UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to (S) 240.14a-11(c) or (S) 240.14a-12 |

Wisconsin Power and Light Company

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

Notes:

Reg. (S) 240.14a-101.

SEC 1913 (3-99)

WISCONSIN POWER AND LIGHT COMPANY

ANNUAL MEETING OF SHAREOWNERS

| | |

| DATE: | | Wednesday, May 25, 2005 |

| |

| TIME: | | 2:00 p.m., Central Daylight Time |

| |

| LOCATION: | | Wisconsin Power and Light Company Nile Meeting Room 4902 North Biltmore Lane Madison, Wis. |

SHAREOWNER INFORMATION

| | |

| LOCAL (Madison, Wis., area) | | (608) 458-3110 |

| |

| TOLL FREE | | (800) 356-5343 |

Wisconsin Power and Light Company

4902 North Biltmore Lane

P. O. Box 2568

Madison, WI 53701-2568

Phone: 608.458.3110

NOTICE OF ANNUAL MEETING AND PROXY STATEMENT

Dear Wisconsin Power and Light Company Shareowner:

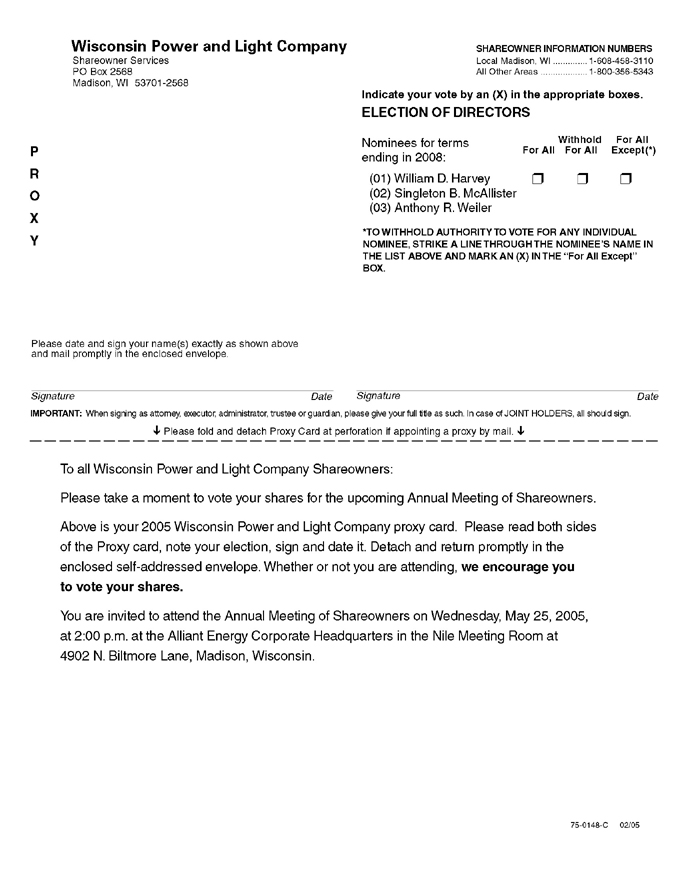

On Wednesday, May 25, 2005, Wisconsin Power and Light Company (the “Company”) will hold its 2005 Annual Meeting of Shareowners at the offices of Alliant Energy Corporation, 4902 North Biltmore Lane, Nile Meeting Room, Madison, Wis. The meeting will begin at 2:00 p.m. Central Daylight Time.

Only the sole common shareowner, Alliant Energy Corporation, and preferred shareowners who owned stock at the close of business on April 5, 2005, may vote at this meeting. All shareowners are requested to be present at the meeting in person or by proxy so that a quorum may be ensured. At the meeting, the Company’s shareowners will:

| | 1. | Elect three directors for terms expiring at the 2008 Annual Meeting of Shareowners; and |

| | 2. | Attend to any other business properly presented at the meeting. |

The Board of Directors of the Company presently knows of no other business to come before the meeting.

Please sign and return the enclosed proxy card as soon as possible.

The Company’s 2004 Annual Report appears as Appendix A to this proxy statement. The proxy statement and Annual Report have been combined into a single document to improve the effectiveness of our financial communication and to reduce costs, although the Annual Report does not constitute a part of the proxy statement.

Any Wisconsin Power and Light Company preferred shareowner who desires to receive a copy of the Alliant Energy Corporation 2004 Annual Report, Notice of Annual Meeting and Proxy Statement may do so by calling the Company’s Shareowner Services Department at the shareowner information numbers shown at the front of this proxy statement or writing to the Company at the address shown above.

By Order of the Board of Directors,

F. J. Buri

Corporate Secretary

Dated and mailed on or about April 13, 2005.

TABLE OF CONTENTS

QUESTIONS AND ANSWERS

| 1. Q: | Why am I receiving these materials? |

| A: | The Board of Directors of Wisconsin Power and Light Company (the “Company”) is providing these proxy materials to you in connection with the Company’s Annual Meeting of Shareowners (the “Annual Meeting”), which will take place on Wednesday, May 25, 2005. As a shareowner, you are invited to attend the Annual Meeting and are entitled to and requested to vote on the proposal described in this proxy statement. |

| 2. Q: | What is Wisconsin Power and Light Company and how does it relate to Alliant Energy Corporation? |

| A: | The Company is a subsidiary of Alliant Energy Corporation (“AEC”), a public utility holding company whose other primary first tier subsidiaries are Interstate Power and Light Company (“IP&L”), Alliant Energy Resources, Inc. (“Resources”) and Alliant Energy Corporate Services, Inc. (“Corporate Services”). |

| 3. Q: | Who is entitled to vote at the Annual Meeting? |

| A: | Only shareowners of record at the close of business on April 5, 2005 are entitled to vote at the Annual Meeting. As of the record date, 13,236,601 shares of common stock (owned solely by AEC) and 1,049,225 shares of preferred stock, in seven series (representing 599,630 votes), were issued and outstanding. Each share of Company common stock and Company preferred stock, with the exception of the 6.50% Series, is entitled to one vote per share. The 6.50% series of Company preferred stock is entitled to ¼ vote per share. |

| 4. Q: | What may I vote on at the Annual Meeting? |

| A: | You may vote on the election of three nominees to serve on the Company’s Board of Directors for terms expiring at the 2008 Annual Meeting of Shareowners. |

| 5. Q: | How does the Board of Directors recommend I vote? |

| A: | The Board of Directors recommends that you vote your shares FOR each of the listed director nominees. |

| 6. Q: | How can I vote my shares? |

| A: | You may vote either in person at the Annual Meeting or by appointing a proxy. If you desire to appoint a proxy, then sign and date each proxy card you receive and return it in the envelope provided. Appointing a proxy will not affect your right to vote your shares if you attend the Annual Meeting and desire to vote in person. |

| 7. Q: | How are votes counted? |

| A: | In the election of directors, you may vote FOR all of the director nominees or you may WITHHOLD your vote with respect to one or more nominees. If you return your signed proxy card but do not mark the boxes showing how you wish to vote, your shares will be voted FOR all listed director nominees. |

| 8. Q: | Can I change my vote? |

| A: | You have the right to revoke your proxy at any time before the Annual Meeting by: |

| | • | | Providing written notice to the Corporate Secretary of the Company and voting in person at the Annual Meeting; or |

| | • | | Appointing a new proxy prior to the start of the Annual Meeting. |

Attendance at the Annual Meeting will not cause your previously appointed proxy to be revoked unless you specifically so request in writing.

| 9. Q: | What does it mean if I get more than one proxy card? |

| A: | If your shares are registered differently and are in more than one account, then you will receive more than one proxy card. Be sure to vote all of your accounts to ensure that all of your shares are voted. The Company encourages you to have all accounts registered in the same name and address (whenever possible). You can accomplish this by contacting the Company’s Shareowner Services Department at the shareowner information numbers shown at the front of this proxy statement. |

| 10. Q: | Who may attend the Annual Meeting? |

| A: | All shareowners who owned shares of the Company’s common and preferred stock on April 5, 2005, may attend the Annual Meeting. |

1

| 11. Q: | How will voting on any other business be conducted? |

| A: | The Board of Directors of the Company does not know of any business to be considered at the Annual Meeting other than the election of directors. If any other business is properly presented at the Annual Meeting, your proxy gives Barbara J. Swan, the Company’s President, and F. J. Buri, the Company’s Corporate Secretary, authority to vote on such matters at their discretion. |

| 12. Q: | Where and when will I be able to find the results of the voting? |

| A: | The results of the voting will be announced at the Annual Meeting. You may also call the Company’s Shareowner Services Department at the shareowner information numbers shown at the front of this proxy statement for the results. The Company will also publish the final results in its Quarterly Report on Form 10-Q for the second quarter of 2005 to be filed with the Securities and Exchange Commission (“SEC”). |

| 13. Q: | When are shareowner proposals for the 2006 Annual Meeting due? |

| A: | All shareowner proposals to be considered for inclusion in the Company’s proxy statement for the 2006 Annual Meeting must be received at the principal office of the Company by Dec. 14, 2005. In addition, any shareowner who intends to present a proposal from the floor at the 2006 Annual Meeting must submit the proposal in writing to the Corporate Secretary of the Company no later than Feb. 27, 2006. |

| 14. Q: | Who are the independent auditors of the Company and how are they appointed? |

| A: | Deloitte & Touche LLP audited the financial statements of the Company for the year ended Dec. 31, 2004. Representatives of Deloitte & Touche LLP are not expected to be present at the meeting. The Audit Committee of the Board of Directors expects to appoint the Company’s independent auditors for 2005 later in the year. |

| 15. Q: | Who will bear the cost of soliciting proxies for the Annual Meeting and how will these proxies be solicited? |

| A: | The Company will pay the cost of preparing, assembling, printing, mailing and distributing these proxy materials. In addition to the mailing of these proxy materials, the solicitation of proxies or votes may be made in person, by telephone or by electronic communication by the Company’s officers and employees who will not receive any additional compensation for these solicitation activities. The Company will pay banks, brokers, nominees and other fiduciaries reasonable charges and expenses incurred in forwarding the proxy materials to their principals. |

| 16. Q. | How can I obtain a copy of the Company’s Annual Report on Form 10-K? |

| A: | The Company will furnish without charge, to each shareowner who is entitled to vote at the Annual Meeting and who makes a written request, a copy of the Company’s Annual Report on Form 10-K (without exhibits) as filed with the SEC. Written requests for the Form 10-K should be mailed to the Corporate Secretary of the Company at the address on the first page of this proxy statement. |

| 17. Q: | If more than one shareowner lives in my household, how can I obtain an extra copy of the Company’s 2004 Annual Report and proxy statement? |

| A: | Pursuant to the rules of the SEC, services that deliver the Company’s communications to shareowners that hold their stock through a bank, broker or other holder of record may deliver to multiple shareowners sharing the same address a single copy of the Company’s 2004 Annual Report and proxy statement. Upon written or oral request, the Company will mail a separate copy of the 2004 Annual Report and proxy statement to any shareowner at a shared address to which a single copy of the document was delivered. You may notify the Company of your request by calling or writing the Company’s Shareowner Services Department at the shareowner information numbers shown at the front of this proxy statement or at the address of the Company shown on the Notice of Annual Meeting. |

2

ELECTION OF DIRECTORS

At the Annual Meeting, three directors will be elected for terms expiring in 2008. The nominees for election as recommended by the Nominating and Governance Committee and selected by the Board of Directors are: William D. Harvey, Singleton B. McAllister and Anthony R. Weiler. Each of the nominees is currently serving as a director of the Company. Each person elected as a director will serve until the Annual Meeting of Shareowners of the Company in 2008, or until his or her successor has been duly elected and qualified.

Directors will be elected by a plurality of the votes cast at the meeting (assuming a quorum is present). Consequently, any shares not voted at the meeting will have no effect on the election of directors. The proxies solicited may be voted for a substitute nominee or nominees if any of the nominees are unable to serve, or for good reason will not serve, a contingency not now anticipated.

Brief biographies of the director nominees and continuing directors follow. These biographies include their ages (as of Dec. 31, 2004), an account of their business experience and the names of publicly held and certain other corporations of which they are also directors. Except as otherwise indicated, each nominee and continuing director has been engaged in his or her present occupation for at least the past five years.

NOMINEES

| | | | |

| | WILLIAM D. HARVEY Age 55 | | Director since 2005 Nominated term expires in 2008 |

| | Mr. Harvey has served as President and Chief Operating Officer of AEC and Chief Operating Officer of IP&L, the Company and Resources since January 2004, and President of Resources since January 2005. He previously served as Executive Vice President – Generation for AEC, IP&L and Resources and President of the Company from 1998 to January 2004. He also previously served as the Company’s Senior Vice President from 1993 to 1998, Vice President and General Counsel from 1990 to 1993 and Vice President and Associate General Counsel from 1986 to 1990. He was recommended as a nominee by the Nominating and Governance Committee and appointed as a Director of the Company, AEC, IP&L, and Resources in January 2005 in connection with the Company’s succession plan. |

| | |

| | SINGLETON B. MCALLISTER Age 52 | | Director since 2001 Nominated term expires in 2008 |

| | Ms. McAllister has been a partner in the public law and policy strategies group of the Washington, D.C. law firm office of Sonnenschein, Nath & Rosenthal, LLP since 2003. She was previously a partner at Patton Boggs LLP, a Washington, D.C. law firm, from 2001 to 2003. From 1996 until 2001, Ms. McAllister was General Counsel for the United States Agency for International Development. She was also a partner at Reed, Smith, Shaw and McClay where she specialized in government relations and corporate law. She serves on the Board of Directors of United Rentals, Inc. Ms. McAllister has served as a Director of IP&L (or predecessor companies), AEC and Resources since 2001. Ms. McAllister is Chairperson of the Compensation and Personnel Committee. |

| | |

| | ANTHONY R. WEILER Age 68 | | Director since 1998 Nominated term expires in 2008 |

| | Mr. Weiler is Chairman and President of A. R. Weiler Co. LLC, a consulting firm for home furnishings organizations. He was previously a Senior Vice President of Heilig-Meyers Company, a national furniture retailer headquartered in Richmond, Va. He is a Director of the Retail Home Furnishings Foundation.

Mr. Weiler has served as a Director of IP&L (or predecessor companies) since 1979 and of AEC and Resources since 1998. Mr. Weiler is Chairperson of the Nominating and Governance Committee and the Lead Independent Director. |

The Board of Directors unanimously recommends a vote FOR all nominees for election as directors.

3

CONTINUING DIRECTORS

| | | | |

| | ERROLL B. DAVIS, JR. Age 60 | | Director since 1984 Term expires in 2006 |

| | Mr. Davis joined the Company in 1978 and served as President of the Company from 1987 until 1998. He was elected Chief Executive Officer of the Company in 1988. Mr. Davis has served as Chairman of the Board of the Company and AEC since 2000 and as Chief Executive Officer of AEC since 1990. He also served as President of AEC from 1990 through 2003. He has also served as Chief Executive Officer of Resources and IP&L (or predecessor companies) since 1998. He is a member of the Boards of Directors of BP p.l.c.; PPG Industries, Inc.; Union Pacific Corporation; Electric Power Research Institute; the Edison Electric Institute; and the U. S. Olympic Committee. Mr. Davis has served as a Director of AEC since 1982, of Resources since 1988 and of IP&L (or predecessor companies) since 1998. |

| | |

| | MICHAEL L. BENNETT Age 51 | | Director since 2003 Term expires in 2007 |

| | Mr. Bennett has served as President and Chief Executive Officer of Terra Industries Inc., an international producer of nitrogen products and methanol ingredients headquartered in Sioux City, Iowa, since April 2001. From 1997 to 2001, he was Executive Vice President and Chief Operating Officer of Terra Industries Inc. He also serves as Chairman of the Board for Terra Nitrogen Corp., a subsidiary of Terra Industries Inc. Mr. Bennett has served as a Director of AEC, IP&L and Resources since 2003. Mr. Bennett is Chairperson of the Audit Committee. |

| | |

| | ANN K. NEWHALL Age 53 | | Director since 2003 Term expires in 2006 |

| | Ms. Newhall is Executive Vice President, Chief Operating Officer, Secretary and a Director of Rural Cellular Corporation, a cellular communications corporation located in Alexandria, Minn. She has served as Executive Vice President and Chief Operating Officer since August 2000, as Secretary since February 2000 and as a Director since August 1999. Prior to assuming her current positions, she served as Senior Vice President and General Counsel from 1999 to 2000. She was previously a shareholder and President of the Moss & Barnett law firm in Minneapolis, Minn. Ms. Newhall has served as a Director of AEC, IP&L and Resources since 2003. |

| | |

| | DAVID A. PERDUE Age 55 | | Director since 2001 Term expires in 2007 |

| | Mr. Perdue is Chairman of the Board and Chief Executive Officer of Dollar General Corporation, a sales organization headquartered in Goodlettsville, Tenn. He was named Chief Executive Officer and a Director in April 2003 and elected Chairman of the Board in June 2003. From July 2002 to March 2003, he was Chairman and Chief Executive Officer of Pillowtex Corporation, a textile manufacturing company located in Kannapolis, N.C. Pillowtex filed for bankruptcy in July 2003 after emerging from a previous bankruptcy in May 2002. From 1998 to 2002, he was employed by Reebok International Limited, where he served as President of the Reebok Brand from 2000 to 2002. Mr. Perdue has served as a Director of AEC, IP&L (or predecessor companies) and Resources since 2001. |

| | |

| | JUDITH D. PYLE Age 61 | | Director since 1994 Term expires in 2007 |

| | Ms. Pyle is President of Judith Dion Pyle and Associates, a financial services company located in Middleton, Wis. Prior to assuming her current position in 2003, she served as Vice Chair of The Pyle Group, a financial services company located in Madison, Wis. She previously served as Vice Chair and Senior Vice President of Corporate Marketing of Rayovac Corporation, a battery and lighting products manufacturer located in Madison, Wis. In addition, Ms. Pyle is a Director of Uniek, Inc. Ms. Pyle has served as a Director of AEC and Resources since 1992 and of IP&L (or predecessor companies) since 1998. |

| | |

| | ROBERT W. SCHLUTZ Age 68 | | Director since 1998 Term expires in 2006 |

| | Mr. Schlutz is President of Schlutz Enterprises, Inc., a diversified farming and retailing business in Columbus Junction, Iowa. Mr. Schlutz has served as a Director of IP&L (or predecessor companies) since 1989, and of AEC and Resources since 1998. Mr. Schlutz is Chairperson of the Environmental, Nuclear, Health and Safety Committee. |

4

MEETINGS AND COMMITTEES OF THE BOARD

The Board of Directors has standing Audit; Compensation and Personnel; Nominating and Governance; Environmental, Nuclear, Health and Safety; and Capital Approval Committees. The Board of Directors has adopted formal written charters for each of the Audit, Compensation and Personnel, and Nominating and Governance Committees, which are available, free of charge, on AEC’s Web site atwww.alliantenergy.com/investors under the “Corporate Governance” caption or in print to any shareowner who requests them from the Company’s Corporate Secretary. The following is a description of each of these committees:

Audit Committee

The Audit Committee held seven joint meetings (the Company, AEC, IP&L and Resources) in 2004. The Committee currently consists of M. L. Bennett (Chair), S. B. McAllister, A. K. Newhall and D. A. Perdue. Each of the members of the Committee is independent as defined by the New York Stock Exchange (“NYSE”) listing standards and SEC rules. The Board of Directors has determined that Mr. Bennett and one additional Audit Committee member qualify as “audit committee financial experts” as defined by SEC rules. The Audit Committee is responsible for assisting Board oversight of: (1) the integrity of the Company’s financial statements; (2) the Company’s compliance with legal and regulatory requirements; (3) the independent auditors’ qualifications and independence; and (4) the performance of the Company’s internal audit function and independent auditors. The Audit Committee is also directly responsible for the appointment, retention, termination, compensation and oversight of the Company’s independent auditors.

Compensation and Personnel Committee

The Compensation and Personnel Committee held four joint meetings in 2004. The Committee currently consists of S. B. McAllister (Chair), M. L. Bennett, D. A. Perdue and J. D. Pyle. Each of the members of the Committee is independent as defined by the NYSE listing standards. This Committee reviews and approves corporate goals and objectives relevant to Chief Executive Officer (“CEO”) compensation, evaluates the CEO’s performance and determines and approves as a committee, or together with the other independent directors, the CEO’s compensation level based on the evaluation of the CEO’s performance. In addition, the Committee has responsibilities with respect to the Company’s executive compensation and incentive programs and management development programs.

Nominating and Governance Committee

The Nominating and Governance Committee held three joint meetings in 2004. The Committee currently consists of A. R. Weiler (Chair), K. C. Lyall, A. K. Newhall and R. W. Schlutz. Each of the members of the Committee is independent as defined by the NYSE listing standards. This Committee’s responsibilities are to: (1) identify individuals qualified to become Board members, consistent with the criteria approved by the Board, and to recommend nominees for directorships to be filled by the Board or shareowners; (2) identify and recommend Board members qualified to serve on Board committees; (3) develop and recommend to the Board a set of corporate governance principles; (4) oversee the evaluation of the Board and the Company’s management; and (5) advise the Board with respect to other matters relating to corporate governance of the Company.

In making recommendations to the Company’s Board of Directors of nominees to serve as directors, the Nominating and Governance Committee will examine each director nominee on a case-by-case basis regardless of who recommended the nominee and take into account all factors it considers appropriate, which may include strength of character, mature judgment, career specialization, relevant technical skills or financial acumen, diversity of viewpoint and industry knowledge. However, the Committee believes that, to be recommended as a director nominee, each candidate must:

| | • | | display the highest personal and professional ethics, integrity and values. |

| | • | | have the ability to exercise sound business judgment. |

| | • | | be highly accomplished in his or her respective field, with superior credentials and recognition and broad experience at the administrative and/or policy-making level in business, government, education, technology or public interest. |

| | • | | have relevant expertise and experience, and be able to offer advice and guidance to the CEO based on that expertise and experience. |

| | • | | be independent of any particular constituency, be able to represent all shareowners of the Company and be committed to enhancing long-term shareowner value. |

5

| | • | | have sufficient time available to devote to activities of the Board of Directors and to enhance his or her knowledge of the Company’s business. |

The Committee also believes the following qualities or skills are necessary for one or more directors to possess:

| | • | | At least one director should have the requisite experience and expertise to be designated as an “audit committee financial expert” as defined by the applicable rules of the SEC. |

| | • | | Directors generally should be active or former senior executive officers of public companies or leaders of major and/or complex organizations, including commercial, governmental, educational and other non-profit institutions. |

| | • | | Directors should be selected so that the Board of Directors is a diverse body, with diversity reflecting age, gender, race and political experience. |

The Nominating and Governance Committee will consider nominees recommended by shareowners in accordance with the Company’s Nominating and Governance Committee Charter and the Corporate Governance Principles.

The Company and the Committee maintain a file of recommended potential director nominees which is reviewed at the time a search for a new director needs to be performed. To assist the Committee in its identification of qualified director candidates, the Committee may engage an outside search firm.

Any shareowner wishing to make a recommendation should write to the Corporate Secretary of the Company and include appropriate biographical information concerning each proposed nominee. The Corporate Secretary will forward all recommendations to the Committee. The Company’s Bylaws also set forth certain requirements for shareowners wishing to nominate director candidates directly for consideration by shareowners. These provisions require such nominations to be made pursuant to timely notice (as specified in the Bylaws) in writing to the Corporate Secretary of the Company.

Environmental, Nuclear, Health and Safety Committee

The Environmental, Nuclear, Health and Safety Committee held two joint meetings in 2004. The Committee currently consists of R. W. Schlutz (Chair), K. C. Lyall, J. D. Pyle and A. R. Weiler. The Committee’s responsibilities are to review environmental policy and planning issues of interest to the Company, including matters involving the Company before environmental regulatory agencies and compliance with air, water and waste regulations. In addition, the Committee reviews policies and operating issues related to the Company’s nuclear generating station investments, including planning and funding for decommissioning of the plants. The Committee also reviews health and safety-related policies, activities and operational issues as they affect employees, customers and the general public.

Capital Approval Committee

The Capital Approval Committee held no meetings in 2004. The Committee currently consists of M. L. Bennett, D. A. Perdue and A. R. Weiler. Mr. Davis is the Chair and a non-voting member of this Committee. The purpose of this Committee is to evaluate certain investment proposals where (1) an iterative bidding process is required, and/or (2) the required timelines for such a proposal would not permit the proposal to be brought before a regular meeting of the Board of Directors and/or a special meeting of the full Board of Directors is not practical or merited.

The Board of Directors held seven joint meetings during 2004. Each director attended at least 75% of the aggregate number of meetings of the Board and Board committees on which he or she served.

The Board and each Board committee conduct performance evaluations annually to determine their effectiveness and suggest improvements for consideration and implementation. In addition, the Compensation and Personnel Committee evaluates Mr. Davis’ performance as CEO on an annual basis.

Board members are not expected to attend the Company’s Annual Meeting. In 2004, none of the Board members were present for the Company’s Annual Meeting.

6

CORPORATE GOVERNANCE

Corporate Governance Principles

The Board of Directors has adopted Corporate Governance Principles that, in conjunction with the Board committee charters, establish processes and procedures to help ensure effective and responsive governance by the Board. The Corporate Governance Principles are available, free of charge, on AEC’s Web site atwww.alliantenergy.com/investors under the “Corporate Governance” caption or in print to any shareowner who requests them from the Company’s Corporate Secretary.

The Board of Directors has adopted certain categorical standards of independence to assist it in making determinations of director independence under the NYSE listing standards. Under these categorical standards, the following relationships that currently exist or that have existed, including during the preceding three years, willnot be considered to be material relationships that would impair a director’s independence:

| • | A family member of the director is or was an employee (other than an executive officer) of the Company. |

| • | A director, or a family member of the director, receives or received less than $100,000 during any twelve-month period in direct compensation from the Company, other than director and committee fees and pension or other forms of deferred compensation for prior service (provided that such compensation is not contingent in any way on continued service with the Company). |

| • | A director, or a family member of the director, is a former partner or employee of the Company’s internal or external auditor but did not personally work on the Company’s audit within the last three years; or a family member of a director is employed by an internal or external auditor of the Company but does not participate in such auditor’s audit, assurance or tax compliance practice. |

| • | A director, or a family member of the director, is or was employed other than as an executive officer of another company where any of the Company’s present executives serve on that company’s compensation committee. |

| • | A director is or was an executive officer, employee or director of, or has or had any other relationship (including through a family member) with, another company, that makes payments (other than contributions to tax exempt organizations) to, or receives payments from, the Company for property or services in an amount which, in any of the last three fiscal years, does not exceed the greater of $1 million or 2% of such other company’s consolidated gross revenues. |

| • | A director is or was an executive officer, employee or director of, or has or had any other relationship (including through a family member) with, a tax exempt organization to which the Company’s discretionary charitable contributions in any single fiscal year do not exceed the greater of $1 million or 2% of such organization’s consolidated gross revenues. |

In addition, any relationship that a director (or an “immediate family member” of the director) previously had that constituted an automatic bar to independence under NYSE listing standards will not be considered to be a material relationship that would impair a director’s independence three years after the end of such relationship in accordance with NYSE listing standards.

Based on these standards, the Board of Directors has affirmatively determined by resolution that each of the Company’s directors (other than Mr. Davis, the Company’s Chairman and CEO, and Mr. Harvey, the Company’s Chief Operating Officer (“COO”)) has no material relationship with the Company and, therefore, is independent in accordance with the NYSE listing standards. The Board of Directors will regularly review the continuing independence of the directors.

The Corporate Governance Principles provide that at least 75% of the members of the Board of Directors must be independent directors under the NYSE listing standards. The Audit, Compensation and Personnel, and Nominating and Governance Committees must consist of all independent directors.

Lead Independent Director; Executive Sessions

The Corporate Governance Principles provide that the chairperson of the Nominating and Governance Committee shall be the designated “Lead Independent Director” and will preside as the chair at meetings or executive sessions of the independent directors. As the Chairperson of the Nominating and Governance Committee, Mr. Weiler is currently designated as the Lead Independent Director. At every regular in-person meeting of the Board of Directors, the independent directors meet in executive session with no member of Company management present.

7

Communication with Directors

Shareowners and other interested parties may communicate with the full Board, non-management directors as a group or individual directors, including the Lead Independent Director, by providing such communication in writing to the Company’s Corporate Secretary, who will post such communications directly to the Company’s Board of Directors’ Web site.

Ethical and Legal Compliance Policy

The Company has adopted a Code of Ethics that applies to all employees, including its CEO, COO, Chief Financial Officer and Chief Accounting Officer, as well as its Board of Directors. The Company makes its Code of Ethics available, free of charge, on AEC’s Web site atwww.alliantenergy.com/investors under the “Corporate Governance” caption or in print to any shareowner who requests it from the Company’s Corporate Secretary. The Company intends to satisfy the disclosure requirements under Item 5.05 of Form 8-K regarding amendments to, or waivers from, the Code of Ethics by posting such information on its Web site address stated above under the “Corporate Governance” caption.

COMPENSATION OF DIRECTORS

No retainer fees are paid to Mr. Davis or Mr. Harvey for their service on the Company’s Board of Directors. In 2004, all other directors (the “non-employee directors”), each of whom served on the Boards of the Company, AEC, IP&L and Resources, received an annual retainer for service on all four Boards consisting of $70,000 in cash. Also, in 2004, the Chairperson of the Audit Committee received an additional $7,500 cash retainer and the Chairpersons of the Compensation and Personnel, Nominating and Governance, and Environmental, Nuclear, Health, and Safety Committees received an additional $5,000 cash retainer. Travel expenses incurred by the Directors are paid for each meeting attended.

In 2005, the non-employee directors will each receive a cash retainer of $85,000. In 2005, the Chairperson of the Audit Committee will receive an additional $10,000 cash retainer; the Chairpersons of the Compensation and Personnel, Nominating and Governance, and Environmental, Nuclear, Health, and Safety Committees will each receive an additional $5,000 cash retainer; other members of the Audit Committee will each receive an additional $3,500 cash retainer; and the Lead Independent Director will receive an additional $15,000 cash retainer.

Each director is encouraged to voluntarily elect to use not less than 50% of his or her cash retainer to purchase shares of AEC common stock pursuant to AEC’s Shareowner Direct Plan or to defer such amount through the AEC stock account in the AEC Director’s Deferred Compensation Plan.

Director’s Deferred Compensation Plan

Under the AEC Director’s Deferred Compensation Plan, directors may elect to defer all or part of their retainer fee. Amounts deposited to a Deferred Compensation Interest Account receive an annual return based on the A-Utility Bond Rate with a minimum return no less than the prime interest rate published inThe Wall Street Journal, provided that the return may not be greater than 12% or less than 6%. Amounts deposited to the AEC Stock Account are treated as though invested in the common stock of AEC and will be credited with dividends, which will be treated as if reinvested. The director may elect that the AEC Deferred Compensation Account be paid in a lump sum or in annual installments for up to 10 years beginning in the year of or one, two or three tax years after retirement or resignation from the Board of Directors of AEC.

Director’s Charitable Award Program

AEC maintains a Director’s Charitable Award Program for certain members of its Board of Directors beginning after three years of service. The participants in this Program currently are E. B. Davis, K. C. Lyall, D. A. Perdue, J. D. Pyle and A. R. Weiler. S. B. McAllister has enrolled in the Program and is expected to become a participant. The purpose of the Program is to recognize the interest of the Company and its directors in supporting worthy institutions. Under the Program, when a director dies, the Company and/or AEC will donate a total of $500,000 to one qualified charitable organization or divide that amount among a maximum of five qualified charitable organizations selected by the individual director. The individual director derives no financial benefit from the Program. All deductions for charitable contributions are taken by the Company and/or AEC, and the donations are funded by the Company or AEC through life insurance policies on the directors. Over the life of the Program, all costs of donations and premiums on the life insurance policies, including a return of the Company’s or AEC’s cost of funds, will be recovered through life insurance proceeds on the directors. The Program, over its life, will not result in any material cost to the Company or AEC. The Board of Directors of AEC has terminated this Program for all new directors who join the Board after Jan. 1, 2005.

8

Director’s Life Insurance Program

AEC maintains a split-dollar Director’s Life Insurance Program for non-employee directors. The participants in this Program currently include K. C. Lyle, J. D. Pyle and A. R. Weiler. The Program provides a maximum death benefit of $500,000 to each eligible director. Under the split-dollar arrangement, directors are provided a death benefit only and do not have any interest in the cash value of the policies. The Program is structured to pay a portion of the total death benefit to AEC to reimburse AEC for all costs of the Program, including a return on its funds. The Program, over its life, will not result in any material cost to AEC. The imputed income allocations reported for each director in 2004 under this Program were as follows: K. C. Lyall — $528, J. D. Pyle — $29, and A. R. Weiler — $50. In November 2003, the Board of Directors of AEC terminated this insurance benefit for any director not already having the required vesting period of three years of service and for all new directors.

OWNERSHIP OF VOTING SECURITIES

All of the common stock of the Company is held by AEC. None of the directors or officers of the Company own any shares of the Company’s preferred stock. Listed in the following table are the number of shares of AEC’s common stock beneficially owned by (1) the executive officers listed in the Summary Compensation Table, (2) all director nominees and directors of the Company, and (3) all director nominees, directors and executive officers as a group as of Feb. 28, 2005. The directors and executive officers of the Company as a group owned 1.4% of the outstanding shares of AEC common stock on that date. No individual director or officer owned more than 1% of the outstanding shares of AEC common stock on that date.

| | | |

NAME OF BENEFICIAL OWNER

| | SHARES

BENEFICIALLY

OWNED(1)

| |

Executive Officers(2) | | | |

Thomas L. Aller | | 101,264 | (3) |

Eliot G. Protsch | | 210,089 | (3) |

Barbara J. Swan | | 149,575 | (3) |

| |

Director Nominees | | | |

William D. Harvey | | 218,536 | (3) |

Singleton B. McAllister | | 5,054 | (3) |

Anthony R. Weiler | | 17,888 | (3) |

| |

Directors | | | |

Michael L. Bennett | | 3,482 | (3) |

Erroll B. Davis, Jr. | | 799,433 | (3) |

Katharine C. Lyall | | 16,567 | (4) |

Ann K. Newhall | | 7,408 | (3) |

David A. Perdue | | 7,518 | (3) |

Judith D. Pyle | | 14,111 | |

Robert W. Schlutz | | 21,271 | (3) |

| |

All Executive Officers and Directors as a Group | | | |

15 people, including those listed above | | 1,673,240 | (3) |

| (1) | Total shares of AEC common stock outstanding as of Feb. 28, 2005, were 116,183,026. |

| (2) | Stock ownership of Mr. Davis is shown with the directors and stock ownership for Mr. Harvey is shown with the director nominees. |

| (3) | Included in the beneficially owned shares shown are indirect ownership interests with shared voting and investment powers: Mr. Davis — 9,435, Mr. Harvey — 2,826, Mr. Weiler — 1,389, Mr. Protsch — 845 and Mr. Aller – 1,000; shares of common stock held in deferred compensation plans: Mr. Bennett — 3,082, Mr. Davis — 50,744, Mr. Harvey — 29,011, Ms. McAllister — 2,104, Ms. Newhall — 6,110, Mr. Perdue — 7,518, Mr. Schlutz — 9,797, Mr. Weiler — 6,707, Mr. Aller — 6,695, Mr. Protsch — 35,235 and Ms. Swan — 21,526 (all executive officers and directors as a group — 183,042); and stock options exercisable on or within 60 days of Feb. 28, 2005: Mr. Davis — 667,566, Mr. Harvey — 149,977, Mr. Aller — 86,136, Mr. Protsch — 139,157 and Ms. Swan — 110,644 (all executive officers and directors as a group — 1,240,675). |

| (4) | Ms. Lyall will retire as a director of the Company at AEC’s 2005 Annual Meeting on May 19, 2005. |

9

To the Company’s knowledge, no shareowner beneficially owned 5% or more of any class of the Company’s preferred stock as of Dec. 31, 2004. The following table sets forth information, as of Dec. 31, 2004 regarding beneficial ownership by the only persons known to AEC to own more than 5% of AEC’s common stock. The beneficial ownership set forth below has been reported on Schedule 13G filings with the SEC by the beneficial owners.

Amount and Nature of Beneficial Ownership

| | | | | | | | | | | | |

| | | Voting Power | | Investment Power | | | | |

Name and Address of Beneficial Owner | | Sole | | Shared | | Sole | | Shared | | Aggregate | | Percent

of

Class |

Franklin Resources, Inc. (and certain affiliates) One Franklin Parkway San Mateo, CA 94403 | | 6,411,600 | | 0 | | 6,411,600 | | 0 | | 6,411,600 | | 5.6% |

Hotchkis & Wiley Capital Management, LLC (and certain affiliates) 725 South Figueroa Street 39th Floor Los Angeles, CA 90017-5439 | | 5,382,800 | | 0 | | 6,566,600 | | 0 | | 6,566,600 | | 5.7% |

COMPENSATION OF EXECUTIVE OFFICERS

The following Summary Compensation Table sets forth the total compensation paid by the Company, AEC and AEC’s other subsidiaries to the Chief Executive Officer and certain other executive officers of the Company for all services rendered during 2004, 2003 and 2002.

SUMMARY COMPENSATION TABLE

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Annual Compensation | | | Long-Term Compensation | | | |

| | | | | | | | | | | | | | | Awards(2) | | | Payouts | | | |

Name and Principal Position | | Year | |

| Base

Salary | | | Bonus | |

| Other

Annual

Compensation(1) | |

| Restricted

Stock

Awards(3) | | Securities

Underlying

Options

(Shares) | |

| LTIP

Payouts | |

| All Other

Compensation(4) |

Erroll B. Davis, Jr. Chairman and Chief Executive Officer | | 2004

2003

2002 | | $

| 749,019

685,000

685,000 | | $

| 375,197

0

0 | | $

| 74,987

14,949

17,582 | | $

| 300,453

0

0 | | 234,732

151,687

151,687 | | $

| 0

0

0 | | $

| 138,719

45,253

45,485 |

William D. Harvey Chief Operating Officer | | 2004

2003

2002 | |

| 459,442

290,000

282,500 | |

| 206,805

0

0 | |

| 6,246

5,954

7,707 | |

| 100,143

0

0 | | 73,454

26,642

26,642 | |

| 0

0

0 | |

| 48,896

15,562

17,599 |

Eliot G. Protsch Chief Financial Officer | | 2004

2003

2002 | |

| 364,539

290,000

282,500 | |

| 142,167

0

0 | |

| 6,014

4,825

6,131 | |

| 149,981

0

0 | | 40,996

26,642

26,642 | |

| 0

0

0 | |

| 43,611

15,605

16,318 |

Barbara J. Swan President | | 2004

2003

2002 | |

| 298,674

265,000

260,000 | |

| 110,791

0

0 | |

| 5,255

0

6,716 | |

| 100,143

0

0 | | 32,026

24,705

24,705 | |

| 0

0

0 | |

| 18,843

14,536

16,356 |

Thomas L. Aller(5) Senior Vice President | | 2004

2003

2002 | |

| 237,692

200,000

190,000 | |

| 123,203

189,170

0 | |

| 0

0

0 | |

| 0

0

0 | | 21,654

17,438

17,438 | |

| 0

0

0 | |

| 4,164

8,693

8,223 |

| (1) | Other Annual Compensation consists of income tax gross-ups for split-dollar life insurance and, for Mr. Davis only, air travel. Certain personal benefits provided by the Company or AEC to the executive officers named in the Summary Compensation Table above are not included in the Table. The aggregate amount of such personal benefits for each such executive officer in each year reflected in the Table did not exceed the lesser of $50,000 or 10% of the sum of such executive officer’s base salary and bonus in each respective year. |

10

| (2) | Awards made in 2004 were in addition to performance share awards as described in the table entitled “Long-Term Incentive Awards in 2004.” |

| (3) | The amounts in the Summary Compensation Table above for restricted stock in 2004 represent the market value based on the closing price of AEC common stock on the date of the grants. The restricted stock awards are subject to (i) two year cliff vesting in the case of 2,008 shares for Mr. Protsch, and (ii) the remaining awards are subject to three year cliff vesting. As of Dec. 31, 2004, the total number of shares of AEC restricted common stock (and their market value based on the closing price of AEC common stock on that date) held by each executive officer listed in the Summary Compensation Table above were as follows: Mr. Davis, 11,605 shares ($331,903); Mr. Harvey, 3,868 shares ($110,625); Mr. Protsch, 5,876 shares ($168,054); Ms. Swan, 3,868 shares ($110,625); and Mr. Aller, 0 shares ($0). |

| (4) | The table below shows the components of the compensation reflected under this column for 2004: |

| | | | | | | | | | | | | | | |

| | | | | | |

| | | | Erroll B. Davis, Jr. | | | William D. Harvey | | | Eliot G. Protsch | | | Barbara J. Swan | | | Thomas L. Aller |

A. | | $ | 22,672 | | $ | 6,580 | | $ | 8,140 | | $ | 6,272 | | $ | 2,591 |

B. | | | 95,649 | | | 35,096 | | | 28,058 | | | 7,500 | | | 0 |

C. | | | 8,470 | | | 3,244 | | | 1,373 | | | 1,095 | | | 1,573 |

D. | | | 11,928 | | | 3,976 | | | 6,040 | | | 3,976 | | | 0 |

Total | | $ | 138,719 | | $ | 48,896 | | $ | 43,611 | | $ | 18,843 | | $ | 4,164 |

| | A. | Matching contributions to 401(k) Savings Plan and Deferred Compensation Plan |

| | B. | Split dollar life insurance premiums |

| | C. | Life insurance coverage in excess of $50,000 |

| | D. | Dividends earned in 2004 on AEC restricted stock |

| (5) | Mr. Aller became an executive officer of the Company in September 2003, and previously served as an officer of Resources. |

STOCK OPTIONS

The following table sets forth certain information concerning options to purchase shares of AEC common stock granted during 2004 to the executives named below:

STOCK OPTION GRANTS IN 2004

| | | | | | | | | | | | | | | | | | |

| | | Individual Grants | |

| Potential Realizable Value at

Assumed Annual Rates

of Stock Price Appreciation

for Option Term(3) |

Name | | Grant

Date (1) | | Number of

Securities

Underlying

Options Granted (2) | | % of Total Options

Granted to

Employees in

Fiscal Year |

| |

| Exercise or

Base Price

($/Share) | | Expiration

Date | | | 5% | | | 10% |

Erroll B. Davis, Jr. | | 01/02/04

01/02/04

02/09/04 | | 146,917

74,413

13,402 | | 21.6

11.0

2.0 | %

%

% | | $

| 24.90

31.54

25.93 | | 01/02/14

01/02/14

01/02/14 | | $

| 2,300,720

671,205

215,638 | | $

| 5,829,667

2,458,606

544,925 |

William D. Harvey | | 01/02/04

02/09/04 | | 50,938

22,516 | | 7.5

3.3 | %

% | |

| 24.90

25.93 | | 01/02/14

01/02/14 | |

| 797,689

362,282 | |

| 2,021,220

915,501 |

Eliot G. Protsch | | 01/02/04

02/09/04 | | 31,099

9,897 | | 4.6

1.5 | %

% | |

| 24.90

25.93 | | 01/02/14

01/02/14 | |

| 487,010

159,243 | |

| 1,234,008

402,412 |

Barbara J. Swan | | 01/02/04

02/09/04 | | 28,418

3,608 | | 4.2

0.5 | %

% | |

| 24.90

25.93 | | 01/02/14

01/02/14 | |

| 445,026

58,053 | |

| 1,127,626

146,701 |

Thomas L. Aller | | 01/02/04

02/09/04 | | 18,767

2,887 | | 2.8

0.4 | %

% | |

| 24.90

25.93 | | 01/02/14

01/02/14 | |

| 293,891

46,452 | |

| 744,675

117,385 |

11

| (1) | The three separate grants of non-qualified stock options to purchase shares of AEC common stock are as follows: (a) All of the named executives received options on Jan. 2, 2004 as part of AEC’s annual long-term incentive (LTI) grant; (b) On Jan. 2, 2001, Mr. Davis was granted options that inadvertently exceeded the individual limit for option grants under the applicable plan by 74,413 shares. These options had an exercise price of $31.54, the fair market value of AEC’s common stock at the time of grant. AEC determined that the options in excess of the individual limit were not valid, so on Jan. 2, 2004, to make him whole, the Compensation Committee granted Mr. Davis 74,413 options from the current plan, at the same exercise price of $31.54; and (c) Supplemental grants of options were made on Feb. 9, 2004, to all named executives to adjust target values for the 2004 LTI awards to account for new salaries, target incentive changes and/or promotions. |

| (2) | Consists of non-qualified stock options to purchase shares of AEC common stock. Options vest as outlined below. Upon a “change in control” of AEC or upon retirement, disability or death of the option holder, the options will become immediately exercisable. |

| | | | |

Jan. 2, 2004 grant for all named executives | | - | | 1/3rd vests 1/2/05, 1/3rd vests 1/1/06, 1/3rd vests 1/1/07 |

Jan. 2, 2004 replacement grant for Mr. Davis | | - | | 100% vests 1/2/05 (same vesting date used for prior grant) |

Feb. 9, 2004 grant for all named executives | | - | | 1/3rd vests 2/9/05, 1/3rd vests 1/1/06, 1/3rd vests 1/1/07 |

| (3) | The hypothetical potential appreciation shown for the named executives is required by rules of the SEC. The amounts shown do not represent the historical or expected future performance of AEC’s common stock. Rather, in order for the named executives to realize the potential values set forth in the 5% and 10% columns in the table above, the price per share of AEC’s common stock would be as follows for each of the grants, all as of the expiration date of the options. |

| | | | | | |

| | | 5%

| | 10%

|

Jan. 2, 2004 grant for all named executives | | $ | 40.56 | | $ | 64.58 |

Jan. 2, 2004 replacement grant for Mr. Davis | | | 40.56 | | | 64.58 |

Feb. 9, 2004 grant for all named executives | | | 42.02 | | | 66.59 |

The following table provides information for the executives named below regarding options exercised in 2004 and the number and value of exercisable and unexercisable options.

AGGREGATE OPTION EXERCISES IN 2004 AND OPTION VALUES AT DEC. 31, 2004

| | | | | | | | | | | | | | | |

| | | Shares

Acquired on Exercise | | Value

Realized ($) | | Number of Securities

Underlying Unexercised

Options at Fiscal Year End | | Value of Unexercised In-the-Money Options at Year End(1) |

Name | | | | Exercisable | | Unexercisable | | | Exercisable | | | Unexercisable |

Erroll B. Davis, Jr. | | -- | | $ | -- | | 451,687 | | 386,419 | | $ | 699,194 | | $ | 1,811,580 |

William D. Harvey | | -- | | | -- | | 112,430 | | 100,096 | | | 126,724 | | | 465,010 |

Eliot G. Protsch | | -- | | | -- | | 112,430 | | 67,638 | | | 126,724 | | | 357,913 |

Barbara J. Swan | | 8,235 | | | 72,221 | | 86,398 | | 56,731 | | | 18,100 | | | 315,467 |

Thomas L. Aller | | -- | | | -- | | 67,292 | | 39,092 | | | 77,978 | | | 218,801 |

| (1) | Based on the closing per share price of AEC common stock on Dec. 31, 2004 of $28.60. |

12

LONG-TERM INCENTIVE AWARDS

The following table provides information concerning long-term incentive awards made to the executives named below in 2004.

LONG-TERM INCENTIVE AWARDS IN 2004

| | | | | | | | | | |

Name | | Number of

Shares, Units

or Other Rights

(#)(1) | | Performance or

Other Period

Until Maturation

or Payout | | Estimated Future Payouts Under

Non-Stock Price-Based Plans |

| | | | Threshold

(#) | | Target

(#) | | Maximum

(#) |

Erroll B. Davis, Jr. | | 36,020 | | 1/1/2007 | | 18,010 | | 36,020 | | 72,040 |

William D. Harvey | | 16,486 | | 1/1/2007 | | 8,243 | | 16,486 | | 32,972 |

Eliot G. Protsch | | 9,208 | | 1/1/2007 | | 4,604 | | 9,208 | | 18,416 |

Barbara J. Swan | | 7,194 | | 1/1/2007 | | 3,597 | | 7,194 | | 14,388 |

Thomas L. Aller | | 5,064 | | 1/1/2007 | | 2,532 | | 5,064 | | 10,128 |

| (1) | Consists of performance shares awarded as part of AEC’s annual LTI grant. The payout from the performance shares is based on AEC’s three-year Total Shareowner Return (“TSR”) relative to an investor-owned utility peer group during the three-year performance cycle ending Dec. 31, 2006. Payouts are subject to modification pursuant to a performance multiplier that ranges from 0 to 2.00, and will be made in shares of AEC common stock or a combination of AEC common stock and cash. |

CERTAIN AGREEMENTS

Mr. Davis currently has an employment agreement with AEC, pursuant to which he will serve as the Chairman of AEC until the expiration of the term of the agreement on the date of AEC’s 2006 Annual Meeting, but no later than May 30, 2006. In addition, he will serve as the Chief Executive Officer of AEC during the term of the agreement unless otherwise determined by the Board of Directors. Mr. Davis will also serve as the Chief Executive Officer of AEC and each subsidiary of AEC, including the Company, as long as he holds the same position for AEC. Pursuant to the employment agreement, Mr. Davis will be paid an annual base salary of not less than $750,000. Mr. Davis also will have the opportunity to earn short-term and long-term incentive compensation (including stock options, restricted stock and other long-term incentive compensation) at least equal to other executive officers and receive supplemental retirement benefits (including continued participation in the AEC Executive Tenure Compensation Plan) and life insurance providing a death benefit of three times his annual salary. For purposes of AEC’s Supplemental Executive Retirement Plan described in detail under “Retirement and Employee Benefit Plans,” (i) Mr. Davis will be deemed to have been paid an annual bonus for 2003 of $595,539 (the amount that he would have received had he been eligible for such a bonus for such year); (ii) if Mr. Davis ceases to be the Chief Executive Officer while remaining the Chairman in 2005 and if the annual bonus for 2005 payable in 2006 is less than the target award for Mr. Davis for 2005, Mr. Davis will be deemed to have earned the target award; (iii) a special calculation will apply to protect the dollar amount that Mr. Davis could have been paid on May 1, 2003 if he had retired on April 30, 2003; and (iv) upon termination of employment Mr. Davis generally will be deemed to be a retiree not subject to the early commencement reduction factors that would otherwise apply. For purposes of AEC’s Executive Tenure Compensation Plan, the Board of Directors has determined to treat Mr. Davis as an eligible retiree at his future termination of employment, regardless of the circumstances other than death. If, prior to the end of the term of the agreement, the employment of Mr. Davis is terminated by AEC without cause (as defined in the employment agreement), or if Mr. Davis terminates his employment for good reason (as defined in the employment agreement), or if the employment of Mr. Davis is terminated as a result of the mutual agreement of Mr. Davis and the Board of Directors of AEC, AEC or its affiliates will continue to provide the compensation and benefits called for by the employment agreement through the later of the end of the term of the agreement or one year after such termination of employment (with incentive compensation based on the maximum potential awards and with any stock compensation paid in cash), and all unvested stock compensation will vest immediately. If Mr. Davis dies or terminates his employment without good reason prior to the end of the term of the agreement, AEC or its affiliates will pay to Mr. Davis or his beneficiaries or estate all compensation earned through the date of death or such termination (including previously deferred compensation and pro rata incentive compensation based upon the maximum potential awards). If Mr. Davis’ employment is terminated by reason of his disability, he will be entitled to such benefits as may be provided by AEC’s current disability program. If Mr. Davis is terminated for cause, AEC or its affiliates will pay his base salary through the date

13

of termination plus any previously deferred compensation. In any such case, Mr. Davis shall also be eligible for the benefits he has accrued under the applicable retirement plans, including the benefits under the Supplemental Executive Retirement Plan and the Executive Tenure Compensation Plan. Under the employment agreement, if any payments thereunder constitute an excess parachute payment under the Internal Revenue Code (“Code”), then AEC will pay to Mr. Davis the amount necessary to offset the excise tax and any applicable taxes on this additional payment.

AEC currently has in effect key executive employment and severance agreements (the “KEESAs”) with certain executive officers and key employees of AEC (including Messrs. Davis, Harvey, Protsch and Aller and Ms. Swan). The KEESAs provide that each executive officer who is a party thereto is entitled to benefits if, within a period of up to three years (depending on which executive is involved) after a change in control of AEC (as defined in the KEESAs) (the “Employment Period”), the officer’s employment is ended through (a) termination by AEC, other than by reason of death or disability or for cause (as defined in the KEESAs); or (b) termination by the officer due to a breach of the agreement by AEC or a significant change in the officer’s responsibilities; or (c) in the case of Mr. Davis’ agreement, termination by Mr. Davis following the first anniversary of the change of control. The benefits provided are (a) a cash termination payment of up to three times (depending on which executive is involved) the sum of the officer’s annual salary and his or her average annual bonus during the three years before the termination; and (b) continuation for up to the end of the Employment Period of equivalent hospital, medical, dental, accident and life insurance coverage as in effect at the time of termination. Each KEESA for executive officers below the level of Executive Vice President of AEC provides that if any portion of the benefits under the KEESA or under any other agreement for the officer would constitute an excess parachute payment for purposes of the Code, benefits will be reduced so that the officer will be entitled to receive $1 less than the maximum amount which he or she could receive without becoming subject to the 20% excise tax imposed by the Code on certain excess parachute payments, or which AEC may pay without loss of deduction under the Code. The KEESAs for the Chief Executive Officer, President, Senior Executive Vice President and the Executive Vice Presidents of AEC (including Messrs. Davis, Harvey, Protsch and Aller and Ms. Swan) provide that if any payments thereunder or otherwise constitute an excess parachute payment, AEC will pay to the appropriate officer the amount necessary to offset the excise tax and any additional taxes on this additional payment. Mr. Davis’ employment agreement as described above limits benefits paid thereunder to the extent that duplicate payments would be provided to him under his KEESA.

RETIREMENT AND EMPLOYEE BENEFIT PLANS

Alliant Energy Cash Balance Pension Plan

Salaried employees (including officers) of the Company are eligible to participate in the Alliant Energy Cash Balance Pension Plan (the “Pension Plan”) maintained by Corporate Services. The Pension Plan bases a participant’s defined benefit pension on the value of a hypothetical account balance. For individuals participating in the Pension Plan as of Aug. 1, 1998, a starting account balance was created equal to the present value of the benefit accrued as of Dec. 31, 1997, under the applicable prior benefit formula. In addition, such individuals received a special one-time transition credit amount equal to a specified percentage varying with age multiplied by credited service and pay. For 1998 and thereafter, a participant receives annual credits to the account equal to 5% of base pay (including certain incentive payments, pre-tax deferrals and other items), plus an interest credit on all prior accruals equal to 4%, plus a potential share of the gain on the investment return on assets in the trust investment for the year.

The life annuity payable under the Pension Plan is determined by converting the hypothetical account balance credits into annuity form. Individuals who were participants in the Pension Plan on Aug. 1, 1998, are in no event to receive any less than what would have been provided under the prior formula that was applicable to them, had it continued, if they terminate on or before Aug. 1, 2008, and do not elect to commence benefits before the age of 55.

All of the individuals listed in the Summary Compensation Table participate in the Pension Plan and are “grandfathered” under the applicable prior plan benefit formula. Because their estimated benefits under the applicable prior plan benefit formula are expected to be higher than under the Pension Plan formula, utilizing current assumptions, their benefits would currently be determined by the applicable prior plan benefit formula. The following tables illustrate the estimated annual benefits payable upon retirement at age 65 under the applicable prior plan formula based on average annual compensation and years of service. To the extent benefits under the Pension Plan are limited by tax law, any excess will be paid under the Unfunded Excess Plan described below.

Company Plan A Prior Formula. One of the applicable prior plan formulas provided retirement income based on years of credited service and final average compensation for the 36 highest consecutive months, with a reduction for Social Security

14

offset. The individuals listed in the Summary Compensation Table covered by this formula are Messrs. Davis, Harvey and Protsch and Ms. Swan. The benefits would be as follows:

Company Plan A Prior Plan Formula Table

| | | | | | | | | | | | |

Average Annual Compensation

| | Annual Benefit After Specified Years in Plan

|

| | 15

| | 20

| | 25

| | 30+

|

$ 200,000 | | $ | 55,000 | | $ | 73,333 | | $ | 91,667 | | $ | 110,000 |

300,000 | | | 82,500 | | | 110,000 | | | 137,500 | | | 165,000 |

400,000 | | | 110,000 | | | 146,667 | | | 183,333 | | | 220,000 |

500,000 | | | 137,500 | | | 183,333 | | | 229,167 | | | 275,000 |

600,000 | | | 165,000 | | | 220,000 | | | 275,000 | | | 330,000 |

700,000 | | | 192,500 | | | 256,667 | | | 320,833 | | | 385,000 |

800,000 | | | 220,000 | | | 293,333 | | | 366,667 | | | 440,000 |

900,000 | | | 247,500 | | | 330,000 | | | 412,500 | | | 495,000 |

1,000,000 | | | 275,000 | | | 366,667 | | | 458,333 | | | 550,000 |

1,100,000 | | | 302,500 | | | 403,333 | | | 504,167 | | | 605,000 |

For purposes of the Pension Plan, compensation means payment for services rendered, including vacation and sick pay, and is substantially equivalent to the salary amounts reported in the Summary Compensation Table. Pension Plan benefits depend upon length of Pension Plan service (up to a maximum of 30 years), age at retirement and amount of compensation (determined in accordance with the Pension Plan) and are reduced by up to 50% of Social Security benefits. The estimated benefits in the table above do not reflect the Social Security offset. The estimated benefits are computed on a straight-life annuity basis. Benefits will be adjusted if the employee receives one of the optional forms of payment. Credited years of service under the Pension Plan for covered persons named in the Summary Compensation Table are as follows: Erroll B. Davis, Jr., 25 years; William D. Harvey, 17 years; Eliot G. Protsch, 25 years; and Barbara J. Swan, 16 years.

IES Industries Pension Plan Prior Formula. The other applicable prior plan formula provided retirement income based on years of service and final average compensation for the highest consecutive 36 months out of the last 10 years of employment. Mr. Aller is the only individual listed in the Summary Compensation Table covered by this formula. The benefits would be as follows:

IES Industries Pension Plan Prior Formula Table

| | | | | | | | | | | | | | | |

Average Annual Compensation

| | Annual Benefit After Specified Years in Plan

|

| | 15

| | 20

| | 25

| | 30

| | 35

|

$ 200,000 | | $ | 42,847 | | $ | 57,130 | | $ | 71,413 | | $ | 85,696 | | $ | 99,978 |

300,000 | | | 66,098 | | | 88,130 | | | 110,163 | | | 132,196 | | | 154,228 |

400,000 | | | 89,348 | | | 119,130 | | | 148,913 | | | 178,696 | | | 208,478 |

500,000 | | | 112,598 | | | 150,130 | | | 187,663 | | | 225,196 | | | 262,728 |

600,000 | | | 135,848 | | | 181,130 | | | 226,413 | | | 271,696 | | | 316,978 |

For purposes of the Pension Plan, compensation means payment for services rendered, including vacation and sick pay, and is substantially equivalent to the salary amounts reported in the Summary Compensation Table. Pension Plan benefits depend upon length of Pension Plan service (up to a maximum of 35 years), age at retirement and amount of compensation (determined in accordance with the Pension Plan). The estimated benefits are computed on a straight-life annuity basis. Benefits will be adjusted if the employee receives one of the optional forms of payment. Mr. Aller has 11 credited years of service under the Pension Plan.

Unfunded Excess Plan

Corporate Services maintains an Unfunded Excess Plan that provides funds for payment of retirement benefits above the limitations on payments from qualified pension plans in those cases where an employee’s retirement benefits exceed the qualified plan limits. The Unfunded Excess Plan provides an amount equal to the difference between the actual pension benefit payable under the Pension Plan and what such pension benefit would be if calculated without regard to any limitation imposed by the Code on pension benefits or covered compensation.

Unfunded Executive Tenure Compensation Plan

Corporate Services maintains an Unfunded Executive Tenure Compensation Plan to provide incentive for selected key executives to remain in the service of AEC by providing additional compensation that is payable only if the executive

15

remains with AEC until retirement (or other termination if approved by the Board of Directors of AEC). Any participant in the Plan must be approved by the Board of Directors of AEC. Mr. Davis was the only active participant in the Plan as of Dec. 31, 2004. The Plan provides for monthly payments to a participant after retirement (at or after age 65, or with Board approval, prior to age 65) for 120 months. The payments will be equal to 25% of the participant’s highest average salary for any consecutive 36-month period. If a participant dies prior to retirement or before 120 payments have been made, the participant’s beneficiary will receive monthly payments equal to 50% of such amount for 120 months in the case of death before retirement or, if the participant dies after retirement, 50% of such amount for the balance of the 120 months. Annual benefits of $187,500 would be payable to Mr. Davis upon retirement, assuming he continues in the service of AEC until retirement at the same salary as was in effect on Dec. 31, 2004.

Supplemental Executive Retirement Plan

AEC maintains an unfunded Supplemental Executive Retirement Plan (“SERP”) to provide incentive for key executives to remain in the service of AEC by providing additional compensation that is payable only if the executive remains with AEC until retirement, disability or death. While the SERP provides different levels of benefits depending on the executive covered, this summary reflects the terms applicable to all of the individuals listed in the Summary Compensation Table. Participants in the SERP must be approved by the Compensation and Personnel Committee of the Board of Directors of AEC. The SERP provides for payments of 60% of the participant’s average annual earnings (base salary and bonus) for the highest paid three years out of the last 10 years of the participant’s employment reduced by the sum of benefits payable to the officer from the officer’s defined benefit plan and the Unfunded Excess Plan. The normal retirement date under the SERP is age 62 with at least 10 years of service and early retirement is at age 55 with at least 10 years of service. If a participant retires prior to age 62, the 60% payment under the SERP is reduced by 3% per year for each year the participant’s retirement date precedes his/her normal retirement date. The actuarial reduction factor will be waived for participants who have attained age 55 and have a minimum of 10 years of service in a senior executive position with AEC after April 21, 1998. At the timely election of the participant, benefits under the SERP will be made in a lump sum, in installments over a period of up to 10 years, or for the lifetime of the participant. If the lifetime benefit is selected and the participant dies prior to receiving 12 years of payments, payments continue to any surviving spouse or dependent children of a deceased participant who dies while still employed by AEC, payable for a maximum of 12 years. A post-retirement death benefit of one times the participant’s final average earnings at the time of retirement will be paid to the designated beneficiary. Messrs. Davis, Harvey, Protsch and Aller and Ms. Swan are participants in the SERP. The following table shows the amount of retirement payments under the SERP, assuming a minimum of 10 years of service at retirement age and payment in the annuity form.

Supplemental Executive Retirement Plan Table

| | | | | | |

Average Annual Compensation

| | Annual Benefit After Specified Years in Plan

|

| | <10 Years

| | >10 Years*

|

$ 200,000 | | $ | 0 | | $ | 120,000 |

300,000 | | | 0 | | | 180,000 |

400,000 | | | 0 | | | 240,000 |

500,000 | | | 0 | | | 300,000 |

600,000 | | | 0 | | | 360,000 |

700,000 | | | 0 | | | 420,000 |

800,000 | | | 0 | | | 480,000 |

900,000 | | | 0 | | | 540,000 |

1,000,000 | | | 0 | | | 600,000 |

1,100,000 | | | 0 | | | 660,000 |

*Reduced by the sum of the benefit payable from the applicable defined benefit pension plan and the Unfunded Excess Plan.

Key Employee Deferred Compensation Plan

AEC maintains a Key Employee Deferred Compensation Plan under which participants may defer up to 100% of base salary and incentive compensation. Participants who have made the maximum allowed contribution to the AEC-sponsored 401(k) Savings Plan may receive an additional credit to the Deferred Compensation Plan. The credit will be equal to 50% of the lesser of (a) the amount contributed to the 401(k) Savings Plan plus the amount deferred under this Plan; or (b) 6% of base salary, reduced by the amount of any matching contributions in the 401(k) Savings Plan. The employee may elect to have his or her deferrals credited to an Interest Account or an AEC Stock Account. Deferrals and matching contributions to the Interest Account receive an annual return based on the A-Utility Bond Rate with a minimum return no less than the prime

16

interest rate published inThe Wall Street Journal, provided that the return may not be greater than 12% or less than 6%. Deferrals and matching contributions credited to the AEC Stock Account are treated as though invested in AEC common stock and will be credited with dividends, which will be treated as if reinvested. The shares of common stock identified as obligations under the Plan are held in a rabbi trust. Payments from the Plan may be made in a lump sum or in annual installments for up to 10 years at the election of the participant. Participants are selected by the Chief Executive Officer of Corporate Services. Messrs. Davis, Harvey, Protsch and Aller and Ms. Swan are participants in the Plan.

REPORT OF THE COMPENSATION AND PERSONNEL

COMMITTEE ON EXECUTIVE COMPENSATION

To Our Shareowners:

The Compensation and Personnel Committee (the “Committee”) of the Board of Directors of the Company is currently composed of four independent directors (the same directors that comprise the AEC Compensation and Personnel Committee). The following is a report prepared by these directors with respect to compensation paid by AEC, the Company and AEC’s other subsidiaries.

The Committee assesses the effectiveness and competitiveness of, approves the design of, and administers executive compensation programs within a consistent total compensation framework for the Company. The Committee also reviews and approves all salary arrangements and other remuneration for executive officers, evaluates executive officer performance, and considers related matters. It also makes recommendations to the Nominating and Governance Committee regarding Director compensation. To support it in carrying out its mission, the Committee engages an independent consultant (which is retained by the Committee rather than Company executives).

The Committee Charter was amended in January 2004 to enhance corporate governance through the adoption of recommended and required modifications detailing the role and functions of the Committee in compliance with the NYSE listing standards.

The Committee is committed to implementing an overall compensation program for executive officers that furthers the Company’s mission. Therefore, the Committee adheres to the following compensation policies, which are intended to facilitate the achievement of the Company’s business strategies:

| • | | Executive management compensation (and particularly, long-term incentive compensation) should be closely and strongly aligned with the long-term interests of AEC’s shareowners and customers. |

| • | | Total compensation should enhance the Company’s ability to attract, retain and encourage the development of exceptionally knowledgeable and experienced executive officers, upon whom, in large part, the successful operation and management of the Company depends. |

| • | | Base salary levels should be targeted at a competitive market range of base salaries paid to executive officers of comparable companies. Specifically, the Company targets the median (50th percentile) of base salaries paid by companies of similar revenue base within the utility and general industries. |

| • | | Incentive compensation programs should strengthen the relationship between pay and performance by emphasizing variable at-risk compensation that is consistent with meeting predetermined corporate, subsidiary, business unit and individual performance goals. In addition, the Committee targets incentive levels at the median (50th percentile) of incentive compensation paid by companies of similar revenue base within the utility and general industries. |

Components of Compensation