UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a party other than the Registrant ¨

Check the appropriate box:

| | |

| x | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ¨ | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

STANCORP FINANCIAL GROUP, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than The Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

March 24, 2014

Fellow Shareholder:

On behalf of the Board of Directors, management and employees, it is my pleasure to invite you to attend the 2014 Annual Meeting of Shareholders of StanCorp Financial Group, Inc. The meeting will take place on Monday, May 12, 2014 at 11:00 a.m. Pacific Time at the Hilton Portland Executive Tower, located at 545 SW Taylor Street in Portland, Oregon. Information regarding the location and the business to be conducted at the meeting is contained in the attached Notice of Annual Meeting of Shareholders and Proxy Statement.

We are pleased with our 2013 financial performance. In 2013, we saw strong earnings growth in Employee Benefits and record earnings in Individual Disability and Asset Management. In addition, we returned more than $130 million of capital to shareholders through dividends and share repurchases. During the meeting we’ll present a brief report on the results for 2013.

Stanley R. Fallis and Michael G. Thorne will be retiring from our Board of Directors. We are grateful to them for their many contributions during 30 combined years of service to the Company.

In November 2013, Kevin M. Murai was appointed to the Board of Directors. In January 2014, Timothy A. Holt was appointed to the Board of Directors. Mr. Murai’s proven leadership capabilities as the chief executive of a publicly-traded company and global business experience, and Mr. Holt’s many years of leadership experience in financial services and investment management, will make them valuable contributors to our Company and our Board of Directors.

We hope that you will attend the meeting, but whether or not you are planning to attend, please vote your proxy via one of the methods available so that your shares can be represented at the Annual Meeting of Shareholders.

Sincerely,

J. Greg Ness

Chairman, President and Chief Executive Officer

TABLE OF CONTENTS

STANCORP FINANCIAL GROUP, INC.

1100 SW Sixth Avenue

Portland, Oregon 97204

Notice of Annual Meeting of Shareholders

| | |

| |

Date: | | May 12, 2014 |

| |

Time: | | 11:00 a.m. |

| |

Place: | | Hilton Portland Executive Tower |

| |

| | 545 SW Taylor Street, Portland, OR 97204 |

Items of Business:

| | 1. | Elect three Class III Directors and two Class I Directors; |

| | 2. | Ratify the appointment of Deloitte & Touche USA LLP as our independent registered public accounting firm for 2014; |

| | 3. | Amend the Articles of Incorporation to declassify the Board of Directors; |

| | 4. | Advisory approval of executive compensation; and |

| | 5. | Consider any other business properly brought before the Annual Meeting. |

Record Date: March 7, 2014. Only StanCorp shareholders of record at the close of business on that date may vote at the meeting.

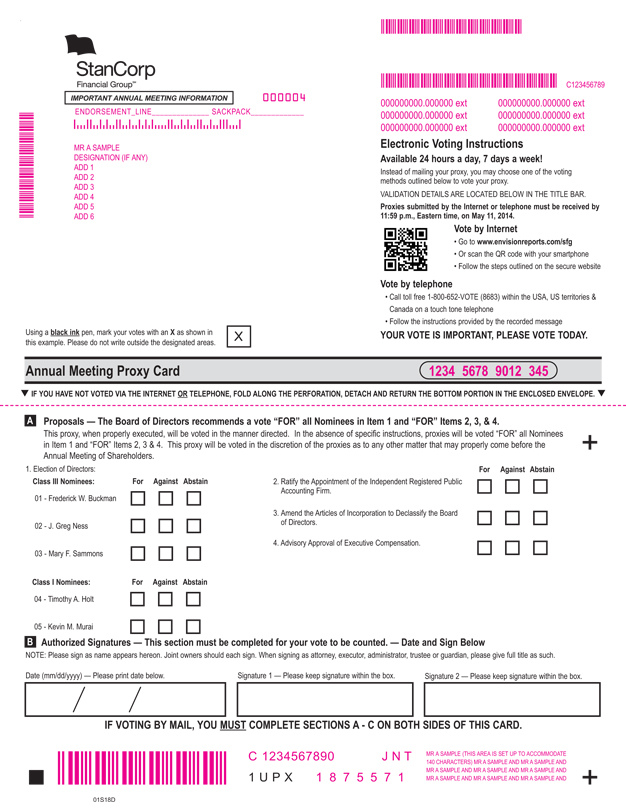

Proxy Voting:On March 24, 2014 the Company mailed to shareholders a “Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to Be Held on Monday, May 12, 2014,” containing instructions on how to access the Company’s 2014 Proxy Statement and 2013 Form 10-K.

The Proxy Statement and the 2013 Form 10-K are available at http://www.envisionreports.com/sfg.

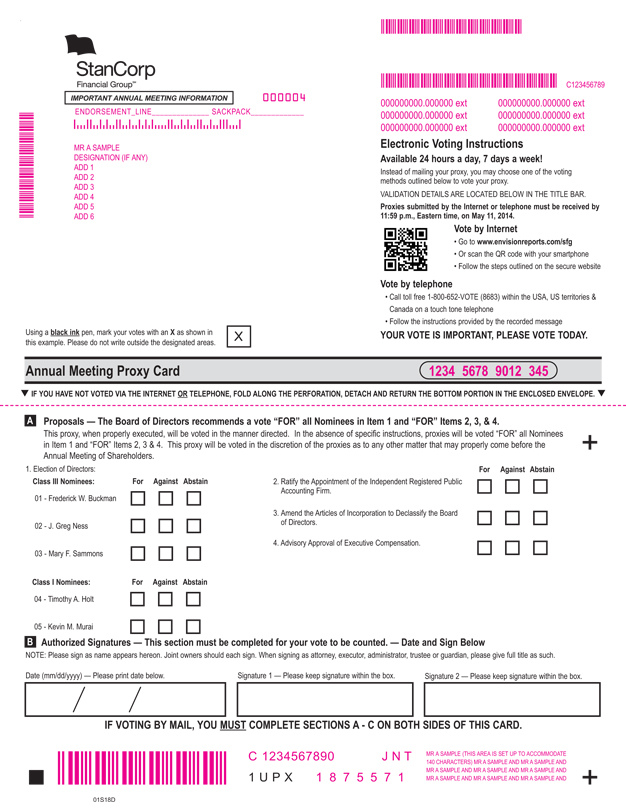

There are four different ways to vote your shares:

| | |

By Internet: | | You may submit a proxy or voting instructions over the Internet by following the instructions at http://www.envisionreports.com/sfg. |

| |

By Telephone: | | You may submit a proxy or voting instructions by calling(800) 652-VOTE (8683) and following the instructions. |

| |

By Mail: | | If you received your proxy materials via U.S. mail, you may complete, sign and return the accompanying proxy and voting instructions card in the postage-paid envelope provided. |

| |

In Person: | | If you are a shareholder as of the record date, you may vote in person at the meeting. If you attend the meeting and intend to vote in person, please notify the Company’s personnel of your intent as you sign in for the meeting. |

|

BY ORDEROFTHE BOARDOF DIRECTORS |

|

Holley Y. Franklin Corporate Secretary |

March 24, 2014

STANCORP FINANCIAL GROUP, INC.

1100 SW Sixth Avenue

Portland, Oregon 97204

PROXY STATEMENT

GENERAL INFORMATION

The Company’s shares of common stock trade on the New York Stock Exchange Euronext (“NYSE Euronext”) under the ticker symbol “SFG.” The Company has only one outstanding class of common stock that is eligible to vote. As of March 7, 2014 (the “Record Date”), the Company had outstanding shares of common stock.

On behalf of the Board of Directors (the “Board”), the Company is soliciting your proxy for use at the 2014 Annual Meeting of Shareholders (“2014 Annual Meeting”) and at any adjournment of the meeting.

Voting Rights

Each share of the Company’s common stock is entitled to one vote on each proposal and with respect to each Director position to be filled. There is no cumulative voting. To be eligible to vote on matters coming before the 2014 Annual Meeting, you must own a share of the Company’s common stock on the Record Date. The Board has set the Record Date as the close of business on the Record Date. Your ability to vote by telephone or by the Internet will close at 11:59 p.m. Eastern time on May 11, 2014. If you choose to vote by mail, the Company must receive your proxy card prior to the 2014 Annual Meeting.

Voting by Proxy

The Company is soliciting a proxy from you on behalf of its Board. The proxy holder(s), the person(s) designated in the proxy to cast your vote, also known as “proxies,” will vote your shares according to your instructions. If you return your proxy signed, but without directions, the proxy holders will vote your shares in accordance with the recommendations of the Board with regard to Items 1, 2, 3, and 4. If other matters come before the 2014 Annual Meeting that require a shareholder vote, the proxy holders will vote your shares in accordance with the recommendation of the Board.

You have the right to revoke your proxy at any time up to the time your shares are voted. You have three ways to revoke your proxy. First, you may do so in writing. Please send your revocation to the Company’s Corporate Secretary, P12B, StanCorp Financial Group, Inc., P. O. Box 711, Portland, OR 97207. Your written revocation must be received by May 11, 2014. Second, you can cast another valid proxy in writing, by telephone or over the Internet. Your vote will be cast in accordance with the latest valid proxy the Company has received from you. Third, you can revoke your proxy by voting in person at the 2014 Annual Meeting. If you choose to vote in person, please let the Company’s personnel know that you are revoking a previously given proxy and are now voting in person.

Votes Required

Pursuant to Oregon law, the Company’s Articles of Incorporation and Bylaws, the election of nominees to the Board at the 2014 Annual Meeting requires a quorum. After achieving a quorum, the nominees receiving more votes “for” election than “against” election will be elected. Pursuant to the Company’s

| | |

Notice of Annual Meeting of Shareholders and 2014 Proxy Statement | | 1 |

Articles of Incorporation, for Proposal 3 to pass at the 2014 Annual Meeting, at least 70 percent of the outstanding shares of common stock must be voted in favor of Proposal 3. Abstentions and broker non-votes have the same effect as “no” votes on Proposal 3. For any other proposal to pass at the 2014 Annual Meeting, the meeting must have a quorum and the proposal must receive more votes in its favor than were cast against it. Broker non-votes and abstentions will be treated as if the shares were present at the 2014 Annual Meeting, but not voting.

Cost of Proxy Solicitation

The Company pays the cost of soliciting proxies. The Company’s Directors, officers or employees may solicit proxies on its behalf in person or by telephone, facsimile or other electronic means. The Company has also engaged the firm of Georgeson Inc. to assist in the distribution and solicitation of proxies. The Company has agreed to pay Georgeson Inc. a fee of $6,000 plus expenses for their services.

In accordance with the regulations of the Securities and Exchange Commission (“SEC”) and the NYSE Euronext, the Company will also reimburse brokerage firms and other custodians, nominees and fiduciaries for their expenses incurred in sending proxies and proxy materials to beneficial owners of StanCorp common stock.

MATTERS TO BE VOTED ON

|

Proposal 1 - Election of Directors |

The Company’s business, property and affairs are managed under the direction of the Board. The Board is currently comprised of 12 Directors divided into three classes. Each of these classes serves a three-year term in office. At the 2014 Annual Meeting, shareholders will be requested to elect three Class III Directors for a three-year term. Class III currently consists of three Directors, all of whom have agreed to stand for re-election. Shareholders will also be requested to elect Timothy A. Holt and Kevin M. Murai as Class I Directors. One Class I Director, Stanley R. Fallis, and one Class II Director, Michael G. Thorne, will be retiring, having reached mandatory retirement age at the 2013 Annual Meeting and after agreeing to serve one additional year at the request of the Board. The Board has decided to reduce the number of Directors to ten effective at the 2014 Annual Meeting.

On the recommendation of the Nominating & Corporate Governance Committee, the Board is nominating the following five Directors for re-election. If any nominee should become unable to serve, the proxy holder will vote for the person or persons the Board recommends, if any.

Board of Director Nominees

| | | | | | | | | | | | | | |

| | | | | |

| Name | | Age | | | Director

Since | | | Experience | | Independent (yes/no) | |

| | | | |

Frederick W. Buckman | | | 67 | | | | 1996 | | | President Frederick Buckman Inc., Chairman & CEO Powerlink Transmission Company | | | yes | |

| | | | |

Timothy A. Holt | | | 60 | | | | 2014 | | | Former Chief Investment Officer, Aetna, Inc. | | | yes | |

| | | | |

Kevin M. Murai | | | 50 | | | | 2013 | | | President & CEO SYNNEX Corporation | | | yes | |

| | | | |

J. Greg Ness | | | 56 | | | | 2009 | | | Chairman, President & CEO StanCorp Financial Group, Inc. | | | no | |

| | | | |

Mary F. Sammons | | | 67 | | | | 2008 | | | Former Chairman, President & CEO Rite Aid Corporation | | | yes | |

| | |

| 2 | | Notice of Annual Meeting of Shareholders and 2014 Proxy Statement |

Kevin M. Murai was first appointed as a Director by the Board on November 12, 2013 and is a nominee for election as a Class I Director at the 2014 Annual Meeting. Mr. Murai was recommended as a candidate by a third-party director search firm retained by the Nominating & Corporate Governance Committee, and was chosen by the Board from among the pool of eligible candidates based on his proven leadership capabilities and global business experience.

Timothy A. Holt was first appointed as a Director by the Board on January 28, 2014 and is a nominee for election as a Class I Director at the 2014 Annual Meeting. Mr. Holt was recommended as a candidate by a third-party director search firm retained by the Nominating & Corporate Governance Committee, and was chosen by the Board from among a pool of eligible candidates based on his demonstrated leadership and expertise in financial services and investment management.

Votes may not be cast for a greater number of Director nominees than five.

Board members of the Company also serve on the Board of the Company’s principal subsidiary, Standard Insurance Company. The Company’s Directors serve on the same board committees of Standard Insurance Company as they do for StanCorp.

The Company’s Articles of Incorporation include a majority vote standard for uncontested elections under which shareholders may vote “for” or “against”, or abstain with respect to each nominee, and a nominee will be elected only if shares voted “for” exceed shares voted “against.” Under Oregon law, an incumbent Director nominee who is not re-elected continues to serve on the Board until his or her successor is elected and qualified. The Company’s Corporate Governance Guidelines provide that any nominee for Director as to whom a majority of the shares are voted “against” his or her election shall promptly tender his or her resignation to the Chair of the Nominating & Corporate Governance Committee. The Nominating & Corporate Governance Committee will recommend to the Board the action to be taken with respect to such offer of resignation.

Directors in Classes

Set forth below is information about each nominee and continuing Director as of December 31, 2013.

| | | | | | | | | | | | | | |

| | | | | |

| Name | | Age | | | Director Since(1) | | | Position Held | | Term Expires | |

Class I | | | | | | | | | | | | | | |

Virginia L. Anderson | | | 66 | | | | 1989 | | | Director | | | 2015 | |

Timothy A. Holt | | | 60 | | | | 2014 | | | Director | | | (2) | |

Kevin M. Murai | | | 50 | | | | 2013 | | | Director | | | (2) | |

Eric E. Parsons | | | 65 | | | | 2002 | | | Director | | | 2015 | |

| | | | |

Class II | | | | | | | | | | | | | | |

Debora D. Horvath | | | 58 | | | | 2012 | | | Director | | | 2016 | |

Duane C. McDougall | | | 61 | | | | 2009 | | | Director | | | 2016 | |

E. Kay Stepp | | | 68 | | | | 1997 | | | Lead Independent

Director | | | 2016 | |

| | | | |

Class III | | | | | | | | | | | | | | |

Frederick W. Buckman | | | 67 | | | | 1996 | | | Director | | | 2014 | |

J. Greg Ness | | | 56 | | | | 2009 | | | Chairman | | | 2014 | |

Mary F. Sammons | | | 67 | | | | 2008 | | | Director | | | 2014 | |

| | (1) | Directors elected prior to 1999 served on the Board of Standard Insurance Company, and became Directors of StanCorp Financial Group, Inc. during the reorganization in 1999. | |

| | (2) | Mr. Holt and Mr. Murai were appointed by the Board between the 2013 and 2014 Annual Meetings. They are nominees for election as Class I Directors at the 2014 Annual Meeting. | |

| | |

Notice of Annual Meeting of Shareholders and 2014 Proxy Statement | | 3 |

Business History, Qualifications, Skills and Expertise of Nominees for Election

Below are brief biographies for each of the five Director nominees. Following each Director’s biography is a description of the Director’s key qualifications, skills and experience that are important in light of StanCorp’s business and structure.

Frederick W. Buckman. Mr. Buckman has been Chairman and Chief Executive Officer of Powerlink Transmission Company, a facilitator of independent power transmission infrastructure development, since June 2012. From March 2009 through August 2010, Mr. Buckman was President of the Power Group, a division of The Shaw Group Inc., a provider of engineering, design, construction, and maintenance services to government and private-sector clients in the energy, environmental, infrastructure, and emergency response markets. From 2007 to 2009, Mr. Buckman was Managing Partner, Utilities, of Brookfield Asset Management, a global asset manager focused on property, power and other infrastructure assets. From 1999 to 2006, Mr. Buckman served as Chairman of Trans-Elect, Inc. an independent company engaged in the ownership and management of electric transmission systems. Mr. Buckman is also President of Frederick Buckman, Inc., a consulting firm located in Vancouver, Washington. From 1994 to 1998 Mr. Buckman served as President, Chief Executive Officer and director of PacifiCorp, a holding company of diversified businesses, including an electric utility, based in Portland, Oregon. Mr. Buckman brings his extensive history as a business leader to the Board, and his demonstrated management ability at senior levels allows him to provide critical insight into the operational aspects of the Company.

Timothy A. Holt. Mr. Holt retired from Aetna, Inc., a diversified health care benefits company, in 2008, after 30 years of service. Mr. Holt served as Chief Investment Officer from 1997 to 2008. Prior to being named Chief Investment Officer, Mr. Holt held various senior management positions with Aetna. Mr. Holt is on the board of directors of Virtus Investment Partners, Inc., where he has served since 2009, and is currently Chairman of the Risk and Finance Committee and a member of the Audit Committee. Mr. Holt is also on the board of directors of MGIC Investment Corporation, where he has served since 2012, and is on the Audit Committee and the Securities Investment Committee. Mr. Holt brings years of senior leadership experience and expertise in financial services and investment management to the Board, which make him a valuable contributor.

Kevin M. Murai. Mr. Murai is President and Chief Executive Officer and Director of SYNNEX Corporation and has served in this capacity since 2008. Prior to SYNNEX, Mr. Murai was employed for 19 years at Ingram Micro Inc., most recently as President, Chief Operating Officer and a member of the board of directors. During his nineteen-year tenure at Ingram Micro, Mr. Murai served in several executive management positions. Currently, he serves on the board of directors for the Global Technology Distribution Council, and also serves on the Dean’s Advisory Council of the University of Waterloo. As the chief executive of a large publicly-traded company with global operations Mr. Murai’s proven leadership abilities and significant business experience make him a valuable contributor to the Board.

J. Greg Ness. Mr. Ness is Chairman, President and Chief Executive Officer of StanCorp and the Company’s principal subsidiary, Standard Insurance Company, and has served in this capacity since December 2011. From July 2009 through November 2011 he served as President and Chief Executive Officer. He previously served as President and Chief Operating Officer beginning in September, 2008. Prior to his appointment as President, Mr. Ness served in a variety of positions since 1979, including Senior Vice President of Insurance Services, Senior Vice President of Investments, President of StanCorp Mortgage Investors, LLC and StanCorp Investment Advisers, Vice President and Corporate Secretary, and Vice President of retirement plans sales and marketing. Mr. Ness’s long history of service to the Company in many different capacities gives him a depth and breadth of experience that is an essential component of the leadership profile that the Board seeks in its membership and needed for service as Chairman of the Board.

| | |

| 4 | | Notice of Annual Meeting of Shareholders and 2014 Proxy Statement |

Mary F. Sammons. Ms. Sammons was Chairman of the board of Rite Aid Corporation until June 2012 and served on the board of directors of Rite Aid from 1999 until June 2013. From 2003 until June 2010, Ms. Sammons served as the Chief Executive Officer of Rite Aid and from December 1999 to September 2008, Ms. Sammons also served as President of Rite Aid Corporation. From January 1998 to December 1999, Ms. Sammons served as President and Chief Executive Officer of Fred Meyer Stores, Inc., and from 1980 to 1998, she held a number of senior level positions with Fred Meyer. She is a director of Magellan Health Services, a specialty health care manager. Ms. Sammons brings a unique perspective to the Board through her extensive retail, marketing and operational experience. Her extensive CEO and senior executive experience brings valuable insight into Company financial operations and business issues facing the Company.

Business History, Experience, Skills and Qualifications of Continuing Directors

Virginia L. Anderson. Ms. Anderson is currently a Principal of VLA Consulting, a sole proprietorship. From May 2007 through November 2008, Ms. Anderson was President of the Safeco Insurance Foundation, a private charitable foundation established by Safeco Insurance in Seattle, Washington. From 1988 to April 2006, Ms. Anderson was the director of the Seattle Center, a 74-acre, 31-facility urban civic center, located in Seattle, Washington. Previously, Ms. Anderson spent ten years at Cornerstone Development Company, a Seattle real estate and property management firm, where she served as senior vice president of several key divisions. She has served on multiple corporate and civic boards, including Washington Energy Company, U.S. Bank of Washington, and the University of Washington Foundation. She currently serves as Chair of the Board of Trustees for Cornish College of the Arts. Ms. Anderson’s many years of experience as director of the Seattle Center, her real estate and property management experience, service on other company boards and her civic contributions make her a valued contributor to the Board and a prime example of the Board’s goal of retaining members with a breadth of business experience.

Debora D. Horvath. Ms. Horvath is the Principal of Horvath Consulting LLC, which she founded in 2010. From 2008 to 2010, Ms. Horvath was Executive Vice President for JP Morgan Chase & Co. From 2004 to 2008, Ms. Horvath was Executive Vice President and Chief Information Officer for Washington Mutual, Inc. Ms. Horvath, a 25-year veteran from GE, also served 12 years as Senior Vice President and Chief Information Officer for the GE Insurance businesses. Ms. Horvath was a director of the Federal Home Loan Bank of Seattle until November 2013. Ms. Horvath’s leadership of a global information technology organization and robust experience in information technology leadership positions, as well as financial services and insurance industry expertise, make her an excellent fit to round out the skills the Board is seeking in order to maximize its oversight role.

Duane C. McDougall. Mr. McDougall served as Chairman and Chief Executive Officer of Boise Cascade, LLC, a privately held manufacturer of wood products from December 2008 to August 2009. He was President and Chief Executive Officer of Willamette Industries, Inc., an international forest products company, from 1998 to 2002. Prior to becoming President and Chief Executive Officer, Mr. McDougall served as Chief Accounting Officer and in other operating and finance positions during his 23-year tenure with Willamette Industries, Inc. He serves as Chairman of the board of Boise Cascade LLC, and is the lead independent director and audit committee chair of The Greenbrier Companies, Inc., where he has served as a director since 2003. Mr. McDougall also served as a director of West Coast Bancorp until 2011 and as a director of Cascade Corporation until it was sold to a third party in the spring of 2013. Mr. McDougall’s many years of experience as CEO and other executive leadership positions with Willamette Industries, Inc., along with his strong financial expertise, human resource and government expertise, and service on other public company boards of directors make him an excellent fit for the Board.

Eric E. Parsons. Mr. Parsons was Chairman of the Board of StanCorp from May 2004 through November 2011 and was Chief Executive Officer of StanCorp and the Company’s principal subsidiary,

| | |

Notice of Annual Meeting of Shareholders and 2014 Proxy Statement | | 5 |

Standard Insurance Company, from January 2003 through June 2009. From May 2002 to September 2008, Mr. Parsons also served as President of both entities. Prior to his appointment as President and Chief Executive Officer, Mr. Parsons was President and Chief Operating Officer of StanCorp and Standard Insurance Company in 2002. Prior to May 2002, he served as Chief Financial Officer and previously held management positions in finance, investments, mortgage loans and real estate. Mr. Parsons’ long history as an executive in various divisions of the Company and as President and Chief Executive Officer of Standard Insurance Company provide the in-depth knowledge of the Company’s operations and the depth of experience needed for service as a Director.

E. Kay Stepp. Ms. Stepp is the Board’s independent Lead Director. From 1994 to 2002, Ms. Stepp was Principal and Owner of Executive Solutions, a management consulting firm in Portland, Oregon. From 1989 to 1992, Ms. Stepp was President and Chief Operating Officer of Portland General Electric (“PGE”), a Portland, Oregon utility company. From 1978 to 1989, Ms. Stepp held various executive positions at PGE. From 2002 through 2009, Ms. Stepp served as Chair of the corporate board of Providence Health & Services. She is a director of Franklin Covey Co., where she has served since 1997, and currently serves as Chair of the Organization & Compensation Committee. Ms. Stepp is a former director of Planar Systems, Inc. and of the Federal Reserve Bank of San Francisco. Ms. Stepp brings a breadth of executive and governance experience to the Board. Her past executive leadership roles in human resources, marketing, information technology and operations; her work as an executive coach to senior executives; and her service on diverse public and private company boards in the financial, retail, technology, manufacturing, services and consulting sectors make her an excellent member of the Board.

|

Proposal 2 - Ratify the Appointment of the Independent Registered PublicAccounting Firm |

The Audit Committee of the Board has appointed Deloitte & Touche USA LLP (“Deloitte & Touche”) as independent auditors for the year 2014. Although not required, the Board is requesting ratification by the Company’s shareholders of this appointment. If ratification is not obtained, the Audit Committee will reconsider the appointment.

The Company has been advised that representatives of Deloitte & Touche will be present at the 2014 Annual Meeting. They will be afforded the opportunity to make a statement and to respond to appropriate questions.

The aggregate fees billed by Deloitte & Touche for professional services rendered for the years 2013 and 2012 were as follows:

| | | | | | | | |

| | | 2013 | | | 2012 | |

Audit Fees | | $ | 1,930,456 | | | $ | 2,317,200 | |

Audit-Related Fees | | | 463,014 | | | | 599,487 | |

Tax Fees | | | — | | | | 40,000 | |

All Other Fees | | | 237,543 | | | | 27,200 | |

| | | | | | | | |

Total | | $ | 2,631,013 | | | $ | 2,983,887 | |

Audit fees were paid for audits of the financial statements and internal controls of the Company and its subsidiaries, and review of its quarterly financial statements. Audit-related fees were paid for an audit of the Company’s employee benefit plans, reports on Statement on Standards for Attestation Engagements No. 16 (“SSAE 16”) of certain Company divisions and services rendered for other miscellaneous regulatory filings with the Securities and Exchange Commission. Tax fees include assistance with tax return preparation, tax planning, and other tax related services. All other fees include services provided in connection with participating in studies, surveys, and other subscriptions, which took place in 2013.

| | |

| 6 | | Notice of Annual Meeting of Shareholders and 2014 Proxy Statement |

The Audit Committee has established a policy under which all services performed by the independent auditors must be approved in advance by the Audit Committee or, if such pre-approval of a particular activity is not feasible, by the Chair of the Audit Committee.

|

Proposal 3 - Amend the Articles of Incorporation to Declassify the Board of Directors |

The Company’s Articles of Incorporation currently divide the Board of Directors into three classes of Directors serving staggered three-year terms. The Board has adopted, and recommends that shareholders approve, an amendment to the Company’s Articles of Incorporation to provide for the declassification of the Board over a three-year period beginning in 2015. The proposed amendment revises Article 3.A of the Company’s Articles of Incorporation to read as follows:

“A. The number of directors of the Corporation shall be not less than nine (9) nor more than twenty-one (21), and within such limits the exact number shall be fixed and increased or decreased from time to time by resolution of the Board of Directors. Until the annual meeting of shareholders held in 2015, the directors shall be divided into three classes, as nearly equal in number as possible, with directors in each class elected to serve three-year terms and until their successors are elected and qualified, so that the term of one class of directors will expire each year. At the annual meeting of shareholders held in 2015 and in each year thereafter, directors elected to succeed those directors whose terms expire shall be elected to serve one-year terms and until their successors are elected and qualified. No decrease in the number of directors constituting the Board of Directors shall shorten the term of any incumbent director.”

Reasons for the Proposed Amendment

Upon the recommendation of the Nominating & Corporate Governance Committee, the Board has determined that it is appropriate to propose declassification over a three-year period beginning in 2015. The Board believes that the existing classified structure provides many important benefits, including continuity and stability of leadership, enhanced independence of non-management directors, and time and leverage to explore alternatives and negotiate for enhanced shareholder value in the event of hostile change-in-control attempts. However, the Board acknowledges growing investor sentiment in favor of annual elections and believes the Board would continue to be effective in protecting shareholder interests under an annual election system. The Board recognizes that many investors believe that the election of Directors is the primary means for shareholders to influence corporate governance policies and hold management accountable for implementing those policies. After balancing these interests, the Board has decided to recommend the phased elimination of its classified structure.

Impact of the Proposed Amendment

If the proposed amendment is approved by the shareholders, it will become effective upon the filing of Articles of Amendment to the Company’s Articles of Incorporation with the Oregon Corporation Division. The Company would make this filing promptly after approval of the proposal at the 2014 Annual Meeting. Then, beginning at the 2015 Annual Meeting, Directors would be elected for one-year terms expiring at the following year’s annual meeting. However, the proposed amendment would not shorten the terms of previously elected directors. Accordingly, directors who were elected prior to the 2015 Annual Meeting would continue to hold office until the end of the terms for which they were elected and until their successors are elected and qualified. Thus, Directors elected at the 2013 Annual Meeting would continue to have terms that expire at the 2016 Annual Meeting and Class III Directors elected under Item 1 at this 2014 Annual Meeting would have terms that expire at the 2017 Annual Meeting. The phase-in process would therefore be complete at the 2017 Annual Meeting with the entire Board standing for re-election to a one-year term at that meeting and at each annual meeting

| | |

Notice of Annual Meeting of Shareholders and 2014 Proxy Statement | | 7 |

thereafter. If there is a vacancy in the Board after the 2014 Annual Meeting, whether because the number of directors is increased or otherwise, any director elected to fill such vacancy would hold office for a term expiring at the next annual meeting.

If the proposed amendment to the Articles of Incorporation is approved by the shareholders, the Board intends to make conforming amendments to the Company’s Bylaws to make them consistent. If the proposed amendment is not approved, the Articles of Incorporation will remain unchanged and the Board will remain classified.

|

Proposal 4 - Advisory Approval of Executive Compensation |

This Proxy Statement includes extensive disclosure regarding the compensation of the Company’s Named Executive Officers (“NEOs”) under the headings “Compensation Discussion and Analysis” and “Executive Compensation.” Section 14A of the Securities Exchange Act of 1934, as enacted as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act in July 2010, requires the Company to submit to its shareholders a nonbinding advisory resolution to approve the compensation of the NEOs disclosed in this Proxy Statement. Accordingly, the Board has approved the submission of the following resolution to the shareholders for approval at the 2014 Annual Meeting:

“RESOLVED, that the compensation of the Company’s NEOs, as disclosed pursuant to the compensation disclosure rules of the SEC under the headings “Compensation Discussion and Analysis” and “Executive Compensation” in the Proxy Statement for the Company’s 2014 Annual Meeting of Shareholders, is approved.”

This proposal gives you as a shareholder the opportunity to endorse or not endorse the Company’s executive compensation program by voting for or against the above resolution. As discussed under “Compensation Discussion and Analysis” below, the Company’s executive compensation program has been carefully designed and implemented to attract, retain and motivate high quality executives, and to reward them appropriately for achievement of short and long term business objectives. Accordingly, the Board recommends that you vote “for” the above resolution.

Because the shareholder vote on the above resolution is advisory, it will not be binding on the Company, the Board or the Organization & Compensation Committee. The Company intends to carefully consider the results of the shareholder vote on this proposal, but will have no obligation to make any changes to its executive compensation program in response to a negative vote.

| | | | |

| | | Matter to be Voted On | | Board

Recommendation |

Proposal 1 | | Election of Directors | | FOR ALL |

Proposal 2 | | Ratify the Appointment of the Independent Registered Public Accounting Firm | | FOR |

Proposal 3 | | Amend the Articles of Incorporation to Declassify the Board of Directors | | FOR |

Proposal 4 | | Advisory Approval of Executive Compensation | | FOR |

| | |

| 8 | | Notice of Annual Meeting of Shareholders and 2014 Proxy Statement |

OTHER INFORMATION

Corporate Governance Guidelines

The Company’s Corporate Governance Guidelines (the “Guidelines”), which are available publicly atwww.stancorpfinancial.com or upon written request of the Company’s Corporate Secretary, P12B, StanCorp Financial Group, Inc., PO Box 711, Portland, Oregon 97207, set forth the principles by which the Board manages the affairs of the Company. Among other principles, the Guidelines specify Director qualifications and independence standards, new Director selection practices, responsibilities of Board members, compensation and the annual Board performance evaluation process. The Nominating & Corporate Governance Committee reviews the Guidelines on at least an annual basis.

Director Independence

The Board is comprised of a majority of Directors who qualify as independent under the NYSE Euronext listing standards. The Board reviews annually any relationship that each Director has with the Company (either directly, or as a partner, shareholder, officer or an employee of an organization with which the Company does business or makes charitable contributions). The Board’s review includes a qualitative and quantitative assessment of any relationships from the perspective of both the Director and the Company. Following such annual review, only those Directors whom the Board affirmatively determines have no material relationship with the Company are considered independent.

Under NYSE Euronext standards, each current Director is independent except for Chairman, President and Chief Executive Officer, J. Greg Ness.

Board Leadership

The Board places emphasis on independent Board leadership and has had a Lead Independent Director (“Lead Director”) since 2003. E. Kay Stepp was appointed as the Lead Director in May 2011. The Lead Director provides leadership and counsel to the independent Directors with an emphasis on the appropriate roles and responsibilities of the independent Directors. She enhances the effective functioning of the independent Directors by facilitating communications and collaboration between and among them. In conjunction with the Chairman of the Board, she provides leadership to the Board in reviewing and deciding upon matters that exert major influence on the manner in which the corporation’s business is conducted. She acts in a general advisory capacity to the Board in all matters concerning Board governance, activities, operations and performance, and performs such duties as may be conferred by law or assigned by the Board.

The Board believes that the optimal leadership structure for the Board and the Company is to combine the Chairman and Chief Executive Officer role. The Chief Executive Officer maintains primary management responsibility for the Company’s day-to-day operations and his experience and qualifications enable him to fulfill the responsibilities of Chairman of the Board.

J. Greg Ness is Chairman of the Board and presides at regular and special meetings of the Board, other than Executive Sessions. In conjunction with the Lead Independent Director, he provides leadership to the Board in reviewing and deciding upon matters which exert major influence on the manner in which the Company’s business is conducted and he performs such duties as may be conferred by law or assigned by the Board.

Board Risk Oversight

The Board implements its risk oversight role by receiving and analyzing reports from management at each regular meeting on a wide variety of matters that may impact the Company’s assessment or

| | |

Notice of Annual Meeting of Shareholders and 2014 Proxy Statement | | 9 |

acceptance of risk. The full Board or a committee of the Board receives these reports from the member of management with direct authority over the relevant matter or risk mitigation strategy. When a committee receives such reports, the committee chair reports on the substance of the matter and the committee’s analysis of management’s report to the full Board. Matters regularly reported on to the Board or a committee thereof include financial reporting, capital structure, legal matters, internal controls, compensation practices, incentives, and business operations.

The assumption of risk is inherent in many of the Company’s businesses, and management dedicates substantial time and resources to ensuring appropriate processes and controls exist for those businesses. Management is primarily responsible for assessing business risks and for implementing appropriate controls over risk and financial reporting.

In tandem with other committees of the Board, the Audit Committee oversees management’s effectiveness in assessing and controlling risk. This responsibility is documented in the Audit Committee’s charter, which is available atwww.stancorpfinancial.com. The Audit Committee is also responsible for providing independent review and oversight of the Company’s financial reporting process and internal controls, and assisting the full Board in overseeing the integrity of the Company’s financial statements. The Audit Committee receives reports at each regular meeting from management, including the Vice President of Internal Audit and the Vice President and Corporate Actuary. The Audit Committee reports on its findings to the full Board at each regularly scheduled meeting.

The Nominating & Corporate Governance Committee is responsible for overseeing the Company’s ethics and compliance program and advising the Company on corporate governance practices in light of public company standards and legal and regulatory considerations. This Nominating & Corporate Governance Committee also has responsibility for overseeing Chief Executive Officer succession planning. These are important components in the Company’s overall efforts to reduce risks associated with conducting business.

The Organization & Compensation Committee (the “O & C Committee”) is charged with overseeing and approving executive compensation, and routinely reviews the executive compensation program to ensure that incentives do not present inappropriate risk and are aligned with shareholder interests. In particular, the O & C Committee pays considerable attention each year to balancing short and long-term compensation and incentives in a manner that encourages achievement of the Company’s publicly-stated long-term goals as an organization.

Board of Directors and Committee Meetings, Membership, Attendance, Independence and Other Board Matters

Charters for the Audit, Nominating & Corporate Governance and Organization & Compensation Committees are available on the Company’s investor relations website,www.stancorpfinancial.com. Printed copies of these documents are available upon request of the Company’s Corporate Secretary, P12B, StanCorp Financial Group, Inc., PO Box 711, Portland, Oregon 97207.

The full Board held nine meetings during 2013. From time to time, the Board or its committees act by unanimous written consent when it is impractical for them to meet.

| | |

| 10 | | Notice of Annual Meeting of Shareholders and 2014 Proxy Statement |

The following table shows the membership, summary of responsibilities and number of meetings in 2013 for each of the committees:

| | | | | | | | | | | | |

| Committee | | | | 2013-2014

Membership* | | | | Primary Responsibilities | | | | Total number

of meetings |

| | | | | | | | | | | | | |

| | | | | | |

Audit | | | | Mary F. Sammons, Chair Frederick W. Buckman Stanley R. Fallis Debora D. Horvath Duane C. McDougall E. Kay Stepp | | | | • provide independent review and oversight of the Company’s accounting and financial reporting processes and internal controls • oversee the independent registered public accountant’s appointment, compensation, qualifications, independence and performance • assist Board oversight of the integrity of the Company’s financial statements, assessment and management of Company risks, the Company’s compliance with legal and regulatory requirements, and the performance of the Company’s internal auditors | | | | 9 |

| | | | | | | | | | | | | |

| | | | | | |

| Nominating & Corporate Governance | | | | E. Kay Stepp, Chair Virginia L. Anderson Debora D. Horvath Mary F. Sammons Michael G. Thorne | | | | • review the organization and structure of the Board • review the qualifications of and recommend candidates for the Board and its committees • oversee CEO succession planning • lead the Board and its committees in its annual performance evaluation • oversee the ethics and compliance programs • review Board compensation | | | | 4 |

| | | | | | | | | | | | | |

| | | | | | |

| Organization & Compensation | | | | Frederick W. Buckman, Chair Virginia L. Anderson Stanley R. Fallis Duane C. McDougall Michael G. Thorne | | | | • monitor CEO performance • review executive compensation and recommend changes, as appropriate • review certain organizational changes recommended by the CEO • oversee senior executive succession planning • oversee stock incentive and stock purchase plans | | | | 5 |

| | *Committee | appointments are made annually in conjunction with the May Annual Meeting of Shareholders. |

The Board has determined that Stanley R. Fallis and Duane C. McDougall meet the qualifications of and have been designated as the Audit Committee Financial Experts in accordance with the requirements of applicable SEC rules. The Board also has determined that each member of the Audit Committee meets all additional independence and financial literacy requirements for Audit Committee membership under applicable NYSE Euronext and SEC rules. For additional information concerning the Audit Committee’s responsibilities, see the Report of the Audit Committee below.

Executive Sessions

Executive Sessions of the Board are held at each regular meeting. Executive Sessions are chaired by the Lead Independent Director and take place without the presence of the Chief Executive Officer or other officers.

| | |

Notice of Annual Meeting of Shareholders and 2014 Proxy Statement | | 11 |

Attendance

Each Director attended greater than 92 percent of the aggregate number of Board meetings and meetings of committees of which he or she was a member. The Guidelines require attendance at each Annual Meeting of Shareholders. Each Director in office on the date of the May 2013 Annual Meeting of Shareholders attended the Meeting.

Transactions with Related Parties

The Nominating & Corporate Governance Committee also oversees the Company’s policies governing conflicts of interest and transactions with related parties. Directors and Executive Officers are required to disclose any related party transactions, as well as any actual or apparent conflicts of interest. The Company’s legal staff first reviews all such disclosures, and also reviews annually all other external affiliations and relationships of each Executive Officer and Director.

The Company’s Related Party Transactions Policy requires approval or ratification by the Nominating & Corporate Governance Committee of any transaction exceeding $120,000 in which the Company is a participant and any related party has a material interest. Related parties include the Company’s Executive Officers, Directors and their immediate family members.

This policy requires that if a related party transaction is identified, the Nominating & Corporate Governance Committee will review all of the relevant facts and circumstances and approve the transaction only if the transaction is found to be in, or not inconsistent with, the best interests of the Company and its shareholders. If advance approval of a transaction is not feasible, the transaction is considered for ratification at the Nominating & Corporate Governance Committee’s next regularly scheduled meeting. No Director or Executive Officer participates in any discussion or approval of related party transactions for which he or she is a related party. The policy generally does not require review of transactions for which disclosure is not required under SEC rules.

Communications with the Board

The Board welcomes communications from shareholders and other interested parties. Shareholders and interested parties may contact the Board by writing to:

Lead Independent Director

c/o Corporate Secretary, P12B

StanCorp Financial Group, Inc.

PO Box 711

Portland, Oregon 97207

All shareholder communications and interested party concerns will be reviewed by the Lead Independent Director.

Director Nominations

StanCorp endeavors to maintain a Board representing a diverse spectrum of expertise, background, perspective and experience. In addition, a candidate for service on the Board of the Company should possess the following qualities:

| | A. | Sound judgment, good reputation and integrity, and should be a person of influence who is recognized as a leader in his/her community. | |

| | B. | A keen sense of the responsibilities of directorship and the ability to take a long-term, strategic view. | |

| | |

| 12 | | Notice of Annual Meeting of Shareholders and 2014 Proxy Statement |

| | C. | The willingness and availability to attend at least 75 percent of all Board and committee meetings and to study background material in advance, and to otherwise fully perform all of the responsibilities associated with serving as a Director of the Company. | |

| | D. | An understanding of conflicts of interest and the willingness to disclose any real or potential conflict that would prevent or influence his/her acting as a Director in trust for shareholders of the Company. | |

| | E. | Be or become a shareholder of the Company. The candidate should have a positive conviction concerning the businesses of the Company, and be committed to serving the long-term interests of the Company’s shareholders. | |

| | F. | Be currently or formerly actively engaged in business, professional, educational or governmental work. Successful experience leading large organizations is preferred, as is ability, skills or experience in some or all of the following areas: | |

| | i) | Expertise in financial accounting and corporate finance. | |

| | ii) | An understanding of management trends in general. | |

| | iii) | Knowledge of the Company’s industry. | |

| | iv) | Leadership skills in motivating high-performance talent. | |

| | v) | The ability to provide strategic insight and vision. | |

| | G. | The willingness at all times to express ideas about matters under consideration at Board meetings. The candidate should have the ability to dissent without creating adversarial relations among Board members or management. | |

| | H. | The ability to meet any requirement of the Oregon Business Corporation Act and, to the extent applicable, of the Oregon Insurance Code. | |

| | I. | A reputation and a history of positions or affiliations befitting a director of a large publicly held company. | |

In conjunction with the Board’s annual self-assessment process, individual Director evaluations are also conducted. With this information, the Board is able to consider the adequacy of the Board’s composition, including the number of directors as well as the skills, experience, expertise and other characteristics represented by the directors individually and collectively. Based upon this process, the Board will determine whether the Company should add one or more additional directors. If such a determination is made, the Board will develop a pool of nominees to be considered for each additional position.

Candidate Recommendations and Identification Process

Director or Executive Officer Recommends a Potential Candidate. If a Director or Executive Officer of the Company wishes to recommend a particular candidate for the Board, he or she will provide the Company with the name of the candidate as well as a brief description of the candidate’s current status, relevant experience and qualifications, contact information, and any other pertinent and available information. This information should be communicated in writing or verbally to the Nominating & Corporate Governance Committee Chair.

The Nominating & Corporate Governance Committee Chair will arrange to discuss the merits of the candidate with the Nominating & Corporate Governance Committee. This discussion may result in the formulation of a recommendation to the full Board whether to consider the candidate, follow up for more information regarding the candidate, or reject the candidate. Following discussion, the full Board will determine whether to reject or add the individual to the pool of eligible candidates.

| | |

Notice of Annual Meeting of Shareholders and 2014 Proxy Statement | | 13 |

The Director or Executive Officer making the nomination will be kept regularly apprised of any discussions and actions taken with respect to such nominee.

Search Firm. The Company may elect to retain a search firm to identify potential candidates. The decision to retain a search firm shall be made by the Nominating & Corporate Governance Committee in consultation with the full Board. Any such search firm shall be formally retained by the Company’s Nominating & Corporate Governance Committee. The Nominating & Corporate Governance Committee also will be responsible for reviewing and approving all fees and expenses charged by the firm.

The Nominating & Corporate Governance Committee Chair will coordinate communications with the search firm, and arrange to discuss the merits of any candidate recommended by the search firm with the Nominating & Corporate Governance Committee. This discussion may result in the formulation of a recommendation to the full Board whether to consider the candidate, follow up for more information regarding the candidate, or reject the candidate. Following discussion, the full Board will then determine whether to reject or add the individual to the pool of eligible candidates.

Shareholder Recommends a Potential Candidate. In accordance with the procedures set forth below, shareholders and other interested parties may propose director candidates for consideration by the Nominating & Corporate Governance Committee. Consistent with the Nominating & Corporate Governance Committee’s procedures for screening all candidates, such nominees are expected to embody the attributes listed above. In reviewing candidates referred by shareholders or other interested parties, the Nominating & Corporate Governance Committee also will give due consideration to any desired skills, experience, expertise or other characteristics as identified by the Board in its annual self-assessment process.

Shareholders and interested parties may recommend director candidates to the Nominating & Corporate Governance Committee by writing the Company’s Corporate Secretary at P12B, StanCorp Financial Group, Inc., PO Box 711, Portland, Oregon 97207. Such recommendations will be accepted in the month of June of each year, and should be accompanied by the candidate’s name and information regarding his or her qualifications to serve as a Director of the Company.

Following receipt of such a recommendation, the Nominating & Corporate Governance Committee Chair will coordinate necessary communications with the nominee and nominating shareholder or interested party, and arrange to review the qualifications and discuss the merits of the candidate with the Nominating & Corporate Governance Committee. This discussion may result in the formulation of a recommendation to the full Board whether to consider the candidate, follow up for more information regarding the candidate, or reject the candidate. Following discussion, the full Board will then determine whether to reject or add the individual to the pool of eligible candidates.

As set forth below in “Shareholder Nominations and Proposals for 2015,” the Company’s Bylaws also provide shareholders with a separate process by which director candidates can be nominated for election at an Annual Meeting of Shareholders.

Interview and Selection Process. The Nominating & Corporate Governance Committee, in consultation with the full Board, shall determine whether to interview any individuals in the pool of eligible director candidates.

Following the interview process, the Nominating & Corporate Governance Committee Chair will lead a discussion with the Nominating & Corporate Governance Committee regarding the relative merits and qualifications of the candidates and whether the Company should extend an offer to any such candidate. The Nominating & Corporate Governance Committee will, in turn, develop a recommendation to the full Board in that regard. No offer will be extended to a director candidate unless the candidate has been discussed with the full Board and the full Board has approved making such offer.

| | |

| 14 | | Notice of Annual Meeting of Shareholders and 2014 Proxy Statement |

The Nominating & Corporate Governance Committee Chair shall, in the course of regularly scheduled Board meetings, keep the full Board informed of all significant developments in regard to the director interview and selection process. The Nominating & Corporate Governance Committee Chair also shall regularly consult with the Company’s Chief Executive Officer in regard to the need for new directors, the qualifications of director candidates and any recommendations regarding such candidates. Any final decisions in that regard, however, are to be made by the Board in their sole discretion.

Additional Materials Available Online

Shareholders and other interested parties may view the Guidelines, Codes of Business Conduct and Ethics for the Board of Directors, Senior Officers and employees, as well as other documentation concerning the Board and governance structure atwww.stancorpfinancial.com. Print copies of these documents are available upon request to Investor Relations, StanCorp Financial Group, Inc., PO Box 711, Portland, Oregon 97207.

|

Report of the Audit Committee |

The Audit Committee operates pursuant to a Charter approved by the Company’s Board of Directors. The Audit Committee reports to the Board of Directors and is responsible for providing independent review and oversight of the Company’s accounting and financial reporting processes and internal controls and overseeing the independent auditor’s appointment, compensation, qualifications, independence, and performance. The Audit Committee Charter sets out the responsibilities, authority, and specific duties of the Audit Committee. The Charter specifies, among other things, the purpose and membership requirements of the Audit Committee as well as the relationship of the Audit Committee to the independent accountants, the Internal Audit department, and management of the Company. All members of the Audit Committee are independent as such term is defined by the SEC and in the listing requirements of the New York Stock Exchange Euronext.

Report of the Audit Committee.The Audit Committee reports as follows with respect to the Company’s audited financial statements for the year ended December 31, 2013:

| | • | | The Audit Committee has completed its review and discussion of the Company’s audited financial statements with management; | |

| | • | | The Audit Committee has discussed with the independent auditors, Deloitte & Touche, the matters required to be discussed by Public Company Accounting Oversight Board (“PCAOB”) Auditing Standard 16. Additionally, the Audit Committee discussed matters related to the conduct of the audit of the Company’s financial statements; | |

| | • | | The Audit Committee has received the written disclosures and the letter from the independent auditors as required by applicable requirements of the PCAOB regarding the independent auditors’ communications with the Audit Committee concerning independence, and has discussed with the auditors the auditors’ independence from the Company; and | |

| | • | | The Audit Committee has, based on its review and discussions with management of the Company’s 2013 audited financial statements and discussions with the independent auditors, recommended to the Board of Directors that the Company’s audited financial statements for the year ended December 31, 2013 be included in the Company’s Annual Report on Form 10-K. | |

| | |

| Audit Committee |

| |

| Mary F. Sammons, Chair | | Frederick W. Buckman |

| Stanley R. Fallis | | Debora D. Horvath |

| Duane C. McDougall | | E. Kay Stepp |

| | |

Notice of Annual Meeting of Shareholders and 2014 Proxy Statement | | 15 |

Security Ownership of Certain Beneficial Owners

The following table sets forth those persons known to us to be beneficial owners of more than five percent of the Company’s common stock as of December 31, 2013. In furnishing this information, the Company relied on information filed by the beneficial owners with the SEC.

| | | | | | | | |

| | |

| | | Common Stock Beneficially Owned |

| | | |

| Name | | Direct | | | Exercisable Options | | % of Class |

FMR LLC

245 Summer Street, Boston, MA 02210 | | | 3,502,051 | | | N/A | | 7.9 % |

The Vanguard Group, Inc.

100 Vanguard Blvd, Malvern, PA 19355 | | | 3,119,156 | | | N/A | | 7.1 |

BlackRock Inc.

40 East 52nd Street, New York, NY 10022 | | | 2,571,343 | | | N/A | | 5.8 |

Franklin Resources, Inc.

One Franklin Parkway, San Mateo, CA 94403 | | | 2,520,027 | | | N/A | | 5.7 |

Invesco Ltd.

1555 Peachtree Street NE, Atlanta, GA 30309 | | | 2,415,180 | | | N/A | | 5.5 |

Share Ownership of Directors and Executive Officers

The following table sets forth information regarding the beneficial ownership, as of December 31, 2013, of the Company’s common stock by each Director and nominee, the Chief Executive Officer and certain Executive Officers, and by Executive Officers and Directors as a group.

| | | | | | | | | | | | |

| | |

| | | Common Stock Beneficially Owned | |

| | | |

| Name | | Indirect and Direct | | | Exercisable

Options(1) | | | % of Class | |

Virginia L. Anderson | | | 6,825 | | | | 41,901 | | | | * | |

Frederick W. Buckman | | | 21,230 | | | | 33,901 | | | | * | |

Stanley R. Fallis | | | 11,136 | | | | 25,901 | | | | * | |

Timothy A. Holt | | | — | | | | — | | | | * | |

Debora D. Horvath | | | 1,202 | | | | — | | | | * | |

Duane C. McDougall | | | 8,572 | | | | 7,401 | | | | * | |

Kevin M. Murai | | | — | | | | — | | | | * | |

Eric E. Parsons | | | 125,429 | | | | 39,875 | | | | * | |

Mary F. Sammons | | | 7,144 | | | | 10,901 | | | | * | |

E. Kay Stepp | | | 8,840 | | | | 25,901 | | | | * | |

Michael G. Thorne | | | 19,896 | | | | 33,901 | | | | * | |

J. Greg Ness | | | 64,627 | | | | 336,084 | | | | * | |

Floyd F. Chadee | | | 15,100 | | | | 99,695 | | | | * | |

James B. Harbolt | | | 6,578 | | | | 18,841 | | | | * | |

Scott A. Hibbs | | | 21,681 | | | | 70,937 | | | | * | |

Daniel J. McMillan | | | 4,090 | | | | 10,738 | | | | * | |

Executive Officers and Directors as a Group (18 individuals) | | | 336,228 | | | | 856,284 | | | | 2.7 | % |

| | * | Represents holdings of less than one percent. |

| | (1) | Beneficial ownership includes stock options that vested on or before March 1, 2014. |

| | |

| 16 | | Notice of Annual Meeting of Shareholders and 2014 Proxy Statement |

|

Compensation Discussion and Analysis (“CD&A”) |

Our Company and 2013 Business Highlights

We are a financial services company headquartered in Portland Oregon. We collectively view and operate our businesses as Insurance Services and Asset Management, which both deliver distinct value to customers and shareholders. Insurance Services contains two reportable product segments, Employee Benefits and Individual Disability. Asset Management is reported as a separate reportable segment. Holding company and corporate activities are reported in the Other category. Due to the growth in the Individual Disability business in relation to total Insurance Services over the last several years, Individual Disability has become a separate reportable product segment within Insurance Services in 2013. Resources are allocated and performance is evaluated at the segment level. Insurance Services includes our traditional risk acceptance businesses that reflect the application of our specialized expertise in the development, underwriting and administration of insurance products and services. Insurance Services offers group and individual disability insurance, group life and AD&D insurance, group dental and group vision insurance, and absence management services. Asset Management provides investment and asset management products and services and offers full-service 401(k) plans, 403(b) plans, 457 plans, defined benefit plans, money purchase pension plans, profit sharing plans and non-qualified deferred compensation products and services. Asset Management also offers investment advisory and management services, financial planning services, origination and servicing of fixed-rate commercial mortgage loans and individual fixed-rate annuity products. For more information about our business, see our Annual Report on Form 10-K for the year ended December 31, 2013.

In 2013, we reported our highest annual net income per common share reflecting earnings growth in all of our businesses. We performed well in the following areas:

| | • | | Shareholder Returns: Our total shareholder return for 2013 was 83.8%. In 2013, we returned over $130 million to our shareholders through share repurchases and dividends. During the fourth quarter of 2013, we paid an annual dividend of $1.10 per share, an 18.3% increase compared to 2012. The increase represents the fourteenth consecutive annual increase. | |

| | • | | Return on Average Equity, Excluding Accumulated Other Comprehensive Income (“AOCI”): We reported return on average equity, excluding AOCI, of 11.8% for 2013, compared to 7.7% for 2012. | |

| | • | | Employee Benefits Income Before Income Taxes: During 2013, we made good progress in implementing pricing actions to address continued elevated group long term disability claims incidence and the low interest rate environment. As a result of the pricing actions, improved claims incidence and expense management, our 2013 Employee Benefits income before income taxes increased 66.7% compared to 2012. | |

| | • | | Individual Disability Income Before Income Taxes: We grew Individual Disability income before income taxes by 12.0%, compared to 2012. | |

| | • | | Asset Management Income Before Income Taxes: We grew Asset Management income before income taxes by 23.9%, compared to 2012. | |

| | • | | Strong Balance Sheet: We maintained a strong financial position. | |

We are committed to providing superior service to our customers, maintaining our strong financial position, returning value to shareholders and retaining key leadership talent. In making 2013 compensation decisions, the O & C Committee considered our financial results against our operating plan on both an overall and a divisional basis.

| | |

Notice of Annual Meeting of Shareholders and 2014 Proxy Statement | | 17 |

Named Executive Officers

The NEOs who appear in the compensation tables of this Proxy Statement are:

| | |

| | |

| Name | | Position Held |

J. Greg Ness | | Chairman, President and Chief Executive Officer (“CEO”) |

Floyd F. Chadee | | Senior Vice President and Chief Financial Officer (“CFO”) |

James B. Harbolt | | Vice President, Asset Management Group |

Scott A. Hibbs | | Vice President and Chief Investment Officer |

Daniel J. McMillan | | Vice President, Employee Benefits |

Executive Compensation Highlights

The O & C Committee of the Board made the following key compensation decisions in or for 2013:

| | • | | Increased the base salaries of three NEOs whose salaries were substantially below the median of survey data for their positions, and then further increased the salaries of two of those Executive Officers in connection with strategic leadership changes in September 2013. | |

| | • | | Increased the target short term incentive percentage and target long term incentive award value for three NEOs to position their compensation slightly below the median of peer group data. | |

| | • | | Added time-based Restricted Stock Units (“RSUs”) as an additional component of ourlong-term incentives to conform to the most prevalent market practice as reported by Mercer. | |

| | • | | Adopted an incentive compensation recoupment, or “clawback” policy. | |

Say-on-Pay Vote Results

The Board of Directors has adopted a policy providing for an annual advisory shareholder vote to approve our executive compensation. The non-binding proposal regarding compensation of the NEOs submitted to shareholders at our 2013 Annual Meeting was approved by 97% of the votes cast. Following the previous year’s approval by 96% of the votes cast, the O & C Committee considered this trend of favorable votes by the shareholders as a strong endorsement of our compensation program and therefore has not made, and is not considering, any changes to the compensation program in response to those votes.

Compensation Philosophy

Our compensation program is designed to meet the following key objectives:

| | • | | Align compensation so that goals are tied to actual business results. | |

| | • | | Provide total compensation that allows us to attract and retain high-quality executives and compete with other organizations nationwide for executive talent. | |

| | • | | Provide incentives to reward achievement of short and long-term profitability, growth and expense control goals that deliver value to shareholders. | |

| | • | | Ensure that the interests of our Executive Officers are aligned with those of our shareholders through grants of equity. | |

| | • | | Motivate our officers to deliver superior performance without encouraging unnecessary or excessive risk taking by aligning incentives with long-term financial objectives where possible and ensuring adequate controls exist over achievement of incentive pay. | |

In making decisions with respect to the executive compensation program or any specific element of compensation, the O & C Committee considers the total current compensation that may be awarded to the Executive Officer, including salary, benefits and short and long-term incentive compensation.

| | |

| 18 | | Notice of Annual Meeting of Shareholders and 2014 Proxy Statement |

Elements of Compensation

The following table outlines the elements that comprise the total compensation awarded to our NEOs:

| | | | |

| | | |

| Compensation Component | | Description | | Purpose |

Base Salary | | Fixed compensation. Reviewed annually and adjusted when and if appropriate | | Intended to compensate fairly for

performance and the

responsibilities of the position |

| Short-Term Incentive Plan (“STIP”) | | Variable annual performance based incentive compensation | | Intended to reward achievement

of annual goals |

Long-Term Incentives | | Variable three-year performance share awards, stock options, and RSUs | | Intended to reward achievement

of long term goals and stock

price appreciation |

Defined benefit and defined contribution retirement plans | | Qualified and supplemental nonqualified retirement benefits | | Intended to provide benefits that

support employees in attaining

financial security |

| Change of Control Arrangements | | Cash severance benefits, option and RSU acceleration and pro-rated performance share target payouts, with no tax gross-ups | | Intended to provide continuity of

management in the event of a

change of control |

| | |

Notice of Annual Meeting of Shareholders and 2014 Proxy Statement | | 19 |

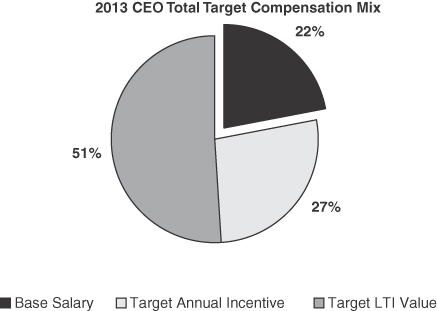

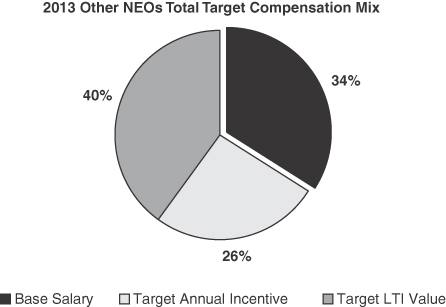

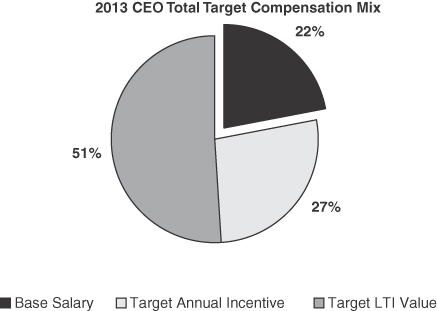

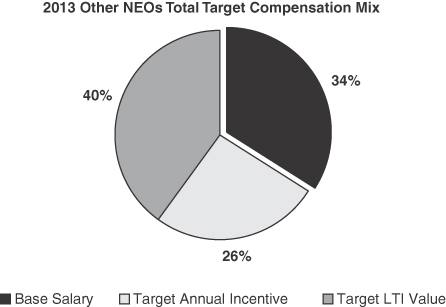

Pay for Performance

The O & C Committee is committed to tying the compensation of our NEOs to Company performance. Therefore, a key focus for the O & C Committee in establishing compensation levels at the beginning of each year is the mix between an Executive Officer’s base salary, target annual incentive, and target long-term incentive (“LTI”) value for equity awards granted in the year, which include performance share awards, stock options and RSUs. As shown on the following chart, 78% of the CEO’s 2013 total target compensation was based on Company performance and was therefore ‘‘at risk.’’ Similarly, 66% of the total target compensation of our other four NEOs was based on Company performance and was therefore “at risk.”

| | |

| 20 | | Notice of Annual Meeting of Shareholders and 2014 Proxy Statement |

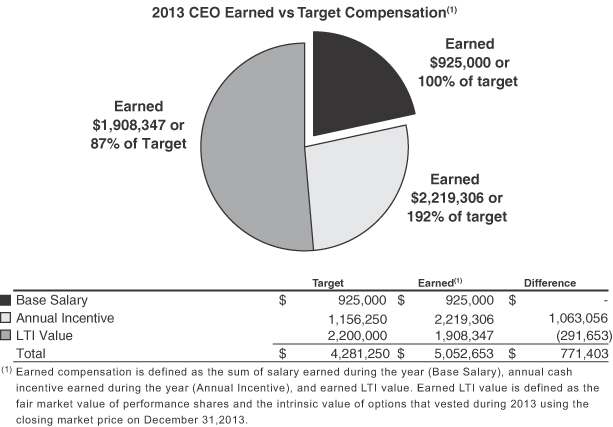

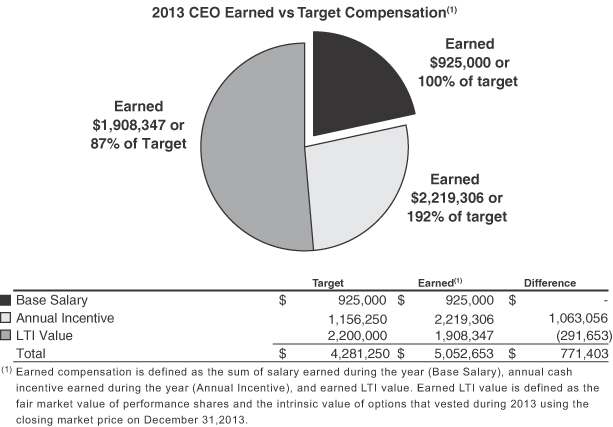

The Company’s record financial performance in 2013 resulted in an annual incentive payout of 192% of target for Mr. Ness. In addition, as a result of our extraordinary stock price performance in 2013, stock options held by Mr. Ness that vested in 2013 had significant intrinsic value. On the other hand, the performance goals for our 2011-2013 performance share awards were only achieved at the 25% payout level. As a result of the combination of these factors, Mr. Ness’s earned compensation in 2013 was 18% higher than his target compensation. The following chart shows Mr. Ness’s earned compensation as compared to target compensation by component:

| | |

Notice of Annual Meeting of Shareholders and 2014 Proxy Statement | | 21 |

The following table illustrates the variability of compensation paid under our pay for performance standards, as applied to the three-year performance share awards we made to the CEO for the last three completed performance periods. The table compares the grant date value of each award as disclosed in the Summary Compensation Table for the applicable grant year with the actual value realized on vesting under each award as disclosed in the Option Exercises and Stock Vested table for the final year of the applicable performance period:

| | | | | | | | |

| Performance Share Awards for J. Greg Ness | |

| | |

| Performance Period(1) | | Grant Date Value | | | Value Realized on Vesting | |

2011-2013 | | $ | 1,158,309 | | | $ | 418,435 | |

2010-2012 | | | 669,076 | | | | — | |

2009-2011 | | | 210,541 | | | | 46,048 | |

| | (1) | The award for the 2009-2011 performance period was granted before Mr. Ness was promoted to Chief Executive Officer. |

Use of Market Data

The Company is a complex organization and the O & C Committee necessarily must make each compensation decision in the context of the particular Executive Officer, including the characteristics of the business or market in which the individual operates and the individual’s specific roles, responsibilities, qualifications and experience. The O & C Committee reviews competitive market data provided by its compensation consultant, Mercer, as one tool to establish a competitive range of base salary and short and long-term incentive compensation. We use two information sources. The first is a “peer” group of thirteen insurance industry companies selected by the O & C Committee based on comparability to the Company on several financial metrics including annual revenues, net income, total assets and market capitalization. In November 2012, when the O & C Committee reviewed data for 2013 compensation decision-making purposes, this group consisted of the following companies:

| | |

American Financial Group Inc. | | HCC Insurance Holdings, Inc. |

American National Insurance Company | | Kemper Corporation (formerly known as Unitrin, Inc.) |

Arch Capital Group Ltd. | | The Phoenix Companies Inc. |

Axis Capital Holdings Ltd. | | Protective Life Corporation |

Cincinnati Financial Corporation | | Symetra Financial Corporation |

Everest Re Group Ltd. | | Torchmark Corporation |

Hanover Insurance Group, Inc. | | |

This is the same peer group used in the prior year, except that upon the recommendation of Mercer, Delphi Financial Group, Inc., FBL Financial Group, Inc. and Transatlantic Holdings Inc., each of which was either acquired or reduced in size due to the sale of a major subsidiary, were removed from the peer group, and were replaced by three other insurance companies similar in size to us: The Hanover Insurance Group, Inc., Cincinnati Financial Corporation, and HCC Insurance Holdings, Inc.

The second information source we use is a broader market composite by position prepared by Mercer based on data from two published compensation surveys in which we participate and trended forward to the beginning of 2013 using a 3.0% annual growth rate. The following published compensation surveys were used in the analysis for 2013 compensation:

| | • | | LOMA (Life Office Management Association),2012 Executive Compensation Survey |

| | • | | Mercer, 2012 Executive Compensation Survey |

| | |

| 22 | | Notice of Annual Meeting of Shareholders and 2014 Proxy Statement |

Mercer discontinued the use of a third survey from Towers Watson due to changes limiting their ability to extract specific data. When collecting data from the published compensation surveys, Mercer used data for similar sized companies (approximately $18 billion of average assets) in the non-healthcare insurance, finance and banking industries.

Base Salaries