SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12

STANCORP FINANCIAL GROUP, INC.

(Name of Registrant as Specified In Its Certificate)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

¨ Fee paid previously with preliminary materials.

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

March 24, 2006

Fellow Shareholder:

We invite you to attend the 2006 Annual Meeting of Shareholders of StanCorp Financial Group, Inc., on Monday, May 8, 2006. The meeting will take place at 11:00 a.m. Pacific time at the Hilton Portland & Executive Tower, located at 921 SW 6th Avenue in Portland, Oregon.

Information regarding the business to be conducted at the meeting is contained in the attached Notice of Annual Meeting and Proxy Statement. We will also present a report on our 2005 operations at the meeting. Our 2005 Annual Report to Shareholders, which includes our Form 10-K and audited financial statements for fiscal year 2005, is also enclosed with this mailing.

If you are unable to attend and vote in person, you can still participate in the Annual Meeting by voting your proxy by mail, telephone, or over the Internet. For instructions on voting by each of these methods, please refer to the proxy card in this packet. A vote by telephone or over the Internet must be received by 11:59 p.m. Eastern time on May 7, 2006. A mailed proxy card must be received prior to the Annual Meeting.

On behalf of the entire Board of Directors, I encourage you to vote your proxy either in person or via one of the other methods available so that your shares can be represented at the Annual Meeting.

|

Sincerely, |

|

|

ERIC E. PARSONS |

Chairman, President and Chief Executive Officer |

CONTENTS

STANCORP FINANCIAL GROUP, INC.

1100 SW Sixth Avenue

Portland, Oregon 97204

Notice of Annual Meeting of Shareholders

Notice is hereby given that the Annual Meeting of Shareholders of StanCorp Financial Group, Inc., an Oregon corporation, will be held May 8, 2006 at 11:00 am Pacific time at the Hilton Portland & Executive Tower, 921 SW 6th Ave, Portland, Oregon, for the following purposes:

| | 1. | | Election of directors; |

| | 2. | | Proposal to ratify appointment of independent registered public accounting firm; and |

| | 3. | | To transact any other business that may properly come before the shareholders at the Annual Meeting. |

The close of business on March 1, 2006 has been fixed as the record date for determination of shareholders entitled to notice of, and to vote at, the Annual Meeting.

Shareholders may vote in person, by written proxy, by telephone or over the Internet. Instructions for voting by telephone and over the Internet are printed on the enclosed proxy card. If you attend the meeting and intend to vote in person, please notify our personnel of your intent as you sign in for the meeting.

|

BY ORDEROFTHE BOARDOF DIRECTORS |

|

|

|

Michael T. Winslow |

Senior Vice President, General Counsel |

and Corporate Secretary |

March 24, 2006

STANCORP FINANCIAL GROUP, INC.

1100 SW Sixth Avenue

Portland, Oregon 97204

PROXY STATEMENT

I. GENERAL INFORMATION

This Proxy Statement concerns the Annual Meeting of Shareholders of StanCorp Financial Group, Inc. (“StanCorp,” the “Company,” “we,” “us,” “our”) to be held on May 8, 2006 (“Annual Meeting”). The Annual Meeting will be held at 11:00 a.m. Pacific time at the Hilton Portland & Executive Tower, 921 SW 6th Ave, Portland, Oregon. Our shares of common stock trade on the New York Stock Exchange (“NYSE”) under the ticker symbol “SFG.” We have only one outstanding class of common stock that is eligible to vote. As of March 1, 2006, we had 54,696,809 outstanding shares of common stock (“Common Stock”).

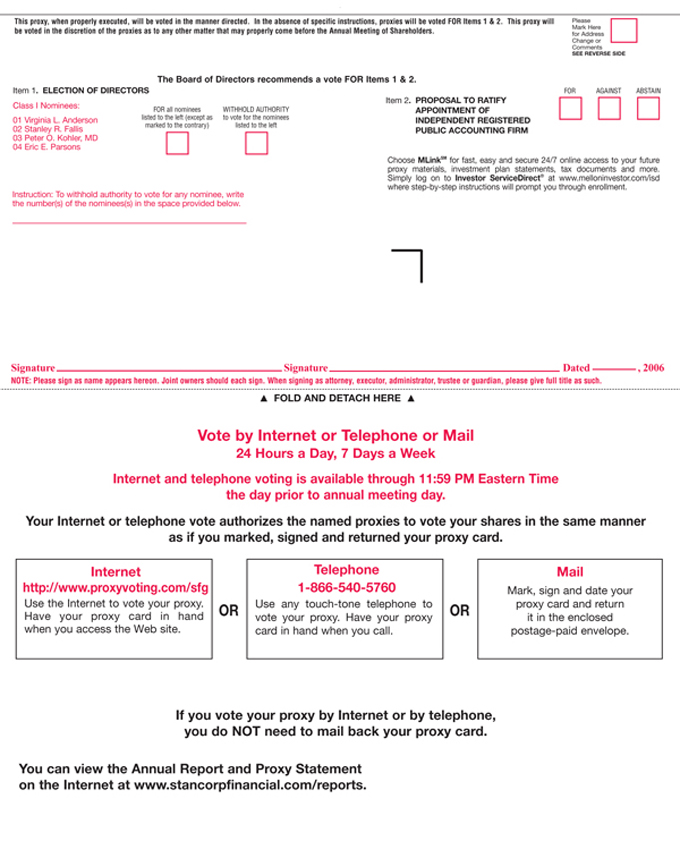

On behalf of the Board of Directors (the “Board”), the Company is soliciting your proxy for use at the Annual Meeting and at any adjournment of the meeting. You will be asked to vote upon two items: Item 1. Election of Directors; and Item 2. Proposal to Ratify Appointment of Independent Registered Public Accounting Firm. Your proxy also will permit a vote on any other matter that may legally come before the Annual Meeting. We currently are not aware of any other item that will require a shareholder vote.

Included with this mailing is a copy of our 2005 Annual Report to Shareholders, which includes our Annual Report on Form 10-K and our audited financial statements. Distribution of this Proxy Statement, the accompanying proxy card and voting instructions occurs on or about March 24, 2006 to holders of our Common Stock as of the record date for the Annual Meeting.

Voting Rights

Each share of our Common Stock is entitled to one vote on each proposal and with respect to each director position to be filled. There is no cumulative voting. To be eligible to vote on matters coming before the Annual Meeting, you must own our Common Stock on the record date. The Board has set the record date as the close of our business day on March 1, 2006 (“Record Date”). If you owned shares as of the Record Date, you may vote either in person at the Annual Meeting or by proxy. You may vote by proxy by completing a proxy card and mailing it in the postage paid envelope, by using a toll-free telephone number, or by voting over the Internet. Please refer to your proxy card or the information forwarded to you by your bank, broker or other holder of record to see which options are available to you. Your ability to vote by telephone or by the Internet will close at 11:59 p.m. Eastern time on May 7, 2006. If you choose to vote by mail, we must receive your proxy card prior to the Annual Meeting.

Voting by Proxy

Included in this packet is a proxy card. The Company is soliciting this proxy from you on behalf of its Board of Directors. The proxyholder(s), the person(s) designated in the proxy to cast your vote, also known as “proxies,” will vote your shares according to your instructions. If you return your proxy signed, but without directions, the proxyholders will vote your shares in accordance with the recommendations of our Board with regard to Items 1 and 2. If other matters come before the Annual Meeting that require a shareholder vote, the proxyholder will vote your shares in accordance with the recommendation of the Board.

1

You have the right to revoke your proxy at any time up to the time your shares are voted. You have three ways to revoke your proxy. First, you may do so in writing. Please send your revocation to our Corporate Secretary, StanCorp Financial Group, Inc., P. O. Box 711, Portland, OR 97207. Your written revocation must be received prior to the Annual Meeting. Second, you can cast another valid proxy in writing, by telephone or over the Internet. Your vote will be cast in accordance with the latest valid proxy we have received from you. Third, you can revoke your proxy by voting in person at the Annual Meeting. If you choose to vote in person, please let our personnel know that you are revoking a previously given proxy and are now voting in person.

Votes Required

Pursuant to Oregon law, our Articles of Incorporation and our Bylaws, the election of nominees to our Board at the Annual Meeting requires a quorum. After achieving a quorum, the nominees receiving the highest number of votes cast in each class will be elected. For a proposal to pass at the Annual Meeting, the meeting must have a quorum and the proposal must receive more votes in its favor than were cast against it. Broker non-votes and abstentions will be treated as if the shares were present at the Annual Meeting, but not voting.

Cost of Proxy Solicitation

We pay the cost of soliciting proxies. Our directors, officers or employees may solicit proxies on our behalf in person or by telephone, facsimile or other electronic means. We have also engaged the firm of Georgeson Shareholder to assist us in the distribution and solicitation of proxies. We have agreed to pay Georgeson Shareholder a fee of $5,000 plus expenses for their services.

In accordance with the regulations of the Securities and Exchange Commission (“SEC”) and the NYSE, we will also reimburse brokerage firms and other custodians, nominees and fiduciaries for their expenses incurred in sending proxies and proxy materials to beneficial owners of StanCorp Common Stock.

II. MATTERS TO BE VOTED UPON

1. Election of Directors

StanCorp’s business, property and affairs are managed under the direction of the Board of Directors. The Board is comprised of 12 directors divided into three equal classes. Each of these classes serves a three-year term in office. At this Annual Meeting, shareholders will be requested to elect four Class I directors for a three-year term. Class I currently consists of four directors, all of whom have agreed to stand for re-election.

Votes may not be cast for a greater number of director nominees than four.

Our Board also serves as the Board of Directors of our principal subsidiary, Standard Insurance Company. Our directors serve on the same board committees of Standard Insurance Company as they do for StanCorp.

2

Directors in Classes

We have set forth below information, as of December 31, 2005, about each nominee and continuing director. This information includes the director’s age, positions held with us, principal occupation, business history for at least the last five years, committees of our Board on which the director serves, and other corporate directorships held.

| | | | | | | | |

Name

| | Age

| | Director

Since(1)

| | Position Held

| | Term

Expires

|

Class I | | | | | | | | |

Virginia L. Anderson | | 58 | | 1989 | | Director | | 2006 |

Stanley R. Fallis | | 65 | | 2006 | | Director | | 2006 |

Peter O. Kohler, MD | | 67 | | 1990 | | Director | | 2006 |

Eric E. Parsons | | 57 | | 2002 | | Chairman | | 2006 |

| | | | |

Class II | | | | | | | | |

Jerome J. Meyer | | 67 | | 1995 | | Director | | 2007 |

Ralph R. Peterson | | 61 | | 1992 | | Director | | 2007 |

E. Kay Stepp | | 60 | | 1997 | | Director | | 2007 |

Michael G. Thorne | | 65 | | 1992 | | Director | | 2007 |

| | | | |

Class III | | | | | | | | |

Frederick W. Buckman | | 59 | | 1996 | | Lead Director | | 2008 |

John E. Chapoton | | 69 | | 1996 | | Director | | 2008 |

Wanda G. Henton | | 54 | | 2002 | | Director | | 2008 |

Ronald E. Timpe | | 66 | | 1993 | | Director | | 2008 |

| (1) | | Directors elected prior to 1999 served on the Board of Directors of Standard Insurance Company, and became directors of StanCorp Financial Group, Inc. during the reorganization in 1999. |

Nominees for Election at the Annual Meeting

The Board has proposed the following individuals for election as Class I directors: Virginia L. Anderson, Peter O. Kohler, Eric E. Parsons, and Stanley R. Fallis, all of whom are current directors. Mr. Fallis was elected as a director in January 2006 by the Board to fill a newly-created vacancy. Each nominee for election under Class I qualifies as an independent director under applicable NYSE rules, with the exception of Mr. Parsons, who serves as President & Chief Executive Officer of StanCorp and Standard Insurance Company. If elected, Class I directors will serve a three-year term of office to expire at the Annual Meeting of Shareholders in 2009 and until their successors are elected and qualified.

If any nominee should become unable to serve, the proxyholder will vote for the person or persons the Board recommends, if any. We have no reason to believe that any of the nominees will be unable to serve if elected.

Business History of Nominees for Election

Virginia L. Anderson. Since 1988, Ms. Anderson has been the Director of the Seattle Center, a 74-acre, 31-facility urban civic center, located in Seattle, Washington. Ms. Anderson serves on the Audit Committee and the Nominating and Corporate Governance Committee.

Stanley R. Fallis. From 1994 to 1999 Mr. Fallis was the Chair and Chief Executive Officer of Everen Clearing Corporation, a securities execution and clearing company, and the Senior Executive Vice President and Chief Administrative Officer for Everen Securities, Inc., a national full service brokerage firm. Mr. Fallis is also a director of Hines Horticulture, Inc., one of the largest commercial nursery operations in North America. Mr. Fallis serves on the Audit Committee and the Nominating and Corporate Governance Committees.

3

Peter O. Kohler, MD. Since 1988, Dr. Kohler has been President of Oregon Health & Science University, located in Portland, Oregon. He is also a member of the Oregon Health & Science University Board of Directors and is a director of the Portland Branch of the Federal Reserve Bank of San Francisco. Dr. Kohler serves on the Finance and Operations Committee and the Organization and Compensation Committee.

Eric E. Parsons. Mr. Parsons is Chairman, President and Chief Executive Officer of StanCorp and our principal subsidiary, Standard Insurance Company. Prior to his appointment as President and CEO, Mr. Parsons was President and Chief Operating Officer of StanCorp and Standard Insurance Company. He has also served as Chief Financial Officer and has held management positions in finance, investments, mortgage loans and real estate since joining the Company in 1968. Mr. Parsons is Chairman of the Portland Development Commission, a special purpose government agency which fulfills the city’s urban renewal, housing and economic development functions.

Our Board of Directors recommends a vote FOR the election of the above nominees as directors.

Business History of Continuing Directors

Frederick W. Buckman. Since 1999, Mr. Buckman has served as Chairman of Trans-Elect, Inc., an independent company engaged in the ownership and management of electric transmission systems, and as President of Frederick Buckman, Inc., a consulting firm located in Portland, Oregon. From 1994 to 1998, Mr. Buckman was President, Chief Executive Officer and Director of PacifiCorp, a holding company of diversified businesses, including an electric utility, based in Portland, Oregon. Mr. Buckman serves as Lead Director of StanCorp, chairs the Nominating and Corporate Governance Committee, and serves on the Organization and Compensation Committee.

John E. Chapoton. Since 2001, Mr. Chapoton has been a partner of Brown Advisory in Washington, D.C. From 1984 to 2000, Mr. Chapoton was a partner in the law firm of Vinson & Elkins, serving as managing partner of the Washington, D.C. office of that firm through 1999. Mr. Chapoton is a director of Saul Centers, Inc., a Real Estate Investment Trust based in Bethesda, Maryland. Mr. Chapoton serves on the Nominating and Corporate Governance Committee and the Organization and Compensation Committee.

Wanda G. Henton. Since 1996, Ms. Henton has been Chair and Chief Executive Officer of Lloyd Bridge Advisory Corporation, a marketing and private placement consulting firm serving investment management organizations. From 1992 to 1995, Ms. Henton served as Senior Vice President of Lazard Freres, an international investment bank. Ms. Henton serves on the Nominating and Corporate Governance Committee.

Jerome J. Meyer. Mr. Meyer is the retired Chairman of the Board and Chief Executive Officer of Tektronix, Inc., a high technology company located in Beaverton, Oregon. Mr. Meyer serves on the Audit Committee and the Finance and Operations Committee.

Ralph R. Peterson. Since 1991, Mr. Peterson has been Chairman, President and Chief Executive Officer of CH2M Hill Companies, Ltd., an engineering, design and consulting firm located in Denver, Colorado. Mr. Peterson is also a director of Xcel Energy, a multi-state electricity and natural gas utility headquartered in Minneapolis, Minnesota. Mr. Peterson is Chair of the Audit Committee and serves on the Finance and Operations Committee.

E. Kay Stepp. From 1994 to 2002, Ms. Stepp was principal and owner of Executive Solutions, a management consulting firm in Portland, Oregon. From 1989 to 1992, Ms. Stepp was President and Chief Operating Officer of Portland General Electric, an electric utility. Ms. Stepp is Chair of the Corporate Board of Providence Health System and also serves as a director of Planar Systems, Inc. and Franklin Covey Co. Ms. Stepp is Chair of the Organization and Compensation Committee and serves on the Finance and Operations Committee.

4

Michael G. Thorne. From January 2002 to October 2004, Mr. Thorne was Director and Chief Executive Officer of the Washington State Ferry System located in Seattle, Washington. From 1991 to 2001, Mr. Thorne was Executive Director of the Port of Portland, a regional port authority responsible for ownership and management of marine terminals, airports and business parks, located in Portland, Oregon. He maintains an active ownership and management interest in the Thorne family farm near Pendleton, Oregon. Mr. Thorne is Chair of the Finance and Operations Committee and serves on the Audit Committee.

Ronald E. Timpe. From 1998 to May 2004, Mr. Timpe was Chairman of the Board of Directors of StanCorp and our principal subsidiary, Standard Insurance Company. From 1994 until 2003, Mr. Timpe served as President and Chief Executive Officer of Standard Insurance Company and, upon its formation in 1998, StanCorp Financial Group, Inc. Mr. Timpe serves on the Finance and Operations Committee.

2. Proposal to Ratify Appointment of Independent Registered Public Accounting Firm

The Audit Committee of the Board has appointed Deloitte & Touche USA LLP (“Deloitte & Touche”) as independent auditors for the year 2006. Although not required, our Board is requesting ratification by our shareholders of this appointment. If ratification is not obtained, the Audit Committee will reconsider the appointment.

We have been advised that representatives of Deloitte & Touche will be present at the Annual Meeting. They will be afforded the opportunity to make a statement, and to respond to appropriate questions.

The aggregate fees billed by Deloitte & Touche for professional services rendered for the years 2005 and 2004 were as follows:

| | | | | | |

| | | 2005

| | 2004

|

Audit Fees | | $ | 1,222,000 | | $ | 1,323,500 |

Audit-Related Fees | | | 146,000 | | | 148,700 |

Tax Fees | | | 35,014 | | | 72,190 |

All Other Fees | | | — | | | — |

| | |

|

| |

|

|

Total | | $ | 1,403,014 | | $ | 1,544,390 |

Audit fees were paid for audits of the financial statements and internal controls of the Company and its subsidiaries, and review of its quarterly financial statements. “Audit-related” fees were paid for audit of the Company’s employee benefit plans, a report on the procedures of the Retirement Plans Division (per Statement on Auditing Standards No. 70), and audits of certain real estate operating expenses.

Tax fees were paid for the purchase of software produced by a Deloitte & Touche subsidiary that is used in the filing of the Company’s federal income tax return. In 2004, tax fees also included assistance related to an appeal with the Internal Revenue Service that concluded in that year.

The Audit Committee has established a policy under which all services performed by the independent auditors must be approved in advance by the Audit Committee or, if such pre-approval of a particular activity is not feasible, by the Chair of the Audit Committee.

Our Board of Directors recommends a vote FOR ratification of Deloitte & Touche

as the Company’s independent registered public accounting firm for 2006.

3. Other Matters

Our Board knows of no other matters to be brought before the Annual Meeting. If other matters are presented, the persons named as proxies will vote on such matters as recommended by the Board.

5

III. OTHER INFORMATION

Performance of the Company’s Common Stock

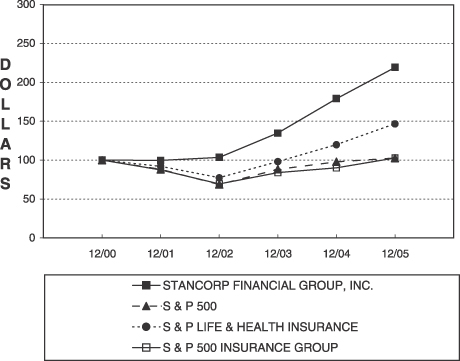

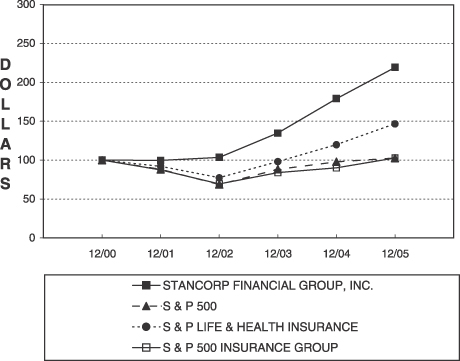

The following graph provides a comparison of the cumulative total shareholder return on the Company’s Common Stock with the cumulative total return of the Standard & Poor’s (“S&P”) 500 Index, the S&P Life and Health Insurance Index and the S&P Insurance Group Index. The comparison assumes $100 was invested on December 31, 2000 in the Company’s Common Stock and in each of the foregoing indexes, and assumes the reinvestment of dividends.

This graph covers the period of time beginning December 31, 2000 through December 31, 2005.

6

Corporate Governance

Corporate Governance Guidelines

The Company’s Corporate Governance Guidelines, which are available publicly at www.stancorpfinancial.com/investors or upon written request of our Corporate Secretary, set forth the principles by which the Board manages the affairs of the Company. Among other principles, the Corporate Governance Guidelines specify director qualifications and independence standards, new director selection practices, responsibilities of board members, compensation, and the annual Board performance evaluation process. The Nominating and Corporate Governance Committee reviews the Guidelines on at least an annual basis.

Director Independence

Our Board is comprised of a majority of directors who qualify as independent under the NYSE listing standards. The Board reviews annually any relationship that each director has with the Company (either directly, or as a partner, shareholder, officer or an employee of an organization with which the Company does business). The Board’s review includes a qualitative and quantitative assessment of any relationships from the perspective of both the director and the Company. Following such annual review, only those directors whom the Board affirmatively determines have no material relationship with the Company are considered independent.

Under Company and NYSE standards, each current director is independent except for Ronald E. Timpe, due to his previous tenure as CEO, and current Chairman, President & CEO Eric E. Parsons.

Committees of the Board

Our Board has four committees, the functions of which are discussed below. Each of these committees has a written charter. Charters for the Audit, Nominating and Corporate Governance, and Organization and Compensation Committees are available on the Company’s Web site, www.stancorpfinancial.com/investors. Printed copies of these documents are available upon request of our Corporate Secretary, PO Box 711, Portland, Oregon 97207.

Audit Committee. The Audit Committee met four times in 2005, and in addition meets via teleconference each quarter to discuss the Company’s financial results and earnings release. It is the responsibility of the Audit Committee to: provide independent review and oversight of the Company’s accounting and financial reporting processes and internal controls; oversee the independent registered public accountant’s appointment, compensation, qualifications, independence, and performance; and assist Board oversight of the integrity of the Company’s financial statements, the Company’s compliance with legal and regulatory requirements, and the performance of the Company’s internal auditors.

Members of the Audit Committee are Ralph R. Peterson, Chair, and Directors Anderson, Fallis, Meyer and Thorne. The Board has determined that Ralph R. Peterson, Chair of the Audit Committee, meets the qualifications of and has been designated as the “audit committee financial expert” in accordance with the requirements of applicable SEC rules. The Board has also determined that each member of the Audit Committee meets all additional independence and financial literacy requirements for Audit Committee membership under applicable NYSE and SEC rules. For additional information concerning the Audit Committee’s responsibilities, see the Report of the Audit Committee below.

Finance and Operations Committee. The Finance and Operations Committee met five times in 2005. It is the responsibility of the Finance and Operations Committee to: oversee the maintenance of an appropriate capital structure; review operational plans and budgets; oversee the investment policy and review and approve investment reports; make periodic recommendations regarding dividends; and provide counsel to management regarding acquisitions, divestitures and other business combinations. The Committee Chair reviews earnings

7

press releases and financial earnings guidance that will be released publicly. Members of the Finance and Operations Committee are Mike Thorne, Chair, and Directors Kohler, Meyer, Peterson, Stepp and Timpe.

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee met four times in 2005. It is the responsibility of the Nominating and Corporate Governance Committee to: review the organization and structure of the Board; review the qualifications of and recommend candidates for the Board and its committees; and review the effectiveness of the Board and oversee the ethics and compliance programs. Members of the Nominating and Corporate Governance Committee are Frederick Buckman, Chair, and Directors Anderson, Chapoton, Fallis, and Henton.

Organization and Compensation Committee. The Organization and Compensation Committee met five times in 2005. It is the responsibility of the Organization and Compensation Committee to: review executive compensation and recommend changes, as appropriate; develop and administer an overall compensation policy; monitor the performance of the CEO; oversee CEO and senior executive succession planning; oversee stock option and stock purchase plans; review certain organizational changes recommended by the CEO; and review Board compensation. Members of the Organization and Compensation Committee are E. Kay Stepp, Chair, and Directors Buckman, Chapoton, and Kohler.

Board and Committee Meetings

In 2005, our full Board of Directors met five times, and executive sessions of the Board were held at each meeting. Executive sessions are chaired by the Lead Director and take place without the presence of the CEO, other officers, or directors who are not independent under applicable NYSE and Company director independence standards. Each Director attended greater than 90 percent of the aggregate number of Board meetings and meetings of committees of which he or she was a member. Our corporate governance guidelines, available at www.stancorpfinancial.com/investors, require attendance at each Annual Meeting of Shareholders. Each Director attended the 2005 Annual Meeting.

Communications with the Board of Directors

Our Board welcomes communications from shareholders. Shareholders may contact the Board by writing to:

Lead Director

c/o Corporate Secretary, P17A

StanCorp Financial Group, Inc.

PO Box 711

Portland, Oregon 97207

All shareholder communications and interested party concerns will be reviewed by the Lead Director.

Director Nominations

StanCorp endeavors to maintain a Board of Directors representing a broad spectrum of expertise, background, perspective and experience. In addition, a candidate for service on the Board of the Company should possess the following qualities:

| | A. | | Sound judgment, good reputation and integrity, and should be a person of influence who is recognized as a leader in his/her community. |

| | B. | | A keen sense of the responsibilities of directorship and the ability to take a long-term, strategic view. |

| | C. | | The willingness and availability to attend at least 75 percent of all Board and committee meetings and to study background material in advance, and to otherwise fully perform all of the responsibilities associated with serving as a Director of the Company. |

8

| | D. | | An understanding of conflicts of interest and the willingness to disclose any real or potential conflict that would prevent or influence his/her acting as a Director in trust for shareholders of the Company. |

| | E. | | Be or become a shareholder of the Company. The candidate should have a positive conviction concerning the businesses of the Company, and be committed to serving the long-term interests of the Company’s shareholders. |

| | F. | | Be currently or formerly actively engaged in business, professional, educational or governmental work. Successful experience leading large organizations is preferred, as is ability, skills or experience in some or all of the following areas: |

| | i) | | expertise in financial accounting and corporate finance, |

| | ii) | | an understanding of management trends in general, |

| | iii) | | knowledge of the Company’s industry, |

| | iv) | | leadership skills in motivating high-performance talent, and |

| | v) | | the ability to provide strategic insight and vision. |

| | G. | | The willingness at all times to express ideas about matters under consideration at Board meetings. The candidate should have the ability to dissent without creating adversarial relations among Board members or management. |

| | H. | | The ability to meet any requirement of the Oregon Business Corporation Act and, to the extent applicable, of the Oregon Insurance Code. |

| | I. | | A reputation and a history of positions or affiliations befitting a director of a large publicly held company. |

In conjunction with the Board’s annual self-assessment process, the Board considers the adequacy of the Board’s composition, including the number of directors as well as the skills, experience, expertise and other characteristics represented by the directors individually and collectively. Based upon this process the Board will determine whether the Company should add one or more additional directors. If such a determination is made, the Board will develop a pool of nominees to be considered for each additional position.

Candidate Recommendations and Identification Process

Director or Officer Recommends a Potential Candidate. If a director or Executive Officer of the Company wishes to recommend a particular candidate for the Board, he or she will provide the Company with the name of the candidate as well as a brief description of the candidate’s current status, relevant experience and qualifications, contact information, and any other pertinent and available information. This information should be communicated in writing or verbally to the Nominating and Corporate Governance Committee Chair (“Nominating Committee Chair”).

The Nominating Committee Chair will arrange to discuss the merits of the candidate with the Nominating and Corporate Governance Committee. This discussion may result in the formulation of a recommendation to the full Board whether to consider the candidate, follow up for more information regarding the candidate, or reject the candidate. Following discussion, the full Board will determine whether to reject or add the individual to the pool of eligible candidates.

The director or Executive Officer making the nomination will be kept regularly apprised of any discussions and actions taken with respect to such nominee.

Search Firm. The Company may elect to retain a search firm to identify potential candidates. The decision to retain a search firm shall be made by the Nominating and Corporate Governance Committee in consultation

9

with the full Board. Any such search firm shall be formally retained by the Company’s Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee also will be responsible for reviewing and approving all fees and expenses charged by the firm.

The Nominating Committee Chair will coordinate communications with the search firm, and arrange to discuss the merits of any candidate recommended by the search firm with the Nominating and Corporate Governance Committee. This discussion may result in the formulation of a recommendation to the full Board whether to consider the candidate, follow up for more information regarding the candidate, or reject the candidate. Following discussion, the full Board will then determine whether to reject or add the individual to the pool of eligible candidates.

Shareholder Recommends a Potential Candidate. In accordance with the procedures set forth below, shareholders and other interested parties may propose director candidates for consideration by the Nominating and Corporate Governance Committee. Consistent with the Nominating and Corporate Governance Committee’s procedures for screening all candidates, such nominees are expected to embody the attributes listed above. In reviewing candidates referred by shareholders or other interested parties, the Nominating and Corporate Governance Committee will also give due consideration to any desired skills, experience, expertise or other characteristics as identified by the Board in its annual self-assessment process.

Shareholders and interested parties may recommend director candidates to the Nominating and Corporate Governance Committee by writing the Company’s Corporate Secretary at PO Box 711, Portland, Oregon 97207. Such recommendations will be accepted in the month of June of each year, and should be accompanied by the candidate’s name and information regarding his or her qualifications to serve as a director of the Company.

Following receipt of such a recommendation, the Nominating Committee Chair will coordinate necessary communications with the nominee and nominating shareholder or interested party, and arrange to review the qualifications and discuss the merits of the candidate with the Nominating and Corporate Governance Committee. This discussion may result in the formulation of a recommendation to the full Board whether to consider the candidate, follow up for more information regarding the candidate, or reject the candidate. Following discussion, the full Board will then determine whether to reject or add the individual to the pool of eligible candidates.

As set forth below in “Shareholder Nominations and Proposals for 2007,” the Company’s Bylaws also provide shareholders with a separate process by which director candidates can be nominated for election at an annual meeting of shareholders.

Interview and Selection Process. The Nominating and Corporate Governance Committee, in consultation with the full Board, shall determine whether to interview any individuals in the pool of eligible director candidates.

Following the interview process, the Nominating Committee Chair will lead a discussion with the Nominating and Corporate Governance Committee regarding the relative merits and qualifications of the candidates and whether the Company should extend an offer to any such candidate. The Nominating and Corporate Governance Committee will, in turn, develop a recommendation to the full Board in that regard. No offer will be extended to a director candidate unless the candidate has been discussed with the full Board and the full Board has approved making such offer.

The Nominating Committee Chair shall, in the course of regularly scheduled Board meetings, keep the full Board informed of all significant developments in regard to the director interview and selection process. The Nominating Committee Chair shall also regularly consult with the Company’s CEO in regard to the need for new directors, the qualifications of director candidates, and any recommendations regarding such candidates. Any final decisions in that regard, however, are to be made by the Board in their sole discretion.

10

Additional Materials Available Online

Shareholders and other interested parties may view the Company’s Corporate Governance Guidelines, Codes of Business Conduct and Ethics for the Board of Directors, senior officers and employees, as well as other documentation concerning our Board and governance structure at www.stancorpfinancial.com/investors. Print copies of these documents are available upon request to Shareholder Relations, PO Box 711, Portland, Oregon 97207.

Committee Reports

Report of the Organization and Compensation Committee

Overview

The Organization and Compensation Committee of StanCorp’s Board of Directors (the “Committee”) is comprised entirely of independent directors as determined by the Board and in accordance with applicable NYSE standards. Among other responsibilities, the Committee exercises sole authority with respect to performance evaluation, compensation and benefits of the CEO, oversees succession planning for Executive Officers, and approves the compensation of Executive Officers. The Committee also oversees all of the Company’s broad-based compensation and stock programs.

The Company’s compensation program is designed to reward superior performance at the organizational and personal levels and attract, retain and motivate highly talented individuals whose abilities are critical to the success of the Company. The Company’s compensation program is guided by the following fundamental principles:

| | • | | compensation is based on the performance of the Company, the business operations for which the officer is responsible, and the individual; |

| | • | | compensation is designed to allow the Company to compete with other organizations for executive talent; and |

| | • | | compensation aligns the interests of officers with those of the Company’s stockholders. |

In 2005, the Committee reviewed the CEO and Executive Officer compensation program and benefits to ensure they continue to further these principles and reflect the Committee’s commitment to link performance with compensation. The 2005 review included a comprehensive report from an independent consulting firm, which assessed the effectiveness of the compensation program. As part of this analysis, the Committee compared the Company’s compensation program and performance to those of comparable companies, and also reviewed the program for internal equity amongst the Executive Officers. In addition to this annual review, the Committee regularly meets in executive session, without management present, to discuss items relating to executive and CEO compensation and performance. These annual and ongoing compensation reviews permit a continual evaluation of the link between organizational performance and compensation within the context of the compensation programs of comparable companies.

To establish a competitive range of base salary and short- and long-term incentive compensation, the Committee reviews competitive market data from surveys, information from comparable companies, historical Company practices and the recommendations of independent compensation consultants, which are retained and compensated at the sole discretion of the Committee. The resulting decisions regarding compensation levels are based on competitive market practices, the officer’s level of responsibility, the strategic decision-making requirements of the position and organization and individual performance as measured against stated objectives. The Committee believes that the long-term focus on organizational performance brought about by these compensation principles keeps management focused on strategies that position the Company for sustained growth in earnings, revenue and ultimately shareholder returns.

11

On an annual basis the Committee reports on the executive compensation package to the full Board. The Committee and the Board also engage in an annual self assessment process to ensure that the each committee, the Board, and individual directors are meeting the accountabilities as outlined in this Report, the Company’s Corporate Governance Guidelines, and each committee’s charter.

Compensation Components

In establishing executive compensation, the various components of compensation are considered collectively in order to properly assess the appropriateness of the Company’s program relative to the attainment of its objectives. The Company’s compensation program consists of three key elements: (i) an annual component, which includes base salary and an annual cash bonus, (ii) a long-term component, which primarily includes stock options and performance shares and cash units, and to a lesser extent tenure-based restricted stock, and (iii) benefits, including defined benefit and defined contribution retirement plans, group life, health and disability insurance, and financial planning and tax consulting services.

Annual Component

In 2005, annual compensation for all officers of the Company consisted of two components—base salary and a cash payment under the Company’s Short Term Incentive Program (“STIP”). The base salaries for Executive Officers and the CEO were determined by the Committee with the assistance of its compensation consultant and based upon the criteria discussed above.

Annual bonuses paid to Executive Officers under the STIP are a significant element of the Company’s executive compensation program. The STIP is designed to reward participants for the achievement and success of general corporate goals and to recognize and reward their individual performance in achieving these goals.

Each officer’s individual STIP is designed to connect a significant portion of their annual compensation with attainment of annual performance goals relative to specific aspects of his or her job performance, the results achieved in their business unit, and overall corporate financial results. The financial criteria used to measure results may include sales or revenue targets, business unit expense targets and specially crafted measures at the business unit level, and net income excluding after-tax capital gains and losses, earnings growth and return on equity at the corporate level. Performance criteria combine these objective elements, which constitute 80% of the annual award at target, and a subjective component, which accounts for 20% of the award at target.

The Committee is responsible for determinations regarding performance goals for the CEO and those officers who report directly to him. All other determinations for officers below the Executive Officer level are made by the appropriate officers. Final payouts to all officers are subject to the approval of the Committee. In 2005, each Executive Officer with responsibility for a product division (Mr. Ness and Mr. Ledbetter) had a targeted annual payout of 60%, to a maximum of 90% of base salary. Ms. McPike and Mr. Winslow had a targeted annual payout of 50% to a maximum of 75% of base salary. The targeted annual payout for Mr. Parsons was 75% of base salary with a maximum payout of 112.5%. Further details regarding the 2005 STIP awards are contained in the Summary Compensation Table, contained herein, under the Bonus category.

Long-Term Compensation

The Committee believes that share ownership by the Executive Officers is a key tool to reward positive growth and shareholder return over an extended period. The long-term incentive component of the Company’s executive compensation program currently consists of awards under the 1999 Omnibus Stock Incentive Plan (“1999 Stock Plan”) and the 2002 Stock Incentive Plan (“2002 Stock Plan”). These incentives are designed to reinforce management’s long-term focus on corporate performance and provide an incentive for key executives to remain with the Company for the long term.

12

Awards under these stock plans have been a significant element of the Company’s executive compensation program. Compensation derived from stock ownership provides a strong incentive to increase shareholder value, since the ultimate value of this compensation is determined by an increase in the price of the Company’s Common Stock over the term of each award. To date, awards under the 1999 and 2002 Stock Plans have taken the form of stock options and restricted stock awards.

Performance Shares and Cash Performance Units

Performance shares, or restricted stock shares which are forfeited if specified performance criteria are not met, are an integral part of the Company’s long term compensation plan. These performance shares focus the recipient on designated long term performance goals and vest only if those targets are met. In 2005 the Company made a performance share grant to each Executive Officer with vesting based on achievement of performance goals in 2007. In each future year, the Committee intends to make an award to each Executive Officer with vesting based on Company performance in the third year following the award. Each award consisted of approximately 60% restricted shares issued to the participant subject to forfeiture if continued employment and financial performance criteria for 2007 are not met, and approximately 40% cash performance units each representing a right to receive cash equal to the value of one share of common stock subject to the same employment and financial performance criteria. These grants are designed to be aligned with the Company’s financial targets and strategic plans, and provide a range of potential payouts based upon actual performance.

For the 2007 performance year, the performance criteria are based on three components:

| | • | | earnings per share excluding after-tax capital gains (50%), |

| | • | | growth in revenues (35%), and |

| | • | | pretax income of all businesses other than life and disability insurance (15%). |

The exact number of restricted shares and cash performance units that will vest are determined based upon achievement of specific criteria related to these three components as further specified in a long-term incentive award agreement executed at the time of the grant between each individual Executive Officer and the Company. Failure to meet established annual goals during 2007 will result in the forfeiture of shares and units that have not vested. The performance share program includes cash performance units to allow recipients to pay tax liabilities associated with the release of shares without selling those shares.

The performance-based awards granted in 2005 to the Executive Officers totaled 38,458 restricted shares and 24,622 cash performance units. Performance share and unit grants to individual Executive Officers are detailed in the table “Long-Term Incentive Plan – Awards in 2005” below. Executive Officers received similar awards in 2004 covering the 2005 performance year, based upon three components: earnings per share excluding after-tax capital gains (50%); growth in premium revenues (35%); and pre-tax income of all businesses other than life and disability insurance (15%). Based upon the Company’s performance in 2005, these awards vested for 75.4% of shares and units awarded, and the balance was forfeited.

Stock Options

The Committee grants stock options to each Executive Officer as well as other officers of the Company on an annual basis. Options promote executive retention because they carry multiple year vesting periods and, if not exercised, are forfeited if the employee leaves the Company before retirement or vesting occurs. Stock options are granted at the fair market value on the date of grant, with terms not to exceed 10 years, and are designed to keep management and professional employees oriented to long-term growth rather than short-term profits. Awards are granted at the discretion of the Committee based on a variety of factors, including a recipient’s demonstrated past and expected future performance, a recipient’s level of responsibility within the Company and his or her ability to affect shareholder value. In making awards, the Committee considers various measures of option valuation and the equity practices of comparable companies.

13

The Company made stock option awards to the CEO and the four other most highly compensated Executive Officers in 2005 as follows: 80,000; 25,000; 23,000; 23,000; and 15,000 for Parsons, Ness, Ledbetter, McPike, and Winslow, respectively. Stock options also were awarded to each other executive and non-executive officer of the Company in 2005. Further information regarding stock option grants and exercises in 2005 is contained in the “2005 Option Grants” and “2005 Option Exercises and Year-End Option Values” tables below.

Tenure-Based Restricted Stock

The Company has selectively granted tenure-based restricted stock to Executive Officers in prior years. These shares vest only if the executive remains with the Company until a specified date in the future. No grants of tenure-based restricted stock were made in 2005.

Stock Ownership Guidelines

The Committee has adopted a compensation philosophy based significantly on stock ownership, which it believes promotes long-term growth in both the Company and in shareholder returns. Accordingly, the Committee also has adopted the following stock ownership guidelines for Executive Officers:

President & CEO—four times annual salary

All other Executive Officers—two times annual salary

For purposes of our guidelines, “ownership” excludes stock options that are not yet vested, stock options that are vested but not yet exercised, and restricted shares that have not yet vested.

In adopting these guidelines, the Committee acknowledged that current executives, as well as executives hired in the future, would require several years to achieve the intended ownership levels, but also committed to undertake an annual review of stock ownership in order to be assured that reasonable progress is being made toward the attainment of the guidelines.

Chief Executive Officer Compensation

The Committee determines the CEO’s compensation based upon a number of factors, including financial results, shareholder returns, the compensation for CEOs at comparable companies, and the advice of the Committee’s compensation consultant. An annual assessment of the CEO’s performance is also conducted by the Committee prior to making compensation decisions for the next year. Mr. Parsons’ compensation for 2005 was determined pursuant to the philosophy and objectives described earlier in this report and includes the same performance measures as provided for the Company’s other Executive Officers. A proportionally higher amount of the CEO’s compensation is tied to performance, and hence at risk, than other executives.

In awarding compensation for 2005, the Committee took note of Mr. Parsons’ continued and substantial contributions to the Company’s performance as measured against the Company’s goals and its peer group’s performance, in particular the total return to shareholders and progress in improving the Company’s return on equity and earnings per share. For 2005, the Company achieved an EPS growth of 12.7% and growth in premium earnings of 10.7%. Non-premium earnings grew by 14.5%.

Mr. Parsons’ annual targeted payment under the STIP, or annual bonus plan, is 75% of base salary at target and capped at 112.5% of base salary for exceptional performance. For 2005, the Committee approved Mr. Parsons’ base salary of $725,000, an increase of 7.4% over 2004, and a cash bonus relating to 2005 performance of $722,644 under the STIP. Mr. Parsons received a stock option grant of 80,000 shares in January 2005. Based upon previously detailed performance measures, Mr. Parsons vested for 16,437 restricted shares and 10,858 cash performance units pursuant to the performance program for the 2005 performance year. The full Board of Directors has ratified the Committee’s compensation decisions.

14

Mr. Parsons participates in the Company’s qualified defined benefit retirement plan, which is available to all employees hired before January 1, 2003. He also participates in a supplemental non-qualified defined benefit plan available to Executive Officers. The benefit available under this supplemental plan is the difference between the benefit that would be provided under the qualified plan if it were not subject to compensation or annual benefit limitations, as determined by the Internal Revenue Service, and the benefit actually provided by the qualified plan. Further details about the projected benefits payable to Mr. Parsons and other Executive Officers under these two retirement plans is contained in the table under “Standard Retirement Program” below.

Deductibility Cap on Executive Compensation

Section 162(m) of the Internal Revenue Code generally disallows a tax deduction to public companies for annual compensation over $1 million paid to their chief executive officer and certain other highly compensated executive officers. The Internal Revenue Code generally excludes from the calculation of the $1 million cap compensation that is based on the attainment of pre-established, objective performance goals established under a shareholder-approved plan. Where practicable, it is the policy of the Committee to establish compensation practices that are both cost-efficient from a tax standpoint and effective as a compensation program. However, the Committee considers it important to be able to utilize the full range of incentive compensation, even though some compensation may not be fully deductible, and has done so with respect to the chief executive officer in 2005. Stock option grants and performance-based restricted stock and cash units received under the 2002 Stock Plan are intended to qualify for exclusion from the Section 162(m) limitations.

Summary

The intent of this Committee is to provide a reasonable total compensation package for the CEO and other Executive Officers which promotes the interests of shareholders, and hence the Company’s long term strategic and financial objectives, while promoting equity in pay for the Executive Officers as a group. In seeking to achieve such a total compensation package, the Committee considers all facets of executive remuneration, the market for executive talent, the performance of the Company and each executive in multiple measures as discussed throughout this Proxy Statement. It is the aim of this Committee to place a significant portion of each executive’s compensation at risk, and to fully disclose the compensation paid out following achievement of those goals in an open and transparent manner.

| | |

Organization and Compensation Committee: | | |

E. Kay Stepp, Chair | | Frederick W. Buckman |

John E. Chapoton | | Peter Kohler, M.D. |

15

Report of the Audit Committee

Overview

The Audit Committee operates under a Charter approved by the Company’s Board of Directors. The Audit Committee reports to the Board of Directors and is responsible for providing independent review and oversight of the Company’s accounting and financial reporting processes and internal controls and overseeing the independent registered public accounting firm’s appointment, compensation, qualifications, independence, and performance. The Audit Committee Charter sets out the responsibilities, authority, and specific duties of the Audit Committee. The Charter specifies, among other things, the purpose and membership requirements of the Audit Committee as well as the relationship of the Audit Committee to the independent accountants, the Internal Audit department, and management of the Company. All members of the Audit Committee are independent as such term is defined by the SEC and in the listing requirements of the New York Stock Exchange.

Findings and Recommendation

The Audit Committee reports as follows with respect to the Company’s audited financial statements for the year ended December 31, 2005:

| | • | | The Audit Committee has completed its review and discussion of the Company’s audited financial statements with management; |

| | • | | The Audit Committee has discussed with the independent registered public accounting firm, Deloitte & Touche, the matters required to be discussed by Statement on Auditing Standards (“SAS”) No. 61,Communication with Audit Committees, as amended by SAS No. 90,Audit Committee Communications, including matters related to the conduct of the audit of the Company’s financial statements; |

| | • | | The Audit Committee has received written disclosures as required by Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees, indicating all relationships, if any, between the independent registered public accounting firm and its related entities and the Company and its related entities which, in the public accountants’ professional judgment, reasonably may be thought to bear on their independence. The Audit Committee has reviewed the letter from the public accountants confirming that in its professional judgment, it is independent from the Company and has discussed with the public accountants their independence from the Company; and |

| | • | | The Audit Committee has, based on its review and discussions with management of the Company’s 2005 audited financial statements and discussions with the public accountants, recommended to the Board of Directors that the Company’s audited financial statements for the year ended December 31, 2005 be included in the Company’s Annual Report on Form 10-K. |

| | |

Audit Committee: | | |

Ralph R. Peterson, Chair | | Jerome J. Meyer |

Virginia L. Anderson | | Michael G. Thorne |

Stanley R. Fallis | | |

16

Security Ownership of Certain Beneficial Owners

The following table sets forth those persons known to us to be beneficial owners of more than five percent of our Common Stock as of January 31, 2006. In furnishing this information, we relied on information filed by the beneficial owners with the SEC.

| | | | | |

| | | Common Stock Beneficially Owned

| |

Name and Address of Beneficial Owner

| | Direct

| | % of Class

| |

Barclays Global Investors, NA | | 5,484,594 | | 10.03 | % |

45 Fremont Street, San Francisco, California | | | | | |

Share Ownership of Directors and Officers

The following table sets forth information regarding the beneficial ownership, as of December 31, 2005, of our Common Stock by each director and nominee, the CEO and certain Executive Officers, and by directors, nominees and Executive Officers as a group. Any restricted shares held by an officer are included. The table also includes stock options that vested on or before March 1, 2006. Except as otherwise noted, the named individual or family members had sole voting and investment power with respect to such securities.

| | | | | | | | |

| | | Common Stock Beneficially Owned

| |

| | | Direct

| | | Vested

Options

| | % of

Class

| |

Virginia L. Anderson | | 2,942 | | | 33,000 | | * | |

Frederick W. Buckman | | 14,602 | | | 30,000 | | * | |

John E. Chapoton | | 3,730 | | | 33,000 | | * | |

Stanley R. Fallis | | — | | | — | | — | |

Wanda G. Henton | | 1,432 | | | 24,000 | | * | |

Peter O. Kohler, MD | | 3,730 | | | 27,000 | | * | |

Jerome J. Meyer | | 8,116 | | | 27,000 | | * | |

Ralph R. Peterson | | 3,718 | (1) | | 33,000 | | * | |

E. Kay Stepp | | 3,644 | | | 33,000 | | * | |

Michael G. Thorne | | 5,714 | | | 33,000 | | * | |

Ronald E. Timpe | | 61,890 | | | 73,418 | | * | |

Eric E. Parsons | | 157,396 | | | 291,000 | | * | |

Kim. W. Ledbetter | | 52,911 | (2) | | 93,250 | | * | |

J. Gregory Ness | | 46,938 | | | 116,750 | | * | |

Cindy J. McPike | | 24,200 | | | 56,000 | | * | |

Michael T. Winslow | | 23,583 | (2) | | 37,500 | | * | |

Executive Officers and Directors as a Group (17 individuals) | | 426,462 | | | 952,168 | | 2.45 | % |

| * | | Represents holdings of less than one percent. |

| (1) | | Includes 104 shares owned by Mr. Peterson’s spouse. |

| (2) | | Not included are 272,557 shares owned by Standard Insurance Company’s Defined Contribution Plan Trust for Home Office Employees and Standard Insurance Company’s Defined Contribution Plan Trust for Field Personnel. The purchase and sale of Common Stock by these plans are determined by terms of the plan and are carried out by the administrator. Mr. Ledbetter, Mr. Winslow and one other officer are co-trustees of the trusts. The co-trustees have voting power over the shares owned in the trust, but do not have investment or dispositive power over the shares. The co-trustees cannot withdraw shares from the trust and, upon retirement, neither the co-trustees nor any other employee participants receive distributions in stock from the plan. |

17

Shares owned on December 31, 2005 included 9,102 performance-based restricted shares that were forfeited on February 15, 2006, including: 5,363; 984; 984; 984; and 787 for Parsons, Ledbetter, Ness, McPike, and Winslow, respectively.

Our Board believes it is important for the Company’s Executive Officers to own significant amounts of Company stock. This enhances the alignment of the Company’s Executive Officers with the interests of the Company’s shareholders, and demonstrates a commitment to the Company’s long-term financial success. In that regard, our Board has developed stock ownership guidelines for the Executive Officer group ranging from a multiple of four times base salary for the President and CEO to two times for other Executive Officers. For purposes of these guidelines, ownership will be measured over a rolling 24 month period. It is anticipated that targeted ownership levels will be met over time largely by means of acquisitions through company compensation plans such as the Long Term Incentive Program (“LTIP”) discussed herein.

Compensation of Directors and Officers

Director Compensation

Each director who is not an employee of StanCorp or Standard Insurance Company receives an annual retainer fee of $45,000 and a $1,250 meeting fee for each committee meeting attended. Each chair of a Board committee receives an additional annual retainer fee of $5,000. The Lead Director receives a premium retainer fee of $25,000 for a total annual retainer fee of $70,000. All cash compensation is paid quarterly. The retainer fee is paid 66.7% in cash and 33.3% in unrestricted common stock. Additionally, each director receives an annual option to purchase 8,000 shares of common stock at fair market value on the date of grant. Our current Chairman, Eric E. Parsons, does not receive additional compensation for his service on the Board or as Chairman.

We reimburse directors for all travel and other expenses incurred in connection with their duties. Our directors receive only one retainer for serving on StanCorp’s and Standard Insurance Company’s boards and one meeting fee for joint meetings of StanCorp and Standard Insurance Company committees.

Officers’ Compensation

The information set forth below describes the components of total compensation of the CEO and the four other most highly compensated Executive Officers (collectively, the “Named Executives”) of the Company or its subsidiaries. For bonus and LTIP payout compensation, the Company reports amounts with respect to the year in which they are earned, even if paid in subsequent periods. All share amounts in the table have been adjusted to reflect the two-for-one stock split effected on December 9, 2005.

18

Summary Compensation Table

| | | | | | | | | | | | | | | | |

Name and Principal Position

| | Year

| | Annual Compensation

| | Long Term Compensation

| | All Other

Compensation

($)(4)

|

| | | | Awards

| | Payouts

| |

| | | | Restricted

Stock

Awards

($)(2)

| | Stock

Options

(#)

| | LTIP

Payouts

($)(3)

| |

| | | Salary

($)

| | Bonus

($)

| | Other

($)(1)

| | | | |

Eric E. Parsons Chairman, President and Chief Executive Officer | | 2005

2004

2003 | | 725,000

675,000

575,000 | | 722,644

579,567

555,235 | | 41,536

32,700

16,100 | | —

—

— | | 80,000

106,000

120,000 | | 1,438,992

1,131,850

943,600 | | 50,861

44,305

2,322 |

| | | | | | | | |

J. Gregory Ness Senior Vice President, Insurance Services Group | | 2005

2004

2003 | | 400,000

336,923

257,500 | | 327,648

240,300

154,500 | | 7,500

6,000

4,025 | | —

123,740

— | | 25,000

30,000

25,000 | | 262,335

206,398

235,900 | | 16,473

14,810

1,485 |

| | | | | | | | |

Kim W. Ledbetter Senior Vice President, Asset Management Group | | 2005

2004

2003 | | 330,000

300,000

232,500 | | 220,532

176,595

146,405 | | 7,000

6,000

4,025 | | —

103,515

— | | 23,000

25,000

20,000 | | 262,335

206,398

227,500 | | 14,346

12,106

23,400 |

| | | | | | | | |

Cindy J. McPike Senior Vice President and Chief Financial Officer | | 2005

2004

2003 | | 325,000

285,000

235,000 | | 223,276

187,530

164,500 | | 7,000

6,000

3,065 | | —

—

97,620 | | 23,000

25,000

25,000 | | 262,335

206,398

179,688 | | 13,846

6,235

389 |

| | | | | | | | |

Michael T. Winslow Senior Vice President, General Counsel and Corporate Secretary | | 2005

2004

2003 | | 325,000

285,000

235,000 | | 210,438

180,975

162,150 | | 5,625

4,800

3,065 | | —

—

97,620 | | 15,000

15,000

15,000 | | 214,676

168,807

179,688 | | 13,743

11,681

1,725 |

| (1) | | Other compensation consists of dividends paid on unvested performance-based restricted shares held by Named Executives. |

| (2) | | Restricted stock awards represent the number of tenure-based restricted shares awarded to the Named Executive multiplied by the market value per share on the date of award. At December 31, 2005, Mr. Parsons held 4,000 tenure-based restricted shares valued at $199,800 which vested on February 11, 2006. Mr. Ness, Ms. McPike and Mr. Winslow each held 4,000 shares valued at $199,800 each that will vest in 2007. Mr. Ledbetter held 3,000 shares valued at $149,850 that vest in 2007. The holders of this stock receive any dividends that are paid with respect to these shares. |

| (3) | | LTIP payouts for 2005 represent the value of shares and cash performance units that vested based on the Company’s performance for the year under the terms of the Company’s 2005 performance-based restricted stock program (similar to the terms of the restricted stock program described under “Long-Term Incentive Plan – Awards in 2005” below). In 2005, the Company’s financial performance resulted in the vesting of 16,437; 3,016; 3,016; 3,016 and 2,413 shares for Parsons, Ness, Ledbetter, McPike, and Winslow respectively. These executives also received cash performance units (each equal to the value of one share) in the amounts of 10,858; 1,960; 1,960; 1,960; and 1,659 respectively. LTIP payouts for 2003 represented the value of shares that vested based on the Company’s return on equity for the year under the terms of the Company’s 2000-2003 performance-based restricted stock program. |

| (4) | | Amounts shown include matching contributions credited to the accounts of the Named Executives under Standard Insurance Company’s non-qualified deferred compensation plans and imputed income from the Company’s group life insurance plan. Amounts of imputed income for 2005 for group term life contributions are: $1,355; $473; $725; $315 and $725 for Parsons, Ness, Ledbetter, McPike, and Winslow respectively. Company matching amounts contributed to the non-qualified plan in 2005 are: $49,506; $16,000; $13,621; $13,531 and $13,018 for these same executives. |

19

2005 Option Grants

| | | | | | | | | | | | |

Name

| | Number of

Securities

Underlying

Options

Granted(1)

| | % of Total

Options

Granted to

Employees in

Fiscal Year

| | Exercise Price

($/per share)

| | Expiration

Date

| | Potential Realized Value

at Assumed Annual Rates

of Stock Price

Appreciation for Option

Term(2)

|

| | | | | | 5% ($)

| | 10% ($)

|

Eric E. Parsons | | 80,000 | | 23.11 | | 41.25 | | 1/5/2015 | | 2,075,352 | | 5,259,350 |

J. Gregory Ness | | 25,000 | | 7.22 | | 41.25 | | 1/5/2015 | | 648,548 | | 1,643,547 |

Kim W. Ledbetter | | 23,000 | | 6.64 | | 41.25 | | 1/5/2015 | | 596,664 | | 1,512,063 |

Cindy J. McPike | | 23,000 | | 6.64 | | 41.25 | | 1/5/2015 | | 596,664 | | 1,512,063 |

Michael T. Winslow | | 15,000 | | 4.33 | | 41.25 | | 1/5/2015 | | 389,129 | | 986,128 |

| (1) | | The options were granted on January 3, 2005 and vest in four equal installments on the first four anniversaries of the grant date. Vesting will accelerate in certain circumstances if employment terminates following a change of control. See “Certain Relationships and Related Transactions” below. |

| (2) | | Potential realized value at expiration is based on an assumption that the share price of Common Stock appreciates at the rate shown (compounded annually) from the date of the grant until the end of the 10-year term. |

2005 Option Exercises and Year-End Option Values

| | | | | | | | | | | | |

Name

| | Shares Acquired

on Exercise (#)

| | Value Realized

($)

| | Securities Underlying

Unexercised Options at

12/31/05 (#)

| | Value of Unexercised In-the-Money

Options at 12/31/05 ($)(1)

|

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Eric E. Parsons | | 28,000 | | 887,801 | | 206,500 | | 237,500 | | 5,483,398 | | 4,030,108 |

J. Gregory Ness | | 25,000 | | 670,776 | | 91,750 | | 66,250 | | 2,689,963 | | 1,082,588 |

Kim W. Ledbetter | | 8,000 | | 334,500 | | 71,250 | | 56,750 | | 2,070,706 | | 900,469 |

Cindy J. McPike | | 6,000 | | 184,290 | | 36,750 | | 60,250 | | 875,264 | | 995,146 |

Michael T. Winslow | | 7,500 | | 223,032 | | 22,500 | | 37,500 | | 522,881 | | 606,769 |

| (1) | | Potential unrealized value is (i) the value of a share of Common Stock at December 31, 2005 ($49.95) less the option exercise price, times (ii) the number of shares covered by the options. |

20

Long-Term Incentive Plan—Awards in 2005

During 2005 the Company made performance-based awards under the 2002 Stock Incentive Plan which are summarized in the following table:

| | | | | | | | | | | | |

| | | Restricted

Shares

Granted

| | Cash

Performance

Units Granted

| | Performance or

Other Period Until

Maturation or

Payout

| | |

| | | | | Number of Shares and Units

|

Name

| | | | | Threshold

| | Target

| | Maximum

|

Eric E. Parsons | | 22,858 | | 14,286 | | 2007 | | 0 | | 26,000 | | 37,144 |

J. Gregory Ness | | 4,000 | | 2,600 | | 2007 | | 0 | | 4,620 | | 6,600 |

Kim W. Ledbetter | | 3,200 | | 2,134 | | 2007 | | 0 | | 3,734 | | 5,334 |

Cindy J. McPike | | 3,200 | | 2,134 | | 2007 | | 0 | | 3,734 | | 5,334 |

Michael T. Winslow | | 2,600 | | 1,734 | | 2007 | | 0 | | 3,034 | | 4,334 |

On February 15, 2008, participants who are employed by the Company on that date (or whose employment terminated as a result of retirement, death or disability) will be vested with respect to all or a portion of the Restricted Shares and Performance Units as determined according to the Company’s financial performance for the prior year. The Compensation Committee established financial performance criteria for 2007 based on the Company’s earnings per share excluding after-tax capital gains (weighted at 50 percent), growth in revenues (weighted at 35 percent) and pre-tax income of all businesses other than life and disability insurance (weighted at 15 percent). The financial performance criteria established by the Compensation Committee require significant improvement in financial performance over the prior year in order for vesting of awards to occur. Notwithstanding the foregoing, the Compensation Committee may, in its sole discretion, reduce by up to 50 percent the calculated numbers of Restricted Shares and Performance Units that will vest based on circumstances relating to the performance of the Company or a participant. Upon a change in control (as defined) of the Company, all outstanding Restricted Shares and Performance Units will vest.

Approximately 60 percent of each participant’s performance-based award was granted in the form of Common Stock issued to the participant subject to forfeiture if continued employment and financial performance criteria are not met (“Restricted Shares”). Approximately 40 percent of each participant’s performance-based award was granted in the form of cash performance units which each represent the right to be paid in cash an amount equal to the value of one share of Common Stock at the time of payment, subject to the same employment and financial performance criteria applicable to the grants of Restricted Shares (“Performance Units”). Cash performance units allow recipients to pay tax liabilities associated with the release of shares without selling those shares.

On February 15, 2006 the participants vested with respect to a portion of the Restricted Shares and Performance Units based on 2005 performance as described in Note 3 of the Summary Compensation Table, above.

21

Standard Retirement Program

Each of the Named Executives participates in both the Standard Insurance Company Retirement Plan for Home Office Personnel and the Supplemental Retirement Plan for Senior Executives (the “Retirement Plans”).

The following table sets forth the benefits payable, assuming retirement at age 65, to participants in the Retirement Plans at the levels of compensation and the periods of service contained therein. Actual benefits payable to executives may be up to $1,000 per year less than the amount shown due to the effect of an additional variable in the benefit formula.

Annual Retirement Plan Benefits

| | | | | | | | | | | | | | | | |

High 5-Year

Average

Remuneration

| | Annual Benefit at Age 65 for Years of Service

|

| | 15

| | 20

| | 25

| | 30

| | 35

|

| | $ 150,000 | | $ | 34,571 | | $ | 46,346 | | $ | 58,121 | | $ | 69,896 | | $ | 81,671 |

| | 200,000 | | | 46,571 | | | 62,346 | | | 78,121 | | | 93,896 | | | 109,671 |

| | 250,000 | | | 58,571 | | | 78,346 | | | 98,121 | | | 117,896 | | | 137,671 |

| | 300,000 | | | 70,571 | | | 94,346 | | | 118,121 | | | 141,896 | | | 165,671 |

| | 350,000 | | | 82,571 | | | 110,346 | | | 138,121 | | | 165,896 | | | 193,671 |

| | 400,000 | | | 94,571 | | | 126,346 | | | 158,121 | | | 189,896 | | | 221,671 |

| | 450,000 | | | 106,571 | | | 142,346 | | | 178,121 | | | 213,896 | | | 249,671 |

| | 500,000 | | | 118,571 | | | 158,346 | | | 198,121 | | | 237,896 | | | 277,671 |

| | 550,000 | | | 130,571 | | | 174,346 | | | 218,121 | | | 261,896 | | | 306,671 |

| | 600,000 | | | 142,571 | | | 190,346 | | | 238,121 | | | 285,896 | | | 333,671 |

| | 650,000 | | | 154,571 | | | 206,346 | | | 258,121 | | | 309,896 | | | 361,671 |

| | 700,000 | | | 166,571 | | | 222,346 | | | 278,121 | | | 333,896 | | | 389,671 |

| | 750,000 | | | 178,571 | | | 238,346 | | | 298,121 | | | 357,896 | | | 417,671 |

| | 800,000 | | | 190,571 | | | 254,346 | | | 318,121 | | | 381,896 | | | 445,671 |

| | 850,000 | | | 202,571 | | | 270,346 | | | 338,121 | | | 405,896 | | | 473,671 |

| | 900,000 | | | 214,571 | | | 286,346 | | | 358,121 | | | 429,896 | | | 501,671 |

| | 950,000 | | | 226,571 | | | 302,346 | | | 378,121 | | | 453,896 | | | 529,671 |

| | 1,000,000 | | | 238,571 | | | 318,346 | | | 398,121 | | | 477,896 | | | 557,671 |

| | 1,050,000 | | | 250,571 | | | 334,346 | | | 418,121 | | | 501,896 | | | 585,671 |

| | 1,100,000 | | | 262,571 | | | 350,346 | | | 438,121 | | | 525,896 | | | 613,671 |

The benefits shown in the above table are payable in the form of a straight life annuity with annualized cost of living increases not to exceed a cumulative limit of 3% of the original benefit amount for each year after retirement. Benefits payable under the Retirement Plans are not subject to offset for Social Security benefits. Compensation taken into account under the Retirement Plans is the average monthly compensation paid to a participant during the consecutive 60-month period over the most recent 120-month period that produces the highest average compensation. For this purpose, compensation is the total of base salary and short-term incentive bonus in the year accrued.

As of December 31, 2005, the estimated highest 5-year average remuneration and credited years of service for each of the Named Executives under the Retirement Plans was: Mr. Parsons, $1,027,787 and 15 years; Mr. Ness, $495,942 and 26 years; Mr. Ledbetter, $414,057 and 31 years; Ms. McPike, $363,963 and 7 years; and Mr. Winslow $418,037 and 4 years.

Certain Relationships and Related Transactions

Change of Control Agreements