UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement | | ¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x Definitive Proxy Statement | | |

|

¨ Definitive Additional Materials | | |

|

¨ Soliciting Material Pursuant to § 240.14a-11(c) or § 240.14a-12 | | |

StanCorp Financial Group, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

¨ | | Fee computed on table below per Exchange Act Rules 14a-6(I)(4) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

¨ | | Fee paid previously with preliminary materials. |

¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

March 29, 2002

Dear Fellow Shareholder:

On behalf of your Board of Directors, I have the pleasure of inviting you to attend our 2002 Annual Meeting of Shareholders. The meeting will be held on Monday, May 6, 2002, at 11:00 a.m. Pacific Time in Brunish Hall of the Portland Center for the Performing Arts, Portland, Oregon. I hope that you will participate in the Annual Meeting in one of four available ways. You can do so by attending the meeting and voting in person. Alternatively, you may vote by completing the enclosed proxy card and returning it as promptly as possible. You also may complete your proxy by telephone or over the Internet.

Included with this mailing, you will find our 2001 Annual Report to Shareholders, which includes our Annual Report on Form 10-K. The Annual Report includes audited financial statements for our fiscal year, which ended on December 31, 2001. You will also find our proxy statement. The proxy statement outlines the items of business that will be discussed and voted upon at the Annual Meeting. I urge you to read the Annual Report and the proxy statement carefully, as they contain information about the Company that you may find important.

I hope to see you at the Annual Meeting. If you are unable to attend, I again ask that you complete your proxy and return it by mail, telephone or over the Internet as soon as possible.

Topic

| | Page

|

| | |

|

| | |

|

| | 1 |

|

| | 1 |

|

| | 1 |

|

| | 2 |

|

| | 2 |

|

| | 2 |

|

| | 2 |

|

| | 3 |

|

| | 3 |

|

| | 4 |

|

| | 5 |

|

| | 5 |

|

| | 6 |

|

| | 6 |

|

| | 7 |

|

| | 7 |

|

| | 10 |

|

| | 10 |

|

| | 11 |

|

| | 11 |

|

| | 11 |

|

| | 12 |

|

| | 13 |

|

| | 14 |

|

| | 15 |

|

| | 16 |

|

| | 17 |

|

| | 17 |

|

| | 17 |

|

| | 18 |

|

| | 19 |

i

STANCORP FINANCIAL GROUP, INC.

1100 SW Sixth Avenue

Portland, Oregon 97204

Notice of Annual Meeting of Shareholders

Notice is hereby given that the Annual Meeting of Shareholders of StanCorp Financial Group, Inc., an Oregon corporation, will be held May 6, 2002, at 11:00 a.m. Pacific Time in Brunish Hall of the Portland Center for the Performing Arts, 1111 SW Broadway, Portland, Oregon, for the following purposes:

| | 1. | | to elect four directors to serve for three-year terms expiring in 2005 and one director to serve a one-year term expiring in 2003; |

| | 2. | | to approve the 2002 Stock Incentive Plan; |

| | 3. | | to ratify the appointment of Deloitte & Touche LLP (Deloitte & Touche) as StanCorp’s independent auditors for the year 2002; and |

| | 4. | | to transact any other business that may properly come before the Annual Meeting. |

The close of business on February 27, 2002 has been fixed as the record date for determination of shareholders entitled to notice of, and to vote at, the Annual Meeting.

Shareholders may vote in person, by written proxy, by telephone or over the Internet. Instructions for voting by telephone and over the Internet are printed on the proxy card. If you attend the meeting and intend to vote in person, please notify our personnel of your intent as you sign in for the meeting.

| | BY | ORDEROFTHE BOARDOF DIRECTORS |

| | Vic | e President, General Counsel |

March 29, 2002

STANCORP FINANCIAL GROUP, INC.

1100 SW Sixth Avenue

Portland, Oregon 97204

This proxy statement concerns the Annual Meeting of Shareholders of StanCorp Financial Group, Inc. (“StanCorp,” “the Company,” “we,” “us,” “our”) to be held on May 6, 2002 (“Annual Meeting”). The Annual Meeting will be held at 11:00 a.m. Pacific Time in Brunish Hall of the Portland Center for the Performing Arts, 1111 SW Broadway, Portland, Oregon. Our shares of common stock trade on the New York Stock Exchange under the ticker symbol “SFG.” We have only one outstanding class of common stock that is eligible to vote. As of February 27, 2002, we had 29,718,104 outstanding shares of common stock (“Common Stock”).

The Company is soliciting your proxy for use at the Annual Meeting and at any adjournment of the meeting. You will be asked to vote upon three items: Item 1. Election of Directors; Item 2. Approval of the 2002 Stock Incentive Plan and Item 3. Ratification of Deloitte & Touch as our independent auditors. Your proxy will also permit a vote on any other matter that may legally come before the Annual Meeting. We are currently not aware of any other item that will require a shareholder vote.

We have included in this mailing a copy of our 2001 Annual Report to Shareholders, which includes our Annual Report on Form 10-K. The Annual Report includes audited financial statements. You may wish to review the Annual Report carefully. We are mailing this proxy statement and the accompanying forms of proxy and voting instructions on or about March 29, 2002, to holders of our Common Stock on the record date for the Annual Meeting.

Each share of our Common Stock is entitled to one vote on each proposal and with respect to each director position to be filled. There is no cumulative voting. To be eligible to vote on matters coming before the Annual Meeting, you must own our Common Stock on the record date. The Board of Directors has set the record date as close of our business day on February 27, 2002 (“Record Date”). If you own shares as of the Record Date, you may vote either in person at the Annual Meeting or by proxy. You may vote by proxy by completing a proxy card and mailing it in the postage paid envelope, by using a toll-free telephone number, or by voting over the Internet. Please refer to your proxy card or the information forwarded to you by your bank, broker or other holder of record to see which options are available to you. Your ability to vote by telephone or by the Internet will close at 4:00 p.m. Eastern Time on May 3, 2002. If you choose to vote by mail, we must receive your proxy card prior to the Annual Meeting.

We have included a proxy in this packet. The Company is soliciting this proxy from you. The proxyholder(s), the person(s) designated in the proxy to cast your vote, also known as “proxies,” will vote your shares according to your instructions. If you return your proxy signed, but without directions, the proxyholders will vote your shares in accordance with the recommendations of our Board of Directors with regard to Items 1 through 3. If other matters come before the Annual Meeting that require a shareholder vote, the proxyholder will vote your shares in accordance with the recommendation of our management.

You have the right to revoke your proxy at any time up to the time your shares are voted. You have three ways to revoke your proxy. First, you may do so in writing. Please send your revocation to our Corporate Secretary, P. O. Box 711, Portland, OR 97207. Your written revocation must be received by May 3, 2002. Second, you can cast another valid proxy in writing, by telephone or over the Internet. Your vote will be cast in

1

accordance with the latest valid proxy. Third, you can revoke your proxy by voting in person at the Annual Meeting. If you choose to vote in person, please let our personnel know that you are revoking a previously given proxy and are now voting in person.

As required by Oregon law, our Articles of Incorporation and our Bylaws, to elect nominees to our Board of Directors at the Annual Meeting, the meeting must have a quorum and the nominees receiving the highest number of votes cast in each class will be elected. For a proposal to pass at the Annual Meeting, the meeting must have a quorum and the proposal must receive more votes in its favor than were cast against it, provided that, with respect to Item 2, the total votes cast represent over 50% of all common shares entitled to vote on the proposal. Broker non-votes and abstentions will be treated as if the shares were present at the Annual Meeting, but not voting.

We pay the cost of soliciting proxies. Our directors, officers or employees may solicit proxies on our behalf in person or by telephone, facsimile or other electronic means. We have also engaged the firm of Georgeson Shareholder to assist us in the distribution and solicitation of proxies. We have agreed to pay Georgeson Shareholder a fee of $4,000 plus expenses for their services.

In accordance with the regulations of the Securities and Exchange Commission (“SEC”) and the New York Stock Exchange, we will also reimburse brokerage firms and other custodians, nominees and fiduciaries for their expenses incurred in sending proxies and proxy materials to beneficial owners of StanCorp Common Stock.

Under Oregon law and pursuant to our Articles of Incorporation and Bylaws, StanCorp’s business, property and affairs are managed under the direction of our Board of Directors. Members of our Board of Directors are kept informed of our business through discussions with our Chairman, President and Chief Executive Officer and other officers, by reviewing materials provided to them, through reliance on qualified experts in professional disciplines, and by participating in meetings of the board and its committees.

During 2001, we had thirteen directors. Our Board of Directors is divided into three classes of a nearly equal number of directors. Each class serves a three-year term in office. At this Annual Meeting, you will be requested to elect four Class III directors and one Class I director. Class III currently consists of five directors, four of whom have agreed to stand for re-election. One Class I director, Mr. Peter T. Johnson, and one Class III director, Mr. Franklin E. Ulf, will reach mandatory retirement age and retire from our board this year. Our Board of Directors thanks Mr. Johnson and Mr. Ulf for their many years of service to us and to our subsidiaries.

Class III directors, if elected, will serve until the annual meeting of shareholders in 2005. If any director resigns, dies or is otherwise unable to serve, the Board of Directors may fill the vacancy for the unexpired term.

Our Board of Directors also serves as the Board of Directors of our principal subsidiary, Standard Insurance Company. Unless otherwise noted in the biographical information below, our directors serve on the same board committees of Standard Insurance Company as they do for StanCorp.

The Board of Directors has proposed the following individuals for election as Class III directors: Frederick W. Buckman, John E. Chapoton and Ronald E. Timpe, all of whom are current directors, and nominee Wanda G.

2

Henton. If elected, these directors will serve a three-year term of office to expire at the annual meeting of 2005 and until their successors are elected and qualified. In addition, the Board of Directors has proposed Dr. Peter O. Kohler for election as a Class I director. If elected, Dr. Kohler will serve a one-year term of office to expire at the annual meeting of 2003 and until his successor is elected and qualified. Dr. Kohler, currently a Class III director, has agreed to stand for election as a Class I director to equalize the classes.

If any nominee should become unable to serve, the proxyholder will vote for the person or persons the Board of Directors recommends, if any. We have no reason to believe that any of the nominees is not available or would be unable to serve if elected.

We have set forth below information, as of December 31, 2001, about each nominee and continuing director. This information includes the director’s age, positions held with us, principal occupation, business history for at least the last five years, committees of our board on which the director serves, and other directorships held.

Name

| | Age

| | Director Since (1)

| | | Position Held

| | Term Expires

|

Class III | | | | | | | | | |

| Frederick W. Buckman | | 55 | | 1996 | | | Director | | 2002 |

| John E. Chapoton | | 65 | | 1996 | | | Director | | 2002 |

| Wanda G. Henton | | 50 | | 2002 | (2) | | Director | | 2002 |

| Ronald E. Timpe | | 62 | | 1993 | | | Chairman, President and CEO | | 2002 |

|

Class I | | | | | | | | | |

| Barry J. Galt | | 68 | | 1988 | | | Director | | 2003 |

| Richard Geary | | 66 | | 1991 | | | Director | | 2003 |

| Peter O. Kohler, MD | | 63 | | 1990 | | | Director | | 2003 |

|

Class II | | | | | | | | | |

| Virginia L. Anderson | | 54 | | 1989 | | | Director | | 2004 |

| Jerome J. Meyer | | 63 | | 1995 | | | Director | | 2004 |

| Ralph R. Peterson | | 57 | | 1992 | | | Director | | 2004 |

| E. Kay Stepp | | 56 | | 1997 | | | Director | | 2004 |

| Michael G. Thorne | | 61 | | 1992 | | | Director | | 2004 |

| (1) | | Reflects the year in which the director was elected to Standard Insurance Company’s Board of Directors. All directors except Ms. Henton joined StanCorp’s Board of Directors in March of 1999, prior to Standard Insurance Company’s demutualization and StanCorp’s initial public offering. |

| (2) | | Ms. Henton is a first-time nominee for election as a Class III director at the 2002 Annual Meeting. |

Frederick W. Buckman—Since 1999, Mr. Buckman has served as Chairman and Chief Executive Officer of Trans-Elect, Inc. and since 1999 as President of Frederick Buckman, Inc., a consulting firm located in Portland, Oregon. From 1994 to 1998, Mr. Buckman was President, Chief Executive Officer and Director of PacifiCorp, a holding company of diversified businesses, including an electric utility, based in Portland, Oregon. Mr. Buckman serves as the Chair of the Finance and Operations Committee and serves on the Audit Committee. Mr. Buckman is Chairman of the Board of Celerity Energy of Portland, Oregon and Oregon Health & Science University.

John E. Chapoton—In 2001, Mr. Chapoton became a partner of Brown Investment Advisory Incorporated in Washington, D.C. From 1984 to 2001, Mr. Chapoton was the managing partner of the Washington, D.C. office of the law firm of Vinson & Elkins. Mr. Chapoton serves as the Chair of the Audit Committee.

3

Wanda G. Henton—Since 1996, Ms. Henton has been Chair and Chief Executive Officer of Lloyd Bridge Advisory Corporation, a marketing and private placement consulting firm serving investment management organizations. From 1992 to 1995, Ms. Henton served as Senior Vice President of Lazard Freres, an international investment bank. Ms. Henton is a member of the Board of Directors of Ocean Energy, Inc.

Peter O. Kohler—Since 1988, Dr. Kohler has been President of Oregon Health & Science University, located in Portland, Oregon. Dr. Kohler serves as Chair of the Nominating and Corporate Governance Committee and serves on the Executive Committee.

Ronald E. Timpe—Mr. Timpe has been Chairman, President and Chief Executive Officer of StanCorp since its incorporation. Mr. Timpe has been President and Chief Executive Officer of our principal subsidiary, Standard Insurance Company, since 1994 and became Chairman of its Board of Directors in 1998. Mr. Timpe is the Chair of the Executive Committee of StanCorp and of the Management Committee of Standard Insurance Company.

The Board of Directors recommends a vote “For” the above nominees for election as directors.

Virginia L. Anderson—Since 1988, Ms. Anderson has been the Director of the Seattle Center, a 74-acre, 31-facility urban civic center, located in Seattle, Washington. Ms. Anderson serves on the Audit Committee and the Nominating and Corporate Governance Committee. Ms. Anderson is a member of the Board of Directors of the Downtown Development Association of Seattle, Washington.

Barry J. Galt—Mr. Galt is now retired. In 1998, Mr. Galt was Chairman of Seagull Energy Corporation and Vice Chairman in 1999. From 1983 to 1998, Mr. Galt was the Chairman and Chief Executive Officer of Seagull Energy Corporation, a diversified energy company, located in Houston, Texas. Mr. Galt serves on the Finance and Operations Committee and the Organization and Compensation Committee. Mr. Galt is a member of the Board of Directors of Ocean Energy, Inc. (formerly Seagull Energy Corporation), Trinity Industries, Inc. and Friede Goldman Halter Inc.

Richard Geary—Mr. Geary is a retired Executive Vice President of Peter Kiewit Sons’, Inc., a diversified construction company based in Omaha, Nebraska. From 1984 to 1998, Mr. Geary was President of Kiewit Pacific company, a subsidiary based in Vancouver, Washington. He serves on the Executive Committee and the Finance and Operations Committee. Mr. Geary is a member of the Board of Directors of Peter Kiewit Sons’, Inc., Kiewit Materials Company, Today’s Bank and David Evans and Associates.

Jerome J. Meyer—Mr. Meyer is the Retired Chairman and Chief Executive Officer of Tektronix, Inc., a high technology company located in Wilsonville, Oregon. From 1990 to 1999, Mr. Meyer was Chairman of the Board and Chief Executive Officer of Tektronix, Inc. Mr. Meyer serves as the Chair of the Organization and Compensation Committee and serves on the Finance and Operations Committee. Mr. Meyer is a member of the Board of Directors of Centerspan Communications, AirAdvice and Entreon Corporation.

Ralph R. Peterson—Since 1991, Mr. Peterson has been Chairman, President and Chief Executive Officer of CH2M Hill Companies, Ltd., an engineering, design and consulting firm located in Denver, Colorado. Mr. Peterson serves on the Nominating and Corporate Governance Committee and on the Organization and Compensation Committee. Mr. Peterson also serves as Chairman of the Board of Kaiser-Hill Company, LLC.

E. Kay Stepp—Since 1994, Ms. Stepp has been principal and owner of Executive Solutions, a management consulting firm in Portland, Oregon. From 1989 to 1992, Ms. Stepp was President and Chief Operating Officer of Portland General Electric, an electric utility. Ms. Stepp serves on the Nominating and Corporate Governance

4

Committee and on the Organization and Compensation Committee. Ms. Stepp is a member of the Board of Directors of Planar Systems, Inc., Franklin Covey Company, Bank of the Northwest and Providence Health System.

Michael G. Thorne—Since 2002, Mr. Thorne has been Director and Chief Executive Officer of the Washington State Ferry System. From 1991 to 2001, Mr. Thorne was Executive Director of the Port of Portland, located in Portland, Oregon. Mr. Thorne serves on the Executive Committee and the Finance and Operations Committee. Mr. Thorne is a member of the Board of Directors of Oregon Health & Science University and Willamette Industries, Inc.

In 2001, our board met six times and committees of the board held meetings as follows: Audit Committee (4 times), Finance and Operations Committee (4 times), Nominating and Corporate Governance Committee (3 times), Organization and Compensation Committee (6 times). No member of the board attended fewer than 75% of the aggregate number of board meetings and meetings of committees of which he or she was a member.

Our Board of Directors has established five committees. They are the Executive Committee, the Audit Committee, the Nominating and Corporate Governance Committee, the Finance and Operations Committee and the Organization and Compensation Committee. The function of each committee is discussed below.

Executive Committee—The Executive Committee did not meet in 2001. Except as otherwise provided in Oregon law, our Articles of Incorporation, Bylaws or the Charter, the Executive Committee exercises the full authority of our Board of Directors during those periods in which our full Board of Directors is not scheduled to meet. Mr. Timpe chairs the Executive Committee. In addition to Mr. Timpe, the committee is currently comprised of Messrs. Geary, Johnson, Kohler, Thorne and Ulf.

Audit Committee—The Audit Committee met four times in 2001. It is the responsibility of the Audit Committee to: determine the firm of independent public accountants to recommend to the Board; review the quality of the public accountants’ work; assure the independence of the public accountants; review the audit scope and plan; review and discuss with the public accountants their annual audit report and accompanying management letter and quarterly financial reviews; and oversee the adequacy of the internal control structure. For additional information concerning the Audit Committee’s responsibilities, see “Audit Committee Matters.”

Finance and Operations Committee—The Finance and Operations Committee met four times in 2001. It is the responsibility of the Finance and Operations Committee to: oversee the appropriate capital structure of StanCorp; approve operational plans and budgets; oversee the investment policy and review and approve investment reports and significant acquisitions; make periodic recommendations regarding dividends; counsel the Board regarding acquisitions, divestitures and other business combinations; and review financial information that will be released publicly.

Nominating and Corporate Governance Committee—The Nominating and Corporate Governance Committee met three times in 2001. It is the responsibility of the Nominating and Corporate Governance Committee to: review the organization and structure of the Board; review the qualifications of and recommend candidates for the Board and its committees; review the effectiveness of the Board; recommend directors’ compensation and oversee the compliance program.

Organization and Compensation Committee—The Organization and Compensation Committee met six times in 2001. It is the responsibility of the Organization and Compensation Committee to: review executive compensation and recommend changes, as appropriate; develop and administer an overall compensation policy; monitor the performance of the chief executive officer; oversee succession planning; oversee stock option and stock purchase plans; review organizational changes recommended by the chief executive officer and review Board compensation. All directors who are members of the Organization and Compensation Committee were independent directors within the meaning of the Securities Exchange Act of 1934 and its regulations (“ ’34 Act”). There were no “interlocks” within the meaning of the ’34 Act.

5

Each director who is not an employee of StanCorp or Standard Insurance Company receives an annual retainer fee of $25,000 and a $1,000 meeting fee for each Board meeting and committee meeting attended. Each chair of a Board committee receives an additional annual retainer of $3,000. The retainer is paid quarterly one-half in cash and one-half in StanCorp Common Stock. Additionally, each director receives an annual grant of options to purchase 4,000 shares of Common Stock at fair market value on the date of grant, on the date of our annual meeting. We reimburse directors for all travel and other expenses. Our directors receive only one retainer for serving on StanCorp’s and Standard Insurance Company’s boards and one meeting fee for joint meetings of StanCorp’s and Standard Insurance Company’s boards.

SHARE OWNERSHIP OF DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth information regarding the beneficial ownership, as of January 31, 2002, of our Common Stock by each director, nominee and named executive officer, and by directors, nominees and officers as a group. Except as otherwise noted, the named individual or family members had sole voting and investment power with respect to such securities. No director, nominee or executive officer or directors, nominees and executive officers as a group beneficially own 1% or more of StanCorp’s outstanding shares of Common Stock.

Name

| | Common Stock Beneficially Owned

| |

| Virginia L. Anderson | | 2,800 | |

| Frederick W. Buckman | | 7,585 | |

| John E. Chapoton | | 2,585 | |

| Barry J. Galt | | 3,450 | |

| Richard Geary | | 21,450 | |

| Wanda G. Henton | | 0 | |

| Peter T. Johnson | | 3,736 | |

| Peter O. Kohler | | 2,585 | |

| Jerome J. Meyer | | 4,778 | |

| Ralph R. Peterson | | 2,502 | (1) |

| E. Kay Stepp | | 2,465 | |

| Michael G. Thorne | | 3,550 | |

| Ronald E. Timpe | | 219,760 | (2)(3) |

| Franklin E. Ulf | | 2,450 | |

| Kim W. Ledbetter | | 47,817 | (2)(3)(4) |

| Douglas T. Maines | | 68,647 | (2)(3) |

| J. Gregory Ness | | 38,682 | (2)(3) |

| Eric E. Parsons | | 72,294 | (2)(3) |

| Executive Officers and Directors as a Group (21 Individuals) | | 555,595 | |

| (1) | | Includes 52 shares owned by Mr. Peterson’s spouse. |

| (2) | | Not included is 158,251 shares owned by Standard Insurance Company Defined Contribution Plan Trust for Home Office Employees and Standard Insurance Company Defined Contribution Plan Trust for Field Personnel. The trust is a unitized trust that matches 3% of employees’ contributions, upon election, with StanCorp Common Stock. The purchase and sale of Common Stock are determined by the terms of the plan and are carried out by the administrator. Mr. Timpe, Mr. Ledbetter and another executive officer are co-trustees of the trust. The co-trustees have voting power over the shares owned in trust, but do not have investment or dispositive power over the shares. The co-trustees cannot withdraw shares from the trust and, upon retirement, neither the co-trustees nor any other employee participants receive distributions in stock from the plan. |

| (3) | | Includes 63,000, 10,500, 23,000, 10,500 and 23,000 shares of restricted stock for Messrs. Timpe, Ledbetter, Maines, Ness and Parsons, respectively. Each has voting power over their respective shares. With respect to |

6

| | 4,000 shares owned each by Mr. Maines and Mr. Parsons, 2,000 of such shares will vest provided each is an employee of the Company on February 5, 2005, and the remainder will vest provided each is an employee of the Company on February 11, 2006. All other shares of restricted stock are subject to forfeiture restrictions set forth below under “Compensation of Executive Officers.” |

| (4) | | Includes 412 shares held in trust for Mr. Ledbetter’s son and 200 shares owned by Mr. Ledbetter’s mother’s living trust, of which Mr. Ledbetter is a trustee and beneficiary. |

There are no shareholders of the Company known to management to be beneficial owners of more than 5% of our Common Stock. Under Oregon law, no individual or group of individuals may own 5% or more of our voting shares for the first five years from the effective date of our reorganization, unless they first receive permission to do so from the Director of the Oregon Department of Consumer and Business Affairs.

REPORT OF THE ORGANIZATION AND COMPENSATION COMMITTEE

This report was prepared by the Organization and Compensation Committee of the Company’s Board of Directors (“Committee”). The Committee advises management and exercises authority with respect to compensation and benefits afforded the CEO and members of the Company’s Management Committee (senior executives who report directly to the CEO). The Committee oversees all of the Company’s broad-based compensation and benefit programs. The current members of the Organization and Compensation Committee are Mr. Meyer, Mr. Galt, Mr. Peterson and Ms. Stepp, all of whom are independent directors.

Overview

The Company’s compensation program is designed to attract, retain and motivate highly talented individuals whose abilities are critical to the success of the Company. Compensation policies that attract personnel of this caliber are particularly important for a relatively new public entity like StanCorp. The Company’s compensation program is guided by the following fundamental principles:

| | • | | compensation is based on the level of job responsibility, the performance of the Company and business operations for which the officer is responsible, and the performance of the individual; |

| | • | | total compensation levels are designed to be competitive with compensation paid by organizations with which the Company competes for executive talent; and |

| | • | | compensation should align the interests of the officers with those of the Company’s stockholders by basing a significant part of total compensation on the long-term performance of the Company’s Common Stock. |

In 2001, the Committee reviewed the compensation program to ensure it continues to serve the overall objectives of the Company. This review included a comprehensive report from an independent consulting firm, which assessed the effectiveness of the compensation program. As part of this analysis, the Committee reviewed the Company’s performance and compared it to the performance of a group of comparator companies. This annual compensation review permits an ongoing evaluation of the link between organizational performance and its compensation practices within the context of the compensation programs of comparator companies.

To establish a competitive range of base salary, annual and long-term incentive compensation, the Committee reviews competitive market data of these comparator companies, historical Company practices and the recommendations of outside compensation specialists. The resulting decisions regarding compensation levels are based on competitive market practices, the executive’s level of responsibility and strategic decision-making requirements as well as organization and individual performance measured against stated objectives. The Committee believes that the long-term focus on organization performance brought about by the compensation principles keeps management focused on strategies that position the Company for sustained growth in earnings and return on equity.

7

Compensation Components

In establishing executive compensation, the various components of compensation are considered collectively in order to properly assess the appropriateness of the Company’s program relative to the attainment of its objectives. The Company’s compensation program consists of two key elements: (i) an annual component, i.e. base salary and annual bonus and (ii) a long-term component, i.e. stock options and restricted stock.

Annual Component

In 2001, annual compensation for officers of the Company consisted of two components—base salary and a cash payment under the Company’s Short Term Incentive Plan (“STIP”). The base salaries for senior officers (including Mr. Timpe) were determined by the Committee based on each individual’s performance and, as previously discussed, the Company’s performance and the range of compensation of senior officers with similar responsibilities in comparable companies.

Annual bonuses paid to officers under the STIP are a significant element of the executive compensation program. The STIP is designed to reward participants for the achievement and success of general corporate goals and to recognize and reward their individual performance in achieving such goals.

Under the STIP, each officer of the Company is assigned annual performance goals that may relate to aspects of his or her personal performance, the results attained in a divisional, departmental or other business unit for which that officer is responsible and overall corporate results. The financial criteria used to measure results may include sales or revenue targets, business unit expense targets and specially crafted measures at the departmental and divisional levels and after-tax operating income, earnings growth and return on equity, at the corporate level. Performance criteria may combine objective and subjective elements, and contains a discretionary component.

The Committee is responsible for determinations regarding performance goals for the CEO and those officers who report directly to him. All other determinations for employees below the Management Committee level are made by the appropriate officers and employees subject to the approval of the Committee. In 2002, each Management Committee officer (other than the CEO) has a targeted annual payout of 50%, to a maximum of 75% of base salary, depending on the level of the individual’s assignment in the organization. The CEO has a targeted annual payout range of 75% to 112.5% of base salary. Actual annual payouts may range from zero to as much as 150% of the targeted amount. STIP bonuses are paid in February of the year following the year for which performance was measured.

Long-Term Compensation

The long-term incentive component of the Company’s executive compensation program currently consists of awards under the 1999 Omnibus Stock Incentive Plan (“1999 Stock Plan”). These incentives are designed to reinforce management’s long-term perspective on corporate performance and provide an incentive for key executives to remain with the Company for the long term.

Awards under the 1999 Stock Plan have been a significant element of the Company’s executive compensation program. Compensation derived from stock ownership provides a strong incentive to increase shareholder value, since the value of this compensation is determined by changes in the price of the Company’s Common Stock over the term of each award. To date, awards under the 1999 Stock Plan have taken the form of stock options and restricted stock awards.

Stock options, the principal form of long-term incentive compensation, promote executive retention because they carry multiple year vesting periods and, if not exercised, are generally forfeited if the employee leaves the Company before retirement or vesting occurs. Stock options, granted at the fair market value on the date of grant and with terms not to exceed 10 years, are designed to keep management and professional employees oriented to growth over the long-term and not simply to short-term profits. Awards are granted subjectively at the discretion of the Organization and Compensation Committee based on a variety of factors, including a recipient’s demonstrated past and expected future performances, a recipient’s level of responsibility with the Company and his or her ability to affect shareholder value. In making awards, the Committee considers various measures of option valuation and current comparator group equity practices.

8

The Company made stock option awards to the CEO and other members of the Management Committee in February 2001 as follows: 60,000; 16,000; 16,000; 12,500 and 10,000 for Messrs. Timpe, Parsons, Maines, Ness and Ledbetter respectively.

The Company made no performance-based restricted-stock awards in 2001 because awards made in 2000 were designed as a four-year program. The performance-based restricted stock program is intended to measure and reward management’s efforts to improve the Company’s operating return on equity (“ROE”) during the four-year time period 2000-2004. Forfeiture restrictions are incrementally released from shares as the Company attains annual ROE targets between 10.5% and 15%. Certain provisions permit adjustment to increase or decrease the number of shares released upon attainment of intermediate ROE targets during the program. Failure to meet ROE goals during the time period 2000-2004 will result in the forfeiture of shares which have not been released at the end of 2004.

In 2001, the Company awarded 2,000 shares of tenure-based restricted stock to each Mr. Maines and Mr. Parsons. These shares will vest provided each is an employee of the Company on February 5, 2005.

The Company intends to rely in 2002 on stock options and restricted stock as the sole means of long-term compensation, believing compensation in the form of stock ownership increases long-term value for the stockholders while compensating individual employees for superior performance.

Deductibility Cap on Executive Compensation

Section 162(m) of the Internal Revenue Code generally disallows a tax deduction to public companies for annual compensation over $1 million paid to their chief executive officer and certain other highly compensated executive officers. The Internal Revenue Code generally excludes from the calculation of the $1 million cap compensation that is based on the attainment of pre-established, objective performance goals. Where practicable, it is the policy of the Committee to establish compensation practices that are both cost-efficient from a tax standpoint and effective as a compensation program. However, the Committee considers it important to be able to utilize the full range of incentive compensation, even though some compensation may not be fully deductible, and has done so in the past with respect to the chief executive officer. Non-Statutory Stock Option Compensation received under the 2002 Stock Incentive Plan is intended to qualify for exclusion from the Section 162(m) limitations.

Chief Executive Officer Compensation

The CEO’s compensation for 2001 was determined pursuant to the same philosophy and objectives described earlier in this report and includes the same elements and performance measures as the Company’s other senior executives. Under the STIP, the CEO’s annual targeted payment is between 75% and 112.5% of base salary. For 2001, the Committee approved Mr. Timpe’s base salary of $625,000. In addition, the Committee approved a cash bonus relating to 2001 performance of $650,000 under the STIP and a stock option grant of 60,000 shares. The Board has approved the Committee’s compensation decisions. In awarding compensation, the Committee took note of Mr. Timpe’s continued and substantial contributions to the Company’s performance as measured against the Company’s goals and its peer group’s performance, in particular the total return to shareholders and progress in improving the Company’s ROE.

Summary

Subject to the oversight of the Board of Directors, the Committee is responsible for the overall review, monitoring and approval of all compensation decisions affecting the Company’s senior executives. The Committee actively monitors the effectiveness of the executive compensation program and, from time to time, reviews the program against the principles set forth in this report and makes modifications it believes to be appropriate.

| Organization and Compensation Committee: | | |

| Jerome J. Meyer, Chair | | Barry J. Galt |

| Ralph R. Peterson | | E. Kay Stepp |

9

The information set forth below describes the components of total compensation of the Chief Executive Officer and the four other most highly compensated executive officers (collectively, the “Named Executives”) of the Company or its subsidiaries. To reflect completely the compensation paid Named Executives in the most recent prior period, the Company reports compensation with respect to the year in which it is earned, even if paid in subsequent time periods.

| | | | | Annual Compensation

| | Awards

| | Payouts

| | |

Name and Principal Position

| | Year

| | Salary ($)

| | Bonus ($)

| | Other Annual Compensation ($)(1)

| | Restricted Stock Awards ($)(2)

| | LTIP Payouts ($)(3)

| | All Other

Compensation

($)(4)

|

Ronald E. Timpe (5) | | 2001 | | 625,000 | | 650,000 | | 158 | | | | 0 | | 19,314 |

| Chairman, President and | | 2000 | | 560,000 | | 485,000 | | 158 | | | | 156,015 | | 23,310 |

| Chief Executive Officer | | 1999 | | 518,000 | | 350,500 | | 647 | | | | 186,480 | | 21,378 |

|

Eric E. Parsons (5) | | 2001 | | 320,000 | | 214,536 | | 241 | | 85,000 | | 0 | | 16,992 |

Senior Vice President

| | 2000 | | 260,000 | | 223,280 | | 722 | | | | 48,282 | | 20,854 |

| and Chief Financial Officer | | 1999 | | 250,000 | | 97,875 | | 1,675 | | | | 60,000 | | 19,080 |

|

Douglas T. Maines | | 2001 | | 320,000 | | 195,000 | | 180 | | 85,000 | | 0 | | 16,560 |

| Senior Vice President, | | 2000 | | 291,667 | | 199,209 | | 114 | | | | 0 | | 16,412 |

| Employee Benefits—Insurance | | 1999 | | 240,000 | | 96,118 | | 108 | | | | 0 | | 12,013 |

|

Kim W. Ledbetter | | 2001 | | 205,000 | | 125,767 | | 238 | | | | 0 | | 15,455 |

| Senior Vice President, | | 2000 | | 190,000 | | 124,488 | | 184 | | | | 35,283 | | 12,613 |

| Individual Insurance and Retirement Plans | | 1999 | | 180,000 | | 66,947 | | 1,223 | | | | 43,200 | | 9,103 |

|

J. Gregory Ness | | 2001 | | 230,000 | | 123,027 | | 333 | | | | 0 | | 10,789 |

Senior Vice President,

| | 2000 | | 197,500 | | 92,820 | | 0 | | | | 36,675 | | 525 |

| Investments | | 1999 | | 150,000 | | 58,302 | | 1,223 | | | | 36,000 | | 0 |

| (1) | | Amounts shown reflect preferential earnings on deferred compensation of Named Executives. |

| (2) | | For each year these dollar amounts represent the number of tenure-based restricted shares awarded to the Named Executive multiplied by the market value per share, on the date of award. The 2001 awards are subject to forfeiture unless Mr. Parsons and Mr. Maines remain employed by the Company through February 5, 2005. |

| (3) | | Amounts shown are amounts paid with respect to three-year LTIP plans covering 1998-2000 and 1997-1999. No awards have been made under the LTIP plans since the demutualization of the Company in 1999. All amounts shown reflect payments of awards made prior to that time. |

| (4) | | Amounts shown include matching contributions credited to the accounts of the Named Executives under Standard Insurance Company’s non-qualified Supplemental Executive Compensation Plan and imputed income from Group Life Insurance Plan for Home Office Employees. Amounts of imputed income for 2001 for group term life contributions are: $3,564; $1,242; $810; $627 and $439 for Messrs. Timpe, Parsons, Maines, Ledbetter and Ness, respectively. Amounts contributed to the non-qualified plan in 2001 are: $15,750; $15,750; $15,750; $14,828 and $10,350, respectively. |

| (5) | | Mr. Timpe and Mr. Parsons hold their respective positions for both StanCorp and certain of its subsidiaries. All other Named Executives are employed only by subsidiaries of StanCorp Financial Group, Inc. |

10

2001 Option Grants

| | | Individual Grants

| | Potential Realized Value at Assumed Annual Rates of Stock Price Appreciation for Option Term (2)

|

| | | Number of Securities Underlying Options Granted (1)

| | % of Total Options Granted to Employees in Fiscal Year

| | Exercise Price ($/per share)

| | Expiration Date

| |

Name

| | | | | | 5% ($)

| | 10% ($)

|

| Ronald E. Timpe | | 60,000 | | 27.22 | | 42.50 | | 02/05/2011 | | 1,603,681 | | 4,064,043 |

| Eric E. Parsons | | 16,000 | | 7.25 | | 42.50 | | 02/05/2011 | | 427,648 | | 1,083,745 |

| Douglas T. Maines | | 16,000 | | 7.25 | | 42.50 | | 02/05/2011 | | 427,648 | | 1,083,745 |

| Kim W. Ledbetter | | 10,000 | | 4.53 | | 42.50 | | 02/05/2011 | | 267,280 | | 677,341 |

| J. Gregory Ness | | 12,500 | | 5.67 | | 42.50 | | 02/05/2011 | | 334,100 | | 846,676 |

| (1) | | The options vest in four equal installments on the successive anniversary of the grant date. The exercise period is 10 years. |

| (2) | | Potential realized value at expiration is based on an assumption that the share price of Common Stock appreciates at the rate shown (compounded annually) from the date of the grant until the end of the 10-year term. |

2001 Option Exercises and 2001 Year-End Option Values

| | | Shares Acquired on Exercise (#)

| | Value Realized ($)

| | Securities Underlying Unexercised Options at 12/31/01 (#)

| | Value of Unexercised In-the-Money Options at 12/31/01 ($) (1)

|

Name

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

| Ronald E. Timpe | | 0 | | 0 | | 93,333 | | 106,667 | | 2,344,992 | | 2,680,008 |

| Eric E. Parsons | | 0 | | 0 | | 29,334 | | 30,666 | | 737,017 | | 770,483 |

| Douglas T. Maines | | 0 | | 0 | | 28,000 | | 30,000 | | 703,500 | | 753,750 |

| Kim W. Ledbetter | | 0 | | 0 | | 21,333 | | 20,667 | | 535,992 | | 519,258 |

| J. Gregory Ness | | 0 | | 0 | | 17,167 | | 21,833 | | 431,321 | | 548,554 |

| (1) | | Potential unrealized value is (i) the value of a share of Common Stock at December 31, 2001 ($47.25) less the option exercise price times (ii) the number of shares covered by the options. |

The following table describes performance-based restricted stock held by the Named Executive. No new awards of performance-based restricted stock occurred in 2001 as the grant made in 2000 was intended to cover a four-year period. In any year, shares of restricted stock awarded under the Performance Stock Program may be released, at the discretion of the Board of Directors, upon attainment in any annual measuring period of progressive improvement in return on equity from that of preceding years, within a range between 10.5% (a 10% payout) and 15.0% (a 100% payout).

| | | Shares Reported 1/31/2001

| | Shares Released 2/5/2001

| | | Balance of Shares Issued With Performance-

Based Restrictions 12/31/2001 (1)

|

| Ronald E. Timpe | | 75,000 | | (12,000 | ) | | 63,000 |

| Eric E. Parsons | | 25,000 | | (4,000 | ) | | 21,000 |

| Douglas T. Maines | | 25,000 | | (4,000 | ) | | 21,000 |

| J. Gregory Ness | | 12,500 | | (2,000 | ) | | 10,500 |

| Kim W. Ledbetter | | 12,500 | | (2,000 | ) | | 10,500 |

| (1) | | The program is not structured with a target payment expectation. If annual corporate ROE remains below 10% throughout the period, no payment will occur; if the Company attains an annual 15% ROE during the period, full payment occurs. |

11

Each of the Named Executives participates in both Standard Insurance Company Retirement Plan for Home Office Personnel (“Retirement Plan”) and the Supplemental Retirement Plan for Senior Executives (“Supplemental Retirement Plan”).

The following table sets forth the benefits payable, assuming retirement at age 65, to participants in the Retirement Plan and the Supplemental Retirement Plan (“Retirement Plans”) at the levels of compensation and the periods of service contained therein.

Annual Retirement Plan Benefits

High 5-Year Average

Remuneration

| | Annual Benefit at Age 65 for Years of Service (1)

|

| | 15

| | 20

| | 25

| | 30

| | 35

|

| $ 150,000 | | $ | 35,325 | | $ | 47,100 | | $ | 58,875 | | $ | 70,650 | | $ | 82,425 |

| $ 200,000 | | $ | 47,325 | | $ | 63,100 | | $ | 78,875 | | $ | 94,650 | | $ | 110,425 |

| $ 250,000 | | $ | 59,325 | | $ | 79,100 | | $ | 98,875 | | $ | 118,650 | | $ | 138,425 |

| $ 300,000 | | $ | 71,325 | | $ | 95,100 | | $ | 118,875 | | $ | 142,650 | | $ | 166,425 |

| $ 350,000 | | $ | 83,325 | | $ | 111,100 | | $ | 138,875 | | $ | 166,650 | | $ | 194,425 |

| $ 400,000 | | $ | 95,325 | | $ | 127,100 | | $ | 158,875 | | $ | 190,650 | | $ | 222,425 |

| $ 450,000 | | $ | 107,325 | | $ | 143,100 | | $ | 178,875 | | $ | 214,650 | | $ | 250,425 |

| $ 500,000 | | $ | 119,325 | | $ | 159,100 | | $ | 198,875 | | $ | 238,650 | | $ | 278,425 |

| $ 550,000 | | $ | 131,325 | | $ | 175,100 | | $ | 218,875 | | $ | 262,650 | | $ | 306,425 |

| $ 600,000 | | $ | 143,325 | | $ | 191,100 | | $ | 238,875 | | $ | 286,650 | | $ | 334,425 |

| $ 650,000 | | $ | 155,325 | | $ | 207,100 | | $ | 258,875 | | $ | 310,650 | | $ | 362,425 |

| $ 700,000 | | $ | 167,325 | | $ | 223,100 | | $ | 278,875 | | $ | 334,650 | | $ | 390,425 |

| $ 750,000 | | $ | 179,325 | | $ | 239,100 | | $ | 298,875 | | $ | 358,650 | | $ | 418,425 |

| $ 800,000 | | $ | 191,325 | | $ | 255,100 | | $ | 318,875 | | $ | 382,650 | | $ | 446,425 |

| $ 850,000 | | $ | 203,325 | | $ | 271,100 | | $ | 338,875 | | $ | 406,650 | | $ | 474,425 |

| $ 900,000 | | $ | 215,325 | | $ | 287,100 | | $ | 358,875 | | $ | 430,650 | | $ | 502,425 |

| $ 950,000 | | $ | 227,325 | | $ | 303,100 | | $ | 378,875 | | $ | 454,650 | | $ | 530,425 |

| $1,000,000 | | $ | 239,325 | | $ | 319,100 | | $ | 398,875 | | $ | 478,650 | | $ | 558,425 |

| $1,050,000 | | $ | 251,325 | | $ | 335,100 | | $ | 418,875 | | $ | 502,650 | | $ | 586,425 |

| (1) | | Maximum service under the plan is 35 years. |

The benefits shown in the above table are payable in the form of a straight life annuity with annualized cost of living increases not to exceed a cumulative limit of 3% of the original benefit amount for each year after retirement. Benefits payable under the Retirement Plans are not subject to offset for Social Security benefits. Compensation taken into account under the Retirement Plans is the average monthly compensation paid to a participant during the consecutive 60-month period over the most recent 120-month period that produces the highest average compensation. For this purpose, compensation is the total of base salary and short-term incentive bonus in the year accrued.

As of December 31, 2001, the estimated highest 5-year average remuneration and credited years of service for each of the Named Executives under the Retirement Plans was: Mr. Timpe, $872,196 and 33 years; Mr. Maines, $431,797 and 3 years; Mr. Parsons, $379,121 and 11 years; and Mr. Ledbetter, $249,863 and 27 years and Mr. Ness, $222,047 and 22 years. Mr. Maines became an employee in 1998 and is not yet vested in the Supplemental Retirement Plan.

12

Change of Control Agreement. Standard Insurance Company has also entered into Change of Control Agreements with each of the Named Executives and certain other executive officers (each, an “executive”). The provisions of these agreements become effective if and when there is a Change of Control (as defined below) of StanCorp or Standard Insurance Company. The Change of Control Agreements will continue in effect through December 31, 2002. The agreements will be automatically renewed for successive one-year terms unless StanCorp gives notice to the executive that StanCorp will not extend the expiration date (provided that no such notice can be given during the pendency of a potential Change of Control). If a Change of Control occurs, the expiration date is automatically extended for 24 months beyond the month in which the Change of Control occurs.

Under the Change of Control Agreements, StanCorp will provide the executive with the following benefits in the event of termination by StanCorp or Standard Insurance Company within 24 months of a Change of Control other than for cause:

| | • | | a lump-sum payment in an amount equal to three times the sum of (a) the executive’s annual base salary in effect at the time the Change of Control occurs and (b) target incentive compensation payable to the executive under any short-term incentive plan; |

| | • | | an amount equal to the target bonus payable under any cash long-term incentive plan in effect immediately prior to the Change of Control; |

| | • | | outstanding stock options, stock bonuses or other stock awards shall become immediately vested, become exercisable in full and all outstanding stock options shall remain exercisable; and |

| | • | | immediate vesting of all benefits to which the executive is entitled under any of the Company’s Retirement Plans and a 30-month continuation of certain welfare plans. |

The Change of Control Agreements also provide that, to the extent any payments to the executives would be subject to “golden parachute” excise taxes under Section 4999 of the Internal Revenue Code, the executives will receive “gross-up” payments in order to make them whole with respect to such taxes and any related interest and penalties.

For the purposes of the Change of Control Agreements, a “Change of Control” is defined generally to include:

| | • | | an acquisition of 30% or more of the voting stock of StanCorp or Standard Insurance Company; |

| | • | | a change in the majority of the members of StanCorp’s or Standard Insurance Company’s Board within a 12-month period that is not supported by two-thirds of the incumbent directors; |

| | • | | approval by the shareholders of a merger or reorganization in which StanCorp’s or Standard Insurance Company’s shareholders do not own at least 51% of the voting securities of the resulting entity; |

| | • | | a sale of all or substantially all of StanCorp’s assets or those of Standard Insurance Company; |

| | • | | a tender or exchange offer which results in at least 30% of StanCorp’s voting securities or those of Standard Insurance Company being purchased by the offeror; or |

| | • | | adoption by StanCorp’s or Standard Insurance Company’s Board of Directors of a resolution to the effect that a Change of Control has occurred. |

Acquisition by an executive, or a group of persons including an executive, of 25% or more of the voting securities of StanCorp or Standard Insurance Company does not constitute a Change of Control under the Change of Control Agreements.

13

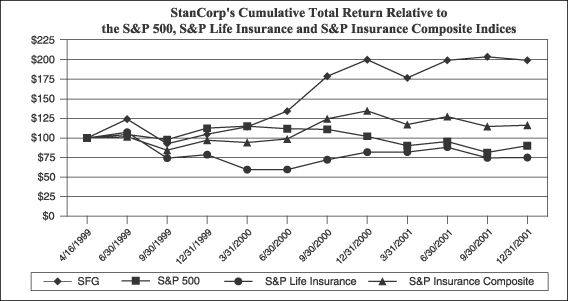

The following graph provides a comparison of the cumulative total shareholder return on the Company’s Common Stock, with the cumulative total return of the S&P Life Insurance Index, the S&P 500 Index and the S&P Insurance Composite Index. The comparison assumes $100 was invested on April 16, 1999 in the Company’s Common Stock and in each of the foregoing indexes and assumes the reinvestment of dividends.

This graph covers the period of time beginning April 16, 1999, when our shares were first traded on the New York Stock Exchange, through December 31, 2001.

14

APPROVAL OF THE 2002 STOCK INCENTIVE PLAN

The Board of Directors Recommends a Vote “For” This Proposal

On February 11, 2002, the Board of Directors adopted the 2002 Stock Incentive Plan (the “2002 Plan”) subject to shareholder approval, reserving 1,450,000 shares of Common Stock for issuance under the 2002 Plan. The Board of Directors believes that the availability of stock options and other stock incentives is an important factor in the Company’s ability to attract, retain and motivate qualified employees, directors and certain non-employees who provide service to the Company. The Company also maintains the 1999 Omnibus Stock Incentive Plan, under which a total of 382,756 shares remain available for grant.

Description of the 2002 Stock Incentive Plan

The following summary of the 2002 Plan is qualified in its entirety by reference to the full text of the 2002 Plan attached to this proxy statement as Exhibit A.

Eligibility. Employees, officers and directors of the Company or any subsidiary of the Company, and selected non-employee agents, consultants, advisors, product salespersons and independent contractors of the Company or any parent or subsidiary of the Company, are eligible to participate in the 2002 Plan.

Administration. The 2002 Plan is administered by the Board of Directors. The Board of Directors may delegate to a committee of the Board of Directors or to specified officers of the Company, or to both (the “Committee”) any or all authority for administration of the 2002 Plan.

Term of Plan; Amendments. The 2002 Plan will continue until all shares available for issuance under the 2002 Plan have been issued and all restrictions on such shares have lapsed. The Board of Directors may at any time modify or amend the 2002 Plan in any respect, however, no change in an award already granted shall be made without the written consent of the award holder if the change would adversely affect the holder.

Stock Options. The Board of Directors determines the persons to whom options are granted, the option price, the number of shares subject to each option, the period of each option and the time or times at which the options may be exercised and whether the option is an Incentive Stock Option, as defined in Section 422 of the Internal Revenue Code (“ISO”), or an option other than an ISO (“Non–Statutory Stock Option” or “NSO”). The option price cannot be less than the fair market value of the Common Stock covered by the option on the date of grant. Options are exercisable in accordance with the terms of an option agreement entered into at the time of grant.

Restricted Stock. The Plan provides that the Board of Directors may issue restricted stock in such amounts, for such consideration, and subject to such terms, conditions and restrictions as the Board of Directors may determine. The 2002 Plan limits the total number of shares that may be issued as a restricted stock to 350,000 shares.

Changes in Capital Structure. The 2002 Plan authorizes the Board of Directors to make appropriate adjustment in outstanding options and awards and in shares reserved under the 2002 Plan in the event of a stock split, recapitalization or in certain other transactions. The Board of Directors also has discretion to convert options, to limit the exercise period of outstanding options and to accelerate the exercisability of options in the event of merger or certain other changes in capital structure.

Tax Consequences. The following description is a summary of the federal income tax consequences of awards under the 2002 Plan. Applicable state, local and foreign tax consequences may differ.

Under current federal income tax law, the Company will not be allowed any deduction for federal income tax purposes at either the time of the grant or exercise of an ISO. Upon any disqualifying disposition by an employee, the Company will generally be entitled to a deduction to the extent the employee realized ordinary income. With respect to NSO’s, the Company will generally be entitled to a deduction, in the amount by which

15

the market value of the shares subject to the option at the time of exercise exceeds the exercise price. With respect to restricted stock issued to employees, the Company generally will be entitled to a tax deduction equal to the amount includable as income by the employee at the same time or times as the employee recognizes income with respect to the shares.

Section 162(m) of the Internal Revenue Code limits to $1,000,000 per person the amount that the Company may deduct for compensation paid to certain of its most highly compensated officers in any year. Under Internal Revenue Service regulations, compensation received through the exercise of an option will not be subject to the $1,000,000 limit if the option and the plan pursuant to which it is granted meet certain requirements. Assuming that future option grants or awards are made in compliance with these requirements, the Company believes that the options or awards granted under the 2002 Plan will be exempt from the $1,000,000 deduction limit.

Vote Required for Approval and Recommendation by the Board

The Board of Directors unanimously recommends a vote FOR Item 2. The proposal to approve the 2002 Plan must be approved by shareholders. For a proposal to pass at the Annual Meeting, the meeting must have a quorum and the proposal must receive more votes in its favor than were cast against it, provided that, with respect to Item 2, the total votes cast represent over 50% of all common shares entitled to vote on the proposal. Abstentions and broker non-votes are counted for purposes of determining whether a quorum exists at the annual meeting but are not counted and have no effect on the results of the vote.

Our Board of Directors, on the recommendation of the Audit Committee, has appointed Deloitte & Touche as independent auditors for the year 2002. Although not required, our Board has determined that it is desirable to request ratification of this appointment by our shareholders. If ratification is not obtained, the Board will reconsider the appointment.

Audit Fees

The aggregate fees billed by Deloitte & Touche LLP, the member firms of Deloitte Touche Tohmatsu, and their respective affiliates (collectively, “Deloitte & Touche”) for professional services rendered for the audit of the Company’s annual financial statements for the fiscal year ended 2001 and for the reviews of the financial statements included in the Company’s Quarterly Reports on Form 10-Q for that fiscal year were $421,000.

Financial Information Systems Design and Implementation Fees

There were no fees billed by Deloitte & Touche for professional services rendered for information technology services relating to financial information systems design and implementation for the fiscal year ended 2001.

All Other Fees

The aggregate fees billed by Deloitte & Touche for services rendered to the Company, other than the services described above under “Audit Fees” and “Financial Information Systems Design and Implementation Fees,” for the fiscal year ended 2001 were $227,500 including audit related services of approximately $157,500 and non-audit services of $70,000 which consisted entirely of tax consulting services. Audit related services generally include fees for audits of the Company’s subsidiaries and employee benefit plans.

The Audit Committee has considered whether the provision of non-audit services is compatible with maintaining the principal accountant’s independence.

We have been advised that representatives of Deloitte & Touche will be present at the Annual Meeting. They will be afforded the opportunity to make a statement, should they desire to do so, and to respond to appropriate questions.

Our Board of Directors unanimously recommends a vote “For” this proposal.

16

The Audit Committee operates pursuant to a Charter approved by the Company’s Board of Directors. The Audit Committee reports to the Board of Directors and is responsible for overseeing and monitoring financial accounting and reporting, the system of internal controls established by management and the audit process of the Company. The Audit Committee Charter sets out the responsibilities, authority and specific duties of the Audit Committee. The Charter specifies, among other things, the structure and membership requirements of the Audit Committee, as well as the relationship of the Audit Committee to the independent accountants, the internal audit department, and management of the Company. All members of the Audit Committee are independent, as such term is defined in the listing requirements of the New York Stock Exchange.

Report of the Audit Committee. The Audit Committee reports as follows with respect to the Company’s audited financial statements for the year ended December 31, 2001:

| | • | | the Audit Committee has completed its review and discussion of the Company’s audited financial statements with management; |

| | • | | the Audit Committee has discussed with the independent auditors, Deloitte & Touche, the matters required to be discussed by Statement on Auditing Standards (“SAS”) No. 61,Communication with Audit Committees, as amended by SAS No. 90,Audit Committee Communications, including matters related to the conduct of the audit of the Company’s financial statements; |

| | • | | the Audit Committee has received written disclosures, as required by Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees, indicating all relationships, if any, between the independent auditor and its related entities and the Company and its related entities which, in the auditor’s professional judgment, reasonably may be thought to bear on the auditor’s independence. The Audit Committee has considered whether the independent auditor’s provision of information technology services and other non-audit services to the Company is compatible with maintaining the auditor’s independence. The Audit Committee has reviewed the letter from the independent auditors confirming that, in its professional judgment, it is independent from the Company, and has discussed with the auditors the auditor’s independence from the Company; and |

| | • | | the Audit Committee has, based on its review and discussions with management of the Company’s 2001 audited financial statements and discussions with the independent auditors, recommended to the Board of Directors that the Company’s audited financial statements for the year ended December 31, 2001 be included in the Company’s Annual Report on Form 10-K. |

| Audit Committee: | | |

| John E. Chapoton, Chair | | Frederick W. Buckman |

| Virginia L. Anderson | | Peter T. Johnson |

Our Board of Directors knows of no other matters to be brought before the Annual Meeting. If other matters are presented, the persons named as proxies will vote on such matters as recommended by management.

BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the ’34 Act requires our directors and executive officers to file reports of holdings and transactions in our Common Stock with the Securities and Exchange Commission. Based on our records and other information, we believe that filing requirements applicable to our directors and executive officers with respect to 2001 have been met, except that Mr. Geary filed one late report with respect to two transactions.

17

SHAREHOLDER NOMINATIONS AND PROPOSALS

Shareholders who wish to submit names to the Nominating and Corporate Governance Committee for consideration for election to the Board of Directors should do so in writing between February 19, 2003 and March 16, 2003, addressed to the Nominating and Corporate Governance Committee, c/o Corporate Secretary, StanCorp Financial Group, Inc., P. O. Box 711, Portland, OR 97207. The notice should set forth as to each nominee whom the shareholder proposes to nominate for election or re-election as director the following:

| | • | | the name, age, business and residence addresses of the nominee; |

| | • | | the principal occupation or employment of the nominee; |

| | • | | the number of shares of Common Stock beneficially owned by the nominee; and |

| | • | | any other information concerning the nominee that would be required to appear in a proxy statement for the election of such nominee under the rules of the Securities and Exchange Commission. |

The nominating shareholder giving notice must also provide his or her name and record address and the number of shares of Common Stock owned by the shareholder.

Under our Bylaws, shareholders who wish to present proposals for action at an annual meeting must give timely notice of the proposed business to our Corporate Secretary. To be timely, a shareholder’s notice must be in writing, delivered to or mailed and received at our principal office in Portland, Oregon not less than 50 days nor more than 75 days prior to that year’s annual meeting. However, if we have not provided shareholders notice of, or otherwise publicly disclosed, the date of the annual meeting within 65 days of the meeting date, notice must be received not later than the close of business on the 15th day following the date on which such notice was mailed or public disclosure was made. Our 2003 annual meeting is scheduled to be held on May 5, 2003. Therefore, a notice, to be timely, must be received by us between February 19, 2003 and March 16, 2003. If received after that date, the proposal, when and if raised at the 2003 annual meeting, will be subject to the discretionary vote of the proxyholder as described earlier in this material.

Please note that these rules govern raising proposals at the annual meeting. In order for a shareholder’s proposal to be considered for inclusion in our 2003 proxy statement, under SEC Rules, we must receive the proposal by November 28, 2002. Shareholders should mail their proposal to our Corporate Secretary, P. O. Box 711, Portland, OR 97207.

In order to make a proposal, the shareholder must also provide us with a brief description of the matter to be brought before the meeting and the reasons for the proposal. The shareholder must also provide us with his or her name and address of record, the number of shares of Common Stock that the shareholder owns, and any interest that the shareholder may have in the proposal.

| | Vic | e President, General Counsel |

March 29, 2002

18

STANCORP FINANCIAL GROUP, INC.

2002 STOCK INCENTIVE PLAN

1. Purpose. The purpose of this 2002 Stock Incentive Plan (“Plan”) is to enable StanCorp Financial Group, Inc., an Oregon corporation (“Company”) to attract and retain the services of (i) employees, officers and directors of the Company or of any subsidiary of the Company, (ii) selected non-employee agents, consultants, advisors, persons involved in the sale or distribution of the products of the Company or any subsidiary of the Company, and independent contractors of the Company or any subsidiary of the Company, and (iii) non-employees to whom an offer of employment has been made. For purposes of this Plan, a person is considered to be employed by or in the service of the Company if the person is employed by or in the service of any entity (“Employer”) that is either the Company or a subsidiary of the Company.

2. Shares Subject to the Plan. Subject to adjustment as provided below and in Section 8, the shares to be offered under the Plan shall consist of Common Stock of the Company, and the total number of shares of Common Stock that may be issued under the Plan shall be 1,450,000 shares. The shares issued under the Plan may be authorized and unissued shares or reacquired shares. If an option granted under the Plan expires, terminates or is canceled, the unissued shares subject to that option shall again be available under the Plan. If shares issued pursuant to Section 7 under the Plan are forfeited to the Company or repurchased by the Company, the number of shares forfeited or repurchased shall again be available under the Plan.

3. Effective Date and Duration of Plan.

3.1 Effective Date. The Plan shall become effective as of May 6, 2002. No Incentive Stock Option (as defined in Section 5 below) granted under the Plan shall become exercisable, however, until the Plan is approved by the affirmative vote of the holders of a majority of the shares of Common Stock represented at a shareholders meeting at which a quorum is present, and the exercise of any Incentive Stock Options granted under the Plan before the receipt of shareholder approval shall be conditioned on and subject to that approval. Subject to this limitation, options may be granted and shares may be awarded or sold under the Plan at any time after the effective date and before termination of the Plan.

3.2 Duration. The Plan shall continue in effect until all shares available for issuance under the Plan have been issued and all restrictions on the shares have lapsed. The Board of Directors may suspend or terminate the Plan at any time except with respect to options and shares subject to restrictions then outstanding under the Plan. Termination shall not affect any outstanding options, or any right of the Company to repurchase shares or the forfeitability of shares issued under the Plan.

4. Administration.

4.1 Board of Directors. The Plan shall be administered by the Board of Directors of the Company, which shall determine and designate from time to time the individuals to whom awards shall be made, the amount of the awards and the other terms and conditions of the awards. Subject to the provisions of the Plan, the Board of Directors may adopt and amend rules and regulations relating to administration of the Plan, advance the lapse of any waiting period, accelerate any exercise date, waive or modify any restriction applicable to shares (except those restrictions imposed by law) and make all other determinations in the judgment of the Board of Directors necessary or desirable for the administration of the Plan. The interpretation and construction of the provisions of the Plan and related agreements by the Board of Directors shall be final and conclusive. The Board of Directors may correct any defect or supply any omission or reconcile any inconsistency in the Plan or in any related agreement in the manner and to the extent it deems expedient to carry the Plan into effect, and the Board of Directors shall be the sole and final judge of such expediency.

19

4.2 Committee. The Board of Directors may delegate to any committee of the Board of Directors (“Committee”) any or all authority for administration of the Plan. If authority is delegated to the Committee, all references to the Board of Directors in the Plan shall mean and relate to the Committee, except (i) as otherwise provided by the Board of Directors and (ii) that only the Board of Directors may amend or terminate the Plan as provided in Sections 3 and 9.

4.3 Officers. The Board of Directors may delegate to any officer or officers of the Company authority to grant awards under the Plan, subject to any restrictions imposed by the Board of Directors.

5. Types of Awards, Eligibility, Limitations. The Board of Directors may, from time to time, take the following actions, separately or in combination, under the Plan: (i) grant Incentive Stock Options, as defined in Section 422 of the Internal Revenue Code of 1986, as amended (“Code”), as provided in Sections 6.1 and 6.2; (ii) grant options other than Incentive Stock Options (“Non-Statutory Stock Options”) as provided in Sections 6.1 and 6.3; and (iii) issue shares subject to restrictions as provided in Section 7. Awards may be made to employees, including employees who are officers or directors, and to other individuals described in Section 1 selected by the Board of Directors; provided, however, that only employees of the Company or any parent or subsidiary of the Company (as defined in subsections 424(e) and 424(f) of the Code) are eligible to receive Incentive Stock Options under the Plan. The Board of Directors shall select the individuals to whom awards shall be made and shall specify the action taken with respect to each individual to whom an award is made. No employee may be granted options for more than an aggregate of 250,000 shares of Common Stock in any calendar year.

6. Option Grants.

6.1 General Rules Relating to Options.

6.1-1 Terms of Grant. The Board of Directors may grant options under the Plan. With respect to each option grant, the Board of Directors shall determine the number of shares subject to the option, the option price, the period of the option, the time or times at which the option may be exercised and whether the option is an Incentive Stock Option or a Non-Statutory Stock Option.

6.1-2 Exercise of Options. Except as provided in Section 6.1-4 or as determined by the Board of Directors, no option granted under the Plan may be exercised unless at the time of exercise the optionee is employed or in the service of the Company or any subsidiary of the Company and shall have been so employed or provided such service continuously since the date such option was granted. Except as provided in Sections 6.1-4 and 8, options granted under the Plan may be exercised from time to time over the period stated in each option in amounts and at times prescribed by the Board of Directors, provided that options may not be exercised for fractional shares. Unless otherwise determined by the Board of Directors, if an optionee does not exercise an option in any one year for the full number of shares to which the optionee is entitled in that year, the optionee’s rights shall be cumulative and the optionee may purchase those shares in any subsequent year during the term of the option.

6.1-3 Nontransferability. Each Incentive Stock Option and, unless otherwise determined by the Board of Directors, each other option granted under the Plan by its terms (i) shall be nonassignable and nontransferable by the optionee, either voluntarily or by operation of law, except by will or by the laws of descent and distribution of the state or country of the optionee’s domicile at the time of death, and (ii) during the optionee’s lifetime, shall be exercisable only by the optionee.

6.1-4 Termination of Employment or Service.

6.1-4(a) General Rule. Unless otherwise determined by the Board of Directors, if an optionee’s employment or service with the Company terminates for any reason other than because of Total Disability, death, Retirement, resignation or termination by the Company without cause (such as set forth below), any options (or portions thereof) held by such optionee shall immediately terminate.

20