UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period endedJune 30, 2011

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

| | | | |

Commission File Number | | Name of Registrant, State of Incorporation, Address of Principal Executive Offices and Telephone Number | | IRS Employer Identification Number |

| 1-9894 | | ALLIANT ENERGY CORPORATION | | 39-1380265 |

| | (a Wisconsin corporation) | | |

| | 4902 N. Biltmore Lane | | |

| | Madison, Wisconsin 53718 | | |

| | Telephone (608)458-3311 | | |

| | |

| 0-4117-1 | | INTERSTATE POWER AND LIGHT COMPANY | | 42-0331370 |

| | (an Iowa corporation) | | |

| | Alliant Energy Tower | | |

| | Cedar Rapids, Iowa 52401 | | |

| | Telephone (319)786-4411 | | |

| | |

| 0-337 | | WISCONSIN POWER AND LIGHT COMPANY | | 39-0714890 |

| | (a Wisconsin corporation) | | |

| | 4902 N. Biltmore Lane | | |

| | Madison, Wisconsin 53718 | | |

| | Telephone (608)458-3311 | | |

This combined Form 10-Q is separately filed by Alliant Energy Corporation, Interstate Power and Light Company and Wisconsin Power and Light Company. Information contained in the Form 10-Q relating to Interstate Power and Light Company and Wisconsin Power and Light Company is filed by such registrant on its own behalf. Each of Interstate Power and Light Company and Wisconsin Power and Light Company makes no representation as to information relating to registrants other than itself.

Indicate by check mark whether the registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrants were required to file such reports), and (2) have been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrants have submitted electronically and posted on their corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrants were required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrants are large accelerated filers, accelerated filers, non-accelerated filers, or smaller reporting companies. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | |

| | | Large

Accelerated

Filer | | Accelerated

Filer | | Non-accelerated

Filer | | Smaller

Reporting

Company

Filer |

Alliant Energy Corporation | | x | | | | | | |

Interstate Power and Light Company | | | | | | x | | |

Wisconsin Power and Light Company | | | | | | x | | |

Indicate by check mark whether the registrants are shell companies (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

Number of shares outstanding of each class of common stock as of June 30, 2011:

| | |

Alliant Energy Corporation | | Common stock, $0.01 par value, 110,979,511 shares outstanding |

| |

Interstate Power and Light Company | | Common stock, $2.50 par value, 13,370,788 shares outstanding (all of which are owned beneficially and of record by Alliant Energy Corporation) |

| |

Wisconsin Power and Light Company | | Common stock, $5 par value, 13,236,601 shares outstanding (all of which are owned beneficially and of record by Alliant Energy Corporation) |

TABLE OF CONTENTS

| | | | | | |

| | | | | Page | |

| | Forward-looking Statements | | | 1 | |

Part I. | | Financial Information | | | 3 | |

Item 1. | | Condensed Consolidated Financial Statements (Unaudited) | | | 3 | |

| | Alliant Energy Corporation: | | | | |

| | Condensed Consolidated Statements of Income for the Three and Six Months Ended June 30, 2011 and 2010 | | | 3 | |

| | Condensed Consolidated Balance Sheets as of June 30, 2011 and Dec. 31, 2010 | | | 4 | |

| | Condensed Consolidated Statements of Cash Flows for the Six Months Ended June 30, 2011 and 2010 | | | 6 | |

| | Interstate Power and Light Company: | | | | |

| | Condensed Consolidated Statements of Income for the Three and Six Months Ended June 30, 2011 and 2010 | | | 7 | |

| | Condensed Consolidated Balance Sheets as of June 30, 2011 and Dec. 31, 2010 | | | 8 | |

| | Condensed Consolidated Statements of Cash Flows for the Six Months Ended June 30, 2011 and 2010 | | | 10 | |

| | Wisconsin Power and Light Company: | | | | |

| | Condensed Consolidated Statements of Income for the Three and Six Months Ended June 30, 2011 and 2010 | | | 11 | |

| | Condensed Consolidated Balance Sheets as of June 30, 2011 and Dec. 31, 2010 | | | 12 | |

| | Condensed Consolidated Statements of Cash Flows for the Six Months Ended June 30, 2011 and 2010 | | | 14 | |

| | Combined Notes to Condensed Consolidated Financial Statements | | | 15 | |

| | 1. Summary of Significant Accounting Policies | | | 15 | |

| | 2. Utility Rate Cases | | | 18 | |

| | 3. Receivables | | | 19 | |

| | 4. Income Taxes | | | 20 | |

| | 5. Benefit Plans | | | 22 | |

| | 6. Common Equity and Preferred Stock | | | 27 | |

| | 7. Short-term Debt | | | 28 | |

| | 8. Investments | | | 28 | |

| | 9. Fair Value Measurements | | | 29 | |

| | 10. Derivative Instruments | | | 33 | |

| | 11. Commitments and Contingencies | | | 35 | |

| | 12. Segments of Business | | | 39 | |

| | 13. Goodwill and Other Intangible Assets | | | 40 | |

| | 14. Discontinued Operations | | | 41 | |

| | 15. Asset Retirement Obligations | | | 42 | |

| | 16. Variable Interest Entities | | | 42 | |

| | 17. Related Parties | | | 42 | |

| | 18. Earnings Per Share | | | 43 | |

FORWARD-LOOKING STATEMENTS

Statements contained in this report that are not of historical fact are forward-looking statements intended to qualify for the safe harbors from liability established by the Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified as such because the statements include words such as “expect,” “anticipate,” “plan” or other words of similar import. Similarly, statements that describe future financial performance or plans or strategies are forward-looking statements. Such forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, such statements. Some, but not all, of the risks and uncertainties of Alliant Energy Corporation (Alliant Energy), Interstate Power and Light Company (IPL) and Wisconsin Power and Light Company (WPL) that could materially affect actual results include:

| | • | | federal and state regulatory or governmental actions, including the impact of energy, tax, financial and health care legislation, and of regulatory agency orders; |

| | • | | IPL’s and WPL’s ability to obtain adequate and timely rate relief to allow for, among other things, the recovery of operating costs, fuel costs, transmission costs, deferred expenditures, capital expenditures, and remaining costs related to generating units that may be permanently closed, the earning of reasonable rates of return, and the payments to their parent of expected levels of dividends; |

| | • | | the ability to continue cost controls and operational efficiencies; |

| | • | | the impact of IPL’s retail electric base rate freeze in Iowa through 2013; |

| | • | | the state of the economy in IPL’s and WPL’s service territories and resulting implications on sales, margins and ability to collect unpaid bills; |

| | • | | developments that adversely impact their ability to implement their strategic plans, including unanticipated issues with Alliant Energy Resources, LLC’s (Resources’) construction of and selling price of the electricity output from its new 100 megawatt (MW) wind generating project, new emission control equipment for various coal-fired generating facilities of IPL and WPL, WPL’s potential purchase of the Riverside Energy Center (Riverside) or a similar facility, IPL’s potential construction of a new natural gas-fired electric generating facility in Iowa, and the potential decommissioning of certain generating facilities of IPL and WPL; |

| | • | | weather effects on results of utility operations; |

| | • | | successful resolution of the pending challenge by interveners of the approval by the Public Service Commission of Wisconsin (PSCW) of WPL’s Bent Tree - Phase I wind project; |

| | • | | issues related to the availability of generating facilities and the supply and delivery of fuel and purchased electricity and price thereof, including the ability to recover and to retain the recovery of purchased power, fuel and fuel-related costs through rates in a timely manner; |

| | • | | the impact that fuel and fuel-related prices may have on IPL’s and WPL’s customers’ demand for utility services; |

| | • | | IPL’s potential rate refunds to customers resulting from final rates set by the Minnesota Public Utilities Commission (MPUC) that are less than the interim rate increases IPL is currently collecting from its Minnesota retail customers; |

| | • | | the ability to defend against environmental claims brought by state and federal agencies, such as the United States of America (U.S.) Environmental Protection Agency (EPA), or third parties, such as the Sierra Club; |

| | • | | issues associated with environmental remediation efforts and with environmental compliance generally, including changing environmental laws and regulations; |

| | • | | potential impacts of changing regulations on the ability to utilize already-purchased emission allowances and forward contracts to purchase additional emission allowances; |

| | • | | the ability to recover through rates all environmental compliance costs, including costs for projects put on hold due to uncertainty of future environmental laws and regulations; |

| | • | | potential impacts of any future laws or regulations regarding global climate change or carbon emissions reductions, including those that contain proposed regulations (including cap-and-trade) of greenhouse gas (GHG) emissions; |

| | • | | continued access to the capital markets on competitive terms and rates; |

1

| | • | | inflation and interest rates, which may be negatively impacted by downgrades of the credit rating of the U.S. government; |

| | • | | financial impacts of risk hedging strategies, including the impact of weather hedges or the absence of weather hedges on earnings; |

| | • | | changes to the creditworthiness of counterparties which Alliant Energy, IPL and WPL have contractual arrangements including participants in the energy markets and fuel suppliers and transporters; |

| | • | | sales and project execution for RMT, Inc. (RMT), the level of growth in the wind and solar development market and the impact of the American Recovery and Reinvestment Act of 2009 and the Tax Relief, Unemployment Insurance Reauthorization and Job Creation Act of 2010, and future legislation; |

| | • | | issues related to electric transmission, including operating in Regional Transmission Organization (RTO) energy and ancillary services markets, the impacts of potential future billing adjustments and cost allocation changes from RTOs and recovery of costs incurred; |

| | • | | unplanned outages, transmission constraints or operational issues impacting fossil or renewable generating facilities and risks related to recovery of resulting incremental costs through rates; |

| | • | | Alliant Energy’s ability to successfully pursue appropriate appeals with respect to, and any liabilities arising out of, the alleged violation of the Employee Retirement Income Security Act of 1974 by Alliant Energy’s Cash Balance Pension Plan; |

| | • | | current or future litigation, regulatory investigations, proceedings or inquiries; |

| | • | | Alliant Energy’s ability to sustain its dividend payout ratio goal; |

| | • | | employee workforce factors, including changes in key executives, collective bargaining agreements and negotiations, work stoppages or additional restructurings; |

| | • | | impacts that storms or natural disasters in IPL’s and WPL’s service territories may have on their operations and recovery of and rate relief for costs associated with restoration activities; |

| | • | | access to technological developments; |

| | • | | any material post-closing adjustments related to any past asset divestitures; |

| | • | | increased retirement and benefit plan costs; |

| | • | | the impact of necessary accruals for the terms of incentive compensation plans; |

| | • | | the effect of accounting pronouncements issued periodically by standard-setting bodies; |

| | • | | the ability to utilize tax credits and net operating losses generated to date, and those that may be generated in the future, before they expire; |

| | • | | the ability to successfully complete tax audits and appeals with no material impact on earnings and cash flows; |

| | • | | the direct or indirect effects resulting from terrorist incidents, including cyber terrorism, or responses to such incidents; and |

| | • | | factors listed in Management’s Discussion and Analysis of Financial Condition and Results of Operations and in Item 1A Risk Factors in the combined Annual Report on Form 10-K filed by Alliant Energy, IPL and WPL for the year ended Dec. 31, 2010 (2010 Form 10-K). |

Alliant Energy, IPL and WPL assume no obligation, and disclaim any duty, to update the forward-looking statements in this report.

2

PART I. FINANCIAL INFORMATION

ITEM 1. CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

ALLIANT ENERGY CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED)

| | | | | | | | | | | | | | | | |

| | | For the Three Months | | | For the Six Months | |

| | | Ended June 30, | | | Ended June 30, | |

| | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

| | | (dollars in millions, except per share amounts) | |

Operating revenues: | | | | | | | | | | | | | | | | |

Utility: | | | | | | | | | | | | | | | | |

Electric | | $ | 620.5 | | | $ | 627.3 | | | $ | 1,240.8 | | | $ | 1,232.2 | |

Gas | | | 67.1 | | | | 59.5 | | | | 296.1 | | | | 284.4 | |

Other | | | 13.3 | | | | 15.4 | | | | 30.0 | | | | 33.0 | |

Non-regulated | | | 118.6 | | | | 39.4 | | | | 197.6 | | | | 82.2 | |

| | | | | | | | | | | | | | | | |

Total operating revenues | | | 819.5 | | | | 741.6 | | | | 1,764.5 | | | | 1,631.8 | |

| | | | | | | | | | | | | | | | |

Operating expenses: | | | | | | | | | | | | | | | | |

Utility: | | | | | | | | | | | | | | | | |

Electric production fuel and energy purchases | | | 180.7 | | | | 193.2 | | | | 374.7 | | | | 403.6 | |

Purchased electric capacity | | | 67.2 | | | | 72.5 | | | | 125.0 | | | | 135.8 | |

Electric transmission service | | | 80.1 | | | | 71.1 | | | | 153.7 | | | | 133.4 | |

Cost of gas sold | | | 34.8 | | | | 28.7 | | | | 191.2 | | | | 185.1 | |

Other operation and maintenance | | | 168.9 | | | | 152.2 | | | | 329.5 | | | | 302.7 | |

Non-regulated operation and maintenance | | | 108.0 | | | | 33.1 | | | | 177.9 | | | | 71.3 | |

Depreciation and amortization | | | 82.2 | | | | 65.1 | | | | 161.0 | | | | 139.5 | |

Taxes other than income taxes | | | 25.6 | | | | 25.0 | | | | 51.7 | | | | 50.7 | |

| | | | | | | | | | | | | | | | |

Total operating expenses | | | 747.5 | | | | 640.9 | | | | 1,564.7 | | | | 1,422.1 | |

| | | | | | | | | | | | | | | | |

Operating income | | | 72.0 | | | | 100.7 | | | | 199.8 | | | | 209.7 | |

| | | | | | | | | | | | | | | | |

Interest expense and other: | | | | | | | | | | | | | | | | |

Interest expense | | | 40.4 | | | | 39.6 | | | | 81.0 | | | | 80.3 | |

Equity income from unconsolidated investments, net | | | (9.6 | ) | | | (9.6 | ) | | | (19.5 | ) | | | (19.4 | ) |

Allowance for funds used during construction | | | (2.7 | ) | | | (5.5 | ) | | | (5.8 | ) | | | (9.4 | ) |

Interest income and other | | | (0.8 | ) | | | 0.5 | | | | (1.6 | ) | | | (0.3 | ) |

| | | | | | | | | | | | | | | | |

Total interest expense and other | | | 27.3 | | | | 25.0 | | | | 54.1 | | | | 51.2 | |

| | | | | | | | | | | | | | | | |

Income from continuing operations before income taxes | | | 44.7 | | | | 75.7 | | | | 145.7 | | | | 158.5 | |

| | | | | | | | | | | | | | | | |

Income tax expense (benefit) | | | (10.6 | ) | | | 23.0 | | | | 12.0 | | | | 57.7 | |

| | | | | | | | | | | | | | | | |

Income from continuing operations, net of tax | | | 55.3 | | | | 52.7 | | | | 133.7 | | | | 100.8 | |

| | | | | | | | | | | | | | | | |

Income (loss) from discontinued operations, net of tax | | | — | | | | (0.2 | ) | | | 1.3 | | | | (0.2 | ) |

| | | | | | | | | | | | | | | | |

Net income | | | 55.3 | | | | 52.5 | | | | 135.0 | | | | 100.6 | |

| | | | | | | | | | | | | | | | |

Preferred dividend requirements of subsidiaries | | | 4.2 | | | | 4.7 | | | | 10.4 | | | | 9.4 | |

| | | | | | | | | | | | | | | | |

Net income attributable to Alliant Energy common shareowners | | $ | 51.1 | | | $ | 47.8 | | | $ | 124.6 | | | $ | 91.2 | |

| | | | | | | | | | | | | | | | |

Weighted average number of common shares outstanding (basic) (000s) | | | 110,624 | | | | 110,409 | | | | 110,596 | | | | 110,389 | |

| | | | | | | | | | | | | | | | |

Earnings per weighted average common share attributable to Alliant Energy common shareowners (basic): | | | | | | | | | | | | | | | | |

Income from continuing operations, net of tax | | $ | 0.46 | | | $ | 0.43 | | | $ | 1.12 | | | $ | 0.83 | |

Income from discontinued operations, net of tax | | | — | | | | — | | | | 0.01 | | | | — | |

| | | | | | | | | | | | | | | | |

Net income | | $ | 0.46 | | | $ | 0.43 | | | $ | 1.13 | | | $ | 0.83 | |

| | | | | | | | | | | | | | | | |

Weighted average number of common shares outstanding (diluted) (000s) | | | 110,677 | | | | 110,490 | | | | 110,654 | | | | 110,471 | |

| | | | | | | | | | | | | | | | |

Earnings per weighted average common share attributable to Alliant Energy common shareowners (diluted): | | | | | | | | | | | | | | | | |

Income from continuing operations, net of tax | | $ | 0.46 | | | $ | 0.43 | | | $ | 1.12 | | | $ | 0.83 | |

Income from discontinued operations, net of tax | | | — | | | | — | | | | 0.01 | | | | — | |

| | | | | | | | | | | | | | | | |

Net income | | $ | 0.46 | | | $ | 0.43 | | | $ | 1.13 | | | $ | 0.83 | |

| | | | | | | | | | | | | | | | |

Amounts attributable to Alliant Energy common shareowners: | | | | | | | | | | | | | | | | |

Income from continuing operations, net of tax | | $ | 51.1 | | | $ | 48.0 | | | $ | 123.3 | | | $ | 91.4 | |

Income (loss) from discontinued operations, net of tax | | | — | | | | (0.2 | ) | | | 1.3 | | | | (0.2 | ) |

| | | | | | | | | | | | | | | | |

Net income attributable to Alliant Energy common shareowners | | $ | 51.1 | | | $ | 47.8 | | | $ | 124.6 | | | $ | 91.2 | |

| | | | | | | | | | | | | | | | |

Dividends declared per common share | | $ | 0.425 | | | $ | 0.395 | | | $ | 0.85 | | | $ | 0.79 | |

| | | | | | | | | | | | | | | | |

The accompanying Combined Notes to Condensed Consolidated Financial Statements are an integral part of these statements.

3

ALLIANT ENERGY CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED)

| | | | | | | | |

ASSETS | | June 30,

2011 | | | December 31,

2010 | |

| | | (in millions) | |

Property, plant and equipment: | | | | | | | | |

Utility: | | | | | | | | |

Electric plant in service | | $ | 8,025.8 | | | $ | 7,676.8 | |

Gas plant in service | | | 835.6 | | | | 830.1 | |

Other plant in service | | | 509.3 | | | | 499.2 | |

Accumulated depreciation | | | (3,117.2 | ) | | | (2,982.2 | ) |

| | | | | | | | |

Net plant | | | 6,253.5 | | | | 6,023.9 | |

Construction work in progress: | | | | | | | | |

Bent Tree - Phase I wind project (Wisconsin Power and Light Company) | | | — | | | | 154.5 | |

Other | | | 185.9 | | | | 155.5 | |

Other, less accumulated depreciation | | | 35.1 | | | | 126.0 | |

| | | | | | | | |

Total utility | | | 6,474.5 | | | | 6,459.9 | |

| | | | | | | | |

Non-regulated and other: | | | | | | | | |

Non-regulated Generation, less accumulated depreciation | | | 236.5 | | | | 119.0 | |

Alliant Energy Corporate Services, Inc. and other, less accumulated depreciation | | | 155.4 | | | | 151.7 | |

| | | | | | | | |

Total non-regulated and other | | | 391.9 | | | | 270.7 | |

| | | | | | | | |

Total property, plant and equipment | | | 6,866.4 | | | | 6,730.6 | |

| | | | | | | | |

| | |

Current assets: | | | | | | | | |

Cash and cash equivalents | | | 77.1 | | | | 159.3 | |

Accounts receivable: | | | | | | | | |

Customer, less allowance for doubtful accounts | | | 127.8 | | | | 120.5 | |

Unbilled utility revenues | | | 72.1 | | | | 82.3 | |

Other, less allowance for doubtful accounts | | | 121.6 | | | | 213.1 | |

Production fuel, at weighted average cost | | | 99.7 | | | | 122.8 | |

Materials and supplies, at weighted average cost | | | 61.5 | | | | 61.6 | |

Gas stored underground, at weighted average cost | | | 24.1 | | | | 48.6 | |

Regulatory assets | | | 79.5 | | | | 109.0 | |

Derivative assets | | | 28.7 | | | | 19.1 | |

Prepayments and other | | | 185.7 | | | | 156.4 | |

| | | | | | | | |

Total current assets | | | 877.8 | | | | 1,092.7 | |

| | | | | | | | |

| | |

Investments: | | | | | | | | |

Investment in American Transmission Company LLC | | | 233.9 | | | | 227.9 | |

Other | | | 62.2 | | | | 61.3 | |

| | | | | | | | |

Total investments | | | 296.1 | | | | 289.2 | |

| | | | | | | | |

| | |

Other assets: | | | | | | | | |

Regulatory assets | | | 1,139.0 | | | | 1,032.7 | |

Deferred charges and other | | | 121.9 | | | | 137.7 | |

| | | | | | | | |

Total other assets | | | 1,260.9 | | | | 1,170.4 | |

| | | | | | | | |

| | |

Total assets | | $ | 9,301.2 | | | $ | 9,282.9 | |

| | | | | | | | |

The accompanying Combined Notes to Condensed Consolidated Financial Statements are an integral part of these statements.

4

ALLIANT ENERGY CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED) (Continued)

| | | | | | | | |

CAPITALIZATION AND LIABILITIES | | June 30,

2011 | | | December 31,

2010 | |

| | | (in millions, except per share and share amounts) | |

Capitalization: | | | | | | | | |

Alliant Energy Corporation common equity: | | | | | | | | |

Common stock - $0.01 par value - 240,000,000 shares authorized; 110,979,511 and 110,893,901 shares outstanding | | $ | 1.1 | | | $ | 1.1 | |

Additional paid-in capital | | | 1,509.7 | | | | 1,506.8 | |

Retained earnings | | | 1,425.1 | | | | 1,394.7 | |

Accumulated other comprehensive loss | | | (0.6 | ) | | | (1.4 | ) |

Shares in deferred compensation trust - 258,405 and 246,301 shares at a weighted average cost of $31.21 and $30.75 per share | | | (8.1 | ) | | | (7.6 | ) |

| | | | | | | | |

Total Alliant Energy Corporation common equity | | | 2,927.2 | | | | 2,893.6 | |

Cumulative preferred stock of Interstate Power and Light Company | | | 145.1 | | | | 183.8 | |

Noncontrolling interest | | | 2.0 | | | | 2.0 | |

| | | | | | | | |

Total equity | | | 3,074.3 | | | | 3,079.4 | |

Cumulative preferred stock of Wisconsin Power and Light Company | | | 60.0 | | | | 60.0 | |

Long-term debt, net (excluding current portion) | | | 2,703.5 | | | | 2,703.4 | |

| | | | | | | | |

Total capitalization | | | 5,837.8 | | | | 5,842.8 | |

| | | | | | | | |

| | |

Current liabilities: | | | | | | | | |

Current maturities of long-term debt | | | 1.4 | | | | 1.3 | |

Commercial paper | | | — | | | | 47.4 | |

Accounts payable | | | 305.8 | | | | 336.3 | |

Regulatory liabilities | | | 168.8 | | | | 173.7 | |

Accrued taxes | | | 45.8 | | | | 45.3 | |

Accrued interest | | | 46.6 | | | | 46.7 | |

Derivative liabilities | | | 30.3 | | | | 55.3 | |

Other | | | 161.4 | | | | 160.7 | |

| | | | | | | | |

Total current liabilities | | | 760.1 | | | | 866.7 | |

| | | | | | | | |

| | |

Other long-term liabilities and deferred credits: | | | | | | | | |

Deferred income taxes | | | 1,477.9 | | | | 1,434.3 | |

Regulatory liabilities | | | 771.3 | | | | 626.4 | |

Pension and other benefit obligations | | | 241.8 | | | | 303.8 | |

Other | | | 212.3 | | | | 208.9 | |

| | | | | | | | |

Total long-term liabilities and deferred credits | | | 2,703.3 | | | | 2,573.4 | |

| | | | | | | | |

| | |

Total capitalization and liabilities | | $ | 9,301.2 | | | $ | 9,282.9 | |

| | | | | | | | |

The accompanying Combined Notes to Condensed Consolidated Financial Statements are an integral part of these statements.

5

ALLIANT ENERGY CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

| | | | | | | | |

| | | For the Six Months Ended June 30, | |

| | | 2011 | | | 2010 | |

| | | (in millions) | |

Cash flows from operating activities: | | | | | | | | |

Net income | | $ | 135.0 | | | $ | 100.6 | |

Adjustments to reconcile net income to net cash flows from operating activities: | | | | | | | | |

Depreciation and amortization | | | 161.0 | | | | 140.4 | |

Other amortizations | | | 28.3 | | | | 23.1 | |

Deferred tax expense (benefit) and investment tax credits | | | (25.5 | ) | | | 48.1 | |

Equity income from unconsolidated investments, net | | | (19.5 | ) | | | (19.4 | ) |

Distributions from equity method investments | | | 15.9 | | | | 16.2 | |

Other | | | 16.7 | | | | (0.1 | ) |

Other changes in assets and liabilities: | | | | | | | | |

Accounts receivable | | | 27.8 | | | | 64.6 | |

Sales of accounts receivable | | | 55.0 | | | | 120.0 | |

Regulatory assets | | | (110.3 | ) | | | (56.6 | ) |

Regulatory liabilities | | | 165.9 | | | | (20.2 | ) |

Deferred income taxes | | | 70.8 | | | | 9.5 | |

Pension and other benefit obligations | | | (62.0 | ) | | | 36.7 | |

Other | | | 7.7 | | | | 16.3 | |

| | | | | | | | |

Net cash flows from operating activities | | | 466.8 | | | | 479.2 | |

| | | | | | | | |

| | |

Cash flows used for investing activities: | | | | | | | | |

Construction and acquisition expenditures: | | | | | | | | |

Utility business | | | (338.1 | ) | | | (384.8 | ) |

Alliant Energy Corporate Services, Inc. and non-regulated businesses | | | (20.6 | ) | | | (11.2 | ) |

Other | | | 17.6 | | | | 0.4 | |

| | | | | | | | |

Net cash flows used for investing activities | | | (341.1 | ) | | | (395.6 | ) |

| | | | | | | | |

| | |

Cash flows used for financing activities: | | | | | | | | |

Common stock dividends | | | (94.2 | ) | | | (87.2 | ) |

Preferred dividends paid by subsidiaries | | | (8.9 | ) | | | (9.4 | ) |

Payments to redeem cumulative preferred stock of IPL | | | (40.0 | ) | | | — | |

Proceeds from issuance of long-term debt | | | 0.4 | | | | 300.0 | |

Payments to retire long-term debt | | | (0.6 | ) | | | (100.8 | ) |

Net change in short-term borrowings | | | (47.4 | ) | | | (190.0 | ) |

Other | | | (17.2 | ) | | | (0.4 | ) |

| | | | | | | | |

Net cash flows used for financing activities | | | (207.9 | ) | | | (87.8 | ) |

| | | | | | | | |

| | |

Net decrease in cash and cash equivalents | | | (82.2 | ) | | | (4.2 | ) |

Cash and cash equivalents at beginning of period | | | 159.3 | | | | 175.3 | |

| | | | | | | | |

Cash and cash equivalents at end of period | | $ | 77.1 | | | $ | 171.1 | |

| | | | | | | | |

| | |

Supplemental cash flows information: | | | | | | | | |

Cash paid (refunded) during the period for: | | | | | | | | |

Interest, net of capitalized interest | | $ | 80.2 | | | $ | 82.5 | |

Income taxes, net of refunds | | ($ | 3.0 | ) | | ($ | 6.7 | ) |

Significant noncash investing and financing activities: | | | | | | | | |

Accrued capital expenditures | | $ | 43.3 | | | $ | 47.0 | |

The accompanying Combined Notes to Condensed Consolidated Financial Statements are an integral part of these statements.

6

INTERSTATE POWER AND LIGHT COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED)

| | | | | | | | | | | | | | | | |

| | | For the Three Months | | | For the Six Months | |

| | | Ended June 30, | | | Ended June 30, | |

| | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

| | | (in millions) | |

Operating revenues: | | | | | | | | | | | | | | | | |

Electric utility | | $ | 323.9 | | | $ | 344.8 | | | $ | 654.1 | | | $ | 654.4 | |

Gas utility | | | 38.7 | | | | 31.1 | | | | 170.6 | | | | 159.8 | |

Steam and other | | | 11.5 | | | | 13.4 | | | | 26.9 | | | | 29.6 | |

| | | | | | | | | | | | | | | | |

Total operating revenues | | | 374.1 | | | | 389.3 | | | | 851.6 | | | | 843.8 | |

| | | | | | | | | | | | | | | | |

| | | | |

Operating expenses: | | | | | | | | | | | | | | | | |

Electric production fuel and energy purchases | | | 87.4 | | | | 101.3 | | | | 184.2 | | | | 201.8 | |

Purchased electric capacity | | | 34.6 | | | | 33.8 | | | | 73.9 | | | | 72.4 | |

Electric transmission service | | | 54.0 | | | | 45.9 | | | | 101.9 | | | | 83.5 | |

Cost of gas sold | | | 20.9 | | | | 14.6 | | | | 113.5 | | | | 105.8 | |

Other operation and maintenance | | | 100.5 | | | | 91.9 | | | | 197.2 | | | | 184.2 | |

Depreciation and amortization | | | 45.0 | | | | 43.6 | | | | 88.9 | | | | 86.6 | |

Taxes other than income taxes | | | 13.2 | | | | 13.0 | | | | 26.4 | | | | 26.0 | |

| | | | | | | | | | | | | | | | |

Total operating expenses | | | 355.6 | | | | 344.1 | | | | 786.0 | | | | 760.3 | |

| | | | | | | | | | | | | | | | |

| | | | |

Operating income | | | 18.5 | | | | 45.2 | | | | 65.6 | | | | 83.5 | |

| | | | | | | | | | | | | | | | |

| | | | |

Interest expense and other: | | | | | | | | | | | | | | | | |

Interest expense | | | 19.8 | | | | 20.3 | | | | 39.7 | | | | 40.6 | |

Allowance for funds used during construction | | | (1.6 | ) | | | (2.4 | ) | | | (3.0 | ) | | | (3.7 | ) |

Interest income and other | | | — | | | | 0.3 | | | | (0.2 | ) | | | — | |

| | | | | | | | | | | | | | | | |

Total interest expense and other | | | 18.2 | | | | 18.2 | | | | 36.5 | | | | 36.9 | |

| | | | | | | | | | | | | | | | |

| | | | |

Income before income taxes | | | 0.3 | | | | 27.0 | | | | 29.1 | | | | 46.6 | |

| | | | | | | | | | | | | | | | |

| | | | |

Income tax expense (benefit) | | | (0.7 | ) | | | 5.8 | | | | 1.0 | | | | 15.7 | |

| | | | | | | | | | | | | | | | |

| | | | |

Net income | | | 1.0 | | | | 21.2 | | | | 28.1 | | | | 30.9 | |

| | | | | | | | | | | | | | | | |

| | | | |

Preferred dividend requirements | | | 3.3 | | | | 3.8 | | | | 8.7 | | | | 7.7 | |

| | | | | | | | | | | | | | | | |

| | | | |

Earnings available (loss) for common stock | | ($ | 2.3 | ) | | $ | 17.4 | | | $ | 19.4 | | | $ | 23.2 | |

| | | | | | | | | | | | | | | | |

Earnings per share data is not disclosed given Alliant Energy Corporation is the sole shareowner of all shares of IPL’s common stock outstanding during the periods presented.

The accompanying Combined Notes to Condensed Consolidated Financial Statements are an integral part of these statements.

7

INTERSTATE POWER AND LIGHT COMPANY

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED)

| | | | | | | | |

| | | June 30, | | | December 31, | |

ASSETS | | 2011 | | | 2010 | |

| | | (in millions) | |

Property, plant and equipment: | | | | | | | | |

Electric plant in service | | $ | 4,593.8 | | | $ | 4,562.2 | |

Gas plant in service | | | 420.3 | | | | 418.7 | |

Steam plant in service | | | 34.9 | | | | 34.9 | |

Other plant in service | | | 250.3 | | | | 245.3 | |

Accumulated depreciation | | | (1,790.6 | ) | | | (1,738.4 | ) |

| | | | | | | | |

Net plant | | | 3,508.7 | | | | 3,522.7 | |

Construction work in progress | | | 87.2 | | | | 74.5 | |

Other, less accumulated depreciation | | | 20.0 | | | | 106.0 | |

| | | | | | | | |

Total property, plant and equipment | | | 3,615.9 | | | | 3,703.2 | |

| | | | | | | | |

| | |

Current assets: | | | | | | | | |

Cash and cash equivalents | | | 21.0 | | | | 5.7 | |

Accounts receivable, less allowance for doubtful accounts | | | 83.6 | | | | 174.1 | |

Income tax refunds receivable | | | 18.0 | | | | 19.1 | |

Production fuel, at weighted average cost | | | 66.9 | | | | 80.1 | |

Materials and supplies, at weighted average cost | | | 34.2 | | | | 33.5 | |

Gas stored underground, at weighted average cost | | | 11.7 | | | | 21.8 | |

Regulatory assets | | | 45.9 | | | | 59.0 | |

Derivative assets | | | 20.1 | | | | 12.6 | |

Prepayments and other | | | 22.4 | | | | 22.3 | |

| | | | | | | | |

Total current assets | | | 323.8 | | | | 428.2 | |

| | | | | | | | |

Investments | | | 16.8 | | | | 16.4 | |

| | | | | | | | |

| | |

Other assets: | | | | | | | | |

Regulatory assets | | | 880.4 | | | | 740.6 | |

Deferred charges and other | | | 49.6 | | | | 49.2 | |

| | | | | | | | |

Total other assets | | | 930.0 | | | | 789.8 | |

| | | | | | | | |

| | |

Total assets | | $ | 4,886.5 | | | $ | 4,937.6 | |

| | | | | | | | |

The accompanying Combined Notes to Condensed Consolidated Financial Statements are an integral part of these statements.

8

INTERSTATE POWER AND LIGHT COMPANY

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED) (Continued)

| | | | | | | | |

| | | June 30, | | | December 31, | |

CAPITALIZATION AND LIABILITIES | | 2011 | | | 2010 | |

| | | (in millions, except per share and share amounts) | |

Capitalization: | | | | | | | | |

Interstate Power and Light Company common equity: | | | | | | | | |

Common stock - $2.50 par value - 24,000,000 shares authorized; 13,370,788 shares outstanding | | $ | 33.4 | | | $ | 33.4 | |

Additional paid-in capital | | | 903.4 | | | | 974.0 | |

Retained earnings | | | 358.1 | | | | 382.4 | |

| | | | | | | | |

Total Interstate Power and Light Company common equity | | | 1,294.9 | | | | 1,389.8 | |

Cumulative preferred stock | | | 145.1 | | | | 183.8 | |

| | | | | | | | |

Total equity | | | 1,440.0 | | | | 1,573.6 | |

Long-term debt, net | | | 1,308.8 | | | | 1,308.6 | |

| | | | | | | | |

Total capitalization | | | 2,748.8 | | | | 2,882.2 | |

| | | | | | | | |

| | |

Current liabilities: | | | | | | | | |

Accounts payable | | | 119.8 | | | | 146.0 | |

Accounts payable to associated companies | | | 51.2 | | | | 37.1 | |

Regulatory liabilities | | | 145.0 | | | | 155.8 | |

Accrued taxes | | | 57.4 | | | | 62.4 | |

Accrued interest | | | 22.8 | | | | 22.8 | |

Derivative liabilities | | | 10.9 | | | | 23.0 | |

Other | | | 28.1 | | | | 35.4 | |

| | | | | | | | |

Total current liabilities | | | 435.2 | | | | 482.5 | |

| | | | | | | | |

| | |

Other long-term liabilities and deferred credits: | | | | | | | | |

Deferred income taxes | | | 873.8 | | | | 849.0 | |

Regulatory liabilities | | | 610.3 | | | | 472.1 | |

Pension and other benefit obligations | | | 74.9 | | | | 110.2 | |

Other | | | 143.5 | | | | 141.6 | |

| | | | | | | | |

Total other long-term liabilities and deferred credits | | | 1,702.5 | | | | 1,572.9 | |

| | | | | | | | |

| | |

Total capitalization and liabilities | | $ | 4,886.5 | | | $ | 4,937.6 | |

| | | | | | | | |

The accompanying Combined Notes to Condensed Consolidated Financial Statements are an integral part of these statements.

9

INTERSTATE POWER AND LIGHT COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

| | | | | | | | |

| | | For the Six Months Ended June 30, | |

| | | 2011 | | | 2010 | |

| | | (in millions) | |

Cash flows from operating activities: | | | | | | | | |

Net income | | $ | 28.1 | | | $ | 30.9 | |

Adjustments to reconcile net income to net cash flows from operating activities: | | | | | | | | |

Depreciation and amortization | | | 88.9 | | | | 86.6 | |

Deferred tax expense (benefit) and investment tax credits | | | (41.4 | ) | | | 25.4 | |

Other | | | 15.4 | | | | 6.8 | |

Other changes in assets and liabilities: | | | | | | | | |

Accounts receivable | | | 35.1 | | | | 39.8 | |

Sales of accounts receivable | | | 55.0 | | | | 120.0 | |

Regulatory assets | | | (133.3 | ) | | | (37.7 | ) |

Regulatory liabilities | | | 158.0 | | | | (8.1 | ) |

Deferred income taxes | | | 65.8 | | | | 7.6 | |

Pension and other benefit obligations | | | (35.3 | ) | | | 14.7 | |

Other | | | 8.6 | | | | (0.5 | ) |

| | | | | | | | |

Net cash flows from operating activities | | | 244.9 | | | | 285.5 | |

| | | | | | | | |

| | |

Cash flows used for investing activities: | | | | | | | | |

Utility construction and acquisition expenditures | | | (163.5 | ) | | | (183.0 | ) |

Proceeds from sale of wind project assets to affiliate | | | 115.3 | | | | — | |

Other | | | (11.7 | ) | | | (18.0 | ) |

| | | | | | | | |

Net cash flows used for investing activities | | | (59.9 | ) | | | (201.0 | ) |

| | | | | | | | |

| | |

Cash flows used for financing activities: | | | | | | | | |

Common stock dividends | | | (43.7 | ) | | | — | |

Preferred stock dividends | | | (7.2 | ) | | | (7.7 | ) |

Capital contributions from parent | | | — | | | | 50.0 | |

Repayment of capital to parent | | | (71.0 | ) | | | (58.7 | ) |

Payments to redeem cumulative preferred stock | | | (40.0 | ) | | | — | |

Proceeds from issuance of long-term debt | | | — | | | | 150.0 | |

Net change in short-term borrowings | | | — | | | | (190.0 | ) |

Other | | | (7.8 | ) | | | — | |

| | | | | | | | |

Net cash flows used for financing activities | | | (169.7 | ) | | | (56.4 | ) |

| | | | | | | | |

| | |

Net increase in cash and cash equivalents | | | 15.3 | | | | 28.1 | |

Cash and cash equivalents at beginning of period | | | 5.7 | | | | 0.4 | |

| | | | | | | | |

Cash and cash equivalents at end of period | | $ | 21.0 | | | $ | 28.5 | |

| | | | | | | | |

| | |

Supplemental cash flows information: | | | | | | | | |

Cash paid (refunded) during the period for: | | | | | | | | |

Interest | | $ | 39.0 | | | $ | 39.9 | |

Income taxes, net of refunds | | $ | 15.5 | | | ($ | 22.4 | ) |

Significant noncash investing and financing activities: | | | | | | | | |

Accrued capital expenditures | | $ | 19.1 | | | $ | 24.6 | |

The accompanying Combined Notes to Condensed Consolidated Financial Statements are an integral part of these statements.

10

WISCONSIN POWER AND LIGHT COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED)

| | | | | | | | | | | | | | | | |

| | | For the Three Months | | | For the Six Months | |

| | | Ended June 30, | | | Ended June 30, | |

| | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

| | | (in millions) | |

Operating revenues: | | | | | | | | | | | | | | | | |

Electric utility | | $ | 296.6 | | | $ | 282.5 | | | $ | 586.7 | | | $ | 577.8 | |

Gas utility | | | 28.4 | | | | 28.4 | | | | 125.5 | | | | 124.6 | |

Other | | | 1.8 | | | | 2.0 | | | | 3.1 | | | | 3.4 | |

| | | | | | | | | | | | | | | | |

Total operating revenues | | | 326.8 | | | | 312.9 | | | | 715.3 | | | | 705.8 | |

| | | | | | | | | | | | | | | | |

| | | | |

Operating expenses: | | | | | | | | | | | | | | | | |

Electric production fuel and energy purchases | | | 93.3 | | | | 91.9 | | | | 190.5 | | | | 201.8 | |

Purchased electric capacity | | | 32.6 | | | | 38.7 | | | | 51.1 | | | | 63.4 | |

Electric transmission service | | | 26.1 | | | | 25.2 | | | | 51.8 | | | | 49.9 | |

Cost of gas sold | | | 13.9 | | | | 14.1 | | | | 77.7 | | | | 79.3 | |

Other operation and maintenance | | | 68.4 | | | | 60.3 | | | | 132.3 | | | | 118.5 | |

Depreciation and amortization | | | 36.1 | | | | 19.9 | | | | 69.5 | | | | 49.8 | |

Taxes other than income taxes | | | 10.9 | | | | 10.5 | | | | 22.1 | | | | 21.1 | |

| | | | | | | | | | | | | | | | |

Total operating expenses | | | 281.3 | | | | 260.6 | | | | 595.0 | | | | 583.8 | |

| | | | | | | | | | | | | | | | |

| | | | |

Operating income | | | 45.5 | | | | 52.3 | | | | 120.3 | | | | 122.0 | |

| | | | | | | | | | | | | | | | |

| | | | |

Interest expense and other: | | | | | | | | | | | | | | | | |

Interest expense | | | 20.0 | | | | 18.7 | | | | 40.1 | | | | 38.5 | |

Equity income from unconsolidated investments | | | (9.7 | ) | | | (9.6 | ) | | | (19.1 | ) | | | (19.1 | ) |

Allowance for funds used during construction | | | (1.1 | ) | | | (3.1 | ) | | | (2.8 | ) | | | (5.7 | ) |

Interest income and other | | | — | | | | (0.1 | ) | | | — | | | | (0.1 | ) |

| | | | | | | | | | | | | | | | |

Total interest expense and other | | | 9.2 | | | | 5.9 | | | | 18.2 | | | | 13.6 | |

| | | | | | | | | | | | | | | | |

| | | | |

Income before income taxes | | | 36.3 | | | | 46.4 | | | | 102.1 | | | | 108.4 | |

| | | | | | | | | | | | | | | | |

| | | | |

Income taxes | | | 11.3 | | | | 16.2 | | | | 32.7 | | | | 41.2 | |

| | | | | | | | | | | | | | | | |

| | | | |

Net income | | | 25.0 | | | | 30.2 | | | | 69.4 | | | | 67.2 | |

| | | | | | | | | | | | | | | | |

| | | | |

Preferred dividend requirements | | | 0.9 | | | | 0.9 | | | | 1.7 | | | | 1.7 | |

| | | | | | | | | | | | | | | | |

| | | | |

Earnings available for common stock | | $ | 24.1 | | | $ | 29.3 | | | $ | 67.7 | | | $ | 65.5 | |

| | | | | | | | | | | | | | | | |

Earnings per share data is not disclosed given Alliant Energy Corporation is the sole shareowner of all shares of WPL’s common stock outstanding during the periods presented.

The accompanying Combined Notes to Condensed Consolidated Financial Statements are an integral part of these statements.

11

WISCONSIN POWER AND LIGHT COMPANY

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED)

| | | | | | | | |

| | | June 30, | | | December 31, | |

ASSETS | | 2011 | | | 2010 | |

| | | (in millions) | |

Property, plant and equipment: | | | | | | | | |

Electric plant in service | | $ | 3,432.0 | | | $ | 3,114.6 | |

Gas plant in service | | | 415.3 | | | | 411.4 | |

Other plant in service | | | 224.1 | | | | 219.0 | |

Accumulated depreciation | | | (1,326.6 | ) | | | (1,243.8 | ) |

| | | | | | | | |

Net plant | | | 2,744.8 | | | | 2,501.2 | |

Leased Sheboygan Falls Energy Facility, less accumulated amortization | | | 86.3 | | | | 89.4 | |

Construction work in progress: | | | | | | | | |

Bent Tree - Phase I wind project | | | — | | | | 154.5 | |

Other | | | 98.7 | | | | 81.0 | |

Other, less accumulated depreciation | | | 15.1 | | | | 20.0 | |

| | | | | | | | |

Total property, plant and equipment | | | 2,944.9 | | | | 2,846.1 | |

| | | | | | | | |

| | |

Current assets: | | | | | | | | |

Cash and cash equivalents | | | 13.2 | | | | 0.1 | |

Accounts receivable: | | | | | | | | |

Customer, less allowance for doubtful accounts | | | 74.2 | | | | 84.2 | |

Unbilled utility revenues | | | 72.1 | | | | 82.3 | |

Other, less allowance for doubtful accounts | | | 35.8 | | | | 38.1 | |

Income tax refunds receivable | | | 6.9 | | | | 40.6 | |

Production fuel, at weighted average cost | | | 32.8 | | | | 42.7 | |

Materials and supplies, at weighted average cost | | | 26.3 | | | | 25.7 | |

Gas stored underground, at weighted average cost | | | 12.4 | | | | 26.8 | |

Regulatory assets | | | 33.6 | | | | 50.0 | |

Prepaid gross receipts tax | | | 38.4 | | | | 38.6 | |

Derivative assets | | | 6.5 | | | | 6.5 | |

Prepayments and other | | | 15.0 | | | | 9.4 | |

| | | | | | | | |

Total current assets | | | 367.2 | | | | 445.0 | |

| | | | | | | | |

| | |

Investments: | | | | | | | | |

Investment in American Transmission Company LLC | | | 233.9 | | | | 227.9 | |

Other | | | 20.2 | | | | 20.8 | |

| | | | | | | | |

Total investments | | | 254.1 | | | | 248.7 | |

| | | | | | | | |

| | |

Other assets: | | | | | | | | |

Regulatory assets | | | 258.6 | | | | 292.1 | |

Deferred charges and other | | | 49.6 | | | | 57.7 | |

| | | | | | | | |

Total other assets | | | 308.2 | | | | 349.8 | |

| | | | | | | | |

| | |

Total assets | | $ | 3,874.4 | | | $ | 3,889.6 | |

| | | | | | | | |

The accompanying Combined Notes to Condensed Consolidated Financial Statements are an integral part of these statements.

12

WISCONSIN POWER AND LIGHT COMPANY

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED) (Continued)

| | | | | | | | |

| | | June 30, | | | December 31, | |

CAPITALIZATION AND LIABILITIES | | 2011 | | | 2010 | |

| | | (in millions, except per share and share amounts) | |

Capitalization: | | | | | | | | |

Wisconsin Power and Light Company common equity: | | | | | | | | |

Common stock - $5 par value - 18,000,000 shares authorized; 13,236,601 shares outstanding | | $ | 66.2 | | | $ | 66.2 | |

Additional paid-in capital | | | 869.0 | | | | 844.0 | |

Retained earnings | | | 471.3 | | | | 459.1 | |

| | | | | | | | |

Total Wisconsin Power and Light Company common equity | | | 1,406.5 | | | | 1,369.3 | |

Cumulative preferred stock | | | 60.0 | | | | 60.0 | |

Long-term debt, net | | | 1,082.0 | | | | 1,081.7 | |

| | | | | | | | |

Total capitalization | | | 2,548.5 | | | | 2,511.0 | |

| | | | | | | | |

| | |

Current liabilities: | | | | | | | | |

Commercial paper | | | — | | | | 47.4 | |

Accounts payable | | | 100.0 | | | | 118.5 | |

Accounts payable to associated companies | | | 19.3 | | | | 16.0 | |

Regulatory liabilities | | | 23.8 | | | | 17.9 | |

Accrued interest | | | 21.6 | | | | 21.6 | |

Derivative liabilities | | | 19.4 | | | | 32.3 | |

Other | | | 33.2 | | | | 38.9 | |

| | | | | | | | |

Total current liabilities | | | 217.3 | | | | 292.6 | |

| | | | | | | | |

| | |

Other long-term liabilities and deferred credits: | | | | | | | | |

Deferred income taxes | | | 606.3 | | | | 570.4 | |

Regulatory liabilities | | | 161.0 | | | | 154.3 | |

Capital lease obligations - Sheboygan Falls Energy Facility | | | 105.2 | | | | 107.0 | |

Pension and other benefit obligations | | | 103.7 | | | | 119.2 | |

Other | | | 132.4 | | | | 135.1 | |

| | | | | | | | |

Total long-term liabilities and deferred credits | | | 1,108.6 | | | | 1,086.0 | |

| | | | | | | | |

| | |

Total capitalization and liabilities | | $ | 3,874.4 | | | $ | 3,889.6 | |

| | | | | | | | |

The accompanying Combined Notes to Condensed Consolidated Financial Statements are an integral part of these statements.

13

WISCONSIN POWER AND LIGHT COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

| | | | | | | | |

| | | For the Six Months Ended June 30, | |

| | | 2011 | | | 2010 | |

| | | (in millions) | |

Cash flows from operating activities: | | | | | | | | |

Net income | | $ | 69.4 | | | $ | 67.2 | |

Adjustments to reconcile net income to net cash flows from operating activities: | | | | | | | | |

Depreciation and amortization | | | 69.5 | | | | 49.8 | |

Other amortizations | | | 21.2 | | | | 19.7 | |

Deferred tax expense and investment tax credits | | | 34.3 | | | | 24.1 | |

Equity income from unconsolidated investments | | | (19.1 | ) | | | (19.1 | ) |

Distributions from equity method investments | | | 15.9 | | | | 16.2 | |

Other | | | 8.1 | | | | (3.7 | ) |

Other changes in assets and liabilities: | | | | | | | | |

Accounts receivable | | | 19.9 | | | | 19.8 | |

Income tax refunds receivable | | | 33.7 | | | | (6.2 | ) |

Regulatory assets | | | 23.0 | | | | (18.9 | ) |

Pension and other benefit obligations | | | (15.5 | ) | | | 11.6 | |

Other | | | 10.1 | | | | 6.2 | |

| | | | | | | | |

Net cash flows from operating activities | | | 270.5 | | | | 166.7 | |

| | | | | | | | |

| | |

Cash flows used for investing activities: | | | | | | | | |

Utility construction and acquisition expenditures | | | (174.6 | ) | | | (201.8 | ) |

Other | | | 3.3 | | | | 2.5 | |

| | | | | | | | |

Net cash flows used for investing activities | | | (171.3 | ) | | | (199.3 | ) |

| | | | | | | | |

| | |

Cash flows from (used for) financing activities: | | | | | | | | |

Common stock dividends | | | (55.5 | ) | | | (56.0 | ) |

Preferred stock dividends | | | (1.7 | ) | | | (1.7 | ) |

Capital contributions from parent | | | 25.0 | | | | 50.0 | |

Proceeds from issuance of long-term debt | | | — | | | | 150.0 | |

Payments to retire long-term debt | | | — | | | | (100.0 | ) |

Net change in short-term borrowings | | | (47.4 | ) | | | — | |

Other | | | (6.5 | ) | | | (0.5 | ) |

| | | | | | | | |

Net cash flows from (used for) financing activities | | | (86.1 | ) | | | 41.8 | |

| | | | | | | | |

| | |

Net increase in cash and cash equivalents | | | 13.1 | | | | 9.2 | |

Cash and cash equivalents at beginning of period | | | 0.1 | | | | 18.5 | |

| | | | | | | | |

Cash and cash equivalents at end of period | | $ | 13.2 | | | $ | 27.7 | |

| | | | | | | | |

| | |

Supplemental cash flows information: | | | | | | | | |

Cash paid (refunded) during the period for: | | | | | | | | |

Interest | | $ | 40.0 | | | $ | 41.1 | |

Income taxes, net of refunds | | ($ | 35.8 | ) | | $ | 21.7 | |

Significant noncash investing and financing activities: | | | | | | | | |

Accrued capital expenditures | | $ | 16.9 | | | $ | 21.7 | |

The accompanying Combined Notes to Condensed Consolidated Financial Statements are an integral part of these statements.

14

ALLIANT ENERGY CORPORATION

INTERSTATE POWER AND LIGHT COMPANY

WISCONSIN POWER AND LIGHT COMPANY

COMBINED NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(1) SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

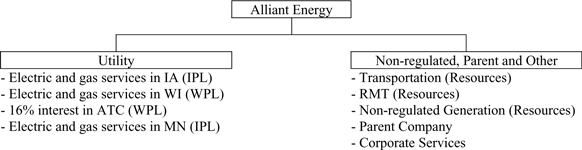

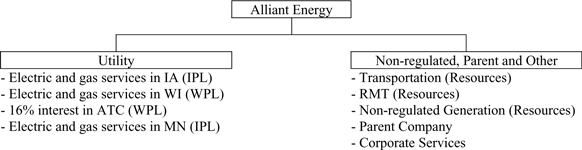

(a) General -The interim condensed consolidated financial statements included herein have been prepared by Alliant Energy, IPL and WPL, without audit, pursuant to the rules and regulations of the Securities and Exchange Commission. Accordingly, certain information and note disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the U.S. (GAAP) have been condensed or omitted, although management believes that the disclosures are adequate to make the information presented not misleading. Alliant Energy’s condensed consolidated financial statements include the accounts of Alliant Energy and its consolidated subsidiaries (including IPL, WPL, Resources and Alliant Energy Corporate Services, Inc. (Corporate Services)). IPL’s condensed consolidated financial statements include the accounts of IPL and its consolidated subsidiary. WPL’s condensed consolidated financial statements include the accounts of WPL and its consolidated subsidiary. These financial statements should be read in conjunction with the financial statements and the notes thereto included in Alliant Energy’s, IPL’s and WPL’s latest combined Annual Report on Form 10-K.

In the opinion of management, all adjustments, which unless otherwise noted are normal and recurring in nature, necessary for a fair presentation of the condensed consolidated results of operations for the three and six months ended June 30, 2011 and 2010, the condensed consolidated financial position at June 30, 2011 and Dec. 31, 2010, and the condensed consolidated statements of cash flows for the six months ended June 30, 2011 and 2010 have been made. Results for the six months ended June 30, 2011 are not necessarily indicative of results that may be expected for the year ending Dec. 31, 2011. A change in management’s estimates or assumptions could have a material impact on Alliant Energy’s, IPL’s and WPL’s respective financial condition and results of operations during the period in which such change occurred. Certain prior period amounts have been reclassified on a basis consistent with the current period financial statement presentation. Unless otherwise noted, the notes herein have been revised to exclude discontinued operations for all periods presented.

(b) Regulatory Assets and Regulatory Liabilities -

Regulatory assets were comprised of the following items (in millions):

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Alliant Energy | | | IPL | | | WPL | |

| | | June 30, | | | Dec. 31, | | | June 30, | | | Dec. 31, | | | June 30, | | | Dec. 31, | |

| | | 2011 | | | 2010 | | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

Tax-related | | $ | 580.5 | | | $ | 395.9 | | | $ | 561.3 | | | $ | 377.2 | | | $ | 19.2 | | | $ | 18.7 | |

Pension and other postretirement benefits costs | | | 354.9 | | | | 418.9 | | | | 176.6 | | | | 217.4 | | | | 178.3 | | | | 201.5 | |

Asset retirement obligations | | | 54.4 | | | | 49.6 | | | | 36.2 | | | | 33.2 | | | | 18.2 | | | | 16.4 | |

Environmental-related costs | | | 40.0 | | | | 38.4 | | | | 33.1 | | | | 32.1 | | | | 6.9 | | | | 6.3 | |

Derivatives | | | 38.4 | | | | 66.8 | | | | 11.5 | | | | 24.0 | | | | 26.9 | | | | 42.8 | |

IPL’s electric transmission service costs | | | 29.1 | | | | 33.3 | | | | 29.1 | | | | 33.3 | | | | — | | | | — | |

Proposed base-load projects costs | | | 25.1 | | | | 27.3 | | | | 17.8 | | | | 18.9 | | | | 7.3 | | | | 8.4 | |

Debt redemption costs | | | 22.7 | | | | 23.7 | | | | 15.8 | | | | 16.5 | | | | 6.9 | | | | 7.2 | |

Other | | | 73.4 | | | | 87.8 | | | | 44.9 | | | | 47.0 | | | | 28.5 | | | | 40.8 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | $ | 1,218.5 | | | $ | 1,141.7 | | | $ | 926.3 | | | $ | 799.6 | | | $ | 292.2 | | | $ | 342.1 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

15

Regulatory liabilities were comprised of the following items (in millions):

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Alliant Energy | | | IPL | | | WPL | |

| | | June 30, | | | Dec. 31, | | | June 30, | | | Dec. 31, | | | June 30, | | | Dec. 31, | |

| | | 2011 | | | 2010 | | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

Cost of removal obligations | | $ | 401.9 | | | $ | 395.4 | | | $ | 258.8 | | | $ | 257.6 | | | $ | 143.1 | | | $ | 137.8 | |

IPL’s customer cost management plan | | | 341.3 | | | | 193.5 | | | | 341.3 | | | | 193.5 | | | | — | | | | — | |

IPL’s electric transmission assets sale | | | 59.9 | | | | 71.8 | | | | 59.9 | | | | 71.8 | | | | — | | | | — | |

Emission allowances | | | 28.3 | | | | 34.4 | | | | 28.3 | | | | 33.9 | | | | — | | | | 0.5 | |

Commodity cost recovery | | | 23.1 | | | | 12.7 | | | | 20.0 | | | | 7.5 | | | | 3.1 | | | | 5.2 | |

Energy conservation cost recovery | | | 20.4 | | | | 8.6 | | | | 2.5 | | | | 1.7 | | | | 17.9 | | | | 6.9 | |

IPL’s Duane Arnold Energy Center (DAEC) sale | | | 17.1 | | | | 42.3 | | | | 17.1 | | | | 42.3 | | | | — | | | | — | |

Tax-related (excl. customer cost management plan) | | | 15.0 | | | | 16.8 | | | | 3.8 | | | | 4.6 | | | | 11.2 | | | | 12.2 | |

Other | | | 33.1 | | | | 24.6 | | | | 23.6 | | | | 15.0 | | | | 9.5 | | | | 9.6 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | $ | 940.1 | | | $ | 800.1 | | | $ | 755.3 | | | $ | 627.9 | | | $ | 184.8 | | | $ | 172.2 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Tax-related and IPL’s customer cost management plan -Alliant Energy’s and IPL’s “Tax-related” regulatory assets and “IPL’s customer cost management plan” regulatory liabilities in the above tables increased significantly in the first half of 2011 due to the impacts of a tax accounting method change for mixed service costs. Refer to Note 4 for additional details of the mixed service costs tax accounting method change.

Pension and other postretirement benefits costs -In May 2011, Alliant Energy, IPL and WPL amended their defined benefit postretirement health care plans, which required a remeasurement of these plans. The remeasurement caused changes in previously unrecognized net actuarial losses and prior service credits for the plans that decreased “Regulatory assets” on Alliant Energy’s, IPL’s and WPL’s Condensed Consolidated Balance Sheets by $53 million, $35 million and $18 million, respectively, in the second quarter of 2011. Refer to Note 5(a) for additional details of the plan amendment and remeasurement.

Derivatives -In accordance with IPL’s and WPL’s fuel and natural gas recovery mechanisms, prudently incurred costs from derivative instruments are recovered from customers in the future after any losses are realized and gains from derivative instruments are refunded to customers in the future after any gains are realized. Based on these recovery mechanisms, the changes in the fair value of derivative liabilities/assets resulted in comparable changes to regulatory assets/liabilities on Alliant Energy’s, IPL’s and WPL’s Condensed Consolidated Balance Sheets during the first half of 2011. Refer to Note 10 for additional details of Alliant Energy’s, IPL’s and WPL’s derivative assets and liabilities.

Proposed base-load projects costs - The MPUC’s June 2011 oral decision related to IPL’s 2009 test year Minnesota retail electric rate case authorized IPL to recover $2 million of previously incurred plant cancellation costs for its proposed base-load project referred to as Sutherland #4. As a result, Alliant Energy and IPL recorded a $2 million increase to “Regulatory assets” on their Condensed Consolidated Balance Sheets and a $2 million credit to “Utility - other operation and maintenance” on their Condensed Consolidated Statements of Income in the second quarter of 2011.

IPL’s Whispering Willow - East wind project - In accordance with the Iowa Utilities Board’s (IUB’s) January 2011 order related to IPL’s 2009 test year Iowa retail electric rate case, Alliant Energy and IPL utilized $23 million of “IPL’s DAEC sale” regulatory liability and $3 million of “IPL’s electric transmission assets sale” regulatory liability in the first half of 2011 to offset IPL’s Whispering Willow - East wind project plant in service balance. As a result, Alliant Energy and IPL recorded reductions of $26 million in both “Electric plant in service” and “Regulatory liabilities” on their Condensed Consolidated Balance Sheets in the first half of 2011.

IPL’s electric transmission assets sale -Based on the MPUC’s June 2011 oral decision related to IPL’s 2009 test year Minnesota retail electric rate case, IPL currently expects to refund a higher amount of the gain realized from the sale of its electric transmission assets in 2007 to its Minnesota retail electric customers than previously estimated. As a result, Alliant Energy and IPL recorded a $5 million increase to “Regulatory liabilities” on their Condensed Consolidated Balance Sheets and a $5 million charge to “Utility - other operation and maintenance” on their Condensed Consolidated Statements of Income in the second quarter of 2011 based on an estimate of the additional amount that is probable of being refunded. This amount is subject to change pending the MPUC’s final order for the rate case, which is expected to be issued in the third quarter of 2011, and any subsequent proceeding if IPL disputes the MPUC’s decision.

16

Emission allowances -Refer to Note 13 for discussion of potential reductions to regulatory liabilities related to emission allowances in the third quarter of 2011 resulting from the EPA’s issuance of the Cross-State Air Pollution Rule (CSAPR) in July 2011.

Energy conservation cost recovery -WPL collects revenues from its customers to offset certain expenditures incurred by WPL as part of participating in conservation programs, including state mandated programs and WPL’s Shared Savings program. Differences between forecasted costs used to set rates and actual costs for these programs are deferred as a regulatory asset or regulatory liability. In the first half of 2011, WPL’s forecasted costs used to set current rates exceeded actual costs for these programs, resulting in an $11 million increase to Alliant Energy’s and WPL’s “Energy conservation cost recovery” regulatory liability.

Other -Based on an assessment completed in the second quarter of 2011, Alliant Energy, IPL and WPL recognized impairment charges of $6 million, $1 million and $5 million, respectively, for regulatory assets that are no longer probable of future recovery. The regulatory asset impairment charges were recorded by Alliant Energy, IPL and WPL as reductions in “Regulatory assets” on their Condensed Consolidated Balance Sheets and charges to “Utility - other operation and maintenance” on their Condensed Consolidated Statements of Income in the second quarter of 2011.

(c) Utility Property, Plant and Equipment -

Franklin County Wind Project -In 2008, Alliant Energy entered into a master supply agreement with Vestas-American Wind Technology, Inc. (Vestas) to purchase 500 MW of wind turbine generator sets and related equipment. Alliant Energy utilized 400 MW of these wind turbine generator sets and related equipment to construct IPL’s Whispering Willow - East and WPL’s Bent Tree - Phase I wind projects. In the second quarter of 2011, Alliant Energy decided to utilize the remaining 100 MW of wind turbine generator sets and related equipment at Resources to build a non-regulated 100 MW wind project in Iowa, referred to as the Franklin County wind project. In the second quarter of 2011, IPL sold Resources assets for this wind project for $115 million, which represented IPL’s book value for progress payments to-date for the 100 MW of wind turbine generator sets and related equipment and land rights in Franklin County, Iowa. In addition, Resources assumed the remaining progress payments to Vestas for the 100 MW of wind turbine generator sets and related equipment. The sale of these wind project assets by IPL to Resources resulted in a decrease in “Utility - other property, plant and equipment” on Alliant Energy’s and IPL’s Condensed Consolidated Balance Sheets and an increase in “Non-regulated and other - Non-regulated Generation property, plant and equipment” on Alliant Energy’s Condensed Consolidated Balance Sheet in the first half of 2011. The proceeds received by IPL were recorded in investing activities in IPL’s Condensed Consolidated Statement of Cash Flows in the first half of 2011. IPL utilized the proceeds to reduce outstanding commercial paper and sales of accounts receivable, to invest in various short-term assets, and for general working capital purposes.

WPL’s Bent Tree - Phase I Wind Project -In 2009, WPL received approval from the MPUC and PSCW to construct the Bent Tree - Phase I wind project, which began generating electricity in late 2010. WPL incurred capitalized expenditures of $433 million and recognized $14 million of allowance for funds used during construction (AFUDC) for the wind project. In 2010, WPL placed $265 million of the wind project into service. In the first half of 2011, WPL placed the remaining portion of the wind project into service, which resulted in a transfer of $182 million of capitalized project costs from “Construction work in progress - Bent Tree - Phase I wind project” to “Electric plant in service” on Alliant Energy’s and WPL’s Condensed Consolidated Balance Sheets in the first half of 2011. The capitalized costs for the wind project are being depreciated using a straight-line method of depreciation over a 30-year period.

IPL’s Whispering Willow - East Wind Project -In June 2011, IPL received an oral decision from the MPUC approving a temporary recovery rate for the Minnesota retail portion of its Whispering Willow - East wind project construction costs. In its oral decision, the MPUC did not conclude on the prudence of these project costs. The prudence of these project costs and the final recovery rate for these costs will be addressed in a separate proceeding that is expected to be completed in 2012. The initial recovery rate approved by the MPUC is below the amount required by IPL to recover the Minnesota retail portion of its total project costs. Based on its interpretation of the oral decision, IPL currently believes that it is probable it will not be allowed to recover all of the Minnesota retail portion of its project costs. IPL currently believes the most likely outcome of the final rate proceeding will result in the MPUC effectively disallowing recovery of approximately $8 million of project costs out of a total of approximately $30 million of project costs allocated to the Minnesota retail jurisdiction. This amount is subject to change until the MPUC determines the final recovery rate for these project costs. As a result, IPL recognized an $8 million impairment related to this probable disallowance, which was recorded as a reduction to “Electric plant in service” on Alliant Energy’s and IPL’s Condensed Consolidated Balance Sheets and a charge to “Utility - other operation and maintenance” in Alliant Energy’s and IPL’s Consolidated Statements of Income in the second quarter of 2011.

17

WPL’s Green Lake and Fond du Lac Counties Wind Site -In 2009, WPL purchased development rights to an approximate 100 MW wind site in Green Lake and Fond du Lac counties in Wisconsin. Due to events in the first quarter of 2011 resulting in uncertainty regarding wind siting requirements in Wisconsin and increased risks with permitting this wind site, WPL determined it would be difficult to effectively use the site for wind development. As a result, WPL recognized a $5 million impairment in the first quarter of 2011 for the amount of capitalized costs incurred for this site. The impairment was recorded as a reduction to “Utility - other property, plant and equipment” on Alliant Energy’s and WPL’s Condensed Consolidated Balance Sheets and a charge to “Utility - other operation and maintenance” in Alliant Energy’s and WPL’s Condensed Consolidated Statements of Income in the first half of 2011.

WPL’s Edgewater Unit 5 Purchase -In March 2011, WPL purchased Wisconsin Electric Power Company’s (WEPCO’s) 25% ownership interest in Edgewater Unit 5 for $38 million. The $38 million was equal to WEPCO’s net book value of the facility and related assets at the time of the purchase. WPL now owns 100% of Edgewater Unit 5. As of the closing date, the carrying values of the assets purchased were as follows (in millions):

| | | | |

Electric plant in service | | $ | 84 | |

Accumulated depreciation | | | (50 | ) |

Construction work in progress | | | 2 | |

Production fuel | | | 1 | |

Materials and supplies | | | 1 | |

| | | | |

| | $ | 38 | |

| | | | |

(d) Comprehensive Income -

Alliant Energy’s comprehensive income and the components of other comprehensive income (loss), net of taxes, for the three and six months ended June 30 were as follows (in millions):

| | | | | | | | | | | | | | | | |

| | | Three Months | | | Six Months | |

| | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

Net income | | $ | 55.3 | | | $ | 52.5 | | | $ | 135.0 | | | $ | 100.6 | |

Other comprehensive income (loss), net of tax: | | | | | | | | | | | | | | | | |

Unrealized losses on securities, net of tax | | | — | | | | (0.2 | ) | | | — | | | | (0.2 | ) |

Pension and other postretirement benefits plans adjustments, net of tax | | | 0.8 | | | | (0.7 | ) | | | 0.8 | | | | (0.7 | ) |

| | | | | | | | | | | | | | | | |

Total other comprehensive income (loss) | | | 0.8 | | | | (0.9 | ) | | | 0.8 | | | | (0.9 | ) |

| | | | | | | | | | | | | | | | |

Comprehensive income | | | 56.1 | | | | 51.6 | | | | 135.8 | | | | 99.7 | |

Preferred dividend requirements of subsidiaries | | | (4.2 | ) | | | (4.7 | ) | | | (10.4 | ) | | | (9.4 | ) |

| | | | | | | | | | | | | | | | |

Comprehensive income attributable to Alliant Energy common shareowners | | $ | 51.9 | | | $ | 46.9 | | | $ | 125.4 | | | $ | 90.3 | |

| | | | | | | | | | | | | | | | |

For the three and six months ended June 30, 2011 and 2010, IPL and WPL had no other comprehensive income; therefore their comprehensive income was equal to their earnings available for common stock for such periods.

(2) UTILITY RATE CASES

IPL’s Minnesota Retail Electric Rate Case (2009 Test Year) -In May 2010, IPL filed a request with the MPUC to increase annual rates for its Minnesota retail electric customers by $15 million, or approximately 22%. The request was based on a 2009 historical test year as adjusted for certain known and measurable items at the time of the filing. The key drivers for the filing include recovery of investments in the Whispering Willow - East wind project and emission control projects at Lansing Unit 4, and recovery of increased electric transmission service costs. In conjunction with the filing, IPL implemented an interim retail rate increase of $14 million, on an annual basis, effective July 6, 2010. The interim retail rate increase was approved by the MPUC and is subject to refund pending determination of final rates from the request. In June 2011, IPL received an oral decision from the MPUC that, based on IPL’s interpretation, authorizes an annual retail electric rate increase of approximately $11 million, or approximately 18%. Because the final rate increase level is expected to be below the interim retail rate increase implemented in July 2010, IPL expects to refund to its Minnesota retail electric customers a portion of the interim rates collected. As of June 30, 2011, Alliant Energy and IPL reserved $3 million, including interest, for refunds anticipated to be paid to IPL’s Minnesota retail electric customers in 2011. In the first half of 2011, Alliant Energy and IPL recorded $6 million in electric revenues from IPL’s Minnesota retail electric customers related to the interim retail electric rate increase. Refer to Note 1(b) for discussion of changes to regulatory assets and regulatory liabilities in the second quarter

18

of 2011 based on the MPUC’s oral decisions to provide IPL’s retail electric customers in Minnesota additional refunds from the gain on the sale of electric transmission assets in 2007 and to provide IPL recovery of $2 million of previously incurred costs for Sutherland #4. Refer to Note 1(c) for discussion of an impairment recognized in the second quarter of 2011 based on the MPUC’s oral decision regarding the recovery of Whispering Willow - East wind project costs.

IPL’s Iowa Retail Electric Rate Case (2009 Test Year) -In March 2010, IPL filed a request with the IUB to increase annual rates for its Iowa retail electric customers. The request was based on a 2009 historical test year as adjusted for certain known and measurable changes occurring up to 12 months after the commencement of the proceeding. The key drivers for the filing included recovery of investments in the Whispering Willow - East wind project and emission control projects at Lansing Unit 4, and recovery of increased electric transmission service costs. In conjunction with the filing, IPL implemented an interim retail electric rate increase of $119 million, on an annual basis, effective March 20, 2010. In the first half of 2011 and 2010, Alliant Energy and IPL recorded $54 million and $31 million, respectively, in electric revenues from IPL’s Iowa retail electric customers related to the retail electric rate increase and the reserve for rate refund discussed below. In February 2011, IPL received an order from the IUB authorizing a final annual retail electric rate increase of $114 million, or approximately 10%. As of June 30, 2011, Alliant Energy and IPL reserved $4 million, including interest, for remaining refunds anticipated to be paid to IPL’s retail electric customers in Iowa in the second half of 2011 in accordance with the IUB’s February 2011 order.

WPL’s Retail Fuel-related Rate Case (2012 Test Year) - In May 2011, WPL filed a request with the PSCW to increase annual retail electric rates by $13 million to recover anticipated increases in retail fuel-related costs in 2012 due to higher purchased power energy costs and emission compliance costs. In July 2011, the EPA issued the CSAPR, which requires sulfur dioxide (SO2) and nitrogen oxide (NOx) emissions reductions from IPL’s and WPL’s fossil-fueled electric generating units (EGUs) with greater than 25 MW of capacity located in Iowa, Minnesota and Wisconsin beginning in 2012. While the net impact of CSAPR to WPL’s 2012 projected retail fuel-related costs is not known at this time, WPL anticipates that the emission compliance costs will increase from the initial estimates included in its May 2011 filing. WPL currently plans to file an updated 2012 fuel-related rate case request with the PSCW in the third quarter of 2011 after further evaluation of the CSAPR. Any rate changes granted from this request are expected to be effective on Jan. 1, 2012.

WPL’s Retail Electric Rate Case (2011 Test Year) - In April 2010, WPL filed a request with the PSCW to reopen the rate order for its 2010 test year to increase annual retail electric rates for 2011. The request was based on a forward-looking test period that included 2011. The key drivers for the filing included recovery of investments in WPL’s Bent Tree - Phase I wind project and expiring deferral credits, partially offset by lower variable fuel expenses. In December 2010, WPL received an order from the PSCW authorizing an annual retail electric rate increase of $8 million, or approximately 1%, effective Jan. 1, 2011. This $8 million increase in annual rates effective Jan. 1, 2011, combined with the termination of the $9 million interim fuel-related rate increase effective Dec. 31, 2010, resulted in a net $1 million decrease in annual electric retail rates charged to customers effective January 2011. Refer to “WPL’s Retail Fuel-related Rate Case (2010 Test Year)” below for additional details of the interim fuel-related rate increase implemented in 2010 and a $5 million reduction to the 2011 test year base rate increase for refunds owed to electric retail customers related to interim fuel cost collections in 2010.

WPL’s Retail Fuel-related Rate Case (2010 Test Year) - In April 2010, WPL filed a request with the PSCW to increase annual retail electric rates by $9 million to recover anticipated increased electric production fuel and energy purchases (fuel-related costs) in 2010. Actual fuel-related costs through March 2010, combined with projections of continued higher fuel-related costs for the remainder of 2010, significantly exceeded the amounts being recovered in retail electric rates at the time of the filing. WPL received approval from the PSCW to implement an interim rate increase of $9 million, on an annual basis, effective in June 2010. Updated annual 2010 fuel-related costs during the proceeding resulted in WPL no longer qualifying for a fuel-related rate increase for 2010. In December 2010, the PSCW issued an order authorizing no increase in retail electric rates in 2010 related to fuel-related costs and required the interim rate increase to terminate at the end of 2010. The order also authorized WPL to use $5 million of the interim fuel rates collected in 2010 as a reduction to the 2011 test year base rate increase. As of June 30, 2011, Alliant Energy’s and WPL’s remaining reserves were $3 million, including interest, for interim fuel cost collections in 2010.

Refer to Note 1(b) for discussion of various other rate matters.

(3) RECEIVABLES

Sales of Accounts Receivable - Effective April 1, 2010, IPL entered into an amended and restated Receivables Purchase and Sale Agreement (Agreement) whereby it may sell its customer accounts receivables, unbilled revenues and certain other accounts receivables to a third-party financial institution through wholly-owned and consolidated special purpose entities. In

19