QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

VALUECLICK, INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

|

|

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

ValueClick, Inc.

30699 Russell Ranch Road, Suite 250

Westlake Village, CA 91361

(818) 575-4500

May 2, 2005

Dear Stockholder:

You are cordially invited to attend the Annual Meeting (the "Annual Meeting") of ValueClick, Inc., a Delaware corporation (the "Company" or "ValueClick"), to be held on Monday, June 6, 2005, at 9:00 a.m., Pacific Time, at the Company's corporate offices located at 30699 Russell Ranch Road, Suite 250, Westlake Village, CA 91361.

The Annual Meeting has been called for the purpose of (i) electing five members to the Board of Directors of ValueClick to serve until the next annual meeting of ValueClick stockholders and until their successors have been elected and qualified and (ii) considering and voting upon such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof.

The Board of Directors has fixed the close of business on April 11, 2005 as the record date for determining stockholders entitled to notice of, and to vote at, the Annual Meeting and any adjournments or postponements thereof.

The Board of Directors of the Company recommends that you vote "FOR" the election of the nominees of the Board of Directors as Directors of the Company.

IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AT THE ANNUAL MEETING. WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, YOU ARE REQUESTED TO COMPLETE, DATE, SIGN, AND RETURN THE ENCLOSED PROXY CARD IN THE ENCLOSED ENVELOPE WHICH REQUIRES NO POSTAGE IF MAILED IN THE UNITED STATES. YOUR PROXY IS REVOCABLE UP TO THE TIME IT IS VOTED, AND, IF YOU ATTEND THE ANNUAL MEETING, YOU MAY VOTE IN PERSON, EVEN IF YOU HAVE PREVIOUSLY RETURNED YOUR PROXY CARD.

| | | Sincerely, |

|

|

James R. Zarley

Chairman and Chief Executive Officer |

ValueClick, Inc.

30699 Russell Ranch Road, Suite 250

Westlake Village, CA 91361

(818) 575-4500

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on Monday, June 6, 2005

NOTICE IS HEREBY GIVEN that the Annual Meeting (the "Annual Meeting") of Stockholders of ValueClick, Inc. (the "Company" or "ValueClick") will be held on Monday, June 6, 2005, at 9:00 a.m., Pacific Time, at the Company's corporate offices located at 30699 Russell Ranch Road, Suite 250, Westlake Village, CA 91361. The Annual Meeting is being called for the purpose of considering and voting upon:

- 1.

- The election of five members to the Board of Directors of ValueClick to serve until the next annual meeting of ValueClick stockholders and until their successors have been elected and qualified; and,

- 2.

- Such other business as may properly come before the Annual Meeting and any adjournments or postponements thereof.

The Board of Directors has fixed the close of business on April 11, 2005 as the record date for determination of stockholders entitled to notice of, and to vote at, the Annual Meeting and any adjournments or postponements thereof. Only holders of record of the Company's common stock, par value $.001 per share, at the close of business on that date will be entitled to notice of, and to vote at, the Annual Meeting and any adjournments or postponements thereof.

In the event there are not sufficient shares to be voted in favor of any of the foregoing proposals at the time of the Annual Meeting, the Annual Meeting may be adjourned in order to permit further solicitation of proxies.

Directions to the Company can be obtained by contacting the Company at (818) 575-4500.

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING IN PERSON, YOU ARE REQUESTED TO COMPLETE, DATE, SIGN, AND RETURN THE ENCLOSED PROXY CARD IN THE ENCLOSED ENVELOPE WHICH REQUIRES NO POSTAGE IF MAILED IN THE UNITED STATES. YOUR PROXY IS REVOCABLE UP TO THE TIME IT IS VOTED, AND, IF YOU ATTEND THE ANNUAL MEETING, YOU MAY VOTE IN PERSON EVEN IF YOU HAVE PREVIOUSLY RETURNED YOUR PROXY CARD.

| | | By Order of the Board of Directors |

|

|

Scott P. Barlow

Secretary |

Westlake Village, California

May 2, 2005

VALUECLICK, INC.

30699 Russell Ranch Road, Suite 250

Westlake Village, CA 91361

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

To Be Held on Monday, June 6, 2004

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of ValueClick, Inc. (the "Company" or "ValueClick") for use at the Annual Meeting of Stockholders of the Company to be held on Monday, June 6, 2005 at 9:00 a.m., Pacific Time, and any adjournments or postponements thereof (the "Annual Meeting"). The Annual Meeting will be held at the Company's corporate offices located at 30699 Russell Ranch Road, Suite 250, Westlake Village, CA 91361.

At the Annual Meeting, the stockholders of the Company will be asked to consider and vote upon the following matters:

- 1.

- The election of five members to the Board of Directors of ValueClick to serve until the next annual meeting of ValueClick stockholders and until their successors have been elected and qualified; and,

- 2.

- Such other business as may properly come before the meeting and any adjournments or postponements thereof.

The Notice of Annual Meeting, Proxy Statement and Proxy Card are first being mailed to stockholders of the Company on or about May 9, 2005 in connection with the solicitation of proxies for the Annual Meeting. The Board of Directors has fixed the close of business on April 11, 2005 as the record date for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting (the "Record Date"). Only holders of record of the Company's common stock, par value $.001 per share (the "Common Stock"), at the close of business on the Record Date will be entitled to notice of, and to vote at, the Annual Meeting. As of the Record Date, there were 82,821,235 shares of common stock outstanding and entitled to vote at the Annual Meeting and approximately 782 stockholders of record. Each holder of a share of common stock outstanding as of the close of business on the Record Date will be entitled to one vote for each share held of record with respect to each matter submitted at the Annual Meeting.

The presence, in person or by proxy, of holders of at least a majority of the total number of outstanding shares of Common Stock entitled to vote is necessary to constitute a quorum for the transaction of business at the Annual Meeting. A quorum being present, the affirmative vote of a plurality of the votes cast is necessary to elect each nominee as a Director of the Company.

Shares that reflect abstentions or "broker non-votes" (i.e., shares represented at the meeting held by brokers or nominees as to which instructions have not been received from the beneficial owners or persons entitled to vote such shares and with respect to which the broker or nominee does not have discretionary voting power to vote such shares) will be counted for purposes of determining whether a quorum is present for the transaction of business at the Annual Meeting. With respect to the election of a Director, votes may be cast for or withheld from the nominee. Votes cast for the nominee will count as "yes" votes; votes that are withheld from the nominee will not be voted with respect to the election of the nominee although they will be counted when determining whether there is a quorum. Broker non-votes will have no effect on the outcome of the election of Directors.

Stockholders of the Company are requested to complete, date, sign, and return the accompanying Proxy Card in the enclosed envelope. Common Stock represented by properly executed proxies received by the Company and not revoked will be voted at the Annual Meeting in accordance with the instructions contained therein. If instructions are not given therein, properly executed proxies will be voted "FOR" the election of the nominees for Director listed in this Proxy Statement. It is not anticipated that any matters other than the election of Directors will be presented at the Annual Meeting. If other matters are presented, proxies will be voted in accordance with the discretion of the proxy holders.

Any properly completed proxy may be revoked at any time before it is voted on any matter by giving written notice of such revocation to the Secretary or Assistant Secretary of the Company, or by signing and duly delivering a proxy bearing a later date, or by attending the Annual Meeting and voting in person. Attendance at the Annual Meeting will not, by itself, revoke a proxy.

The Annual Report to stockholders of the Company, which includes the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2004 ("Fiscal 2004") is being mailed to stockholders of the Company concurrently with this Proxy Statement. Except where otherwise incorporated by reference, the Annual Report and Annual Report on Form 10-K are not a part of the proxy solicitation material.

CORPORATE GOVERNANCE

Independence of Directors

The Company's Board of Directors has affirmatively determined that each Director, other than James R. Zarley, our Chief Executive Officer, and Tom Vadnais, is an "independent director" under the listing standards of The NASDAQ Stock Market, Inc. ("NASDAQ"). Under NASDAQ listing standards, an "independent director" is a director who, in the judgment of the board, does not have any relationships that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

In addition, all members of the Audit Committee and the Compensation Committee are independent directors. In accordance with NASDAQ listing standards, all the members of the Audit Committee also meet additional independence criteria applicable to audit committee members.

Lead Director

The Board has determined that its non-management members will meet a minimum of two times per year to discuss any issues that might more properly be raised outside of the presence of management and has appointed David S. Buzby as Lead Director to facilitate these meetings.

Code of Ethics and Business Conduct/Reporting of Concerns

We have adopted a Code of Ethics and Business Conduct (the "Code") for our principal executive, financial and accounting, and other officers, and our directors, employees, agents, and consultants. The Code is publicly available on our website at www.valueclick.com under "Corporate Info." Among other things, the Code addresses such issues as conflicts of interest, corporate opportunities, confidentiality, fair dealing, protection and proper use of company assets, compliance with applicable laws (including insider trading laws), and reporting of illegal or unethical behavior.

Within the Code, ValueClick has established an accounting ethics complaint procedure for all employees of the Company and its subsidiaries. The complaint procedure is for employees who may have concerns regarding accounting, internal accounting controls and auditing matters. The Company treats all complaints confidentially and with the utmost professionalism. If an employee desires, he or she may submit any concerns or complaints on an anonymous basis, and his or her concerns or

2

complaints will be addressed in the same manner as any other complaints. The Company does not, and will not, condone any retaliation of any kind against an employee who comes forward with an ethical concern or complaint.

The Board also has established a process through which interested parties may communicate directly with Mr. Buzby, the Chairman of the Audit Committee, or with the Company's outside compliance attorney, Mr. Brad Weirick at Gibson, Dunn & Crutcher LLP. In particular, confidential communications may be sent directly to Mr. Buzby at the Company's corporate offices, 30699 Russell Ranch Road, Suite 250, Westlake Village, CA 91361, while confidential communications may be sent directly to Mr. Weirick at Gibson, Dunn & Crutcher LLP, 2029 Century Park East, Los Angeles, CA, 90067.

Communications with the Board of Directors

The Board has established a process for stockholders and other interested parties to communicate with the Board. Anyone wishing to communicate with the Board should send their communication to the Company's corporate headquarters, c/o the Secretary of the Company at 30699 Russell Ranch Road, Suite 250, Westlake Village, CA 91361. Communications intended for a specific director, such as the Lead Director, should be addressed to their attention c/o the Secretary of the Company at this address. The Secretary shall forward all such communications to the appropriate director or directors for consideration.

Nomination of Directors/Director Presence at Annual Meetings

General Criteria

The Company does not have a standing nominating committee, but rather historically has engaged the full Board of Directors in the process of nominating directors for election. The Board of Directors views the breadth of the experience of the full Board as greater than that of a committee made up of only a portion of the Board. Additionally, the Company's Board of Directors does not believe it is in the best interests of the Company to establish rigid criteria for the selection of nominees to the Board. Rather, the Board of Directors recognizes that the challenges and needs of the Company will vary over time and, accordingly, believes that the selection of director nominees should be based on skill sets most pertinent to the issues facing or likely to face the Company at the time of nomination. At the same time, the Board of Directors believes that the Company will benefit from a diversity of background and experience on the Board and, therefore, will consider and seek nominees who, in addition to general management experience and business knowledge, possess, among other attributes, an expertise in one or more of the following areas: finance, technology, international business, investment banking, business law, corporate governance, risk assessment, and investor relations. In addition, there are certain general attributes that the Board of Directors believes all director candidates must possess including:

- •

- A commitment to ethics and integrity;

- •

- A commitment to personal and organizational accountability;

- •

- A history of achievement that reflects superior standards for themselves and others; and

- •

- A willingness to express alternate points of view while, at the same time, being respectful of the opinions of others and working collaboratively as a team player.

The Board of Directors has adopted a resolution addressing the director nominations process. The resolution is available on our website at www.valueclick.com under "Corporate Info." As noted above, all members of the Board other than James R. Zarley, our Chief Executive Officer, and Tom Vadnais, are independent directors under NASDAQ listing standards.

3

Stockholder Nominations

The Board of Directors will consider nominees for directors recommended by stockholders when such recommendations are made in accordance with the notice and information provisions of the Company's By-laws. In particular, a stockholder must deliver written notice of such recommendation to the Secretary of the Company, at the Company's principal executive offices, not later than the close of business on the 90th day or earlier than the close of business on the 120th day prior to the first anniversary of the preceding year's Annual Meeting. Therefore, in order to be considered by the Board of Directors for nomination as a director at the Annual Meeting to be held in 2006, stockholder recommendations for director nominees must be received by ValueClick's Secretary between February 6, 2006 and March 6, 2006. In addition, as provided in the By-laws, any such recommendation also must set forth (a) all information relating to each such stockholder nominee that is required to be disclosed in solicitations of proxies for election of directors in an election contest or which is otherwise required pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended, and Rule 14a-11 thereunder (including such person's written consent to being named in the Proxy Statement as a nominee and to serving as a director if elected); and (b) with respect to the stockholder making the recommendation and the beneficial owner, if any, on whose behalf the recommendation is made, the name, address, class and number of shares held by such stockholder and/or beneficial owner. Recommendations that meet the criteria outlined above and meet the notice and information provisions of the Company's By-laws described above will be forwarded to the Board of Directors for further review and consideration.

Selection and Evaluation of Candidates

In addition to considering candidates recommended by stockholders, the Board of Directors may consider candidates recommended by current directors, officers and employees of the Company and, in addition, from time to time, may utilize the services of a search firm to identify and approach potential candidates. In evaluating candidates for director, the Board of Directors assesses the skills, experience and qualifications of the individual against the general criteria set forth above, including the particular needs of and issues facing the Company at the time. In addition, with regard to current directors, the Board of Directors takes into consideration each individual's past performance as a director. The Board of Directors intends to evaluate any stockholder candidates in the same manner as candidates from all other sources.

Director Attendance at Annual Meetings

The Board typically schedules the Annual Meeting in consideration of Board members' schedules and members are encouraged to attend the Annual Meeting. Two directors attended the 2004 Annual Meeting.

4

Our Board and Committee Structure

Executive Officers, Directors and Other Key Employees

Set forth below is information concerning ValueClick's directors, executive officers and other key employees as of March 31, 2005.

Name

| | Age

| | Position(s)

|

|---|

| James R. Zarley | | 60 | | Chairman of the Board, Chief Executive Officer and President |

| Samuel J. Paisley | | 55 | | Chief Financial Officer and Chief Operating Officer—Media |

| Peter Wolfert | | 41 | | Chief Technology Officer |

| Scott P. Barlow | | 36 | | Secretary |

| David S. Buzby(1)(2) | | 45 | | Director |

| Martin T. Hart(1)(2) | | 69 | | Director |

| Tom A. Vadnais | | 57 | | Director |

| Jeffrey F. Rayport(1) | | 45 | | Director |

- (1)

- Member of the Audit Committee.

- (2)

- Member of the Compensation Committee.

JAMES R. ZARLEY is the Chairman of the Board and Chief Executive Officer of ValueClick. He has served as Chairman, and has been an advisor to ValueClick, since May 1998. In February 1999, Mr. Zarley joined ValueClick in a full-time capacity and in May 1999 he became Chief Executive Officer. In January of 2001, Mr. Zarley assumed the added position of President of ValueClick, Inc. Prior to joining ValueClick, from April 1987 to December 1996, Mr. Zarley was Chief Executive Officer of Quantech Investments, an information services company. From December 1996 to May 1998, Mr. Zarley was the Chairman and Chief Executive Officer of Best Internet until its merger with Hiway Technologies, a Web hosting company, in May 1998. From May 1998 to January 1999, Mr. Zarley was the Chief Operating Officer of Hiway Technologies until its merger with Internet service provider, Verio, Inc. Mr. Zarley currently serves as a director of Texas Roadhouse, Inc., a restaurant chain.

SAMUEL J. PAISLEY is the Chief Financial Officer and Chief Operating Officer—Media. Mr. Paisley joined ValueClick in his initial role of Executive Vice President in April 2000, added the position of Chief Operating Officer—Media in January 2001 and assumed the role of Chief Financial Officer in June 2002. Mr. Paisley previously served as Chief Financial Officer and Executive Vice President of Automata International, an integrated circuit manufacturer, from June 1998 to March 2000. Between August 1980 and June 1998 he held several positions at KPMG Peat Marwick LLP, an audit firm, finishing his employment as a partner in Information, Communications and Entertainment. Mr. Paisley graduated with a B.A. from Washington & Jefferson College and an M.B.A. from the University of Pittsburgh.

PETER WOLFERT joined ValueClick as its Chief Technology Officer in June 2000. Previously, Mr. Wolfert was the Senior Vice President and Director of Information Technology for Mellon Capital Management, an investment management firm in San Francisco, from October 1998 until June 2000. Prior to that he served as Senior Vice President of Information Technology at AIM Funds in San Francisco from October 1995 to October 1998. From January 1992 until October 1995, Mr. Wolfert was Senior Vice President of Information Technology at Trust Company of the West in Los Angeles. Mr. Wolfert graduated with a B.S. from the University of California at Davis, and also earned an M.B.A. with emphasis in Management Information Systems from the University of California at Irvine.

5

SCOTT P. BARLOW joined ValueClick as its Vice President and General Counsel in October of 2001 and has also served as its Secretary since February 2002. Prior to joining ValueClick, Mr. Barlow served as the General Counsel and Secretary for Mediaplex, Inc., a provider of technology-based marketing and products and services, from December 2000 to October 2001. From October 1999 to December 2000, Mr. Barlow served as Mediaplex's Assistant General Counsel. Prior to his employment with Mediaplex, Mr. Barlow was a senior associate with Raifman & Edwards LLP, a San Francisco-based corporate law firm from 1995 to 1999. Mr. Barlow graduated with a B.S. from the University of Florida and a J.D. from the University of Akron School of Law.

DAVID S. BUZBY has been a director of ValueClick since May 1999. Mr. Buzby is a San Francisco-based investor and operator of entrepreneurial companies. From June 1999 to September 2000, Mr. Buzby was the Chief Operating Officer and a founding investor of Internet Barter, Inc., an international business-to-business e-commerce barter exchange. From August 1994 to January 1999, Mr. Buzby worked with Best Internet, a Web hosting company. Mr. Buzby held various positions at Best Internet including Chief Financial Officer and Vice Chairman of the Board and was a founding investor. Mr. Buzby graduated with a B.A. from Middlebury College and received an M.B.A. from Harvard Business School.

MARTIN T. HART has been a director of ValueClick since March 1999. Mr. Hart has been a private investor in the Denver area since 1969. He has owned and developed a number of companies into successful businesses, and has served on the board of directors for many public and private corporations. Presently, Mr. Hart is serving on the board of the following public companies: MassMutual Corporate Investors, an investment company; MassMutual Participation Investors, an investment company; Texas Roadhouse, a restaurant chain; and Spectranetics Corporation, a medical device company. He also continues to serve on the board of directors of several private companies. Mr. Hart graduated with a B.A. from Regis University and is a Certified Public Accountant.

TOM A. VADNAIS has been a director of ValueClick since October 2001. From April 2001 to October 2001, Mr. Vadnais was President, Chief Executive Officer and a director of Mediaplex, Inc., a provider of technology-based marketing and products and services. Prior to joining Mediaplex, Mr. Vadnais was the Executive Vice President of Professional Services for Compuware Corporation, a software and professional services provider for IT professionals, where he was retained to perform the integration of Data Processing Resources Corporation (DPRC) and managed mergers and acquisitions. Mr. Vadnais was the President and Chief Operating Officer of DPRC, prior to its acquisition by Compuware. From 1992 to 1999, Mr. Vadnais was the President and Chief Operating Officer of Tascor, Inc., a wholly-owned subsidiary of Norrell Inc., where he was a member of Norrell's board of directors. Until 1992, Mr. Vadnais worked at IBM for twenty-three years in various management roles, where he had experience in sales, marketing, and as Vice President of Operations. He graduated with a B.A. from the University of California, Los Angeles, and an M.B.A. from Golden Gate University.

JEFFERY F. RAYPORT has been a director of ValueClick since May 2002. Dr. Rayport was a former Director of Be Free, Inc. Dr. Rayport currently works at Monitor Group, a management consulting firm, as the founder and Chief Executive Officer of Monitor Marketspace, an e-commerce research and media unit established in 1998. From 1991 to 2000, he was a faculty member at Harvard Business School in the Service Management Unit. He currently serves as a director of Global Sports Interactive. Dr. Rayport earned an A.B., A.M. and Ph.D. from Harvard University and an M. Phil. from the University of Cambridge (U.K.).

Committees

Audit Committee

Function. The Audit Committee acts under a written charter that was revised in February 2004 and reapproved by our Board of Directors in February 2005. Under its charter, the Audit Committee,

6

among other things, appoints our independent accountants each year and approves the compensation and terms of engagement of our independent accountants, approves services proposed to be provided by the independent accountants as well as all services provided by other professional financial services providers, and monitors and oversees the quality and integrity of our accounting process and systems of internal controls. The Audit Committee reviews the annual audit report of our independent accountants and reports of examinations by any regulatory agencies, and it generally oversees our internal audit program. A copy of the Audit Committee's charter as revised in February 2004 was attached to the Proxy Statement for the year ended December 31, 2003. There have been no changes to the Audit Committee's charter since February 2004.

Members. The current members of the Audit Committee are David S. Buzby—Chairman, Martin T. Hart, and Jeffrey F. Rayport. Each member of the Audit Committee is an independent director under NASDAQ listing standards. In addition, in accordance with NASDAQ listing standards, each member of the Audit Committee meets additional independence criteria applicable to audit committee members. As determined by the Board, each Audit Committee member meets NASDAQ's financial literacy requirements, and the Board has determined that Mr. Buzby, the Committee Chairman, qualifies as an "audit committee financial expert" as that term is defined by rules of the Securities and Exchange Commission.

Compensation Committee

The Compensation Committee, which consists of Messrs. Hart and Buzby (both of which are independent directors under NASDAQ listing standards), reviews and recommends the compensation arrangements for the Company's Chief Executive Officer and for all other officers and senior level employees, reviews general compensation levels for other employees as a group, determines the awards to be granted to eligible persons under the Company's 2002 Incentive Stock Option Plan, and takes such other action as may be required in connection with the Company's compensation and incentive plans.

Board and Committee Meetings

During 2004, the Board of Directors held four meetings. The Compensation Committee held four meetings in 2004. The Audit Committee held five meetings in 2004. In 2004, each director attended or participated in 75% or more of the aggregate number of meetings held by the Board of Directors and meetings held by all committees on which the director served.

PROPOSAL 1

ELECTION OF DIRECTORS

ValueClick's By-laws provide that the exact number of directors will be fixed from time to time by action of its stockholders or Board of Directors. ValueClick's Board of Directors has fixed the number of directors for the 2005 fiscal year at five directors. Five members of ValueClick's Board of Directors will be elected at the Annual Meeting. ValueClick's Board of Directors has nominated each of the persons listed below to be elected as directors to serve for a one-year term and until his successor is duly elected and qualified.

Holders of proxies solicited by this Proxy Statement will vote the proxies received by them as directed on the proxy card or, if no direction is made, for the election of the Board of Directors' five director nominees below. Proxies cannot be voted for more than the five named director nominees.

Each nominee for election has agreed to serve if elected, and ValueClick has no reason to believe that each director nominee will be unavailable to serve. If any director nominee is unable or declines to serve as a director at the time of the Annual Meeting, the proxy holders will vote for a director nominee designated by the present Board of Directors to fill the vacancy. Unless otherwise instructed, the proxy holders will vote the proxies received by them"FOR" the director nominees named below.

7

The biographies of ValueClick's nominees for directors are included above, under the heading "Executive Officers, Directors and Other Key Employees."

The names of the nominees, and certain information about them, are set forth below.

Nominees

Name

| | Age

| | Director

Since

| | Position

|

|---|

| James R. Zarley | | 60 | | 1998 | | Chairman of the Board and Chief Executive Officer |

| David S. Buzby | | 45 | | 1999 | | Director |

| Martin T. Hart | | 69 | | 1999 | | Director |

| Tom A. Vadnais | | 57 | | 2001 | | Director |

| Jeffrey F. Rayport | | 45 | | 2002 | | Director |

Vote Required For Approval

The affirmative vote of a plurality of the votes cast is necessary to elect each nominee as a director of the Company. This means that the nominees receiving the highest number of votes cast for the number of positions to be filled are elected.

THE BOARD OF DIRECTORS OF THE COMPANY RECOMMENDS A VOTE FOR THE ELECTION OF THE NOMINEES OF THE BOARD OF DIRECTORS AS DIRECTORS OF THE COMPANY.

Certain Relationships

There are no family relationships among any of our directors or executive officers. In addition, neither the Company nor any of its subsidiaries, during Fiscal 2004, was a party to any transactions in which an executive officer, director, nominee, 5% shareholder or immediate family member of any of the foregoing persons had a material direct or indirect interest. During Fiscal 2004, none of the following were indebted to the Company: (i) executive officers, directors, nominees, or immediate family member of any of the foregoing persons; (ii) corporations or organizations (other than the Company or subsidiaries of the Company) of which an officer, director or nominee of the Company is an executive officer, partner or greater than 10% beneficial owner; or (iii) trusts or other estates with respect to which an executive officer, director or nominee of the Company has a substantial beneficial interest or serves as trustee.

COMPENSATION

Director Compensation

For the 2004 fiscal year, each non-employee member of our Board of Directors is entitled to annual compensation of $10,000. The members of the Audit Committee of the Board and its chairman are entitled to additional annual compensation of $5,000 and $20,000, respectively. The members of the Board are also reimbursed for reasonable travel and other out-of-pocket expenses incurred in connection with attendance at meetings of the Board of Directors and committees of the Board of Directors. Directors are also eligible to receive options and to be issued shares of common stock directly under our 2002 Incentive Stock Option Plan. Those directors who are our employees do not receive compensation for their services as directors.

Executive Compensation

The following table sets forth the compensation paid in each of our last three completed fiscal years to our Chief Executive Officer and our other most highly compensated executive officers who

8

were serving as executive officers at the end of 2004 and whose total salary and bonus exceeded $100,000 during 2004. We refer to each of these individuals in this Proxy Statement as our "named executive officers."

Summary Compensation Table

| |

| | Annual

Compensation

| | Long-Term

Compensation

| |

|

|---|

Name and Principal Position

| | Year

| | Salary

| | Bonus

| | Other Annual

Compensation

| | Securities

Underlying

Options/SARs

| | All Other

Compensation(6)

|

|---|

James R. Zarley

Chairman, Chief Executive Officer and President | | 2004

2003

2002 | | $

$

$ | 375,000

375,000

340,625 |

(1) | $

| 150,000

—

— | | —

—

— | | —

150,000

1,500,000 | | $

$

| 3,375

1,290

— |

Samuel J. Paisley

Chief Financial Officer and Chief Operating Officer—Media |

|

2004

2003

2002 |

|

$

$

$ |

300,000

300,000

300,000 |

(2) |

$

|

150,000

—

— |

|

—

—

— |

|

50,000

100,000

300,000 |

|

$

$

$ |

3,000

3,125

4,750 |

Peter Wolfert

Chief Technology Officer |

|

2004

2003

2002 |

|

$

$

$ |

300,000

300,000

300,000 |

(3) |

$

|

75,000

—

— |

|

—

—

— |

|

—

50,000

200,000 |

|

$

$

$ |

3,000

3,125

5,450 |

Scott P. Barlow

Secretary, VP and General Counsel |

|

2004

2003

2002 |

|

$

$

$ |

202,916

178,333

150,000 |

(5)

(4)

|

|

—

—

— |

|

—

—

— |

|

25,000

40,000

10,000 |

|

$

$

$ |

2,029

1,650

4,406 |

- (1)

- Mr. Zarley's base salary increased from $200,000 to $375,000, effective February 2002.

- (2)

- Mr. Paisley's base salary increased from $200,000 to $300,000, effective January 2002.

- (3)

- Mr. Wolfert's base salary increased from $200,000 to $300,000, effective January 2002.

- (4)

- Mr. Barlow's base salary increased from $150,000 to $180,000, effective February 2003 and to $200,000 effective December 2003.

- (5)

- Mr. Barlow's base salary increased from $200,000 to $235,000, effective December 2004.

- (6)

- Represents 401(k) matching contributions paid by ValueClick on the executive's behalf.

Option Grants in Fiscal Year 2004

The following table sets forth information regarding options granted to each named executive officer during the fiscal year ended December 31, 2004. We did not grant any stock appreciation rights during the fiscal year ended December 31, 2004.

| |

| | Individual Grants

| |

| |

|

|---|

| |

| | Potential Realizable Value

at Assumed Annual Rates

of Stock Appreciation

for Option Term(4)

|

|---|

| | Number of

Securities

Underlying

Options

Granted(#)

| | Percent of

Total Options

Granted to

Employees in

2004(2)

| |

| |

|

|---|

| | Exercise

Price Per

Share

($/share)(3)

| |

|

|---|

Name

| | Expiration

Date

|

|---|

| | 5%($)

| | 10%($)

|

|---|

| James R. Zarley | | — | | — | | | — | | — | | | — | | | — |

| Samuel J. Paisley | | 50,000 | (1) | 3.3 | % | $ | 10.57 | | 2/16/2014 | | $ | 332,371 | | $ | 842,293 |

| Peter Wolfert | | — | | — | | | — | | — | | | — | | | — |

| Scott P. Barlow | | 25,000 | (1) | 1.7 | % | $ | 10.57 | | 2/16/2014 | | $ | 166,185 | | $ | 421,146 |

- (1)

- The options vest monthly over a four-year period measured from the date of grant.

9

- (2)

- During the fiscal year ended December 31, 2004, we granted options to purchase 1,507,689 shares of our common stock.

- (3)

- Options were granted at an exercise price equal to the fair market value of our common stock at the date of the grant as measured by the closing price of our common stock as reported on NASDAQ. Each option has a maximum term of ten years, subject to earlier termination upon the optionee's cessation of service with ValueClick, Inc.

- (4)

- Potential realizable values are net of exercise price, but before the payment of taxes associated with exercise. Amounts represent hypothetical gains that could be achieved for the respective options if exercised at the end of the option term. The 5% and 10% assumed annual rates of compounded stock price appreciation are mandated by rules of the Securities and Exchange Commission and do not represent our estimates or projections of our future common stock prices. These amounts represent assumed rates of appreciation in the value of the common stock from the fair market value on the date of grant. Actual gains, if any, on stock option exercises are dependent on the future performance of the common stock and overall stock market conditions. The amounts reflected in the table may not necessarily be achieved.

Aggregate Option Exercises in Fiscal Year 2004 and Fiscal Year-End Option Values

The following table sets forth information with respect to each of our named executive officers concerning their exercise of stock options during the fiscal year ended December 31, 2004 and the number of shares subject to unexercised stock options held by them as of the close of such fiscal year.

In the following table, the "Value Realized" is equal to the difference between the fair value of the shares at the time of exercise and the exercise price paid for the shares and the "Value of Unexercised In-The-Money Options" is based on the closing price per share at the close of the 2004 fiscal year less the exercise price payable per share. Options are "In-the-Money" if the fair market value of the underlying options exceeds the exercise price of the option.

| |

| |

| | Number of Shares

of Common Stock

Underlying Unexercised

Options at

December 31, 2004

| |

| |

|

|---|

| |

| |

| | Value of Unexercised

In-the-Money

Options at

December 31, 2004

|

|---|

| | Number of

Shares

Acquired on

Exercise(#)

| |

|

|---|

Name

| | Value

Realized

($)

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable($)

| | Unexercisable($)

|

|---|

| James R. Zarley | | 1,594,445 | | 10,805,921 | | 406,205 | | 593,750 | | 4,363,000 | | 6,460,000 |

| Samuel J. Paisley | | 200,000 | | 1,408,302 | | 270,834 | | 179,166 | | 2,823,088 | | 1,626,912 |

| Peter Wolfert | | 150,000 | | 1,052,931 | | 155,209 | | 94,791 | | 1,668,924 | | 1,030,576 |

| Scott P. Barlow | | 18,458 | | 143,772 | | 31,766 | | 52,709 | | 206,871 | | 407,042 |

10

COMMITTEE REPORTS

Report of the Compensation Committee of the Board of Directors

on Executive Compensation

The following is a report of the Compensation Committee of the Board of Directors (the "Compensation Committee") describing the compensation policies applicable to our executive officers during the fiscal year ended December 31, 2004. The Compensation Committee is responsible for ensuring that we provide competitive compensation practices and that those practices are in accordance with all legal requirements and are of the highest quality. These responsibilities include making recommendations to the Board of Directors regarding all forms of compensation to be provided to the executive officers, senior executives and directors of the corporation, and all bonus and stock compensation paid to all employees.

General Compensation Policy

Under the supervision of the Compensation Committee, our compensation policy is designed to attract and retain qualified key executives critical to growth and long-term success. It is the objective of the Compensation Committee to have a portion of each executive's compensation contingent upon our performance, as well as upon the individual's personal performance. Accordingly, each executive officer's compensation package is comprised of three elements: (1) base salary which reflects individual performance and expertise; (2) variable bonus awards established explicitly in employment agreements or determined individually by the Board or Compensation Committee, payable in cash and tied to the achievement of certain performance goals; and (3) long-term, stock-based incentive awards designed to strengthen the mutuality of interests between the executive officers and our stockholders.

The following summary describes in more detail the factors which the Compensation Committee considers in establishing each of the three primary components of the compensation package provided to the executive officers.

Base Salary

The level of base salary is established on the basis of the individual's qualifications and relevant experience, the strategic goals for which he or she has responsibility, compensation levels at companies which compete with us for business and executive talent, and incentives necessary to attract and retain qualified management. Base salary is adjusted annually to take into account the individual's performance and to maintain a competitive salary structure. It is the policy of ValueClick that the Compensation Committee or the Board of Directors review and approve base wage compensation proposals for executive officers.

Cash-Based Incentive Compensation

Cash bonuses are awarded to executive officers on the basis of their success in achieving designated individual goals and our success in achieving specific Company-wide goals, such as revenue growth, operating margin targets and new business opportunities.

Long-Term Incentive Compensation

We utilize our stock option plans to provide executives and other key employees with incentives to maximize long-term stockholder values. Awards under this plan take the form of incentive stock options designed to give the recipient a meaningful stake in the equity in ValueClick and thereby closely align his or her interests with those of our stockholders.

11

Compensation of the Chief Executive Officer

The plans and policies discussed above were the basis for the 2004 compensation of the Company's Chief Executive Officer, James R. Zarley. In accordance with these plans and policies, Mr. Zarley received a base salary of $200,000 in January 2002. In February 2002, Mr. Zarley's salary was increased to $375,000 and remained at that level for the duration of 2002 and through 2004. On February 11, 2003, the Company granted 150,000 stock options to Mr. Zarley (the "Options"). The Options were issued with an exercise price of $2.83 and vest monthly over a period of one year. In addition, Mr. Zarley earned a cash bonus of $150,000 during 2004 which was awarded based upon the Company's financial performance during the year.

Deductibility of Executive Compensation

The Compensation Committee has considered the impact of Section 162(m) of the Internal Revenue Code adopted under the Omnibus Budget Reconciliation Act of 1993, which section disallows a deduction for any publicly held corporation for individual compensation exceeding $1 million in any taxable year for the chief executive officer and the four other most highly compensated executive officers, respectively, unless such compensation meets the requirements for the "performance-based" exception to Section 162(m). As the cash compensation paid by ValueClick to each of its executive officers is expected to be below $1 million and the Compensation Committee believes that options granted under our 2002 Incentive Stock Option Plan to such officers will meet the requirements for qualifying as performance-based, the Compensation Committee believes that Section 162(m) will not affect the tax deductions available to us with respect to the compensation of its executive officers. It is the Compensation Committee's policy to qualify, to the extent reasonable, its executive officers' compensation for deductibility under the applicable tax law. However, we may from time to time pay compensation to our executive officers that may not be deductible.

Submitted by the Compensation Committee of the Board of Directors

David S. Buzby

Martin T. Hart

12

Report of the Audit Committee of the Board of Directors

The Audit Committee has furnished the following report on Audit Committee matters:

Pursuant to its charter, the Audit Committee is primarily responsible for overseeing and monitoring the accounting, financial reporting and internal controls practices of the Company and its subsidiaries. Its primary objective is to promote and preserve the integrity of the Company's financial statements and the independence and performance of the Company's independent auditors. The Committee also oversees the performance of the Company's internal audit capability and the Company's compliance with legal and regulatory requirements.

It is important to note, however, that the role of the Audit Committee is one of oversight, and the Committee relies, without independent verification, on the information provided to it and the representations made by management, the Company's internal auditors and the independent auditors. Management retains direct responsibility for the financial reporting process and system of internal controls.

In furtherance of its role, the Audit Committee has an annual agenda which includes periodic reviews of the Company's internal controls and of areas of potential exposure for the Company such as litigation matters. The Committee meets at least quarterly and reviews the Company's interim financial results and earnings releases prior to their publication.

The Audit Committee's policy is to pre-approve all audit and non-audit services provided by the independent auditors and other financial professional services providers. These services may include audit services, audit-related services, tax services and other services. Pre-approval generally is provided for up to one year and any pre-approval is detailed as to the particular service or category of services and generally is subject to a specific budget. The Audit Committee has delegated pre-approval authority to its Chairperson when expedition of services is necessary. The independent auditors and management report annually to the full Audit Committee regarding the extent of services provided by the independent auditors in accordance with this pre-approval, and the fees for the services performed. All of the audit, audit-related, tax, and other services provided by Deloitte & Touche LLP in Fiscal 2004 and related fees were approved in accordance with the Audit Committee's policy.

The Audit Committee has reviewed and discussed the audited financial statements of the Company for the fiscal year ended December 31, 2004, the Company's evaluation of the effectiveness of its internal controls over financial reporting and the related opinion by the Company's independent auditors, with management and it has discussed with Deloitte & Touche LLP the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees) relating to the conduct of the audit. The Audit Committee also has received written disclosures and a letter from Deloitte & Touche LLP regarding its independence from the Company as required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) and has discussed with Deloitte & Touche LLP the independence of that firm. Based upon these materials and discussions, the Audit Committee has recommended to the Board of Directors that the audited financial statements be included in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2004.

Submitted by the Audit Committee of the Board of Directors

David S. Buzby

Martin T. Hart

Jeffrey F. Rayport

13

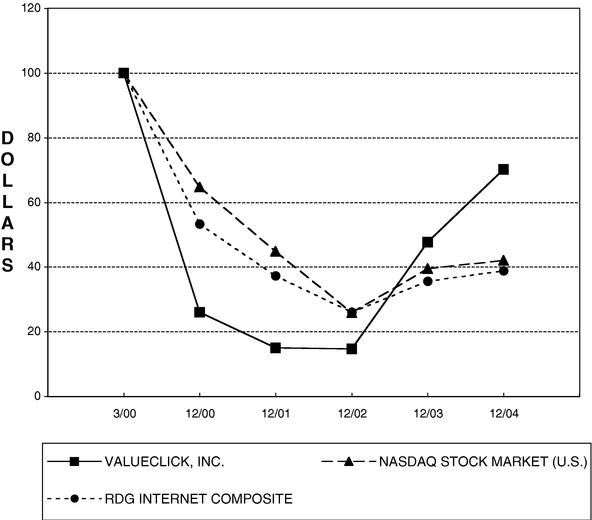

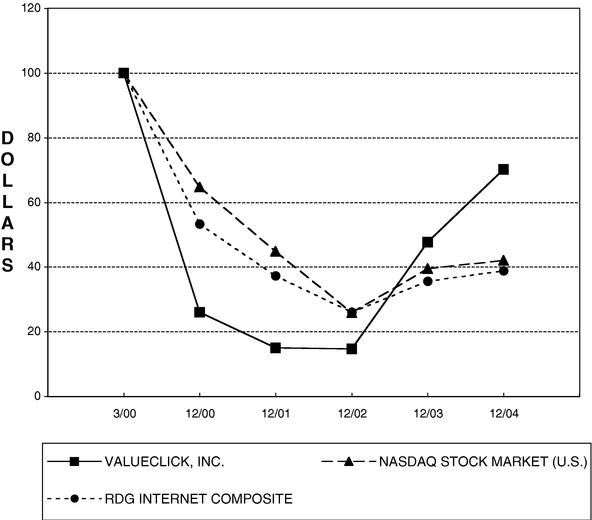

STOCKHOLDER RETURN PERFORMANCE GRAPH

Set forth below is a graph comparing the cumulative total stockholder return of $100 invested in our common stock on March 31, 2000 (the day our shares commenced trading) through December 31, 2004 relative to the cumulative total return of $100 invested in the NASDAQ Stock Market (U.S.) Index and the RDG Internet Composite Index calculated similarly for the same period.

COMPARISON OF 57-MONTH CUMULATIVE TOTAL RETURN*

AMONG VALUECLICK, INC., THE NASDAQ STOCK MARKET (U.S) INDEX

AND THE RDG INTERNET COMPOSITE INDEX

* $100 invested on 3/31/00 in stock or index—including reinvestment of dividends. Fiscal year ended December 31.

14

EMPLOYMENT AGREEMENTS

ValueClick has entered into employment agreements with each of Messrs. Zarley, Paisley, Wolfert, and Barlow. Under these agreements, each of them is entitled to a base salary as set forth in the table below. In connection with these agreements, we have granted each of them options to purchase shares of ValueClick common stock under either our 2002 Incentive Stock Option Plan or 1999 Stock Option Plan as set forth in the table below.

Options Granted Under Employment Agreements

Name

| | Base Salary

| | Number of

Securities

Underlying

Options

| | Exercise

Price

| | Expiration Date

|

|---|

| James R. Zarley | | $ | 375,000 | | 800,000

600,000

1,500,000

150,000 | (1)

(1)

(1)

(1) | $

$

$

$ | 0.25

1.00

2.45

2.83 | | May 13, 2009

May 19, 2009

July 31, 2012

February 11, 2013 |

Samuel J. Paisley |

|

$ |

300,000 |

|

200,000

200,000

100,000

100,000

50,000 |

(2)

(2)

(2)

(2)

(2) |

$

$

$

$

$ |

4.25

2.46

2.45

2.83

10.57 |

|

January 11, 2005

February 14, 2007

July 31, 2012

February 11, 2013

February 6, 2014 |

Peter Wolfert |

|

$ |

300,000 |

|

150,000

150,000

50,000

50,000 |

(3)

(3)

(3)

(3) |

$

$

$

$ |

4.25

2.46

2.45

2.83 |

|

January 11, 2005

February 14, 2007

July 31, 2012

February 11, 2013 |

Scott P. Barlow |

|

$ |

235,000 |

|

10,000

25,000

40,000

25,000 |

(4)

(4)

(4)

(4) |

$

$

$

$ |

2.46

2.04

2.83

10.57 |

|

February 14, 2007

February 10, 2011

February 11, 2013

February 6, 2014 |

- (1)

- 150,000 of Mr. Zarley's options became exercisable in June 1999. An additional 155,555 of Mr. Zarley's options became exercisable in December 1999. 450,000 options became exercisable upon the closing of ValueClick's initial public offering in March 2000. 644,445 options became exercisable in equal monthly installments over 29 months beginning April 2000. 150,000 of Mr. Zarley's options vest monthly over a one-year term measured from February 11, 2003.

- (2)

- 200,000 of Mr. Paisley's options vest monthly over a four-year term measured from March 27, 2001. 200,000 of Mr. Paisley's options vest annually over a four-year term measured from February 14, 2002. 100,000 of Mr. Paisley's options vest monthly over a four-year term measured from July 31, 2002. 100,000 of Mr. Paisley's options vest monthly over a one-year term measured from February 11, 2003. 50,000 of Mr. Paisley's options vest monthly over a four-year term measured from February 6, 2004.

- (3)

- 150,000 of Mr. Wolfert's options vest annually over a four-year term measured from July 12, 2000. 150,000 of Mr. Wolfert's options vest annually over a four-year term measured from February 14, 2002. 50,000 of Mr. Wolfert's options vest monthly over a four-year term measured from July 31, 2002. 50,000 of Mr. Wolfert's options vest monthly over a one-year term measured from February 11, 2003.

15

- (4)

- 25,000 of Mr. Barlow's options vest annually over a four-year term measured from October 26, 2001. 10,000 of Mr. Barlow's options vest annually over a four-year term measured from February 14, 2002. 40,000 of Mr. Barlow's options vest monthly over a four-year term measured from February 11, 2003. 25,000 of Mr. Barlow's options vest monthly over a four-year term measured from February 6, 2004.

All of the current employment agreements described above may be terminated at any time by either party upon ten days notice. These employment agreements continue until terminated by either us or the employee. Upon a change of control of the Company, as defined, in which employment with the Company is involuntarily terminated without cause, the employment agreements with Messrs. Zarley, Paisley and Wolfert provide for the payment of one year annual base salary and the immediate vesting of all unvested stock options, while the employment agreement with Mr. Barlow provides for the payment of four months of annual base salary and the immediate vesting of all unvested stock options.

Compensation Committee Interlocks and Insider Participation; Certain Relationships

The Compensation Committee consists of Messrs. Hart and Buzby.

None of our executive officers serves as a member of the board of directors or compensation committee of any entity that has one or more of its executive officers serving as a member of our Compensation Committee or Board of Directors.

Our policy is that any future related party transactions, as defined under Item 404 of Regulation S-K, be approved in advance by the Audit Committee and be on terms no less favorable to us than we could obtain from non-affiliated parties.

PRINCIPAL STOCKHOLDERS

The following table sets forth information regarding the beneficial ownership of the shares of our common stock as of April 11, 2005, except as noted in the footnotes below, by:

- •

- Each person who we know to be the beneficial owner of 5% or more of our outstanding common stock;

- •

- Each named executive officer;

- •

- Each of our directors; and

- •

- All of our named executive officers and directors as a group.

Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission. In computing the number of shares beneficially owned by a person and the percentage of ownership of that person, shares of common stock subject to options held by that person that are currently exercisable or that will become exercisable within sixty days after April 11, 2005, are deemed to be beneficially owned by the person, even if the options have not actually been exercised, and are deemed to be outstanding for the purpose of computing the percentage ownership of that person. Those shares, however, are not deemed outstanding for the purpose of computing the percentage ownership of any other person. As of April 11, 2005, 82,821,235 shares of our common stock were issued and outstanding. Unless otherwise indicated in the footnotes below, and subject to community property laws where applicable, each of the named persons have sole voting and investment power with respect to the shares shown as beneficially owned. Unless otherwise indicated, the address of the

16

beneficial owner below is c/o ValueClick, Inc., 30699 Russell Ranch Road, Suite 250, Westlake Village, California 91361.

| | Shares

Beneficially Owned

| |

|---|

Name and Address of Beneficial Owner

| |

|---|

| | Number

| | Percent

| |

|---|

| Directors, Executive Officers and Significant Employees: | | | | | |

| James R. Zarley(1) | | 1,069,445 | | 1.3 | % |

| Samuel J. Paisley(2) | | 337,501 | | * | |

| Peter Wolfert(3) | | 197,916 | | * | |

| Scott P. Barlow(4) | | 29,121 | | * | |

| David S. Buzby(5) | | 108,000 | | * | |

| Martin T. Hart | | 300,000 | | * | |

| Tom A. Vadnais | | 311,300 | | * | |

| Jeffrey F. Rayport(6) | | 174,053 | | * | |

| 5% Stockholders: | | | | | |

| RS Investment Management Co. LLC(7) | | 4,412,120 | | 5.3 | % |

| All Directors and Officers as a group (8 persons)(8) | | 2,527,336 | | 3.0 | % |

- *

- Less than 1%

- (1)

- Includes 125,000 shares of common stock issuable upon exercise of stock options which are presently exercisable or will become exercisable within sixty days from April 11, 2005.

- (2)

- Includes 337,500 shares of common stock issuable upon exercise of stock options which are presently exercisable or will become exercisable within sixty days from April 11, 2005.

- (3)

- Includes 197,916 shares of common stock issuable upon exercise of stock options which are presently exercisable or will become exercisable within sixty days from April 11, 2005.

- (4)

- Includes 29,121 shares of common stock issuable upon exercise of stock options which are presently exercisable or will become exercisable within sixty days from April 11, 2005.

- (5)

- Includes 32,700 shares of common stock issuable upon exercise of stock options which are presently exercisable or will become exercisable within sixty days from April 11, 2005.

- (6)

- Includes 91,175 shares of common stock issuable upon exercise of stock options which are presently exercisable or will become exercisable within sixty days from April 11, 2005.

- (7)

- Number of shares beneficially owned based on Schedule 13G filed with the Securities and Exchange Commission ("SEC") on February 15, 2005. RS Investment Management Co. LLC is the parent company of registered investment advisers whose clients have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, the Company's common stock. No individual client's holdings of the Company's common stock are more than five percent of the Company's outstanding common stock.

- (8)

- Includes 813,412 shares of common stock issuable upon the exercise of stock options which are presently exercisable or will become exercisable within sixty days from April 11, 2005.

INDEPENDENT PUBLIC ACCOUNTANTS

On June 30, 2004, the Company, with the approval of its Audit Committee, dismissed PricewaterhouseCoopers LLP as its independent accountants. The reports of PricewaterhouseCoopers LLP on the consolidated financial statements of the Company and its subsidiaries for the years ended December 31, 2003 and 2002 contained no adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles. In connection with its

17

audits for the two most recent fiscal years and through June 30, 2004, there were no disagreements with PricewaterhouseCoopers LLP on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which disagreements if not resolved to the satisfaction of PricewaterhouseCoopers LLP would have caused it to make reference thereto in its reports on the consolidated financial statements for such years. During the two most recent fiscal years and through June 30, 2004, there were no reportable events (as defined in Item 304(a)(1)(v) of Regulation S-K).

The Company engaged Deloitte & Touche LLP as its new independent accountants as of July 2, 2004. During the two most recent fiscal years and through July 2, 2004, the Company did not consult with Deloitte & Touche LLP regarding any of the following:

- 1)

- The application of accounting principles to a specified transaction, either completed or proposed;

- 2)

- The type of audit opinion that might be rendered on the Company's consolidated financial statements, and none of the following was provided to the Company: (a) a written report, or (b) oral advice that Deloitte & Touche LLP concluded was an important factor considered by the Company in reaching a decision as to an accounting, auditing or financial reporting issue;

- 3)

- Any matter that was the subject of a disagreement, as that term is defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions to Item 304 of Regulation S-K; or

- 4)

- A reportable event, as that item is defined in Item 304(a)(1)(v) of Regulation S-K.

The Company's new independent auditors, Deloitte & Touche LLP, audited the consolidated financial statements of the Company and its subsidiaries as of and for the year ended December 31, 2004. Representatives of Deloitte & Touche LLP are expected to be present at the 2005 Annual Meeting with an opportunity to make a statement if they desire to do so, and the representatives are expected to be available to respond to appropriate questions. The Audit Committee of the Board of Directors will select the Company's independent auditors to audit the financial statements of the Company and its subsidiaries for the year ending December 31, 2005. The Audit Committee has considered whether the provision of services by Deloitte & Touche LLP and PricewaterhouseCoopers LLP other than the audit of the financial statements of the Company for fiscal years 2004, 2003 and 2002, and the reviews of the quarterly financial statements during these periods is compatible with maintaining Deloitte & Touche LLP's and PricewaterhouseCoopers LLP's independence.

During the fiscal years ended December 31, 2004 and 2003, Deloitte & Touche LLP and PricewaterhouseCoopers LLP provided the following services to ValueClick:

Audit Fees. Fees for audit services provided by Deloitte & Touche LLP for the 2004 annual audit and the review of the financial statements included in the Company's Quarterly Reports on Form 10-Q for the second and third quarters of 2004 were $1,283,000. Fees for audit services provided by PricewaterhouseCoopers LLP for the 2004 fiscal year were $42,000 and include their review of the financial statements included in the Company's Quarterly Report on Form 10-Q for the first quarter of 2004, and the issuance of their consent for the inclusion in the 2004 Form 10-K of their audit report on the consolidated financial statements as of and for the two years ended December 31, 2003. Fees for audit services provided by PricewaterhouseCoopers LLP for the 2003 annual audit and the review of the financial statements included in the Company's Quarterly Reports on Form 10-Q for the first three quarters in 2003 were $303,000. These amounts include statutorily required audits and reviews of our majority-owned subsidiary in Japan and our wholly-owned subsidiaries in Europe. Further, the amount of fees for 2004 includes services provided by Deloitte & Touche LLP related to the internal control audit required under Section 404 of the Sarbanes-Oxley Act.

18

Audit-Related Fees. Fees for audit-related services provided by Deloitte & Touche LLP for 2004 were $15,000 and include fees for accounting standard and transaction consultations. Fees for audit-related services provided by PricewaterhoueCoopers LLP for 2004 and 2003 were $7,000 and $25,000, respectively, and included fees for accounting standard and transaction consultations.

Tax Fees. Neither Deloitte & Touche LLP nor PricewaterhouseCoopers LLP rendered any professional tax services during the 2004 or 2003 fiscal years.

Other Fees. Fees for other services provided by Deloitte & Touche LLP were $63,000 and zero in 2004 and 2003, respectively. The services provided in 2004 relate to financial due diligence services in connection with a business acquisition. PricewaterhouseCoopers LLP did not render any services other than as described above during the 2004 or 2003 fiscal years.

MARKET VALUE

On December 31, 2004, the closing price of a share of the Company's common stock on the NASDAQ Stock Exchange was $13.33.

EXPENSES OF SOLICITATION

The Company will pay the entire expense of soliciting proxies for the Annual Meeting. In addition to solicitations by mail, certain directors, officers and regular employees of the Company (who will receive no compensation for their services other than their regular compensation) may solicit proxies by telephone or personal interview. Banks, brokerage houses, custodians, nominees, and other fiduciaries have been requested to forward proxy materials to the beneficial owners of shares held of record by them and such custodians will be reimbursed for their expenses.

SUBMISSION OF STOCKHOLDER PROPOSALS FOR

ANNUAL MEETING IN 2006

Stockholder proposals intended to be presented at the Annual Meeting of stockholders to be held in 2006 must be received by the Company on or after February 6, 2006 and not later than March 6, 2006 in order to be considered for inclusion in the Company's Proxy Statement and form of proxy for that meeting. These proposals must also comply with the rules of the SEC governing the form and content of proposals in order to be included in the Company's Proxy Statement and form of proxy.

In addition, a stockholder who wishes to present a proposal at the Annual Meeting of stockholders to be held in 2006 must deliver the proposal to the Company so that it is received on or after February 6, 2006 and not later than March 6, 2006 in order to be considered at that annual meeting. The Company's By-laws provide that any stockholder of record wishing to have a stockholder proposal considered at an annual meeting must provide written notice of such proposal and appropriate supporting documentation, as set forth in the By-laws, to the Company at its principal executive office not less than 90 days nor more than 120 days prior to the first anniversary of the date of the preceding year's annual meeting. In the event, however, that the annual meeting is scheduled to be held more than 30 days before such anniversary date or more than 60 days after such anniversary date, notice must be so delivered not earlier than the close of business on the 120th day prior to such annual meeting and not later than the close of business on the later of the 90th day prior to such annual meeting or the 10th day after the date of public disclosure of the date of such meeting is first made. Proxies solicited by the Board of Directors will confer discretionary voting authority with respect to these proposals, subject to SEC rules governing the exercise of this authority.

Any stockholder proposals should be mailed to: Secretary, ValueClick, Inc., 30699 Russell Ranch Road, Suite 250, Westlake Village, CA 91361.

19

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires ValueClick's executive officers and directors, and persons who own more than 10% of a registered class of ValueClick equity securities, to file an initial report of securities ownership on Form 3 and reports of changes in securities ownership on Form 4 or 5 with the Securities and Exchange Commission. Such executive officers, directors and 10% stockholders are also required by SEC rules to furnish ValueClick with copies of all Section 16(a) forms that they file. Based solely on ValueClick's review of the copies of such forms received by it, or written representations from certain reporting persons that no Forms 5 were required for such persons, ValueClick believes that, for the reporting period from January 1, 2004 to December 31, 2004, its executive officers and directors complied with all their reporting requirements under Section 16(a) for such fiscal year, except for the following transactions: a purchase of stock by Mr. Buzby on December 15, 2004 for which a Form 4 was not filed until December 21, 2004; a purchase of stock by Mr. Vadnais on June 10, 2004 for which a Form 4 was not filed until June 17, 2004; and the granting of stock options to Messrs. Paisley and Barlow on February 6, 2004 for which a Form 4 was not filed until March 23, 2004.

OTHER MATTERS

The Board of Directors does not know of any matters other than those described in this Proxy Statement that will be presented for action at the Annual Meeting. If other matters are duly presented, proxies will be voted in accordance with the best judgment of the proxy holders.

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING IN PERSON, YOU ARE REQUESTED TO COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY CARD IN THE ENCLOSED ENVELOPE WHICH REQUIRES NO POSTAGE IF MAILED IN THE UNITED STATES.

20

PROXY

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

VALUECLICK, INC.

PROXY FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 6, 2005

The undersigned hereby appoints James R. Zarley and Samuel J. Paisley, and each of them, the attorneys, agents and proxies of the undersigned, with full powers of substitution to each, to attend and act as proxy or proxies of the undersigned at the Annual Meeting of Shareholders of ValueClick, Inc. to be held at the Company's headquarters located at 30699 Russell Ranch Road, Suite 250, Westlake Village, California, on Monday, June 6, 2005 at 9:00 AM Pacific Time, and at any and all adjournments thereof, and to vote as specified herein the number of shares which the undersigned, if personally present, would be entitled to vote.

(Continued, and to be marked, dated and signed, on the other side)

Address Change/Comments(Mark the corresponding box on the reverse side)

/\ FOLD AND DETACH HERE /\ |

You can now access yourVALUECLICK INC. account online.

Access yourVALUECLICK INC. shareholder/stockholder account online via Investor ServiceDirect® (ISD).

Mellon Investor Services LLC, Transfer Agent forVALUECLICK INC., now makes it easy and convenient to get current information on your shareholder account.

| • View account status | | • View payment history for dividends |

| • View certificate history | | • Make address changes |

| • View book-entry information | | • Obtain a duplicate 1099 tax form |

| | | • Establish/change your PIN |

Visit us on the web athttp://www.melloninvestor.com

For Technical Assistance Call 1-877-978-7778 between

9am-7pm Monday-Friday Eastern Time

Investor ServiceDirect® is a registered trademark of Mellon Investor Services LLC

| THIS PROXY WILL BE VOTED AS DIRECTED, OR IF NO DIRECTION IS INDICATED, WILL BE VOTED "FOR" THE PROPOSALS. | | Mark here for Address Change or Comments | | o |

| | | PLEASE SEE REVERSE SIDE

|

| | | FOR | | WITHHELD

FOR ALL | | |

| ITEM 1. ELECTION OF DIRECTORS | | o | | o | | |

Nominees:

01 James R. Zarley

02 David S. Buzby

03 Martin T. Hart

04 Tom A. Vadnais | | 05 Jeffrey F. Rayport | | Item 2—Other Business. In their discretion, the proxies are authorized to vote upon such other business as may properly come before the meeting and at any and all adjournments thereof. The board of directors at present knows of no other business to be presented by or on behalf of ValueClick or the board of directors at the meeting. |

Withheld for the nominees you list below: (Write that nominee's name in the space provided below.) |

|

|

| | | |

| | |

NOTE: Please sign as name appears hereon. Joint owners should each sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such.

/\ FOLD AND DETACH HERE /\ |

Vote by Internet or Telephone or Mail

24 Hours a Day, 7 Days a Week

Internet and telephone voting is available through 11:59 PM Eastern Time

the day prior to annual meeting day.

Your telephone or Internet vote authorizes the named proxies to vote your shares in the same

manner as if you marked, signed and returned your proxy card.

Internet

http://www.proxyvoting.com/vclk | | | | Telephone

1-866-540-5760 | | | | Mail |

| | | OR | | | | OR | | |

Use the internet to vote your proxy. Have your proxy card in hand when you access the web site. |

|

|

|

Use any touch-tone telephone to vote your proxy. Have your proxy card in hand when you call. |

|

|

|

Mark sign and date your proxy card and return it in the enclosed postage-paid envelope.

|

If you vote your proxy by Internet or by telephone,

you do NOT need to mail back your proxy card.

QuickLinks

CORPORATE GOVERNANCEPROPOSAL 1 ELECTION OF DIRECTORSNomineesCOMPENSATIONSummary Compensation TableOption Grants in Fiscal Year 2004Aggregate Option Exercises in Fiscal Year 2004 and Fiscal Year-End Option ValuesCOMMITTEE REPORTS Report of the Compensation Committee of the Board of Directors on Executive CompensationReport of the Audit Committee of the Board of DirectorsSTOCKHOLDER RETURN PERFORMANCE GRAPHEMPLOYMENT AGREEMENTSOptions Granted Under Employment AgreementsPRINCIPAL STOCKHOLDERSINDEPENDENT PUBLIC ACCOUNTANTSMARKET VALUEEXPENSES OF SOLICITATIONSUBMISSION OF STOCKHOLDER PROPOSALS FOR ANNUAL MEETING IN 2006SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCEOTHER MATTERS