SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12

STANCORP FINANCIAL GROUP, INC.

(Name of Registrant as Specified In Its Certificate)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

¨ Fee paid previously with preliminary materials.

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

March 25, 2009

Fellow Shareholder:

It is my pleasure to invite you to join me and the Board of Directors at the 2009 Annual Meeting of Shareholders of StanCorp Financial Group, Inc., on Monday, May 4, 2009. The meeting will take place at 11:00 a.m. Pacific time at the Hilton Portland Executive Tower, located at 545 SW Taylor Street in Portland, Oregon.

Information regarding the business to be conducted at the meeting is contained in the attached Notice of Annual Meeting and Proxy Statement. We will also present a report on our 2008 operations at the meeting.

John E. Chapoton is retiring from the Board this year and we are grateful for his many years of dedicated service.

We are very pleased that Mary F. Sammons is a new nominee for the Board this year.

Shareholders of record can vote their shares by mail, telephone, or over the Internet. For instructions on voting by each of these methods, please refer to the proxy card. A vote by telephone or over the Internet must be received by 11:59 p.m. Eastern time on May 3, 2009. A mailed proxy card must be received prior to the Annual Meeting.

On behalf of the entire Board of Directors, I encourage you to vote your proxy either in person or via one of the other methods available so that your shares can be represented at the Annual Meeting.

|

Sincerely, |

|

|

| ERIC E. PARSONS |

Chairman and Chief Executive Officer |

CONTENTS

STANCORP FINANCIAL GROUP, INC.

1100 SW Sixth Avenue

Portland, Oregon 97204

Notice of Annual Meeting of Shareholders

Notice is hereby given that the Annual Meeting of Shareholders of StanCorp Financial Group, Inc., an Oregon corporation, will be held May 4, 2009 at 11:00 a.m. Pacific time at the Hilton Portland Executive Tower, 545 SW Taylor Street, Portland, Oregon, for the following purposes:

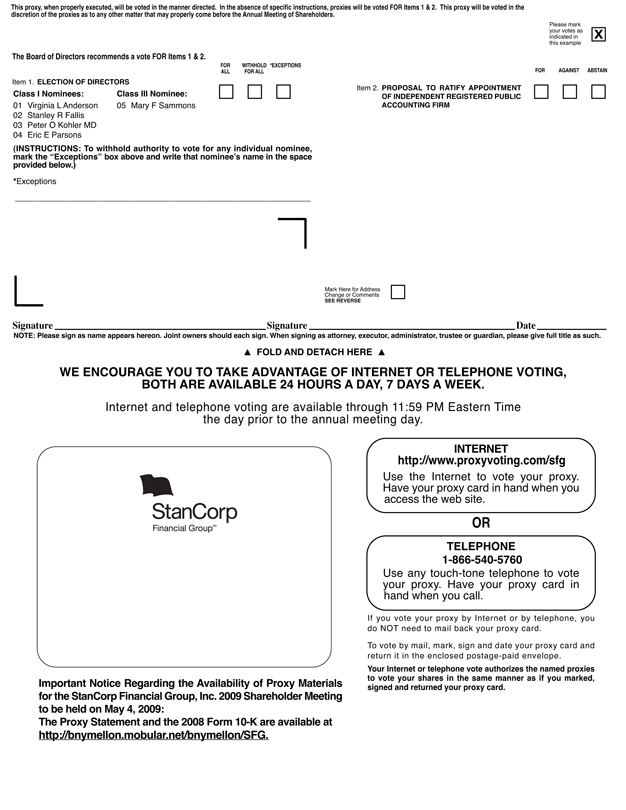

| | 1. | | Election of four Class I Directors and one Class III Director; |

| | 2. | | Proposal to Ratify Appointment of Independent Registered Public Accounting Firm; |

| | 3. | | To transact any other business that may properly come before the shareholders at the Annual Meeting. |

The close of business on March 2, 2009 has been fixed as the record date for determination of shareholders entitled to notice of, and to vote at, the Annual Meeting.

Important Notice Regarding the Availability of Proxy Materials for the StanCorp Financial Group, Inc. 2009 Annual Meeting of Shareholders to Be Held on May 4, 2009:

Securities and Exchange Commission rules now allow companies to furnish proxy materials to shareholders over the Internet and the Company has elected to deliver proxy materials to our shareholders over the Internet. On March 25, 2009, we mailed to our shareholders a “Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to Be Held on Monday, May 4, 2009,” containing instructions on how to access our 2009 Proxy Statement and 2008 Form 10-K.

The Proxy Statement and the 2008 Form 10-K are available at http://bnymellon.mobular.net/bnymellon/SFG

There are four different ways to vote your shares:

By Internet: You may submit a proxy or voting instructions over the Internet by following the instructions at http://www.proxyvoting.com/sfg.

By Telephone: You may submit a proxy or voting instructions by calling (866) 540-5760 and following the instructions.

By Mail: If you received your proxy materials via U.S. mail, you may complete, sign and return the accompanying proxy and voting instructions card in the postage-paid envelope provided.

In Person: If you are a stockholder as of the record date, you may vote in person at the meeting. If you attend the meeting and intend to vote in person, please notify our personnel of your intent as you sign in for the meeting.

|

| BY ORDEROFTHE BOARDOF DIRECTORS |

|

Holley Y. Franklin Corporate Secretary |

March 25, 2009

STANCORP FINANCIAL GROUP, INC.

1100 SW Sixth Avenue

Portland, Oregon 97204

PROXY STATEMENT

I. GENERAL INFORMATION

This Proxy Statement concerns the Annual Meeting of Shareholders of StanCorp Financial Group, Inc. (“StanCorp,” the “Company,” “we,” “us,” “our”) to be held on May 4, 2009 (“Annual Meeting”). The Annual Meeting will be held at 11:00 a.m. Pacific time at the Hilton Portland Executive Tower, 545 SW Taylor Street, Portland, Oregon. Our shares of common stock trade on the New York Stock Exchange Euronext (“NYSE Euronext”) under the ticker symbol “SFG.” We have only one outstanding class of common stock that is eligible to vote. As of March 2, 2009 (the “Record Date”), we had 48,973,480 outstanding shares of common stock (“Common Stock”).

On behalf of the Board of Directors (the “Board”), the Company is soliciting your proxy for use at the Annual Meeting and at any adjournment of the meeting.

Voting Rights

Each share of our Common Stock is entitled to one vote on each proposal and with respect to each director position to be filled. There is no cumulative voting. To be eligible to vote on matters coming before the Annual Meeting, you must own our Common Stock on the record date. The Board has set the record date as the close of our business day on the Record Date. Your ability to vote by telephone or by the Internet will close at 11:59 p.m. Eastern time on May 3, 2009. If you choose to vote by mail, we must receive your proxy card prior to the Annual Meeting.

Voting by Proxy

The Company is soliciting a proxy from you on behalf of its Board of Directors. The proxy holder(s), the person(s) designated in the proxy to cast your vote, also known as “proxies,” will vote your shares according to your instructions. If you return your proxy signed, but without directions, the proxy holders will vote your shares in accordance with the recommendations of our Board with regard to Item 1 and Item 2. If other matters come before the Annual Meeting that require a shareholder vote, the proxy holder will vote your shares in accordance with the recommendation of the Board.

You have the right to revoke your proxy at any time up to the time your shares are voted. You have three ways to revoke your proxy. First, you may do so in writing. Please send your revocation to our Corporate Secretary, P7E, StanCorp Financial Group, Inc., P. O. Box 711, Portland, OR 97207. Your written revocation must be received by May 1, 2009. Second, you can cast another valid proxy in writing, by telephone or over the Internet. Your vote will be cast in accordance with the latest valid proxy we have received from you. Third, you can revoke your proxy by voting in person at the Annual Meeting. If you choose to vote in person, please let our personnel know that you are revoking a previously given proxy and are now voting in person.

Votes Required

Pursuant to Oregon law, our Articles of Incorporation and our Bylaws, the election of nominees to our Board at the Annual Meeting requires a quorum. After achieving a quorum, the nominees receiving the highest

1

number of votes cast in each class will be elected. For a proposal to pass at the Annual Meeting, the meeting must have a quorum and the proposal must receive more votes in its favor than were cast against it. Broker non-votes and abstentions will be treated as if the shares were present at the Annual Meeting, but not voting.

Cost of Proxy Solicitation

We pay the cost of soliciting proxies. Our directors, officers or employees may solicit proxies on our behalf in person or by telephone, facsimile or other electronic means. We have also engaged the firm of Georgeson, Inc. to assist us in the distribution and solicitation of proxies. We have agreed to pay Georgeson Inc. a fee of $5,500 plus expenses for their services.

In accordance with the regulations of the Securities and Exchange Commission (“SEC”) and the NYSE Euronext, we will also reimburse brokerage firms and other custodians, nominees and fiduciaries for their expenses incurred in sending proxies and proxy materials to beneficial owners of StanCorp Common Stock.

II. MATTERS TO BE VOTED UPON

1. Election of Directors

StanCorp’s business, property and affairs are managed under the direction of the Board of Directors. The Board is comprised of 12 directors divided into three equal classes, but the number of directors will be reduced to eleven effective at the Annual Meeting. Each of these classes serves a three-year term in office. At this Annual Meeting, shareholders will be requested to elect four Class I directors for a three-year term and one Class III Director for a two-year term. Class I currently consists of four directors, all of whom have agreed to stand for re-election. One Class III director, John Chapoton, will reach mandatory retirement age with the 2009 Annual Meeting. The Board and management thank Mr. Chapoton for his many years of dedicated service to the Company. Mary F. Sammons was first elected a director by the Board in December 2008 and is a nominee for re-election as a Class III director at the 2009 Annual Meeting. Ms. Sammons, Chairman and Chief Executive Officer of Rite Aid Corporation, was recommended as a candidate by one of our non-management directors and was chosen by the Board from among the pool of eligible candidates based on a thorough review of her skills, experience and expertise as described in “Corporate Governance – Director Nominations” below.

Votes may not be cast for a greater number of director nominees than five.

Board members of the Company also serve on the Board of Directors of our principal subsidiary, Standard Insurance Company. Our directors serve on the same board committees of Standard Insurance Company as they do for StanCorp.

The StanCorp Corporate Governance Guidelines include a majority vote standard for the election of directors whereby any nominee for director in an uncontested election as to whom a majority of shares are designated to be “withheld” from his or her election will promptly tender his or her resignation to the Nominating & Corporate Governance Committee. The Nominating & Corporate Governance Committee will recommend to the Board the action to be taken with respect to such offer of resignation.

2

Directors in Classes

We have set forth below information, as of December 31, 2008, about each nominee and continuing director. This information includes the director’s age, positions held with us, principal occupation, business history for at least the last five years, committees of our Board on which the director serves, and other corporate directorships held.

| | | | | | | | |

Name | | Age | | Director Since(1) | | Position Held | | Term Expires |

Class I | | | | | | | | |

Virginia L. Anderson | | 61 | | 1989 | | Director | | 2009 |

Stanley R. Fallis | | 68 | | 2006 | | Director | | 2009 |

Peter O. Kohler, MD | | 70 | | 1990 | | Director | | 2009 |

Eric E. Parsons | | 60 | | 2002 | | Chairman | | 2009 |

| | | | |

Class II | | | | | | | | |

Jerome J. Meyer | | 70 | | 1995 | | Director | | 2010 |

Ralph R. Peterson | | 64 | | 1992 | | Director | | 2010 |

E. Kay Stepp | | 63 | | 1997 | | Director | | 2010 |

Michael G. Thorne | | 68 | | 1992 | | Lead Director | | 2010 |

| | | | |

Class III | | | | | | | | |

Frederick W. Buckman | | 62 | | 1996 | | Director | | 2011 |

Mary F. Sammons | | 62 | | 2008 | | Director | | 2011 |

Ronald E. Timpe | | 69 | | 1993 | | Director | | 2011 |

(1) | | Directors elected prior to 1999 served on the Board of Directors of Standard Insurance Company, and became directors of StanCorp Financial Group, Inc. during the reorganization in 1999. |

Nominees for Election at the Annual Meeting

The Board has proposed the following individuals for election as Class I directors: Virginia L. Anderson, Stanley R. Fallis, Peter O. Kohler, MD and Eric E. Parsons, all of whom are current directors. If elected, Class I directors except for Dr. Kohler will serve a three-year term of office to expire at the Annual Meeting of Shareholders in 2012 and until their successors are elected and qualified. Dr. Kohler will reach the mandatory retirement age in our Corporate Governance Guidelines at the 2011 Annual Meeting. In addition, the Board of Directors has proposed Mary F. Sammons for election as a Class III director. If elected, Ms. Sammons will serve a two-year term of office to expire at the annual meeting of 2011 and until her successor is elected and qualified. Each nominee for election qualifies as an independent director under applicable NYSE Euronext rules, except for Eric E. Parsons, current Chairman and Chief Executive Officer.

If any nominee should become unable to serve, the proxy holder will vote for the person or persons the Board recommends, if any.

Business History of Nominees for Election

Virginia L. Anderson. From May 2007 through November 2008, Ms. Anderson was President of the Safeco Insurance Foundation, a private charitable foundation established by Safeco Insurance in Seattle, Washington. From 1988 to April 2006, Ms. Anderson was the Director of the Seattle Center, a 74-acre, 31-facility urban civic center, located in Seattle, Washington. Ms. Anderson serves on the Audit Committee and the Finance & Operations Committee.

Stanley R. Fallis. From 1994 to 1999, Mr. Fallis was the Chair and Chief Executive Officer of Everen Clearing Corporation, a securities execution and clearing company, and the Senior Executive Vice President and Chief Administrative Officer for Everen Securities, Inc., a national full service brokerage firm. Mr. Fallis serves on the Audit and Nominating & Corporate Governance Committees.

3

Peter O. Kohler, MD. Since 2007, Dr. Kohler has been Vice Chancellor of the University of Arkansas for Medical Sciences-NW. From 1988 to September 2006, Dr. Kohler was President of Oregon Health & Science University, located in Portland, Oregon, and is now President emeritus of that institution. He also served as a director of the Portland Branch of the Federal Reserve Bank of San Francisco through December 2006. Dr. Kohler serves on the Nominating & Corporate Governance Committee and the Organization & Compensation Committee.

Eric E. Parsons. Mr. Parsons has been Chief Executive Officer of StanCorp and our principal subsidiary, Standard Insurance Company since 2003 and Chairman since 2004. From 2003 to September 2008, Mr. Parsons also served as President of both entities. Prior to his appointment as President and CEO, Mr. Parsons was President and Chief Operating Officer of StanCorp and Standard Insurance Company during 2002. Prior to May 2002, he served as Chief Financial Officer and has held management positions in finance, investments, mortgage loans and real estate.

Mary F. Sammons. Since June 2007, Ms. Sammons has been chairman and chief executive officer of Rite Aid Corporation. From December 1999 to September 2008, Ms. Sammons also served as President of Rite Aid Corporation. She has been a member of Rite Aid’s Board of Directors since 1999 and Chief Executive Officer since 2003. From January 1998 to December 1999, Ms. Sammons served as President and Chief Executive Officer of Fred Meyer Stores, Inc., which was purchased by The Kroger Company in April 1999. Ms. Sammons serves on the Audit and Nominating & Corporate Governance Committees.

Our Board of Directors recommends a vote FOR the election

of the above nominees as directors.

Business History of Continuing Directors

Frederick W. Buckman. Since 2007 Mr. Buckman has been Managing Partner, Utilities, of Brookfield Asset Management, a global asset manager focused on property, power and other infrastructure assets. From 1999 to September 2006, Mr. Buckman served as Chairman of Trans-Elect, Inc., an independent company engaged in the ownership and management of electric transmission systems. Mr. Buckman is also President of Frederick Buckman, Inc., a consulting firm located in Portland, Oregon and from 1994 to 1998 served as President, Chief Executive Officer and director of PacifiCorp, a holding company of diversified businesses, including an electric utility, based in Portland, Oregon. Mr. Buckman is a director of MMC Energy, Inc., an energy acquisition company which acquires and operates power generation and energy infrastructure assets. He also serves on the board of Terra Systems, Inc., a clean energy technology company. Mr. Buckman serves on the Audit Committee and the Nominating & Corporate Governance Committee.

Jerome J. Meyer. From 1990 to 1999, Mr. Meyer was Chairman of the Board and Chief Executive Officer of Tektronix, Inc., a high technology company located in Beaverton, Oregon. Mr. Meyer is Chair of the Finance & Operations Committee and serves on the Organization & Compensation Committee.

Ralph R. Peterson. From 1991 through 2008, Mr. Peterson was Chairman, President and Chief Executive Officer of CH2M Hill Companies, Ltd., an engineering, design and consulting firm located in Denver, Colorado. Mr. Peterson is now Chairman of that organization. Mr. Peterson is Chair of the Audit Committee and serves on the Finance & Operations Committee.

E. Kay Stepp. From 1994 to 2002, Ms. Stepp was principal and owner of Executive Solutions, a management consulting firm in Portland, Oregon. From 1989 to 1992, Ms. Stepp was President and Chief Operating Officer of Portland General Electric, an electric utility. Ms. Stepp is Chair of the Corporate Board of Providence Health & Services and also serves as a director of Planar Systems, Inc. and Franklin Covey Co. Ms. Stepp is Chair of the Organization & Compensation Committee and serves on the Finance & Operations Committee.

4

Michael G. Thorne. From January 2002 to October 2004, Mr. Thorne was Director and Chief Executive Officer of the Washington State Ferry System located in Seattle, Washington. From 1991 to 2001, Mr. Thorne was Executive Director of the Port of Portland, a regional port authority responsible for ownership and management of marine terminals, airports and business parks, located in Portland, Oregon. He maintains an active ownership and management interest in the Thorne family farm near Pendleton, Oregon. Mr. Thorne serves as Lead Director of StanCorp, chairs the Nominating & Corporate Governance Committee and serves on the Organization & Compensation Committee.

Ronald E. Timpe. From 1998 to May 2004, Mr. Timpe was Chairman of the Board of Directors of StanCorp and our principal subsidiary, Standard Insurance Company. From 1994 until 2003, Mr. Timpe served as President and Chief Executive Officer of Standard Insurance Company and, upon its formation in 1998, StanCorp Financial Group, Inc. Mr. Timpe serves on the Finance & Operations Committee.

| | 2. | | Proposal to Ratify Appointment of Independent Registered Public Accounting Firm |

The Audit Committee of the Board has appointed Deloitte & Touche USA LLP (“Deloitte & Touche”) as independent auditors for the year 2009. Although not required, our Board is requesting ratification by our shareholders of this appointment. If ratification is not obtained, the Audit Committee will reconsider the appointment.

We have been advised that representatives of Deloitte & Touche will be present at the Annual Meeting. They will be afforded the opportunity to make a statement, and to respond to appropriate questions.

The aggregate fees billed by Deloitte & Touche for professional services rendered for the years 2008 and 2007 were as follows:

| | | | | | |

| | | 2008 | | 2007 |

Audit Fees | | $ | 1,657,000 | | $ | 1,567,500 |

Audit-Related Fees | | | 240,000 | | | 185,000 |

Tax Fees | | | — | | | — |

All Other Fees | | | — | | | — |

| | | | | | |

Total | | $ | 1,897,000 | | $ | 1,752,500 |

Audit fees were paid for audits of the financial statements and internal controls of the Company and its subsidiaries, and review of its quarterly financial statements. “Audit-related” fees were paid for audit of the Company’s employee benefit plans, a report on the procedures of the Retirement Plans Division (per Statement on Auditing Standards No. 70), and audits of certain real estate operating expenses.

The Audit Committee has established a policy under which all services performed by the independent auditors must be approved in advance by the Audit Committee or, if such pre-approval of a particular activity is not feasible, by the Chair of the Audit Committee.

Our Board of Directors recommends a vote FOR Ratification of Deloitte & Touche

as the Company’s Independent Registered Public Accounting Firm for 2009.

Our Board knows of no other matters to be brought before the Annual Meeting. If other matters are presented, the persons named as proxies will vote on such matters as recommended by the Board.

5

III. OTHER INFORMATION

Corporate Governance

Corporate Governance Guidelines

The Company’s Corporate Governance Guidelines, which are available publicly atwww.stancorpfinancial.com or upon written request of our Corporate Secretary, set forth the principles by which the Board manages the affairs of the Company. Among other principles, the Corporate Governance Guidelines specify director qualifications and independence standards, new director selection practices, responsibilities of board members, compensation and the annual Board performance evaluation process. The Nominating & Corporate Governance Committee reviews the Guidelines on at least an annual basis.

Director Independence

Our Board is comprised of a majority of directors who qualify as independent under the NYSE Euronext listing standards. The Board reviews annually any relationship that each director has with the Company (either directly, or as a partner, shareholder, officer or an employee of an organization with which the Company does business or makes charitable contributions). The Board’s review includes a qualitative and quantitative assessment of any relationships from the perspective of both the director and the Company. Following such annual review, only those directors whom the Board affirmatively determines have no material relationship with the Company are considered independent.

Under Company and NYSE Euronext standards, each current director is independent except for Chairman & CEO, Eric E. Parsons.

Committees of the Board

Our Board has four committees, the functions of which are discussed below. Each of these committees has a written charter. Charters for the Audit, Nominating & Corporate Governance and Organization & Compensation Committees are available on the Company’s web site,www.stancorpfinancial.com. Printed copies of these documents are available upon request of our Corporate Secretary, P7E, StanCorp Financial Group, Inc., PO Box 711, Portland, Oregon 97207.

Audit Committee. The Audit Committee met eight times in 2008. It is the responsibility of the Audit Committee to: provide independent review and oversight of the Company’s accounting and financial reporting processes and internal controls; oversee the independent registered public accountant’s appointment, compensation, qualifications, independence and performance; and assist Board oversight of the integrity of the Company’s financial statements, the Company’s compliance with legal and regulatory requirements, and the performance of the Company’s internal auditors.

Members of the Audit Committee are Ralph R. Peterson, Chair, and Directors Anderson, Buckman, Fallis and Sammons. The Board has determined that Ralph R. Peterson, Chair of the Audit Committee, meets the qualifications of and has been designated as the “audit committee financial expert” in accordance with the requirements of applicable SEC rules. The Board also has determined that each member of the Audit Committee meets all additional independence and financial literacy requirements for Audit Committee membership under applicable NYSE Euronext and SEC rules. For additional information concerning the Audit Committee’s responsibilities, see the Report of the Audit Committee below.

Finance & Operations Committee. The Finance and Operations Committee met six times in 2008. It is the responsibility of the Finance and Operations Committee to: oversee the maintenance of an appropriate capital structure; review operational plans and budgets; assess operational performance against publicly stated targets; and monitor the Company’s investment operations. Members of the Finance and Operations Committee are Jerome J. Meyer, Chair, and Directors Anderson, Chapoton, Peterson, Stepp and Timpe.

6

Nominating & Corporate Governance Committee. The Nominating & Corporate Governance Committee met five times in 2008. It is the responsibility of the Nominating & Corporate Governance Committee to: review the organization and structure of the Board; review the qualifications of and recommend candidates for the Board and its committees; review Board compensation; oversee CEO succession planning; review the effectiveness of the Board; and oversee the ethics and compliance programs. Members of the Nominating & Corporate Governance Committee are Michael G. Thorne, Chair, and Directors Buckman, Fallis, Kohler and Sammons.

Organization & Compensation Committee. The Organization & Compensation Committee met seven times in 2008. It is the responsibility of the Organization & Compensation Committee to: review executive compensation and recommend changes, as appropriate; monitor the performance of the CEO; oversee senior executive succession planning; oversee stock option and stock purchase plans; and review certain organizational changes recommended by the CEO. Members of the Organization & Compensation Committee are E. Kay Stepp, Chair, and Directors Chapoton, Kohler, Meyer and Thorne.

Transactions with Related Parties

The Nominating & Corporate Governance Committee also oversees the Company’s policies governing conflicts of interest and transactions with related parties. Directors and Executive Officers are required to disclose any related party transactions, as well as any actual or apparent conflicts of interest. The Company’s legal staff first reviews all such disclosures, and also reviews annually all other external affiliations and relationships of each Executive Officer and Director.

The Company’s Related Party Transactions Policy requires approval or ratification by the Nominating & Corporate Governance Committee of any transaction exceeding $120,000 in which the Company is a participant and any related party has a material interest. Related parties include the Company’s Directors and Executive Officers and their immediate family members.

Once a related party transaction has been identified, the Committee reviews all of the relevant facts and circumstances and approves the transaction only if the transaction is found to be in, or not inconsistent with, the best interests of the Company and its shareholders. If advance Committee approval of a transaction is not feasible, the transaction is considered for ratification at the Committee’s next regularly scheduled meeting. No director or Executive Officer participates in any discussion or approval of related party transactions for which he or she is a related party. The policy generally does not require review of transactions for which disclosure is not required under SEC rules.

Board and Committee Meetings

In 2008, our full Board of Directors met seven times, and executive sessions of the Board were held at each regular meeting. Executive sessions are chaired by the Lead Director and take place without the presence of the CEO, other officers, or directors who are not independent under applicable NYSE Euronext and Company director independence standards. Each Director attended greater than 75 percent of the aggregate number of Board meetings and meetings of committees of which he or she was a member. Our Corporate Governance Guidelines, available atwww.stancorpfinancial.com, require attendance at each Annual Meeting of Shareholders. Each Director attended the 2008 Annual Meeting.

7

Communications with the Board of Directors

Our Board welcomes communications from shareholders and other interested parties. Shareholders and interested parties may contact the Board by writing to:

Lead Director

c/o Corporate Secretary, P7E

StanCorp Financial Group, Inc.

PO Box 711

Portland, Oregon 97207

All shareholder communications and interested party concerns will be reviewed by the Lead Director.

Director Nominations

StanCorp endeavors to maintain a Board of Directors representing a broad spectrum of expertise, background, perspective and experience. In addition, a candidate for service on the Board of the Company should possess the following qualities:

| | A. | | Sound judgment, good reputation and integrity, and should be a person of influence who is recognized as a leader in his/her community. |

| | B. | | A keen sense of the responsibilities of directorship and the ability to take a long-term, strategic view. |

| | C. | | The willingness and availability to attend at least 75 percent of all Board and committee meetings and to study background material in advance, and to otherwise fully perform all of the responsibilities associated with serving as a Director of the Company. |

| | D. | | An understanding of conflicts of interest and the willingness to disclose any real or potential conflict that would prevent or influence his/her acting as a Director in trust for shareholders of the Company. |

| | E. | | Be or become a shareholder of the Company. The candidate should have a positive conviction concerning the businesses of the Company, and be committed to serving the long-term interests of the Company’s shareholders. |

| | F. | | Be currently or formerly actively engaged in business, professional, educational or governmental work. Successful experience leading large organizations is preferred, as is ability, skills or experience in some or all of the following areas: |

| | i) | | Expertise in financial accounting and corporate finance. |

| | ii) | | An understanding of management trends in general. |

| | iii) | | Knowledge of the Company’s industry. |

| | iv) | | Leadership skills in motivating high-performance talent. |

| | v) | | The ability to provide strategic insight and vision. |

| | G. | | The willingness at all times to express ideas about matters under consideration at Board meetings. The candidate should have the ability to dissent without creating adversarial relations among Board members or management. |

| | H. | | The ability to meet any requirement of the Oregon Business Corporation Act and, to the extent applicable, of the Oregon Insurance Code. |

| | I. | | A reputation and a history of positions or affiliations befitting a director of a large publicly held company. |

8

In conjunction with the Board’s annual self-assessment process, the Board considers the adequacy of the Board’s composition, including the number of directors as well as the skills, experience, expertise and other characteristics represented by the directors individually and collectively. Based upon this process the Board will determine whether the Company should add one or more additional directors. If such a determination is made, the Board will develop a pool of nominees to be considered for each additional position.

Candidate Recommendations and Identification Process

Director or Officer Recommends a Potential Candidate. If a director or Executive Officer of the Company wishes to recommend a particular candidate for the Board, he or she will provide the Company with the name of the candidate as well as a brief description of the candidate’s current status, relevant experience and qualifications, contact information, and any other pertinent and available information. This information should be communicated in writing or verbally to the Nominating & Corporate Governance Committee Chair (“Nominating Committee Chair”).

The Nominating Committee Chair will arrange to discuss the merits of the candidate with the Nominating & Corporate Governance Committee. This discussion may result in the formulation of a recommendation to the full Board whether to consider the candidate, follow up for more information regarding the candidate, or reject the candidate. Following discussion, the full Board will determine whether to reject or add the individual to the pool of eligible candidates.

The director or Executive Officer making the nomination will be kept regularly apprised of any discussions and actions taken with respect to such nominee.

Search Firm. The Company may elect to retain a search firm to identify potential candidates. The decision to retain a search firm shall be made by the Nominating & Corporate Governance Committee in consultation with the full Board. Any such search firm shall be formally retained by the Company’s Nominating & Corporate Governance Committee. The Nominating & Corporate Governance Committee also will be responsible for reviewing and approving all fees and expenses charged by the firm.

The Nominating Committee Chair will coordinate communications with the search firm, and arrange to discuss the merits of any candidate recommended by the search firm with the Nominating & Corporate Governance Committee. This discussion may result in the formulation of a recommendation to the full Board whether to consider the candidate, follow up for more information regarding the candidate, or reject the candidate. Following discussion, the full Board will then determine whether to reject or add the individual to the pool of eligible candidates.

Shareholder Recommends a Potential Candidate. In accordance with the procedures set forth below, shareholders and other interested parties may propose director candidates for consideration by the Nominating & Corporate Governance Committee. Consistent with the Nominating & Corporate Governance Committee’s procedures for screening all candidates, such nominees are expected to embody the attributes listed above. In reviewing candidates referred by shareholders or other interested parties, the Nominating & Corporate Governance Committee also will give due consideration to any desired skills, experience, expertise or other characteristics as identified by the Board in its annual self-assessment process.

Shareholders and interested parties may recommend director candidates to the Nominating & Corporate Governance Committee by writing the Company’s Corporate Secretary at P7E, StanCorp Financial Group, Inc., PO Box 711, Portland, Oregon 97207. Such recommendations will be accepted in the month of June of each year, and should be accompanied by the candidate’s name and information regarding his or her qualifications to serve as a director of the Company.

Following receipt of such a recommendation, the Nominating Committee Chair will coordinate necessary communications with the nominee and nominating shareholder or interested party, and arrange to review the

9

qualifications and discuss the merits of the candidate with the Nominating & Corporate Governance Committee. This discussion may result in the formulation of a recommendation to the full Board whether to consider the candidate, follow up for more information regarding the candidate, or reject the candidate. Following discussion, the full Board will then determine whether to reject or add the individual to the pool of eligible candidates.

As set forth below in “Shareholder Nominations and Proposals for 2008,” the Company’s Bylaws also provide shareholders with a separate process by which director candidates can be nominated for election at an annual meeting of shareholders.

Interview and Selection Process. The Nominating & Corporate Governance Committee, in consultation with the full Board, shall determine whether to interview any individuals in the pool of eligible director candidates.

Following the interview process, the Nominating Committee Chair will lead a discussion with the Nominating & Corporate Governance Committee regarding the relative merits and qualifications of the candidates and whether the Company should extend an offer to any such candidate. The Nominating & Corporate Governance Committee will, in turn, develop a recommendation to the full Board in that regard. No offer will be extended to a director candidate unless the candidate has been discussed with the full Board and the full Board has approved making such offer.

The Nominating Committee Chair shall, in the course of regularly scheduled Board meetings, keep the full Board informed of all significant developments in regard to the director interview and selection process. The Nominating Committee Chair also shall regularly consult with the Company’s CEO in regard to the need for new directors, the qualifications of director candidates and any recommendations regarding such candidates. Any final decisions in that regard, however, are to be made by the Board in their sole discretion.

Additional Materials Available Online

Shareholders and other interested parties may view the Company’s Corporate Governance Guidelines, Codes of Business Conduct and Ethics for the Board of Directors, senior officers and employees, as well as other documentation concerning our Board and governance structure atwww.stancorpfinancial.com. Print copies of these documents are available upon request to Shareholder Relations, PO Box 711, Portland, Oregon 97207.

10

Report of the Audit Committee

The Audit Committee operates pursuant to a Charter approved by the Company’s Board of Directors. The Audit Committee reports to the Board of Directors and is responsible for providing independent review and oversight of the Company’s accounting and financial reporting processes and internal controls and overseeing the independent auditor’s appointment, compensation, qualifications, independence, and performance. The Audit Committee Charter sets out the responsibilities, authority, and specific duties of the Audit Committee. The Charter specifies, among other things, the purpose and membership requirements of the Audit Committee as well as the relationship of the Audit Committee to the independent accountants, the Internal Audit department, and management of the Company. All members of the Audit Committee are independent as such term is defined by the SEC and in the listing requirements of the New York Stock Exchange.

The Audit Committee reports as follows with respect to the Company’s audited financial statements for the year ended December 31, 2008:

| | • | | The Audit Committee has completed its review and discussion of the Company’s audited financial statements with management; |

| | • | | The Audit Committee has discussed with the independent auditors, Deloitte & Touche, the matters required to be discussed by Statement on Auditing Standards (“SAS”) No. 61,Communication with Audit Committees, as amended by SAS No. 90,Audit Committee Communications, including matters related to the conduct of the audit of the Company’s financial statements; |

| | • | | The Audit Committee has received the written disclosures and the letter from the independent auditors as required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent auditors’ communications with the Audit Committee concerning independence, and has discussed with the auditors the auditors’ independence from the Company; and |

| | • | | The Audit Committee has, based on its review and discussions with management of the Company’s 2008 audited financial statements and discussions with the independent auditors, recommended to the Board of Directors that the Company’s audited financial statements for the year ended December 31, 2008 be included in the Company’s Annual Report on Form 10-K. |

| | |

Audit Committee: |

| Ralph R. Peterson, Chair | | Stanley R. Fallis |

| Virginia L. Anderson | | Mary F. Sammons |

| Frederick W. Buckman | | |

11

Beneficial Ownership

Security Ownership of Certain Beneficial Owners

The following table sets forth those persons known to us to be beneficial owners of more than five percent of our Common Stock as of December 31, 2008. In furnishing this information, we relied on information filed by the beneficial owners with the SEC.

| | | | |

| | | Common Stock Beneficially Owned |

Name and Address of Beneficial Owner | | Direct | | % of Class |

None | | | | |

Share Ownership of Directors and Officers

The following table sets forth information regarding the beneficial ownership, as of December 31, 2008, of our Common Stock by each director and nominee, the CEO and certain Executive Officers, and by directors, nominees and Executive Officers as a group. Any restricted shares held by an officer are included. The table also includes stock options that vested on or before February 28, 2009. Except as otherwise noted, the named individual or family members had sole voting and investment power with respect to such securities.

| | | | | | | | |

| | | Common Stock Beneficially Owned | |

Name | | Direct | | | Vested

Options | | % of

Class | |

Virginia L. Anderson | | 2,510 | | | 49,500 | | * | |

Frederick W. Buckman | | 15,283 | | | 49,500 | | * | |

John E. Chapoton | | 8,139 | | | 49,500 | | * | |

Stanley R. Fallis | | 3,409 | | | 11,500 | | * | |

Peter O. Kohler, MD | | 5,279 | | | 46,500 | | * | |

Jerome J. Meyer | | 9,525 | | | 46,500 | | * | |

Ralph R. Peterson | | 9,173 | (1) | | 52,500 | | * | |

Mary F. Sammons | | — | | | — | | * | |

E. Kay Stepp | | 4,709 | | | 43,500 | | * | |

Michael G. Thorne | | 10,169 | | | 49,500 | | * | |

Ronald E. Timpe | | 33,811 | | | 32,918 | | * | |

Eric E. Parsons | | 148,786 | | | 469,881 | | 1.2 | % |

J. Gregory Ness | | 51,082 | | | 190,893 | | * | |

Floyd F. Chadee | | 458 | | | — | | * | |

Robert M. Erickson | | 1,268 | | | 3,400 | | * | |

Kim W. Ledbetter | | 50,565 | | | 113,762 | | * | |

Michael T. Winslow | | 23,220 | | | 71,706 | | * | |

| | | | | | | | |

Executive Officer and Directors as a Group (17 individuals) | | 377,386 | | | 1,281,060 | | 3.3 | % |

| * | | Represents holdings of less than one percent. |

(1) | | Includes 104 shares owned by Mr. Peterson’s spouse. |

Shares owned on December 31, 2008 included performance-based restricted shares that were forfeited on February 15, 2009 including: 12,369; 2,405; 2,255 and 1,545 for Parsons, Ness, Ledbetter and Winslow, respectively.

12

Compensation Discussion and Analysis

Executive Summary

The Compensation Discussion and Analysis provides a detailed explanation of the compensation philosophy and executive compensation programs adopted by StanCorp Financial Group, Inc.

The Company’s executive compensation program is designed to reward superior performance at the organizational and individual levels and to attract, retain and motivate highly talented executives whose abilities are critical to our success. The following elements comprise the total compensation awarded to our Named Executive Officers (“NEOs”):

| | • | | Short Term Incentive Plan (annual performance-based bonus) |

| | • | | Three-year performance-based share awards |

| | • | | Defined benefit and defined contribution retirement plans |

| | • | | Change in control arrangements |

The NEOs who appear in the compensation tables of this Proxy Statement are:

| | • | | Eric E. Parsons, Chairman and Chief Executive Officer (“CEO”) |

| | • | | J. Gregory Ness, President and Chief Operating Officer (“COO”) |

| | • | | Floyd F. Chadee, Senior Vice President and Chief Financial Officer (“CFO”) (appointed CFO effective April 7, 2008) |

| | • | | Kim W. Ledbetter, Senior Vice President, Asset Management Group (retired effective January 2, 2009) |

| | • | | Robert M. Erickson, Vice President, Corporate Financial Services & Controller (served as interim Principal Financial Officer from January 1, 2008 to April 7, 2008) |

| | • | | Michael T. Winslow, Senior Vice President and General Counsel |

Philosophy

The Committee’s goal is to award compensation that is reasonable when all elements of potential compensation are considered. Our compensation program is guided by the following fundamental principles:

| | • | | Provide a competitive base salary and benefits to attract and retain high quality executives. |

| | • | | Provide incentives to achieve short-term and long-term profitability, growth and expense control. |

| | • | | Provide total compensation that allows us to compete with other organizations nationwide for executive talent. |

| | • | | Align the interests of officers with those of our shareholders through grants of equity. |

Our long-term financial goals, as publicly-stated at the beginning of 2008 and set forth below, drove the Committee’s design of goals for the Short Term Incentive Plan and the three-year performance share awards.

| | • | | 12% to 15% annual growth in net income per diluted share excluding after-tax net capital gains and losses. |

13

| | • | | Maintain 14% to 15% return on average equity, excluding after-tax net capital gains and losses from net income and excluding accumulated other comprehensive income from average equity. |

| | • | | 10% to 12% average annual growth in premiums over the long term, with increases each year of at least 1% to 2% greater than the industry growth rate. |

| | • | | 10% to 15% annual growth in assets under administration, excluding acquisitions. |

In making decisions with respect to the executive compensation program or any specific element of compensation, the Committee considers the total current compensation that may be awarded to the officer, including salary, benefits and short and long-term incentive compensation.

Operation of the Organization & Compensation Committee

The Organization & Compensation Committee of the Board of Directors (the Committee) exercises sole authority with respect to performance evaluation, compensation and benefits of the CEO, oversees succession planning for Executive Officers other than the CEO, and approves the compensation of Executive Officers. The Committee also oversees all of our broad-based compensation and stock programs. The Committee is comprised of directors E. Kay Stepp, John E. Chapoton, Peter O. Kohler, M.D., Jerome J. Meyer and Michael G. Thorne, each of whom is an independent director under applicable NYSE Euronext listing standards. Ms. Stepp serves as Chair of the Committee.

The Committee operates pursuant to a written charter that is available on our web site and may be accessed atwww.stancorpfinancial.com. Pursuant to its charter, the Committee has full authority to determine the compensation of Executive Officers. The Committee may not delegate this authority. The Committee receives recommendations from the CEO as to compensation of other officers, and the CEO participates in Committee discussions regarding the compensation of other officers. The Committee meets in executive session without the CEO to determine his compensation.

In 2008, the Committee reviewed the CEO and Executive Officer compensation program and benefits to ensure they continue to further our compensation philosophy and reflect the Committee’s commitment to link performance with compensation. The 2008 review included a comprehensive report from a compensation consultant, which assessed the effectiveness of the compensation program. As part of this analysis, the Committee compared the Company’s compensation program and performance to those of comparable companies, and also reviewed internal equity among the Executive Officers. In addition to this annual review, the Committee regularly meets in executive session, without management present, to discuss items relating to executive and CEO compensation and performance. These annual and ongoing compensation reviews permit a continual evaluation of the link between organizational performance and compensation within the context of the Board’s compensation philosophy and the compensation programs of comparable companies.

The Committee directly retains the services of a consulting firm, Mercer, to advise the Committee on executive compensation matters, to assist in the evaluation of the competitiveness of executive compensation programs and to provide overall guidance to the Committee in the design and operation of these programs. Mercer reports to the Committee Chair, who establishes Mercer’s work agenda and determines how and to what extent Mercer interacts with management in the course of its work for the Committee. Mercer’s primary role is to provide objective analysis, advice and information and otherwise to support the Committee in the performance of its duties. The Committee’s decisions about the executive compensation program, including the specific amounts paid to Executive Officers, are its own and may reflect factors and considerations other than the information and recommendations provided by Mercer.

In 2008, the Committee instructed Mercer to perform the following activities:

| | • | | Evaluate the competitive positioning of the Company’s base salary, annual incentive opportunity, long-term incentive compensation and benefits for the CEO and Executive Officers relative to the market and competitive practice. |

14

| | • | | Advise the Committee on base salary and equity award levels for the Executive Officers and, as needed, on actual compensation actions. |

| | • | | Assess the alignment of the Company compensation levels relative to the performance of the Company and relative to the Company’s articulated compensation philosophy. |

| | • | | Brief the Committee on executive compensation trends among the Company’s peers, the broader industry, and the market and on regulatory, legislative and other developments relative to executive compensation, including proxy disclosure rules. |

| | • | | Evaluate the impact of the Company’s equity plans on annual share use, run rate and total dilution. |

With the Committee Chair’s approval, during 2008 Mercer worked with the CEO and selected members of the Human Resource and legal staff to obtain the information necessary to carry out its assignments from the Committee. With respect to the CEO’s compensation, Mercer worked with the Committee Chair and discussed CEO compensation with the assistant vice president of compensation and benefits in the Company’s Human Resources Department.

Use of Market Data

The Company is a complex organization and the Committee necessarily must make each compensation decision in the context of the particular executive, including the characteristics of the business or market in which the individual operates and the individual’s specific roles, responsibilities, qualifications and experience. The Committee reviews competitive market data provided by Mercer as one tool to establish a competitive range of base salary and short and long-term incentive compensation. We use two information sources. One is a “peer” group selected by the Committee which consists of ten insurance companies of similar size to us. In November 2007, when the Committee reviewed data for 2008 compensation decision-making purposes, this group consisted of the following companies:

| | |

| Protective Life Corporation | | The Phoenix Companies Inc. |

| Everest Re Group Ltd. | | Reinsurance Group of America, Incorporated |

| Delphi Financial Group, Inc. | | Torchmark Corporation |

| Unitrin, Inc. | | FBL Financial Group, Inc. |

| Transatlantic Holdings Inc. | | American Financial Group Inc. |

The second information source we use is a broader market composite by position prepared by Mercer based on data from three published compensation surveys in which we participate and trended forward using a 3.9% annual growth rate. The following published compensation surveys were used in the analysis for 2008 compensation:

| | • | | LOMA (Life Office Management Association),2006 Executive Compensation Survey |

| | • | | Mercer,2007 Executive Compensation Survey |

| | • | | Watson Wyatt,2007/2008 Report on Top Management Compensation |

When collecting data from the published compensation surveys, Mercer used data for similar sized companies (approximately $13.6 billion average assets) in the insurance industry.

After considering the results of these two information sources for each executive position, the Committee generally sets base salary and annual target bonus levels under the Company’s Short Term Incentive Plan near the 50th percentile, and total long-term incentive awards between the 50th and 75th percentiles. These percentages are generally indicative of the Committee’s historical practice and consistent with its compensation philosophy.

15

Annual Component

Base Salaries

Base salaries are established by the Committee based on the executive’s contribution to the Company’s strategic direction and past performance. The Committee also considers market data prepared by Mercer. As described above, these analyses include two information sources: peer group data and salary survey data. The Committee uses this information as a guide to set competitive base salaries designed to retain high quality incumbents. Generally, it is the Committee’s intent to target executives’ base salaries near the 50th percentile. Salary levels are in line with our philosophy and historical practice of placing greater emphasis on performance-based compensation as a component of the overall compensation package.

In the Committee’s annual review of base salaries in December 2007, none of the Named Executive Officers received a salary increase for 2008. This decision reflects the Committee’s continued emphasis on incentive compensation over base salaries, which it believes better aligns the executives’ interests with those of our shareholders. In connection with his promotion to President and COO in September 2008, Mr. Ness received a 10% increase in base salary to $575,000, which was the average of the median points of the salary survey and peer group data for his new position. Floyd F. Chadee, Senior Vice President & CFO, was hired on April 7, 2008 with a base salary of $431,250, which was the average between the median points of the salary survey and peer group data.

Hiring Bonus

In connection with the hiring of Mr. Chadee as CFO in April 2008, the Committee approved a bonus to enable his recruitment and to compensate him in part for benefits he lost by leaving his former employment. The total hiring bonus of $300,000 was payable one-third upon commencement of his employment with an additional $100,000 payable following each of the first two anniversaries of his initial employment if he remains with the Company.

Short Term Incentive Plan

Annual incentives are paid to Named Executive Officers under the Company’s Short Term Incentive Plan (“STIP”). The STIP rewards participants for the achievement of annual goals, which are designed to incrementally achieve our publicly-stated long-term financial objectives of increasing earnings per share, premiums and assets under administration, while maintaining our return on average equity.

The Committee establishes a target bonus for each Named Executive Officer expressed as a percentage of salary. The maximum bonus under the STIP is 150% of the target bonus. In determining target bonus levels, the Committee considers peer group and market survey data and recommendations received from Mercer, and sets target bonus levels considering the market data and each executive’s potential impact upon shareholder returns. Targets are generally set for each tier of executives reflecting their contributions and responsibilities. Overall, the total of salary and target bonus falls near the median level for total cash compensation by position, with opportunities for higher cash compensation based on superior performance. In the Committee’s annual review in December 2007, the target bonus as a percentage of salary remained unchanged for all Named Executive Officers. When Mr. Chadee joined the Company as CFO in April 2008, he was assigned a target bonus percentage of 60% which was the same percentage assigned to the Company’s previous CFO. In connection with his promotion to President and COO in September 2008, Mr. Ness received a target bonus percentage increase from 75% to 90% in view of his increased responsibilities, resulting in a pro-rated target bonus of 80% for him for 2008.

The Committee approved individual 2008 STIPs for the Named Executive Officers under which various percentages of their target bonuses were tied to specific performance goals. Certain terms of the 2008 STIP are discussed in greater detail in footnote (1) under the “Grants of Plan-Based Awards in 2008” table below.

| | • | | All Named Executive Officers had some percentage (from 20% to 40%) of their target bonus tied to our 2008 earnings per share excluding after-tax net capital gains and losses, one of our publicly stated |

16

| | financial objectives. The target payout level was set at $4.91 per share, a 13% increase over 2007 performance consistent with our long-term goal of 12% to 15% annual earnings growth. |

| | • | | Mr. Parsons had 20% of his target bonus tied to growth in revenues before net capital gains and losses, with target payout at a 10% increase in such revenues for 2008 over 2007 and maximum payout at a 12% increase in such revenues. Accordingly, these targets were consistent with our long-term objective of 10% to 12% average annual growth in premiums. |

| | • | | Mr. Parsons and Mr. Chadee had 10% of their target bonus tied to goals for operating expenses as a percentage of premiums for the Insurance Services segment and as a percentage of average assets under administration for the Asset Management segment, with the target payout level based on achieving both a 14.8% operating expense level for Insurance Services (compared to 15.2% achieved in 2007) and a 0.54% operating expense level for Asset Management (compared to 0.58% achieved in 2007). |

| | • | | Mr. Ness and Mr. Ledbetter had 44% and 40%, respectively, of their target bonuses tied primarily to the financial performance of the businesses they each led, with goals based on divisional income before income taxes, sales, revenues and/or expenses. The goals for our two segments reflected our expectations at the beginning of 2008 that Insurance Services would be challenged in 2008 by a competitive sales environment and unfavorable interest rate and employment trends, while Asset Management’s results for 2008 would benefit from a full year of inclusion of the DPA acquisition and other increases in assets under administration. |

| | • | | In addition, Mr. Parsons and Mr. Chadee also had 10% of their target bonus tied to goals for maintaining the strength of our balance sheet, which the Committee views as very important for long-term growth and financial flexibility, with the maximum payout being paid for achieving the same target Standard & Poor’s capital adequacy ratio and double leverage ratio as of December 31, 2008 as we achieved at December 31, 2007. |

The Named Executive Officers other than Mr. Parsons also had portions of their target bonuses tied to completion of projects included in their individual or divisional plans for the year. Finally, 20% of the target bonus for each Named Executive Officer is at the discretion of the Committee, allowing the Committee to consider and reward other aspects of the individual performance of each Named Executive Officer for the year.

17

Total STIP payouts as a percentage of target for 2008 were 81% for Mr. Parsons, 91% for Mr. Ness, 81% for Mr. Ledbetter, 106% for Mr. Chadee, 88% for Mr. Winslow and 135% for Mr. Erickson. The following table summarizes our performance in 2008 under the various STIP financial performance goals described above and in footnote (1) to the “Grants of Plan-Based Awards in 2008” table, either in absolute terms or by comparison to 2007 performance, and the resulting payouts as a percentage of target for each goal.

| | | | | | | |

Performance Goal | | Officer(s) Covered | | 2008 Performance | | Payout

% | |

Earnings per share excluding after-tax net capital gains and losses | | All | | $5.00 per share | | 116 | % |

Revenues before net capital gains and losses | | Parsons | | 3.2% increase | | 0 | % |

Operating expense percentages | | Parsons & Chadee | | 16.0% for Insurance Services; 0.62% for Asset Management | | 0 | % |

Balance sheet ratios | | Parsons & Chadee | | 175% for capital adequacy; 110% for double leverage | | 150 | % |

Insurance Services segment income before income taxes | | Ness | | 13.6% increase | | 150 | % |

Insurance sales (annualized new premiums) | | Ness | | 23.2% decrease | | 0 | % |

Insurance Services segment premium revenues | | Ness | | 2.2% increase | | 0 | % |

Insurance Services segment operating expense percentage | | Ness | | 16.0% | | 0 | % |

Asset Management segment income before income taxes | | Ledbetter | | 18.6% decrease | | 0 | % |

Asset Management segment income before income taxes (aggregates separate goals for four primary businesses of this segment) | | Ledbetter | | 18.6% decrease | | 58 | % |

Consolidated net investment income | | Ledbetter | | 4.8% increase | | 67 | % |

STIP payouts for completion of projects included in individual or divisional plans as a percentage of target were 138% for Mr. Chadee, 116% for Mr. Ness, 75% for Mr. Ledbetter, 67% for Mr. Winslow and 137% for Mr. Erickson. Payouts under the discretionary portion of the 2008 STIP as a percentage of target were 100% for Mr. Parsons, 140% for Mr. Chadee, 125% for Mr. Winslow, 135% for Mr. Ness, 125% for Mr. Ledbetter and 150% for Mr. Erickson.

Long-Term Component

The long-term incentive component of our executive compensation program consists of stock options and performance share awards. These incentives are designed to align the interests of our officers with those of our shareholders, to reinforce management’s long-term focus on corporate performance, and to provide an incentive for key executives to remain with the Company for the long term. In prior years, the long-term component has also included tenure-based restricted stock on a selective basis. Because all of our long-term incentives are stock-based, these incentives carry a significant exposure for the executives to downside equity performance risk.

In setting levels of long-term incentive awards granted in early 2008, the Committee considered peer group and market survey data provided by Mercer. The Committee also considered internal equity and retention objectives and applied judgment in weighing the relative contributions and responsibilities of the executives. For purposes of comparing long-term incentive compensation between executives and between companies, Mercer valued (i) stock option compensation based on the Black-Scholes value of options granted during the year, (ii) performance-based share compensation based on the grant date market price of the target number of shares covered by awards made during the year and (iii) tenure-based restricted stock compensation based on the grant date market price of the shares covered by awards made during the year. One effect of this valuation methodology is that the value of an award of a fixed number of options or performance shares will vary

18

year-to-year in proportion to changes in the stock price at the time of the grants. The Committee generally seeks to set grant levels for long-term compensation such that the total value measured in this way for any year is between the 50th and 75th percentiles of the market information. Valued this way, Mercer advised that Mr. Parsons’ long-term incentive compensation for 2007 of approximately $1.9 million was near the 75th percentile of the market information. Mercer advised the Committee that peer group data indicated a trend to lower long-term incentive grant values. Accordingly, the Committee approved 2008 long-term incentive compensation for Mr. Parsons that was 6% lower than his 2007 award value. The same 6% reduction in award values was applied in setting the 2008 long-term incentive grant values for the other Named Executive Officers. When Mr. Chadee joined the Company as Chief Financial Officer in April 2008, he was awarded long-term incentives with a value near the average between the medians of the salary survey and peer group data for his position. As part of the compensation adjustments made by the Committee upon the promotion of Mr. Ness to President and COO in September 2008, he was granted an additional stock option award with a Black-Scholes value of $250,000 on the grant date.

For purposes of determining the specific award levels for options and performance shares, in past years the Committee generally sought to allocate approximately two-thirds of the total annual award value to stock options, and one-third of the total annual award value to performance shares. The greater allocation of award value to stock options reflects the Committee’s continuing strong belief in the efficacy of stock options as long term incentives due to the alignment with shareholders’ interest in stock price performance. For 2008, Mercer advised the Committee that peer group data indicated a trend towards allocating a greater portion of long-term grant values to performance shares and, accordingly, award values were allocated 58% to stock options and 42% to performance shares in 2008. For awards made in 2009, the Committee decided that 25% of the award value would be allocated to each of stock options and performance shares, and that executives would be allowed to make an advance election regarding the allocation of the remaining 50% of the award value between stock options and performance shares. This new approach to allocating long-term grant values reflects the Committee’s recognition that each executive is the best judge of which long-term incentive provides the greater motivation to him or her. We believe that this increases the perceived value of the awards to the executive and further aligns the interests of executives with those of shareholders.

Stock Options

Options for 2008 for the Named Executive Officers were approved by the Committee on December 7, 2007 to be granted effective on January 2, 2008 with an exercise price based on the closing market price on that day. This was consistent with our usual practice of making our annual option grants effective on the first business day of each year. Options promote executive retention because they carry four-year vesting periods and are forfeited if the employee leaves before retirement or vesting occurs. Stock options are granted with terms of 10 years. The Committee views stock options as a key tool to match executive performance with long term shareholder goals. Stock options also provide significant upside reward to executives for strong stock performance, but little or no reward for poor stock performance.

In making awards, the Committee considers data from Mercer on total long-term award values and allocation guidelines among various long-term incentive components as discussed above, and then applies judgment in weighing the relative contributions and responsibilities of the executives. Mr. Parsons received an option for 83,525 shares in 2008 compared to an option for 100,000 shares granted in 2007, consistent with downward trends in long-term award values and in stock option grants relative to performance share grants as reported by Mercer. The same 17% reduction in the number of shares covered by 2008 option grants as compared to 2007 grants was applied to the other Named Executive Officers. As part of the compensation adjustments made by the Committee upon the promotion of Mr. Ness to President and COO in September 2008, he was granted an additional stock option for 20,000 shares.

19

Performance Shares

Performance shares, which are issuable only if performance criteria specified in the award agreement are met, are an integral part of our long-term incentive program. Performance shares focus the recipients on designated long-term performance goals and vest only to the extent those goals are met. The Committee makes annual performance share awards with payouts based on our financial performance in the last year of the three-year performance cycle commencing with the year the award is made. Accordingly, in 2008 the Company made a performance share grant to each Named Executive Officer with vesting based on achievement of performance goals in 2010. Awards made in 2008 provide that 100% of the award will be in performance shares to be issued at the end of the performance period to the extent performance goals are met, and with a portion of the shares withheld to cover required tax withholding. Recipients do not receive dividends on the performance shares prior to completion of the performance cycle.

Consistent with performance share awards made for the last several years, the performance criteria for the awards made in 2008 based on performance in 2010 consist of the following three components:

| | • | | Growth in earnings per share excluding after-tax net capital gains and losses (weighted at 50%). This component is based on our publicly-stated financial objective of cumulative annual growth of 12% to 15% in this earnings measure. Our approach in setting the 2010 performance goals for this component was to calculate earnings goals based on cumulative annual growth from 2007 to 2010 of 12% for a target payout and 15% for a payout of 90% of maximum. |

| | • | | Growth in revenues excluding net capital gains and losses (weighted at 35%). This component also compares with one of our publicly-stated financial objectives, with payout at target under this criteria resulting from cumulative annual revenue growth of 10% from 2007 to 2010 and payout at 90% of the maximum level resulting from cumulative annual growth of 12% from 2007 to 2010. |

| | • | | Growth in income before income taxes of the Asset Management segment (weighted at 15%). Payout at target will result from cumulative annual growth of 23% from 2007 to 2010 and payout at 90% of maximum will result from cumulative annual growth of 28% from 2007 to 2010. This is generally consistent with our publicly-stated objective of increasing assets under administration by 10% to 15% per year excluding acquisitions, and reflected our expectation that additional growth will be achieved through acquisitions. |

Each performance share award specifies a maximum number of shares issuable if exceptional performance is achieved on all three performance criteria. The target level of each award is equal to 70% of the maximum number of shares and is issuable if target performance levels are achieved on all three criteria. As discussed above, in applying comparative market data provided by Mercer, performance share awards in any year are valued based on the grant date market price of the target number of shares granted in that year. Similar to its stock option award methodology, in setting target levels for performance share awards, the Committee considers data from Mercer on total long-term award values and allocation guidelines among various long-term incentive components as discussed above, and then applies judgment in weighing the relative contributions and responsibilities of the executives. For Mr. Parsons, the total number of shares granted at target level in 2008 increased to 15,424 shares from 14,500 shares in 2007, as the reduction in overall long-term incentive grant value approved by the Committee was more than offset by the increased allocation to performance shares. Similar 4% to 6% increases in the number of shares covered by 2008 performance share awards as compared to 2007 awards were also applied to the other Named Executive Officers.

Executive Officers received similar awards in 2006 covering the 2008 performance year, based upon growth targets for three similar performance criteria with the same relative weightings. Based upon our performance in 2008, these awards vested for 40% of the maximum number of shares and cash performance units awarded, and the balance was forfeited. Earnings per share excluding after-tax net capital gains and losses was $5.00 for 2008, representing a 10.2% compounded annual increase over 2005 results, and resulting in a payout percentage of 58% of maximum for that goal (weighted at 50%). Revenues of $2.67 billion represented a 4.5% compounded

20

annual increase over 2005 revenues, resulting in a payout percentage of 30% of maximum for that goal (weighted at 35%). Income before income taxes of all businesses other than life and disability insurance in 2008 represented a compounded annual increase of 0.7% over 2005 resulting in a payout percentage of 2% of maximum for that goal (weighted at 15%).

Tenure-Based Restricted Stock

No tenure-based restricted stock was granted in 2008, nor does the Committee presently intend to make future grants of tenure-based restricted stock except in unusual circumstances as Committee members believe that the performance requirements inherent in options and performance shares make them more appropriate as long-term incentive awards. Mr. Ness and Mr. Ledbetter each received an award of 4,000 shares of tenure-based restricted stock with a value of approximately $200,000 in January 2006, all of which vested on January 1, 2009.

Benefits Component

Retirement Plans

Defined Benefit Plans. The Standard Retirement Plan for Home Office Personnel is our qualified pension plan generally available to our employees hired on or before January 1, 2003, including all of the Named Executive Officers other than Mr. Chadee. We closed the pension plan to new participants in January 2003 to gradually phase out this benefit; employees hired since then receive annual supplemental contributions to our defined contribution plans in lieu of participation in the pension plan. Benefits under the pension plan are based on years of service and final average earnings, as is typical for defined benefit plans. However, the Internal Revenue Code limits the amount of annual earnings that can be included in calculating final average earnings under a qualified pension plan, which limits the retirement benefits of senior executives relative to their earnings during employment. To provide a level of income replacement in retirement consistent with that provided to other employees, and to provide a benefit package believed to be competitive with that provided to executives in comparable positions at comparable insurance companies, we provide the Named Executive Officers other than Mr. Chadee with nonqualified supplemental pension benefits under our Supplemental Retirement Plan for the Senior Management Group. This plan provides benefits that cover the difference between benefits payable under the pension plan and the benefits that would be payable under the pension plan without the limit on covered compensation required by the Internal Revenue Code. For details regarding the determination and payment of benefits under the pension plan and the supplemental plan, and the present value of accumulated benefits for each Named Executive Officer, see “Pension Benefits at December 31, 2008.”

In September 2008, the Committee approved an amendment to the pension plan (which also affected the supplemental plan) that decreased the age at which certain long-serving employees become eligible for unreduced retirement benefits. Under the pension plan prior to the amendment, a participant was entitled to a monthly retirement benefit equal to the full normal retirement benefit if benefits commenced after the participant reached age 60 and the sum of his or her age plus years of service was at least 90. The amendment eliminated the requirement that a participant reach age 60 to receive an unreduced early retirement benefit, thereby making a participant eligible for this unreduced benefit if benefits commence anytime after the sum of his or her age plus years of service is at least 90. The Committee made this change to better align the pension plan with current market practices. As of the amendment date, the only executive officers affected by the change were Mr. Ness and Mr. Ledbetter.