico nominees named in the form will vote your shares “for” the matters.

Telephone Voting:

Shareholders who wish to vote by phone should call 1-800-454-8683. You will require a 16-digit Control Number located on the front of your voting instruction form to identify yourself on the system.

Internet Voting:

If you want to vote online, you may do so atwww.proxyvote.com.You will require a 16-digit Control Number located on the front of your voting instruction form to identify yourself on the system.

If you have any questions or need assistance completing your proxy or voting instruction form, please contact our proxy solicitation agent, Kingsdale, toll free in North America at 1-888-518-1562 or call collect from outside North America at 416-867-2272 or by email at contactus@kingsdaleshareholder.com.

Processing Your Vote

Registered and Canadian non-objecting beneficial owners (non-registered Shareholders) receive proxy materials directly from our transfer agent (Computershare).

8

|

| If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder |

| Services at 1-888-518-1562 or call collect at (416) 867-2272 or emailcontactus@kingsdaleshareholder.com |

Canadian objecting beneficial owners (non-registered Shareholders), U.S. non-objecting beneficial owners and U.S. objecting beneficial owners (non-registered Shareholders), receive proxy materials directly from Broadridge or their nominee.

If you received the materials directly from our transfer agent, we assume responsibility for delivering these materials and executing your proper voting instructions. Personal information like your name, address and the number of shares you own has been obtained from your nominee according to the securities laws that apply. If you received the materials from your nominee, they assume responsibility for delivering the materials and executing your voting instructions.

Other than the non-binding, advisory resolution accepting the Company’s approach to executive compensation, all resolutions placed before the Meeting will be ordinary resolutions requiring the approval of a simple majority of the votes cast for each resolution.

Revoking Your Proxy

Registered Shareholders

You can revoke a vote you made by proxy in one of three ways:

| 1. | Complete a new proxy form that is dated later than the proxy form you want to revoke, and then mail it to Computershare, so that they receive it by 10:00 a.m. (Toronto time) on May 5, 2015 or no later than 10:00 a.m. (Toronto time), two full business days before the time of an adjourned or postponed meeting. This may be completed over the internet or by telephone; |

| | |

| 2. | Send a notice in writing from you, or your attorney, to our Investor Relations department (shareholders@auricogold.com) by 10:00 a.m. (Toronto time) on May 5, 2015 or no later than 10:00 a.m. (Toronto time), two full business days before the time of an adjourned or postponed meeting; or |

| | |

| 3. | Provide a notice in writing from you, or your attorney, to the Chairman of the Meeting at the Meeting or, if it is adjourned, when the meeting resumes. |

Non-registered Shareholders

You can revoke your voting instructions by sending a note in writing to your nominee at least seven days before the meeting.

Follow this same process if you want to waive the right to receive meeting materials or to vote.

Notice and Access

The Company is sending out proxy-related materials to Registered Shareholders and Non-Registered Holders using the notice-and-access mechanism that came into effect on February 11, 2013 under Canadian securities laws. The Company anticipates that notice-and-access will directly benefit the Company through a reduction in both postage and material costs, and also promote environmental responsibility by decreasing the large volume of paper documents generated by printing proxy-related materials.

Shareholders will be provided with electronic access to the Notice of the Meeting and this Circular on Computershare’s hosted webpage athttp://www.envisionreports/AURICOGOLD2015, on SEDAR atwww.sedar.com, and on the Company’s website atwww.auricogold.com/investor-information/reports-and-filings. The Company’s most recent Annual Information Form can also be found on SEDAR and on the Company’s website.

9

|

| If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder |

| Services at 1-888-518-1562 or call collect at (416) 867-2272 or emailcontactus@kingsdaleshareholder.com |

In accordance with the rules set out in Canadian securities laws for the first meeting of Shareholders of a reporting issuer for which the notice-and-access mechanism is being utilized, the Company filed on SEDAR a notification of meeting and record date on February 20, 2015, being at least 25 days before the Record Date for the Meeting. Shareholders will receive paper copies of a notice package (the “Notice Package”) via prepaid mail containing a notice with information prescribed by Canadian securities laws, a letter to Shareholders and a form of proxy (if you are a Registered Shareholder) or a voting instruction form (if you are a Non-Registered Holder), in each case with a supplemental mail list return box for Shareholders to request that they be included in the Company’s supplementary mailing list for receipt of the Company’s annual and interim financial statements. Shareholders may obtain paper copies of the Notice of Meeting and this Circular free of charge, or more information about notice-and-access, by contacting the Company’s transfer agent, Computershare Investor Services Inc. at 100 University Avenue, 8th Floor, Toronto, Ontario, Canada M5J 2Y1 or toll-free at 1-800-564-6253. In order to receive paper copies of these materials in time to vote before the Meeting, your request should be received by April 28, 2015.

Electronic Delivery of Material

You have the option to receive certain disclosure documentation from AuRico electronically, by email notification inviting you to access documentation online atwww.sedar.com or in the “Investor Information”section of AuRico’s website atwww.auricogold.com. Delivery in electronic format, rather than paper, reduces costs to the Company and benefits the environment.

Registered Shareholders can consent to electronic delivery by completing and returning the consent form accompanying this Circular to Computershare Investor Services Inc. Non-registered holders can consent to electronic delivery by completing and returning the appropriate form received from their intermediary. If you do not consent to receive documentation through email notification, you will continue to receive documentation by mail.

If you wish to receive (or continue to receive) quarterly financial statements and Management’s Discussion and Analysis (“MD&A”) by mail during 2015, you must check the appropriate box on the form of proxy (if you are a registered shareholder) or Supplemental Mailing List Card (if you are a non-registered shareholder). If you do not make this request, quarterly reports will not be sent to you. Financial results are announced by media release, and the financial statements and MD&A are available on the Company’s website atwww.auricogold.com.

10

|

| If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder |

| Services at 1-888-518-1562 or call collect at (416) 867-2272 or emailcontactus@kingsdaleshareholder.com |

PART 2: BUSINESS OF THE MEETING

The Meeting will be held in order to:

| i. | | Receive and consider the consolidated financial statements of the Company for its financial year ended December 31, 2014, and the auditors’ report thereon; |

| | | |

| ii. | | Elect the Company’s directors who will serve until the next annual meeting of Shareholders; |

| | | |

| iii. | | Appoint KPMG LLP, Chartered Accountants, as auditors for the Company, and to authorize the directors of the Company to set the auditors’ remuneration; |

| | | |

| iv. | | Consider and, if deemed advisable, pass an ordinary resolution of Shareholders ratifying, confirming and approving amendments to the Company’s 2014 ESPP as more fully described in the accompanying management proxy circular (the “Circular”); |

| | | |

| v. | | Consider, and if deemed advisable, pass a non-binding, advisory resolution accepting the Company’s approach to executive compensation; and |

| | | |

| vi. | | Transact such other business as may properly be brought before the Meeting or any adjournment or postponement thereof. |

1. Receiving the Consolidated Financial Statements

Our audited consolidated financial statements for the year ended December 31, 2014 and the report of the auditors thereon will be placed before the Meeting. These audited consolidated financial statements form part of our 2014 Annual Report. Copies of the 2014 Annual Report may be obtained from the Investor Relations department (shareholders@auricogold.com) upon request and will be available at the Meeting. The Company’s consolidated financial statements for the year ended December 31, 2014 are also available on AuRico’s website atwww.auricogold.com, on the System for Electronic Document Analysis and Retrieval (“SEDAR”) website atwww.sedar.com and on the U.S. Securities and Exchange Commission’s (“SEC”) website atwww.sec.gov.

2. Election of Directors

The Company’s Policy on Majority Voting

AuRico has adopted a majority voting policy as part of its corporate governance guidelines pursuant to which any nominee proposed for election as a director in an uncontested meeting who receives, from the shares voted at the meeting in person or by proxy, a greater number of votes withheld than votes in favour of his or her election, must immediately tender his or her resignation to the Board of Directors of the Company (the “Board” or the “Board of Directors”), to take effect upon acceptance by the Board. The Board shall refer the matter to the Nominating & Corporate Governance Committee for consideration. A director who tenders a resignation pursuant to this policy will not participate in any meeting of the Board or any sub-committee deliberations on the matter. The Board shall accept the resignation unless the Nominating & Corporate Governance Committee determines that there are exceptional circumstances. In any case, the Board shall determine whether or not to accept the resignation within 90 days after the date of the relevant Shareholders’ meeting, and AuRico will promptly issue a news release with the Board’s decision. If the Board determines not to accept a resignation, the news release must fully state the reasons for that decision.

Nominees for the Board of Directors

Ms. Janice Stairs was appointed to the Board of Directors on September 17, 2014 following the resignation of Mr. Luis Chavez from the Board of Directors on that same day.

11

|

| If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder |

| Services at 1-888-518-1562 or call collect at (416) 867-2272 or emailcontactus@kingsdaleshareholder.com |

The Articles of the Company provide for a minimum of three and a maximum of nine directors. On February 19, 2015, the Board resolved to set the number of directors to be elected at the Meeting at eight. It is proposed that the eight individuals listed below be nominated for election as directors of AuRico to hold office until the next annual meeting or until their successors are elected or appointed. All of the proposed nominees are currently directors of AuRico and have been directors since the dates indicated below.Unless authority to do so is withheld, the persons named in the accompanying proxy intend to vote FOR the election of the following proposed nominees:

| Alan R. Edwards | Patrick D. Downey | Joseph G. Spiteri |

| Richard M. Colterjohn | Scott G. Perry | Janice A. Stairs |

| Mark J. Daniel | Ronald E. Smith | |

If any proposed nominee is unable to serve as a director or withdraws his or her name, the individuals named in your form of proxy or voting instruction form reserve the right to nominate and vote for another individual in their discretion.

We expect all of our directors to demonstrate leadership and integrity and to conduct themselves in a manner that reinforces our core values and culture of transparency. Above all, we expect that all directors will exercise their good judgment in a manner that keeps the interests of Shareholders at the forefront of decisions and deliberations. Each candidate must have a demonstrated record in several of the skills and experience requirements contained in a corporate skills matrix (described below) and deemed important for a balanced and effective Board.

Seven of the eight nominated directors are independent, as determined by the Board, which means they are independent of Management and free from conflict of interest. A nominated director is not independent if he or she has a direct or indirect relationship that the Board believes could reasonably be expected to interfere with his or her ability to exercise independent judgment. Mr. Perry, the Company’s President and CEO is not independent.

| Alan R. Edwards, 57

Tucson, Arizona,

United States Director since

May 13, 2010 Chairman since

July 1, 2013 Independent | Mr. Alan Edwards has over 30 years of international mining experience. Mr. Edwards was formerly the CEO of Oracle Mining Corporation and was President and Chief Executive Officer and Director of Copper One Inc. Prior to that, he held positions as Chief Executive Officer and Director of Frontera Copper Corporation, and Executive Vice President and Chief Operating Officer of Apex Silver Mines Corporation. Mr. Edwards holds a Bachelor of Science degree in Mining Engineering and an MBA. Areas of Expertise Strategy and Leadership, Operations and Exploration, Metals and Mining, Public Policy, Human Resources, Accounting and International Business |

| Securities Held | Member | Meeting Attendance in 2014 |

| Shares: 70,885 | Board | 6 of 6 |

| Options: 125,000 | Technical & Sustainability | 4 of 4 |

| DSUs: 45,861 | Committee | |

| RSUs: 27,048 | | |

| Other Directorships | Duration |

| | Scorpio Mining Corporation | December 23, 2014 – Present |

| Previous Years’ Vote Results (For) | AQM Copper Inc. (Chairman) | October 5, 2011 – Present |

| 2014: 96.8% | Entrée Gold Inc. | March 10, 2011 – Present |

| 2013: 88.1% | | |

| 2012: 88.2% | | |

| | | |

12

|

| If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder |

| Services at 1-888-518-1562 or call collect at (416) 867-2272 or emailcontactus@kingsdaleshareholder.com |

| | | |

| Richard M. Colterjohn, 57

Toronto, Ontario,

Canada Director since

April 12, 2010 Independent | Mr. Richard Colterjohn is an independent director with more than 20 years of experience in the mining sector, as an investment banker, director, and operator. Mr. Colterjohn is currently a Managing Partner of Glencoban Capital Management Inc. (private investment fund). He was founder and CEO of Centenario Copper Corporation and previously served as a Managing Director of UBS Warburg and UBS Bunting Warburg. Mr. Colterjohn holds a Bachelor of Commerce degree and an MBA. Areas of Expertise

Strategy and Leadership, Metals and Mining, Finance, Public Policy, Accounting, International Business and Legal |

| Securities Held | Member | Meeting Attendance in 2014 |

| Shares: 156,942 | Board | 6 of 6 |

| Options: 125,000 | Audit Committee | 5 of 5 |

| DSUs: 35,470 | Nominating & Corporate | 2 of 2 |

| RSUs: 26,551 | Governance Committee (Chair) | |

| | | |

| Previous Years’ Vote Results (For) | Other Directorships | Duration |

| 2014: 98.7% | Roxgold Inc. | September 2012 – Present |

| 2013: 97.5% | MAG Silver Corp. | October 2007 – Present |

| 2012: 83.2% | | |

| | | |

| Mark J. Daniel, 68

Toronto, Ontario,

Canada Director since

October 26, 2011 Independent | Mr. Mark Daniel is an independent director with more than 35 years of international experience. Most recently, Mr. Daniel was Vice President, Human Resources for Vale Canada (formerly Inco Limited). Prior to that, he worked with the Bank of Canada and a number of other federal agencies before joining the Conference Board of Canada. During Mr. Daniel’s 15 year career with the Conference Board, he benchmarked leadership and management practices in some of the most successful companies in North America, Europe and Japan. Mr. Daniel holds a PhD in Economics. Areas of Expertise

Strategy and Leadership, Human Resources and International Business |

| Securities Held | Member | Meeting Attendance in 2014 |

| Shares: 16,945 | Board | 6 of 6 |

| Options: 162,050 | Human Resources Committee | 6 of 6 |

| DSUs: 15,865 | (Chair) | |

| RSUs: 26,551 | Nominating & Corporate | 2 of 2 |

| | Governance Committee | |

| | | |

| Previous Years’ Vote Results (For) | Other Directorships | Duration |

| 2014: 80.6% | None | N/A |

| 2013: 90.3% | | |

| 2012: 98.2% | | |

| | | |

13

|

| If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder |

| Services at 1-888-518-1562 or call collect at (416) 867-2272 or emailcontactus@kingsdaleshareholder.com |

| | | |

| Patrick D. Downey, 71

Port Perry, Ontario,

Canada Director since

October 26, 2011 Independent | Mr. Patrick Downey, CPA, CA, ICD.D, is a corporate director who has been involved in the copper and gold mining industry throughout most of his 35 year career. Mr. Downey was an executive and director for several public resource companies and the Chief Financial Officer of Northgate Minerals Corporation for four years, retiring as President and CEO in 1994. He is certified by the Institute of Corporate Directors and a member of the Ontario Chapter of the Canadian Institute of Chartered Accountants. Mr. Downey holds an Honours Bachelor of Commerce degree from Laurentian University. Areas of Expertise

Strategy and Leadership, Operations and Exploration, Metals and Mining, Finance, Accounting and International Business |

| Securities Held | Member | Meeting Attendance in 2014 |

| Shares: 18,961 | Board | 6 of 6 |

| Options: 180,300 | Audit Committee | 5 of 5 |

| DSUs: 15,865 | Human Resources Committee | 6 of 6 |

| RSUs: 26,551 | | |

| | | |

| Previous Years’ Vote Results (For) | Other Directorships | Duration |

| 2014: 99.6% | Minco Plc | September 2011 – Present |

| 2013: 97.4% | | |

| 2012: 96.1% | | |

| | | |

| Scott G. Perry, 38

Toronto, Ontario,

Canada Director since

September 3, 2012 Not Independent | Mr. Scott Perry is the President and Chief Executive Officer and a Director of AuRico. Mr. Perry has held increasingly senior financial positions in the mining industry over the past 15 years. Most recently, he served as the Company’s Executive Vice President and Chief Financial Officer for over four years. Prior to joining the Company, Mr. Perry was the Chief Financial Officer (seconded from Barrick Gold) for Highland Gold Mining, where he managed the company’s financial reporting and compliance commitments, as well as the execution of its short and long-term financial and operational strategies. He also led Highland Gold’s business and corporate development initiatives. Before being seconded to Highland Gold, he held increasingly senior financial roles with Barrick in Australia, the United States, and in Russia, Central Asia where he was instrumental in establishing Barrick’s presence in Russia and assembling a strong financial team. Mr. Perry holds a Bachelor of Commerce degree from Curtin University, a post-graduate diploma in applied finance and investment, as well as a CPA designation. Areas of Expertise

Strategy and Leadership, Operations and Exploration, Metals and Mining, Finance, Public Policy, Human Resources, Accounting and International Business |

| Securities Held | Member | Meeting Attendance in 2014 |

| Shares: 159,035 | Board | 6 of 6 |

| Options: 2,158,914 | Technical & Sustainability Committee | 4 of 4 |

| DSUs: 54,543 | | |

| RSUs: 40,734 | | |

| PSUs: 260,742 | | |

| | | |

| Previous Years’ Vote Results (For) | Other Directorships | Duration |

| 2014: 99.8% | None | Not Applicable |

| 2013: 97.6% | | |

| 2012: N/A | | |

| | | |

14

|

| If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder |

| Services at 1-888-518-1562 or call collect at (416) 867-2272 or emailcontactus@kingsdaleshareholder.com |

| | | |

| Ronald E. Smith, 64

Yarmouth, Nova Scotia,

Canada Director since

May 15, 2009 Independent | Mr. Ronald Smith, BBA, FCA, ICD.D, is an independent director with over 40 years of experience in the financial, telecommunications and energy sectors. Most recently, Mr. Smith was Senior Vice President and Chief Financial Officer of Emera Incorporated. Prior to that, he was Chief Financial Officer with Maritime Tel and Tel Limited. He served as a member of the Canada Pension Plan Investment Board from 2002 to 2012. Mr. Smith was formerly a Partner of Ernst & Young and holds an FCA designation. Areas of Expertise

Strategy and Leadership, Finance, Public Policy, Human Resources and Accounting |

| Securities Held | Member | Meeting Attendance in 2014 |

| Shares: 14,903 | Board | 6 of 6 |

| Options: 125,000 | Audit Committee (Chair) | 5 of 5 |

| DSUs: 33,488 | Human Resources Committee | 6 of 6 |

| RSUs: 26,551 | | |

| | | |

| Previous Years’ Vote Results (For) | Other Directorships | Duration |

| 2014: 80.8% | Pro Real Estate Investment Trust | March 2013 – Present |

| 2013: 90.5% | | |

| 2012: 82.1% | | |

| | | |

| Joseph G. Spiteri, 61

Acton, Ontario,

Canada Director since

May 25, 2012 Independent | Mr. Joseph Spiteri is an independent director with over 35 years of international mining experience. Mr. Spiteri is an independent mining consultant focused on advanced-stage exploration, feasibility, construction, operations management and acquisitions. Prior to that, he held senior management or executive positions with Placer Dome Incorporated, Northgate Explorations Limited, Lac Minerals Limited, and Campbell Resources Incorporated. Mr. Spiteri holds a Bachelor of Science degree from the University of Toronto. He is a member of The Canadian Institute of Mining and The Association of Professional Geoscientists of Ontario. Areas of Expertise

Strategy and Leadership, Operations and Exploration, Metals and Mining, Public Policy and International Business |

| Securities Held | Member | Meeting Attendance in 2014 |

| Shares: 17,284 | Board | 6 of 6 |

| Options: 100,000 | Technical & Sustainability Committee | 4 of 4 |

| DSUs: 14,820 | (Chair) | |

| | Nominating & Corporate Governance | 2 of 2 |

| RSUs: 26,551 | Committee1 | |

| | | |

| | | |

| Previous Years’ Vote Results (For) | Other Directorships | Duration |

| 2014: 99.7% | Marathon Gold Corporation | April 2010 – Present |

| 2013: 97.5% | Roxgold Inc. | September 2012 – Present |

| 2012: 99.4% | | |

| | | |

_____________________________

1 Mr. Joseph Spiteri resigned from the Nominating & Corporate Governance Committee effective February 19, 2015

15

|

| If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder |

| Services at 1-888-518-1562 or call collect at (416) 867-2272 or emailcontactus@kingsdaleshareholder.com |

| | | |

| Janice A. Stairs, 55

Halifax, Nova Scotia,

Canada Director since

September 17, 2014 Independent | Ms. Janice Stairs has over 25 years of experience in senior management and senior advisory roles with public and private companies involved in the natural resource and other sectors. Ms. Stairs is also a director of NovaCopper Inc. where she serves as a member of the Corporate Governance and Compensation Committees and is a director and Chair of Nova Scotia Business Inc. where she serves on the Investment Committee. Previously, Ms. Stairs served as General Counsel to Endeavour Mining Corporation, was Vice President and Corporate Counsel for Etruscan Resources Inc. and prior to 2004 was a partner with the law firm of McInnes Cooper where she continues to act as counsel to the firm. Ms. Stairs practiced law in private practice for 19 years specializing in corporate finance, securities and resource-related issues for private and public companies. Ms. Stairs graduated from Dalhousie Law School and holds a Masters of Business Administration degree from Queen's University. Areas of Expertise

Strategy and Leadership, Metals and Mining, Finance, Public Policy, International Business, and Legal |

| Securities Held | Member | Meeting Attendance in 2014 |

| Shares: 843 | Board | 2 of 22 |

| DSUs: 7,169 | | |

| RSUs: 16,726 | Other Directorships | Duration |

| | NovaCopper Inc. | April 2012 - Present |

| Previous Years’ Vote Results (For) | | |

| 2014: N/A | | |

| 2013: N/A | | |

| 2012: N/A | | |

| | | |

Cease Trade Orders or Bankruptcies

No proposed director of the Company is, as at the date of this Circular, or has been, within ten years before the date of this Circular, a director, chief executive officer or chief financial officer of any company (including the Company) that, (i) was the subject of a cease trade order, an order similar to a cease trade order or an order that denied the Company access to any exemption under securities legislation, that was in effect for a period of more than 30 consecutive days; or (ii) was subject to an order that was issued after the proposed director ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in the capacity as director, chief executive officer or chief financial officer.

Except as described below, no proposed director of the Company is, as at the date of this Circular, or has been, within ten years before the date of this Circular, a director or executive officer of any company (including the Company) that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets.

In February 2015, Lachlan Star Limited entered into voluntary administration. Mr. Scott Perry was a former Director of that company, having ceased to be a Director in October 2014.

No proposed director of the Company has, within ten years before the date of this Circular, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the proposed director.

_____________________________

2 Ms. Janice A. Stairs joined the Board of Directors effective September 17, 2014 following the resignation of Mr. Luis M. Chavez from the Board of Directors and was appointed to the Nominating & Corporate Governance Committee effective February 19, 2015.

16

|

| If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder |

| Services at 1-888-518-1562 or call collect at (416) 867-2272 or emailcontactus@kingsdaleshareholder.com |

2014 Board and Committee Meetings and Attendance Levels

Regular Board and Committee meetings are set one to two years in advance, and special meetings are scheduled as required. Directors are expected to attend all Board and Committee meetings. Directors are encouraged to attend meetings in person, but they may also participate by teleconference. The Chairman monitors attendance levels and has a duty to address attendance concerns should they arise.

Individual meeting attendance of each nominee proposed for election as director is reported above. Below is a summary of attendance by all directors at Board and Committee meetings held during 2014.

| Board/Committee | | Number of Meetings | | | Attendance at all Meetings | |

| Board | | 6 | | | 100% | |

| Audit Committee | | 5 | | | 100% | |

| Technical & Sustainability Committee | | 4 | | | 100% | |

| Human Resources Committee | | 6 | | | 100% | |

| Nominating & Corporate Governance Committee | | 2 | | | 100% | |

| Total number of meetings held | | 23 | | | 100% | |

3. Appointment of Auditors

The Board proposes that the firm of KPMG LLP, Chartered Accountants, of Toronto, Ontario, be appointed as auditors of AuRico to hold office until the next annual meeting of Shareholders and that the Board be authorized to set the auditors’ remuneration.

As part of the Company’s corporate governance practices, the Audit Committee has adopted a policy whereby the Committee must pre-approve any audit, audit-related and non-audit services provided by AuRico’s auditors. The objective of this policy is to specify the scope of services permitted to be performed by the Company’s auditors and to ensure that the independence of the Company’s auditors is not compromised by engaging them for other services. All services provided by the Company’s auditors are pre-approved by the Audit Committee as they arise or through an annual pre-approval of amounts for specific types of services. All services performed by AuRico’s auditors comply with the Policy on Pre-Approval of Audit, Audit-Related and Non-Audit Services, and professional standards and securities regulations governing auditor independence.

Aggregate fees paid to AuRico’s auditors relating to the fiscal years ended December 31, 2014 and 2013 were as follows:

| Fees in Canadian dollars | 2014(4) | 2013(4) |

| Audit fees(1) | $584,950 | $630,250 |

| Audit-related fees(2) | $135,000 | $42,500 |

| Tax fees(3) | $121,000 | $132,450 |

| All other fees | $Nil | $Nil |

| Total | $840,950 | $805,200 |

| | |

Notes: |

| (1) | The aggregate fees billed for audit services, including fees relating to the review of quarterly financial statements, statutory audits of the Company’s subsidiaries. |

| (2) | The aggregate fees billed for assurance and related services that are reasonably related to the performance of the audit or review of the Company’s financial statements and are not disclosed in the “Audit Fees” row. |

| (3) | The aggregate fees billed for tax compliance, tax advice and tax planning services. |

| (4) | For the years ended December 31, 2013 and December 31, 2014, none of the Company’s audit-related fees, tax fees or all other fees described in the table above made use of the de minimis exception to pre-approval provisions contained in Rule 2-01(c)(7)(i)(C) of SEC Regulation S-X or Section 2.4 of NI 52-110. |

Unless authority to do so is withheld, the persons named in the accompanying proxy intend to vote FOR the appointment of KPMG LLP, Chartered Accountants as auditor of AuRico until the close of the next annual general meeting of Shareholders and to authorize the directors to fix their remuneration.

17

|

| If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder |

| Services at 1-888-518-1562 or call collect at (416) 867-2272 or emailcontactus@kingsdaleshareholder.com |

4. Approval of Amendments to the 2014 ESPP

To encourage employee ownership in Common Shares of the Company as further described below, the Company has an Amended and Restated Employee Share Purchase Plan that was approved by Shareholders at the annual and special meeting held on May 9, 2014 (the “2014 ESPP”). In 2014, the ESPP plan was promoted to the hourly employees at the Young-Davidson mine site in conjunction with the increased head count due to ramp up of operations, leading to increased participation with, and contributions to, the 2014 ESPP. Therefore, this increased level of employee ownership through the 2014 ESPP has necessitated more frequent replenishment of Common Shares held for issuance under the plan.

Under the 2014 ESPP, 1,250,000 Common Shares were reserved for issuance, which in percentage terms equals approximately 0.5% of the Company’s issued and outstanding Common Shares as of March 19, 2015. As of such date, 600,357 Common Shares remain available for issuance under the 2014 ESPP.

To ensure the required number of Common Shares are available under the plan on a continuous basis, the Company proposes to amend the 2014 ESPP to convert it from a plan with a fixed maximum number of Common Shares issuable thereunder, to a plan with a rolling maximum percentage of issued and outstanding Common Shares.

As described below, the aggregate number of Common Shares to be reserved and set aside for issue from treasury under the proposed amendments to the 2014 ESPP shall be 0.2% of the issued and outstanding Common Shares of the Company from time to time on a non-diluted basis. The provision in the 2014 ESPP that the aggregate number of shares issued pursuant to the 2014 ESPP, together with all other established security-based compensation arrangements of the Company, shall not exceed 6.5% of the issued and outstanding Common Shares at the time the shares are issued (from treasury) (on a non-diluted basis), will continue to apply without amendment.

If the proposed amendments to the 2014 ESPP are approved by Shareholders, any increase in the issued and outstanding Common Shares of the Company will result in an increase in the available number of Common Shares issuable under the 2014 ESPP, and any Common Shares issued under the 2014 ESPP will make additional Common Shares available for issue under the 2014 ESPP.

In accordance with Toronto Stock Exchange (“TSX”) rules in respect of security based compensation arrangements that do not contain a fixed maximum aggregate of securities issuable, if the amendments described below are approved by Shareholders, the unallocated Common Shares issuable under the 2014 ESPP shall be re-approved by Shareholders every three years after such amendments are approved.

The Company believes that the proposed amendments to the 2014 ESPP will help contribute to the Company’s ability to attract and retain the highest calibre of qualified employees available.

The following is a summary of proposed amendments to the 2014 ESPP (collectively, the “Amendments”). Except for changes reflected by the Amendments, the 2014 ESPP will remain unchanged.

• | Shares Reserved For Issuance and Subject to the ESPP: The 2014 ESPP is proposed to be converted from a plan with a fixed maximum number of Common Shares issuable thereunder, to a plan with a rolling maximum percentage of Common Shares issuable thereunder equal to 0.2% of the issued and outstanding Common Shares of the Company from time to time on a non-diluted basis. |

18

|

| If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder |

| Services at 1-888-518-1562 or call collect at (416) 867-2272 or emailcontactus@kingsdaleshareholder.com |

| | |

• | Conforming Changes: Other than as described above, no additional material amendments to the 2014 ESPP are proposed. Certain minor conforming changes in the wording of the 2014 ESPP are necessary to address the conversion from a fixed number plan to a rolling percentage plan, such as any reference in the plan itself to a fixed number plan will be changed to a fixed percentage plan. In addition, provisions in the 2014 ESPP on the effective date of the plan will be updated to refer to the date of the Amendments. |

Summarized below are the key terms of the 2014 ESPP, including the Amendments, the full text of which can be requested from the Investor Relations department (shareholders@auricogold.com) of the Company.

| Eligibility | Officers, directors, employees and consultants of the Company and its subsidiaries. |

| Description | The purpose of the 2014 ESPP is to advance the long-term interests of the Company by providing officers, directors, employees and consultants of the Company and its subsidiaries with the opportunity and incentive to acquire an ownership interest in the Company, promoting a greater alignment of interests between such persons and Shareholders. Participants in the 2014 ESPP are entitled to contribute up to 10% of their annual base salary to the 2014 ESPP. The Company will contribute an amount equal to 75% of a participant’s contribution and the combined contributions will then be used to purchase Common Shares on a quarterly basis. |

| Types of Awards | Common Shares. |

| Number ofSecurities Issuedand Issuable | If the Amendments are approved by Shareholders, the aggregate number of Common Shares to be reserved and set aside for issue from treasury under the 2014 ESPP shall be 0.2% of the issued and outstanding Common Shares of the Company from time to time on a non-diluted basis, provided that the aggregate number of shares issued pursuant to the 2014 ESPP, together with all other established security-based compensation arrangements of the Company, shall not exceed 6.5% of the issued and outstanding Common Shares at the time the shares are issued (from treasury) (on a non-diluted basis). As at March 19, 2015, a total of 1,561,520 Common Shares have been issued under the 2014 ESPP and its predecessor ESPP. |

| Based on the total issued and outstanding Common Shares of the Company as at March 19, 2015 being 253,488,335, an aggregate 0.2% maximum of the Company’s issued and outstanding Common Shares under the 2014 ESPP would be equal to 506,977 Common Shares available to be reserved for issuance. If the Amendments are approved by Shareholders, Common Shares issuable under the 2014 ESPP will be based on a rolling maximum percentage (instead of a fixed number) of issued and outstanding Common Shares from time to time. Accordingly, any increase in the issued and outstanding Common Shares of the Company will result in an increase in the available number of Common Shares issuable under the 2014 ESPP, and any Common Shares issued under the 2014 ESPP will also make additional Common Shares available for issue under the 2014 ESPP. |

| Plan Limits | When combined with all of the Company’s other established security-based compensation arrangements, the 2014 ESPP shall not result in: |

| • | a number of Common Shares issued to insiders within a one-year period exceeding 10% of the issued and outstanding Common Shares; |

| • | a number of Common Shares issuable to insiders at any time exceeding 10% of the issued and outstanding Common Shares; or |

| • | a number of Common Shares (i) issuable to all non-executive directors of the Company exceeding 1% of the issued and outstanding Common Shares at such time, and (ii) issuable to any one non-executive director within a one-year period exceeding an award value of $150,000 per such non-executive director. |

19

|

| If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder |

| Services at 1-888-518-1562 or call collect at (416) 867-2272 or emailcontactus@kingsdaleshareholder.com |

| Method forDetermining thePurchase Price forSecurities | In the case of shares issued from the Company’s treasury, the purchase price will be a price per Common Share equal to 100% of the volume-weighted average trading price of the Common Shares for the 5 trading days immediately preceding the end of the reporting quarter (the “Market Price”) in respect of which the shares are issued, as reported by the TSX. For all other Common Shares purchased in the market, the purchase price will be 100% of the average purchase price of the Common Shares purchased by the Company on behalf of the participants through the TSX or the NYSE, as applicable. |

CircumstancesInvolvingCessation ofEntitlement toParticipate | Reasons forTermination | Treatment of ESPP shares |

Death | The participant’s personal representative will have 30 days to elect to withdraw or sell all of the ESPP shares credited to the participant’s account. If such election is not made, the Participant's Personal Representative (or such other designated person) will automatically be deemed to have elected to withdraw the balance of Plan Shares as of the date of death. |

Disability | The participant will have 30 days to elect to withdraw or sell all of the ESPP shares credited to the participant’s account. If such election is not made, the participant’s ESPP shares will be withdrawn. |

Retirement | The participant will have 30 days to elect to withdraw or sell all of the ESPP shares credited to the participant’s account. If such election is not made, the participant’s ESPP shares will be withdrawn. |

Resignation | The participant will have 30 days to elect to withdraw or sell all of the ESPP shares credited to the participant’s account. If such election is not made, the participant’s ESPP shares will be withdrawn. |

Termination without Cause / Wrongful Dismissal | The participant will have 30 days to elect to withdraw or sell all of the ESPP shares credited to the participant’s account. If such election is not made, the participant’s ESPP shares will be withdrawn. |

Termination with Cause | The participant will have 30 days to elect to withdraw or sell all of the ESPP shares credited to the participant’s account. If such election is not made, the participant’s ESPP shares will be withdrawn. |

Assignability | No Common Shares credited to a participant’s account, nor any rights to receive Common Shares under the 2014 ESPP, may be assigned, transferred, charged, pledged or otherwise alienated, in any way by the participant other than by will or the laws of descent and distribution. |

20

|

| If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder |

| Services at 1-888-518-1562 or call collect at (416) 867-2272 or emailcontactus@kingsdaleshareholder.com |

| AmendingProcedures | Subject to the requirements for Shareholder approval in certain circumstances (as set out below), the Board may amend the 2014 ESPP at any time, provided, however, that no such amendment may materially and adversely affect any ESPP shares previously awarded to a participant without the consent of the participant, except to the extent required by applicable law (including TSX requirements). Without limiting the generality of the foregoing, the Board may make certain amendments to the 2014 ESPP without obtaining the approval of Shareholders including, but not limited to: |

| • | Ensuring compliance with applicable laws, regulations or policies, including, but not limited to the rules and policies of any stock exchange on which the Common Shares are listed for trading; |

| • | Providing additional protection to Shareholders; |

| • | Removing conflicts or other inconsistencies which may exist between any terms of the 2014 ESPP and any provisions of any applicable laws, regulations or policies, including, but not limited to the rules and policies of any stock exchange on which the Common Shares are listed for trading; |

| • | Curing or correcting any typographical error, ambiguity, defective or inconsistent provision, clerical omission, mistake or manifest error; |

| • | Facilitating the administration of the 2014 ESPP; |

| • | Amending the definitions of the terms used in the 2014 ESPP, the dates on which participants may become eligible to participate in the 2014 ESPP, the minimum and maximum permitted payroll deduction rate, the amount of participants’ contributions and the procedures for making, changing, processing, holding and using such contributions, vesting, the rights of holders of ESPP shares, the rights to sell or withdraw ESPP shares and cash credited to a participant’s account and the procedures for doing the same, the interest payable on cash credited to a participant’s account, the transferability of ESPP shares, contributions or rights under the 2014 ESPP, the adjustments to be made in the event of certain transactions, 2014 ESPP expenses, restrictions on corporate action, or use of funds; or |

| • | Making any other change that is not expected to materially adversely effect the interests of the Shareholders. |

| | |

Notwithstanding the foregoing, Shareholder approval shall be required for the following amendments: |

| • | Extending the date on which the shares will be forfeited or terminated in accordance with their terms; |

| • | Increasing the fixed maximum percentage or number of Common Shares reserved for issuance under the 2014 ESPP; |

| • | Revising the definition of “market price” or the method for determining the “purchase price” of shares that would result in a decrease in the purchase price of shares for the benefit of insiders; |

| • | Revising insider participation limits or the non-executive director limits; |

| • | Revising the restriction on assignment provision to permit awards to be transferable or assignable other than for estate settlement purposes; |

| • | Revising the definition of “eligible person” that may permit the introduction or reintroduction of non-executive directors on a discretionary basis; |

| • | Revising the definition of “employer’s contribution” that would result in a change to the employer matching contribution amount; and |

| • | Revising the amending provisions. |

| FinancialAssistance | For each participant, the Company will credit an amount equal to 75% of the participant’s contribution every quarter (i.e. the employer’s matching contribution). |

| Term | Not applicable. |

| Vesting | Common Shares purchased under the 2014 ESPP vest immediately with the participant for whom they were purchased at the time of purchase. |

| Credit to ESPPAccount | Rights to receive the payments in cash or Common Shares, based on dividends declared on ESPP shares, shall be credited to a participant’s ESPP account in the following forms: |

| • | Any cash dividends credited to a participant’s ESPP account will be deemed to have been invested in additional Common Shares. The number of Common Shares shall be determined by dividing (i) the value of the dividend on the record date by (ii) the Market Price of the Common Shares on the record date, and such additional shares shall be subject to the same terms and conditions as are applicable in respect of the ESPP shares; and |

| • | If any dividends are paid in shares or other securities, such shares or other securities will be subject to the same vesting and other restrictions applicable in respect of the ESPP shares. |

21

|

| If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder |

| Services at 1-888-518-1562 or call collect at (416) 867-2272 or emailcontactus@kingsdaleshareholder.com |

| Administrator | The 2014 ESPP is administered by the Board of Directors. |

If approved by Shareholders at the Meeting, the Amendments will be reflected in the 2014 ESPP. If the Amendments to the 2014 ESPP are not approved by Shareholders, the Board will continue to make awards under the 2014 ESPP as it was approved by Shareholders on May 9, 2014.

The Board approved the Amendments to the 2014 ESPP on March 24, 2015.

The full text of the ordinary resolution confirming, ratifying and approving the Amendments to the 2014 ESPP is as follows:

BE IT RESOLVED THAT:

| 1. | The Amendments to the 2014 ESPP, as described in the Circular, be and are hereby ratified, confirmed and approved; |

| | |

| 2. | The unallocated Common Shares issuable under the 2014 ESPP shall be re-approved by Shareholders of the Company on or before May 7, 2018; |

| | |

| 3. | The form of the 2014 ESPP may be amended in order to satisfy the requirements or requests of any regulatory authority or stock exchange without requiring further approval of the Shareholders of the Company; and |

| | |

| 4. | Any one of the officers of the Company be and is hereby authorized, on behalf of the Company, to perform all such acts, to execute and deliver all such documents and agreements as such officer may determine necessary or desirable to give effect to the foregoing resolution, such determination to be conclusively evidenced by the performing of such actions or the execution and delivery of such documents and agreements. |

The Board has determined that the adoption of the Amendments to the 2014 ESPPis in the best interest of the Company and unanimously recommends that Shareholders vote to ratify, confirm and approve the Amendments to the 2014 ESPP.

Unless instructed otherwise, the persons named in the accompanying proxy intend to vote FOR the ratification, confirmation and approval of the Amendments to the 2014 ESPP.

5. Advisory Vote on Approach to Executive Compensation

At the Company’s 2013 annual and special meeting, the Board introduced a non-binding advisory vote relating to executive compensation to solicit feedback from Shareholders on our approach to executive compensation. The non-binding advisory vote relating to executive compensation received 68.5% support at the 2014 annual and special meeting.

The underlying principle for the executive compensation program is “pay-for-performance”. Over the course of 2014, specifically following the results of the advisory vote relating to executive compensation in 2014, the Human Resources Committee spent considerable time and effort reviewing and implementing the Company’s executive compensation program. As part of this process, the Board and management engaged extensively with Shareholders (representing more than 50% of the outstanding Common Shares), to solicit their views on executive compensation and corporate governance practices. Shareholders have access to the Board via one-on-one meetings with the Chairman, and the President and CEO (who is a Board Director as well). The Chairman, and President and CEO, meet regularly with Shareholders, including representatives of the Company’s top 20 Shareholders.

22

|

| If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder |

| Services at 1-888-518-1562 or call collect at (416) 867-2272 or emailcontactus@kingsdaleshareholder.com |

Feedback received from proxy advisory firms was also carefully examined. These efforts, conducted over the course of 2014, yielded valuable perspectives on topics which included executive compensation, equity-based incentive compensation, enhanced scorecard disclosure, use of discretion and overall pay for performance alignment, among others. The results of these efforts were carefully reviewed by the Human Resources Committee, the Nominating & Corporate Governance Committee, and the Board, and discussed at meetings throughout 2014. In response to this process, AuRico has bolstered its disclosure in respect of its compensation plans to provide Shareholders with a better understanding of AuRico’s compensation decision-making process. In addition, the Company continues to review the executive compensation program as part of its ongoing commitment to strengthen the pay for performance linkage, including an evaluation of the PSU program in 2015 focused on ascertaining what performance metric, in addition to relative total shareholder return (TSR), performance period and equity pay mix should be used to best align compensation with the long term interests of Shareholders. Please see “Part 5 – Executive Compensation – Shareholder Engagement and Key Accomplishments” for further details.

The full text of the advisory resolution accepting the Company’s approach to executive compensation is as follows:

BE IT RESOLVED THAT, on an advisory basis, and not to diminish the role and responsibilities of the Board of Directors of the Company, the Shareholders accept the approach to executive compensation disclosed in this Circular.

Because your vote is advisory, it will not be binding upon the Board. However, the Human Resources Committee and the Board will review the results of this advisory vote and will consider the outcome when considering future executive compensation arrangements.

The Board is appreciative of Shareholders’ feedback and questions on our executive compensation practices. The Human Resources Committee and the Board will review and consider all Shareholder comments in designing the executive compensation program and we believe that some of the changes to our executive compensation practices (as outlined in “Part 5 – Executive Compensation”) reflect this feedback.

The Board unanimously recommends that Shareholders vote FOR the advisory resolution to accept the approach to executive compensation disclosed in this Circular.

Unless instructed otherwise, the persons named in the accompanying proxy intend to vote FOR the approval of the approach to executive compensation in this Circular.

23

|

| If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder |

| Services at 1-888-518-1562 or call collect at (416) 867-2272 or emailcontactus@kingsdaleshareholder.com |

PART 3: ABOUT AURICO

Corporate Governance Practices

AuRico believes in the importance of a strong Board of Directors and sound corporate governance policies and practices to direct and manage our business affairs. Good corporate governance is essential to retaining the trust of our Shareholders, attracting the right people to the organization, and maintaining our social license in the communities where we work and operate. We also believe that good governance enhances our performance.

The Company’s governance framework and related Corporate Governance Guidelines are continuously adjusting to a changing environment but a constant is that they reflect our values. Our governance policies also respect the rights of Shareholders and comply with the rules of the Canadian Securities Administrators (CSA) and the TSX. Specifically, AuRico has complied with the CSA’s amendments to National Instrument 58-101– Disclosure of Corporate Governance Practicesintended to increase transparency for investors and other stakeholders regarding the representation of women on boards and in senior management. Most notably, the Company appointed its first female director in September 2014, who is a qualified lawyer with extensive knowledge and experience in the mining industry.

The Board has adopted written policies and practices regarding, among other things, director selection criteria, board size, board and committee responsibilities, gender diversity (including the identification and nomination of women directors), and minimum attendance requirements for directors within the Company’s Corporate Governance Guidelines. Independent directors hold in-camera meetings at all regularly scheduled board meetings without members of Management present. Since January 1, 2014, 5 meetings of independent directors have been held. A copy of the Company’s Code of Business Conduct and Ethics (“Code of Conduct”), as well as Board and Committee mandates, are posted on AuRico’s website atwww.auricogold.com and can be requested from the Investor Relations department (shareholders@auricogold.com).

The Board formally approved updates to the Company’s Corporate Governance Guidelines on January 16, 2015 including a policy on gender diversity. This policy highlights the importance the Board of Directors places on differences in skills, experience, education, gender, age, ethnicity and geographic background of its directors and is intended to serve as a framework to promote diversity on the Board of Directors. Pursuant to the terms of the policy the selection of candidates for appointment to the Board of Directors will continue to be based on merit, however within that overriding emphasis on merit, the Nominating & Corporate Governance Committee will seek to fill Board vacancies having regard to achieving an appropriate level of diversity on the Board of Directors. In its annual review of the composition of the Board, the Nominating & Corporate Governance Committee will consider the benefits of diversity, including gender diversity, in order to maintain an optimum mix of skills on the Board and will recommend to the Board objectives for achieving diversity on the Board in light of the skills required on the Board at that time. The assessment of the implementation of the policy and the effectiveness of the policy will form part of the Nominating & Corporate Governance Committee’s annual assessment of Board composition.

The Board has not specified director term limits or a policy on overboarding based on the belief that length of service and/or number of board seats are not, in and of themselves, determinants of a director’s ability to make an effective contribution to the governance of the Company. Overboarding thresholds will be higher, for instance, for directors who are retired from active employment. The Board believes that there is value to having continuity of directors who have experience with the Company, and who are evaluated through a robust annual assessment process, to ensure appropriate board renewal. Accordingly, there are no limits on the number of terms for which a director may hold office.

The following discussion outlines some of AuRico’s current corporate governance practices, particularly with respect to the matters addressed by National Policy 58-201 –Corporate Governance Guidelines (the “Canadian Guidelines”) and National Instrument 58-101 –Disclosure of Corporate Governance Practices (“NI 58-101”), adopted by the CSA, and the corporate governance standards adopted by the New York Stock Exchange (NYSE). AuRico is a “foreign private issuer” for purposes of its NYSE listing. As such, not all of the NYSE standards that are applicable to U.S. domestic issuers apply to AuRico. However, the Board has implemented a number of governance structures and procedures to comply with the requirements of the NYSE standards. Details of the Company’s corporate governance practices compared to the corporate governance listing standards of the NYSE are available for review atwww.auricogold.com, under the Corporate Governance section.

24

|

| If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder |

| Services at 1-888-518-1562 or call collect at (416) 867-2272 or emailcontactus@kingsdaleshareholder.com |

Code of Business Conduct and Ethics

AuRico is committed to adhering to high standards of corporate governance. The Company’s Code of Conduct embodies the commitment of AuRico to conduct business in accordance with all applicable laws and regulations and the highest ethical standards. The Code of Conduct has been adopted by the Board and applies to every director, officer, consultant and employee of the Company. In addition, directors, officers, and employees must also comply with corporate policies, including AuRico’s Anti-Bribery and Corruption Policy, Disclosure Policy, Insider Trading Policy, and Sustainability Framework.

The Code of Conduct requires high standards of professional and ethical conduct in AuRico’s business dealings. AuRico’s reputation for honesty and integrity is integral to the success of its business and no person associated with the Company will be permitted to achieve results through violations of laws or regulations or through unscrupulous dealings. AuRico also seeks to ensure that its business practices are compatible with the economic and social priorities of each location in which it operates. Although customs vary by country and standards of ethics may vary in different business environments, AuRico’s business activities are always expected to be conducted with honesty, integrity, and accountability.