UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| (Mark One) | ||

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended December 31, 2009 | ||

or | ||

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the transition period from to | ||

Commission File No. 0-30319

THERAVANCE, INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) | 94-3265960 (I.R.S. Employer Identification No.) | |

901 Gateway Boulevard, South San Francisco, California (Address of principal executive offices) | 94080 (Zip Code) | |

Registrant's telephone number, including area code:650-808-6000 | ||

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

| Title of Each Class | Name of Each Exchange On Which Registered | |

|---|---|---|

| Common Stock $0.01 Par Value | Nasdaq Global Market |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT:NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 205 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether registrant is a large accelerated filer, an accelerated filer or a non-accelerated filer. See definition of "accelerated filer and large accelerated filer" in Rule 12b-2 of the Exchange Act (Check One):

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting companyo |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The aggregate market value of the voting and non-voting common equity (consisting of Common Stock, $0.01 par value and Class A Common Stock, $0.01 par value) held by non-affiliates of the registrant based upon the closing price of the Common Stock on the Nasdaq Global Market on June 30, 2009 was $576,528,588.

On February 16, 2010, there were 54,830,359 shares of the registrant's Common Stock and 9,401,499 shares of the registrant's Class A Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Specified portions of the registrant's definitive Proxy Statement to be issued in conjunction with the registrant's 2010 Annual Meeting of Stockholders, which is expected to be filed not later than 120 days after the registrant's fiscal year ended December 31, 2009, are incorporated by reference into Part III of this Annual Report. Except as expressly incorporated by reference, the registrant's Proxy Statement shall not be deemed to be a part of this Annual Report on Form 10-K.

2009 Form 10-K Annual Report

Table of Contents

PART I | ||||

Item 1. | Business | 3 | ||

Item 1A. | Risk Factors | 15 | ||

Item 1B. | Unresolved Staff Comments | 33 | ||

Item 2. | Properties | 33 | ||

Item 3. | Legal Proceedings | 33 | ||

Item 4. | Submission of Matters to a Vote of Security Holders | 33 | ||

PART II | ||||

Item 5. | Market for the Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 34 | ||

Item 6. | Selected Financial Data | 37 | ||

Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | 39 | ||

Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 50 | ||

Item 8. | Financial Statements and Supplementary Data | 51 | ||

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 81 | ||

Item 9A. | Controls and Procedures | 81 | ||

Item 9B. | Other Information | 84 | ||

PART III | ||||

Item 10. | Directors, Executive Officers and Corporate Governance | 84 | ||

Item 11. | Executive Compensation | 84 | ||

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 84 | ||

Item 13. | Certain Relationships and Related Transactions, and Director Independence | 84 | ||

Item 14. | Principal Accounting Fees and Services | 84 | ||

PART IV | ||||

Item 15. | Exhibits and Financial Statement Schedules | 85 | ||

Signatures | 89 | |||

Exhibits | ||||

2

Special Note regarding Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements involve substantial risks, uncertainties and assumptions. All statements in this Annual Report on Form 10-K, other than statements of historical facts, including statements regarding our strategy, future operations, future financial position, future revenues, projected costs, prospects, plans, intentions, expectations and objectives could be forward-looking statements. The words "anticipates," "believes," "designed," "estimates," "expects," "goal," "intends," "may," "plans," "projects," "pursuing," "will," "would" and similar expressions (including the negatives thereof) are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We may not actually achieve the plans, intentions, expectations or objectives disclosed in our forward-looking statements and the assumptions underlying our forward-looking statements may prove incorrect. Therefore, you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions, expectations and objectives disclosed in the forward-looking statements that we make. Factors that we believe could cause actual results or events to differ materially from our forward-looking statements include, but are not limited to, those discussed below in "Risk Factors" in Item 1A, "Management's Discussion and Analysis of Financial Condition and Results of Operations" in Item 7 and elsewhere in this Annual Report on Form 10-K. Our forward-looking statements in this Annual Report on Form 10-K are based on current expectations and we do not assume any obligation to update any forward-looking statements.

Overview

Theravance is a biopharmaceutical company with a pipeline of internally discovered product candidates. We are focused on the discovery, development and commercialization of small molecule medicines across a number of therapeutic areas including respiratory disease, bacterial infections and gastrointestinal motility dysfunction. Our key programs include: VIBATIV™ (telavancin) with Astellas Pharma Inc. (Astellas) and our RELOVAIR™ program (formerly referred to as Horizon) and the Bifunctional Muscarinic Antagonist-beta2 Agonist (MABA) program with GlaxoSmithKline plc (GSK). By leveraging our proprietary insight of multivalency to drug discovery focused primarily on validated targets, we are pursuing a next generation strategy designed to discover superior medicines in areas of significant unmet medical need. Our headquarters are located at 901 Gateway Boulevard, South San Francisco, California 94080. Theravance was incorporated in Delaware in November 1996 under the name Advanced Medicine, Inc. and began operations in May 1997. The Company changed its name to Theravance, Inc. in April 2002.

Our strategy focuses on the discovery, development and commercialization of medicines with superior efficacy, convenience, tolerability and/or safety. By primarily focusing on biological targets that have been clinically validated either by existing medicines or by potential medicines in late-stage clinical studies, we can leverage years of available knowledge regarding a target's activity and the animal models used to test potential medicines against such targets. We move a product candidate into development after it demonstrates the potential to be superior to existing medicines or drug candidates in animal models that we believe correlate to human clinical experience. This strategy of developing the next generation of existing medicines or potential medicines is designed to reduce technical risk and increase productivity. We believe that we can enhance the probability of successfully developing and commercializing medicines by identifying at least two structurally different product candidates, whenever practicable, in each therapeutic program. In total, our research and development expenses,

3

including stock-based compensation expense, incurred for all of our therapeutic programs in 2009, 2008 and 2007 were $77.5 million, $82.0 million and $155.3 million, respectively.

We have entered into collaboration arrangements with GSK and Astellas for the development and commercialization of our product candidates. In November 2002 we entered into our long-acting beta2 agonist (LABA) collaboration with GSK to develop and commercialize a once-daily LABA product candidate both as a single-agent new medicine for the treatment of chronic obstructive pulmonary disease (COPD) and as part of a new combination medicine with an inhaled corticosteroid (ICS) for the treatment of asthma and/or a long-acting muscarinic antagonist (LAMA) for COPD. This collaboration is now known as the RELOVAIR™ program. In March 2004 we entered into a strategic alliance agreement with GSK under which GSK received an option to license exclusive development and commercialization rights to product candidates from all of our full drug discovery programs initiated prior to September 1, 2007, on pre-determined terms and on an exclusive, worldwide basis. Our 2005 collaboration arrangement with Astellas covers the development and commercialization of VIBATIV™, a bactericidal, once-daily injectable antibiotic developed by us for the treatment of Gram-positive infections, including methicillin-resistantStaphylococcus aureus. The U.S. Food and Drug Administration has approved VIBATIV™ for the treatment of adult patients with complicated skin and skin structure infections (cSSSI) caused by susceptible Gram-positive bacteria, includingStaphylococcus aureus, both methicillin-resistant (MRSA) and methicillin-susceptible (MSSA) strains. VIBATIV™ is also approved in Canada for the treatment of adult patients with cSSSI.

4

Our Programs

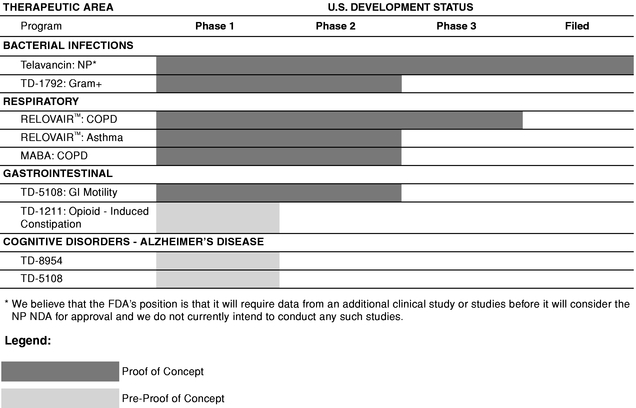

Our drug discovery efforts are based on the principles of multivalency. Multivalency involves the simultaneous attachment of a single molecule to multiple binding sites on one or more biological targets. We have applied our expertise in multivalency to discover product candidates and lead compounds in a wide variety of therapeutic areas. We have conducted extensive research in both relevant laboratory and animal models to demonstrate that by applying the design principles of multivalency, we can achieve significantly stronger and more selective attachment of our compounds to a variety of intended biological targets. We believe that medicines that attach more strongly and selectively to their targets will be superior to many medicines by substantially improving potency, duration of action and/or safety. The table below summarizes the status of our most advanced product candidates for internal development or co-development. Prior to entering into human clinical studies, a product candidate undergoes preclinical studies which include formulation development or safety testing in animal models.

In the table above:

- •

- Development Status indicates the most advanced stage of development that has been completed or is in process.

- •

- Phase 1 indicates initial clinical safety testing in healthy volunteers, or studies directed toward understanding the mechanisms of action of the drug.

- •

- Phase 2 indicates further clinical safety testing and preliminary efficacy testing in a limited patient population.

- •

- Phase 3 indicates evaluation of clinical efficacy and safety within an expanded patient population.

- •

- Filed indicates that a New Drug Application (NDA) or Market Authorization Application (MAA) has been submitted to and accepted for filing by the FDA or the European Medicines Agency (EMEA), respectively.

- •

- We consider programs in which at least one compound has successfully completed a Phase 2a study showing efficacy and tolerability as having achieved Proof of Concept.

5

Our Relationship with Astellas

2005 License, Development and Commercialization Agreement

In November 2005, we entered into a collaboration arrangement with Astellas for the development and commercialization of telavancin. In July 2006, Japan was added to our telavancin collaboration, thereby giving Astellas worldwide rights to this medicine. Through December 31, 2009, we have received $190.0 million in upfront, milestone and other fees from Astellas and we are eligible to receive up to an additional $30.0 million in remaining milestone payments related to regulatory filings and approvals in various regions of the world. Additionally, certain costs related to the collaboration are reimbursable by Astellas.

In 2009 the FDA approved VIBATIVTM for the treatment of adult patients with cSSSI caused by susceptible Gram-positive bacteria, includingStaphylococcus aureus, both MRSA and MSSA strains. VIBATIVTM also was approved in Canada in 2009 for the treatment of adult patients with cSSSI. We are entitled to receive royalties on global net sales of VIBATIVTM that, on a percentage basis, range from the high teens to the upper twenties depending on sales volume. We were responsible for substantially all costs to develop and obtain U.S. regulatory approval for VIBATIVTM and Astellas is responsible for substantially all costs associated with commercialization of VIBATIVTM.

Our Relationship with GlaxoSmithKline

RELOVAIRTM Program

In November 2002, we entered into our long-acting beta2 agonist (LABA) collaboration with GSK to develop and commercialize a once-daily LABA product candidate both as a single-agent new medicine for the treatment of COPD and as part of a new combination medicine with an ICS for the treatment of asthma and/or a LAMA for COPD. These programs, now known collectively as the RELOVAIRTM program, are aimed at developing next generation respiratory products to replace GSK's Seretide and Advair franchise, which reported 2009 sales of approximately $8.0 billion. Each company contributed four LABA product candidates to the collaboration.

In connection with the RELOVAIRTM program, in 2002 we received from GSK an upfront payment of $10.0 million and sold to an affiliate of GSK shares of our Series E preferred stock for an aggregate purchase price of $40.0 million. In addition, we were eligible to receive up to $495.0 million in development, approval, launch, and sales milestones and royalties on the sales of any product resulting from this program. Through December 31, 2009, we have received a total of $60.0 million in upfront and development milestone payments. GSK has determined to focus the collaboration's resources on the development of the lead LABA, GW642444 ('444), a GSK-discovered compound, together with GSK's ICS, fluticasone furoate (FF). Accordingly, we do not expect to receive any further milestone payments from the RELOVAIRTM program. In the event that a LABA product candidate discovered by GSK is successfully developed and commercialized, we will be obligated to make milestone payments to GSK which could total as much as $220.0 million if both a single-agent and a combination product were launched in multiple regions of the world. Based on available information, we do not estimate that a significant portion of these potential milestone payments to GSK are likely to be made in the next two years. Moreover, we are entitled to receive the same royalties on sales of medicines from the RELOVAIRTM program, regardless of whether the product candidate originated with Theravance or with GSK. Theravance is entitled to annual royalties of 15% on the first $3.0 billion of annual global net sales and 5% for all annual global net sales above $3.0 billion. Sales of single-agent LABA medicines and combination medicines would be combined for the purposes of this royalty calculation. For other products combined with a LABA from the RELOVAIRTM program, such as a combination LABA/LAMA medicine, which are launched after a LABA/ICS combination medicine, royalties are upward tiering and range from the mid-single digits to 10%. However, if GSK is

6

not selling a LABA/ICS combination product at the time that the first other LABA combination is launched, then the royalties described above for the LABA/ICS combination medicine are applicable.

2004 Strategic Alliance

In March 2004, we entered into our strategic alliance with GSK. Under this alliance, GSK received an option to license exclusive development and commercialization rights to product candidates from all of our full drug discovery programs initiated prior to September 1, 2007, on pre-determined terms and on an exclusive, worldwide basis. Pursuant to the terms of the strategic alliance agreement, we initiated three new full discovery programs between May 2004 and August 2007. These three programs are (i) our peripheral Opioid-Induced Bowel Constipation (PUMA) program, (ii) our AT1 Receptor—Neprilysin Inhibitor (ARNI) program for cardiovascular disease and (iii) our MonoAmine Reuptake Inhibitor (MARIN) program for chronic pain. GSK has the right to license product candidates from these three programs, and must exercise this right no later than sixty days subsequent to the "proof-of-concept" stage (generally defined as the successful completion of a Phase 2a clinical study showing efficacy and tolerability if the biological target for the drug has been clinically validated by an existing medicine, and successful completion of a Phase 2b clinical study showing efficacy and tolerability if the biological target for the drug has not been clinically validated by an existing medicine). Under the terms of the strategic alliance, GSK has only one opportunity to license each of our programs. Upon its decision to license a program, GSK is responsible for funding all future development, manufacturing and commercialization activities for product candidates in that program. In addition, GSK is obligated to use diligent efforts to develop and commercialize product candidates from any program that it licenses. Consistent with our strategy, we are obligated at our sole cost to discover two structurally different product candidates for any programs that are licensed by GSK under the alliance. If these programs are successfully advanced through development by GSK, we are entitled to receive clinical, regulatory and commercial milestone payments and royalties on any sales of medicines developed from these programs. For product candidates licensed to date under this agreement, the royalty structure for a product containing one of our compounds as a single active ingredient would result in an average percentage royalty rate in the low double digits. If a product is successfully commercialized, in addition to any royalty revenue that we receive, the total upfront and milestone payments that we could receive in any given program that GSK licenses range from $130.0 million to $162.0 million for programs with single-agent medicines and up to $252.0 million for programs with both a single-agent and a combination medicine. If GSK chooses not to license a program, we retain all rights to the program and may continue the program alone or with a third party. To date, GSK has licensed our two COPD programs: LAMA and MABA. We received a $5.0 million payment from GSK in connection with its license of each of our LAMA and MABA programs in August 2004 and March 2005, respectively. However, in 2009, GSK returned the LAMA program to us because the formulation of the lead product candidate was incompatible with GSK's proprietary inhaler device. GSK has chosen not to license our bacterial infections program, our anesthesia program and our 5-HT4 program. There can be no assurance that GSK will license any of the remaining programs under the alliance agreement, which could have an adverse effect on our business and financial condition.

In connection with the strategic alliance with GSK, we received from GSK a payment of $20.0 million. In May 2004, GSK purchased through an affiliate 6,387,096 shares of our Class A common stock for an aggregate purchase price of $108.9 million. Through December 31, 2009, we have received $46.0 million in upfront and milestone payments from GSK relating to the strategic alliance agreement. In addition, pursuant to a partial exercise of its rights under the governance agreement, upon the closing of our initial public offering on October 8, 2004, GSK purchased through an affiliate an additional 433,757 shares of Class A common stock. GSK's ownership position of our outstanding stock was approximately 14.6% as of February 16, 2010.

7

Development Programs

Respiratory Programs

RELOVAIRTM

In December 2008, we announced positive results from a Phase 2b study evaluating the dose-response, safety, and efficacy of five doses of the lead LABA compound, '444, in patients with moderate-to-severe COPD, and in February 2009 we announced positive results from three separate Phase 2b clinical studies assessing the safety and efficacy of GSK's ICS, FF across a range of eight doses in over 1,800 patients with mild, moderate and severe asthma.

In late October 2009, we and GSK announced that the first patient commenced treatment in the Phase 3 program in COPD. The program comprises a broad range of large-scale Phase 3 clinical studies to evaluate the once-a-day LABA, '444, in combination with the once-a-day ICS, FF, for the treatment of COPD. The overall registrational program, which will study more than 6,000 patients, includes two 12-month exacerbation studies, two six-month efficacy and safety studies and a detailed lung function profile study. In addition, other studies are planned to assess the potential for superiority of the fixed combination of '444 and FF versus other treatments for COPD. GSK is responsible for funding the aforementioned studies.

In addition to the COPD development program, we and GSK remain committed to the progression of the RELOVAIRTM program for the treatment of asthma, details of which are expected to be announced later in 2010.

Inhaled Bifunctional Muscarinic Antagonist-beta2 Agonist (MABA) Program

In our MABA program, we are developing with GSK a bifunctional long-acting inhaled bronchodilator. By combining bifunctional activity and high lung selectivity, we intend to develop a medicine with greater efficacy than single mechanism bronchodilators (such as tiotropium or salmeterol) and with equal or better tolerability. In our MABA program in COPD, we are currently waiting for the completion and review of Phase 2b enabling studies before determining whether to commence the next stage of clinical development. All clinical studies in this program are fully funded and paid for by GSK.

Bacterial Infections Program

Telavancin

In October 2009, Astellas and we announced that Astellas Pharma Europe B.V. submitted a MAA to the EMEA for telavancin for the treatment of NP, including ventilator-associated pneumonia, and complicated skin and soft tissue infections in adults (cSSTI). The EMEA has since completed the Validation Phase for the MAA and initiated the scientific review of the application.

On November 27, 2009 we announced that we received a Complete Response letter from the FDA relating to our telavancin NDA for NP, which was filed in January 2009. The Complete Response instructed us that submission of additional data and analyses for the NP patient population to support an evaluation of all-cause mortality as the primary efficacy endpoint was necessary to demonstrate the safety and efficacy of telavancin. The Phase 3 NP clinical program included clinical response as the primary efficacy endpoint, consistent with current draft FDA guidelines for antibacterial clinical trial design in NP, and all-cause mortality as a secondary endpoint. The Complete Response did not specify the time point at which the FDA will measure the all-cause mortality data, nor did it indicate the populations in which these analyses will be considered. The Complete Response letter also requested a scientific rationale for pooling the all-cause mortality data from the two studies as they may individually

8

be of insufficient size and statistical power to support the evaluation of all-cause mortality as the primary efficacy endpoint.

We responded to the Complete Response letter in December 2009. The key elements of our response included a rationale for pooling the two Phase 3 NP studies to evaluate all-cause mortality as the primary efficacy endpoint and all available all-cause mortality data that was analyzed using Kaplan-Meier survival estimates. In January 2010 the FDA sent us a letter notifying us that it considered our response "incomplete," and stating that even if pooling of the two studies is acceptable for analyzing mortality, the two pooled studies would then equate to only one adequate and well-controlled trial and therefore would not constitute the substantial evidence of efficacy required for approval. In addition, the FDA noted that the adequacy and similarity of populations across the studies for the purposes of pooling had not yet been determined, and is still a review issue. Finally, the FDA also noted several design criteria that should be taken into account in the design of new clinical trials. These design criteria do not include a specific primary endpoint for the evaluation of efficacy, the size or number of studies required, or what the appropriate statistical analysis might be. As a result, the design, size and scope of any additional studies required by the FDA are unclear at this time. With regard to our telavancin NP NDA, we believe that the FDA's position is that it will require data from an additional clinical study or studies before it will consider the NP NDA for approval and we do not currently intend to conduct any such studies.

Other Pipeline Programs

In addition to telavancin, RELOVAIRTM and MABA, we have a number of other clinical-stage programs for bacterial infections, gastrointestinal motility and cognitive disorders.

TD-1792 is our investigational heterodimer antibiotic that combines the antibacterial activities of a glycopeptide and a beta-lactam in one molecule. The goal of our program with TD-1792 is to develop a next-generation antibiotic for the treatment of serious infections caused by Gram-positive bacteria. During the third quarter of 2009, we began a Phase 1 bronchoalveolar lavage (BAL) study that will provide data on the penetration of TD-1792 into lung tissue and lung fluids in order to evaluate the potential of this compound as a treatment for NP.

Our Gastrointestinal (GI) Motility Dysfunction program is dedicated to finding new medicines for GI motility disorders such as chronic idiopathic constipation (CIC) and other disorders related to reduced gastrointestinal motility. Our lead compound in this area is TD-5108, a highly selective 5-HT4 receptor agonist that has successfully completed a 400 patient Phase 2 study in CIC.

We are also developing TD-1211, an oral peripheral Mu-opioid antagonist (PUMA) for the treatment of opioid-induced bowel constipation. We completed a successful single-ascending dose Phase 1 study with TD-1211 and recently progressed the compound into a multiple-ascending dose Phase 1 study.

In cognitive disorders, we are currently evaluating compounds TD-5108 and TD-8954 as potential treatments for Alzheimer's disease. In the second quarter of 2009, we announced that TD-8954 successfully completed a single-ascending dose Phase 1 study. Recently we began multiple-ascending dose Phase 1 studies with each of TD-5108 and TD-8954 to evaluate their penetration into the central nervous system.

In our MARIN program for the treatment of neuropathic pain, we have completed IND-enabling studies with compound TD-9855 and anticipate commencing Phase 1 studies later in 2010.

Multivalency

Our proprietary approach combines chemistry and biology to efficiently discover new product candidates using our expertise in multivalency. Multivalency refers to the simultaneous attachment of a

9

single molecule to multiple binding sites on one or more biological targets. When compared to monovalency, whereby a molecule attaches to only one binding site, multivalency can significantly increase a compound's potency, duration of action and/or selectivity. Multivalent compounds generally consist of several individual small molecules, at least one of which is biologically active when bound to its target, joined by linking components.

Our approach is based on an integration of the following insights:

- •

- many targets have multiple binding sites and/or exist in clusters with similar or different targets;

- •

- biological targets with multiple binding sites and/or those that exist in clusters lend themselves to multivalent drug design;

- •

- molecules that simultaneously attach to multiple binding sites can exhibit considerably greater potency, duration of action and/or selectivity than molecules that attach to only one binding site; and

- •

- greater potency, duration of action and/or selectivity provides the basis for superior therapeutic effects, including enhanced convenience, tolerability and/or safety compared to conventional drugs.

Our Strategy

Our objective is to discover, develop and commercialize new medicines with superior efficacy, convenience, tolerability and/or safety. The key elements of our strategy are to:

Apply our expertise in multivalency primarily to validated targets to efficiently discover and develop superior medicines in areas of significant unmet medical need. We intend to continue to concentrate our efforts on discovering and developing product candidates where:

- •

- existing drugs have levels of efficacy, convenience, tolerability and/or safety that are insufficient to meet an important medical need;

- •

- we believe our expertise in multivalency can be applied to create superior product candidates that are more potent, longer acting and/or more selective than currently available medicines;

- •

- there are established animal models that can be used to provide us with evidence as to whether our product candidates have the potential to provide superior therapeutic benefits relative to current medicines; and

- •

- there is a relatively large commercial opportunity.

Identify two structurally different product candidates in each therapeutic program whenever practicable. We believe that we can increase the likelihood of successfully bringing superior medicines to market by identifying, whenever practicable, two product candidates for development in each program. Our second product candidates are typically in a different structural class from the first product candidate. Applying this strategy can reduce our dependence on any one product candidate and provide us with the potential opportunity to commercialize two compounds in a given area.

Partner with global pharmaceutical companies. Our strategy is to seek collaborations with leading global pharmaceutical companies to accelerate development and commercialization of our product candidates at the strategically appropriate time. The RELOVAIRTM program and our strategic alliance with GSK, and our telavancin collaboration with Astellas, are examples of these types of partnerships.

Leverage the extensive experience of our people. We have an experienced senior management team with many years of experience discovering, developing and commercializing new medicines with

10

companies such as Bristol-Myers Squibb Company, Merck & Co., Gilead Sciences, Pfizer and ICOS Corporation.

Improve, expand and protect our technical capabilities. We have created a substantial body of know-how and trade secrets in the application of our multivalent approach to drug discovery. We believe this is a significant asset that distinguishes us from our competitors. We expect to continue to make substantial investments in drug discovery using multivalency and other technologies to maintain what we believe are our competitive advantages.

Manufacturing

We primarily rely on a number of third parties, including contract manufacturing organizations and our collaborative partners, to produce our active pharmaceutical ingredient and drug product. Manufacturing of compounds in our RELOVAIRTM and MABA programs is handled by GSK. Additionally, GSK will be responsible for the manufacturing of any additional product candidates associated with the programs that it licenses under the strategic alliance agreement.

We believe that we have in-house expertise to manage a network of third-party manufacturers. We believe that we will be able to continue to negotiate third party manufacturing arrangements on commercially reasonable terms and that it will not be necessary for us to develop internal manufacturing capacity in order to commercialize our products. However, if we are unable to obtain contract manufacturing or obtain such manufacturing on commercially reasonable terms, or if manufacturing is interrupted at one of our suppliers, whether due to regulatory or other reasons, we may not be able to develop or commercialize our products as planned.

Government Regulation

The development and commercialization of our product candidates and our ongoing research are subject to extensive regulation by governmental authorities in the United States and other countries. Before marketing in the United States, any medicine we develop must undergo rigorous preclinical studies and clinical studies and an extensive regulatory approval process implemented by the FDA under the Federal Food, Drug, and Cosmetic Act. Outside the United States, our ability to market a product depends upon receiving a marketing authorization from the appropriate regulatory authorities. The requirements governing the conduct of clinical studies, marketing authorization, pricing and reimbursement vary widely from country to country. In any country, however, we will be permitted to commercialize our medicines only if the appropriate regulatory authority is satisfied that we have presented adequate evidence of the safety, quality and efficacy of our medicines.

Before commencing clinical studies in humans in the United States, we must submit to the FDA an Investigational New Drug application that includes, among other things, the results of preclinical studies. If the FDA accepts the Investigational New Drug submission, clinical studies are usually conducted in three phases and under FDA oversight. These phases generally include the following:

Phase 1. The product candidate is introduced into healthy human volunteers and is tested for safety, dose tolerance and pharmacokinetics.

Phase 2. The product candidate is introduced into a limited patient population to assess the efficacy of the drug in specific, targeted indications, assess dosage tolerance and optimal dosage, and identify possible adverse effects and safety risks.

Phase 3. If a compound is found to be potentially effective and to have an acceptable safety profile in Phase 2 evaluations, the clinical study will be expanded to further demonstrate clinical efficacy, optimal dosage and safety within an expanded patient population.

11

The results of product development, preclinical studies and clinical studies must be submitted to the FDA as part of a new drug application, or NDA. The NDA also must contain extensive manufacturing information. NDAs for new chemical entities are subject to performance goals defined in the Prescription Drug User Fee Act (PDUFA) which suggests a goal for FDA action within 6 months for applications that are granted priority review and 10 months for applications that receive standard review. For a product candidate no active ingredient of which has been previously approved by the FDA, the FDA must either refer the product candidate to an advisory committee for review or provide in the action letter on the application for the product candidate a summary of the reasons why the product candidate was not referred to an advisory committee prior to approval. In addition, under the 2008 Food and Drug Administration Amendments Act, the FDA has authority to require submission of a formal Risk Evaluation and Management Strategy (REMS) to ensure safe use of the product. At the end of the review period, the FDA communicates an approval of the NDA or issues a complete response listing the application's deficiencies.

Once approved, the FDA may withdraw the product approval if compliance with pre- and post-marketing regulatory standards is not maintained or if safety or quality issues are identified after the product reaches the marketplace. In addition, the FDA may require post-marketing studies, referred to as Phase 4 studies, to monitor the effect of approved products, and may limit further marketing of the product based on the results of these post-marketing studies. The FDA has broad post-market regulatory and enforcement powers, including the ability to suspend or delay issuance of approvals, seize or recall products, withdraw approvals, enjoin violations, and institute criminal prosecution.

If we obtain regulatory approval for a medicine, this clearance to market the product will be limited to those diseases and conditions for which the medicine is effective, as demonstrated through clinical studies and included in the medicine's labeling. Even if this regulatory approval is obtained, a marketed medicine, its manufacturer and its manufacturing facilities are subject to continual review and periodic inspections by the FDA. The FDA ensures the quality of approved medicines by carefully monitoring manufacturers' compliance with its current Good Manufacturing Practice (cGMP) regulations. The cGMP regulations for drugs contain minimum requirements for the methods, facilities, and controls used in manufacturing, processing, and packing of a medicine. The regulations make sure that a medicine is safe for use, and that it has the ingredients and strength it claims to have. Discovery of previously unknown problems with a medicine, manufacturer or facility may result in restrictions on the medicine or manufacturer, including costly recalls or withdrawal of the medicine from the market.

We are also subject to various laws and regulations regarding laboratory practices, the experimental use of animals and the use and disposal of hazardous or potentially hazardous substances in connection with our research. In each of these areas, as above, the FDA and other regulatory authorities have broad regulatory and enforcement powers, including the ability to suspend or delay issuance of approvals, seize or recall products, withdraw approvals, enjoin violations, and institute criminal prosecution, any one or more of which could have a material adverse effect upon our business, financial condition and results of operations.

Outside the United States our ability to market our products will also depend on receiving marketing authorizations from the appropriate regulatory authorities. Risks similar to those associated with FDA approval described above exist with the regulatory approval processes in other countries.

Patents and Proprietary Rights

We will be able to protect our technology from unauthorized use by third parties only to the extent that our technology is covered by valid and enforceable patents or is effectively maintained as trade secrets. Our success in the future will depend in part on obtaining patent protection for our product candidates. Accordingly, patents and other proprietary rights are essential elements of our business.

12

Our policy is to seek in the United States and selected foreign countries patent protection for novel technologies and compositions of matter that are commercially important to the development of our business. For proprietary know-how that is not patentable, processes for which patents are difficult to enforce and any other elements of our drug discovery process that involve proprietary know-how and technology that is not covered by patent applications, we rely on trade secret protection and confidentiality agreements to protect our interests. We require all of our employees, consultants and advisors to enter into confidentiality agreements. Where it is necessary to share our proprietary information or data with outside parties, our policy is to make available only that information and data required to accomplish the desired purpose and only pursuant to a duty of confidentiality on the part of those parties.

As of December 31, 2009, we own 183 issued United States patents and 765 granted foreign patents. In addition, we have 122 United States patent applications pending and 740 foreign patent applications pending. The claims in these various patents and patent applications are directed to compositions of matter, including claims covering product candidates, lead compounds and key intermediates, pharmaceutical compositions, methods of use and processes for making our compounds along with methods of design, synthesis, selection and use relevant to multivalency in general and to our research and development programs in particular.

United States issued patents and foreign patents generally expire 20 years after filing. The patent rights relating to telavancin owned by us and licensed to Astellas currently consist of United States patents that expire between 2019 and 2024, additional pending United States patent applications and counterpart patents and patent applications in a number of jurisdictions, including Europe. Nevertheless, issued patents can be challenged, narrowed, invalidated or circumvented, which could limit our ability to stop competitors from marketing similar products and threaten our ability to commercialize our product candidates. Our patent position, similar to other companies in our industry, is generally uncertain and involves complex legal and factual questions. To maintain our proprietary position we will need to obtain effective claims and enforce these claims once granted. It is possible that, before any of our products can be commercialized, any related patent may expire or remain in force only for a short period following commercialization, thereby reducing any advantage of the patent. Also, we do not know whether any of our patent applications will result in any issued patents or, if issued, whether the scope of the issued claims will be sufficient to protect our proprietary position.

We have entered into a License Agreement with Janssen Pharmaceutica pursuant to which we have licensed rights under certain patents owned by Janssen covering an excipient used in the formulation of telavancin. We believe that the general and financial terms of the agreement with Janssen are ordinary course terms. Pursuant to the terms of this license agreement, we are obligated to pay royalties and milestone payments to Janssen based on any commercial sales of telavancin. Astellas has agreed to assume responsibility for these payments under the terms of our license agreement with them. The license is terminable by us upon prior written notice to Janssen or upon an uncured breach or a liquidation event of one of the parties.

Competition

Our objective is to discover, develop and commercialize new medicines with superior efficacy, convenience, tolerability and/or safety. To the extent that we are able to develop medicines, they are likely to compete with existing drugs that have long histories of effective and safe use and with new therapeutic agents. We expect that any medicines that we commercialize with our collaborative partners or on our own will compete with existing, market-leading medicines.

Many of our potential competitors have substantially greater financial, technical and personnel resources than we have. In addition, many of these competitors have significantly greater commercial

13

infrastructures than we have. Our ability to compete successfully will depend largely on our ability to leverage our experience in drug discovery and development to:

- •

- discover and develop medicines that are superior to other products in the market;

- •

- attract qualified scientific, product development and commercial personnel;

- •

- obtain patent and/or other proprietary protection for our medicines and technologies;

- •

- obtain required regulatory approvals; and

- •

- successfully collaborate with pharmaceutical companies in the discovery, development and commercialization of new medicines.

VIBATIVTM (telavancin). VIBATIV™ competes with vancomycin, a generic drug that is manufactured by a variety of companies, as well as other drugs targeted at Gram-positive bacterial infections. Currently marketed products include but are not limited to daptomycin (marketed by Cubist Pharmaceuticals), linezolid (marketed by Pfizer) and tigecycline (marketed by Wyeth). To effectively compete with these medicines, and in particular with the relatively inexpensive generic option of vancomycin, we and our partner Astellas will need to demonstrate to physicians that, based on experience, clinical data, side-effect profiles and other factors, VIBATIV™ is preferable to vancomycin and other existing or subsequently-developed anti-infective drugs in certain clinical situations.

RELOVAIRTM Program with GSK. We anticipate that, if approved, any product from our RELOVAIRTM program with GSK will compete with a number of approved bronchodilator drugs and drug candidates under development that are designed to treat asthma and COPD. These include but are not limited to salmeterol and fluticasone (marketed by GSK), formoterol (marketed by a number of companies) and formoterol and budesonide as a combination (marketed by AstraZeneca), and tiotropium (marketed by Boehringer Ingelheim and Pfizer). Indacaterol is being developed as a single-agent by Novartis and, in combination with an ICS (mometasone). In addition, indacaterol combined with a muscarinic antagonist is being developed by Novartis. New combinations of formoterol with fluticasone or mometasone are being developed by Abbott (with SkyePharma), and Merck respectively. Boehringer-Ingelheim is developing a combination product with tiotropium and the long-acting beta agonist BI-1744 for the treatment of COPD. In addition, several firms are reported to be developing new formulations of salmeterol-fluticasone and formoterol-budesonide which may be marketed as generics or branded generics relative to the innovator products from GSK and AstraZeneca respectively. However, the ability of such generics to achieve fully substitutable status is uncertain as there is no well established regulatory pathway for demonstration of bioequivalence for inhaled medicines. All of these efforts represent potential competition for any product from our RELOVAIRTM program.

In addition, as the principles of multivalent medicine design become more widely known and appreciated based on patent and scientific publications and regulatory filings, we expect the field to become highly competitive. Pharmaceutical companies, biotechnology companies and academic and research institutions may seek to develop product candidates based upon the principles underlying our multivalent technologies.

Employees

As of December 31, 2009, we had 194 employees, 146 of which were primarily engaged in research and development activities. None of our employees are represented by a labor union. We consider our employee relations to be good.

14

Available Information

Our Internet address iswww.theravance.com. Our investor relations website is located athttp://ir.theravance.com. We make available free of charge on our investors relations website under "SEC Filings" our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, our directors' and officers' Section 16 Reports and any amendments to those reports as soon as reasonably practicable after filing or furnishing such materials to the U.S. Securities and Exchange Commission (SEC). The information found on our website is not part of this or any other report that we file with or furnish to the SEC.

In addition to the other information in this Annual Report on Form 10-K, the following risk factors should be considered carefully in evaluating our business and us.

Risks Related to our Business

If the RELOVAIR™ program does not progress into Phase 3 asthma studies, or if the Phase 3 program in asthma or chronic obstructive pulmonary disease (COPD) does not demonstrate safety and efficacy, the RELOVAIRTM program will be significantly delayed, our business will be harmed, and the price of our securities could fall.

In late 2008 and early 2009, we announced results from multiple RELOVAIRTM program Phase 2b asthma studies and a COPD study, and the Phase 3 program for COPD commenced in October 2009. Any adverse developments or results or perceived adverse developments or results with respect to the RELOVAIRTM program will significantly harm our business and could cause the price of our securities to fall. Examples of such adverse developments include, but are not limited to:

- •

- the U.S. Food and Drug Administration (FDA) determining that any of the Phase 2b asthma studies failed to meet study endpoints or raised safety concerns, or that additional clinical studies are required prior to commencing Phase 3 asthma studies;

- •

- the FDA concluding that any of the Phase 3 enabling studies or other clinical or preclinical studies currently underway raise safety or other concerns;

- •

- the FDA, after being presented with data from the Phase 2b studies as well as additional studies, requiring further evidence that the long-acting beta2 agonist (LABA) is a once-daily medication;

- •

- the Phase 3 program in asthma or COPD raising safety concerns or not demonstrating efficacy; or

- •

- any change in FDA policy or guidance regarding the use of LABAs to treat asthma or COPD.

With regard to changes in FDA policy or guidance concerning LABAs, on March 10-11, 2010, the FDA has scheduled an Advisory Committee to discuss the design of medical research studies (known as "clinical trial design") to evaluate serious asthma outcomes (such as hospitalizations, a procedure using a breathing tube known as intubation, or death) with the use of LABAs in the treatment of asthma in adults, adolescents, and children.

In addition, on February 18, 2010 the FDA announced that LABAs should not be used alone in the treatment of asthma, and will require manufacturers to include this warning in the product labels of these drugs, along with taking other steps to reduce the overall use of these medicines. The FDA will now require that the product labels for LABA medicines reflect, among other things, that the use of LABAs is contraindicated without the use of an asthma controller medication such as an inhaled corticosteroid, that LABAs should only be used long-term in patients whose asthma cannot be adequately controlled on asthma controller medications, and LABAs should be used for the shortest

15

duration of time required to achieve control of asthma symptoms and discontinued, if possible, once asthma control is achieved.

It is unknown at this time what, if any, effect these recent or future FDA actions will have on the development of the RELOVAIRTM program.

With regard to our telavancin NP NDA, we believe that the FDA's position is that it will require data from an additional clinical study or studies before it will consider the NP NDA for approval and we do not currently intend to conduct any such studies.

Our first New Drug Application (NDA) for telavancin was submitted in late 2006 and on September 11, 2009 the FDA approved VIBATIV™ (telavancin) for the treatment of adults with complicated skin and skin structure infections (cSSSI) caused by susceptible Gram-positive bacteria. In January 2009 we submitted a second telavancin NDA to the FDA for the NP indication and we received a Complete Response letter from the FDA in late November 2009. The Complete Response instructed us that submission of additional data and analyses for the NP patient population to support an evaluation of all-cause mortality as the primary efficacy endpoint is necessary to demonstrate the safety and efficacy of telavancin. The Phase 3 NP clinical program included clinical response as the primary efficacy endpoint, consistent with current draft FDA guidelines for antibacterial clinical trial design in NP, and all-cause mortality as a secondary endpoint. The Complete Response did not specify the time point at which the FDA will measure the all-cause mortality data, nor did it indicate the populations in which these analyses will be considered. The Complete Response letter also requested a scientific rationale for pooling the all-cause mortality data from the two studies as they may individually be of insufficient size and statistical power to support the evaluation of all-cause mortality as the primary efficacy endpoint.

We responded to the Complete Response letter in December 2009. The key elements of our response included a rationale for pooling the two Phase 3 NP studies to evaluate all-cause mortality as the primary efficacy endpoint and all available all-cause mortality data which was analyzed using Kaplan-Meier survival estimates. In January 2010 the FDA sent us a letter notifying us that it considered our response "incomplete," and stating that even if pooling of the two studies is acceptable for analyzing mortality, the two pooled studies would then equate to only one adequate and well-controlled trial and therefore would not constitute the substantial evidence of efficacy required for approval. In addition, the FDA noted that the adequacy and similarity of populations across the studies for the purposes of pooling had not yet been determined, and is still a review issue. Finally, the FDA also suggested several design criteria that should be taken into account in the design of new clinical trials. These design criteria do not include a specific primary endpoint for the evaluation of efficacy, the size or number of studies required, or what the appropriate statistical analysis might be. As a result, the design, size and scope of any additional studies required by the FDA are unclear at this time. With regard to our telavancin NP NDA, we believe that the FDA's position is that it will require data from an additional clinical study or studies before it will consider the NP NDA for approval and we do not currently intend to conduct any such studies. Any further adverse developments or perceived adverse developments with respect to telavancin for the NP indication, could harm our business and cause the price of our securities to fall.

If telavancin is not approved by the European Medicines Agency (EMEA) or if the EMEA requires data from additional clinical studies of telavancin, our business will be adversely affected and the price of our securities could fall.

On October 28, 2009, Astellas Pharma Europe B.V., a subsidiary of our telavancin partner, Astellas Pharma Inc. (Astellas), announced that it submitted a new European marketing authorization application (MAA) for telavancin to the European Medicines Agency (EMEA) for the treatment of

16

complicated skin and soft tissue infections (cSSTI) and NP and on November 30, 2009 we announced that the EMEA had completed the validation phase for the MAA and the EMEA's scientific review process had begun. In October 2008, we announced that Astellas Pharma Europe B.V. voluntarily withdrew a previously filed MAA for telavancin for the treatment of cSSTI from the EMEA based on communications from the Committee for Medicinal Products for Human Use (CHMP) of the EMEA that the data provided were not sufficient to allow the CHMP to conclude a positive benefit-risk balance for telavancin for the sole indication of cSSTI at that time.

If the EMEA does not approve our application, requires data from additional clinical studies regarding telavancin, or if telavancin is ultimately approved by the EMEA but with restrictions, including labeling that may limit the targeted patient population, our business will be harmed and the price of our securities could fall.

If our product candidates, in particular the lead compounds in the RELOVAIRTM program with GSK that recently commenced a Phase 3 clinical program in COPD, and telavancin for the treatment of NP are determined to be unsafe or ineffective in humans, our business will be adversely affected and the price of our securities could fall.

Although our first approved product, VIBATIV™, was commercially launched in the U.S. by our partner Astellas in November 2009, we have not yet commercialized any of our other product candidates. We are uncertain whether any of our other product candidates will prove effective and safe in humans or meet applicable regulatory standards. In addition, our approach to applying our expertise in multivalency to drug discovery may not result in the creation of successful medicines. The risk of failure for our product candidates is high. For example, in late 2005, we discontinued our overactive bladder program based upon the results of our Phase 1 studies with compound TD-6301, and GSK discontinued development of TD-5742, the first LAMA compound licensed from us, after completing initial Phase 1 studies. To date, the data supporting our drug discovery and development programs is derived solely from laboratory experiments, preclinical studies and clinical studies. A number of other compounds remain in the lead identification, lead optimization, preclinical testing or early clinical testing stages.

Several well-publicized approvable and Complete Response letters issued by the FDA and safety-related product withdrawals, suspensions, post-approval labeling revisions to include boxed warnings and changes in approved indications over the last few years, as well as growing public and governmental scrutiny of safety issues, have created an increasingly conservative regulatory environment. The implementation of new laws and regulations, and revisions to FDA clinical trial design guidelines, have increased uncertainty regarding the approvability of a new drug. In addition, there are additional requirements for approval of new drugs, including advisory committee meetings for new chemical entities, and formal risk evaluation and mitigation strategy (REMS) at the FDA's discretion. These new laws, regulations, additional requirements and changes in interpretation could cause non-approval or further delays in the FDA's review and approval of our product candidates.

With regard to all of our programs, any delay in commencing or completing clinical studies for product candidates, as we are currently experiencing in our Bifunctional Muscarinic Antagonist-beta2 Agonist (MABA) program with GSK, and any adverse results from clinical or preclinical studies or regulatory obstacles product candidates may face, would harm our business and could cause the price of our securities to fall.

Each of our product candidates must undergo extensive preclinical and clinical studies as a condition to regulatory approval. Preclinical and clinical studies are expensive, take many years to complete and study results may lead to delays in further studies or decisions to terminate programs. For example, we had planned to commence Phase 2b clinical studies in our MABA Program with GSK in 2009, but we are awaiting the completion and review of data from several preclinical studies. These

17

key studies, which we have also referred to as "Phase 2b enabling studies," will likely determine whether or not Phase 2b clinical studies in this program proceed as planned. If the analysis of the results of these studies lead to a decision not to proceed, GSK may need to conduct additional work which could significantly delay the MABA Program, or GSK may decide to terminate the entire program.

The commencement and completion of clinical studies for our product candidates may be delayed by many factors, including:

- •

- lack of effectiveness of product candidates during clinical studies;

- •

- adverse events, safety issues or side effects relating to the product candidates or their formulation into medicines;

- •

- inability to raise additional capital in sufficient amounts to continue our development programs, which are very expensive;

- •

- the need to sequence clinical studies as opposed to conducting them concomitantly in order to conserve resources;

- •

- our inability to enter into partnering arrangements relating to the development and commercialization of our programs and product candidates;

- •

- our inability or the inability of our collaborators or licensees to manufacture or obtain from third parties materials sufficient for use in preclinical and clinical studies;

- •

- governmental or regulatory delays and changes in regulatory requirements, policy and guidelines;

- •

- failure of our partners to advance our product candidates through clinical development;

- •

- delays in patient enrollment, which we experienced in our Phase 3 NP program for telavancin, and variability in the number and types of patients available for clinical studies;

- •

- difficulty in maintaining contact with patients after treatment, resulting in incomplete data;

- •

- a regional disturbance where we or our collaborative partners are enrolling patients in our clinical trials, such as a pandemic, terrorist activities or war, or a natural disaster; and

- •

- varying interpretations of data by the FDA and similar foreign regulatory agencies.

If our product candidates that we develop on our own or through collaborative partners are not approved by regulatory agencies, including the FDA, we will be unable to commercialize them.

The FDA must approve any new medicine before it can be marketed and sold in the United States. We must provide the FDA and similar foreign regulatory authorities with data from preclinical and clinical studies that demonstrate that our product candidates are safe and effective for a defined indication before they can be approved for commercial distribution. We will not obtain this approval for a product candidate unless and until the FDA approves a NDA. The processes by which regulatory approvals are obtained from the FDA to market and sell a new product are complex, require a number of years and involve the expenditure of substantial resources. In order to market our medicines in foreign jurisdictions, we must obtain separate regulatory approvals in each country. The approval procedure varies among countries and can involve additional testing, and the time required to obtain approval may differ from that required to obtain FDA approval. Approval by the FDA does not ensure approval by regulatory authorities in other countries, and approval by one foreign regulatory authority does not ensure approval by regulatory authorities in other foreign countries or by the FDA. Conversely, failure to obtain approval in one or more jurisdictions may make approval in other jurisdictions more difficult.

18

Clinical studies involving our product candidates may reveal that those candidates are ineffective, inferior to existing approved medicines, unacceptably toxic, or that they have other unacceptable side effects. In addition, the results of preclinical studies do not necessarily predict clinical success, and larger and later-stage clinical studies may not produce the same results as earlier-stage clinical studies.

Frequently, product candidates that have shown promising results in early preclinical or clinical studies have subsequently suffered significant setbacks or failed in later clinical studies. In addition, clinical studies of potential products often reveal that it is not possible or practical to continue development efforts for these product candidates. If our clinical studies are substantially delayed or fail to prove the safety and effectiveness of our product candidates in development, we may not receive regulatory approval of any of these product candidates and our business and financial condition will be materially harmed.

VIBATIV™ may not be accepted by physicians, patients, third party payors, or the medical community in general.

The commercial success of VIBATIV™ will depend upon its acceptance by physicians, patients, third party payors and the medical community in general. We cannot be sure that VIBATIV™ will be accepted by these parties. VIBATIV™ competes with vancomycin, a relatively inexpensive generic drug that is manufactured by a variety of companies, a number of existing anti-infectives manufactured and marketed by major pharmaceutical companies and others, and potentially against new anti-infectives that are not yet on the market. Even if the medical community accepts that VIBATIV™ is safe and efficacious for its indicated use, physicians may choose to restrict the use of VIBATIV™. If we and our partner, Astellas, are unable to demonstrate to physicians that, based on experience, clinical data, side-effect profiles and other factors, VIBATIV™ is preferable to vancomycin and other existing or subsequently-developed anti-infective drugs, we may never generate meaningful revenue from VIBATIV™. The degree of market acceptance of VIBATIV™ depends on a number of factors, including, but not limited to:

- •

- the demonstration of the clinical efficacy and safety of VIBATIV™;

- •

- the approved labeling for VIBATIV™;

- •

- the advantages and disadvantages of VIBATIV™ compared to alternative therapies;

- •

- potential negative perceptions, if any, of physicians related to delays with our NP NDA;

- •

- our and Astellas' ability to educate the medical community about the safety and effectiveness of VIBATIV™;

- •

- the reimbursement policies of government and third party payors; and

- •

- the market price of VIBATIV™ relative to competing therapies.

We commenced a workforce restructuring in April 2008 to focus our efforts on our key research and exploratory development programs and to reduce our overall cash burn rate. Even after giving effect to this restructuring, we do not have sufficient cash to fully develop and commercialize our un-partnered product candidates, and the restructuring may impact our ability to execute our business plan.

In April 2008, we commenced a significant workforce restructuring involving the elimination of approximately 40% of our positions through layoffs from all departments throughout our organization, including senior management. Our objective with the restructuring was to reduce our overall cash burn rate and focus on our key clinical programs while maintaining core research and exploratory development capability. However, the restructuring has adversely affected the pace and breadth of our research and development efforts. We may in the future decide to restructure operations and reduce expenses further by taking such measures as additional reductions in our workforce and program

19

spending. There can be no assurance that following this restructuring, or any future restructuring, we will have sufficient cash resources to allow us to fund our operations as planned.

Even if our product candidates receive regulatory approval, such as VIBATIV™, commercialization of such products may be adversely affected by regulatory actions and oversight.

Even if we receive regulatory approval for our product candidates, this approval may include limitations on the indicated uses for which we can market our medicines or the patient population that may utilize our medicines, which may limit the market for our medicines or put us at a competitive disadvantage relative to alternative therapies. For example, VIBATIV™'s labeling contains a boxed warning regarding the risks of use of VIBATIV™ during pregnancy. Products with boxed warnings are subject to more restrictive advertising regulations than products without such warnings. These restrictions could make it more difficult to market VIBATIV™ effectively. Further, now that VIBATIV™ is approved, we remain subject to continuing regulatory obligations, such as safety reporting requirements and additional post-marketing obligations, including regulatory oversight of promotion and marketing. In addition, the labeling, packaging, adverse event reporting, advertising, promotion and recordkeeping for the approved product remain subject to extensive and ongoing regulatory requirements. If we become aware of previously unknown problems with an approved product in the U.S. or overseas or at our contract manufacturers' facilities, a regulatory agency may impose restrictions on the product, our contract manufacturers or on us, including requiring us to reformulate the product, conduct additional clinical studies, change the labeling of the product, withdraw the product from the market or require our contract manufacturer to implement changes to its facilities. In addition, we may experience a significant drop in the sales of the product, our royalties on product revenues and reputation in the marketplace may suffer, and we could face lawsuits.

We are also subject to regulation by regional, national, state and local agencies, including the Department of Justice, the Federal Trade Commission, the Office of Inspector General of the U.S. Department of Health and Human Services and other regulatory bodies with respect to VIBATIV™, as well as governmental authorities in those foreign countries in which any of our product candidates are approved for commercialization. The Federal Food, Drug, and Cosmetic Act, the Public Health Service Act and other federal and state statutes and regulations govern to varying degrees the research, development, manufacturing and commercial activities relating to prescription pharmaceutical products, including preclinical and clinical testing, approval, production, labeling, sale, distribution, import, export, post-market surveillance, advertising, dissemination of information and promotion. If we or any third parties that provide these services for us are unable to comply, we may be subject to regulatory or civil actions or penalties that could significantly and adversely affect our business. Any failure to maintain regulatory approval will limit our ability to commercialize our product candidates, which would materially and adversely affect our business and financial condition.

We have incurred operating losses in each year since our inception and expect to continue to incur substantial losses for the foreseeable future.

We have been engaged in discovering and developing compounds and product candidates since mid-1997. Our first approved product, VIBATIV™, was launched by our partner Astellas in the U.S. in November 2009, and we expect modest revenues and royalties during its launch phase. We may never generate sufficient revenue from selling medicines to achieve profitability. As of December 31, 2009, we had an accumulated deficit of approximately $1.1 billion.

We expect to incur substantial expenses as we continue our drug discovery and development efforts, particularly to the extent we advance our product candidates into and through clinical studies, which are very expensive. As a result, we expect to continue to incur substantial losses for the foreseeable future. We are uncertain when or if we will be able to achieve or sustain profitability.

20

Failure to become and remain profitable would adversely affect the price of our securities and our ability to raise capital and continue operations.

If we fail to obtain the capital necessary to fund our operations, we may be unable to develop our product candidates and we could be forced to share our rights to commercialize our product candidates with third parties on terms that may not be favorable to us.

We need large amounts of capital to support our research and development efforts. If we are unable to secure capital to fund our operations we will not be able to continue our discovery and development efforts and we might have to enter into strategic collaborations that could require us to share commercial rights to our medicines to a greater extent than we currently intend. Based on our current operating plans, milestone forecasts and spending assumptions, we believe that our cash and cash equivalents and marketable securities will be sufficient to meet our anticipated operating needs for at least the next twelve months. We are likely to require additional capital to fund operating needs thereafter. If we were to conduct additional studies to support the telavancin NP NDA and we were required to fund such studies, our capital needs could increase substantially. In addition, under our RELOVAIR™ program with GSK, in the event that a LABA product candidate discovered by GSK is successfully developed and commercialized, we will be obligated to pay GSK milestone payments which could total as much as $220.0 million if both a single-agent and a combination product were launched in multiple regions of the world. The current lead LABA candidate, GW642444, is a GSK-discovered compound and GSK has determined to focus the collaboration's LABA development resources on the development of this compound only. If this GSK-discovered compound, which recently commenced a Phase 3 program in COPD, is advanced through regulatory approval and commercialization, we would not be entitled to receive any further milestone payments from GSK with regard to the RELOVAIR™ program and we would have to pay GSK the milestones noted above. We cannot guarantee that future financing will be available in sufficient amounts or on terms acceptable to us, if at all. Even if we are able to raise additional capital, such financing may result in significant dilution to existing security holders. If we are unable to raise additional capital in sufficient amounts or on terms acceptable to us, we may have to make additional reductions in our workforce and may be prevented from continuing our discovery and development efforts and exploiting other corporate opportunities. This could harm our business, prospects and financial condition and cause the price of our securities to fall.

Global financial and economic conditions have had an impact on our industry, may adversely affect our business and financial condition in ways that we currently cannot predict, and may limit our ability to raise additional funds.

Global financial conditions and general economic conditions, including the decreased availability of credit, have had an impact on our industry, and may adversely affect our business and our financial condition. Our ability to access the capital or debt markets and raise funds required for our operations may be severely restricted at a time when we would like, or need, to do so, which would have an adverse effect on our ability to fund our operations as planned. In addition, many biotechnology and biopharmaceutical companies with limited funds have been unable to raise capital during the recent period of financial and economic uncertainty and volatility, and they are left with limited alternatives including merging with other companies or out-licensing their assets. The large number of companies in this situation has led to an increase in supply of biotechnology and biopharmaceutical assets available for license or sale, which disadvantages companies like us that intend to partner certain of their assets.

If our partners do not satisfy their obligations under our agreements with them, or if they terminate our partnership with them, we will be unable to develop our partnered product candidates as planned.

We entered into our collaboration agreement for the RELOVAIR™ program with GSK in November 2002, our strategic alliance agreement with GSK in March 2004, and our telavancin

21

development and commercialization agreement with Astellas in November 2005. In connection with these agreements, we have granted to these parties certain rights regarding the use of our patents and technology with respect to compounds in our development programs, including development and marketing rights. Under our GSK agreements, GSK has full responsibility for development and commercialization of any product candidates in the programs that it has in-licensed, including RELOVAIR™ and MABA. Any future milestone payments or royalties to us from these programs will depend on the extent to which GSK advances the product candidate through development and commercial launch. In connection with our license, development and commercialization agreement with Astellas, Astellas is responsible for the commercialization of VIBATIV™ and any royalties to us from net sales of VIBATIV™ will depend upon Astellas' ability to commercialize the medicine.