Exhibit 3

GREENLIGHT'S ORIGINAL TERM SHEET PROVIDED TO GM:

SUMMARY OF TERMS FOR

DIVIDEND SHARES OF

GENERAL MOTORS COMPANY

Thefollowingis asummary ofterms andconditionsfortheissuanceofsharesoftheDividend Shares.

| Issuer: | GeneralMotorsCompany(NYSE:GM)(the “Issuer”). |

| Issue: | Dividend ShareCommonStock(the “Dividend Shares”). |

| Issuance: | OneDividend Shareto beissuedvia dividendforeachshare of existingCommon Stock(the “CapitalAppreciation Shares”).TheCapitalAppreciation Shareswill havethe samerights and privilegesasthe currently outstanding sharesofCommon Stock andmay pay dividends as described below. |

| | Dividend Shares are commonstock(not preferred),andtheboardofdirectorsoftheIssuer(the “Board”)will oweitsfiduciary dutiesto holders of boththeCapitalAppreciation Shares andtheDividend Shares. |

| Voting: | Excepttothe extentrequired byDelawarelaw or assetforth below,theCapitalAppreciation Shares andDividend Shareswillvotetogether as asingle class on allmatterssubmittedtostockholders. WhenvotingtogetherwiththeCapitalAppreciation Shares, eachDividend Sharewill possess 1/10 of avote pershare, and eachCapitalAppreciation Sharewill continuetohave onevote per share. |

| Dividends: | TheDividend Sharesshall be entitledto a quarterly dividend,payablein cash,when andif declared bytheBoard,in an amount equalto $0.38(the “Dividend ShareDividend”). While an aggregate amount equalto atleasttheDividend ShareDividendfor each quarter sincetheissuance oftheDividend Shares has not beenpaidinrespectof eachDividendShare, no dividendsordistributionsmaybe paidinrespect ofCapitalAppreciation Shares, andtheIssuermay not conduct any discretionaryrepurchaseofCapitalAppreciation Shares(otherthanasrequired pursuanttotheterms of anybonafide employee benefit plan).If dividends ontheDividend Shares are current,theBoardmay declare and pay dividendsormake optionalrepurchasesinrespectofCapitalAppreciation Shares.In addition,inthe exerciseofitsfiduciaryduties,theBoardmaymake optionalrepurchasesofDividend Shares. |

| Change ofControl: | In connectionwith aChange ofControl,theDividend Shareswillvote as aseparate classto approvesuchChange ofControlandthe consideration offeredtotheDividend Sharesin connectiontherewith. |

| | “ChangeofControl”means anoccurrencewheretheIssuer(orany ofits subsidiaries)sell,convey,license,leaseor otherwise disposeofallorsubstantiallyall ofthe assets or businessoftheIssueranditssubsidiaries(taken as awhole) ormergewith orinto orconsolidatewith any other corporation,limitedliability company or other entity(otherthan awholly-ownedsubsidiary oftheIssuer), orthereis anytransactionor series ofrelatedtransactionsinwhichin excess of 50% oftheIssuer’s outstandingvoting securities aretransferredto one person orgroup ofpersons,in each case,tothe extentthat such occurrenceortransactionissubmittedtostockholders. |

| Liquidation: | Upon aliquidation(otherthan aChange ofControl) oftheIssuer, paymentwillbemade equally(on a per share basis)totheCapitalAppreciation Shares andtheDividend Shares.To accountforthese payments beingmade on a pershare basis,theDividend Shareswillbesubjectto adjustment as determined bytheBoardinthe exerciseofitsfiduciary dutiesfor stock splits, combinations, share dividendsand othersimilartransactions. |

| Listing: | TheCapitalAppreciationShareswill continueto belisted ontheNYSE andTSX, andtheDividend Shareswillbelisted ontheNYSE. |

| Registration: | WhiletheDividend Shareswill beissued pursuanttoan exemptionfromregistration underthe SecuritiesActof 1933,theywill beregisteredpursuanttothe SecuritiesExchangeAct of1934. |

| Non-Binding: | Exceptwith respecttothis provision,thisTerm Sheetisintended solely asan outlineof generalterms and asthe basisforfurtherdiscussion.Itis notintendedto be, and does not constitute, alegally binding obligation or commitmenton behalfofanyperson. This Term Sheetdoes not create andis notintendedto create adutytonegotiate,in goodfaith orotherwise,towards a binding contract andmay notberelied upon asthe basisfor a contract by estoppelorotherwise. This Term Sheetmay bewithdrawn at anytimeforanyreason or noreason.Nolegally binding obligation or commitmentwill becreated,implied orinferred hereby. This Term Sheetdoes not constitute an offertosell or asolicitation ofan offerto buy securities. |

TERM SHEET GM PURPORTEDLY PRESENTED TO THE CREDIT RATING AGENCIES:

STRICTLYCONFIDENTIAL

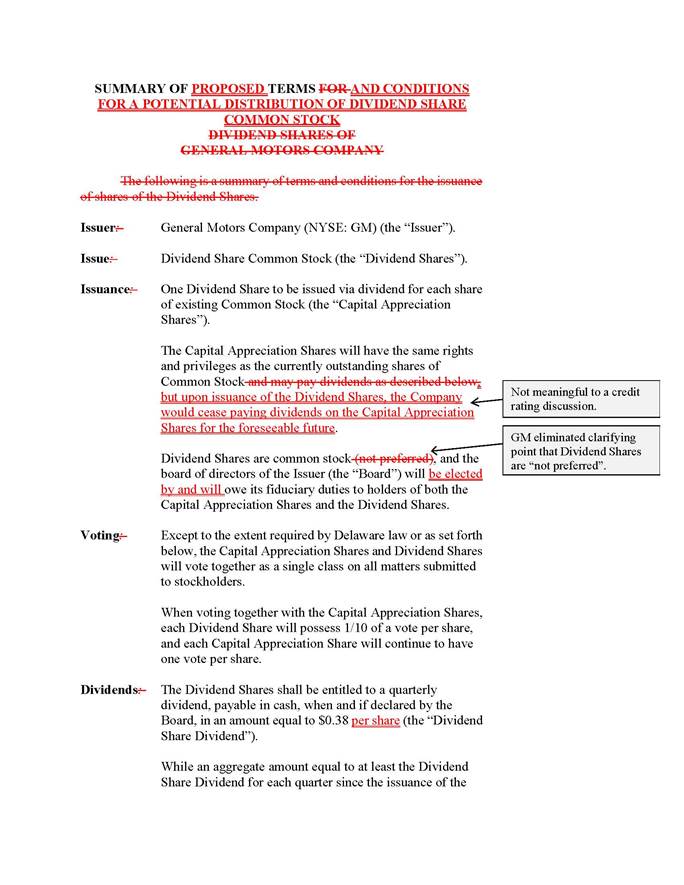

SUMMARYOFPROPOSED TERMS ANDCONDITIONSFOR A POTENTIAL DISTRIBUTION OF DIVIDEND SHARE COMMONSTOCK

| Issuer | General Motors Company(NYSE: GM)(the“Issuer”). |

| Issue | Dividend Share CommonStock(the“Dividend Shares”). |

| Issuance | One Dividend Share to be issued via dividendforeach share ofexisting CommonStock(the“Capital AppreciationShares”). The Capital AppreciationShares will have the samerightsand privileges as thecurrently outstanding shares of CommonStock, but uponissuance of theDividendShares, the Company wouldcease paying dividends on the Capital AppreciationShares for theforeseeablefuture. Dividend Sharesarecommon stock,and the board of directorsof theIssuer(the“Board”) will beelectedbyand will owe its fiduciary duties to holders ofboth the Capital AppreciationShares and theDividendShares. |

| Voting | Exceptto theextentrequiredby Delaware law oras setforth below, the Capital AppreciationShares and Dividend Shares will vote togetheras a singleclass onall matters submitted tostockholders. When voting togetherwiththe Capital AppreciationShares, each DividendShare will possess 1/10 of a vote per share,andeach Capital AppreciationShare willcontinue to have one vote per share. |

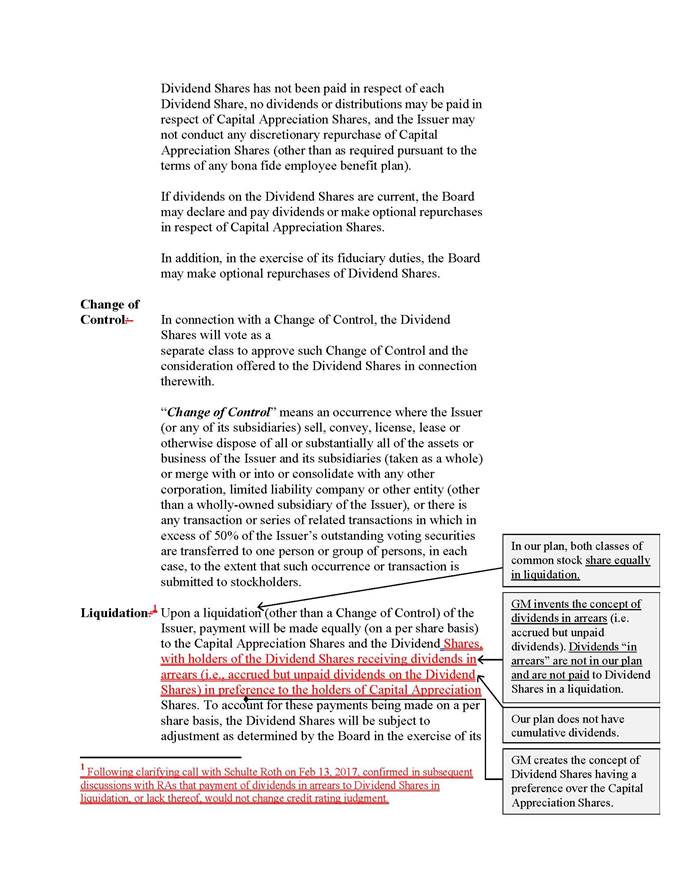

| Dividends | The Dividend Shares shall beentitled to a quarterly dividend, payable incash, whenand ifdeclaredbytheBoard, inanamountequalto $0.38 per share (the“Dividend Share Dividend”). Whileanaggregateamount equaltoatleasttheDividendShare Dividendforeach quarter since the issuance of the Dividend Shares has notbeen paidinrespect ofeach DividendShare, no dividends or distributions may bepaidinrespect of Capital AppreciationShares, and theIssuer may notconduct any discretionary repurchaseof Capital AppreciationShares (other thanasrequired pursuantto the terms ofany bona fideemployeebenefit plan). If dividends on the Dividend Sharesarecurrent,theBoard may declareand pay dividends or make optional repurchases inrespect ofCapital AppreciationShares. Inaddition,in theexercise of its fiduciary duties,theBoard may make optional repurchases of DividendShares. |

Change of

Control | Inconnection with a Changeof Control, the Dividend Shares will voteas a separateclass to approve such Change of Controland theconsideration offered to theDividendShares inconnection therewith. “Change of Control” meansan occurrence where theIssuer (oranyof itssubsidiaries) sell,convey, license, lease or otherwise dispose ofall or substantiallyall of theassets or business of the Issuerand its subsidiaries (takenas a whole)or merge with or into orconsolidate withany othercorporation, limited liabilitycompany or otherentity(other than a wholly-owned subsidiary of the Issuer), or there isany transaction or series ofrelatedtransactions in which inexcess of 50% of the Issuer’s outstanding voting securitiesare transferred to one person or group of persons, ineachcase, to theextent that such occurrence or transaction is submitted to stockholders. |

| Liquidation1 | Upon a liquidation(other than a Changeof Control) of theIssuer, payment will bemadeequally(on a pershare basis) to the Capital AppreciationSharesand theDividendShares, with holders of the Dividend Sharesreceiving dividends inarrears (i.e.,accrued but unpaid dividends on the Dividend Shares) in preference tothe holders of Capital AppreciationShares. Toaccount for these payments beingmade on aper share basis, the DividendShareswill be subject toadjustmentas determined by the Board in theexercise of itsfiduciary duties for stocksplits,combinations, share dividendsand other similar transactions. |

| Ranking1 | The Dividend Shares willrankequallyamongstthemselves in allrespectsand rank senior to the Capital AppreciationShares withrespectto dividend rightsand rankpari passu with anyclass or series of stock orotherequity securities that is not expressly made senior or subordinated to theDividendShares as to the payment of distributions. The DividendShares willrank junior totheIssuer’s existingand futureindebtedness(and junior to anyclass or series of stock orequitysecurities, including preferred shares,expresslymade senior tothe Dividend Shares). |

Restrictions

on Issuances of OtherShare Classes | None |

Conversion

Rights | None |

Redemption

Rights | No specialredemption rights. |

Preemptive

Rights | No special preemptiverights wouldattach tothe Dividend Shares. |

1Following clarifying callwith SchulteRothon Feb13,2017, confirmedinsubsequentdiscussionswithRAs thatpaymentofdividendsin arrears to DividendSharesin liquidation,or lack thereof,wouldnotchange creditratingjudgment.

Financial or

Other Covenants | None |

| Listing | The Capital AppreciationShares willcontinue to be listed on the NYSEand such otherexchangesas theymaycurrently be listed,and theDividendShares will be listed on the NYSE. |

| Registration | While theDividendShares will be issued pursuant toanexemption from registration under theSecuritiesAct of 1933, they will beregistered pursuantto the Securities Exchange Act of 1934. |

ANNOTATED COMPARISON OF THE GREENLIGHT AND GM TERM SHEETS: