THIS LETTER OF TRANSMITTAL IS FOR USE ONLY IN CONJUNCTION WITH THE PROPOSED ARRANGEMENT UNDER SECTION 182 OF THE BUSINESS CORPORATIONS ACT (ONTARIO) IN RESPECT OF AURICO GOLD INC. AND ITS SHAREHOLDERS, ALAMOS GOLD INC. AND ITS SHAREHOLDERS AND INVOLVING AURICO METALS INC.

THIS LETTER OF TRANSMITTAL MUST BE VALIDLY COMPLETED, DULY EXECUTED AND RETURNED TO THE DEPOSITARY, KINGSDALE SHAREHOLDER SERVICES. IT IS IMPORTANT THAT YOU VALIDLY COMPLETE, DULY EXECUTE AND RETURN THIS LETTER OF TRANSMITTAL IN A TIMELY BASIS IN ACCORDANCE WITH THE INSTRUCTIONS CONTAINED BELOW. THE DEPOSITARY (AS DEFINED HEREIN) OR OTHER FINANCIAL ADVISOR CAN ASSIST YOU IN COMPLETING THIS LETTER OF TRANSMITTAL.

The instructions accompanying this Letter of Transmittal should be read carefully before this Letter of Transmittal is completed or submitted to the Depositary. If you have any questions or require more information with regard to the procedures for completing this Letter of Transmittal, please contact the Depositary at 1-800-775-5159 (North American Toll Free Number) or 1-416-867-2272 (collect outside North America). You can email the Depositary at contactus@kingsdaleshareholder.com.

LETTER OF TRANSMITTAL

FOR COMMON SHARES OF

AURICO GOLD INC.

| TO: | KINGSDALE SHAREHOLDER SERVICES (the “Depositary”) |

| | |

| AND TO: | AURICO GOLD INC. (“AuRico”) |

| | |

| AND TO: | ALAMOS GOLD INC. (“Alamos”) |

| | |

| AND TO: | AURICO METALS INC (“New AuRico”) |

This letter of transmittal (“Letter of Transmittal”) is for use by registered holders (“Registered Shareholders”) of common shares of AuRico (“AuRico Shares”) in connection with the proposed arrangement (the “Arrangement”) involving AuRico, Alamos and New AuRico that is being submitted for approval at the special meeting of holders of AuRico Shares (the “AuRico Shareholders”) scheduled to be held on June 24, 2015 or any adjournment(s) or postponement(s) thereof (the “AuRico Meeting”). The Arrangement involves among other things, a transfer of certain assets of AuRico to a newly created company called AuRico Metals Inc. (“New AuRico”), the amalgamation of AuRico and Alamos to form a company (“Amalco”) and a capital reorganization of Amalco, the effect of which is that, subject to adjustment as described in the Information Circular (as defined below), each AuRico Shareholder will ultimately receive, for each AuRico Share held, 0.5046 of a Class A common share of Amalco (the “Class A Shares”) and a pro rata portion of a common share of New AuRico (the “New AuRico Shares”). Registered Shareholders are referred to the Notices of Special Meetings and the Joint Management Information Circular dated May 22, 2015 (collectively, the “Information Circular”) prepared in connection with the AuRico Meeting that accompanies this Letter of Transmittal.

- 2 -

Capitalized terms used but not defined in this Letter of Transmittal have the meanings set out in the Information Circular. Registered Shareholders are encouraged to carefully review the Information Circular in its entirety.

This Letter of Transmittal is for use by Registered Shareholders only and is not to be used by beneficial holders of AuRico Shares that are not Registered Shareholders (the “Beneficial Shareholders”). A Beneficial Shareholder does not have AuRico Shares registered in its name; rather, such AuRico Shares are registered in the name of the brokerage firm, bank or trust company (an “Intermediary”) through which the Beneficial Shareholder purchased the AuRico Shares or in the name of a clearing agency (such as CDS Clearing and Depository Services Inc.) of which the Intermediary is a participant. If you are a Beneficial Shareholder, you should contact your Intermediary for instructions and assistance in delivering your AuRico Shares and receiving the consideration for such AuRico Shares.

The Arrangement is anticipated to close in the third quarter of 2015. If the Arrangement is completed, at the Effective Time, AuRico Shareholders will receive for each AuRico Share held, the consideration described above.

No DRS Advices (as defined below) representing fractional Class A Shares or New AuRico Shares shall be issued upon the surrender for exchange of certificates representing AuRico Shares and no dividend, stock split or other change in the capital structure of Amalco shall relate to any such fractional security and such fractional interests shall not entitle the holder thereof to exercise any rights as a security holder of Amalco. The number of Class A Shares or New AuRico Shares to be issued to any Registered Shareholder shall be rounded up or down to the nearest whole Class A Share or New AuRico Share, as applicable. For greater certainty, where such fractional interest is greater than or equal to 0.5, the number of Class A Shares or New AuRico Shares, as applicable, to be issued will be rounded up to the nearest whole number and where such fractional interest is less than 0.5, the number of Class A Shares or New AuRico Shares, as applicable, to be issued will be rounded down to the nearest whole number. In calculating such fractional interests, all Class A Shares or New AuRico Shares, as applicable, registered in the name of or beneficially held by an holder of Class A Shares or New AuRico Shares, as applicable, or its nominee shall be aggregated.

To receive the appropriate number of Class A Shares and New AuRico Shares that a holder of AuRico Shares is entitled to receive pursuant to the Arrangement, Registered Shareholders are required to deposit the certificate(s) representing their AuRico Shares with the Depositary. This Letter of Transmittal, properly completed and duly executed, together with all other required documents, must accompany the certificate(s) for AuRico Shares deposited for receipt of Class A Shares and New AuRico Shares pursuant to the Arrangement.

Whether or not the undersigned delivers the required documentation to the Depositary, as of the Effective Time, the undersigned will cease to be a holder of AuRico Shares and, subject to the ultimate expiry deadline identified below, will only be entitled to receive the consideration to which the undersigned is entitled under the Arrangement. REGISTERED SHAREHOLDERS WHO DO NOT DELIVER CERTIFICATES REPRESENTING THEIR AURICO SHARES AND ALL OTHER REQUIRED DOCUMENTS TO THE DEPOSITARY ON OR BEFORE THE SIXTH ANNIVERSARY OF THE EFFECTIVE DATE WILL LOSE THEIR RIGHT TO RECEIVE ANY CONSIDERATION FOR THEIR AURICO SHARES AND ANY CLAIM OR INTEREST OF ANY KIND OR NATURE AGAINST AURICO, ALAMOS, NEW AURICO, AMALCO OR THE DEPOSITARY.

- 3 -

Please read the Information Circular and the instructions set out below carefully before completing this Letter of Transmittal. Delivery of this Letter of Transmittal to an address other than as set forth herein will not constitute a valid delivery. If AuRico Shares are registered in different names, a separate Letter of Transmittal must be submitted for each different Registered Shareholder. See Instruction 2.

In connection with the Arrangement being considered for approval at the AuRico Meeting, the undersigned hereby deposits with the Depositary the enclosed certificate(s) representing AuRico Shares, details of which are as follows:

| Certificate Number(s) | Name(s) in which Registered | Number of AuRico Shares Represented by Certificate |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | TOTAL | |

(Please print or type. If space is insufficient, please attach a list to this Letter of Transmittal in the above form.)

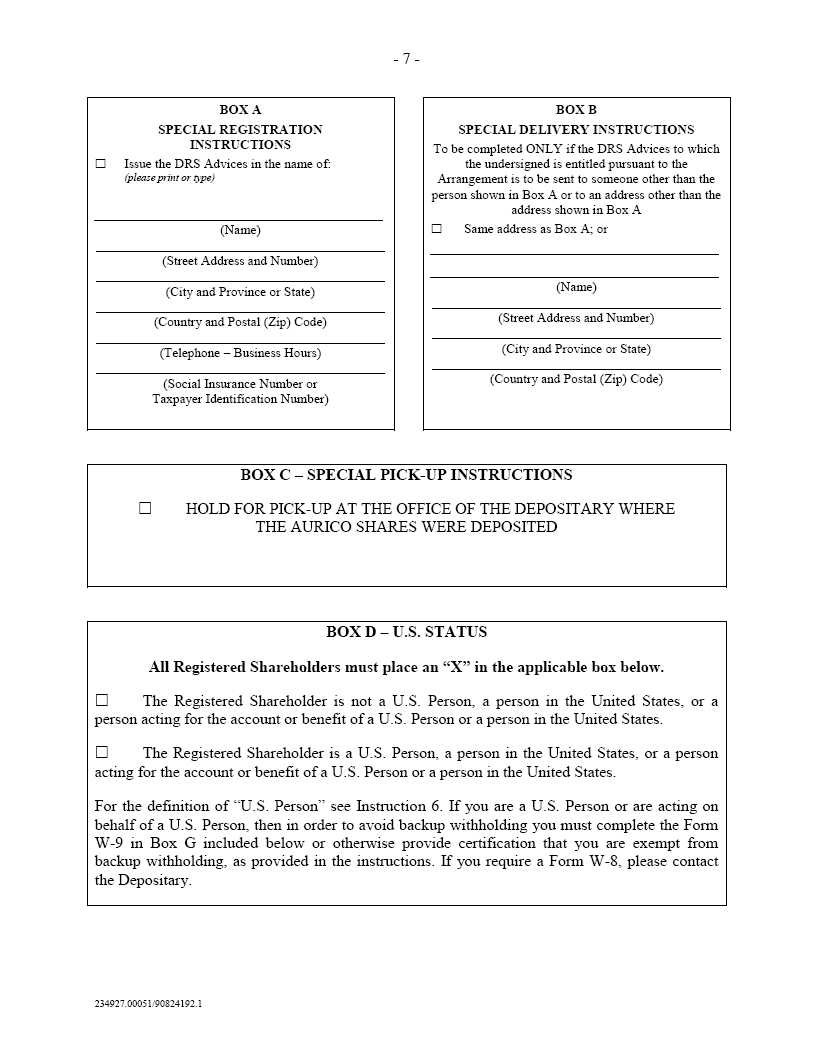

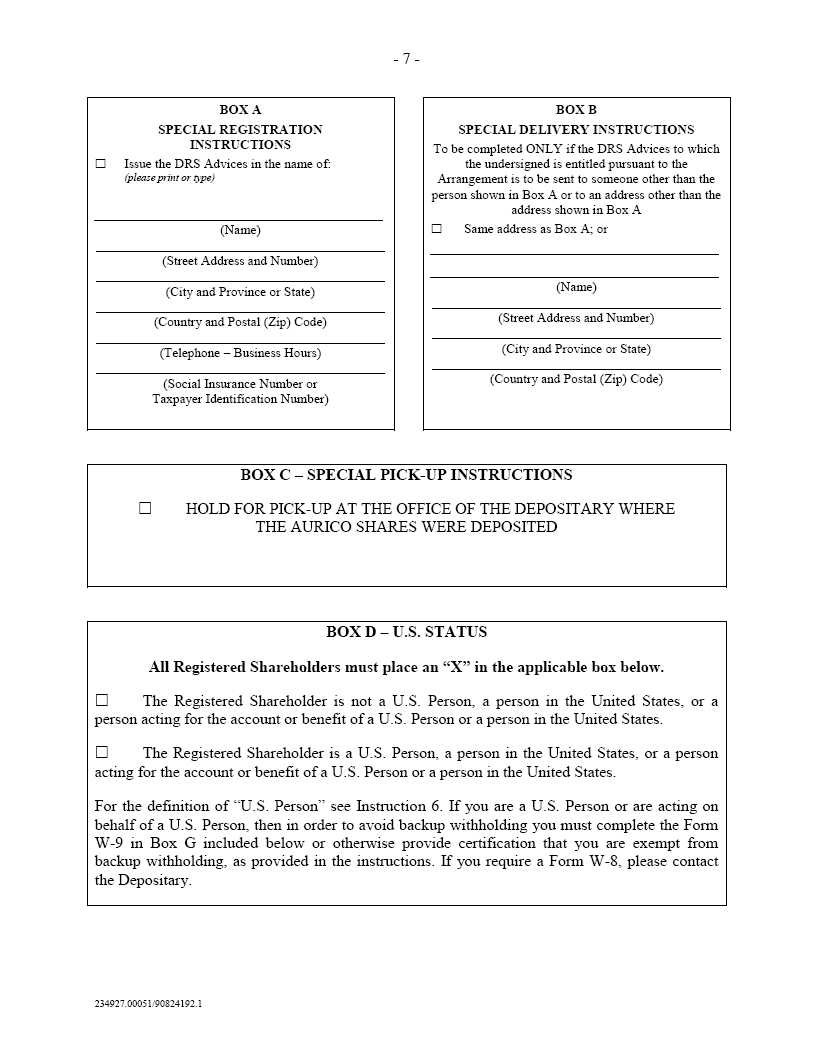

It is understood that, upon receipt of this duly completed and signed Letter of Transmittal and of the certificate(s) representing the AuRico Shares deposited herewith (the “Deposited AuRico Shares”) and following the Effective Time of the Arrangement, the Depositary will deliver to the undersigned, in accordance with the issuance and delivery instructions provided in Box A and Box B below, Direct Registration System Advices (“DRS Advices”) representing the Class A Shares and New AuRico Shares that the undersigned is entitled to receive under the Arrangement, or hold such statements for pick-up in accordance with the instructions set out in Box C below, and the certificate(s) representing the Deposited AuRico Shares will forthwith be cancelled. If neither Box A nor Box B is completed, any DRS Advices issued in exchange for the Deposited AuRico Shares will be issued in the name of the registered holder of the Deposited AuRico Shares and will be mailed to the address of the registered holder of the Deposited AuRico Shares as it appears on the register of AuRico.

The undersigned holder of AuRico Shares represents and warrants in favour of AuRico, Alamos and New AuRico that: (i) the undersigned is the registered and legal owner of the Deposited AuRico Shares, has good right and title to the rights represented by the above mentioned certificates, and that such Deposited AuRico Shares represent all of the AuRico Shares owned, directly or indirectly, by the undersigned; (ii) such Deposited AuRico Shares are owned by the undersigned free and clear of all mortgages, liens, charges, encumbrances, security interests and adverse claims; (iii) the undersigned has full power and authority to execute and deliver this Letter of Transmittal and to deposit, sell, assign, transfer and deliver the Deposited AuRico Shares and that, when the Class A Shares and the New AuRico Shares are delivered, none of AuRico, Alamos, Amalco and New AuRico, or any affiliate thereof or successor thereto will be subject to any adverse claim in respect of such Deposited AuRico Shares; (iv) the Deposited AuRico Shares have not been sold, assigned or transferred, nor has any agreement been entered into to sell, assign or transfer any such Deposited AuRico Shares, to any other person; (v) the transfer of the Deposited AuRico Shares complies with all applicable laws; (vi) all information inserted by the undersigned into this Letter of Transmittal is complete, true and accurate; and (vii) the delivery of the applicable number of Class A Shares and New AuRico Shares will discharge any and all obligations of AuRico, Alamos, Amalco, New AuRico and the Depositary with respect to the matters contemplated by this Letter of Transmittal and the Arrangement. These representations and warranties shall survive the completion of the Arrangement. The undersigned further acknowledges receipt of the Information Circular.

- 4 -

Except for any proxy deposited with respect to the vote on the AuRico Arrangement Resolution in connection with the AuRico Meeting or as granted by this Letter of Transmittal, the undersigned revokes any and all authority, other than as granted in this Letter of Transmittal, whether as agent, attorney-in-fact, proxy or otherwise, previously conferred or agreed to be conferred by the undersigned at any time with respect to the Deposited AuRico Shares and no subsequent authority, whether as agent, attorney-in-fact, proxy or otherwise, will be granted with respect to the Deposited AuRico Shares.

The undersigned hereby agrees to transfer, effective at the Effective Time and pursuant to the Arrangement, all right, title and interest in the Deposited AuRico Shares and irrevocably appoints and constitutes the Depositary, each director and officer of AuRico and Alamos, and any other person designated by AuRico, Alamos and Amalco in writing, as the lawful attorney of the undersigned, with full power of substitution to deliver the Deposited AuRico Shares pursuant to the Arrangement and to effect the transfer of the Deposited AuRico Shares on the books of AuRico to the extent and in the manner provided under the Arrangement.

The undersigned will, upon request, execute any signature guarantees or additional documents deemed by the Depositary to be reasonably necessary or desirable to complete the transfer of the Deposited AuRico Shares contemplated by this Letter of Transmittal.

The undersigned agrees that all questions as to validity, form, eligibility (including timely receipts) and acceptance of any AuRico Shares transferred in connection with the Arrangement shall be determined by AuRico in its sole discretion and that such determination shall be final and binding and acknowledges that there is no duty or obligation upon AuRico, Alamos, New AuRico, Amalco, the Depositary or any other person to give notice of any defect or irregularity in any such surrender of AuRico Shares and no liability will be incurred by any of them for failure to give any such notice.

- 5 -

The undersigned hereby acknowledges that the delivery of the Deposited AuRico Shares shall be effected and the risk of loss to such Deposited AuRico Shares shall pass only upon proper receipt thereof by the Depositary.

The undersigned acknowledges that all authority conferred, or agreed to be conferred, by the undersigned herein may be exercised during any subsequent legal incapacity of the undersigned and shall survive the death, incapacity, bankruptcy or insolvency of the undersigned and all obligations of the undersigned herein shall be binding upon the heirs, personal or legal representatives, successors and assigns of the undersigned.

The undersigned instructs the Depositary to issue the DRS Advices for the Class A Shares and New AuRico Shares that the undersigned is entitled to pursuant to the Arrangement, in exchange for the Deposited AuRico Shares, promptly after the Effective Time, by first-class insured mail, postage prepaid, to the undersigned, or to issue the DRS Advices for the Class A Shares and New AuRico Shares and hold the same for the Deposited AuRico Shares for pick-up, in accordance with the instructions given below.

The undersigned acknowledges that if the Arrangement is completed, the delivery of Deposited AuRico Shares pursuant to this Letter of Transmittal is irrevocable. If the Arrangement is not completed or proceeded with, the enclosed certificate(s) and all other ancillary documents will be returned as soon as possible to the undersigned at the address set out below in Box A or Box B, as applicable, or, failing such address being specified, to the undersigned at the last address of the undersigned as it appears on the securities register of AuRico.

It is understood that the undersigned will not receive the DRS Advices for the Class A Shares and the New AuRico Shares in respect of the Deposited AuRico Shares until the certificate(s) representing the Deposited AuRico Shares owned by the undersigned are received by the Depositary at the address set forth on the back of this Letter of Transmittal, together with a duly completed Letter of Transmittal and such additional documents as the Depositary may require, and the same are processed by the Depositary. It is understood that under no circumstances will interest accrue or be paid in respect of the Deposited AuRico Shares in connection with the Arrangement.

The undersigned acknowledges that AuRico, Alamos, Amalco and the Depositary shall be entitled to deduct or withhold from any consideration otherwise payable to any former AuRico Shareholder under the Arrangement and from all dividends or other distributions otherwise payable to any former AuRico Shareholder such amounts as AuRico, Alamos, Amalco or the Depositary is required or permitted to deduct or withhold with respect to such payment under the Tax Act or any provision of any applicable federal, provincial, state, local or foreign tax law or treaty, in each case, as amended. To the extent that amounts are so deducted or withheld, such deducted or withheld amounts shall be treated for all purposes hereof as having been paid to the former AuRico Shareholder in respect of which such deduction and withholding was made, provided that such deducted or withheld amounts are actually remitted to the appropriate taxing authority. The undersigned acknowledges that it has consulted or has had the opportunity to consult its own tax advisor with respect to the potential income tax consequences to it of the Arrangement, including any elections to be made in respect thereof.

- 6 -

The undersigned represents and warrants that the undersigned has such knowledge and experience in financial and business matters that the undersigned is capable of evaluating the merits and risks of an investment in the Class A Shares and New AuRico Shares.

If the undersigned is in the United States, it understands and acknowledges that the Class A Shares and New AuRico Shares to be received by it pursuant to the Arrangement have not been registered under the United States Securities Act of 1933, as amended (the “Securities Act”), and are being issued in reliance on the Section 3(a)(10) exemption thereunder. The Class A Shares and New AuRico Shares will be freely transferable under U.S. federal securities laws, except by persons who are “affiliates” (as such term is understood under U.S. securities laws) of Amalco or New AuRico, as applicable, after the Effective Date, or were “affiliates” of AuRico or New AuRico, as applicable, within 90 days prior to the Effective Date. Persons who may be deemed to be “affiliates” of an issuer include individuals or entities that control, are controlled by, or are under common control with, the issuer, whether through the ownership of voting securities, by contract, or otherwise, and generally include executive officers and directors of the issuer as well as principal shareholders of the issuer. Any resale of such Class A Shares or New AuRico Shares by such an affiliate (or former affiliate) may be subject to the registration requirements of the Securities Act, absent an exemption therefrom as more fully described in the Information Circular.

By reason of the use by the undersigned of an English language Letter of Transmittal, the undersigned shall be deemed to have required that any contract in connection with the delivery of the AuRico Shares pursuant to the Arrangement through this Letter of Transmittal, as well as all documents related thereto, be drawn exclusively in the English language. En raison de l’utilisation d’une lettre d’envoi en langue anglaise par le soussigné, le soussigné sont présumés avoir requis que tout contrat relié à l’envoi d’actions ordinaires de AuRico en vertue de l’arrangement au moyen de la présente lettre d’envoi, de même que tous les documents qui s’y rapportent, soient rédigés exclusivement en langue anglaise.

This letter will be governed by and construed in accordance with the laws of the Province of Ontario and the federal laws of Canada applicable therein.

- 9 -

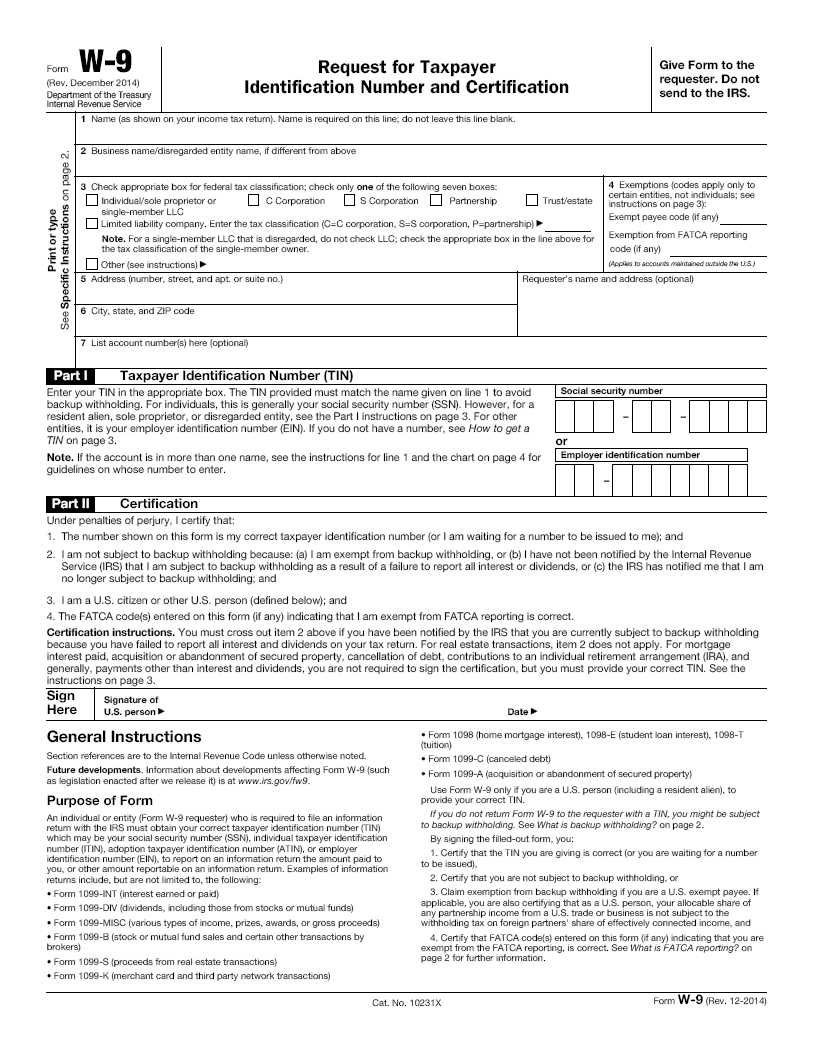

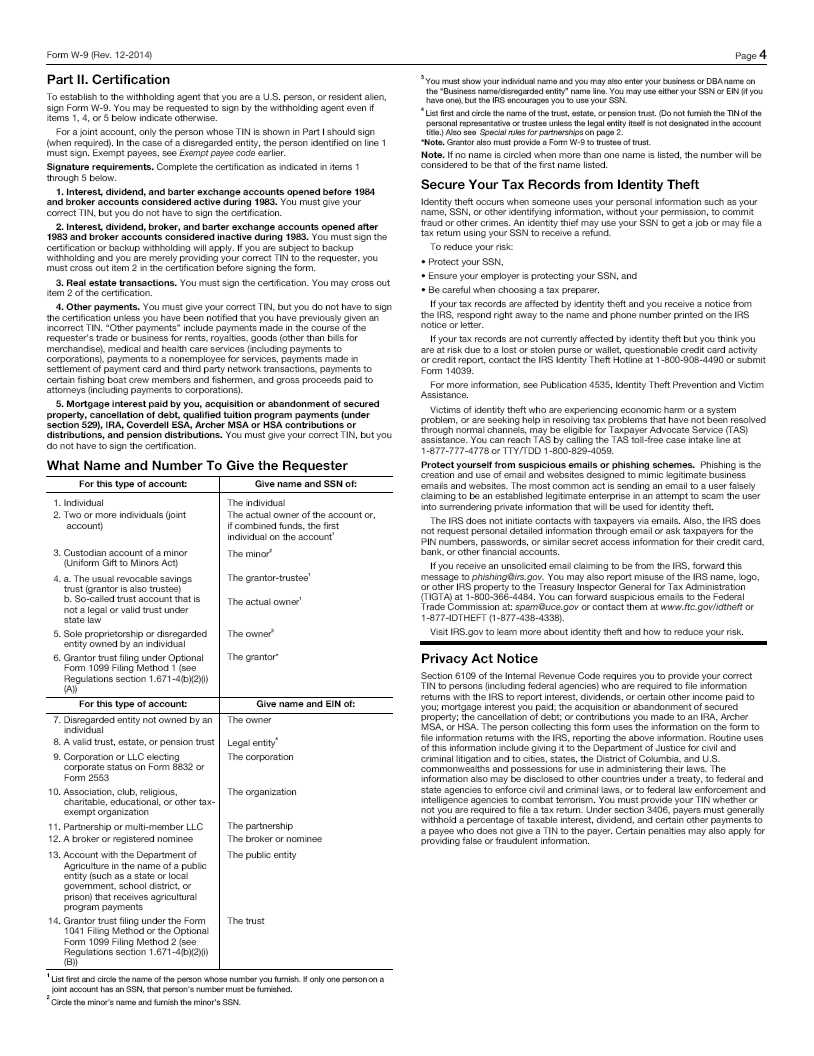

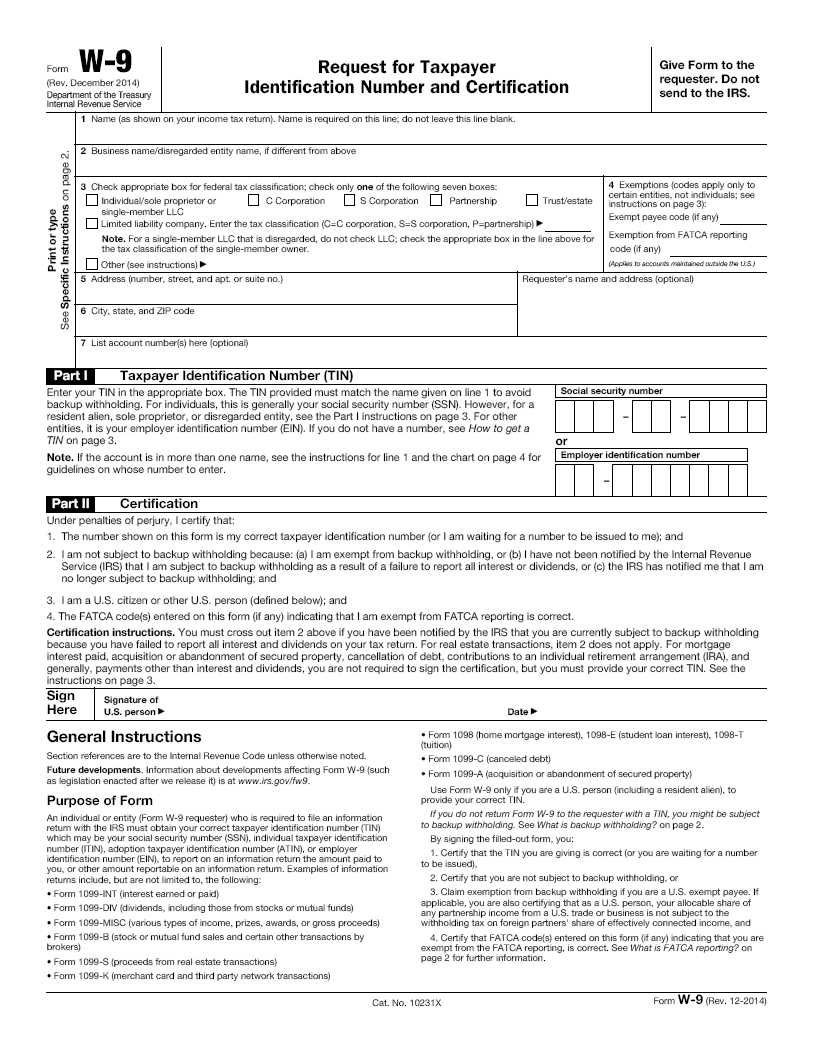

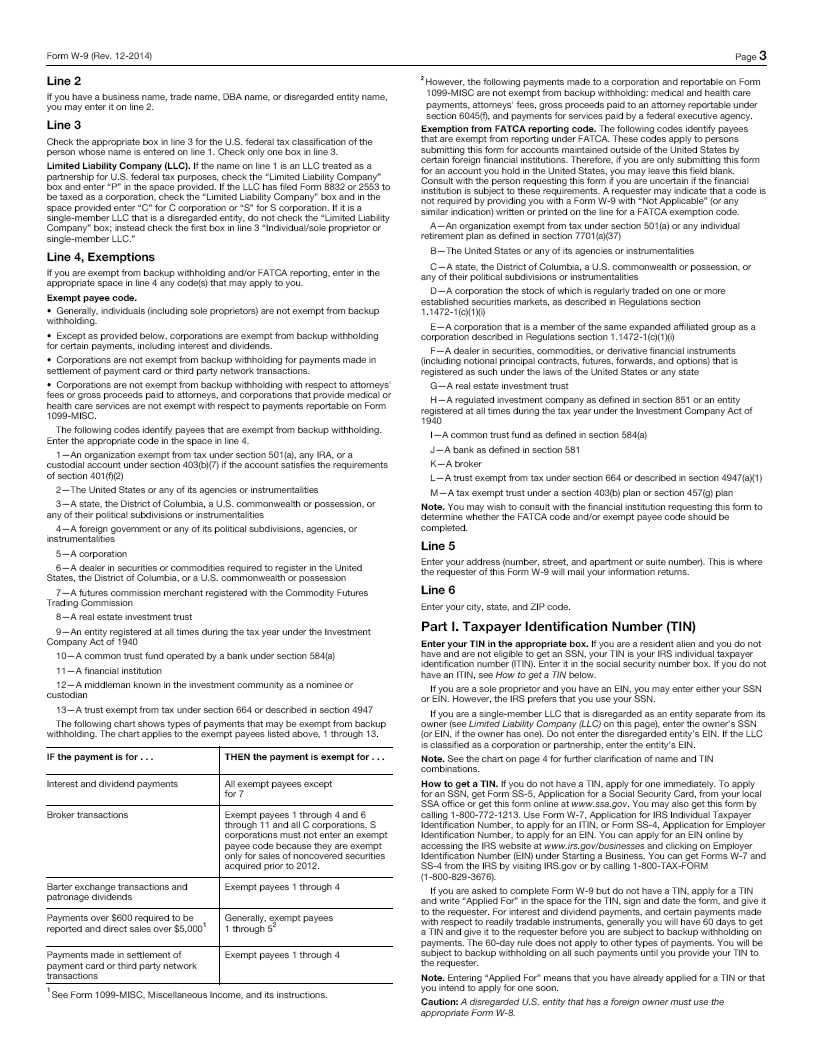

BOX G– FORM W-9

REQUEST FOR TAXPAYER

- 10 -

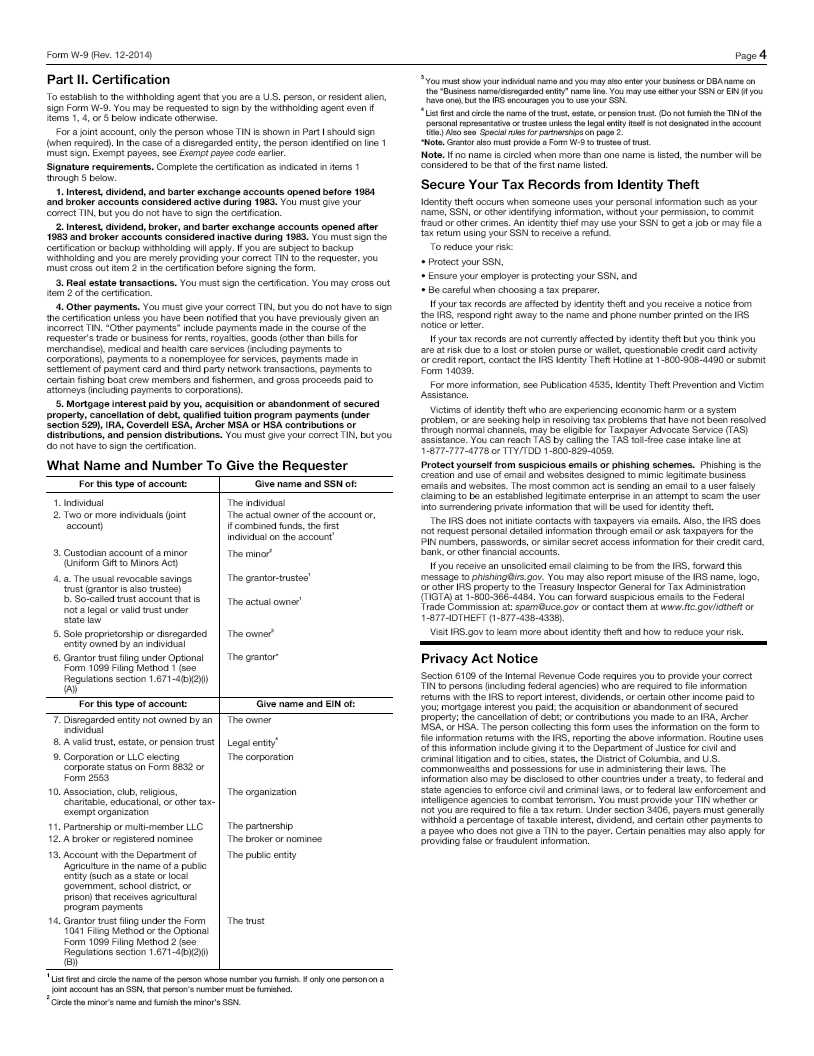

| BOX H – CERTIFICATION OF AWAITING TAXPAYER IDENTIFICATION NUMBER |

| |

| NOTE: FAILURE TO FURNISH YOUR CORRECT TIN MAY RESULT IN A PENALTY IMPOSED BY THE INTERNAL REVENUE SERVICE AND IN BACKUP WITHHOLDING OF 28% OF THE GROSS AMOUNT OF CONSIDERATION PAID TO YOU PURSUANT TO THE ARRANGEMENT. |

| |

| YOU MUST COMPLETE THE FOLLOWING CERTIFICATE IF YOU WROTE “APPLIED FOR” IN PART I OF THE ATTACHED FORM W-9. |

| |

| I certify under penalties of perjury that a taxpayer identification number has not been issued to me, and either (a) I have mailed or delivered an application to receive a taxpayer identification number to the appropriate IRS Center or Social Security Administration Officer, or (b) I intend to mail or deliver an application in the near future. I understand that if I do not provide a TIN by the time of payment, 28% of the gross proceeds of such payment made to me may be withheld. |

| |

| Signature of U.S. Person ______________________________ Date: _______________ |

| |

INSTRUCTIONS

| 1. | Use of Letter of Transmittal |

| | | |

| (a) | Registered Shareholders should read the accompanying Information Circular prior to completing this Letter of Transmittal. Capitalized terms used but not defined in this Letter of Transmittal have the meanings set out in the Information Circular. |

| | | |

| (b) | This Letter of Transmittal duly completed and signed (or an originally signed facsimile copy thereof) together with accompanying certificates representing the AuRico Shares and all other required documents must be sent or delivered to the Depositary at the addresses set out on the back of this Letter of Transmittal. In order to receive the DRS Advices for the Class A Shares and New AuRico Shares under the Arrangement for the Deposited AuRico Shares, it is recommended that the foregoing documents be received by the Depositary at the address set out on the back of this Letter of Transmittal as soon as possible. |

| | | |

| (c) | The method used to deliver this Letter of Transmittal and any accompanying certificates representing AuRico Shares and all other required documents is at the option and risk of the Registered Shareholder and delivery will be deemed effective only when such documents are actually received by the Depository, AuRico recommends that the necessary documentation be hand delivered to the Depositary at the address set out on the back of this Letter of Transmittal, and a receipt obtained; otherwise the use of registered mail with return receipt requested, properly insured, is recommended. Beneficial Shareholders whose AuRico Shares are registered in the name of a broker, investment dealer, bank, trust company or other nominee should contact that nominee for assistance in depositing those AuRico Shares. Delivery to an office other than to the specified office does not constitute delivery for this purpose. |

- 11 -

| | (d) | AuRico, Alamos and Amalco reserve the right if they so elects in their absolute discretion to instruct the Depositary to waive any defect or irregularity contained in any Letter of Transmittal and/or accompanying documents received by it. |

| | | |

| | (e) | If the DRS Advices representing the Class A Shares and New AuRico Shares is to be issued in the name of a person other than the person(s) signing this Letter of Transmittal under Box F or if the DRS Advices representing the Class A Shares and New AuRico Shares is to be mailed to someone other than the person(s) signing this Letter of Transmittal under Box F or to the person(s) signing this Letter of Transmittal under Box F at an address other than that which appears on the register of AuRico, the appropriate boxes on this Letter of Transmittal should be completed (Box A and Box B). |

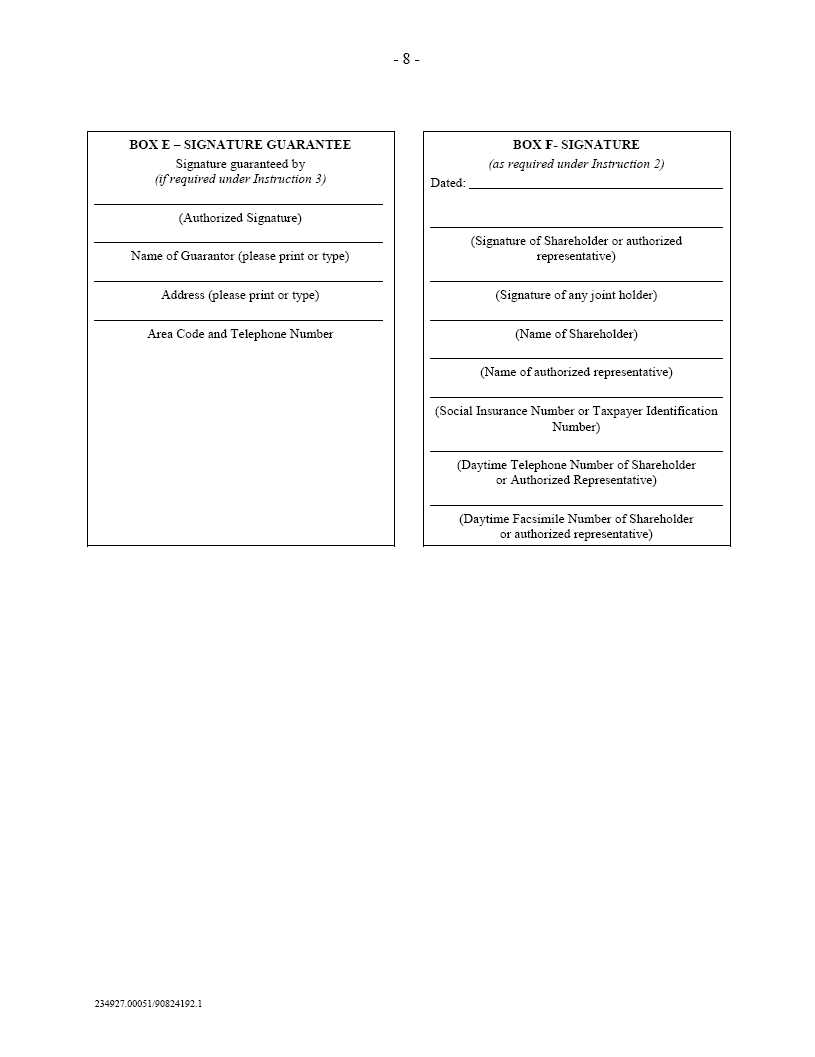

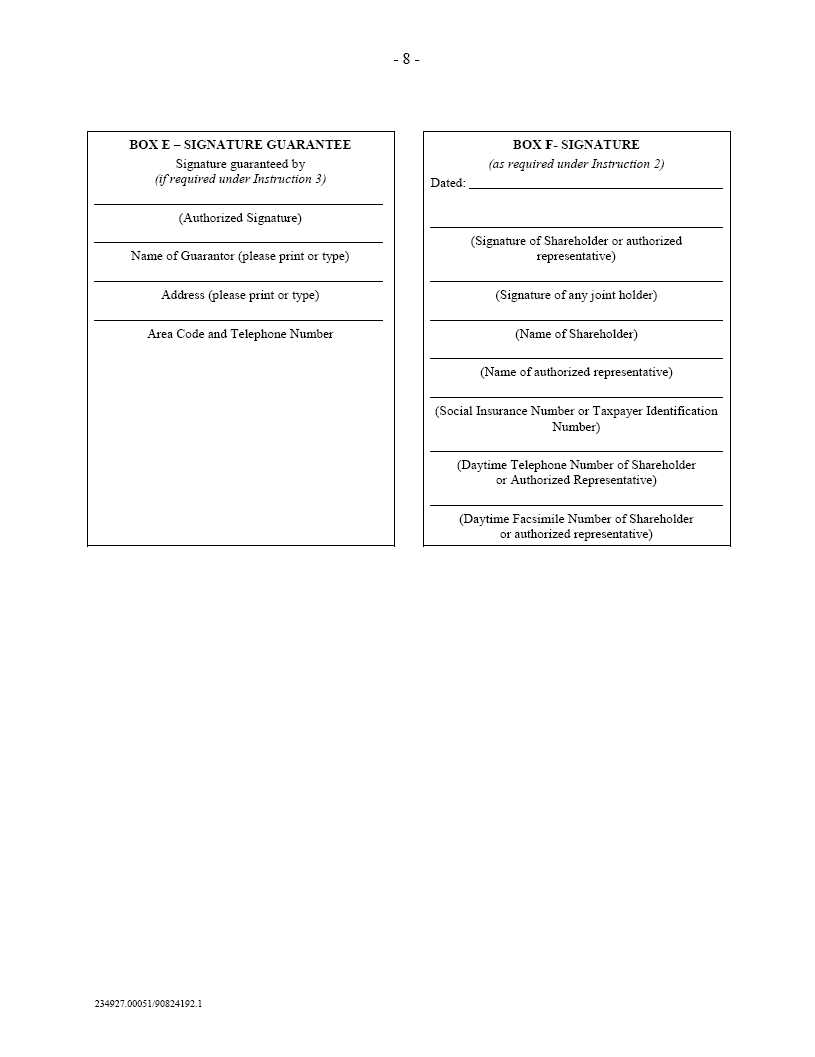

This Letter of Transmittal must be completed and signed by the Registered Shareholder of AuRico Shares under Box F or by such Registered Shareholder’s duly authorized representative (in accordance with Instruction 4).

| | (a) | If this Letter of Transmittal is signed by the Registered Shareholders of the accompanying certificate(s), such signature(s) on this Letter of Transmittal must correspond with the name(s) as registered or as written on the face of such certificate(s) without any change whatsoever, and the certificate(s) need not be endorsed. If such deposited certificate(s) are owned of record by two or more joint owners, all such owners must sign this Letter of Transmittal (Box F). |

| | | |

| | (b) | If this Letter of Transmittal is signed on behalf of a Registered Shareholder by a person other than the Registered Shareholder(s) of the accompanying certificate(s) representing Deposited AuRico shares, or if DRS Advices representing Class A Shares and New AuRico Shares are to be issued to a person other than the Registered Shareholder: |

| | (i) | such Deposited AuRico Shares must be endorsed or be accompanied by appropriate share transfer power(s) of attorney duly and properly completed by the Registered Shareholder; and |

| | | |

| | (ii) | the signature on such endorsement or share transfer power(s) of attorney must correspond exactly to the name of the Registered Shareholder as registered or as appearing on the certificate(s) and must be guaranteed as noted in paragraph 3 below of these Instructions. |

| | (c) | If any of the Deposited AuRico Shares are registered in different names on several certificates, it will be necessary to complete, sign and submit as many separate Letters of Transmittal as there are different registrations of such Deposited AuRico Shares. |

- 12 -

| 3. | Guarantee of Signatures |

If this Letter of Transmittal is signed on behalf of a Registered Shareholder by a person other than the Registered Shareholder of the AuRico Shares or if the payment is to be issued in a name other than the Registered Shareholder of the AuRico Shares, such signature must be guaranteed by an Eligible Institution (as defined below), or in some other manner satisfactory to the Depositary (except that no guarantee is required if the signature is that of an Eligible Institution). An “Eligible Institution” means a Canadian Schedule I chartered bank, a member of the Securities Transfer Agents Medallion Program (STAMP), a member of the Stock Exchanges Medallion Program, (SEMP) or a member of the New York Stock Exchange, Inc. Medallion Signature Program (MSP). Members of these programs are usually members of a recognized stock exchange in Canada or the United States, members of the Investment Industry Regulatory Organization of Canada, members of the Financial Industry Regulatory Authority or banks and trust companies in the United States.

| 4. | Fiduciaries, Representatives and Authorizations |

Where this Letter of Transmittal or any share transfer power(s) of attorney is executed by a person as an executor, administrator, trustee or guardian, or on behalf of a corporation, partnership or association or is executed by any other person acting in a representative capacity, such person should so indicate when signing and this Letter of Transmittal must be accompanied by satisfactory evidence of the authority to act. AuRico or the Depositary, at their discretion, may require additional evidence of authority or additional documentation.

If neither Box A nor Box B is completed, any DRS Advices to be issued for the Deposited AuRico Shares will be issued in the name of the Registered Shareholder of the Deposited AuRico Shares and will be mailed to the address of the Registered Shareholder of the Deposited AuRico Shares as it appears on the register of AuRico. Otherwise, the DRS Advices to be issued in exchange for the Deposited AuRico Shares will be issued in the name of the person indicated in Box A and delivered to the address indicated in Box A (unless another address has been provided in Box B). If any DRS Advices representing Class A Shares or New AuRico Shares is to be held for pick-up at the offices of the Depositary, complete Box C. Any DRS Advices mailed in accordance with this Letter of Transmittal will be deemed to be delivered at the time of mailing.

| 6. | U.S. Persons and Form W-9 |

For purposes of this Letter of Transmittal, a “U.S. Person” is a beneficial owner of AuRico Shares that, for U.S. federal income tax purposes, is (a) an individual who is a citizen or resident of the U.S., (b) a corporation, partnership, or other entity classified as a corporation or partnership for U.S. federal income tax purposes, that is created or organized in or under the laws of the United States, or any political subdivision thereof or therein, (c) an estate if the income of such estate is subject to U.S. federal income tax regardless of the source of such income, or (d) a trust if (i) such trust has validly elected to be treated as a U.S. person for U.S. federal income tax purposes, or (ii) a U.S. court is able to exercise primary supervision over the administration of such trust and one or more U.S. persons have the authority to control all substantial decisions of such trust.

- 13 -

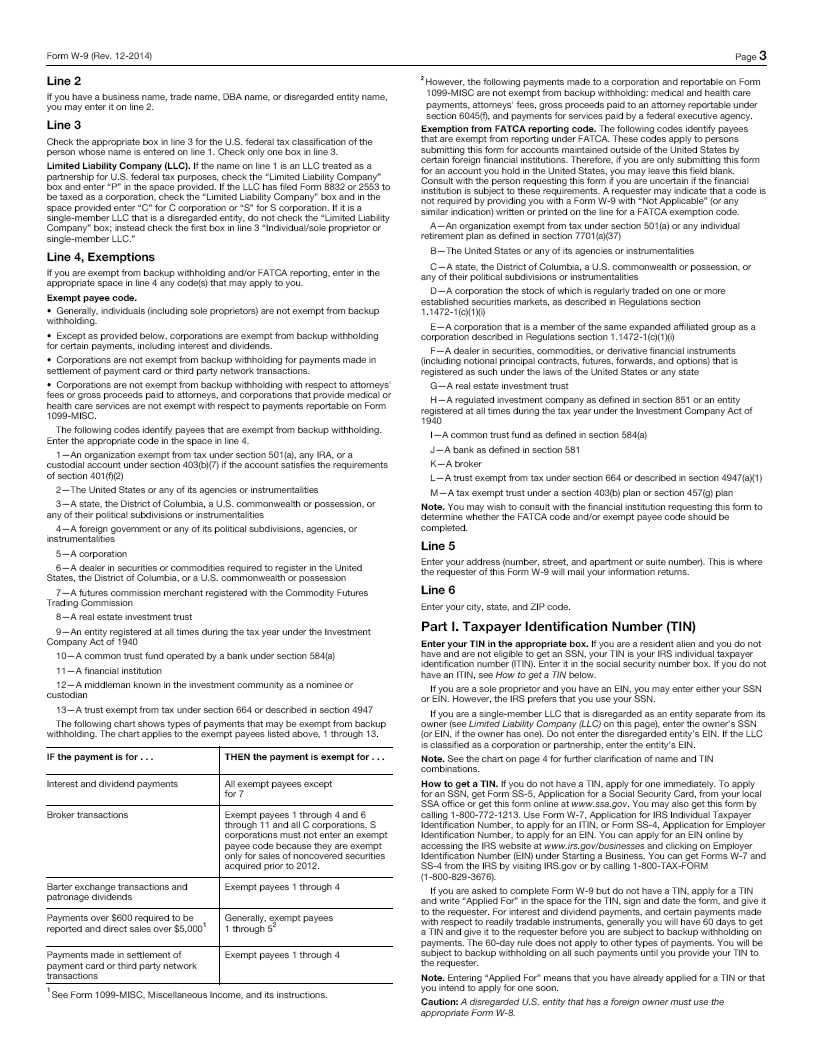

United States federal income tax law generally requires that a U.S. Person who receives New AuRico Shares in the Arrangement provide the Depositary with its correct Taxpayer Identification Number (“TIN”) or Employer Identification Number (“EIN”), which, in the case of a holder of AuRico Shares who is an individual, is generally the individual’s social security number. If the Depositary is not provided with the correct TIN or EIN or an adequate basis for an exemption, as the case may be, such holder may be subject to penalties imposed by the U.S. Internal Revenue Service (“IRS”) and backup withholding in an amount equal to 28% of the New AuRico Shares received hereunder. If withholding results in an overpayment of taxes, a refund may be obtained by the holder from the IRS.

To prevent backup withholding, each U.S. Person must provide his correct TIN or EIN by completing the Form W-9 set out in this document, which requires such holder to certify under penalty of perjury: (1) that the TIN or EIN provided is correct (or that such holder is awaiting a TIN or EIN); (2) that (i) the holder is exempt from backup withholding; (ii) the holder has not been notified by the Internal Revenue Service that such holder is subject to backup withholding as a result of a failure to report all interest or dividends; or (iii) the IRS has notified the holder that such holder is no longer subject to backup withholding; (3) that the holder is a U.S. person (including a U.S. resident alien); and (4) that any FACTA codes entered on the form are correct.

Exempt holders are not subject to backup withholding requirements. To prevent possible erroneous backup withholding, an exempt holder must enter its correct TIN or EIN in Part 1 of the Form W-9, enter an exempt payee code on Line 4 of such form, and sign and date the form.

If a U.S. Person does not have a TIN or EIN, such holder should: (i) consult with its own U.S. tax adviser on applying for a TIN or EIN; (ii) write “Applied For” in the space for the TIN in Part I of the Form W-9; and (iii) sign and date the Form W-9 and the Certification of Awaiting Taxpayer Identification Number set out in this Letter of Transmittal and Election. In such case, the Depositary may withhold 28% of the gross proceeds of any payment made to such holder prior to the time a properly certified TIN or EIN is provided to the Depositary, and if the Depositary is not provided with a TIN within sixty (60) days, such amounts will be paid over to the IRS.

If the Form W-9 is not applicable to a Registered Shareholder that checked box 2 of Box D “U.S. Status”, such holder will instead need to submit an appropriate and properly completed IRS Form W-8 Certificate of Foreign Status, signed under penalty of perjury. An appropriate IRS Form W-8 (W-8BEN, W-8EXP or other form) may be obtained from the Depositary.

A U.S. PERSON WHO FAILS TO PROPERLY COMPLETE THE FORM W-9 SET OUT IN THIS LETTER OF TRANSMITTAL AND ELECTION OR, IF APPLICABLE, THE APPROPRIATE IRS FORM W-8, MAY BE SUBJECT TO BACKUP WITHHOLDING OF 28% OF THE GROSS PROCEEDS OF ANY PAYMENTS MADE TO SUCH HOLDER PURSUANT TO THE ARRANGEMENT AND MAY BE SUBJECT TO PENALTIES. BACKUP WITHHOLDING IS NOT AN ADDITIONAL TAX. RATHER, THE TAX LIABILITY OF PERSONS SUBJECT TO BACKUP WITHHOLDING WILL BE REDUCED BY THE AMOUNT OF TAX WITHHELD. IF WITHHOLDING RESULTS IN AN OVERPAYMENT OF TAXES, A REFUND MAY BE OBTAINED BY FILING A CLAIM FOR REFUND WITH THE IRS. THE DEPOSITARY CANNOT REFUND AMOUNTS WITHHELD BY REASON OF BACKUP WITHHOLDING.

- 14 -

EACH HOLDER OF AURICO SHARES IS URGED TO CONSULT HIS, HER OR ITS OWN TAX ADVISOR TO DETERMINE WHETHER SUCH HOLDER IS REQUIRED TO FURNISH AN IRS FORM W-9, IS EXEMPT FROM BACKUP WITHHOLDING AND INFORMATION REPORTING, OR IS REQUIRED TO FURNISH AN APPLICABLE IRS FORM W-8.

In the event any certificate, that immediately prior to the Effective Time represented one or more outstanding AuRico Shares that were exchanged pursuant to the Arrangement, shall have been lost, stolen or destroyed, the holder claiming such certificate to be lost, stolen or destroyed must make an affidavit of that fact and the Depositary will deliver DRS Advices representing the Class A Shares and New AuRico Shares that such holder is entitled to receive in accordance with the Arrangement. When authorizing such delivery, the holder to whom DRS Advices representing such Class A Shares and New AuRico Shares is to be delivered shall, as a condition precedent to such delivery, give a bond satisfactory to AuRico, Amalco and the Depositary in such amount as AuRico, Amalco and the Depositary may direct, or otherwise indemnify AuRico, Amalco and the Depositary in a manner satisfactory to AuRico, Amalco and the Depositary, against any claim that may be made against AuRico, Amalco and the Depositary with respect to the certificate alleged to have been lost, stolen or destroyed.

Upon receipt of the Deposited AuRico Shares and all other required documents, DRS Advices will be issued by the Depositary to the registered holder of Class A Shares and New AuRico Shares representing the ownership of their Class A Shares and New AuRico Shares, as applicable. Registered holders of Class A Shares and New AuRico wishing to request a share certificate representing some or all of such Class A Shares or New AuRico Shares should refer to the instructions provided upon receipt of the DRS Advices. Only Registered Shareholders will receive a DRS Advices.

The Direct Registration System, or DRS, is a system that allows you to hold your Class A Shares and New AuRico Shares in “book-entry” form without having a physical share certificate issued as evidence of ownership. Instead, your Class A Shares and New AuRico Shares will be held in your name and registered electronically in Amalco and New AuRico’s records, respectively, which will be maintained by their transfer agent, Computershare Investor Services Inc. (“Computershare”). The Direct Registration System eliminates the need for shareholders to safeguard and store certificates, it avoids the significant cost of a surety bond for the replacement of, and the effort involved in replacing physical certificate(s) that might be lost, stolen or destroyed and it permits and enables electronic share transactions.

- 15 -

The first time your Class A Shares and New AuRico Shares are recorded under DRS (upon completion of the Arrangement) you will receive a initial DRS Advice in respect of each of your Class A Shares and New AuRico Shares, acknowledging the number of Class A Shares and New AuRico Shares you hold in your DRS accounts.

Each time you have any movement of shares into or out of your DRS accounts, you will be mailed an updated DRS Advice. You may request a statement at any time by contacting Computershare or by accessing your accounts online at www.computershare.com/investorcentrecanada.

There is no fee to participate in DRS. In addition, you will be able to easily transfer your Class A Shares or New AuRico Shares from your respective DRS account to your brokerage account. To do so, in Canada, you should have your broker request that your Class A Shares or New AuRico Shares in your applicable DRS account be sent to them through the Canadian Depository for Securities CDSX System. You need to supply your broker with a copy of your latest DRS Advice and the following information:

- your Computershare account number (found on your DRS Advice)

- your Social Insurance Number

- the number of whole Class A Shares or New AuRico Shares you wish to move from your Computershare DRS account to your brokerage account

In the United States, you should have your broker request that your Class A Shares or New AuRico Shares in your applicable DRS account be sent to them through the Depository Trust Company’s Direct Registration Profile System. You need to supply your broker with a copy of your latest DRS Advice and the following information:

- your Computershare account number (found on your DRS Advice)

- your Social Security Number or Taxpayer Identification Number

- Computershare’s DTC number: 7807

- the number of whole Class A Shares or New AuRico Shares you wish to move from your applicable Computershare DRS account to your brokerage account

Your broker will then electronically initiate the transfer of your Class A Shares or New AuRico Shares in your applicable DRS account based on your instructions.

To sell your Class A Shares or New AuRico Shares in the applicable DRS account you can:

- instruct your broker to sell all or part of your Class A Shares or New AuRico Shares in your DRS account, but first your Class A Shares or New AuRico Shares must be delivered/transferred to your broker. Please read the instructions immediately above which describe the information your broker requires to move your Class A Shares or New AuRico Shares in the applicable DRS account electronically to their control within their respective depository; or

- 16 -

- request a physical share certificate(S) representing your Class A Shares or New AuRico Shares from Computershare and deliver it to your broker to sell.

To transfer ownership of your Class A Shares or New AuRico Shares in the applicable DRS account you must submit written instructions along with your current DRS Advice, a completed stock power of attorney and the appropriate Medallion Signature Guarantee to Computershare’s address shown on the DRS Advice. A new DRS Advice showing the transfer of the Class A Shares or New AuRico Shares, as applicable, and the remaining DRS balance (even if the amount is zero) will be sent to you and a new DRS Advice will also be sent to the holder to whom the Class A Shares or New AuRico Shares have been transferred as per your instructions.

At any time you may request a share certificate for all or a portion of the Class A Shares or New AuRico Shares held in your respective DRS account.

Simply contact Computershare with your request. A share certificate for the requested number of Class A Shares or New AuRico Shares will be sent to you by first class mail upon receipt of your instructions, at no cost to you.

For more information about DRS, please contact Computershare at 1-800-564-6253 (toll free within Canada and the U.S.) or 514-982-7555 (outside of Canada and the U.S.) or visit Computershare online at www.computershare.com/investorcentrecanada.

| | (a) | If the space on this Letter of Transmittal is insufficient to list all certificates for AuRico Shares, additional certificate numbers and number of AuRico Shares may be included on a separate signed list affixed to this Letter of Transmittal. |

| | | |

| | (b) | If AuRico Shares are registered in different forms (e.g., “John Doe” and “J. Doe”) a separate Letter of Transmittal should be signed for each different registration. |

| | | |

| | (c) | No alternative, conditional or contingent deposits of AuRico Shares will be accepted and no fractional Class A Shares and New AuRico Shares will be issued. |

| | | |

| | (d) | Additional copies of the Letter of Transmittal may be obtained from the Depositary at the address set out on the back of this Letter of Transmittal. |

| | | |

| | (e) | This Letter of Transmittal will be construed in accordance with and be governed by the laws of the Province of Ontario and the federal laws of Canada applicable therein. |

| | | |

| | (f) | The holder of the AuRico Shares that are the subject of this Letter of Transmittal hereby unconditionally and irrevocably attorns to the jurisdiction of the courts of the Province of Ontario and the courts of appeal therefrom. |

- 17 -

The representations made by the holders of AuRico Shares in this Letter of Transmittal will survive the Effective Time of the Arrangement.

THE DEPOSITARY FOR THE ARRANGEMENT IS:

The office of the Depositary is:

By Mail

The Exchange Tower

130 King Street West, Suite 2950,

P.O. Box 361

Toronto, Ontario

M5X 1E2

Attention: Corporate Actions

By Registered Mail, Hand or Courier

The Exchange Tower

130 King Street West, Suite 2950, Toronto,

Ontario M5X 1E2

Attention: Corporate Actions

By Facsimile

Facsimile: 416-867-2271

Toll Free Facsimile: 1-866-545-5580

Inquiries

Toll free (North America): 1-800-775-5159

Outside of North America: 416-867-2272

E-Mail: contactus@kingsdaleshareholder.com

Any questions and requests for assistance may be directed by holders of AuRicoShares to the Depositary at the telephone number and locations set out above.