Exhibit 99.1

Annual Information Form

For the year ended December 31, 2010

Dated as of March 23, 2011

| 2010ANNUAL INFORMATION FORM |

GAMMON GOLD INC.

(the “Company” or “Gammon Gold”)

1701 Hollis Street

Founders Square, PO Box 2067

Halifax, Nova Scotia

B3J 2Z1

ANNUAL INFORMATION FORM

TABLE OF CONTENTS

| 2 | |

| 2010ANNUAL INFORMATION FORM |

| 3 | |

| 2010ANNUAL INFORMATION FORM |

GLOSSARY OF TERMS

Ag– Silver

Assay -Analysis to determine the amount or proportion of the element of interest contained within a sample

Au– Gold

Aue– Gold equivalent

Ball mill- A horizontal rotating steel cylinder which grinds ore to fine particles. The grinding is carried out by the pounding and rolling of a charge of steel balls carried within the cylinder

Bench- The horizontal ledge in an excavation or mining operation that is drilled, blasted and excavated separately from other benches

Clastic Rock- A consolidated sedimentary rock composed principally of broken fragments that are derived from pre-existing rocks (of any origin) or from the solid products formed during chemical weathering of such rocks, and that have been transported mechanically to their places of deposition; i.e., a sandstone, conglomerate, or shale; or a limestone consisting of particles derived from a pre-existing limestone

Concentrate- A processing product containing the valuable ore mineral from which most of the waste mineral has been eliminated

Crushing- Breaking of ore from the size delivered from the mine into smaller and more uniform fragments to be then fed to grinding mills or to a leach pad

Cut-off grade -the minimum metal grade at which material can be economically mined and processed (used in the calculation of ore reserves)

Cyanidation- A method of extracting gold or silver by dissolving it in a weak solution of sodium cyanide

Development- Work carried out for the purpose of opening up a mineral deposit. In an underground mine, this includes shaft sinking, crosscutting, drifting and raising. In an open pit mine, development includes the removal of overburden and/ or waste rock

Dilution- Sub-economic material that is unavoidably included with the mined ore, lowering the mined grade

Doré- Unrefined gold and silver bullion bars usually consisting of approximately 90 percent precious metals that will be further refine (generally offsite) to almost pure metal

Drift- A horizontal tunnel generally driven within or alongside an orebody and aligned parallel to the long dimension of the ore

Drilling -

Core: a drilling method that uses a rotating barrel and an annular-shaped, diamond-impregnated rock-cutting bit to produce cylindrical rock cores and lift such cores to the surface, where they may be collected, examined and assayed

Geotechnical: diamond drilling targeted and utilized specifically for the collection of information used for mine engineering, slope stability, and underground ground reinforcement purposes

Reverse circulation: a drilling method that uses a rotating cutting bit within a double-walled drill pipe and produces rock chips rather than core. Air or water is circulated down to the bit between the inner and outer wall of the drill pipe. The chips are forced to surface through the centre of the drill pipe and are collected, examined and assayed

Exploration- Prospecting, sampling, mapping, diamond-drilling and other work involved in locating the presence of economic deposits and establishing their nature, shape and grade

| 4 | |

| 2010ANNUAL INFORMATION FORM |

Felsic- mnemonic (adj.) derived from (fe) for feldspar, (l) for feldspathoid, and (s) for silica, and applied to light-colored rocks containing an abundance of one or all of these constituents. Also applied to the minerals themselves, the chief felsic minerals being quartz, feldspar, feldspathoid, and muscovite

Flotation- A process by which some mineral particles are induced to become attached to bubbles and float, and other particles to sink, so that the valuable minerals are concentrated and separated from the uneconomic gangue or waste

Grade- The amount of metal in each ton of ore, expressed as troy ounces per ton or grams per tonne for precious metals and as a percentage for most other metals

Mill-head grade: metal content of mined ore going into a mill for processing

Recovered grade:metal content that was extracted from ore by processing

Reserve grade:estimated metal content of an orebody that satisfies all economic, mining, and other criteria to be considered a reserve

g– Grams

g/t –Grams per tonne

Grinding (Milling)- Powdering or pulverizing of ore, by pressure or abrasion, to liberate valuable minerals for further metallurgical processing

LIBOR- The London Inter-Bank Offered Rate for deposits

Metric conversion

| Troy ounces | x | 31.10348 | = | Grams |

| Troy ounces per short ton | x | 34.28600 | = | Grams per tonne |

| Tons | x | 0.90718 | = | Tonnes |

| Feet | x | 0.30480 | = | Metres |

| Miles | x | 1.60930 | = | Kilometres |

| Acres | x | 0.40468 | = | Hectares |

| Fahrenheit | (°F-32) x 5 ÷ 9 | | = | Celsius |

Mill- A processing facility where ore is finely ground and thereafter undergoes physical or chemical treatment to extract the valuable metals. Also the device used to perform grinding (milling)

Mineral Reserve -See“Narrative Description of Business – Mineral Reserves and Mineral Resources.”

Mineral Resource -See“Narrative Description of Business – Mineral Reserves and Mineral Resources.”

Mining claim- That portion of applicable mineral lands that a party has staked or marked out in accordance with applicable mining laws to acquire the right to explore for and exploit the minerals under the surface

Net profits interest royalty(also called “net profits interest” or “net profit interest”) - A royalty based on the profit remaining after recapture of certain operating, capital and other costs

Net smelter return royalty(also called a “net smelter return”) - A royalty based on a percentage of valuable minerals produced with settlement made either in kind or in currency based on the spot sale proceeds received less all of the offsite smelting, refining and transportation costs associated with the purification of the economic metals

NI 43-101- National Instrument 43-101 – Standards of Disclosure for Mineral Projects

Open pit mine- A mine where materials are removed entirely from a working that is open to the surface

| 5 | |

| | | |

| 2010ANNUAL INFORMATION FORM |

Ore- Rock, generally containing metallic or non-metallic minerals, which can be mined and processed at a profit

Orebody- A sufficiently large amount of ore that is contiguous and can be mined economically

Oxide ore(also called “oxides”)- Mineralized rock in which some of the original minerals have been oxidized. Oxidation tends to make the ore more amenable to cyanide solutions so that minute particles of gold will be readily dissolved

Qualified Person -An individual who is an engineer or geoscientist with at least five years of experience in mineral exploration, mine development or operation or mineral project assessment, or any combination of these; has experience relevant to the subject matter of the mineral project and the relevant technical report; and is a member or licensee in good standing of a professional association as defined in NI 43-101

Ramp- An inclined roadway connecting two levels in an open pit mine, or inclined tunnel in an underground mine

Reclamation- The process by which lands disturbed as a result of mining activity are modified to support beneficial land use. Reclamation activity may include the removal of buildings, equipment, machinery and other physical remnants of mining, closure of tailings storage facilities, leach pads and other mine features, and contouring, covering and re-vegetation of waste rock and other disturbed areas

Reclamation Costs- The cost of reclamation plus other costs, including without limitation certain personnel costs, insurance, property holding costs such as taxes, rental and claim fees, and community programs associated with closing an operating mine in compliance with relevant regulations in the local jurisdiction

Recovery rate- A term used in process metallurgy to indicate the proportion of valuable material physically recovered in the processing of ore. It is generally stated as a percentage of the material recovered compared to the total material originally present

Resuing- A method of stoping wherein the wall rock on one side of the vein is removed before the ore is broken. Employed on narrow veins, less than 30 in (76 cm), and yields cleaner ore than when wall and ore are broken together.

Refining- The final stage of metal production in which impurities are removed from the molten metal

Skarn- A metamorphic rock that is usually variably colored green or red, occasionally grey, black, brown or white.

Shaft- A vertical passageway to an underground mine for ventilation, moving personnel, equipment, supplies and material including ore and waste rock

Stope- An underground excavation from which ore is extracted

Tailings- The ground rock material that remains after all economically and technically recoverable precious metals have been removed from the ore during processing

Tailings storage facility- A natural or man-made confined area suitable for depositing the material that remains after the treatment of ore

Tons- Short tons (2,000 pounds)

Tonnes- Metric tonnes (1,000 kilograms), mt

Total cash costs-See “Narrative Description of Business-Production and Total Cash Costs”

tpd- tonnes per day

Volcanics- A general collective term for extrusive igneous and pyroclastic material and rocks

Volcanoclastic- Pertaining to a clastic rock containing volcanic material without regard to its origin or environment

| 6 | |

| 2010ANNUAL INFORMATION FORM |

Vuggy Silica- The texture produced by the dissolving of minerals and rock fragments, and the replacement of the remaining matrix of the rock by silica minerals, usually quartz. This texture is common in high-sulphidation epithermal systems. |

| |

| Wallrock- The rock forming the walls of a vein or other mineral deposit |

| |

REPORTING CURRENCY AND FINANCIAL INFORMATION

All currency amounts in this Annual Information Form are expressed in United States dollars, unless otherwise indicated. The exchange rate used to calculate US dollar to Mexican Peso throughout this Annual Information Form is, PESO 1.00 = US$0.08102, as at December 31, 2010.

Gammon Gold Inc. (“Gammon Gold” or the “Company”) prepares its financial statements in accordance with Canadian generally accepted accounting principles (“GAAP”), which differ in certain material respects from accounting principles generally accepted in the United States of America (“U.S. GAAP”). The Company’s annual financial statements are reconciled to U.S. GAAP. Unless otherwise stated, financial information in this Annual Information Form is presented in accordance with Canadian GAAP.

MINERAL RESOURCE REPORTING STANDARDS

Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or other economic studies. United States investors are cautioned not to assume that all or any part of Measured or Indicated Mineral Resources will ever be converted into Mineral Reserves. United States investors are also cautioned not to assume that all or any part of an Inferred Mineral Resource exists, or is economically or legally mineable.

FORWARD-LOOKING INFORMATION

Certain statements included herein, including information as to the future financial or operating performance of the Company, its subsidiaries and its projects, constitute forward-looking statements. The words ‘‘believe’’, ‘‘expect’’, ‘‘anticipate’’, ‘‘contemplate’’, ‘‘target’’, ‘‘plan’’, ‘‘intends’’, ‘‘continue’’, ‘‘budget’’, ‘‘estimate’’, “forecast”, ‘‘may’’, ‘‘will’’, ‘‘schedule’’ and similar expressions identify forward-looking statements. Forward-looking statements include, among other things, statements regarding targets, estimates and assumptions in respect of gold and silver and gold equivalent production and prices, cash and operating costs, results and capital expenditures, mineral reserves and mineral resources and anticipated grades, recovery rates, future financial or operating performance, margins, operating and exploration expenditures, costs and timing of the development of new deposits, costs and timing of construction, costs and timing of future exploration and reclamation expenses, anticipated 2010 year-end and 2011 results, the Company’s ability to fully fund its business model, including its capital and exploration program, internally, anticipated 2010 year-end and 2011 interim and annual gold and silver production and the cash and operating costs associated with the same, the ability to achieve productivity and operational efficiencies, the ability to achieve cash flow margin improvements, the ability to complete further reduction in the open pit stripping ratio, the ability to develop and put into production its exploration targets and the timing of each thereof, the ability to successfully execute its acquisition strategy, the acquisition of Capital Gold (the “Acquisition”) including whether the completion of the Acquisition will ultimately occur, whether the anticipated synergies of the proposed Acquisition will occur, the assessment of the value of the properties of Capital Gold and obtaining the required security holder, regulatory, third party and other approvals and the outcome of any pending litigation related to the Acquisition. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by Gammon Gold, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Important factors that could cause actual results to differ materially from Gammon Gold’s expectations include, among others, risks related to international operations, the actual results of current exploration activities, conclusions of economic evaluations and changes in project parameters as plans continue to be refined, future prices of gold and silver, known and unknown uncertainties and risks relating to additional funding requirements, reserve and resource estimates, hedging activities, development and operating risks, illegal miners, uninsurable risks, competition, limited mining operations, production risks, environmental regulation and liability, government regulation, currency fluctuations, recent losses and write-downs, restrictions in Gammon Gold's loan facility, dependence on key employees, possible variations of ore grade or recovery rates, failure of plant, equipment or process to operate as anticipated, accidents and labour disputes as well as those factors discussed in the section entitled “Risk Factors” herein. Although Gammon Gold has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements are not guarantees of future performance. Accordingly, readers should not place undue reliance on forward-looking statements.

| 7 | |

| 2010ANNUAL INFORMATION FORM |

The Company may, from time to time, make oral forward-looking statements. The Company advises that the above paragraph and the risk factors described in this Annual Information Form and in the Company's other documents filed with the Canadian securities commissions and the United States Securities and Exchange Commission (the “SEC”) should be read for a description of certain factors that could cause the actual results of the Company to materially differ from those in the oral forward-looking statements. Forward-looking statements are made as of the date of this Annual Information Form or, in the case of documents incorporated by reference herein, as of the date of such document. The Company disclaims any intention or obligation to update or revise any oral or written forward-looking statements whether as a result of new information, future events or otherwise, except as required by applicable law.

SCIENTIFIC AND TECHNICAL INFORMATION

Mineral Reserves have been estimated in accordance with the National Instrument 43-101 (“NI 43-101”), as required by Canadian securities regulatory authorities. In addition, while the terms “Measured”, “Indicated” and “Inferred” Mineral Resources are required pursuant to NI 43-101, the SEC does not recognize such terms. Canadian standards differ significantly from the requirements of the SEC, and Mineral Resource information contained herein is exclusive of, and not comparable to similar information regarding Mineral Reserves disclosed in accordance with requirements of the SEC. Investors should understand that “Inferred” Mineral Resources have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility.

Scientific and technical information for the El Cubo property have been prepared by employees of Gammon Gold Inc. under the supervision of Glenn R. Clark, P. Eng. of Glenn R. Clark & Associates Limited.

Unless otherwise indicated, scientific or technical information in this Annual Information Form relating to Mineral Reserves or Mineral Resources for the Ocampo property have been prepared by employees of Gammon Gold Inc. under the supervision of Ramon Luna, P. Geo.

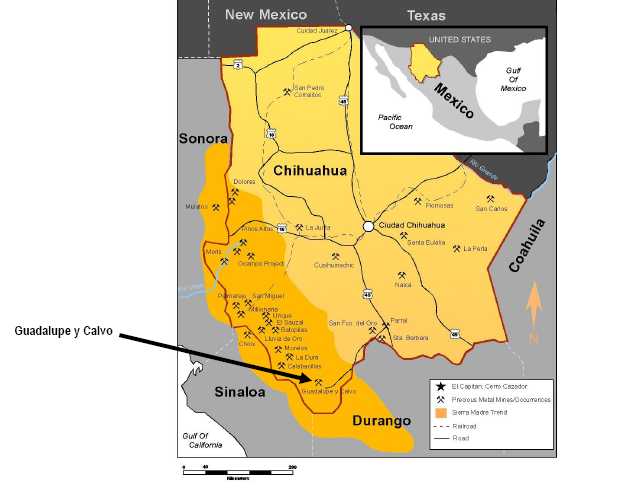

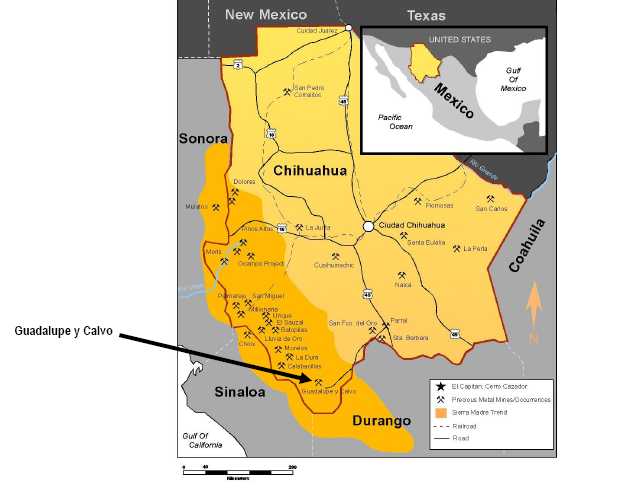

The scientific and technical information relating to the Guadalupe y Calvo Project is based on the technical report on the Guadalupe y Calvo Project dated November 25, 2002 and was prepared by Clancy J. Wendt and Mark G. Stevens, C.P.G., Pincock, Allen & Holt in accordance with NI 43-101. The full text of this report is available under the Company’s profile at www.sedar.com.

The scientific and technical information relating to the Venus, Los Jarros and Mezquite mineral properties was prepared by Peter Drobeck., Registered Geologist, Senior Vice President of Exploration and Business Development of Gammon Gold Inc.

Each of Messrs. Luna, Clark, Wendt, Stevens and Drobeck is a “Qualified Person” as defined in NI 43-101. A “Qualified Person” means an individual who is an engineer or geoscientist with at least five years of experience in mineral exploration, mine development or operation or mineral project assessment, or any combination of these, has experience relevant to the subject matter of the mineral project and the relevant technical report, and is a member in good standing of a professional association.

Definitions

AMineral Resource(or a “Resource”) is a concentration or occurrence of natural, solid, inorganic or fossilized organic material in or on the Earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge. Mineral Resources are sub-divided, in order of increasing geological confidence, into Inferred, Indicated and Measured categories.

AnInferred Mineral Resource is that part of a Mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence, limited sampling and reasonably assumed but not verified geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes.

AnIndicated Mineral Resource is that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed.

| 8 | |

| 2010ANNUAL INFORMATION FORM |

AMeasured Mineral Resourceis that part of a Mineral Resource for which quantity, grade or quality, densities, shape, physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity.

AMineral Reserve(or a “Reserve”) is the economically mineable part of a Measured or Indicated Mineral Resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting that economic extraction can be justified. A Mineral Reserve includes diluting materials and allowances for losses that may occur when the material is mined. Mineral Reserves are sub-divided in order of increasing confidence into Probable Mineral Reserves and Proven Mineral Reserves.

AProbable Mineral Reserveis the economically mineable part of an Indicated and, in some circumstances, a Measured Mineral Resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified.

AProven Mineral Reserveis the economically mineable part of a measured Mineral Resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified.

GENERAL INFORMATION

Incorporation

Gammon Gold has its executive office located at 56 Temperance Street, 5thFloor, Toronto, Ontario, M5H 3V5. The registered office of the Company is located at 1, Place Ville-Marie, Suite 3900, Montreal, Quebec, H3B 4M7. The President & Chief Executive Officer and Chief Financial Officer currently work out of the executive office. The Company’s common shares are listed on the Toronto Stock Exchange (TSX: GAM), the New York Stock Exchange (NYSE: GRS) and the Berlin Stock Exchange (BSX: GL7).

The Company was incorporated under Part 1A of the Companies Act (Quebec) on February 25, 1986, under the name “Golden Rock Explorations Inc.” By Articles of Amendment dated April 17, 1998, the Company changed its name to, “Gammon Lake Resources Inc.”, and consolidated its common shares on a 15:1 basis (the “Common Shares”). By Articles of Amendment dated June 7, 2007, the Company changed its name to its current name, “Gammon Gold Inc.”

Subsidiaries

The table below provides details with respect to the Company’s direct and indirect wholly-owned subsidiaries:

Name of Subsidiary(1)

| Percentage of

Voting Securities

Owned

| Jurisdiction of

Incorporation

or Organization

|

Nature of Business |

| Gammon Lake Holdings Inc.(2) | 100% (direct) | Nova Scotia | Holding corporation for Gammon Lake de Mexico |

| Gammon Lake Chihuahua, S.A de C.V.(3) | 100% (indirect) | Mexico | Holding corporation for Minera El Cubo |

| Gammon Lake de México, S.A. de C.V.(4) | 100% (indirect) | Mexico | Operating corporation for the Ocampo mine |

| Gammon Lake Resources (USA) Inc.(5) | 100% (direct) | Arizona | Operating corporation for United States office administrative matters |

| Mexgold Resources Inc.(6) | 100% (direct) | Ontario | Holding corporation for Minera El Cubo and Metales |

| Compania Minera del Cubo, S.A. de C.V.(7) | 100% (indirect) | Mexico | Operating corporation for the Minera El Cubo |

| Metales Interamericanos, S.A. de C.V.(8) | 100% (indirect) | Mexico | Inactive |

| Gammon Lake GYC, S.A de C.V.(9) | 100% (indirect) | Mexico | Holding corporation for Minera El Cubo |

| Capital Gold AcquireCo Inc.(10) | 100% (direct) | Delaware | Inactive |

| 9 | |

| 2010ANNUAL INFORMATION FORM |

Notes:

| 1. | Gammon Gold and all of its subsidiaries are sometimes referred to collectively in this document as the “Company”. |

| 2. | Referred to in this document as “Gammon Lake Holdings”. |

| 3. | Referred to in this document as “Gammon Lake Chihuahua”. |

| 4. | Referred to in this document as “Gammon Lake de Mexico”. 2% of the issued and outstanding shares of Gammon Lake de Mexico, S.A. de C.V. are held by Gammon Gold directly in accordance with Mexican corporate law requirements. |

| 5. | Referred to in this document as “Gammon Lake Resources USA”. |

| 6. | Referred to in this document as “Mexgold”. |

| 7. | Referred to in this document as “Minera El Cubo”. |

| 8. | Referred to in this document as “Metales”. |

| 9. | Referred to in this document as“Gammon Lake GYC” |

| 10. | Referred to in this document as“Capital Gold AcquireCo.” |

3 Year History

Mineral Projects

During the past three years, the Company has been focused on the exploration and development of its mineral interests and the production of gold and silver at its Ocampo mine, in the municipality of Ocampo, in the State of Chihuahua, Mexico (collectively referred to herein as the (“Ocampo Mine”). The Ocampo Mine is described in this document under “Mineral Properties - The Ocampo Mine”. The Company has also been producing gold and silver from its El Cubo mine and certain related properties located in Guanajuato State (collectively referred to herein as the “El Cubo Mine”). The El Cubo Mine is described in this document under “Mineral Properties - The El Cubo Mine”.

On December 16, 2010 the Company announced that it had entered into binding Letter of Intent with Aurion Resources Limited wherein both parties agreed to negotiate a definitive agreement that would provide Gammon with an option to earn up to a 70% joint venture interest in the 12,985 hectare La Bandera Project, located in Durango, Mexico. Under the terms defined in the Letter of Intent, Gammon will have the option to earn its interest through a $250,000 private placement in Aurion and a series of escalating work commitments.

In September 2010, the Company applied for a mineral concession over an area of 14,699 hectares in the northern part of San Luis Potosí State, Mexico. At the end of the year the application was still in the process of being titled. This application occurs on the north side of properties controlled by Negociacion Minera Santa Maria de la Paz y Anexos, S.A. de C.V. who are presently operating an underground mine on their properties and recovering gold, silver, and copper from complex skarn deposits. The Company considers it reasonable that similar deposits could occur underneath the valley immediately north of this competitor’s operations, and has therefore applied for this concession to explore this valley. The valleys in this part of Mexico are commonly filled with less than 100 metres of colluvial material, making such a valley a good target to explore with conventional geophysical methods. A geophysical program is planned for 2011.

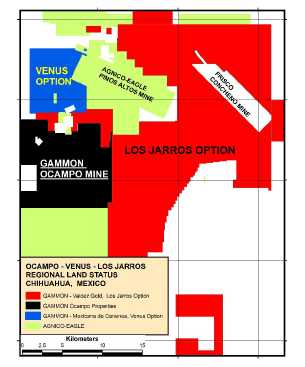

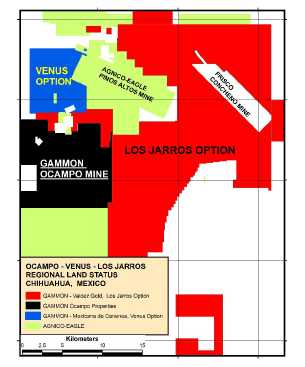

In August 2010, the Company executed a definitive purchase agreement for the Los Jarros Project (“Los Jarros”) in Chihuahua State, Mexico. The project consists of one purchase option agreement with Valdez Gold Inc., of Canada and includes eight mineral concessions covering 43,229 hectares surface area. The agreement allows the Company to purchase a 100% interest in the properties for $2,500,000 over a four year term, and can be cancelled with 30 days’ notice. Los Jarros covers ground between Ocampo and Venus, the eastern side of the Ocampo district, the southeast structural trend of the Pinos Altos district, the northwest and southeast structural trend of the Concheno mine, and a block of ground further to the south that covers an epithermal gold occurrence. The project is a grass roots exploration project with no defined Resources or Reserves.

During 2010, the Company executed two purchase option agreements that now comprise the Venus Project (“Venus”) in Chihuahua, Mexico. The agreement with Mexicana de Cananea S.A. de C.V. allows the Company to purchase 100% of the rights of four mineral concessions that total 4,491 hectares in area, for a total price of $7,000,000 over a four year option period. The agreement also stipulates that the Company will invest a minimum of $3,000,000 in exploration works over the four-year option period. The second agreement is with Pedro Murillo M., and concerns one mineral concession covering 84 hectares area. This agreement allows the Company to purchase 100% of the mineral rights covered by the concession for a total of $750,000 paid over four years. Both agreements allow the Company to terminate the agreements at any time with 30 days’ notice with no further payment obligations. The Venus Project occurs one kilometre north of the Ocampo Mine properties, eight kilometres north of the Ocampo Northeast underground mine, and eight kilometres northwest of the Pinos Altos Mine operated by Agnico Eagle Mines Limited. The properties cover outcropping showings of gold-silver veins that are geologically similar to those found in the Ocampo and Pinos Altos districts. The property is a grass roots exploration project with no defined resources or reserves.

| 10 | |

| 2010ANNUAL INFORMATION FORM |

In March 2010, Gammon signed a definitive purchase option agreements on a group of properties called the Mezquite Project (“Mezquite”) covering 460 hectare in Zacatecas State, Mexico. The option agreements include a series of option payments that total $1,400,000 over a 3 year period.

In May 2009, Gammon Lake de Mexico obtained surface control of surface land around the Ocampo Mine site which consists of 4,275 hectares through a land acquisition expropriation procedure validated by both the Ejidos and the Mexican authorities; this was finalized by the Company successfully obtaining the Presidential decree of expropriation. Total price paid for this land was approximately $1,000 per hectare.

El Cubo Labour Disruption

On June 17, 2010, the Company announced the suspension of operations at the El Cubo mine as a result of continued labour disruptions, the termination of 397 unionized workers for participating in a work stoppage, and rising operating costs associated with the failure of the unionized workforce to achieve expected productivity levels, the union subsequently declared a strike on June 30, 2010. On October 2, 2010, the Labour Court released its ruling that declared the strike action illegal. In accordance with this ruling, the union released the assets to the Company. 154 contract miners, including supervisors, surveyors, geologists and maintenance personnel, as well as 30 pieces of key underground mining equipment were redeployed from El Cubo to the Ocampo mine in late June to focus on development of the underground mines. On February 23, 2011, the Company announced that it had successfully resolved the labour disruption at its 100% owned El Cubo mine, located in Guanajuato State, Mexico. The Company has now secured a new two year collective agreement which has been unanimously approved by the union. In March 2011, employees were rehired and commenced training at the University of Guanajuato.

Shareholder Rights Plan

On August 19, 2010, the directors of the Company approved the entering into of a Shareholder Rights Plan Agreement, dated as of August 19, 2010, between Gammon and Computershare Investor Services Inc., as rights agent (the “Rights Agreement”), that contains the terms of a shareholder rights plan applicable to Gammon’s shareholders the (“Rights Plan”). On February 18, 2011 the Rights Plan was approved by the independent shareholders of Gammon.

Corporate Finance

In the last three years, the Company completed a public offering of 12,926,000 common shares at a price of $8.90 per common share for gross proceeds of $115,041,400 completed on October 22, 2009. The offering was sold on a bought deal basis to a syndicate of underwriters led by BMO Nesbitt Burns Inc., UBS Securities Canada Inc. and including Dundee Securities Corporation, Macquarie Capital Markets Canada Ltd., Canaccord Capital Corporation and Research Capital Corporation. In addition, 1,686,000 common shares were issued pursuant to the full exercise of the over-allotment option.

On November 28, 2008, the Company restructured its credit facility and under terms of the new agreement, gained access to a $50,000,000 credit facility split evenly between Bank of Montreal and Bank of Nova Scotia. The facility was comprised of a US$30 million non-revolving term loan (the “NRT”) and a $20,000,000 revolving line of credit (the “RT”). The NRT was repayable in instalments, with the last instalment due in June 2010. The RT was set to mature on November 28, 2009 with the balance payable at that date. Interest was payable at prime rate plus 2.5% or in the case of US dollar advances, LIBOR + 3.5%.

On November 5, 2009, the Company’s credit facility was restructured and replaced with a $30,000,000 revolving line of credit with the Bank of Nova Scotia. The agreement included an option to increase the facility to $50,000,000 under similar terms and conditions, provided that the Bank of Nova Scotia’s exposure did not exceed $30,000,000. On December 31, 2009, the Company signed an agreement with Société Générale to increase the total revolving credit facility to $50,000,000, with the exposure divided equally between the two lenders. Interest is payable at LIBOR + 3.75% to 4.25% depending on the leverage ratio of the Company.

On November 5, 2010, the Company renegotiated the credit facility with the Bank of Nova Scotia and Société Générale. The revised agreement provides for a $75,000,000 revolving facility, which may be increased to $100,000,000 upon the completion of the acquisition of Capital Gold Corporation, subject to satisfactory due diligence by the lenders on Capital Gold. The credit facility does not require principal repayments other than a one-time payment at maturity equal to the drawn balance at that point in time. The revised agreement expires 36 months from the date of closing with interest payable at a rate of LIBOR plus a margin of 3.25% to 3.75%. There are no operational covenants associated with this facility, and there are no restrictions on the use of the proceeds. As of December 31, 2010, the Company had drawn $26,380,000 under the revolving facility and had issued a $1,000,000 letter of credit against the facility.

| 11 | |

| 2010ANNUAL INFORMATION FORM |

Proposed & Significant Acquisitions

On October 1, 2010, the Company and its wholly-owned subsidiary, Capital Gold AcquireCo, Inc. ("AcquireCo"), entered into a merger agreement with Capital Gold Corporation ("Capital Gold") pursuant to which Gammon Gold will acquire all of the outstanding common stock of Capital Gold (the “Acquisition”). Under the merger agreement, AcquireCo will merge with and into Capital Gold, and the separate corporate existence of AcquireCo will cease with Capital Gold surviving as a wholly-owned subsidiary of Gammon Gold. Under the original merger agreement, each stockholder of Capital Gold was to receive 0.5209 common shares of Gammon Gold and a cash payment in the amount of $0.79 per share (plus cash in lieu of any fractional share interests) for each share of Capital Gold common stock such stockholder holds immediately prior to the completion of the Acquisition, unless such stockholder exercises and perfects its appraisal rights under the Delaware General Corporation Law. On October 29, 2010, Capital Gold and Gammon Gold entered into Amendment No. 1 to the merger agreement to provide that appraisal rights are available in connection with the Acquisition and included a closing condition that provides that Gammon Gold is not obligated to complete the Acquisition if holders of more than 10% of the outstanding shares of Capital Gold common stock have exercised appraisal rights under Delaware Law with respect to the Acquisition. On March 9, 2011, Capital Gold and Gammon Gold entered into Amendment No. 2 to the merger agreement to provide that the termination fee payable by Capital Gold, under certain circumstances, be reduced from $10,300,000 to $5,575,000. In addition, Gammon Gold’s ability to terminate the amended merger agreement for any reason with the payment of a $2,000,000 termination fee was eliminated. On March 17, 2011, Capital Gold and Gammon Gold entered into Amendment No. 3 to the merger agreement to provide an increase to the cash component of the merger consideration to be paid to Capital Gold’s stockholders by $0.30 per share, for a total cash payment in the amount of $1.09 per share. In addition, the outstanding warrants and stock options of Capital Gold will be exchanged for (or will be deemed to become) warrants and options to acquire common shares of the Company, with the exercise price of such warrants and options and the number of shares issuable on exercise being adjusted to reflect any change in the market value of the Company's common shares between the date of the merger agreement and the date the Acquisition is completed. It is expected that the current stockholders of Capital Gold will own approximately 20% of the outstanding common shares of the Company on a fully diluted basis immediately following the completion of the Acquisition.

In addition, three officers and consultants of Capital Gold are party to agreements with Capital Gold that provide for certain payments in event that their employment or engagement by Capital Gold is terminated following a change of control of Capital Gold. The amended merger agreement contemplates that, if such amounts become payable, they may be satisfied by payment in cash or by the issuance of common shares of the Company at the volume weighted average price of the Gammon Gold common shares on the NYSE for the five trading days immediately preceding the completion of the Acquisition, subject to the consent of the officers and consultants involved.

If the Acquisition is not completed, under the amended merger agreement, Capital Gold has agreed to pay a termination fee of $5,750,000 to Gammon Gold under certain circumstances. Capital Gold may also be entitled to a termination fee of up to $2,000,000 under certain circumstances. Capital Gold has, among other things, agreed to provide Gammon Gold with certain other customary deal protections, including a non-solicitation provision and a right to match.

The Acquisition is subject to approval by the stockholders of Capital Gold, [in addition to regulatory approvals] and the satisfaction of certain other customary conditions. The Acquisition is not subject to approval by the shareholders of Gammon Gold because the number of common shares to be issued will not exceed 25% of the outstanding common shares of Gammon Gold. On February 17, 2011, Capital Gold provided to Capital Gold stockholders of record as of February 14, 2011, a definitive proxy statement/prospectus, dated February 16, 2011, relating to a special meeting of Capital Gold’s stockholders that convened and adjourned on March 18, 2011. The special meeting was called for the purpose of considering and voting on the proposal to approve and adopt the plan of merger contained in the amended merger agreement, as well as the adjournment of the special meeting, if necessary or appropriate, including to solicit additional proxies if there are not sufficient votes to adopt the amended merger agreement at the time of the special meeting. On March 18, 2011, Capital Gold convened the special meeting to vote on a proposal to adjourn the special meeting to give Capital Gold’s stockholders additional time to consider the increased consideration offered by Gammon Gold and to review a supplement to the definitive proxy statement/prospectus after it was filed with the U.S. Securities and Exchange Commission (the “SEC”). Capital Gold’s stockholders adjourned the special meeting until April 1, 2011. Gammon Gold prepared and filed with the SEC a registration statement on Form F-4 (as amended and supplemented from time to time, (the “Registration Statement”) to register the shares issuable in connection with the Acquisition for issuance in the United States. The Registration Statement was declared effective by the SEC on February 17, 2011.

| 12 | |

| 2010ANNUAL INFORMATION FORM |

Capital Gold is a gold production and exploration company. Through its Mexican subsidiaries and affiliates, it owns 100% of the El Chanate gold mine (“El Chanate”) located near the town of Caborca in Sonora, Mexico. On August 2, 2010, Capital Gold acquired Nayarit Gold Inc., which owns the Orion gold project in Nayarit, Mexico. Capital Gold is focused on optimizing the El Chanate operations and advancing the Del Norte deposit in the Orion District in the State of Nayarit, Mexico. Capital Gold also owns and leases mineral concessions near the town of Saric, also located in Sonora, that are undergoing exploration for gold and silver mineralization.

On July 16, 2010, the Company completed a non-brokered private placement with Corex Gold Corporation (“Corex”) by acquiring 4,706,000 units of Corex for an aggregate purchase price of CAD$3,200,000 ($3,000,000). Each unit consists of one common share and one half of one share purchase warrant exercisable at CAD$0.90, for a period of twenty four months following the closing date of the transaction. Corex is a gold exploration Company whose principal asset is the Santana Gold Project in Sonora State, Mexico.

On June 1, 2010, the Company completed a non-brokered private placement with Golden Queen Mining Co. Limited (“Golden Queen”) by acquiring 5,000,000 units of Golden Queen for an aggregate purchase price of CAD$8,000,000 ($7,600,000). Each unit consists of one common share, one quarter of one share purchase warrant exercisable at CAD$1.75, and one quarter of one share purchase warrant exercisable at CAD$2.00, for a period of eighteen months following the closing date of the transaction. Golden Queen is a gold exploration and development company whose principal asset is the Soledad Mountain property located in Kern County, Southern California.

NARRATIVE DESCRIPTION OF BUSINESS

General

Gammon Gold Inc. is a publicly traded mid tier gold and silver producer engaged in the mining, development, exploration and acquisition of resource properties in North America. The Company owns two mines in Mexico, the Ocampo mine in Chihuahua State, and the El Cubo mine in Guanajuato State, and also owns the Guadalupe y Calvo advanced exploration property in Chihuahua State, Mexico. The Company has also recently executed purchase option agreements to acquire the Mezquite Project in Zacatecas State, Mexico (460 hectares), the Venus Project located north of the Ocampo mine in Chihuahua State, Mexico (4,575 hectares), the Los Jarros Project in Chihuahua State, Mexico (43,229 hectares), and has signed a binding Letter of Intent to enter into a joint venture regarding the La Bandera gold project in Durango State. The Company has also acquired a new block of three claims on the west side of the Ocampo Mine properties that added 2,886 hectares to the Ocampo mineral properties – now totalling 14,641 hectares. A major new exploration concession of 14,669 hectares, “Fraile Norte” was also staked in the state of San Luis Potosi to cover potential extensions of the Santa Maria de la Paz mining district. The Company has also made strategic investments in Golden Queen and Corex.

Production and Total Cash Costs

Summarized Annual Financial and Operating Results

| (in thousands, except ounces, per share amounts, average realized prices and total cash costs) | | | |

| | | Year Ended | |

| | | December 31, 2010 | |

| Gold ounces sold | | 111,775 | |

| Silver ounces sold | | 4,970,777 | |

| Gold equivalent ounces sold (realized)(1) | | 193,429 | |

| Gold equivalency ratio (realized)(5) | | 61 | |

| Gold ounces produced | | 114,064 | |

| Silver ounces produced | | 4,953,870 | |

| Gold equivalent ounces produced (realized)(1) | | 195,566 | |

| Revenue from mining operations | $ | 238,266 | |

| Production costs, excluding amortization and depletion | $ | 90,866 | |

| 13 | |

| 2010ANNUAL INFORMATION FORM |

| Earnings before other items | $ | 60,263 | |

| Net (loss) / earnings | $ | (147,487 | ) |

| Net (loss) / earnings per share | $ | (1.06 | ) |

| Net (loss) / earnings per share, diluted(2) | $ | (1.06 | ) |

| Cash flows from operations | $ | 97,583 | |

| Net free cash flow(3) | $ | (9,633 | ) |

| Total cash | $ | 113,142 | |

| Total assets | $ | 819,388 | |

| Total long-term financial liabilities | $ | 31,035 | |

| Cash dividends declared | $ | Nil | |

| Total cash costs per gold equivalent ounce (realized)(3) | $ | 479 | |

| Total cash costs per gold ounce(3) | $ | (73 | ) |

| Average realized gold price per ounce | $ | 1,229 | |

| Average realized silver price per ounce | $ | 20.30 | |

| Gold equivalent ounces sold (55:1)(4) | | 202,152 | |

| Gold equivalent ounces produced (55:1)(4) | | 204,133 | |

| Total cash costs per gold equivalent ounce (55:1)(3)(4) | $ | 459 | |

Notes:

| | 1. | Gold equivalent ounces include silver ounces produced and sold converted to a gold equivalent based on the ratio of the actual realized sales prices of the commodities. |

| | 2. | Net loss per share on a diluted basis is the same as net loss per share on an undiluted basis in 2010 as all factors were anti-dilutive. |

| | 3. | See the Non-GAAP Measures section on page 31. |

| | 4. | Gold equivalent ounces include silver ounces produced and sold converted to a gold equivalent, based on the Company’s long-term gold equivalency ratio of 55:1. |

| | 5. | Silver ounce equal to one gold ounce. |

| (in thousands, except ounces and total cash costs) |

| | | 2010 | | | 2010 | | | 2010 | |

| | | Ocampo | | | El Cubo | | | Other | |

| | | (US$) | | | (US$) | | | (US$) | |

| Gold ounces produced | | 103,220 | | | 10,844 | | | - | |

| Silver ounces produced | | 4,417,413 | | | 536,457 | | | - | |

| Gold equivalent ounces produced(1) | | 176,458 | | | 19,108 | | | - | |

| Gold ounces sold | | 100,615 | | | 11,160 | | | - | |

| Silver ounces sold | | 4,415,308 | | | 555,469 | | | - | |

| Gold equivalent ounces sold(1) | | 173,716 | | | 19,713 | | | - | |

| Revenue from mining operations | $ | 215,717 | | $ | 22,549 | | | - | |

| Production costs | $ | 74,819 | | $ | 16,047 | | | - | |

| Refining costs | $ | 1,631 | | $ | 242 | | | - | |

| Mine standby costs | | - | | $ | 9,214 | | | - | |

| Net earnings /(loss) before other items | $ | 89,616 | | $ | (10,018 | ) | $ | (19,335 | ) |

| Total cash costs (per gold equivalent ounce)(2) | $ | 440 | | $ | 826 | | | - | |

| Total cash costs per gold ounce(2) | $ | (146 | ) | $ | 587 | | | - | |

| Total cash costs per gold equivalent ounce(2)(3) | $ | 423 | | $ | 766 | | | - | |

| | | |

| 14 | |

| 2010ANNUAL INFORMATION FORM |

Notes: |

| 1. | Gold equivalent ounces include silver ounces produced and sold converted to a gold equivalent based on the ratio of the actual realized sales prices of the commodities. |

| 2. | See the Non-GAAP Measures section on page 31 of the Company’s Management Discussion & Analysis for the year ended December 31, 2010. |

| 3. | Gold equivalent ounces include silver ounces produced and sold converted to a gold equivalent, based on the Company’s long-term gold equivalency ratio of 55:1. |

Mineral Reserves and Mineral Resources

The Company completed extensive drilling at the Ocampo Mine property during the year, completing 751 drill holes for a total of 137,393 metres. The drilling at Ocampo was divided into 400 drill surface holes for 73,266 metres, and 351 underground drill holes for 64,127 metres. The entire drill database for Ocampo, from 1997 through 2010, now totals 2,954 drill holes for 523,889 metres.

The primary focus of the 2010 underground drilling program was to extend known vein resources in the Northeast underground mine, both along strike and downward below existing ore shoots, infill new vein discoveries drilled from surface at the Northeast underground, and to delineate additional resources in the Santa Eduviges veins directly under the operating open pits. The Company was successful on all three fronts, with the addition of Reserves in 15 of the existing 21 veins at the Northeast underground, the addition of six new vein discoveries at the Northeast underground, and the addition of five new veins in the Santa Eduviges complex. After accounting for 2010 depletion, and assuming current underground mining rates, the Company has effectively added more than three additional years of production to its underground operations at Ocampo.

The Ocampo drilling resulted in the definition of an additional 398,000 ounces gold equivalent in Reserves, which after depletion and adjustment for different gold and silver prices resulted in a net addition of 195,000 ounces gold equivalent at Ocampo. In addition to these Reserve additions, the drilling helped define an additional 184,000 ounces gold equivalent in Measured and Indicated Resources at Ocampo at metal prices significantly lower than spot prices. Apart from the definition of Reserves, the surface drilling work also made numerous new discoveries, and extended several known occurrences, many of which will be followed-up with additional drilling in 2011 with the intent to define Reserves or Resources on some of these target areas.

Key additions to the reserves at Ocampo included the Santa Juliana, Santa Eduviges, Belen, Las Molinas, Upper Balvanera, and Altagracia areas. Key new discoveries included the Santa Librada target area, the El Rayo Vein, Polvorin Vein, Refugio Norte zone, Los Monos, and the Stockwork Hill target area. All of these showed some drill intercepts with grade–width combinations in excess of current mine cut-off grades.

At the El Cubo Mine, the Company completed 18,388 metres of surface drilling and 3,250 metres of underground drilling during the first half of the year before the mine was closed by the union. This work helped to define an additional 61,000 ounces gold equivalent Reserves at El Cubo, which after depletion and adjustment for different gold-to-silver price ratio, resulted in the net addition of 38,000 ounces gold equivalent to the Reserves. A new Resources addition from the exploration program is the Dolores and Capulin target areas in the south-central portion of the property. In addition, the drilling discovered new mineralization south of the previously-known ores in the “South Villalpando” target area. The initial Measured and Indicated Resource at Dolores Capulin is 43,000 gold equivalent ounces.

At December 31, 2010, Gammon’s total Proven and Probable gold equivalent Reserves were 2,726,000 gold equivalent ounces. Mineral Reserves and Mineral Resources have been estimated as at December 31, 2010 in accordance with definitions adopted by the Canadian Institute of Mining, Metallurgy and Petroleum and incorporated into NI 43-101. Reserves for the Ocampo and El Cubo properties have been estimated using an assumed gold price of $1,025 per ounce and a silver price of $16.60 per ounce for a gold equivalent ratio of 61.75:1. Resources at the Ocampo and El Cubo properties have been estimated assuming a gold price of $1,250 per ounce and a silver price of $22.75 per ounce and have been summarized at a gold equivalent ratio of 55:1.The Guadalupe y Calvo Inferred Resources have been summarized at a gold equivalent ratio of 55:1. Reserve estimations incorporate current and/or expected mine plans and cost levels at each property. Varying cut-off grades have been used depending on the mine and type of ore. Gammon Gold’s normal data verification procedures have been employed in connection with the calculations. For the cut-off grades used in the estimation of Reserves, see“Notes to the Mineral Resources and Reserves Tables.”

Although the Company has carefully prepared and verified the Mineral Reserve figures presented below and elsewhere in this Annual Information Form, such figures are estimates, which are, in part, based on forward-looking information, and no assurance can be given that the indicated level of mineral will be produced. Estimated Reserves may have to be recalculated based on actual production experience. Market price fluctuations of gold and silver as well as increased production costs or reduced recovery rates may render the present Proven and Probable Reserves unprofitable to develop at a particular site or sites for periods of time. See“Risk Factors” and “Forward-Looking Information”.

| 15 | |

| 2010ANNUAL INFORMATION FORM |

| Ocampo Proven & Probable Reserves(4)(5)(7)(8)(10)(11) | |

Mineral Category

| |

Tonnes

(000's)

| | |

Gold

(g/t)(6) |

| |

Silver

(g/t)(6) |

| | Gold

Equivalent

(g/t)(6)

| | | Gold

Ounces

(000's) |

| | Silver

Ounces

(000's) |

| | Gold

Equivalent

Ounces

(000's)(1) | |

| Open Pit Area(9) | | | | | | | | | | | | | | | | | | | | | |

| Proven | | 30,355 | | | 0.39 | | | 15 | | | 0.64 | | | 380 | | | 14,843 | | | 620 | |

| Probable | | 33,933 | | | 0.37 | | | 15 | | | 0.62 | | | 408 | | | 16,510 | | | 676 | |

| Total Open Pit Area Proven & Probable | | 64,287 | | | 0.38 | | | 15 | | | 0.63 | | | 788 | | | 31,353 | | | 1,296 | |

| Underground Area | | | | | | | | | | | | | | | | | | | | | |

| Proven | | 3,049 | | | 3.14 | | | 146 | | | 5.50 | | | 308 | | | 14,282 | | | 539 | |

| Probable | | 2,080 | | | 2.26 | | | 110 | | | 4.04 | | | 151 | | | 7,350 | | | 270 | |

| Total Underground Area Proven & Probable | | 5,130 | | | 2.79 | | | 131 | | | 4.91 | | | 459 | | | 21,632 | | | 810 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Total Proven | | 33,404 | | | 0.64 | | | 27 | | | 1.08 | | | 688 | | | 29,125 | | | 1,160 | |

| Total Probable | | 36,013 | | | 0.48 | | | 21 | | | 0.82 | | | 560 | | | 23,860 | | | 946 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Total Ocampo Proven & Probable | | 69,417 | | | 0.56 | | | 24 | | | 0.94 | | | 1,248 | | | 52,985 | | | 2,106 | |

| El Cubo Proven & Probable Reserves(4)(5)(7)(10)(11) | |

Mineral Category

| |

Tonnes

(000's) |

| |

Gold

(g/t)(6) |

| |

Silver

(g/t)(6) |

| | Gold

Equivalent

(g/t)(6) |

| | Gold

Ounces

(000's) |

| | Silver

Ounces

(000's) |

| | Gold

Equivalent

Ounces

(000's)(1) | |

| El Cubo | | | | | | | | | | | | | | | | | | | | | |

| Proven | | 1,542 | | | 2.62 | | | 154 | | | 5.11 | | | 130 | | | 7,618 | | | 254 | |

| Probable | | 1,877 | | | 2.69 | | | 134 | | | 4.86 | | | 163 | | | 8,075 | | | 293 | |

| Total El Cubo Proven & Probable Reserves | | 3,419 | | | 2.66 | | | 143 | | | 4.97 | | | 293 | | | 15,694 | | | 547 | |

| Las Torres (Underground) | | | | | | | | | | | | | | | | | | | | | |

| Proven | | 266 | | | 1.96 | | | 137 | | | 4.18 | | | 17 | | | 1,173 | | | 36 | |

| Probable | | 250 | | | 2.34 | | | 146 | | | 4.70 | | | 19 | | | 1,172 | | | 38 | |

| Total Las Torres Proven & Probable Reserves | | 516 | | | 2.14 | | | 141 | | | 4.43 | | | 36 | | | 2,345 | | | 74 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Total Proven – El Cubo and Las Torres | | 1,808 | | | 2.53 | | | 151 | | | 4.98 | | | 147 | | | 8,791 | | | 289 | |

| Total Probable – El Cubo and Las Torres | | 2,127 | | | 2.65 | | | 135 | | | 4.84 | | | 181 | | | 9,247 | | | 331 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Total Proven & Probable Reserves – El Cubo and LasTorres | | 3,936 | | | 2.59 | | | 143 | | | 4.90 | | | 328 | | | 18,038 | | | 620 | |

| Total Summary of Proven & Probable Reserves(4)(5)(7)(8)(10)(11) | |

Mineral Category

| |

Tonnes

(000's) |

| |

Gold

(g/t)(6) |

| |

Silver

(g/t)(6) |

| | Gold

Equivalent

(g/t)(6)

|

| | Gold

Ounces

(000's) |

| | Silver

Ounces

(000's) |

| | Gold

Equivalent

Ounces

(000's)(1) |

|

| | | | | | | | | | | | | | | | | | | | | | |

| Total Proven | | 35,212 | | | 0.74 | | | 33 | | | 1.28 | | | 835 | | | 37,916 | | | 1,449 | |

| Total Probable | | 38,141 | | | 0.60 | | | 27 | | | 1.04 | | | 741 | | | 33,107 | | | 1,277 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Total Proven & Probable Reserves | | 73,353 | | | 0.67 | | | 30 | | | 1.16 | | | 1,576 | | | 71,023 | | | 2,726 | |

| 16 | |

| 2010ANNUAL INFORMATION FORM |

| Ocampo Measured, Indicated & Inferred Resources(3)(4)(5)(7)(8)(10)(11) |

Mineral Category

| |

Tonnes

(000’s) |

| |

Gold

(g/t)(6) |

| |

Silver

(g/t)(6) |

| | Gold

Equivalent

(g/t)(6) |

| | Gold

Ounces

(000's) |

| | Silver

Ounces

(000's) |

| | Gold

Equivalent

Ounces

(000)(2) | |

| Open Pit Area(9) | | | | | | | | | | | | | | | | | | | | | |

| Measured | | 13,644 | | | 0.15 | | | 6 | | | 0.26 | | | 67 | | | 2,627 | | | 114 | |

| Indicated | | 20,037 | | | 0.20 | | | 8 | | | 0.34 | | | 126 | | | 5,127 | | | 219 | |

| Total Open Pit Area Measured & Indicated | | 33,682 | | | 0.18 | | | 7 | | | 0.31 | | | 192 | | | 7,754 | | | 333 | |

| Inferred | | 15,523 | | | 0.47 | | | 23 | | | 0.89 | | | 237 | | | 11,507 | | | 446 | |

| Underground Area | | | | | | | | | | | | | | | | | | | | | |

| Measured | | 649 | | | 0.86 | | | 46 | | | 1.68 | | | 18 | | | 951 | | | 35 | |

| Indicated | | 628 | | | 0.87 | | | 45 | | | 1.69 | | | 18 | | | 911 | | | 34 | |

| Total Underground Measured & Indicated | | 1,277 | | | 0.86 | | | 45 | | | 1.69 | | | 35 | | | 1,862 | | | 69 | |

| Inferred | | 5,092 | | | 4.12 | | | 256 | | | 8.77 | | | 674 | | | 41,922 | | | 1,437 | |

| Summary - Total Measured & Indicated | | | | | | | | | | | | | | | | | | | | | |

| Total Measured | | 14,294 | | | 0.18 | | | 8 | | | 0.33 | | | 84 | | | 3,579 | | | 150 | |

| Total Indicated | | 20,665 | | | 0.22 | | | 9 | | | 0.38 | | | 143 | | | 6,038 | | | 253 | |

| Total Ocampo Measured & Indicated | | 34,959 | | | 0.20 | | | 9 | | | 0.36 | | | 228 | | | 9,617 | | | 403 | |

| Summary - Total Inferred | | | | | | | | | | | | | | | | | | | | | |

| Total Ocampo Inferred | | 20,615 | | | 1.37 | | | 81 | | | 2.84 | | | 911 | | | 53,428 | | | 1,883 | |

| El Cubo Measured, Indicated & Inferred Resources(3)(4)(5)(7)(10)(11) | |

Mineral Category

| |

Tonnes

(000’s)

| | |

Gold

(g/t)(6)

| | |

Silver

(g/t)(6) |

| | Gold

Equivalent

(g/t)(6) |

| | Gold

Ounces

(000's) |

| | Silver

Ounces

(000's) |

| | Gold

Equivalent

Ounces

(000)(2) | |

| El Cubo | | | | | | | | | | | | | | | | | | | | | |

| Measured | | 149 | | | 1.80 | | | 121 | | | 4.00 | | | 9 | | | 579 | | | 19 | |

| Indicated | | 477 | | | 1.93 | | | 157 | | | 4.78 | | | 30 | | | 2,404 | | | 73 | |

| Total El Cubo Measured & Indicated | | 627 | | | 1.90 | | | 148 | | | 4.59 | | | 38 | | | 2,983 | | | 92 | |

| Inferred | | 3,499 | | | 3.29 | | | 176 | | | 6.49 | | | 370 | | | 19,788 | | | 730 | |

| Las Torres | | | | | | | | | | | | | | | | | | | | | |

| Measured | | 8 | | | 1.73 | | | 54 | | | 2.71 | | | 0 | | | 13 | | | 1 | |

| Indicated | | 19 | | | 1.76 | | | 52 | | | 2.71 | | | 1 | | | 32 | | | 2 | |

| Total Las Torres Measured & Indicated | | 27 | | | 1.75 | | | 53 | | | 2.71 | | | 2 | | | 45 | | | 2 | |

| Inferred | | 546 | | | 4.12 | | | 169 | | | 7.20 | | | 72 | | | 2,973 | | | 126 | |

| Fenix Pit | | | | | | | | | | | | | | | | | | | | | |

| Measured | | - | | | - | | | - | | | - | | | - | | | - | | | - | |

| Indicated | | 2,100 | | | 2.72 | | | 49 | | | 3.61 | | | 184 | | | 3,308 | | | 244 | |

| Total Fenix Pit Measured & Indicated | | 2,100 | | | 2.72 | | | 49 | | | 3.61 | | | 184 | | | 3,308 | | | 244 | |

| Inferred | | - | | | - | | | - | | | - | | | - | | | - | | | - | |

| Summary - Measured & Indicated | | | | | | | | | | | | | | | | | | | | | |

| Total Measured – El Cubo and Las Torres | | 157 | | | 1.80 | | | 118 | | | 3.93 | | | 9 | | | 592 | | | 20 | |

| Total Indicated – El Cubo and Las Torres | | 2,597 | | | 2.57 | | | 69 | | | 3.82 | | | 214 | | | 5,744 | | | 319 | |

| Total Measured & Indicated – El Cubo and Las Torres | | 2,753 | | | 2.52 | | | 72 | | | 3.83 | | | 223 | | | 6,336 | | | 339 | |

| Summary – Inferred | | | | | | | | | | | | | | | | | | | | | |

| Total Inferred – El Cubo and Las Torres | | 4,045 | | | 3.40 | | | 175 | | | 6.59 | | | 443 | | | 22,761 | | | 857 | |

Guadalupe y Calvo Estimate of Inferred Resources(3)(4)(5)(7)(10)(11)

| 17 | |

| 2010ANNUAL INFORMATION FORM |

Deposit Location

| |

Tonnes

(000’s) | | |

Gold

(g/t)(6) | | |

Silver

(g/t)(6) | | | Gold

Equivalent

(g/t)(6) | | | Gold

Ounces

(000's) | | | Silver

Ounces

(000's) | | | Gold

Equivalent Ounces

(000)(2) | |

| Rosario Bulk Tonnage (at 75% of available tonnes) | | 10,700 | | | 1.60 | | | 96 | | | 3.35 | | | 566 | | | 33,100 | | | 1,168 | |

| Rosario Underground (at 33% of available tonnes) | | 700 | | | 18.50 | | | 435 | | | 26.41 | | | 393 | | | 9,200 | | | 560 | |

| Rosario | | | | | | | | | | | | | | | | | | | | | |

| Total Rosario Inferred | | 11,400 | | | 2.64 | | | 117 | | | 4.77 | | | 959 | | | 42,300 | | | 1,728 | |

| Nankin Underground (at 33% of available tonnes) | | 400 | | | 9.25 | | | 260 | | | 13.98 | | | 118 | | | 3,300 | | | 178 | |

| Nankin | | | | | | | | | | | | | | | | | | | | | |

| Total Nankin Inferred | | 400 | | | 9.25 | | | 260 | | | 13.98 | | | 118 | | | 3,300 | | | 178 | |

| Summary – Inferred | | | | | | | | | | | | | | | | | | | | | |

| Total Rosario and Nankin Inferred | | 11,800 | | | 2.84 | | | 120 | | | 5.02 | | | 1,077 | | | 45,600 | | | 1,906 | |

| Total Summary of Measured, Indicated and Inferred Resources(3)(4)(5)(7)(8)(10)(11) | |

Mineral Category

| |

Tonnes

(000’s) | | |

Gold

(g/t)(6) | | |

Silver

(g/t)(6) | | | Gold

Equivalent

(g/t)(6) | | | Gold

Ounces

(000's) | | | Silver

Ounces

(000's) | | | Gold

Equivalent Ounces

(000)(2) | |

| Summary - Measured & Indicated | | | | | | | | | | | | | | | | | | | | | |

| Total Measured | | 14,450 | | | 0.20 | | | 9 | | | 0.36 | | | 94 | | | 4,171 | | | 169 | |

| Total Indicated | | 23,262 | | | 0.48 | | | 16 | | | 0.76 | | | 358 | | | 11,782 | | | 572 | |

| Total Measured & Indicated | | 37,712 | | | 0.37 | | | 13 | | | 0.61 | | | 451 | | | 15,953 | | | 741 | |

| Summary – Inferred | | | | | | | | | | | | | | | | | | | | | |

| Total Inferred | | 36,460 | | | 2.07 | | | 104 | | | 3.96 | | | 2,431 | | | 121,789 | | | 4,645 | |

Notes to Mineral Resources and Reserves Tables:

| 1. | Gold equivalent calculations use the Reserve metal prices of $1025/oz for gold and $16.60/oz for silver for a gold-to-silver ratio of 61.75:1 . Individual process recoveries are not factored into the gold-to-silver ratio calculation. |

| 2. | Gold equivalent calculations use the Resource metal prices of $1250/oz for gold and $22.75/oz for silver for a gold-to-silver ratio of 55.00:1. Individual process recoveries are not factored into the gold-to-silver ratio calculation. |

| 3. | These Mineral Resources are in addition to Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability when estimated using Mineral Reserve assumptions. |

| 4. | Reserves have been estimated in accordance with NI 43-101, as required by Canadian securities regulatory authorities. In addition, while the terms “Measured”, “Indicated and “Inferred” Mineral Resources are required pursuant to NI 43-101, the SEC does not recognize such terms. Canadian standards differ significantly from the requirements of the SEC, and Mineral Resources disclosed in accordance with the requirements of the SEC. Investors should understand that “Inferred” Mineral Resources have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. In addition, investors are cautioned not to assume that any part or all of Gammon’s Mineral Resources constitute or will be converted into Reserves. |

| 5. | Mineral Reserves and Resources have been estimated as at December 31, 2010. |

| 6. | Grade represents an average, weighted by reference to tons of ore type where several recovery processes apply. |

| 7. | The metallurgical recovery applicable at each property and the cut-off grades used to determine Reserves as at December 31, 2010 are as follows: |

| Mine | Au Metallurgical Recovery (%) | Ag Metallurgical Recovery (%) | Cut-off Grade g/t |

| Ocampo Open-Pit Mill | 95 | 82 | >1.70 |

| Ocampo Open Pit Leach | 82 | 72 | >0.17-1.70 |

| Ocampo Underground | 95 | 82 | 1.80 |

| El Cubo | 90 | 88 | 1.86 |

All ores at Ocampo demonstrate similar metallurgical recoveries regardless of whether oxides are sulfides.

| 8. | The Ocampo Open Pit strip ratio is 2.7:1. |

| 9. | The basis for the Reserve estimation is the Whittle pit optimization methodology. |

| 10. | Sums may not add to totals due to rounding. |

| 11. | The following are the Qualified Persons responsible for Mineral Reserve and Mineral Resource estimates as at December 31, 2010: |

| Property | Qualified Person |

| El Cubo | Glenn R. Clark, P.Eng, Principal, Glenn R. Clark & Associates |

| Ocampo | Ramon Luna, P. Geo, Director, Servicios y Proyectos Mineros de México S.A. de C.V. |

Guadalupe y Calvo

| Barton G. Stone, C.P.G., Chief Geologist, Pincock Allen & Holt,

Mark G. Stevens, C.P.G, former Pincock, Allen & Holt employee,

Clarence J. Wendt, P. Geo, Consulting Geologist, former Pincock, Allen & Holt employee |

| 18 | |

| 2010ANNUAL INFORMATION FORM |

Sampling and Analysis, Data Verification

An analytical quality assurance program has been established for all of the Company’s mineral properties to control and assure the analytical quality of assays in all of the Company’s exploration programs. This program includes the systematic addition of blank samples, duplicate samples and certified standards to each batch of samples sent for analysis to commercial accredited laboratories. Blank samples are used to check for possible contamination in laboratories, duplicate samples quantify overall precision, while certified standards determine the analytical accuracy. The split core samples are sent directly from the project sites to ALS Chemex, an ISO accredited laboratory with facilities in Hermosillo, Mexico (or another internationally certified laboratory) that performs gold and silver analyses at its laboratory in Vancouver, British Colombia, Hermosillo, Mexico, or Reno, Nevada. The Company also uses its onsite laboratory at Ocampo for the analysis of mine channel samples, ore-control samples, and some exploration drilling samples. Standard quality assurance programs are performed at the Ocampo laboratory, and in addition, check samples are sent to commercial accredited laboratories for additional confirmation.

Uses of Gold

Product fabrication and bullion investment are two principal uses of gold. The introduction of more readily accessible and more liquid gold investment vehicles (such as gold exchange traded funds) may further facilitate investment in gold. Within the fabrication category, there are a wide variety of end uses, the largest of which is the manufacture of jewelry. Other fabrication purposes include official coins, electronics, miscellaneous industrial and decorative uses, dentistry, medals and medallions.

Markets, Sales and Refining

Gold and silver can be readily sold on numerous markets throughout the world and it is not difficult to ascertain its market price at any particular time. Since there are a large number of available purchasers, the Company is not dependent upon the sale of gold or silver to any one customer or group of customers. The Company currently does not have any long term refining sales contracts in place.

Employees and Labour Relations

As at December 31, 2010, the Company had approximately 101 direct full-time employees, and 2,063 individuals employed on a contract basis.

Despite generally good labour relations, recent increased demand for skilled workers in the resource industry has led to employee turnover at certain of the Company’s operations. This competition for qualified employees may lead to workforce shortages.

Cycles

As a mid-tier mining Company and a growing producer of gold and silver, the Company, in general, is subject to the cyclical nature of gold, silver and the metals markets.

Competitive Conditions

Competition in the precious metals mining industry is primarily for mineral-rich properties that can be developed and produced economically; for technical expertise to find, develop, and mine such properties; for the labour to operate the properties; and for the capital to finance development of such properties. Many competitors not only explore for and mine precious metals, but also conduct refining and marketing operations on a world-wide basis, and some companies have much greater financial and technical resources than the Company.

The Company competes with other mining and exploration companies in connection with the acquisition of mining claims and leases and in connection with the recruitment and retention of qualified employees; see “Employees and Labour Relations”. There is significant competition for mining claims and leases and, as a result, the Company may be unable to continue to acquire attractive assets on terms it considers acceptable.

| 19 | |

| 2010ANNUAL INFORMATION FORM |

Environmental Protection

There are no known environmental issues that may impact the mineral properties. The Company will be obliged to carry out site reclamation on its current properties at the end of their mine life, and expects to be able to finance the same from the revenues generated by such projects.

Foreign Operations

The Company’s mineral properties are located in Mexico and California, United States.

MINERAL PROPERTIES

The Ocampo Mine

Property Description and Location

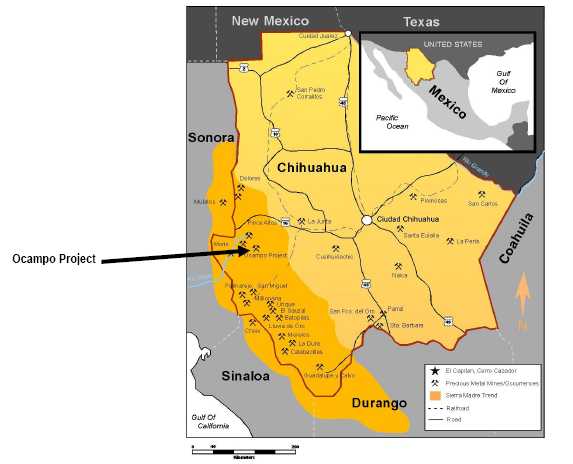

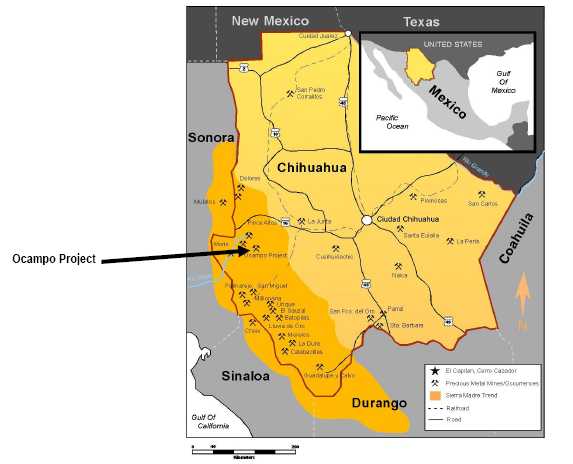

The Ocampo Mine is located approximately 235 kilometres west southwest of the state capital, Chihuahua, within the Ocampo Municipio, in the State of Chihuahua, Mexico.

The Ocampo property is currently comprised of 6 exploitation concessions covering a total of 11,245 hectares. The concessions have various expiration dates ranging from December 04, 2015 to October 17, 2057. During 2009, two more new concessions were acquired totaling 1,008 hectares. During 2010, an additional concession of 84 hectares was acquired.

Seven of the concessions (covering 120.6 hectares) are subject to a royalty and certain contingent payments under an agreement with Compania Minera Brenda, S.A. de C.V. (“Brenda”) dated February 21, 2003 (the “Minera Fuerte Buy-Out Agreement”) and 13 of the concessions (covering 211.8 hectares) are subject to a contingent payment owed to Compania Minera Global, S.A. de C.V. (“Global”); see“Royalties and Contingent Payments.”

| 20 | |

| 2010ANNUAL INFORMATION FORM |

Forty-seven of the concessions (covering approximately 3,566 hectares), including the ones referred to above, are subject to a pledge in favour of The Bank of Nova Scotia that guarantees the obligations acquired by the Company and Mexgold deriving from a credit agreement dated October 14, 2005 and its amendments.

In April 2010, Gammon Lake de Mexico signed an exploration contract with Mexicana de Cananea, known as Venus, for 4 concessions (covering 4,491 hectares) near Ocampo, with a 4 year purchase option for $7,000,000.

In August 2010, Gammon Lake de Mexico signed an exploration contract with Minera Valdez Gold, known as Los Jarros, for 8 concessions (covering 43,258 hectares) near Ocampo, with a 4 year purchase option for $2,500,000.

All of the concessions are held by the Company’s indirect wholly-owned subsidiary, Gammon Lake de Mexico.

The concessions are for mineral rights only and the Company has secured the surface rights in the current areas of interest. On March 20, 2002, Gammon Lake de Mexico and Minerales de Soyopa, S.A. de C.V. (“Soyopa”) entered into a surface rights lease with the Common Land (Ejido) Commissariat covering the mining concessions of Gammon Lake de Mexico and Soyopa. This agreement covered approximately 2,000 hectares. The agreement was to be in effect for 30 years for the initial and only payment of $20,000.

In May 2009, Gammon Lake de Mexico obtained surface control of 4,275 hectares through a land acquisition expropriation procedure validated by both the Ejidos and the Mexican authorities; this was finalized by the Company successfully obtaining the Presidential decree of expropriation. The total price paid for this land was approximately $1,000 per hectare. As a result of this acquisition, the surface rights lease mentioned above has since been nullified as Gammon Lake de Mexico is the new owner.

Outside of the Ocampo project area, Gammon Lake de Mexico has control of 4 concessions located in the vicinity of Chinipas, South of Ocampo, that covers 1,242 hectares.

It should be noted that some small concessions held by others exist within the Company’s concession blocks. These concessions are not in areas of significant mineralization and are not expected to materially and adversely impact the Ocampo Mine.

The Company currently has all necessary permits for exploration and for commercial mining activity on these concessions.

Minimum Investment / Assessment Work 2010

To keep the concessions in good standing, a minimum investment or assessment work (“MI”) must be made or filed (as the case may be) each year. The amount of the MI varies based on the size, age and type of the concession. The required MI changes annually with the Department of Mines publishing a new list at the end of each year and it varies with the consumer price index.

It is possible to group concessions together and carry forward the excess work from previous years. The current work programs coupled with the past work by the Company should satisfy the minimum requirements for many years.

For exploitation concessions, the annual amount of MI only varies with the size of the concessions. The smallest concessions of up to 30 hectares only have a requirement of 49.02 pesos per hectare or approximately $3.97 per hectare. Thirty-four of the concessions are in that category. As the size of concessions increase, the MI increases. For 30 to 100 hectares, the annual MI is 98.05 pesos or approximately $7.94 per hectare. Five of the concessions fall into that category. The concessions that are greater than 100 hectares have a fixed fee per concession plus an amount per hectare. Gammon has 2 concessions just over 100 hectares and the average MI is 203.87 pesos per hectare for the 105 hectares concession or approximately $16.52 per hectare and 203.65 pesos per hectare for the 108 hectares concession or approximately $16.50 per hectare. The largest concession of 1,657.92 hectares has an MI of 787.13 pesos per hectare or approximately $63.77 per hectare.

The average MI on the Company’s 3,563 hectares of exploitation concessions is currently 472.80 pesos or approximately $38.31 per hectare totaling $136,485.

| 21 | |

| 2010ANNUAL INFORMATION FORM |

MINIMUM INVESTMENT / ASSESSMENT WORK FOR EXPLOITATION CONCESSIONS

SURFACE RANK

(HECTARES)

| FIXED ANNUAL FEE

(PESOS)

| ADDITIONAL ANNUAL FEE

PER HECTARE

(PESOS PER HECTARE) |

| Up to 30 | 0.00 | 49.02 |

| >30 up to 100 | 0.00 | 98.05 |

| >100 up to 500 | 817.05 | 196.09 |

| >500 up to 1,000 | 2,451.15 | 392.18 |

| >1,000 up to 5,000 | 4,902.30 | 784.37 |

| More than 5,000 | 17,158.05 | 1,568.74 |

Mining Duty (Tax)

The rate of the mining duty (“MD”) depends exclusively on the age of the concession. The following are the current rates of mining duties and could be changed by the Government at the beginning of any year depending mostly on the existing economic situation and such variations shall be published at the Official Gazette of the Federation. The MD is due twice each year in both January and July.

MD RATES 2010

(in Mexican Pesos per Hectare): |

| During the first year and 2nd year | | 5.08 |

| For the 3rd and 4th year | | 7.60 |

| For the 5th and 6th year | | 15.72 |

| For the 7th and 8th year | | 31.62 |