UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| INVESTMENT COMPANY ACT FILE NUMBER: | | 811-09237 |

| | | |

| EXACT NAME OF REGISTRANT AS SPECIFIED IN CHARTER: | | Calamos Advisors Trust |

| | | |

| ADDRESS OF PRINCIPAL EXECUTIVE OFFICES: | | 2020 Calamos Court |

| | | Naperville, Illinois 60563-2787 |

| | | |

| NAME AND ADDRESS OF AGENT FOR SERVICE: | | John P Calamos, Sr., Founder, Chairman and

Global Chief Investment Officer |

| | | Calamos Advisors LLC |

| | | 2020 Calamos Court |

| | | Naperville, Illinois 60563-2787 |

| | | |

| REGISTRANT’S TELEPHONE NUMBER, INCLUDING AREA CODE: | | (630) 245-7200 |

| | | |

| DATE OF FISCAL YEAR END: | | December 31, 2024 |

| | | |

| DATE OF REPORTING PERIOD: | | January 1, 2024 through December 31, 2024 |

ITEM 1. REPORTS TO SHAREHOLDERS.

TABLE OF CONTENTS

Calamos Growth and Income Portfolio

Annual Shareholder Report - December 31, 2024

This annual shareholder report contains important information about the Calamos Growth and Income Portfolio for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Portfolio at www.calamos.com/resources. You can also request this information by contacting us at 800-582-6959.

WHAT WERE THE PORTFOLIO COSTS FOR THE LAST YEAR?

(based on a hypothetical $10,000 investment)

| Portfolio Name | Costs of a $10,000 Investment | Costs Paid as a Percentage of a $10,000 Investment |

|---|

| Calamos Growth and Income Portfolio | $139 | 1.26% |

|---|

HOW THE PORTFOLIO PERFORMED

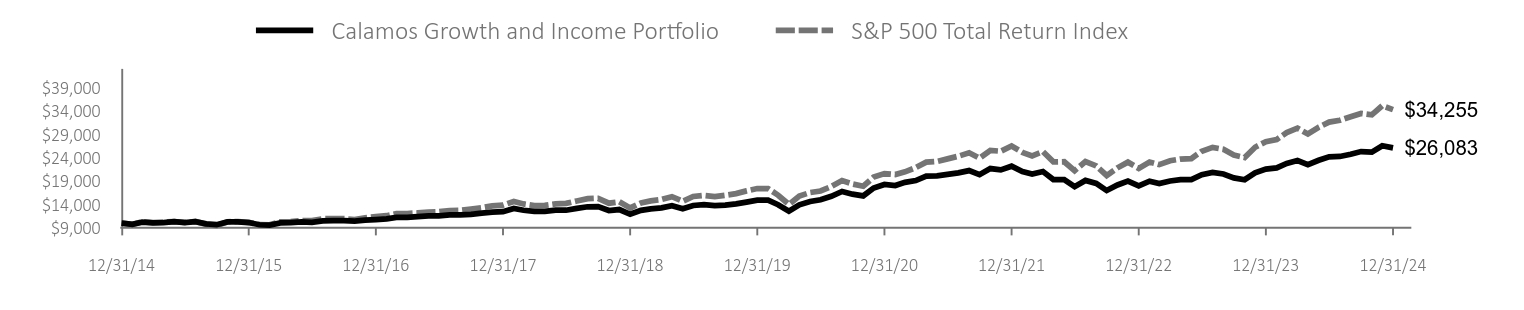

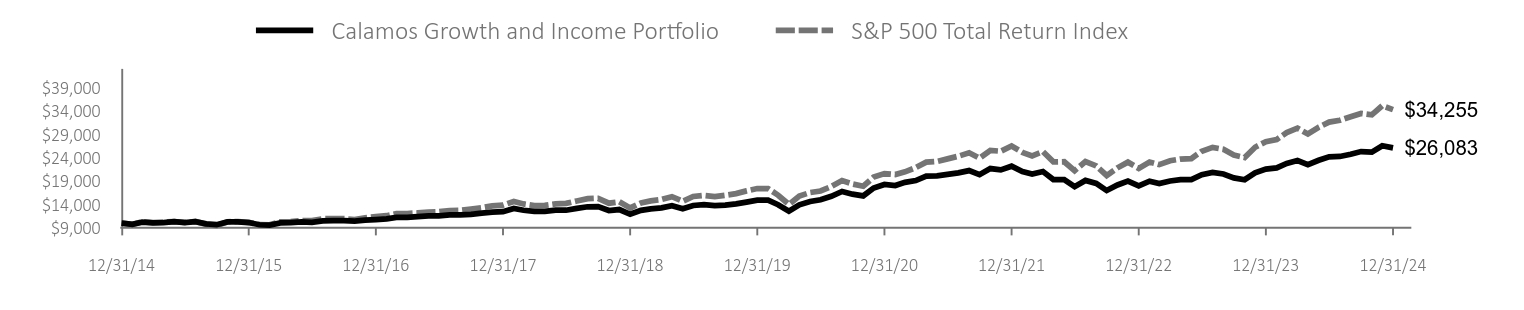

For the 12-months ended December 31, 2024 (“annual period”), the Portfolio delivered strong returns, capturing much of the all-equity index’s gain, as the equity market enjoyed solid economic growth and tamer inflation through 2024. It should be noted that a smaller subset of names within the equity market drove its performance; the largest companies capitalizing on AI opportunities performed best. To put it in perspective, the top 10 names of the S&P 500 Index accounted for approximately 63% of the benchmark’s return for the period. The Portfolio’s focus on quality businesses with a bias toward higher growth metrics worked well for the year. Portfolio holdings in non-common stocks, utilized for risk management, lagged the equity market.

| Calamos Growth and Income Portfolio | S&P 500 Total Return Index |

|---|

| 12/31/14 | $10,000 | $10,000 |

|---|

| 1/31/15 | $9,724 | $9,700 |

|---|

| 2/28/15 | $10,195 | $10,258 |

|---|

| 3/31/15 | $10,025 | $10,095 |

|---|

| 4/30/15 | $10,100 | $10,192 |

|---|

| 5/31/15 | $10,292 | $10,323 |

|---|

| 6/30/15 | $10,113 | $10,123 |

|---|

| 7/31/15 | $10,293 | $10,336 |

|---|

| 8/31/15 | $9,836 | $9,712 |

|---|

| 9/30/15 | $9,646 | $9,472 |

|---|

| 10/31/15 | $10,254 | $10,271 |

|---|

| 11/30/15 | $10,247 | $10,301 |

|---|

| 12/31/15 | $10,112 | $10,139 |

|---|

| 1/31/16 | $9,631 | $9,636 |

|---|

| 2/29/16 | $9,537 | $9,623 |

|---|

| 3/31/16 | $10,038 | $10,275 |

|---|

| 4/30/16 | $10,089 | $10,315 |

|---|

| 5/31/16 | $10,241 | $10,500 |

|---|

| 6/30/16 | $10,161 | $10,528 |

|---|

| 7/31/16 | $10,450 | $10,916 |

|---|

| 8/31/16 | $10,494 | $10,931 |

|---|

| 9/30/16 | $10,534 | $10,933 |

|---|

| 10/31/16 | $10,403 | $10,734 |

|---|

| 11/30/16 | $10,600 | $11,131 |

|---|

| 12/31/16 | $10,751 | $11,351 |

|---|

| 1/31/17 | $10,887 | $11,567 |

|---|

| 2/28/17 | $11,227 | $12,026 |

|---|

| 3/31/17 | $11,235 | $12,040 |

|---|

| 4/30/17 | $11,372 | $12,164 |

|---|

| 5/31/17 | $11,516 | $12,335 |

|---|

| 6/30/17 | $11,530 | $12,412 |

|---|

| 7/31/17 | $11,736 | $12,667 |

|---|

| 8/31/17 | $11,758 | $12,706 |

|---|

| 9/30/17 | $11,873 | $12,968 |

|---|

| 10/31/17 | $12,101 | $13,270 |

|---|

| 11/30/17 | $12,330 | $13,677 |

|---|

| 12/31/17 | $12,419 | $13,829 |

|---|

| 1/31/18 | $13,114 | $14,621 |

|---|

| 2/28/18 | $12,739 | $14,082 |

|---|

| 3/31/18 | $12,479 | $13,724 |

|---|

| 4/30/18 | $12,487 | $13,777 |

|---|

| 5/31/18 | $12,743 | $14,109 |

|---|

| 6/30/18 | $12,743 | $14,196 |

|---|

| 7/31/18 | $13,137 | $14,724 |

|---|

| 8/31/18 | $13,483 | $15,204 |

|---|

| 9/30/18 | $13,503 | $15,290 |

|---|

| 10/31/18 | $12,672 | $14,245 |

|---|

| 11/30/18 | $12,890 | $14,536 |

|---|

| 12/31/18 | $11,874 | $13,223 |

|---|

| 1/31/19 | $12,705 | $14,283 |

|---|

| 2/28/19 | $13,035 | $14,741 |

|---|

| 3/31/19 | $13,232 | $15,028 |

|---|

| 4/30/19 | $13,720 | $15,636 |

|---|

| 5/31/19 | $13,035 | $14,643 |

|---|

| 6/30/19 | $13,752 | $15,675 |

|---|

| 7/31/19 | $13,924 | $15,900 |

|---|

| 8/31/19 | $13,726 | $15,648 |

|---|

| 9/30/19 | $13,840 | $15,941 |

|---|

| 10/31/19 | $14,090 | $16,286 |

|---|

| 11/30/19 | $14,485 | $16,877 |

|---|

| 12/31/19 | $14,909 | $17,387 |

|---|

| 1/31/20 | $14,901 | $17,380 |

|---|

| 2/29/20 | $13,919 | $15,949 |

|---|

| 3/31/20 | $12,529 | $13,979 |

|---|

| 4/30/20 | $13,890 | $15,771 |

|---|

| 5/31/20 | $14,605 | $16,522 |

|---|

| 6/30/20 | $14,975 | $16,851 |

|---|

| 7/31/20 | $15,727 | $17,801 |

|---|

| 8/31/20 | $16,754 | $19,081 |

|---|

| 9/30/20 | $16,168 | $18,356 |

|---|

| 10/31/20 | $15,814 | $17,868 |

|---|

| 11/30/20 | $17,479 | $19,823 |

|---|

| 12/31/20 | $18,253 | $20,586 |

|---|

| 1/31/21 | $18,014 | $20,378 |

|---|

| 2/28/21 | $18,697 | $20,940 |

|---|

| 3/31/21 | $19,077 | $21,857 |

|---|

| 4/30/21 | $20,044 | $23,023 |

|---|

| 5/31/21 | $20,073 | $23,184 |

|---|

| 6/30/21 | $20,403 | $23,725 |

|---|

| 7/31/21 | $20,723 | $24,289 |

|---|

| 8/31/21 | $21,217 | $25,027 |

|---|

| 9/30/21 | $20,340 | $23,863 |

|---|

| 10/31/21 | $21,658 | $25,535 |

|---|

| 11/30/21 | $21,368 | $25,358 |

|---|

| 12/31/21 | $22,159 | $26,495 |

|---|

| 1/31/22 | $21,005 | $25,124 |

|---|

| 2/28/22 | $20,462 | $24,371 |

|---|

| 3/31/22 | $21,007 | $25,276 |

|---|

| 4/30/22 | $19,293 | $23,072 |

|---|

| 5/31/22 | $19,271 | $23,115 |

|---|

| 6/30/22 | $17,766 | $21,207 |

|---|

| 7/31/22 | $19,112 | $23,162 |

|---|

| 8/31/22 | $18,487 | $22,217 |

|---|

| 9/30/22 | $16,956 | $20,171 |

|---|

| 10/31/22 | $18,134 | $21,804 |

|---|

| 11/30/22 | $18,962 | $23,023 |

|---|

| 12/31/22 | $17,933 | $21,696 |

|---|

| 1/31/23 | $18,955 | $23,060 |

|---|

| 2/28/23 | $18,434 | $22,497 |

|---|

| 3/31/23 | $18,993 | $23,323 |

|---|

| 4/30/23 | $19,279 | $23,687 |

|---|

| 5/31/23 | $19,301 | $23,790 |

|---|

| 6/30/23 | $20,339 | $25,362 |

|---|

| 7/31/23 | $20,844 | $26,177 |

|---|

| 8/31/23 | $20,481 | $25,760 |

|---|

| 9/30/23 | $19,652 | $24,532 |

|---|

| 10/31/23 | $19,266 | $24,016 |

|---|

| 11/30/23 | $20,741 | $26,209 |

|---|

| 12/31/23 | $21,541 | $27,400 |

|---|

| 1/31/24 | $21,806 | $27,860 |

|---|

| 2/29/24 | $22,765 | $29,348 |

|---|

| 3/31/24 | $23,372 | $30,292 |

|---|

| 4/30/24 | $22,498 | $29,055 |

|---|

| 5/31/24 | $23,417 | $30,495 |

|---|

| 6/30/24 | $24,172 | $31,590 |

|---|

| 7/31/24 | $24,240 | $31,974 |

|---|

| 8/31/24 | $24,722 | $32,750 |

|---|

| 9/30/24 | $25,288 | $33,449 |

|---|

| 10/31/24 | $25,153 | $33,146 |

|---|

| 11/30/24 | $26,523 | $35,092 |

|---|

| 12/31/24 | $26,083 | $34,255 |

|---|

AVERAGE ANNUAL TOTAL RETURNS (%)

| AATR | 1 YEAR | 5 YEARS | 10 YEARS |

|---|

| Calamos Growth and Income Portfolio | 21.08 | 11.84 | 10.06 |

|---|

| S&P 500 Total Return Index | 24.99 | 14.53 | 13.10 |

|---|

The Portfolio's past performance is not a good predictor of the Portfolio's future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average. All performance shown assumes reinvestment of dividends and capital gains distributions. Visit https://www.calamos.com/funds/mutual/ for the most recent performance information.

| Total Net Assets | # of Portfolio Holdings | Portfolio Turnover Rate | Total Advisory Fees Paid |

|---|

| $32,732,256 | 157 | 29% | $233,012 |

Calamos Growth and Income Portfolio

Annual Shareholder Report - December 31, 2024

WHAT DID THE PORTFOLIO INVEST IN?

The Portfolio employs an equity-oriented approach that blends stocks with complementary allocations to convertibles, fixed income, and options, seeking to generate total returns higher than the benchmark S&P 500 Index but with less risk and lower volatility.

Sector weightings and top 10 holdings exclude, if any, cash or cash equivalents.

| SECTOR WEIGHTINGS | % OF NET ASSETS |

|---|

| Information Technology | 30.0 |

| Financials | 12.9 |

| Consumer Discretionary | 12.6 |

| Communication Services | 11.3 |

| Health Care | 7.2 |

| Industrials | 6.9 |

| Consumer Staples | 5.3 |

| Utilities | 3.4 |

| Energy | 3.2 |

| Other | 2.1 |

| Materials | 2.0 |

| Real Estate | 1.7 |

| TOP 10 HOLDINGS | % OF NET ASSETS |

|---|

| Apple, Inc. | 6.2 |

| NVIDIA Corp. | 5.9 |

| Microsoft Corp. | 5.3 |

| Alphabet, Inc. - Class A | 5.0 |

| Amazon.com, Inc. | 4.5 |

| Broadcom, Inc. | 2.2 |

| Meta Platforms, Inc. - Class A | 2.1 |

| Tesla, Inc. | 1.8 |

| Boeing Co., 6.000%, 10/15/27 | 1.6 |

| JPMorgan Chase & Co. | 1.4 |

For additional information about the Portfolio, including its prospectus, financial information, holdings and proxy information, please visit www.calamos.com/resources. You can also request information by contacting us at 800-582-6959.

©2024 Calamos Investments LLC. All Rights Reserved. Calamos® and Calamos Investments® are registered trademarks of Calamos Investments LLC.

Calamos Investments LLC | 2020 Calamos Court | Naperville, IL 60563 | 800-582-6959 | www.calamos.com | CATTSRA 24

ITEM 2: CODE OF ETHICS.

(a) As of the end of the period covered by this report, the registrant has adopted a code of ethics (the “Code of Ethics”) that applies to its principal executive officer, principal financial officer, principal accounting officer or controller, or person performing similar functions.

(b) No response required.

(c) The registrant has not amended its Code of Ethics as it relates to any element of the code of ethics definition enumerated in paragraph(b) of this Item 2 during the period covered by this report.

(d) The registrant has not granted a waiver or an implicit waiver from its Code of Ethics during the period covered by this report.

(e) Not applicable.

(f) (1) The registrant’s Code of Ethics is attached as an Exhibit hereto.

ITEM 3: AUDIT COMMITTEE FINANCIAL EXPERT.

The registrant’s Board of Trustees has determined that, for the period covered by the shareholder report presented in Item 1 hereto, it has five audit committee financial experts serving on its audit committee, each of whom is an independent Trustee for purpose of this N-CSR item: John E. Neal, William R. Rybak, Virginia G. Breen, Karen L. Stuckey and Christopher M. Toub. Under applicable securities laws, a person who is determined to be an audit committee financial expert will not be deemed an “expert” for any purpose, including without limitation for the purposes of Section 11 of the Securities Act of 1933, as a result of being designated or identified as an audit committee financial expert pursuant to this Item. The designation or identification of a person as an audit committee financial expert does not impose on such person any duties, obligations, or liabilities that

are greater than the duties, obligations and liabilities imposed on such person as a member of audit committee and board of directors in the absence of such designation or identification. The designation or identification of a person as an audit committee financial expert pursuant to this Item does not affect the duties, obligations, or liabilities of any other member of the audit committee or board of directors.

ITEM 4: PRINCIPAL ACCOUNTANT FEES AND SERVICES.

| Fiscal Years Ended | | 12/31/2023 | | | 12/31/2024 | |

| Audit Fees (a) | | $ | 37,439 | | | $ | 38,449 | |

| Audit-Related Fees(b) | | $ | 13,743 | | | $ | 17,160 | |

| Tax Fees(c) | | $ | - | | | $ | - | |

| All Other Fees(d) | | $ | - | | | $ | - | |

| Total | | $ | 51,183 | | | $ | 55,609 | |

(a) Audit fees are the aggregate fees billed in each of the last two fiscal years for professional services rendered by the principal accountant to the registrant for the audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years.

(b) Audit-related fees are the aggregate fees billed in each of the last two fiscal years for assurance and related services rendered by the principal accountant to the registrant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of this Item 4.

(c) Tax fees are the aggregate fees billed in each of the last two fiscal years for professional services rendered by the principal accountant to the registrant for tax compliance, tax advice and tax planning.

(d) All other fees are the aggregate fees billed in each of the last two fiscal years for products and services provided by the principal accountant to the registrant, other than the services reported in paragraph (a)-(c) of this Item 4.

(e) (1) Registrant’s audit committee meets with the principal accountants and management to review and pre-approve all audit services to be provided by the principal accountants.

The audit committee shall pre-approve all non-audit services to be provided by the principal accountants to the registrant, including the fees and other compensation to be paid to the principal accountants; provided that the pre-approval of non-audit services is waived if (i) the services were not recognized by management at the time of the engagement as non-audit services, (ii) the aggregate fees for all non-audit services provided to the registrant are less than 5% of the total fees paid by the registrant to its principal accountants during the fiscal year in which the non-audit services are provided, and (iii) such services are promptly brought to the attention of the audit committee by management and the audit committee approves them prior to the completion of the audit.

The audit committee shall pre-approve all non-audit services to be provided by the principal accountants to the investment adviser or any entity controlling, controlled by or under common control with the adviser that provides ongoing services to the registrant if the engagement relates directly to the operations or financial reporting of the registrant, including the fees and other compensation to be paid to the principal accountants; provided that pre-approval of non-audit services to the adviser or an affiliate of the adviser is not required if (i) the services were not recognized by management at the time of the engagement as non-audit services, (ii) the aggregate fees for all non-audit services provided to the adviser and all entities controlling, controlled by or under common control with the adviser are less than 5% of the total fees for non-audit services requiring pre-approval under paragraph (e)(1) of this Item 4 paid by the registrant, the adviser or its affiliates to the registrant’s principal accountants during the fiscal year in which the non-audit services are provided, and (iii) such services are promptly brought to the attention of the audit committee by management and the audit committee approves them prior to the completion of the audit.

(e) (2) No percentage of the principal accountant’s fees or services described in each of paragraphs (b)–(d) of this Item were approved pursuant to the waiver provision paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) No disclosures are required by this Item 4(f).

(g) The following table presents the aggregate non-audit fees billed in each of the last two fiscal years for services rendered by the principal accountant to the registrant and the aggregate non-audit fees billed in each of the last two fiscal years for services rendered by the principal accountant to the investment advisor or any entity controlling, controlled by or under common control of the adviser.

| Fiscal Years Ended | | 12/31/2023 | | | 12/31/2024 | |

| Registrant | | $ | - | | | $ | - | |

| Investment Adviser | | $ | - | | | $ | - | |

(h) No disclosures are required by this Item 4(h).

(i) Not applicable.

(j) Not applicable.

ITEM 5: AUDIT COMMITTEE OF LISTED REGISTRANTS.

Not applicable.

ITEM 6: INVESTMENTS.

Not applicable. The complete schedule of investments is included in the financial statements filed under Item 7 of this Form.

ITEM 7. FINANCIAL STATEMENTS AND FINANCIAL HIGHLIGHTS FOR OPEN-END MANAGEMENT INVESTMENT COMPANIES.

Growth and Income Portfolio

ANNUAL FINANCIAL STATEMENTS AND OTHER INFORMATION DECEMBER 31, 2024

Statement of Assets and Liabilities December 31, 2024

ASSETS | |

Investments in securities, at value (cost $17,363,069)* | | $ | 32,937,682 | | |

Cash with custodian | | | 347,789 | | |

Restricted cash for short positions | | | 114 | | |

Receivables: | |

Accrued interest and dividends | | | 45,530 | | |

Portfolio shares sold | | | 7,432 | | |

Prepaid expenses | | | 222 | | |

Other assets | | | 100,097 | | |

Total assets | | | 33,438,866 | | |

LIABILITIES | |

Collateral for securities loaned | | | 526,436 | | |

Foreign currency overdraft (cost $1) | | | 1 | | |

Options written, at value (premium $3,424) | | | 3,910 | | |

Payables: | |

Portfolio shares redeemed | | | 18,535 | | |

Affiliates: | |

Investment advisory fees | | | 21,211 | | |

Deferred compensation to trustees | | | 100,097 | | |

Trustees' fees and officer compensation | | | 144 | | |

Other accounts payable and accrued liabilities | | | 36,276 | | |

Total liabilities | | | 706,610 | | |

NET ASSETS | | $ | 32,732,256 | | |

COMPOSITION OF NET ASSETS | |

Paid in capital | | $ | 15,138,864 | | |

Accumulated distributable earnings (loss) | | | 17,593,392 | | |

NET ASSETS | | $ | 32,732,256 | | |

Shares outstanding (no par value; unlimited number of shares authorized) | | | 1,410,371 | | |

Net asset value and redemption price per share | | $ | 23.21 | | |

| * Includes securities on loan | | $ | 671,136 | | |

See accompanying Notes to Financial Statements

www.calamos.com

1

Statement of Operations Year Ended December 31, 2024

INVESTMENT INCOME | |

Interest | | $ | 142,038 | | |

Interest on short sales | | | 116 | | |

(Amortization)/accretion of investment securities | | | (126,257 | ) | |

Net interest | | | 15,897 | | |

Dividends | | | 312,214 | | |

Dividend taxes withheld | | | (221 | ) | |

Securities lending income, net of rebates received or paid to borrowers | | | 3,149 | | |

Total investment income | | | 331,039 | | |

EXPENSES | |

Investment advisory fees | | | 233,012 | | |

Audit fees | | | 52,583 | | |

Printing and mailing fees | | | 28,770 | | |

Legal fees | | | 25,405 | | |

Trustees' fees and officer compensation | | | 12,752 | | |

Accounting fees | | | 12,176 | | |

Transfer agent fees | | | 7,811 | | |

Custodian fees | | | 5,058 | | |

Fund administration fees | | | 1,958 | | |

Tax fees | | | 786 | | |

Other | | | 10,660 | | |

Total expenses | | | 390,971 | | |

NET INVESTMENT INCOME (LOSS) | | | (59,932 | ) | |

REALIZED AND UNREALIZED GAIN (LOSS) | |

Net realized gain (loss) from: | |

Investments, excluding purchased options | | | 2,879,167 | | |

Purchased options | | | (151,513 | ) | |

Foreign currency transactions | | | (1,486 | ) | |

Written options | | | 10,030 | | |

Change in net unrealized appreciation/(depreciation) on: | |

Investments, excluding purchased options | | | 3,221,831 | | |

Purchased options | | | (11,677 | ) | |

Written options | | | (486 | ) | |

NET GAIN (LOSS) | | | 5,945,866 | | |

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 5,885,934 | | |

See accompanying Notes to Financial Statements

CALAMOS GROWTH AND INCOME PORTFOLIO ANNUAL REPORT

2

Statements of Changes in Net Assets

| | YEAR

ENDED

DECEMBER 31,

2024 | | YEAR

ENDED

DECEMBER 31,

2023 | |

OPERATIONS | |

Net investment income (loss) | | $ | (59,932 | ) | | $ | (22,357 | ) | |

Net realized gain (loss) | | | 2,736,198 | | | | 619,998 | | |

Change in unrealized appreciation/(depreciation) | | | 3,209,668 | | | | 4,541,326 | | |

Net increase (decrease) in net assets resulting from operations | | | 5,885,934 | | | | 5,138,967 | | |

DISTRIBUTIONS TO SHAREHOLDERS | |

Total distributions | | | (589,260 | ) | | | (934,860 | ) | |

CAPITAL SHARE TRANSACTIONS | |

| Issued | | | 1,682,854 | | | | 1,347,471 | | |

| Issued in reinvestment of distributions | | | 589,260 | | | | 934,860 | | |

| Redeemed | | | (4,355,409 | ) | | | (3,422,565 | ) | |

Net increase (decrease) in net assets from capital share transactions | | | (2,083,295 | ) | | | (1,140,234 | ) | |

TOTAL INCREASE (DECREASE) IN NET ASSETS | | | 3,213,379 | | | | 3,063,873 | | |

NET ASSETS | |

Beginning of year | | $ | 29,518,877 | | | $ | 26,455,004 | | |

End of year | | $ | 32,732,256 | | | $ | 29,518,877 | | |

CAPITAL SHARE TRANSACTIONS | |

Shares issued | | | 77,973 | | | | 76,253 | | |

Shares issued in reinvestment of distributions | | | 28,553 | | | | 55,747 | | |

Shares redeemed | | | (206,843 | ) | | | (190,862 | ) | |

Net increase (decrease) in capital shares outstanding | | | (100,317 | ) | | | (58,862 | ) | |

See accompanying Notes to Financial Statements

www.calamos.com

3

Selected data for a share outstanding throughout each year were as follows:

| | YEAR ENDED DECEMBER 31, | |

| | 2024 | | 2023 | | 2022 | | 2021 | | 2020 | |

PER SHARE OPERATING PERFORMANCE | |

Net asset value, beginning of year | | $ | 19.54 | | | $ | 16.86 | | | $ | 22.85 | | | $ | 20.57 | | | $ | 17.01 | | |

Income from investment operations: | |

Net investment income (loss)(a) | | | (0.04 | ) | | | (0.01 | ) | | | 0.00 | ** | | | (0.09 | ) | | | 0.18 | | |

Net realized and unrealized gain (loss) | | | 4.11 | | | | 3.29 | | | | (4.18 | ) | | | 4.19 | | | | 3.57 | | |

Total from investment operations | | | 4.07 | | | | 3.28 | | | | (4.18 | ) | | | 4.10 | | | | 3.75 | | |

Less distributions to common shareholders from: | |

Net investment income | | | (0.08 | ) | | | (0.10 | ) | | | (0.13 | ) | | | (0.08 | ) | | | (0.09 | ) | |

Net realized gains | | | (0.32 | ) | | | (0.50 | ) | | | (1.68 | ) | | | (1.74 | ) | | | (0.10 | ) | |

Total distributions | | | (0.40 | ) | | | (0.60 | ) | | | (1.81 | ) | | | (1.82 | ) | | | (0.19 | ) | |

Net asset value, end of year | | $ | 23.21 | | | $ | 19.54 | | | $ | 16.86 | | | $ | 22.85 | | | $ | 20.57 | | |

TOTAL RETURN APPLICABLE TO COMMON SHAREHOLDERS | |

Total investment return based on:(b) | |

Net asset value(c) | | | 21.08 | % | | | 20.12 | % | | | (19.07 | )% | | | 21.40 | % | | | 22.43 | % | |

RATIOS TO AVERAGE NET ASSETS APPLICABLE TO COMMON SHAREHOLDERS | |

Net expenses | | | 1.26 | % | | | 1.44 | % | | | 1.33 | % | | | 1.20 | % | | | 1.29 | % | |

Net investment income (loss) | | | (0.19 | %) | | | (0.08 | %) | | | (0.01 | %) | | | (0.40 | %) | | | 1.01 | % | |

SUPPLEMENTAL DATA | |

Net assets applicable to common shareholders, end of year (000) | | $ | 32,732 | | | $ | 29,519 | | | $ | 26,455 | | | $ | 35,663 | | | $ | 32,254 | | |

Portfolio turnover rate | | | 29 | % | | | 21 | % | | | 23 | % | | | 16 | % | | | 45 | % | |

** Amounts are less than $0.005.

(a) Net investment income allocated based on average shares method.

(b) Performance figures of the Portfolio do not reflect fees charged pursuant to the terms of variable life insurance policies and variable annuity contracts. If they did, performance would be lower.

(c) Total return measures net investment income and capital gain or loss from portfolio investments assuming reinvestment of dividends and capital gains distributions.

CALAMOS GROWTH AND INCOME PORTFOLIO ANNUAL REPORT

4

Growth and Income Portfolio Schedule of Investments December 31, 2024

PRINCIPAL

AMOUNT | | | | VALUE | |

CONVERTIBLE BONDS (16.3%) | | | |

| | | Communication Services (1.9%) | |

| | 90,000 | | | Liberty Media Corp.-Liberty Formula One

2.250%, 08/15/27 | | $ | 110,051 | | |

| | 270,000 | | | Live Nation Entertainment, Inc.*

2.875%, 01/15/30 | | | 271,437 | | |

| | 90,000 | | | Snap, Inc.*

0.500%, 05/01/30 | | | 76,336 | | |

| | 150,000 | | | Uber Technologies, Inc.

0.875%, 12/01/28 | | | 165,537 | | |

| | | 623,361 | | |

| | | Consumer Discretionary (3.3%) | |

| | 75,000 | | | Alibaba Group Holding, Ltd.*

0.500%, 06/01/31 | | | 80,197 | | |

| | 95,000 | | | Booking Holdings, Inc.

0.750%, 05/01/25 | | | 251,108 | | |

| | 80,000 | | | JD.com, Inc.*

0.250%, 06/01/29 | | | 85,066 | | |

| | 205,000 | | | Meritage Homes Corp.*^

1.750%, 05/15/28 | | | 201,617 | | |

| | 36,000 | | | Royal Caribbean Cruises, Ltd.

6.000%, 08/15/25 | | | 167,296 | | |

| | 210,000 | | | Trip.com Group, Ltd.*

0.750%, 06/15/29 | | | 258,455 | | |

| | 35,000 | | | Wayfair, Inc.

3.250%, 09/15/27 | | | 37,456 | | |

| | | 1,081,195 | | |

| | | Consumer Staples (0.5%) | |

| | 30,000 | | | Freshpet, Inc.

3.000%, 04/01/28 | | | 66,366 | | |

| | 70,000 | | | Post Holdings, Inc.

2.500%, 08/15/27 | | | 82,238 | | |

| | | 148,604 | | |

| | | Financials (0.7%) | |

| | 22,000 | | | Affirm Holdings, Inc.*

0.750%, 12/15/29 | | | 21,279 | | |

| | 45,000 | | | Federal Realty OP, LP*

3.250%, 01/15/29 | | | 45,926 | | |

| | 110,000 | | | Morgan Stanley Finance, LLC, Series B

1.000%, 11/23/27 | | | 170,500 | | |

| | | 237,705 | | |

| | | Health Care (0.2%) | |

| | 50,000 | | | Integer Holdings Corp.

2.125%, 02/15/28 | | | 79,973 | | |

| | | 79,973 | | |

| | | Industrials (0.9%) | |

| | 55,000 | | | Axon Enterprise, Inc.

0.500%, 12/15/27 | | | 143,274 | | |

| | 70,000 | | | Middleby Corp.

1.000%, 09/01/25 | | | 78,405 | | |

PRINCIPAL

AMOUNT | | | | VALUE | |

| | 65,000 | | | Tetra Tech, Inc.

2.250%, 08/15/28 | | $ | 76,180 | | |

| | | 297,859 | | |

| | | Information Technology (5.2%) | |

| | 58,000 | | | Advanced Energy Industries, Inc.

2.500%, 09/15/28 | | | 63,306 | | |

| | 71,000 | | | BILL Holdings, Inc.*

0.000%, 04/01/30 | | | 70,460 | | |

| | 135,000 | | | Datadog, Inc.*

0.000%, 12/01/29 | | | 130,477 | | |

| | 95,000 | | | Guidewire Software, Inc.*

1.250%, 11/01/29 | | | 92,982 | | |

| | 80,000 | | | Itron, Inc.*

1.375%, 07/15/30 | | | 84,648 | | |

| | 60,000 | | | Lumentum Holdings, Inc.

1.500%, 12/15/29 | | | 83,689 | | |

| | 80,000 | | | MACOM Technology Solutions

Holdings, Inc.*

0.000%, 12/15/29 | | | 80,189 | | |

| | 210,000 | | | MKS Instruments, Inc.*

1.250%, 06/01/30 | | | 203,482 | | |

| | 50,000 | | | NCL Corp., Ltd.

5.375%, 08/01/25 | | | 71,716 | | |

| | 85,000 | | | Nutanix, Inc.*

0.500%, 12/15/29 | | | 84,734 | | |

| | 170,000 | | | ON Semiconductor Corp.

0.500%, 03/01/29 | | | 160,473 | | |

| | 90,000 | | | Parsons Corp.*

2.625%, 03/01/29 | | | 105,847 | | |

| | 125,000 | | | Seagate HDD Cayman

3.500%, 06/01/28 | | | 150,870 | | |

| | 90,000 | | | Snowflake, Inc.*

0.000%, 10/01/29 | | | 106,961 | | |

| | 74,000 | | | Vertex, Inc.*

0.750%, 05/01/29 | | | 117,247 | | |

| | 60,000 | | | Western Digital Corp.

3.000%, 11/15/28 | | | 79,607 | | |

| | | 1,686,688 | | |

| | | Real Estate (1.2%) | |

| | 115,000 | | | Pebblebrook Hotel Trust

1.750%, 12/15/26 | | | 107,148 | | |

| | 90,000 | | | Welltower OP, LLC*

2.750%, 05/15/28 | | | 122,120 | | |

| | 155,000 | | | 3.125%, 07/15/29 | | | 177,027 | | |

| | | 406,295 | | |

| | | Utilities (2.4%) | |

| | 165,000 | | | CMS Energy Corp.

3.375%, 05/01/28 | | | 171,372 | | |

| | 145,000 | | | Duke Energy Corp.

4.125%, 04/15/26 | | | 148,844 | | |

| | 55,000 | | | NextEra Energy Capital Holdings, Inc.*

3.000%, 03/01/27 | | | 63,836 | | |

See accompanying Notes to Schedule of Investments

www.calamos.com

5

Growth and Income Portfolio Schedule of Investments December 31, 2024

PRINCIPAL

AMOUNT | | | | VALUE | |

| | 195,000 | | | PPL Capital Funding, Inc.^

2.875%, 03/15/28 | | $ | 203,699 | | |

| | 175,000 | | | Southern Company

3.875%, 12/15/25 | | | 184,387 | | |

| | | 772,138 | | |

| | | TOTAL CONVERTIBLE BONDS

(Cost $4,685,823) | | | 5,333,818 | | |

NUMBER OF

SHARES | | | | VALUE | |

COMMON STOCKS (76.1%) | | | |

| | | Communication Services (9.3%) | |

| | 8,580 | | | Alphabet, Inc. - Class A | | | 1,624,194 | | |

| | 1,185 | | | Meta Platforms, Inc. - Class A | | | 693,829 | | |

| | 325 | | | Netflix, Inc.# | | | 289,679 | | |

| | 1,175 | | | T-Mobile U.S., Inc. | | | 259,358 | | |

| | 1,575 | | | Walt Disney Company | | | 175,376 | | |

| | | 3,042,436 | | |

| | | Consumer Discretionary (9.3%) | |

| | 6,665 | | | Amazon.com, Inc.# | | | 1,462,234 | | |

| | 2,350 | | | Chipotle Mexican Grill, Inc.# | | | 141,705 | | |

| | 560 | | | Home Depot, Inc. | | | 217,835 | | |

| | 1,865 | | | Las Vegas Sands Corp. | | | 95,786 | | |

| | 535 | | | Lowe's Companies, Inc. | | | 132,038 | | |

| | 560 | | | McDonald's Corp. | | | 162,338 | | |

| | 1,185 | | | Starbucks Corp. | | | 108,131 | | |

| | 1,470 | | | Tesla, Inc.# | | | 593,645 | | |

| | 970 | | | TJX Companies, Inc. | | | 117,186 | | |

| | | 3,030,898 | | |

| | | Consumer Staples (4.8%) | |

| | 3,160 | | | Coca-Cola Company | | | 196,742 | | |

| | 1,320 | | | Colgate-Palmolive Company | | | 120,001 | | |

| | 350 | | | Costco Wholesale Corp. | | | 320,694 | | |

| | 1,105 | | | Mondelez International, Inc. - Class A | | | 66,002 | | |

| | 1,365 | | | Philip Morris International, Inc. | | | 164,278 | | |

| | 1,620 | | | Procter & Gamble Company | | | 271,593 | | |

| | 790 | | | Target Corp. | | | 106,792 | | |

| | 3,480 | | | Walmart, Inc. | | | 314,418 | | |

| | | 1,560,520 | | |

| | | Energy (3.2%) | |

| | 625 | | | Chevron Corp. | | | 90,525 | | |

| | 610 | | | ConocoPhillips | | | 60,494 | | |

| | 1,865 | | | EQT Corp. | | | 85,995 | | |

| | 3,885 | | | Exxon Mobil Corp. | | | 417,909 | | |

| | 730 | | | Hess Corp. | | | 97,097 | | |

| | 1,035 | | | Marathon Petroleum Corp. | | | 144,383 | | |

NUMBER OF

SHARES | | | | VALUE | |

| | 2,335 | | | Schlumberger, NV | | $ | 89,524 | | |

| | 1,215 | | | Williams Companies, Inc. | | | 65,756 | | |

| | | 1,051,683 | | |

| | | Financials (10.8%) | |

| | 485 | | | American Express Company | | | 143,943 | | |

| | 500 | | | Assurant, Inc. | | | 106,610 | | |

| | 6,320 | | | Bank of America Corp. | | | 277,764 | | |

| | 90 | | | Blackrock, Inc. | | | 92,260 | | |

| | 895 | | | Chubb, Ltd. | | | 247,289 | | |

| | 1,915 | | | Citigroup, Inc. | | | 134,797 | | |

| | 1,100 | | | Fidelity National Information Services, Inc. | | | 88,847 | | |

| | 660 | | | Fiserv, Inc.# | | | 135,577 | | |

| | 270 | | | Goldman Sachs Group, Inc. | | | 154,607 | | |

| | 1,935 | | | JPMorgan Chase & Company | | | 463,839 | | |

| | 554 | | | KKR & Company, Inc. | | | 81,942 | | |

| | 1,100 | | | Marsh & McLennan Companies, Inc. | | | 233,651 | | |

| | 755 | | | Mastercard, Inc. - Class A | | | 397,560 | | |

| | 1,415 | | | Morgan Stanley | | | 177,894 | | |

| | 255 | | | S&P Global, Inc. | | | 126,998 | | |

| | 1,285 | | | Visa, Inc. - Class A | | | 406,111 | | |

| | 3,655 | | | Wells Fargo & Company | | | 256,727 | | |

| | | 3,526,416 | | |

| | | Health Care (7.0%) | |

| | 810 | | | Abbott Laboratories | | | 91,619 | | |

| | 935 | | | AbbVie, Inc. | | | 166,149 | | |

| | 2,480 | | | Boston Scientific Corp.# | | | 221,514 | | |

| | 445 | | | Danaher Corp. | | | 102,150 | | |

| | 685 | | | Dexcom, Inc.# | | | 53,272 | | |

| | 230 | | | Elevance Health, Inc. | | | 84,847 | | |

| | 480 | | | Eli Lilly & Company | | | 370,560 | | |

| | 370 | | | ICON, PLC# | | | 77,593 | | |

| | 1,385 | | | Johnson & Johnson | | | 200,299 | | |

| | 1,360 | | | Medtronic, PLC | | | 108,637 | | |

| | 2,065 | | | Merck & Company, Inc. | | | 205,426 | | |

| | 230 | | | Stryker Corp. | | | 82,811 | | |

| | 320 | | | Thermo Fisher Scientific, Inc. | | | 166,474 | | |

| | 515 | | | UnitedHealth Group, Inc. | | | 260,518 | | |

| | 1,095 | | | Zimmer Biomet Holdings, Inc. | | | 115,665 | | |

| | | 2,307,534 | | |

| | | Industrials (4.3%) | |

| | 6,005 | | | American Airlines Group, Inc.# | | | 104,667 | | |

| | 7,935 | | | CSX Corp. | | | 256,062 | | |

| | 1,935 | | | Emerson Electric Company | | | 239,805 | | |

| | 275 | | | GE Vernova, Inc. | | | 90,456 | | |

| | 810 | | | General Electric Company | | | 135,100 | | |

See accompanying Notes to Schedule of Investments

CALAMOS GROWTH AND INCOME PORTFOLIO ANNUAL REPORT

6

Growth and Income Portfolio Schedule of Investments December 31, 2024

NUMBER OF

SHARES | | | | VALUE | |

| | 555 | | | Norfolk Southern Corp. | | $ | 130,258 | | |

| | 375 | | | Parker-Hannifin Corp. | | | 238,511 | | |

| | 1,740 | | | RTX Corp. | | | 201,353 | | |

| | | 1,396,212 | | |

| | | Information Technology (24.4%) | |

| | 795 | | | Advanced Micro Devices, Inc.# | | | 96,028 | | |

| | 8,140 | | | Apple, Inc. | | | 2,038,419 | | |

| | 3,150 | | | Broadcom, Inc. | | | 730,296 | | |

| | 1,900 | | | Cisco Systems, Inc. | | | 112,480 | | |

| | 444 | | | CyberArk Software, Ltd.# | | | 147,918 | | |

| | 100 | | | Intuit, Inc. | | | 62,850 | | |

| | 1,250 | | | Lam Research Corp. | | | 90,287 | | |

| | 775 | | | Micron Technology, Inc. | | | 65,224 | | |

| | 4,130 | | | Microsoft Corp. | | | 1,740,795 | | |

| | 14,500 | | | NVIDIA Corp. | | | 1,947,205 | | |

| | 215 | | | NXP Semiconductors, NV | | | 44,688 | | |

| | 1,470 | | | Oracle Corp. | | | 244,961 | | |

| | 510 | | | Palo Alto Networks, Inc.# | | | 92,800 | | |

| | 475 | | | Salesforce, Inc. | | | 158,807 | | |

| | 440 | EUR | | SAP, SE | | | 108,229 | | |

| | 295 | | | ServiceNow, Inc.# | | | 312,735 | | |

| | | 7,993,722 | | |

| | | Materials (2.0%) | |

| | 2,665 | | | Freeport-McMoRan, Inc. | | | 101,483 | | |

| | 615 | | | Linde, PLC | | | 257,482 | | |

| | 535 | | | Sherwin-Williams Company | | | 181,863 | | |

| | 490 | | | Vulcan Materials Company | | | 126,043 | | |

| | | 666,871 | | |

| | | Real Estate (0.5%) | |

| | 680 | | | American Tower Corp. | | | 124,719 | | |

| | 1,540 | | | Invitation Homes, Inc. | | | 49,234 | | |

| | | 173,953 | | |

| | | Utilities (0.5%) | |

| | 1,130 | | | Vistra Corp. | | | 155,793 | | |

| | | 155,793 | | |

| | | TOTAL COMMON STOCKS

(Cost $10,127,385) | | | 24,906,038 | | |

CONVERTIBLE PREFERRED STOCKS (4.0%) | | | |

| | | Financials (1.4%) | |

| | 1,180 | | | AMG Capital Trust II

5.150%, 10/15/37 | | | 62,479 | | |

| | 2,905 | | | Apollo Global Management, Inc.

6.750%, 07/31/26 | | | 252,474 | | |

| | 2,560 | | | Ares Management Corp.

6.750%, 10/01/27 | | | 140,902 | | |

| | | 455,855 | | |

NUMBER OF

SHARES | | | | VALUE | |

| | | Industrials (1.7%) | |

| | 8,410 | | | Boeing Company

6.000%, 10/15/27 | | $ | 512,085 | | |

| | 678 | | | Chart Industries, Inc.

6.750%, 12/15/25 | | | 47,785 | | |

| | | 559,870 | | |

| | | Information Technology (0.4%) | |

| | 2,160 | | | Hewlett Packard Enterprise Company

7.625%, 09/01/27 | | | 135,454 | | |

| | | 135,454 | | |

| | | Utilities (0.5%) | |

| | 875 | | | CenterPoint Energy, Inc. (Warner Media,

LLC, Charter Communications

Time, Inc.)^#**§

3.369%, 09/15/29 | | | 35,266 | | |

| | 1,405 | | | NextEra Energy, Inc.

7.299%, 06/01/27 | | | 68,550 | | |

| | 1,345 | | | PG&E Corp.#

6.000%, 12/01/27 | | | 66,967 | | |

| | | 170,783 | | |

| | | TOTAL CONVERTIBLE

PREFERRED STOCKS

(Cost $1,145,675) | | | 1,321,962 | | |

EXCHANGE-TRADED FUND (0.2%) | | | |

| | | Other (0.2%) | |

| | 540 | | | iShares Biotechnology ETF^

(Cost $74,298) | | | 71,393 | | |

PRINCIPAL

AMOUNT | | | | VALUE | |

U.S. GOVERNMENT AND AGENCY SECURITIES (1.9%) | | | |

| | | Other (1.9%) | |

| | 235,000 | | | U.S. Treasury Note

4.625%, 02/28/25 | | | 235,097 | | |

| | 240,000 | | | 4.250%, 05/31/25 | | | 239,981 | | |

| | 155,000 | | | 5.000%, 08/31/25^ | | | 155,763 | | |

| | | TOTAL U.S. GOVERNMENT AND

AGENCY SECURITIES

(Cost $630,304) | | | 630,841 | | |

NUMBER OF

CONTRACTS/

NOTIONAL

AMOUNT | | | | VALUE | |

PURCHASED OPTIONS (0.5%)# | | | |

| | | Communication Services (0.1%) | |

| | 23 | | | Alphabet, Inc. | | | | | |

| | 438,012 | | | Put, 02/21/25, Strike $195.00 | | | 25,990 | | |

| | | 25,990 | | |

See accompanying Notes to Schedule of Investments

www.calamos.com

7

Growth and Income Portfolio Schedule of Investments December 31, 2024

NUMBER OF

CONTRACTS/

NOTIONAL

AMOUNT | | | | VALUE | |

| | | Other (0.4%) | |

| 34

1,738,182 | | | Invesco QQQ Trust Series 1

Put, 03/21/25, Strike $515.00 | | $ | 60,690 | | |

| | 85 | | | iShares MSCI EAFE ETF | | | | | |

| | 642,685 | | | Call, 03/21/25, Strike $80.00 | | | 5,780 | | |

| | 28 | | | iShares Russell 2000 ETF | | | | | |

| | 618,688 | | | Call, 03/21/25, Strike $235.00 | | | 11,480 | | |

| | 3 | | | S&P 500® Index | | | | | |

| | 1,764,489 | | | Put, 01/31/25, Strike $5,950.00 | | | 33,690 | | |

| | 31 | | | SPDR® S&P 500® ETF Trust | | | | | |

| | 1,816,848 | | | Put, 01/17/25, Strike $575.00 | | | 9,564 | | |

| | | 121,204 | | |

| | | | | TOTAL PURCHASED OPTIONS

(Cost $173,148) | | | 147,194 | | |

NUMBER OF

SHARES/

PRINCIPAL

AMOUNT | | | | VALUE | |

INVESTMENT OF CASH COLLATERAL FOR SECURITIES

LOANED (1.6%) | | | |

| | 526,436 | | | State Street Navigator Securities

Lending Government Money Market

Portfolio, 4.482%***†

(Cost $526,436) | | | 526,436 | | |

| | | | | TOTAL INVESTMENTS (100.6%)

(Cost $17,363,069) | | | 32,937,682 | | |

LIABILITIES, LESS OTHER ASSETS (-0.6%) | | | (205,426 | ) | |

NET ASSETS (100.0%) | | $ | 32,732,256 | | |

NUMBER OF

CONTRACTS/

NOTIONAL

AMOUNT | | | | VALUE | |

WRITTEN OPTION (0.0%)# | | | |

| | | Communication Services (0.0%) | |

| | (23 | ) | | Alphabet, Inc. | | | | | |

| (438,012

| ) | | Put, 02/21/25, Strike $165.00

(Premium $3,424) | | | (3,910 | ) | |

NOTES TO SCHEDULE OF INVESTMENTS

* Securities issued and sold pursuant to a Rule 144A transaction are exempted from the registration requirement of the Securities Act of 1933, as amended. These securities may only be sold to qualified institutional buyers ("QIBs"), such as the Fund. Any resale of these securities must generally be effected through a sale that is registered under the Act or otherwise exempted from such registration requirements.

^ Security, or portion of security, is on loan.

# Non-income producing security.

** Step coupon security. Coupon changes periodically based upon a predetermined schedule. The rate shown is the rate in effect at December 31, 2024.

§ Securities exchangeable or convertible into securities of one or more entities that are different than the issuer. Each entity is identified in the parenthetical.

*** The rate disclosed is the 7 day net yield as of December 31, 2024.

† Represents investment of cash collateral received from securities on loan as of December 31, 2024.

FOREIGN CURRENCY ABBREVIATION

EUR European Monetary Unit

Note: Value for securities denominated in foreign currencies is shown in U.S. dollars. The date on options represents the expiration date of the option contract. The option contract may be exercised at any date on or before the date shown.

See accompanying Notes to Schedule of Investments

CALAMOS GROWTH AND INCOME PORTFOLIO ANNUAL REPORT

8

Notes to Financial Statements

Note 1 – Organization and Significant Accounting Policies

Organization. Calamos Advisors Trust (the "Trust"), a Massachusetts business trust organized February 17, 1999, consists of a single series, Calamos Growth and Income Portfolio (the "Portfolio"), which commenced operations on May 19, 1999.

The Trust currently offers the Portfolio's shares to certain life insurance companies for allocation to certain separate accounts established for the purpose of funding qualified and non-qualified variable annuity contracts and variable life insurance contracts. The Portfolio seeks high long-term total return through growth and current income.

The Portfolio invests primarily in a diversified portfolio of convertible instruments (including synthetic convertible instruments), equity and fixed-income securities of U.S. companies without regard to market capitalization. In pursuing its investment objective, the Portfolio attempts to utilize these different types of securities to strike, in the investment adviser's opinion, the appropriate balance between risk and return in terms of growth and income.

Significant Accounting Policies. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (U.S. GAAP), and the Portfolio is considered an investment company under U.S. GAAP and follows the accounting and reporting guidance applicable to investment companies. Under U.S. GAAP, management is required to make certain estimates and assumptions at the date of the financial statements and actual results may differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued, have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Portfolio:

In November 2023, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") No. 2023-07, Segment Reporting (Topic 280). The ASU applies to all public entities that are required to report segment information in accordance with Accounting Standards Codification Topic 280 (ASC 280). ASU 2023-07 improves reportable segment disclosure requirements, primarily through enhanced disclosures about significant segment expenses. An operating segment is defined as a component of a public entity that engages in business activities from which it may recognize revenues and incur expense, has operating results that are regularly reviewed by the chief operating decision maker, and for which discrete financial information is available. The Portfolio has adopted ASU 2023-07 as of December 31, 2024, with no material impact on the Portfolio's financial statements.

Portfolio Valuation. The Trust's Board of Trustees ("Board" or "Trustees"), including a majority of the Trustees who are not "interested persons" of the Trust, have designated Calamos Advisors LLC ("Calamos Advisors", or the "Adviser") to perform fair valuation determinations related to all Portfolio investments under the oversight of the Board. As "valuation designee" Calamos Advisors has adopted procedures (as approved by the Board) to guide the determination of the net asset value ("NAV") on any day on which the Portfolio's NAVs is determined. The valuation of the Portfolio's investments is in accordance with these procedures.

Portfolio securities that are traded on U.S. securities exchanges, except option securities, are valued at the official closing price, which is the last current reported sales price on its principal exchange at the time the Portfolio determines its NAV. Securities traded in the over-the-counter market and quoted on The NASDAQ Stock Market are valued at the NASDAQ Official Closing Price, as determined by NASDAQ, or lacking a NASDAQ Official Closing Price, the last current reported sale price on NASDAQ at the time a Portfolio determines its NAV. When a last sale or closing price is not available, equity securities, other than option securities, that are traded on a U.S. securities exchange and other equity securities traded in the over-the-counter market are valued at the mean between the most recent bid and asked quotations on its principal exchange in accordance with guidelines adopted by the Board. Each option security traded on a U.S. securities exchange is valued at the mid-point of the consolidated bid/ask quote for the option security, also in accordance with guidelines adopted by the Board. Each over-the-counter option that is not traded through the Options Clearing Corporation is valued either by an independent pricing agent approved by the Board or based on a quotation provided by the counterparty to such option under the ultimate supervision of the Board.

Fixed income securities, bank loans, certain convertible preferred securities, and non-exchange traded derivatives are normally valued by independent pricing services or by dealers or brokers who make markets in such securities. Valuations of such fixed income securities, bank loans, certain convertible preferred securities, and non-exchange traded derivatives consider yield or price of equivalent securities of comparable quality, coupon rate, maturity, type of issue, trading characteristics and other market data and do not rely exclusively upon exchange or over-the-counter prices.

Trading on European and Far Eastern exchanges and over-the-counter markets is typically completed at various times before the close of business on each day on which the New York Stock Exchange ("NYSE") is open. Each security trading on these

www.calamos.com

9

Notes to Financial Statements

exchanges or in over-the-counter markets may be valued utilizing a systematic fair valuation model provided by an independent pricing service approved by the Board. The valuation of each security that meets certain criteria in relation to the valuation model is systematically adjusted to reflect the impact of movement in the U.S. market after the foreign markets close. Securities that do not meet the criteria, or that are principally traded in other foreign markets, are valued as of the last reported sale price at the time the Portfolio determines its NAV, or when reliable market prices or quotations are not readily available, at the mean between the most recent bid and asked quotations as of the close of the appropriate exchange or other designated time. Trading of foreign securities may not take place on every NYSE business day. In addition, trading may take place in various foreign markets on Saturdays or on other days when the NYSE is not open and on which the Portfolio's NAV is not calculated.

If the valuation designee determines that the valuation of a security in accordance with the methods described above is not reflective of a fair value for such security, the security is valued at a fair value by the valuation designee.

The Portfolio also may use fair value pricing, pursuant to guidelines adopted by Calamos Advisors, if trading in the security is halted or if the value of a security it holds is materially affected by events occurring before the Portfolio's pricing time but after the close of the primary market or exchange on which the security is listed. Those procedures may utilize valuations furnished by pricing services approved by Calamos Advisors, which may be based on market transactions for comparable securities and various relationships between securities that are generally recognized by institutional traders, a computerized matrix system, or appraisals derived from information concerning the securities or similar securities received from recognized dealers in those securities.

When fair value pricing of securities is employed, the prices of securities used by the Portfolio to calculate its NAV may differ from market quotations or official closing prices. There can be no assurance that the Portfolio could purchase or sell a portfolio security at the price used to calculate the Portfolio's NAV.

Investment Transactions. Investment transactions are recorded on a trade date basis as of December 31, 2024. Net realized gains and losses from investment transactions are reported on an identified cost basis. Interest income is recognized using the accrual method and includes accretion of original issue and market discount and amortization of premium. Dividend income is recognized on the ex-dividend date, except that certain dividends from foreign securities are recorded as soon as the information becomes available after the ex-dividend date.

Foreign Currency Translation. Values of investments and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars using a rate quoted by a major bank or dealer in the particular currency market, as reported by a recognized quotation dissemination service.

The Portfolio does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss from investments.

Reported net realized foreign currency gains or losses arise from disposition of foreign currency, the difference in the foreign exchange rates between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the ex-date or accrual date and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes (due to the changes in the exchange rate) in the value of foreign currency and other assets and liabilities denominated in foreign currencies held at year end.

Allocation of Expenses. Expenses directly attributable to the Portfolio are charged to the Portfolio; certain other common expenses of Calamos Advisors Trust, Calamos Investment Trust, Calamos Convertible Opportunities and Income Fund, Calamos Convertible and High Income Fund, Calamos Strategic Total Return Fund, Calamos Global Total Return Fund, Calamos Global Dynamic Income Fund, Calamos Dynamic Convertible and Income Fund, Calamos Long/Short Equity & Dynamic Income Trust, Calamos Antetokounmpo Sustainable Equities Trust, and Calamos ETF Trust are allocated proportionately among each fund to which the expenses relate in relation to the net assets of each fund or on another reasonable basis.

As defined under ASU No. 2023-07 the chief operating decision maker ("CODM") consists of the members of Calamos Advisors' Investment Committee and Senior Executive Team. The Portfolio operates as a single reportable segment, which reflects how the CODM monitors and manages the operating results of the Portfolio. The financial information used by the CODM to assess the segment's performance and to allocate resources, including total return, expense ratios, changes in net assets from operations and portfolio composition, is consistent with that presented within the Portfolio's financial statements and financial highlights.

CALAMOS GROWTH AND INCOME PORTFOLIO ANNUAL REPORT

10

Notes to Financial Statements

Income Taxes. No provision has been made for U.S. income taxes because the Trust's policy is to continue to qualify as a regulated investment company under the Internal Revenue Code of 1986, as amended, and distribute to shareholders substantially all of the Portfolio's taxable income and net realized gains.

Dividends and distributions paid to shareholders are recorded on the ex-dividend date. The amount of dividends and distributions from net investment income and net realized capital gains is determined in accordance with federal income tax regulations, which may differ from U.S. generally accepted accounting principles. To the extent these "book/tax" differences are permanent in nature, such amounts are reclassified within the capital accounts based on their federal tax-basis treatment. These differences are primarily due to differing treatments for foreign currency transactions, contingent payment debt instruments and methods of amortizing and accreting for fixed income securities. The financial statements are not adjusted for temporary differences.

The Portfolio recognized no liability for uncertain tax positions. A reconciliation is not provided as the beginning and ending amounts of unrecognized benefits are zero, with no interim additions, reductions or settlements. Tax years 2021 – 2024 remain subject to examination by the U.S. and the State of Illinois tax jurisdictions.

Indemnifications. Under the Trust's organizational documents, the Trust is obligated to indemnify its officers and trustees against certain liabilities incurred by them by reason of having been an officer or trustee of the Trust. In addition, in the normal course of business, the Trust may enter into contracts that provide general indemnifications to other parties. The Portfolio's maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Portfolio that have not yet occurred. Currently, the Portfolio's management expects the risk of material loss in connection to a potential claim to be remote.

Note 2 – Investment Adviser and Transactions With Affiliates Or Certain Other Parties

Pursuant to an investment advisory agreement with Calamos Advisors, the Portfolio pays a monthly investment advisory fee based on the average daily net assets of the Portfolio at the annual rate of 0.75%.

The Portfolio reimburses Calamos Advisors for a portion of compensation paid to the Trust's Chief Compliance Officer. This compensation is reported as part of the "Trustees' fees and officer compensation" expense on the Statement of Operations.

A Trustee and certain officers of the Trust are also officers and directors of Calamos Financial Services LLC ("CFS") and Calamos Advisors. Such trustee and officers serve without direct compensation from the Trust. The Trust's Statement of Additional Information contains additional information about the Trust's Trustees and Officers and is available without charge, upon request, at www.calamos.com or by calling 800.582.6959.

The Trust has adopted a deferred compensation plan (the "Plan"). Under the Plan, a trustee who is not an "interested person" (as defined in the 1940 Act) and has elected to participate in the Plan (a "participating trustee") may defer receipt of all or a portion of their compensation from the Trust. The deferred compensation payable to the participating trustee is credited to the trustee's deferral account as of the business day such compensation would have been paid to the participating trustee. The value of amounts deferred for a participating trustee is determined by reference to the change in value of Class I shares of one or more funds of Calamos Investment Trust designated by the participant. The value of the account increases with contributions to the account or with increases in the value of the measuring shares, and the value of the account decreases with withdrawals from the account or with declines in the value of the measuring shares. The Portfolio's obligation, if any, to make payments under the Plan is a general obligation of the Portfolio and is included in "Payable for deferred compensation to trustees" on the Statement of Assets and Liabilities at December 31, 2024. Deferred compensation of $100,097 is included in "Other assets" on the Statement of Assets and Liabilities at December 31, 2024.

Note 3 – Investments

The cost of purchases and proceeds from sales of long-term investments for the year ended December 31, 2024 were as follows:

| | U.S. GOVERNMENT

SECURITIES | | OTHER | |

Cost of purchases | | $ | — | | | $ | 8,863,700 | | |

Proceeds from sales | | | 595,000 | | | | 11,714,324 | | |

www.calamos.com

11

Notes to Financial Statements

Note 4 – Income Taxes

The cost basis of investments for federal income tax purposes at December 31, 2024 was as follows:

Cost basis of investments | | $ | 17,831,615 | | |

| Gross unrealized appreciation | | | 15,476,430 | | |

| Gross unrealized depreciation | | | (374,273 | ) | |

Net unrealized appreciation (depreciation) | | $ | 15,102,157 | | |

For the fiscal year ended December 31, 2024, the Portfolio recorded the following permanent reclassifications to reflect tax character. The results of operations and net assets were not affected by these reclassifications.

Paid-in capital | | $ | (9,343 | ) | |

Undistributed net investment income/(loss) | | | 133,405 | | |

Accumulated net realized gain/(loss) on investments | | | (124,062 | ) | |

Distributions were characterized for federal income tax purposes as follows:

| | YEAR ENDED

DECEMBER 31, 2024 | | YEAR ENDED

DECEMBER 31, 2023 | |

Distributions paid from: | |

Ordinary income | | $ | 120,038 | | | $ | 160,047 | | |

Long-term capital gains | | | 469,222 | | | | 774,813 | | |

Return of capital | | | — | | | | — | | |

As of December 31, 2024, the components of accumulated earnings/(loss) on a tax basis were as follows:

Undistributed ordinary income | | $ | 169,945 | | |

Undistributed capital gains | | | 2,600,689 | | |

Total undistributed earnings | | | 2,770,634 | | |

Accumulated capital and other losses | | | — | | |

Net unrealized gains/(losses) | | | 15,102,157 | | |

Total accumulated earnings/(losses) | | | 17,872,791 | | |

Other | | | (279,399 | ) | |

Paid-in-capital | | | 15,138,864 | | |

Net assets applicable to common shareholders | | $ | 32,732,256 | | |

Note 5 – Derivative Instruments

Foreign Currency Risk. The Portfolio may engage in portfolio hedging with respect to changes in currency exchange rates by entering into forward foreign currency contracts to purchase or sell currencies. A forward foreign currency contract is a commitment to purchase or sell a foreign currency at a future date at a negotiated forward rate. Risks associated with such contracts include, among other things, movement in the value of the foreign currency relative to the U.S. dollar and the ability of the counterparty to perform.

To mitigate the counterparty risk, the Portfolio may enter into an International Swaps and Derivatives Association, Inc. Master Agreement ("ISDA Master Agreement") or similar agreement with its derivative contract counterparties. An ISDA Master Agreement is a bilateral agreement between the Portfolio and a counterparty that governs Over-The-Counter derivatives and foreign exchange contracts and typically contains, among other things, collateral posting terms and netting provisions in the event of a default and/or termination event. Under an ISDA Master Agreement, the Portfolio may, under certain circumstances, offset with the counterparty certain derivative financial instrument's payables and/or receivables with collateral held and/or posted and create one single net payment. The provisions of the ISDA Master Agreement typically permit a single net payment in the event of default (close-out netting) including the bankruptcy or insolvency of the counterparty. Generally, collateral is exchanged between the Portfolio and the counterparty and the amount of collateral due from the Portfolio or to a counterparty has to exceed a minimum transfer amount threshold before a transfer has to be made. To the extent amounts due to the Portfolio from its counterparties are not fully collateralized, contractually or otherwise, the Portfolio bears the risk of loss from counterparty nonperformance. When a Portfolio is required to post collateral under the terms of a derivatives transaction and master netting agreement, the Portfolio's custodian holds the collateral in a segregated account,

CALAMOS GROWTH AND INCOME PORTFOLIO ANNUAL REPORT

12

Notes to Financial Statements

subject to the terms of a tri-party agreement among the Portfolio, the custodian and the counterparty. The master netting agreement and tri-party agreement provide, in relevant part, that the counterparty may have rights to the amounts in the segregated account in the event that the Portfolio defaults in its obligation with respect to the derivative instrument that is subject to the collateral requirement. When a counterparty is required to post collateral under the terms of a derivatives transaction and master netting agreement, the counterparty delivers such amount to the Portfolio's custodian. The master netting agreement provides, in relevant part, that the Portfolio may have rights to such collateral in the event that the counterparty defaults in its obligation with respect to the derivative instrument that is subject to the collateral requirement.

For financial reporting purposes, the Portfolio does not offset derivative assets and derivative liabilities that are subject to netting arrangements in the Statement of Assets and Liabilities. The net unrealized gain, if any, represents the credit risk to the Portfolio on a forward foreign currency contract. The contracts are valued daily at forward foreign exchange rates. The Portfolio realizes a gain or loss when a position is closed or upon settlement of the contracts. Please see the disclosure regarding ISDA Master Agreements under Foreign Currency Risk within this note.

As of December 31, 2024, the Portfolio had no outstanding forward foreign currency contracts.

Equity Risk. The Portfolio may engage in option transactions and in doing so achieves similar objectives to what it would achieve through the sale or purchase of individual securities. A call option, upon payment of a premium, gives the purchaser of the option the right to buy, and the seller of the option the obligation to sell, the underlying security, index or other instrument at the exercise price. A put option gives the purchaser of the option, upon payment of a premium, the right to sell, and the seller the obligation to buy, the underlying security, index, or other instrument at the exercise price.

To seek to offset some of the risk of a potential decline in value of certain long positions, the Portfolio may also purchase put options on individual securities, broad-based securities indexes or certain exchange-traded funds ("ETFs"). The Portfolio may also seek to generate income from option premiums by writing (selling) options on a portion of the equity securities (including securities that are convertible into equity securities) in a Portfolio's holdings, on broad-based securities indexes, or certain ETFs.

When the Portfolio purchases an option, it pays a premium and an amount equal to that premium is recorded as an asset. When the Portfolio writes an option, it receives a premium and an amount equal to that premium is recorded as a liability. The asset or liability is adjusted daily to reflect the current market value of the option. If an option expires unexercised, the Portfolio realizes a gain or loss to the extent of the premium received or paid. If an option is exercised, the premium received or paid is recorded as an adjustment to the proceeds from the sale or the cost basis of the purchase. The difference between the premium and the amount received or paid on a closing purchase or sale transaction is also treated as a realized gain or loss. The cost of securities acquired through the exercise of call options is increased by premiums paid. The proceeds from securities sold through the exercise of put options are decreased by the premiums paid. Gain or loss on written options and purchased options is presented separately on the Statement of Operations as net realized gain or loss on written options and net realized gain or loss on purchased options, respectively.

Options written by the Portfolio do not typically give rise to counterparty credit risk since options written obligate the Portfolio and not the counterparty to perform. Exchange traded purchased options have minimal counterparty credit risk to the Portfolio since the exchange's clearinghouse, as counterparty to such instruments, guarantees against a possible default.

As of December 31, 2024, the Portfolio had outstanding purchased options and/or written options as listed on the Schedule of Investments.

As of December 31, 2024, the Portfolio had outstanding derivative contracts which are reflected on the Statement of Assets and Liabilities as follows:

| | ASSET

DERIVATIVES | | LIABILITY

DERIVATIVES | |

Gross amounts at fair value: | |

Purchased options(1) | | $ | 147,194 | | | $ | — | | |

Written option(2) | | | — | | | | 3,910 | | |

| | $ | 147,194 | | | $ | 3,910 | | |

www.calamos.com

13

Notes to Financial Statements

For the year ended December 31, 2024, the volume of derivative activity for the Portfolio is reflected below:*

| | VOLUME | |

Purchased options(1) | | | 1,043 | | |

Written option(2) | | | 146 | | |

(1) Generally, the Statement of Assets and Liabilities location for Purchased Options is "Investments in securities, at value".

(2) Generally, the Statement of Assets and Liabilities location for Written Options is "Options written, at value".

* Activity during the period is measured by opened number of contracts for options purchased or written (measured in notional).

Note 6 – Securities Lending

The Portfolio may loan one or more of its securities to broker-dealers and banks through the Securities Loan Agreement. In the Securities Loan Agreement, the "collateral" are the loaned securities themselves. Additionally, the set-off and netting provisions of the Securities Loan Agreement may not extend to the obligations of the counterparty's affiliates or across varying types of transactions. Any such loan must be secured by collateral in cash or cash equivalents maintained on a current basis in an amount at least equal to the value of the securities loaned by the Portfolio. The Portfolio continues to receive the equivalent of the interest or dividends paid by the issuer on the securities loaned and also receives an additional return that may be in the form of a fixed fee or a percentage of the collateral. The additional return is disclosed on a net basis as Securities lending income in the Statement of Operations. Upon receipt of cash collateral, the Portfolio's securities lending agent invests any cash collateral into short term investments following investment guidelines approved by Calamos Advisors. The Portfolio records the investment of collateral as an asset and the value of the collateral as a liability on the Statement of Assets and Liabilities. The securities on loan are collateralized by securities and cash collateral received as disclosed in the Statement of Assets and Liabilities and the Schedule of Investments. The contractual maturity of the collateral received under the securities lending agreement is classified as overnight and continuous. If the value of the invested collateral declines below the value of the collateral deposited by the borrower, the Portfolio will record unrealized depreciation equal to the decline in value of the invested collateral. The Portfolio will pay reasonable fees to persons unaffiliated with the Portfolio for services in arranging these loans. The Portfolio has the right to call a loan and obtain the securities loaned at any time. The Portfolio does not have the right to vote the securities during the existence of the loan but could call the loan in an attempt to permit voting of the securities in certain circumstances. Upon return of the securities loaned, the cash or cash equivalent collateral will be returned to the borrower. In the event of bankruptcy or other default of the borrower, the Portfolio could experience both delays in liquidating the loan collateral or recovering the loaned securities and losses, including (a) possible decline in the value of the collateral or in the value of the securities loaned during the year while the Portfolio seeks to enforce its rights thereto, (b) possible subnormal levels of income and lack of access to income during this year, and (c) the expenses of enforcing its rights. In an effort to reduce these risks, the Portfolio's security lending agent monitors and reports to Calamos Advisors on the creditworthiness of the firms to which the Portfolio lends securities.

The following table indicates the total amount of securities loaned by asset class, reconciled to the gross liability payable upon return of the securities loaned by the Portfolio as of December 31, 2024.

AMOUNT OF

COLLATERAL

HELD IN

SHORT TERM

INVESTMENTS

AND

RESTRICTED | | AMOUNT OF

NON-CASH | | TOTAL | | VALUE OF SECURITIES ON

LOAN TO BROKER-DEALERS AND

BANKS BY ASSET CLASS ON LOAN | | EXCESS

AMOUNT

DUE TO/(FROM) | |

| CASH | | COLLATERAL | | COLLATERAL | | EQUITY | | FIXED INCOME | | TOTAL | | COUNTERPARTY | |

$ | 526,436 | | | $ | 161,588 | | | $ | 688,024 | | | $ | 106,350 | | | $ | 564,786 | | | $ | 671,136 | | | $ | 16,888 | | |

CALAMOS GROWTH AND INCOME PORTFOLIO ANNUAL REPORT

14

Notes to Financial Statements

Note 7 – Fair Value Measurements

Various inputs are used to determine the value of the Portfolio's investments. These inputs are categorized into three broad levels as follows:

• Level 1 – Prices are determined using inputs from unadjusted quoted prices from active markets (including securities actively traded on a securities exchange) for identical assets.

• Level 2 – Prices are determined using significant observable market inputs other than unadjusted quoted prices, including quoted prices of similar securities, fair value adjustments to quoted foreign securities, interest rates, credit risk, prepayment speeds, and other relevant data.

• Level 3 – Prices reflect unobservable market inputs (including the Portfolio's own judgments about assumptions market participants would use in determining fair value) when observable inputs are unavailable.

Debt securities are valued based upon evaluated prices received from an independent pricing service or from a dealer or broker who makes markets in such securities. Pricing services utilize various observable market data and as such, debt securities are generally categorized as Level 2. The levels are not necessarily an indication of the risk or liquidity of the Portfolio's investments.

The following is a summary of the inputs used in valuing the Portfolio's holdings at fair value:

| | LEVEL 1 | | LEVEL 2 | | LEVEL 3 | | TOTAL | |

Assets: | |

Convertible Bonds | | $ | — | | | $ | 5,333,818 | | | $ | — | | | $ | 5,333,818 | | |

Common Stocks | | | 24,797,809 | | | | 108,229 | | | | — | | | | 24,906,038 | | |

Convertible Preferred Stocks | | | 1,224,217 | | | | 97,745 | | | | — | | | | 1,321,962 | | |

Exchange-Traded Funds | | | 71,393 | | | | — | | | | — | | | | 71,393 | | |

U.S. Government and Agency Securities | | | — | | | | 630,841 | | | | — | | | | 630,841 | | |

Purchased Options | | | 147,194 | | | | — | | | | — | | | | 147,194 | | |

Investment of Cash Collateral For Securities Loaned | | | — | | | | 526,436 | | | | — | | | | 526,436 | | |

Total | | $ | 26,240,613 | | | $ | 6,697,069 | | | $ | — | | | $ | 32,937,682 | | |

Liabilities: | |

Written Option | | $ | 3,910 | | | $ | — | | | $ | — | | | $ | 3,910 | | |

Total | | $ | 3,910 | | | $ | — | | | $ | — | | | $ | 3,910 | | |

www.calamos.com

15

Report of Independent Registered Public Accounting Firm

To the shareholders and the Board of Trustees of Calamos Advisors Trust

Opinion on the Financial Statements and Financial Highlights

We have audited the accompanying statement of assets and liabilities of Calamos Growth and Income Portfolio (the "Fund"), a series of the Calamos Advisors Trust (the "Trust"), including the schedule of investments, as of December 31, 2024, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended, and the related notes. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Fund as of December 31, 2024, and the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on the Fund's financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund's internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. Our procedures included confirmation of securities owned as of December 31, 2024, by correspondence with the custodian and brokers. We believe that our audits provide a reasonable basis for our opinion.

Chicago, Illinois

February 10, 2025

We have served as the auditor of one or more Calamos investment companies since 2003.

CALAMOS GROWTH AND INCOME PORTFOLIO ANNUAL REPORT

16

Tax Information (Unaudited)